Is Bitcoin the world’s safest reserve asset?

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Is Bitcoin the world’s safest reserve asset?

By Thibaud Marechal on [Knox] Custody](https://blog.knoxcustody.com/)

Posted August 14, 2020

Bitcoin • Aug 14, 2020

NASDAQ-listed MicroStrategy’s opening gambit says so.

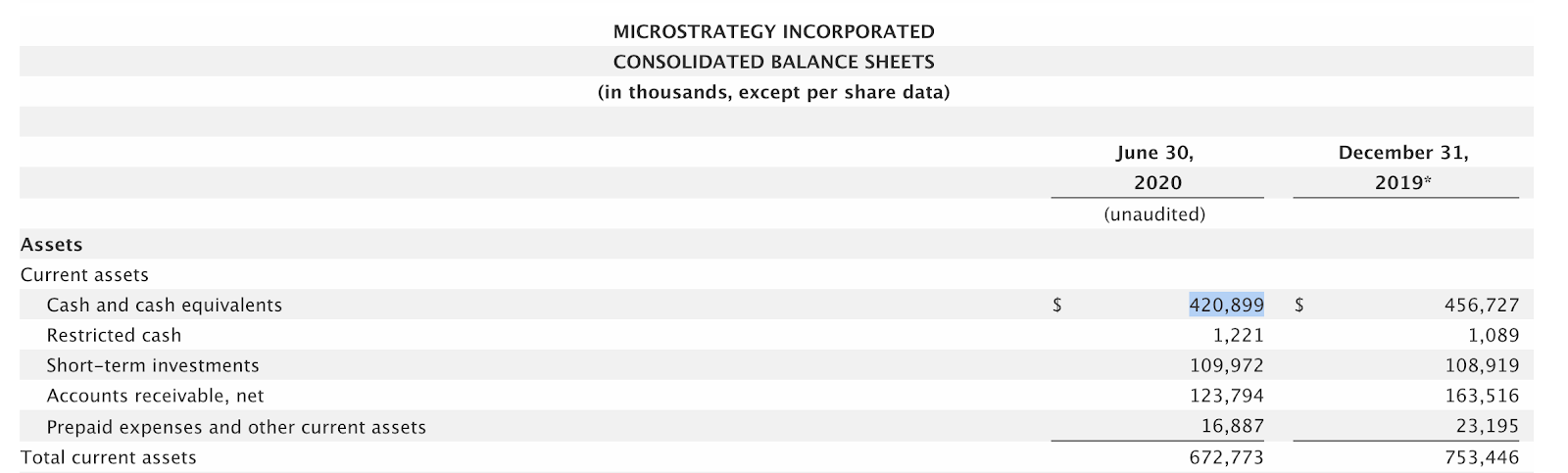

August 11th, 2020 marked Bitcoin as a corporate treasury asset on Wall Street. The public $1.2 billion business intelligence software company, MicroStrategy, announced that it bought 21,454 BTC, converting $250 million of their cash treasury. It is the first mainstream public corporation to announce Bitcoin holdings at this scale. In this article, we will attempt to analyze what this means for corporate treasury, public company valuations and indirect institutional participation in Bitcoin.

MicroStrategy’s move snapped up 0.1% of Bitcoin’s fixed supply of 21 million units, accounting for 50% of their excess cash reserves in a novel capital allocation strategy. Given the finite pool, such a material grab of bitcoin could only be accomplished by 978 companies before the supply technically “runs out”, though in practice a large chunk of extant supply is not even for sale.

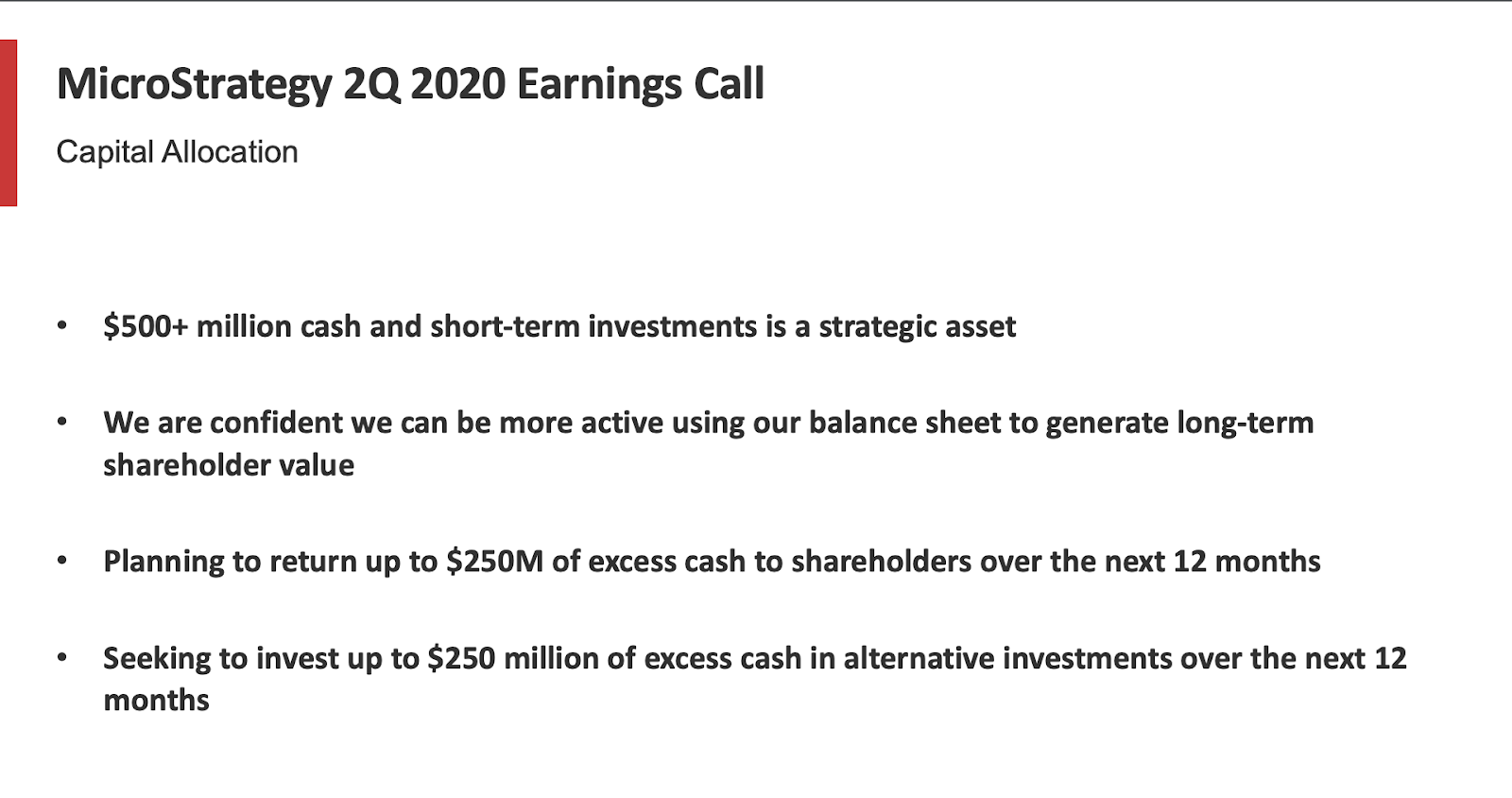

During their second quarter earnings call in late July 2020, Michael Saylor, CEO of MicroStrategy, announced his intention to explore purchasing Bitcoin, gold or other alternative assets. During the Covid-19 recession, MicroStrategy saw its cash, cash equivalents and short-term investments grow to over $500 million, with only $50 million needed to cover operational expenditures for the year, leaving the company with extra cash on hand.

MicroStrategy’s 2Q 2020 Earnings Call

MicroStrategy’s 2Q 2020 Earnings Call

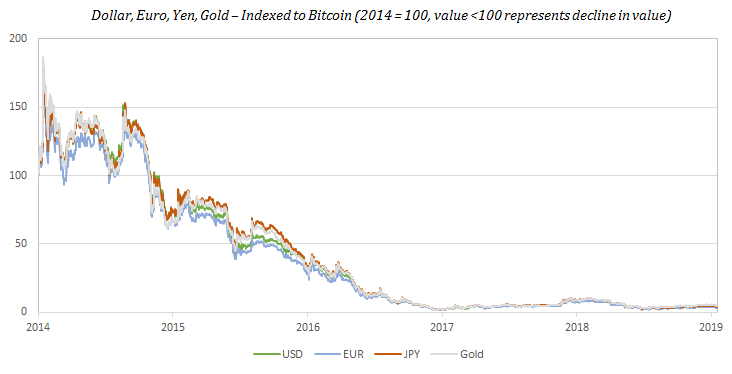

While initially hinting at a broader portfolio of alternative assets, the full allocation targeted only one of the assets previously mentioned: Bitcoin. All-in. The argument was built around the potential for the deterioration of real value in fiat currencies, and a belief that Bitcoin represents a safer store of value than other alternatives. These concerns were explained in the announcement MicroStrategy released earlier this week, expanding on the rationale behind exclusively purchasing bitcoin as part of their new capital allocation strategy, which seeks to support their fiduciary obligations to maximize long-term value creation for their shareholders.

“MicroStrategy spent months deliberating to determine our capital allocation strategy. Our decision to invest in Bitcoin at this time was driven in part by a confluence of macro factors affecting the economic and business landscape that we believe is creating long-term risks for our corporate treasury program ― risks that should be addressed proactively,”

Is this capital allocation into Bitcoin signaling the emergence of a novel trend in corporate treasury programs? Should CFOs and executive teams of other publicly-listed firms reconsider their allocation plans for their excess cash reserves? How exposed are the aggregate cash holdings of businesses to currency debasement and other global macro risks? What does Bitcoin as a corporate reserve asset mean for Wall Street’s balance sheets and cash flow modelling?

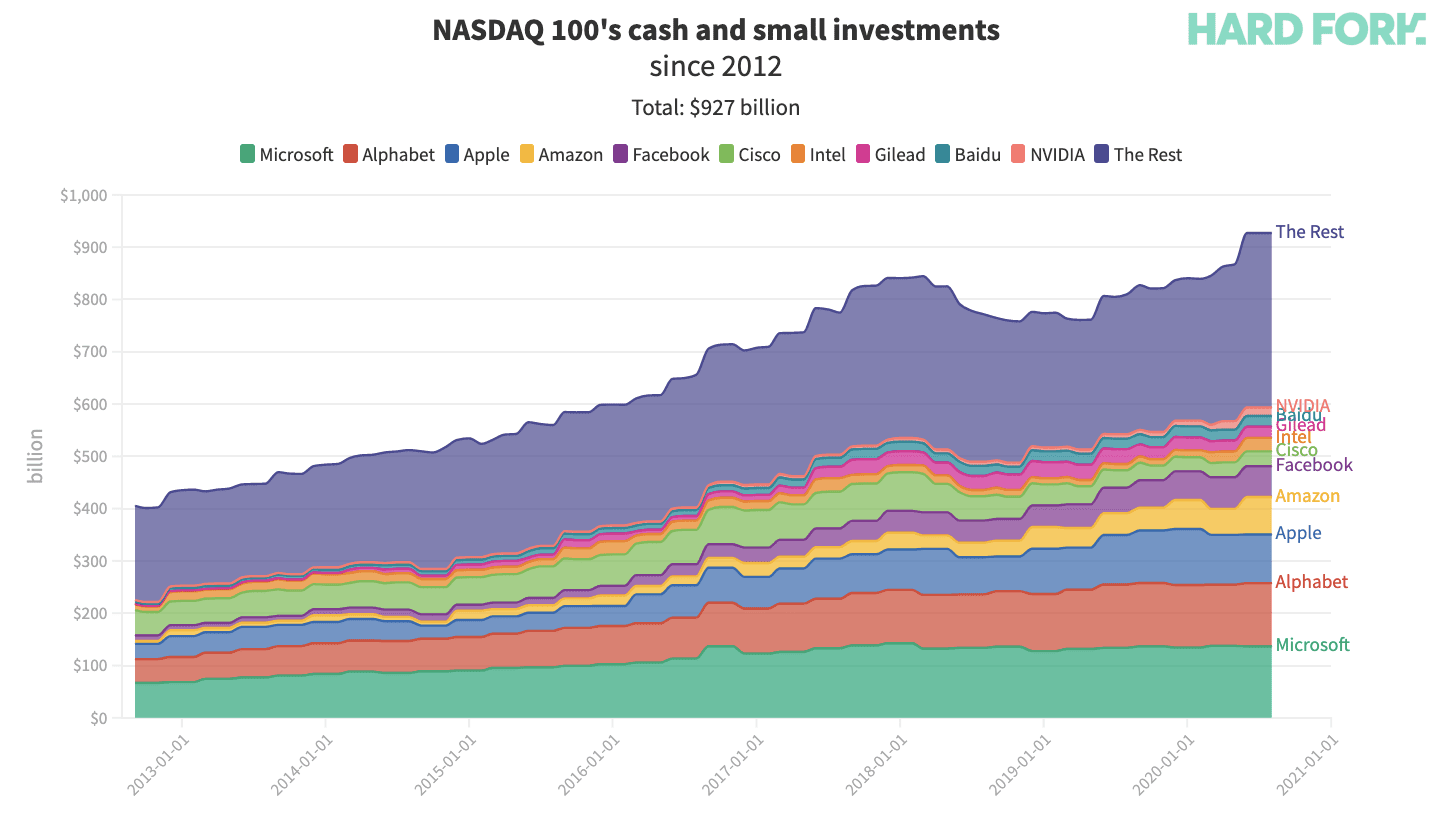

A glut of cash is being hoarded

Now that Bitcoin has been adopted as a primary reserve asset by MicroStrategy, a well-capitalized NASDAQ-listed firm, other companies will be forced to sit up and take notice. Amid the recent economic downturn driven by globalized lockdowns and supply chain disruptions in the first half of 2020, companies slowed down their investment programs, reduced costs, and raised cash reserves to adjust to the economic uncertainty. The companies comprising the Nasdaq 100, the index of the 100 largest non-financial companies traded on the Nasdaq stock market, are now sitting on nearly $1 trillion in cash. US tech moguls like Microsoft, Google and Apple are accumulating more cash than ever. Despite sitting on $121 billion of cash and cash equivalents, Alphabet, Google’s parent company, raised $10 billion issuing its most affordable bonds ever recorded. Collectively, since 2012, the Nasdaq 100 went from holding $405 billion to just shy of $1 trillion in cash reserves.

NASDAQ 100 sits on nearly $1T in cash

NASDAQ 100 sits on nearly $1T in cash

Global stimulus is hurting cash

Near-zero interest rates pulled down the cost of capital, acting as a favorable ingredient for an $840 million surge in corporate debt financing in the first half of 2020 alone, while monetary expansion is adding to the global stimulus programs that were triggered earlier in March, as a result of the response to the Covid outbreak. Business operators liquidating assets and cutting costs to manage operational risk end up raising their excess cash reserves, but now must also ensure these reserves are not excessively devalued in the face of aggressive quantitative easing programs.

“Macro factors include, among other things, the economic and public health crisis precipitated by COVID-19, unprecedented government financial stimulus measures including quantitative easing adopted around the world, and global political and economic uncertainty. We believe that, together, these and other factors may well have a significant depreciating effect on the long-term real value of fiat currencies and many other conventional asset types, including many of the assets traditionally held as part of corporate treasury operations.”

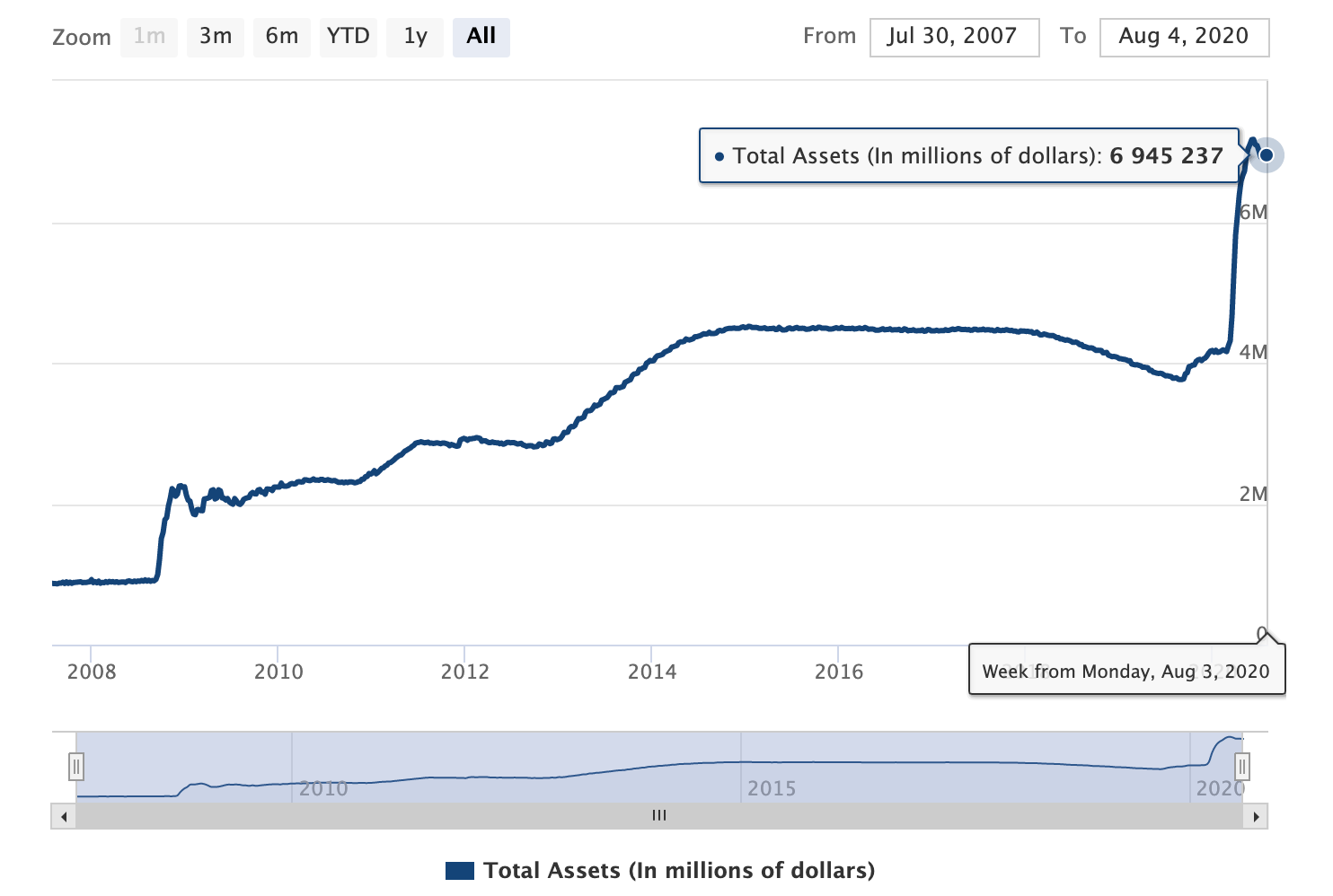

Led by the US Federal Reserve and supported by other central banks, global QE asset purchases in 2020 alone are set to hit a staggering $6 trillion, more than half the cumulative global QE seen between 2009 and 2018. While equities have been soaring with new liquidity injections via corporate debt purchasing programs, the US Federal Reserve now holds almost $7 trillion of assets on its balance sheet, an astounding rise of around 72% in less than 3 months, according to The St. Louis Fed.

Credit and Liquidity Programs and the Balance Sheet

Credit and Liquidity Programs and the Balance Sheet

As demonstrated by MicroStrategy’s move, monetary expansion at this scale is triggering even large publicly listed companies to reconsider the long-term real value of existing cash reserves, as the supply of fiat currencies are inflated away to prevent generalized deleveraging events, and drastic market sell-offs. While the dollar may not see inflation right away given its dominant global reserve currency status, some firms such as MicroStrategy are noticing and taking preventive measures to protect their balance sheets and to manage long-term risk for their shareholders. The evolution of capital allocation strategies is now favoring assets that are not trivially debasable to guard against currency devaluation risks.

Bitcoinization of corporate treasury

Treasury operations generally include the management of a firm’s cash holdings, with the ultimate goal of managing the enterprise’s liquidity and mitigating operational and financial risks. Based on the size of the firm and its activities, such operations may include holding positions in a variety of fiat currencies, trading bonds or using financial derivatives. It is an essential activity of any company, especially for listed entities who have a duty to publicly disclose their financial health to the markets.

A good and reliable holding in a corporate treasury should be dependable over the long term whether it be for price stability, liquidity or long term value creation for shareholders. MicroStrategy’s decision to hold bitcoin as a primary reserve asset is a market signal that Nakamoto’s digital cash is gradually being adopted for its sound properties by responsible institutions.

“This investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash. Since its inception over a decade ago, Bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions. MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy.”

Fiduciaries need Bitcoin

Senior management executives or CFOs managing corporate treasury programs may be in breach of their fiduciary duty if due diligence and adequate capital allocation strategies are not developed for bitcoin. As a public company, MicroStrategy’s move effectively “removed career risk for CFOs from putting company treasury into Bitcoin”. Andy Yee, Senior Director of Public Policy at Visa pointed out that this allocation is similar to hedge fund billionaire Paul Tudor Jones’s letter about his recent 1–2% allocation into bitcoin as part of his portfolio.

Paul Tudor Jones removed career risk for hedge fund managers from investing in Bitcoin.

MicroStrategy removed career risk for CFOs from putting company treasury into Bitcoin.#Bitcoin #crypto— Andy Yee (@ahkyee) August 11, 2020

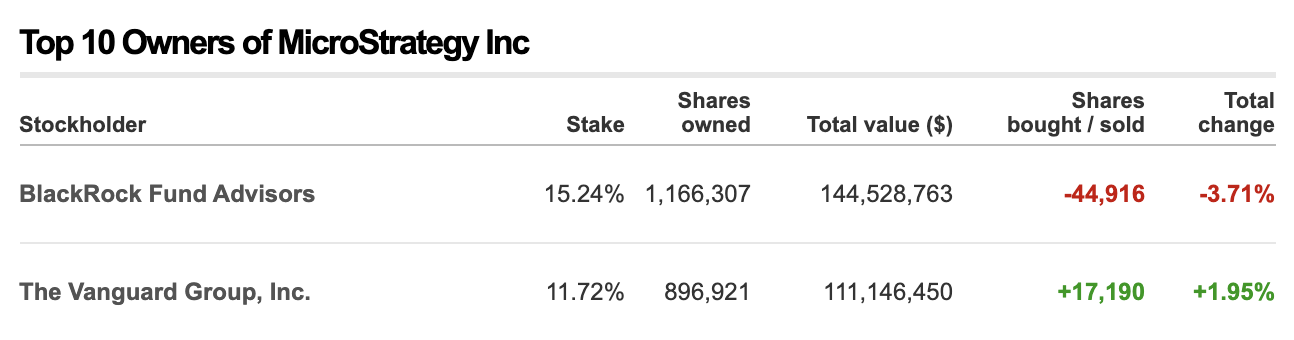

MicroStrategy’s ownership structure is mostly institutional, which accounts for 466 firms representing 97% of total shares. BlackRock and Vanguard, two leading institutional fund and wealth managers, holding $7.43 trillion and $6.2 trillion of assets under management respectively, comprise more than 25% of MicroStrategy’s capitalization table, as surfaced by Swan Bitcoin, a US Bitcoin brokerage service. Both institutional participants now have an indirect exposure to bitcoin, which will incentivize them to perform extensive due diligence and research on Bitcoin. Being shareholders of a multitude of other public companies, these institutional investors regularly assess the health of their portfolio, comparing industry benchmarks, cash flow modeling and competitors’ use of capital in production among other things. Bitcoin is now part of the equation.

MicroStrategy Inc - Ownership Structure

MicroStrategy Inc - Ownership Structure

Bitcoin is no one else’s liability

One obvious question comes to mind: what happens if MicroStrategy’s bitcoin holdings appreciate substantially in the coming years? How does management handle this exposure and decide to rebalance their risk? As bitcoin’s purchasing power rises, it could act as major leverage for MicroStrategy’s future capital deployments when it comes to entering others markets, launching new products or even acquiring competitors. As Preston Pysh, host of the Investors Podcast suggested, the practice of companies holding bitcoin on their balance sheet is just getting started. MicroStrategy investing $250 million from close to $420 million of cash reserves into bitcoin is the beginning of a new era in corporate treasury.

MicroStrategy Incorporated - Consolidated Balance Sheets

MicroStrategy Incorporated - Consolidated Balance Sheets

More than an inflation hedge, holding bitcoin may become a capital-efficient way to strengthen corporate balance sheets in times of financial turmoil when income flows lessen. As bitcoin holdings inflate unrealized gains for corporate owners, it may be used as a source of liquidity to service operational expenditures and stay afloat while other competitors suffer from bad economic conditions and over-leveraged balance sheets. The massive rise in US corporate debt from $3.3 trillion to $6.5 trillion, combined with the most brutal decline in consumer spending ever experienced in the US will prove very profitable for companies holding bitcoin and seeking acquisitions of distressed competitors. The competitive landscape may be completely reshaped by Bitcoin in the next decade, proving that balance sheet resilience is worth more than efficiency and cheap leverage.

Strikingly, MicroStrategy’s board of directors has five members acting as fiduciaries for an institutional-centric shareholder base. Responsible for capital allocation strategies and long term value creation, the board elected bitcoin as the desired primary reserve asset for the company’s treasury, allowing MicroStrategy to become an indirect vehicle for public bitcoin price exposure. If bitcoin appreciates in the coming years, MicroStrategy’s stocks may rise substantially, as Wall Street’s equities investing is already established and seeking diversified yield. At what point does MicroStrategy become a Bitcoin ETF, rather than a software firm? If Bitcoin rises, is management under pressure to execute regular treasury rebalancing? Is it their duty to seek the dollar profits or hold onto unrealized gains for future leverage? These remain open questions that MicroStrategy’s management team will have to sort out for their shareholders.

The rise of a new numeraire

As part of an inescapable Monetary Darwinism, CFOs and executive teams will gradually, then suddenly add bitcoin to their books in an effort to protect their cash reserves for productive use later on. MicroStrategy’s CEO tweeted back in 2013 that “Bitcoin days are numbered”. Some seven years later, MicroStrategy has now moved $250 million or around 50% of its cash treasuries into it. Eventually, everyone will understand the monetary evolution that Bitcoin brings. For most it will take time, and the revisiting of pre-established yet obsolete mental models. Michael Saylor should be commended for updating his views, and it is likely his peers will soon follow suit.

Appearing as a de facto hedge against inflation with its inalterable scarcity, bitcoin can also be understood as a high-return investable asset. Companies in the future could even decide to denominate their operating margins and returns on investment using bitcoin, not dollars or other inflation-based fiat currency. Holding bitcoin in corporate treasury accounts may become a standard for all Wall Street tickers. As bitcoin obsoletes all other money and its value appreciates over time, bitcoin capital deployment to resources for production will become more conservative. Simply holding bitcoin for long term price appreciation is resetting the importance of opportunity cost in the economic calculus to plan for resource allocation in the production cycle for most companies.

Once it reaches a certain monetary base and purchasing power stability, corporate returns may have to be denominated in bitcoin, not dollars or any other fiat currency. As Preston Pysh highlighted on Stephan Livera’s podcast, Bitcoin could become the default global numeraire—a benchmark item in comparing the value of similar products or financial instruments. Cash flow and treasury denomination in bitcoin will change how companies such as MicroStrategy shape their capital allocation strategies in the long term, turning bitcoin into a unit of account, its ultimate monetization tipping point leading to sustained global deflation—the root of an abundant future.

Unchained Capital Blog - Gradually, Then Suddenly

Unchained Capital Blog - Gradually, Then Suddenly

Zooming out, it remains to be seen what will happen if and when other companies decide to update their capital allocation strategies to include bitcoin as part of their corporate treasury programs. Should they invest 1%, 5% or 50% of their excess cash reserves walking in MicroStrategy’s footsteps? One thing is certain: this target number should no longer be zero. Management teams of public companies have a fiduciary duty to their shareholders, and must get off zero, a meme popularized by Partner of institutional fund Morgan Creek Digital, Anthony Pompliano.

Pragmatic risk management

Short term, a slew of additional questions emerge around the custody of bitcoin holdings for listed companies that are not specialized in managing private keys, including the internal controls and governance model that must be adopted by management teams. Should they be using trusted custodians such as Knox or Fidelity, or should the fund administrators be holding keys in sovereign collaborative multisig quorums such as Unchained Capital? What about a hybrid custody model? From their SEC filings on August 11, 2020, it appears that MicroStrategy’s bitcoin holdings are currently held at various custodians, with the absence of insurance clearly presented as an unmitigated risk:

“While we hold the bulk of our BTC assets with established cryptocurrency custodians, a successful security breach or cyberattack could result in a partial or total loss of our BTC assets in a manner that may not be covered by insurance or indemnity provisions of our custody agreements with those custodians. Such a loss could have a material adverse effect on our financial condition and results of operations.”

Considering how much time we at Knox spend managing Bitcoin custodial systems with comprehensive insurance coverage, this has become another interesting area to watch. Our own questions include wondering if auditors and securities regulators may demand that NASDAQ-listed companies such as MicroStrategy’s holdings be protected by full insurance coverage, which has been historically difficult to obtain for the first wave of mainstream Bitcoin custodians. We believe that fiduciaries, executives and the management teams of listed companies will continue having to think through all risks present in allocating to bitcoin, whether it be limiting onerous costs such as execution slippage when building large bitcoin treasury positions, or attaining adequate insurance coverage for their long-term holdings.

Towards deflation-based markets

After over a decade of successful block production, 99.98% uptime, appreciating value, community growth, infrastructure build-out, and deepening liquidity, Bitcoin can no longer be ignored. Michael Saylor’s Bitcoin dismissal in 2013 juxtaposed against MicroStrategy’s attitude today speaks volumes. “MicroStrategy’s investment thesis on Bitcoin as a store of value is spot on. Across all other assets, Bitcoin matches all the properties of being a treasury asset that a company can allocate cash into to preserve its future buying power in an environment of easy money. Now, since it has made the first move, the game of musical chairs for corporations buying bitcoin is officially on,” mentioned Louis Liu, CIO at Mimesis Capital, a single-family office that focuses on wealth preservation through Bitcoin.

Overall this news is undeniably bullish for Bitcoin’s scarce information space, considering bitcoin’s stock-to-flow ratio strengthened to over 50 during last May’s halving event, and is catching up to gold’s S2F of 60. With all the documentation made available openly on the Internet, will CFOs and finance executive teams still be able to meet their fiduciary obligations if they don’t hold bitcoin in their corporate treasury within the next 10 years? Bitcoin price appreciation will also be a direct result of this new adoption if companies start allocating their treasuries into bitcoin, though one may wonder if other traditional asset classes can depreciate from corporate treasury divestments. Once bitcoin gets adopted by most companies, a global and sustained deflationary future may await us, allowing responsible capital allocators to invest soundly accumulated capital for truly productive uses, as popularized by Jeff Booth, author of The Price of Tomorrow.

We may look back on this move in years and see it as a historical moment for Bitcoin.