Tweetstorm My Bitcoin Forecast

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Tweetstorm My Bitcoin Forecast

By Charles Edwards

Posted February 16, 2020

My #Bitcoin Forecast

RocketBitcoin $100K within 5 years

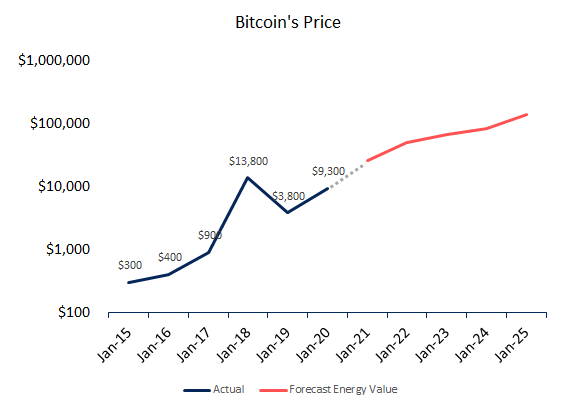

Based on a conservative estimate of Bitcoin’s Energy Value, it is likely that $BTC will 𝟭𝟬𝗫 within the next 5 years.

A thread forecasting Bitcoin’s long-term price using Energy Value.

Approach

Bitcoin’s Energy Value has tracked Bitcoin’s price for the last 10 years.

Let’s use it to forecast price.

There are only two varying inputs in Energy Value: High voltage signHash Rate GearMining Hardware efficiency

We can forecast each of these to predict BTC’s Price.

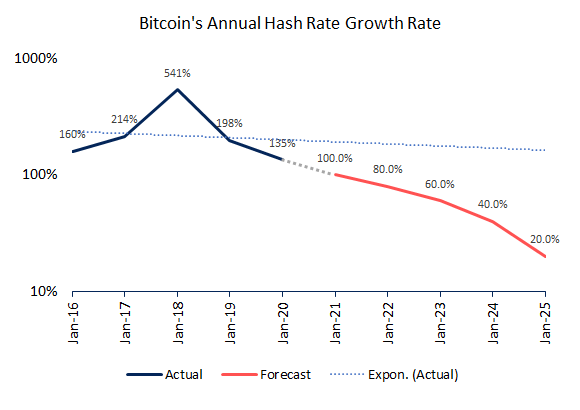

Hash Rate

Over the last 5yrs, Bitcoin’s HR has grown exponentially (linear on a log scale).

Assuming this relationship holds, but allowing for some market saturation, we can estimate that the HR growth rate drops from ~135% p.a. today to ~20% p.a. in 2025.

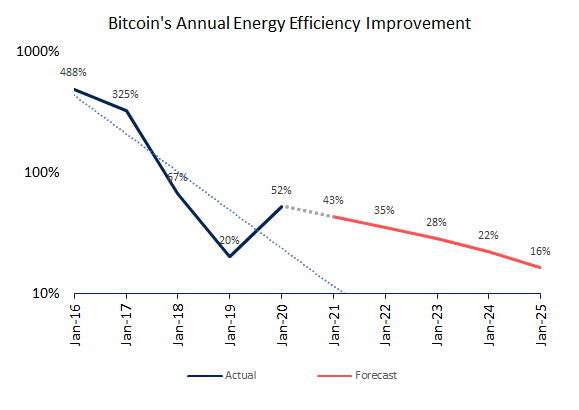

Mining Hardware Efficiency

Energy efficiency has also improved exponentially.

But the annual rate of improvement has fallen from over 400% in 2015 to 50% last year.

I expect this trend of declining improvement will continue.

The Forecast

Combining these estimates for HR and Efficiency, Bitcoin’s Energy Value should reach $𝟭𝟬𝟬𝗞 by 2025.

- Sanity check: $100K Bitcoin = 1.8T market cap.

- That’s just 20% Gold’s market cap

Mr. Market

So far, we have only looked at fair value.

As always, price fluctuates around value.

Bitcoin’s Price has deviated to as low as -70% discount to Energy Value, to as high as a +600% premium.

If this cycle repeats, BTC could see prices as high as $600K+.

2X Fair Value?

While 6X fair value is a possibility, excessive swings will become more difficult with time due to the law of large numbers.

For the coming market cycle, I expect 2X fair value is definitely within the realm of possible.

Where will this money come from?

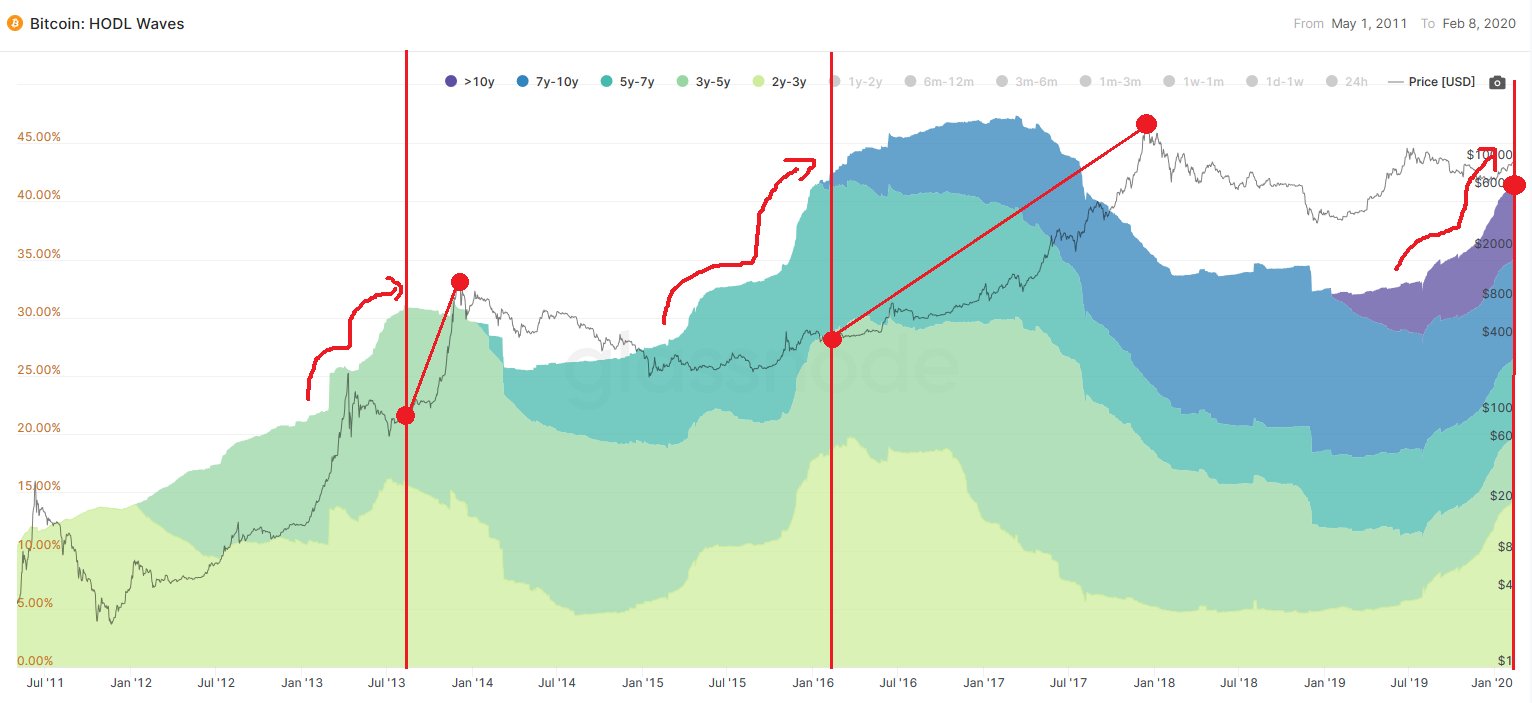

Supply Falling:

- 40% of BTC is locked in wallets that have not moved their coin in >2 yrs.

- Bitcoin Inflation rate to halve in May & again in 4 years.

BTC will be the lowest inflation asset ever known to man

Note: HODL Wave patternEyes

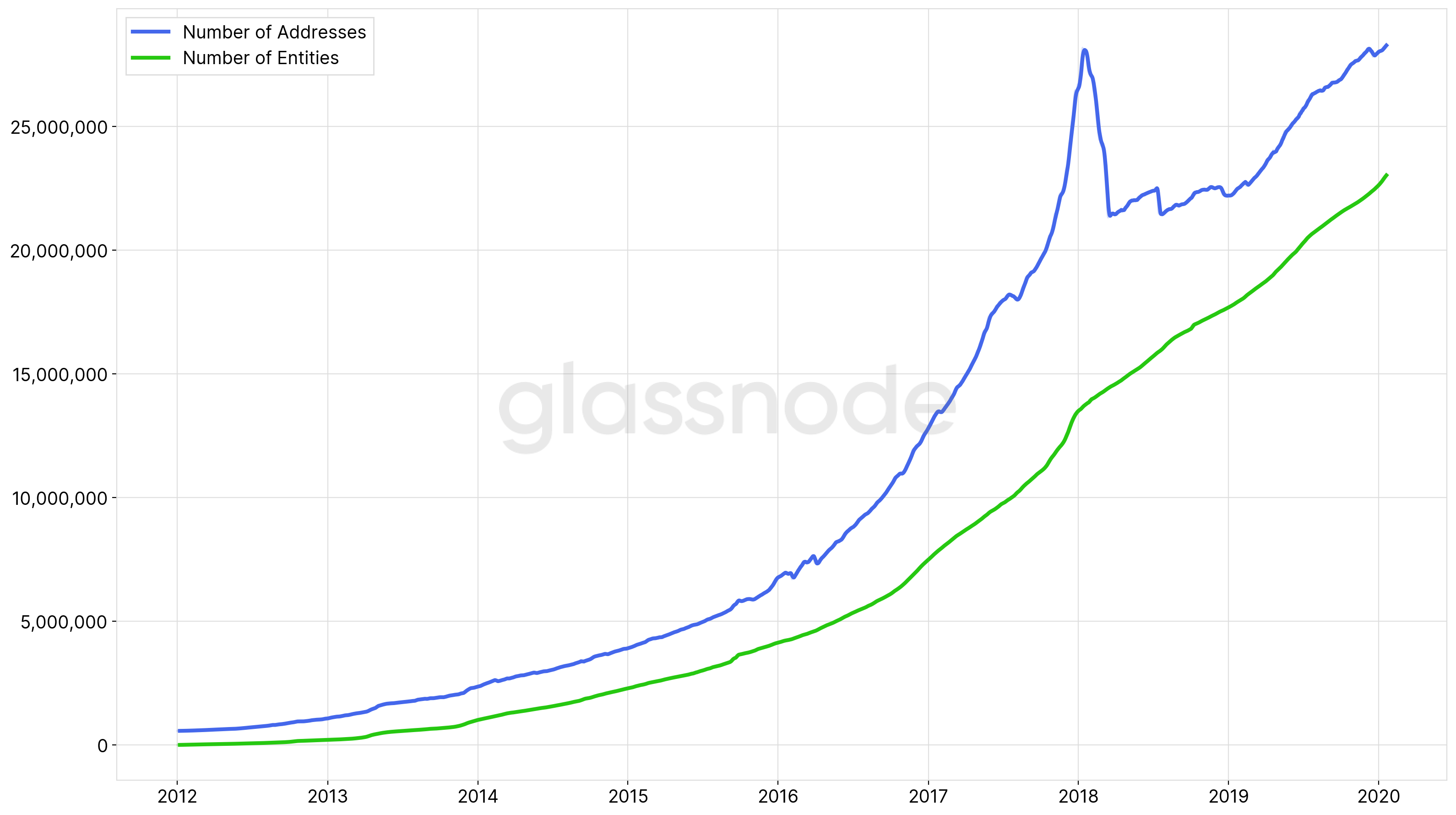

Demand growing:

- @Glassnode number of entities ATH

- New onramps: VAR management now possible w/ options. Prev. Bitcoin’s volatility blocked access to institutions

- Bitcoin up 100% in 2019, yet no growth in Google searches

- Number of 1+ BTC addresses ATH

- It’s a QE hedge

What about electricity?

BTC uses ~0.3% of global elec.

With continued improvements in Energy Efficiency, $100K BTC will likely consume just 3X current energy.

A BTC market cap of $1.8T - 8T (=gold) could consume less than 1.5% of the world’s power.

Note 1

Because the HR forecast is below the historic trendline, and the efficiency forecast is above the trendline, both forecasts can be considered historically conservative.

–> $100K Energy Value is conservative.

Note 2

The ASIC chips caused a step-change improvement in Energy Efficiency in 2013/14, dropping Bitcoin’s Energy Value.

Should such an event occur again in the next 5 years (eg. Quantum computing), this would cause a 1-for-1 drop in predicted Energy Value.

Note 3

Perhaps the 2 most critical risks to Bitcoin’s future are:

- Quantum Computing: breaking SHA-256 algorithm / accessing lost coins

- Government outlaw: while decreasing with time, major economic outlawing of BTC would curtail mass adoption and Energy Value

Conclusion

This forecast should be considered a “base case”. All forecasts are wrong, some are useful.

I expect Bitcoin will hit at least $100,000 within 5yrs.

Based on historic BTC fundamentals, growth rates and market cycles this is a conservative estimate.

Final Thoughts

Risks considered, Bitcoin is an attractive investment.

Each generation has a “once in a lifetime” opportunity.

Bitcoin was the best performing asset of the last 10yrs.

There are plenty of reasons to think the next 5 will be no different.