Masters and Slaves of Money

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Masters and Slaves of Money

By Robert Breedlove

Posted July 5, 2020

Money is a tool for trading human time. Central banks, the modern-era masters of money, wield this tool as a weapon to steal time and inflict wealth inequality. History shows us that the corruption of monetary systems leads to moral decay, social collapse, and slavery. As the temptation to manipulate money has always proven to be too strong for mankind to resist, the only antidote for this poison is an incorruptible money — Bitcoin.

Counterfeiters are Slavemasters

“Knowledge makes a man unfit to be a slave.” —Frederick Douglass

In ancient western Africa, _aggry beads—_small, decorative glass beads—were used as money for many centuries. Of uncertain origins, these beads were a means of wealth transfer between people in trade (as money) and across generations (as dowries or heirlooms). When European explorers appeared in Africa in the 16th century, it was quickly apparent to them that aggry beads were highly valued by African locals. Since glass-making technology in Africa was primitive at the time, aggry beads were difficult to produce and, therefore, reliably scarce relative to other goods—a monetary property which supported their market value.

Back in Europe, glass-making technology was more sophisticated; counterfeit beads virtually identical to aggry beads could be mass produced at a low cost. Seizing the economic opportunity, many crafty Europeans soon began arranging expeditions to western Africa, shipping in huge quantities of (indistinguishably counterfeit) aggry beads expertly fashioned in European glass-making facilities. This scheme was one of the first known large-scale money counterfeiting operations in the world. What followed this seemingly innocuous exportation of glass beads was a multi-decade plundering of African wealth, natural resources, and—ultimately—time.

As European ships arrived on African shores, many with hulls packed full of glass beads, locals readily traded their hard-earned assets for what they believed were precious aggry beads. Spanning the course of decades, this trading of real assets for counterfeit beads facilitated a surreptitious confiscation of African wealth by Europeans—a slow-motion criminal episode that crippled African society for centuries to come. Aggry beads would later become known as “slave beads”; as newly impoverished Africans became desperate, some were forced to sell themselves or others as slaves to their European usurpers. Slave beads—one of history’s many monetary systems weaponized by counterfeiters—became instrumental in the multi-century trans-Atlantic slave trade.

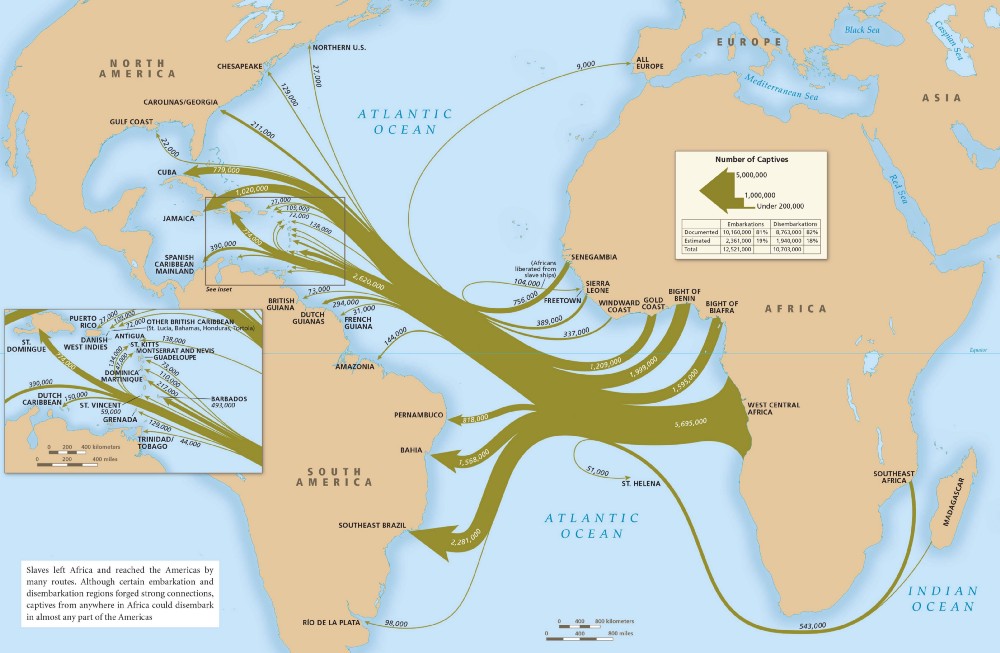

Over the course of 365 years, over 12.5M slaves were transited from Africa to Europe and the Americas.

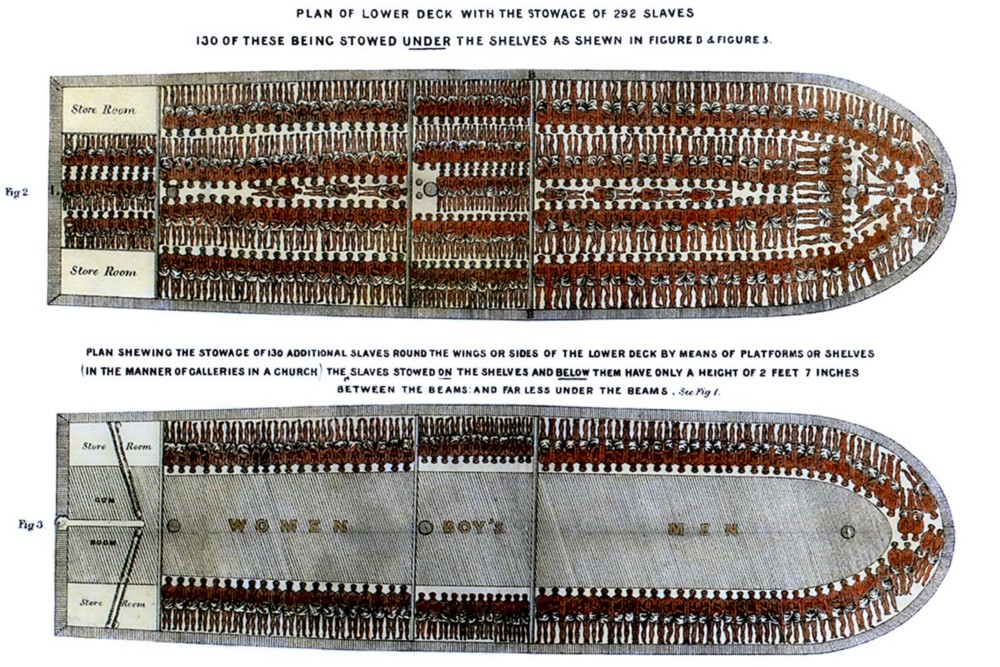

In a barbaric irony of history, ships landing in Africa stuffed with (counterfeit) aggry beads later departed for European and American shores with full payloads of precious human cargo. Inhumane and unforgivingly precise, masters of these slave ships packed their hulls tightly with African slaves, just like the glass beads that were used to purchase their captive human cargo in the first place.

Like the counterfeit aggry beads used to purchase them, African slaves were packed tightly inside the hulls of ships for transit to Europe and the Americas.

Unfortunately, this pillaging of wealth was not an isolated episode. Cloth strips were another form of money used in ancient Africa, which became a well-established transactional medium over many centuries of dealing with Muslim traders from the north. Local African tribes soon began producing these cloth strips—known colloquially as panos—but were outcompeted by the more efficient production methods employed by the Portuguese. A perversely profitable economic arrangement ensued, in which the Portuguese used panos to purchase African slaves who were then put to work producing the very cloth strips with which their freedom was stolen. As Scottish historian Christopher Fyfe described this dreadful trade relationship:

“Some of the slaves were weavers by profession, and wove the cotton into country cloths as they had done on the mainland. New elaborate patterns of North African type were introduced, and from the middle of the 16th century Cape Verde panos [cloth strips] were regularly exported to Guiné to be exchanged for slaves.”

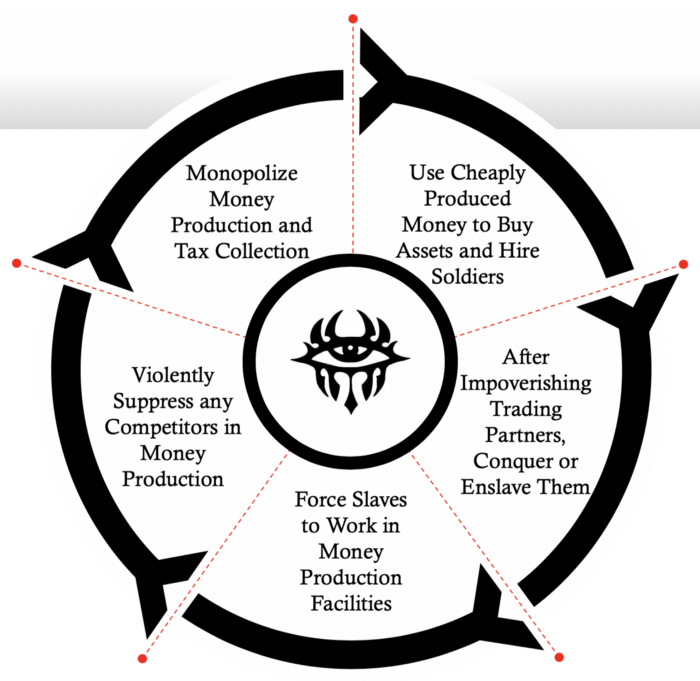

Lured by a virtually limitless profit potential, Portuguese panos producers soon established a state-sponsored monopoly called the Grão Pará and Maranhão Company, which mandated the use of its warehousing and trading-post operations for all financial flows denominated in panos. This company enforced the use of panos for tax payments, to forcibly denominate slave trade contracts, and to hire soldiers. To name just one similar, non-coincidental example today: the US government enforces the use of dollars for tax collections, as legal tender, as the nominal currency for contracts on oil (the energy slave of modernity), and as the international reserve currency (the infamous “exorbitant privilege”).

Events strikingly similar to aggry beads and panos are playing out today throughout the global economy: the US dollar in your pocket, the one you sacrificed so much to obtain, was recently mass-produced by the US government with a (near-effortless) keystroke. In the same way Europeans had access to superior glass-making technology that gave them the ability to counterfeit money at a low cost, or the Portuguese monopolized panos production, central banks have an exclusive privilege to produce money at near-zero cost, enabling them to confiscate wealth from all users of dollars at will. Although less visible and overtly violent, central banks today carry out operations using the same weaponized methods of theft as those wielded by wily Europeans against unsuspecting Africans.

Histories of human action related to aggry beads and panos hold important lessons for societies suffering under central banking: those who can monopolize money production become de facto currency counterfeiting operations that steal human labor in perpetuity. When free market forces are manipulated, producers gain an asymmetric ability to set prices without regard to customer preferences, thereby converting economic democracies into dictatorships, and freedom into tyranny. For money, this implies monopolists can acquire human time (aka labor) in the marketplace at an unfair price. Said differently: money monopolists can steal human time—a malevolent power that effectively makes them slavemasters.

An exclusive right to produce money without regard for competitive market pressures is an apparatus of enslavement—a vile privilege that monopolists can only preserve through deception and violence.

Counterfeit aggry beads and panos were weapons used to acquire human time; acts which led to the direct theft of 12.5M human lives between 1501 and 1806 (and the indirect theft of their progeny). The trans-Atlantic slave trade was a slow-motion holocaust on Africans; roughly 2M died in transit through the infamous Middle Passage, and those who survived spent the rest of their waking lives toiling away, or bearing children to replenish their slavemaster’s stock. Quantifying this atrocity from an economic perspective (not counting those born into slavery): assuming the average slave could labor 5,000 hours each year for 40 years, the staggering total time stolen amounts to over 2.5T (2,5000,000,000,000) hours, or 6.8B hours stolen per year for 365 years (source link).

The trans-Atlantic slave trade was a travesty as gruesome as it was gigantic; if only money production monopolies had faced free market competition, this horror of human history would not have reached such a colossal scale. In (non-violent) market competition, producer actions are guided by the preferences of customers: a dynamic that drives low prices and technological innovation. Absent this accountability, producers are incentivized to do anything necessary to expand their market share—up to and including violent coercion. Simply, market pressures keep people honest: as such, the structures of markets and moralities are mutually intertwined.

Markets, Sovereignty, and Morality

“To be moral, an act must be free.” ― Murray N. Rothbard

Competition is a natural process of discovery: in sports, it is the way we discover which team is more competent in any single game; throughout an entire season of play, repeated competition is how we discover which team is best overall. In free markets, competition is the set of games played to discover “satisfactions of wants”: each entrepreneur places “bets” (investments of capital, money, and time) as they attempt to prove their competitors wrong in the marketplace by delivering better, faster, or cheaper solutions to the problems their customers want solved. Market competition is the catalyst of honest work and true progress for civilization. As the American pragmatists said: “truth is the end of inquiry”—in this sense, the free market may be thought of as a setting of continuous inquiry that zeroes-in on truth. The ideas competition generates, which withstand its sustained entrepreneurial inquisition, are our best approximations of truth—as William James said:

“Any idea upon which we can ride … any idea that will carry us prosperously from any one part of our experience to any other part, linking things satisfactorily, working securely, saving labor; is true for just so much, true in so far forth, true instrumentally”

Pragmatically, truth is difficult to distinguish from that which is most useful. In forums of free exchange, truth is generated in the form of accurate prices, useful tools, and individual virtue. Prices dynamically represent market participant concurrences on relative exchange ratios, a derivation of countless trade decisions across time. A tool with superior usefulness is the manifestation of mankind’s sharpest present knowledge for solving a specific problem. Put another way: as entrepreneurs inquire about the nature of reality through experimentation, the tools they produce—and the knowledge structure with which these tools are configured—adapt according to customer preferences until one or a few favored solutions become market dominant. Virtue and competitive competency are the character traits infused into successful entrepreneurs that manage to survive the constant economic pressures holding them accountable for profit generation. This truth-seeking function of free markets is inherently iterative: prices, tools, and virtues are constantly changing according to market conditions.

“Points” in market-based games of discovery are denominated in money — the tool used to calculate, negotiate, and execute trades most effectively. Market competition is the process that keeps producers honest: when it is suppressed through coercion or violence—as it is within “legal monopolies”—truth becomes distorted into inaccurate prices, low-quality tools, and individual wickedness. For money producers, monopolization means dishonest producers become counterfeiters and gain a (deceptive and violent) dominion over human time.

Stealing human time through currency counterfeiting led to the the auctioning of slave labor.

Stealing human time through currency counterfeiting led to the the auctioning of slave labor.

Contrary to conventional wisdom, money is not “the root of all evil,” it is actually just a tool for trading time (or labor)—the means by which market participants signify sacrifices and successes to one another across the history of economic transactions. Like all tools, money has no independent morality of its own. Tools are amoral, meaning they can be used for both good and evil purposes alike. The moral outcome of using a tool is inextricably dependent on the intention of its user. Money is a temporal trading tool, but (as we’ve seen) it can also be wielded maliciously to steal time, in the same way a hammer can be used to build a house or bash a skull.

More accurately, money—along with its precursors action and speech—is “the root of all sovereignty”: the authority to act in the world as one sees fit. Sovereignty — a word etymologically associated with monarchy, money, and royalty — refers to the locus of supreme power in the sphere of human action. According to Natural Law, sovereignty inheres within the individual, as each person must consciously decide what actions to take, despite any exogenous influences they may face. An inner sanctum of sovereignty’s generative source lives within each of us — an inviolable principle of reason known as the logos. An interface layer between the primary domains of experience—order and chaos—the logos is the defining feature of humanity: our ability to tell and believe stories is what distinguishes man from animal. Victor Frankl calls this interiorized space the “last human freedom”:

“The last of the human freedoms: to choose one’s attitude in any given set of circumstances, to choose one’s own way. And there were always choices to make. Every day, every hour, offered the opportunity to make a decision, a decision which determined whether you would or would not submit to those powers which threatened to rob you of your very self, your inner freedom; which determined whether or not you become the plaything to circumstance, renouncing freedom and dignity…”

From sovereignty, we derive the word reign, which commonly refers to a period of royal rulership. Most of us now live in an era well-past submission to a royal family, and our civilizational conception of sovereignty has been steadily decentralizing over time, moving closer to a clear reflection of Natural Law. As Jordan Peterson charts this historical progression:

“First of all, the only sovereign was the king. Then the nobles became sovereign. Then all men became sovereign. Then came the Christian revolution and every individual soul, impossibly, became sovereign. That idea of individual sovereignty and worth is the core presupposition of our legal and cultural systems, so we all walk around acting as if every one of us is a divine centre of logos. We grant each other the respect of individual citizens who are sovereign and are equal before the law.”

At the foundation of Western Civilization today is the precept that the sovereignty of the individual is held higher than the state: an embodied belief at the heart of legal principles such as habeus corpus, the presumption of “innocent until proven guilty,” and freedom of speech rights.

Freedom of speech is essential to a peaceful society, as our ideas must be free to clash and resolve conflicts so that our bodies don’t. Speech arose in humans as a direct result of our evolutionary development: once a vertical stance was adopted by our ancestral primates, our visual field was expanded, and our hands became more adept at manipulating the natural environment since they were no longer needed for locomotion. Newly outfitted with opposable thumbs, we developed a dexterity that enabled us to particularize the natural world in useful ways—like sorting things, counting, and making tools. Fine musculature in the face and tongue evolved alongside this precision of hand, giving rise to spoken language, which complemented the hand’s ability to categorize the world, and the mind’s ability to comprehend it (even our internal dialogue is composed of speech). An ability to manually reconfigure the world reinforced our abstractive capacity to do so verbally, thereby forming a feedback dynamic between these two defining faculties of man. This co-evolution of craftsmanship and verbal articulation led naturally to trade, and (quite simply) the most exchangeable thing in any trading society is its most important tool—money.

Seen this way, money is a direct derivation of action and speech: all three of which are essential media for sovereign self-expression. In this sense, money may be considered a form of speech in and unto itself—the language of value. Placing limitations on the use of this language (the purpose of central banks) is commensurately catastrophic to restricting the freedom of speech (which can lead to absurdities like illegal numbers). Free speech digs the grave for despotism, whereas its suppression is the trademark of totalitarian regimes. Indeed, the first effort of every aspiring dictator is always to restrict the voice of dissent—to darken the light of inquiry radiating from the logos. The 20th century had many logos-suppressing dictatorships, we will name two:

“In 1917, the Russian Bolsheviks moved to limit freedom of speech the very day after the October coup-d’état. They adopted the “Decree on the Press,” which shut down any newspapers “sowing discord by libelous distortion of facts.” Similarly, only a few months after coming to power in 1933, German National Socialists started to burn books, and the Ministry of Propaganda introduced strict censorship.

Logos (λόγος) is a Greek word that means “ratio” or “word”—the principle at the core of interpersonal communications, which are largely conducted via words and prices (which are exchange ratios expressed in monetary terms). Both words and prices are “categorical comparatives,” protocols for encapsulating, comparing, and communicating different aspects of reality — herein lives the power of the divine logos to render order from chaos. In language, consider how all words only have meaning relative to one another: all definitions are comprised of other words. In markets, the intersection of subjective supply and objective demand is the price: a dynamic figure reflecting the consensus of the collective logos on any particular good’s exchange value for any other good (for simplicity, expressed in the common language of economic numeracy: money).

For money, governments corrupt the pricing mode of comparative expression by constantly violating the supply of money (via inflation) while simultaneously compelling its demand (via legal tender and tax collection laws). Distorting natural price discovery, a manipulation of the collective logos, is equivalent to perverting the vox populi—the voice of the people. George Orwell once said: “If liberty means anything at all, it means the right to tell people what they do not want to hear.” An inability to speak the truth (with words), or prove others wrong in the marketplace (with prices), is the death of liberty; as the 20th century so painfully taught us, restricting the logos is a slippery slope toward totalitarianism. Free expression in all forms is antecedent to proper moral action.

In Soviet Russia, freedom of speech was suppressed and dissent was punished. Independent political activities were not tolerated, whether these involved participation in free labour unions, private corporations, independent churches or opposition political parties.

In Soviet Russia, freedom of speech was suppressed and dissent was punished. Independent political activities were not tolerated, whether these involved participation in free labour unions, private corporations, independent churches or opposition political parties.

Like speech, money lacks an intrinsic morality of its own. However, its economic character does influence moral standards—as Buddha taught us: “Money is the worst discovery of human life, but it is the most trusted material to test human nature.” Honest money encourages righteous action, and dishonest money induces moral hazard. To comprehend money’s impact on morality, consider the (hypothetical) case of a winemaker living in a centrally banked economy. He knows that his central bank recently doubled the money supply by printing trillions of dollars to “save the economy,” and is now faced with three options:

- Continue selling his wine for $20, knowing that the value of each dollar has declined 50% due to inflation*

- Water down his wine or use cheaper ingredients, thereby decreasing the production cost and the quality of his wine, but continue selling it for $20

- Double the selling price of his wine to $40, to get the same value for his wine denominated in post-inflation dollars

*For simplicity, we will ignore the spatiotemporal unevenness of inflation.

If the winemaker chooses the first option, he incurs a 50% loss. If he decides to water down his wine, he defrauds his customers by selling them an inferior product. If he doubles his price to maintain quality, he risks losing customers to less honest competitors who are willing to compromise on quality. Since diluting wine with water is difficult to detect (for non-connoisseurs) and offers an immediate financial gain, all winemakers face strong incentives to defraud their customers when inflation strikes (a cause of wine scandals). In a similar vein, monetary inflation incentivizes sellers across all industries to deceive their customers. Inflation imposes the temptation of larceny onto seller’s hearts, forcing them to weigh financial wellbeing against moral integrity. In this way, inflation is an infectious disease to society’s moral fabric. Inflation-resistant money, then, is an antidote to an afflicted social morality. In this (critically important) sense, Bitcoin—the only money with a 0% terminal inflation rate—is the cure for many of the moral cancers riddling our world.

Inflation is a great immiseration on the soul of humanity—a source much moral sickness worldwide.

Inflation is a great immiseration on the soul of humanity—a source much moral sickness worldwide.

Money is a source of great temptation, as it can be considered the “list of who owns what,” since money can (by definition) be used to buy anything in the marketplace. When a singularly privileged group (a monopoly) can create money out of thin air, they can amend this “list of who owns what” arbitrarily, and have a powerful incentive to do so to their own benefit. This “money as an ownership ledger” angle sheds light on the underlying impetus for central banking—an institution which arrogates itself as “master of the list” with an exclusive privilege to advance the interests of its private shareholders, even at the expense of enslaving everyone else.

Since everything in the marketplace requires sacrifices of human time to produce (even land needs hands to sell), we can say that money is human time emblematized. In the same way a stock certificate is title to company capital, money is title to human time; people sacrifice time earning money which they can then spend on commensurate sacrifices from others. Clearly, a tool that can command human time is an object of great temptation, as it is a potent source of power (defined by physics as work over time). A lust for power is the motivation of most warfare—typically involving attempts to forcibly acquire capital, food, or territory. And a lack of power is closely related to unhappiness, which makes its consolidation alluring—as Philo Judaeus said:

“No slave is really happy, for what greater misery is there than to live with no power over anything, including oneself?”

Money has always been a critical piece of mankind’s notions of sovereignty and slavery. When naturally selected by free market processes, money is a culmination of the collective logos: a synthesis of individual self-sovereign expressions. But natural money has been hijacked by artificial tyrants: the reason we call states “sovereigns” today is only because they are the gangs that hold most of the world’s freely chosen money — gold.

The So-Called Sovereign States

“I did not know I was a slave until I found out I couldn’t do the things I wanted.” —Frederick Douglass

For over 5,000 years, precious metals have been favored as money since they best fulfilled its five properties: divisibility, durability, portability, recognizability, and scarcity. Gold came to reign supreme because of all the monetary metals, it was the most scarce. Scarcity is arguably the most important property of money, as without an assurance of supply limitation, someone always gives in to the temptation to inflate and steal the value stored therein (see: aggry beads, panos cloth money, or fiat currencies today).

Governments have always interceded in the market for money to commandeer gold coinage and warehousing operations, both of which sought to improve the divisibility, portability, and recognizability properties of money by issuing standardized coins or warehouse receipts. By monopolizing these “certification function” businesses, the state shifted the burden of trust from transacting parties onto itself. States throughout history have always made it their (exclusive) business to certify the value (weight or fineness) of money (coins or bars) and money-substitutes (paper warehouse receipts). Remember: insulation from competition interrupts the truth discovery process engendered by free markets; for this reason, trust placed in any monopoly always ends up shattered.

Government exists to protect property rights: a purpose it defiles by monopolizing and counterfeiting money.

Government exists to protect property rights: a purpose it defiles by monopolizing and counterfeiting money.

All national currencies began as paper promises for real money. Today, these currencies are no longer redeemable for real money, and instead have been transformed into perennially unfulfilled promises called fiat currencies. Governments require societies (a restriction of the collective logos) to transact in these money-substitutes and reserve the exclusive right to manipulate their supplies as a means of siphoning wealth (aka stealing time) from citizens. In effect, fiat currencies are uncollateralized debts undergoing slow-motion default while their use is forced on society. All the while, central banks continue to hoard the real money—gold—and perform final settlement with one another in this authentic, free-market-selected medium of exchange.

Seen this way, _“_printing money” actually refers to currency counterfeiting—the production of false promises, as currencies are no longer tied to real money. Said simply: fiat currency is a living lie. Regardless of whether you consider it a tool or a weapon (depending on the subjectivities of user intentionality), manipulating money supplies is objectively useful for only one thing: inflicting wealth inequalities (by stealing time). As G. Braschi puts it: “Every tool is a weapon (if you hold it right).” As a means of gaining an advantage in contests of will, currency counterfeiting is a weapon.

In war times, belligerent nations have made attempts to counterfeit opponent currencies to cause hyperinflation. For example, Nazi Germany had plans to bomb England with counterfeit bank notes to sabotage their economy. And in Imperial Japan, the Noborito Laboratory experimented with currency counterfeiting operations as an economic subversion strategy. In peacetimes, currency counterfeiting is the exclusive domain of the central bank, whose “expansionary monetary policy” increases the money supply by, say, 7% per year—that is, stealing only 7% of dollar-holder wealth (an accumulation of time-savings) each year via counterfeiting operations.

Of course, when circumstances become too uncertain, market participants naturally flock back to the trust-minimization of physical gold, since money-substitutes are (at best) promises to receive money in the future, they are vulnerable to default. Unlike fiat currencies, gold is an expression of the collective logos, not compulsion from a counterparty. The self-declared “sovereign” state is a business model built on the confiscation of self-sovereign monies like gold and silver. The superior monetary properties of gold made it the most valuable form of self-sovereign money in history, a reign it has maintained since before the founding of ancient Egypt.

The Great Pyramids

“There are two ways to conquer and enslave a country. One is by the sword. The other is by debt.” —John Adams

Ancient Egypt is the archetypal tyranny in the Bible. Egypt is renowned for its Great Pyramids, monoliths which were built on the backs of slave labor. Indeed, the grandeur of these constructions owes a major debt of gratitude to the many slaves whose time was stolen by the Pharaohs—masters of Ancient Egypt. To gain a glimmer of understanding as to just how arduous the construction process was for even a single Great Pyramid, consider this data point from the book Heroes of History by Will Durant:

“According to Herodotus… the pyramid itself required the labor of 100,000 men through twenty years.”

Many slave hours went into building the Great Pyramids, but history has even worse pyramid schemes…

Many slave hours went into building the Great Pyramids, but history has even worse pyramid schemes…

To quantify this time-theft from Egyptian slaves more precisely, again assuming that each slave spent 5,000 hours per year engaged in manual labor, a workforce of 100,000 slaves building for 20 years equals 10B hours of time stolen. A staggering amount of man hours condemned to the brutality of physical bondage during the construction of a single Great Pyramid, but (terribly) still less than the time stolen by the greatest pyramid schemes in human history—fiat currencies. As Henry Ford foretold:

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

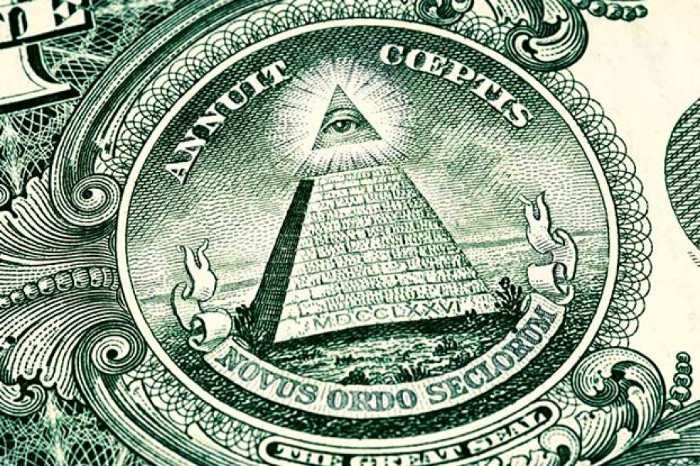

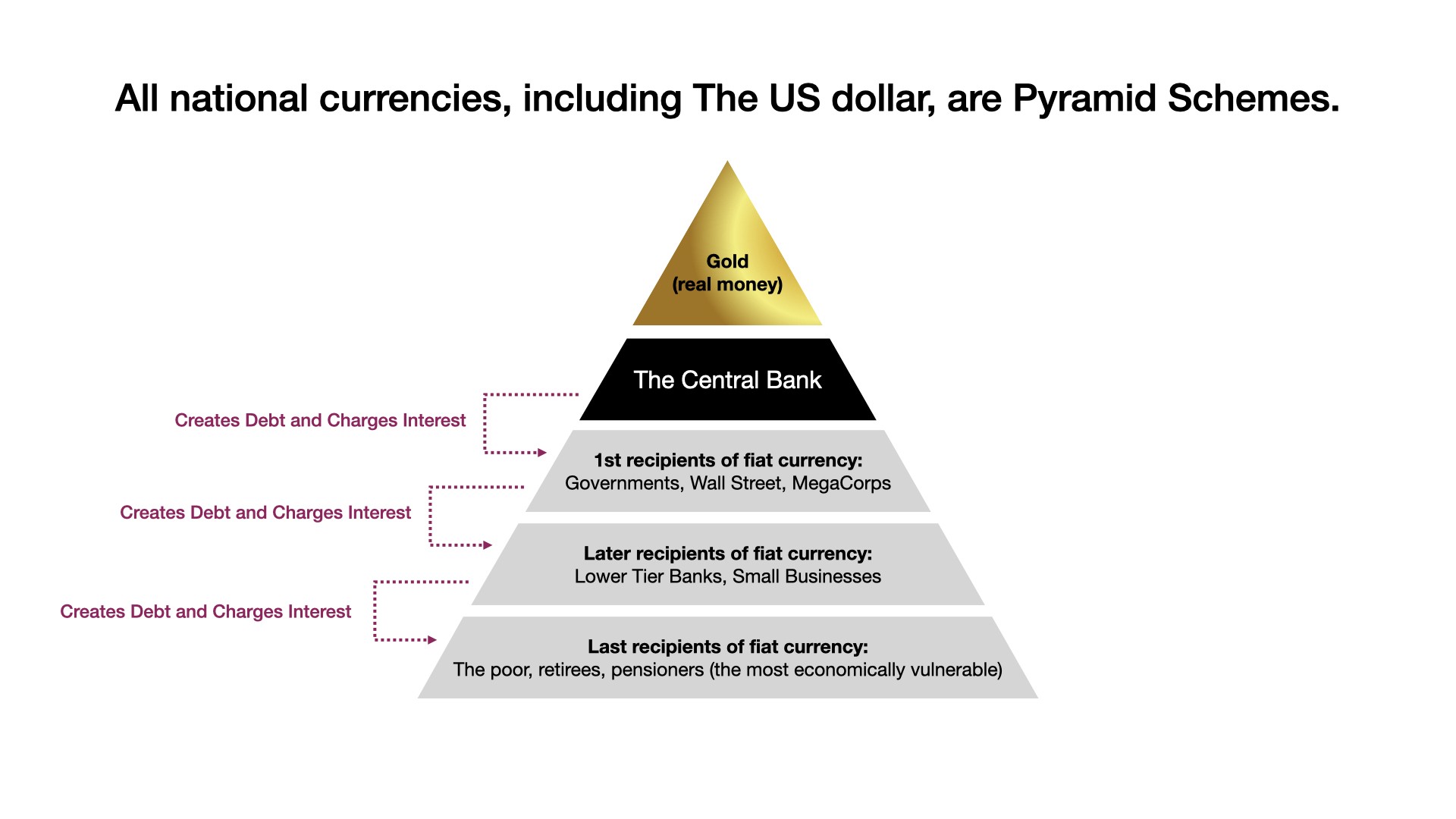

A pyramid scheme is an investment scam based on a hierarchical setup of network marketing, in which higher layer participants profit at the expense of those lower down. Fiat currencies are pyramid schemes erected by central banks, who restrict access to and suppress the price of gold, which would otherwise outcompete their inferior currencies on the free market, since gold is reliably scarce and holds its value across time. The use of fiat currencies is compelled via legal tender and tax laws. It may be hard to believe that the world’s most popular currency is a pyramid scheme, but the symbology of the US dollar tells its own story:

Novus Ordo Seclorum is Latin for “New order of the ages” — this symbol appeared soon after the founding of The Fed: perhaps it refers to the new system of slavery implemented under the monicker of “central banking.”

Novus Ordo Seclorum is Latin for “New order of the ages” — this symbol appeared soon after the founding of The Fed: perhaps it refers to the new system of slavery implemented under the monicker of “central banking.”

After a long-game legerdemain by governments, these pyramid schemes came to dominate the world. Fiat currencies are debt-based money-substitutes controlled by central banks, which impose these monetary networks on users and suppress all competition in the market coercively or violently (similar to the Grão Pará and Maranhão Company). Most despicably, it is the poorest people in society—who (by necessity) hold the majority of their wealth in fiat currency—that are most victimized by this fraudulent system.

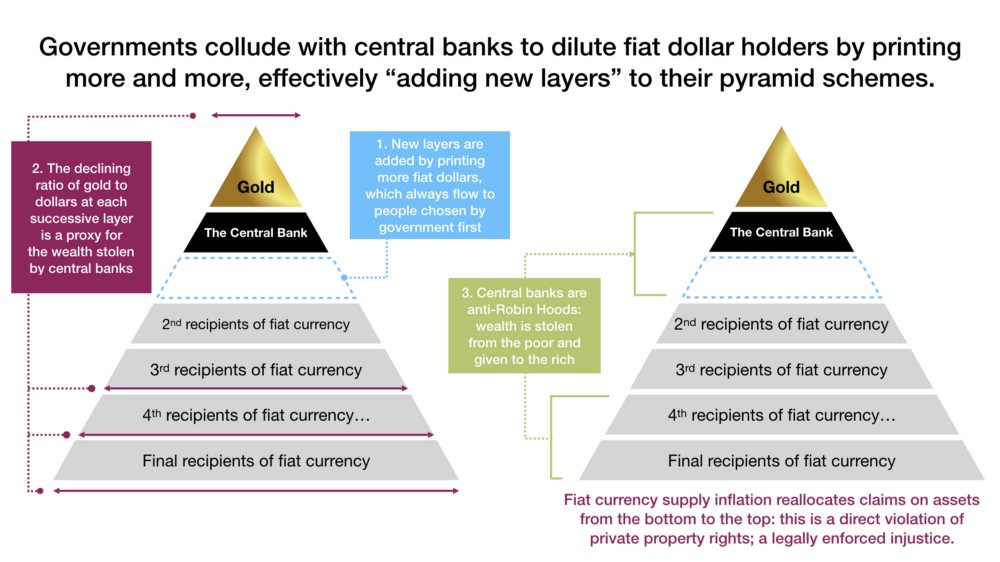

At the pinnacle fiat currency pyramid schemes is gold: a technology selected as money by the cumulative free choice (the collective logos) of countless entrepreneurs throughout history. Paper currency abstractions of gold were introduced purely to make it more convenient for exchange, not to replace it. Over time, the option to redeem currency for gold was eliminated, giving governments full control over currency scarcity, and therefore an unlimited capacity to confiscate wealth from their citizens by compromising its supply.

In effect, every time a new unit of fiat currency is printed (euphemistically called “quantitative easing” or QE by central banks), new layers to the pyramid scheme are laid from the top down, and the inflationary costs are externalized onto those using fiat as a store of value. Worse still, each unit of fiat currency is leveraged, so that one unit is multiplied by several orders of magnitude by the time it becomes part of the broad money supply. Looking at The Fed as a specific example: after netting service fee revenue for itself (to fund its operations and a 6% annual dividend to its undisclosed shareholders), The Fed uses the new fiat dollars to purchase US government debt. Freshly printed (more accurately, electronically generated) fiat dollars are then doled out at the discretion of government bureaucrats, who (unsurprisingly) tend to favor the bankers, corporations, and lobbyists that pay for their political campaigns. Detestably, this dynamic reallocates wealth from the poor to the rich (Robin Hood would be ashamed).

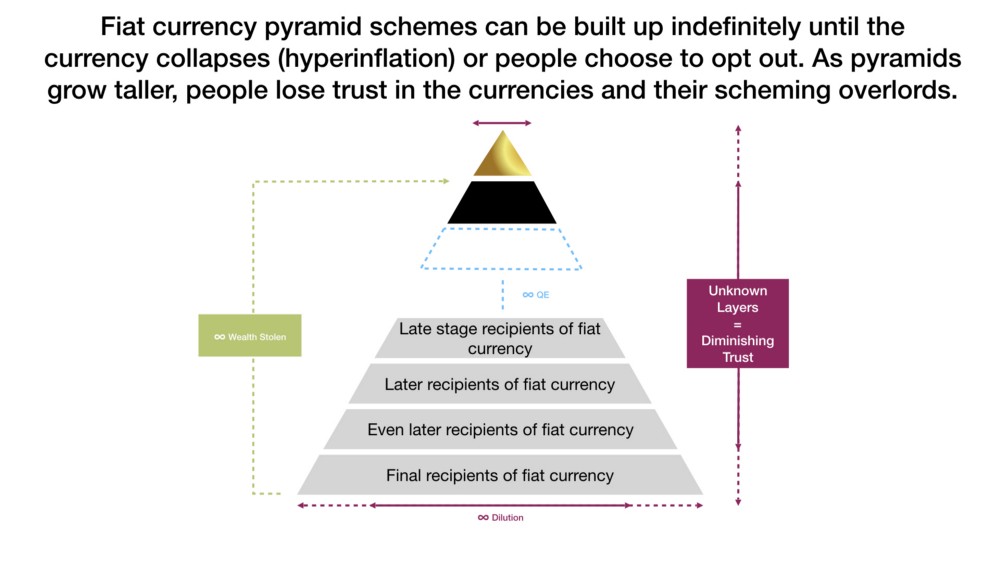

So long as people remain sufficiently passive yet productive, these pyramid schemes can be built ever-higher, and continue to operate as a weapon of wealth extraction (time-theft) for their political perpetrators. However, since there are no free lunches in this universe, this fiat currency supply expansion cannot continue forever. As layers continue to accumulate in round after round of QE, and people are implicitly taxed harder and harder through price inflation, trust in the currency becomes diminished. Like Hemingway said about bankruptcy, this happens gradually at first, then suddenly as inflation gives way to hyperinflation: a total meltdown of the economic trust money is intended to facilitate in the first place. At this point, the “central bank master” has pushed his “fiat-slave citizens” too hard, as they finally reach the edge of their economic livelihoods.

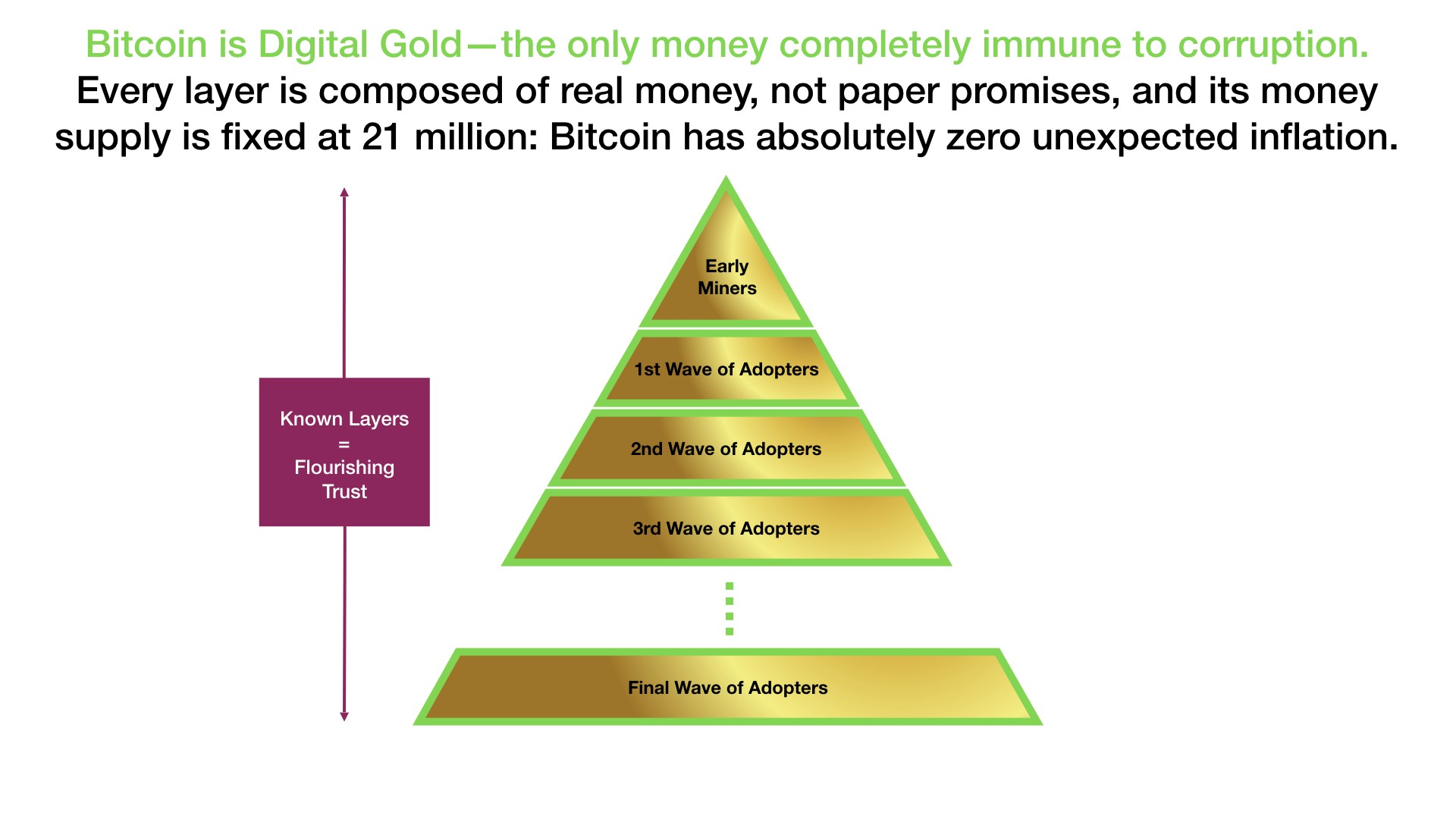

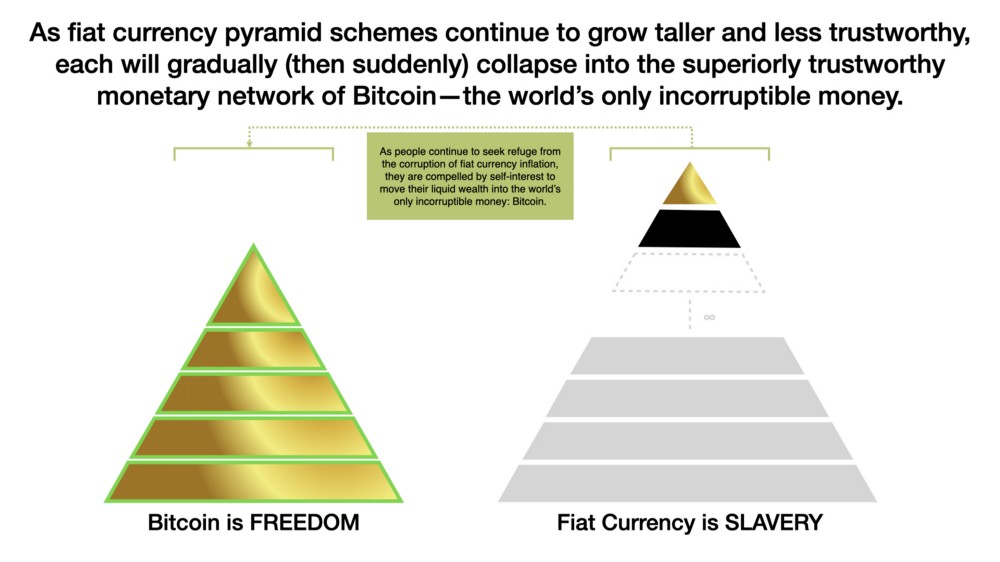

Fortunately, thanks to Bitcoin, these financial pyramid schemes can no longer be shielded from direct competition (as they are from gold). All fiat currencies are critically dependent on the ability of central banks to subdue competition—the discovery process that would otherwise disrupt their illusion. Owning 20% of the global gold supply gives central banks significant influence over its price, which they actively suppress in the paper markets. Without intervention, fiat currencies would quickly collapse to the superior value proposition of gold as money, as people always favor a money that holds its value across time (by remaining scarce). In this regard, Bitcoin—the world’s only “digital gold”—represents a major breakthrough: a monetary technology that is disruptive to gold, resistant to competitive suppression by central banks, and the one-time discovery of an absolutely scarce money.

All monies exhibit a multi-level marketing valuation dynamic: for Bitcoin, early adopters benefit disproportionately by anticipating later adoption by others (the Bitcoin economic bootstrapping process is characterized by a virtuous cycle). But unlike the unknowable supplies of fiat currency pyramid schemes, Bitcoin has a universally known supply. For fiat currencies, the “early adopters” are perpetually those with access to the printing press; a positional asymmetry (a political privilege) that makes the game unfair.

A more symmetrical system, Bitcoin is uniquely characterized by [perfect information](https://en.wikipedia.org/wiki/Perfect_information#:~:text=In%20economics%2C%20perfect%20information%20(sometimes,utility%2C%20and%20own%20cost%20functions.)meaning that all market participants can see the rules that govern it, verify that that there will never be more than 21 million units, and determine precisely when each will be produced—meaning all unexpected supply inflation for Bitcoin is optimized for holders at absolute zero. Perfect information is a prerequisite to the economic concept of perfect competition: an ideal (yet unattainable) market condition where competitiveness is entirely unhampered by unnecessary regulations and wealth generation is maximized. A great promise of Bitcoin is to pull global markets closer toward this state of perfection by separating money and state.

Laid in layers of permanence, this “digital gold” pyramid outshines the inherent uncertainties of fiat currencies. Since money is “insurance against uncertainty,” its demand is centered on the relative certainty of its monetary properties; and Bitcoin optimizes for all five: it exhibits the divisibility, durability, portability, and recognizability of pure information; and the scarcity of time. Like death and taxes, the certainty of “21 million bitcoin” is a concept that cannot be refuted. Coupled with the incentive to front-run future adoption of this digital, absolutely scarce, and theft-proof money makes Bitcoin a game-theoretic gravity-well that the market for money simply cannot escape. Paradoxically, it is precisely this inescapability that is leading to the liberation of more and more fiat-slaves worldwide.

Symbolized by its fixed height in the image above, the absolute scarcity of the Bitcoin monetary pyramid increasingly outcompetes fiat currency pyramid schemes as they grow comparatively taller and less trustworthy through supply expansion. Eventually, these proverbial “houses of cards” collapse into the full transparency and certainty of Bitcoin. Whether it is understood or not, in the sphere of money, the known serves as protection from the unknown.

Viewed this way, we have much to be hopeful for in the world, as there is finally an incorruptible alternative to the completely unethical system of central banking. Bitcoin is honest money freeing the world from the falsehood of fiat currency. In a transcendental sense, Bitcoin may actually be what the ancient alchemists spent centuries pursuing: the incorruptible substance—called the lapis philosophorum in archaic texts—that would serve as an antidote to the corruption of the world. As Jordan Peterson wrote of alchemy in his profound book Maps of Meaning:

“The sequence of the alchemical transformation paralleled Christ’s Passion, paralleled the myth of the hero and his redemption. The essential message of alchemy is that individual rejection of tyranny, voluntary pursuit of the unknown and terrifying — predicated upon faith in the ideal — may engender an individual transformation so overwhelming that its equivalent can only be found in the most profound of religious myths…The lapis philosophorum is “agent of transformation,” equivalent to the mythological redemptive hero — able to turn “base metals into gold.” It is, as such, something more valuable than gold — just as the hero is more valuable than any of his concrete productions.”

Alchemical methodologies were “proto-science”: experimental processes practiced for thousands of years that were foundational to the later development of the scientific method (even Isaac Newton was an alchemist). As a school of thought, alchemy was a “fork” off of The Church premised on the belief that redemptive knowledge could be found in the laboratory of nature (a heretical concept at the time). Standing at the vanguard of human technological achievement, existing as the only money characterized by a manipulation-proof supply, and inspiring earnest transformations in the lives of true believers, perhaps Bitcoin actually is the lapis philosophorum pursued by alchemists for centuries—the incorruptible substance giving rebellion to state tyranny and, in doing so, bringing mankind closer to God. Bitcoin is the truth, and by one definition, God is expressed in the truthful speech that rectifies pathological hierarchies. Or as Benjamin Franklin said:

“Rebellion to tyrants is obedience to God.”

Like freedom, love, and truth—God is timeless. I am not talking about a “guy in the sky” here: the ancient idea from Genesis is that God is the force that freely confronts the chaos of potential with courage, truth, and love to convert it into good and useful order. Being made in the image of God, we are all sovereign individuals imbued with the logos, a self-generating power responsible for our ability to harmoniously reconfigure the natural world into good and habitable space. Our future is seeded in our imaginations, a reality we call forth by freely exercising the logos in thought, speech, and action. The logos is the divine spark intrinsic to us all; realizing that words can only miss the mark of spiritual truth, we can venture to say: God is the anti-entropic principle eternally propagating through all life. As G.K. Chesterton said:

“A dead thing can go with the stream, but only a living thing can go against it.”

To most truthfully embody the divine principle of the logos individually, and more closely approach the timelessness of God collectively, we must triumph against the evil forces that steal our time secretively and constantly.

Stealing Time

“There is one kind of robber whom the law does not strike at, and who steals what is most precious to men: time.” —Napoleon Bonaparte

Many mistakenly blame capitalism for the myriad economic problems in the world. However, at the heart of every modern economy is an institution of socialism: the central bank. In a primitive sense, the first man who dug a hole to shelter himself from the weather was the first capitalist, and the man who violently encroached on his tiny territory for his own selfish purposes was the first socialist. Capitalism simply means everyone has exclusive rights to the fruits of their own labor; in other words, everyone owns their own time. True capitalists are free to trade any valuables they invest their time to create (goods, services, or knowledge) with other self-owned people doing the same. Socialism, on the other hand, entails that governments (aka other people) own a (greater or lesser) portion of your time; the “pound of flesh” they take through conscription, taxation, and inflation.

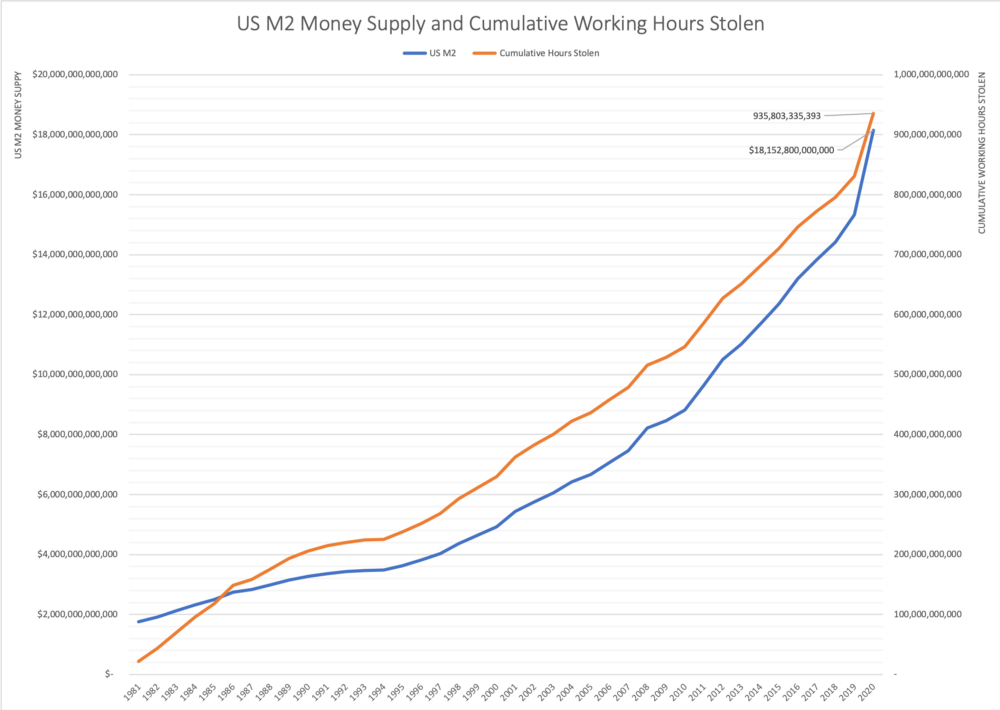

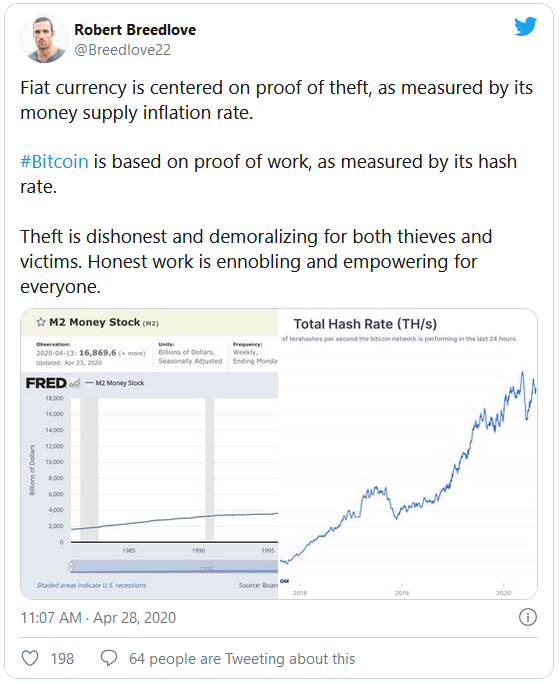

Socialistic fiat currency is the lifeblood of state tyranny: to comprehend just how colossal the central banking system of time-theft has become, let’s take a close look at The Fed. Using annual wage data from the social security administration, changes in US M2 money supply, and assuming 2,000 average annual working hours per worker, we arrive at some startling figures. By dividing the growth in USD supply by the average hourly wage each year in dollars, we calculate a proxy for the hours stolen from society through USD supply expansion (source link).

“Printing money” is currency counterfeiting and the theft of human time—in a word, slavery.

Stealing an average of 7.6% working hours per year since 1981, bureaucrats at The Fed have managed to scalp nearly one trillion hours off the backs of hard working people. Assuming each person works an average of 2,000 hours per year, this is equivalent to enslaving 11.7M people for 40 years straight. This implicit taxation via inflation is in addition to all explicit taxes imposed by the US government—all of which are acts of outright socialism. Unless transactions are made by consensual and willing market participants, then exchange is extortive—this is a central tenet of free market capitalism.

Time stolen by The Fed since 1981 is 341% more per year than the trans-Atlantic slave trade. With 23.4B hours stolen annually, The Fed could (in theory) build 2.3 Great Pyramids each year. In terms of absolute human time stolen per year, fiat currency is the largest pyramid scheme and institution of slavery in human history.

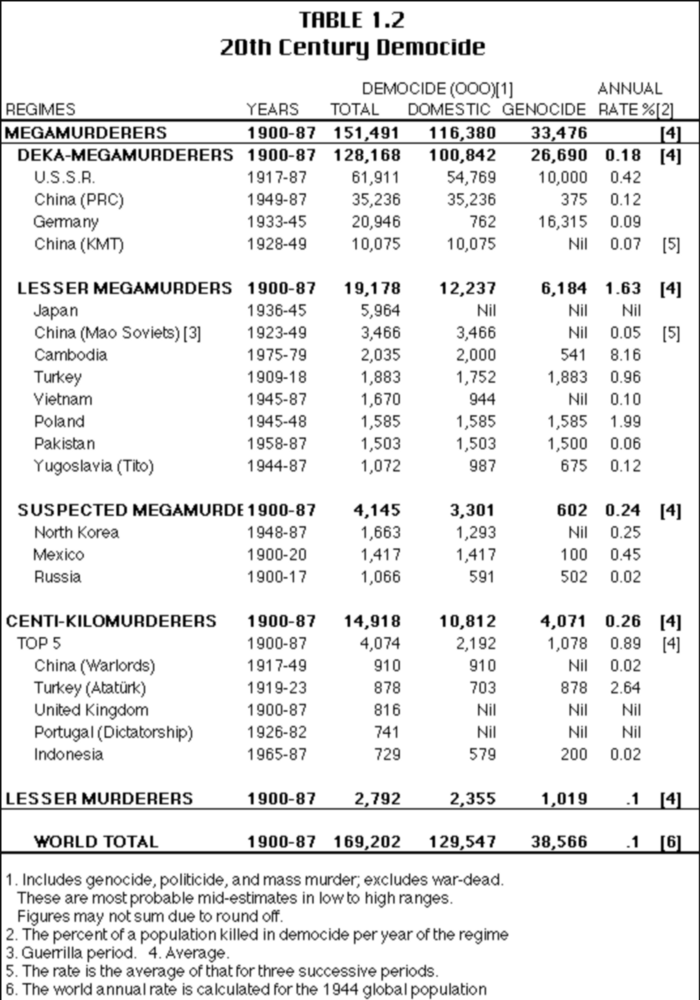

When we stop conceiving of central banking as an economics story, and start to see it as a crime story, we are beginning to get the true picture. Capitalism is established in truth (hard work, delayed gratification, and honest trade), whereas socialism is founded in falsehood (bureaucratizing, propagandizing, and theft). Like counterfeit aggry beads and panos, counterfeit dollars are also used to mobilize military efforts, which (before fiat) required explicit taxation or borrowing to finance. Socialistic money is the stealth funding source of evil: it has been used to finance every dictator, world war, and internment camp in human history. In the 20th century alone, fiat-currency-funded-governments murdered over 169M people—a modern mega-atrocity called democide:

A table quantifying murders by governments from 1900–1987 in millions: 169,202,000 victims of democide.

History is clear: enforced enactment of the fiat currency lie worldwide leads to loss of life on a monstrous scale. Said simply: socialism is fraud, and those who remain silent on the truth of central banking are complicit in its criminality. As Nassim Taleb succinctly states this ethic:

”If you see fraud and do not say fraud, you are a fraud.”

The central planning of money is not a new idea. In Marx’s 1848 Manifesto to the Communist Party, measure number five reads: “Centralization of credit in the hands of the state, by means of a national bank with State capital and an exclusive monopoly.” Straight out of Marx’s playbook, there is nothing capitalist at all about central banking; it is an anticapitalist organization, so let us speak of it truthfully: central banking is monetary socialism—an institution of financial slavery. Further, Karl Marx was a known racist; his socialistic system of central banking is solely designed to extract wealth from those the state deems to be “inferior.” It is little surprise, then, that an institution centered on Marxist philosophy has mutated into a racist slavemaster.

Slavemasters seek to steal the benefits of work without making the requisite sacrifices. Across trading societies, gold was favored as money because it required “proof of work” to obtain: an unforgeable costliness that could not be counterfeited, and therefore self-represented the collective sacrifices made to procure it. Work is a noble pursuit, as it carries us closer to the timelessness of God, since all innovations are just productivity enhancers — instruments for accomplishing greater results within the same expanse of time. Theft is the opposite: a twisting of the moral fabric of reality to serve the present ego in defiance of the eternal God. Attempts to twist reality in this way always snap back to devastate those who try: our only salvation from this deceit is the truth.

Money is a social construct created to sacrifice time now and store it for later enjoyment. Debt is created by enjoying now at the cost of later sacrifice. Real money is the final extinguisher of debt. Fiat currency is oxymoronic to the concept of money, since it is born by borrowing. Accordingly, fiat-currency-fueled-economies have spent over a century gorging on debt, and the day of reckoning is at hand: economic reality demands its later sacrifices paid—explaining why governments are on the edge of bankruptcy (morally and financially) today.

An integral element of the social contract, the time we spend serving society today must earn us money redeemable for equivalent services from it in the future. When this intertemporal trust arrangement breaks down due to inflation, society slides into disintegration. Fiat currency is a supreme instrument of evil in the world: a weapon of intergenerational dispossession wielded by wily slavemasters over unsuspecting subjects.

Modern Slavemasters

“To be a poor man is hard, but to be a poor race in a land of dollars is the very bottom of hardships.” —W.E.B. Du Bois

Master and slave dynamics have almost always been racial or cultural in nature, a fact that has not changed even in our present “civilized” age. Recent years in the US have witnessed a rash of police brutality largely targeted at African Americans. And it seems the latest act of police brutality was the last straw for a society fed up with the seemingly endless stories of black lives assaulted by police. On May 25, 2020, a 46-year-old father, friend, and brother named George Floyd was murdered by a state police officer. The cop pinned Floyd down with a knee to the neck, executing a nine-minute-long slow-motion homicide in broad daylight with citizens onlooking helplessly.

Remember: truth is the end of all inquiry. In the digital age, the windows of perception have become exponentially multiplied, thus projecting the light of inquiry into prismatic and interpenetrating patterns. This multi-perspective quality of digitized existence is an accelerant to the truth-finding function of free markets: consider the role of digital technology in the Arab Spring uprising, Wikileaks, and now the George Floyd protests occurring worldwide. In 1965, when Martin Luther King led a protest of unequal voting practices in Alabama, police violently attacked the activists as they marched. Although many events similar to this had come before, this one was televised, and that made all the difference. With the eyes of the world watching police brutalize peaceful protestors in real time, the US government was soon pushed to pass legislation banning racial segregation and discrimination.

Free market capitalism is a social system in which we see the world through as many eyes as possible (via words and prices) to attain a high resolution picture of reality. In the digital age, this multi-perspectivism of markets has been amplified with smart phones, social media, and live-streaming; thereby further awakening our collective consciousness. The truth is that thousands of tragic stories like George Floyd’s have unfolded over time, but the distribution of his via social media sparked a global outcry against police brutality. In the past, murders like this went less noticed, but in modernity the murder of one man can ignite a “fiat-slave rebellion” the world over. George Floyd’s murder spreading like wildfire on social media and erupting into a conflagration of protests worldwide is testament to the refractive influence of digital technology on the light of inquiry and, thus, the discovery of truth.

Synthesis of multiple perspectives is the key to gaining a high resolution image of reality: this is the essence of free markets—the forums within which unceasing inquiries become truth.

Synthesis of multiple perspectives is the key to gaining a high resolution image of reality: this is the essence of free markets—the forums within which unceasing inquiries become truth.

In truth, police are protectors of government “property”: their job is to “keep the peace” while the state maintains its scheme of constant confiscation from fiat-slaves. Police departments in many southern US cities began as slave patrols tasked with assisting landowners in the recovery and punishment of runaway slaves—thus preserving the “property rights” of slavemasters. Even today, the job of police is to investigate crime by collecting information for the court, not to protect the lives of citizens. As the axiom goes: “possession is nine-tenths of the law,” so clearly the police—a group of militarized fact finders—are truthfully nothing more than glorified government henchmen.

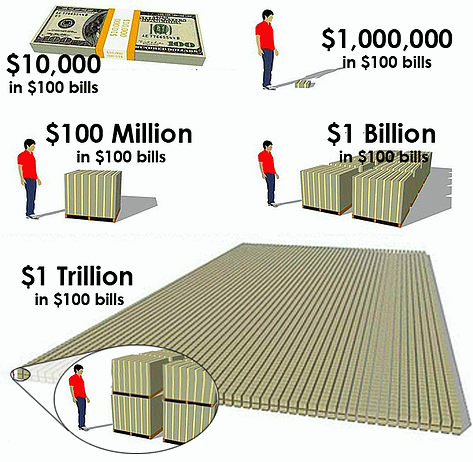

The light of inquiry melts down lies to reveal truth: this is why central banking will fail—it is critically dependent on ignorance, fear, and the suppression of free choice; it cannot stand the galvanizing gaze ever-present in the digital age. Centralized counterfeiting operations will not be tolerated in a world with unprecedented access to knowledge. Before being killed, George Floyd was arrested for attempting to use a counterfeit US $20 bill: the same crime The Fed perpetrates by the trillion. Millions, billions, trillions: it is easy to say these numbers, but much more difficult to comprehend the actual magnitude of state-sponsored counterfeiting operations. A visualization will help:

George Floyd was murdered for using a counterfeit $20 bill whereas The Fed counterfeits bills by the trillion.

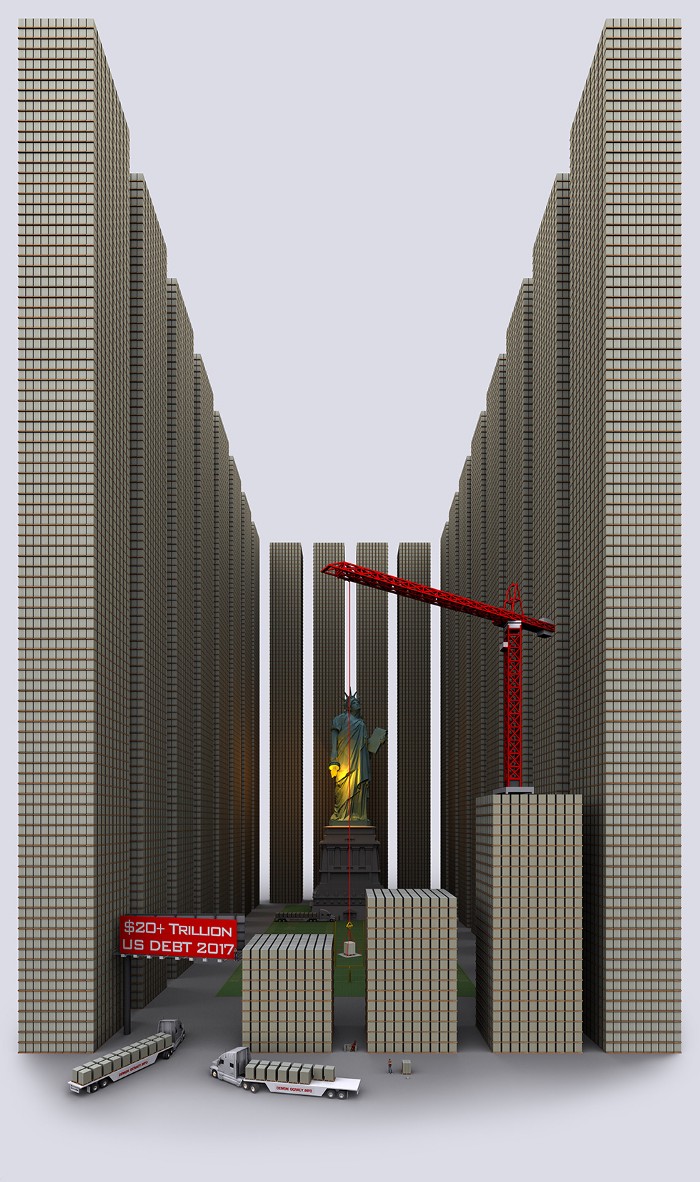

Every US dollar printed is proof of time stolen—a visualization of US national debt gives us some sense of just how colossal the central banking system of institutionalized time-theft has become:

The US national debt in physical fiat dollars. This rendering is from 2017; with US national debt now pushing $26T, the Statue of Liberty would no longer be visible today.

The US national debt in physical fiat dollars. This rendering is from 2017; with US national debt now pushing $26T, the Statue of Liberty would no longer be visible today.

Remember: society always slides towards slavery when a privileged few are able to produce money more cheaply than everyone else. As such, a free world is forever beyond reach before central banking is eliminated.

As sickening as it is ironic, George Floyd was pressured to use a counterfeit $20 bill precisely because The Fed counterfeits US dollars at scale. Again, the economic character of money directly influences moral standards: fiat currency pyramid schemes are premised on proof-of-theft, which pushes people to rent-seek, steal, and deceive others to make ends meet. Inflation impacts the poorest among us the worst, which explains why the median wealth held by a black family in modern America is less than 10% of that held by a white family ($17,000 to $171,000) and falling. As Michael Krieger describes this systemic weaponization of debt-based currencies:

“rather than empowering people, it turns them into modern-day indentured servants endlessly stuck on a hamster wheel with little to no hope of getting off. This is not an accident, it’s a tried and tested tool which, when combined with incessant mass media propaganda, is an effective way of creating a submissive, confused, and desperate underclass.”

By buying Bitcoin, you are participating in a global protest against state-controlled currency pyramid schemes in a way that politicians cannot ignore—since money is the only voting system in which your voice cannot be muted.

Buy Bitcoin = bye bye slavemasters.

Buy Bitcoin = bye bye slavemasters.

Although none of us were given the choice of what state to be born in, thanks to Satoshi Nakamoto we are all now free to choose our own money. The first step on this journey is self-education: it is no coincidence that state-owned curriculum teaches us nothing about the origins of money or how it works. Thankfully, the internet is a treasure trove of resources if you know where to look (check out some comprehensive reading here, here, here, here, here, here, here, here, and here).

Again, free markets are economic games played for the purpose of finding truth, and market manipulators are lying cheaters. In this sense, the Fed is like a professional sports franchise that can effortlessly score points at the touch of a button: a malicious team that doesn’t play by the same rules as the rest of us. Facing an “invincible” opponent like this is clearly demoralizing for other players in the marketplace, who are constantly robbed no matter how well they play. Money is a game played for keeps, and it involves the highest stakes imaginable—human freedom. Counterfeiting currency is a mechanism of slavery. By breaking the central bank dominion over money, Bitcoin is an emerging emancipatory force for a world suffering under fiat bondage.

Chasing Starlight

“I prayed for freedom for twenty years, but received no answer, until I prayed with my legs.” —Frederick Douglass

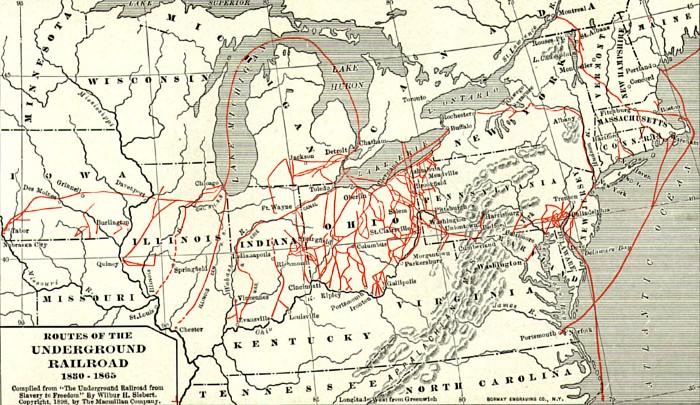

Making haste under starry skies, aided by stalwart abolitionists, escaped slaves in the Antebellum South risked everything to flee northward as they attempted to cross into the free states of Canada. Finding true north could be challenging at times, fortunately there were many clues — like moss growing on the north sides of trees or the northbound flight paths of migrating birds — that helped runaway slaves in their quests for freedom. Perhaps the most crucial of these clues was the North Star which, unlike other heavenly bodies, never changes position in the night sky.

Gaining stealth under the cover of darkness, intrepid former slaves relied upon the fixity of the North Star to light their pathway to liberty. Operating under conditions of dire uncertainty and never knowing who to trust, this celestial torch — a true lodestar — served as the guiding light for the Underground Railroad: a network of secret routes and safe-houses providing safe passage for runaway African Americans into Canada. Antislavery activists like Harriet Tubman supported this volunteer-based, flexible, and covert network that was so instrumental in undermining the heavily enforced institution of slavery in pre-Civil War America.

In modernity, we once again find hope of overcoming the financial slavery imposed upon us by The Fed in a volunteer-programmed, open-source, and cryptographically clandestine network guided by its own “North Star”: an immutable supply of 21 million bitcoin. For runaway African slaves, the North Star suspended high in the heavens beyond the reach of vengeful masters was a gift from God: an inextinguishable light for liberation. Bitcoin—a free market money with a supply firmly fixed at 21 million—is the unclosing gateway for fiat-slaves escaping economies controlled by central banking. Acceptance of Bitcoin is the manumission of humanity from central bank bondage, once and for all.

We are all living witnesses to the incineration of institutional falsity by unstoppable honest money. Bitcoin is a burning star of sincerity engulfing the enforced fiction of fiat currencies everywhere. From the ashes of this phoenix immolation, a society structured on the sound principles of accountability, honor, and integrity can arise. As an implementation of absolutely truthful money, it is a luminous beacon that cannot be coerced or concealed. As Buddha taught us:

“Three things cannot be long hidden: the sun, moon, and truth.”

Bitcoin is a rebellion against the most powerful bastion of socialism in the free world: central banking. It is a peaceful revolution involving the permanent disarmament of tyrants who weaponize money to confiscate wealth. Bitcoin is a weapon of peace; the final assassin to time-theft. An alchemical archetype, it is an antidote to state corruption and social moral affliction. As a purely honest free market money, Bitcoin is an irrepressible truth; an expression of pure monetary capitalism and a modern-day declaration of independence for fiat-slaves worldwide.

Bitcoin is money without masters: a system governed by rules instead of rulers. By awakening the world from the nightmare of financial slavery, Bitcoin is a dream of freedom coming true.

Thank you for reading Masters and Slaves of Money.

- Follow me on Twitter: https://twitter.com/Breedlove22

- Stack sats with me, get $10 in free Bitcoin through this link: https://www.swanbitcoin.com/breedlove

- Journey with me as I write my first book: https://bit.ly/3aWITZ5

- If you enjoyed this, please send sats: https://tippin.me/@Breedlove22

- Or, send sats via Lightning Network with Strike: https://strike.me/breedlove22

- Or, send sats via PayNymID: +tightking693

Bitcoin accepted here: 3LzRt3a3aoPRuM6pex9ygLZPkR6xPsKPFQ

Bitcoin accepted here: 3LzRt3a3aoPRuM6pex9ygLZPkR6xPsKPFQ

Translations:

Thank you for feedback during the writing process: Jimmy Song Tuur Demeester Brandon Quittem Gigi Willem Van Den Bergh Stephen Cole Alex Gladstein PlanB Saifedean Ammous

My sincerest gratitude to these amazing minds:

@real_vijay, Saifedean Ammous, Brandon Quittem, Dan Held, Naval Ravikant, @NickSzabo4, Nic Carter, @MartyBent, Pierre Rochard, Anthony Pompliano, Chris Burniske, @MarkYusko, @CaitlinLong_, Nik Bhatia, Nassim Nicholas Taleb, Stephan Livera, Peter McCormack, Gigi, Hasu, @MustStopMurad, Misir Mahmudov, Mises Institute, John Vallis, @FriarHass, Conner Brown, Ben Prentice, Aleksandar Svetski, Cryptoconomy, Citizen Bitcoin, Keyvan Davani, @RaoulGMI, @DTAPCAP, Parker Lewis, @Rhythmtrader, Russell Okung, @sthenc, Nathaniel Whittemore, @ck_SNARKs, Trevor Noren, Cory Klippsten, Knut Svanholm @relevantpeterschiff, Preston Pysh, @bezantdenier

And anyone else I forgot :)

Sources:

a. https://www.amazon.com/Bitcoin-Standard-Decentralized-Alternative-Central/dp/1119473861

b. https://www.bdratings.org/l/tales-of-soft-money-cotton-on-cape-verde/

d. https://en.wikipedia.org/wiki/Number_Nine_Research_Laboratory

e. https://pathways.thinkport.org/secrets/gourd1.cfm

f. https://www.ssa.gov/oact/cola/awidevelop.html

g. https://fred.stlouisfed.org/series/M2

h. https://www.slavevoyages.org/assessment/estimates

i. https://www.amazon.com/Heroes-History-Civilization-Ancient-Modern/dp/0743235940#ace-4302123154

j. https://twitter.com/visualizevalue/status/1272736037673021441?s=21

l. https://www.visualcapitalist.com/20-trillion-of-u-s-debt-visualized-using-stacks-of-100-bills/

n. https://projects.britishmuseum.org/pdf/RP%20171-%200%20Prelims%20rev.pdf

o. https://projects.britishmuseum.org/pdf/RP%20171%20texts%201.pdf

p. https://projects.britishmuseum.org/pdf/RP%20171%20texts%202.pdf

q. https://projects.britishmuseum.org/pdf/RP%20171%20texts%203%20rev%20table.pdf

r. https://www.bdratings.org/sources/

s. https://libertyblitzkrieg.com/2020/02/18/financial-feudalism/

t. https://i.redd.it/nj6mbq1dtrz11.jpg

u. https://imrussia.org/en/nation/763-totalitarianism-and-freedom-of-speech