Bitcoin: Separating Money From State

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Bitcoin: Separating Money From State

With the introduction of Bitcoin, we discuss the key achievement and massive win for the people of today: the separation of money from the state.

By Pedro Febrero on Quantum Economics

Posted July 29, 2020

Image: Author

Image: Author

Today our goal is to give readers a comprehensive analysis of what makes Bitcoin unique and how this digital commodity may break the shackles of state currency.

We will look into how the Bitcoin network has evolved, from a simple payments network, to digital gold; the reason why Bitcoin is, in fact, a living organism that adapts to new situations and overcomes any challenge that crosses its way; and, finally, the path Bitcoin must take to conquer the entire digital space.

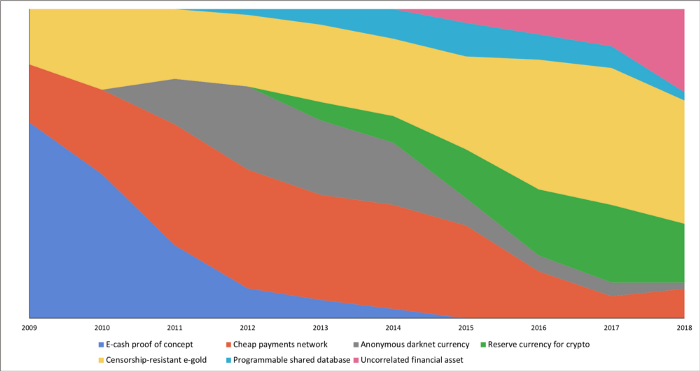

Only now, 10 years after the creation of Bitcoin, the picture of themes brewing around the cryptocurrency starts to take shape. Nic Carter wrote one of the most important pieces to describe the narratives surrounding Bitcoin. Below you can see the juice of his ideas: the evolution of Bitcoin as an e-cash proof of concept toward an uncorrelated financial asset.

Hasufl and Nick Carter’s “Visions of Bitcoin”

What Carter concluded, and we tend to agree with him, is that Bitcoin is not just a technology, and it does not represent a single narrative. Markets and the “crowd” define the narratives behind what any asset is, and Bitcoin is clearly a colourful melting pot of ideas.

It went from being an e-cash proof of concept from 2009 until 2015, from anonymous darknet currency from 2010 until 2018, while today, Bitcoin still aims to be a cost-effective payments network, perhaps through the Lightning Network, and a censorship-resistant e-gold.

We cannot state for sure whether those narratives will die off, much like e-cash and darknet currency did, or whether they’ll survive and mingle with the reserve currency for crypto, programmable shared database and, most recently, uncorrelated financial asset narratives.

What Carter helps readers understand is how easy it is to change a narrative around a technology, especially one that separates money from the state.

But let’s not get ahead of ourselves.

Bitcoin, a living organism

To come from such humble means, much like cheap payments and darknet currency, to global crypto reserve currency or censorship-resistant digital gold, Bitcoin had to evolve.

What we want to emphasize is that the community that supports the technology changed gears, and understood how one simple proof-of-work cryptocurrency could, in fact, change paradigms: Slowly, but surely.

Indeed, Bitcoin had to metamorphose from its initial larva state into a butterfly.

The narratives prove that Bitcoin wasn’t initially seen, or discussed, as a potential replacement for central banks, by the majority of early adopters. Further, they didn’t note that it possessed sound-money properties, or that it could be the first worldwide settlements network.

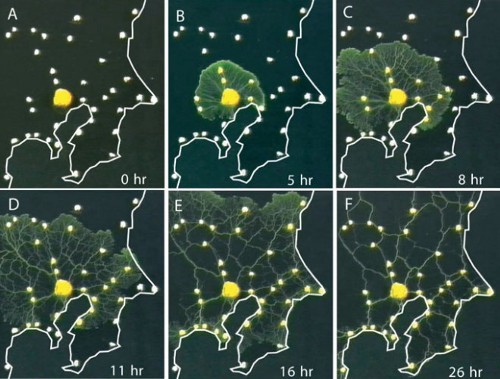

Slime Mold designing Tokyo Subway System, image by Brandon Quittem

Slime Mold designing Tokyo Subway System, image by Brandon Quittem

Great things take time to build. Let’s take a look at nature, as a source of inspiration. One of the most astonishing organisms living on this planet is mycelium, a communication layer between fungi. Mycelium helps fungi communicate across vast regions. However, it took fungi millions of years to develop such a complex mycelium network. Such is the fate of any great and overachieving technology: it takes time to build and adopt. And BTC is no different.

Brandon Quittem showed us exactly that, in his brilliant research papers comparing the Bitcoin network to a living organism (fungi, mushrooms).

An example we would like to pick up is how decentralized networks can, in fact, be considerably more efficient at resource allocation than centralized networks when it comes to decision-making.

“Scientists conducted an experiment where an ancient fungus (slime mold) was incentivized to recreate the Tokyo subway system. Each subway stop (node) was marked with the slime molds favorite food (oat flakes).

After a short while, the slime mold grew to connect all the nodes/stops in a more efficient design than the centrally planned committee of engineers hired by the Japanese government.”

Isn’t it amazing that fungi could be smarter than scientists?

Of course, this is an example that we’ve stretched a bit, in order to show how decentralized networks can have better results than a traditional top-to-bottom decision-making process.

However, the path to global adoption of bitcoin is painful, full of ups and downs, where problems such as critical software bugs and overreaching regulation will most likely happen. Therefore, one should be patient and keep a macro, long-term perspective on the development of the Bitcoin network.

Image by author

Bitcoin: The Road To Independence

Before we dig deep into the core subject of the paper, we would like to explain why Bitcoin is the de facto asset which could change the way the world operates.

In the introduction, we spoke of a great number of qualities Bitcoin possesses, which makes it an incredible foe to central banks, settlement layers and other payments and financial institutions.

Bitcoin opened the doors to digital scarcity. With digital scarcity, we were able to build sound-money-like assets — which are deflationary or disinflationary, as the brilliant Jason Deane explains in this piece.

With scarcity built in a sound-money-like digital asset (aka, bitcoin), there is a chance a new system can take a run at being the internet currency. Above all, the fact this asset’s transactions are transparent while the rules of the protocol are quite easy to enforce and verify, but expensive to change, helped the Bitcoin network to grow.

More, however, Satoshi implemented an anti-inflationary measure, known as the halving, which takes place roughly every four years.

Not only that, but bitcoin gave birth to triple-entry bookkeeping. If you are wondering why triple-entry bookkeeping is much more interesting than double-entry bookkeeping, we’ll give you the juice of it.

Essentially, while double-entry bookkeeping requires each party transacting to keep a record of the ledger, for comparison by a third-party (like a government body such as the IRS), triple-entry bookkeeping is much simpler to audit, since transactions from all parties are stored in a common, shared and public ledger.

All these unique developments kick-started the decentralized finance (DeFi) space (sorry Ethereum. But Bitcoin is the original #DeFi).

However, the greatest achievement of all is yet to come.

Bitcoin: Digital Hard Money

To fully understand concepts like open-source currency, digital sound money, DeFi, or the ability to store value digitally without a central entity controlling transaction flows and/or accounts, one needs to accept that money and the state are two separate entities.

The way currency gets created today is mostly through debt and deposits. What this essentially means is that either central banks mint new currency, which local governments buy through IOUs, or people put currency in a bank as a deposit or as debt, which also gives banks the ability to leverage those reserves and create new currency (credit) on top.

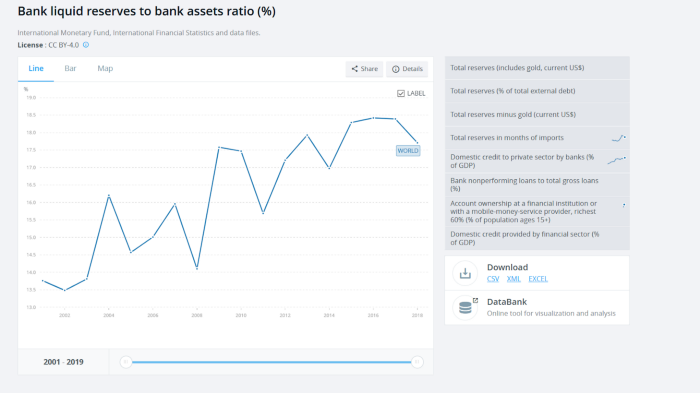

As of 2018, banks around the world held liquid reserves equal to 17.7% of their total assets, according to World Bank Data.

Bank Reserves Liquidity Ratio, by World Bank Data

Recently, the Fed lowered the reserve requirement ratio to zero, a move that may have some worried. In fact, many banks actually increased their reserves in the wake of COVID-19 in order to protect themselves from the eventual economic fallout.

Why is this bit so important? Because the way currency is created is only possible due to the actions of the government bodies.

The main reason behind the abolishment of the gold standard in 1971 is the same behind executive order 6102, which forbade Americans from owning gold: to give governments the power to print money.

However, there is more to money than simply being a currency.

The message we’re trying to pass on is that sound-money, such as gold and bitcoin, exists in nature and cannot simply be printed. It’s a hard asset because it requires much energy to mint an extra unit. What this means is that it’s much more difficult for central banks to leverage deposits and to create “value” out of thin air, and for governments to keep increasing public debt.

Bitcoin: Separating Money From State

To conclude our thesis of why the separation of money and state is the most amazing invention of the 20th century, and how Bitcoin enables human beings to achieve such an outcome, we need to discuss some of the current issues that exist with how currency is produced and some of the problems that arise from such a framework.

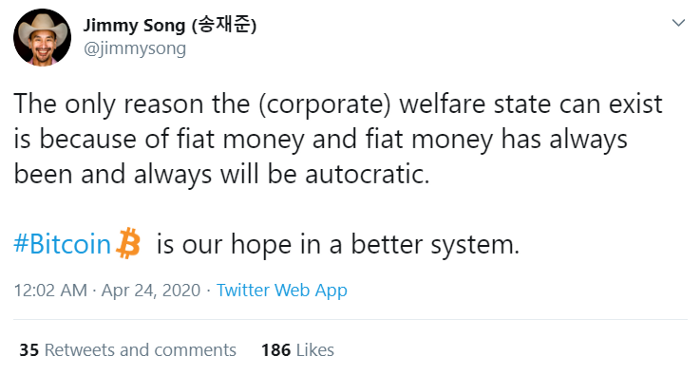

Jimmy Song’s twitter post

As Jimmy Song, a Bitcoin developer, teacher and author, explains in the tweet above, fiat currency is an autocratic system, where governments enforce the use of a certain currency within their borders.

One major problem of fiat currencies is that they can result in significant inflation, and in some cases, hyperinflation. Investopedia explains these difficulties rather effectively.

Additionally, by conveying the ability to mint currency to a select group of individuals, we give rise to other problems.

This chart shows the S&P 500 and the Dow Jones Industrial Average, 2008–2020 (Source: https://www.tradingview.com/x/O5sPX7vu/) Pink periods indicate quantitative easing. Blue periods indicate quantitative tightening.

As we’ve discussed previously, the measures being implemented by central banks worldwide, such as Quantitative Easing (QE), appear to favour the few over the many. As we discuss in this paper, where we took the chart from, QE seems to be quite correlated to the rising value of stock markets. In the example above, it seems there is a clear connection between QE periods and market cycles.

What QE gives birth to is currency and asset price manipulation by central banks, as we discuss in this article.

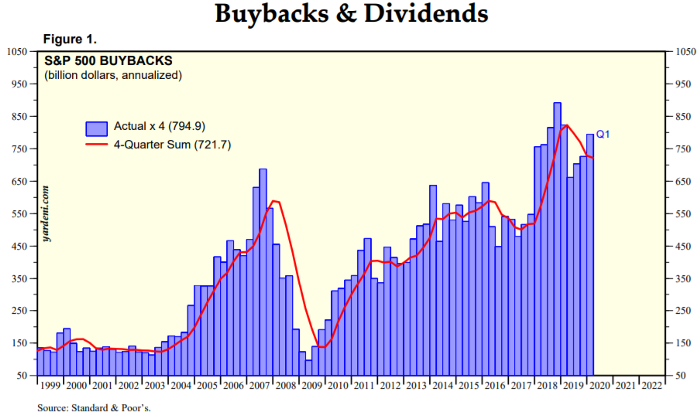

After all, only a minority of existing companies can create bonds and synthesize debt into financial products. Not only that, but such companies are usually publicly traded and have been using the extra cash to go into the markets and pump their own shares through share buybacks, as we can see below, courtesy of Yardeni Research.

Standard & Poor’s, S&P 500 Buybacks

Now, if we can conclude currency is not being fairly distributed, as some people and companies are favoured instead of others, what can we do about that? Is there a meaningful way Bitcoin can really tackle this issue?

The short answer is: yes. Bitcoin does help.

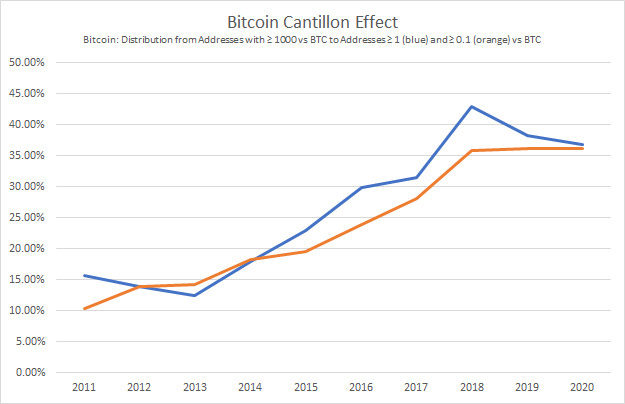

If you take a look at this piece we wrote, discussing what the Cantillon Effect is, and how it takes place within the Bitcoin ecosystem, you’ll notice we reach quite a staggering conclusion.

That bitcoin addresses holding large sums of BTC, over 1,000, are diminishing versus the number of addresses holding small sums, between 0.1 and one bitcoin.

Image by author: The distribution of the volume of BTC held by addresses ≥ 1 and ≥ 0.1 versus addresses ≥ 1000 bitcoin

What the data shows is something rather spectacular. The percentage of the total bitcoin volume held by addresses with at least one and 0.1 bitcoin seems to be growing compared to the addresses containing a minimum of 1,000 bitcoin, which shows how evenly BTC is being distributed.

Since 2013, the number of bitcoin held by addresses with a minimum of one and 0.1 bitcoin more than doubled, from 15% to over 30%. At its peak, the amount of bitcoin volume held by addresses with at least one BTC was almost 45% of the total volume of bitcoin held by addresses with no less than 1,000 BTC. Interestingly, this top coincided with the BTC/USD all-time high.

In sum, the Cantillon Effect in the Bitcoin network is precisely the opposite to traditional currency networks: because no one can dilute your position by increasing the total currency supply (without a public minting schedule), your bitcoin isn’t losing value.

Therefore, the satoshis you hold will never be diluted. This means the Cantillon Effect disappears with Bitcoin since no one can allocate extra currency, not planned in the protocol, to be minted and given to a group of people or companies. Bitcoin can only be minted the hard way: by producing valid proof-of-work.

Essentially, Bitcoin’s greatest innovation was to completely separate money production from central banks and states. Perhaps, that was the greatest achievement of the century.

Conclusion

Before we conclude this piece, it’s important to underline a key message recently shared by Ray Dalio, CEO of Bridgewater Associates.

In one of his latest interviews, Dalio mentions a key aspect most people tend to forget, that technology changes at a much faster pace than human behaviour, morals and values. Hence, the seemingly long time it takes for a technology such as Bitcoin to get massively adopted.

Think of the most important technologies developed to date. Think of the somewhat distant past.

The fact of the matter is only when humankind separated the church from the state, by inventing the printing press, we were able to kick-start the enlightened ages. Before that, science was virtually non existent and publications were dominated by the clergy.

The same logic can be applied to currency. While it remains linked to central powers, the ability for humans to truly be free will always be limited. Only when we accept, as a global species, that money should be decentralized and not linked to central institutions, can we perhaps dream of giving people an easy way to accumulate wealth across generations.

Bitcoin, being a digital hard-money native asset, fixes this problem. It takes away the ability of any government or central power to easily coerce their population by destroying local purchasing power.

If people can easily opt out of the system, with a few clicks, then digital gold is, de facto, born.

What’s the point of storing wealth in an inflationary currency, when there’s a hard-money digital asset you can own, just a few clicks away, that will most likely protect your hard-earned money in the long term?

In our humble opinion, there is a chance for Bitcoin to be the spark that lights up the movement against state-controlled currencies. Each and every year that Bitcoin survives against attacks, be it a bug, a malicious actor or even regulatory bodies, the likelihood it will continue to exist increases.

Therefore, Bitcoin could be the main driver for a global hard money economy.