Why Bitcoin’s volatility can only decrease, but it will take a bit longer

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Why Bitcoin’s volatility can only decrease (but it will take a bit longer)

By acrual

Posted February 19, 2020

At an early stage, hodlers/bitcoin owners was a very small ratio

At an early stage, hodlers/bitcoin owners was a very small ratio

I know I suck at painting stuff, but I hope I can explain my point better within the next paragraphs.

In the image:

- Hodlers are represented by the orange color. They are users because they understand Bitcoin’s extremely low cost of storage / maintenance / deterioration / inflation. They are speculators, but in the very long run, and their speculation is based on the bet that they will hardly ever have to sell their coins.

- The green color is the (still) huge number of people who still don’t get Bitcoin but own it only as short term speculators (STS). They have no problem with selling big amounts of their coins and turn them into fiat. Hodlers+ STS= Bitcoin owners

- The white color is the even larger of people who still don’t own Bitcoin (nocoiners)

My thesis is that information asymmetry is the result of STS guys speculating short term (typically buying at times of FOMO) and selling (typically at times of panic), consequently increasing as such the supply, while hodlers keep their coins with themselves.

The STS (green) guys get in and out very quickly. They completely destabilize the price.

A small number of STS have been becoming over time hodlers (orange), very slowly at first, people that understand that Bitcoin is a long term storage of value. They don’t put their coins for sale easily and as a result stabilize the price creating the floor prices we all know and love.

So how do we create the first FOMO and therefore turn nocoiners into STS?

That is the role of halvings, and happens every four years.

Fast forward a few years and Bitcoin understanding grew. The proportion of hodlers among Bitcoin owners is higher.

Fast forward a few years and Bitcoin understanding grew. The proportion of hodlers among Bitcoin owners is higher.

After the first halving, I think that what we are seeing is a very variable green area that creates the volatility, grows very fast at times of FOMO and decreases very fast at times of panic.

Hodlers on the other hand, grow very slowly, at their own rhythm as Bitcoin understanding grows.

We live in the information age and nowadays good information is way more widespread so I expect soon that the orange area will grow faster than it used to, even if the green one grows very fast too with the next FOMO.

Consequently, with a faster growing orange area of hodlers, I expect the next floor in the price to be way higher than many anticipate, especially given that the next bull run is going to be way more mainstream than any other in the past.

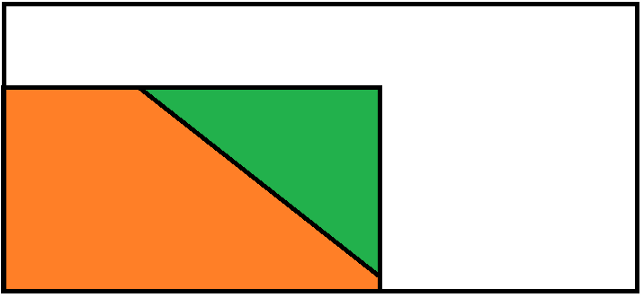

And if this thesis is confirmed, I believe that we are likely to see a situation like this during the next halving of 2024:

After the next halving of 2024, I expect the proportion of hodlers within the total of Bitcoin owners to be way higher. Volatility should decrease drammatically as a result

After the next halving of 2024, I expect the proportion of hodlers within the total of Bitcoin owners to be way higher. Volatility should decrease drammatically as a result

My point is, Bitcoin understanding can only grow and Bitcoin understanding can only grow FASTER. FOMO is at some point going to be unbelievable and probably difficult to manage for many. That’s why I say that the role of Bitcoin educators is wildly underrated.

Mine are not the prettiest articles (and pictures) but I appreciate a good discussion and your opinions. Please let me know what you think here or in my twitter account :)