7 Misconceptions about Bitcoin, and Where to Buy

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

7 Misconceptions about Bitcoin, and Where to Buy

By Lyn Alden

Posted November 11, 2020

Published: November 11, 2020

I initially covered Bitcoin in an article in autumn 2017, and was neutral-to-mildly-bearish for the intermediate term, and took no position.

The technology was well-conceived, but I had concerns about euphoric sentiment and market dilution. I neither claimed that it had to go lower, nor viewed it bullishly, and merely stepped aside to keep watching.

However, I turned bullish on Bitcoin in April 2020 in my research service at about $6,900/BTC and went long. It had indeed underperformed many other asset classes from autumn 2017 into spring 2020, but from that point, a variety of factors turned strongly in its favor. I then wrote a public article about it in July when it was at $9,200/BTC, further elaborating on why I am bullish on Bitcoin.

That July article received a lot of press, and the CEO of MicroStrategy (MSTR), the first publicly-traded company on a major stock exchange to put part of its cash position into Bitcoin, stated that he sent that article among other key resources to his board of directors as part of his team education process. It’s written with institutional readers in mind, in other words, in addition to retail investors.

With a price tag of over $15,000/BTC today, Bitcoin is up over 120% from the initial price at my April pivot point, and is up over 60% from July, but I continue to be bullish through 2021. From there, I would expect a period of correction and consolidation, and I’ll re-assess its forward prospects from that point.

Naturally, I’ve received many emails about Bitcoin over this summer and autumn. I’ve answered several of them via email, but figured I would summarize the most popular ones into a quick article on the subject. These are common misconceptions, risks, or questions. All of which make sense to ask, so I do my best here to address them as I see it.

If you haven’t read it, I’d recommend reading my July Bitcoin article first.

1) “Bitcoin is a Bubble”

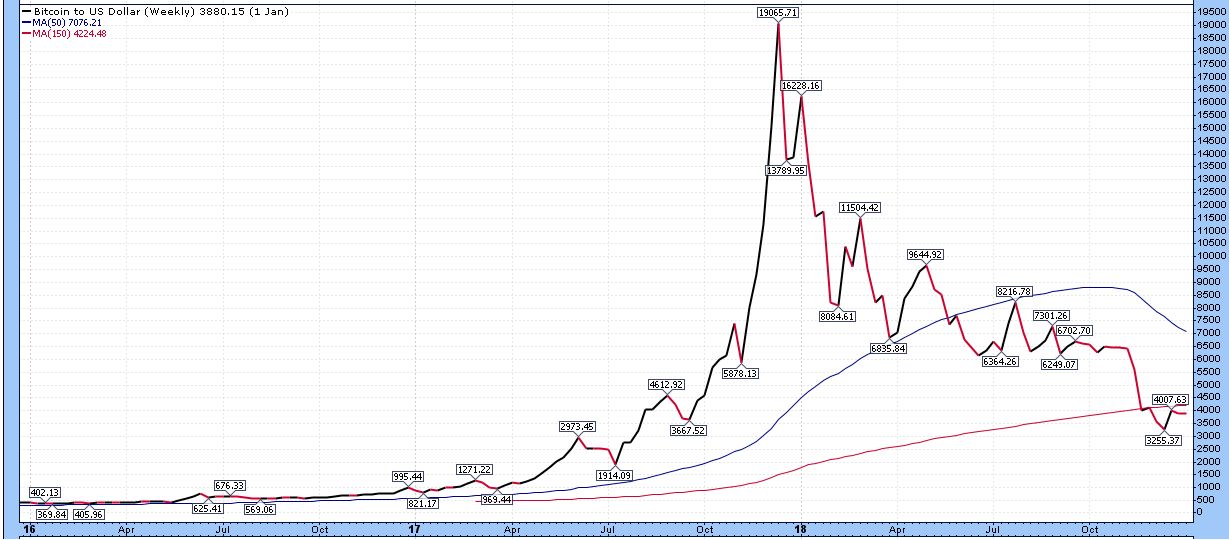

Many people view Bitcoin as a bubble, which is understandable. Especially for folks who were looking at the linear chart in 2018 or 2019, Bitcoin looked like it hit a silly peak in late 2017 after a parabolic rise that would never be touched again.

This linear price chart goes from the beginning of 2016 to the beginning of 2019, and shows how it looked like a classic bubble:

Chart: StockCharts.com

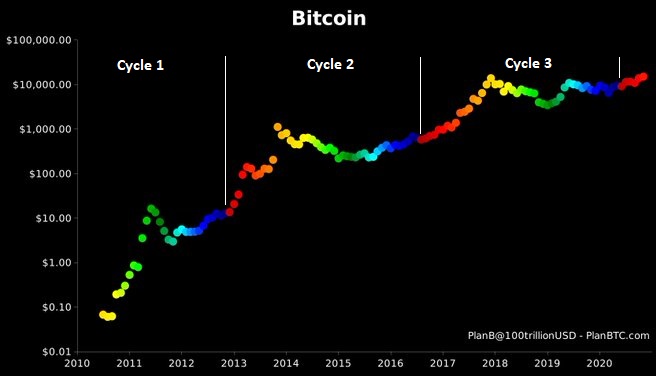

Maybe it is a bubble. We’ll see. However, it looks a lot more rational when you look at the long-term logarithmic chart, especially as it relates to Bitcoin’s 4-year halving cycle.

Chart Source: Chart Source: PlanB @100trillionUSD, with annotations added by Lyn Alden

Each dot in that chart represents the monthly bitcoin price, with the color based on how many months it has been since the prior halving. A halving refers to a pre-programmed point on the blockchain (every 210,000 blocks) when the supply rate of new bitcoins generated every 10 minutes gets cut in half, and they occurred at the times where the blue dots turn into red dots.

The first cycle (the launch cycle) had a massive gain in percent terms from zero to over $20 per bitcoin at its peak. The second cycle, from the peak price in cycle 1 to the peak price in cycle 2, had an increase of over 50x, where Bitcoin first reached over $1,000. The third cycle from peak-to-peak had an increase of about 20x, where Bitcoin briefly touched about $20,000.

Since May 2020, we’ve been in the fourth cycle, and we’ll see what happens over the next year. This is historically a very bullish phase for Bitcoin, as demand remains strong but new supply is very limited, with a big chunk of the existing supply held in strong hands.

The monthly chart is looking solid, with positive MACD, and a higher current price than any monthly close in history. Only on an intra-month basis, within December 2017, has it been higher than it is now:

Chart Source: StockCharts.com

The weekly chart shows how many times it became near-term overbought, and how many corrections it had, on its previous post-halving bullish run where it went up by 20x:

Chart Source: StockCharts.com

My job here is simply to find assets that are likely to do well over a lengthy period of time. For many of the questions/misconceptions discussed in this article, there are digital asset specialists that can answer them with more detail than I can. A downside of specialists, however, is that many of them (not all) tend to be perma-bulls on their chosen asset class.

This is true with many specialist gold investors, specialist stock investors, specialist Bitcoin investors, and so forth. How many gold newsletters suggested that you might want to take profits in gold around its multi-year peak in 2011? How many Bitcoin personalities suggested that Bitcoin was probably overbought in late 2017 and due for a multi-year correction?

I’ve had the pleasure of having conversations with some of the most knowledgeable Bitcoin specialists in the world; the ones that keep their outlooks measured and fact-based, with risks clearly indicated, rather than being constant promoters of their industry at any cost. Bitcoin’s power comes in part from how enthusiastic its supporters are, but there is room for independent analysis on bullish potential and risk analysis as well.

And as someone who isn’t in the digital asset industry myself, but who has a background that blends engineering and finance that lends itself reasonably well to analyzing it, I approach Bitcoin like I approach any other asset class; with an acknowledgement of risks, rewards, bullish cycles, and bearish cycles. I continue to be bullish here.

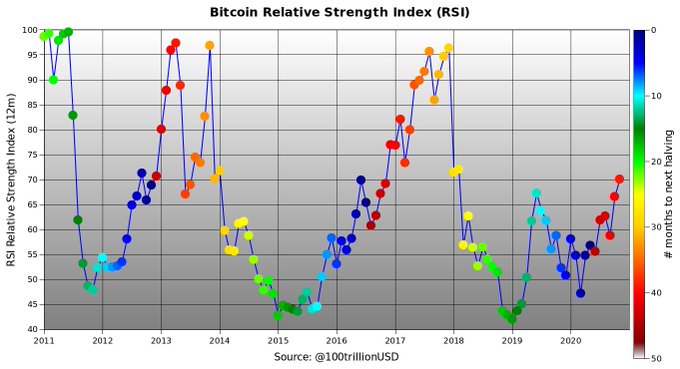

If this fourth cycle plays out anywhere remotely close to the past three cycles since inception (which isn’t guaranteed), Bitcoin’s relative strength index could become quite extreme again in 2021. Here’s a chart from PlanB about Bitcoin’s historical monthly RSI during the bullish and bearish phases of its 4-year halving cycle:

Chart Source: PlanB @100trillionUSD

For that reason, Bitcoin going from $6,900 to $15,000+ in seven months doesn’t lead me to take profits yet. In other words, a monthly RSI of 70 doesn’t cut it as “overbought” in Bitcoin terms, particularly this early after a halving event. I’ll likely look into some rebalancing later in 2021, though.

Each investor has their own risk tolerance, conviction, knowledge, and financial goals. A key way to manage Bitcoin’s volatility is to manage your position size, rather than try to trade it too frequently. If Bitcoin’s price volatility keeps you up at night, your position is probably too big. If you have an appropriately-sized position, it’s the type of asset to let run for a while, rather than to take profits as soon as it’s slightly popular and doing well.

When it’s at *extreme* sentiment, and/or its position has grown to a disproportionately large portion of your portfolio, it’s likely time to consider rebalancing.

2) “Bitcoin’s Intrinsic Value is Zero”

I approached this topic heavily in my autumn 2017 article, and again in my summer 2020 article.

To start with, digital assets can certainly have value. In simplistic terms, imagine a hypothetical online massive multiplayer game played by millions of people around the world. If there was a magical sword item introduced by the developer that was the strongest weapon in the game, and there were only a dozen of them released, and accounts that somehow got one could sell them to another account, you can bet that the price for that digital sword would be outrageous.

Bitcoin’s utility is that it allows people to store value outside of any currency system in something with provably scarce units, and to transport that value around the world. Its founder, Satoshi Nakamoto, solved the double-spending problem and crafted a well-designed protocol that has scarce units that are tradeable in a stateless and decentralized way.

In terms of utility, try bringing $250,000 worth of gold through an international airport vs bringing $250,000 worth of bitcoins with you instead, via a small digital wallet, or via an app on your phone, or even just by remembering a 12-word seed phrase. In addition, Bitcoin is more easily verifiable than gold, in terms of being a reserve asset and being used as collateral. It’s more frictionless to transfer than gold, and has a hard-capped supply. And I like gold too; I’ve been long it since 2018, and still am.

Bitcoin is a digital commodity, as Satoshi envisioned it:

As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties:

– boring grey in colour

– not a good conductor of electricity

– not particularly strong, but not ductile or easily malleable either

– not useful for any practical or ornamental purposeand one special, magical property:

– can be transported over a communications channelIf it somehow acquired any value at all for whatever reason, then anyone wanting to transfer wealth over a long distance could buy some, transmit it, and have the recipient sell it.

-Satoshi Nakamoto, August 2010

Compared to every other cryptocurrency, Bitcoin has by far the strongest network effect by an order of magnitude, and thus is the most secure in terms of decentralization and the amount of computing power and expense that it would take to try to attack the network. There are thousands of cryptocurrencies, but none of them have been able to rival Bitcoin in terms of market capitalization, decentralization, ubiquity, firm monetary policy, and network security combined.

Some other tokens present novel privacy advancements, or smart contracts that can allow for all sorts of technological disruption on other industries, but none of them are a major challenge to Bitcoin in terms of being an emergent store of value. Some of them can work well alongside Bitcoin, but not in place of Bitcoin.

Bitcoin is the best at what it does. And in a world of negative real rates within developed markets, and a host of currency failures in emerging markets, what it does has utility. The important question, therefore, is how much utility.

The pricing of that utility is best thought of in terms of the whole protocol, which is divided into 21 million bitcoins (each of which is divisible into 100 million sats), and combines the asset itself with the means of transmitting it and verifying it. The value of the protocol grows as more individuals and institutions use it to store and transmit and verify value, and can shrink if fewer folks use it.

The total market capitalization of gold is estimated to be over $10 trillion. Could Bitcoin reach 10% of that? 25%? Half? Parity? I don’t know.

I’m focusing on one Bitcoin halving cycle at a time. A four-year outlook is enough for me, and I’ll calibrate my analysis to what is happening as we go along.

3) “Bitcoin Isn’t Scalable”

A common criticism of Bitcoin is that the number of transactions that the network can handle per 10 minutes is very low compared to, say, Visa (V) datacenters. This limits Bitcoin’s ability to be used for everyday transactions, such as to buy coffee.

In fact, this played a key role in the 2017 hard fork between Bitcoin and Bitcoin Cash. Proponents of Bitcoin Cash wanted to increase the block size, which would allow the network to process more transactions per unit of time.

However, with any payment protocol, there is a trade-off between security, decentralization, and speed. Which variables to maximize is a design choice; it’s currently impossible to maximize all three.

Visa, for example, maximizes speed to handle countless transactions per minute, and has moderate security depending on how you measure it. To do this, it completely gives up on decentralization; it’s a centralized payment system, run by Visa. And it of course relies on the underlying currency, which itself is centralized government fiat currency.

Bitcoin, on the other hand, maximizes security and decentralization, at the cost of speed. By keeping the block size small, it makes it possible for people all over the world to run their own full nodes, which can be used to verify the entire blockchain. Widespread node distribution (over 10,000 nodes) helps ensure decentralization and continual verification of the blockchain.

Bitcoin Cash potentially increases transaction throughput with bigger block sizes, but at the cost of lower security and less decentralization. In addition, it still doesn’t come anywhere close to Visa in terms of transaction throughput, so it doesn’t really maximize any variable.

Basically, the dispute between Bitcoin and Bitcoin Cash is whether Bitcoin should be both a settlement layer and a transaction layer (and thus not be perfect at either of those roles), or whether it should maximize itself as a settlement layer, and allow other networks to build on top of it to optimize for transaction speed and throughput.

The way to think about Bitcoin is that it is an ideal settlement layer. It combines a scarce currency/commodity with transmission and verification features, and has a huge amount of security backing it up from its high global hash rate. In fact, that’s what makes Bitcoin vs Visa an inappropriate comparison; Visa is just a layer on top of deeper settlement layers, with merchant banks and other systems involved under the surface, whereas Bitcoin is foundational.

The global banking system has extremely bad scaling when you go down to the foundation. Wire transfers, for example, generally take days to settle. You don’t pay for everyday things with wire transfers for that reason; they’re mainly for big or important transactions.

However, the banking system builds additional layers of scalability onto those types of settlement layers, so we have things like paper checks, electronic checks, credit cards, PayPal, and so forth. Consumers can use these systems to perform a large number of smaller transactions, and the underlying banks settle with each other with more foundational, larger transactions less frequently. Each form of payment is a trade-off between speed and security; banks and institutions settle with each other with the most secure layers, while consumers use the speedier layers for everyday commerce.

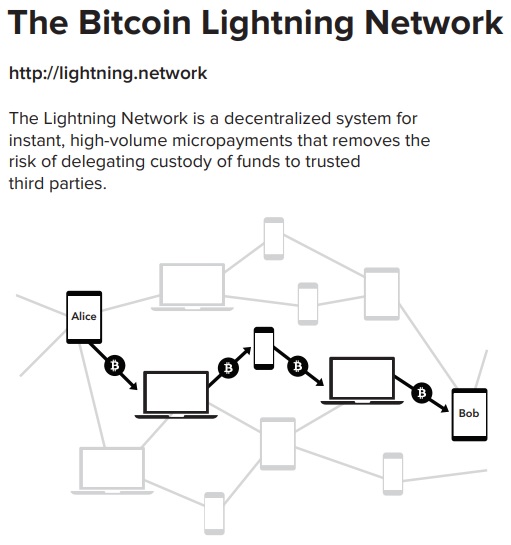

Similarly, there are protocols like the Lightning Network and other smart contract concepts that are built on top of Bitcoin, which increase Bitcoin’s scalability. Lightning can perform tons of quick transactions between counterparties, and reconcile them with Bitcoin’s blockchain in one batch transaction. This reduces the fees and bandwidth limitations per small transaction.

Source: Lightning.Network

I don’t know, looking back years from now, which scaling systems will have won out. There’s still a lot of development being done. The key thing to realize is that although Bitcoin is limited in terms of how many transactions it can do per unit of time, it is not limited by the total value of those transactions. The amount of value that Bitcoin can settle per unit of time is limitless, depending on its market cap and additional layers.

In other words, suppose that the Bitcoin network is limited to 250 transactions per minute, which is low. Those transactions could average $100 or $1 million, or any number. If they average $100 each, it means only $25,000 in transaction value is performed per minute. If they average $1 million each, it means $250 million in transaction value is performed per minute. If Bitcoin grows in use as a store of value, the transaction fees and inherent limitations prioritize the largest and most important transactions: the major settlement transactions.

Additional layers built on top of Bitcoin can do an arbitrary number of transactions per minute, and settle them with batches on the actual Bitcoin blockchain. This is similar to how consumer layers like Visa or PayPal can process an arbitrary number of transactions per minute, while the banks behind the scenes settle with larger transactions less frequently.

The market has already spoken about which technology it thinks is best, between Bitcoin and others like Bitcoin Cash. Ever since the 2017 hard fork, Bitcoin’s market capitalization and hash rate and number of nodes have greatly outperformed Bitcoin Cash’s. Watching this play out in 2017 was one of my initial risk assessments for the protocol, but three years later, that concern no longer exists.

4) “Bitcoin Wastes Energy”

The Bitcoin network currently uses as much energy as a small country. This naturally brings up environmental concerns, especially as it grows.

Similarly, gold mining uses a ton of energy. For each gold coin, a ton of money, energy, and time went into exploration for deposits, developing a mine, and then processing countless tons of rock with heavy equipment to get a few grams of gold per ton. Then, it has to be purified and minted into bars and coins, and transported.

It takes several tons of processed rock to get each 1-ounce gold coin, and thousands of tons of processed rock for each good delivery gold bar. The amount of energy that goes into a small unit of gold is immense.

In fact, that energy is what gives gold value, and what made it internationally recognized as money for thousands of years. Gold is basically concentrated energy, concentrated work, as a dense store of value that does not erode with time.

There’s no limit to how many dollars, euros, or yen we can print, however. Banks multiply them all the time with a stroke of a keyboard. Likewise, industrial metals like iron are very common as well; we have no shortage of them. Gold, however, is very rare, and when found, it takes a ton of energy and time to get into pure form. And then we have to spend more energy transporting, securing, and verifying it from time to time.

However, the world does that anyway, because it derives value from it compared to the value that it had to put in to get it. Gold mining and refining requires energy, but in turn, central banks, institutions, investors, and consumers obtain a scarce store of value, or jewelry, or industrial applications from the rare metal.

Similarly, Bitcoin takes a lot of energy, but that’s because it has so much computing power constantly securing its protocol, compared to countless other cryptocurrencies that are easy to attack or insufficiently decentralized.

Visa uses much less energy than Bitcoin, but it requires complete centralization and is built on top of an abundant fiat currency. Litecoin uses much less energy than Bitcoin as well, but it’s easier for a well-capitalized group to attack.

The question then becomes whether that energy associated with Bitcoin is put to good use. Does Bitcoin justify its energy usage? Does it add enough value?

So far, the market says it does and I agree. A decentralized digital monetary system, separate from any sovereign entity, with a rules-based monetary policy and inherent scarcity, gives people around the world a choice, which some of them use to store value in, and/or use to transmit that value to others.

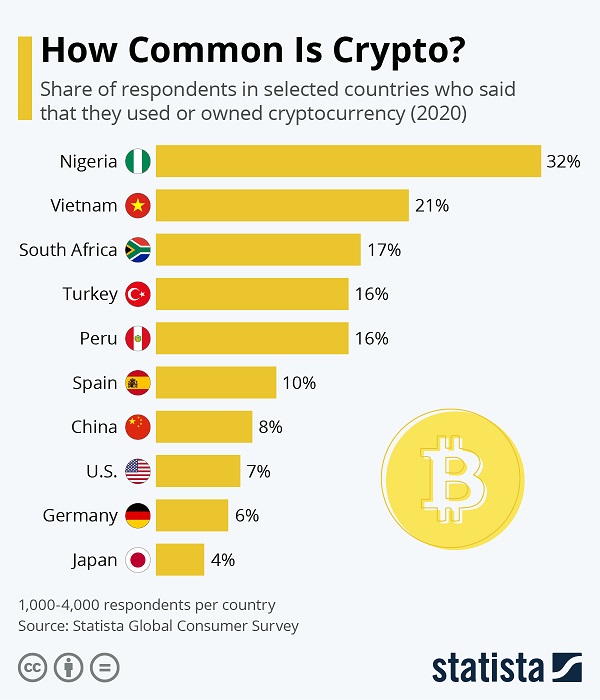

Those of us in developed markets that haven’t experienced rapid inflation for decades may not see the need for it, but countless people in emerging markets have experienced many instances of severe inflation in their lifetimes, and tend to get the concept more quickly.

Chart Source: Statista

Furthermore, a significant portion of the energy that Bitcoin uses could otherwise be wasted. Bitcoin miners seek out the absolute cheapest sources of electricity in the world, which usually means energy that was developed for one reason or another, but that doesn’t currently have sufficient demand, and would therefore be wasted.

Examples of this include over-built hydroelectric dams in certain regions of China, or stranded oil and gas wells in North America. Bitcoin mining equipment is mobile, and thus can be put near wherever the cheapest source of energy is, to arbitrage it and give a purpose to that stranded energy production.

Bitcoin mining converts the output from those cheap stranded sources of energy into something that currently has monetary value.

5) “Bitcoin is Too Volatile”

Bitcoin is promoted as a store of value and medium of exchange, but it has a very volatile price history. This leads, again somewhat understandably, for investors to say it’s not a good store of value or medium of exchange, and thus fails at the one thing that it’s designed to do.

And they’re kind of right. Bitcoin isn’t the asset that you put money into for an emergency fund, or for a down payment on a house that you’re saving up for 6 months from now. When you definitely need a certain amount of currency in a near-term time horizon, Bitcoin is not the asset of choice.

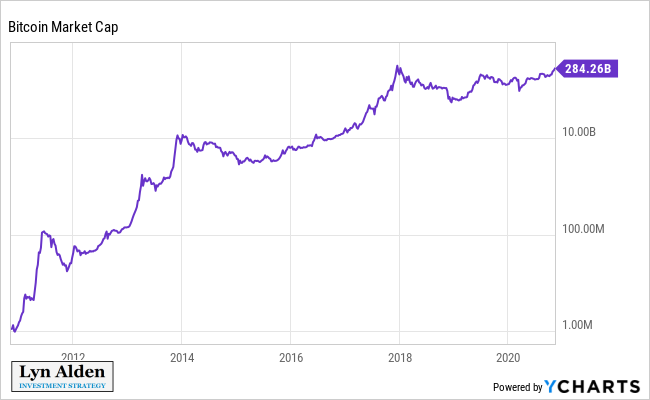

This is because it’s an emerging store of value, roughly 12 years old now, and thus carries with it a significant degree of growth and speculation. Its market capitalization is growing over time, taking some market share from other stores of value, and growing into a meaningful asset class. We’ll see if it continues to do so, or if it levels off somewhere and starts to stagnate.

For Bitcoin’s market cap to grow from a $25 million to $250 million to $2.5 billion to $25 billion to today’s value of over $250 billion, it requires volatility, especially upward volatility (which, of course, comes with associated downside volatility).

As it grows larger, its volatility reduces over time. If Bitcoin becomes a $2.5 trillion asset class one day, with more widespread holding, its volatility would likely be lower than it is now.

Therefore, having a nonzero exposure to Bitcoin is basically a bet that Bitcoin’s network effect and use case will continue to grow until it reaches some equilibrium where it has lower volatility and is more stable. For now, it has plenty of volatility, and it needs that volatility if it is to keep growing. Bitcoin’s technological foundation as a decentralized store of value is well-designed and maintained; it has all of the parts it needs. It just needs to grow into what it can be, and we’ll see if it does.

It’s like if someone identifies a new element, and people begin discovering uses for that element, and it experiences a period of rapid growth and high price volatility, until it has been around for sufficient time that it eventually settles in to a normal volatility band.

While Bitcoin remains as volatile as it is, investors can mitigate the risk by having an appropriate position size.

6) “Governments Will Ban Bitcoin”

Another legitimate concern that folks have is that even if Bitcoin is successful, that will make governments ban it. Some governments already have. So, this falls more in the “risk” category than a “misconception”.

There is precedent for this. The United States made it illegal for Americans to own gold from 1933 to 1975, other than in small amounts for jewelry and collectibles. In the land of the free, there was a benign yellow metal that we could be sent to prison for owning coins and bars of, simply because it was seen as a threat to the monetary system.

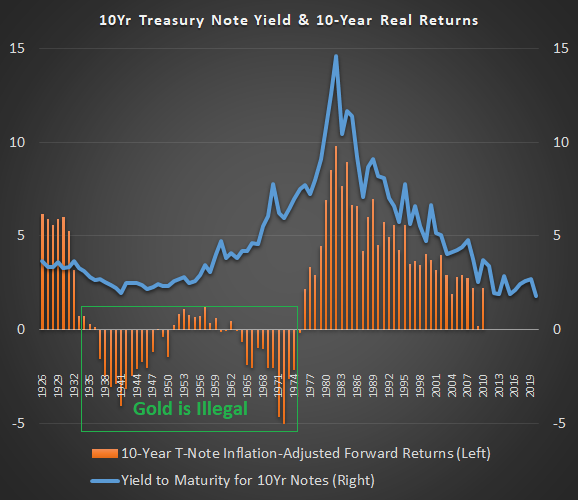

This chart shows the interest rate of 10-year Treasury yields in blue. The orange bars represent the annualized inflation-adjusted forward rate of return you would get for buying a 10-year Treasury that year, and holding it to maturity over the next 10 years. The green square shows the period of time where owning gold was illegal.

Data Sources: Robert Shiller, Aswath Damodaran

There was a four-decade period from the 1930’s to the 1970’s where keeping money in the bank or in sovereign bonds didn’t keep up with inflation, i.e. the orange bars were net negative. Savers’ purchasing power went down if they held these paper assets.

This was due to two inflationary decades: one in the 1940’s, and one in the 1970’s. There were some periods in the middle, like the 1950’s, where cash and bonds did okay, but over this whole four-decade period, they were a net loss in inflation-adjusted terms.

It’s not too shocking, therefore, that one of the release valves for investors was banned during that specific period. Gold did great over that time, and held its purchasing power against currency debasement. The government considered it a matter of national security to “prevent hoarding” and basically force people into the paper assets that lost value, or into more economic assets like stocks and real estate.

This was back when the dollar was backed by gold, so the United States government wanted to own most of the gold, and limit citizens’ abilities to acquire gold. No such backing exists today for gold or Bitcoin, and thus there is less incentive to try to ban it.

And, the gold ban was hard to enforce. There were rather few prosecutions over gold ownership, even though the penalties on paper were severe.

Bitcoin uses encryption, and thus is not really able to be confiscated other than through legal demand. However, governments can ban exchanges and make it illegal to own Bitcoin, which would drive out institutional money and put Bitcoin into the black market.

Here’s the problem. Bitcoin has over $250 billion in market capitalization. Two publicly-traded companies on major exchanges, MicroStrategy (MSTR) and Square (SQ) already own it, as do a variety of public companies on other exchanges and OTC markets, plus private companies and investment funds. Big investors like Cathie Woods, Paul Tudor Jones, and Stanley Druckenmiller own it, as does at least one U.S. senator-elect. Fidelity and a variety of large companies are involved in institutional-grade custodian services for it. PayPal (PYPL) is getting involved. Federally regulated U.S. banks can now officially custody crypto assets. The IRS treats it like a commodity for tax purposes. That’s a lot of mainstream momentum.

It would be extremely difficult for major capital markets like the United States or Europe or Japan to ban it at this point. If, in the years ahead, Bitcoin’s market capitalization reaches over $1 trillion, with more and more institutions holding exposure to it, it becomes harder and harder to ban.

Bitcoin was already an unusual asset that grew into the semi-mainstream from the bottom up, through retail adoption. Once the political donor class owns it as well, which they increasingly do, the game is basically over for banning it. Trying to ban it would be an attack on the balance sheets of corporations, funds, banks, and investors that own it, and would not be popular among millions of voters that own it.

I think regulatory hostility is still a risk to watch out for while the market capitalization is sub–$1 trillion. And the risk can be managed with an appropriate position size for your unique financial situation and goals.

7) “Where to Buy Bitcoin”

The most frequent question I get about Bitcoin is simply where to buy bitcoins. Some people don’t know how to start, and other people are familiar with the popular places to buy, but don’t know which ones are ideal.

There’s no one answer; it depends on your goals with it, and where you live in the world.

The first question to ask is whether you’re a trader or a saver. Do you want to establish a long-term Bitcoin position, or buy some with a plan to sell it in a few months? Or maybe some of both?

The second question to ask yourself is whether you want to self-custody it with private keys and a hardware wallet or multi-signature solution, which has an upfront learning curve but is ultimately more secure, or if you want to have someone else custody it for you, which is simpler but involves counterparty risk.

Bitcoin is accessible through some publicly traded funds, like the Grayscale Bitcoin Trust (GBTC), of which I am long. However, funds like these trade at a premium to NAV, and rely on counterparties. A fund like that can be useful as part of a diversified portfolio in an IRA, due to tax advantages, but outside of that isn’t the best way to establish a core position.

Bitcoin is also available on major exchanges, where it can then be sent to a private hardware wallet or elsewhere. I don’t have a strong view on which exchanges are the best. However, be careful about platforms that don’t let you withdraw your Bitcoin, like Robinhood. I personally bought my core position through an exchange in April when I turned bullish, and transferred a lot of it to personal custody.

From there, I began dollar-cost averaging through Swan Bitcoin, where it can be kept in their cold storage or transferred out to personal custody as well. Swan specializes in Bitcoin (rather than multiple types of digital assets), and has very low fees for folks who like to dollar-cost average. It’s a saver’s platform, in other words, rather than a trader’s platform. I’m an advisor to Swan Bitcoin and know several of their staff including their CEO, so it’s my preferred way to accumulate Bitcoin.

Overall, having access to a crypto exchange, and having access to a dollar-cost averaging platform like Swan, along with a personal custody solution like a hardware wallet or a multi-signature solution, is a good combo.

For folks who are early in the learning curve, keeping it on an exchange or in custody storage is also fine, and as you learn more, you can choose to self-custody if it’s right for your situation.

Acknowledgments to Michael Hartl for editing assistance.