This is a curated collection of posts and essays from Robert Breedlove curated on July 23, 2020.

This is a curated collection of posts and essays from Robert Breedlove curated on July 23, 2020.

WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Money, Bitcoin and Time: 1 of 3

By Robert Breedlove

Posted January 20, 2019

This is part 1 of a 3 part series

A synthesis of perspectives from many prolific thinkers, this 3-part essay will cover the following topics in sequence:

- Money — its properties, story and evolutionary history

- Bitcoin — its nature and significance in the story of money (see PART 2)

- Time — perspectives on its value and how the story of money might play out (see PART 3)

This essay is guided, inspired and adapted from the literary works of many. Each section header will include a number [n] referencing relevant synthesized works at the end of each part. For those seeking further elucidation on any of the topics discussed herein, I highly encourage you to read these original works.

This essay is also available in .pdf form at: https://www.parallaxdigital.io/blog

Please feel free to send any questions or feedback to info@parallaxdigital.io

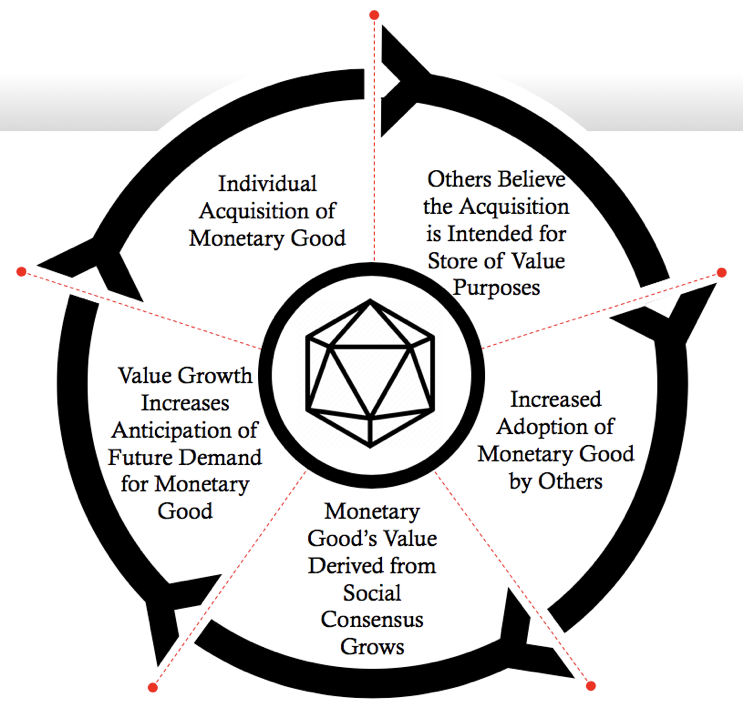

The Simple Truth about Money: Money is the most successful story ever told by humans. It is a reflexive narrative: meaning it has value only because everyone believes it, and everyone believes it because it has value. Money is a story that continues to be written…

Human Exchange [2,6]

Human beings are the networked species. Initially, these were small bands of hunters and gatherers numbering no more than 150 persons strong (Dunbar’s number). When humans began to exchange with one another, they intuitively discovered the division of labor which allows people to focus on their relative advantages and concentrate on their chosen craft. The division of labor enables the specialization of productive efforts for mutual gain. If John makes axes faster than Steve, and Steve makes bows faster than John, then they both are better off by specializing and trading. Interestingly, this holds true even if John is faster than Steve at making axes and bows (up to a point) and, amazingly, this effect compounds.

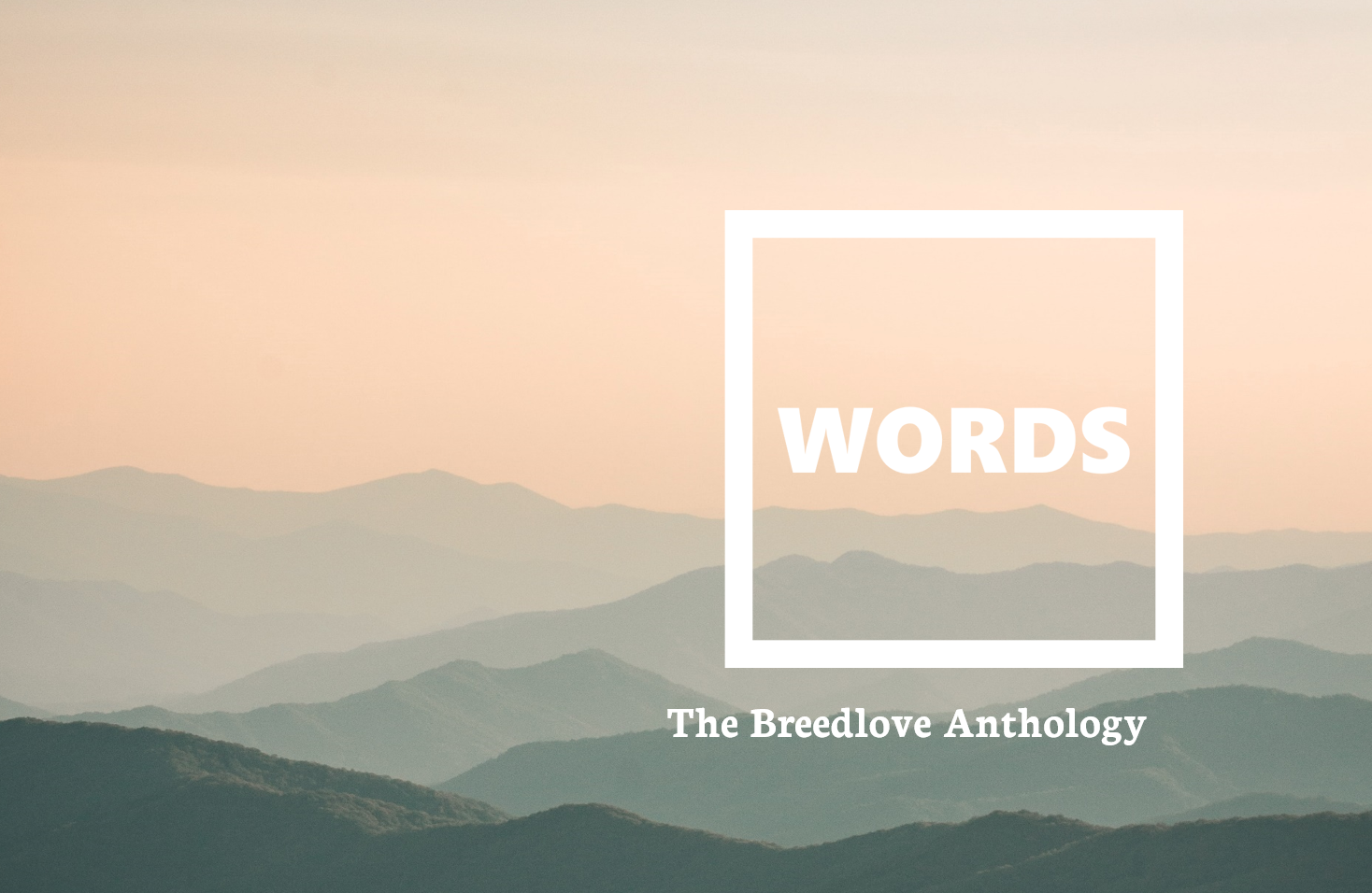

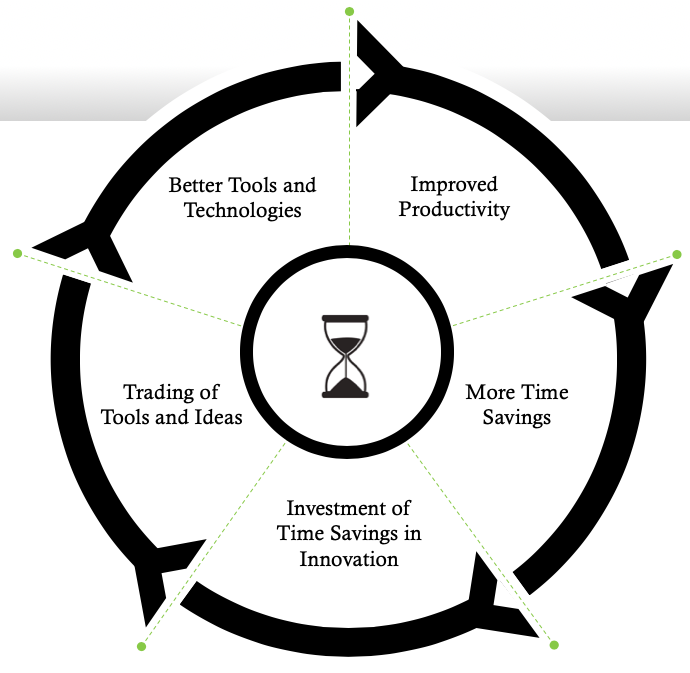

Tools, or technologies, are mechanisms that increase productivity by amplifying the returns on human time directed at production. You can chop more wood per man hour using an axe than you can with your bare hands. As people made and exchanged more tools, time savings increased and specialization deepened. Specialization sparked innovation, because it encouraged the investment of time in tool-making tools, such as whetstones used for making sharper axes. This enabled people to create superior tools, which increased productivity even further. That saved more time, which people used to specialize even further and expand their scope of trade by exchanging with an even greater number and variety of people, which increased the division of labor even further, and so on. This recursive dynamic persists to this day as a virtuous cycle with no known natural limit — modern markets in goods, services and ideas allow human beings to exchange and specialize honestly for the betterment of all. In this way, the act of exchange is the incipient force driving all human progress and prosperity . Prosperity is simply time saved, which is proportional to the division of labor:

Human exchange is the incipient force driving all human progress and _prosperity_ . Prosperity is simply time saved, which is proportional to the division of labor. This recursive dynamic persists to this day as a virtuous cycle with no known natural limit — modern markets in goods, services and ideas allow human beings to exchange and specialize honestly for the betterment of all.

Human exchange is the incipient force driving all human progress and _prosperity_ . Prosperity is simply time saved, which is proportional to the division of labor. This recursive dynamic persists to this day as a virtuous cycle with no known natural limit — modern markets in goods, services and ideas allow human beings to exchange and specialize honestly for the betterment of all.

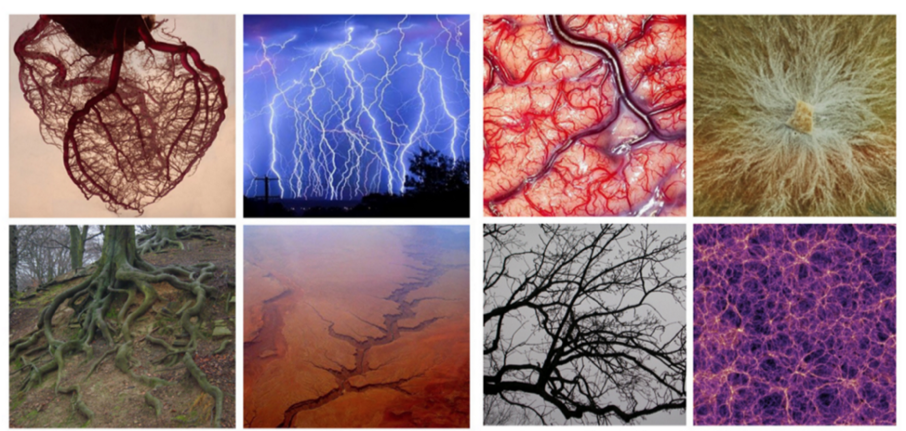

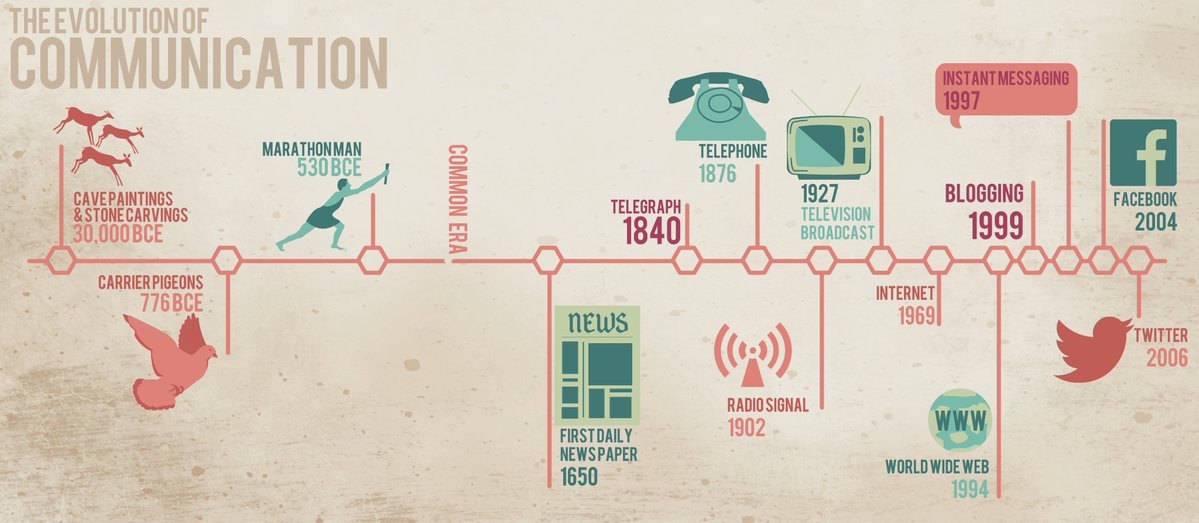

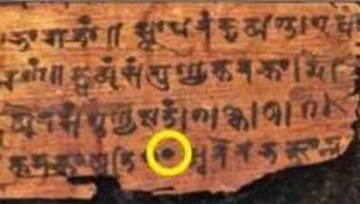

Human exchange is to cultural evolution what sex is to biological evolution. By exchanging and specializing, innovations come into existence and spread. At some point, human intelligence became collective and cumulative in a way that happened to no other animal. Language, and later writing, allowed us to pass our collective learnings to each successive generation. Written language allowed us to manifest and share our belief systems. As the only animal that can tell and believe stories, we learned to organize ourselves using abstractions such as money, mathematics, nations and corporations. Our unique ability to tell and believe stories — as free market capitalists, human rights activists, national citizens or whatever story we accord with — enables us to cooperate flexibly in large numbers and across genetic boundaries. This scale of collaboration, never attained by any other animal before or since, is the reason mankind came to dominate the Earth. We are the networked species, fully interconnected by our acts of exchange. A spontaneous emergent property of these complex human interactions is money, which solved problems inherent to trade and accelerated the rate of human exchange and the division of labor. Money, as the vital lubricant for human exchange, was among the first stories we used to collectively organize ourselves.

Story of Money [1]

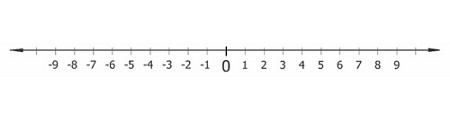

Let’s begin with first principles and follow logic from there. The simplest form of human exchange is the direct trading of actual goods, say guns for boats, in a process known as direct exchange or barter. Direct exchange is only practical when few people are trading few goods. In larger groups of people, there are more opportunities for individuals to specialize in production and trade with more people, which increases the aggregate wealth for everyone. This simple fact, that exchange enables us to produce more goods per hour of human effort is the foundation of economics itself:

Economics is the social science of increasing production per unit of contribution.

Larger groups of people exchanging goods mean larger markets, but also creates a problem of non-coincidence of wants — what you are seeking to acquire by trade is produced by someone who doesn’t want what you have to offer. This problem has three distinct dimensions:

- Non-coincidence in Scales — imagine trying to trade pencils for a house, you cannot acquire fractions of a house and the owner of the house may not need such a large amount of pencils

- Non-coincidence of Locations — imagine trying to trade a coal mine in one place for a factory in another location, unless by coincidence you are seeking a factory in that exact location and the counterparty you are dealing with is seeking a coal mine in that precise place, the deal will not be completed since factories and coal mines are not movable

- Non-coincidence in Time Frames — imagine trying to accumulate enough oranges to trade for a truck, since the oranges are perishable they would likely rot before the deal could be completed

The only way to resolve this three-dimensional problem is with indirect exchange, where you seek to find another person with a good desired by the counterparty and exchange your good for theirs only to, in turn, exchange it for the counterparty’s good to complete the deal. The intermediary good used to complete the deal with the counterparty is called a medium of exchange – the first function of money. Over time, people tend to gradually converge on a single medium of exchange (or, at most, a few media of exchange) as it simplifies trade. A good that becomes widely accepted as a medium of exchange is commonly called money.

Money offers its users pure optionality, as it can be readily exchanged for any good available in the marketplace. In other words, money is the most liquid asset within a trade network. In this sense, money is said to have the highest salability, meaning the ease with which it can be sold on the market at any time with the least loss in price. Salability of a good is relatively determinable by how well it addresses the three dimensions of the non-coincidence of wants problem:

- Salability across Scales — a good that is easily subdivided into smaller units or grouped together in larger units, which allows the user to trade it in whatever quantity desired

- Salability across Space — a good that is easily transported or transmitted over distances

- Salability across Time — a good that can reliably hold its value into the future by being resistant to rot, corrosion, counterfeit, unpredictable increases in supply and other debasements of value

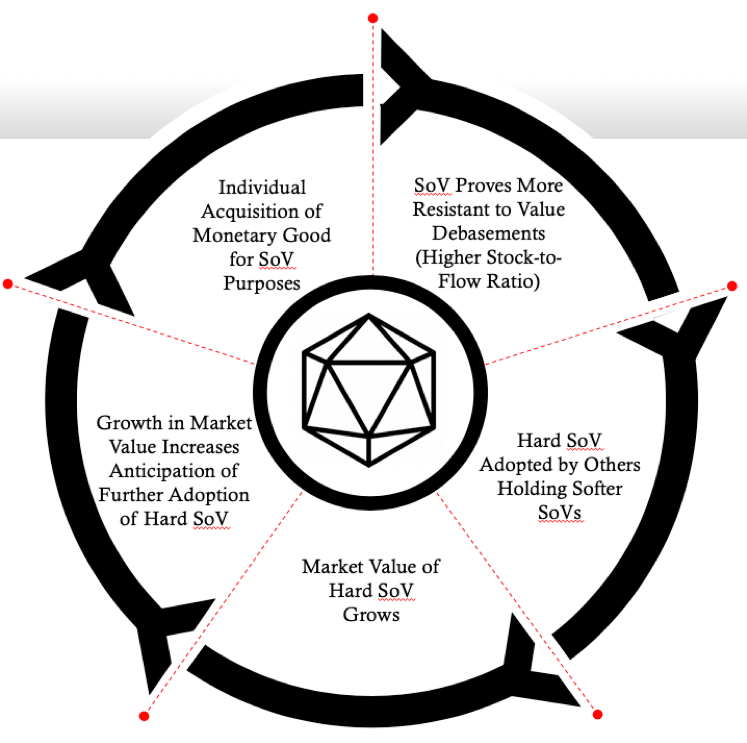

It is the third element, salability across time, that determines a good’s utility as a store of value — the second function of money. Since the production of each new unit of a monetary good makes every other unit relatively less scarce, it dilutes the value of the existing units in a process known as inflation . Protecting value from confiscation via inflation is a critical feature of money, and money is critical to the existence of flourishing trade networks.

Hard Money [1]

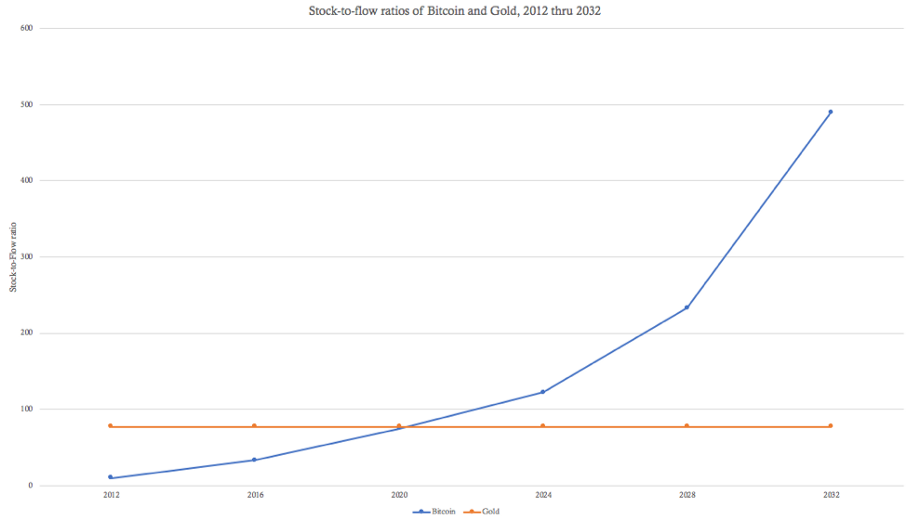

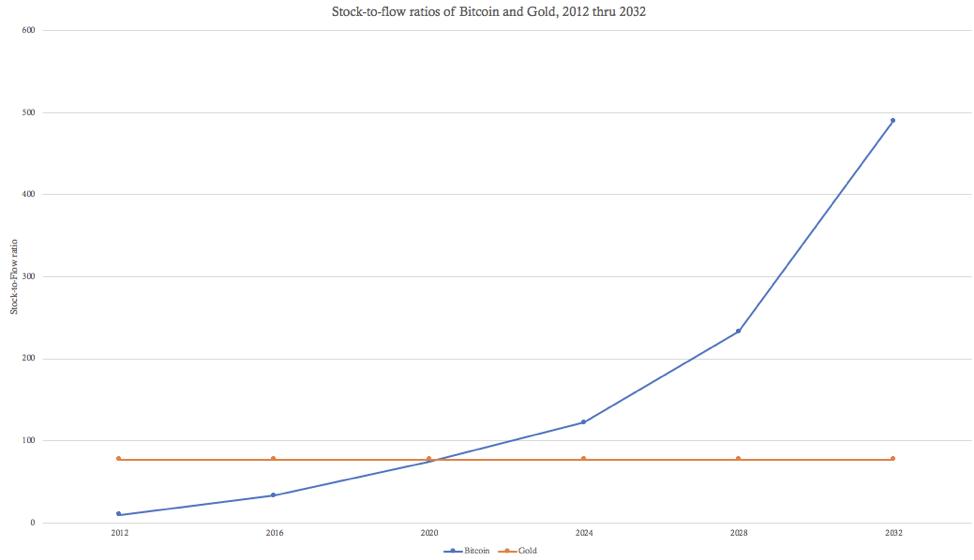

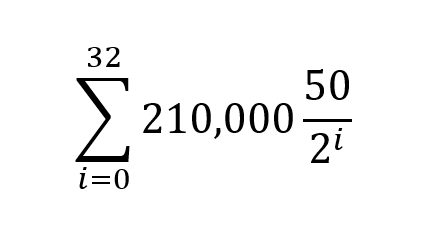

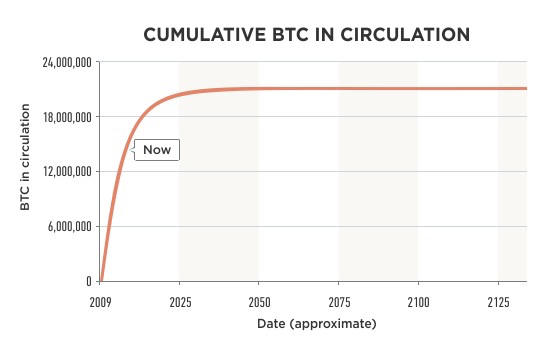

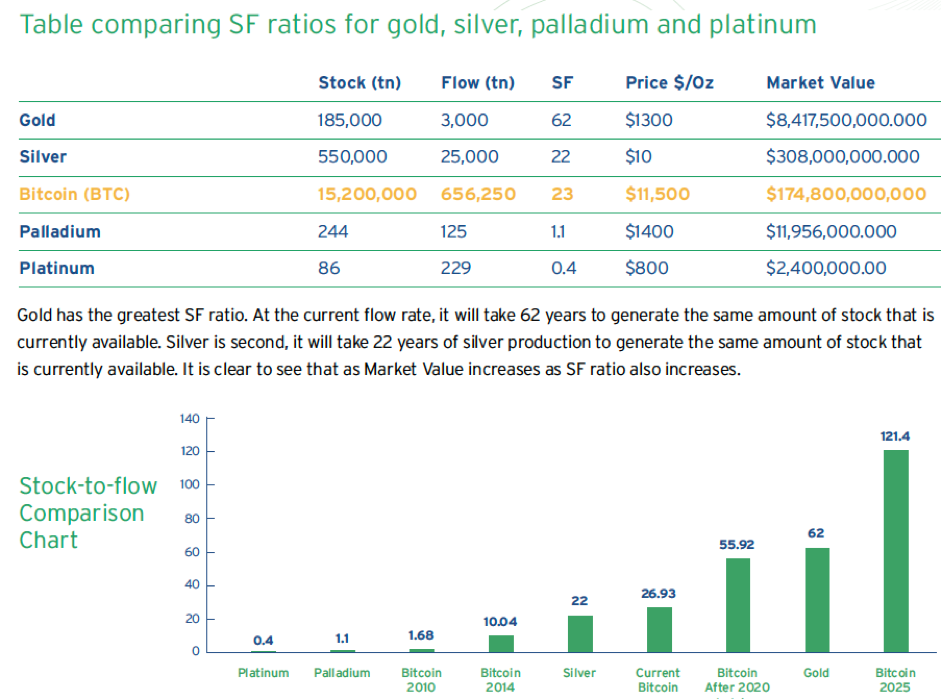

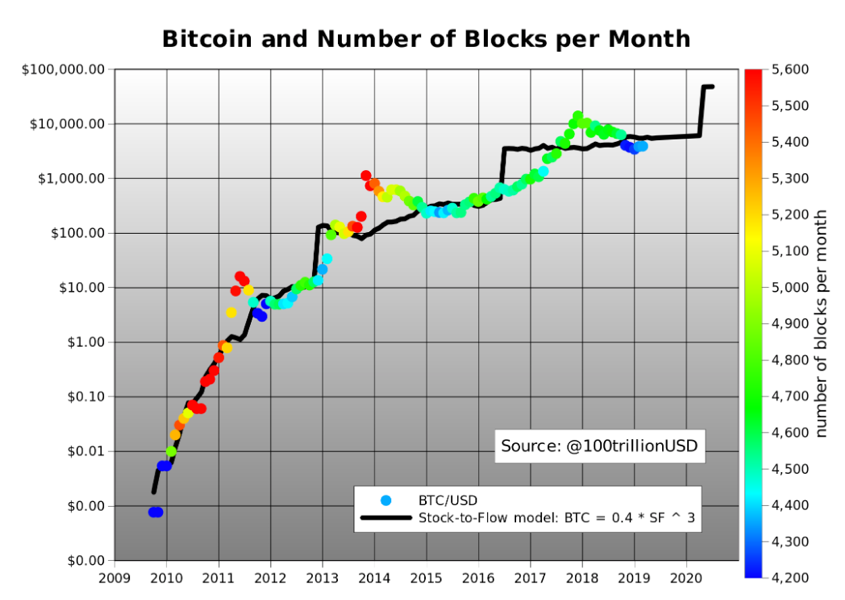

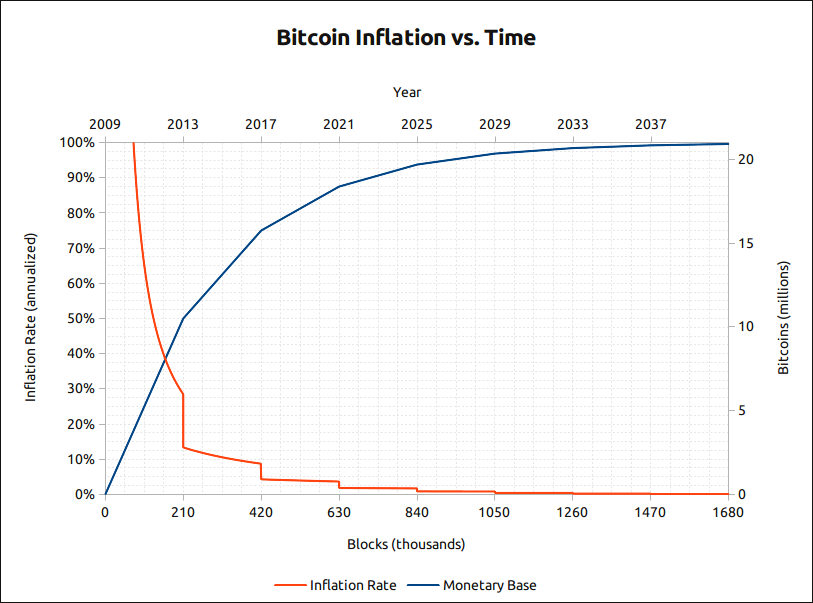

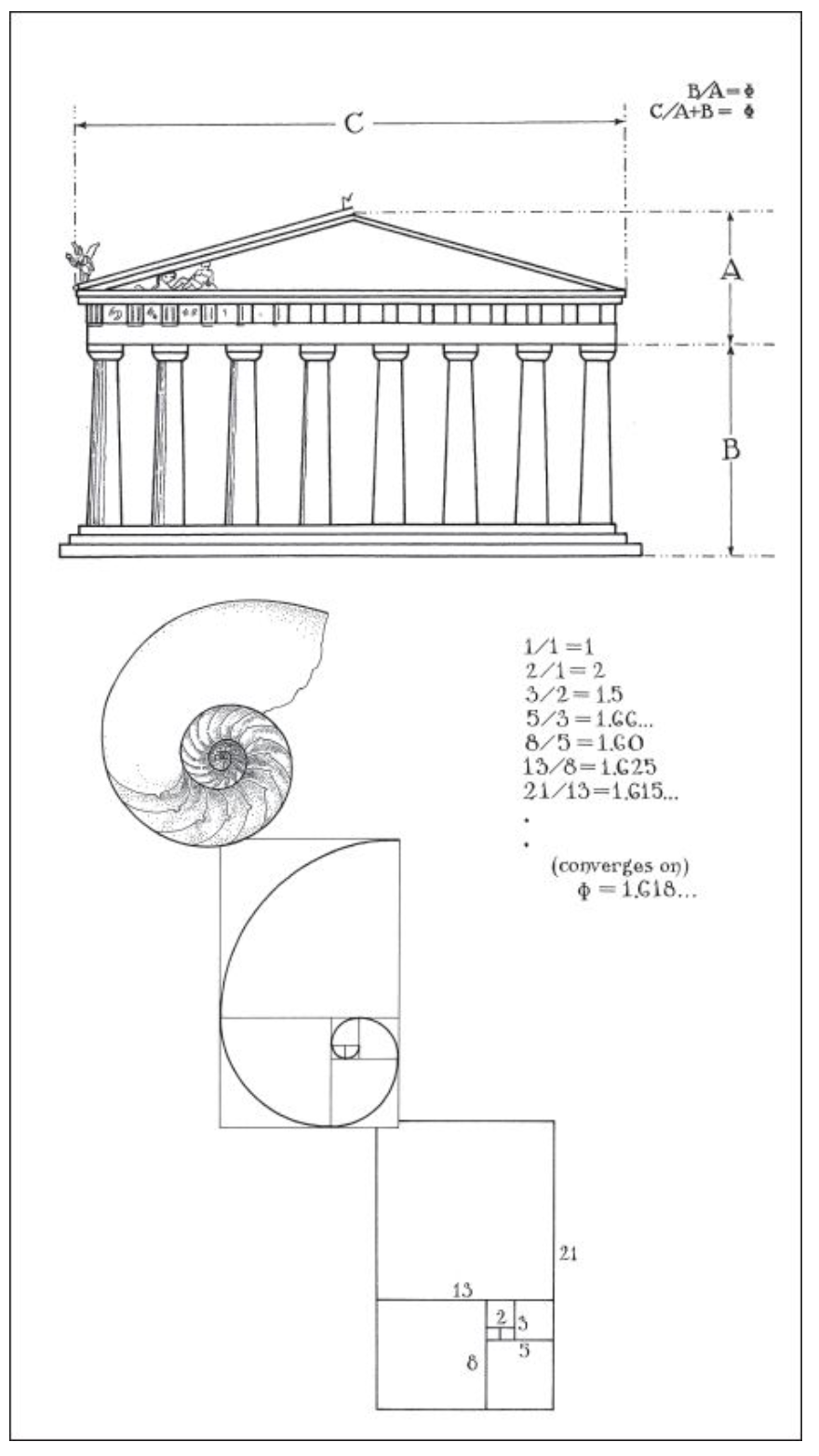

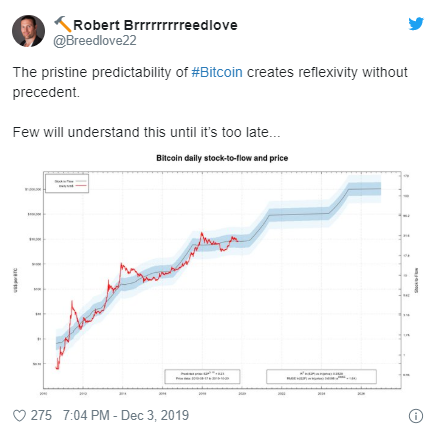

Hard money is more trustworthy as a store of value precisely because it resists intentional debasements of its value by others and therefore maintains salability across time. The hardness of a monetary good, also known as its soundness, is determined by the stock of its existing supply and the flow of its new supply. The ratio which quantifies the hardness of money is called the stock-to-flow ratio:

- ‘Stock’ is the existing supply of monetary units

- ‘Flow’ is the newly created supply over a specified time period, usually one year

- Dividing the stock of a monetary good by its flow equals its stock-to-flow ratio

- The higher the stock-to-flow ratio, the greater the hardness (or soundness) of money

The higher the stock-to-flow ratio, the more resistant the money is to having its value compromised by inflation. There are no correct choices as to forms of money, however there are consequences to what form a market naturally selects. If people choose to store their wealth in a monetary good which exhibits less hardness, then the producers of this monetary good are incentivized to produce more monetary units, which expropriates the wealth of existing unit holders and destroys the monetary good’s salability across time. This is the fatal flaw of soft money: anything used as a store of value that can have its supply increased will have its supply increased, as producers seek to steal the value stored within the soft monetary units and store it in a harder form of money. As many historical examples in this essay will demonstrate, any monetary good which can have its supply cheaply and easily increased will rapidly destroy the wealth of those using it as a store of value.

For a good to assume a dominant monetary role within an economy, it must exhibit superior hardness with a higher stock-to-flow ratio than competing monetary goods. Otherwise, excessive unit production will destroy the wealth of savers and the incentives to use it as a store of value. Particular goods achieve monetary roles based on the interplay of people’s decisions. It is from the chaos of complex human interactions that monetary orders emerge. Therefore, it is important to consider the social aspects of the spontaneous emergence of monetary orders.

Money is a Social Network [1,4]

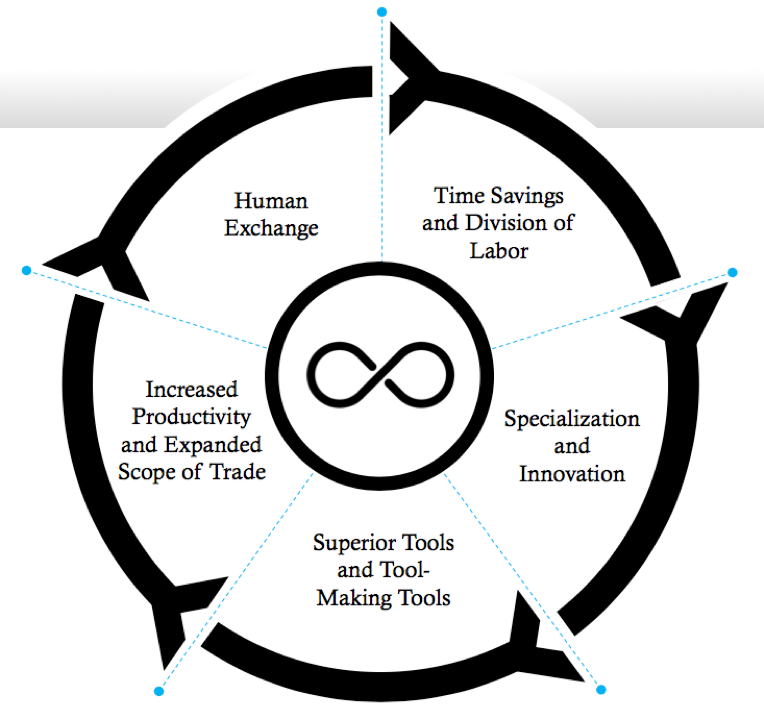

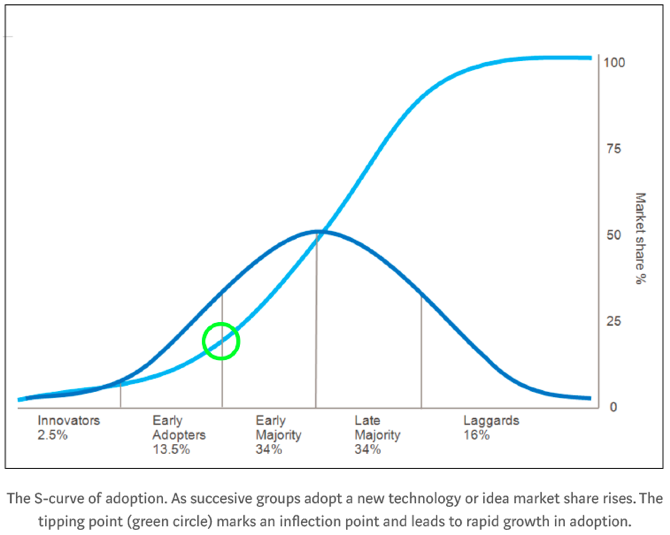

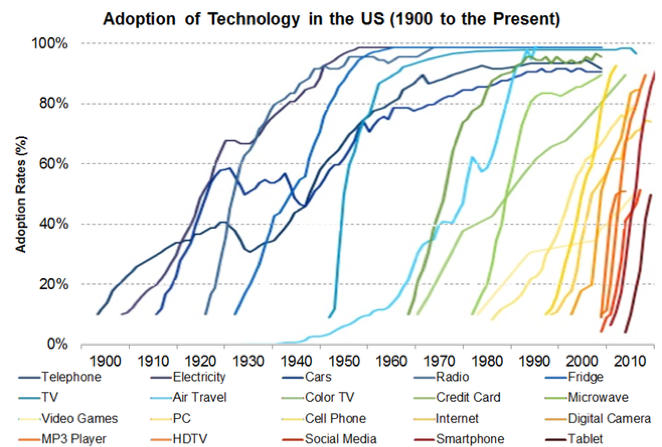

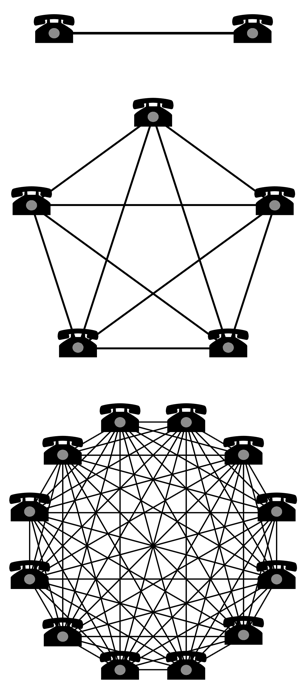

Money, as a value system which connects people across space and time, is the original and largest social network. The value of a network is a reflection of the total number of possible connections it allows. Similar to the telephone and modern social media platforms, a monetary network becomes exponentially more valuable as more people join it because the number of possible connections it allows is proportional to the square of the number of its total network participants, a relationship defined by Metcalfe’s Law:

Network values are based on the number of possible connections they allow. Such values grow exponentially with the addition of each new constituent — a property commonly known as network effects.

Network values are based on the number of possible connections they allow. Such values grow exponentially with the addition of each new constituent — a property commonly known as network effects.

In a monetary network, more possible connections mean more salability and a broader scope of trade. Participants in a monetary network are connected by their use of a common form of money to express and store value. Network effects, defined as the incremental benefit attained by adding a new member to a network for all existing members in that same network, encourage people to adopt a single form of money. Intuitively, a monetary good that holds value across time (hard money) is always preferable to one that loses value (soft money). This causes people to naturally gravitate to the hardest form of money available to them. Further, since human exchange is a singular communal phenomenon suffering from a three-dimensional non-coincidence of wants problem, any monetary good that can solve all three dimensions of this problem will win the entire (or vast majority) of the market. For these reasons, a free market for money exhibits a winner take all (or, at least, a winner take most) dynamic . Network effects accelerate people’s natural coalescence around a single monetary technology since larger monetary networks support higher salability of the monetary good involved. However, the selection of a monetary good is limited by the technological realities of the markets selecting. This can impede the winner take all dynamic, since particular monetary goods each satisfy the desirable traits of money to greater or lesser extents.

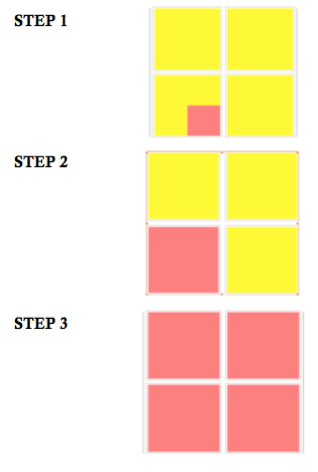

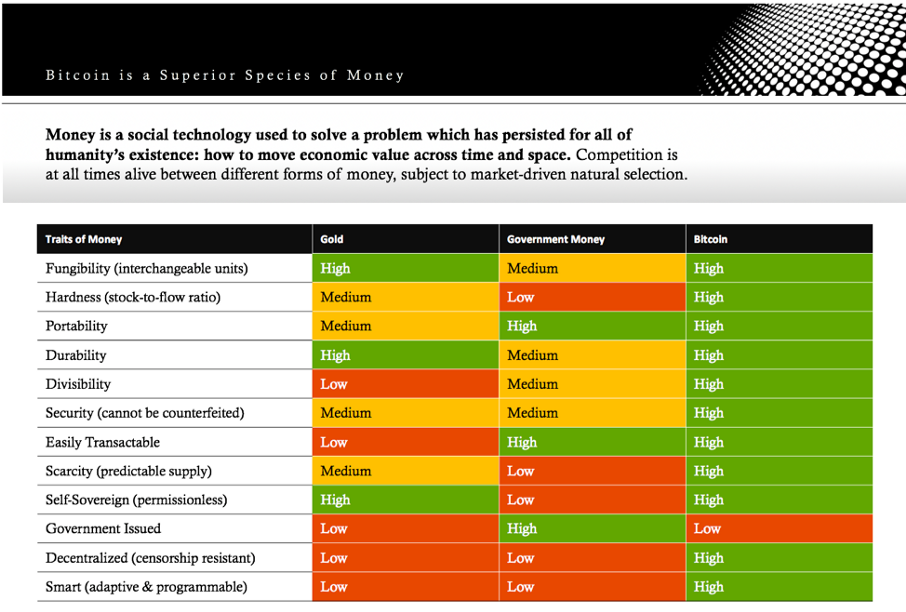

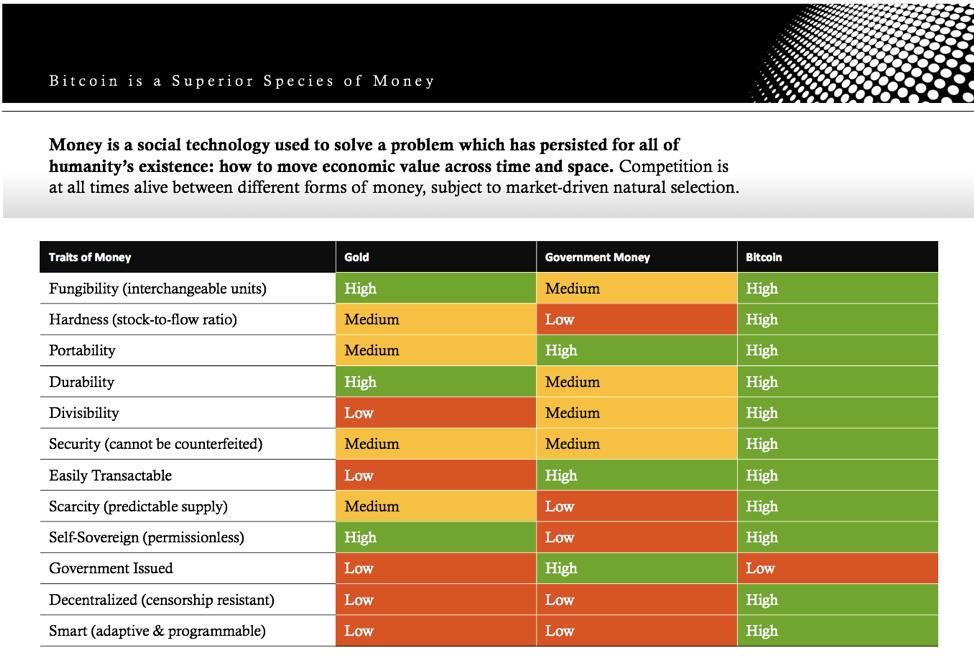

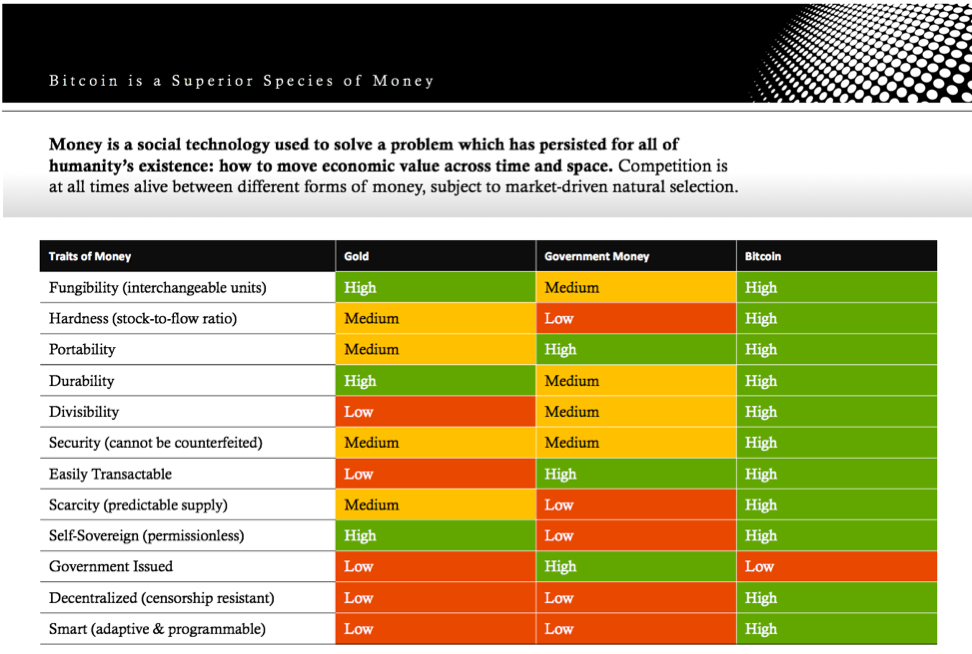

Monetary Traits [1,4]

As we will see, markets have naturally and spontaneously selected for the monetary good which best satisfies a variety of desirable traits that determine how useful a particular monetary good is as a form of money:

- Hardness — resistance to unpredictable supply increases and debasements of value

- Fungibility — units are interchangeable and indistinguishable from one another

- Portability — ease of transporting or transmitting monetary units across distances

- Durability — resistance of monetary units to rot, corrosion or deterioration of value

- Divisibility — ease of subdividing or grouping monetary units

- Security — resistance to counterfeiting or forgery

- Sovereignty — the source of its value, trust factors and permissions necessary to transact with it (natural social consensus or artificial government decree)

- Government Issued — authorized as legal tender by a government

As discussed, hardness is the singular trait that takes primacy over all others in determining a good’s suitability for playing a monetary role. Money, as an expression of value, has remained conceptually constant but has evolved to inhabit many different goods over time. Like language, which was first spoken, then written and now typed, the meaning expressed by money remains the same while its modality continually evolves. As the monetary technologies we use to express value change, so too do our preferences.

Prospects of Prosperity [1]

In economics, a critical aspect of human decision making is called time preference, which refers to the ratio at which an individual values the present relative to the future. Time preference is positive for all humans, as the future is uncertain, and the end could always be near. Therefore, all else being equal, we naturally prefer to receive value sooner rather than later. People who prefer to defer current consumption and instead invest for the future are said to have a lower time preference. The lowering of time preference is closely related to the hardness of money and is also exactly what enables human civilization to advance and become more prosperous. In regard to time preference, hard money is important in three critical aspects:

- By providing a reliable way to protect value across time, hard money incentivizes people to think longer term and thus lowers their time preferences

- As a stable unit of measurement, hard money enables markets to grow ever-larger by reducing the costs and risks of free trade, which increases the incentives for long-term cooperation and lowers time preferences

- Self-sovereign money (like gold and Bitcoin) that cannot be manipulated by any single party reduces governmental intervention which encourages the growth of free markets, which increases their long-term stability and lowers time preferences

A lower time preference is an important part of what separates humans from other animals. By considering what is better for the future, we can curb our animalistic impulses and choose to act rationally and cooperate for the betterment of everyone involved. As humans lower their time preference, they develop a scope for carrying out tasks over longer time horizons. Instead of spending all our time producing goods for immediate consumption, we can choose to spend time creating superior goods that take longer to complete but benefit us more in the long run. Only by lowering time preference can humans produce goods that are not meant to be consumed themselves but are instead used in the production of other goods. Goods used exclusively for the production of other goods are called capital goods .

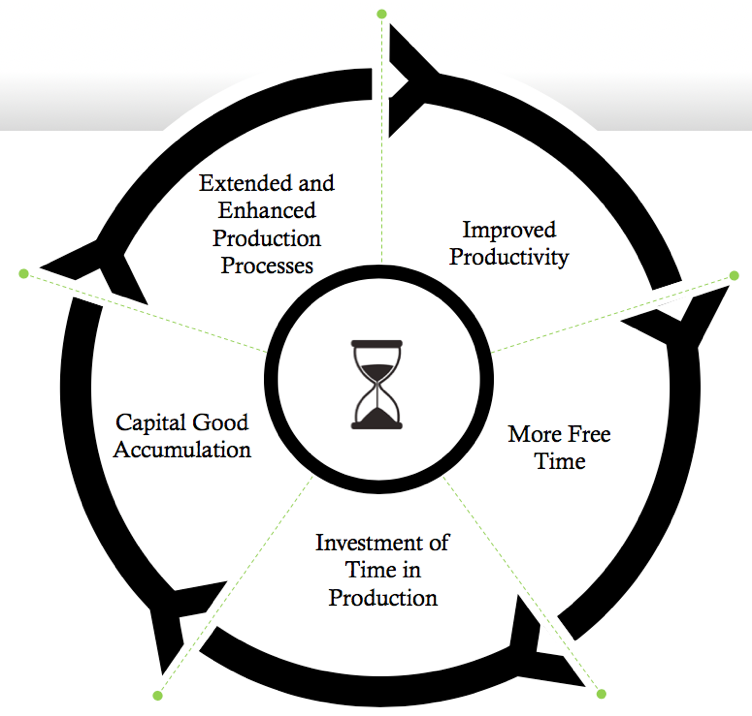

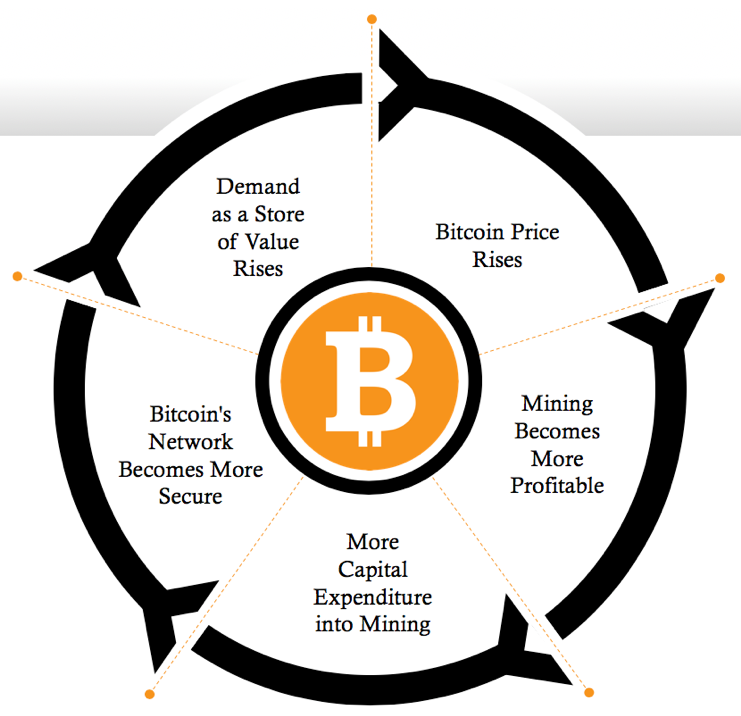

Only humans with a lower time preference can decide to forgo a few hours of fishing and opt to build a superior fishing pole, which cannot be eaten itself, but in the future will enable better results per hour of human effort spent fishing. This is the essence of investment: humans defer immediate gratification and invest their time producing capital goods which will, in turn, make the production process itself more sophisticated, extend it over a longer time horizon and yield superior results per hour of human effort. In this way, investment increases capital good stocks which increases productivity. Amazingly, this effect also transforms into a positive feedback loop . Also known as a virtuous cycle or the flywheel effect, a positive feedback loop is a process that is recursively energized (its outputs also serve as its inputs) and therefore creates compounding effects. Positive feedback loops play an important role in biology, chemistry, psychology, sociology, economics and cybernetics. In respect to investment, as more capital goods are accumulated, levels of productivity are increased even more and the time horizon of production is extended even further:

As people exhibit lower time preferences and spend their time wisely, they increase their capacity for investment and create more free time for themselves.

As people exhibit lower time preferences and spend their time wisely, they increase their capacity for investment and create more free time for themselves.

To understand this preference clearly, let’s consider two hypothetical fishermen, Harold and Louis, who start out with nothing other than their bare hands. Harold has a higher time preference than Louis and chooses to spend his time catching fish with using just his bare hands. Using this approach, Harold spends about 8 hours per day to catch enough fish to feed himself for one day. Louis, on the other hand, spends just 6 hours per day catching fish, makes do with the smaller amount of fish and chooses to spend the other 2 hours building a fishing pole. Two weeks later, Louis has succeeded in building a fishing pole, which he can now use to catch twice as many fish per hour as Harold. Louis’s investment in the fishing pole could allow him to only fish for 4 hours each day, eat the same amount of fish as Harold and spend his other 4 hours in leisure. However, since Louis has a lower time preference, he instead chooses to fish for 4 hours per day and spend the other 4 hours building a fishing boat.

One month later, Louis has succeeded in building a fishing boat, which he can now use to go further out to sea and catch fish that Harold has never even seen. Not only has Louis increased his productivity (fish caught per man hour) but he has also increased the quality of his production (a greater variety of fish from the deep sea). By using his fishing pole and boat, Louis now needs only 1 hour per day to catch a day’s worth of food and spends his other 7 hours engaged in further capital accumulation — building better fishing poles, boats, nets, lures, etc. — which, in turn, further increases his productivity and quality of life.

Should Louis and his descendants continue to exhibit a lower time preference, the results will compound over time and across generations. As they accumulate more capital, their work efforts will be ever-further amplified by productivity gains and enable them to engage in ever-larger projects that take ever-longer to complete. These gains are amplified even further when Louis and his descendants begin trading with others that specialize in crafts in which they themselves do not — such as housing, wine making or farming. Successive layers of learning, productivity gains and flourishing trade networks are the foundational sediment upon which all human advancement in terms of knowledge, technology and culture is built. Human advancement is noticeable in the tools we make and the way we relate with one another.

From this perspective, it becomes clear that the most important economic decisions any individual faces are related to the trade-offs they face with their future self. Eat less fish today, build a fishing boat tomorrow. Eat clean today, be healthy tomorrow. Exercise today, be fit tomorrow. Read books today, be knowledgeable tomorrow. Invest money today, be wealthy tomorrow. We can all take solace that this compounding force of nature is always available to each and every one of us. No matter how bad the circumstances are for a man with a low time preference, he will likely find a way to keep compounding his present efforts and prioritizing his future self until he achieves his objectives. Contrarily, no matter how much fortune and wealth favors the man with a high time preference, he will likely find a way to continue squandering his wealth and shortchanging his future self. These individual relationships with our future selves is the microcosm of the societal macrocosm. As society develops a lower time preference, its prospects of prosperity improve in tandem.

Foundation of Economic Growth [1,4]

There are many factors beyond the scope of this essay which influence time preference. Most relevant to our discussion is the expected future value of money. As we have seen, hard money is superior at holding its value across time. Since its purchasing power tends to remain constant or grow over time, hard money incentivizes people to delay consumption and invest for the future, thereby lowering their time preference. On the other hand, soft money is subject to having its supply increased unexpectedly. Increasing the money supply is the same as lowering the interest rate, which is effectively the price of borrowing money and the incentive to save. By reducing the interest rate, the incentive to save and invest is diminished whereas the incentive to borrow is increased. So, soft money disincentivizes a favorable orientation towards the future. In other words, soft money systems raise society’s time preference. For this reason, soft money, once it is sufficiently debased, tends to precede societal collapse (more on this later).

An ideal hard money would be one whose supply is absolutely scarce, meaning no one could produce more of it. The only noncriminal way to acquire money in such a society would be to produce something of value and exchange it for money. As everyone seeks to acquire more money, everyone would become ever-more productive which would encourage capital accumulation, productivity gains and a lowering of time preference. Since the money supply is fixed, economic growth would cause the prices of real goods and services to drop over time, as a fixed quantity of monetary units chases an increasing quantity of goods. Since people could expect to be able to purchase more with the same amount of money in the future, such a world would discourage immediate consumption and encourage saving and investment for the future. Paradoxically, a world that consistently defers consumption will actually end up consuming more in the long run as its increased savings would increase investment and productivity, thus making its citizens wealthier in the future. This dynamic would spark a positive feedback loop — with present needs met and an ever-greater focus on the future, people naturally begin concentrating other aspects of life such as social, cultural and spiritual endeavors. This is the essence of free market capitalism: people choosing to lower their time preference, defer immediate gratification and invest in the future.

The foundation of all economic growth is delayed gratification, which leads to savings, which leads to investment, which extends the duration of the production cycle and increases productivity in a self-sustaining, virtuous cycle with no known natural limit.

Debt is the opposite of saving. As saving creates the possibility for capital accumulation and its associated benefits, debt is what can reverse it by reducing capital stocks, productivity and living standards across generations. As we will show later, when the gold standard was forcibly ended by governments, money not only became much softer, but it also fell under the command of politicians who are incentivized to operate with high time preferences as they strive for reelection every few years. This explains why politicians continue to mandate the use of soft government money, despite the long-term harm it causes to an economy, ensuring that it remains the dominant form of money in the world (we will cover soft government money’s unnatural ascent to world domination later).

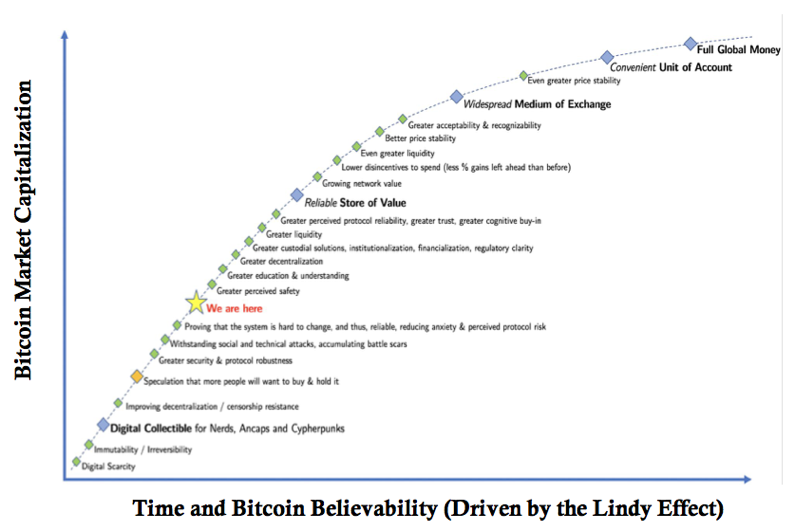

When a form of money becomes globally dominant, it finally serves the third function of money — unit of account . History shows us that this function is the final evolutionary stage in the natural ascendancy of monetary goods that achieve a dominant role — which are first a store of value, then a medium of exchange and finally a unit of account. As economist William Stanley Jevons explained:

“Historically speaking, gold seems to have served, firstly, as a commodity valuable for ornamental purposes; secondly, as stored wealth; thirdly, as a medium of exchange; and, lastly, as a measure of value.”

Today, the US Dollar is dominant and serves as the global unit of account as prices are most commonly expressed in its terms. This consistency of expression simplifies trade and enables a (somewhat) stable pricing structure for the global economy.

The Economic Nervous System [1]

Market prices are an essential communicative force in economics. As economic production moves from a primitive scale, it becomes harder for individuals to make production, consumption and trade decisions without having a fixed frame of reference (unit of account) which to compare the value of different objects to one another.

In his paper ‘The Use of Knowledge in Society’ Friedrich Hayek elucidated the economic problem as not merely a matter of allocating human effort. More accurately, the economic problem is one of allocating human effort according to knowledge that is distributed in the minds of people that are each primarily concerned with their respective area in the broader economy. This distributed knowledge includes the:

- Conditions of production

- Availability of the factors of production

- Preferences of individuals

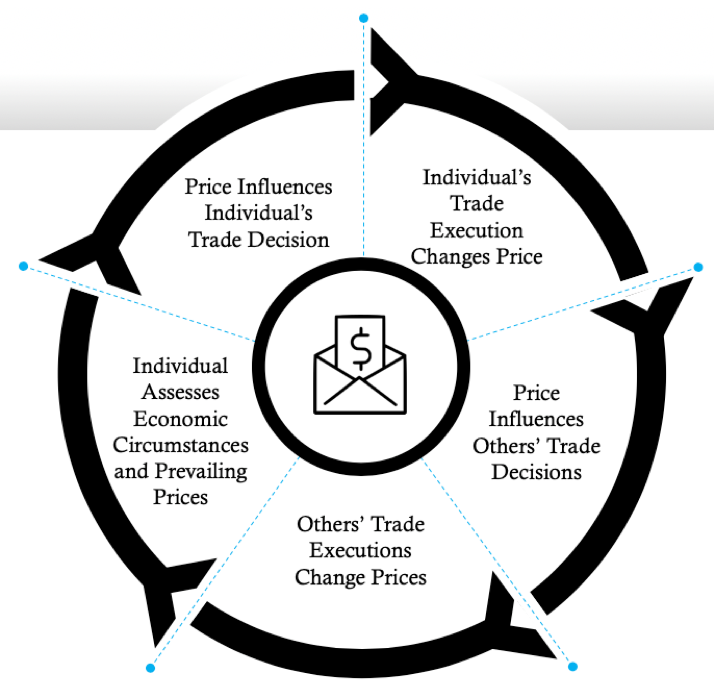

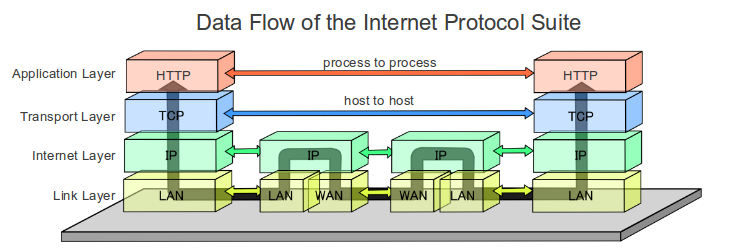

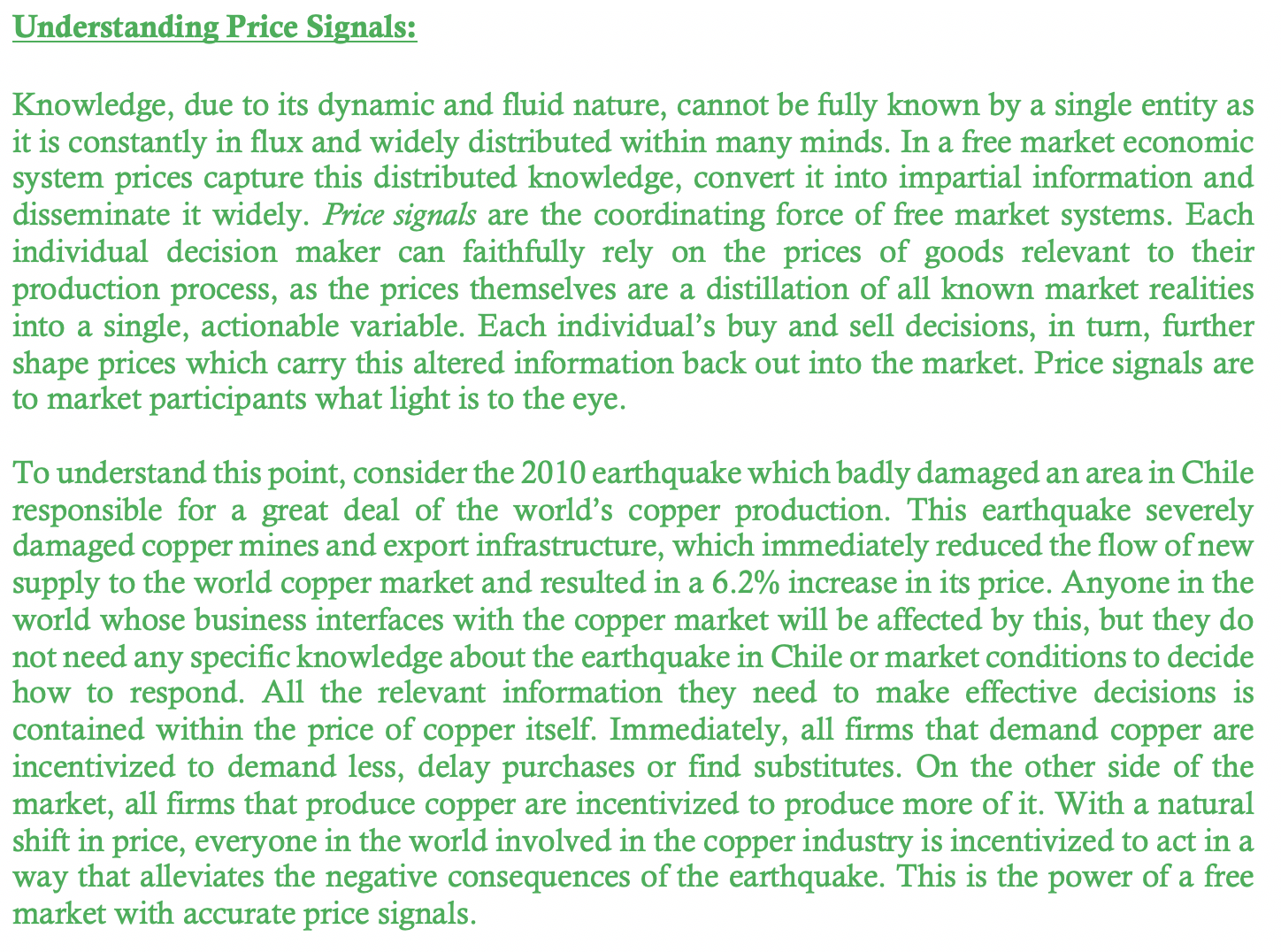

Knowledge, due to its dynamic and fluid nature, cannot be fully known by a single entity as it is constantly in flux and widely distributed within many minds. In a free market economic system prices capture this distributed knowledge, convert it into impartial information and disseminate it widely. Price signals are the coordinating force of free market systems. Each individual decision maker can faithfully rely on the prices of goods relevant to their production process, as the prices themselves are a distillation of all known market realities into a single, actionable variable. Each individual’s buy and sell decisions, in turn, further shape prices which carry this altered information back out into the market. Price signals are to market participants what light is to the eye.

To understand this point, consider the 2010 earthquake which badly damaged an area in Chile responsible for a great deal of the world’s copper production. This earthquake severely damaged copper mines and export infrastructure, which immediately reduced the flow of new supply to the world copper market and resulted in a 6.2% increase in its price. Anyone in the world whose business interfaces with the copper market will be affected by this, but they do not need any specific knowledge about the earthquake in Chile or market conditions to decide how to respond. All the relevant information they need to make effective decisions is contained within the price of copper itself. Immediately, all firms that demand copper are incentivized to demand less, delay purchases or find substitutes. On the other side of the market, all firms that produce copper are incentivized to produce more of it. With a natural shift in price, everyone in the world involved in the copper industry is incentivized to act in a way that alleviates the negative consequences of the earthquake. This is the power of a free market with accurate price signals.

The wisdom of the crowd is always superior to the wisdom of the board room. There is simply no way to recreate the adaptivity and collective intelligence of markets by installing a centralized planning authority. How would they decide who should increase production and by how much? How would they decide who should reduce consumption and by how much? How would they coordinate and enforce their decisions in real time on a global scale? In this sense, prices are the economic nervous system that disseminate knowledge across the world and help coordinate complex production processes by:

- Incentivizing supply and demand changes to match economic reality and restore market equilibriums quickly

- Efficiently matching buyers and sellers in the marketplace

- Compensating producers for their work efforts

Without accurate price signals, humans could not benefit from the division of labor and specialization beyond a small scale. Trade allows producers of goods to mutually increase their living standards by specializing in goods in which they have a relative or comparative advantage — goods they can produce relatively faster, cheaper or better. Accurate prices expressed in a common, stable medium of exchange help people identify their comparative advantage and specialize in it. Specialization, guided by reliable price signals, enables producers to improve their efficiency of production and accumulate capital specific to their craft. This is why the most productive allocation of human efforts is only determinable by an accurate pricing system within a free market. Also (as we will see later), this is exactly why capitalism prevailed over socialism, because socialism lacked an economic nervous system. But before diving into the economic aspects which underpinned this historic ideological struggle and seeing how it is still relevant today, we first need to understand the evolutionary forces that have shaped money throughout history.

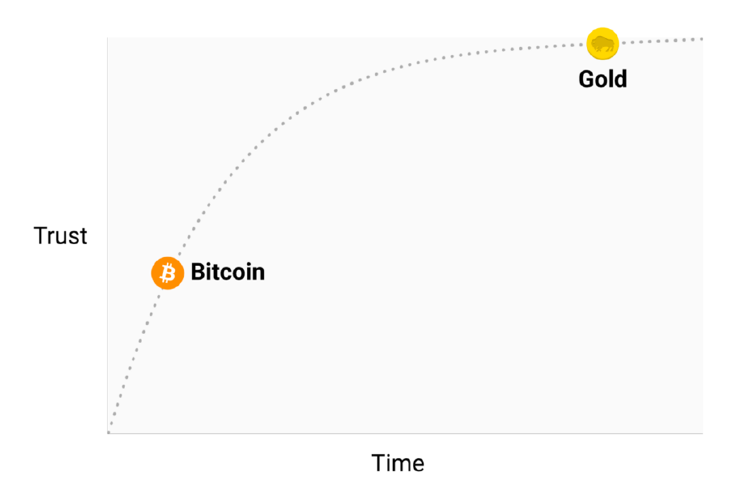

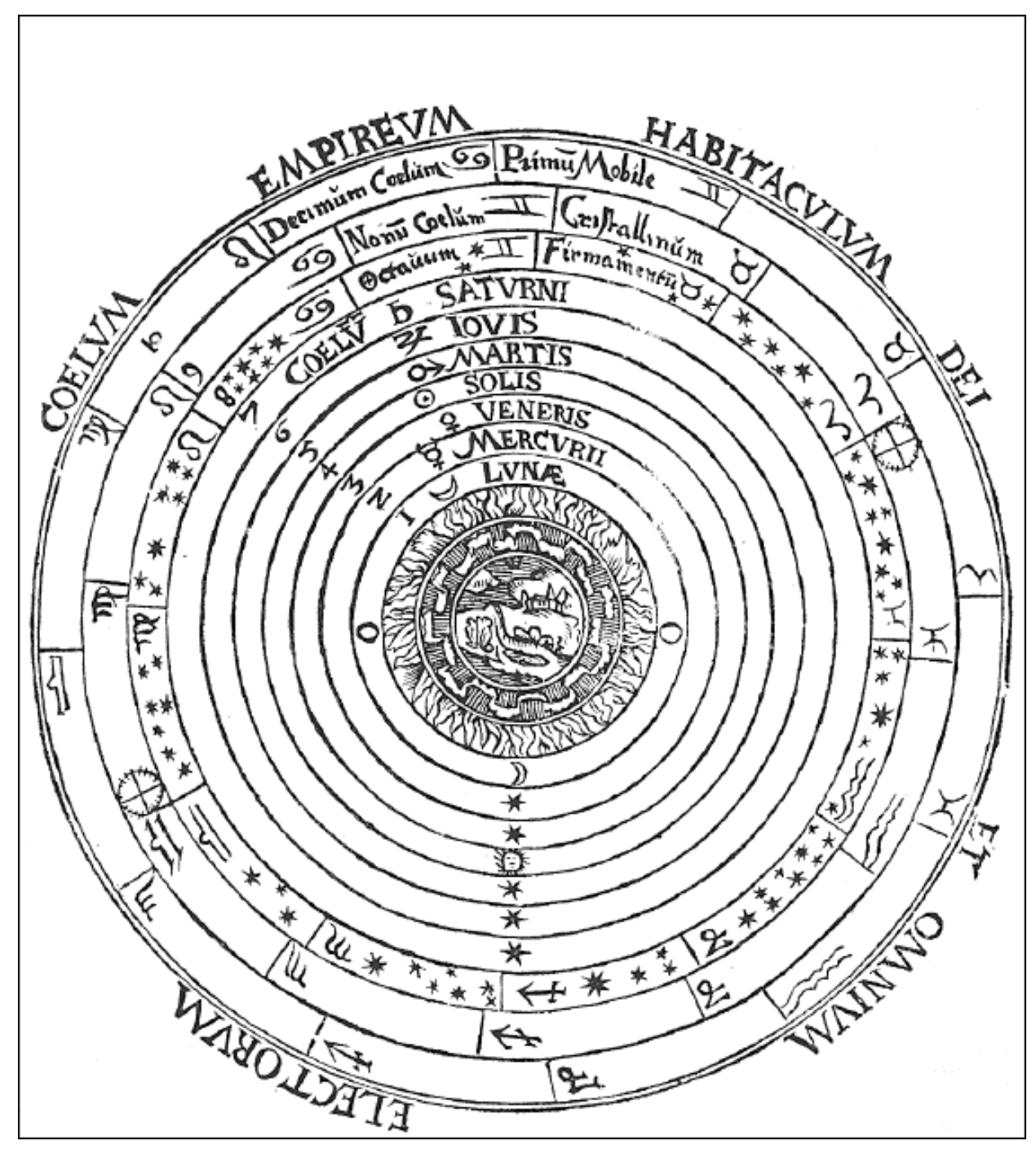

Monetary Evolution [1]

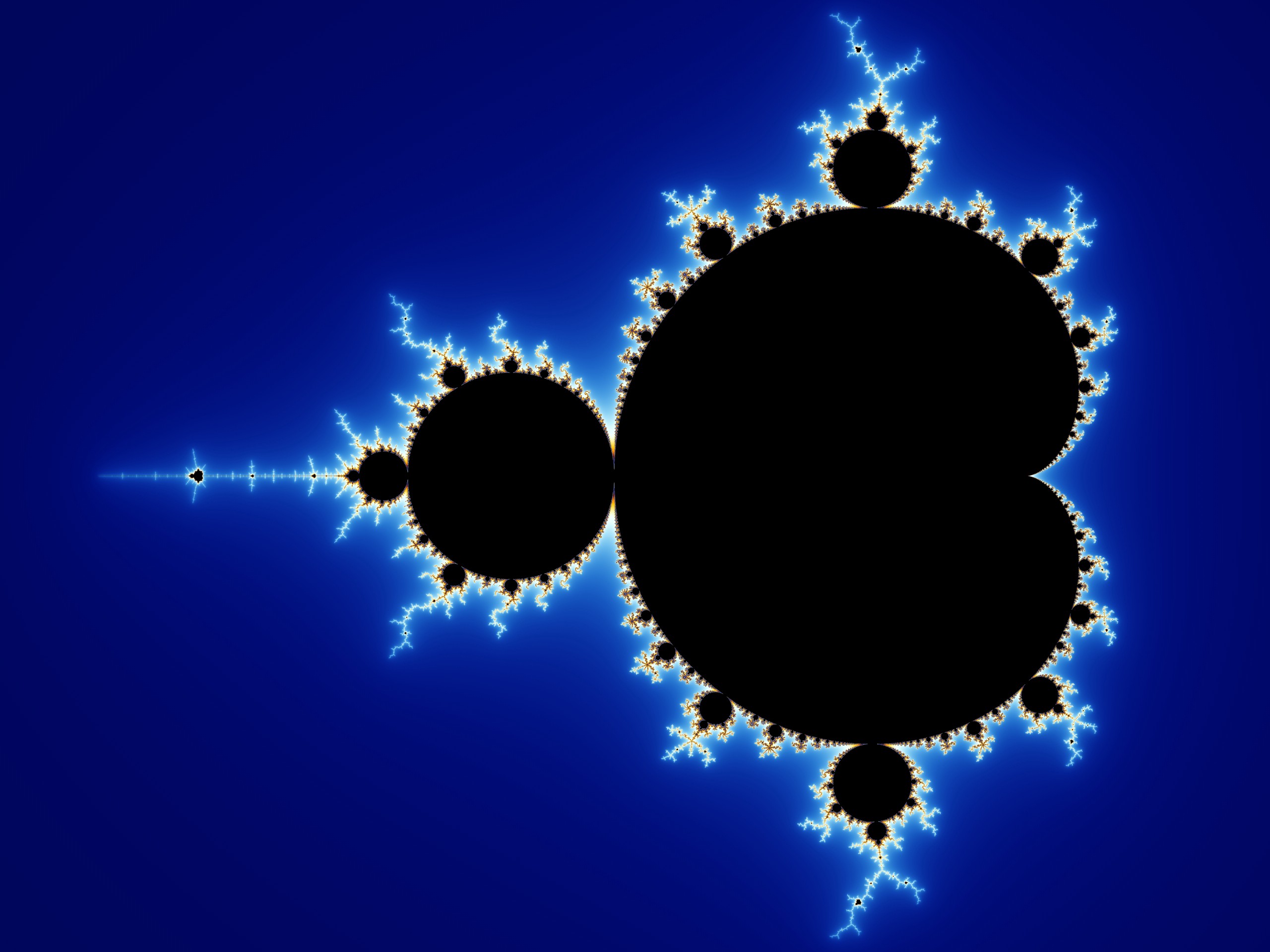

Throughout history, money has taken many forms — seashells, salt, cattle, beads, stones, precious metals and government paper have all functioned as money at one or more points in history. Monetary roles are naturally determined by the technological realities of the societies shaping the salability of goods. Even today, forms of money still spontaneously emerge with things like prepaid mobile phone minutes in Africa or cigarettes in prisons being used as localized currencies. Different monetary technologies are in constant competition, like animals competing within an ecosystem. Although instead of competing for food and mates like animals, monetary goods compete for the belief and trust of people. Believability and trustworthiness form the basis of social consensus — the source of a particular monetary good’s sovereignty from which it derives its market value along with the trust factors and permissions necessary to transact with it.

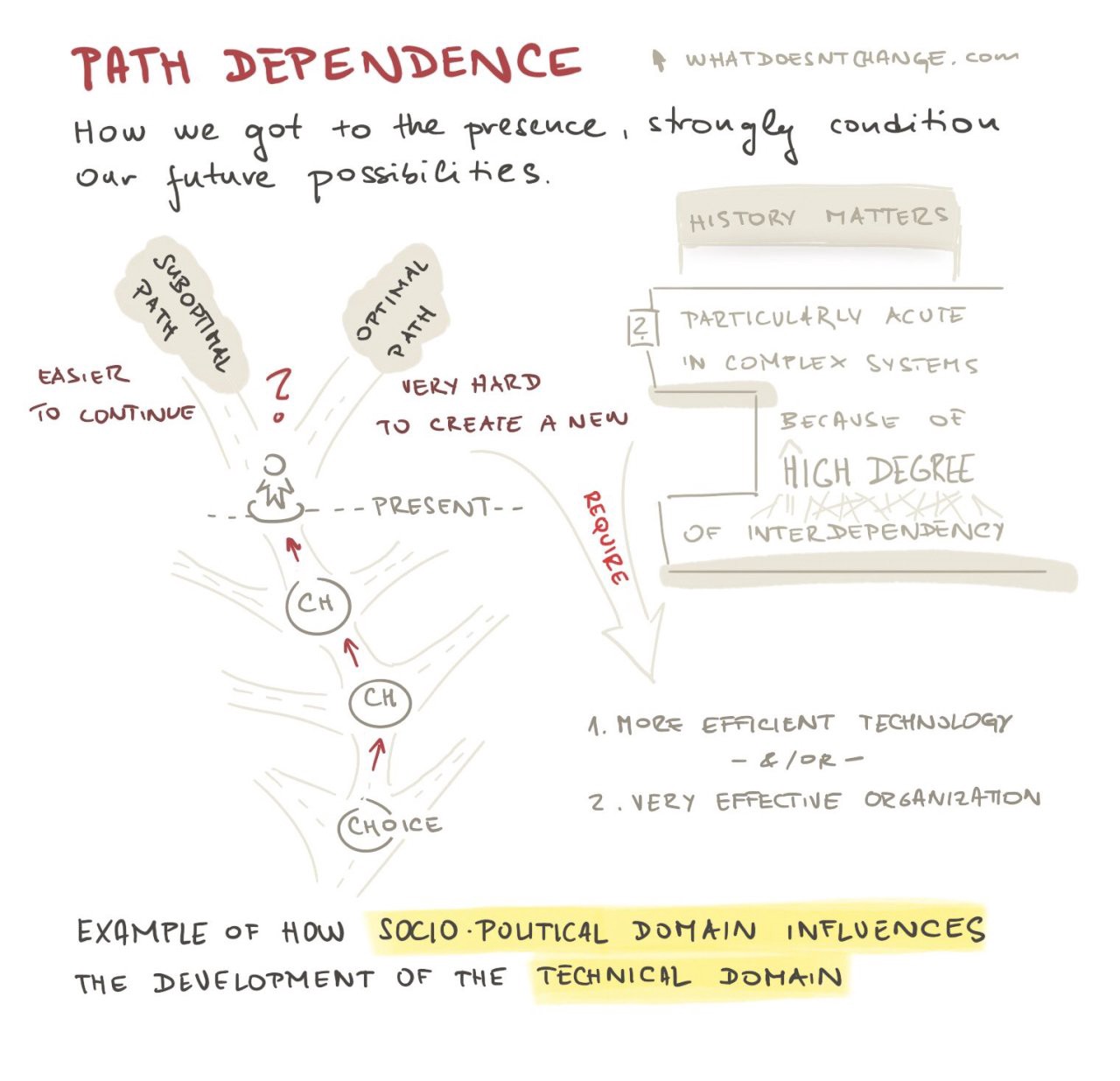

As these competitions continue to unfold in a free market, goods attain and lose monetary roles according to the traits which determine how believable or trustworthy they are and are expected to remain over time. As we will show, free market competition is ruthlessly effective at promulgating hard money as it only allows those who choose the hardest form available to maintain wealth over time. This market-driven natural selection causes new forms of money to come into existence and older forms to fade into extinction. Like biologically-driven natural selection, in which nature continuously favors the organisms which are best suited for success in their respective ecologies, this market-driven natural selection is a process in which people naturally and rationally favor the most believable and trustworthy monetary technologies available in their respective trade networks. Unlike ecological competition which can favor many dominant organisms, the marketplace for money is driven by network effects and favors a winner take all (or, at least, a winner take most) dynamic as the non-coincidence of wants problem is universal and if a single hard money is capable of solving all three of its dimensions than it will become dominant (as discussed earlier in the social network aspects of money).

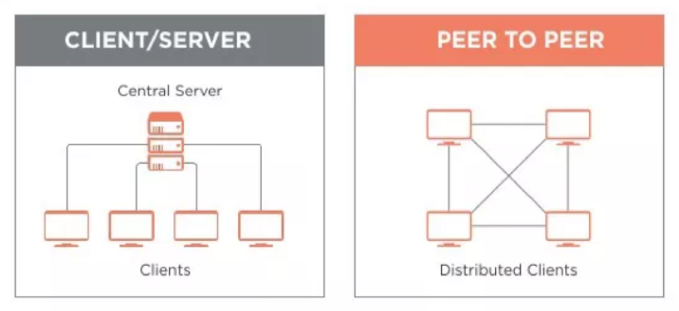

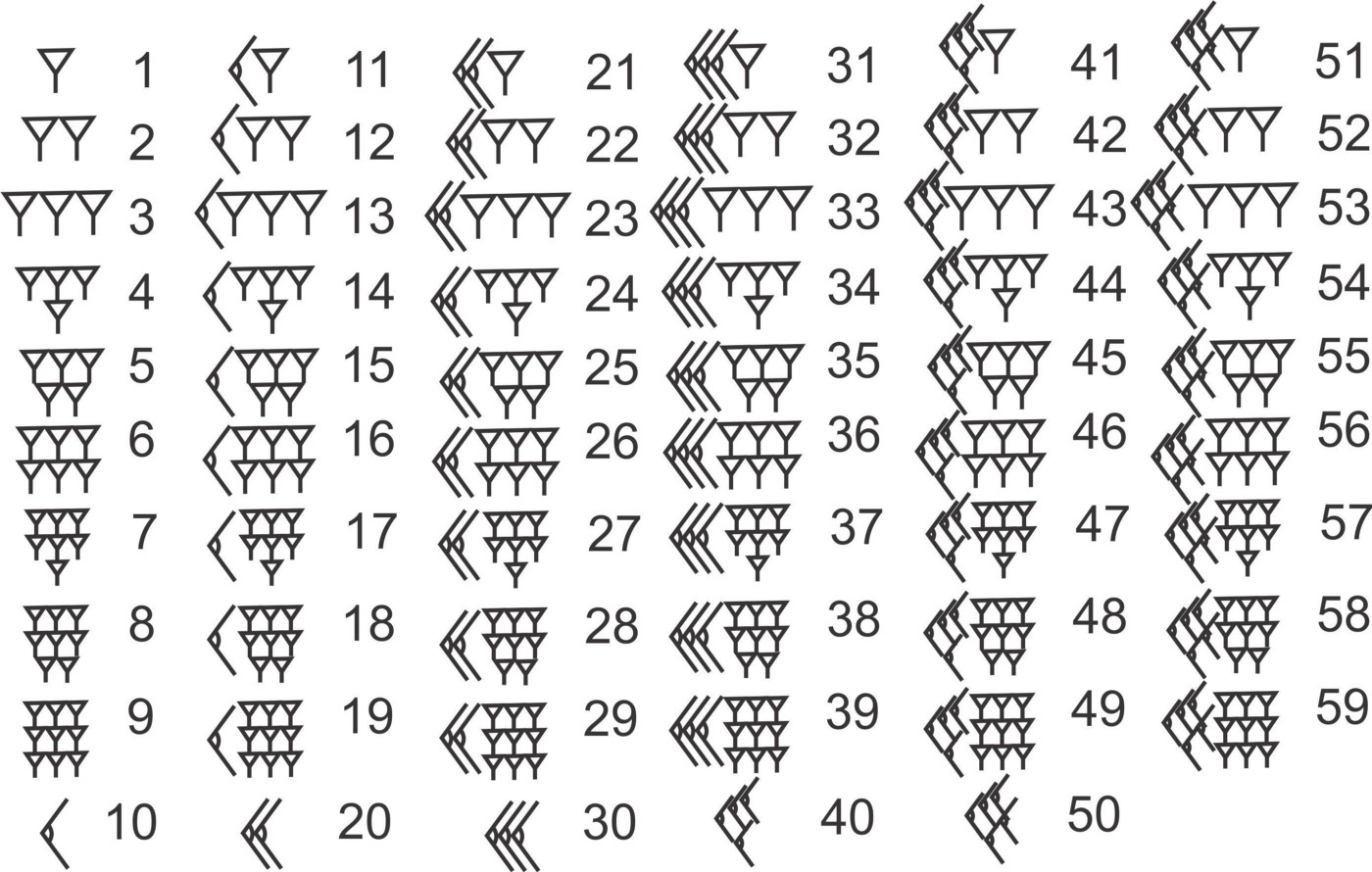

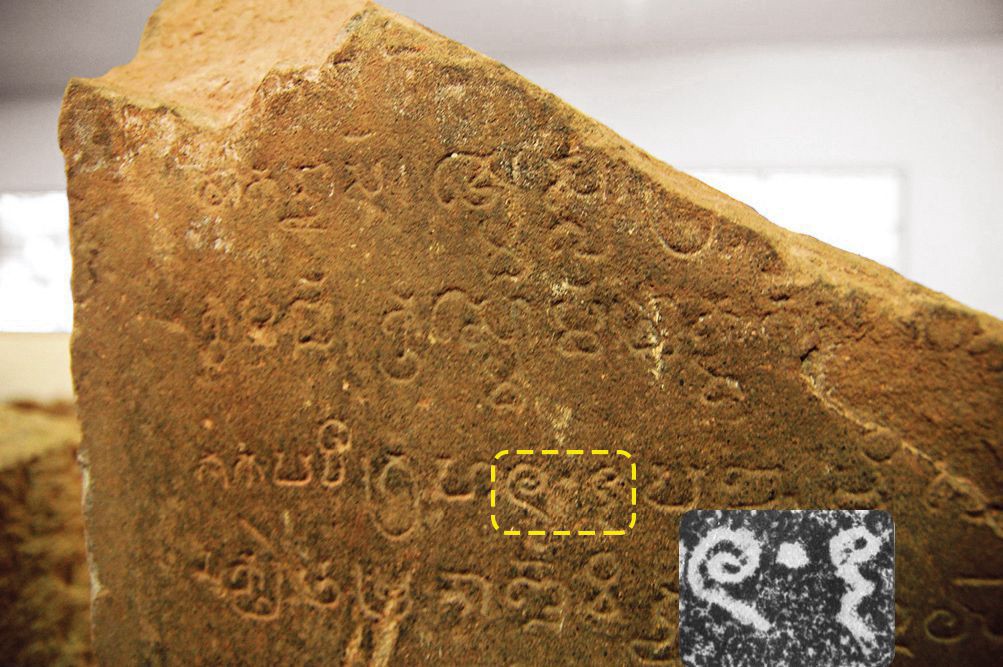

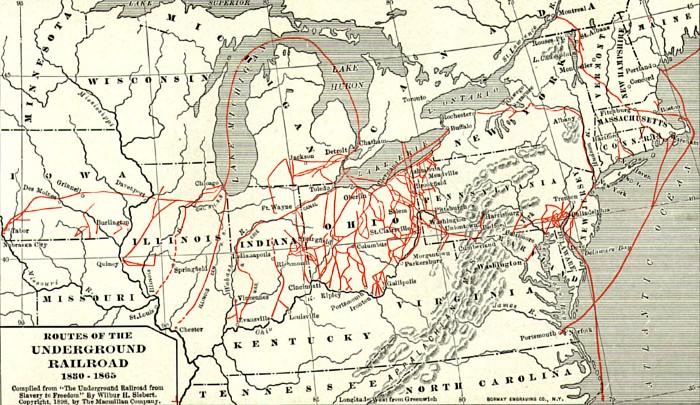

An example of this market-driven natural selection of money comes from the ancient Rai Stones system of Yap Island, located in what is today Micronesia. Rai Stones were large disks of various sizes with a hole in the middle that weighed up to eight thousand pounds each. These stones were mined in neighboring Palau or Guam and were not native to Yap. Acquiring these stones involved a labor-intensive process of quarrying and shipping. Procuring the largest Rai Stones required workforces numbering in the hundreds. Once the stones arrived in Yap, they were placed in a prominent location where everyone could see them. Owners of the stones could then use them as payment by announcing to the townsfolk the transfer of ownership to a new recipient. Everybody in the town would then record the transaction in their individual ledger, noting the new owner of the stone. There was no way to steal the stone because its ownership was recorded by everyone. In this way, the Rai Stones solved the three dimensions of the non-coincidence of wants problem for the Yapese by providing:

- Salability across scales as the stones were various in size and payments could be made in fractions of a stone

- Salability across space as the stones were accepted for payment everywhere on the island and did not have to be moved physically, just recorded by the townsfolks’ individual ledgers (remarkably similar to Bitcoin’s distributed ledger model, as we will see later)

- Salability across time due to the durability of stones and the difficulty of procuring new stones which meant that the existing supply of stones was always large relative to any new supply that could be created within a given time period (a high stock-to-flow ratio)

This monetary system worked well until 1871, when an Irish-American captain named David O’Keefe was found shipwrecked on the shores of Yap by the local islanders. Soon, O’Keefe identified a profit opportunity in buying coconuts from the Yapese and selling them to coconut oil producers. However, he could not transact with the locals because he was not a Rai Stone owner and the locals had no use for his foreign forms of money. Undeterred, O’Keefe sailed to Hong Kong and acquired some tools, a large boat and explosives to procure Rai Stones from neighboring Palau. Although he met resistance from them initially, he was eventually able to use his Rai Stones to purchase coconuts from the Yapese. Other opportunists followed O’Keefe’s lead and soon the flow of Rai Stones increased dramatically. This sparked conflict on the island and disrupted economic activity. By using modern technologies to acquire Rai Stones more cheaply, foreigners were able to compromise the hardness of this ancient monetary good. The market naturally selected against Rai Stones because, as their stock-to-flow ratio declined, they became less reliable as a store of value and thus lost their salability across time, which ultimately led to the extinction of this ancient monetary system.

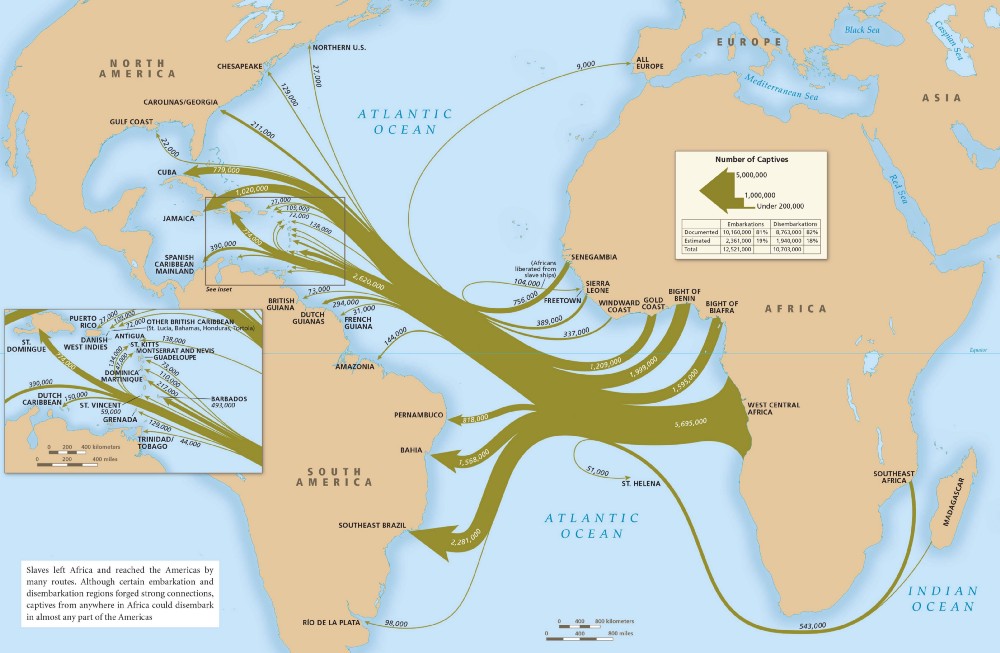

A similar story played out in western Africa which for centuries used aggry beads as money. These small glass beads were used in a region where glassmaking was an expensive craft, which gave them a high stock-to-flow ratio and made them salable across time. Since aggry beads were small and light they could easily be combined into necklaces or bracelets and transported easily, thus giving them salability across scales and space. In the 16th century, European explorers discovered the high value ascribed to these beads by the west Africans and began importing them in mass quantities; as European glassmaking technology made them extremely cheap to produce. Slowly but surely, the Europeans used these cheaply produced beads to acquire most of the precious resources of Africa. The net effect of this incursion into Africa was the transference its vast natural resource wealth to Europeans and the conversion of aggry beads from hard money to soft money. Again, the market naturally selected against a monetary good once its stock-to-flow ratio began to decline, as its store of value functionality and, therefore, its salability across time were compromised as a result. Although the details vary, this underlying dynamic of a declining stock-to-flow ratio presaging a good’s loss of its monetary role has been the same for every form of money throughout history. Today, we are seeing a similar pattern cause the collapse of the Venezuelan bolivar, (where some Venezuelans are using Bitcoin to protect their wealth as the currency collapses).

As societies continued to evolve, they began to move away from artifact money like stones and glass beads and towards monetary metals. It was initially difficult to produce most metals which kept their supply flows low, thus giving them good salability across time. Gold in particular, with its extreme rarity in the Earth’s crust and its virtual indestructibility, made it an extremely hard monetary technology. Gold mining was difficult, limiting supply increases relative to its existing supply, which itself could not be destroyed. Gold gave humans a way to store value across generations and develop a longer-term perspective on their actions (a lower time preference), which led to the proliferation of ancient civilizations:

The earliest coins are found mainly in the parts of modern Turkey that formed the ancient kingdom of Lydia. They are made from a naturally occurring mixture of gold and silver called electrum.

The earliest coins are found mainly in the parts of modern Turkey that formed the ancient kingdom of Lydia. They are made from a naturally occurring mixture of gold and silver called electrum.

Monetary Metals [1]

The last dictator of the Roman Republic, Julius Caesar, issued a gold coin called the aureus coin which contained a standard 8 grams of gold. The aureus was traded widely across Europe and the Mediterranean, alongside a silver coin called the denarius, which was used for its superior salability across scales. Used together, these coins provided a hard money system that increased the scope of trade and specialization in the Old World. The republic became more economically stable and integrated for 75 years until the infamous emperor Nero came into power.

Nero was the first to engage in the act of coin clipping in which he would periodically collect the coins of his citizenry, melt them down and mint them into newer versions with the same face value but less precious metal content, keeping the residual content to enrich himself. Similar to modern day inflation, this was a way of surreptitiously taxing the population by debasing its currency. Nero and successive emperors would continue the practice of coin clipping for several hundred years to finance government expenditures:

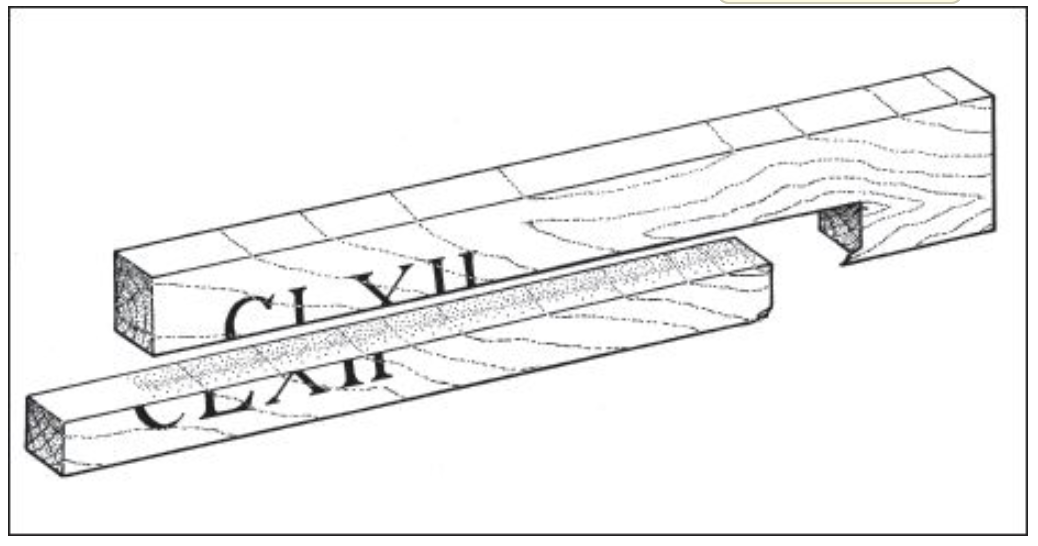

Isaac Newton is attributed with adding the small stripes along the edges of coins as a security measure against coin clipping. These stripes are still present on most coins today.

Isaac Newton is attributed with adding the small stripes along the edges of coins as a security measure against coin clipping. These stripes are still present on most coins today.

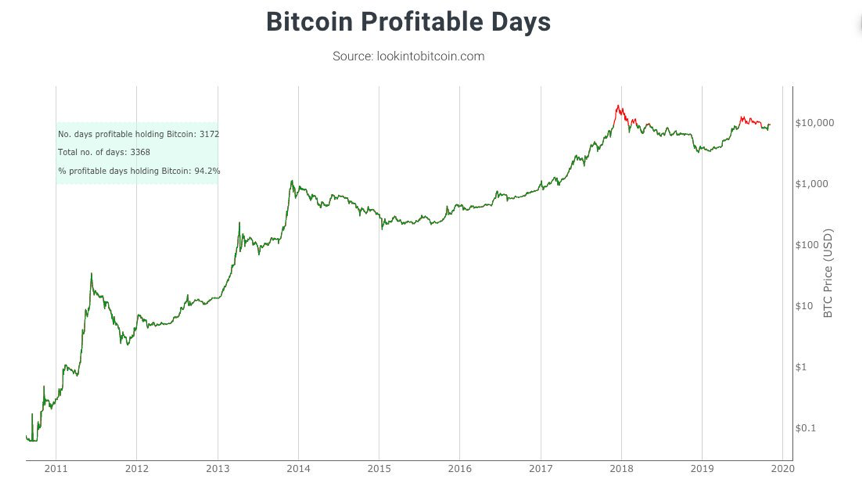

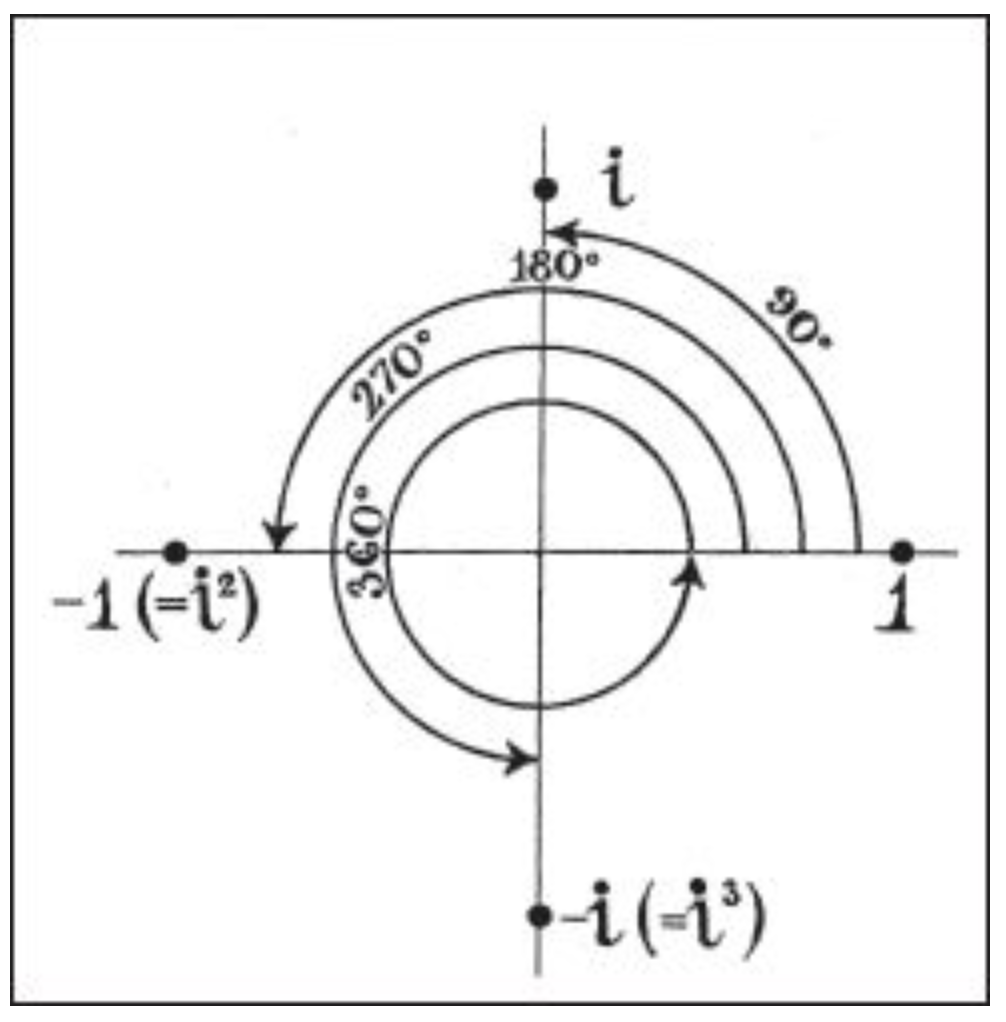

Citizens gradually wised up to this deceit and began hoarding the coins with higher precious metal content and spending the debased coins, as they were legally required to be accepted at face value in settlement of debts, one of the earliest instances of legal tender laws being implemented. This had the effect of driving up the price of coins with higher precious metal content and driving down the price of those with less — a dynamic that came to be known as Gresham’s Law: bad money (soft money) drives good money (hard money) out of circulation. This is an important law to recall when we look at how modern-day hoarding of Bitcoin impacts its price.

Eventually, a new coin called the solidus was introduced which contained only 4.5 grams of gold, almost half the content of the original aureus coin. Pursuant to this decline in monetary value, a cycle familiar to many modern economies running on government money began to take hold — coin clipping reduced the money’s real value, increased the money supply, gave the emperor the means to continue imprudent spending and eventually ended with rampant inflation and economic crisis. Analogous to central bank practices today, Swiss banker Ferdinand Lips summarized this era well:

“Although the emperors of Rome frantically tried to ‘manage’ their economies, they only succeeded in making matters worse. Price and wage controls and legal tender laws were passed, but it was like trying to hold back the tides. Rioting, corruption, lawlessness and a mindless mania for speculation and gambling engulfed the empire like a plague.”

Amid the chaos of the crumbling Roman Republic, Constantine the Great took power. Intent on restoring the once great empire, Constantine began adopting responsible economic policies. He first committed to maintaining the solidus at 4.5 grams of gold, ended the practice of coin clipping and began minting massive quantities of these standardized gold coins. Constantine then moved east and established Constantinople in modern day Istanbul. This became the birthplace of the Eastern Roman Empire, which adopted the solidus as its monetary system.

Rome continued its soft money-induced cultural deterioration until it finally collapsed in 476 AD. Meanwhile, Constantinople flourished. The solidus, which eventually became known as the bezant, provided a hard money system with which Constantinople would remain prosperous and free for centuries to come. As with Rome before it, the fall of Constantinople happened only when its rulers began the debasing its currency around 1050 AD. As with Rome before it, the move away from hard money led to the fiscal and cultural decline of the Eastern Roman Empire. After suffering many successive crises, Constantinople was ultimately overtaken by the Ottomans in 1453. However, the bezant inspired another form of hard money that still circulates to this day, the Islamic dinar. People all over the world have used this coin for over seventeen centuries — which began as the solidus before changing its name to the bezant and finally becoming the Islamic dinar — for transactions, thus highlighting the superior salability of a hard money such as gold across time.

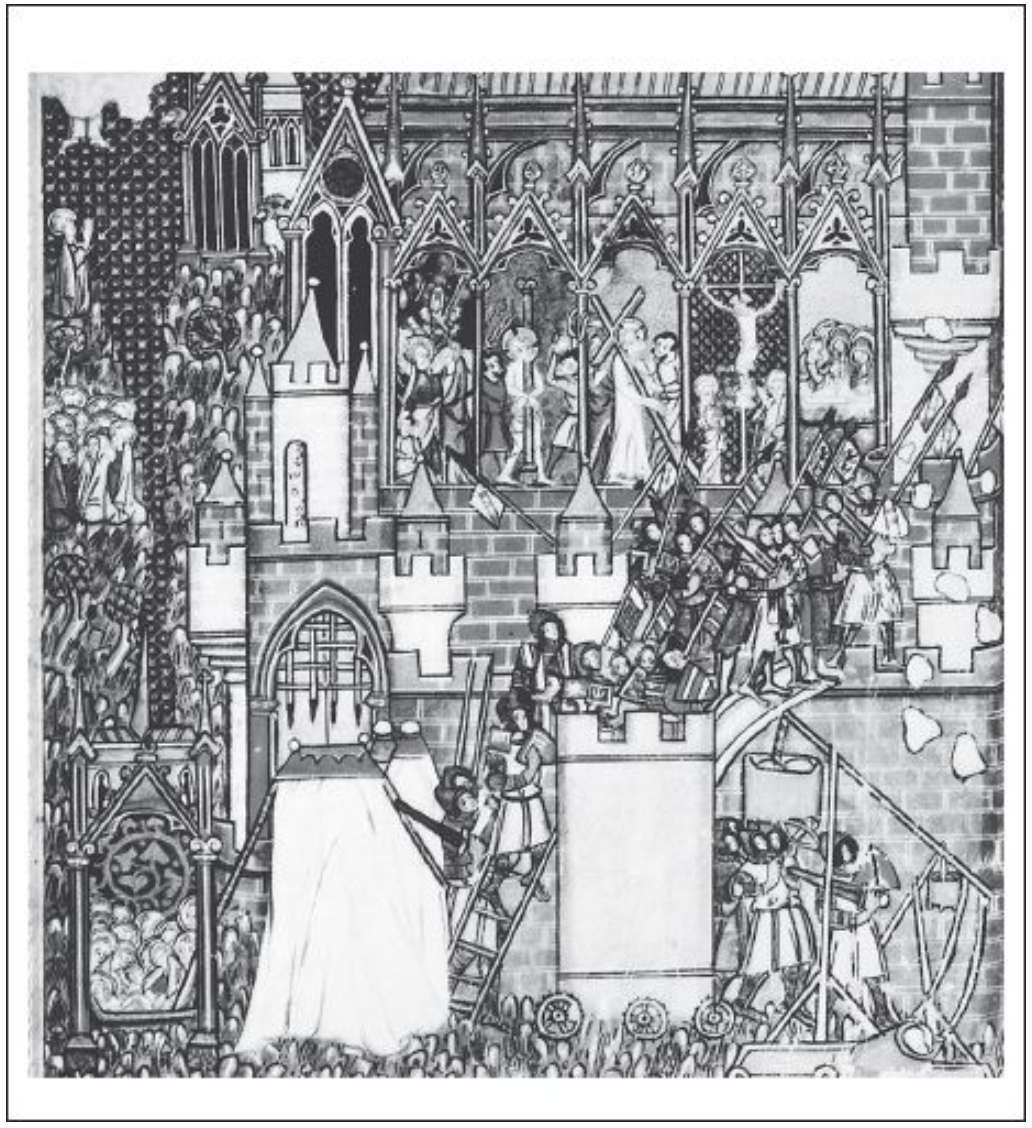

Following the collapse of the Roman Empire, Europe fell into the dark ages. It was the rise of the city-state (a new story mankind would begin organizing itself around) and its use of hard money systems that would pull Europe out of the Dark Ages and into the Renaissance. Beginning in Florence in 1252, the city minted the florin which was the first major European coinage issued since Julius Caesar’s aureus. By the end of the 14th century more than 150 European cities and states had minted coins to the same specifications as the florin. By giving its citizenry the ability to accumulate wealth in a reliable store of value which could be traded freely across scales, space and time, this hard money system unlocked scientific, intellectual and cultural capital within the Italian city-states and eventually spread to the rest of Europe. Of course, the situation was far from perfect, as there were still many periods marked by various rulers choosing to debase their currencies to finance war or lavish expenditure.

Global Gold Standard [1,4]

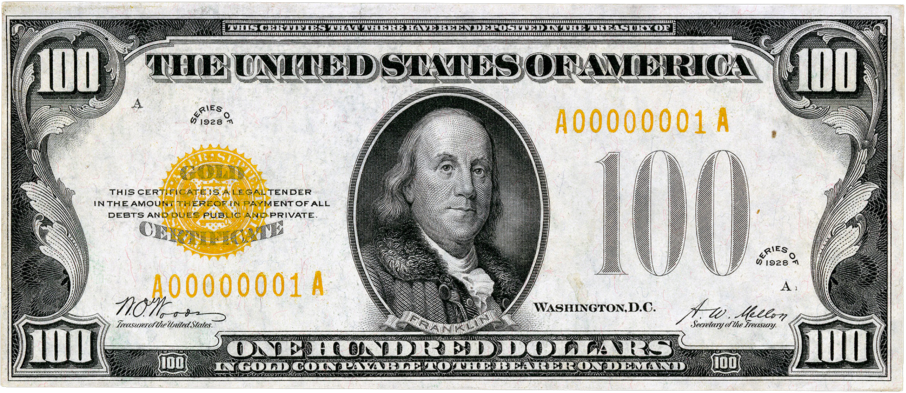

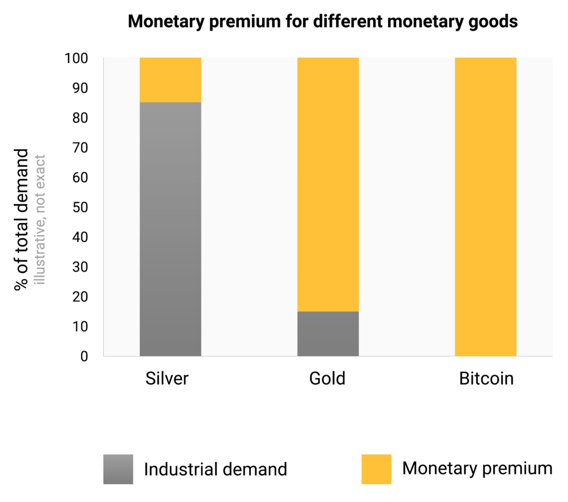

When they were being used as physical means of settlement, gold and silver coins served complementary roles. Silver, having a stock-to-flow ratio second only to that of gold, had the advantage of being a more salable metal across scales, since its lower value per weight than gold made it ideal as a medium of exchange for smaller transactions. In this way, gold and silver were complementary as gold could be used for large settlements and silver could be used for smaller payments. However, by the 19th century, with the development of modern custodial banking and advanced telecommunications, people were increasingly able to transact seamlessly across scales using bank notes or checks backed by gold:

The US Dollar was once redeemable for gold on demand.

The US Dollar was once redeemable for gold on demand.

With all of the critical salability characteristics gathered under a gold standard monetary system facilitated by paper bank notes, the superior salability across scales of physical silver lost relevance, setting it up to become demonetized (due to the winner take all dynamic discussed earlier). Ironically, the same banking industry that enabled a global gold standard would in later years see to its elimination (more on this later).

A brief aside on silver: This demonetization dynamic also explains why the silver bubble popped many times throughout history when facing off with gold and will pop again if it ever reflates. Since silver is not the hardest form of monetary good available, should any significant investment flow into silver, its producers will be incentivized to increase the flow of silver, and store any value expropriated from its increased production in the hardest form of money available to them (which, before Bitcoin, was only gold). This, of course, will bring the price of silver crashing back down, taking the wealth from the investment inflows with it. As a more recent historical example of this dynamic in action: In the 1970s, the affluent Hunt brothers attempted to remonetize silver by buying vast quantities of it in the market. This drove up the price initially, and the Hunt brothers believed they could continue driving up its price until they cornered the market. Their intent was to induce others to chase its appreciation and recreate a monetary demand for silver. As they kept buying and the price kept rising, silver holders and producers kept selling into the market. No matter how much the Hunt brothers purchased, the selling and flow of silver continued to outpace their buying, which decreased its stock-to-flow ratio and eventually led to a dramatic crash in the price of silver. The Hunt brothers lost over $1B (due to rampant inflation of government money since then, their losses equal $6.5B in 2019 dollars) in the ordeal, which is likely the highest price ever paid for learning the importance of hard money and its defining metric, the stock-to-flow ratio.

Driven by expanding telecommunication and trade networks, and with custodial banks enhancing its salability across scales by issuing gold-backed bank notes and checks, the gold standard spread quickly. More nations began switching to paper based monetary systems fully backed by and redeemable in gold. Network effects took hold as more nations moved onto the gold standard, giving gold deeper liquidity, more marketability and creating larger incentives for other nations to join.

Those nations which remained on a silver standard the longest before converting, like China and India, witnessed tremendous devaluations of their currencies in the intervening period. The demonetization of silver for China and India was an effect similar to the west Africans holding aggry beads when Europeans arrived. Foreigners who adopted the gold standard were able to gain control over vast quantities of the capital and resources in China and India. This drives home a key point: every time hard money encounters a softer form of money in a trade network, the softer money is ultimately outcompeted into extinction.

This dynamic has significant consequences for the holders of soft money and is an important lesson for anyone who believes their refusal of Bitcoin means they are protected from its economic impact. History shows us repeatedly that it is not possible to protect yourself from the consequences of others holding money that is harder than yours.

Finally, for the first time in history, the majority of the world economy began operating on a gold-based, hard money standard that was naturally selected for by the free-market.

Hardness of Gold [1,3]

By this point in history, virtually everyone had come to fully trust gold’s superior stock-to-flow ratio and therefore believed they could use it to reliably store value across time. After thousands of years of mining this chemically stable element, virtually all the gold ever procured by humans is still a part of its extant supply. The stock of all the gold in the world fits into an Olympic-sized swimming pool today and is valued at almost $8T USD. Gold is rare in the Earth’s crust and extraction is costly in terms of time and energy, which keeps its flow predictably low. It is impossible to synthesize gold by chemical means (as alchemy never panned out) and the only way to increase its supply is through mining.

The costliness of gold mining is the skin in the game necessary to increase its flow — the risk necessary to procure the reward. Skin in the game is a concept based on symmetry, a balance of incentives and disincentives: in addition to upside exposure, people should also be penalized if something for which they are responsible for goes wrong or hurts others. Skin in the game is the central pillar for properly functioning systems and is at the heart of hard money. For gold, its mining costs and risks form the disincentives which are balanced against the incentives of its market price. Unless consequential decisions are made by people who are exposed to the results of their decisions, the system is vulnerable to total collapse (an important consideration when we discuss soft government money later).

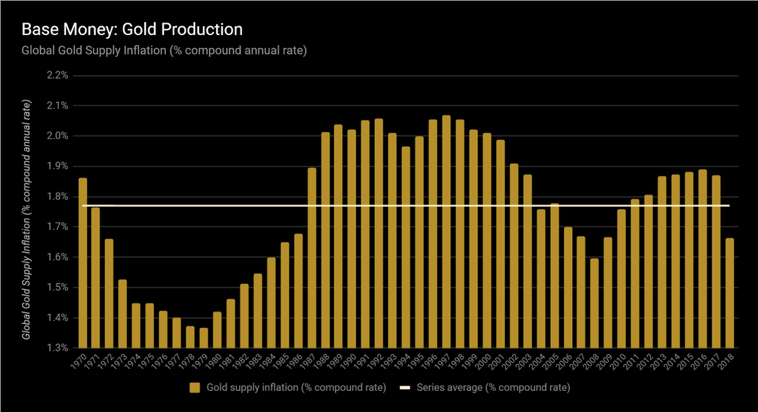

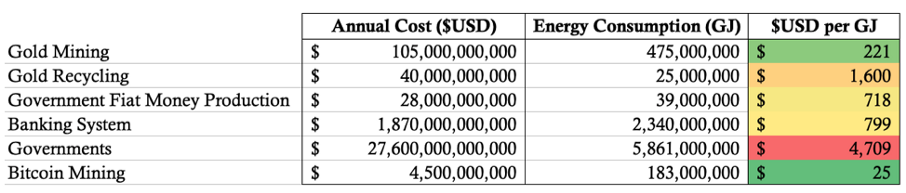

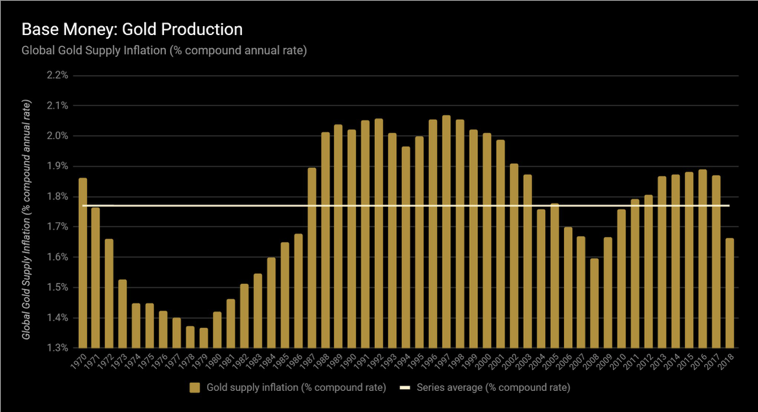

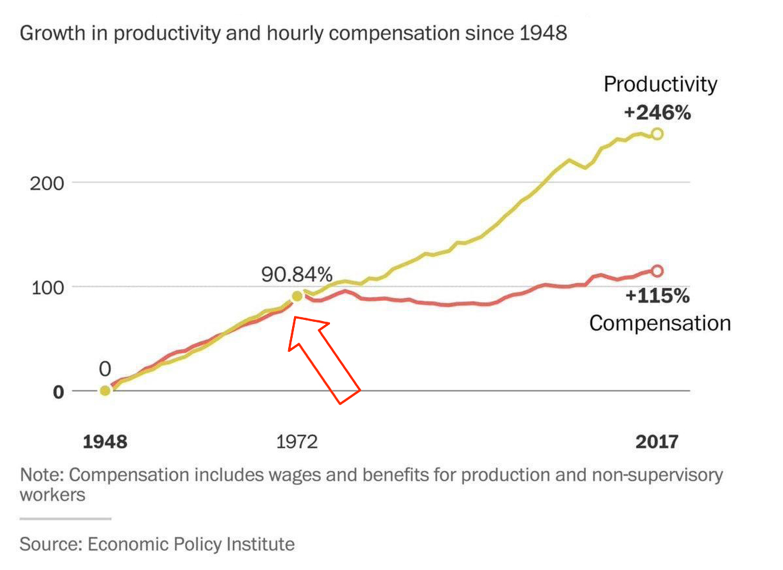

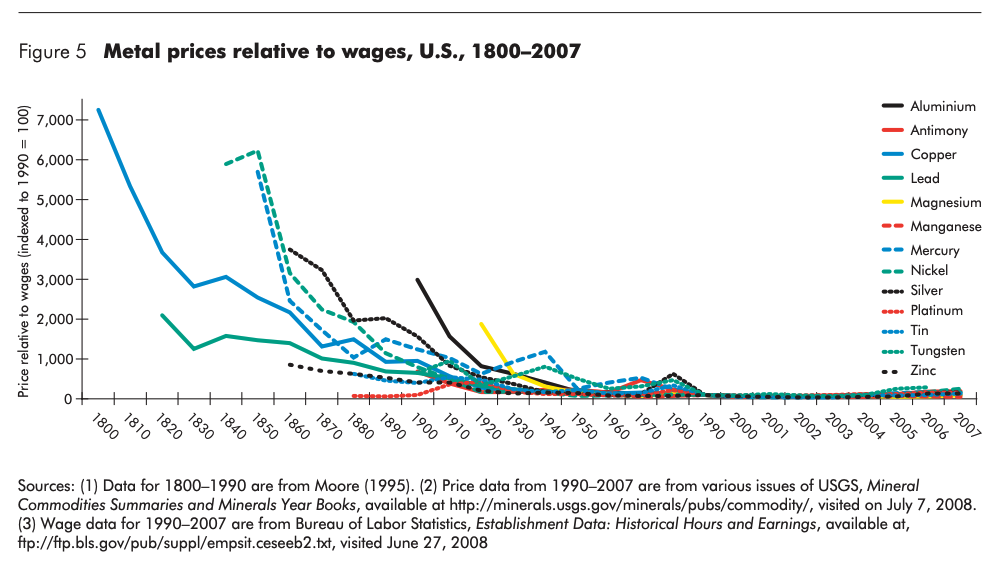

Every market-driven evolutionary step for money has naturally selected the form with the highest stock-to-flow ratio available to its population but stopped when the form lost this key property. With the highest stock-to-flow ratio of all the monetary metals, gold is the hardest physical form of money that has ever existed, which explains its success as hard money throughout history. Even with advances in mining techniques, gold still has a relatively low and predictable flow, as evidenced by its annual supply growth since 1970:

The rarity of gold in the Earth’s crust ensures that its new supply flows are relatively low and predictable. Since gold is virtually indestructible, nearly every ounce that has ever been mined throughout history is still part of current supply stocks. The combination of these factors gives gold the highest stock-to-flow ratio of any monetary metal and is precisely the reason gold became a global hard money standard.

The rarity of gold in the Earth’s crust ensures that its new supply flows are relatively low and predictable. Since gold is virtually indestructible, nearly every ounce that has ever been mined throughout history is still part of current supply stocks. The combination of these factors gives gold the highest stock-to-flow ratio of any monetary metal and is precisely the reason gold became a global hard money standard.

Gold mining, of course, only makes economic sense if the cost of producing an additional ounce of gold is less than gold’s market price per ounce. Relatedly, when the price of gold increases, its mining becomes more profitable and draws new miners into the market and makes new methods of gold mining economically feasible. This, in turn, increases the flow of gold until supply and demand forces again reach equilibrium. So, although gold is the hardest form of physical money, it doesn’t have perfect hardness as changes in demand for it elicit both a supply and price response, meaning:

- An increase in the demand for gold increases its price,

- An increase in the price of gold incentivizes gold miners to increase its flow,

- An increase in the flow of gold increases its supply

- An increase in the supply of gold puts downward pressure on its price

In this way, changes in demand for gold are expressed partially in its price and partially in its supply flow. This price elasticity of supply is true for all physical commodities. For all practical purposes, as we will see later, the Earth always has more natural resources to yield assuming the right amount of time and effort are directed towards their production (this will support an important point later when we look at the impact of changes in demand on Bitcoin’s price).

Final Settlement [1]

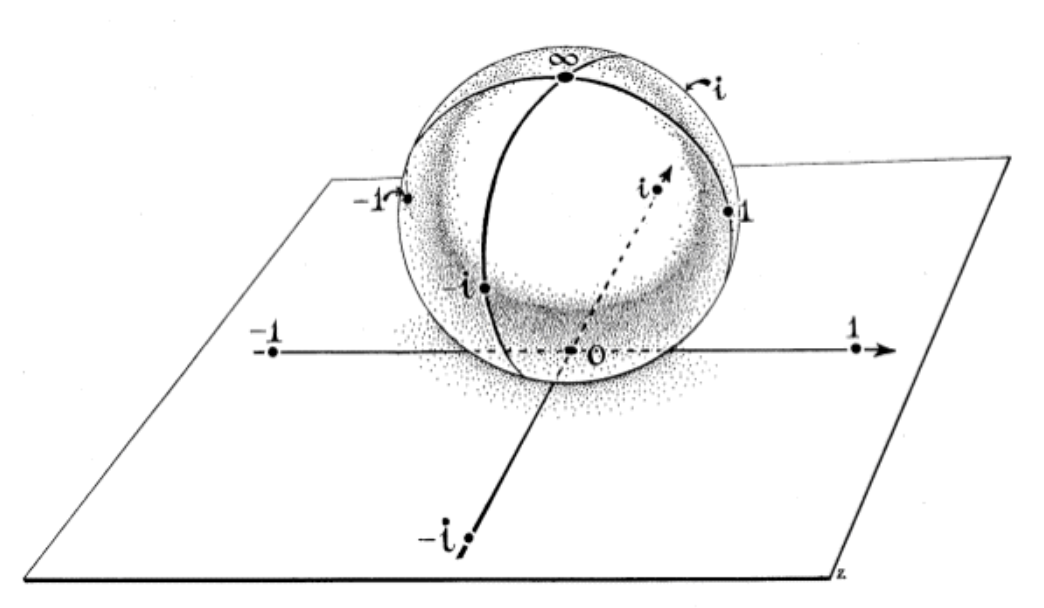

Gold also has the advantage of being an instrument of final settlement . Whereas the use of government money requires trust in the monetary policy and creditworthiness of the issuing authority or payment intermediaries, known as counterparty risk, the act of physically possessing gold comprises all of the trust factors and permissions necessary to use it as money. This makes gold a self-sovereign form of money. This is best understood as an identity of the universal accounting equation: Assets = Liabilities + Owner’s Equity

When you own gold free and clear, it is your asset and no one else’s liability, meaning that your personal balance sheet includes a 100% gold asset matched by 0% liabilities and 100% owner’s equity (since no one else has a claim on your gold asset). This makes gold a bearer instrument, meaning that any individual in physical possession of the asset is presumed to be its rightful owner. This timeless and trustless nature of gold is the reason why it still serves as the base money and final settlement system of central banks worldwide.

In the 19th century, the term cash referred to central bank gold reserves, which was the dominant self-sovereign monetary good at the time. Cash settlement referred the transfer of physical gold between central banks to execute final settlement. Central banks can only settle with finality in physical gold, and still do so periodically in the modern era, since it is the only form of money that requires no trust in any counterparty, is politically neutral and gives its holders full sovereignty over their money. This is why gold maintains its monetary role even today as only the delivery of a bearer instrument can truly be the final extinguisher of debt. In this original sense of the word cash, gold is the only form of dominant cash money that has ever existed (although Bitcoin is well-suited to serve a similar role in the digital age, more on this later). Unfortunately, the combination of gold’s self-sovereignty and physicality would lead to the demise of the gold standard.

Centralization of Gold [1,4]

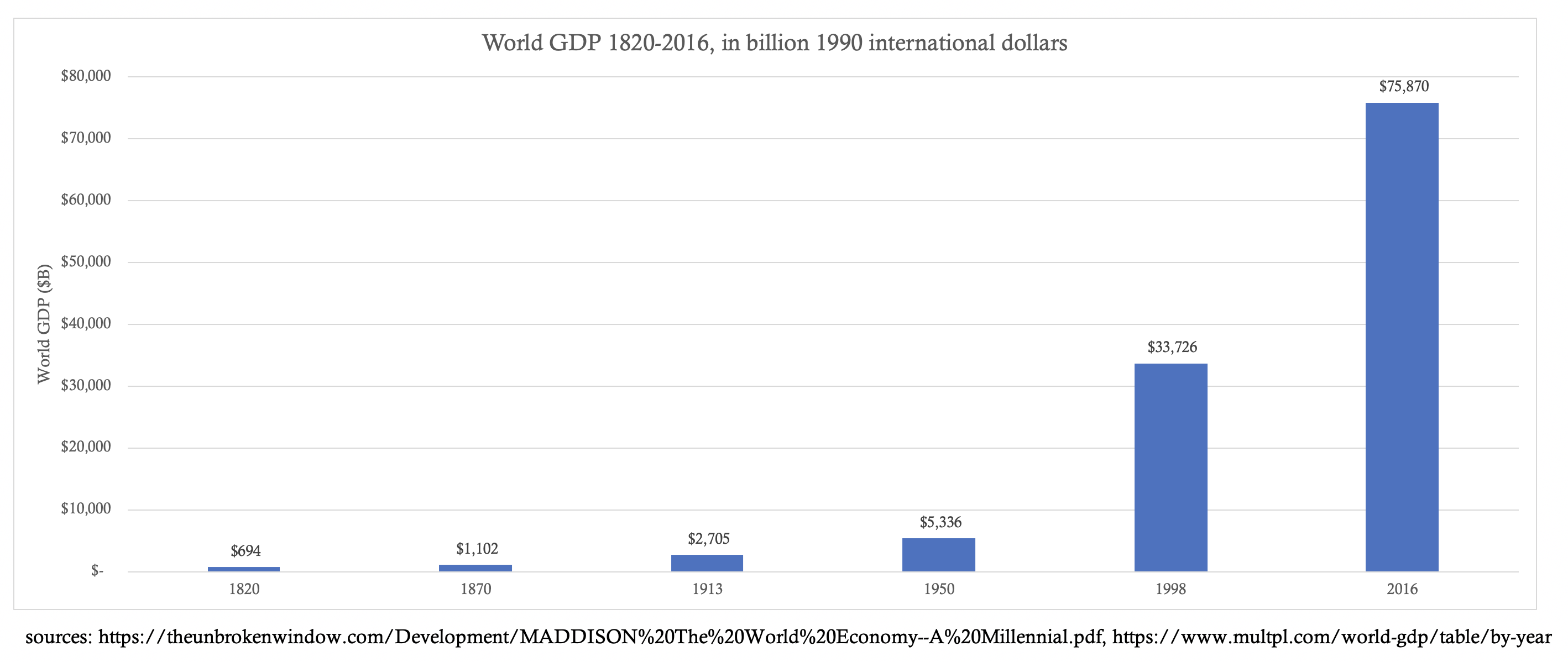

By the end of the 19th century, all the industrialized nations of the world were officially on the gold standard. By virtue of operating on a hard money basis, most of the world witnessed unprecedented levels of capital accumulation, free global trade, restrained government and improving living standards. Some of the most important achievements and inventions in human history were made during this era, which came to be known as la belle époque across Europe and the Gilded Age within the United States. This golden era enabled by the gold standard remains one of the greatest periods in human history:

“La Belle Époque was a period characterized by optimism, regional peace, economic prosperity, an apex of colonial empires, and technological, scientific, and cultural innovations. In the climate of the period, the arts flourished. Many masterpieces of literature, music, theater, and visual art gained recognition.”

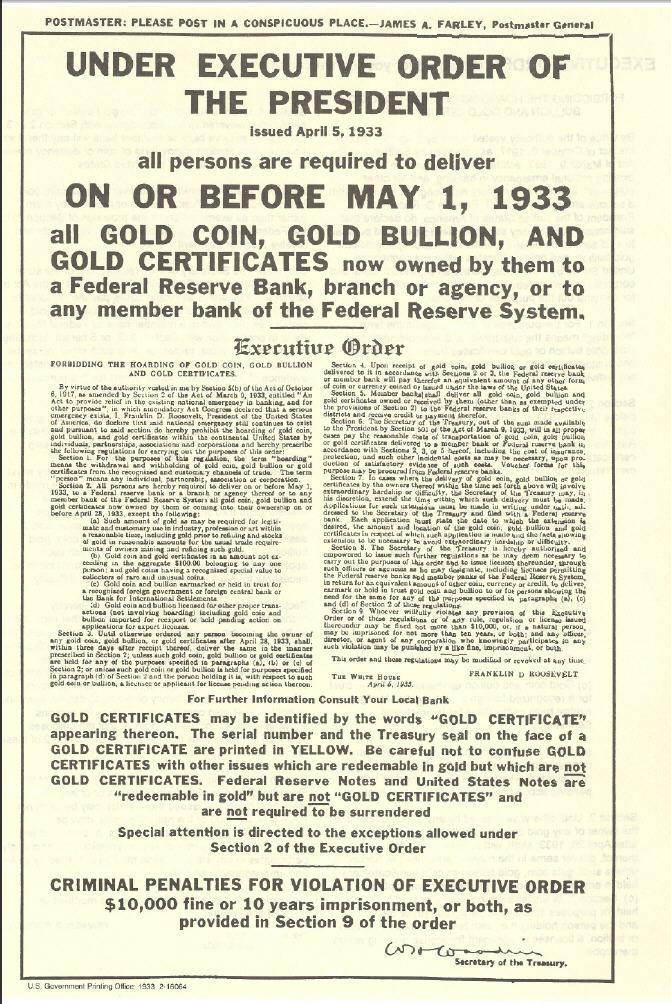

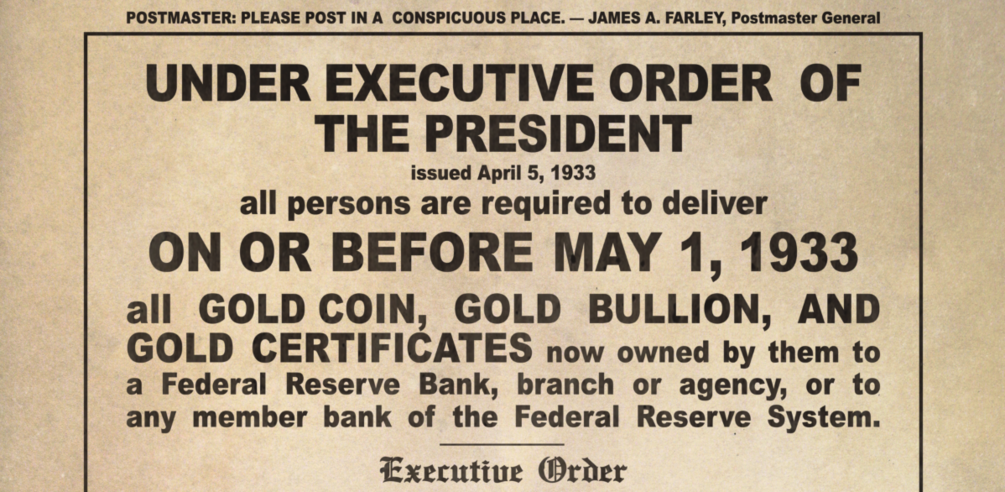

As multiple societies had now converged on gold as their universal store of value, they experienced significant decreases in trade costs and an attendant increase in free trade and capital accumulation. La Belle Époque was an era of unprecedented global prosperity. However, the hard money gold standard which catalyzed it suffered from a major flaw: settlement in physical gold cumbersome, expensive and insecure. This flaw is associated with the physical properties of gold, as it is dense, not deeply divisible and not easily transactable. Gold is expensive to store, protect and transport. It is also heavy per unit of volume which makes it difficult to use for day to day transactions. As discussed earlier, banks built their business model around solving these problems by providing secure custody for people’s gold hoards. Soon after, banks began issuing paper bank notes that were fully redeemable in gold. Carrying and transacting with paper bank notes backed by gold was much easier than using actual gold. Offering superior utility and convenience, the use of bank notes flourished. This, along with government programs to confiscate gold from citizens (such as Executive Order 6102 in the United States), encouraged the centralization of gold supplies within bank vaults all over the world.

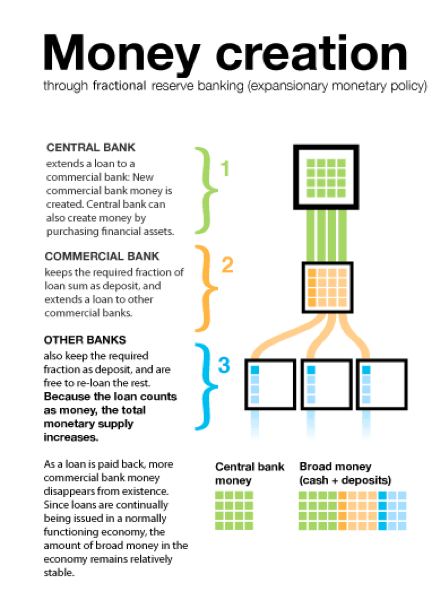

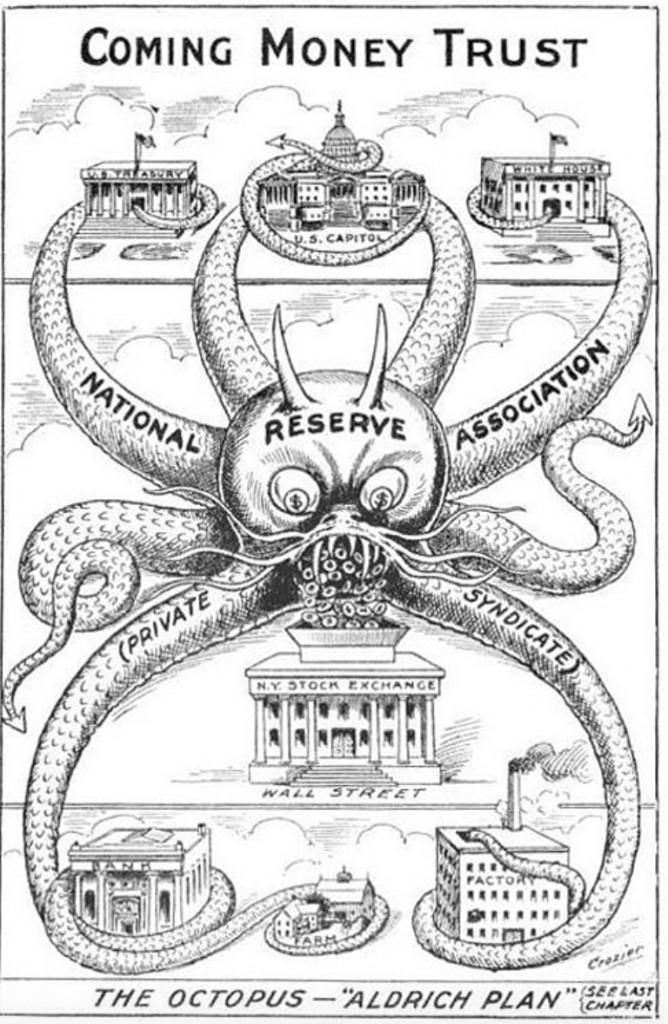

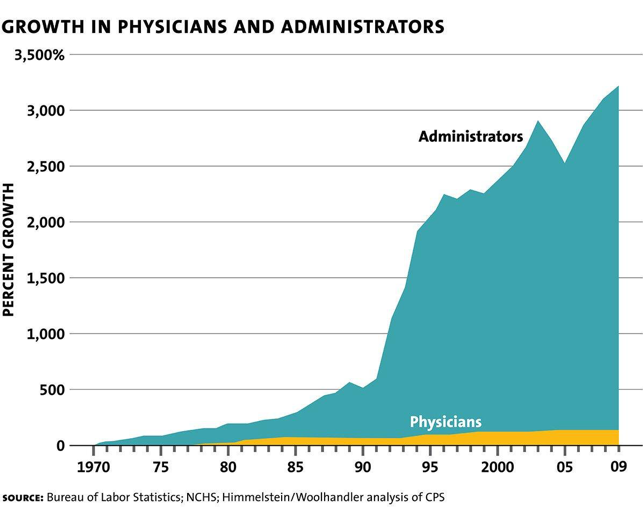

Incapable of resisting the temptation of wealth expropriation by tampering with the money supply, banks soon began issuing more notes than their gold reserves could justify, thus initiating the practice of fractional reserve banking . This banking model facilitated the creation of money without any skin in the game. Governments took notice and began to gradually take over the banking sector by forming central banks, as this model enabled them to engage in seigniorage, a method of profiting directly from the money creation process:

In fractional reserve banking artificial money and credit is created. For instance, assuming a reserve ratio of 10% and an initial deposit of $100 will soon turn into $190. By lending a 90% fraction of the newly created $90, there will soon be $271 in the economy. Then $343.90. The money supply is recursively increasing, since banks are literally lending money they don’t have. In this way, banks magically transform $100 into over $1,000.

In fractional reserve banking artificial money and credit is created. For instance, assuming a reserve ratio of 10% and an initial deposit of $100 will soon turn into $190. By lending a 90% fraction of the newly created $90, there will soon be $271 in the economy. Then $343.90. The money supply is recursively increasing, since banks are literally lending money they don’t have. In this way, banks magically transform $100 into over $1,000.

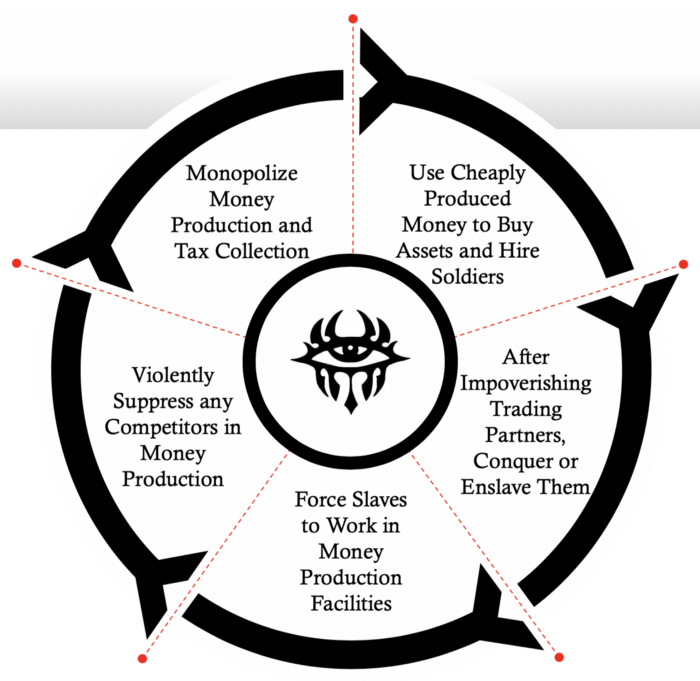

The ability to control this process was too tempting for governments to resist. Total control of over the money supply gave those in charge a mechanism to continually extract wealth from its citizenry. The virtually unlimited financial wealth the printing press provided gave those in power the means to silence dissent, finance propaganda and wage perpetual warfare. It is a fundamental economic reality that wealth cannot be generated by tampering with the money supply, it can only be manipulated and redistributed. Civilization itself relies on the integrity of the money supply to provide a solid economic foundation for free trade and capital accumulation. With a firm grip on the prevailing monetary order established, the next logical step for central banks was to begin moving away from the gold standard altogether.

Abolishing the Gold Standard [1]

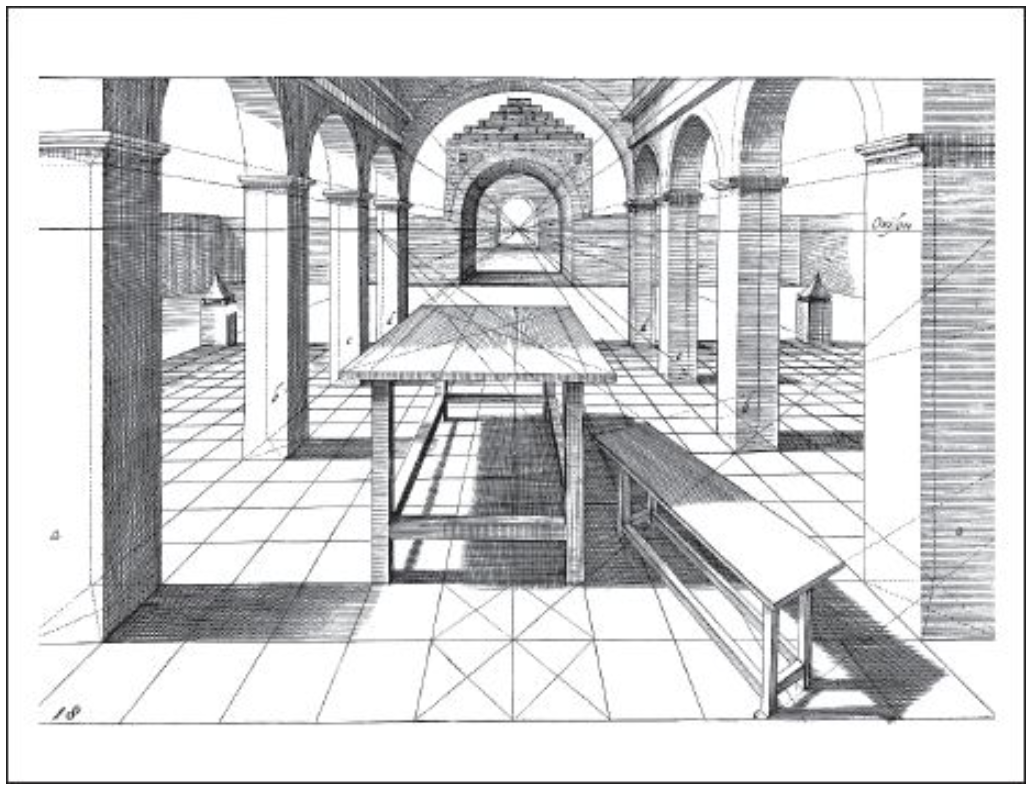

By 1914, most of the major economies had begun printing money is excess of their gold reserves at the onset of World War I. Unsurprisingly, this had many negative consequences, some of which were immediate while others came on more slowly. Eliminating the gold standard immediately destabilized the unit of account by which all economic activity was assessed. Government currency exchange rates would now float against one another and become a source of economic imbalance and confusion. This distorted price signals, which would now be denominated in various government currencies with rapidly fluctuating exchange rates. This made the task of economic planning as difficult as trying to build a house with an elastic measuring tape.

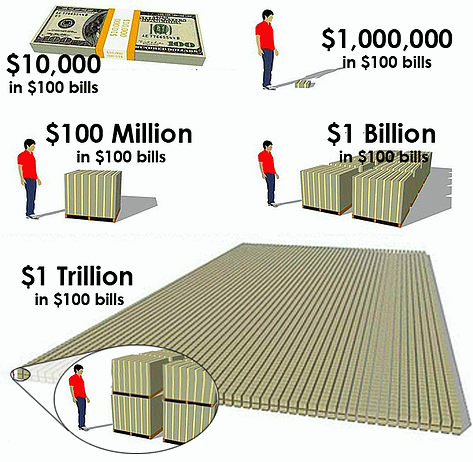

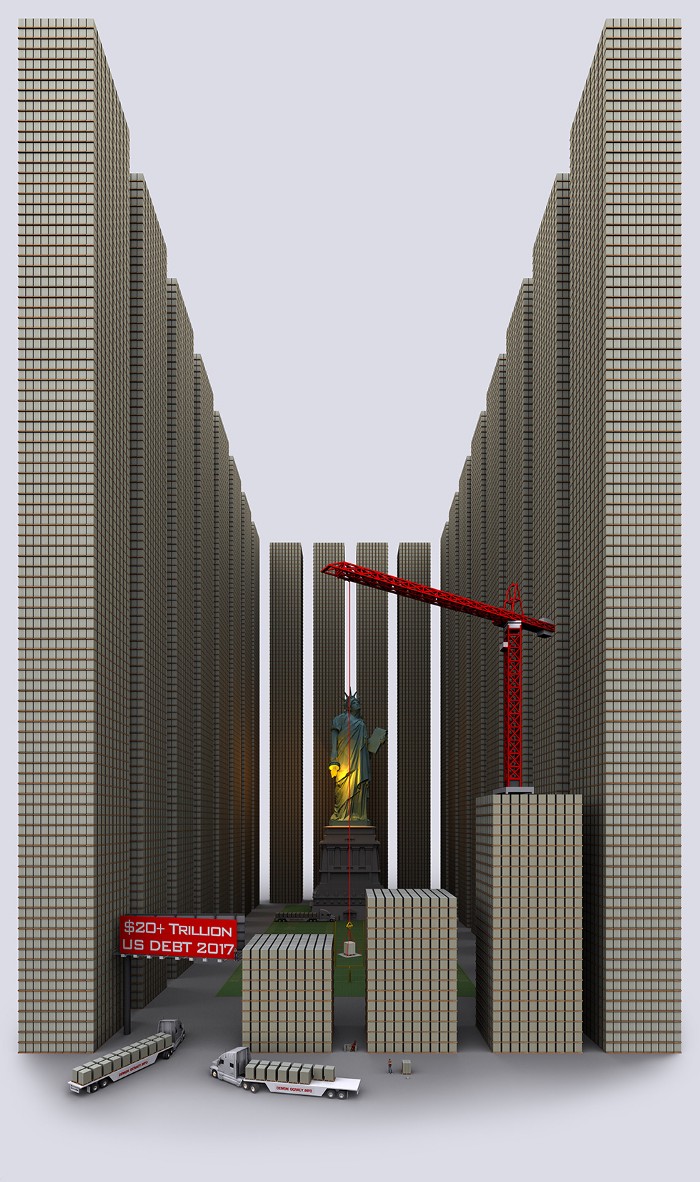

For a world that was becoming increasingly globalized and technologically sophisticated, freely floating currency exchange rates represented a significant step backwards and gave rise to what is commonly called a ‘a system of partial barter’. For people to buy goods from other people who lived on the other side of any number of imaginary lines called national borders, they would now be required to use more than one medium of exchange (their own currency and the foreign currency) to complete the transaction. To an extent, this reignited the non-coincidence of wants problem which money was meant to solve in the first place. Today, over $5T ($5,000,000,000,000) of foreign currencies are exchanged daily, forming an annual market valued at over 12 times global GDP. This industry is purely parasitic — it enriches bankers and sucks real value out of society in the form of global trade frictions, market distortions and transaction fees. For this reason, it is excluded from GDP calculations and exist solely because of the inefficiencies caused by centrally controlled capital markets and the absence of a global, politically neutral hard money system. The resultant frictions to global trade fanned the flames of warfare.

Governments Take Control [1,3]

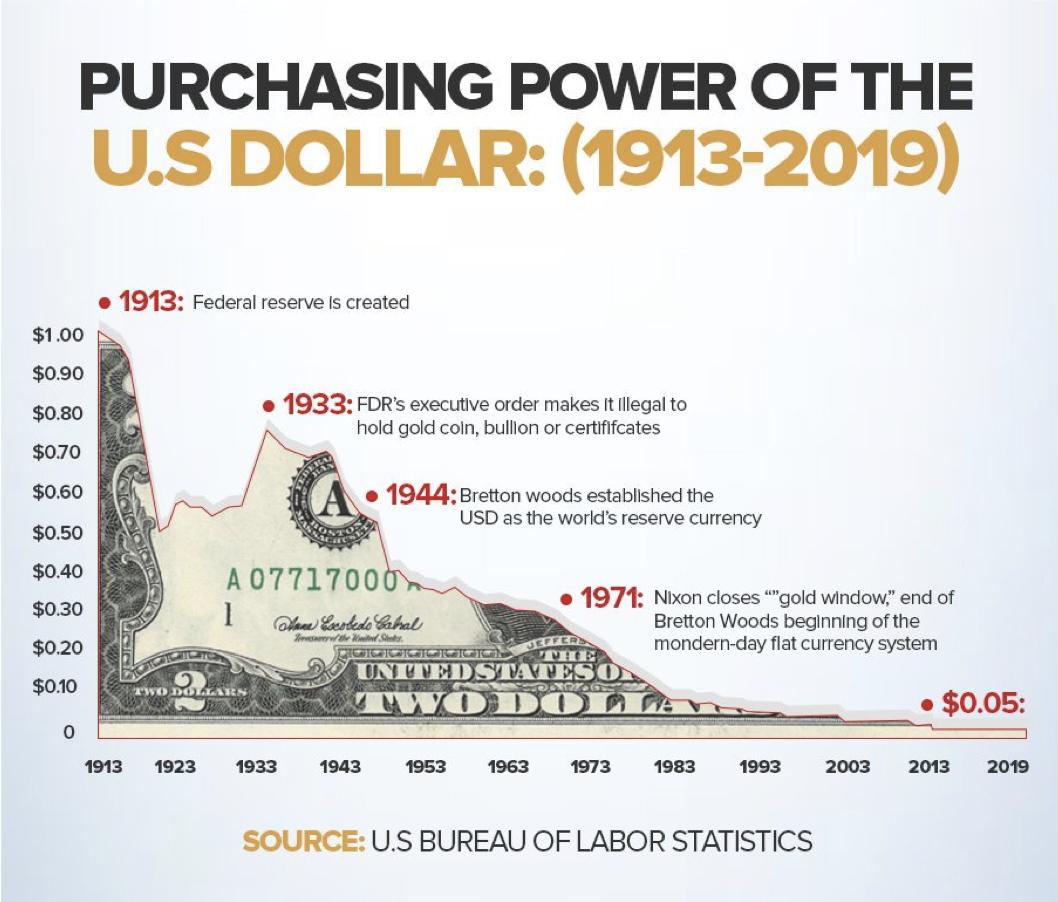

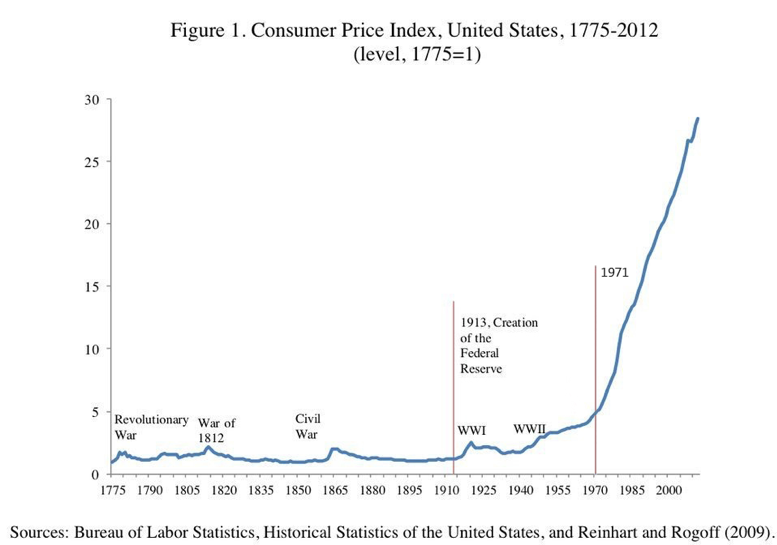

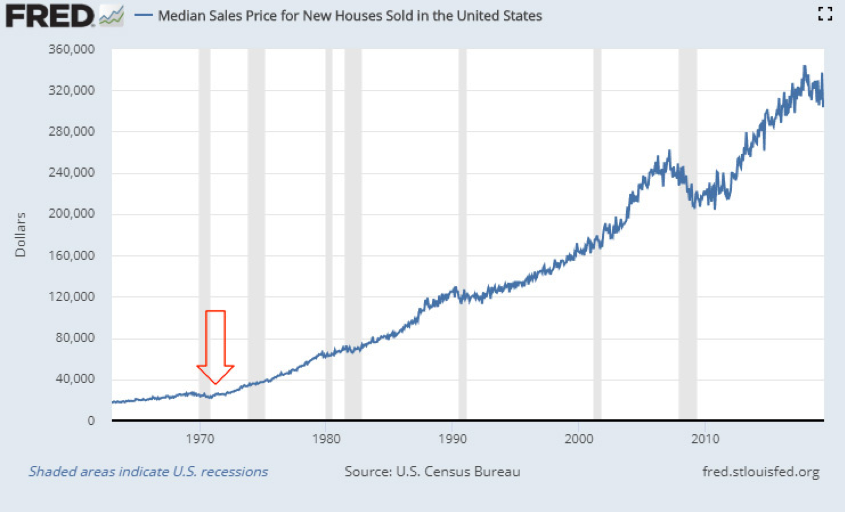

As 20th century wars raged, so did the printing presses. Governments and their central banks continued to grow more powerful with each new bank note printed as their citizens became poorer. The death stroke came when most governments, due to a unilateral decision of President Nixon in United States, finally severed the peg to gold entirely in the 1971. Which brings us to the modern form of dominant money: government fiat money . Fiat is a Latin word meaning decree, order or authorization. This is why government money is commonly referred to as fiat money, since its value exists solely because of government decree:

Today, the US Dollar is not redeemable for anything and its value is derived solely from government decree. Paradoxically, people were coerced into adopting soft government fiat money only because of their shared belief in gold as a hard monetary good.

Today, the US Dollar is not redeemable for anything and its value is derived solely from government decree. Paradoxically, people were coerced into adopting soft government fiat money only because of their shared belief in gold as a hard monetary good.

This is an imperative point: it was possession of gold (self-sovereign, hard money) that gave governments the power to decree the value of their fiat money (soft money) in the first place. National governments were only able to achieve “sovereignty” because they drew this power from their possession of gold. Paradoxically, people were coerced into discarding the gold standard and adopting soft government fiat money only because of their belief in gold as a hard monetary good. This is proof that it is possible to create an artificial asset and endow it with monetary properties, whether by decree or by market-driven natural selection. Governments did so by stealing gold from citizens, which gave them the power to create fiat money and decree its value by force. As we will later see, Satoshi Nakamoto did so by creating Bitcoin and releasing it into the marketplace as a self-sovereign money free to compete for the trust and belief of the people based on its own merits.

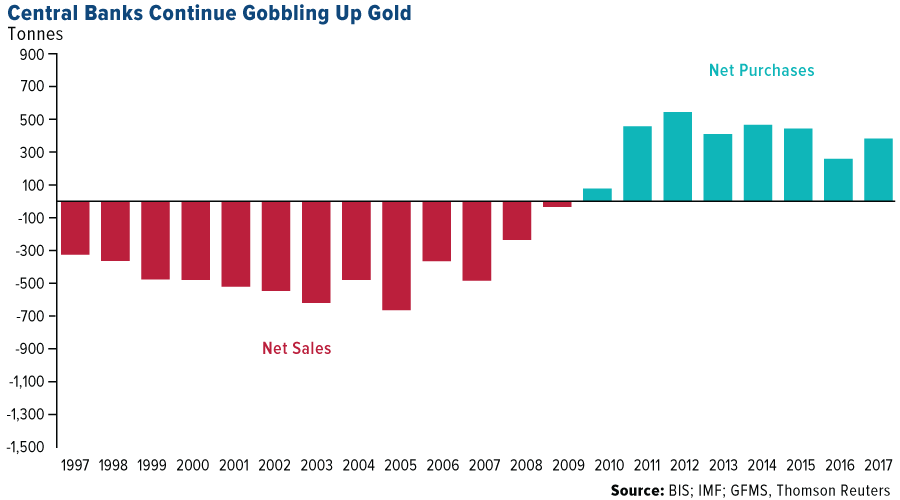

Central banks also began engaging in propaganda campaigns declaring the end of gold’s monetary role. However, their actions rang louder than their words as they continued to accumulate and hold gold, a practice they continue to this day. Gold remains the exclusive instrument of final settlement between central banks. Strategically, holding large gold reserves also makes sense for central banks since they can opt to sell reserves into the market should gold start to appreciate too quickly and threaten the value of fiat money. With their monopoly position protected and reinforced by legal tender laws, propagandists and sufficient control of the gold market central banks were free to print money at will. This exorbitant privilege gives central banks extraordinary power and made them extremely dangerous entities. In the words of former US President Andrew Jackson spoken at the Constitutional Convention in 1787:

“I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”

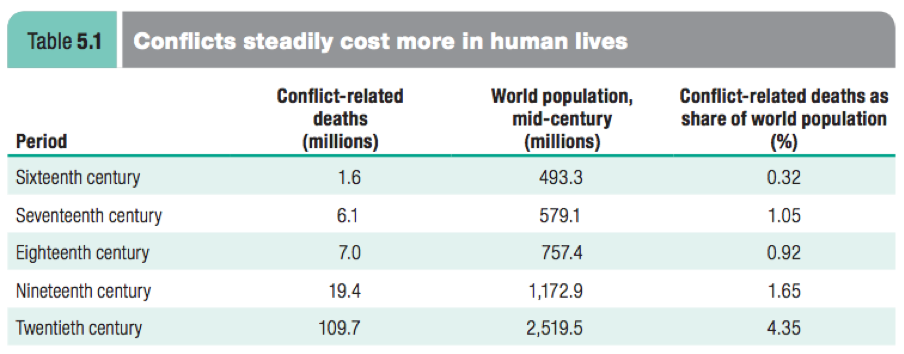

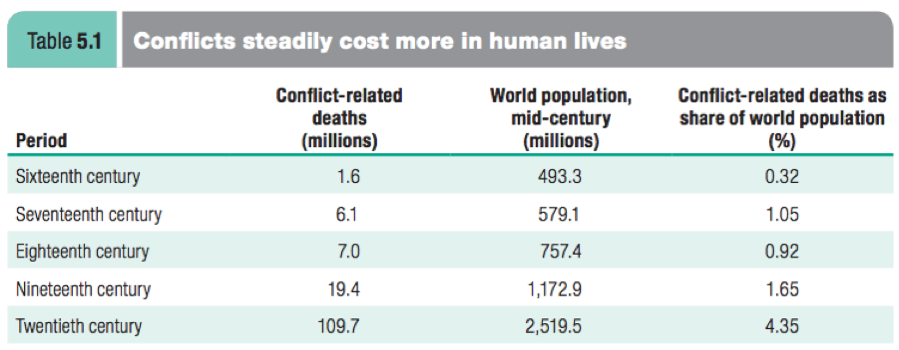

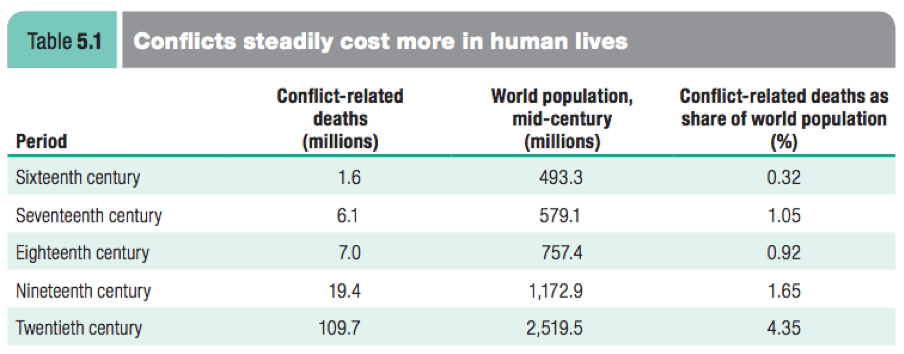

Unlike to the flow restrictions associated with gold mining, there are practically no economic restraints preventing a government from printing more fiat money. Since there is virtually no cost associated with producing additional units (no skin in the game), government fiat money is the softest form of money in the history of the world. Predictably, money supplies grew quickly, especially in the heat of warfare. In the past, for societies operating with hard money systems, once the tide of war had shifted in favor of one belligerent over the other, treaties were quick to be negotiated as war is an extraordinarily expensive endeavor. The fiat money printing press, on the other hand, gave governments the ability to tap the aggregate wealth of entire populations to finance military operations by implicitly taxing them via inflation. This provided a more secretive, implicit method of funding warfare than explicit taxation or selling government wartime bonds. Wars began lasting much longer and became more violent. It is no coincidence that the century of total war coincided with the century of central banking:

The ability to print unlimited quantities of money gives governments a means to finance military operations by implicitly taxing their citizens via inflation. This provides a more secretive method of funding warfare then explicit taxation or selling government wartime bonds. Resultantly, wars have grown in duration and violence.

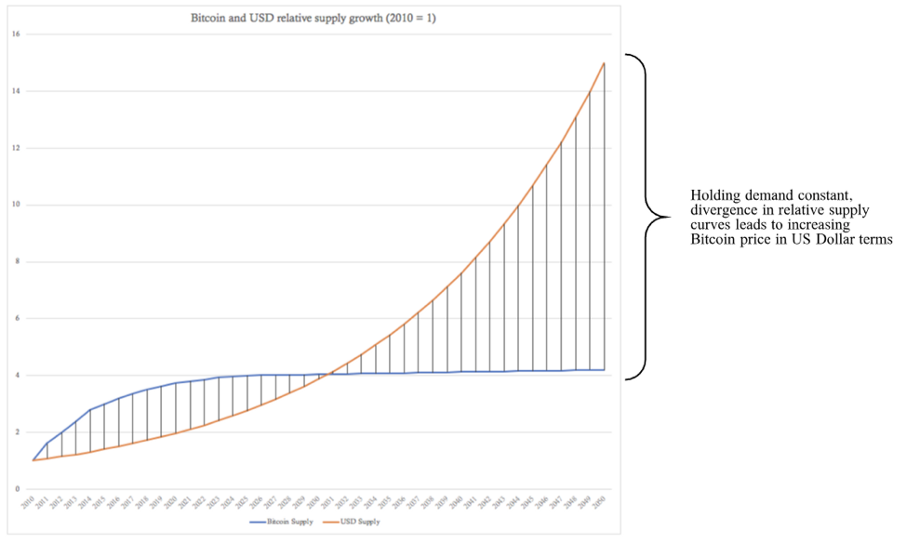

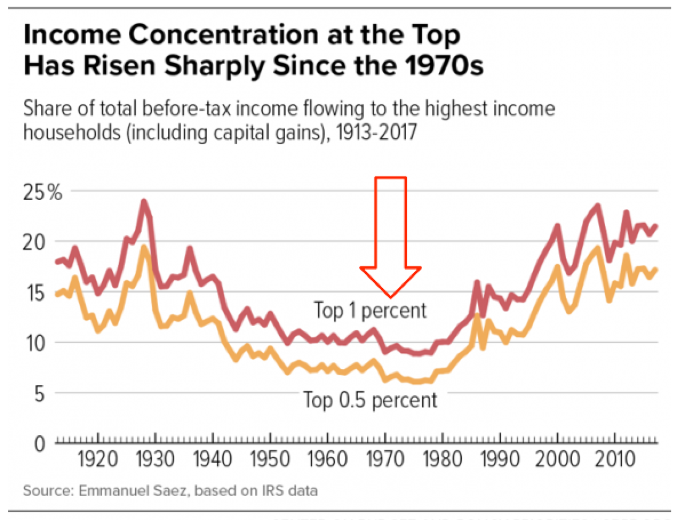

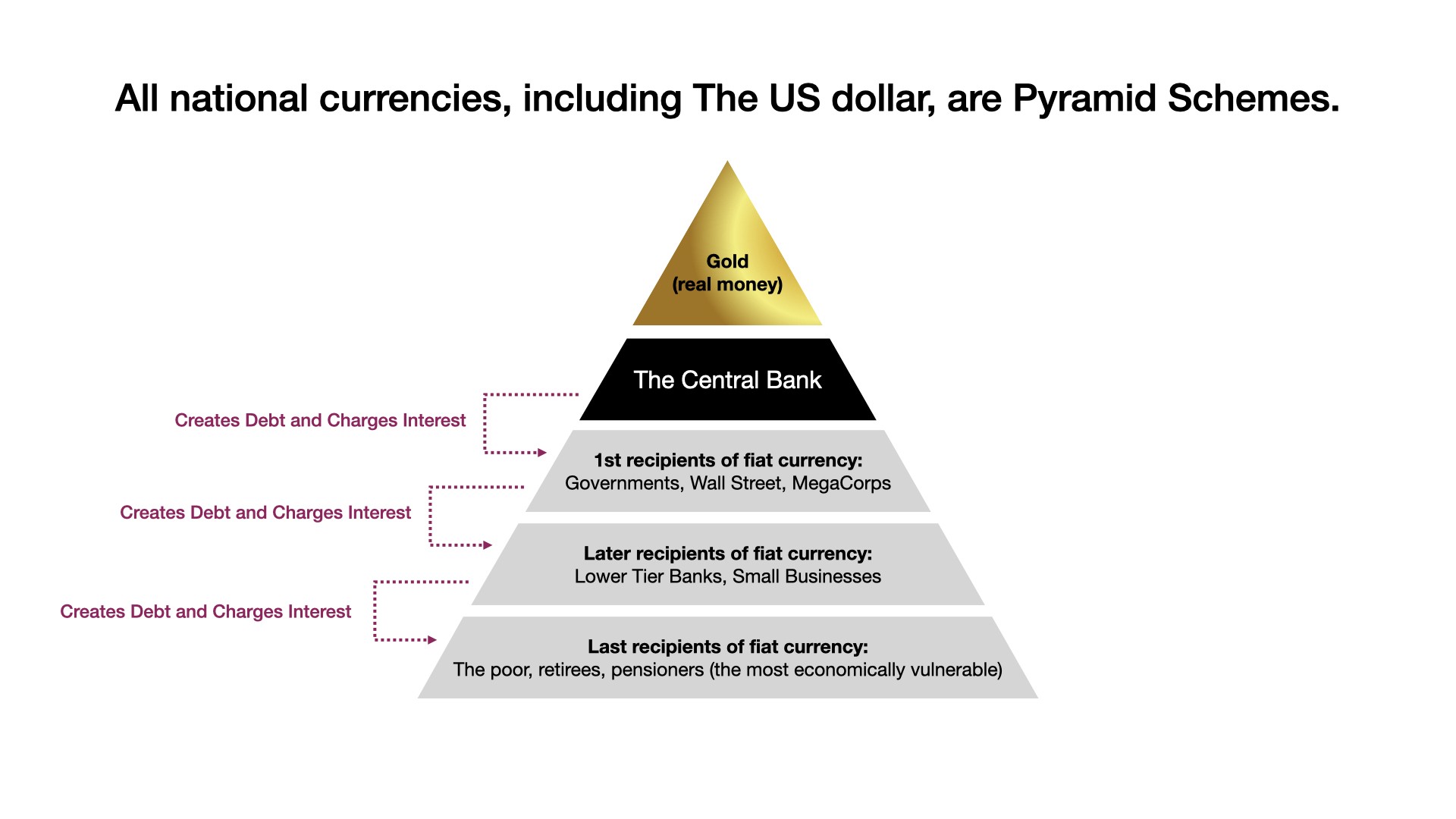

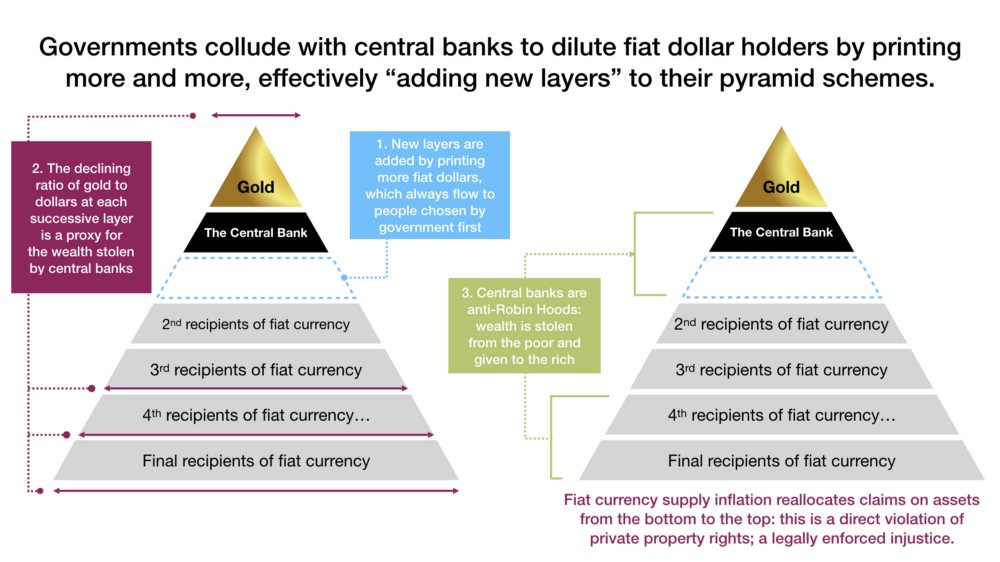

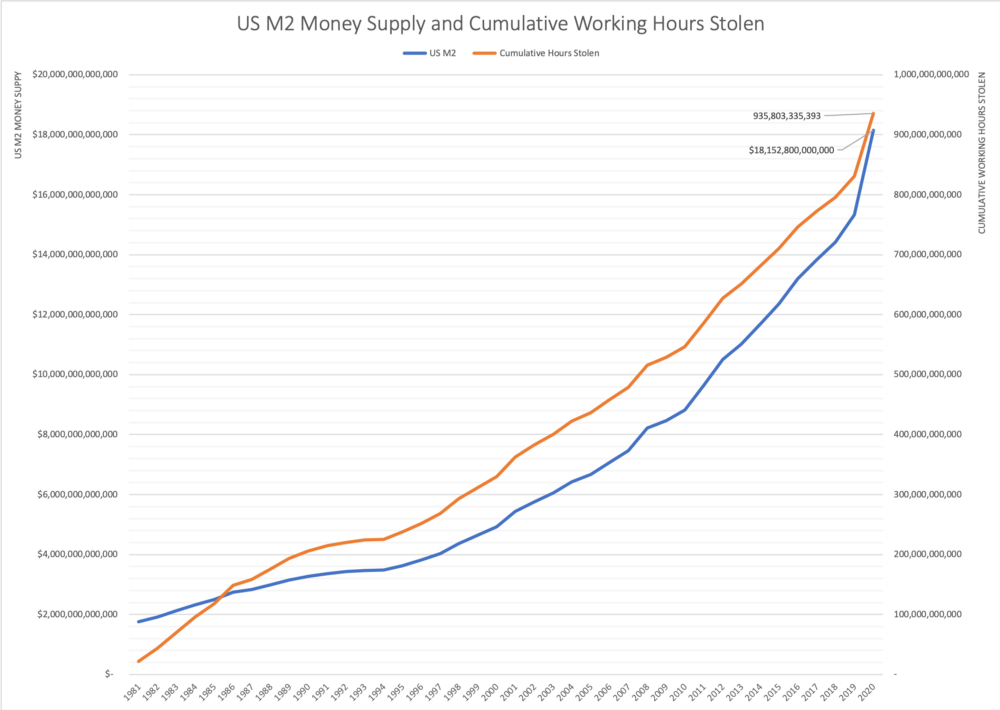

As is to be expected, soft government money has an abysmal track record as a store of value. This becomes abundantly clear when we look at its inflationary effects on the price of gold. An ounce of gold in 1971 was worth $35 USD, and today is worth over $1,200 USD (a decrease of over 97% in the value of each dollar due entirely to inflation). Based on these figures, it is easy to see that gold continues to appreciate as its supply is increased less quickly than the supply of $USD (government fiat money). The constantly increasing supply of government money means its currency depreciates continuously, as wealth is stolen from the holders of the currency (or assets denominated in it) and transferred to those who print the currency or receive it earliest. This transfer of wealth is known as the Cantillon Effect: the primary beneficiaries from expansionary monetary policy are the first recipients of the new money, who are able to spend it before it has entered wider circulation and caused prices to rise. Generally, this is why inflation hurts the poorest and helps the bankers, who are closest to the spigot of liquidity (the government fiat money printing press) in the modern economy. A centrally planned market for money like this completely contradicts the principles of free market capitalism.

Free Market Capitalism versus Socialism [1]

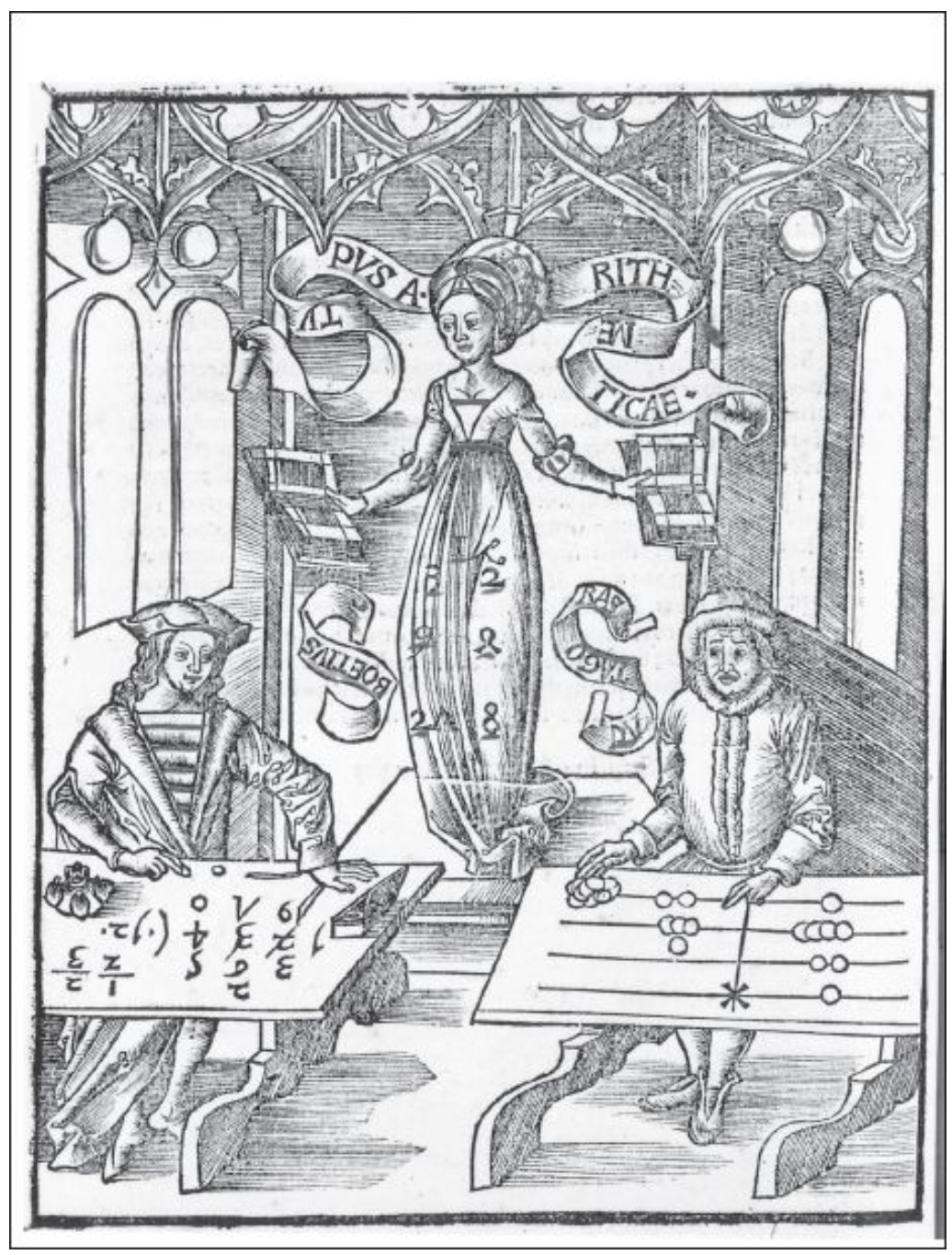

In a socialist system, the government owns and controls all means of production. This ultimately makes the government the sole buyer and seller of all capital goods in its economy. Such centralization stifles market functions, like price signals, and makes decision making highly ineffective. Without accurate pricing of capital goods to signal their relative supply, demand and relevant market conditions, there is no rational way to determine the most productive allocation of capital. Further, there is no rational way to determine how much to produce of each capital good. Scarcity is the starting point of all economics and people’s choices are meaningless without skin in the game in the form of price or trade-offs. A survey without a price would find that everyone wants to own a private island but when price is included, very few can afford to own a private island. The point here is not to trumpet free market capitalism over socialism, but rather to clearly explicate the difference between the two ways of allocating resources and making production decisions:

- Free Market Capitalism places trust in Price Signals

- Socialism places trust in Centralized Planning

A free market is one in which buyers and sellers are free to transact on terms determined solely by them, where entry and exit into the market are free and no third parties can restrict or subsidize any market participants. Most countries today have well-functioning, relatively free markets. However, every country in the world today engages in centralized planning of the market for money (aka the market for financial capital) itself.

No country in the world today has a free market for money, which is the most important market in any economy.

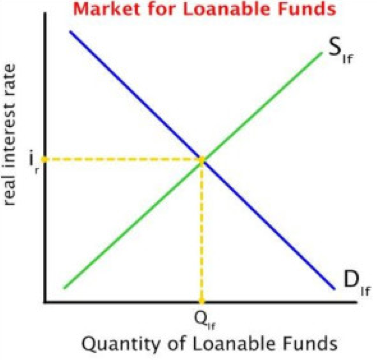

In a modern economy, the market for money consists of the markets loanable funds . These markets match savers with borrowers using the interest rate as their price signal. In a free market for loanable funds, the supply of loanable funds rises as the interest rate rises, as more people are willing to loan their savings out at a higher price. Conversely, the demand for loanable funds decreases as the interest rate rises, as less people are inclined to borrow funds at a higher price:

In a free market for money, the interest rate (the price of money) is determined by natural supply and demand dynamics. Central banks attempt to “manage” these market forces and in doing so create recessions and the boom-and-bust business cycle which is now considered “normal” in the modern era.

In a free market for money, the interest rate (the price of money) is determined by natural supply and demand dynamics. Central banks attempt to “manage” these market forces and in doing so create recessions and the boom-and-bust business cycle which is now considered “normal” in the modern era.

Notice that the interest rate in a free market for capital is always positive because of people’s naturally positive time preference, meaning that no one would part with money unless they could receive more of it in the future. These natural market forces are artificially manipulated in every market for money in the world. All markets for money in the world today are centrally planned by central banks, who are responsible for “managing” the market for loanable funds using monetary policy tools. Since banks today also engage in fractional reserve banking, they lend out not only customers’ savings, but also their demand deposits (monies available to customers on demand, like checking accounts). By loaning out demand deposits to a borrower while simultaneously keeping them available to the depositor, banks can effectively create new, artificial money (a part of the money creation process from earlier). Central banks have the power to manipulate the market for financial capital and can artificially increase the money supply by:

- Reducing interest rates, which increases demand for borrowing and money creation by banks

- Lowering the required reserve ratios, allowing banks to lend more money out than their capital reserves justify

- Purchasing government debt or other financial assets with newly created money in the open market

- Relaxing lending eligibility criteria, allowing banks to increase lending activities and money creation

In a free market for money, the exact amount of savings equals the exact amount of loanable funds available to borrowers for the production of capital goods. This is why the availability of capital goods, as we saw with Harold and Louis, is inexorably linked to a reduction in consumption. Again, scarcity is the starting point of all economics, and its most important implication is the notion that all decisions involve tradeoffs.

In the free market for money, the opportunity cost of saving is foregone consumption, and the opportunity cost of consumption is foregone saving — an indisputable economic reality.

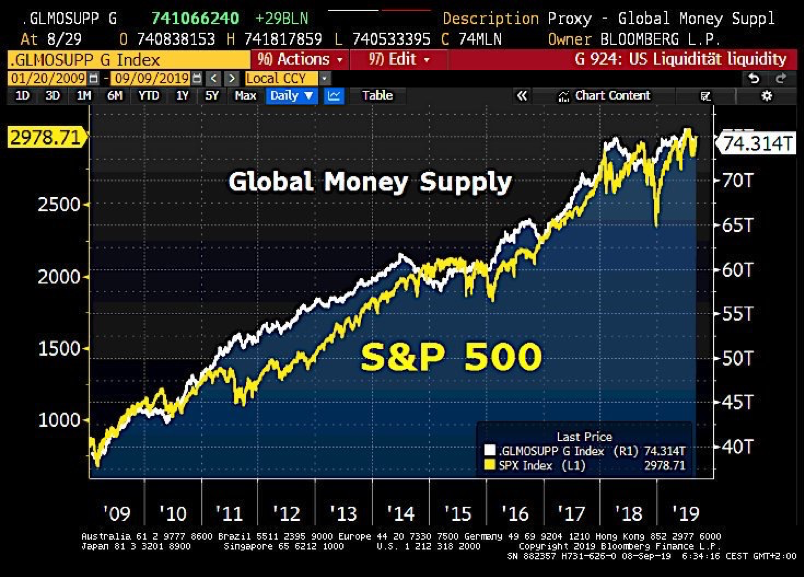

No amount of centralized planning can alter this fundamental economic reality. This is why centrally planned markets always suffer from distortions (aka bubbles, surpluses or shortages) as political agendas run up against the underlying free market forces. Undeterred, central banks continually attempt to “manage” these market forces to achieve politically established policy goals. Most often, central banks are trying to spur economic growth and consumption, so they will increase the supply of loanable funds and lower the interest rate. With the price of loanable funds (the interest rate) artificially suppressed, producers take on more debt to start projects than there are savings to finance these projects. These artificially low interest rates don’t provide any benefit to the economy, rather they simply disseminate distorted price signals that encourage producers to embark on projects which cannot realistically be financed from actual savings. This creates a market distortion (in other words, blows up another bubble) in which the value of consumption deferred is less than the value of the savings borrowed. This distortion can persist for some time but will inevitably unwind with disastrous consequences as economic reality cannot be fooled for long.

The excess supply of loanable funds, backed by no actual deferred consumption, initially encourages producers to borrow as they believe the funds will allow them to buy all the capital goods necessary for their project to succeed. As more producers borrow and bid for the same amount of capital goods, inflation sets in and prices begin to rise. At this point, the market manipulation is exposed since the projects become unprofitable after the rise in capital good prices (due to inflation) and suddenly begin to fail. Projects like these would not have been undertaken in the first place absent the distortions in the market for money created by central banks. An economy-wide simultaneous failure of overextended projects like this is called a recession . The boom and bust business cycle we have all grown accustomed to in the modern economy is an inevitable consequence of this centrally planned market manipulation. The United States and Europe saw a great illustration of this process when the dot-com bubble of the late 1990s was replaced by the housing bubble of the mid-2000s.

Free market capitalism cannot function without a free market for money.

As with all well-functioning markets, the price of money must emerge through the natural interactions of supply and demand. Healthy markets require functional nervous systems, as market participants must have accurate price signals to make decisions effectively. Basic economics shows us clearly that central bank meddling in the market for money is the root cause of all recessions and the business cycle. By imposing an artificial price, in this case the interest rate on loanable funds, central banks inhibit natural price signals which coordinate allocation decisions among savers and borrowers. Their market manipulation creates market distortions and recessions. Attempting to remedy a recession by injecting more artificial liquidity into the system will only exacerbate the distortions which caused the crisis in the first place and blow up new bubbles. Only central planning of a soft money supply and its pricing mechanism can cause widespread failures in an economy like this, as an economy based on hard money remains firmly rooted in economic reality and resists market distortions.

Alignment with natural market forces like supply, demand and the price signal is the principal reason free market capitalism prevailed over socialism.

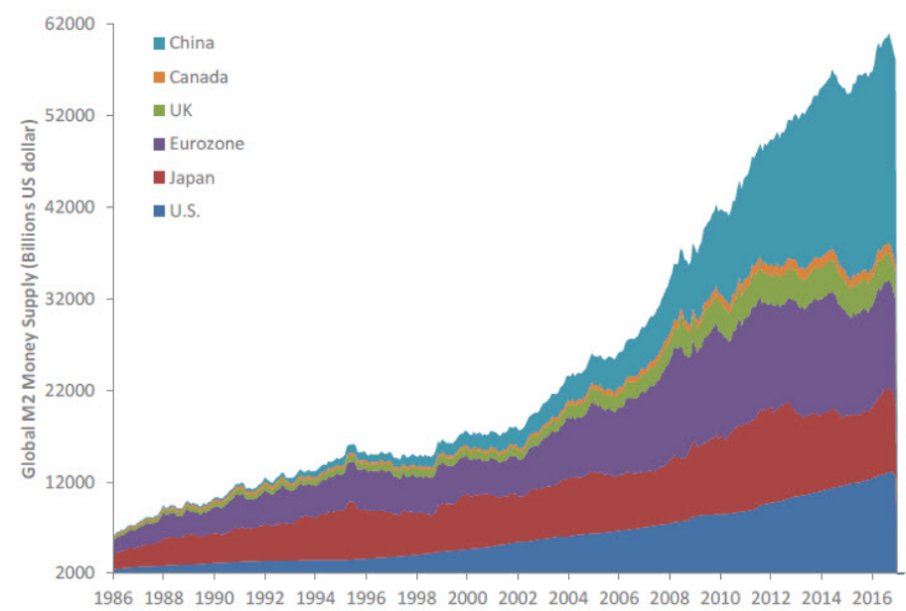

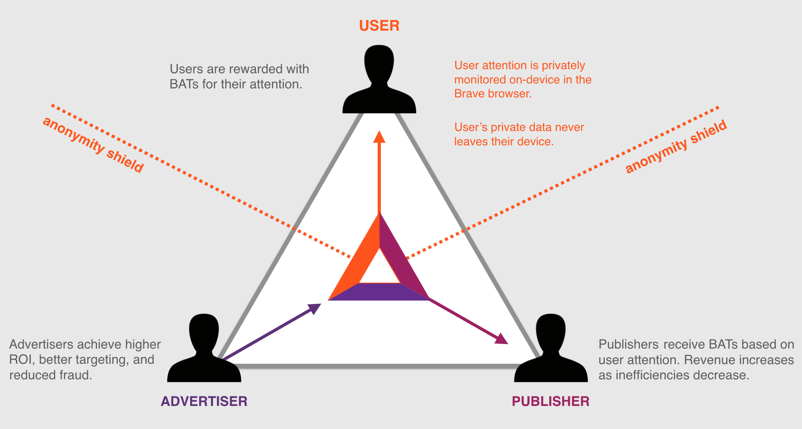

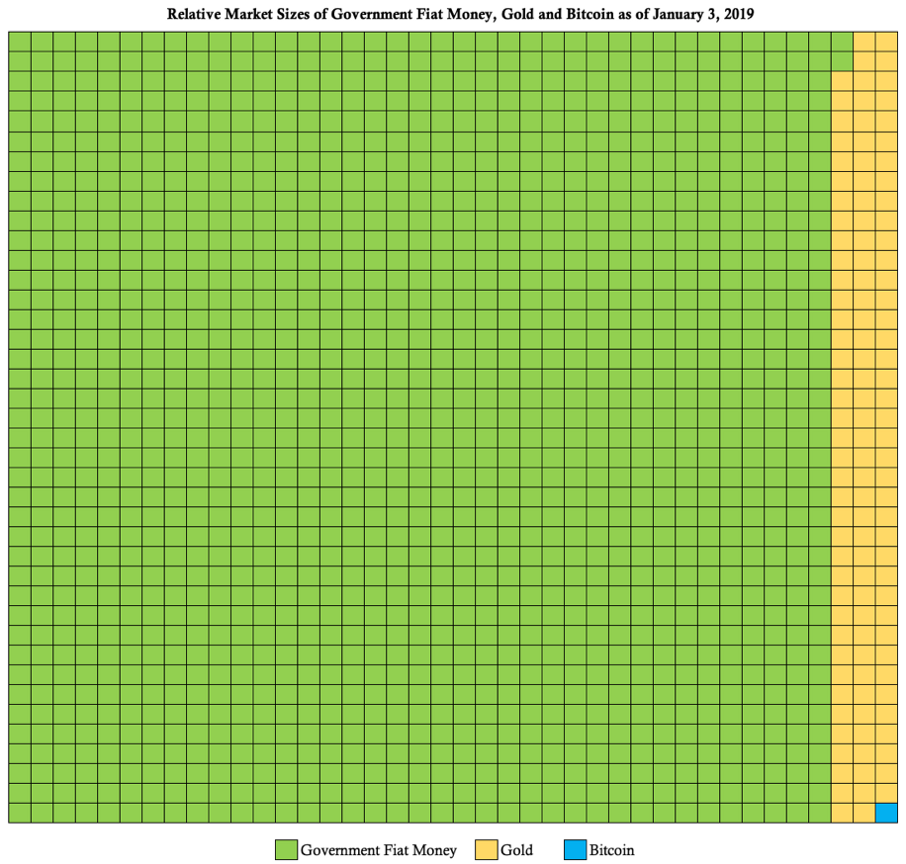

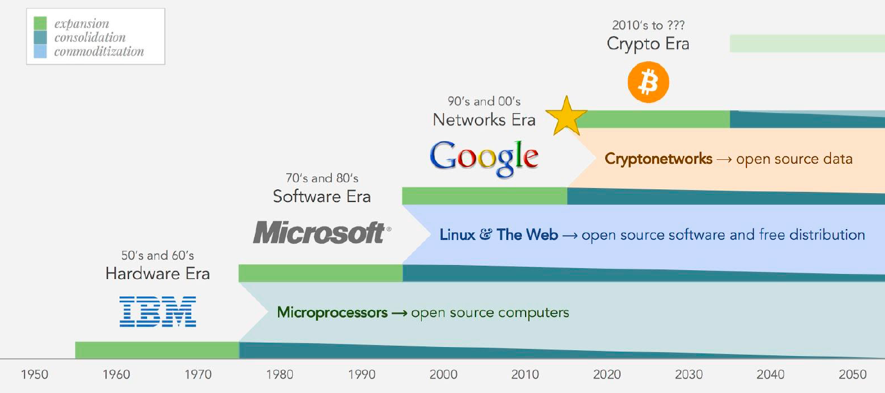

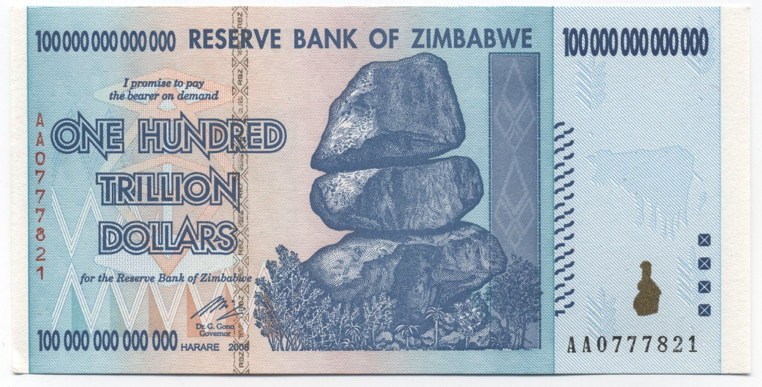

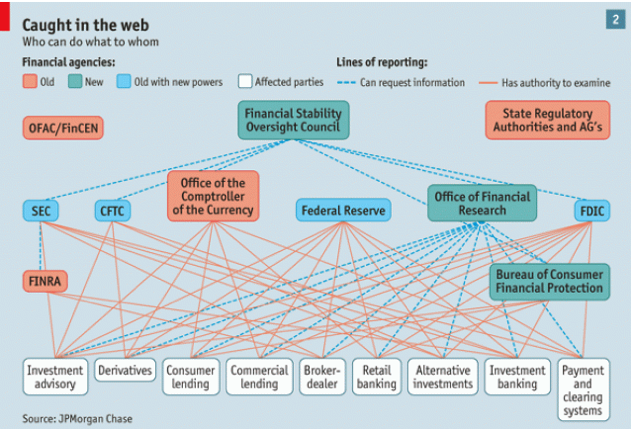

Failure of Government Fiat Money [1,3,4]

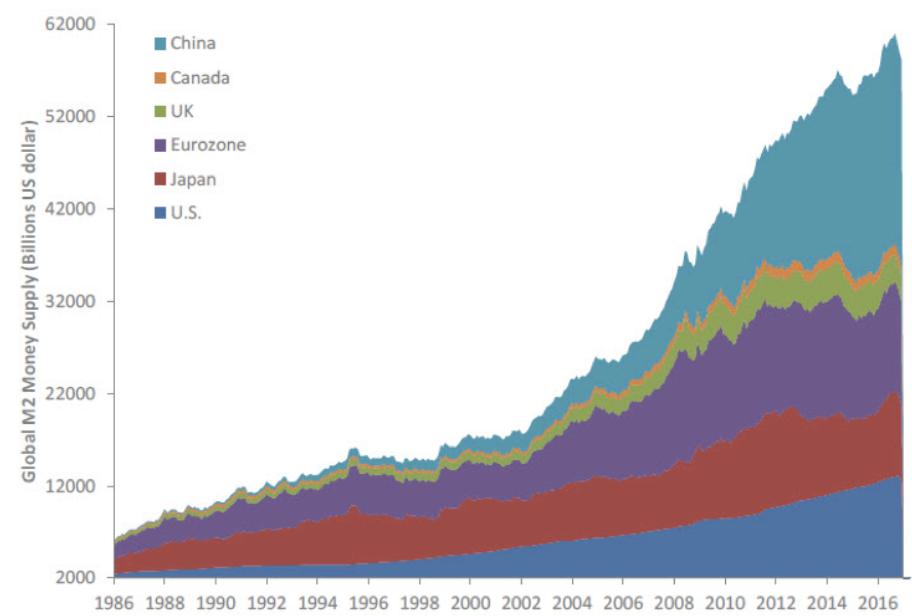

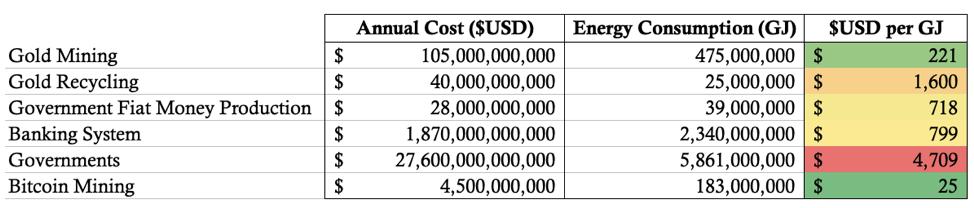

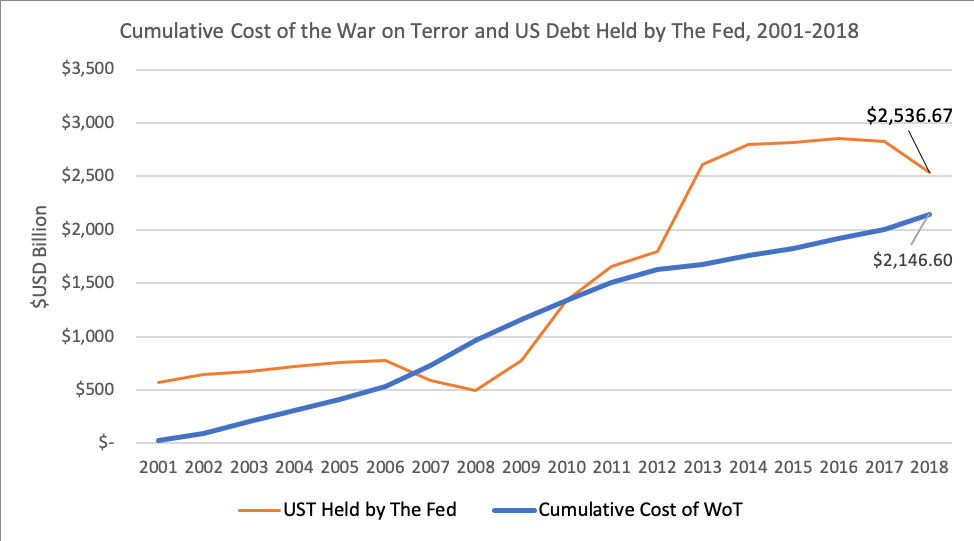

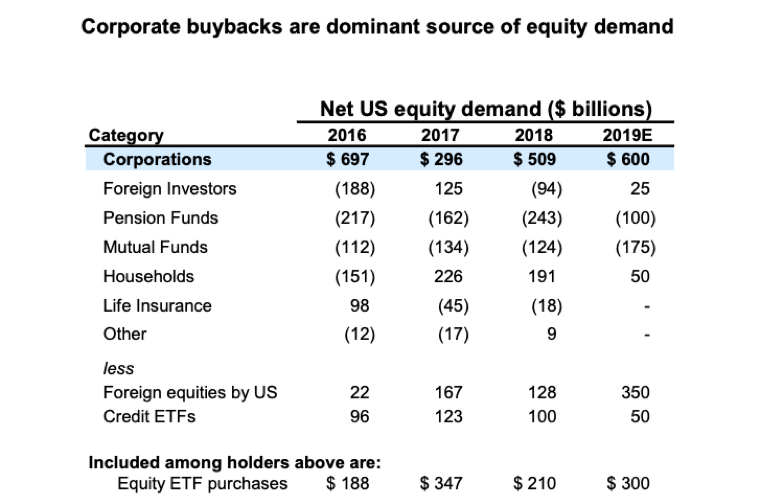

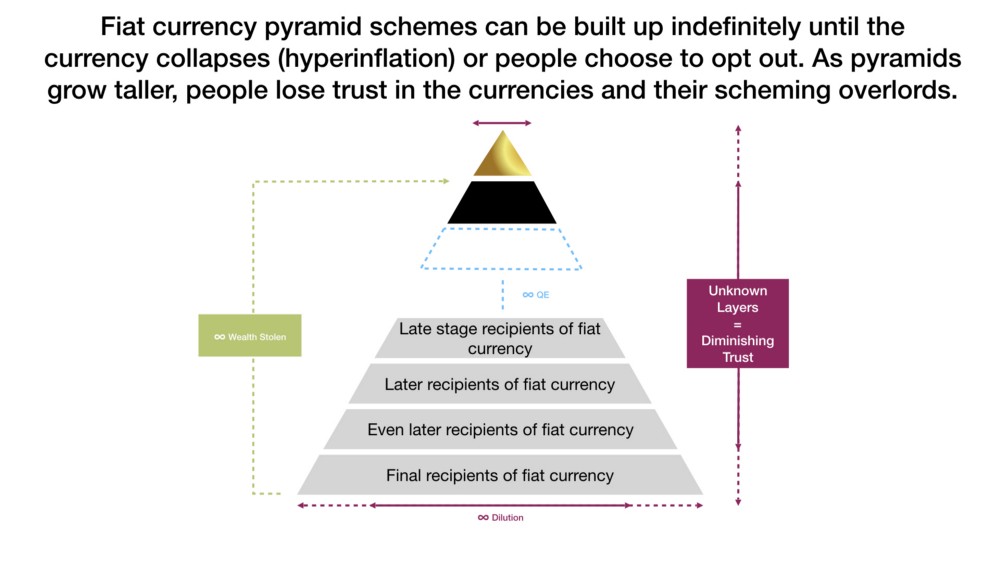

Seeing that governments have been forced to use coercive measures, such as confiscating gold and implementing legal tender laws, to enforce adoption of fiat money is a clear indication that soft money is inferior and doomed to fail in a free market. This severe inadequacy of government fiat money came to the forefront of global consciousness in the wake of the Great Recession that began in 2008. Due to gigantic market distortions driven by artificially low interest rates and credit ratings agencies with no skin in the game, US subprime real estate became the largest bubble in modern history. When it bursts, its affects were globally systemic, and central banks all over the world (predictably) began increasing their money supplies in an attempt to reflate their broken economies.