Proof of Progress - Bitcoin anarchism meets the establishment

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Proof of Progress: Bitcoin anarchism meets the establishment

By Daniel Frumkin

Posted April 12, 2020

“Everybody who deeply understands Bitcoin also owns some Bitcoin.” — Bitcoiners

The Bitcoin industry is full of lots of really smart and conscientious people. Computer scientists, financial analysts, investment fund managers, and even a human rights activist or two.

Something that many of these participants have in common is that they’ve rarely, if ever, encountered somebody who understands Bitcoin really well and who doesn’t buy into it. There are a few famous pundits who serve as exceptions to the rule, but even those can be explained as having conflicting interests, such as running a business that sells gold to people, for example.

Ever since I dove down the rabbit hole in 2016, I have known an entirely obscure cryptocurrency researcher whose status as an exception the rule concerned me far more than the aforementioned famous pundits did.

His Bitcoin skepticism has troubled me deeply because I know he’s ridiculously smart and he understands Bitcoin well. When I was learning about the technical aspects of Bitcoin, he was the one helping me grasp concepts like hash functions and Merkle trees. After I wrote an article explaining the Lightning Network to laypeople, he read it and gave me some tips to improve it. When I got more interested in economics, he came through with lots of cool insights and useful resources. Hell, he even went through real-world examples he thought up to help me understand game theory better. And to top things off, he doesn’t work in the legacy financial system, sell gold to people, or otherwise have a conflict of interest that prevents him from “seeing the beauty of Bitcoin.”

He has understood Bitcoin as well or better than a lot of Bitcoiners do, and he still came to the conclusion that it will be a net negative for the world. Needless to say, this has caused me to spend a lot of time doubting my own beliefs about what it would be like to live in a world where Bitcoin is, at a minimum, in the same category as gold and USD.

The proof of work debate

One of the most fundamental concepts to understand about Bitcoin is proof of work. This is what incentivizes miners who validate blocks to do so honestly (i.e. to not confirm any invalid transactions).

I’m not going to explain proof of work here because this article is going to be long enough as is.

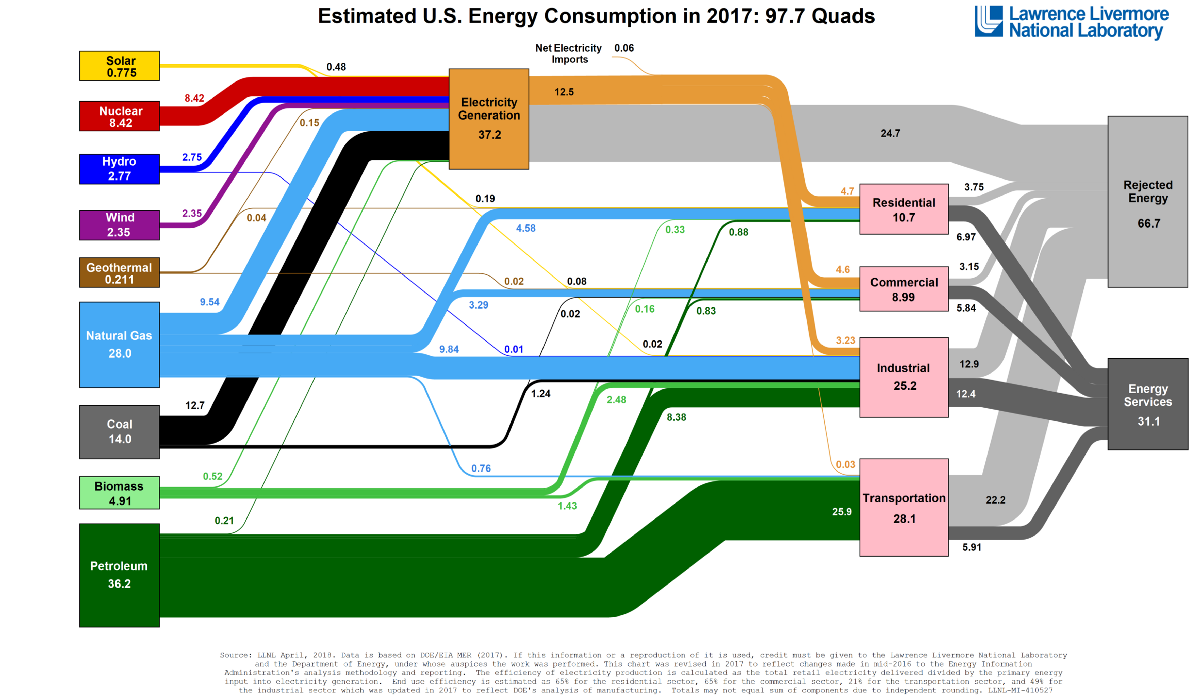

If you understand proof of work, then you know that it inherently incentivizes more and more resource consumption the more valuable Bitcoin becomes. Resources include energy, but also the materials that go into the machines that do the mining, ASICs. Even in a distant hypothetical world with 100% renewable energy, there would still be a lot of raw materials being mined from the earth to produce Bitcoin miners. My friend, being pro-environment (for lack of a better way to say it), has always viewed proof of work as unsustainable should Bitcoin scale to the same market cap size as gold and major fiat currencies.

Back in the day, I tested his anti-PoW stance with whataboutisms. For example, what about the amount of environmental damage caused by mining physical gold? Or what about the cumulative environmental impact of all the banks in the world that Bitcoin could replace? Sadly, none of these things changed the fact that proof of work is still inherently wasteful, so his stance didn’t budge.

More recently, after having worked in the mining business for the past year, I’ve been pushing back pretty hard once again. I sent him articles like Proof of Work is Efficient. I talked about how Bitcoin mining can lead to renewable energy arbitrage and act as a grid-stabilizer to the benefit of energy producers. I shared business models like that of Upstream Data Inc., a company that works on bringing Bitcoin mining to places where excess natural gas is being flared, preventing methane emissions in favor of less damaging carbon dioxide.

Most of all, I’ve stressed that the benefits that Bitcoin provides to society are more than worth the costs of proof of work. Especially considering that the miners with the best chance to survive long-term are those using energy which would otherwise go to waste (i.e. Rejected Energy in the graphic below), as that will always be the cheapest energy available.

Ultimately, I thought that making him see Bitcoin as a relatively green technology that could scale to mass adoption without causing an environmental disaster would be enough to win him over. I was wrong.

When we took proof of work out of the equation, he still didn’t believe a Bitcoin future would be a better future.

The case against Bitcoin

I hope what I’ve explained so far about my friend makes clear that he doesn’t need to read the article You Don’t Understand Bitcoin Because You Think Money Is Real. He’s not debating _if _Bitcoin can succeed, as he agrees it can — at least in growing far beyond the place it is now. Rather, he’s debating how good it would be for the world if Bitcoin _does _succeed.

Before I get into that, I want to mention that this discussion was mostly focused on the US. When I brought up that Bitcoin can provide censorship-resistant, unconfisctable money to people who need it in many less fortunate countries around the world, he didn’t disagree. But our debate wasn’t whether Bitcoin can make life better in Venezuela, as it obviously can. Rather, our debate was whether Bitcoin could make life better in the place where the current global reserve currency heralds from, the USA.

Let me start by explaining some of my positions coming into the conversation.

I believe that Bitcoin will help solve the problem of growing wealth inequality in the United States and around the world. I believe that unchecked inflation is a significant contributor to wealth inequality, and that “hard” money that can actually retain its purchasing power over time helps the lower and middle class because those people are less likely to be invested in things like stocks that can outperform inflation. (See the Cantillon effect.)

Furthermore, I believe that an economy based on hard money is much easier for the average person to understand and succeed in because basic financial literacy is not taught in schools. For example, does the typical person know to factor in inflation when determining their annual wage increase? Or, in a slightly different case, does the minimum wage earner understand that minimum wage is actually worth less each year unless the government steps in and raises it? (For what it’s worth, my friend and I both agree that having a government-mandated minimum wage is not nearly so good for low income people as it’s usually made to seem by politicians.)

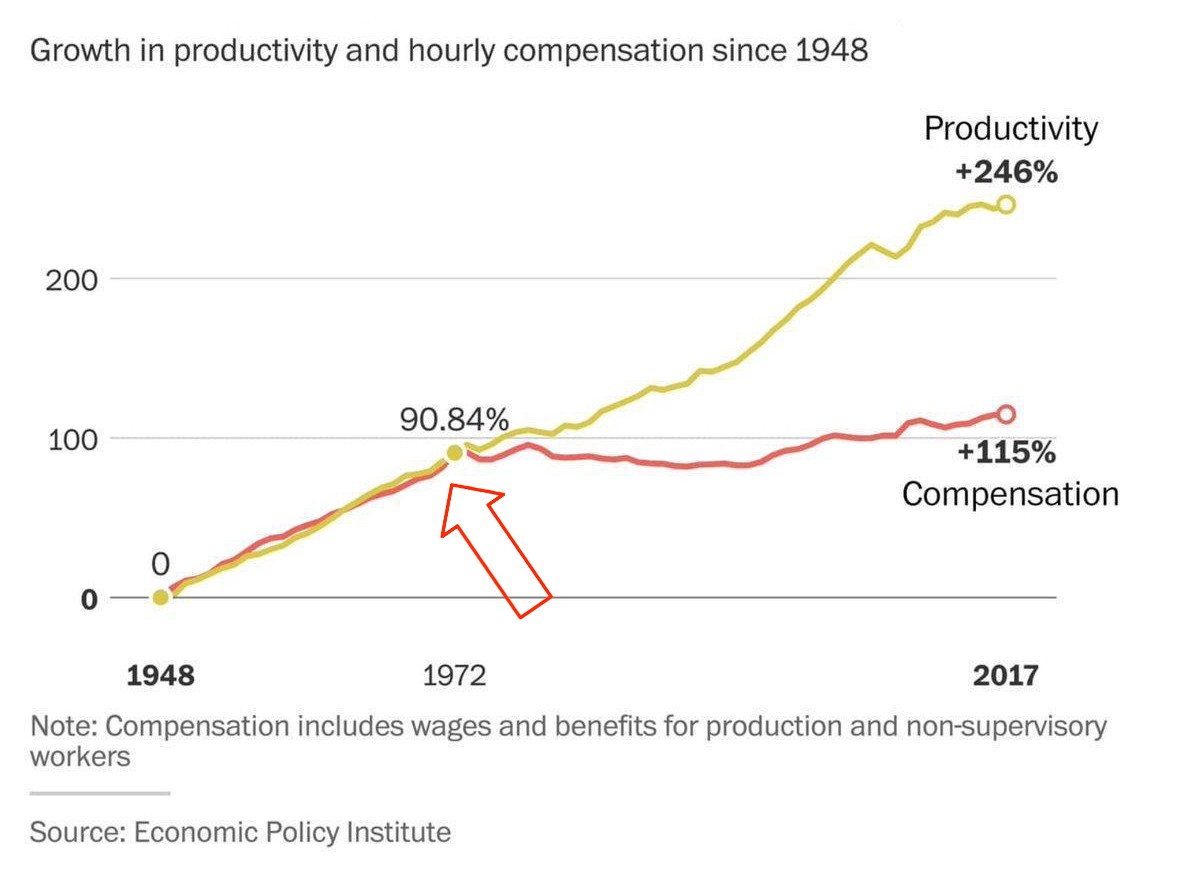

This graph from wtfhappenedin1971.com shows how real wages have stagnated relative to production since the 70’s, when Nixon got rid of the gold standard once and for all. My belief is that Bitcoin helps fix this.

My friend’s stance is that Bitcoin at best partially addresses this, and that it doesn’t solve more substantial problems. Where I was looking at the chart above and seeing the loss of the gold standard as the primary explanation for rising wealth and income inequality, my friend offered 4 other explanations:

- Convoluted tax codes ripe with loopholes and support for tax havens.

- Insufficiently regressive taxes since the Reagan tax cuts of the 1980’s. A common example for this is that Warren Buffet pays less taxes as a percentage of his net worth than his secretary, which is because long-term capital gains tax is at most 20%.

- Unnatural monopolies. An example here would be pharmaceutical patents, which are meant to enable companies to recover R&D costs, but which have been used in conjuncture with intense government lobbying to set ludicrous drug prices and make enormous profits.

- Special interest lobbying. Money and politics go hand-in-hand, hopefully I don’t need to say more.

While Bitcoin can improve monetary policy and help reign in the Cantillon effect, the points listed above aren’t addressed by Bitcoin in any direct way.

At the same time, we had a fundamental disagreement about one of my favorite features of Bitcoin: it’s ability to make government smaller. You see, being in the Bitcoin world everyday, I’m constantly seeing stories about censorship and mass surveillance that make me believe that — given the trend of cash becoming less and less common — the alternative to a future Bitcoin world is a world without much financial privacy or economic freedom for anybody except the ultra-wealthy.

My friend looked at it from an entirely different angle. In his view, the Bitcoin world I was raving about would be one where governments can’t enforce tax policy and thus they would no longer be able to redistribute wealth and provide public goods, resulting in runaway inequality even more extreme than the inequality of today’s society. In his words,

“All of the bank bailouts in the world are a drop in the bucket compared to the compounding interest that the wealthy elites are compiling all the time.”

Now, I’m not writing this article to debate the merits of free markets vs. regulation and taxation. I’m not an economist or a financial analyst and I didn’t even really understand how the Fed works until about a week ago.

The reason I’m writing this article is that I think most of the libertarians and Austrian economists of the world have already found Bitcoin. And for as diverse as the “no-coiners” may be as a group, one thing that most of them seem to have in common is a striking lack of cryptoanarchy in their veins (Hong Kong and Taiwan being the most notable exceptions.) Just as few people outside the Bitcoin world are still actively outraged by the bank bailouts of the 2008 financial crisis, not many of the no-coiners I see in today’s mass-quarantined world seem to care as much about (or even understand) airline and cruise ship bailouts as Bitcoiners do.

If I could find a narrative that would appeal to my friend who knows all about Bitcoin and still doesn’t like it, then maybe that would be a much better narrative to share with all the people who still don’t know about Bitcoin at all.

Censorship (resistance) and inflation

Screenshot from the popular game Animal Crossing, which is now being banned in China because of the presence of Hong Kong protest slogans like the one shown.

Screenshot from the popular game Animal Crossing, which is now being banned in China because of the presence of Hong Kong protest slogans like the one shown.

I want to reiterate here that my debate with my friend was not about whether or not Bitcoin would become much more valuable in the future. It was about what the consequences of Bitcoin becoming much more valuable would be.

When it comes down to it, we actually agree about way more things than we disagree about. In fact, we agree about so much that I’m going to save some time and just skip straight to the only two things that we disagree about: censorship resistance and inflation.

As I explained above, my friend wants the government to be able to collect taxes in order to redistribute wealth and provide public goods. In other words, the inability of governments to censor Bitcoin means that they will have a harder time collecting taxes in a Bitcoin world and, in his view, this can lead to runaway inequality and a lack of public goods. He also believes that inflation is a necessary feature of currencies because it’s what enables cheap credit.

I’m going to write a second article about the inflation part because it’s too big a topic to include here. But I do want to mention that my friend and I agree that people wouldn’t stop spending money if inflation was swapped for deflation. The idea that people would suddenly starve themselves, become homeless, or otherwise destroy the economy by spending less over 1–2% annual deflation is frankly quite dumb.

Nonetheless, my friend and I have diametrically opposing views on those two aspects of the ideal future. In my view, censorship and inflation are similar to secret backdoors in some communication software… they may be meant to “fight terrorism” or prevent other crimes, but they’ll inevitably harm innocent people.

To put it another way, I’ll quote Blackstone’s ratio:

“It is better that ten guilty persons escape than that one innocent suffer.”

Sure, censorship might be used in the majority of cases to enforce tax policy, but it will also be used to continue things like unjust civil asset forfeiture and other crimes against innocent people. As long as the mechanism for censorship exists, it can be used for evil, and therefore my ideal future is one where money is censorship resistant.

At the same time, inflation may be an important or even necessary feature for currency in order to have a useful credit system (stay tuned for Part 2), but it is also a mechanism that the wealthy can use to enrich themselves while the lower and middle class suffer. What’s worse, inflation doesn’t occur overnight (unless there’s a ‘hyper’ in front of it), so most people don’t even really know it’s happening or understand how it’s impacting them. At least taxation is transparent.

To summarize this section, my friend and I simply cannot agree about these two features. Therefore, we introduced a new currency that we could pit up against Bitcoin that shares all of Bitcoin’s features except for the censorship resistance and hard-capped supply. (Note that in place of the hard-capped supply is programmatic inflation of 2–3%.) We called this completely hypothetical currency Fedcoin.

Bitcoin v̶s̶.̶ and Fedcoin

If our debate had simply ended with an agreement to disagree about censorship and inflation, this wouldn’t have been worth the article. Yet, here we are.

As I mentioned two sections back, I found a Bitcoin-centric narrative that actually appealed to my friend. I didn’t change his views about censorship resistance and the 21 million hard-cap, but I re-framed my vision of a Bitcoin future to show how it would fit into my friend’s vision of a Fedcoin future.

I sent him the following message:

I agree that this hypothetical Fedcoin sounds cool and would be a big upgrade on the current financial system. However, let me now present a somewhat hybrid future that I think is slightly more realistic than your ideal version of Fedcoin and also not as bad (in your view) as the full-blown Libertarian version of a Bitcoin future.

Imagine that Bitcoin continues to grow in value over the coming years, especially as inflation hits due to QE and the like. More people get on-boarded to Coinbase, Square, etc. Eventually, some small startups with international teams move their payrolls onto Coinbase (or a similar platform). Everything is KYCed, and taxes can be collected by all the governments involved. After receiving their payments, the employees can either leave them in their insured and easy-to-use Coinbase wallets, or withdraw them to any other wallet of their choice. Gradually as Bitcoin’s utility and infrastructure continue to grow, this trend picks up steam. More and more international commerce occurs with Bitcoin, and less and less occurs through Swift/PayPal/Western Union. (Almost) nothing changes on the surface for the typical person or company. They are basically just using a different system to manage their finances and it happens to be the same for everybody, regardless of their location in the world.

Problem: The wealthy elites and ultra-libertarians will be able to evade taxes by owning their own private keys, using privacy features, and being extremely careful with how they transact on-chain to avoid incrimination by chain analysis.

Final point: How is the problem stated above worse than an incredibly over-complicated tax code with tons of loopholes, corporations moving offshore to avoid taxation and regulation, and individuals using cash under-the-table to avoid taxes?

In my view, if we make this transition, we’ve upgraded from an inefficient banking system to a modern and global one that treats everybody mostly equally, we’ve made it easy to integrate billions of people into this financial system who otherwise wouldn’t have access to a decent currency or financial infrastructure at all, and we’ve solved the problem of hyperinflation. We’ve separated state and money / monetary policy, without eliminating the state’s ability to fund itself and provide public goods to its citizens. And we did it all peacefully through markets that continually pushed us towards the money with superior properties.

This is where my friend and I were finally able to agree on the merits of a Bitcoin future. He doesn’t believe that full-scale Bitcoinization is going to be good for the world, but he can see how partial-scale Bitcoinization can help us get to his ideal future with Fedcoin.

We still disagree about the ideal endgame, but we can find common ground on the transition to it. To me, this conversation helped clarify how I want to present Bitcoin to my no-coiner friends. Not as some unstoppable ultra-libertarian utopia that’s coming whether they like it or not. No.

Bitcoin is simply progress.

It’s a technology incubator for things like zero-knowledge proofs, the Lightning Network, smart contracts, and more. It’s competition for banks and governments that have had little incentive to improve for the past several decades. It’s a country-agnostic currency that gives everybody an opportunity to participate.

Most people today may not understand Bitcoin. But if you asked them if they’d like to have a financial system that’s more transparent, borderless, cheap, fast, secure, and private, they’d say yes. They just wouldn’t care what it’s called.

Thanks for reading. I know the custodial vs. non-custodial debate is a heated one and Coinbase in particular is a controversial company, so I might receive some flack for this. (If so, bring it on.)

Ever since COVID-19 turned into a global pandemic, I have been thinking about how to use this opportunity to educate my friends about Bitcoin and the economy in general. I’ve been posting lots of Instagram stories and making myself available to talk to anybody who has questions. But this is really nuanced and complicated stuff, so it’s been more challenging to create content than I expected. I hope that this article (and Part 2 on inflation vs. scarcity) are helpful to others as they try to explain Bitcoin to people who may not actually want / understand / believe in the potential future it presents.