The Bitcoin Analyst Brain: A Primer

The Bitcoin Analyst Brain: A Primer

By Christopher Bendiksen

Posted September 19, 2018

The industry is in building mode and I love it. It almost even smells like a giant construction site. I kinda want a Bitcoin hard hat.

Institutions are building too, but they are huge, slow-moving beasts whose motions can seem imperceptible against the fury of the Bitcoin anthill. Don’t be fooled though, there is activity happening and their (not to mention their clients’) thirst for information is ever growing. Which brings us to the very topic of this post.

One of the next developments we foresee is the initiation and increased frequency of Bitcoin coverage by financial research desks. This will in turn necessitate the hiring or re-training of a new wave of Bitcoin analysts to fill these new requirements of skills and knowledge.

That is why we are creating a Bitcoin Analyst series geared at training interested readers and the next wave of budding Bitcoin analysts. Our intention is to help readers “level up” in all the areas that are critical to understanding this emerging digital asset class and the technology on which it is built.

Perhaps you will become one of these new analysts. Or maybe you’re just really interested in going deep into Bitcoin so you can humble that insufferable blockchain guy at your next dinner party. In any case, finding this article means you’re already on the right track. It’s a levelling up of sorts in its own right.

But before you get too excited, I feel obliged to let you know that Bitcoin is one of those games where no one can ever truly complete or “beat” it._It’s almost like Chess in that the more you learn, the more there is _to_learn. And if you ever hear anyone claiming to be a Bitcoin (or worse, _blockchain) expert, turn your scam sensors to eleven. The real experts never claim to be such, because as soon as you actually start getting deep into Bitcoin, it immediately dawns on you just how little you actually know.

Over the next few months, I will do my best to guide readers towards the appropriate skills, knowledge and resources needed to succeed in our business through a series of articles. The goal is not to teach you everything, I wouldn’t know how, but to point you in the right directions for applying your own efforts without wasting too much time on the way. I will also be hosting interactive events in London and Stockholm (and NYC if the demand is there) where we’ll cover selected Bitcoin topics in more detail. But I digress..

The Bitcoin Analyst Brain

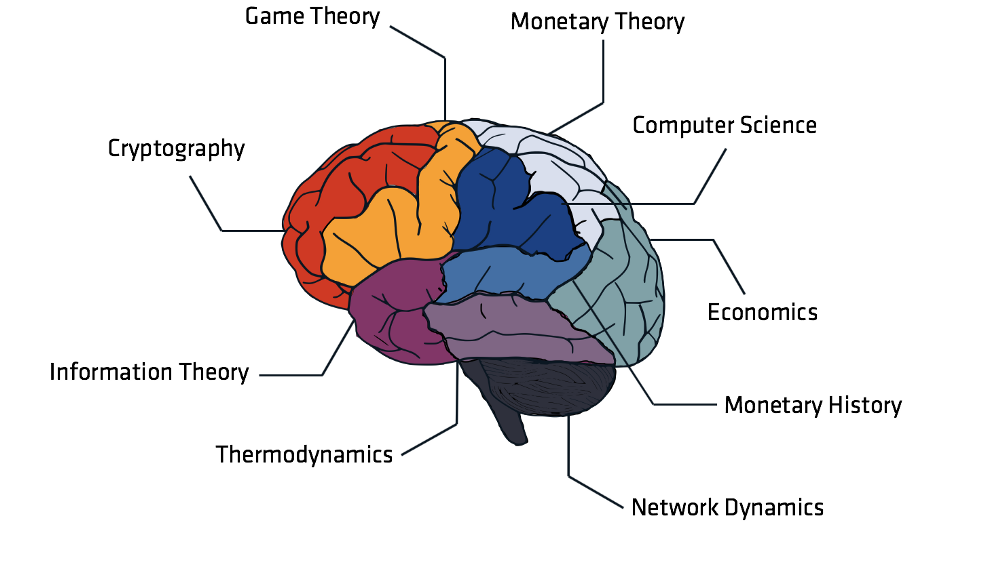

This is a brain. I used to work with them but they weren’t complicated enough so I got into Bitcoin instead.

Behold the Bitcoin Analyst brain in all its phrenological glory. It precisely maps nine important (but non-exhaustive) fields of Bitcoin knowledge to their exact corresponding neurological structures in a colourful and approachable manner while simultaneously illustrating the diverse domains of knowledge required to understand and analyse Bitcoin.

This anatomical masterpiece demonstrates how a successful Bitcoin analyst must be competent across a wide array of topics. Full-blown specialisation is no longer really feasible, or even desirable, particularly as a first-wave analyst (though specialisation may well become more sought-after in time). At least at the moment, Bitcoin analysis is a game reserved for women and men with certain renaissance-like inclinations.

I am not aware of any single person worldwide who can be considered an expert in all of these domains. While such persons might conceivably exist, it is also not necessary to be one in order to understand Bitcoin and add value to those in need of thorough, insightful analysis.

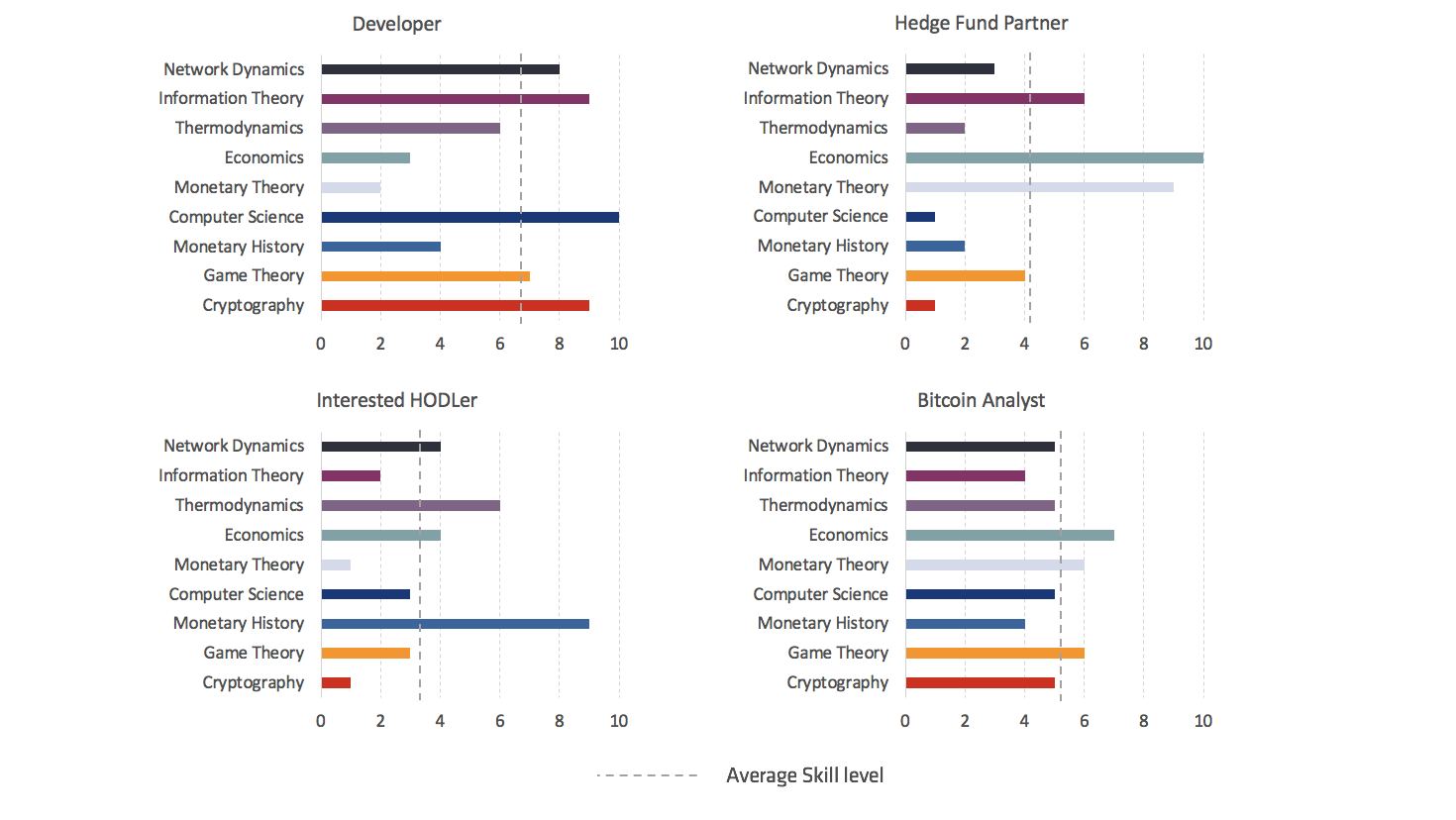

To illustrate further, allow me to pick a few perceived archetypes in the Bitcoin community; heavily prejudice them based on my own jaded perceptions; shamelessly reduce their perceived faculties to our nine colourful metrics; and finally, chart out what their skill distributions might look like:

Just so we’re clear, I made all these numbers up. As far as I know they do not actually represent any real person(s).

Just so we’re clear, I made all these numbers up. As far as I know they do not actually represent any real person(s).

It is your overall score that will serve you as a Bitcoin analyst, not whether you are a world-class specialist in a single domain or not. As you can see, there is really no right or wrong domain to attack in order to increase your overall skill level, some will suit you well, others you will find more difficult.

Work first on the ones that come easy, this way you can trigger that amazing feeling of increasing mastery, but do not shun from the ones that are hard, if your neglect them they will end up limiting your ability to fully grasp the whole picture.

Think about it this way: You can be a strong developer without knowing much about economics, but it’s tough to be on the development side without expertise in computer science. Similarly, you can have a deep understanding of the economics and monetary theory behind Bitcoin’s success without having to know your way around an elliptical curve.

But working towards being a Bitcoin analyst is probably best served by adapting a generalist approach. It is not sufficient to be a world-class cryptographer, nor is it necessary. Your job will be to break down a complicated large-picture phenomenon into more easily digestible components. That necessitates broad knowledge, or you might risk missing significant pieces of the puzzle, jeopardising your entire analysis.

The Next Level

We will kick this series into full gear in our next post where we look at the current state of Bitcoin analysis output; who is doing it right and how you can learn from them; some historic parallels to coverage initiation of emerging industries; and thoughts on how this might play out in the Bitcoin space.

Until then, you should continue reading about Bitcoin and learning as much as you possibly can. I was going to compile the best introductory resources on Bitcoin as an addendum to this piece, but to my express delight, Nima Tabatabai already made an excellent one, published only a couple weeks ago. There’s no need to re-invent the wheel here so I refer you to his work instead.

Read his introduction, follow him on Twitter, and in addition to all his other recommendations, add the following handles on Twitter and Medium:

Twitter:

@danheld, @StopAndDecrypt, @giacomozucco, @LaurentMT, @cburniske, @therealSherwinD, @aantonop, @TraceMayer, @MustStopMurad, @BitMexResearch, @twobitidiot, @jlppfeffer, and @nic__carter.

Medium:

Andreas M. Antonopoulos, StopAndDecrypt, Nic Carter, John Pfeffer, LaurentMT, Murad Mahmudov, Ryan Selkis, Dan Held, Giacomo Zucco, Sherwin Dowlat, Chris Burniske, and Trace Mayer

These lists are nowhere near complete and I’ll add more recommendations as we go along, but starting with too many voices in the room can be confusing so let’s leave it at these for now. Know that what these people write is the real deal. Don’t take my word for it though — thoroughly examine their work and try to punch holes in their arguments (they are obviously not always right about everything).

Before I end this piece, though, I want to repeat one of Nema’s points, as it is probably the best single piece of advice I can offer at this moment of your journey:

I cannot stress enough how important it is that you follow his suggestion and stop reading the news . It is almost entirely worthless and will teach you little to nothing about Bitcoin. In fact, it is virtually certain that they will teach you a bunch of incorrect stuff which you will painstakingly have to un-learn later, costing you valuable learning time.

So… drop out of the mainstream media, get on Twitter and Medium, and enjoy the journey as your Bitcoin knowledge grows.

And that’s another level up. See you at the next checkpoint.

Disclaimer

Please note that this Blog Post is provided on the basis that the recipient accepts the following conditions relating to the provision of the same (including on behalf of their respective organisation).

This Blog Post does not contain or purport to be, financial promotion(s) of any kind.

This Blog Post does not contain reference to any of the investment products or services currently offered by members of the CoinShares Group.

Digital assets and related technologies can be extremely complicated. The digital sector has spawned concepts and nomenclature much of which is novel and can be difficult for even technically savvy individuals to thoroughly comprehend. The sector also evolves rapidly.

With increasing media attention on digital assets and related technologies, many of the concepts associated therewith (and the terms used to encapsulate them) are more likely to be encountered outside of the digital space. Although a term may become relatively well-known and in a relatively short timeframe, there is a danger that misunderstandings and misconceptions can take root relating to precisely what the concept behind the given term is.

The purpose of this Blog Post is to provide objective, educational and interesting commentary. This Blog Post is not directed at any particular person or group of persons. Although produced with reasonable care and skill, no representation should be taken as having been given that this Blog Post is an exhaustive analysis of all of the considerations which its subject matter may give rise to. This Blog Post fairly represents the opinions and sentiments of its author at the date of publishing but it should be noted that such opinions and sentiments may be revised from time to time, for example in light of experience and further developments, and the blog post may not necessarily be updated to reflect the same.

Nothing within this Blog Post constitutes investment, legal, tax or other advice. This Blog Post should not be used as the basis for any investment decision(s) which a reader thereof may be considering. Any potential investor in digital assets, even if experienced and affluent, is strongly recommended to seek independent financial advice upon the merits of the same in the context of their own unique circumstances.

This Blog Post is subject to copyright with all rights reserved.