What Does Bitcoin Really Represent?

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

What Does Bitcoin Really Represent?

Bitcoin beyond the technical aspect.

By Sylvain Saurel on In Bitcoin We Trust

Posted May 15, 2020

Bitcoin is a true technological revolution. For many, Bitcoin is the most important technological invention since the emergence of the Internet. For others, Bitcoin is simply a new financial investment that offers the potential for much higher returns than traditional investments.

The fact that Bitcoin has made it possible to transform $1 invested at the beginning of 2010 into $90K at the end of 2019 can indeed make people dream.

However, Bitcoin cannot, and especially should not, be reduced to a financial investment.

Bitcoin is much more than that. For me, Bitcoin is a multifaceted revolution: technological, industrial, social and ideological.

A lot of people miss the most important thing about Bitcoin, because they only focus on the pursuit of profit. In what follows, I would like to lead you to understand that Bitcoin represents something much more important for the future of humanity.

The impacts of Bitcoin’s paradigm shift are so broad that I would have to write a whole book to hope to be as exhaustive as possible. So I ask you in advance to forgive me if I miss a few things in this story. If so, please feel free to tell me in comments.

Bitcoin’s creation date makes it possible to understand its purpose

If you really want to understand what Bitcoin purpose is, you need to look at when it was conceived. Bitcoin was created by Satoshi Nakamoto in late 2008.

On October 31, 2008, Satoshi Nakamoto published his white paper presenting Bitcoin as “A Peer-to-Peer Electronic Cash System”.

Bitcoin was therefore designed following the banking and financial crisis of 2008. As such, Bitcoin should be seen as a response to the flaws of the monetary and financial system. These flaws are exposed in every economic crisis. The crisis of 2020 is no exception.

The message included in Bitcoin Genesis Block clearly confirms Bitcoin purpose:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

Satoshi Nakamoto inserted in the coinbase transaction of the Bitcoin Genesis Block the title of an article from The Times of January 3, 2009.

The Times of January 3, 2009

The Times of January 3, 2009

The message was very clear: Bitcoin seeks to offer the inhabitants of the Earth an alternative to a fiat system that no longer respects them and has failed in its mission.

Well aware of the importance of his invention, Satoshi Nakamoto made the fundamental choice to remain anonymous and offer it to the world as a gift.

Bitcoin belongs to all its users. It is a true democracy in which every user has potentially equal weight. There is no leader at the head of Bitcoin who could be sued to stop the network. Bitcoin is literally unstoppable.

Bitcoin is a necessity for answering fiat system’s flaws

Bitcoin is a solution that emerges from the people. This solution will only succeed if its users make it a success. All Bitcoin users made Bitcoin what it is today. A hope for millions of people around the world, but also a reality with a market capitalization of more than 170 billion dollars at the time of writing.

By giving power back to the people, Bitcoin represents the first step in the separation of money and state.

A famous quote from Satoshi Nakamoto justifies very well the need for the people to regain power by taking it out of the hands of the central banks:

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.” — Satoshi Nakamoto

To function properly, the current monetary and financial system requires absolute confidence in central bankers and banks.

Unfortunately, history has shown us that this is impossible. The Fed’s current unlimited quantitative easing program is a good example of a central bank abusing trust of its citizens.

The Danske Bank money laundering scandal is another example of trust betrayed by a banking institution. One could easily add to this the totally arbitrary confiscation of assets of certain people, or the refusal to carry out certain transactions for totally false reasons.

Since the advent of Bitcoin, more and more banks are blocking transactions to trading platforms.

They claim that they are trying to protect their clients, but this is not true. The big question is what do they want to protect their customers from?

Perhaps they want to protect them from finding out the truth if they were to exchange fiat money for Bitcoin…

The need for Bitcoin is therefore essential to regain your sovereignty, but also to no longer have to rely on trust in third parties you cannot really trust.

With Bitcoin, you are able to manage your money as you wish.

You can make all the transactions you want without anyone being able to stop you. Best of all, transactions over the Bitcoin network are ultra-fast, and transaction fees are kept to a minimum.

All this within a pseudonymous network that protects your identity as long as you don’t reveal the addresses you use to others. Not everything is perfect when it comes to privacy, but the Bitcoin community is working every day to improve this, and make Bitcoin even more protective of your privacy.

The Taproot evolution, or the Lightning Network, will help improve this in the future.

Bitcoin puts you back in control, which means that Bitcoin allows you to live your life on your own terms. With Bitcoin, you can choose to save what you own. This is exactly the opposite of what happens with the U.S. dollar, for example.

Indeed, the constant increase in the U.S. dollar money supply arbitrarily decided by the Fed devalues what you have in cash.

The great monetary inflation that we are currently experiencing in 2020 will make those who are already poor poorer. Choosing to save your fiat money is impossible under the current system.

With Bitcoin, it’s different. Bitcoin increases in value over time, giving you reasons to keep it as long as possible. By keeping your Bitcoins, you will be rewarded in the future.

Bitcoin’s monetary policy is unique

The power of Bitcoin lies in its unique monetary policy:

- Fully automatic as it is written in the Bitcoin source code.

- Bitcoin supply is finite: a maximum of 21 million Bitcoins will be put into circulation.

- An inflation in the supply of new Bitcoins that decreases over time due to so-called Halving.

- Bitcoin supply inflation will reach zero around 2140.

This monetary policy that reduces the supply of new Bitcoins over time is to be contrasted with the policy pursued by central banks around the world.

While central banks use and abuse quantitative easing, which consists of printing more and more units of their respective currencies, Bitcoin highlights the virtues of quantitative hardening.

Quantitative hardening gives more value to existing Bitcoin units.

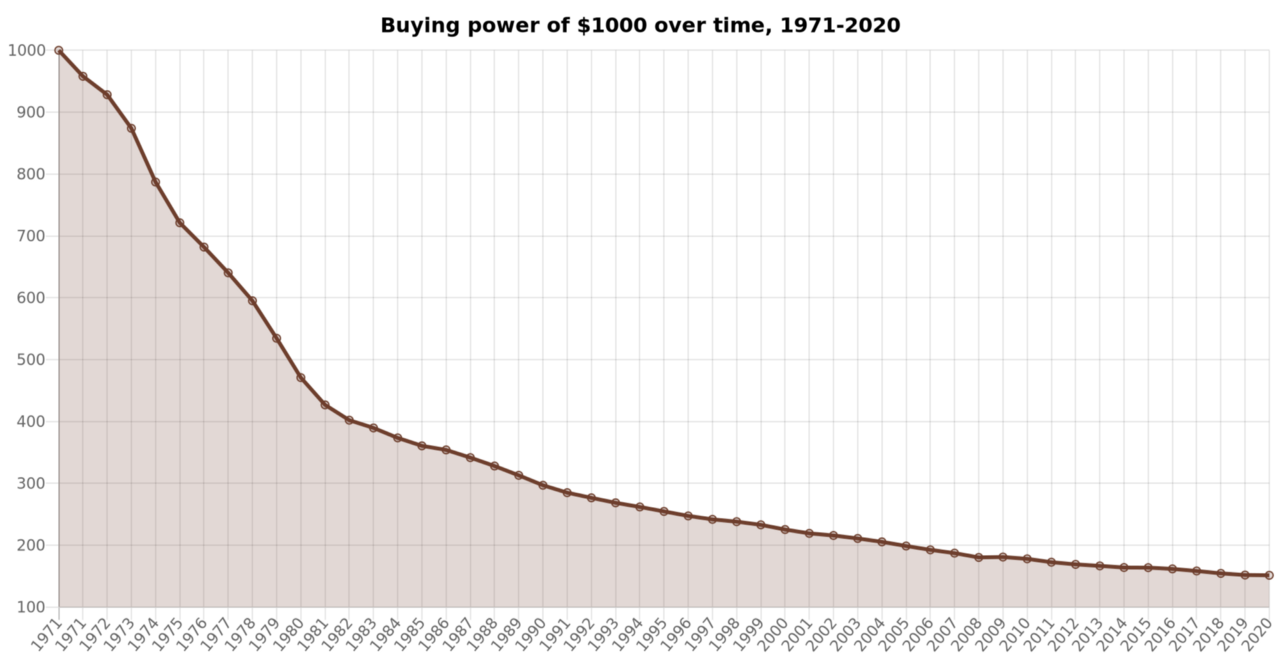

With Bitcoin, you can therefore accumulate wealth with the guarantee that 1 BTC of 2020 will always be equal to 1 BTC of 2100. With the U.S. dollar, this is clearly not the case as shown by the incredible erosion of $1,000 buying power since 1971:

Buying power of $1,000 over time, 1971–2020

Buying power of $1,000 over time, 1971–2020

Your $1,000 from 1971 has lost 85% of its value by 2020 since it only gives you $150 in purchasing power right now.

Bitcoin is completely transparent

The problem with the fiat system is also its lack of transparency in my opinion. Many opponents of Bitcoin claim that it is primarily used to launder money.

In fact, those who accuse Bitcoin of this are the ones who are laundering the most money.

The Danske Bank money laundering scandal is, in my opinion, just the tip of the iceberg.

When you look at the numbers and the transactions, you come to the conclusion that Bitcoin is used less than the U.S. dollar for illegal purposes because it is harder.

The transparency of Bitcoin allows you to have access to all these figures. In today’s banking world, this is virtually impossible and huge grey areas still remain. They allow unscrupulous people to continue to take advantage of a system that is still extremely corrupt.

If you have any doubts about Bitcoin, just check for yourself. Its Blockchain is totally accessible to everyone. It is immutable which means that all transactions made since the Genesis Block have remained as is and could not be modified.

Bitcoin’s slogan is not usurped:

“Don’t trust, verify.”

Bitcoin teaches you to be critical. You have to figure things out for yourself. That’s how you will discover the flaws in the current system. Then you will probably understand that the powerful people at the head of the system know very well that the system is broken, but they simply don’t want to change it.

This system benefits too much to a minority of very wealthy people. They obviously do not want to risk losing their privileges. The Bitcoin revolution is necessary to bring about a fairer system for everyone that will allow the cards to be reshuffled.

Seeing powerful fiat system guys like Warren Buffett being totally opposed to Bitcoin should alert you.

For me, the fact that Warren Buffett is so afraid of Bitcoin clearly shows that it is a necessity for normal people who are tired of being subjected to a totally unfair system. The current monetary and financial system has only increased the disparity in wealth since its creation 49 years ago.

Bitcoin is the best hedge against the Great Monetary Inflation

In the face of the economic crisis we are currently going through, many people are promoting gold as the ultimate hedge against the Great Monetary Inflation.

Recognized for decades, gold is indeed a good store of value. Nevertheless, if we remain objective, Bitcoin is a superior reserve of value in all respects:

- Divisible up to 8 digits after the decimal point. You can buy 1 Satoshi, that is 0.00000001 BTC.

- Portability. Your Bitcoins can fit in your head as long as you learn your 24-word recovery phrase.

- Recognizability. It is much easier to verify that your Bitcoins are authentic.

- Harder to counterfeit.

- Scarcer. The amount of gold on Earth is probably limited, but this limit is much greater than the limit for Bitcoin.

- Non-confiscable.

You can easily carry your Bitcoins with you, or send them to a friend halfway around the world in minutes. With gold, that’s impossible.

Besides, getting into the Bitcoin world requires little effort.

You must just have a smartphone and an Internet connection. From there, you are able to buy your first Bitcoins.

If you want to buy gold in 2020, I doubt you can do it as easily and quickly as you can buy Bitcoin.

Bitcoin is the most secure decentralized network in the world

Bitcoin’s decentralized side makes it much more resistant to attack attempts. Since its inception, more than eleven years ago now, the Bitcoin network has never been hacked. The few bugs that have made the network unavailable some minutes have been solved at an incredible speed when you consider that Bitcoin is open source and belongs to everyone.

While it is only supported by its users, Bitcoin has an uptime that has nothing to envy those of web giants like Google, Amazon, or Facebook.

Bitcoin uptime is 99.98% since its creation on January 3rd 2009.

Bitcoin network’s Hash Rate is also constantly growing which makes Bitcoin the most secure decentralized network in the world in 2020.

By buying Bitcoin, you also have the guarantee that your wealth is safe. Your best guarantee is that you will be responsible for your own security.

It will be up to you to secure your Bitcoins on a hardware wallet. This may scare you initially, but it’s the price you have to pay to take full control of your wealth and your life. It’s a small price to pay in my opinion.

Bitcoin allows anyone who wants to become a network node because its blockchain is permissionless and trustless. Under these conditions, Bitcoin gives you access to the best bank in the world: yourself.

Bitcoin is already a plan A for millions of people

For people living in countries with authoritarian regimes, Bitcoin already plays a vital role. It is an incredible weapon to guard against the inflation that is ravaging Venezuela, Argentina, Iran, and Zimbabwe.

If you still doubt the need for Bitcoin in 2020, I advise you to take a look at the hyperinflation that is currently ravaging Iran.

The situation is the same, or even worse, in Venezuela, or Argentina. For the people in those countries, Bitcoin is already a plan A.

It also helps to maintain the right to freedom of speech. Indeed, since no one can confiscate your Bitcoins, you can speak without fear of having your bank assets frozen, for example.

Bitcoin already plays a fundamental role in the protection of human rights. This role is bound to grow in the future.

And even if you live in a Western country, you too may need Bitcoin to protect you from the surveillance society that more and more governments want to impose.

The example of China’s social credit system seems to give ideas to the leaders of the major Western democracies, which is not a good thing.

Fortunately, Bitcoin can help you cope. Of course, Bitcoin alone will not be the solution that will fully protect you from mass surveillance. Nevertheless, it will be one of the weapons at your disposal.

Bitcoin is the money protocol of the Internet

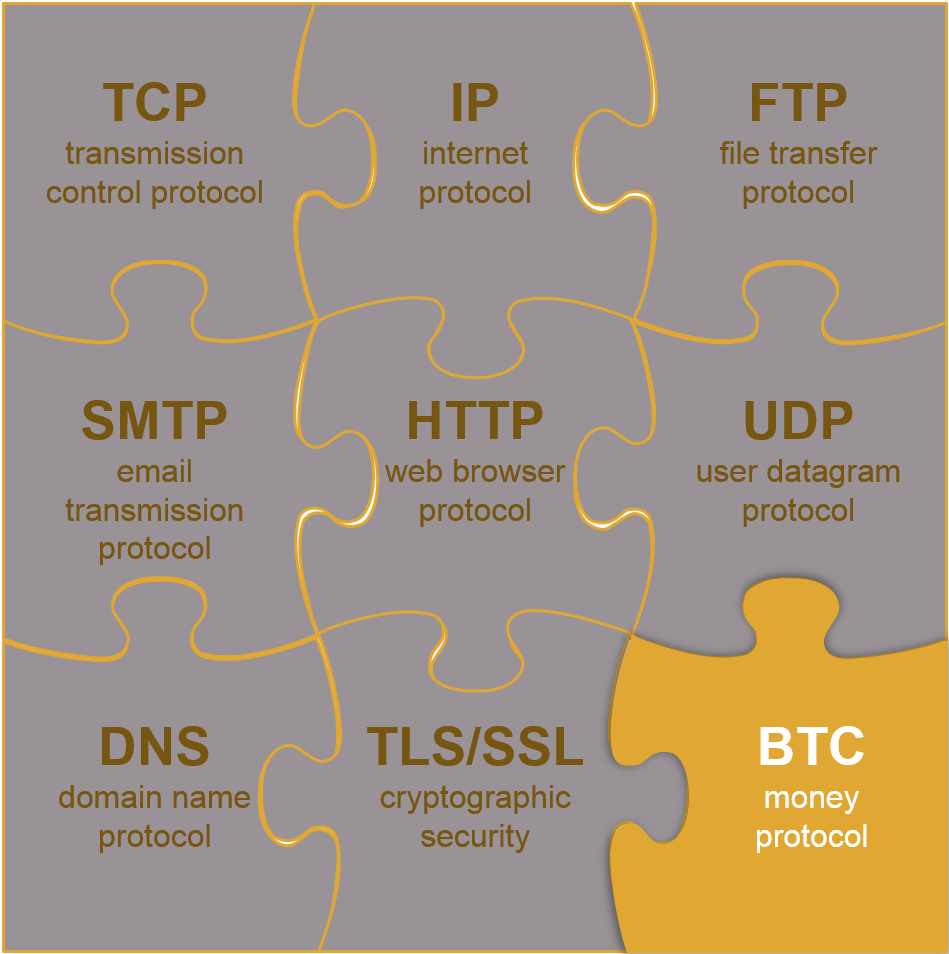

Bitcoin is the weapon you will need to use to protect your privacy when it comes to money. More and more people are starting to realize that Bitcoin cannot be replaced by another cryptocurrency in the future for the simple reason that Bitcoin goes much further:

Bitcoin is the money protocol of the Internet.

I don’t know who is the author of the illustration I will present below, but it helps to understand why Bitcoin is not ready to be replaced by another cryptocurrency in the years to come:

Bitcoin is the money protocol of the Internet

Bitcoin is the money protocol of the Internet

Bitcoin is a protocol in its own right that must be placed on the same level as TCP, IP, HTTP, …

Once you have understood this, you will understand why with each passing day it becomes impossible to replace Bitcoin for other cryptocurrency projects that claim to outperform Bitcoin. The Lindy Effect theory fully applies to Bitcoin which block after block becomes more difficult to replace.

Bitcoin is much more than just a cryptocurrency.

You have to understand this if you want to really get the most out of the Bitcoin revolution. It would be a real shame to limit yourself simply to the financial side of Bitcoin.

So I advise you to ask yourself what Bitcoin really is. By looking for the answer to this question, you will discover how much Bitcoin has already brought to the world, and how much it will bring in the future.

After that, I think there is a good chance that you will become a Bitcoiner too.