The Tortoise and The Hare

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

The Tortoise and The Hare

By Marty Bent

Posted February 10, 2020

“Trust me.”

“Trust me.”

“I want to be candid. This strategy will cost money, involve risk and take time. We will have to try things that we’ve never tried before. We will make mistakes. We will go through periods in which things get worse and progress is uneven or interrupted.” — Timothy Geithner

This is but one snippet of one iteration of the pitch newly appointed Treasury Secretary Timothy Geithner shilled to the public on February 10th, 2009.

At the time, he was frantically running across Washington D.C., from Capitol Hill to media appearance after media appearance in an attempt to convince his fellow citizens that $300 Billion of the remaining TARP funds he was about to spend on toxic assets was not a bad deal. The populace was wary that the banks he would be buying the toxic assets from would refuse to sell below market price. They had been through a lot at this point.

As Geithner was uttering the words quoted above, the computers running bitcoind v0.1.5 and below were racing to confirm the 3,768th block of the Bitcoin blockchain. Ordering their CPUs to go out and seek a SHA-256 hash below the difficulty target at the time so that they could collect 50 bitcoin block subsidy.

No one really noticed it then, but there were two solutions to the Great Recession running in parallel; the one put forth by Timothy Geithner, Ben Bernanke and crew, and another put forth by Satoshi Nakamoto.

The powers that be in the US and across the globe - those attempting to put Humpty Dumpty back together again - were too busy to be cognizant of their competition in the aftermath of the financial crisis. They were rushing to make sure people would be able to get cash out of ATMs. Satoshi and the band of misfits who were drawn to the new open source protocol he launched were hyper aware of their competition. This is evidenced by the message that was etched into Bitcoin’s genesis block, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”. A reference to a headline in that day’s issue of The Times of London.

This wasn’t the only reference to the traditional monetary system that would be made by Bitcoin’s creator. Coincidentally, on the day after Timothy Geithner was making quick iterations of his pitch to the American people Satoshi made a direct reference to the Central Banking system and its flaws in his eyes:

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.” — Satoshi Nakamoto

Over the course of the last eleven years, the two solutions have been going head to head in the market. The solution put forth by Geithner and crew - who have bequeathed control of the levers to the Fed presidents and Treasury secretaries who have followed - is more of the same; money printing. The accumulation of long-term debt in hopes that we can stoke production today. On the surface, it seems to be working. But can this type of monetary policy persist?

The solution put forth by Satoshi is in direct opposition to the one put forth by the banking elite; a sound digital money that cannot be debased or controlled by a select few. Bitcoin is controlled by everyone and no one at the same time.

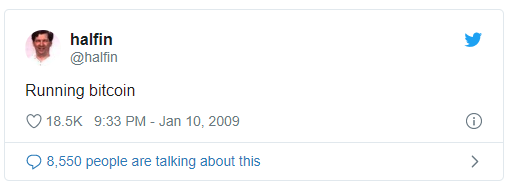

The first man to ever receive a bitcoin transaction. RIP Hal.

The first man to ever receive a bitcoin transaction. RIP Hal.

The two competing solutions are engaged in a classic Tortoise v. The Hare scenario.

The Federal Reserve and other Central Banks around the world have sprinted out of the gate; increasing the size of their monetary bases by orders of magnitude in very short order as they tinker with interest rates on a whim.

The Bitcoin Network has been on a slow grind for the last eleven years. Consistently producing blocks roughly every ten minutes as those who would like to see it succeed meticulously fortify the system. Working to make it more efficient, more scalable, more private and more robust one pull request at a time.

Most people don’t realize it, but we’re all watching a race to fix the money play out in real time. The money game is a long game. My sats are on the Tortoise.