WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the November 2020 Journal PDF Donate & Download the November 2020 Journal ePUB

Bitcoin is the Most Sustainable Money The World Has Ever Seen

By Gael Sánchez Smith

Posted September 15, 2020

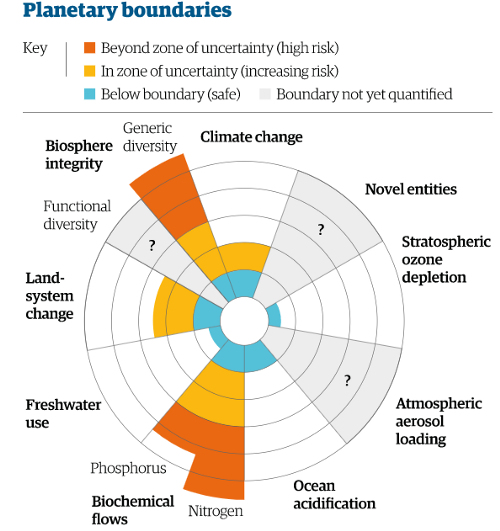

Planetary boundaries: Guiding human development on a changing planet (2015)

Planetary boundaries: Guiding human development on a changing planet (2015)

One of the greatest challenges facing the world is ensuring economic progress is undertaken in a way that doesn’t impose an insurmountable cost to the planet.

Scientists have been warning for decades that the current rate of environmental degradation puts humanity on the brink of disaster and yet the economic machine continues unfettered, eating away at the planet’s life support systems.

In a recent report, researchers point out that four of the nine worldwide processes that underpin life on earth have exceeded the “safe zone”, including anthropogenic climate change, loss of biodiversity, soil and freshwater depletion & ocean acidification.

Many argue that the environmental damage should be tackled through government taxes and regulations, others go as far as calling for the end of capitalism and a return to socialist economic planning. History teaches us that the latter would lead to a disaster that would not only fail in its alleged goal of creating a more sustainable world, it would also impoverish society like every other centrally planned economy of the past.

The radical proposals coming from the extremes of the environmentalist movement make it all the more pressing for lovers of capitalism, free markets and liberty to take ecological challenges seriously and to propose solutions. In this regard, there is one central area of every economy that remains largely unscrutinized but could contain part of the solution, namely the monetary system.

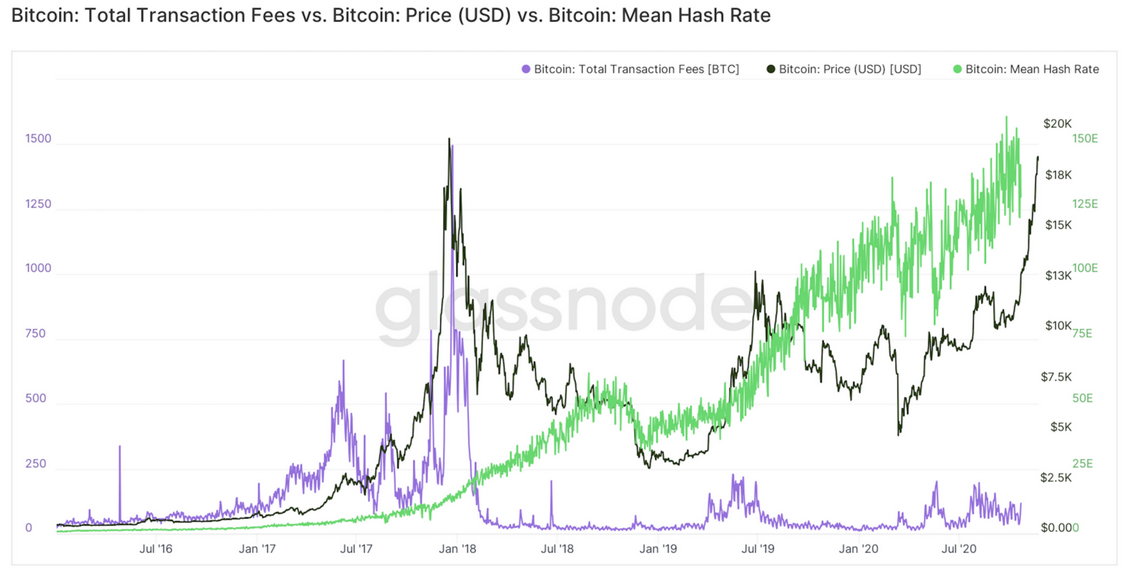

Bitcoin is widely criticized for its high carbon footprint, which, according to the most recent researchers, is estimated around 17 megatonnes of CO2 per year, about the same as the country of Croatia. This increase in carbon emissions couldn’t have come at a worse time, with the world rapidly approaching the 2 degree warming level, which would prove catastrophic for many parts of the world. However, CO2 emissions aren’t an inherent feature of the Bitcoin network and they most certainly won’t be a problem in the long run; let me explain:

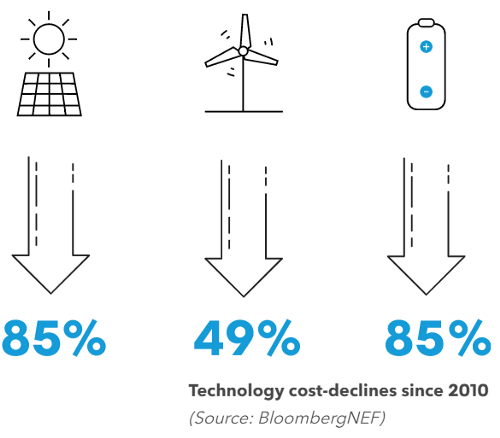

Bloomberg New Energy Finance (2019)

Bloomberg New Energy Finance (2019)

Bitcoin’s carbon footprint is caused by its high electricity consumption, which is needed to secure the decentralization of the network. However, at present more than 35% of the world’s electricity is produced from renewables+nuclear and in the U.S. the figure is even higher, with 38% of electricity being carbon-free. Furthermore, the exponential cost declines of solar and wind over the past 10 years means they are already the cheapest electricity sources across two thirds of the world.

As efficiency improvements continue reducing the cost of generating and storing renewable energy, solar and wind will become the cheapest sources of energy across the globe. Once the availability and intermittency of renewables is solved, fossil fuels will be removed from the world’s energy grid and the Bitcoin network will be 100% carbon-free.

Monetary Policy & Environmentalism

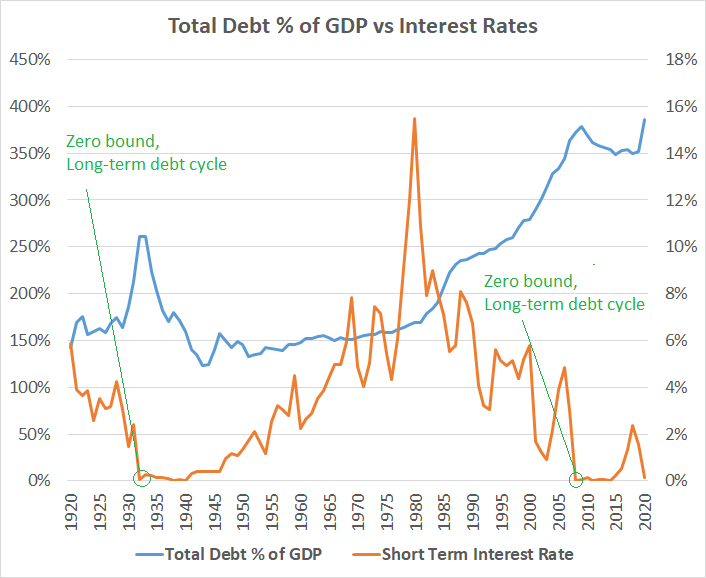

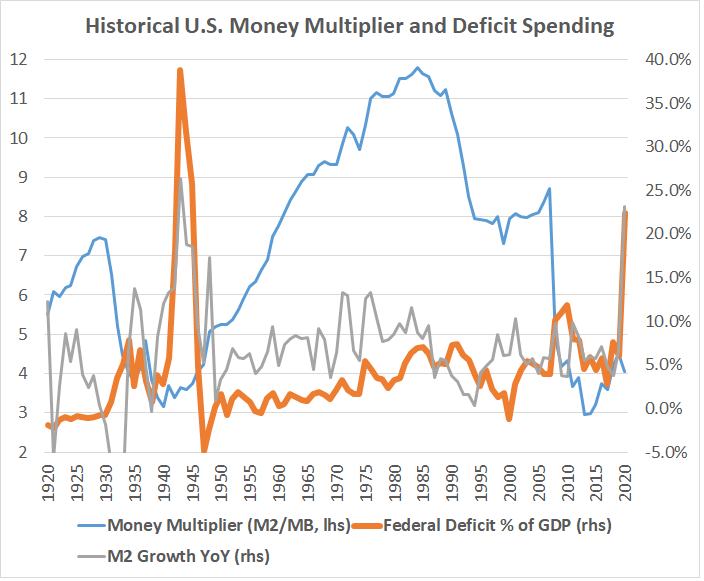

Many of the environmental challenges highlighted at the start of this article can be partially attributed to the fiat monetary system, which has been imposed upon the world:

- The Keynesian obsession with maintaining an ever-expanding rate of aggregate demand, rising government spending to prop up GDP or monetary expansions to punish hoarding, results in high rates of environmental degradation for short-term gains in consumption and investment.

- The overconsumption of natural resources during the malinvestment phase of the business cycle is caused by fractional reserve credit expansion. The relationship between credit expansion and environmental degradation has been pointed out by Jesus Huerta de Soto, who notes how “credit expansion hinders sustainable economic development and needlessly damages the natural environment.”

- Inflationary currency depreciation lowers the incentive to hold cash balances and incentivizes individuals to consume in the present. Consumerism contributes to environmental degradation associated to the manufacturing and distribution of consumer goods.

- Inflationary currency depreciation incentivizes individuals to invest in projects that offer negative real returns, simply to minimize the loss in purchasing power of their savings. These investments are not only destructive of society’s capital stock, many of them also have negative consequences on the environment.

Under a Bitcoin standard, the above-mentioned forms of social engineering would be impossible and consequently, the environment would be given a very much needed breath of fresh air:

- Manipulations of aggregate demand through monetary expansion would be impossible since the monetary supply is capped and stimulus programs would be limited by the government’s fiscal position.

- Business cycles and their resulting malinvestments wouldn’t occur since fractional reserve banking is unfeasible without a central bank. Under a Bitcoin standard, market interest rates would do what they are supposed to do; communicate the time, risk and liquidity preferences of market participants.

- Bitcoin’s fixed money supply introduces incentives for individuals not to spend in the present, since money appreciates over time reflecting gains in productivity. Additionally, only investments that offer a return above the rate of deflation would be undertaken.

A Bitcoin economy would likely be one with more sustainable levels of consumption and investment; in a sense it might resemble the degrowth economy advocated by many environmentalists. The availability of a store of wealth that offers a risk free return would give people the peace of mind and the time required to engage in non-economic activities. Spending less time in the mall and in the factory wouldn’t make society poorer, on the contrary, it would allow individuals to focus on family, friendships, charity, spirituality, religion or whatever they believe will bring them closer to “the good life”.

In his magnum opus, The Bitcoin Standard, Saifedean Ammous explains how the fetishization of growth has been massively destructive of economic progress. In this article, I contend that it has also led us on a path of utter destruction of the environment, putting in danger the very prospect of life on the only home we’ve ever known, a pale blue dot within a boundless, dark night.

The phrase “Pale Blue Dot” was coined in 1990 by Carl Sagan during his reflections on the importance of preserving life in the universe.

The phrase “Pale Blue Dot” was coined in 1990 by Carl Sagan during his reflections on the importance of preserving life in the universe.

References

- https://about.bnef.com/new-energy-outlook/

- https://www.theguardian.com/environment/2015/jan/15/rate-of-environmental-degradation-puts-life-on-earth-at-risk-say-scientists

- https://www.newscientist.com/article/2224037-bitcoins-climate-change-impact-may-be-much-smaller-than-we-thought/

- https://en.wikipedia.org/wiki/List_of_countries_by_carbon_dioxide_emissions

- https://mises.org/library/some-additional-reflections-economic-crisis-and-theory-cycle

- https://nakamotoinstitute.org/mempool/fractional-reserve-banking-is-obsolete/

Our Most Brilliant Idea

By Robert Breedlove

Posted November 1, 2020

Ideas ambulate humanity across history. A new and useful idea is an innovation, which can benefit everyone for the rest of time. Therefore, it is critical we construct socioeconomic structures conducive to the creation of new ideas: civilization can only advance amid an everlasting flow of fresh knowledge. Free trade is the means by which we maximize ideation and its physical manifestation: wealth creation. Anything that impedes trade—like central banking—is (by definition) a terrible idea. Contrarily, all accelerants to free trade—like money—are among the most brilliant ideas we’ve ever had.

Ideas Drive Economics

“A pile of rocks ceases to be so when somebody contemplates it with the idea of a cathedral in mind.” — Antoine De St-Exupery

Ideas are the origins of everything we say, do, or make. The purpose of any economy is to generate and share useful ideas through free trade (to achieve what economists call the division of labor or knowledge specialization). Civilization emerges not by an aimless concourse of variation, but rather it is molded in the image of our ideas, which we express through action to remake the face of the Earth. Better ideas, or sharper knowledge, equip mankind to more intelligently harness the gifts of the Earth to satisfy his wants to ever-higher degrees in ever-less time. In ideological space, competition is free and fierce: only the most useful ideas survive the test of time. Resultant knowledge encodes the patterns of action we use to etch our imaginations into the world around us. Winning ideas are chosen by the market, only to be widely distributed as material riches, finer manners and morals, and more profound art. Our lives are lived enacting our ideas. As HG Wells said:

“Human history is, in essence, a history of ideas.”

Or as William Durant elaborates:

“History as a laboratory rich in a hundred thousand experiments in economics, religion, literature, science, and government—history as our roots and our illumination, as the road by which we came and the only light that can clarify the present and guide us into the future.”

Pouring forth from our forebears is this civilizing heritage of ideas sharpened through free trade and expressed in the tools, techniques, and cultures we make for ourselves. As we trade, our ideas become better, giving everything we say, do, or make more want-satisfying qualities. Consider how our language has evolved from grunts to enunciations, or how our behaviors have been shaped by culture, or how our transportation technologies have progressed from wagons to airplanes. Substantive ingredients for all modern miracles surrounding us today have always been available, but prior to their invention, we simply lacked the ideas necessary to manifest them. As the living generation responsible for ideation, our aim must be to forge our ideas into finer form for posterity: an aim we accomplish through innovation.

Ideally, our civilization is the manifestation of our most useful ideas.

Innovation is simply a reconfiguration of the “raw materials” of nature by indexing them to our most useful idea structures. Said differently: creativity is taking known elements and reassembling them in accordance with new knowledge. Sharpening knowledge to better satisfy ourselves requires fires from the ideological collisions and frictions innate to trade. Trade, then, is mankind’s “meta-idea” — the generative idea of all our best ideas. Meta (from the Greek μετά, meaning “after” or “beyond”) is a prefix meaning more comprehensive or transcending: trade is an idea about improving ideas. It presupposes that anyone may know something everyone else does not, incentivizes them to teach the rest of us, and lets us all capitalize on any such learning opportunities. Trade indicates to us whether we are ill-informed in the pursuit of a goal, which can save us from harm, or help us achieve it more easily. Wealth generation is inseparable from ideation: the more we know, the more effortlessly we satisfy our (present and potential future) wants through innovation, and the more wealth we gain. Author Matt Ridley captures the spirit of this relationship between free trade and innovation in these words:

“Innovation is the child of freedom and the parent of prosperity.”

Free market capitalism is an idea unequaled in its generation of innovation. It proved itself as the most successful economic model for expanding trade, ideation, and wealth creation in the 20th century ideological contention between American capitalism and Soviet communism. Misguided by utopian promises, Soviet Russia attempted to replace the profit motive intrinsic to American capitalism with appeals to nationalistic faith and devotion, thereby poisoning the wellspring of learning engendered by trade. Under the moralistic camouflage of communism (“from each according to their ability, to each according to their needs” was the Marxist slogan) some of the most gruesome atrocities in history were perpetrated. Soon into the Soviet experiment, productivity collapsed, and millions starved or were slaughtered by the state. When governments play God, civilizations burn in hell. Soviet Russia rediscovered what wise Aristotle had warned centuries earlier:

“When everybody owns everything nobody takes care of anything.”

American capitalism outcompeted Soviet communism. Capitalism is a socioeconomic system premised on the three pillars of private property rights, rule of law, and honest money. Private property rights represent an exclusive relationship between individuals and any portion of nature they invest their time in reshaping; rights they can then exchange with similarly self-sovereign people. Rule of law is a mechanism for nonviolently resolving private property disputes. Honest money is the private property unimpeded market processes naturally select as most tradable. Since capitalism optimizes for trade, it supports this generative source of new ideas by incentivizing economic cooperation and (peaceful) competition. Indeed, the stability of rules is the bedrock of peace: with fixed and simple laws, market participants are forced to play the game well to make an honest living. As Bastiat said:

“When goods don’t cross borders, soldiers will.”

In an elemental sense, trade is the water that sustains innovation, and its steadfast flow a source of peace. Capitalism is the socioeconomic “water well” built to protect this everlasting ideological wellspring of civilization—trade.

Capitalism is a socioeconomic “water well” which protects our wellspring of ideas: trade.

The Idea Supercomputer

“Great minds discuss ideas. Average minds discuss events. Small minds discuss people.”—Eleanor Roosevelt

As the ultimate token of trade, money is an indispensable tool for ideation. In trade, everything is valued at some ratio of everything else. For instance, a car might be worth 132 chairs, or a house worth 11 cars. Money is the medium through which we more easily calculate these exchange ratios: a tool that simplifies trade by standardizing its intermediation. Like all tools, money lets us achieve greater results with less efforts, and the time-savings tools impart is wealth. Specifically, money lets us calculate, negotiate, and execute trades more quickly. Without money, a constant recalculation of countless exchange ratios among different economic goods would be necessary. With money, all exchange ratios are compressed into a single number — the money-expressed market price. In this way, money is an accelerant to trade and (its invisible twin) ideation. Standardization to one money creates economies of scale in trade. Such economization is what drives the market to coalesce around a single money — as we saw with gold and (its former currency abstraction, and now apparition) the US dollar:

America’s founding fathers knew the dangers of falsifying money.

Money is the medium through which market participants express their ideas, preferences, and values. Pricing systems are economic telecommunication networks endlessly echoing and coordinating market action by dynamically informing everyone of everyone else’s trades. For instance, when you buy a car and sell a house, the economy responds adaptively by producing more cars and less houses. Even when you buy a public equity, you are expressing the idea its expected future cash flows are worth more than its current price, and the marketplace absorbs this thesis when you execute the trade. Price signals perpetually prime incentives to ensure resources are allocated in accordance with the current aggregate composition of market participant preferences. Entrepreneurs engaging in trade give rise to truthful pricing as they strive to buy low, sell high, and profitably serve one another. A true free market is a forum of unhampered and voluntary exchange where ideas compete, combine, and transform. Seen this way, the free market may be considered the ultimate distributed computing system — a nexus of consciousnesses driven by human action and interconnected by prices.

The distributed computing power of the free market is the most intelligent system in the world.

The distributed computing power of the free market is the most intelligent system in the world.

Money improves the extensibility of our minds. Thinking is an expression of rationality: the act of comparing all relevant factors to any course of action. By cognitively generating different aspects and avatars relevant to any given situation, humans create mental staging areas for future action. As with the root word of rationality — ratio — thinking involves contrasting one thing against another. When we extend our thinking into money, we gain insight into the collective mind of other market participants through price signals, which themselves are expressions of rationality: ratios of exchange denominated in monetary terms. By consolidating the rationality of all market actors into the market price, ideation explodes. In this way, free markets are idea-generating supercomputers. This is why American innovation is unrivaled. Mankind makes the world his own by channeling energy across the ideological field lines fashioned in his extended mind—the free market.

Free Markets are Free Thinking

“Man’s mind, once stretched by a new idea, never regains its original dimensions.”—Oliver Wendell Holmes

Contrary to popular misconception, money is not a government creation. Money is emergent—it is simply the most tradable good in any given market. As people seek to satisfy their wants through trade, they steadily seek to trade their goods for more tradable goods to get closer to obtaining the object(s) they desire. As this process unfolds, a certain asset gains the highest liquidity—whether it is salt, cattle, or gold—this most exchangeable good is (by definition) money. Money, then, is an inexorable outcome of free trade.

As global markets converged, they coalesced around precious metals as money due to their superior monetary properties of durability, divisibility, portability, recognizability, and scarcity. Gold—which excelled all other metals in scarcity—became the dominant money of the world precisely because its supply was the least changeable. Central banks eventually coopted gold and built a pyramid scheme on it called fiat currency. When central banks monopolized the market for money, it became unfree. Violating free market capitalism, as Soviet Russia learned the hard way, is a really bad idea—it runs countervailing to the natural human proclivity for trade, ideation, and wealth generation. As Marcus Aurelius poeticizes our capacity for collaboration:

“We were born to work together like feet, hands, and eyes, like the two rows of teeth, upper and lower. To obstruct each other is unnatural.“

Clearly, obstructing the ability of market participants to express their ideas through trade is a breakdown in the “rules” of capitalism. All frictions on free trade are dissipative to both innovation and wealth creation. A true capitalist society necessitates unbreakable rules of trade such as equitable rule of law, inviolable private property rights, and unstoppable honest money. In such a pure capitalistic system, individuals would have no way to create value for themselves other than giving society what it wants (even if its wants are as yet unarticulated). But our over-regulated world today is a far cry from this ideal.

All regulations are limitations on free market forces that constrict ideation and its physical manifestation: wealth creation. The ultimate expression of legal regulation is monopolization, in which all peaceful competition is suppressed through coercion or violence. In the world today, the market for money is not a free market, as it is forcibly dominated by cartels of central banks — legal monopolies that distort prices, reduce trade, and interrupt ideation. Tellingly, central banking was also a key component of Soviet communism—an exclusive state-owned banking monopoly was the 5th measure in Marx’s 1848 Manifesto to the Communist Party. True capitalism has never existed, precisely because the rules of money have always become twisted by interventionists pursuing their own pecuniary gain in every market known to history. Legal impediments erected by governments to insulate central bank monopolies on money from free market capitalism are manifold. Such artifice destroys accountability, ingenuity, and virtue.

With unbreakable capitalistic rules, the “game” of macroeconomics would impose an organizing principle onto humanity, encouraging us to find better ways of saying, doing, or making things by betting against each other in the marketplace as opposed to lying, stealing, or taxing. When rules cannot break, play is fair, and want-satisfactions escalate. As “players” prove one another wrong in the marketplace—by discovering and selling better means of satisfying wants—the resultant productivity gains diffuse into society through trade. An environment conducive to continuous learning at scale is cultivated through capitalism. Said differently: when ideas compete freely, more wealth is created—most often in the form of better tools, services, or knowledge. Mises describes this inextricable relationship between ideation and market competition in his masterwork Human Action:

“But competition does not mean that anybody can prosper by simply imitating what other people do. It means the opportunity to serve the consumers in a better or cheaper way without being restrained by privileges granted to those whose vested interests the innovation hurts. What a newcomer who wants to defy the vested interest of the old established firms needs most is brains and ideas. If his project is fit to fill the most urgent of the unsatisfied needs of the consumers or to purvey them at a cheaper price than their olde purveyors, he will succeed in spite of the much talked of bigness and power of old firms.”

To use Ray Dalio’s term: free markets are idea meritocracies: unhampered trade networks that incentivize the cultivation and infusion of the best ideas into civilization. Implicit in the meta-idea is the presupposition innovation can only be nurtured, not legislated. Here, the ignorance of MMT advocates clamoring for “the activation of idle capital through inflation” rears its head: proceeds from theft via inflation can mobilize people and capital, but only in an unintelligent way since bureaucrats lack both the accountability and distributed computing power endogenous to the free market, and only until this parasitization of value from the productive economy kills it. In simple economic terms: free markets make mankind more productive; monopolies, or unfree markets, make mankind less productive. Further, the condition of our collective mind closely mirrors the state of our money. We only think in dollars today because they were once redeemable for gold. Central banks have hijacked the monetary extensibility of our minds (the old “bait and switch” tactic), and corrupted our capacity to perceive the world clearly:

Central banking distorts market pricing by counterfeiting currency.

Free minds need freely selected money. By embracing a free market paradigm in the totality of our actions we become more free thinking, intelligent, and wealthy. Another way to think about the free market is as a system of error detection and correction: through prices, it incentivizes the discovery and resolution of unsatisfied wants (socioeconomic errors). Central bank induced inflation distorts this error correction system, and causes dissatisfactions to swell. This market manipulation is (ostensibly) justified by the self-deceptive intentionality of central bankers to “manage the economy,” as if any human had ever successfully managed any complex system without triggering a cascade of unintended consequences. Conviction in the utility of their necessarily limited knowledge, as opposed to the free market processes which continually revivify knowledge, is the black core of central bank malevolence. As John Milton, author of Paradise Lost, brilliantly observed:

“Evil is the force that believes its knowledge is complete.”

Central banks could repent merely by admitting this gargantuan error in ideology, and letting the free market clear its 100+ years of errors. This would be painful at first, but undoubtedly in the long-term best interests of civilization—like a drug addict finally entering rehabilitation. But hubris and greed will almost certainly prevent such an ideal outcome. To summarize the argument: free market pricing is an error-clearing system, and central banking ameliorates its capacity for error detection and correction; acting as if its knowledge of markets is complete, central banking is evil incarnate—an institution of economic tyranny as misguided as Soviet Russia. In the ideological sphere, freedom is as creative as tyranny is destructive.

The Greatest Idea of History

“An Idea Is Salvation By Imagination.” — Frank Lloyd Wright

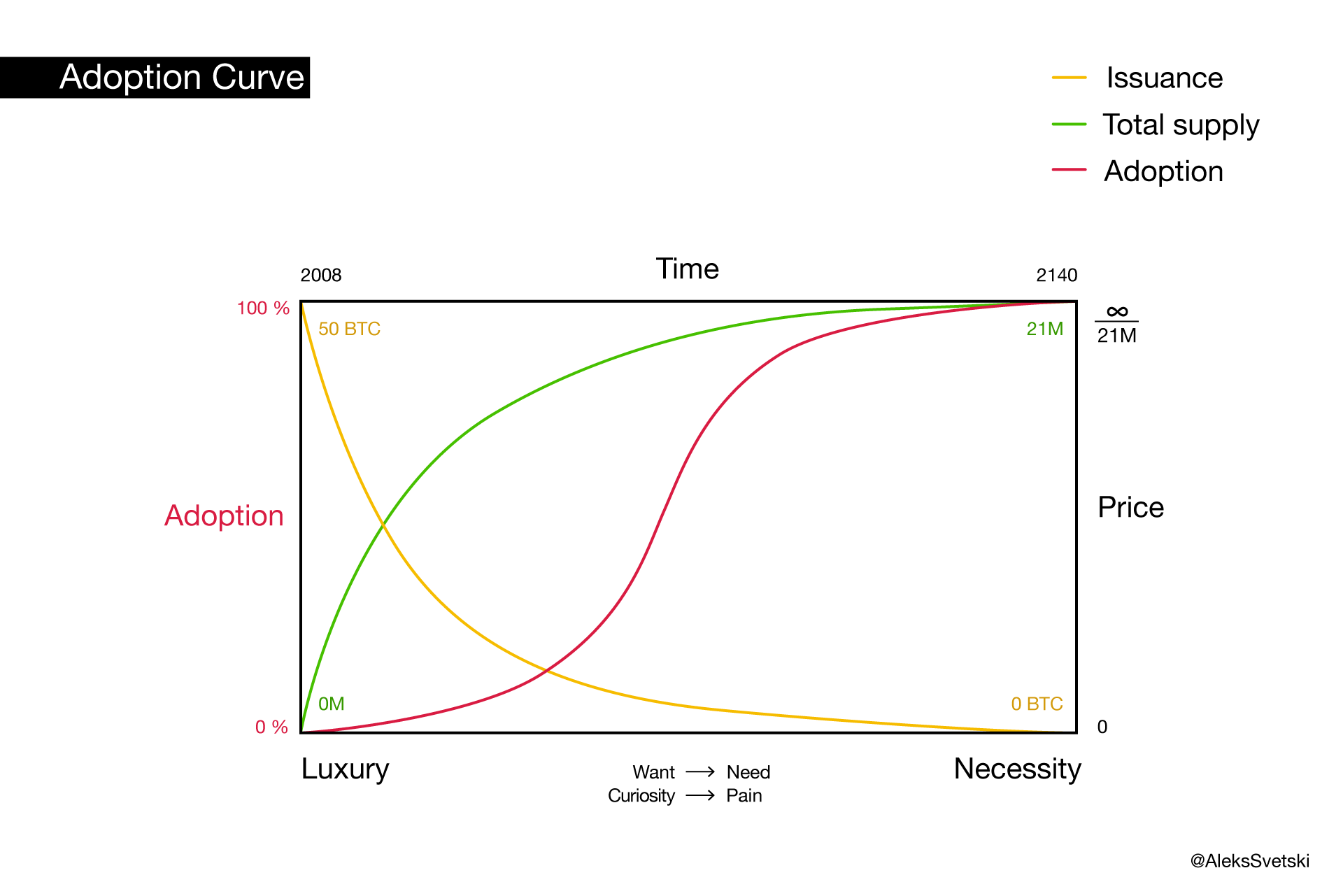

Quintessential to the idea of any money is that both present and future market participants will freely accept it in trade. The likelihood of a money to be accepted by the broadest possible set of trading partners is largely based on how reliably it maintains its scarcity across time. To maximize this store of value function, a money must be resistant to misappropriation—whether by inflation, counterfeit, or confiscation (all of which are theft). The money most resistant to involuntary exchange (aka theft) tends to become the most widely adopted voluntary medium of exchange. Put another way: in free market competition the most theft-proof money wins. Those who erroneously choose a less theft-proof money are disfavored by market processes when their wealth is compromised by thieves through inflation, counterfeiting, or confiscation. Another way to say it: market participants adopt the money which minimizes the need to trust one another. Central banks continue to hoard gold because it is trust-minimized money. Bitcoin exhibits even greater trust-minimization qualities, and is therefore disruptive to gold.

Bitcoin is a renaissance of free market forces.

Money is the best idea we’ve ever had, for without it, all the other marvelous ideas generated by markets would not exist. As the most tradable thing, money is the highest instantiation of our meta-idea, offering us unbridled optionality in market exchange. As a technology, free-market-selected money maximizes both human freedom and cooperation. Historically, gold reduced the incentives to violence, because it was a more securable form of wealth than food, land, and most other assets. In this way, gold greatly constricted the scope of assets worth fighting over, thereby inducing unparalleled social cooperation, trade, and wealth generation. This has profound moral implications too: when money is hard to steal, society becomes hard working; when it is easy to steal, society drifts toward kleptocracy. Let me state the argument in a single sentence: gold was the greatest tool we ever had to incentivize ourselves to civilize ourselves.

If the aim of humanity is to build civilizations, then our most brilliant idea was the use of gold as money.

The global gold standard improved trade (our meta-idea) in a trust-minimized way and standardized the world to a single monetary protocol—thereby maximizing time-savings in trade and its associated wealth creation (two sides of the same coin). Again, wealth creation is absolutely dependent on ideation: using gold as money led the world into an unequaled effulgence of novel ideas and innovations, ushering in an era known colloquially as both The Gilded Age and La Belle Époque:

La Belle Époque—an era of significant innovation and wealth creation—was also considered the “beautiful age” of painting. This epoch of civilization was built on the idea of gold being used as money.

A brilliant idea indeed, but far from perfect: because gold is physical, it is still vulnerable to theft; and because gold is heavy, economies of scale related to its use as money led to the centralization of its custody in bank vaults (since it is cheaper to transact in paper abstractions of gold than physical gold). An anticapitalist institution—the central bank—festered around these centralized gold hoards. These deceptive and evil institutions operate with flagrant disregard for the tenets of capitalism: central banks are above the law, practice perpetual private property confiscation via inflation, and peddle the most dishonest money in history. All central bank business models are critically dependent on the divisibility, portability, and recognizability shortcomings of gold:

- If gold were perfectly divisible, there would be no reason to abstract it into paper currency

- If gold were perfectly portable, it would be encoded as information and there would be no need to place trust in banking custodians as final settlement could be conducted at the speed of light

- If gold were perfectly recognizable, there would be no economic gain from the “public stamp” of national currencies as anyone could verify the veracity of money themselves instantaneously

Indeed, these technological failings of gold formed the attack surface repeatedly exploited by central banks. Fortunately for citizens of the 21st century, free trade—which has been exponentially enhanced by the internet and digital technologies—has generated an even more brilliant idea that promises a permanent ending to the thieving schemes of central banks.

The Greatest Idea of Modernity

“There Is One Thing Stronger Than All The Armies In The World, And That Is An Idea Whose Time Has Come.”– Victor Hugo

America was founded on the three pillars of free market capitalism: private property rights, rule of law, and honest money. The American Constitution authorized states to issue gold or silver currency, outlawed income tax, and prohibited national central banking. Unfortunately, upon successful implementation of the American central bank (after two failed attempts), the private property rights foundational to free market capitalism became vulnerable to limitless violation via inflation. An example of this failure came with the “Great Gold Robbery of 1933” (aka Executive Order 6102): an unconstitutional decree and blatant violation of private property rights. All government decrees by fiat are lies (including fiat currency), for truth need never be forced. Free market forces always zero-in on truth.

Bitcoin perfectly exemplifies the ideas America was founded upon—it is American AF.

Bitcoin is the ideological synthesis of gold and the internet; it perfectly exemplifies the three pillars of free market capitalism undergirding the idea of America in a form that cannot be perverted by fiat decree. As its money supply cannot be changed, its holders are immune to confiscation via inflation, thus perfecting their private property rights (Pillar 1). Disputes within the Bitcoin network are settled consensually, and it is impractical to employ violence in an attempt to sway this process, thus perfecting the process of nonviolent dispute resolution embodied by the rule of law (Pillar 2). By perfecting these first two pillars of free market capitalism, Bitcoin is a self-fulfilling prophecy predestined to perfect its final pillar by becoming the final evolution in free-market-selected honest money (Pillar 3). As the only sacrosanct money in existence, Bitcoin is purified capitalism: a permanent implementation of the soundest socioeconomic “water well” in history:

Bitcoin is purified capitalism: an elegant mathematical solution to the past problems of money.

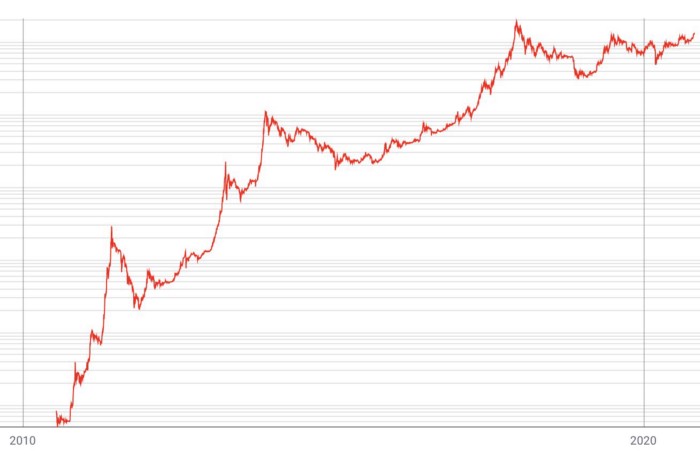

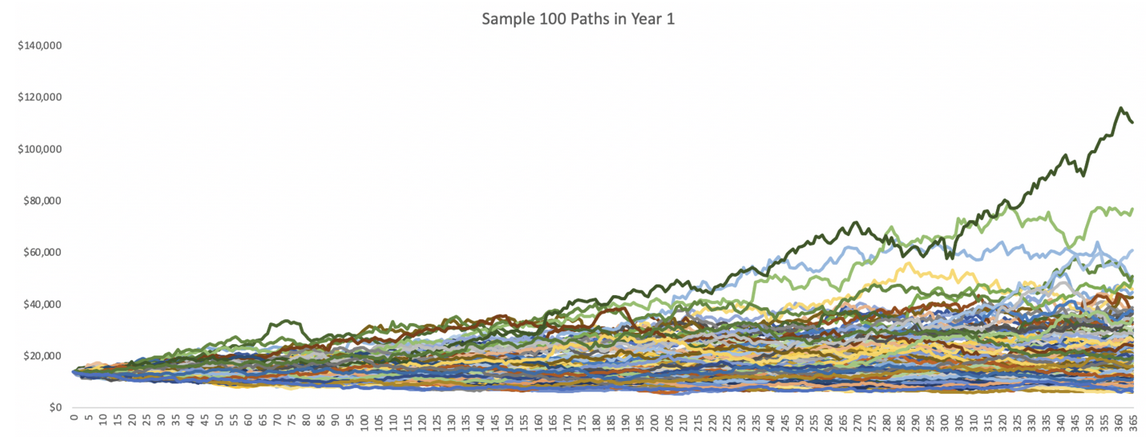

Competition and collaboration are the trades of life. Conservatism of energy is truth—organizations, methods, and tools that accomplish the greatest results with the least effort tend toward dominance as they are willingly embraced by market participants whose “skin is in the game.” Strict adherence to thermodynamic principles is the way all natural systems grow (there is no other way). Monies, moralities, and strategies which best amplify productivity outcompete on the free market for ideas—submission to this truth is freedom. Bitcoin is a system that minimizes competitive asymmetries by maximizing accountability, and thereby incentivizes fair play and error-clearing in the market. Modeled on the unbreakable rules of the universe—thermodynamics—Bitcoin is best known for its meteoric growth pattern:

Adherence to thermodynamic principles has made Bitcoin the most explosive money in history.

We are what we build, and we build what we are. Ideation and wealth creation are mere expressions of life’s central impulse: growth. Without adequate levels of exchange, growth of organisms and economies deteriorate. On this point, nature is ruthlessly clear: when you’re finished changing, you’re finished. As we age, we experience a slowing of blood flow, which presages a breakdown of body and mind. Physical exercise can provide some protection by increasing our metabolic exchange of oxygen, water, and nutrients thereby keeping us smarter, healthier, and more energetic as we grow old. As William Durant eloquently describes this decline into senescence:

“It is a physiological and psychological involution. It is a hardening of the arteries and categories, an arresting of thought and blood; a man is as old as his arteries, and as young as his ideas.”

What is true for the individual market participant microcosm is true for the global market macrocosm: impeding free trade constricts ideological “blood flow” and makes the “socioeconomic superorganism” (aka humanity) more vulnerable to disease and death. Close-minded constituents conjure a build up of misfitness to reality for the collective. Creating blockages to trade via regulation and confiscation—the implicit purpose of central banking—is cancerous to the free market paradigm that invigorates our economic vitality, social morality, and the advancement of civilization.

All individuals seek to attain freedom, goods, and power for themselves. Governments are simply a multiplication of ourselves and our desires, without external governance, and armed with weapons of mass destruction. No amount of tears can wash away the blood war sheds, only practicality, properly implemented, can prevail. Absent a battle to fight — whether moral or physical — people become weaker. Arraying armies against an enemy gives people cause for unity. Perhaps Bitcoin will serve as a moral alternative to war — a peaceful yet disciplinary force on humanity. American Pragmatist William James believed a “moral equivalent” of war was necessary to end its horrors:

“So far war has been the only force that can discipline a whole community, and until an equivalent discipline is organized, I believe that war must have its way.”

If this proves true, Bitcoin would become a new organizing mode for civilization: like a religion born from economic and computer science; a wisdom tradition that defunds and destroys central bank war machines and ideologies. Warfare is Darwinism writ geopolitical, and its atrocities will be endless until all nations agree, or are forced, to yield their self-arrogated sovereignty to a higher authority — a “superstate” hodling individual sovereignty as its axiomatic mantra. Bitcoin — a public utility that facilitates trade flows of private property — is the bridge between communistic utopianism and capitalistic pragmatism, and could grow to become the superstate to which all nations bend the knee. Perhaps this ultimate usurpation of the nation began with the Genesis Block on day one, or perhaps it is still yet to transpire one day. For now, we can only say: Bitcoin is money.

Money is the ultimate token of trade, and trade is mankind’s meta-idea. Whatever wins as money on the free market is a brilliantly formulated, civilizing idea. Capitalism is the socioeconomic system which optimizes for the expansion of trade’s scope by respecting free market principles, foremost of which is individual sovereignty. Bitcoin—an honest money offering its holders inviolable private property rights and perfected rule of law—is the capstone innovation of capitalism. It is as if all trade throughout history led us to the emergence of this idea: an unstoppable, incorruptible, and highly accessible money. Like ideas, Bitcoin exhibits non-corporeality, virality, and antifragility—it can be moved at the speed of light and stored in the mind. By virtue of its resistance to theft and rootedness in the thermodynamics of work, Bitcoin portals us into a world of untold liberty, elevated morality, and enhanced productivity. Bitcoin gives us the freedom to: trade without central bank interference, store our wealth in a place resistant to seizure, and to embrace truth in a world drowning in deception.

Considered in combination, these ideas make Bitcoin mankind’s most brilliant idea yet—a salvific foundation on which we can build a future civilization characterized by more ingenuity, morality, and prosperity.

“Salvation: to see each thing for what it is — its nature and its purpose. To do only what is right, say only what is true, without holding back. What else could it be but to live life fully — to pay out goodness like the rings of a chain, without the slightest gap.” — Marcus Aurelius

Thank you for reading Our Most Brilliant Idea.

- Subscribe to my YouTube Channel: bit.ly/321Lzm0

- Follow me on Twitter: https://twitter.com/Breedlove22

- Stack sats with me, get $10 in free Bitcoin through this link: https://www.swanbitcoin.com/breedlove

- Journey with me as I write my first book: https://bit.ly/3aWITZ5

- If you enjoyed this, please send sats: https://tippin.me/@Breedlove22

- Or, send sats via Lightning Network with Strike: https://strike.me/breedlove22

- Or, send sats via PayNymID: +tightking693

- Or, send dirty fiat dollars via PayPal: https://www.paypal.com/paypalme/RBreedlove

- Or, send dirty fiat dollars via Venmo: https://venmo.com/code?user_id=1784359925317632528

Bitcoin accepted here: 3CiBznmvP2jXVSPR9bUWZwSNtbe9ubp36M

Translations:

Thank you for feedback during the writing process: Jimmy Song Brandon Quittem @Greg Z Zach_of_Earth

My sincerest gratitude to these amazing minds:

@real_vijay, Saifedean Ammous, Brandon Quittem, Dan Held, Naval Ravikant, @NickSzabo4, Nic Carter, @MartyBent, Pierre Rochard, Anthony Pompliano, Chris Burniske, @MarkYusko, @CaitlinLong_, Nik Bhatia, Nassim Nicholas Taleb, Stephan Livera, Peter McCormack, Gigi, Hasu, @MustStopMurad, Misir Mahmudov, Mises Institute, John Vallis, @FriarHass, Conner Brown, Ben Prentice, Aleksandar Svetski, Cryptoconomy, Citizen Bitcoin, Keyvan Davani, @RaoulGMI, @DTAPCAP, Parker Lewis, @Rhythmtrader, Russell Okung, @sthenc, Nathaniel Whittemore, @ck_SNARKs, Trevor Noren, Cory Klippsten, Knut Svanholm @relevantpeterschiff, Preston Pysh, @bezantdenier

And anyone else I forgot :)

Sources:

a. https://www.grunge.com/91938/ideas-changed-course-humanity/

b. Rational Optimist by Matt Ridley

c. Meditations by Marcus Aurelius

d. Fallen Leaves: Last Words on Life, Love, War, and God by Will Durant

e. Manifesto to the Communist Party by Karl Marx

f. https://oll.libertyfund.org/pages/did-bastiat-say-when-goods-don-t-cross-borders-soldiers-will

Thanks to Brandon Quittem, Jimmy Song, and Zach_of_Earth.

The Costs that Haunt Your Dreams of Hyperbitcoinization

By Emil Sandstedt

Posted September 3, 2020

Capitalism, Division of Labor and Money

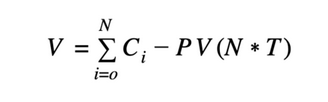

Capitalism incentivizes profit seeking, meaning profit margins are eyed vigilantly. Any sector or niche is vulnerable to attracting entrepreneurs that set to work on making themselves richer, unintentionally shrinking said margins in the process. This profit seeking is conducted by utilizing money, as money leaves the entrepreneur through costs and reaches the entrepreneur through revenues. The entrepreneur, as a way to maximize profits, has chosen to specialize and is thus part of the massive, decentralized collaboration we call Division of Labor. As a participant, he must make use of money — the fragile glue that binds the whole construction together. Therefore, with ever increasing profit seeking and specialization in the world, and therefore ever increasing trade between participants, the transaction costs of money see a continuous increase in economic importance. It follows that transaction costs is an important factor in determining the money of a highly specialized future.

In Mises’s Evenly Rotating Economy abstraction, every day is the same; yesterday is no different from today, and today is no different from tomorrow. In such an economy, all the factors of production are employed in such a way that they provide the highest valued service possible. There are no more entrepreneurs as all profit margins have already been fully exploited. Since every day is the same, there is also no more uncertainty, and so instead of holding money that for instance would put the holder first in line to react to future economic surprises, individuals have simply exchanged their money for debt or equity. The lending- and investment periods in the thought experiment are of course fully flexible, meaning any period could be stipulated in contracts. Since everyone knows the future, they have lent out or invested their money, and the value of money has fallen to zero. Phrased perhaps more coherently, due to no more surprises ever occurring in the economy, producers have set up perpetual barter contracts defined in the final prices of goods and services, and no actual money is used. In this way, the same trade outcomes are iterated day after day without incurring unnecessary transaction costs through the use of an intermediary good. The main takeaway from all this is that, only if the future is uncertain will individuals demand to hold money. Money is for uncertainty.

Money then, to summarize, must facilitate profit seeking or entrepreneurs will use a money better suited for the purpose. It must also facilitate a possibility to respond to unexpected changes such as stock market crashes or unexpected new production (both for which sellers ask for money in return);money is for the proverbial rainy day — an idiom from a time when the weather could not be well predicted. From these prerequisites — two sides of the same coin — it follows that money can only stay money and stay valuable as money if transaction costs are low. If such costs get too high, trade and division of labor are simultaneously eroded until a better money is adopted. The higher the transaction costs, the closer the world economy resembles one-man Robinson Crusoe economies, where holding money obviously is as worthless as in the Evenly Rotating Economy; in this hypothetical case there is certainty not about the future, but that there is no-one to profitably trade with.

Costs of Bitcoin

A severely limited block space, though prudently defending against fraud, monetary over issuance and fatal tinkering by leaving users in control of both economic rules and validation, also means on-chain fees rise astronomically should hyperbitcoinization proceed. Bitcoin is monetarily rather unique in this regard, that it becomes more expensive to use the more people that are using it — a point previously made by Deryk Makgill among others, and I have to say, an obvious hurdle standing between genesis and hyperbitcoinization. When gold was money, certain gold transactions were crowded out in not the same but a similar fashion, as the physical amount of gold for small-value transactions became too impracticable and costly for the buyer and seller to handle — hence the use of silver and copper as money. But in any case, no Bitcoin profit seeking can be expected to take place on-chain, but rather on higher, more complicated layers on top of Bitcoin, such as through Lightning channels and various centralized database solutions offered by third-parties. Only if total costs through such scaling attempts decrease enough to make Bitcoin the generally cheapest medium of exchange can it attempt to monetize fully and become money. By viewing potential Bitcoin hyperbitcoinization through the lens of its ability to be used in universal profit seeking or in reaction to general economic uncertainty, we are simply reiterating a more pragmatic version of the now rather well understood Mengerean theory of money and saleableness. In this theory of money, the winner-takes-it-all effect leaves little room for insufficiencies. This is why Bitcoin transaction costs become incredibly important when speculating about hyperbitcoinization. Somewhere around here, in this mess we call money and economics, is where some people get confused.

Managing Lightning channels are, and likely will be, both tricky and expensive in the foreseeable future. Inescapable costs are for example channel settlement, larger attack surfaces with regards to theft, and larger incident surfaces with regards to simply losing control of Bitcoins due to software bugs or interface deficiencies. Although less tricky and less expensive in some regards, using centralized Bitcoin schemes supplied by trusted third-parties of course introduces other costs. While escaping direct on-chain transaction costs, including costs of settling channels, as well as costs related to bugs in the scaling software, new costs related to custody make themselves felt; legal looting by governments, conventional theft by the custodians themselves, and fraud. So, in an attempt to make up for the sub-optimal prospects of a subset of Bitcoin’s congestion related costs, it is tempting to point to the solution of hodling. To be clear, holding on to a good is of course prudent if expecting monetization to continue. Only a fool would want to get rid of a good he expects to increase in value, as he can just spend bad, inflationary fiat money instead. No, the confusion is not about the rational (non)act of holding on to a medium of exchange currently surfing a Mengerean monetization feedback loop, but about why a specific medium of exchange would qualify for such a loop in the first place; by hodling Bitcoins, and because producing new Bitcoins is a task that seldom becomes any easier, enough costs are thought to be escaped to have total costs stand in competition with established monies. In other words, through hodling, it is said, the saleableness of Bitcoin is high enough to have it start dethrone less saleable monies and impose itself on a shocked world economy through blitzkrieging hyperbitcoinization. There is just one problem: the superior saleableness (which by the way decreases with hodling) may be artificial and therefore shatter in real economic situations.

At a glance, the logic behind lowering costs through hodling seems to check out. By not spending Bitcoins, saleableness-eating transaction costs of course do not accumulate. Saleableness-eating supply dilution costs have already been conquered with the supply cap and the difficulty adjustment algorithm. But anyone decreasing costs by hodling his Bitcoins over a longer period of time is put in the awkward situation where his Bitcoins are now in competition with conventional debt and equity rather than with conventional monies. The reason a person can’t escape monetary costs by making his money artificially illiquid is because the opportunity cost of not lending and not investing then would make itself felt. Another opportunity cost — the inability to act during future economic uncertainty — will take its toll as well for those finding themselves hodling Bitcoins for the sole purpose of lowering costs. To be first in line to spend during a sudden crisis is only an opportunity if the money is not already artificially promised not to be spent. In other words, there are costs for prohibiting your money from being used as money. It is binding yourself to the mast of a ship when you may have to steer it later to escape the storms.

In short, certain costs that people are trying to escape, are very, very hard to run away from because they haunt the attempted money in various forms. There is no running away from what money is meant to be. This means that hodl, by the very nature of how money is successfully used, can’t help make Bitcoin money in and of itself. Only functional scaling can, and that road is full of uncertainty and danger. Hyperbitcoinization then stands or falls with, among other things, the attempted technical solutions’ ability to drastically lower total costs, and not with any collective hodl incantations. The cost situation is serious enough as to having prompted some intelligent Bitcoiners to capitulate with regards to off-chain scaling. They now embrace low on-chain transaction fees and, in my opinion, therefore may stumble into other scary and hidden costs related to the inability of choosing economic rules and validating transactions. For some of these people, it seems to simply be a disagreement about the promises of off-chain scaling as they are seen wandering the foggy transaction- and validation cost trade-off frontier in war-afflicted Bitcoin land.

On a slightly different, albeit more ridiculous note, some Bitcoiners have pursued hodling as part of their sacrifice to the collective. Such self-inflicted economic flagellation is not the same cost as the ones described above, but it goes without saying that if the Bitcoin you own is so bad that it demands sacrifices from you, it is not going to survive very long.

Money or not — how much does it matter?

Whether Bitcoin can become money or not is a question time will answer; the factors involved are complicated enough to throw certainty aside. Still, it is worth thinking about what Bitcoin is if it fails in becoming money. Although what individuals choose to use as money arguably is a manner of subjectivity, Austrian monetary theory has, as earlier indicated, a more objective view of this and states that only the most liquid good is money. In other words, according to this viewpoint, Bitcoin is not money unless it is globally used as a highly liquid medium of exchange. The exclusivity born out of this definition takes us to an interesting focal point. A focal point is something that facilitates an above average probability that the same decision may be made by various parties, absent communication. Absent communication, but knowing the exact day they are supposed to attack, most Byzantine generals likely unsheathe their swords at noon.

Being money then, in a digital world where code bases can be copied and blockchains forked without costs, is thus a focal point worth thinking about. Unlike gold, as an example, Bitcoin can be copied and forked to oblivion over the coming decades, but the position as being money cannot, under Austrian definition. It is because of this that Bitcoiners such as Daniel Krawisz argue that becoming money is the moat Bitcoin needs if it wants to succeed in the long run. A Bitcoin which fails to become money (for example by not facilitating profit seeking), according to Krawisz, would find itself worthless in the end precisely because the neccesary focal point is lacking. I am much more optimistic.

Gold is not used as money today, yet is worth an incredible amount. The reason some refuse to extrapolate that fact and apply it to a Bitcoin not used as money is what has already been touched upon, that Bitcoin is digital whereas gold is not, and so in the long run lacks the focal point needed for it to be distinguishable from digital copies. But there are other focal points involved. Admittedly, becoming global money would be an excellent additional focal point for Bitcoin, given the adversarial nature of no-cost copying. But it might be the case that Bitcoin can’t be money, and so there won’t be any such hyperbitcoinization. This scenario is, it seems to me, not unlikely. Instead, being, and having been for over a decade, the first, most valuable and most liquid cryptocurrency, is a sound focal point as well, with a similar exclusivity extracted out of its definition. It is likely that, given that decentralization, a non-changing code base, and other prerequisites don’t break down in the future, this focal point is enough to build the moat against future digital contenders, despite lacking the focal point discussed earlier. To summarize, a Bitcoin failing to become money is likely to still have a good chance of becoming and staying highly valuable for the same reasons gold stayed valuable after demonetization.

Gold, although not used as money anymore, is still a hedge against coercion and violence of various sorts; escaping inflation may be attempted with equity and other assets, but escaping violence in a similar fashion can be hard as many of the assets are immovable and thus confiscatable or destructible. Owning factories or conventional real estate will do you no good if the Enemy’s war apparatus set to work, or if your fellow countrymen suddenly deem you of an inferior race, or of a heretical religion, or of an exploitative class. When fleeing a country, or fleeing certain government edicts within a country, the shape and form of owned assets decide the success of how much wealth survives. Gold has facilitated good enough resistance against such forms of violence, why it has kept its high valuation beyond the fate sadly bestowed upon it in the previous century. For similar reasons can a non-monetary Bitcoin attain a very high valuation if it facilitates even better resistance against coercion and violence, which, arguably, it does. The confiscation resistance is one of its biggest strengths and it is easy to imagine future scenarios where families escape wealth destruction by simply holding Bitcoins private keys. If Bitcoin fails as money, in other words, it still would likely facilitate more prosperity and more justice through keeping intact property rights when nothing else could.

Special thanks to Daniel Krawisz and Deryk Makgill from whom I silently borrowed ideas about how money works.

Lies, Deception And Unnatural Money

By Nik Hoffman

Posted October 13, 2020 on Bitcoin Magazine

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning”

– Henry Ford

The continued functioning of the financial system you have lived under for your entire life is dependent on the average person not understanding exactly how it works, and there are many reasons for this. As you read deeper and deeper into this article, I hope that you will realize how deceiving our money really is. Governments and banks lie to you and take advantage of you every single day, most people just don’t realize it. The money you use to save your value or purchase goods and services is unnatural; it is the equivalent of manmade garbage that you’d throw away in a second if you understood it better and had a viable alternative to opt into instead.

I was always told growing up that the financial system was broken and that it doesn’t work properly, but that there were no good solutions to its problems. While most agree that the system is unfair, I wanted to find out what about it is broken exactly, and I did. But I also found that because the entire financial system is broken for the vast majority of people, that means it’s working just as intended.

What Makes Money Valuable?

Money is a fundamental aspect of our daily lives that touches almost everything that we do, but the vast majority of people aren’t taught everything they should know about the history of money and how it works.

So, what are people generally taught about money? At most, they are usually taught some basic Keynesian economic principles, which emphasize governments and central banks while deemphasizing the sovereignty of their constituents. Keynesian economics are macroeconomic philosophies that developed in the wake of the Great Depression, but have resulted in an unfair system that most people don’t understand, even if they live under it. But here is some truth about what really makes money valuable.

Good money typically has six main characteristics: durability, portability, divisibility, uniformity, scarcity (limited supply) and acceptability. Each one of these characteristics plays a key role in the value that a certain form of money can provide, with all different forms of traditional money having tradeoffs.

All effective monetary media throughout history have possessed some combination of these qualities, but not all. Historical forms of money include gold, silver, stones, seashells, glass beads and more. These tools were used as money because they fulfilled a certain role in a given society typically in either storing value or facilitating exchange.

Money is a universal tool used by everyone to exchange value for goods and/or services; it’s an asset that requires certain characteristics to be functional in exchange. If someone is using money without most of these characteristics, then it is bad money.

The U.S. dollar, for instance, is not durable, it has an unlimited supply, it’s not very divisible and doesn’t have solid uniformity. You can use just about anything people deem as having any value as money, but there are long-term, harsh consequences to using bad money. Such as wealth evaporation.

Good money comes and goes and has always served a particular role in its given society. But over time, historically good money has often become bad money, as a society shifted to a better form of money. Money has evolved over time, adapting to its surroundings and technology. With enough time having passed, we’ve seen good money turn to bad money and ultimately fail, time and time again.

So, you may be asking yourself: “If these characteristics are what make good money, then how can good money turn to bad money and fail?”

Money Printing Is Inevitable

“The root problem with conventional currency is all the trust that’s required to make it work. The central banks must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

History has proven that if humans are able to print money, they will. Everyone wants a shortcut and nobody can be trusted with this power, as history has demonstrated.

It’s been estimated that during the time of the Civil War, about one-third of all of the money in circulation was counterfeit. And today, counterfeiting is still rampant. Zero Hedge reported earlier this year that a Chinese gold processor was behind a scandal involving 83 tons of fake gold bars, which would account for 4.2 percent of the country’s total gold reserves in 2019.

There have been many different examples of money printing throughout time, resulting from cycles of human greed that lead to lies, deception and unnatural money. Whether it be counterfeiting banknotes, gold bars or even glass beads, people will always try to get an unfair edge over others.

If you were to print money for little to no cost, quickly or over long periods of time, you end up devaluing everyone else’s hard-earned money. But since it costs you little to nothing to produce, you’re not losing any wealth, you’re just stealing it from everyone else. This same reasoning applies to “legitimate” money printing — not just counterfeiting, but governmental money production — and then becomes a function that is dependent on the people not realizing that their wealth is deteriorating.

Inflation stems from money printing, the same process that is known as “counterfeiting.” It’s unnatural, man-made intervention that screws up everything in an otherwise natural, free market.

Money Printing Is Unnatural

Now that we know what makes good money and that money printing is inevitable and inflationary, let’s take a look at the root cause of the failure of all previous forms of good money. If we look at the characteristics that make good money, there is one that stands out among the rest. I’m talking, of course, about scarcity, or the enforcement of a limited supply, which is critical in making good money and simultaneously something that is constantly being undermined by greedy people who find a way to exploit the system.

“Deception is an act or statement which misleads, hides the truth, or promotes a belief, concept, or idea that is not true,” according to Wikipedia. “It is often done for personal gain or advantage.”

As noted above, money printing only “works” if the majority of people don’t even realize that it is steadily devaluing their earnings and savings. People must be deceived into believing a false ideology about this practice, but that can only work for so long; as we’ve seen throughout history, bad money doesn’t last forever. The people who were deceived also pay for the consequences that bad money causes.

One of the most impactful stories of how money printing ruined a society involves the Rai Stones on the Island of Yap. These giant limestones were used as money there and stored families’ value for generations. These stones were very difficult to produce so, the bigger the stone, the more value it had, with some stones larger than a fully-grown human.

As Saifedean Ammous described in “The Bitcoin Standard,” the Island of Yap thrived until Irishman David O’Keefe immigrated there and saw the immense opportunity to mass produce these stones using iron tools. The key here was that O’Keefe was able to make these stones at a quicker rate and to make them smaller, making them more transportable. Over time, the Rai Stone market was so flooded that the stones became worthless, and the value held by the islanders was wiped out.

Effects Of Government Money Printing

One of the most recent examples of the devastating effects of money printing happened in 2019 when the Venezualan bolívar experienced hyperinflation of some 2,000,000 percent, destroying the wealth of the country. Venezuela was once South America’s richest country, until it started going down a slippery slope via corrupt leaders with deceiving, flawed and socialist ideologies. The country’s death knell was put into motion when President Nicolás Maduro was voted into office.

Maduro appealed to many voters because of his socialist policies, knowingly deceiving his target audience. Once Maduro was elected, the money printing press ran hot while deficit spending rose astronomically. The wealth of the country vanished as the once-richest country in Latin America became the poorest. The public was taken advantage of for Maduro’s ideological gain, and was ultimately punished, with many no longer being able to afford to eat.

The destruction of Venezuela’s national currency transformed the country into a totally failed state. Since the government has full control over the bolívar, they are able to force people to get paid at the official exchange rate, which is significantly less than it is on the unmanipulated black market, stopping the citizens from having any hope of saving their wealth or getting ahead, while benefiting the government by keeping hold over its citizens.

This horrible aftermath of money printing is not unique to this specific case. As you study the after effects of other hyperinflated currencies, it becomes apparent that the results are always the same.

You’re Being Blatantly Lied To

“The CPI is deliberately designed to understate and mask the inflation that the Federal Reserve is creating”

Inflation silently steals our wealth from right under us and yet, governments and central banks can’t even be truthful to us about that. But how do we calculate and know what the inflation rate is? We find out through something called the Consumer Price Index (CPI). According to the U.S. Bureau of Labor Statistics, CPI is a measure of the average change over time in the price paid by urban consumers for a market basket of consumer goods and services (food, housing, clothes, transport, medical care, recreation and education).

This bureau implies that CPI is calculated simply, but it’s actually extremely complicated. On the bureau’s website, you can download a PDF file with its methods of calculation. The only problem is that it’s a whopping 107 pages long! And to think it calculates just one simple and fundamental problem: the degree to which the money that you have today will be devalued by tomorrow. The main goal for the Bureau of Labor Statistics seems not to be solving this problem, but to be jumping through loopholes and twisting and turning things until it gets a low enough number to report to the public.

Even as real inflation goes up due to money printing, the government may say that there was 0 percent inflation for that year, because the government calculates inflation via CPI, which allows it to jump through loopholes to get a certain number most appealing to the public. A huge consequence of actual inflation means that your dollar is purchasing less and less every year while you end up getting taxed more because of CPI. Then, the government bumps you up into a new tax bracket in which you are now taxed at a higher percentage of your income and end up taking home less value than before.

It lies about the inflation rate for political gain and it saves the government money while stealing from the citizens.

Bitcoin Fixes This

Humanity cannot advance forward unless we solve the problem of money printing, and Bitcoin actually fixes this.

Bitcoin has all of the qualities of money as mentioned in “What Makes Money Valuable?” above, unlike all previous forms of money before, which have either lacked these qualities or failed to retain them.

Durability isn’t a problem for bitcoin, as it’s completely digital money that can’t be destroyed or withered like paper money or gold. Bitcoin is extremely portable and can be stored or transferred anywhere in the world with ease, as it is not bound to border restrictions — you can send money to anyone in the world no matter where you are, with it arriving safely and quickly.

Bitcoin is the most divisible form of money humanity has ever experienced. Whereas the U.S. dollar is divisible into 100 pennies at most, 1 bitcoin is divisible into 100 million units called satoshis (or “sats” for short). Bitcoin has strong uniformity as each unit is essentially the same as all others.

BTC is accepted by more and more people all over the world every day. We’ve seen a large increase in people, small businesses and large institutions that have come to accept bitcoin as money since it was introduced.

Lastly, the bitcoin supply is capped at 21 million, as mentioned above, and, as a result, it has a finitely limited supply. Historically, money printing was inevitable, but not anymore. Everyone abides by the rules of the network enforced by the nodes and miners, which keep everyone else honest and prevent anyone from ever increasing the supply cap, ever.

You can look at historical forms of good money as having a set of “rules” that the system is based on, until someone comes in and “cheats” the system for selfish gain. That money created by the cheater is unnatural and ruins the “game.” Bitcoin fixes this, because everyone and anyone is capable of running a full node to maintain their own exact copy of the Bitcoin ledger, which keeps everyone honest and prevents bad actors — especially when the nodes and miners are financially incentivized to do so!

Bitcoin is superior money compared to hyper-inflatable currency. It doesn’t bear the same problems that have come with forms of money in the past, and it prevents the issues mentioned above from happening again. History has shown that humanity has thrived when society had hard money, and the impacts of a currency that can never be hyperinflated look very promising. It has the potential to usher in a new Renaissance or Industrial Revolution.

And, last but not least, the Bitcoin network will never lie to you. It is open-source, meaning you can look at the code yourself, for free, right down to every last detail. BTC has an open ledger that lets you become your own bank, and the master of your money. With Bitcoin, you take back the power from the corrupted people you were blindly trusting.

Tweet Thread - The Four Valuation Frameworks for Bitcoin

By Vijay Boyapati

Posted November 9, 2020

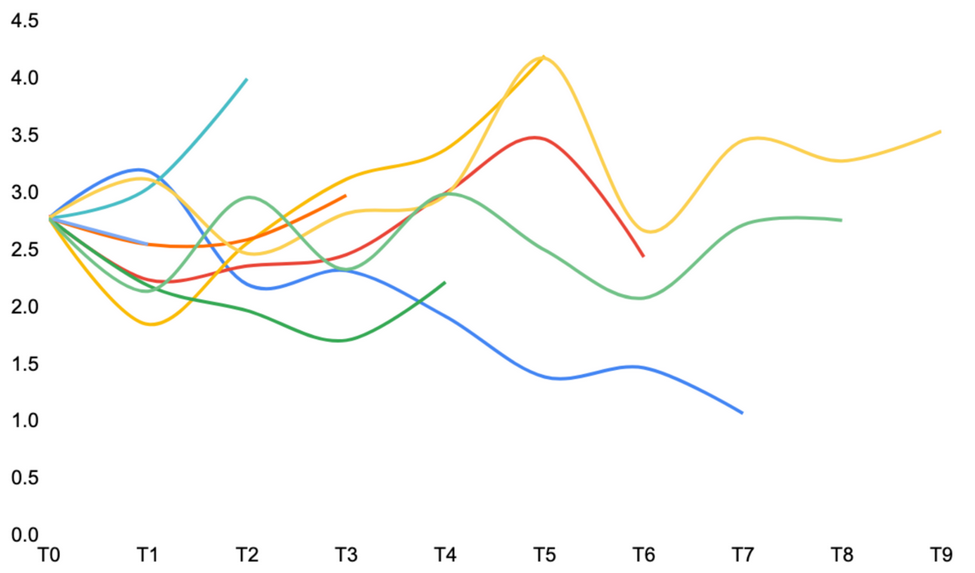

There are four main valuation frameworks for Bitcoin and I wanted to summarize them with a target valuation that one would assign if one subscribed to that framework.

Thread 👇

1) Bitcoin’s rise is equivalent to the Tulip Mania. It has no real comparative advantage to any existing monetary good or to the current fiat monetary system and is a bubble that will eventually pop.

Long term target price: $0.

2) Bitcoin is a new monetary technology whose appeal is largely limited to technologically savvy and libertarian minded people who can tolerate its volatility, which will be a permanent feature of its existence going forward.

Long term target price: $10,000 - $100,000

3) Bitcoin is a new monetary good that will primarily disrupt its closest monetary cousin, gold. It is significantly superior to gold along all the attributes that make gold a good store of value.

Long term target: $300,000 - $1,000,000

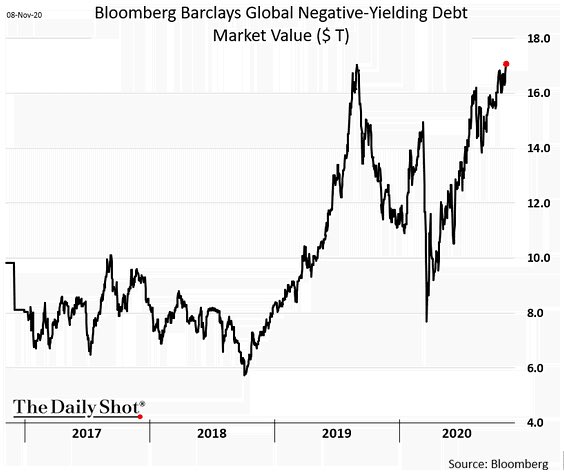

4) Bitcoin will ultimately become the world’s reserve currency. It is superior as a collateral asset to anything ever created and will eventually drain store of value premiums out of government bonds, real-estate, precious metals and rare art.

Long term target: $10,000,000+

After existing for a decade the first valuation framework, which was dominant in the early years, is now only subscribed to by ideologues and luddites (e.g., @PeterSchiff, @paulkrugman and @nouriel). No intelligent thinker who understands Bitcoin subscribes to this framework.

The primary valuation frameworks that investors subscribe to today are 2) and 3) with the market slowly transitioning from 2) to 3). Once framework 3 is widely accepted by the market, it will lay a foundation for framework 4 to be viewed as possible and even inevitable.

Exploring Bitcoin’s core values and why we defend them

By Hasu

Posted November 10, 2020 on Deribit Insights

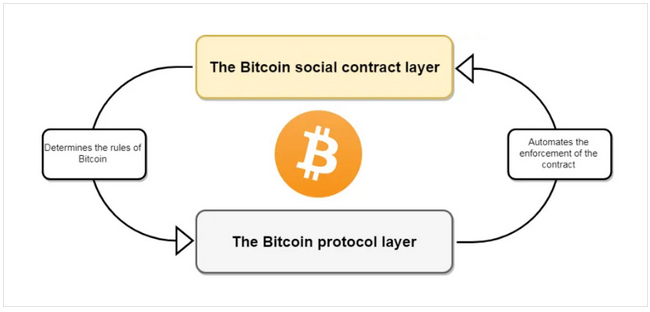

In his essay “Bitcoin’s Existential Crisis”, Nic Carter describes the identity problem that is inherent to Bitcoin. Because no one has the authority to give decentralized systems an identity, they rely on intersubjective consensus around a set of practical core values.

You can think of these core values as the lowest common denominator between all people in Bitcoin, and I tried to formalize them in Unpacking Bitcoin’s Social Contract – with the caveat that any such attempt is necessarily both highly subjective and chasing a moving target.

When people disagree about what Bitcoin is or should be, that can impact the real world in two different ways. For one, there is an unspoken rule that the protocol won’t be updated unless virtually all important stakeholders are satisfied with the proposal. When people disagree over basic principles, no major proposal can ever get the buy-in of all necessary parties. We call this “protocol ossification” and most people seem fine with it today because (1) Bitcoin doesn’t really need to change much from here, and (2) that resistance to change is seen as a valuable property that sets it apart from centralized systems of the past.

But there’s also the risk that some external event occurs that requires Bitcoin to change, whether in response to an attack or bug or more generally due to a lack of success in the market. In that case, the same governance gridlock can quickly become an existential issue as the community fractures into opposing sides.

Mutually exclusive narratives can coexist with each other for some time, but eventually they reach their boiling point. That was the case in Bitcoin with the collision of “Bitcoin is for cheap payments” vs. “store of value” and in Ethereum with “code is law” vs “social consensus is law”. Both sides had just as much a credible claim to being right, because there is no central party to „tie-break“ their disagreement. The only way these conflicts resolve is via messy social consensus formation, market signals, and in some cases, permanent community splits.

The biggest questions today are probably how to address possible incentive problems due to the declining block subsidy, and how private Bitcoin should be in the wake of increasing blockchain surveillance. Nic and I tried to account for these and other possible narrative collisions back in our article Visions of Bitcoin.

As Nic puts it, „systems with more internal consistency and more universally agreed upon value sets are better equipped to last.“ That suggest the optimal social contract

(1) has a very small number of rules (to include as many people as possible)

(2) that users are highly committed to if something ever goes wrong with the software.

In today’s article, I want to build on this existing body of work by exploring where real bitcoiners actually draw the line in terms of their core values, where their logic might reveal potential narrative collisions, and what all this means for Bitcoin’s future.

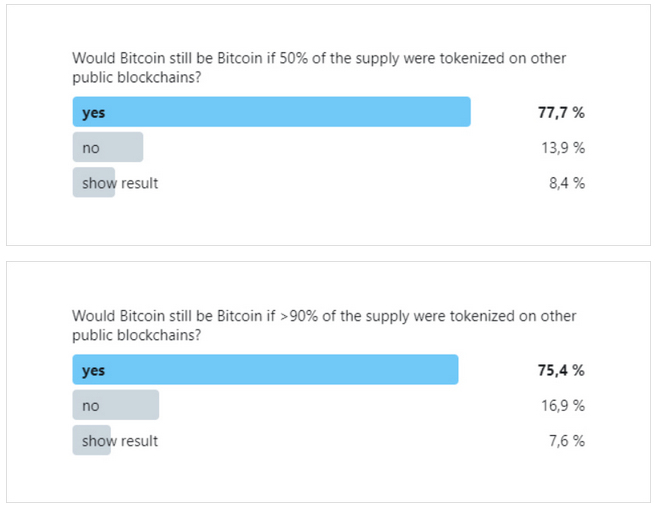

Introducing the questionnaire

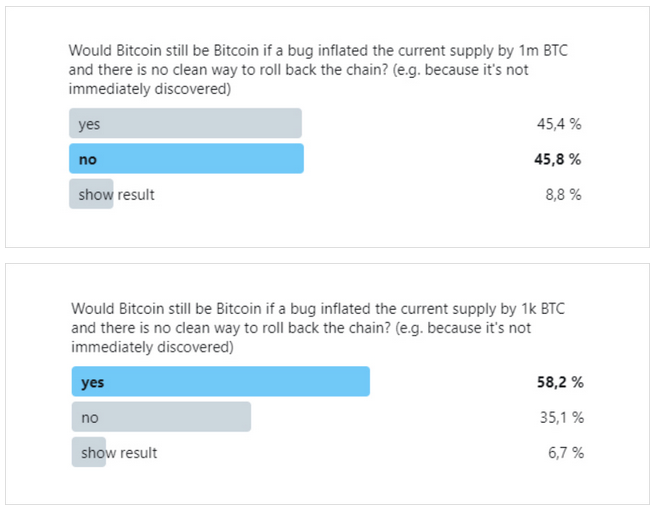

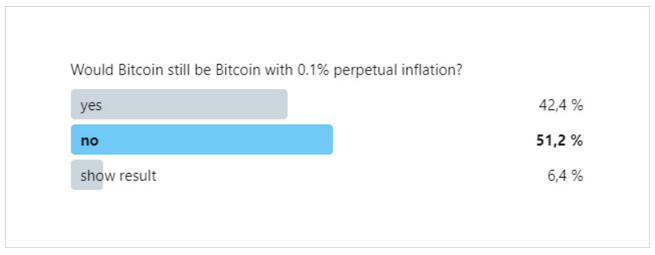

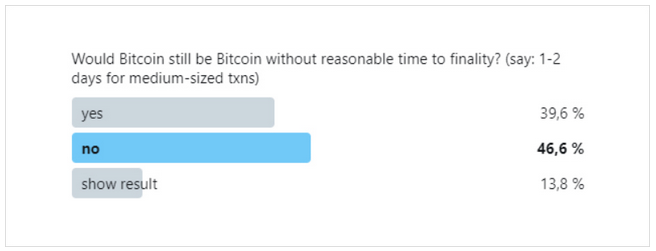

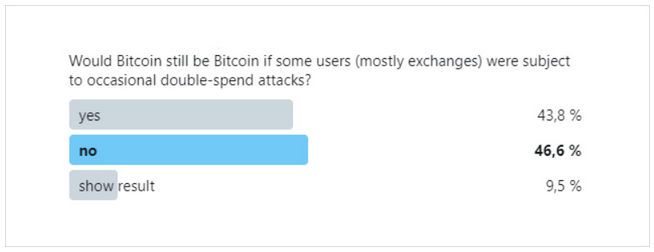

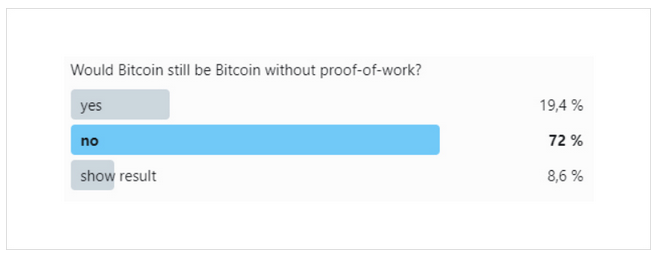

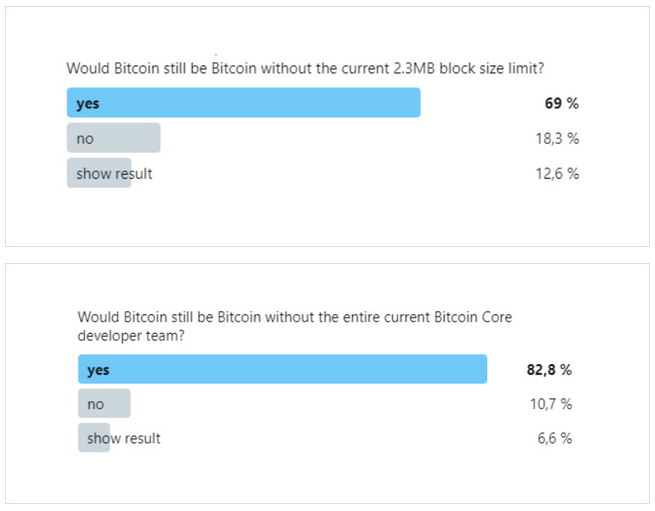

In order to explore this topic, I employed a basic questionnaire to ask my Twitter followers what they see the core values of Bitcoin. The way I framed the questions was to ask for the negative – what changes or events would make Bitcoin no longer Bitcoin to them? The implication here is that users would be bothered enough to sell their coins and leave the project.

All questions can be grouped into these five high level topics:

- Censorship-resistance;

- Intermediation;

- Monetary inflation;

- Settlement guarantees; and

- Means vs. ends (more on that later.)

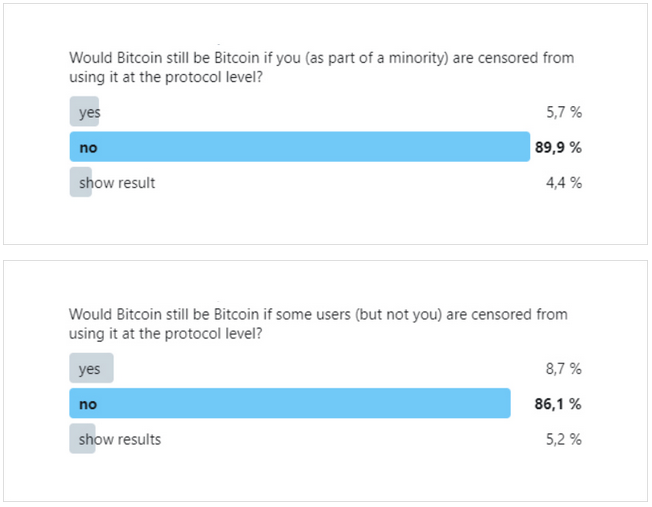

Censorship-resistance

The first topic I asked about was censorship resistance, which has always been one of the core tenants of the Bitcoin social contract. And indeed the results came in like expected: People really value censorship resistance, both for themselves and others, to the degree where it can seem irrational to bystanders. After all, people don‘t stop using Paypal because it has deplatformed legal arms dealers or political dissidents, or leave Twitter after it has censored many a conservative media organization or politician.

This only goes to show that Bitcoin actually *has* a social contract, and people feel disproportionately more violated if censorship happens in Bitcoin than in other systems where they might have come to expect it, even when they are not personally affected.

Indeed, Bitcoin’s design makes censorship very unattractive because if one miner doesn’t include your transaction, the next miner might, and as a result they will make more money in the long run. This holds true unless one miner (or coalition) controls over half of the hashpower and can safely ignore any non-compliant blocks from other miners. It also works with less than half of hashpower if the attacker can credibly scare other miners out of including transactions or addresses that are on a public blacklist (see “feather forking”).

The fact that users aggressively signal that they won’t accept others being censored actually matters to that, if the counter-threat can make it unprofitable for miners to follow the feather-forker. It is also a counter-argument to the popular thesis that only transaction fees and not the block subsidy protect Bitcoin from censorship, as the attacker stands to lose business from uncensored parties as well.

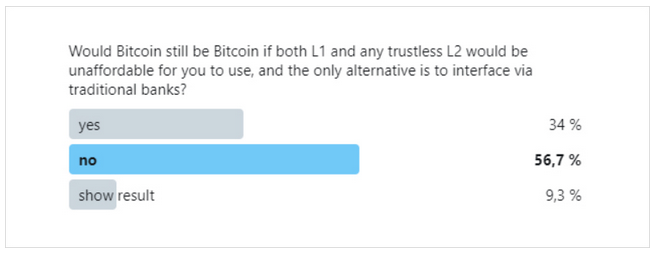

Intermediation

If people are censored from using Bitcoin, this could only really happen in two ways: 1) on the consensus layer by miners, or 2) on the application layer by trusted intermediaries.

Bitcoin is often said to eliminate said trusted third parties, but that applies only when users interact with Bitcoin directly. If most activity happens through trusted third parties, we could see the same encapsulation of a trustless base asset in a trusted wrapper by that eventually led to the failure of the gold standard. For a thought experiment of why intermediation is a big risk to bitcoin, see Why Bitcoin might not survive a Bitcoin Standard.

Given the aptness of bitcoiners for pointing out gold‘s weaknesses, I expected tolerance for a fully intermediated Bitcoin to be very low. But alas, I was surprised by how many people would be a-okay with it. Maybe they are simply pragmatic because Bitcoin indeed can only support so many base layer and LN transactions before fees would price out most smaller users and transactions, and most people might not think of themselves as “rich enough”.

That said, there are good reasons why the worries about an intermediated Bitcoin could be overblown and Bitcoin could fare better than gold has, due to its unique advantages. Because Bitcoin is a digital bearer asset, anyone from anywhere in the world can create a new Bitcoin bank that doesn‘t necessarily have to comply with local regulations. And why intermediaries would still be trusted, there would be more competition between them, putting the customers in a better position than if regulation protected incumbents from disruption. Because Bitcoin can be transferred so easily, this would also make it easier for customers to switch between different intermediaries, further lowering the exit cost.