Lightning is the Better Way to HODL

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Lightning is the Better Way to HODL

By Roy Sheinfeld

Posted August 31, 2020

Bitcoin is revolutionizing the monetary system by decentralizing and democratizing it. Lightning is revolutionizing bitcoin transactions by making them faster and cheaper (I’ll never get tired of saying that) while preserving bitcoin’s openness, resistance to censorship, immutability, and decentralization. We must be moving in the right direction.

But there seems to be a contradiction. On the one hand, Lightning is mobilizing, liquifying, actualizing bitcoin. With Lightning, you can actually live on bitcoin and use it for day-to-day purchases. In the USA. In Europe. Probably everywhere.

On the other hand, HODLing is at a three-year high. Eight million bitcoin are static, immobile, in storage. That’s about 43% of the roughly 18.5 million bitcoin that have been mined so far. Nearly half of the world’s supply of the greatest cryptocurrency in existence is not liquid. A currency needs a current. It needs to flow.

I haven’t made it all the way through the _Encyclopedia of Philosophical Sciences_, but I’m pretty sure he was talking about HODLing on Lightning. Like 85% sure. (Wikimedia)

I haven’t made it all the way through the _Encyclopedia of Philosophical Sciences_, but I’m pretty sure he was talking about HODLing on Lightning. Like 85% sure. (Wikimedia)

Contradictions are crises of logic, and in every crisis lies opportunity. Hegel was the master in this particular discipline. He based his whole philosophy on the generative capacity that results when opposites meet. When Being encounters Nothing, the result is Becoming. “Truth is found neither in the thesis nor the antithesis, but in an emergent synthesis which reconciles the two.”

What if HODLing and Lightning can be reconciled? What if HODLers could store their bitcoin on Lightning? What if HODLing on Lightning is actually better for HODLers, better for bitcoin, and better for Lightning? If we combine these two awesome things, what can they become?

HODLing and HODLers

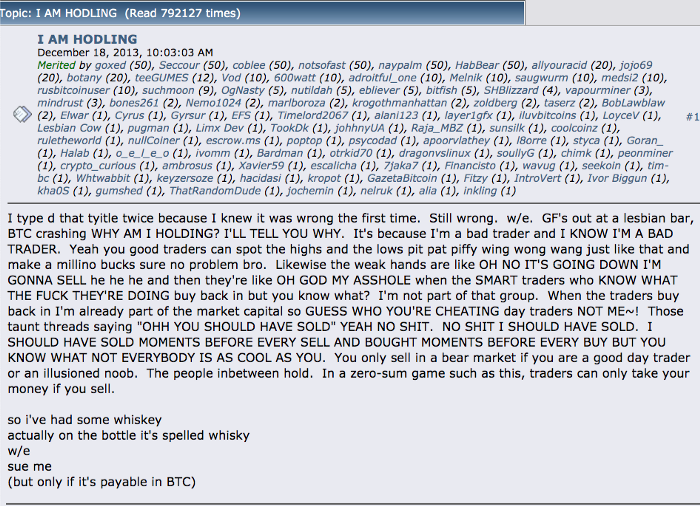

HODLing refers to the strategy of “holding on for dear life” and not selling your bitcoin, no matter what the market does. In fact, it’s more than a strategy; it’s an expression of love. HODLers stick to their bitcoin whatever fate brings.

And the relationship is mutual. Bitcoin needs HODLers too. When the bitcoin price falls, HODLers are its parachutes and its trampoline. Bitcoin could have died in the crib if the first generation of HODLers hadn’t seen its potential and made a commitment to the currency we all love. With every subsequent price dip, bitcoin has faced the risk of evaporation. If everybody sold their bitcoin, it would simply become worthless and join the list of dead coins. HODLers are those few, those happy few, who have the fortitude to stand by their bitcoin, come what may.

Who’s bold enough to draw the line between prophecy and madness? Not I. A thousand blessings be upon you, GameKyuubi.

Who’s bold enough to draw the line between prophecy and madness? Not I. A thousand blessings be upon you, GameKyuubi.

Why HODLing needs an upgrade

Conventional wisdom says that the best way to HODL is cold storage in one of the many digital or graphite/cellulose (i.e. pencil & paper) solutions available. The rationale is that each connection to the network is an attack vector, but HODLers don’t need the connectivity and exposure of a hot wallet, so they cut the cord. If you love something, lock it away from the world where nothing can touch or harm it. It’s a thoroughly understandable impulse.

But as a wise fellow once said, “A ship in harbor is safe, but that is not what ships are built for.” An idle crew doesn’t earn anything, and in time an idle ship’s hull will rot. Similarly, HODLing by shielding bitcoin from the world is suboptimal for HODLers and detrimental for bitcoin.

Caught between gains and custody

In the fiat world, earning returns from your money virtually always entails lending it to someone else. Borrowers either remit a portion of their profits to investors in the form of a dividend, or they pay lenders rent in the form of interest for borrowing their money.

The advantage of lending capital is that it can do useful, productive, profitable things in the world as long as the owner doesn’t actively need it. The major problem is that investors must sacrifice custody over their funds, which implies risk and trust.

The trustless and risk-free fiat financial plan is to store money in a sock under the mattress. Sadly, money in a sock does nobody any good. This strategy makes custody easy to determine, but that’s it. Understandably wanting to retain custody over their funds, HODLers tend to put their bitcoin into a digital sock under the mattress. In doing so, however, they forego the funds’ full potential to grow and they deny the world the productive potential of their capital.

Please don’t tell me that you’re going to take the fruit of the most powerful, dedicated computer network in history, and you’re going to put it in a sock. (Image: Marco Verch)

Please don’t tell me that you’re going to take the fruit of the most powerful, dedicated computer network in history, and you’re going to put it in a sock. (Image: Marco Verch)

A better way to HODL should provide HODLers with returns on their capital while preserving their custody over it.

Caught between the present and the future

Another way to think about this is that HODLers live in the future. Not only are they spending their fiat, which is currently fungible, on bitcoin, whose fungibility is still a work in progress, but they are also living in a future time when something like $350 trillion in fiat will have been replaced by a̶b̶o̶u̶t̶ exactly 21 million BTC. In a HODLer’s vision, their modest bitcoin reserves will have appreciated about 16.7 million times over. I get it.

However, HODLing locks up capital. It takes wealth that people have already worked hard to generate and does … nothing much with it. Meanwhile, the world could use that capital to research vaccines, build universities, and pump up its hash rate. HODLers are keeping the supply of bitcoin-based capital in the future, but the demand for the capital is in the present.

The word to describe something — a wine, an idea, a person, an asset — that displays future potential but whose current performance still disappoints is immature.

Maturity, of course, comes with experience. Just like new software or a new skill, assets need to be tested in the real world in order to determine what they’re worth. Bitcoin needs to engage with the present world in order to realize its future potential. An apple seed may one day grow into a tree that will feed a family, but not unless it is planted. For bitcoin to have real value, it needs to engage with the real world.

HODLers’ funds are no exception. They need a way to HODL that is secure, that preserves their custody, but that allows their capital realize its future value by engaging with the present world.

The future is often closer than you think, so stop dreaming and actualize it. (Image: Pikist)

The future is often closer than you think, so stop dreaming and actualize it. (Image: Pikist)

The benefits of HODLing on Lightning

Before I get into the technical details of HODLing on Lightning, let’s talk about the benefits. There’s no point in learning about how to do it before you’re convinced that it’s worthwhile in the first place.

What’s in it for bitcoin and the HODLers?

Anything that raises bitcoin’s value is good for HODLers. Their interests are the same.

So what is bitcoin and what does it need? First, the uncontroversial: bitcoin converts energy into immutable and scarce cryptographic units (i.e. blocks) on a dynamic ledger. That has no inherent value. And given the difficulty in exchanging bitcoin for anything useful, its momentary value is strictly conventional. The price has swung between effectively nothing and nearly $20 000 because that was the rough consensus of all market participants at the time. Nothing relevant changed about bitcoin between those values. Its value just swings like Michael Keaton’s career.

Okay, bitcoin never starred in Mr. Mom. Fair point. (Image: Alan Noah & James Brief)

Okay, bitcoin never starred in Mr. Mom. Fair point. (Image: Alan Noah & James Brief)

Now for the controversial: bitcoin is a currency. Many of us would argue that bitcoin is divisible, portable, durable, and limited in supply, which are the prerequisites for a currency. Others would argue more genetically than analytically, noting that Nakamoto originally called bitcoin “a peer-to-peer electronic cash system” right in the title.

Those who deny it is a currency also come in two camps. Some are sceptical of the bitcoin project entirely, but my time is too precious to argue with the chronically ignorant. Others resist thinking of bitcoin as a currency for instrumental reasons — it just doesn’t fit their strategy. In other words, currencies are liquid and they flow, but these resistors have committed to HODLing, the whole point of which is not to move bitcoin.

Again, I understand HODLers’ motives, and I sympathize. However, I suspect that their resistance to considering bitcoin a currency comes from a desire to defend HODLing and avoid the cognitive dissonance induced by never spending their currency.

But sheltering bitcoin from the real world is a self-defeating strategy. The more bitcoin is exchanged for sofas, legal services, and strawberry daiquiris, the wider the community of those agreeing on its value grows and the more their opinions about its value in diverse contexts will converge. Bitcoin’s value will become more practical and less speculative; more actual and less potential.

Importantly, as I explain below, HODLers can achieve this without spending their bitcoin or losing custody over it. Lightning lets people use their bitcoin in different ways, so bitcoin can function as a currency, gain value, and lose volatility, and HODLers will not have to spend their bitcoin or relinquish custody. Functioning as a currency is good for bitcoin, and what’s good for bitcoin is good for HODLers.

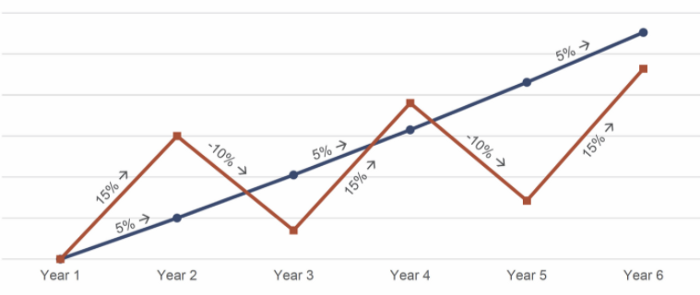

More growth with less volatility? Flatten all the curves!

More growth with less volatility? Flatten all the curves!

What’s in it for Lightning?

I’ve told you why HODLing on Lightning is good for HODLers. Do I also believe that onboarding HODLers would be good for Lightning? Of course I do. Here’s why.

Crucially, funds on Lightning don’t move unless users move them. Yes, users open payment channels to connect themselves with others, but the bitcoins in those payment channels do not enter joint custody. They reside at one end or the other of the channel, completely under the control of one user at a time. Payment channels are a secure storage medium.

To reiterate: every bitcoin on Lightning is only owned by one user at a time, and they cannot move unless their owner actively transfers them. In that sense, every Lightning user is already HODLing their balances until they spend a portion.

You don’t have to send or receive payments to be a part of the Lightning Network. It is possible to just HODL on Lightning. Not only is HODLing on Lightning possible, it’s already happening.

Routing nodes are the best way to HODL on Lightning, and they are crucial to how Lightning functions. As Lightning transactions move through the network, they hop privately from node to node until they’ve found their destination. A routing node simply accepts a payment from a previous waypoint and forwards the payment — minus a modest routing fee — to the next waypoint on the route.

Every step is backed by various layers of encryption pertaining to the route itself, the sender and the receiver, the private keys, etc. Lightning is 100% real bitcoin.

If Lightning were a network of roads, routing nodes would be its roundabouts. Without wanting to push the analogy too far, the incoming and outgoing connections — the nodes’ payment channels — are the roads feeding into and out of the roundabouts. Routing nodes/roundabouts increase the efficiency of the network by increasing the number and probably decreasing the length of possible routes between any two points.

The funds stored in a routing node’s payment channels are analogous to the lanes going around the roundabout. As above, more is better. And as more funds are stored on a node, it will be able to handle more and larger transactions.

However, a network that relies on just a few massive nodes will be vulnerable to all kinds of problems. Anyone who’s driven around the Place de Charles de Gaule in Paris or the magic roundabout in Swindon knows that centralizing traffic around a massive, central point makes life difficult for those in transit. Many smaller roundabouts, on the other hand, make travel faster and more efficient — just like a decentralized network with many routing nodes.

Centralization — what fun! (Image: GoMetro)

Centralization — what fun! (Image: GoMetro)

In short, routing nodes increase the network’s connectivity and liquidity while decreasing its centralization.

Forwarding funds through routing nodes is also a service, which generates fees — just like tolls in a road network. At the moment, those fees are modest, and the volumes are still growing. Their growth, however, depends on the penetration and utility of the Lightning Network. As HODLers help to build Lightning with routing nodes, Lightning will help to build their bitcoin reserves with routing fees.

By running routing nodes, HODLers can increase Lightning’s capacity, increase bitcoin’s fungibility, grow their investments, and give the world the benefits of access to their capital without ever losing custody over it. Lightning gives HODLers returns and custody, utility in the present and value in the future.

This is the awesome synthesis I was talking about.

How to set up a routing node and become the best HODLer you can be

Okay, so HODLing on Lightning means setting up a routing node. It’s more technically demanding than installing Breez, but even enthusiastic n00bs could probably tackle it. There are also three different paths to get started, depending on the time and budget available:

- The first method is to set up a Lightning node on a device at home . The benefits are low cost and full control. The hardware requirements are relatively modest, and the required software is free and open-source. The disadvantages are the technical difficulty, inevitable maintenance, and the drain on resources. This method requires you to configure the software yourself and poke around in the code a bit. It will also take around 250 GB and processing power. And a few more steps than what are listed in those instructions will be required to move your bitcoin onto your node and open payment channels.

- Buy pre-configured hardware. There are several hardware products that deliver a functioning Bitcoin node with either LND or c-lightning pre-installed. The advantage of these products is that someone else has already configured the software and intends to update it, and they won’t sap the resources of your other machine(s). The disadvantage is the cost. You’re looking at a few hundred dollars across the board, though many can be constructed on a DIY basis at less cost and more difficulty.

- There is also a cloud-based node solution, which was introduced just a couple of months ago. They claim to provide non-custodial, fully functional, low-configuration Lightning nodes hosted on their servers, but with full user control. The advantage: that all sounds pretty good. The disadvantage: the service is not yet live, so it’s too early to comment on their reliability, security, cost, etc. But it’s definitely worth watching.

Ready to go full LSP?

At Breez, we’ve introduced the concept of LSPs, which are basically just routing nodes that actively and intentionally connect end users to the network. Whereas a routing node is a more passive operation, an LSP requires more active management. Attracting users generates more returns, but it also requires publicity, responding to user queries, and so on.

LSPs also require more capital. One bitcoin on a routing node is probably enough to make a meaningful contribution to the network and become a HODLer o̶f̶ ̶t̶h̶e̶ ̶f̶u̶t̶u̶r̶e̶ of the present. A viable LSP requires … well … more. How much depends on the services provided, the user base, and other factors.

However, the network needs LSPs, and the Lightning economy certainly does, so it’s a worthwhile pursuit. We’re proving that it can be done, and we’d be happy to help others get started. Just ask.

HODL for you, HODL for bitcoin, HODL for (and on!) Lightning

Lightning lets HODLers grow their capital without losing custody. They get to help the world adopt bitcoin while getting richer in the process. Bitcoin becomes real money in the present, and its future growth becomes more stable and more certain.

There is no contradiction between Lightning and HODLing. Combining them improves each. Thanks Hegel!

Before closing, we have to mention a couple of potential snags. First, getting set up costs some money. Every potential return requires an initial investment. Second, bitcoin stored in Lightning channels is as safe as the system running the client or node, but it cannot be as secure as an air-gapped, cold-storage device. Lightning channels are effectively “hot wallets,” and a routing node must be online with multiple connections to the network in order to function. These are attack vectors. HODLing bitcoin as capital on Lightning allows it to grow and strengthen the currency while preserving custody, but it will have contact with the wider world.

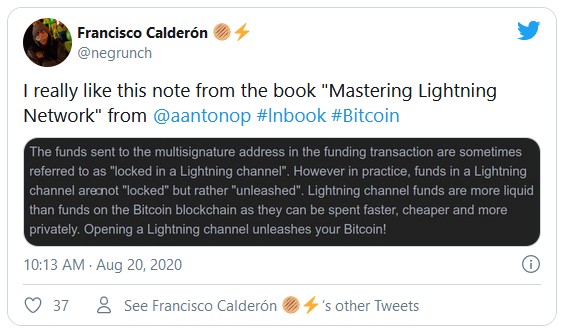

And attentive readers might have noticed that we never refer to bitcoin as “locked” in a payment channel. Instead, we say “stored,” which implies less constraint and more liquidity. We’d like to thank Andreas Antonopoulos and Franceso Calderòn for the mind-expanding reformulation:

I’ll drink to that. Cheers. 🍻