WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the September 2020 Journal PDF Donate & Download the September 2020 Journal ePUB

Once Inflation Starts, It Won’t Be Contained

By Gael Sanchez Smith

Posted June 12, 2020

Introduction

The mainstream media has spent decades underplaying the risks of inflation, claiming that deflation is the most perilous thing that could ever happen in an economy. Amazingly, their propaganda has succeeded and most people have come to accept the ludicrous notion that falling prices of goods and services are an economic problem— for a detailed analysis of the fallacies of deflation see Jeff Booth’s, The Price of Tomorrow. Even today, as central banks around the world implement ever more unorthodox monetary policies such as asset purchases and negative interest rates, the public remains largely oblivious of the risks of inflation.

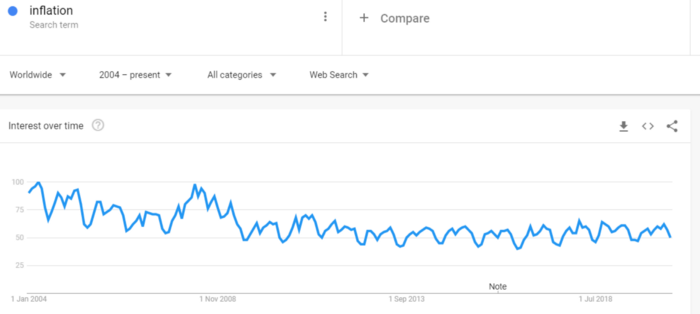

Searches for Inflation Worldwide

Searches for Inflation Worldwide

This article isn’t an attempt to forecast the exact set of circumstances that might give rise to inflation. Instead, it argues that the chief belief that gives fiat money value — namely, the expectation that central banks are capable and willing to preserve their currency’s purchasing power — is unwarranted. In the event of inflation, central banks won’t be able to preserve the value of fiat money for three reasons: The high level of private debt, the high level of public debt and the precariousness of central bank’s balance sheet.

Markets are forward looking, hence, as people come to realize that central banks can’t preserve the purchasing power of their currencies, we should expect a repudiation of State liabilities — fiat money and government bonds — and a move towards hyperbitcoinization.

The Value of Fiat Money

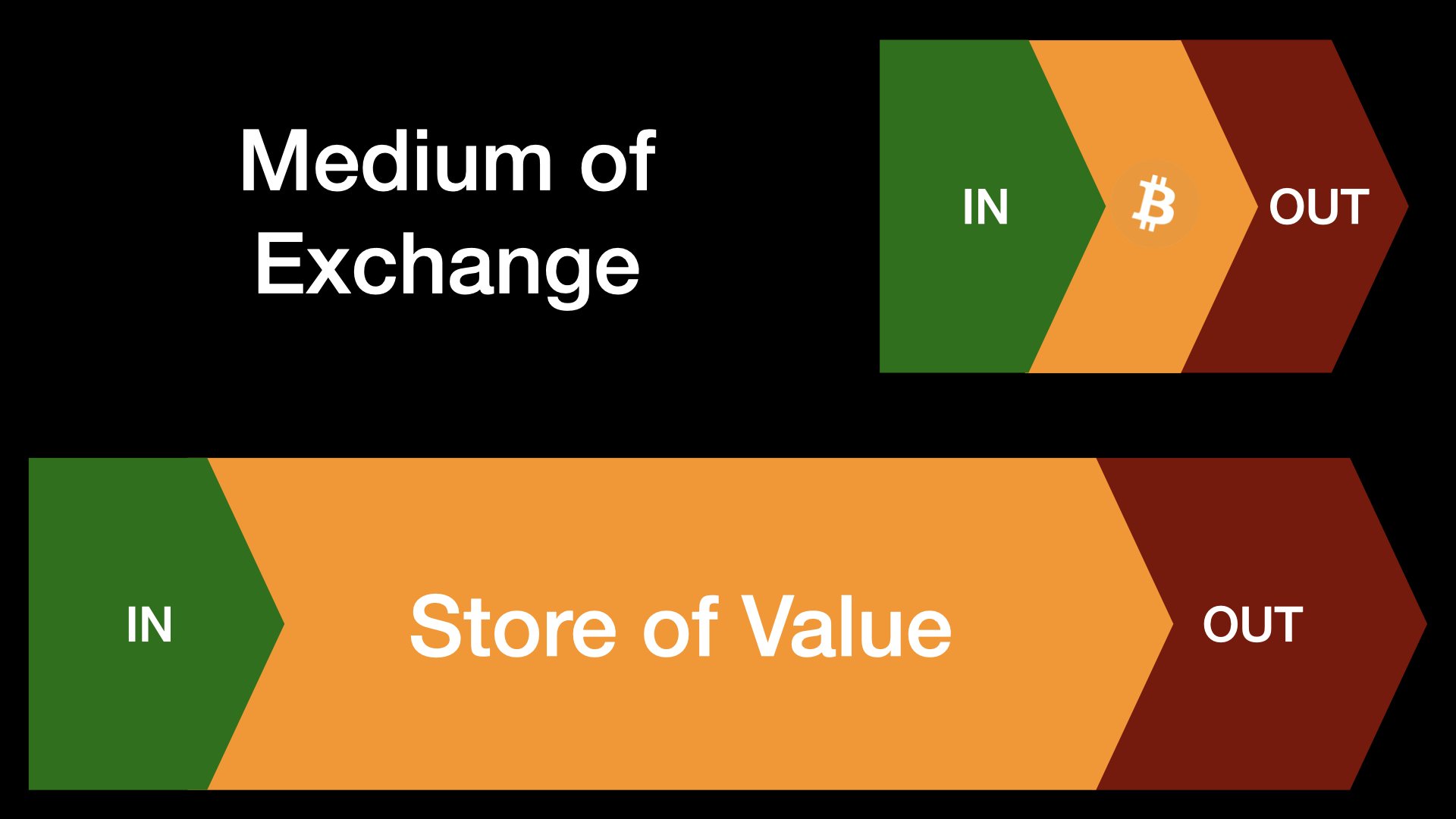

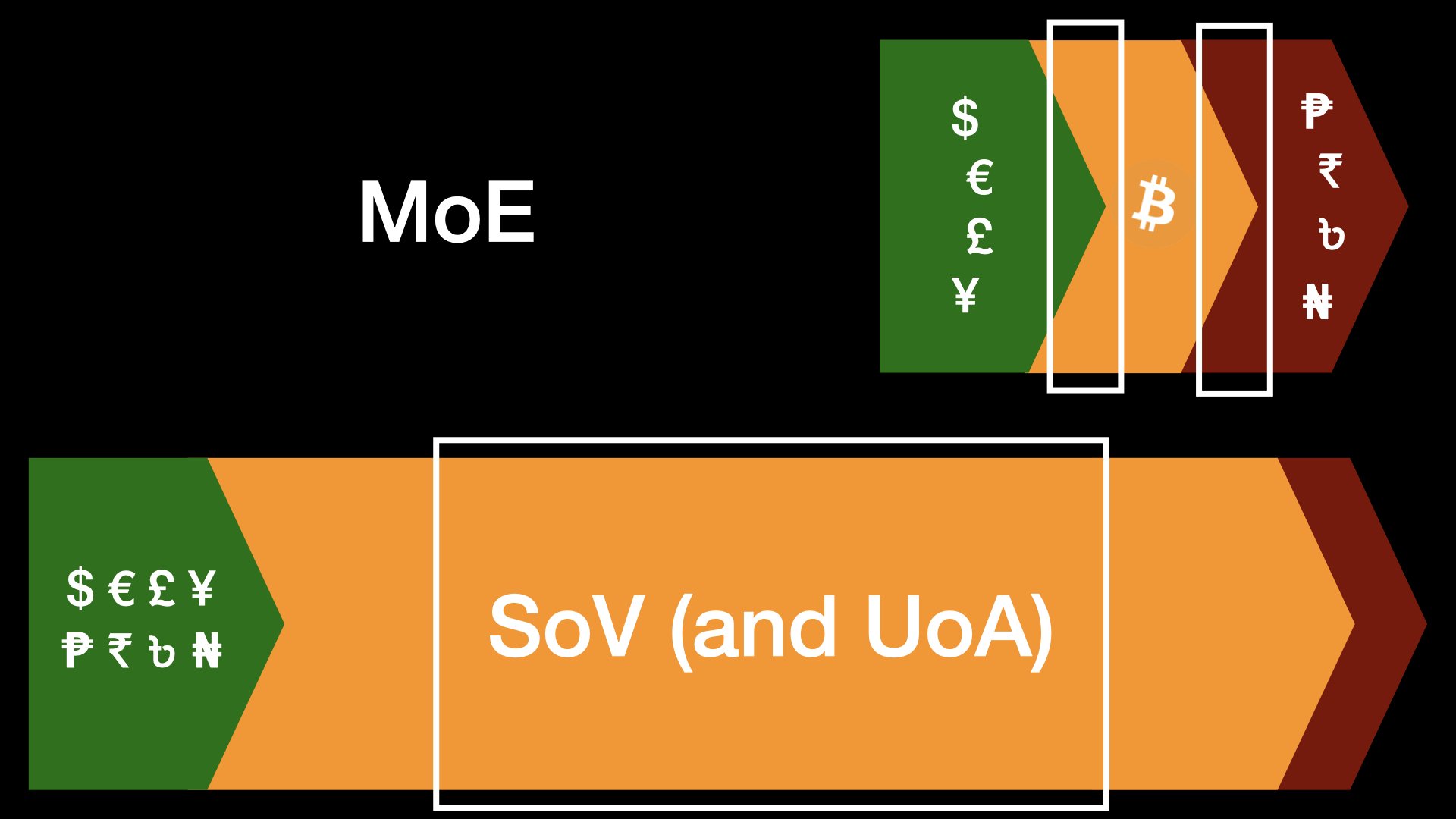

Fiat currencies are financial assets, more specifically they are liabilities issued by a nation’s central bank which we demand for three reasons:

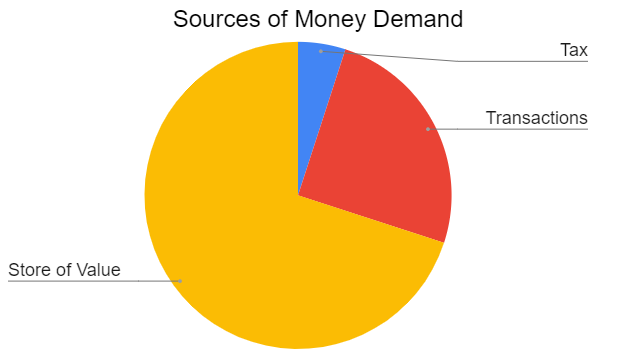

- Tax Demand: The government mandates taxes be paid in the national currency. This is the smallest component of the total demand since it only exerts itself once a year.

- Store of Value (SOV) Demand: Fiat money is used as a highly liquid asset that promise to preserve its purchasing power — i.e. a store of value. This is the largest component of total demand and it is contingent upon the currency‘s price stability.

- Transaction Demand: We use fiat money as a medium of exchange to conduct commercial and private transactions. Transaction demand is closely tied to SOV demand; if the currency doesn’t have stable purchasing power, merchants will apply a high discount rate or will demand a more stable currency.

Illustration:Sources of Money Demand, Gael Sánchez Smith

Illustration:Sources of Money Demand, Gael Sánchez Smith

Chartalists mistakenly believe that the obligation to pay taxes a alone makes fiat money valuable. Of course, there is always a minimum level of Tax Demand since failure to comply with tax laws results in imprisonment, but most of money’s demand is derived from its use as a medium of exchange and a store of value. Consequently, the monetary powers of the State are much more limited than what Chartalists profess; a government can mandate taxes be paid in the national currency but it cannot impose its use as a store of value or a medium of exchange.

In other words, money is always and everywhere a market phenomenon. If a currency starts depreciating at a high rate, SOV demand will collapse and it won’t be used as a medium of exchange regardless of what the State decrees. We can see this reality play out today in countries like Argentina or Venezuela where, even though taxes are collected in the national currency, most transactions are conducted in dollars and value is stored in dollars, Bicoin, or gold.

The value of fiat money, like any other asset, depends not only of its demand but also of its supply. Central banks are very aware that if the supply of money exceeds its demand significantly, the currency will depreciate and its SOV demand will disappear. Hence, they present themselves as independent institutions that are are committed to fighting inflation and divorcing the supply of money from the governments financial needs. In the real world, central banks target 2% inflation and often collude with the government, but functioning monetary territories like Europe, Japan, or the U.S. have until now, shown sufficient restraint from printing their currencies to oblivion.

Central banks influence the supply of money by manipulating the interest rate: When they wish to increase supply, they lower the interest rate and when they wish to reduce the supply, the interest rate is increased (Stefanie von Jan explains the process in further detail here). If the supply of money increases above its demand or if demand falls below its supply (for example due to a loss of trust in the issuer) the currency will depreciate, its discount rate will spike — e.g. workers will sell their labor for 20 $ instead of 10$ in anticipation of inflation — and the Store of Value demand will fall creating an inflationary spiral. In this scenario, it is imperative that the central bank intervenes in order to stabilize the value of the currency and recover its SOV demand. If the central bank were unable or chose not to intervene, the self enforcing depreciation would lead to a vicious cycle of high inflation that ends with the currency’s repudiation.

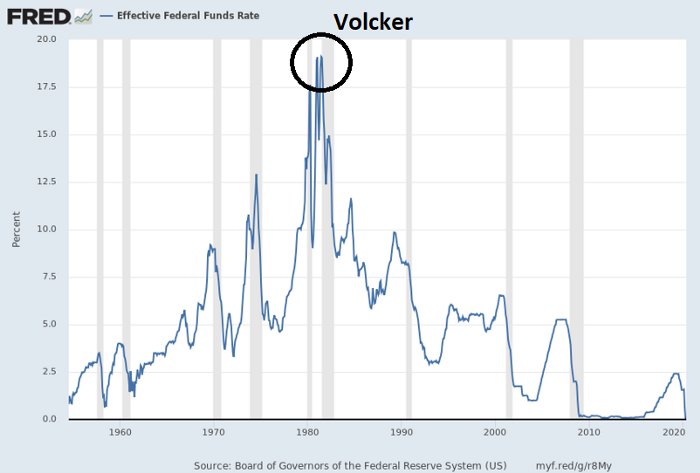

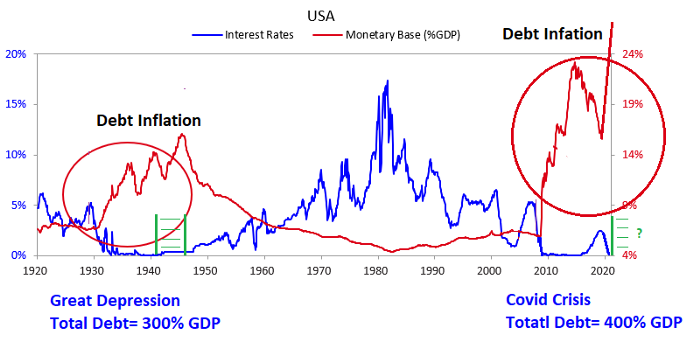

The last time there was an inflationary cycle in the United States was after Nixon closed the gold window in 1971. After 10 years of rampant inflation, Fed Chairman Paul Volcker was forced to raise the interest rate to 20% in order to stabilize the dollar’s purchasing power.

U.S. Effective Federal Funds Rate, Chart Source: FRED

U.S. Effective Federal Funds Rate, Chart Source: FRED

In conclusion, the value of fiat money depends of changes in its supply and its demand. The largest component of fiat currency’s demand is the Store of Value function, if a currency stops acting as a store of value — it starts depreciating — demand falls further and the central bank must intervene in order to reduce the supply and stabilize the currency’s purchasing power. In this regard, the expectation that the central bank will be willing and able to adjust the supply of money in the event of inflation is key to maintaining a currency’s SOV demand. Markets are forward looking, if individuals anticipate the currency will depreciate, they will sell it today. In other words, in order for fiat money to maintain its value, the market must believe that in the event of inflation, central banks are capable and committed to preserving the purchasing power of their currency.

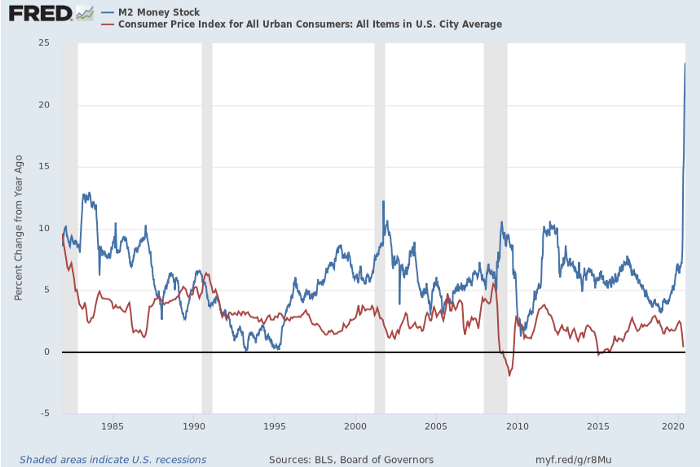

At present, the money supply in the U.S is increasing dramatically: M2 money supply — which includes money in the form of bank cash, bank deposits, and easily convertible near money — is growing at 24% per anum, its highest rate in recorded history, but inflation hasn’t increased in a meaningful manner.

U.S. Yearly Percentage Change M2 Money Supply (blue) & Inflation (Red)

U.S. Yearly Percentage Change M2 Money Supply (blue) & Inflation (Red)

This can be explained because the increase in currency supply has gone hand-in-hand with higher demand for money due to social distancing, uncertainty surrounding the Covid-19 crisis and debt repayments. The absence of inflation also tells us the market is expecting that if in the future, the increase in the money supply leads to inflation, the Fed will be able to raise interest rates in order to stabilize the dollar’s purchasing power.

In this article I argue that the market’s expectations are misplaced; the belief that the Fed can preserve the value of the dollar in the event of rising inflation is unwarranted for three reasons: Firstly, the high debt and leverage in the private sector would make it impossible to raise interest rates without unleashing a depression and a financial crisis. Secondly, balancing the budget in light of the high deficits and public sector debt would require austerity which would lead to social and inter-generational conflicts. Thirdly, the act of raising rates would render the Fed insolvent due to its high leverage and iliquidity.

1- Private Debt

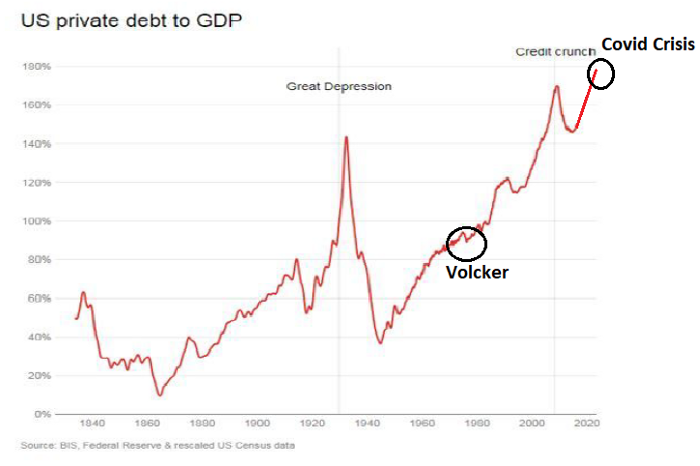

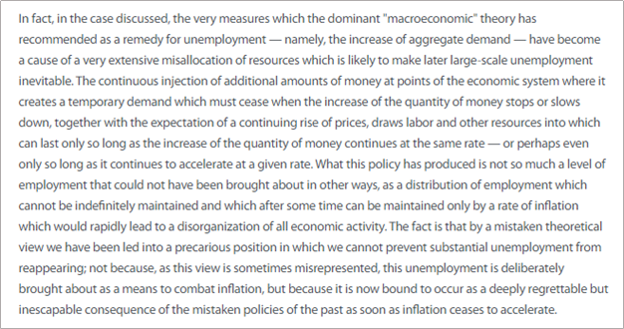

As was mentioned above, the last time there was a loss of faith in the U.S. dollar, Volcker was forced to raise rates to 20% in order to control inflation. The Fed succeeded in stabilizing the value of the currency at the cost of the 1980–1982 recession, however, the economy recovered swiftly thereafter. Back in the 70’s, private debt amounted to less than 100% of GDP but today, it is at an all time high considerably above Great Depression levels.

Total US Private Debt, Source: BIS

Total US Private Debt, Source: BIS

The extreme debt levels means rising rates would not simply cause a moderate recession but would lead to mass defaults in businesses, corporations and households and high unemployment. Austrian economists argue that this “cleansing” process is actually a desirable phenomenon since it corrects the misallocation of resources produced by the artificial credit expansion — See Ben Kaufman’s article for a detailed outline of the Austrian Business Cycle Theory — , however, we are not concerned here with what central banks should do but with what they are likely to do. In this regard, the high levels of unemployment and economic disruption that would result from higher interest rates makes it unlikely that the Fed would chose to go down that path.

To make things worse, most of these loans are issued by commercial banks, and their writing off would result in a financial crisis and a need to — yet again — bailout the banking sector. Before the Great Recession, governments around the world had relatively low debt/GDP ratios which enabled them to recapitalize the banking sector by issuing new debt. Today public debt is at its highest point in history, thus, the government’s ability to bail-out private banks is limited. This would be specially the case in an environment of higher interest rates; since the Fed wouldn’t be buying bonds in the open market, the treasury would have to pay higher interest rates in order to attract bond buyers, making it difficult to issue additional debt to bail-out private corporations. Instead, one should expect a mixture of bail-ins, depositor haircuts and nationalizations.

In conclusion, higher interest rates are unlikely to be pursued by the Central Bank since they would lead to mass insolvencies, a deep depression and a financial crisis.

2- High Deficit & Public Debt

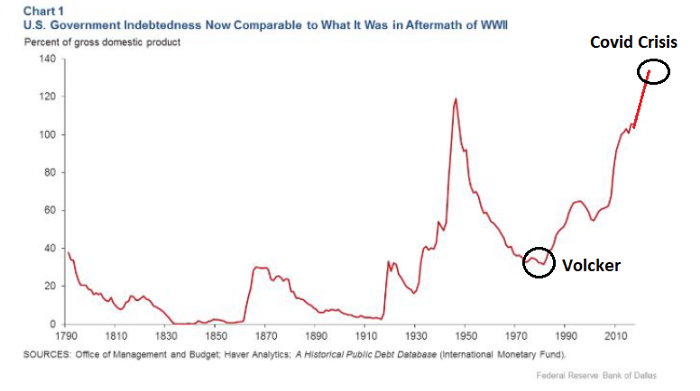

We have already touched upon the second reason why it is unlikely that the fed can keep its commitment to stabilizing the value of the dollar; the high level of public debt. During the 1980’s, government debt only amounted to 35% of GDP compared with an expected all-time high of 140% of GDP post covid-19 crisis.

U.S. Total Government Debt, Source: IMF

U.S. Total Government Debt, Source: IMF

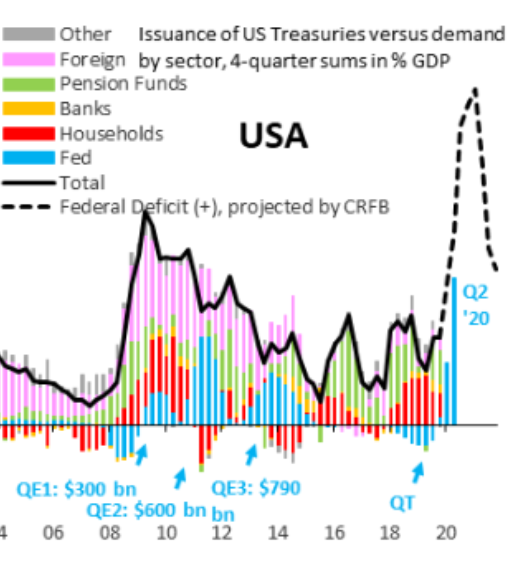

Today, debt levels are so high and yields so low that investor apetite for treasury bonds has dwindled considerably. The following chart shows how foreign investors (pink area) have been purchasing less and less of the total bond issuance every year. Up until 2019, foreign demand was replaced by Pension Funds, households and banks who are legally obliged to buy the Treasury’s bond issuance as long as they can meet their capital requirements.

Source: Federal Reserve, Bloomberg

Source: Federal Reserve, Bloomberg

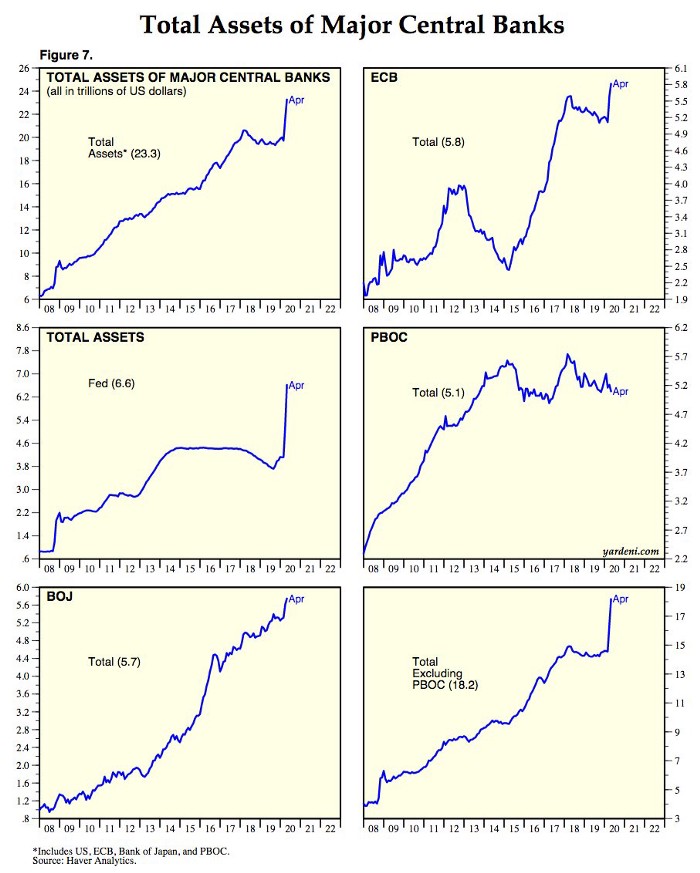

Lyn Alden has pointed out how how the infamous September 2019 spike in the repo market was due to primary dealers not holding sufficient reserves to absorb the Treasury’s bond issuance and meet their post-Great Financial Crisis regulations — See Lyn’s article for a full explanation. It was at this point that the Fed (blue area) was forced to resume quantitative easing, effectively monetizing the government’s budget deficit which is expected to surpass a shocking 20% of GDP this year.

Having the Fed monetize the deficit allows the government to pursue infrastructure projects, pay extra unemployment benefits, tax cuts and other popular measures that the public is advocating in times of economic hardship and humanitarian distress. If the monetization of the deficit leads to higher inflation, and the Fed chose to raise interest rates in order to stabilize the value of the dollar, it would force the government to balance its budget which could lead to social and inter-generational conflicts. e.g. taxes would need to be raised on the younger segments of the population in order to repay bonds held by retirees.

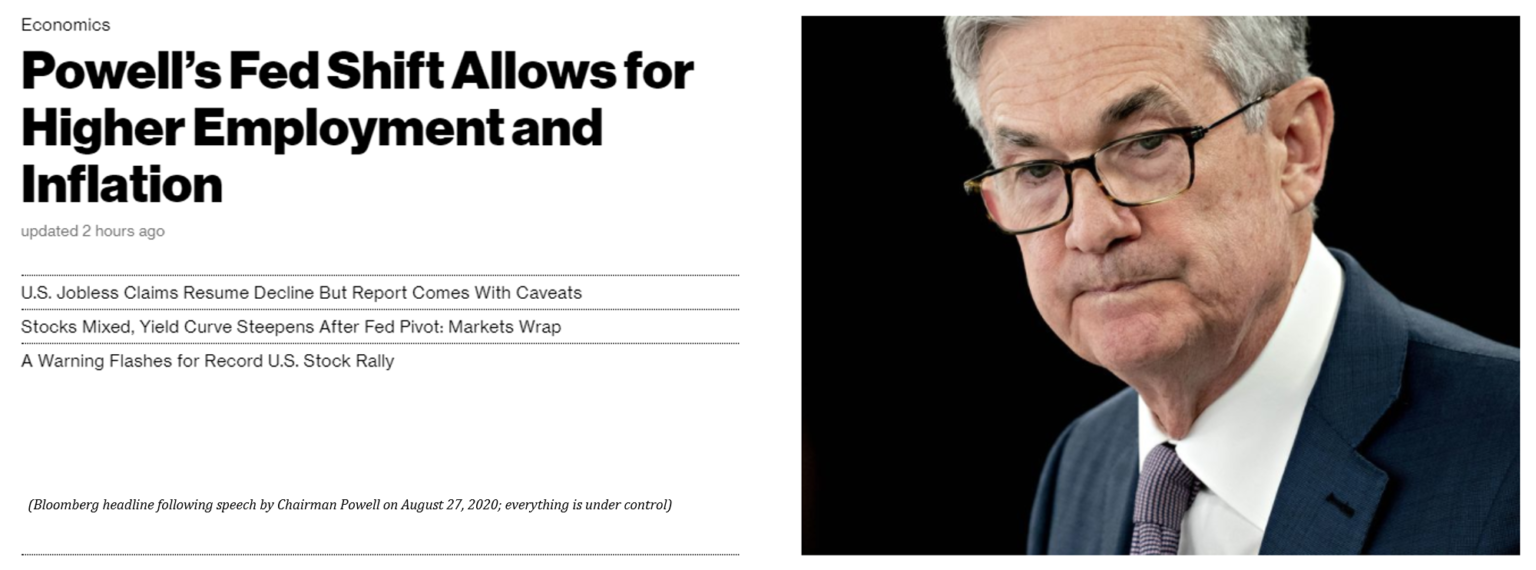

An alternative strategy could be allowing inflation to run high for a prolonged period of time in an effort to reduce the real value of the debt — as prices go up in nominal terms the real value of the debt falls — , and raise interest rates once debt levels as a percentage of GDP have fallen. As will be discussed later, this avenue is already being proposed by the Fed and would likely lead to a complete loss of faith and repudiation of fiat money and a complete adoption of Bitcoin.

3- Precariousness of the Fed’s Balance Sheet

Even if ones believes the Fed would obliterate the banking sector, unleash a depression and force austerity on the government in order to preserve the value of the dollar, there is a third reason why I believe the central bank would be unwilling to control inflation; doing so would make the central bank insolvent.

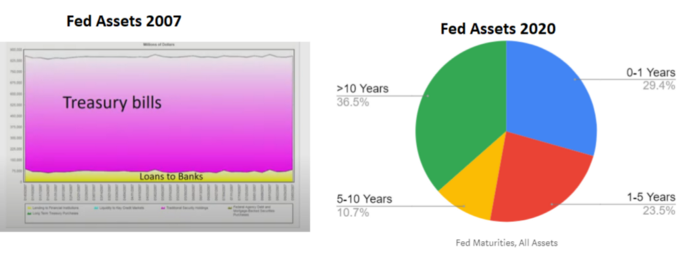

Looking at the Fed’s balance sheet, two things stand out: Maturity mismatching and extreme leverage.

Maturity mismatching:

Prior to the Great Recession, monetary policy was limited to short term bills which enabled the central bank to raise rates by simply allowing its assets to mature. Today, the Fed’s holdings are mostly in the form of long dated treasuries and mortgage backed securities with an average maturity above 5 years.

Fed Assets, Source: Federal Reserve

Fed Assets, Source: Federal Reserve

The long duration of the bonds in its portfolio make it impossible for the Fed to raise interest rates by allowing its assets to matures. Hence, if the central bank wanted to raise interest rates, it would need to either sell some of its holdings or increase the interest it pays on excess reserves (IOER). The low yield on its assets and its over-leverage makes it very difficult for the Fed to implement either of these measures effectively.

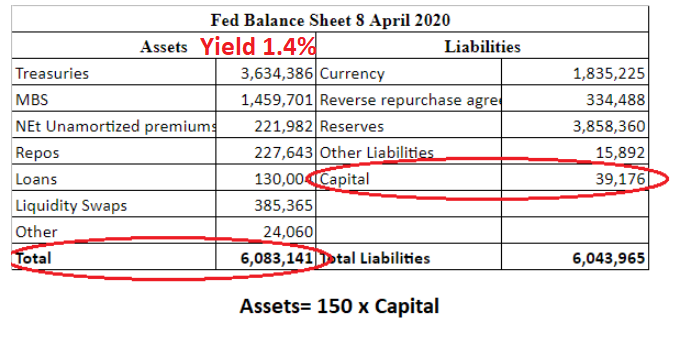

High leverage, assets= 150 x Capital

Fed Balance Sheet 8 April 2020, Source: Federal Reserve

Fed Balance Sheet 8 April 2020, Source: Federal Reserve

At present, the Fed is extremely leveraged with assets just under 151 times capital, ironically, it fails spectacularly to meet the capital requirements it imposes on commercial banks. Furthermore, the average return on its assets has continuously diminished as each round of quantitative easing has pushed bond yields lower: The interest payments it receives on its holdings has dropped from 3% in 2010 to roughly 1,4% in 2019.

These factors make it impossible for the central bank to raise interest rates without revealing its insolvency:

- If it raised rates by selling some of its treasuries, the market would front run its selling resulting in loses which — due to its high leverage — would rapidly lead to negative equity. This already happened during the last unwinding of quantitative easing, when the FED piled billions in paper losses.

- If it chose to raise rates by increasing the interest paid on excess reserves (IOER), it would quickly find itself paying more for its liabilities than the interest payments it earns on its portfolio. Not all of the Fed’s liabilities generate expenses, for example currency in circulation doesn’t pay any interest. Of the total 6 Trillion $ liabilities, 3.9 Trillion (63.4%) are in the form of reserves that the FED would have to pay interest on. The average return on the FED’s assets is circa 1,4%, which leaves them enough room to raise IOER to roughly 2,2 % before their expenditures are higher than their revenues. In today’s ultra low rates environment, 2,2 % interest rates might seem quite high but in a potential scenario of 5 or 7 % inflation — which in light of the financial history of the U.S. doesn’t appear at all outlandish — would lead to massive losses on its holdings.

Of course, the Fed already realizes that any “exit strategy” leads them down the road to insolvency, but what exactly does this mean for this unusual institution? At the end of the day, the Fed’s liabilities (fiat currency) are non-interesting-bearing and irredeemable — having a $10 Federal Reserve note provides a claim on the Fed for $10 worth of Federal Reserve notes, possibly in different denominations, but nothing else. Thus, balance sheet insolvency (assets<liabilities) is a sign of incompetence and mismanagement but the central bank need not worry about a bank run.

Equitable insolvency (failure to pay obligations as they fall due) is more worrisome since the central bank would fail to pay its expenses such as rents, salaries, entertainment services etc. The Fed must rely on the interest it receives on its holdings to fund its operations, but in an environment of higher rates, it would have negative equity. Since the Fed cannot create reserves that are unbaked by assets, it would need to be recapitalized by the Treasury with real tax dollars or new debt issuance in order to pay for its expenses. This would be extremely ironic given that the Fed is currently engaged in Quantitative Easing in order to finance the government’s deficit. It would also be politically unpalatable since the taxpayer would suffer additional austerity in order to recapitalize a central bank that has been used to bail out private corporations.

Conclusions

In the event of inflation, the high levels of public and private debt in the economy and the precariousness of the Fed’s balance sheet would make it impossible for the central bank to preserve the value of the dollar without unleashing a socio-economic and political crisis. If it tried to restore trust in its currency by raising rates, like Volcker did in the 80’s, it would cause household and corporate defaults that would result in a financial crisis and a depression. In parallel, the government would be forced to balance the budget, imposing severe austerity that would lead to inter-generational and social conflicts. Furthermore, in the process of raising rates, the Fed would become insolvent and would need to be recapitalized by the Treasury. This would result in social and political backlash, as well as undermining the central bank’s alleged independence.[1]

Centrals banks were created for the benefit of the financial services industry and the State, hence, it is unlikely that they will chose a policy path that is directly opposed to the interests of their main constituents. Instead, they will likely allow inflation to run rampant, hoping to reduce the real value of public and private debt before they can safely raise rates again — since most debts are fixed nominally, when the currency devalues significantly and prices/assets/wages go up in nominal terms, debts vs GDP goes down. This strategy is nothing new, the Fed already inflated away the debt after World War II and is openly proposing the same approach today — NBER working paper and Cleveland Fed.

Chart Source: Bridgewater Associates, Ray Dalio, Updated by Lyn Alden, Annotated by Gael Sanchez

Chart Source: Bridgewater Associates, Ray Dalio, Updated by Lyn Alden, Annotated by Gael Sanchez

Back in the 40’s, gold had been outlawed and investors didn’t have a highly liquid store of value alternative, so they accepted the losses on their currency and bond holdings and demand for the dollar returned once Volcker stabilized its purchasing power.

We can think of fiat money today as somewhat of a Ponzi scheme, it only holds value for two reasons: Firstly, there is an expectation that in the event of inflation central banks will preserve its purchasing power via contractionary monetary policy and secondly, new buyers will demand it in the future. [2] As the market realizes these two conditions won’t be met, one should expect a repudiation of State liabilities — government bonds and fiat currency — and a move towards hyperbitcoinization.[3] This outcome should come as no surprise as Austrian Economists have been warning about it for decades.

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” Ludwig von Mises, _Human Action (_1949)

I believe Mises would agree that given today’s unsustainable debt levels and the political and social incentives, the latter option is by far the most likely outcome.

Many thanks to Stefanie von Jan, Ben Kaufman and Emil Sandstedt for proofreading the text and for their very insightful comments.

Notes:

- This article is not an argument against the U.S. dollar per se but against the sustainability of the fiat system as a whole. Major central banks around the world are going down the same road as the Fed and the analysis is aplicable to most jurisdictions . Moreover, given that the Dollar is the reserve currency, its demise would most likely breach the trust in the fiat system worldwide.

Source: Haver Analytics

Source: Haver Analytics

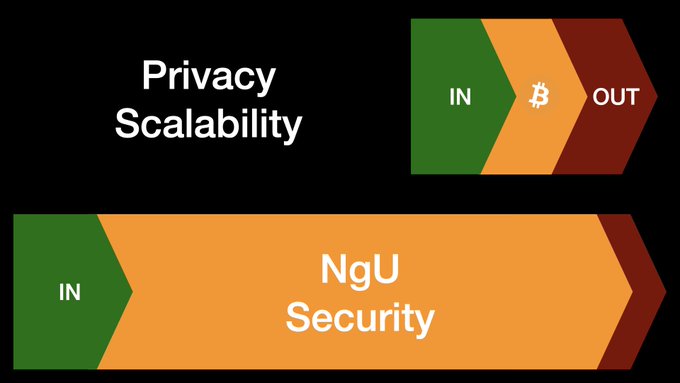

2. Expectations are crucial; even if the growth of the money supply is halted, the demand for a depreciating currency needn’t return instantaneously. Monetary authorities have breached the trust of investors so many times, that in my opinion, even a credible announcement by the Central Bank would not be enough to recover investors trust. They will likely need to buy and prove they hold Bitcoin in order to truly regain trust in their currencies. Of course, by that point, hyperbitcoinization will have run its course and bitcoin will already be the economy’s medium of exchange, unit of account and store of value.

3. As individuals repudiate fiat currencies, governments might try to outlaw Bitcoin like they did with gold in 1933. Whether they succeed in doing this or not will depend largely on technological factors. If the decentralization of the network is preserved and anonymity tools are readily available, banning Bitcoin will be a practical impossibility. Furthermore, as is mentioned in the article, money is always a market phenomenon. Unless fiat money is stabilized, it won’t be used as money regardless of what the State dictates. (we can see this reality today in Argentina and Venezuela)

Bitcoin as a Tool for Secession

By Yuri de Gaia

Posted Summer 2020

The Triumph of Civilization, 1793, Jacques Reattu

The Triumph of Civilization, 1793, Jacques Reattu

Bitcoin may be many things to many people, but one cannot ignore its primary effect on the mind - the realization of how much power is acquired by a simple act of holding private keys to censorship-resistant unconfiscatable property.

The hardest money on earth brings the concept of inalienable property rights back on its feet, and with it, an available opportunity for personal secession.

Throughout history, protests, revolutions and civil wars proved to be ineffective against State tyranny.

The predictable result of any such event was the replacement of one tyrant with another. When the democratic way became the standard around the world, it guaranteed that only bad men could rise to the top. Demagoguery, cunning and trickery were the tools that one had to master to be able to sway the public opinion in your favor. When at the top, all bets were off. The four short years of so-called “office”, turned the dangerous man’s high time preference into a frenzy of wealth redistribution, surveillance and wars. And if a rare good man managed to occupy the desired position, demonization or assassination was sure to follow.

But that was in the past.

Today We Have Bitcoin

The importance of the times we live in cannot be stressed enough. With ease, one can say that on January 3rd 2009, the timeline split into the pre-Bitcoin and Bitcoin eras. Property rights were restored, and personal secession became possible again.

Although the effect may not be immediate and seen by the majority, those in the know understand that what governments around the world took for granted for so many years, is now gone. Taxation and expropriation, the bread and butter of every State, have become nearly unenforceable. What is yours, is yours to keep. There is a key to your property, and you are the key master. Every ten minutes, with each block produced, your belief in the new system is justified and strengthened. There is no referendum or democratic vote that can change that.

The mob has lost.

With the newly restored property rights, you can focus on your work. Slowly but surely, the process of personal secession kicks in. First, it is a purely mental event: the ultimate red pill, the walk through the door. But as soon your stash grows to a sizeable amount, the wheels of secession in the physical realm are set in motion. Capital accumulation becomes a natural habit. And with capital, many more doors open.

Opt Out

Opting out of the oppressive system, disassociating from anyone who supports Leviathan, ignoring unjust rules whenever possible while building your own tools, joining communities of like-minded individuals, creating independent circular economies - this is what personal secession is about.

Replacing the flag of the usurping State with that of human dignity. Summoning the courage to escape the grotesque reality imposed by the Parasites, and step into the brave unknown. Relentlessly studying oneself and the world, cultivating higher aspirations, perfecting skills to become part of the new Natural Elite that will restart the engine of civilization.

The process of civilization is only possible under Natural Order, a state of affairs that adheres strictly to the foundational principles of the Universe. The modern State directs its energies to the defiance of natural laws, and thus must be considered the ultimate agent of decivilization. By infringing on peaceful individuals’ property rights, it degrades relationships among people and distorts the naturally occurring order. Now that it is possible to reclaim individual sovereignty, the unwinding of the global destructive machine has begun. Leviathan’s demise may be slow but certain.

True progress does not always imply a move forward. Sometimes, a better state is achieved by taking a step back. The laws of Nature are universal and eternal. Going against them, as we have done in the past century, is always a mistake. Therefore, to restore Natural Order, we must look back to when it was more prevalent and identify what it is that made it so. The answer is undoubtedly Family - the principal benefactor of property rights, the nucleus of society.

Status of Family Estate

In its traditional form, Family has been under a massive attack, especially in the Western world.

The process of individual atomization, devaluation of familial relationships and degradation of youth has been long, but in many cases successful. Spiking rates of singledom, divorce, single parenting, abortion, abuse and non-traditional sexual relationships are all the proof you need. One may argue that this process occurs naturally due to the general liberalization of society, but it is not so. There is someone who benefits from the disintegration of the most vital unit of civilization - the Parasite.

By encouraging atomic individualism, the parasitic element in our society wants to achieve its ultimate goal: total control and domination over people’s lives.

For what is a better place to do that than in a household? Traditionally, the head of Family is responsible for the ultimate decision making. He is the procurer of goods, the protector of the estate, the reason and the muscle. Removing him from command is akin to relieving the captain of the ship of his duties and telling the sailors that they are now in charge all at the same time. Naturally, only chaos can ensue. And that is what we see. Men are told to be women, women are encouraged to become men, couples are brainwashed to forego having babies, children are incited to rebel against parents. Generational ties become ever weaker to the point where the concept of a family estate ceases to exist. There are only individuals, linked by their DNA, who feel nothing but disdain towards each other. Having no support from immediate family, but still needing it psychologically and often financially, they turn to Leviathan for help. And he is there, waiting with open arms.

Managing people’s political affiliations and professional lives is one thing. Affecting their decisions inside households is a whole new level. It is a crown achievement of the micromanaging State, a parasitic dream come true.

If one can be told how to behave in his own bedroom, then the last glimmer of personal liberty has disappeared.

Unfortunately, in many parts of the world, we are very close to such a condition. But as things seemed to reach the bottom, when sinking further was almost impossible, and the process of moral degradation was near complete, a savior appeared.

Like Prometheus who gave mankind fire, a world-changing technology, Satoshi Nakamoto brought with him the gift of Bitcoin. And with it, a hope of restoring the civilizing force of Family.

As Bitcoin lowers one’s time preference, gradually, the outlook on life starts to change. An existence filled with instant gratification is replaced with one of delayed consumption. Foresight, long-term plans and projects, personal restraint take hold. Man turns his attention to the future. He realizes that there is a moment in the coming years when he will have to pass and leave his legacy behind. But to whom? Who will care about his life achievements more than anyone else? Most certainly Family, a tribe of kinship. And so he starts planning for the ultimate long-term project.

Not only does the act of accumulating Bitcoin strengthen one’s material well-being, it also promotes higher aspirations in man. The focus shifts from short-lived superficial relationships, to the establishment of a family estate that will last generations. Man’s children and grandchildren are raised in an environment that promotes farsightedness, culture and morals. In cooperation with like-minded neighbors, they work diligently to improve their surroundings. The process of civilization is set in motion once again.

Strong individuals create robust families. And strong families form resilient communities. When faced with the moral degeneration of the rest of the world, such outposts of civilization have no choice but to strive for segregation - physical, cultural and intellectual. What starts as personal secession turns into a collective movement for self-determination. This is not a violent global revolution but a peaceful exit of thousands of newly formed congregations into different ways of living that they decide for themselves.

The Parasites may stop one or two of them, but can they really crush a multitude of independent citadels?

Before Bitcoin, one could not help but wonder how far downhill we would go. It seemed like the end of civilization was near, and there was no way to prevent it. Now that we have the necessary tools to create new systems independent from the parasitic status quo, we can finally reverse the painful damage inflicted upon our spirit. The process of personal secession is the creation of a citadel of the mind, first and foremost. A fortress of light, impenetrable to the forces of darkness. Combined with the power of will, it helps us mold the physical reality into what we want it to be. A world of Natural Order, a place of fairness and justice.

You can only change the world by changing yourself. Bitcoin may be the catalyst you were looking for.

Proclaim your independence.

Start a family.

Cultivate your community.

Secede.

Different bitcoins different prices

By JP Koning

Posted September 2, 2020

Not all bitcoins are the same. If someone steals 100 bitcoins from a cryptocurrency exchange and tries to sell them, they’ll have to price them at a discount to the market price in order to compensate the buyer for the risk of laundering them. Different bitcoins different prices.

This isn’t just a bitcoin phenomenon. There are two wholesale markets for banknotes, too. The legitimate one is comprised of banks, retailers, and cash-in-transit companies like Brinks that exchange notes at par. And the illegitimate one is made up of mob lawyers, drug dealers, and note brokers exchanging dirty notes at 20 or 30 cents on the dollar. Different dollars different prices.

You can find this same fractionalization everywhere: in electronics or prescription medicine or used cars. There is a licit and illicit price in each market.

But the difference between dirty and clean prices isn’t the dichotomy that interests me in this post. Could we see a two-tiered market develop for clean bitcoins? In other words, could a situation arise in which Jerry’s 100% legitimate bitcoin’s are worth more than Elaine’s 100% legitimate bitcoins?

I’d argue that the precedent already exists in the gold market.

Last month I wrote a quick explainer on the London Bullion Market Association, or LBMA, for CoinDesk. The LBMA is a standards-setting body for the gold market. It defines what constitutes a London “good delivery” gold bar and what doesn’t. These standards include physical details like purity, weight, height, and appearance. Increasingly, the LBMA’s standards are being stretched to include details about sourcing. Has the miner extracted the metal in an environmentally friendly and ethical way? Are they laundering money for Mexican drug lords?

Good delivery bars can only be stored in a handful of London-based vaults. A strict paper trail is maintained to ensure that nothing gets in (or out) of this walled-garden. The moment a bar is withdrawn from a London vault, it loses it’s good delivery status.

This has the effect of creating a two-tiered licit gold market, one in which London gold is worth more than non-London gold.

Consider that the world’s largest buyers congregate in London to trade gold. A 400-ounce gold bar fabricated by a refiner that doesn’t have the LBMA’s stamp of approval can’t access the incredibly liquid London market. And so it won’t be worth as much as an LBMA-approved 400-ounce bar. (No one wants to buy your metal if it can’t be immediately on-sold in London.)

To be granted London “good delivery” status, an unapproved bar must go through a process of being anointed. That means bringing the bar to a refiner on the LBMA’s approved refiner list. The refiner vets the bar owner to check for money laundering, much like a banker would. Only then can the bar be melted down and reformed into an entirely new and approved bar. But all of these steps are costly.

As my CoinDesk article suggests, we might one day see the same sort of fractionalization emerge in the bitcoin market. A core group of exchanges and custodians would begin to define what qualifies as a “good delivery” bitcoin. Standards would mostly apply to the provenance of bitcoins. Since the history of bitcoin transactions can be easily monitored, it is relatively easy to cast aspersions on certain flows of bitcoins, perhaps because they happen to pass through suspicious addresses or are mixed by coin tumblers. (As Izabella Kaminska suggested a while back, bitcoin has a lien problem. Tim Swanson has been writing about this for a while, for instance in A Kimberly Process for Cryptocurrency.)

Should a bitcoin be withdrawn from this “walled garden” of approved exchanges and custodians it would fall out of the Bitcoin Marketing Association’s “chain of custody” and, as such, would no longer have access to core liquid markets. And so unapproved bitcoins would be forced to trade in lower quality venues with lax vetting standards, and less liquidity.

An online retailer might not want to take the risk of selling their products for unapproved bitcoins (i.e. ones that come from non-vetted personal wallets). Sure, it might be possible for the retailer to accept non-approved flows with the intention of re-depositing them into the Bitcoin Marketing Association’s system in order to get the Bitcoin Marketing Association price. But there would always be the risk of an unexpected blockade or freeze of a customer’s unapproved bitcoins. And so retailers would ask their customers to only spend approved bitcoins straight from their Coinbase wallets.

By the way, the sort of LBMA-driven dichotomy that exists in gold (and could one day exist in bitcoin) does not exist in banknote markets. There is no such thing as a good & expensive $20 bill and a good but cheap $20 bill. Cash, as we say in the monetary biz, is pretty much fungible.

Why do we see a two-tiered gold market but just a single-tiered banknote market?

There are probably many reasons for this, but a big difference is the sorts of people that occupy each market. The gold market is populated by investors, the most dominant of which are large institutional investors and central banks. These big players do not want the risk of having their gold being tarnished in any way. They don’t want their $50 million in gold bars to end up being fake, or subject to a court dispute, or frozen by law enforcement due to money laundering concerns. That’s why the LBMA standards exist; to make gold safe for big institutional buyers.

But cash is different. Warren Buffett and Ray Dalio don’t occupy this particular market. The market for coins and notes is dominated by regular people. Furthermore, banknotes are primarily used in small day-to-day retail purchases, not financial speculation. This sort of activity is not conducive to the emergence of a centralized marketing association. Cash transfers are done too quickly, and in small amounts, and by folks who don’t have deep enough pockets to pay for verification.

The market for banknotes is literally everywhere (each corner store in town will accept them), whereas the market for gold tends to clump up in a certain specific physical locations. This centralization makes standardization easier.

Bitcoins are more like a gold bars than a banknotes. Let’s face it, it’s been ten years since bitcoin appeared on the scene and no one really use bitcoin it as money (just like they don’t use gold as money). The majority of bitcoin demand is a demand to hoard the stuff for price exposure, much like the yellow metal. And like gold, the market for bitcoins has coagulated around exchanges. It’s not an everywhere market, not like the market for banknotes.

So to sum up, the market for bitcoins is very much like that for gold. Given that a standardized gold market has evolved, I wouldn’t be surprised to see the same happen to the bitcoin market, especially if big financial institutions start arriving.

Tweet Thread: What is an xpub?

By Danny Diekroeger

Posted August 30, 2020

~ What is an xpub? ~

An xpub (“extended public key”) along with an xprv (“extended private key”) allows you to generate a nearly endless number of bitcoin addresses without having to store and protect the individual private keys for every single one

👇 Time for a thread 👇

1/ To protect your privacy, it’s good practice to use a new bitcoin address for every transaction

But each new address requires its own private key…

Back in the old days (pre-2013), bitcoin wallets would generate and store a new private key for every new address

2/ Imagine running a popular exchange that uses millions of addresses…

You would be forced to store and protect millions of individual private keys

What a headache! There had to be a better way…

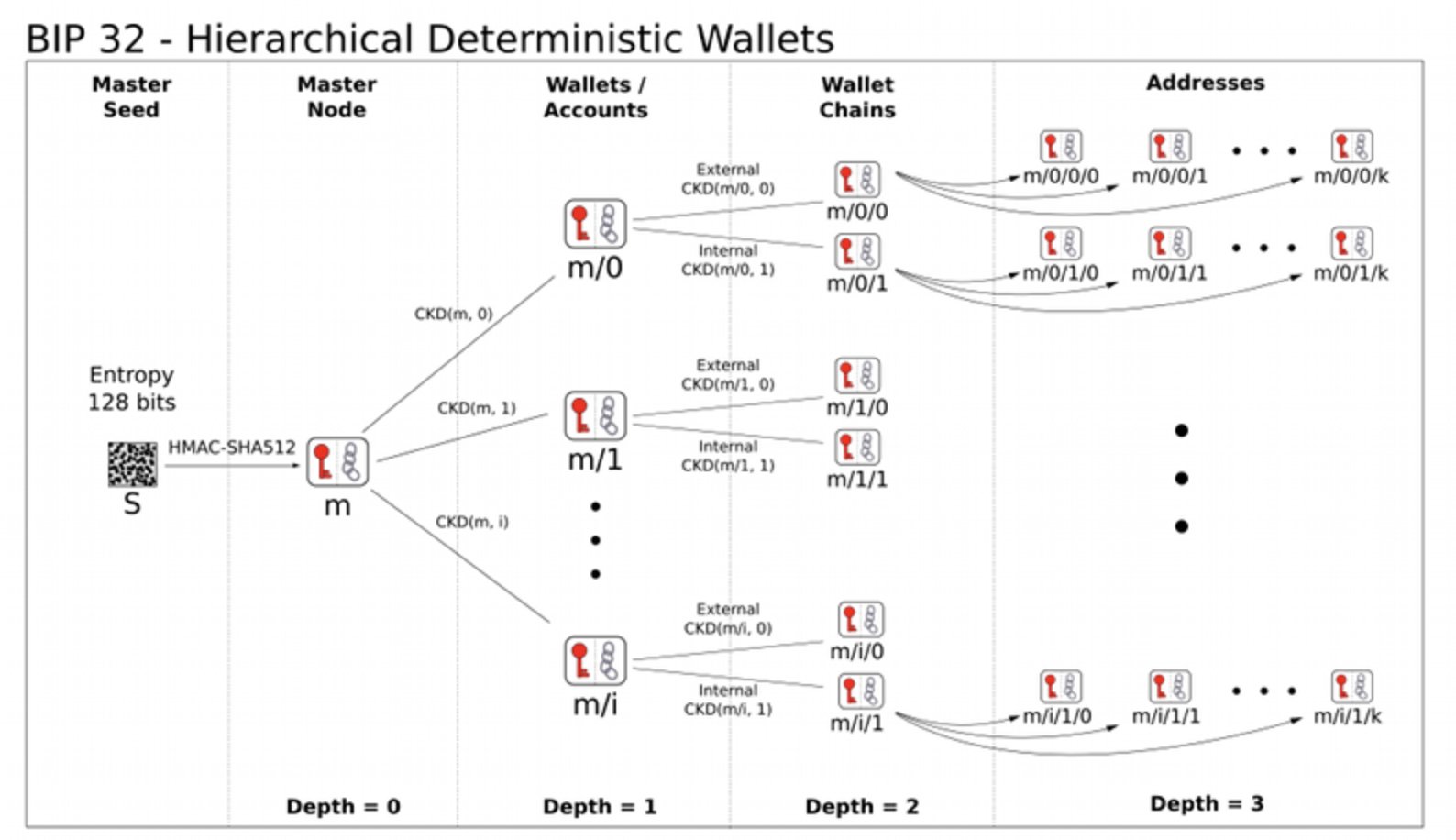

3/ In 2013 @pwuille authored BIP-32, which specified a standard for Hierarchical Deterministic Wallets

This type of wallet allows you to generate a ton of addresses using only a single seed

That single seed is called an xprv (“extended private key”)

4/ If the concepts of private keys and public keys are confusing, now would be a good time to check out my previous thread that goes into more detail:

5/ Essentially an xprv is a private key, and an xpub is its public key, and each one is extended with additional data

This extra data (called the “chain code”) helps you generate a nearly endless number of additional keys

6/ All these additional keys are generated using a standard pattern, so they can be re-calculated at any time!

Why is this useful?

Say you had a wallet with millions of addresses in it, and tragically all the data got destroyed…

7/ As long as you still had your original seed (xprv), you would be able to re-generate all your addresses by following the standard pattern, and you’d be able to recover your whole wallet!

8/ So what is this special pattern that allows you to generate so many addresses from a single seed?

The math involves some hashing which I won’t go into detail about here…

But one concept you should be familiar with is a “Derivation Path”

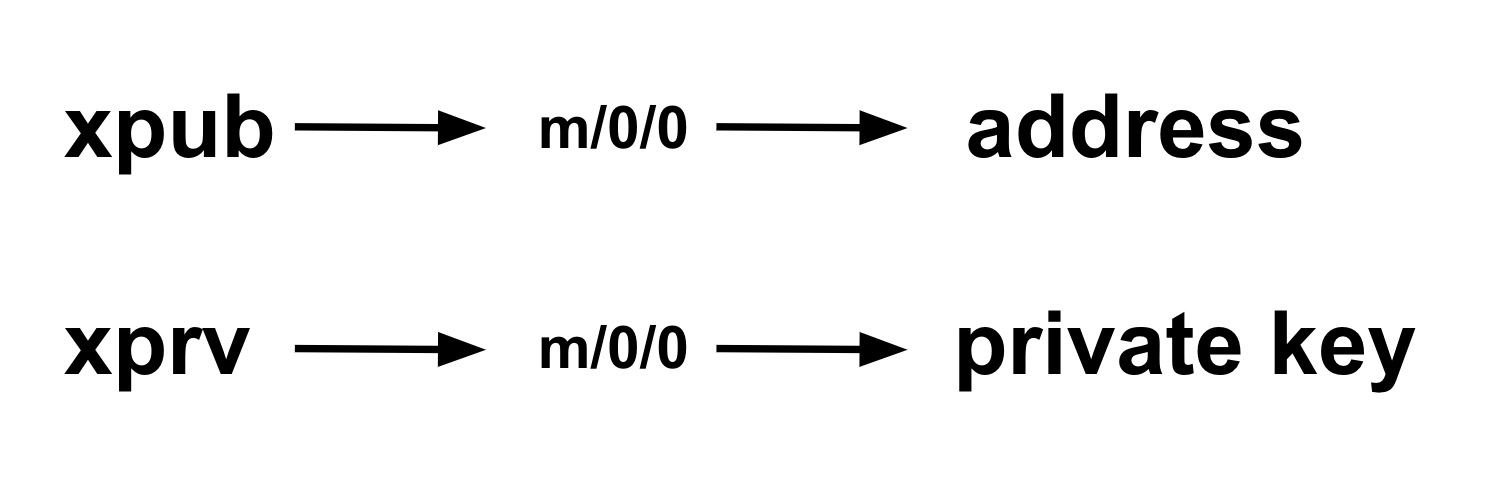

9/ Derivation Paths are like instructions that tell you how to generate an address, and they look something like this:

10/ Each Derivation Path provides all the instructions needed to calculate the address and its corresponding private key

By applying the Derivation Path to the xpub, you get the address

And by applying the Derivation Path to the xprv, you get the private key

11/ Note, I’m skipping over the concept of “Hardened Derivation”, in which the xprv is also used to generate the addresses

But let’s keep it simple for now…

Just think:

- Xpub generates Addresses

- Xprv generates Private Keys

12/ Using HD wallets is a nice way to organize your addresses, as the different numbers in the Path allow you to organize your addresses in a tree-like structure…

A common use case is to put all Receiving addresses on one branch, and all Change addresses on another branch

13/ A note of caution though - it’s a good idea to keep your xpub private!

If somebody has your xpub, and you’re using normal derivation paths, then they’ll be able to calculate all your addresses and see the entire contents of your wallet!

14/ This is why auditors might ask for your wallet’s xpub

Without the xpub, they’d have no way of knowing that all your different addresses are connected (assuming you don’t send transactions between them)

15/ So to recap:

- An xpub is public key with some additional data that lets you generate a ton of addresses

- An xprv is the private key that lets you generate a ton of private keys that correspond to these addresses

16/ And together they are the foundation for HD wallets, which are a neat way to organize your wallet without having to store a bunch of individual private keys

17/ Hope this was helpful! Shoutout to @PeterMcCormack for the original question

I hope that everyone feels comfortable asking questions, and I hope everyone can be more friendly about explaining complex topics to others

This stuff is complicated! 18/ For more educational threads on all the basic technical concepts behind Bitcoin, check out this mega-thread where I’ve linked all my previous ones:

18/ For more educational threads on all the basic technical concepts behind Bitcoin, check out this mega-thread where I’ve linked all my previous ones.

19/19 And check out my email list to stay connected with me

Bitcoin is One for All

By Parker Lewis on Unchained Capital Blog

Posted August 27, 2020

At the Democratic National Convention (August 2020), Congresswoman Alexandria Ocasio-Cortez described the Bernie Sanders presidential campaign as, “a movement that realizes the unsustainable brutality of an economy that rewards explosive inequalities of wealth for the few at the expense of long-term stability for the many.” That the current economic system is working very well for a few at the expense of the many has become more widely recognized and accepted across both sides of the political aisle in recent years. While there is vehement disagreement on the appropriate solution, most everyone at least agrees that there is a problem. Fortunately or unfortunately, there is no political solution to a problem that is inherently of economic origin. It is unfortunate because politicians of all ideologies will make promises of grandeur while further dividing the nation as they hopelessly search for a political solution which does not exist. At the same time, it is fortunate that the solution is not political, as bridging partisan divides has historically proven to be a fool’s errand.

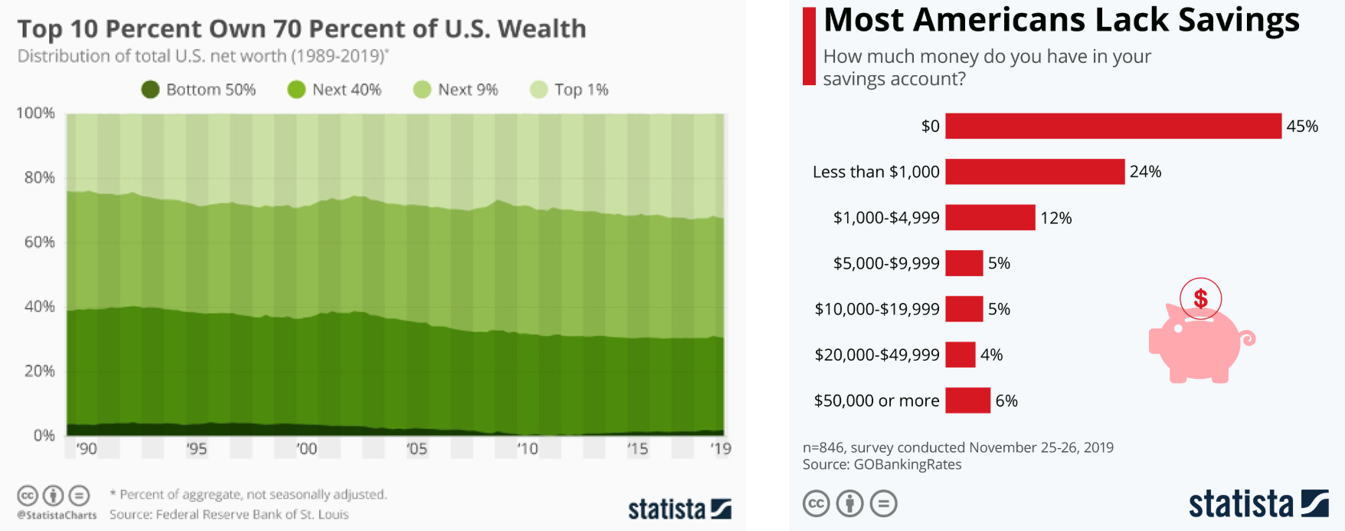

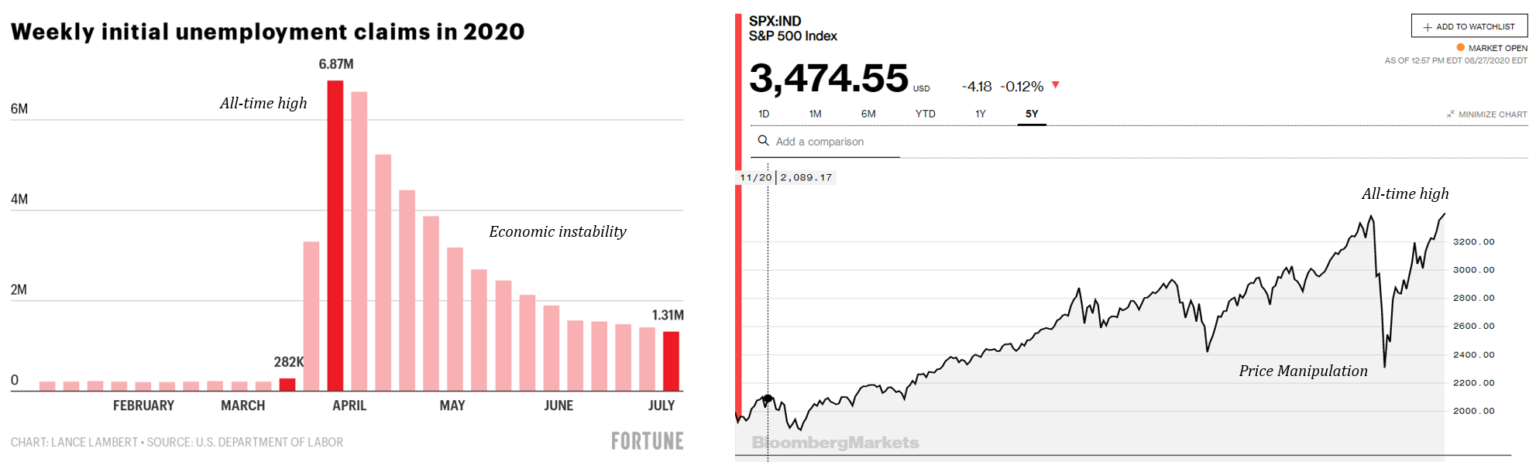

Without doubt, the economic structure is broken. Wealth gaps are only becoming wider, it is unsustainable, and economic instability is everywhere. The stock market and national average home values are back at all time highs while tens of millions of Americans are filing for unemployment and half of society has practically no savings. Economic equations do not add up. That is a hard-to-deny reality; it is suffocating many and it applies globally. Politicians simply are not the answer. The fundamental problem with the current economic structure lies not in politics, but in the currencies which coordinate economic activity (e.g. the dollar, euro, yen, peso, bolivar, etc.). The chink in the armor is in the foundation. No politician can fix problems that stem from structural flaws inherent to modern money. Once the foundation is fixed, then solutions to higher order challenges can follow suit, but until then, any efforts will continue to prove ineffective.

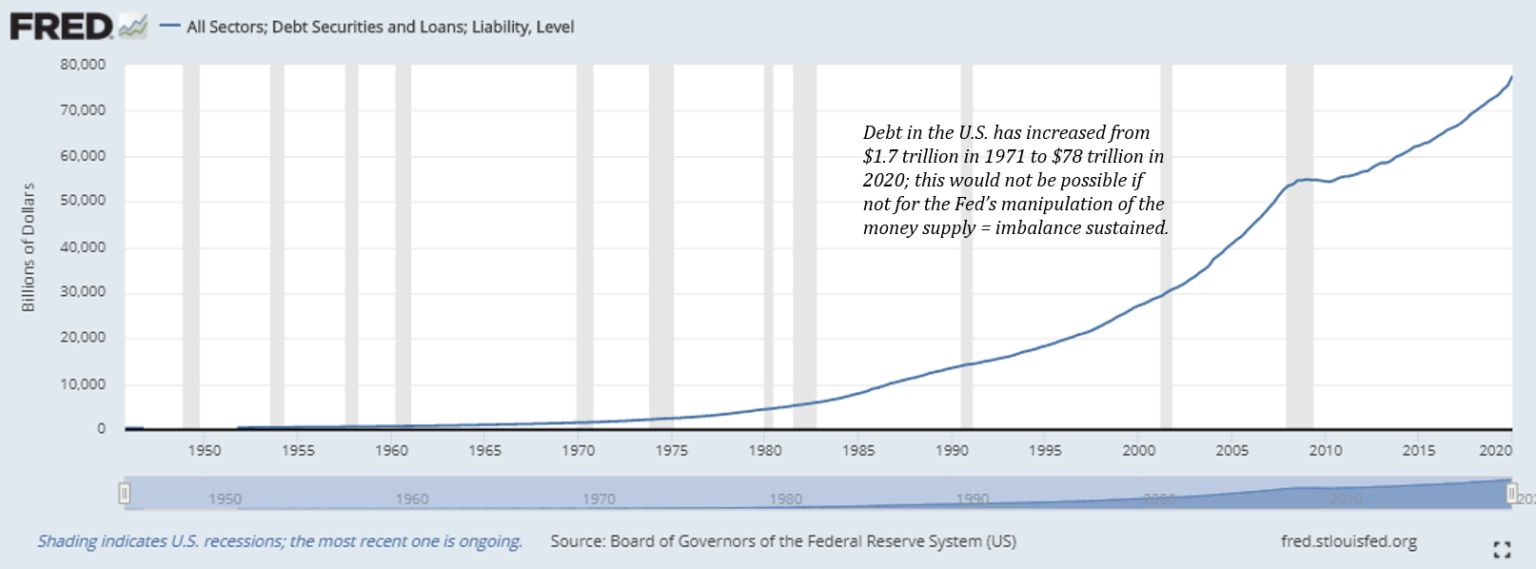

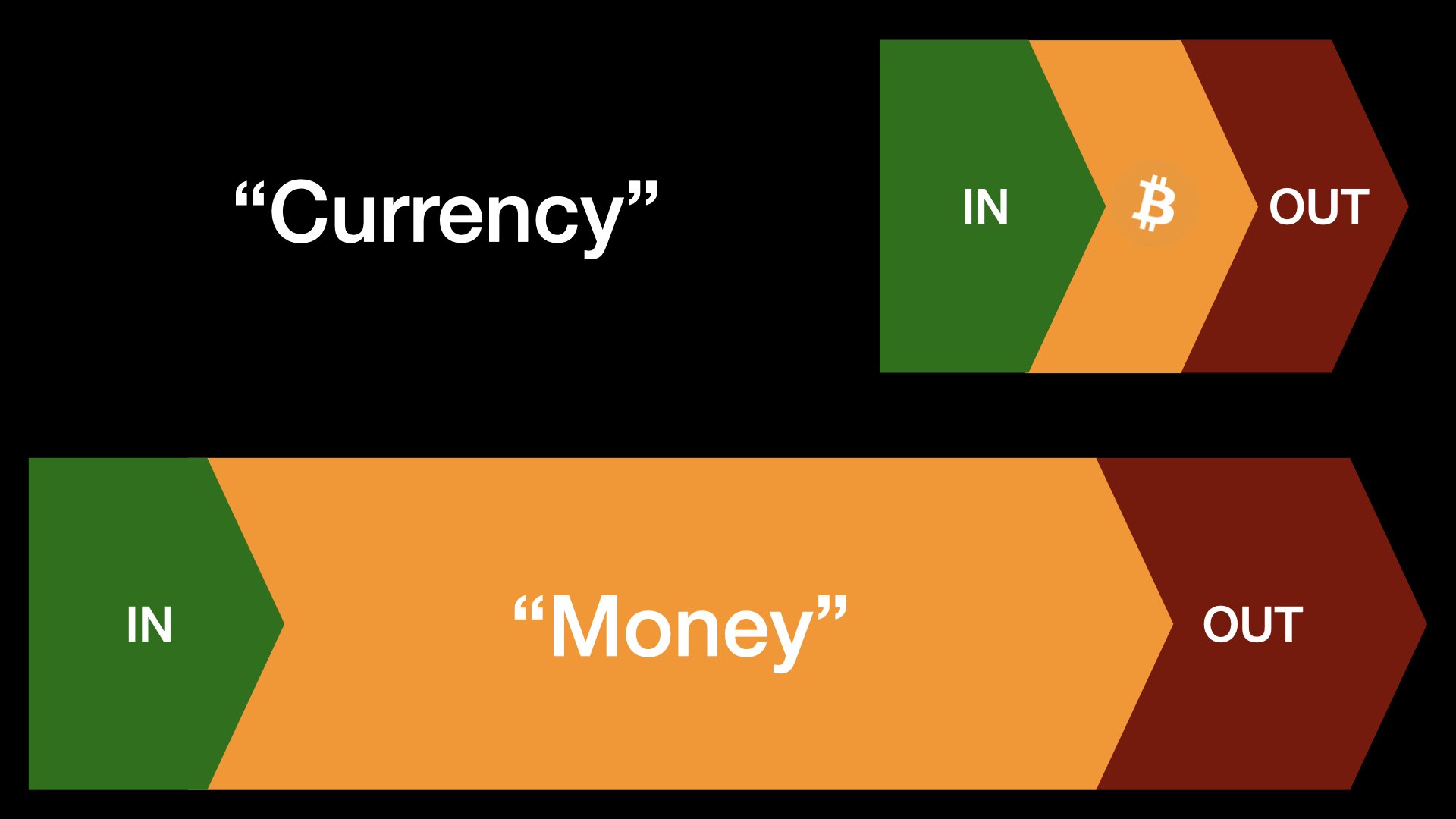

A currency is the foundation of an economy because it coordinates all economic activity. If an economy is functionally breaking down, it would be more appropriate to say that the underlying currency is not effectively coordinating economic activity; the currency is the input and the economy is the output. In short, the fly in the ointment is the money. While many are focused on how to solve the problem of massive wealth inequality, very few connect that the greatest source of inequity lies in the tool that everyone is using to coordinate the entire orchestra. It is not just that the economy is not working for many; it is that the dollar (or euro, yen, etc) as the primary mechanism coordinating economic resources is failing for everyone. Economic imbalance and growing inequality is the new normal, but there is nothing natural about sustained economic imbalance. In fact, it is an economic oxymoron. Balance is critical to the functioning of any economy, and when functioning properly, an economy would naturally eliminate imbalance in its normal course. If an economy fails to do so, and instead allows imbalance to be sustained, that is evidence of a broken economic structure. But, the massive and growing economic imbalance which exists today is not the inevitable and unavoidable consequence of free market capitalism; instead, it is principally a result of central bank monetary policy, which allows economic imbalances to be sustained in ways that would otherwise not be possible.

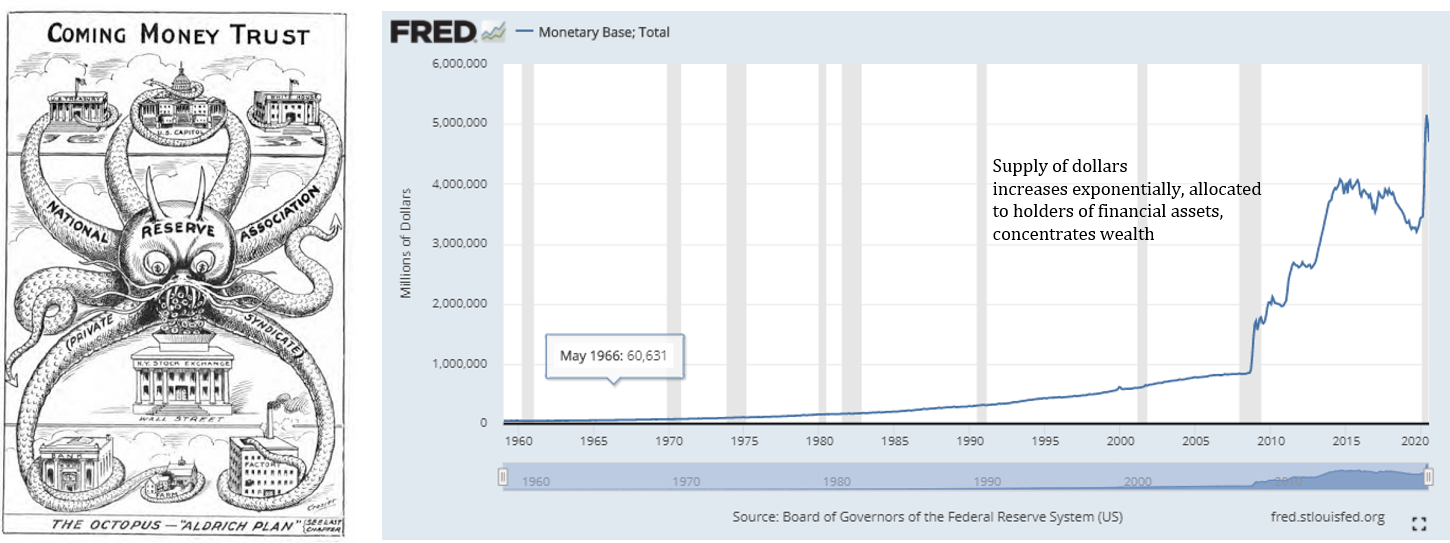

Central bank monetary policy is the exogenous force creating massive economic distortion and extreme levels of inequality. The mere existence of economic inequality is not in itself an inequity; in fact, unequal outcomes are both natural and entirely consistent with economic balance. On the other hand, the inequality which has been created and exacerbated by a flawed monetary system is an inequity, and it is not natural to a free market economy. It is exogenous. The structural flaw inherent to the dollar currency system (or any fiat currency system) is the force most responsible for sustained economic imbalance. Unsustainable and extreme wealth disparity follow from that imbalance. Every other distortive economic action or policy exists at higher orders than the issues created by the manipulation of the money itself. That is the root of all structural economic problems, and until it is fixed, the world will remain suspended in an increasingly fragile state. The legacy monetary system centralizes and consolidates wealth; that is the output of sustaining and exacerbating economic imbalance. It is a system that works for a few in the short-term but fails for all in the long run because the end game of monetary manipulation and an ever-growing economic imbalance is instability. The currency’s ability to coordinate economic activity degrades gradually and eventually fails completely; everyone pays that inevitable price.

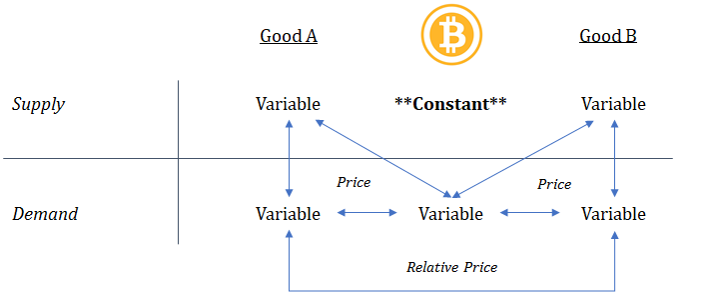

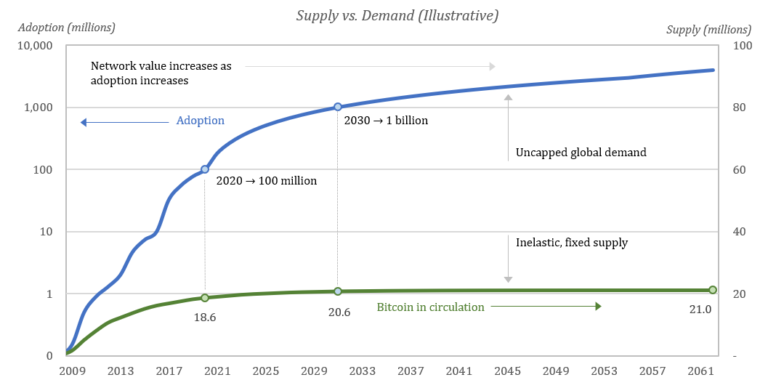

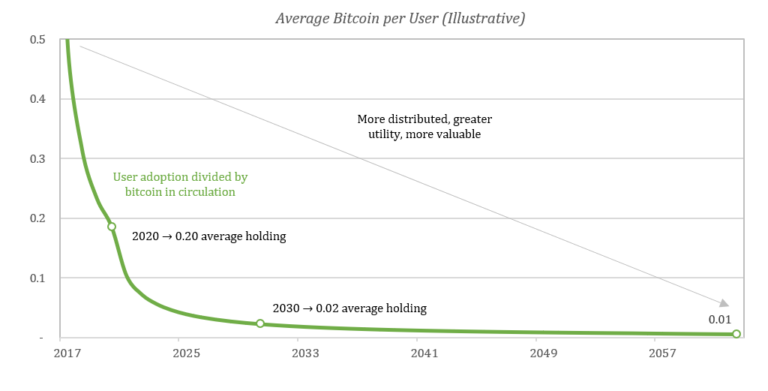

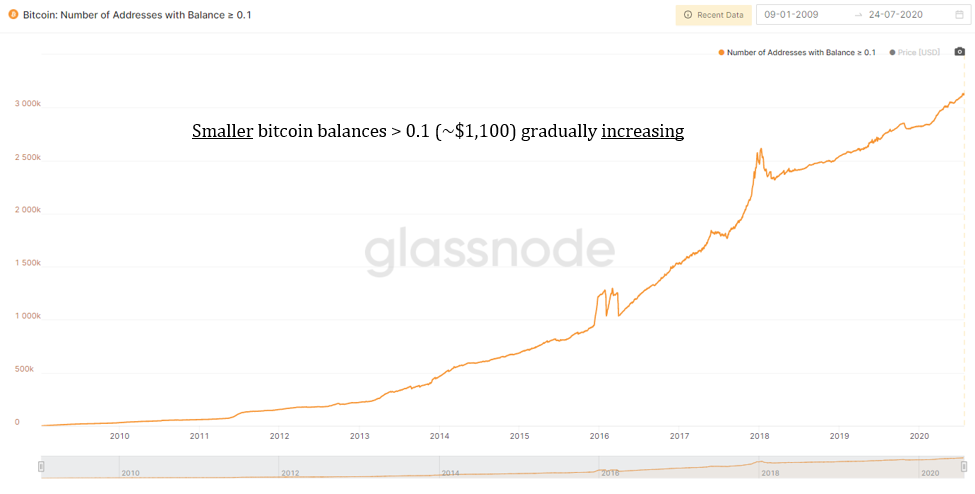

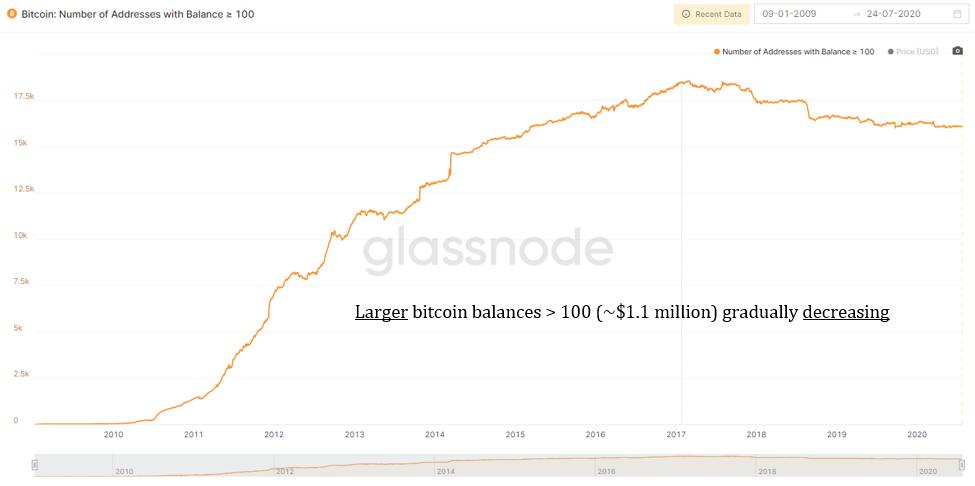

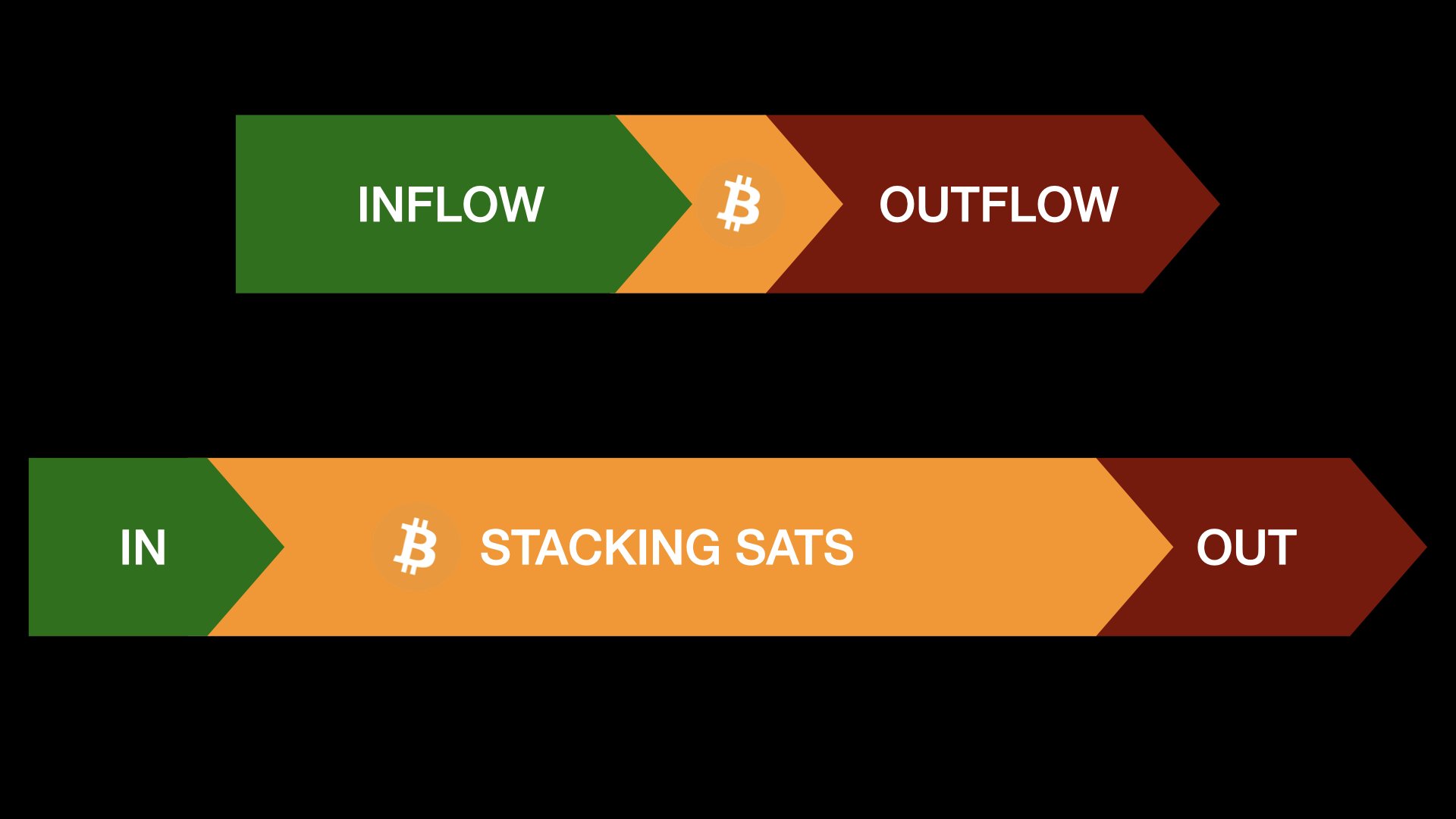

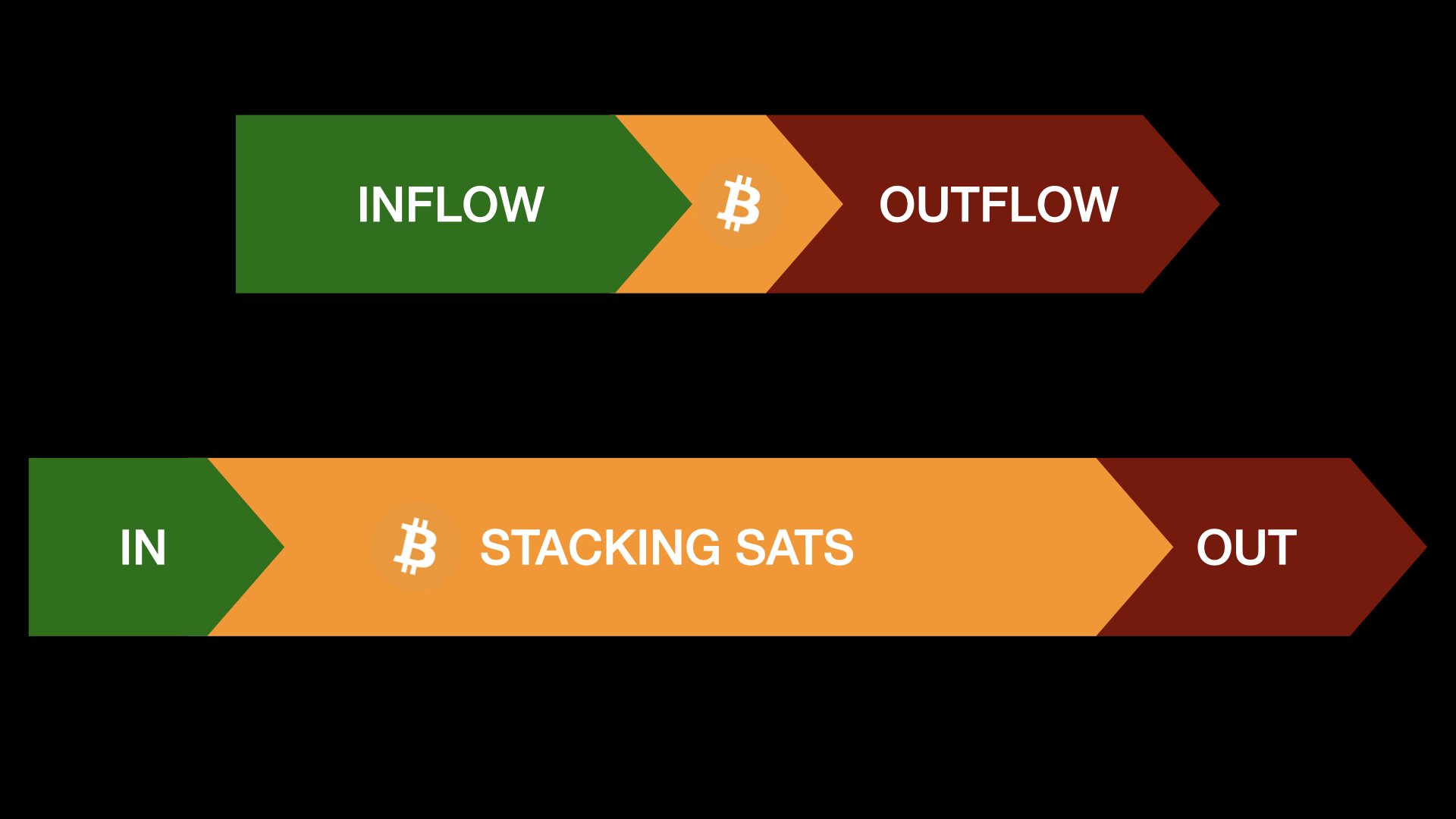

Bitcoin is the polar opposite. It is one currency that works for all, now and in the future. It eliminates imbalance as a natural function, wherever and as soon as it appears, because its supply cannot be manipulated. With a fixed supply capped at 21 million and an ever-increasing adoption curve, more and more people own bitcoin, and each person controls a smaller and smaller share of the same fixed pie. The ownership of the currency naturally becomes more distributed and less concentrated over time, which provides the foundation for greater balance. Bitcoin levels the playing field and ensures that the monetary system cannot itself be a source of extreme inequity. It does so by guaranteeing certain inalienable rights. Every holder of the currency is provided the assurance that more units of the currency will not be arbitrarily produced, and each unit of the currency is treated equally within the network. Bitcoin more effectively coordinates economic activity because its pricing mechanism cannot be distorted or manipulated by exogenous forces, which is the fatal flaw of the legacy currency system. A fixed supply, equal protection, and true price signals deliver greater balance. Bitcoin fixes the economic foundation for everyone such that everything else can then begin to fix itself.

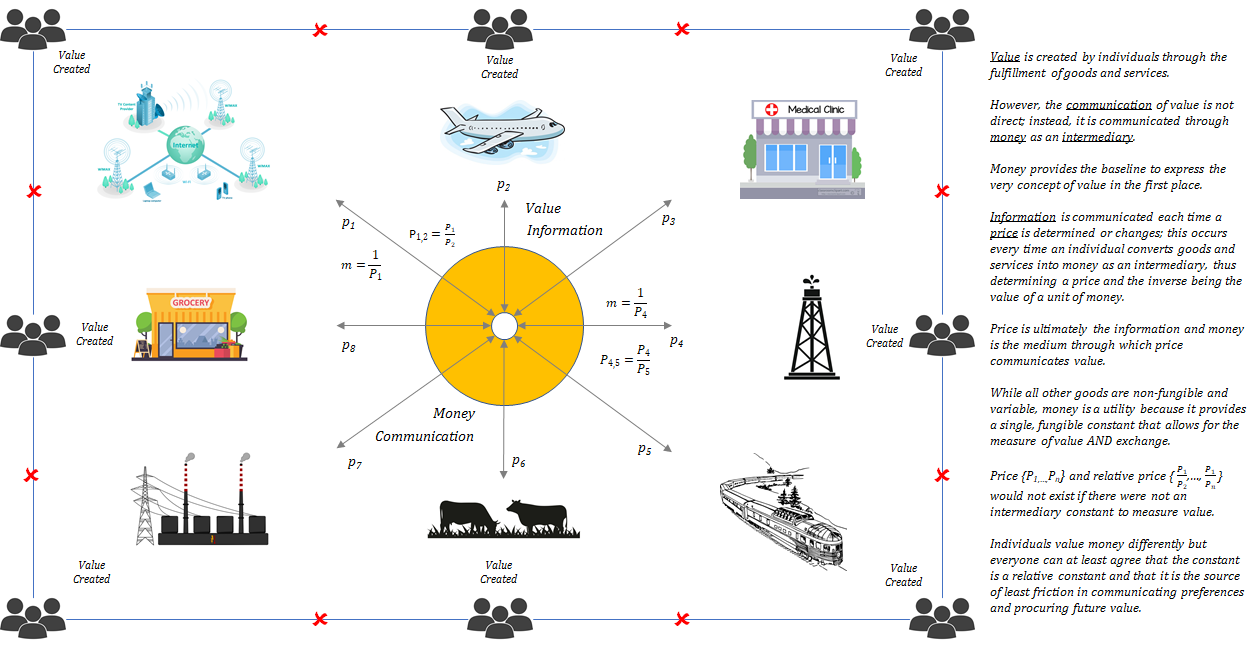

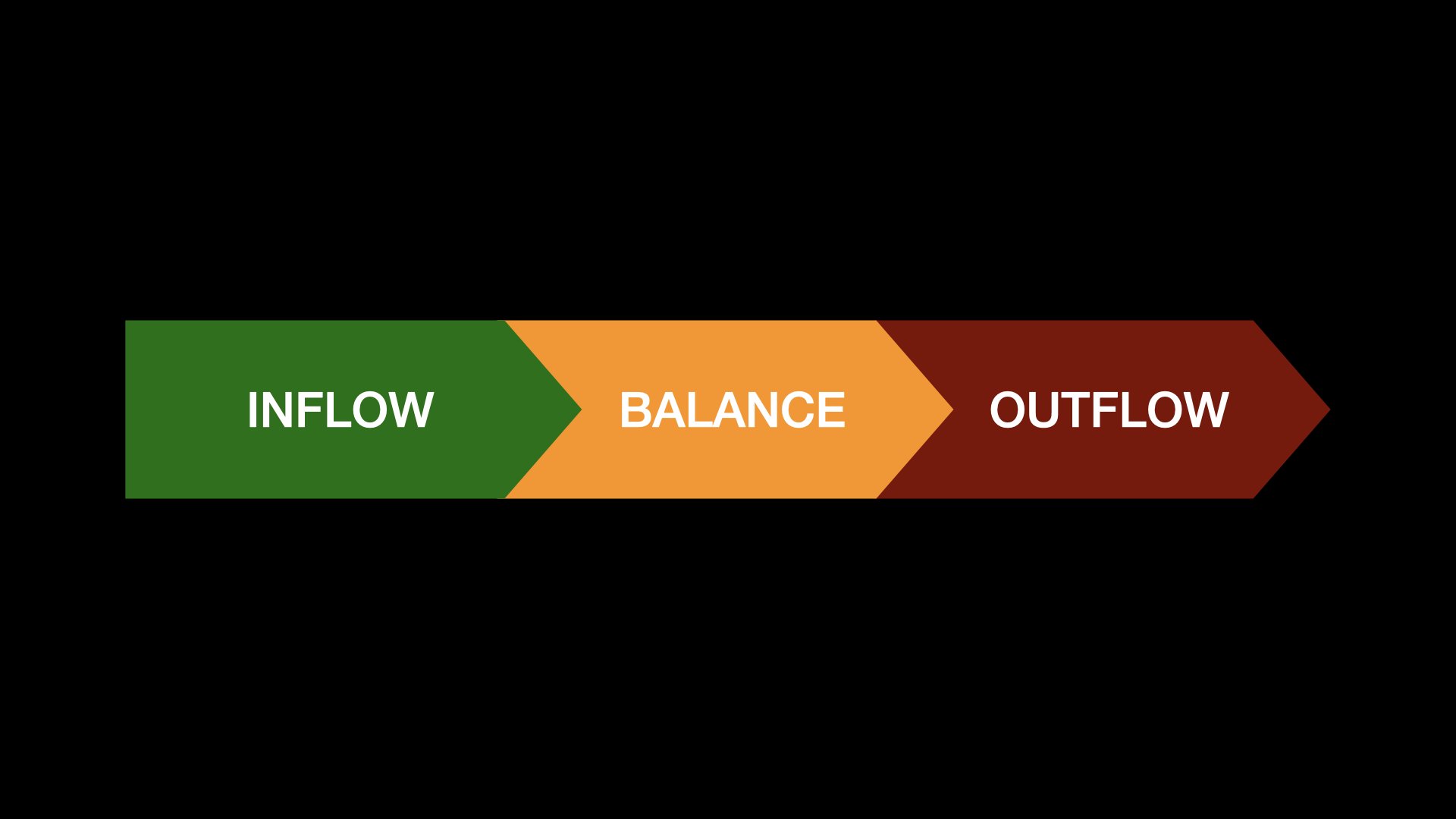

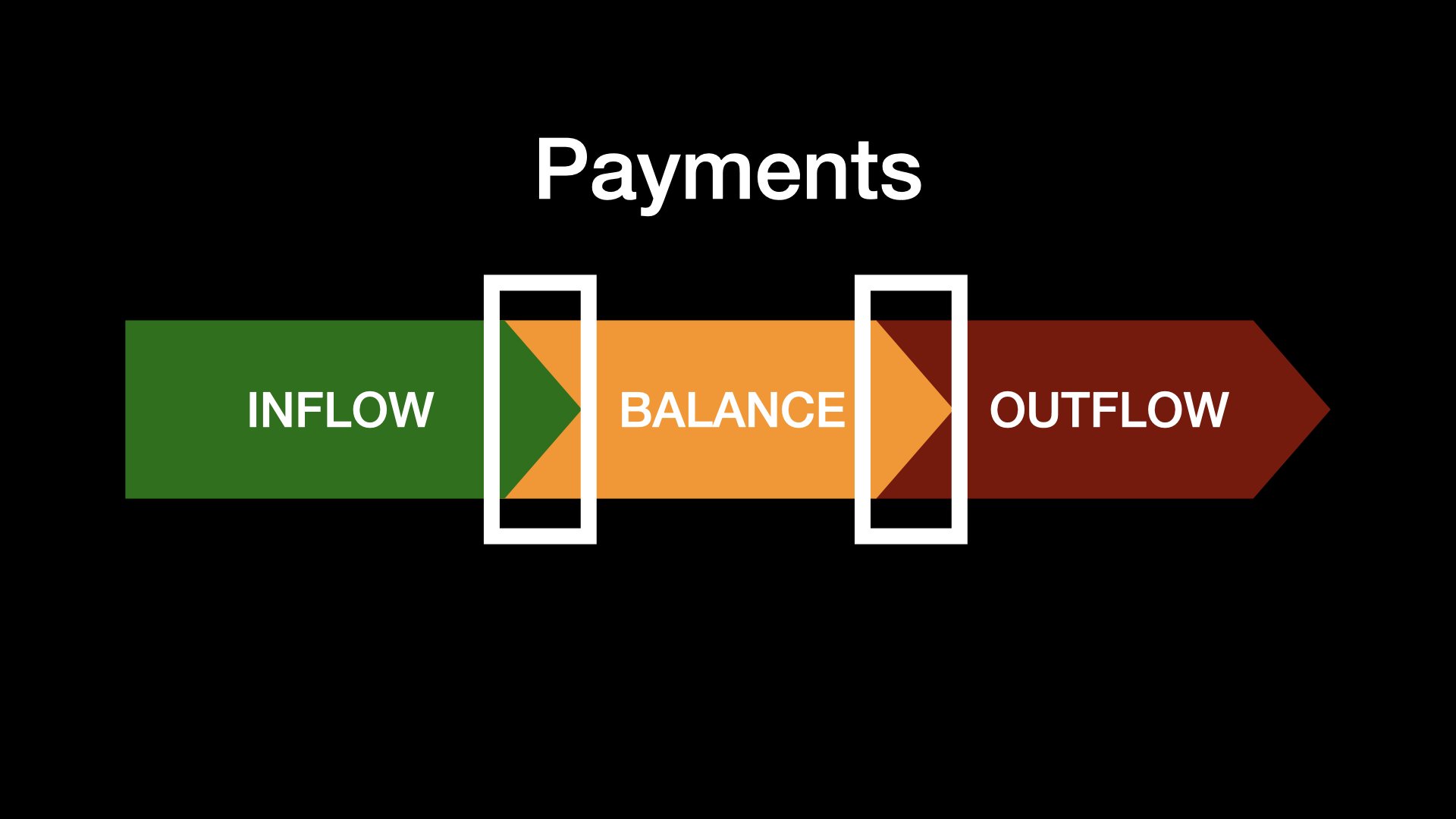

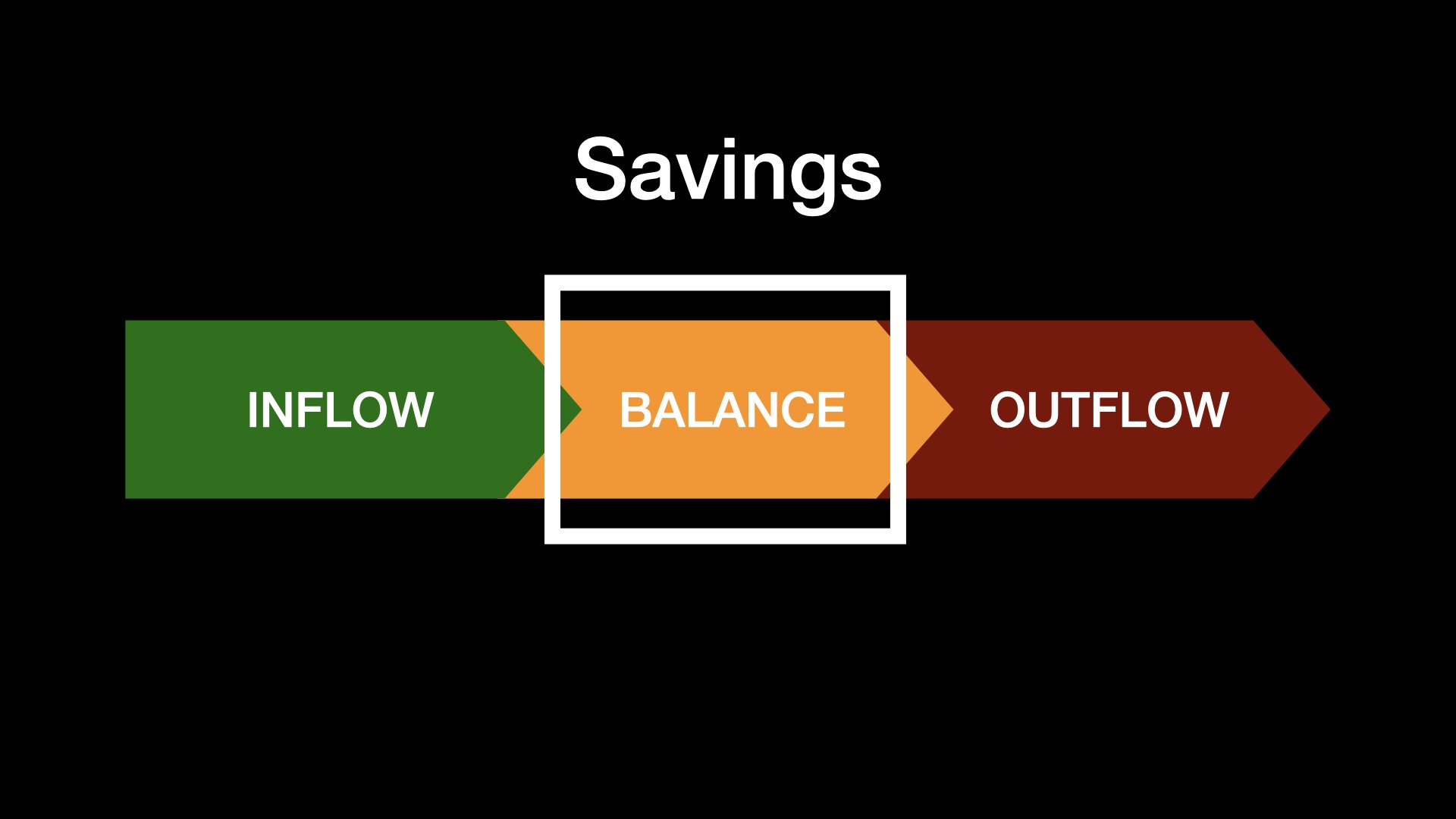

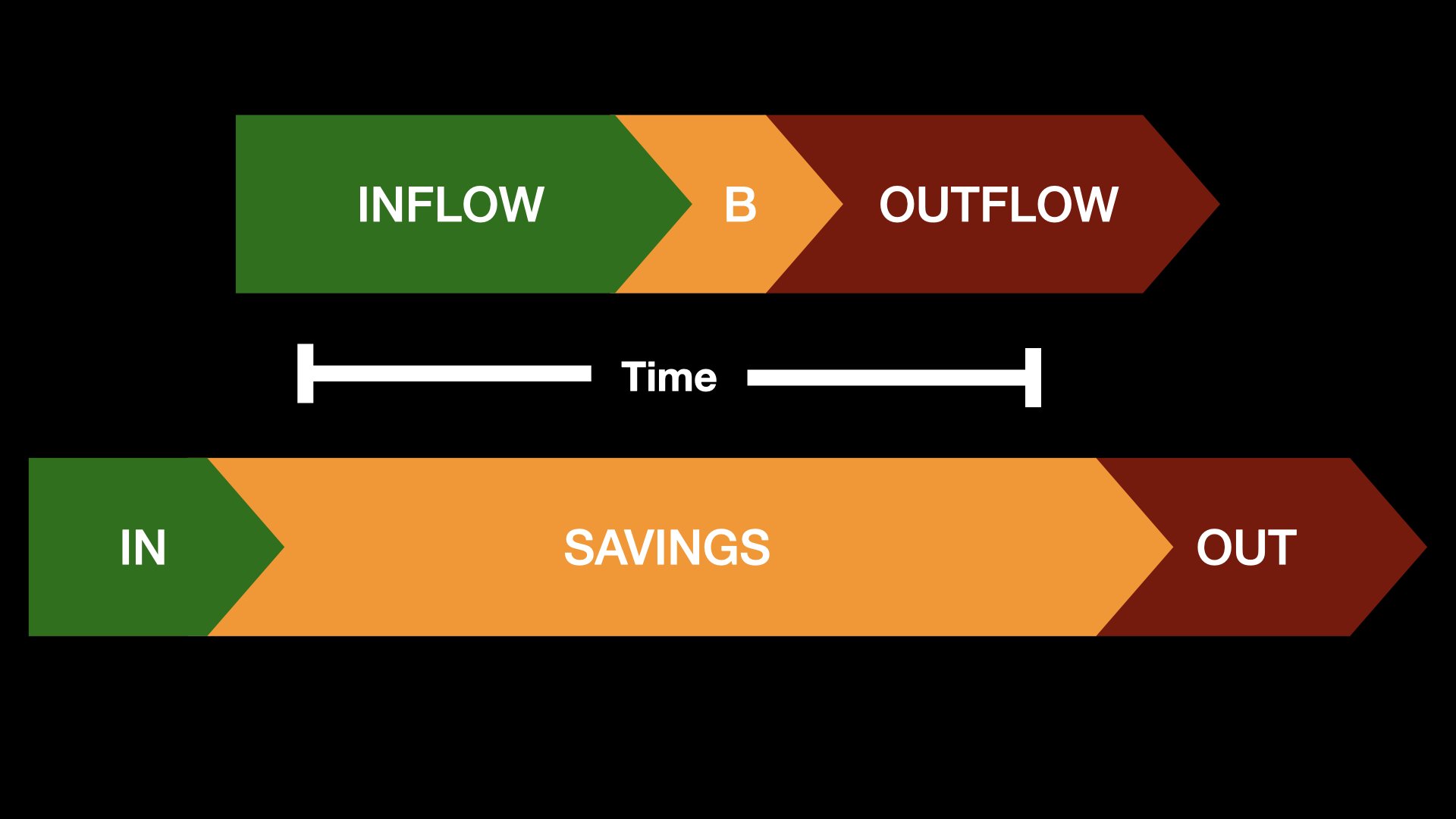

The Role of Money and the Price System

As a simplified construct, think about money as the coordination function within an economy. The utility of money is to intermediate a series of exchanges. Receive, hold, spend (h/t @pierrerochard), that simple. Money is the intermediary good used to both establish and trade value. As the market converges on a common form of money, a price system emerges, which allows for the subjective concept of value to be more objectively measured. Money is the pricing mechanism and the output is a pricing system. The price system communicates information; it aggregates individual preferences within an economy and communicates those preferences through local prices, as measured in a common monetary medium. Change in prices reflects changes in preferences.

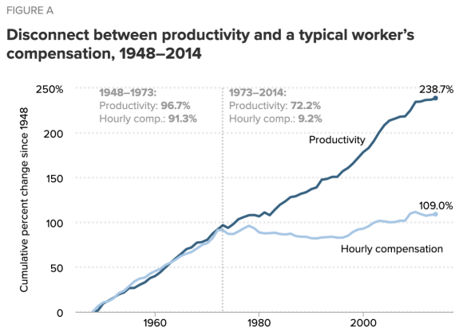

Because preferences are ever changing, so too are prices. Within a developed economy, there are millions of goods, each with individual prices resulting in billions of relative price signals. Relative price signals ultimately communicate exchange ratios between various combinations of goods. While the value of any single good may be static for a period of time, certain prices are always changing within an economy, which dictates that relative prices are ever changing. An economy constantly works to find balance through the aggregate changes in price levels. Anyone and everyone within an economy reacts to the price signals most relevant to their own preferences, which naturally change and become dynamically influenced by changing prices themselves. Through the price system, individual market participants learn both what others value and what they need to produce to meet their own needs. As prices change, behaviors change, and everyone adapts. The price system is the visible hand which allows for balance to be achieved and for imbalance to be identified and eliminated. Long-term economic stability is achieved because variable information is constantly communicated through the price system. It is the fluctuation in prices inherent to undistorted markets that actively prevents large scale and systemic imbalances from forming.

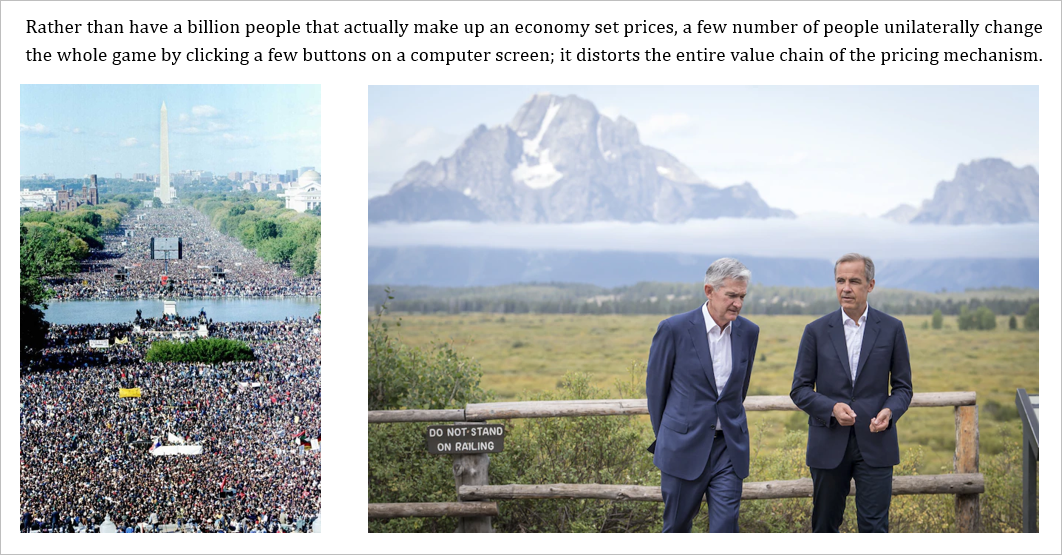

Flaws of the Central Bank Mandate

The foundation of the economy is broken because the money coordinating economic activity is actively manipulated. Most central banks, including the Fed, have the authority to create money arbitrarily at no cost and have a mandate to maintain stable prices (i.e. a price stability mandate). This combination is fatal to the functioning of any price mechanism and ultimately to the underlying economy. When a central bank targets the stability of any price level, it is actually working in opposition to the natural course of an economy, which seeks to find balance and to adapt to a change in preferences through the price system. Worse yet, the means by which a central bank works to achieve price stability is through the manipulation of the money supply, which distorts the entire pricing mechanism underpinning the economy. With every exogenous attempt to achieve price stability, the central bank actively allows imbalances to be sustained and distributes bad information to every person within the economy through false price signals, which in turn causes further imbalances to grow. Imagine this happening each time the economy tried to find balance. By sustaining imbalance, those that principally benefited from the existence of imbalance are continuously advantaged at the expense of everyone else.

Made worse, it actively impedes the ability of those on the lower end of the economic spectrum to contribute and to command a greater share of the resources within an economy. Artificially inflated asset prices create an uphill battle for those that do not own assets, and false signals induce poor economic decisions, disproportionately harming those lowest on the economic spectrum who can least afford errors and setbacks. False and distorted economic signals, created through the manipulation of the money supply, are counterproductive for all in the long run, but in the short-term, benefit those to whom the imbalance is positively skewed.

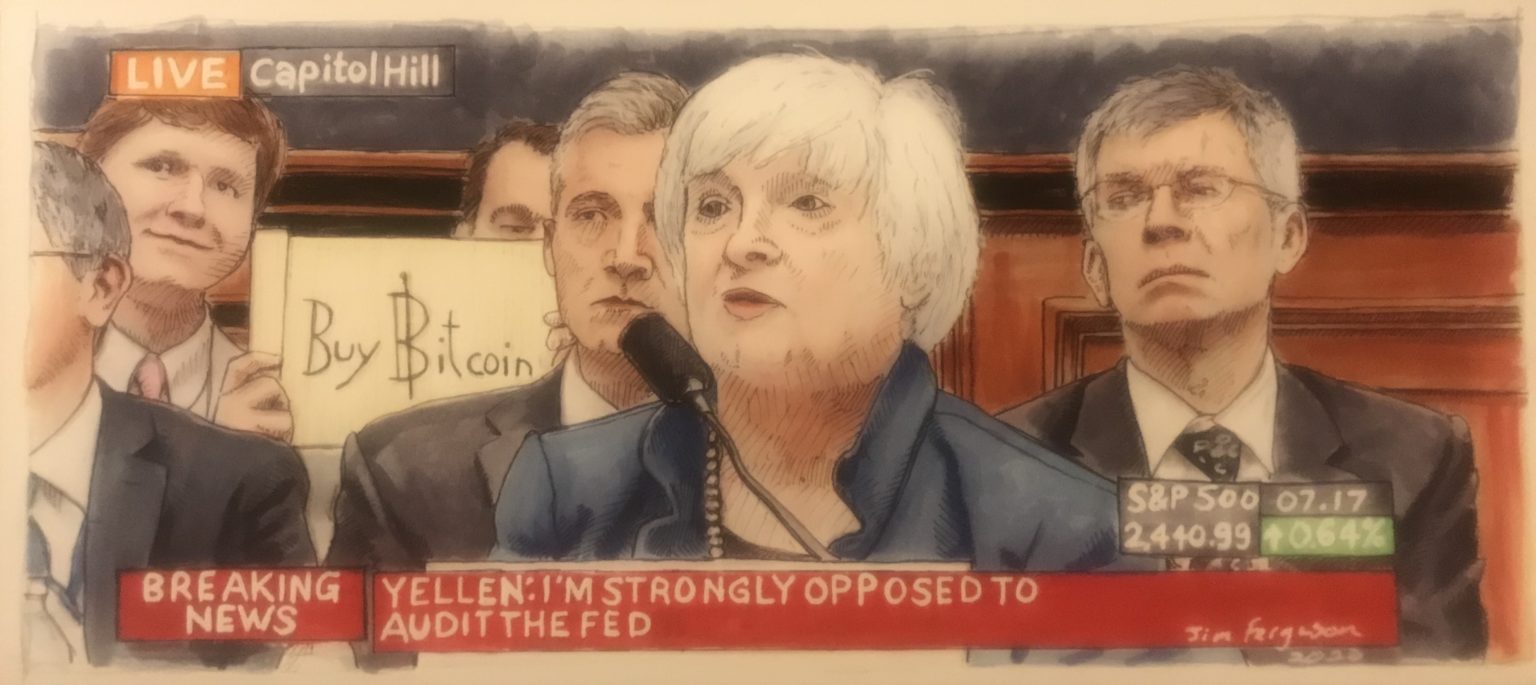

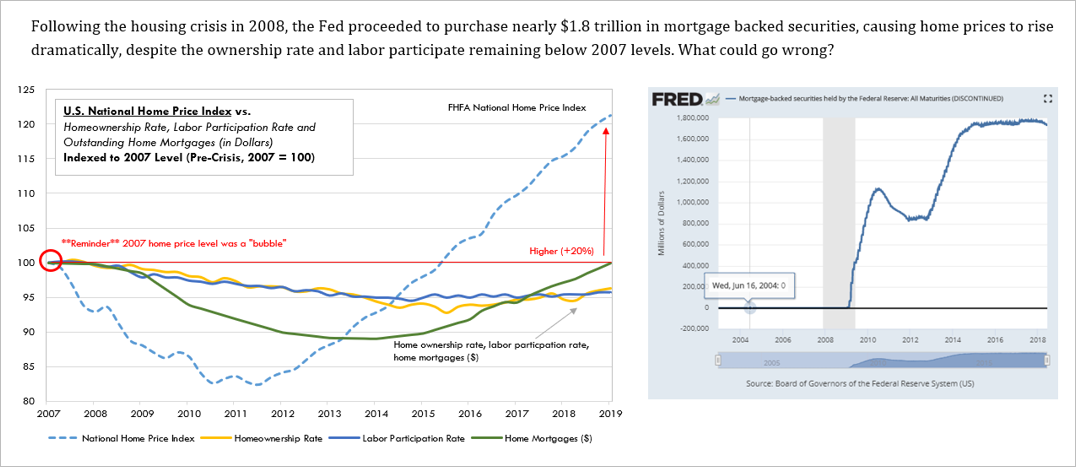

For example, when the value of real estate was declining during the 2008 financial crisis, the price mechanism of the economy was communicating that there was an imbalance. In aggregate, market participants were communicating an increasing demand for money relative to a decreasing demand to hold real estate. At that particular moment in time, the actual amount of money and the available supply of real estate were not rapidly changing. Instead, preferences within the economy were shifting as were relative price signals. Rather than allow the economy to find balance and eliminate imbalance, the Fed increased the supply of dollars in an effort to “stabilize” the dollar value of real estate. More literally, it created $1.7 trillion dollars and used those newly minted dollars to purchase mortgage-backed securities as a direct means to support the value of real estate. Those that owned real estate (e.g. housing) or operated businesses dealing in the production (or financing) of real estate benefited disproportionately at the expense of those that did not. The benefit skewed to the side of existing imbalance, as it always does when imbalance is being sustained artificially.

Not only did the Fed manipulate the value of real estate, it manipulated and distorted all price signals within the economy by significantly increasing the money supply. The market function to eliminate imbalance would have been for prices to change. The Fed’s solution was the opposite. It devalued the money (by increasing its supply), such that the value of real estate (among other goods) as priced in dollars would change the least. Rather than eliminate imbalance, the Fed’s actions allowed imbalances to be sustained and actually grow. Once one actually appreciates the fundamental role which money and the pricing mechanism play in coordinating economic activity, it becomes clear as day that sustaining imbalance is precisely what occurs each time the Fed intervenes to stabilize price levels. Stability when achieved through manipulation merely suppresses volatility. It creates an unnatural rigidity in price, when price fluctuation is both a desired state and the natural function of a market communicating changes in preferences. When imbalances that would otherwise be eliminated are allowed to be sustained by artificial means and for extended periods of time, it ultimately creates greater volatility in the long run and critically impairs the ability of a monetary medium to coordinate economic activity, which is its singular utility. Each time and cumulatively, it advantages and further embeds the incumbents, just as the market is working to eliminate imbalance.

By manipulating price levels, the Fed isn’t just preventing smaller intermittent fires from naturally running their course while creating larger fires down the road. Instead, think of the Fed’s actions as the arsonist that lights a fire, leaves through the back door in the middle of the night, and then is celebrated as the hero when it arrives through the front door to fight the fire with gasoline. A change in price levels, even if particularly volatile, is not a fire that needs putting out. Artificially preventing changes in price, aka a price stability mandate, is what lights the fire in the first place. The Fed coopts the entire value chain of the pricing mechanism. Change in price is actually desired and the central bank works in opposition to that change by manipulating the money supply. The formation of imbalance within an economy is natural; creating a centralized mechanism which prevents imbalances from being eliminated is the unnatural and damaging part. It also creates long-term economic instability by distorting price signals over decades and widens the wealth gap by constantly advantanging those on the right side of imbalance. Predictably and unironically, the existence of the central bank’s price stability mandate, combined with the power to print money, causes both long-term instability and sustained economic imbalances.

Hayek – The Pretense of Knowledge

Most mainstream economics professors would readily agree that price fixing or setting quotas on certain economic goods naturally creates economic inefficiency and imbalance. However, the same cohort of experts would then turn around and avidly defend central bank monetary policy, not realizing the fundamental inconsistency. Economic manipulation is economic manipulation. Rigidity in price or quantity of any economic good driven by exogenous forces results in imbalance; variance allows for balance and equilibrium. Very logical and not controversial. Why then is the same not understood when applied to money? Imbalances are created when central banks target interest rates through the manipulation of the supply of money, just as imbalances are created when the Venezuelan government arbitrarily sets the price of a gallon of gas below its market value. Ironically, the manipulation of the money supply happens to be economically more destructive because it distorts all prices within an economy, and all relative price signals as individual price levels do not adjust ratably (in fact, far from it). When the Fed pursues its price stability mandate, it is actively sending false price signals throughout an economy and causing imbalances in supply and demand structures to be sustained. Price stability is price manipulation, and it is perfectly predictable that when the price of money is manipulated to achieve any definition of stability, the very action causes a degree of economic distortion far worse than the manipulation of any single market.

Hayek – The Use of Knowledge in Society

Consequences of Sustaining Imbalance

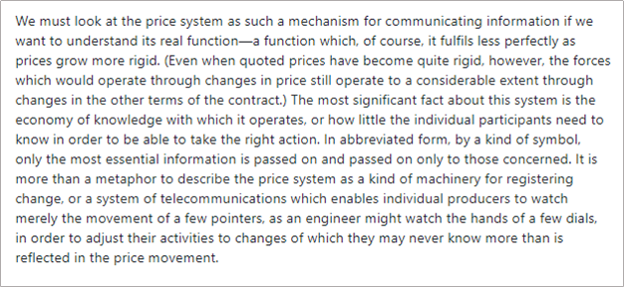

The effects of sustaining imbalance can be best understood and observed through the credit system because that is where the Fed directly intervenes and consequently where the greatest distortion and imbalance exists. As the economy slows and as price levels begin to change counter to the Fed’s desired course, the Fed increases the supply of dollars in the financial system by purchasing debt instruments (typically government treasuries) and crediting the accounts of the sellers with newly minted dollars. At the onset, the credit system was just a tool to effect monetary policy; it was the mechanism through which the Fed pursued price stability. Increase the supply of dollars by purchasing credit instruments, reduce interest rates by that same mechanism, induce economic expansion via cheap credit and cause general price levels to stabilize. That was the theory and intent. However, predictably, this pattern caused imbalances to form and be sustained in the credit system itself. Now the tail is wagging the dog. Today, the credit system in the U.S. stands at $77.9 trillion system wide, whereas there are only $4.5 trillion actual dollars within the banking system. For every dollar that exists, approximately $17 dollars of dollar-denominated debt exists (debt-to-dollars of 17:1). Again, this is an imbalance only made possible and sustained as a function of the Fed. Each time the credit system attempts to contract, the Fed creates more dollars to help maintain the size of the credit system, such that it can further expand. Because the credit system is now orders of magnitude larger than the base money supply, economic activity today is largely coordinated by the allocation and expansion of credit rather than by the base money itself. In aggregate, the credit system is the marginal price setter given its size relative to the base money supply. Because of its price stability mandate, the Fed has an implicit mandate to maintain the size of the credit system, and in order to do so, it must target asset prices that support existing debt levels. It has become circular. The Fed used the credit system as a tool to stabilize price levels but now it must maintain the size of the credit system in order to maintain stable prices.

This vicious cycle was only ever made possible because the Fed has unilateral control of the money supply. In 1971, President Nixon officially ended all convertibility of dollars to gold, and the U.S. government later decoupled the value of the dollar from gold altogether in 1976. While the creation of the Federal Reserve in 1913 was the beginning and President Roosevelt’s executive order in 1933 banning private ownership of gold set the stage, the complete departure from gold as a monetary anchor in the 1970s removed constraints that otherwise prevented the true centralization of the money supply, and which ultimately enabled the great monetary inflation which Paul Tudor Jones recently wrote about. Once the final constraints were removed, it opened the door for the Fed to take a more central role in actively managing the economy via the money supply, which it ultimately effects through the credit system. As a direct consequence, the base money supply and the credit system have expanded in ways that would otherwise not have been possible, allowing imbalances to consistently grow over time and creating long-term economic distortions.

When imbalances emerge in the credit system (i.e. too much debt existing), the Fed supplies more dollars such that existing debt levels can be sustained. Rather than write off bad debt and reduce existing debt levels, imbalances are actively sustained rather than eliminated. This is the real reason why the banking sector and the function of credit has become as large as it has; it would not have been possible if the Fed were not able to print money to artificially sustain unsustainable levels of debt, all in the interest of “price stability.” Effectively, each time the banking sector would otherwise contract, the Fed takes measures to actively prevent it. It sounds crazy because it is, but it exists the way it does because the credit system is the primary transmission mechanism of the Fed’s monetary policy. The Fed needs the credit system to be maintained because it is through this vehicle that the Fed attempts to “manage” the economy. The Fed sees targeting asset prices to sustain debt levels as less disruptive than allowing debt to be restructured and written off. In the Fed’s eyes, it’s six one way, half a dozen the other; effectively the same, but with less disruption. In reality, one path is economic manipulation of the worst kind, and the other is the natural and organic balancing of an economy in imbalance. The Fed chooses the former, trading short-term stability for long-term instability and distortion.

While it should be obvious that asset price targeting advantages those with assets (wealthy) and is a regressive tax on those without assets (poor), the Fed has its price stability mandate. For those on the lower end of the economic spectrum with little to no savings, cash naturally represents most, if not all, of one’s savings. On the other hand, those at the higher end of the economic spectrum typically hold cash in addition to equity in businesses, real estate and financial assets, such as stocks and bonds. Again, consider the 2008 financial crisis. There were imbalances in both the housing market and financial markets; prices within these markets were at unsustainable levels. As imbalance was being eliminated and as price levels were correcting, the Fed stepped in to “stabilize” asset prices. Imagine that you were someone just entering the economy, without any savings, or you could not afford to purchase a home and likely did not own stocks or bonds. Everyone who owned assets was bailed out at the expense of those who did not, all in the interest of price stability.

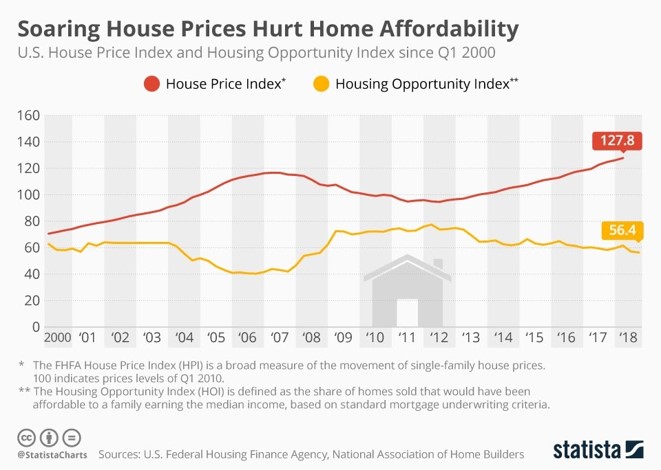

By increasing the supply of dollars to prop up asset prices, each dollar naturally becomes worth less. For those lowest on the economic spectrum, wages paid in dollars (labor) were devalued, and asset prices were directly manipulated higher. Inflation of most all consumer goods broadly followed. It is the equivalent of being hit from both sides. Wages purchase less and less day-to-day, and it becomes measurably more difficult to accumulate the amount of savings necessary to purchase assets. Initially, the effects are at best zero-sum. Those at the top benefit, those at the bottom suffer. In the end, everyone loses because the end game is economic instability. Notice the negative correlation below between housing prices and housing affordability, and then recognize that housing prices are actively manipulated by the Fed. Also recognize that housing prices are at an all-time high (above 2007 bubble levels), when nearly half the country has no savings. That equation only exists in a manipulated world, and it crushes those without savings.

Economists running the show and those that benefit the most will overwhelmingly agree it has to be done (every time); history is written by the winners but it is still all smoke and mirrors.

“Sure, it was a crazy experiment, but the Fed had no other choice. Just imagine all those on the lower end of the spectrum that would have lost their jobs if not for the Fed’s actions. Without a job, the poorest on the economic spectrum would have been far worse off and would not have been able to afford a home.”

At least, this is the common, predictable defense. The same line has certainly been used to defend the Fed’s most recent actions in response to the global pandemic (printing $3 trillion with a T). While it may seem like logic, it is an anecdote that lacks any fundamental economic argument in defense of the manipulation of price levels. The narrative is caught in a vicious cycle that begins with economic imbalance as a starting point (and one created by decades of the same distortive monetary policy). Recall the role of arsonist hailed as a hero fighting the fire. You cannot dig yourself out of a hole by continuing to dig in the same direction. At a fundamental level, manipulating price levels allows imbalances that would otherwise course correct to be sustained. It disproportionately advantages those that contributed to, and benefited the most from, the very existence of imbalance – like having your cake and eating it too, or like getting a second bite at the apple. Those most directly bailed out took an inadvisable risk, and rather than be penalized, the world of imbalance is sustained. The advantages gained from manipulated incentive structures are allowed to continue in a way that would not be possible absent the Fed’s policy decisions.

An Unmanipulated Economic Structure

While there is never perfect balance, the existence and fluctuation of price levels is how an economy works toward balance through trial and error. Every individual reacts to an ever-changing set of price signals. It is how people evaluate which businesses to create, which skillsets to acquire, and which jobs to pursue, all of which are interdependent on each individual’s own interests and capabilities. Imbalances can naturally arise within an economy as individuals speculate and over-invest in certain segments based on imperfect expectations of consumer preferences. That is the nature of trial and error. Nobody knows or can predict the future; they use price signals to best guide decisions. A business or individual produces a good for X and attempts to sell it for Y, and if insufficient demand exists to make the activity profitable, that is the market communicating information to the producer. Better luck next time; build it for less or build something else that is of greater value or valued by more people. Imbalances are eliminated. Those that took the risk own the consequences, and it’s back to the drawing board in a never-ending game aimed at marrying individual ideas and skillsets with the preferences of other market participants.

“Prices and profits are all that most producers need to be able to serve the needs of men they do not know. They are tools for searching — just as, for the soldier or hunter or seaman, the telescope extends the range of vision.” — Friedrich Hayek

Money is the tool that is used to coordinate resources and to test the market by trial and error; it becomes the lifeblood of an economy because it is the foundation of a price system. It is how information is distributed to all participants. The better the money, the more reliable its price system. And the more reliable a price system, the greater the balance in an economy. Those within an economy that deliver the greatest value to the largest number of people are naturally rewarded with the most money, but money would be of little value to the producer if others were not producing goods that they themselves valued. The system would not sustain itself if balance did not exist; in order to purchase a good or service from another individual, one must have earned money in the first place. Acquiring money by voluntarily providing a service valued by others is a far better outcome for everyone in aggregate than if money were to be acquired through any other means. It is so because it’s the only way for the cycle to be repeatable and symbiotic rather than one-off and zero-sum. What good is a customer that runs out of money or doesn’t have any in the first place? In a balanced economy, every producer is a customer of someone else and vice versa.

“Give a man a fish and you feed him for a day; teach him how to fish and you feed him for a lifetime.”

One need not be religious to understand the wisdom. Each individual benefits by having a larger number of people producing more goods or services, and everyone is incentivized to produce output valued by others within an economy. Everyone has a selfish interest in both delivering value to others and in helping others to contribute value in return. But, it is not just a naïve or hopeful economic view of the world; there are discernible benefits to trade, specialization and ultimately, in a broader range of choice for all individuals, which organically dictates a division of labor. Money coordinates the division of labor, and the form of money with the most reliable pricing mechanism will consistently deliver the greatest value with the greatest range of choice and balance. The pricing mechanism with the least distortion provides the clearest signals as to what other people value, and derivatively, provides the greatest assurance that the information communicated is not a false signal. The undistorted function of a monetary medium and its price system is what ensures imbalance is eliminated; it is the governor that allows for balance to be restored and for symbiotic relationships to continuously be discovered in a constant process of trial and error.

A Manipulated and Broken Economic Structure

The Fed’s monetary policy actively prevents the economy from restructuring and from finding balance. Efforts to maintain price stability when imbalance exists equates to maintaining otherwise false price signals. Productive assets remain in the hands of a few, and the world remains suspended in a state of imbalance. Money that makes its way to those on the lower end of the spectrum eventually finds its way back to those that control the productive assets like a steel trap because structural imbalances are never fixed. Instead, the natural healing process is stymied when the Fed intervenes. The structure of the economy cannot sustainably cycle money in a symbiotic way because balance does not exist; skillsets and preferences of market participants are not aligned. The Fed pumping money into a structurally broken economy is akin to giving a man a fish and feeding him for a day, while at the same time preventing him from learning how to fish by sustaining false signals. The existence of imbalance signals that the composition of an economy is not meeting the needs of the participants that make up the market. Or rather, that the assets and individuals which capture the lion’s share of wealth would not continue to do so if the economy was allowed to restructure.

The Fed’s economic structure produces inequity by preventing imbalances from rebalancing. That is what the market attempts to do every time the Fed steps in to keep the dream alive. Giving all benefits of the doubt, the Fed believes it is helping. The starting point of the Fed’s economic theory is that active management of the money supply is a positive driving force. That is in its DNA. It is not questioned or debated. It sees its activities as smoothing out market signals rather than manipulating them. The question for all those within the four walls of the Fed is how much and when to manipulate the money supply, not if. Would anyone expect the Fed to be an honest evaluator of its actions? It would be like grading your own test; no one would reasonably expect an objective assessment because there can be no objectivity. Certain false assumptions are encoded in their brains as true which prevents the possibility of objectivity. They look everywhere for answers but in the mirror, and try the same policies over and over again, always expecting a different result.

“Inequality is something that has been with us increasingly for more than four decades, it’s not really related to monetary policy. It’s more related to [stutter] there are a lot of theories on what causes it, but it’s been something that’s more or less been going up consistently for more than four decades and there are a lot of different theories, one of which is just that globalization and technology call for rising levels of skills and aptitudes and education and that U.S. educational attainment flattened out, certainly relative to our peers, over that period[.]” Jay Powell, Chairman of Federal Reserve (June 2020)

Fed Chairman Powell recently provided this as a response to a question asking whether Fed policy contributes to increasing wealth inequality. Notice how the response is not an argument as to why central bank policy does not cause imbalance and inequality. It is more of a pronouncement followed by a “look over there” defense. Never believe the myths about globalization and technology driving wealth inequality. There is nothing about technology, innovation and globalization that causes sustained economic imbalance or a structurally expanding wealth gap within an economy. For innovation to be valuable, it by definition must solve problems for a range of people, but if those that valued it did not have money or means to afford the innovation, it wouldn’t be valuable. Value becomes self-referencing in that sense. Economic balance is a governing input to value. In order to believe the tall tales of technology and globalization causing economic imbalance, one would have to be willfully blind to the impact of centralizing the money supply, which in turn caused banking to become the epicenter and lifeblood of the economy, and which made it possible for imbalance to actively be sustained over decades as a policy decision. There may be many theories, but the manipulation of every price signal within the economy is ground zero to economic imbalance and inequity; it is the structural flaw in the foundation which creates the unlevel playing field off of which all other contributing factors compound.

If A then B; if not A then not B