Money, Banking, Bitcoin, and Libra

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Money, Banking, Bitcoin, Libra

By Allen Farrington

Posted June 22, 2019

Money

There is a common misunderstanding of Bitcoin as a ‘payment mechanism’, and hence that it somehow ought to capture all payments. I am not really sure, but I suspect this comes from a dogmatic application of the three essential characteristics of money_as typically taught in macroeconomics 101: _unit of account, store of value, and medium of exchange. I think this is rather silly and that, really, money is just universal credit. How it works or what extra characteristics it has is beside the point. The former attitude leads one to say things like: it’s too volatile,_and _, it’s too hard to trade with, and then immediately jump to, it can’t be money, while conveniently ignoring the multitude of other amazing and entirely novel things it can do: for example, it has a guaranteed inflation schedule that cannot be manipulated, transaction fees are either non-existent or regressive, it is totally agnostic to geography or identity, settlement time is rarely over one hour, it is completely transparent, it is a network that is never down and cannot be hacked, it is programmable (to a small degree — more on this later), and more. Better even than the abstraction of ‘money’, a less common but more intelligent approach is to treat Bitcoin as a better version of gold. After a century or so of relentless devaluation of previously gold backed fiat currency we are not used to thinking of the relevance of gold to money or finance. But its legacy is still imprinted on the banking system, and so it is with banks I will begin.

Before getting to the more exciting possibilities it is worth tackling head on why Bitcoin almost certainly can’t_be used for payments all on its own. Bitcoin cannot handle the necessary throughput, _by design: amending the block size or block confirmation time would be a trivial exercise and could solve this ‘problem’ instantly, but would make the blockchain itself unacceptably large as a data structure such that very few parties could run full nodes and authenticate the chain, reintroducing the centralisation that is essential to the social core of the enterprise to begin with. ‘Fixing’ Bitcoin by making it ‘scale’ would really break it altogether (which is why most copycats are entirely pointless)

The implicit trade-off of foregoing practical payment applications may be overcome by second-layer protocols such as Lightning, further abstractions and generalisations as in the Polkadot network, or Bitcoin-backed assets, all of which I will discuss below, but not with Bitcoin itself. The constant furore over Bitcoin ‘failing to scale’ obscures a point that has been really been understood in the core Bitcoin community for almost its entire existence. Hal Finney, the legendary cryptographer and cypherpunk who was the second ever miner of Bitcoin and received its first transaction from Satoshi, gave what really ought to have been the final word on this in the Bitcoin forum in 2010:

“Actually there is a very good reason for Bitcoin-backed banks to exist, issuing their own digital currency, redeemable for Bitcoins. Bitcoin itself cannot scale to have every single financial transaction in the world be broadcast to everyone and included in the block chain. There needs to be a secondary level of payment systems which is lighter weight and more efficient. Likewise, the time needed for Bitcoin transactions to finalize will be impractical for medium to large value purchases. Bitcoin backed banks will solve these problems. They can work like banks did before nationalisation of currency. Different banks can have different policies, some more aggressive, some more conservative. Some would be fractional reserve while others may be 100% Bitcoin backed. Interest rates may vary. Cash from some banks may trade at a discount to that from others. George Selgin has worked out the theory of competitive free banking in detail, and he argues that such a system would be stable, inflation resistant and self-regulating. I believe this will be the ultimate fate of Bitcoin, to be the “high-powered money” that serves as a reserve currency for banks that issue their own digital cash. Most Bitcoin transactions will occur between banks, to settle net transfers. Bitcoin transactions by private individuals will be as rare as … well, as Bitcoin based purchases are today.”

While I think Finney was mostly directionally correct, the picture will likely become far more complicated than what he imagined here, due a combination of both higher ‘layers’ of Bitcoin and interoperability with other protocols, which I discuss below, and the possibility of integration Bitcoin into FX markets to serve a range of business needs.

FX is a gigantic industry that isn’t necessarily cheap. Common pairs such as Dollar to Pound have very liquid markets and very tight spreads (for trade participants, but not even necessarily for consumers) but to consider an extreme example, moving Indonesian Rupiah into Peruvian Sol will likely be very expensive and may invalidate the business case behind the desired move. The more contrived the example, the longer it will take, also. Were both Bitcoin and a range of local fiat exchanges to be liquid enough, this would be far preferable for almost every FX transaction imaginable, possibly only excluding the interchange of Dollars, Pounds, Euros, and Yen. The reason is simple: it rarely takes more than one hour to transact Bitcoin, and is often more like 10–15 minutes. Also, the cost is utterly negligible compared to FX, and is actually regressive: miner fees (if they exist at all) are determined by how congested each block is with the data of individual transactions, which is unrelated to transaction value. And notice that volatility doesn’t matter either: only market liquidity does. Even Bitcoin is not volatile enough to create an exposure risk over the space of 15 minutes, and it will become less so the more it is used as a kind of meta-currency or settlement-commodity (or however else it helps to conceptualise it) rather than a speculative asset. What matters far more is that there are adequately liquid exchanges in the relevant currencies. If there are several markets between Bitcoin and the Dollar, and several more between Bitcoin and the Rupiah and the Sol, that are deep and liquid enough to prevent any arbitrage triangles emerging, then the problem should be solved. What would stymie this would be dramatically different exchange rates for Bitcoin in different exchanges such that value couldn’t really be transferred in the first place — but volatility is largely irrelevant.

This isn’t necessarily an argument in favour of Bitcoin appreciating, since the holding period I am stipulating is only as long as it takes to receive a transaction and flip it back to fiat. However, what would be really interesting is if an equally deep and liquid industry in Bitcoin futures developed, with the notional posted in fiat. What this would mean is that there would then be a use case to hold Bitcoin on the balance sheet of a company that expects to have to do a lot of FX trading or cross-border fiat settlement, especially that cannot be predicted with any precision. The likely volatility absent any futures would make this an extremely risky idea, but with a futures market, a company could maintain a float of Bitcoin that is fully hedged to their preferred fiat, so that the process of engaging in FX and settlement is sped up and cheapened even further. You would never need to rely on fiat exchanges potentially being inaccessible when you need them most; you tap directly into the Bitcoin network, and only return to the fiat exchange when convenient. Most excitingly of all, this market would probably make a lot more sense as part of a prediction market, itself based on another smart-contract platform blockchain, than it would if run out of an investment bank’s prop trading desk. We then come back to familiar questions of which system is more trustworthy, and how valuable it is to have a counterparty for legal reasons, etc.

Banking

The final tumble down the rabbit hole gets us to Bitcoin backed banks. (but if the rabbit hole is a fractal, is there ever a final tumble? anyway …) If you have a global settlement layer with highly liquid markets, then why not hold this asset in reserve and issue digital cash against it? Such digital cash might not even need to be blockchain-based, since you get the trust benefits from the Bitcoin the bank holds in reserve; you should be able to know the bank has adequate capital because you can check the blockchain, and you can redeem it whenever you like. Or maybe you can’t because you don’t have a demand deposit, but you can enter some kind of smart contract as to what exactly you can do with your savings and how you are rewarded for lending your capital. We get the blooming of a thousand flowers in banking experiments contrary to fractional reserve: entrepreneurs can actually try something different and see how the market reacts rather than just the occasional academic whining about it. Again, not predicting this will happen, just that it will be possible.

Bitcoin backed banks are worth pondering for a little longer, as both their risks and potential strike me as being widely misunderstood. Starting from first principles, there are two separate risks in running a bank, and most cryptonerds only seem to be concerned with one. A bank, as opposed to just a depository institution, is necessarily an asset manager that succeeds on the basis of directing capital towards profitable enterprise (this direction may be extremely indirect, but even mortgages rely on this happening somewhere in the monetary ecosystem) The risk managed by the reserve ratio is simply that the bank screws up the promises regarding liquidity made to the loaners of funds in the process of maturity transformation — in other words that they misjudge the true maturity of liabilities. The reserve is a buffer against that happening, but is a distinct concern from the risk of making bad loans — in other words that they misjudge the true quality of assets. Another conceptualisation of the difference is the risk of badly managing working capital as opposed to invested capital, or liquidity as opposed to solvency. You can take your pick.

The liability maturity risk is presumably greatly improved upon by Bitcoin due to its auditability. This seems to be well understood and has been interestingly explored. But the asset quality problem seems more pertinent to the concept of an entirely new kind of money and bank, whereas a lot of hardcore Bitcoiners seem to mistake the second risk for the first and misunderstand both risks in the brave new world. In a sense a wallet is a depository institution, so if you want to avoid illiquidity from the liability maturity risk, you can, which you can’t really do with regular money unless you hide it under your mattress. That’s one of the serious problems of being forced to live within an opaque and corrupt financial system; you are forced to shoulder that risk whether you want to or not, and of course the existence of ‘lenders of last resort’ makes it even worse.

In cryptoland, this problem is naturally avoided because the ‘money under the mattress’ situation is not weird at all. If anything, it is the natural state. But the fallacy here is assuming that the removal of the liability maturity risk via auditability immediately translates to the removal of the asset quality risk too, which it does not. If the bank makes enough bad loans (interestingly this quantum is determined by what it would take to wipe out the reserves, so the risks are related, just in a subtler way than is commonly understood) then it doesn’t matter how auditable everything is — the depositor is not getting anything back. It won’t matter whether it’s gold or Dollars or Bitcoin or magic internet money backed by gold or Dollars or Bitcoin or whatever. If it’s really a bank and not just a depository institution, and enough loans go bad, then the money is gone.

So that’s the risk, but there are opportunities too. To the best of my (admittedly limited) knowledge, the furthest this idea really gained traction was with the distinction between a checking and savings account, but even that difference is mostly trivialised by having money that is basically exclusively digital anyway. Regardless, you could have a structure whereby there are different classes of deposits, or perhaps the nature of the deposits depends on some parameter (the auditable reserve ratio being an obvious contender) It could also be the performance of the loans; you could get transparency on where exactly your funds have gone (or it’s a choice as a depositor as to what class of savings product you take) and both your access to the funds and your interest is somehow programmatic, or dynamic. Really, it could be whatever conceived of reason makes the bank function better, or more appealingly given different customer profiles. This seems to me to be the really intriguing part of Bitcoin backed banks.

For Bitcoin maximalists, this line of thought can even be framed in a way that implicitly mocks the more delusional CS types who have promised us the world with their ‘Bitcoin + X’ contrivances. What many of these amount to is just financial engineering via software engineering. More advanced, transparent, and democratic financial engineering than any investment bank ever provided, but financial engineering nonetheless. Whereas you need actual economic productivity for this to ever matter, for which sound money certainly helps. Keynes had a line that reflected this well,

“Of the maxims of orthodox finance, none, surely, is more anti-social than the fetish of liquidity, the doctrine that it is a positive virtue on the part of the investment institutions to concentrate their resources on the holding of ‘liquid’ securities. It forgets that there is no such thing as liquidity of investment for the community as a whole.”

Despite being highly questionable on economics, Keynes had a remarkable intuition for finance. Liquidity means nothing if the liquid asset doesn’t contribute to economic productivity over at least the term of the debt that financed it, and preferably much longer, which is something a system of Bitcoin-based banking might materially enhance …

Bitcoin

The core thesis behind these speculative ideas is that there are no necessary or sufficient criteria for ‘money’. As I alluded to above, anything that enhances the ability to create and circulate universal credit will do. There is no need for maximalism when we can observe what seems to work following countless independent experiments. If you wanted a slogan for this, how about, ‘unbundling money’, or ‘decentralising capital’? If the functions I suggest, or any others, come into existence, it will not be precisely because, Bitcoin is better money, but because Bitcoin introduces desirable and entirely novel features into the process of storing and transferring value, which can then be used to create credit. Bitcoin cannot transact instantly, cannot support more than around 7 transactions per second (averaged over the settlement period), cannot be reclaimed in cases of fraud, and can’t really be used to buy much stuff at all, at least currently. Fiat currency on existing payment rails can. But fiat currency (over any payments rails) cannot be sound money, cannot be guaranteed to always be online, cannot be transferred for free, cannot be programmed, cannot be audited, and if online cannot be permissionless. Bitcoin can.

With all this in mind, I will briefly cover two blockchain projects that have the potential to extend the capabilities of Bitcoin and, implicitly, any other robust public blockchain: The Lightning Network and The Polkadot Network. Bitcoin has almost certainly won the race to be sound money. Nothing truly ‘competes’ with it. But it also need not exist entirely on its own. Just as nobody gets excited bouncing packets around the network layer of the Internet, but really enjoys watching Netflix, Bitcoin will have truly succeeded when you have no idea you are using it. And so, the most important thing to take from this discussion is not an endorsement of Polkadot or Lightning specifically or exclusively, but to get the reader thinking about the broader concept of layered and interoperable protocols, of which there are - and will be - many. I only mention Lightning and Polkadot because I know the bare minimum about each to say something sensible. Apologies if it’s still questionable …

The Lightning Network is what has come to be known as a ‘layer 2’ protocol, in that it sits ‘on top of’ Bitcoin in a more or less metaphorical sense. I won’t go too far into the technical details here but what this means is that Lightning is a peer-to-peer network of Bitcoin transactors, whose transactions are not being recorded in the Bitcoin blockchain but which are subject to a cryptographic system enforcing eventual settlement in the blockchain. The goal of the project is to get around Bitcoin’s ‘scaling problems’ without corrupting the Bitcoin protocol itself. It is early days, but transactions on the Lightning network appear to be instant, basically free, and scale well with the size of the network. There is also an ingenious incentive system that allows honest and cooperative parties to continue to transact off the blockchain indefinitely, but for dishonest parties to be punished by a financial loss that is settled on the blockchain immediately. Counterparty risk is completely removed by all parties staking collateral that they will programatically lose if they lie.

This may sound too good to be true, and in a sense, it is. There are two enormous caveats relating to any real-world application. The first is that the service is clearly only as useful as Bitcoin itself. In addition to the technical issues with scaling, another obvious reason people don’t regularly transact in Bitcoin (although some do) is the volatility of the price relative to fiat. Lightning solves the key technical problem with transacting in Bitcoin, but not the key financial problem. If anything, it might make it worse, as the second caveat is that involvement in the network requires placing some amount of Bitcoin in a kind of cryptographic custody — ideally slightly larger than the maximum expected net negative balance of the participant at any single moment during the period of participation. This both increases the exchange rate risk — which, recall from above, didn’t originally exist for many uses cases of Bitcoin as a currency proxy — and creates a potentially enormous working capital drain on any business wanting to implement this payments channel. Perhaps weirdly, it is not a zero-sum working capital drain across the economy; one participant’s accounts receivables are not another’s accounts payable. Everybody has accounts receivable from having sunk collateral into the Bitcoin blockchain to enable the incentive mechanism that prevents them from interacting with the network dishonestly. In summary then, nearly free and instant payments, but for a different kind of price.

Consider, however, that this price may very well be worth paying if it enables behaviour not previously possible. Who would want to transact for free? We don’t really know because it has never been possible to send less than around $10 without the fee being an exorbitant portion of the transaction. In mimicking tipping at the very least, online micropayment ecosystems could enable fairly large markets, or expand already large ones. Who would want to transact instantly? Visa allows between 40 and 60 thousand transactions per second. Bitcoin allows 7. Lightning allows billions. To ask a better question, then, who would want to transact billions of times per second? Machines. This is a whole other (probably fractal) rabbit hole that I will leave it to the reader to go down on their own if they so desire. But as Andrew Miller of the ZCash foundation put it,

The Fractal Rabbit Hole of Bitcoin. Great idea by Miles Suter. Not so great graphic design by me.

The Fractal Rabbit Hole of Bitcoin. Great idea by Miles Suter. Not so great graphic design by me.

Who wants to transact instantly and for free? Well, the W3 Consortium abandoned an effort in the mid-90s to extend HTTP to enable Internet native payments — I wouldn’t be at all surprised if this is revived if or when Lightning proves it can scale.

Polkadot is an interchain protocol, among other things enabling interoperability between blockchains. They refer to this as a ‘heterogeneous multi-chain framework’, which intriguingly ought to work for blockchains of all kinds: public, private, whatever Libra is, or some new thing not yet invented. The obvious analogy is between intranets and the Internet, with Polkadot providing a kind of universal data transfer API (I’m not sure how wedded I am to this analogy, but for those familiar with it, Polkadot strikes me as very similar to Mulesoft, but open and public, rather than within an organisation, and for all manner of blockchains) The functioning of this communications layer abstracts away from the conceptualisation I put forward here of the transferable data on a blockchain constituting a balance exchanged for a computational service, to the idea of a ‘message’, which is a data transfer of any kind between blockchain nodes. This may or may not be a token transfer. Furthermore, the transfer may be between wallets (or contracts, or however they are stylised) on different blockchains. In fact, Polkadot encourages this. I mentioned above that Bitcoin is ‘programmable to a small degree’. It is not worth explaining exactly why or how this is the case — although actually the small degree to which it is_the case is what lets Lightning work — but an exciting implication of Polkadot is that it really needn’t be _at all; the programmability can exist somewhere else, on some other blockchain, and tied to Bitcoin via Polkadot.

The implication is that novel ideas around the utility of markets for scarce data need not come in the shape of endless fully formed decentralised computers that really only exist for one specific task. They can be far lighter, but if they require a store of value, they can tie in Bitcoin; if they need free and instant payments, they can tie in Lightning; if they need smart contract execution, they can tie in Ethereum, Tezos, EOS, etc. An analogy to cloud computing is apt. If you have an idea for an app, you may choose to let AWS deal with the infrastructure of storage and compute, within which you can run Kubernetes and Docker; you can let Stripe deal with payments, which you can implement directly, or perhaps go through Wix, in which case Stripe and AWS may well be working in the background; you can build your front-end store on Shopify, or maybe the whole thing, in which case Shopify will do all of the above for you, and so on and so forth, up and up the interlocking layers. The situation in cryptoland is not quite as generous, in that the services you need are not guaranteed to exist, or if they do exist, they are not guaranteed to be effective or robust. But Polkadot will hopefully at least let you utilise them extremely easily.

I find this particularly exciting for Bitcoin — and the idea of money and banking in general — because of what money means: universal credit. Almost any activity can be designed to have a monetary component, which is really only to say that people value the time devoted to their labour, while others value the product of that labour, very probably in the form of capital that will multiply their_labour, and so on and so forth, up and up the interlocking layers. Therefore, Bitcoin — the most secure form of value settlement ever invented — and Lightning — which builds on top of this layer to provide free and instant transfer of that value — can potentially be used in combination with Polkadot to provide either a value-storage or payments functionality to any kind of wonderful, _free and open source, new kind of computer, decentralised corporation that can be imagined:

Photo by Con Karampelas, via Unsplash

Photo by Con Karampelas, via Unsplash

Libra

Of course, this all brings us to Libra. I have three main points to make in order to adequately compare Libra to money, banking, and Bitcoin. We might call them the good, the bad, and the ugly, although unfortunately I won’t treat them in that order. The bad is that the Libra data structure is a database, not a blockchain, and the Libra consortium is a hedge fund, not a network of nodes. The good is that Libra will acclimatise billions of people to digital bearer assets, and may be a force for great social good in the short run. The ugly is that it will be a force for great social evil in the long run.

That Libra is not a blockchain is really just a technicality, but it is worth disabusing anybody who has been fooled by clueless journalists. Libra is a distributed ledger that is an attempt to mashup the most palatable parts of Bitcoin, Ethereum, and Ripple, but none of the parts that make them truly revolutionary. It is very technically interesting, and if it works, it will be an incredible technical achievement, but it is not a blockchain. This matters for more than linguistic reasons; the Libra data structure may be open and may be private, but will definitely not be neutral or permissionless, and the tokens will not be sound. This wouldn’t be worth stressing so much if both the officialand technical white papers didn’t constantly misuse the words ‘blockchain’ and ‘cryptocurrency’. After each of the following extracts, I provide a translation,

“Libra is a permissioned database. We will think really hard about how to transition it to a permissionless database but unfortunately we don’t really like the only known way to do that.”

And,

” There are some really difficult unsolved problems in the theoretical underpinnings of scaling open blockchains. We also don’t know how to solve them.”

And,

“Just to be extra clear: the Libra blockchain is a database of validator-signed ledger states with a Merkle tree of the historical states - not a blockchain.”

Given Libra the data structure is not a blockchain, we must then wonder what the Libra consortium is, given it is clearly not a network of nodes. A collection of transaction validators is accurate enough, but a little dry. It is a lot more revealing to describe it as a hedge fund.

The way it looks like the Libra ‘token’ will come into existence will be in exchange for deposits from users. You will send the consortium fiat over existing payment rails, and they will mint some ‘Libra’ and give it to you, and you can cash in your Libra for fiat and they will ‘burn’ the fake money and return your fiat (the feature of having different names for the data structure and the tokens is not one of the better parts of other blockchains implemented here). The ‘nodes’ are really processing centres, in that they need to contribute a minimum of computing power to handle the transactions being submitted. It all sounds very communitarian until you realise that what is in it for them is interest on the deposits of real assets ‘backing’ the digital assets issued. In order to maintain price stability, these deposits will be invested in the government bonds of the fiat currencies against which Libra is desired to be stable.

This is worth pondering as it is really quite incredible. Libra is going to have zero cost of capital on funds it will lend at the risk-free rate. Despite strictly speaking being total nonsense, the ‘risk-free rate’ ought to be the lowest rate it is possible to borrow at, hence governments borrowing at this rate and not an even lower one. Because Libra has an even lower borrowing cost (none), it can lend at the risk-free rate and earn an arbitrage profit on what will almost certainly be the largest pool of capital ever collected by a corporation. In the above vein of banking theory, it is worth considering that Libra will only need petty cash / liquidity / working capital / however you want to conceptualise it, of the most extreme net negative redemption of Libra to fiat, multiplied by the settlement period of government debt, which in most cases is one or two days. This will almost certainly be utterly trivial compared to the market valuation of minted Libra at most times, and given the intention to charge transaction fees, may actually be completely irrelevant since fees can be dynamically matched to real time outflows even while remaining miniscule. So Libra will be an almost artificially highly leveraged hedge fund. What’s more, it will be a perfectly safely leveraged one, because the assets will be both the highest quality in existence and perfectly liquid. Neither banking risk will exist. This is astonishing.

How it achieves this hedge fund like status is worth exploring because it is the source of both the great social good and great social evil that will likely follow — assuming it works, or is allowed to work. My hunch is it won’t be allowed to work at all, so I would take much of the juxtaposed utopianism and dys topianism below with a pinch of salt.

Every Libra bought will either represent a Dollar/Pound/Euro/Yen given to Libra and invested in government debt denominated in those currencies, in which case who cares, or it will be something else, in which case things get very interesting. A WhatsApp user will transfer their Indian Rupee, let’s say, to Libra in exchange for digital money. Libra will then sell Rupee for Dollar on the FX market to gain the fiat to back the Libra. This will cause the Rupee to depreciate relative to the Dollar/Pound/Euro/Yen, making it more difficult to raise capital in Rupee and easier in Dollars, making Libra even more viable as a medium of exchange, on top of the worldwide networked marketplace in which it is already exclusively accepted by fiat. The role Libra will be playing is the FX broker-dealer that ‘dollarizes’ emerging markets and immediately provides an economy in which the the hybrid Dollar/Pound/Euro/Yen can be spent.

This could initially be a great social good, for three reasons. Firstly, we should not underestimate the dramatic difference this could really make to the billions of unbanked around the world who can afford a phone but not a bank account — and the hundreds of millions more who have bank accounts that achieve nothing given their monetary wealth is consistently inflated away. Additionally, the smart contract elements of Libra could allow for programming of cross border business logic that would previously have been impossible due to combinations of illiquidity, inflation, and capital controls. Facebook’s rhetoric around empowerment, while suspicious to the point of hilarious given its coming from Facebook, is probably entirely accurate in this case. This could be tremendously beneficial to those living in monetary regimes that are inept, corrupt, or both.

Secondly, Libra is arguably a necessary experiment in the development of the banking of digital assets. It is a simple and natural step to first trial a digital asset backed by fiat that, however philosophically flawed, is actually used as money currently. There are fewer degrees of freedom than a bank of a novel digital money backed by Bitcoin, and yet the lessons learned will obviously be relevant, be they technical, economic, or social. This will be truer the more genuinely open Libra turns out to be, since the experiment will not be of the viability of Libra and banking of digital assets alone, but of every other open system that connects to it to incorporate Internet-native money, contracts, and so on. Libra will be psychologically safer to build on to begin with, but via the likes of Polkadot will open the door to Bitcoin, Ethereum, and more.

But the third and most important reason is that in addition to developers and entrepreneurs, Libra will acclimatise billions of regular people to digital bearer assets. Minds.com founder Bill Ottman put it well in a recent interview, “ it’s not Bitcoin, it’s not Ethereum, but maybe it’s a weird bridge? It’s a weird bridge which you don’t necessarily know whether or not it will collapse as you are walking over it.” The acclimatisation will be particularly important when the dream of dollarized digital money collapses_into the nightmare of corporate neo-feudalism. Some readers may have winced at my positive invocation of ‘dollarization’, given its connotations of monetary imperialism. They would have been right to do so had they thought my enthusiasm was unequivocal. But notice I only ever said ‘could’, not ‘will’. This _could be a great social good, but it will likely devolve into a great social evil. If you think the monetary imperialism of the United States of America is bad, wait until you see the monetary imperialism of a corporation that actually makes a profit.

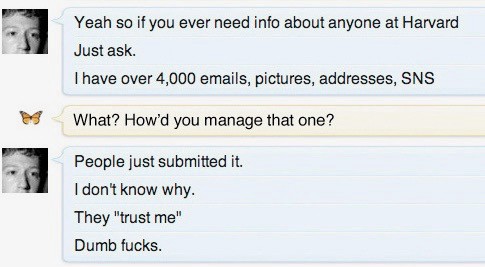

If you believe that Facebook will never use your activity with Libra to better serve you ads, you are delusional. They won’t do it right away, for sure. They said so in the white paper. But there is absolutely nothing about this technology that enforces this promise. It’s a promise from this man:

n.b. this is real, not a joke or a fake. see here for more.

n.b. this is real, not a joke or a fake. see here for more.

What is particularly perverse is that Facebook has a legal obligation to its shareholders to follow this path. The board of directors will be failing in their fiduciary responsibility if they do not encourage Mark Zuckerberg to direct Libra to behave in this way. Which, of course, he can. Libra is not an open, permissionless, neutral, private, sound money like Bitcoin. It is corporate money. It will work better than government money but it will turn out to be even more insidious. If you are actually adding value with your service relative to a useless competitor your customers previously had no choice but to use, you generate an enormous amount of goodwill you can later rapaciously exploit.

Which means there will be mass surveillance and data leaks. Even without leaks there will be deanonymization of the transactional graph. There will be purges, and censorship, and confiscations of wealth. Facebook will control enough economic activity to dictate monetary policy to economically weaker nations. This won’t be in the form of direct confrontation — it will be a system upgrade that optimises something or other that within a few days sees yet more value sucked into lowering the cost of funding the governments of the largest economies in the world — those that have meaningful power over Facebook, the corporation — and a few days after that the power of every other government to affect the economic goings on within their own borders. Shades of this may sound ideal and romantic, but this is not a stripping of the power to interfere with the activity of willing individuals — it is a transfer of that power to Silicon Valley.

Much of the above few paragraphs consist of the worst possible dystopian outcome. I seriously doubt anything like all of this will happen in its entirety, but there will come a point when it becomes obvious that it could happen. The steps to roll back Libra’s power to ensure that it doesn’t happen will not be pretty. And the fallout will see a great many disillusioned people turning to money that is open, permissionless, neutral, private, and sound.

Which is what we wanted all along.

Thanks to Nic Carter for help with editing, and Andreas M. Antonopoulos for his recent talk in Edinburgh, which inspired parts of this post.

follow me on Twitter @allenf32