WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the April 2020 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

Cover Art by Van

A big thank you to Van for allowing me to use your work on the cover of this month’s journal. Van is part of the crypto art movement and is exploring digitally scarce artwork through NFT platforms. Visit Van’s website for more information.

Van is a digital artist and graphic designer from Italy with an interest in abstract digital art, whose work showcases new ways to mix and blend design and art with a touch of bright contrast colors.

The Political Theology of Bitcoin

By Erik Cason

Posted March 29, 2020

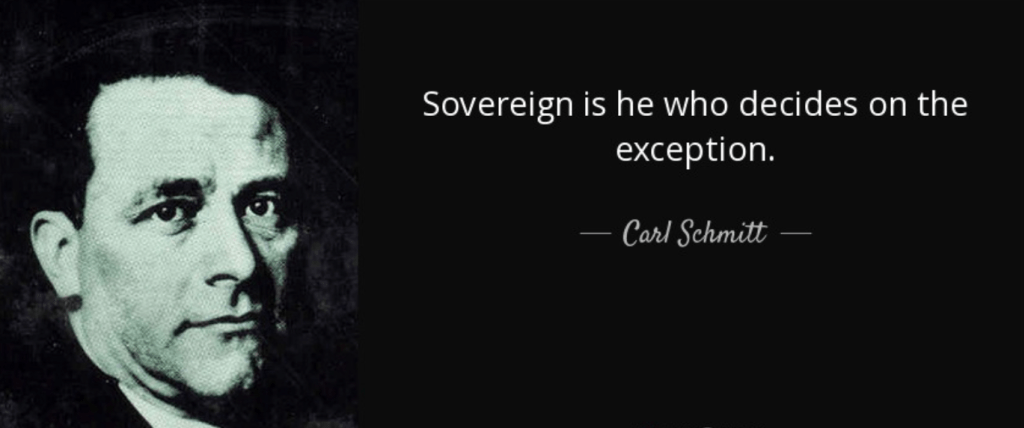

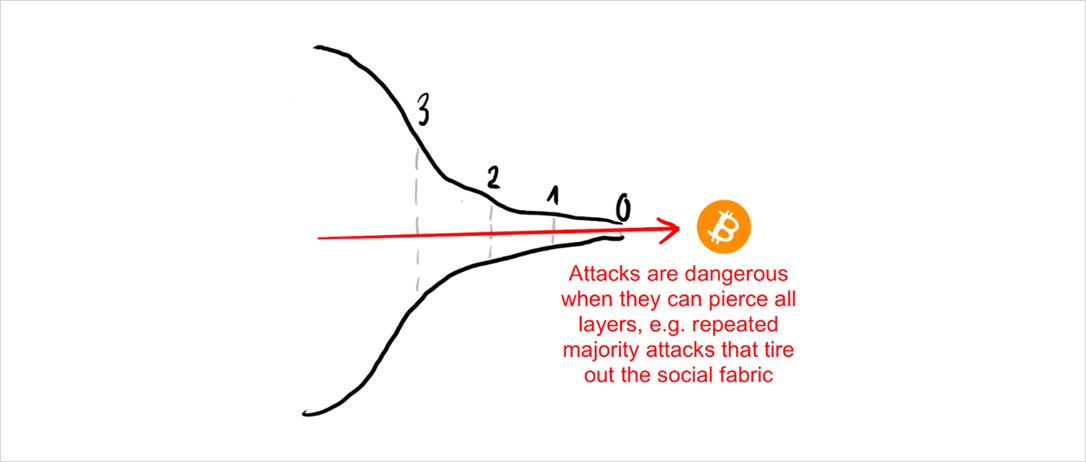

This is the famous opening statement of Political Theology: Four Chapters on the Concept of Sovereignty published by Carl Schmitt in 1922. This statement offers the fundamental axiom of how all sovereign power functions, and how the sovereign exception found in emergency legal decrees allows for any sovereign to overcome and dispose of the law. In the essay the political theology of crypto I explain how cryptography negates the possibility of the sovereign exception through the banishment physical and identifying power, which thereby erodes all forms of contemporary state and legal power. I have also wrote an essay on how the metaphysical tensions between any sovereign and any subject will always result in a power dynamic that where the sovereign decision will always over come any law in times of sincere crisis or emergency, and how cryptography negates this form of power. In this essay I would like to expound more deeply upon the explicit theology of bitcoin, its formula of power, and what it means for the fate of humanity in these darkest of times.

Bitcoin as Subjectivity

While bitcoin is inherently an object of war, it is also an object of art. Art because it is only an expression–an object of non-tangibility, and subjective individual human values according the society we live within. However, through a Hegelian synthesis of art and war; bitcoin spills out from the noosphere as a damnation of all fiat currencies of the world of flesh and steel, and the redemptive answer we seek to rescue and restore law, economy, and order from these crises forced upon them. Through the power of cryptography, and the systems of truth that it demands; Bitcoin expresses a form of truth that no human, institution, or organization is any longer capable of anywhere the physical realm or legal jurisdictions.

This artistic power of war that bitcoin harnesses comes from a totalizing deterritorialization and reterritorialization (in the Deleuzian sense of the word) of the global order through the initiation of a new plane of immanence based upon cryptographic power. This plane of immanence is the renewal of a nomos (law, customs, or social cohesion) of humanity with the internet at its organizational core, and truth as the form of legitimacy. It is a novus ordo seclorum where truth, not authority, becomes the renewed source of legitimacy for all people everywhere. Through the exchange of the legitimacy of power through the sacrifice of authoritarian decrees for the truth of what is, bitcoin inverts the sovereign formula of power.

Both Schmitt and Agamben, two of the leading scholars on the philosophy of sovereignty, define sovereignty as a boarderline concept that is traced throughout the theory of the state. Both conclude that sovereignty finds its foundation in the authentic decision that IS the sovereign exception of the law (also know as ‘a state of emergency’ or ‘sovereign crisis’), not the norm. Schmitt surmises this as, “‘All law is situational law.’ The sovereign produces and guarantees the situation in its totality. He has the monopoly over this last decision.”

This is of great importance because it is through the sovereign exception found in emergency decrees all state law is doomed to the fascism inherent to it. There is no bearing or trace of truth in the sovereign exception; only the raw authoritative power that will justify any legal exceptions. The great father of the theory of the state himself, Thomas Hobbes surmised this in Leviathan rather flippantly as;

“Auctoritas, non veritas facit legem (authority, not truth makes legitimacy)”

Schmitt, whom is among the most esteemed of legal scholars on Hobbes and his theory of the state, further surmises this point of how authority functions within the sovereign exception:

“The exception, which is not codified in the existing legal order, can at best be described as a case of extreme peril, a danger to the existence of the state… It is truly a matter of extreme emergency and how the emergency can be eliminated… From the liberal constitutional point of view, there would be no judicial competence at all. The most guidance the constitution can provide is to indicate who can act in such a case… He [the sovereign] decides if there is an extreme emergency as well as what must be done to eliminate it. Although he stands outside of the normally legally valid system, he nevertheless belongs to it, for it is he who must decide weather the constitution needs to be suspended in its entirety… Whether one has confidence and hope it can be eliminated depends on philosophical, especially on philosophical-historical or metaphysical convictions.” Carl Schmitt, Political Theology p. 7

Bitcoin as Philosophical Conviction

Bitcoin is the philosophical cognition of a world that has lost its nomos, where truth no longer a fact, but an opinion of power. Only in a world where seditious guile rules opening, where money is but a tool for the politically powerful, does bitcoin present its radical antithesis to the current paradigm of law, order, and sovereignty. It is the fulfillment of a crypto-anarchist critique of state, money, and legal power.

It is this philosophical conviction–particular the philosophical-historical cognition of what cryptography is, how it was developed for total war, and what its development throughout the concourse of human history means; that we find a categorical imperative from which the sovereign exception can be totally and completely eliminated. Through the linguistic form that is cryptography; a demand is created that can only be answered in binary form of ‘yes, yes,’ or ‘no, no,’ and nothing else. It is a formula of true / false statements of output ownership protected by the magnanimity of cryptography, which creates the timechain of bitcoin, and the fulfillment of bitcoin’s oath to the cryptography that concretes it.

The sovereign legal form glitches out before naked truth and the total silent obligation that is the secret of all state power, arcana imperii:

“The obligation of subjects to the sovereign is understood to last as long, and no longer, than the power lasteth by which he is able to protect them. For the right men have by nature to protect themselves, when none else can protect them, can by no covenant be relinquished.” -Thomas Hobbes, Leviathan

A world that has lost its nomos is a world where no sovereign power, institution, or government can offer even the most basic protections or assurances that comprises of the dignity of life. While the law is suppose to be the fulfillment of the most basic promise of the social contract by the sovereign, we have entered into a territory where no such promise exist. The law today is little more than authoritarian approvals, appeals, rules, and decrees; lacking even the most basic contractual functions. Through the broken oaths of sovereign powers everywhere towards the most basic aspects of the social contract; all people everywhere have been forsaken, the truth of their laws and their justice corrupted in every way.

In this darkest of nights however, there is a spectacular gem of truth from which light gleams and points towards our exit from this hollowed and damned place. Bitcoin and the cryptographic breakthroughs that it has ushered in over the last decade offers us a totally new and novel strategy of human organization that breaks out of the sovereign form and can restore law, order, and economy to their rightful places. As Foucault warned us, “In political and social theory, we still have not cut off the king’s head.”

Bitcoin and cryptography is a form of power that is beyond any physical force and the brutishness of any form of authoritarianism for the very real truth it must contain in order to function, and the very real protection that the cryptography it contains offers. Bitcoin is the premonition of an idea whose time has come; of a humanity that is ready to rise to its task of the abrogation of the statism, and to restore the political to its rightful place at the forefront of any law.

Bitcoin is a new form of political, economic, and moral organization that raises truth to being the only sacrosanct of any law. It is the philosophical cognition of a world that understands the insipid greed of men, and the infinite vice that is power. Bitcoin has enables a new form of digital organization that banishes the prattling lies of men, and demands the proof of any claim. Bitcoin does this through returning truth to its preeminent place as the foundation of all social contracts, and the meaning of truth in such agreements through the cryptographic formula of verification.

Bitcoin as Political Theology

At the very end of Political Theology, Schmitt of all people, provides us with an anarchist’s critique of any sovereign decision by the very virtue of what any decision by a sovereign power must be and how it is decided:

“Every claim of decision must be evil for the anarchist, because the right emerges by itself if the immanence of life is not disturbed by such claims. This radical antithesis forces him of course to decide against the decision; and this results in the odd paradox where Bakuin, the greatest anarchist of the nineteenth century, had to become in theory the theologian of the antitheological, and in practice the dictator of an antidictatorship.” Carl Schmitt, the final paragraph of Political Theology

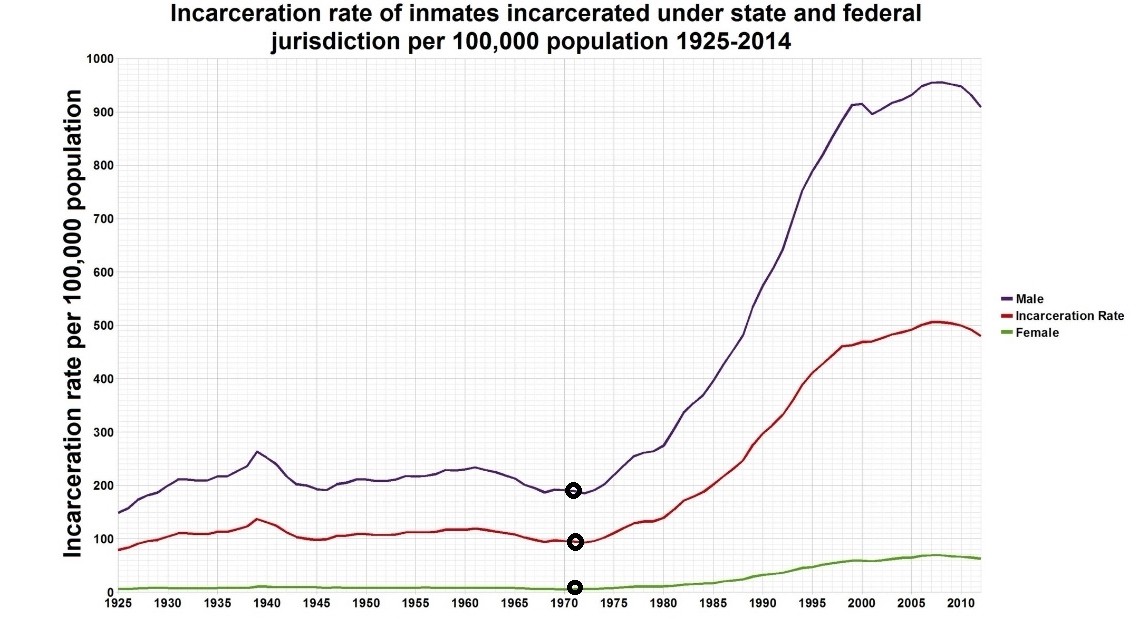

It is this radical antithesis that has us also decide against the decision as well. We are products of the late 20th century; grandchildren of the spectacle society where all forms of life that would not be subjected to the machine were liquidated long ago. Now under the grimace of the total corruption of law, the complete looting of the treasuries of all peoples by political and corporate oligarchies everywhere from ’emergencies’ of their own creation; we find the reason for us to rise against, and choose to reclaim that which is only ours. This the reactivation of the political as the struggle for life, and the right to die trying; opens the truly political (polis) once again.

We understand how Bitcoin makes for the oddest of paradoxes; with anarchism becoming in theory the greatest form of ‘capitalism’ against all states, and in practice, a dictatorship of privacy and pseudonymity which unrelentingly will not give itself to anyone but the individual.

Bitcoin rings with a thunderous crack, “Vires In Numeris” and becomes more powerful and fervent with each seeker that we convert. It is a political theology that restores truth as the final weapon against a system of lies, fear, and exploitation to renew the nomos of humanity, and for us all to discover that there is still a political to be claimed, but only for those who are willing to take the risk.

The Revolutionary Truth Hidden in Bitcoin

Having witnessed the twilight of humanity befall idiotic and empty slogans under the barbarism of statism’s vacant chanting of idiotic lies; the spectacle has envelopes all. In all of its grandeur of stupidity and lobotomization, state capitalism has fused with the totalitarian eye of the internet; idiotically unaware of the beast it was unleashing, the prophecy it was fulfilling.

From the very outset, we can see the fundamental contradiction between the idea of sovereignty and the functions of cryptography. Cryptography is completely unanswerable to any sovereign power, as it lack the capacity to understand anything beyond its binary language of true or false, nor does it capitulate to any form of violence. The only laws that cryptography understands are the laws of mathematics which animates their functions.

By the very nature that no sovereign power can overcome the laws of mathematics that animate cryptographic systems, it points to the very nature of what crypto is and its hidden encrypted meaning. There is no emergency, war, pandemic or crisis that can stop bitcoin. Now there is only the real state of emergency to be introduced, and the final struggle in which we take our rightful place as the owner of ourselves, our political systems, and our wealth for those whom we hodl in common.

This is the political theology of Bitcoin, the radial promise of a machine of truth that can only speak in a binary of true or false, documenting its own claims of just that. From the outset of the creation of the timechain of Satoshi’s; Bitcoin has been nothing more than a mechanization of truth-telling of what address owns what bitcoin, and how many joules of energy were used to produce those bitcoins.

With each block that is built on the bitcoin timechain, it resounds and echos louder and louder against the backdrop of man and his fallen world of lies, deception, and deceit. Only in a time where man has become an insipid beast of guile and sophistry, where politicians and gangsters openly fraternize and discuss how to rape the world with no consequence to themselves, does the theology of bitcoin and the promise it cointains move from revolutionary to messianic.

There is no longer any government anywhere that can offer the same promise as that of Bitcoin does. There is no central bank, no commodity form, no currency, no ‘crypto‘ outside of bitcoin that can offer the same assurances or security as bitcoin. The theological promise of bitcoin is that there will never be more than 21 million coins, and that there is no way to alter the supply schedule, or know exactly who owns what outputs. It is a new social contract based upon the inverted form of the sovereign dictum, with truth–not authority–being the legitimate maker of the law that is bitcoin’s blockchain.

In a world where governments across the globe have promised to create infinite monetary units, swore everlasting loyalty to corporations and melomaniacs before their own citizens; the only thing left to do is refuse their broken social contract they call law, and create new ones better and more fitting for our times. Through the power, glory, and grace that is bitcoin, and for the magnanimous promise that Satoshi Nakamoto has delivered to us; bitcoin is the theological answer to the crises of our time. Its heliotropism directs us towards a world where we use cryptographic systems to verify the truth of all things, and utilize such a power to renew and recreate our systems of liberty and justice for all.

Satoshi Nakamoto’s promise of a money that does not change for the light and transient causes of mortals, nor bend to the callous and pathetic will of politicians around the planet has given us a light to follow in these darkest of times. It is the oath of the cryptographic machine to itself, and its total intransigence to change for any crisis, emergency, or state of exception. Though this most wonderful and theological of tasks, Satoshi Nakamoto has created the machine of economic redemption that we need to renew our world, to free ourselves from the chains of debt and bondage that governments around the globe have forced on to all of us. It is a method to renew the social contract to its original form, and what the promise of a social contract under the rubric of truth really means.

“Every man having been born free and master of himself, no one else may under any pretext whatever subject him without his consent.” –Jean-Jacques Rousseau, The Social Contract, 1762

Bitcoin Correlation to Gold Jumps in 2020

By Gabor Gurbacs

Posted April 3, 2020

Quick take:

- Long-term, bitcoin correlations with traditional asset classes remain low.

- Short-term, the market sell-off induced by the COVID-19 pandemic increased bitcoin correlations with traditional asset classes—particularly gold, potentially hinting at bitcoin’s increasing safe-haven status.

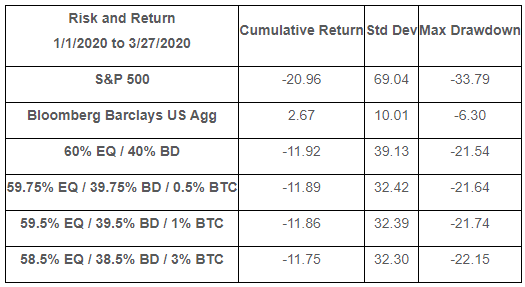

- A small bitcoin addition to a 60% equity/40% bond blended portfolio significantly reduced portfolio volatility during the recent market sell-off. While there are no U.S. bitcoin ETFs available today, we believe such products may have significantly reduced volatility for 60% equity/40% bond blended portfolios.

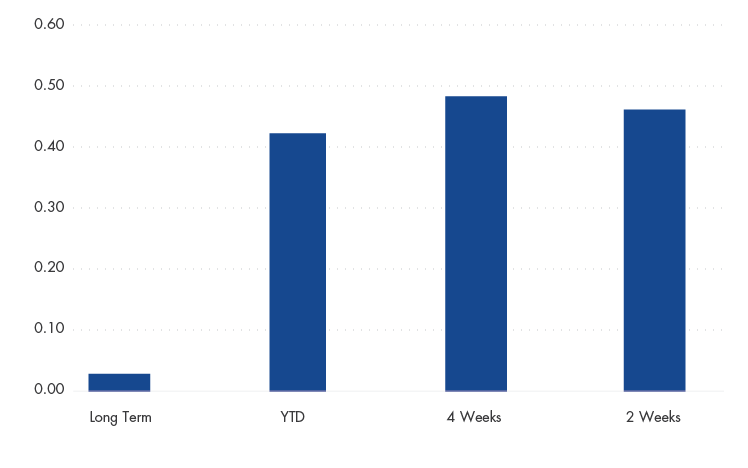

Our analysis shows that bitcoin correlation to gold remains low long-term. However, during the most recent COVID-19 induced broad market sell-off, bitcoin correlation to gold has increased significantly.

Bitcoin’s Correlation to Gold

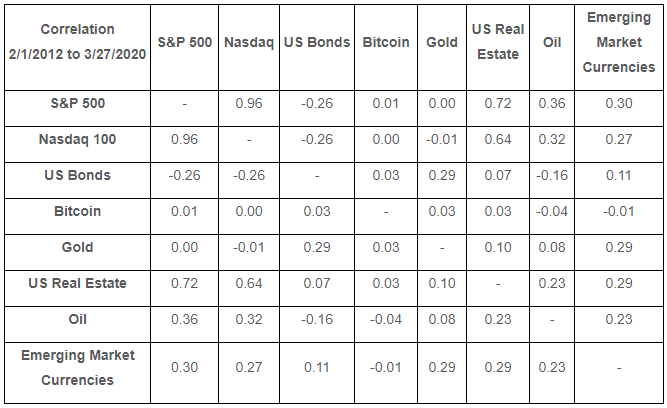

In The Investment Case for Bitcoin, we discussed how bitcoin may potentially increase portfolio diversification because of its low correlation to traditional asset classes, including broad market equity indices, bonds and gold. As shown in our year-end long-term correlation table, this thesis has held up well. Here we examine bitcoin’s correlation to traditional asset classes during the most recent COVID-19 induced market downturn and the months leading up to it. In our long-term study, considering correlation data between 2012 and late March 2020, bitcoin exhibits low correlation to traditional asset classes. Bitcoin falls into the -0.1 and 0.1 correlation range with most traditional asset classes.

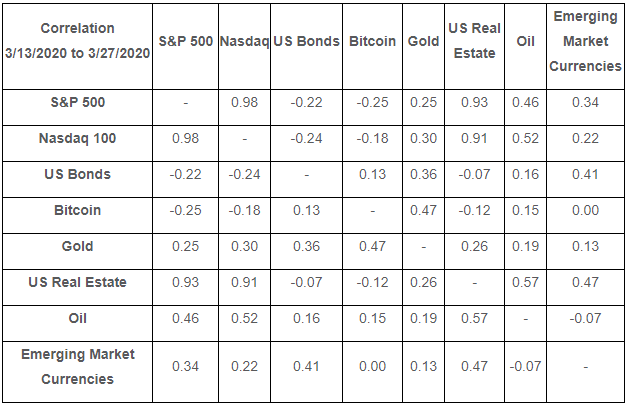

Looking at more recent correlation data, we note that bitcoin’s correlations with traditional asset classes have begun to increase during the COVID-19 induced global market sell-off. Most notably, bitcoin’s correlation with gold has reached levels never before seen. We believe this may further cements its relationship with what is commonly viewed as safe haven assets and may bolster its potential as “digital gold”. We also note that bitcoin correlations with U.S. bonds increased significantly. U.S. bonds historically served as safe-haven assets during equity market sell-offs. Specifically, from March 13 to 27, bitcoin’s correlation with gold was 0.47 and 0.13 with U.S. bonds while -0.25 with the S&P500, -0.18 with the Nasdaq 100 and only -0.12 with US real estate. Bitcoin showed no correlation with emerging market currencies and 0.15 with oil.

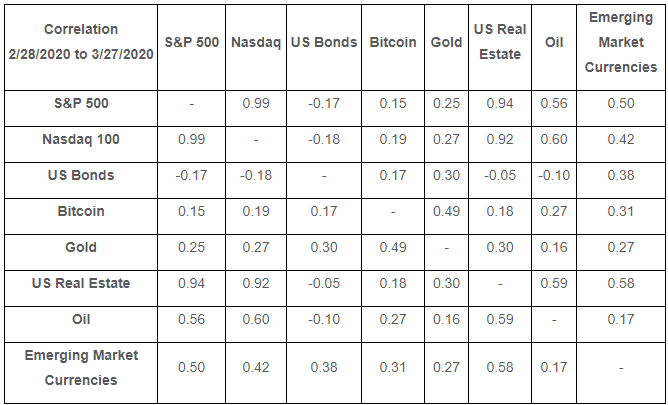

After expanding that timeframe to four weeks, bitcoin’s correlation with gold was 0.49, 0.17 with U.S. bonds, 0.15 with the S&P 500, 0.19 with the Nasdaq 100 and only 0.18 with U.S. real estate. Bitcoin showed a 0.31 correlation with emerging market currencies and 0.27 with oil.

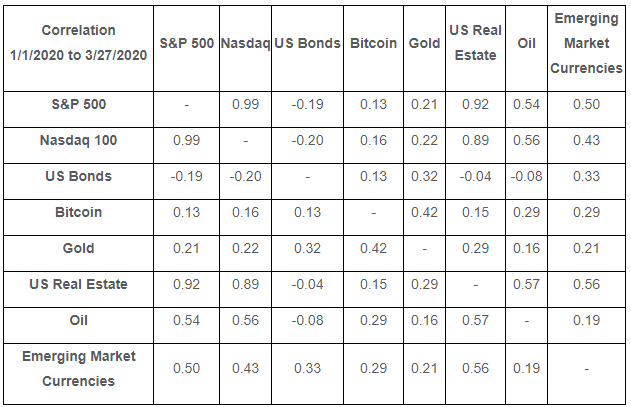

Year to date, bitcoin’s correlation with gold was 0.42, 0.13 with U.S. bonds, 0.13 with the S&P 500, 0.16 with the Nasdaq 100 and 0.15 with U.S. real estate. Bitcoin showed a 0.29 correlation with emerging market currencies and 0.29 with oil.

We also looked at the proportional addition of a 0.5%, 1% and 3% allocation to bitcoin to a 60% equity/40% bond blended portfolio. While YTD portfolio performance with a bitcoin allocation only held up slightly better than the 60-40 blend, we noted that a small addition of bitcoin significantly reduced the volatility (as measured by standard deviation) of the 60-40 blend.

During the market selloff beginning on 2/20/2020, we saw that the volatility reduction of the bitcoin-included blended portfolio was even more pronounced than YTD figures.

We conclude that while long-term bitcoin correlations with traditional asset classes remain low, in the short-term, the COVID-19 induced market sell-off increased bitcoin correlations with traditional asset classes. In particular correlations with gold increased during the sell-off, potentially hinting to bitcoin’s increasing safe-haven status. We also note that a small bitcoin addition to a 60% equity/40% bond blended portfolio may help to reduce portfolio volatility during the recent market sell-off. While there are no U.S. bitcoin exchange traded funds (ETFs) available today, we believe such products may have significantly reduced volatility for 60% equity/40% bond blended portfolios.

Source for all tables: Morningstar. US Bonds is measured by the Bloomberg Barclays US Aggregate Index; Gold is measured by the S&P GSCI Gold Spot Index; US Real Estate is measured by the MSCI US REIT Index; Oil is measured by the Brent Crude oil spot price, Emerging Market Currencies is measured by the Bloomberg Barclays EM Local Currency Government Index.

DISCLOSURES This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities/financial instruments mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck. All indices are unmanaged and include the reinvestment of all dividends but do not reflect the payment of transactions costs, advisory fees or expenses that are typically associated with managed accounts or investment funds. Indices were selected for illustrative purposes only and are not securities in which investments can be made. The returns of actual accounts investing in natural resource equities, energy equities, diversified mining equities, gold equities, commodities, oil, industrial metals, gold, U.S. equities and U.S. bonds strategies are likely to differ from the performance of each corresponding index. In addition, the returns of accounts will vary from the performance of the indices for a variety of reasons, including timing and individual account objectives and restrictions. Accordingly, there can be no assurance that the benefits and risk/return profile of the indices shown would be similar to those of actual accounts managed. Performance is shown for the stated time period only. The S&P® 500 Index: a float-adjusted, market-cap-weighted index of 500 leading U.S. companies from across all market sectors. The Bloomberg Barclays U.S. Aggregate Bond TR Index: is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency). The Bloomberg Barclays EM Local Currency Government TR Index: is a flagship index that measures the performance of local currency Emerging Markets (EM) debt. Classification as an EM is rules-based and reviewed annually using World Bank income group, International Monetary Fund (IMF) country classification and additional considerations such as market size and investability. The MSCI US REIT Index: is a free float-adjusted market capitalization index that is comprised of equity REITs and represents about 99% of the US REIT universe and securities are classified in the Equity REITs Industry (under the Real Estate sector) according to the Global Industry Classification Standard (GICS®). It however excludes Mortgage REIT and selected Specialized REITs. The S&P GSCI Gold Index: Is a sub-index of the S&P GSCI, provides investors with reliable and publicly available benchmark tracking the COMEX gold future. The index is designed to be tradable, readily accessible to market participants, and cost efficient to implement. The MVIS CryptoCompare Bitcoin Index measures the performance of a digital assets portfolio which invests in Bitcoin. The MVIS CryptoCompare Bitcoin Index is the exclusive property of MV Index Solutions GmbH (a wholly owned subsidiary of the Adviser). The NASDAQ-100 Index includes 100 of the largest domestic and international non-financial companies listed on The NASDAQ Stock Market based on market capitalization. All S&P indices listed are products of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones®is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results

Money Printer Go Brrrrr: Bitcoin’s Solution to the Federal Reserve

By Conner Brown

Posted March 31, 2020

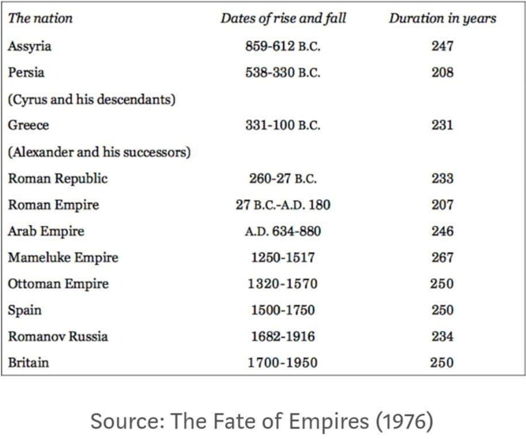

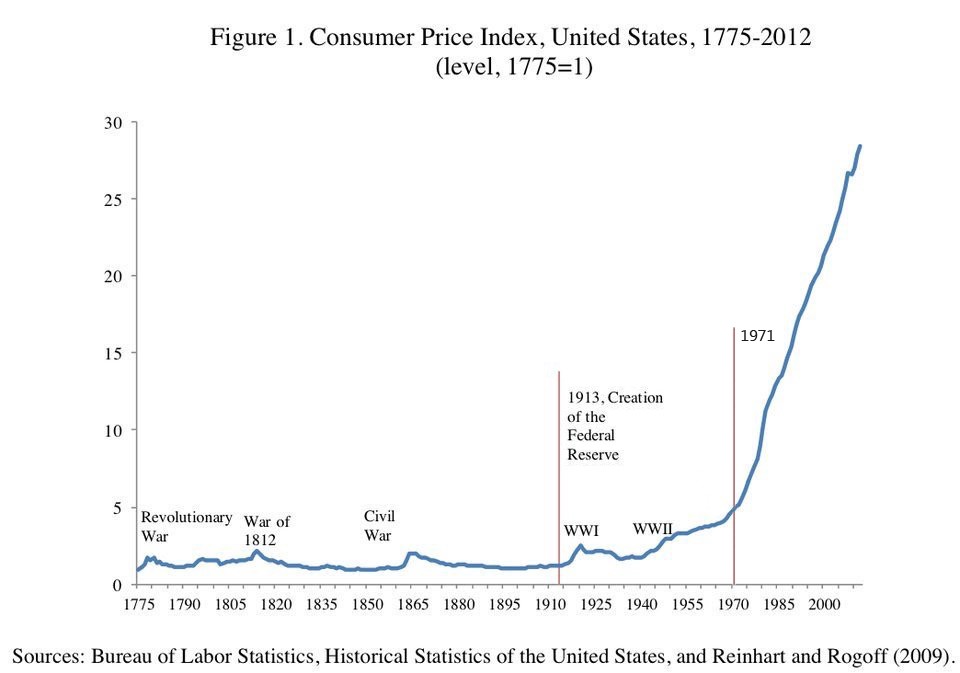

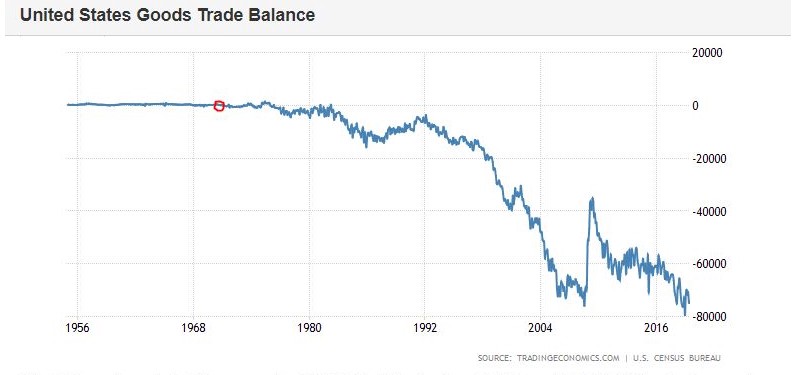

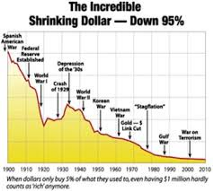

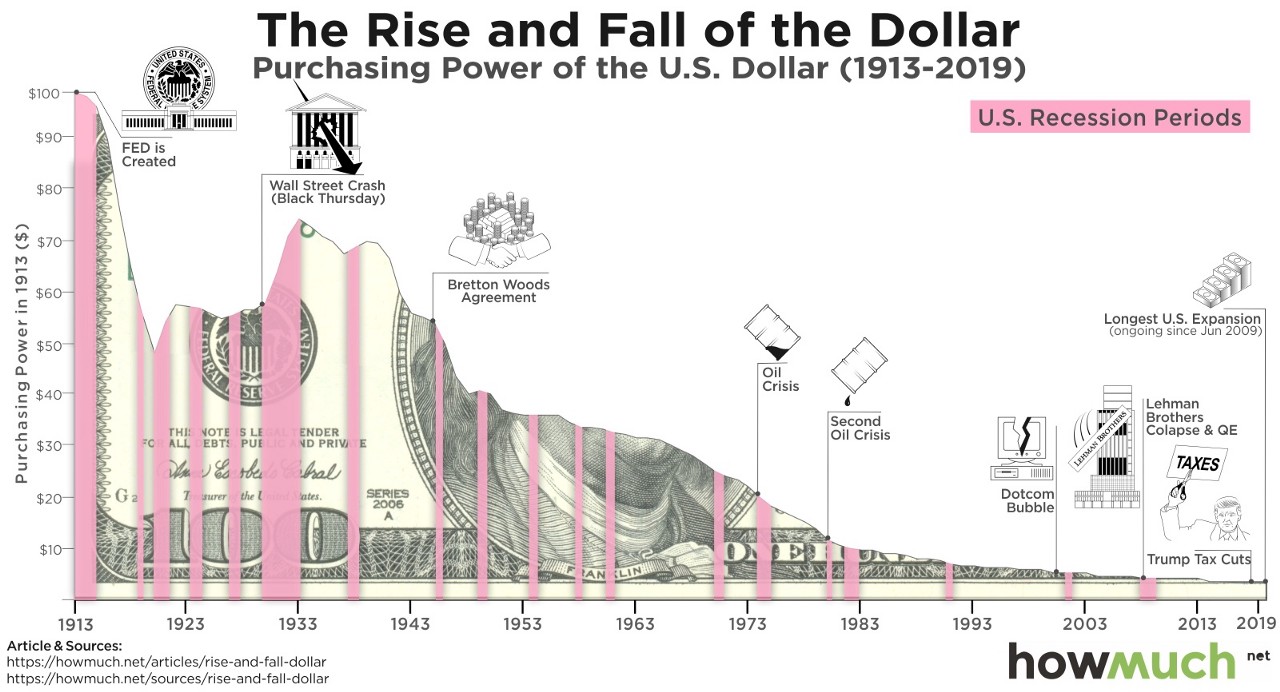

Money printing is an age-old problem. History is littered with societies that attempted to print their way into prosperity. Despite lessons from the past, this confusing ritual still continues to this day, courtesy of central banks like our Federal Reserve.

As a solution to the damage dealt by money printing, Bitcoin was born. In the depths of the financial crisis, Satoshi Nakamoto created Bitcoin as an alternative to the broken monetary system. Bitcoin was designed with a hard cap of 21 million coins which will be mined over the coming decades.

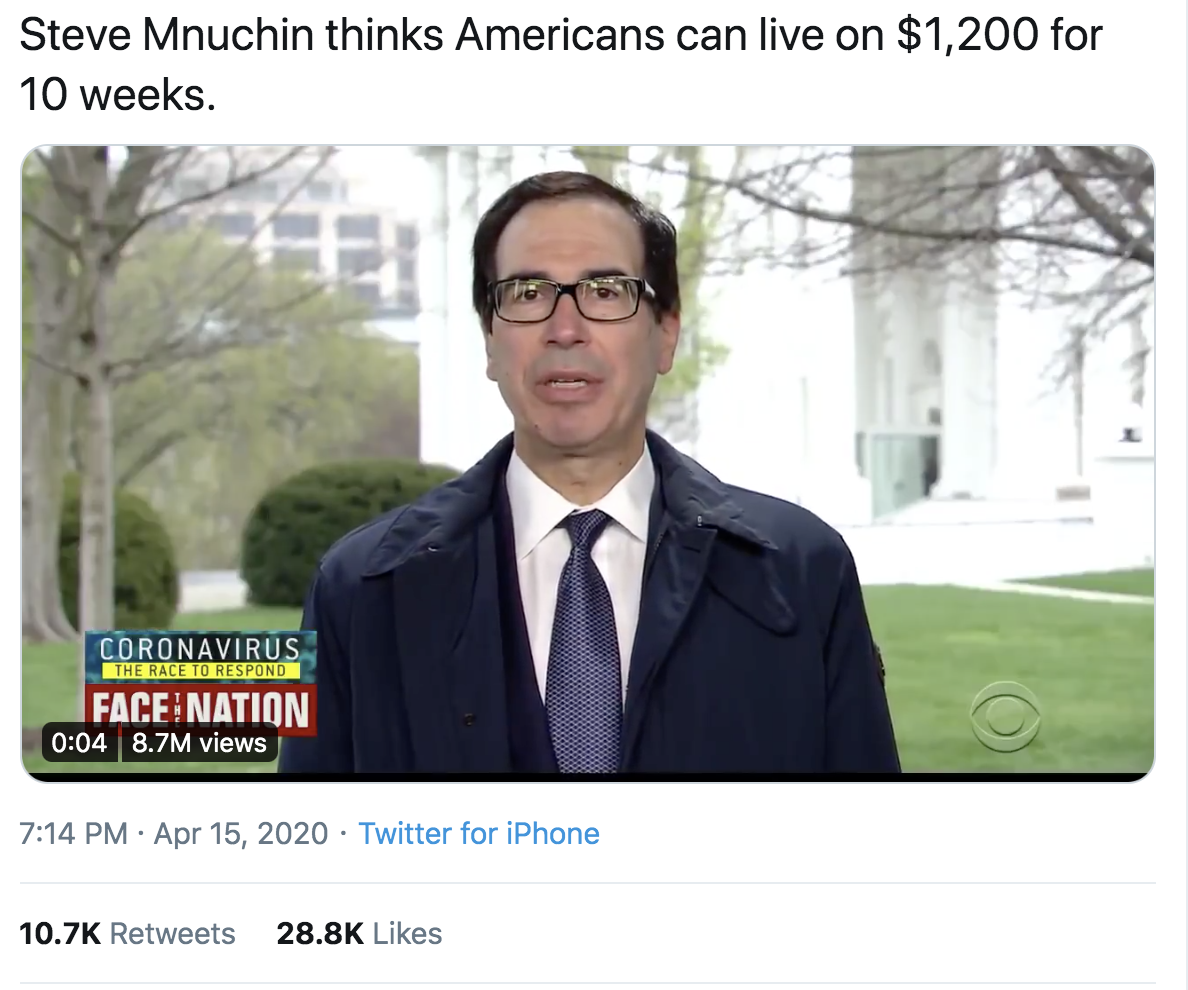

We are witnessing a second serious financial crisis now sparked by the coronavirus. Stocks are in free fall, currencies are swinging wildly, and credit markets are frozen. In an attempt to calm the financial system, the Federal Reserve has been printing money like never before.

What began with a few billion dollars has now morphed into trillions of dollars per month in “liquidity injections,” quantitative easing, and credit facilities. On top of this, Washington is pumping in trillions of fiscal stimulus.

Meanwhile, Bitcoin’s monetary policy remains untouched and as strong as ever.

For someone without a finance background, the actions by authorities may appear confusing and arcane. Where exactly does this government money come from? This article aims to clear that up. I’ll begin with a breakdown of how money printing works in the legacy financial system and then compare that to Bitcoin’s solution.

A Peek Behind The Federal Reserve’s Curtain

The Federal Reserve System (“Fed”) is our Central Bank. It is operated by a series of twelve Regional Reserve Banks with economists and financiers who follow the decisions of its leadership, the Board of Governors.

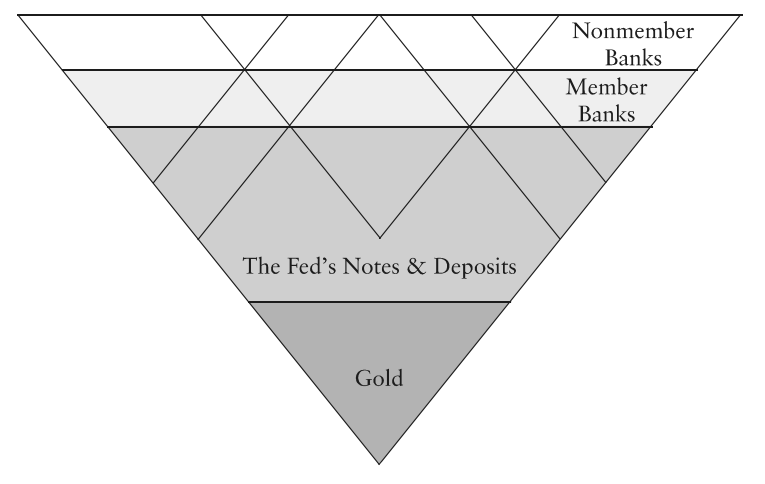

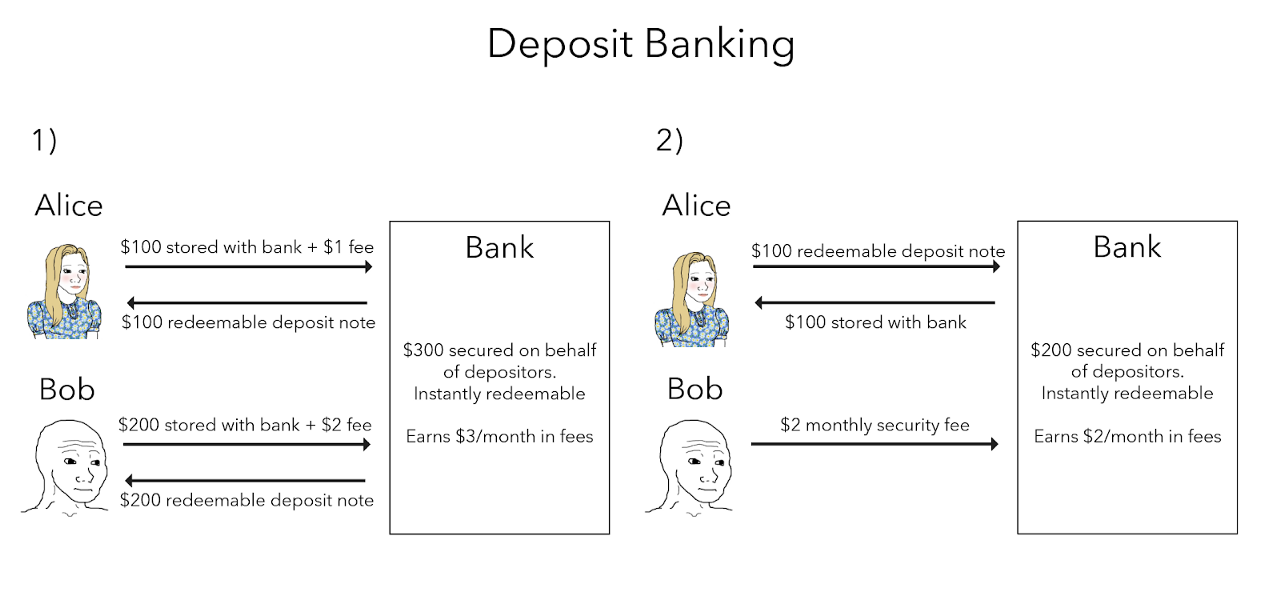

It is often said that the Fed can “print money” — however, this is not spinning up the printing presses and putting that money into the hands of whoever wants it. The process is a bit more involved.

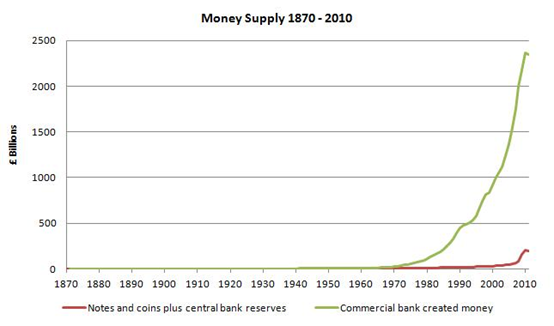

First, remember most dollars are not physical. Physical banknotes are only a small amount of money in circulation and are created by the U.S. Treasury at the discretion of Regional Reserve Banks. Most of the time, money is created in the Federal Reserve System with a stroke of a keyboard.

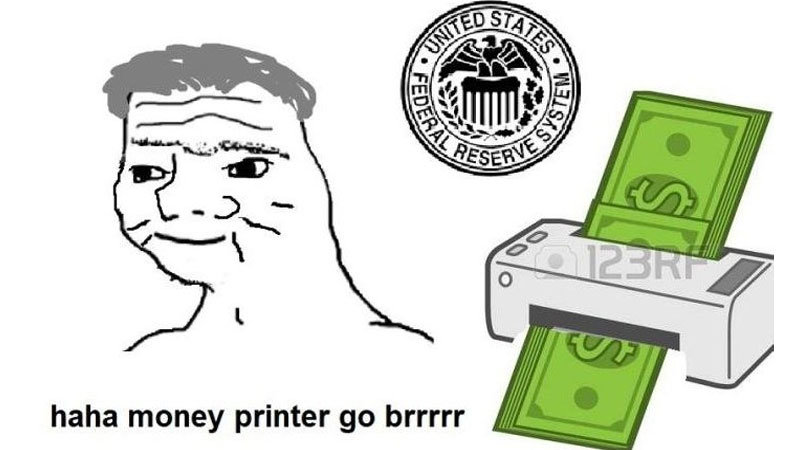

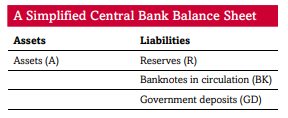

So how exactly does the Federal Reserve print these digital dollars? The secret lies in its balance sheet. To explain, let’s quickly review some accounting basics.

A balance sheet is a record of the assets and liabilities of an entity. For example, a business may have assets such as: cash, inventory, and property. It’s liabilities would be: rents, loans, wages, etc. The balance sheet is a snapshot that records these totals and ensures a company is properly managing its budget.

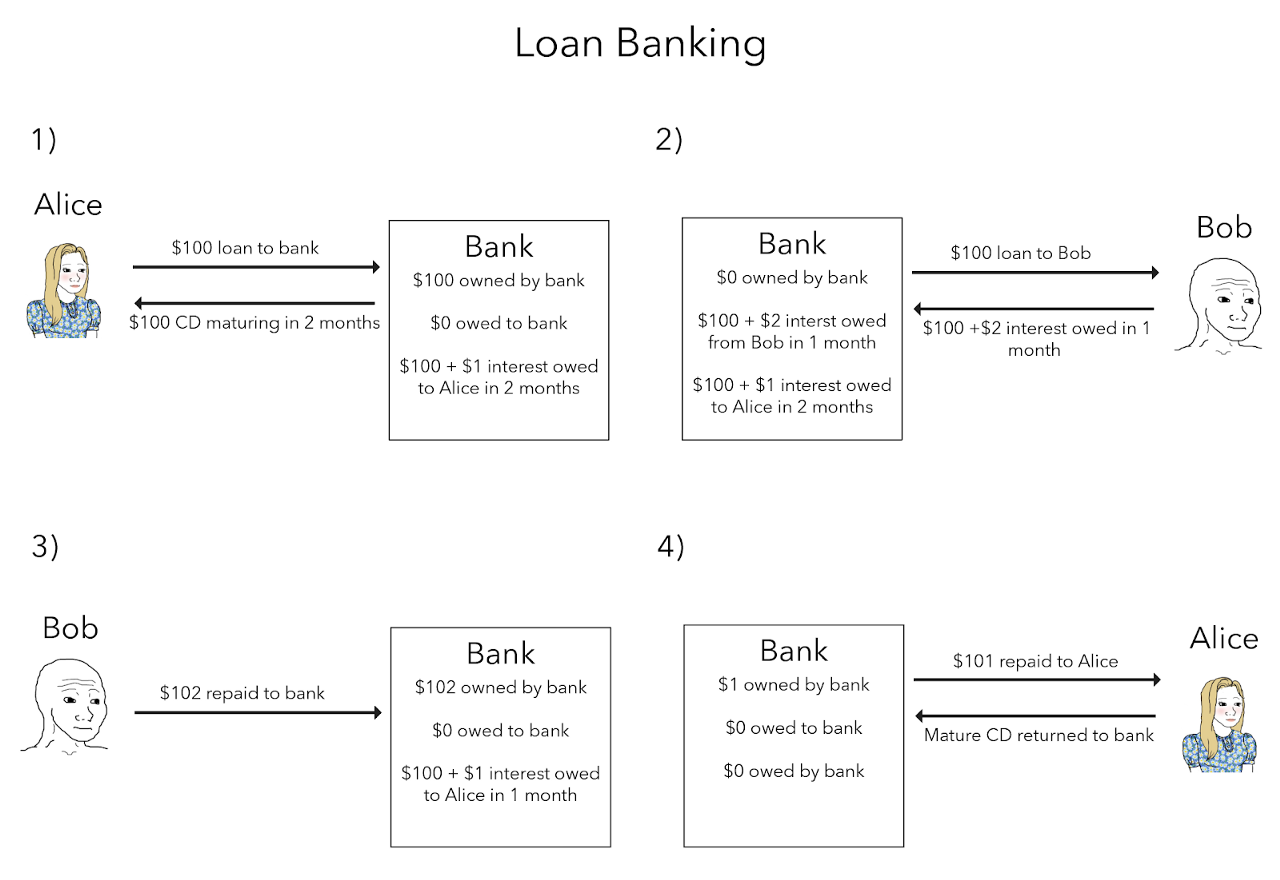

Banks also have balance sheets. On the assets side of their balance sheet, banks have generally have: cash (known as reserves), loans (the expectation of future payments), and financial instruments such as bonds. On the liability side, banks have: deposits (money to be paid upon request) and equity. This is how banks make new loans. When a borrower needs a loan, the bank will place virtual dollars in their account and record that transaction as both an asset (the expected repayment of the loan) and a liability (deposits).

Credit: Paul Sheard, Chief Global Economist of Standard and Poor’s

Credit: Paul Sheard, Chief Global Economist of Standard and Poor’s

So, if new credit is both an asset and liability, what stops banks from making unlimited loans? Capital Requirement Ratios. These are rules and regulations that prevent banks from expanding their balance sheet and taking on excess risk and lending.¹

Central banks hold the money of commercial banks, and they also have a balance sheet. On their balance sheet they have assets on one side such as government bonds and cash, and reserves on the other which is where commercial banks have parked their money.

Credit: Paul Sheard, Chief Global Economist of Standard and Poor’s

Credit: Paul Sheard, Chief Global Economist of Standard and Poor’s

Now, what’s special about the Federal Reserve is that their balance sheet is unlimited. They can buy as many government securities as they want at any price and simply place it on their balance sheet.

For example, lets say the value of mortgages fell by 40% and banks need a boost. The Federal Reserve can bail them out by buying those mortgages at whatever they deem to be the “correct” price and placing them on their balance sheet. It’s that simple. And this is exactly what happened in 2008 when the Federal Reserve purchased over $600 billion of government-insured Mortgage-Backed Securities to artificially increase the value of mortgages (and thereby reduce the cost of borrowing).

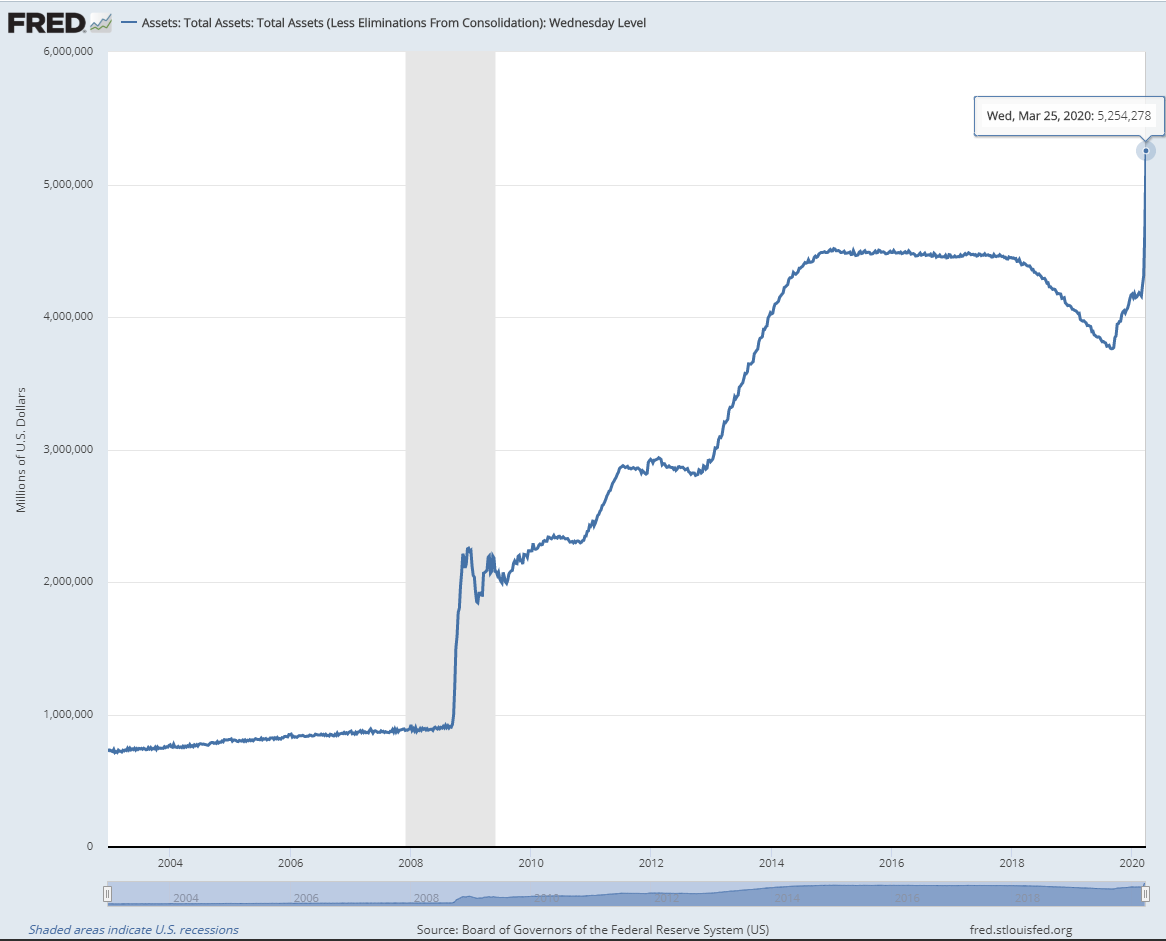

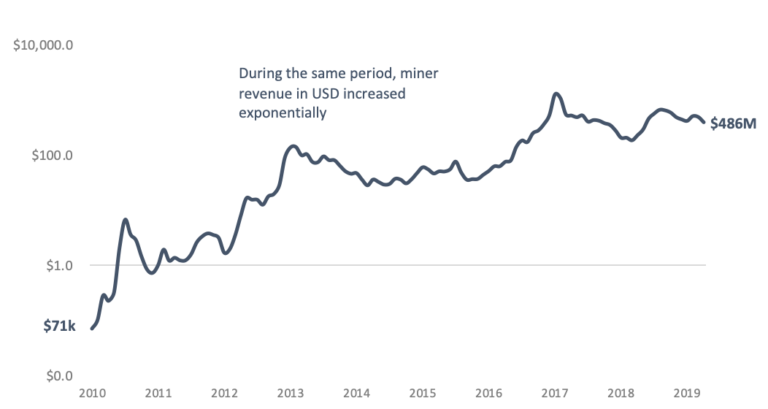

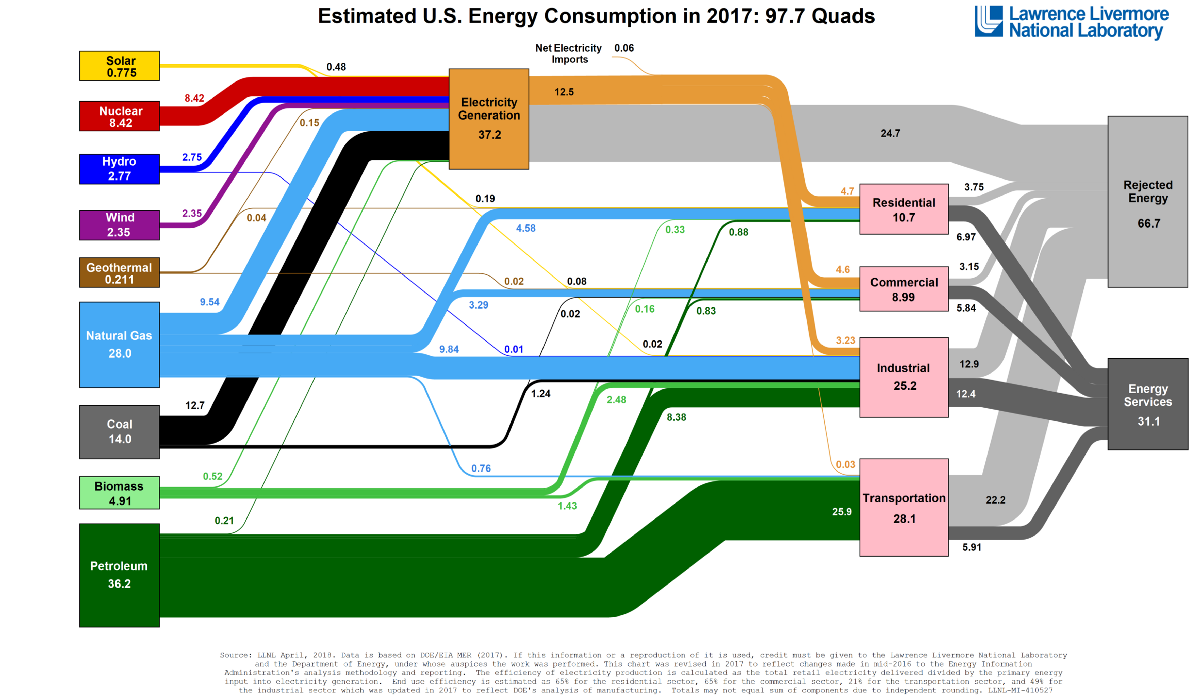

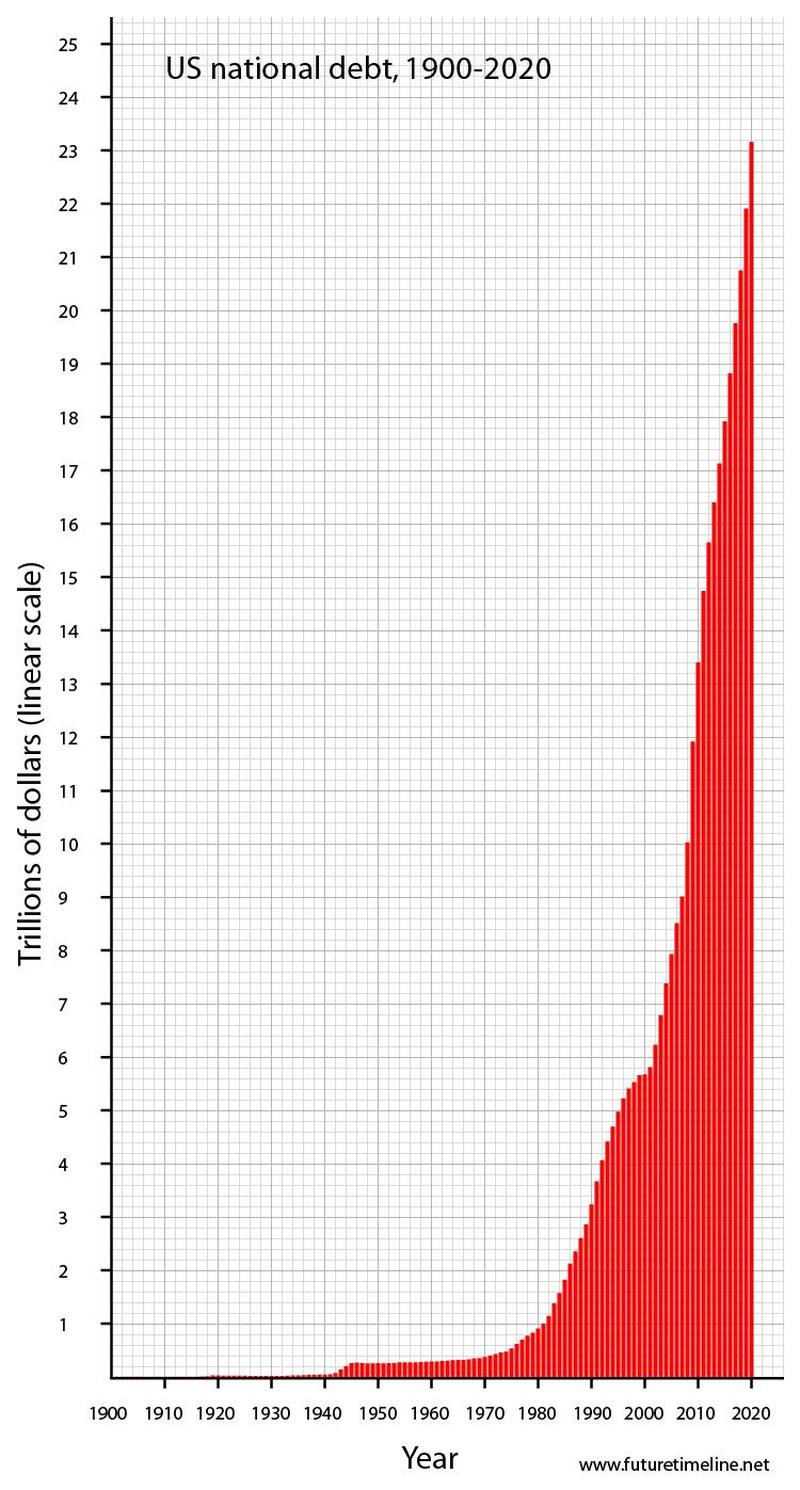

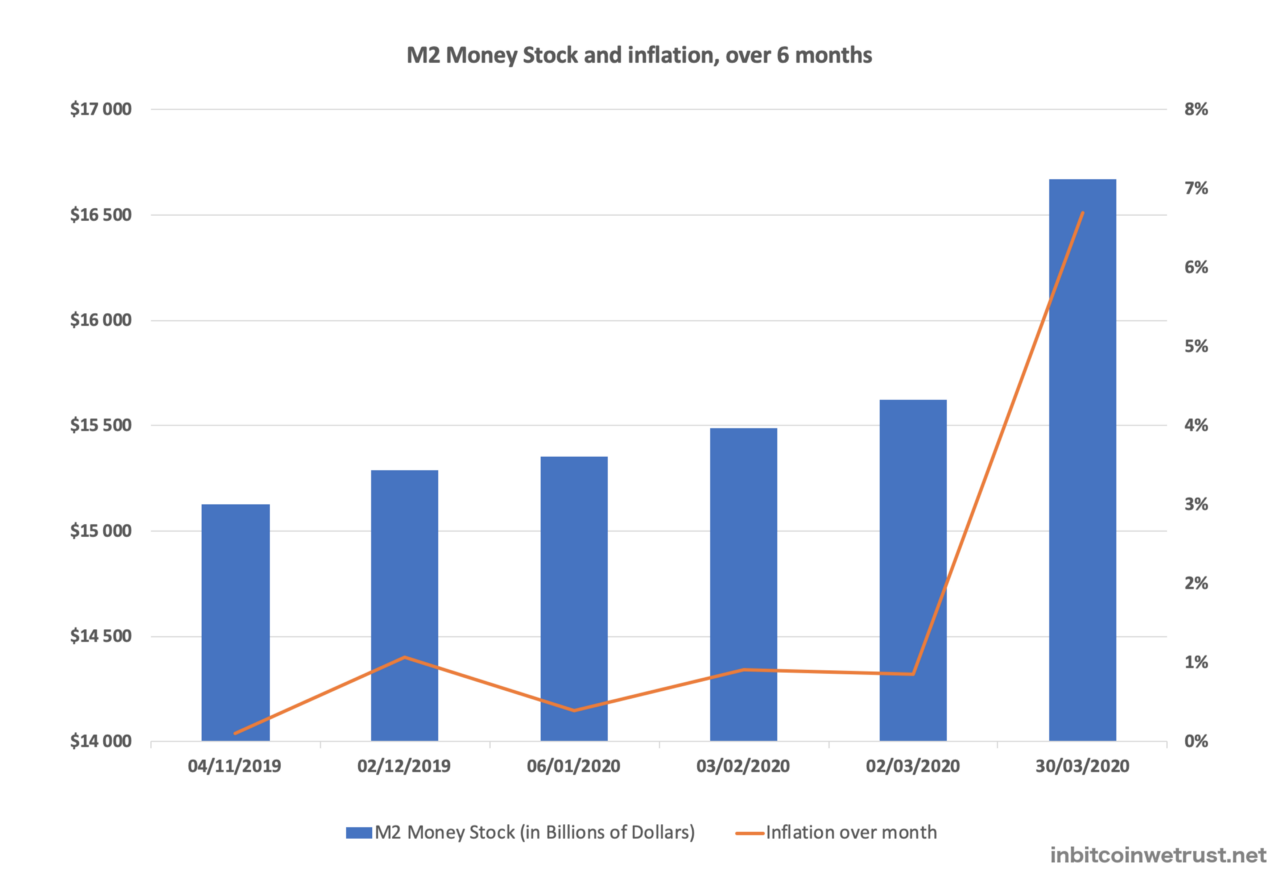

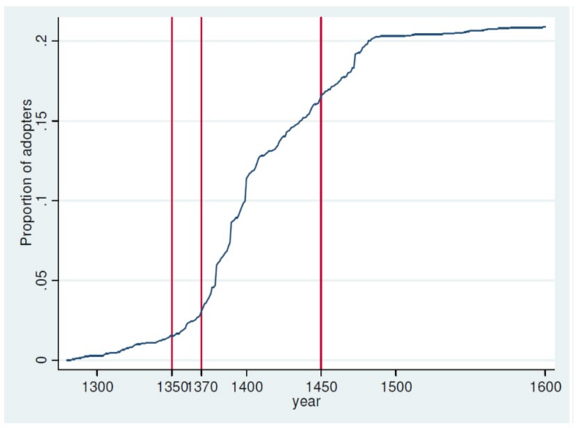

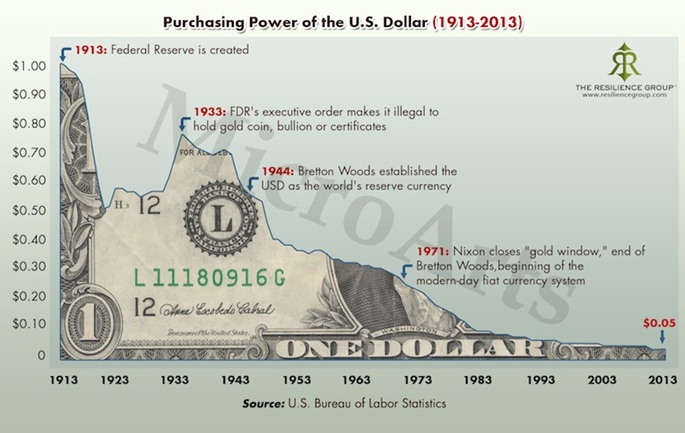

That program was just the beginning. Over the past decade, the Federal Reserve has purchased trillions of dollars of government securities and placed them on its balance sheet. This has, in effect, manipulated markets and monetized the U.S. national debt. Below is a chart of the Federal reserves total assets on its balance sheet. After an initial jump in 2009, it has continued to make new highs for a decade.

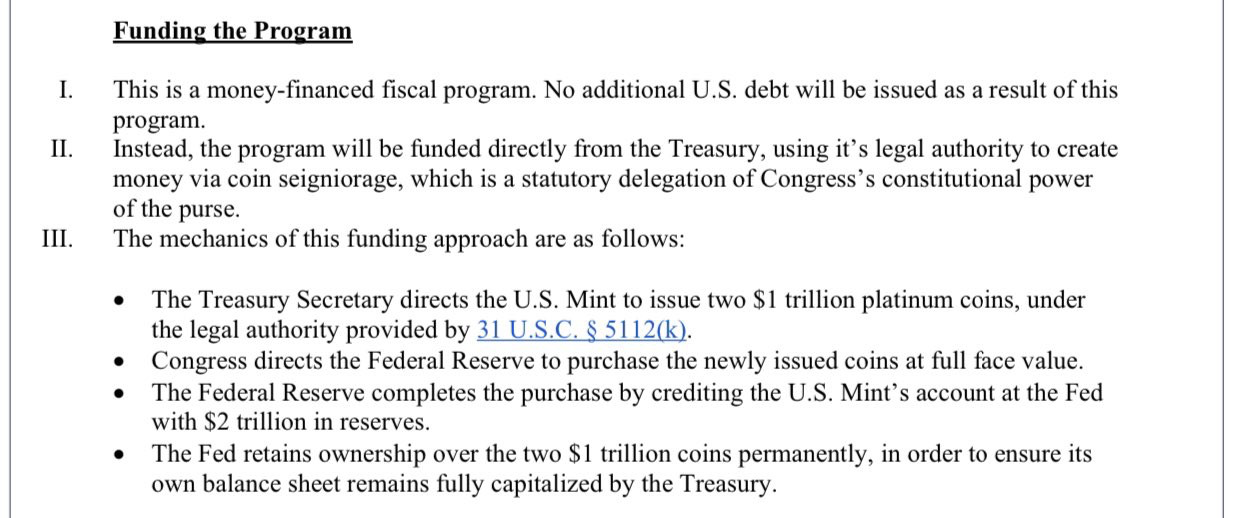

The latest spike is due to the variety of programs the federal reserve has instituted to prop up markets. Just last week, the Federal Reserve stated it will purchase $625 billion per week in government securities and established multiple special (questionably) legal vehicles to purchase commercial paper, asset-backed securities, and corporate bonds. All of this will go onto the Federal Reserve’s infinite balance sheet to 1) bail out institutional investors that took on too much risk, and 2) pay for trillions of dollars of stimulus from the federal government.

Each addition is printing money. Full stop. And as the Federal Reserve has just assured us on national television, “there’s an infinite amount of cash at the Federal Reserve.”

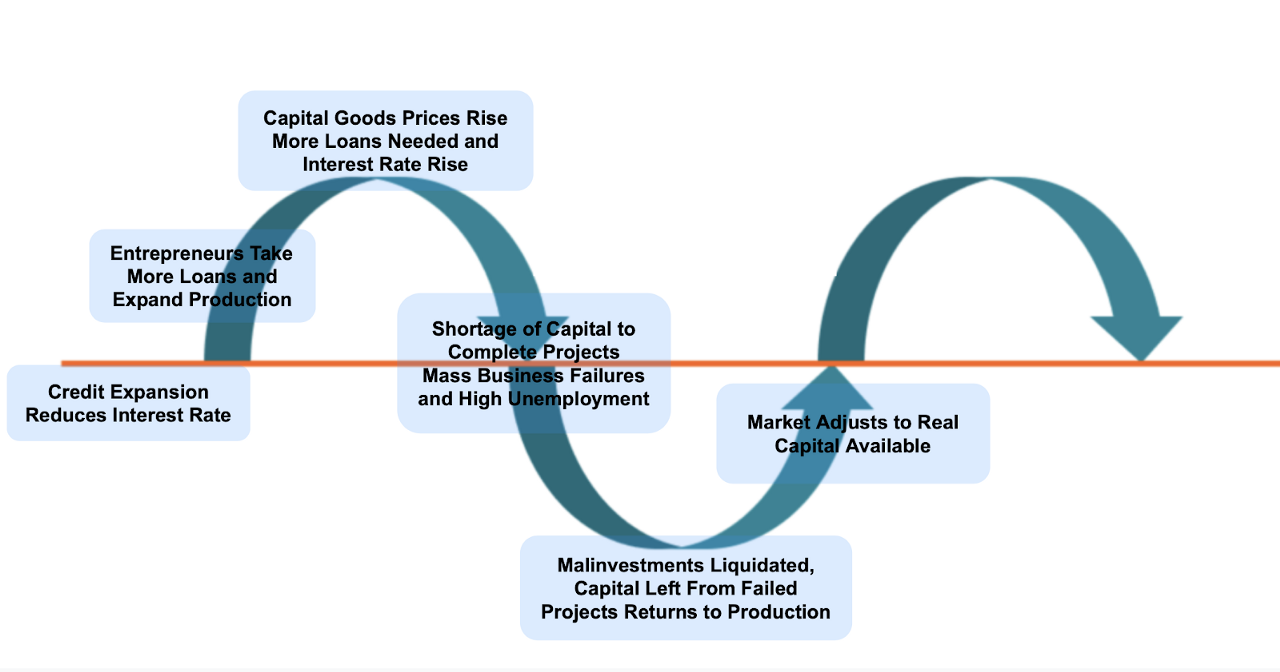

While these actions may provide short-term stability, like any stimulant, they bring a nasty set of side effects:

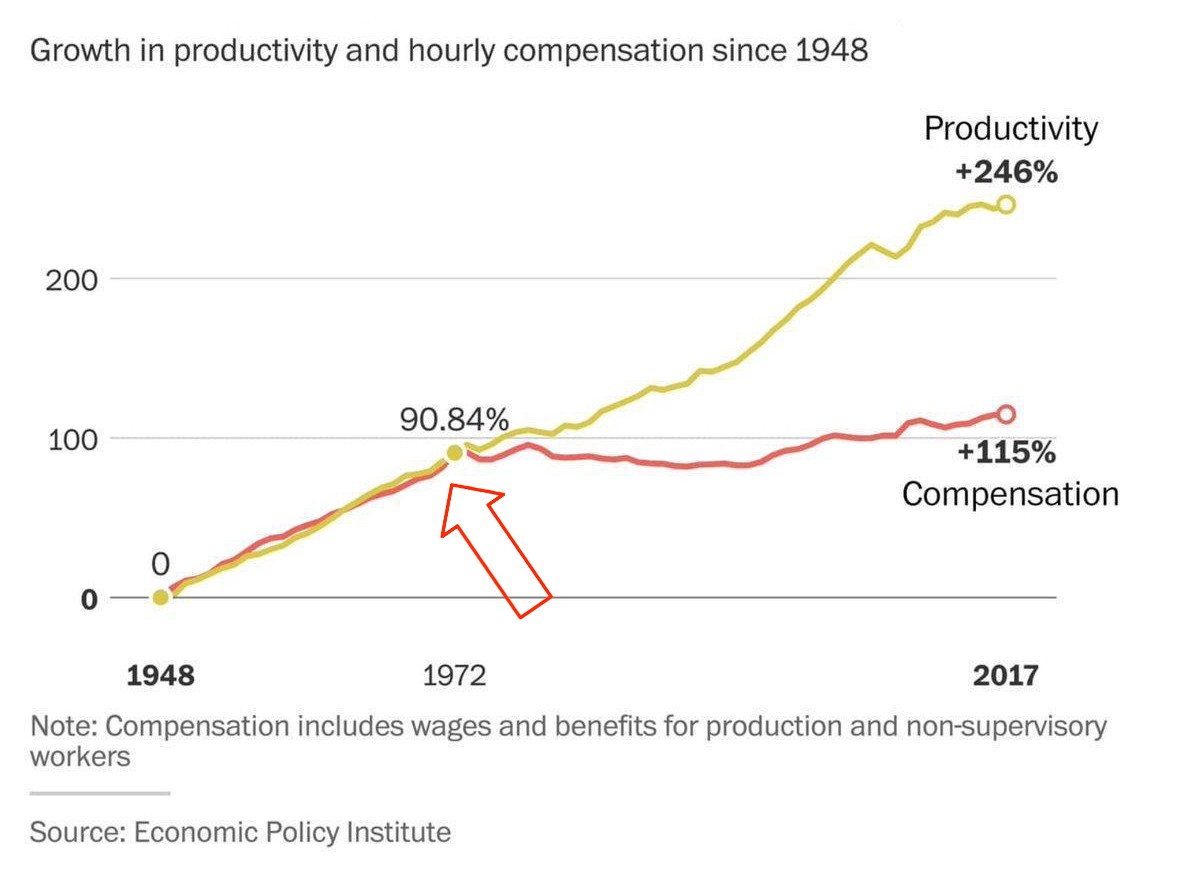

- Asset price inflation and wealth inequality from cheap debt. As the money printing pushes the costs of borrowing artificially low, corporations have taken on massive amounts of low-interest debt to finance trillions in stock buybacks. The stock indexes have increased several hundred percent while economic growth has been lackluster causing massive inequality and social unrest. This phenomenon, where those closest to newly created money see disproportionate benefits, is known as the “Cantillion Effect.”

- Economic stagnation by protecting poorly managed firms. Bailouts prevent capital to be reallocated to more sophisticated and careful management. This rewards poor decisions and and creates unproductive zombie companies which linger for years. For reference, see Japan’s Lost Decade and the sluggish economic growth of the past 10 years.

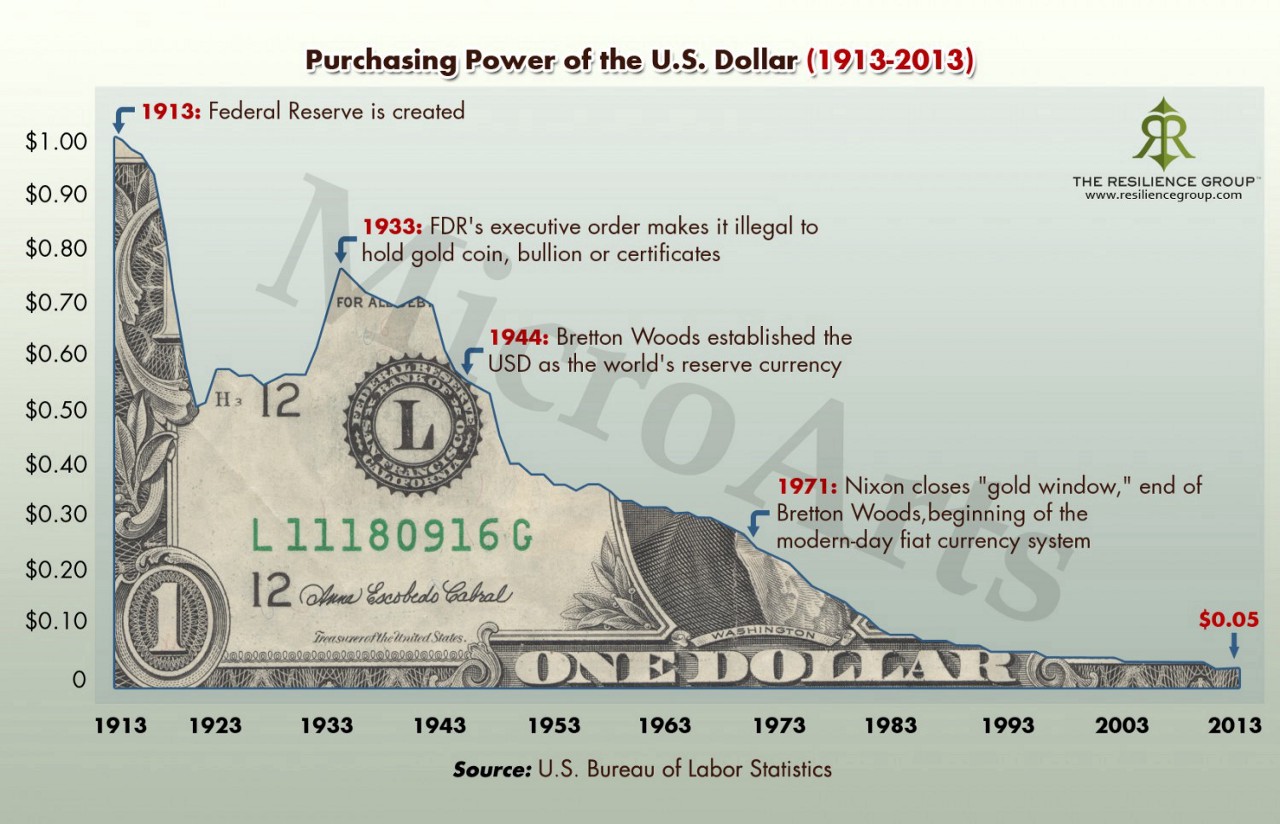

- Erosion of purchasing power by devaluing the US dollar. As money is printed and currencies lose their value, this most severely impacts the savings of average citizens. This punishes people who use their money as a savings vehicle and creates strong incentives for excessive consumption.

- Unsustainable deficits through manipulation of interest rates. As the Federal Reserve purchases trillions of government bonds, this drives interest rates below the natural rate. Thus, the government is able to borrow larger and larger amounts of debt at the cost of future generations.

- Systemic fragility by centralizing financial institutions. Printing money to bail out “too big to fail” banks, while letting smaller financial service providers go bankrupt, centralizes our financial system. With fewer competitors, this makes the remaining players even more powerful and fragile. This perverse system of incentives all but guarantees future bailouts down the road.

In the eyes of many concerned citizens with longer time-horizons than the upcoming election cycle, this is the wrong path. Sacrificing our future to pay for the present will only usher in an era of poverty and disrepair. Thankfully, Bitcoin provides another way.

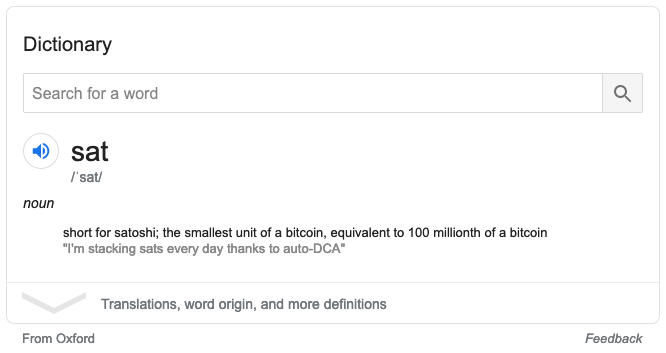

The Bitcoin Solution

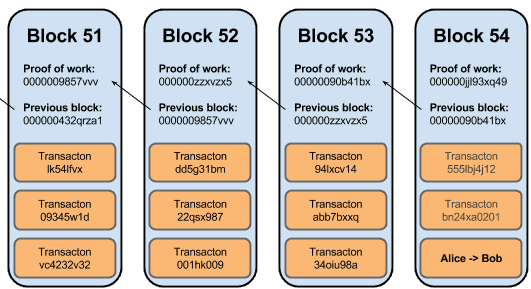

Bitcoin is a virtual currency created in 2008. What makes Bitcoin unique is that it is the first scarce digital asset without a centralized owner. The bitcoins are created, sent, and received over a peer-to-peer protocol without any intermediaries. Bitcoin uses a form of database called a blockchain which creates a linear history of changes to the ledger that cannot be undone. (For a technical introduction, see this video)

An image of the structure of Bitcoin’s blockchain.

An image of the structure of Bitcoin’s blockchain.

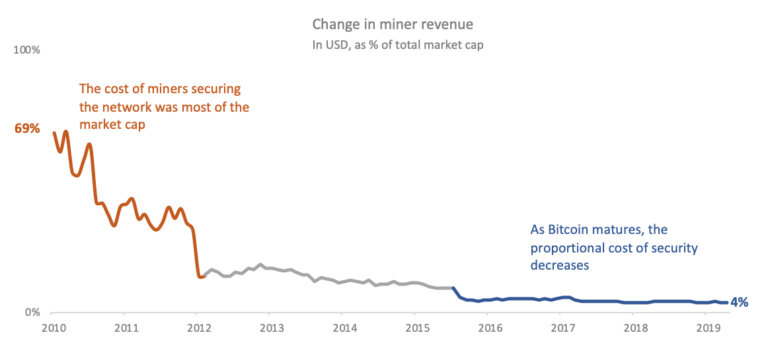

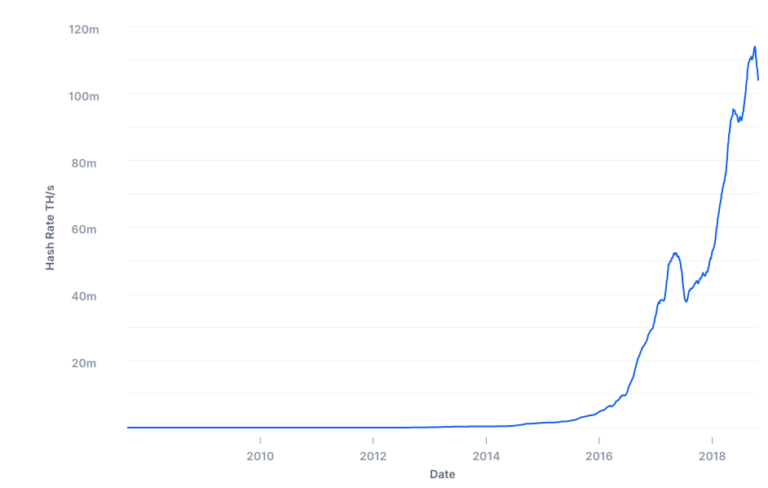

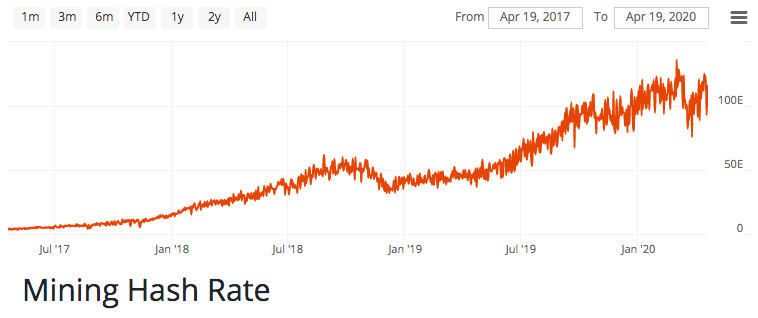

This linear history is created by a series of blocks of transaction data. These blocks are “mined” and propagated about every 10 minutes. Mining is a process where computers around the world compete to solve a math problem which generates the next block. Miners spending their computing power are compensated in newly minted bitcoins which are called “block rewards.”

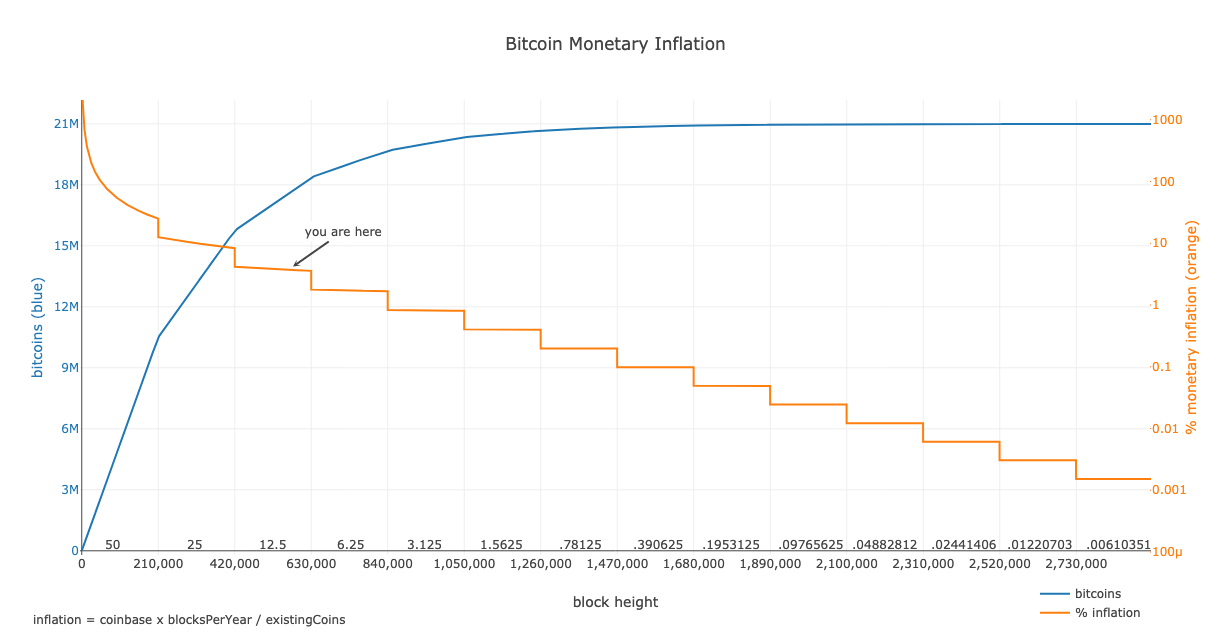

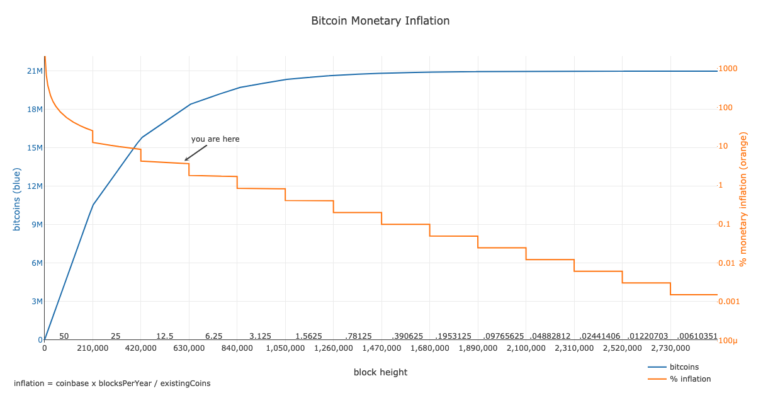

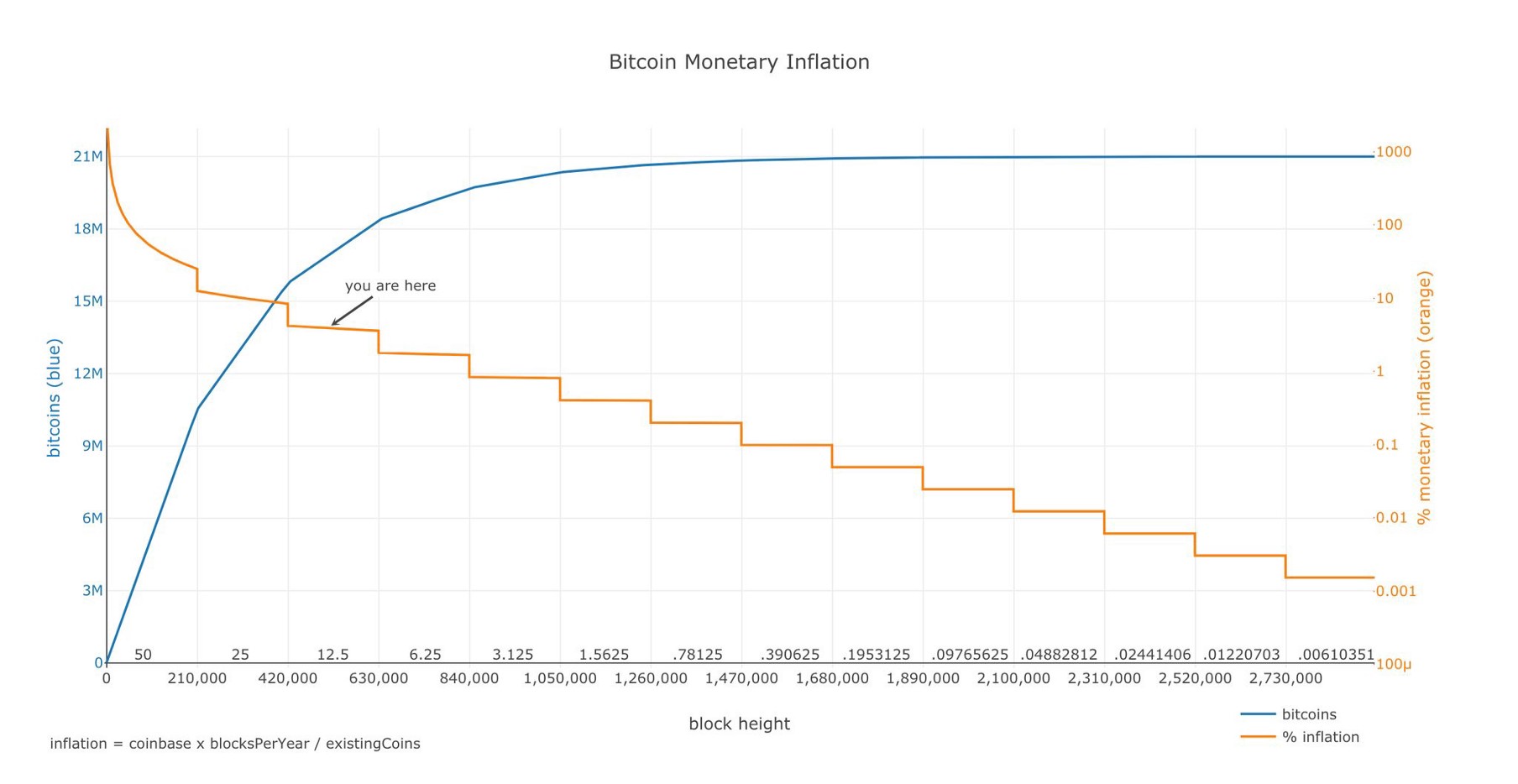

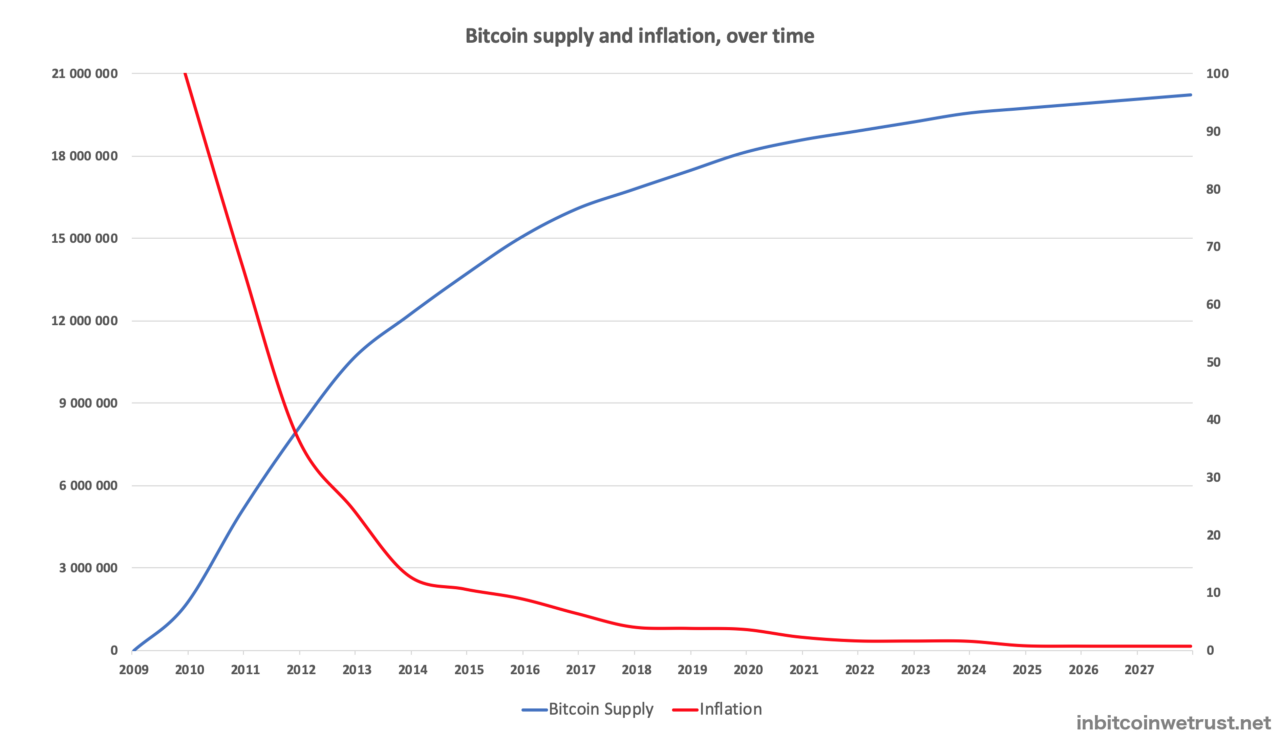

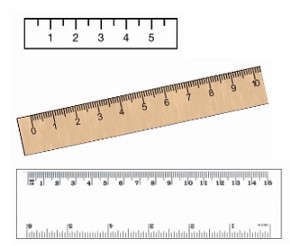

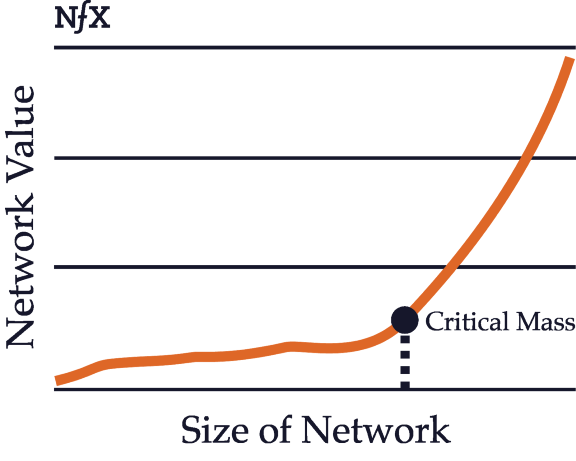

The number of bitcoins for each block reward is based on a simple function. Every 210,000 blocks (approx. 4 years), the block reward is cut in half. For the first 210,000 blocks, the rewards were 50 bitcoin per block. At block 210,001 rewards were cut in half by the protocol to 25 bitcoins per block — which also cut the inflation rate in half. This event is known as a halving.

Soon, Bitcoin will enter into its 4th halving era where miners will receive 6.25 bitcoins per block. This process will continue until around year 2140, as shown below.

As you can see Bitcoin’s monetary policy is strictly set to 21 million coins. No more, no less. Because Bitcoin is decentralized, no entity can print money, bail out their politically-connected friends, or dilute the value of your time.

With a predictable supply, Bitcoin’s monetary policy is ideal for market participants. Under a Bitcoin standard, money no longer decays over time. Ordinary people would not have to invest in risky financial instruments to preserve their wealth. This brings profound benefits and motivates individuals to plan their future and protect their savings.

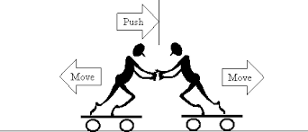

Money can also be thought of as a measuring stick of value. By having a steady measurement, Bitcoin allows prices to freely fluctuate to the supply and demand of the market. Powerful countries could no longer manipulate trade and currency to the detriment of the developing world. No country would have the luxury of global reserve currency status. This shift would cut out legions of financial middlemen and the world could speak one global language of value.

Conclusion

We are witnessing the late stages of a confidence game. Those in power can grease the palms of their friends at the expense of everyone else. It has brought decades of economic stagnation and inequality. While the future is far from certain, we now have an escape hatch. With Bitcoin, there is no lever. There is no committee. There are no printers. There is a level playing field of 21 million, cold, hard coins — and that’s the way it should be. A big thank you to my charming editor Karina.

Footnotes

- Note that this is commonly confused with “fractional reserve banking”. Fractional Reserve banking has not been in practice for quite some time. See, “Repeat After Me: Banks Cannot And Do Not ‘Lend Out’ Reserves” by Paul Sheard.

Controlling the narrative: how defining problems and framing causal stories of harm leads to immutable policy institutions

By Francis Pouliot

Posted April 5, 2020.

I graduated the M.A. Public Policy from King’s College London in 2012, and the following essay was my dissertation thesis. This essay focuses on the prohibition of cannabis as a case-study and covers the institutionalization of public policy. However, it can and should be applied to a much broader context, such as the Bitcoin blocksize wars, the so-called “climate emergency” and, more recently, the public responsive to the Covid19 outbreak. The goal of this essay is to help people dissect the different narratives being fed to them by the media.

INTRODUCTION

Since the publication of Erving Goffman’s influential _Frame Analysis _in 1974, the concept of frame as an analytical device in the public policy scholarship has gained tremendous popularity.

Developed as a response to the failures of the major forms of analysis, particularly the models of decision making centred around instrumental rationality, framing is about understanding how the way individuals make sense of complex political realities affects their decision making process. Ultimately, it is about making sense of the intersubjective nature of social experience and how it might affect the formulation of policy problems and the decision making process for solutions.

By focusing primarily on how political communication affects public opinion at the agenda setting stage of the policy cycle, we believe the explanatory powers of framing have been underexploited.

Moreover, framing remains to this day a “scattered concept”, from which no unifying analytical framework has managed to surface. We argue that framing provides a powerful explanation of the long-term stability of policies and their apparent immunity from change. We are concerned primarily with explaining the resistance of policies from critical evaluations and lack of bargaining and negotiating between the political actors advocating for policy change and the ones promoting the status quo.

The policy process can be conceived as an ongoing conflict between different interpretations of policy problems, in which actors attempt to make their definition of a particular problem the dominant one.

Policies, we argue, are embodiments of causal theories about how a problem will be solved. Problems, on the other hand, are construed in a political setting according a particular interpretation of the mechanism by which harm is inflicted from one set of individuals to another.

The existence of a policy is only justifiable to the extent that the mechanism by which it aims to solve the problem reflects the dominant definition of what the problem is and how it is brought about. When a frame becomes dominant, it limits the scope of acceptable solutions according to the criteria by which the problem is defined.

The purpose of this research is to elaborate an analytical framework from the concept of framing that can be used to identify the different frames present in a policy area, in a way that highlights why they are incompatible with each other. This will enable us to understand how framing can explain the long-term stability of existing policies.

The method by which the framework will be elaborated is by reviewing the different conceptions of framing and assessing their conceptual strengths and weaknesses. A conception of framing that centers around the construction of policy problems according to their causal interpretation will be argued to be the most conceptually adequate.

The new framework proposed by this research shows to which degree compromise between frames is possible and what precise characteristics of frames make them incompatible with others. The framework has been conceived as a hierarchical set of three mutually exclusive axioms of dichotomic value.

The fundamental causal story is the central novel axiom this research developed which combines the unanimously recognized criteria of frames and problem definitions, causality, with a new variable, the causal direction of harm. Not only does this axiom highlight how the frame supposes harm is being created, it clearly makes the distinction between harm created by individual behavior and harm created by policies.

The second axiom this research created was dubbed the precautionary approach to harm. The usefulness of this axiom is that it combines a vague and general criterion, the precautionary principle, and the perception of the substance of cannabis. This allows the framework to identify the specific explanation that frames imply for the justification of government control of cannabis.

The third axiom this framework uses is the criterion of intent of the harm creators. This research has argued that the normative criterion of intent is not sufficient to separate frames that otherwise share the first and second axioms to a degree that they will not support the same policy. Indeed, the perceived intent of the harm creators may lead the frame to support different policy goals, or may lead advocates of the frame to use a different rhetoric, but it will not lead to a change substantial enough to be considered a rupture of stability.

This framework will enable the analyst to identify the particular elements of problem definitions that make them incompatible with each other. This research will argue that long-term stability of policies will occur when the scope of political conflict is constrained by an institutionalized agreed upon problem definition to which the current policy is the only possible solution. To demonstrate how the framework can be used as an analytical device, we will apply it to the policy making process of the U.K.’s drug policy towards cannabis.

We will conclude that conflict in this policy area is limited between two competing frames, the Health and Safety and Harm Reduction frames, both of which define cannabis related social problems in a way that implies that prohibition is the only acceptable solution.

FRAMING THEORY: THE NATURE AND FUNCTION OF FRAMES

Many models of decision making that could explain the apparent non-rational behavior of actors in policy controversies have been developed. A large number of these models, according to Dye, assist us in understanding “why is the policy making not a more rational process”? Answering this fundamental question, Herbert Simon came up with the concept of bounded rational. It argues that individual choice “takes place in an environment of ‘givens’ — premises that are accepted by the subject as bases for his choice; and behavior is adaptive only within the limits set by these ‘givens’”. These “givens” frame the process of choice, and individuals operating without this “bounded rationality” are motivated by “satisficing, rather than maximising”, which means that they make decisions which are not derived from an examination of all the alternatives. On a larger scale, the rationality of the policy process is also bounded by such constraints. Understanding the nature of these constraints and the mechanism by which they limit the rationality of the policy process is fundamental goal of this research.

According to Rochefort and Cobb, the primary constraint on rational decision making in policy is “the intersubjective nature of social experience and its impact both on issue initiation and policy formulation”. This refers to the inability of different individuals to perceive, understand and make sense of the otherwise same objective reality. People experience the world through a lens, an organised system of belief, perception and appreciation, according to which they assign meaning to events, issues and occurrences. This “lens” is what has become commonly referred to as a frame.

The origin of frames can be traced to the concept of “schema”. Following major developments in neurology and psychology regarding the perception of stimuli and experiences by the human mind, notably from Henry Head’s Studies in Neurology (1920), _the german Gestalt Psychology school and Jean Piaget’s _The Language and Thought of the Child, the concept of schema emerged as a way of explaining how information, either as physical stimuli or social experience, is organized and managed by the human mind. Frederic Barlett used this concept to develop his theory memory as being constructive rather than consisting of the storage. From this follows the idea that an individual “has an overmastering tendency simply to get a general impression of the whole; and, on the basis of this, he constructs the probably detail”. The schemata, or frame, can be conceived as on organized set of criteria, much like a template, which guides how individuals fill the blanks.

The concept of the schema transcends scientific borders and derives its usefulness in the social sciences because the perception of the world is not an individual affair. It a great society, it is practically impossible to have such a proximity to an issue that we have all the information necessary to form an opinion, let alone all political issues. Instead, we receive information about the world primarily through communication with others and not through stimuli form our own senses. As human communication is primarily conveyed through language, the way that a phenomenon is talked about, that is the particular language used in the discourse surrounding that phenomenon, can influence how people come to think about it. Consequently, language that describes social problems can be manipulated tactically by actors of the policy process in order to influence how people view these problems, and potentially what solutions to these problems they will come to accept as adequate. This idea is eloquently expressed by Murray Eldeman in Constructing the Politcal Spectacle:

“The critical element in political maneuver for advantage is the creation of meaning: the construction of beliefs about events, policies, leaders, problems, and crises that rationalize or challenge existing inequalities. The strategic need is to immobilize opposition and mobilize support. While coercion and intimidation help to check resistance in all political systems, the key tactic must always be the evocation of interpretation that legitimize favoured courses of action and threaten or reassure people as to encourage them to be supportive or to remain quiescent […] It is language about political events, not the events in any other sense, that people experience; even developments that are close by take their meaning from the language that depicts them. So political language is political reality; there is no other so far as the meaning of events to actors and spectators is concerned”

From a policy process perspective, the use of framing as an analytical device can be traced back to sociologist Erving Goffman, who defined frames as a principle of organization “which governs the subjective meaning we assign to social events”. Von Gorp characterizes frames as organization principles that transform fragmented information into a meaningful whole, thereby selecting some parts of reality and omitting others. In media, a frame is “the central organizing idea for news content that supplies a context and suggest what the issue is through the use of selection, emphasis, exclusion and elaboration”. McCombs defines frames as the dominant perspective use to organize news presentations and personal thoughts about objects, delimited as a special sets of attributes about that object. Gamson and Modigliani argue that every policy issue has a culture, perpetuated by a discourse, which provides interpretative interpretations or packages. At the core of the package, they say, is a central organizing idea, the frame, that makes sense of events and suggest what is at issue. Schön and Rein describe framing as “a way of selecting, organizing, interpreting, and making sense of a complex reality to provide guideposts for knowing, analyzing, persuading and acting. A frame is a perspective from which an amorphous, ill-defined, problematic situation can be made sense of and acted on”. There is thus a shared understanding that frames are essentially ordering devices.

Initially, framing was developed to explain the disproportionate prominence of certain items on the political agenda relative to their observable importance, usually determined by the degree of harm to society they caused. It remains to this day one of the major theories of agenda setting. It was subsequently observed that the prominence of certain attributes of these issues and the way they were described had an effect of decision making. Robert Entman, in his 1993 essay Framing: Towards Clarification of a Fracture Paradigm, attempted to bring together the different conceptualizations of framing, in order to synthesize its disparate usage and construct a theory of political communication, by making explicit common tendencies. His synthesis of frames and framing has become somewhat of a standard definition. He defines the process of framing as “to select some aspects of a perceived reality and make them more salient in a communicating text, in such a way as to promote a particular problem definition, causal interpretation, moral evaluation, and/or treatment recommendation”.

FRAMING AS THE DEFINITION OF PROBLEMS

Entman’s four functions of framing — problem definition, causal interpretation, moral evaluation and treatment recommendation — are described as being independent of each other. He explicitly states that a frame may or may not perform these functions simultaneously. The methodology he proposes for analyzing political discourse involves assessing its different aspects according to these four functions. It makes the task of identifying the frames difficult, for it may lead to treat different aspects of a frame that perform different functions as distinct frames. For instance, arguments proposing moral evaluation or causal interpretation, while in reality being inextricably linked, may be analyzed as different frames. Moreover, there is also no frame that does not, either tacitly or overtly, imply some form of treatment recommendation: the cognitive and normative interpretation of a policy problem determine what should be done and how it can be done. In order to have a parsimonious and clear framework to identify frames and their distinct components, it is preferable to limit frames to the problem definition that they support.

Problem definition is a concept that has been developed on its own, without reference to framing, to the extent that it is now a very developed policy concept. Hogwood and Gunn provide us with an excellent definition of the concept from a public policy standpoint:

problem definition is “the process by which an issue (problem, opportunity or trend), having been recognized as such and placed on the policy agenda, is perceived by various interested parties; further explored, articulated, and possibly quantified; and in some but not all cases, given an authoritative or a least provisionally acceptable definition in terms of its likely causes, components and consequences”

The policy process is driven first and foremost by the recognition of a problem. The idea that some things are problematic and they can be fixed by human intervention is the most basic rationale of policy-making. Invariably, policy aims at the modification of human behavior. In the natural world, occurrences are “unintended, unoriented, unanimated, unguided, ‘purely physical’”. While we may understand the causation that leads to these occurrences, they are beyond the realm of policy because they cannot be subjected to human control. As causation in the natural world can be viewed as “a sequence of events by which one thing leads to another”, events in the social world are the product of human behavior driven by will. Most importantly, human behavior and will can be altered through policy, making it possible to prevent things from happening or to make them happen. All policies are based on a set of beliefs about how their activities are expected to bring about the desired change. They aim preventing occurrences deemed undesirable from happening either by modifying the undesirable status quo resulting from the “natural” behavior of actors or by rectifying modifications of behavior caused by other government interventions. In other words, policies not only aim at influencing behavior for the purpose of fixing problems: they are theories about the nature of problems, their solutions, and appropriate intervention.

Problems, then, are frames applied to issues and conditions. The existence of a policy is justifiable to the extent that the problem definition that it implies is the agreed upon definition. The long-term stability of a policy is caused by the ability of its advocates to promote a particular definition, and they do so via the process of framing. This highlights the idea that framing is a means, and not an end in itself: the ultimate role of the frame is to push forth a new policy or maintain stability for an existing one. March and Olsen’s influential study Ambiguity and Choice in Organization provides a clarification of this point. According to them, an organization, in our present case the government, “is a collection of choices looking for problems […], solutions looking for issues to which they might be the answer, and decision makers looking for work”.

The ability to include or exclude issues in the policy process, and to make their definition stick, has been described by Schattschneider as “the supreme instrument of power”.

Similarly, James Jones argued that “whosoever initially identifies a social problem shapes the initial terms in which it will be debated”. From conflict approach, social conflict is a process of competing problem definitions thriving for domination. Gusfield’s notion of problem ownership emphasizes that individuals or groups that defined the problem do so in order to claim the situation as their exclusive domain of action. (1981, p. 10–11)

Problem definition itself inherently performs the three functions of framing at the same time. Moreover, problem definition is the most important aspect of framing, for it is the element that provides the internal logic of the frame and justifies its existence. The normative and symbolic aspects of the frame are derivatives of the problem definition, because problem definition identifies first and foremost who is to blame. While the overall “image” of problem definition, the frame, can be manipulated strategically to be more sensible to different audiences at a given time, its internal logic is provided by the problem definition. Thus the only function we need to analyse is problem definition, and we can refer to the framing of a policy issue as “problem framing”. Not only does this not take away any of framing’s explanatory as an analytical model, it enables us to focus on explaining stability and change in a policy area. There are two main reasons for this. Firstly, when analysing the stability of a policy, we are first and foremost concerned in explaining its continuing existence, that is, the absence of termination or radical change. A policy will usually be terminated if the problem it is meant to solve has been solved or when it is not perceived any longer as solving the problem. Thus if the definition of the problem that justified the policy changes, the policy is bound to change as well.

The simplicity of problem definition, as opposed to Entman’s framing, enlightens us on the concept of discursive affinity. As Maarten Hajer suggests, a single frame may produce a plethora of arguments, or what he calls discursive clusters. These arguments “are held together by discursive affinity: arguments may vary in origin but still have a similar way of conceptualizing the world”. We consider problem definition to have the same effect. The concept of frame is usually understood in symbolic and linguistic terms, where objects, issues or individuals are stereotyped and presented in a biased manner. There can be two radically different normative presentations an issue which are actively debated on equally normative terms, but if they share a common problem definition, it matters not which side of the normative debate wins: if they share the same cognitive appreciation of what the problem, normative or symbolic differences will only result in marginal differences of the same policy.

THE INSTITUTIONALIZATION OF FRAMES

A major conceptual problem of Entman’s conception of framing is his account of how frames affect the policy process, which is a problem this research has discovered to be similar in most of the framing literature, a conclusion shared by Rocherfort and Cobb which identify the lack of a clear relationship between problem definition and policy outcomes as a major gap in the study of problem definition. As a communications scholar, Entman was most preoccupied by understanding the shaping of public opinion towards particular policies through frames conveyed by the media. Most of his work tacitly assumes that stability and change are caused by fluctuations in public opinion. Moreover, he focused a lot of his work on support for new foreign policies, and his framework is more suited for explaining support for new policies than the stability of long-lasting existing policies. Entman, as well as Edelman and McCombs, take in this Walter Lippman’s concept of “the picture in our heads”, which argues that the public will adopt the dominant frame suggested by the media, which will steer public opinion to favour policy solutions that fit that frame. In light of public opinion polls and of the sizable mobilization of the reform movement concerning the legal status of cannabis, we cannot assume that the public has overwhelmingly adopted the frame that supports prohibition.

Maarten Hajer stresses the fact that “social constructs do not ‘float’ in the world; they can be tied to specific actors and institutions. If a discourse is successful — that is to say, if many people use it to conceptualize the world — it will solidify into an institution, sometimes as organizational practices, sometimes in traditional ways of reasoning”. He argues that there are two conditions a frame has to fulfill in order to become dominant. First, it has to dominate the discursive space. The discursive space is the forum whose members have legitimate control of the policy process intellectual output has influence on the decision-making process. Secondly, the frame has to be reflected in the institutional practice of the policy domain. The policy process is conducted according to the logic of the frame, and that logic is perpetuated by institutions that have adopted it.

While the relationship between frames and institutions has been hinted at by framing and problem definition scholars, it has never been formally made explicit. A recurrent theme is the ability of frames to penetrate and influence institutions, as the ability of institutions to promote and advocate for their own frame. This point has been ably demonstrated by Janet Weiss in her 1989 study of government paperwork policies in America. At the heart of the political conflict is the struggle to promote a problem definition, that struggle is conducted mostly at the institutional level. She identifies three roles of problem definition. First, as the overture to the political process, a particular problem definition makes it possible to promote policies which, under other definitions, would seem odd and irrelevant. It enables for a policy to be considered. Secondly, problem definition has the ongoing power of shaping the dynamic relationship between intellectual understanding the formation of institutions. A problem definition does not “stick” on its own, it must penetrate the institutional arrangement in such a way as to be embodied as a pattern of normal though and behavior across different policy communities. Through this institutionalisation, a problem definition gains a sense of normalcy around which common ground can be achieved between different factions.

Problem definitions succeed when their adherence becomes a requirement to participation in the political process.

Finally, problem definition is a policy outcome in its own right. As it creates a particular language for talking about issues and as it creates responsibility for problems, it puts some groups on the offensive and others on the defensive and mobilises support around the symbols it highlights. It does not only penetrate existing institutions, it becomes an institution.

Scholars of problem definition have recently started to shift their attention to the institutional mechanisms by which frames become dominant. Hoffman and Ventresca, in analysing the institutional framing of the environment v.s. economy debate, argue that “institutions […] are centreal in the basic framing of policy issues such as the environment and economics relationship. Institutions present normative and contextual constraints that alter individual and organizational perspectives on relevant issue”. According to Scott (1995), there are three possible characteristics of institutions: regulative, normative and cognitive. The regulative aspect refers to the ability of institutions to create legal sanctions without a democratic process for reasons of expedience. The normative aspect of institutions refers to their ability to make moral judgement to which actors in the policy process will comply. Cognitive aspects refer to “the collective constructions of social reality via language, meaning systems, and other rules of classifications embodied in public activity”. According to Zucker (1983), the cognitive aspects explain the taken-for-granted beliefs that organisations will follow out of convention, habit, risk-aversiveness or some sense of obligation. The normative and cognitive aspects of institutions bear a striking resemblance to the normative and causal functions of problem definition. A frame’s embodiment in an institution not only provides normative guidance for actors to make moral judgements and cognitive guidance for actors to develop causal interpretations of complex realities, but when the institution in question has legitimate control of the policy making process, it has the ability to enshrine them into law through regulatory decisions. Meyer and Rowan (1977) conceptualise the output of institutions as “rationalized building blocks” in the form of recognized structures, policies and practices available for decision makers in the decision making process. They thus perpetuate and solidify frames through time. They legitimize cognitive biases by using education, advice or coercion, by providing an authoritative base for the definition of policy problems, norms of appropriate policy actions and regulatory frameworks that create incentives for particular decision making outcomes.

IDENTIFYING FRAMES

Most of the research on identifying different problem definitions derives from Deborah Stone’s interpretation of problem definition as the elaboration of a causal story for harm. The intent of her framework being similar to the one proposed in this research, categorizing potential problem definitions to predict their likely policy outcome and strategic use, we will start by reviewing her framework. We will correct what we perceive to be the flaws of her framework by proposing our own.

Stone describes problem definition as

“a process of image making, where the images have to do fundamentally with attributing cause, blame and responsibility […] Political actors deliberately portray [conditions] in ways calculated to gain support for their side. And political actors, in turn, do not simply accept causal models that are given from science or popular culture or any other source. They compose stories that describe harms and difficulties, attribute them to actions of other individuals or organizations, and thereby claim the right to invoke government power to stop harm”.

Causal stories have an empirical or cognitive dimension: they are a hypothesis of the mechanism by which harm is created by human behavior. But they also have a normative dimension; they assign different degrees of blame to certain individuals for causing harm according to their intention. Taken together, these attributes of causal stories justify policies in terms of their desirability as well as their appropriateness or effectiveness. According to Stone, causal stories can be distinguished according to two axioms: the purpose of the perceived harm creator’s actions and the intent or and the intent of the action’s consequences. These two axioms create a framework in which four causal story templates are established: accidental, mechanical, inadvertent and intentional. With each of these causal stories, a particular ligc that guides policy is implied.

As it stands, we consider Stone’s framework to be inadequate to the study of drug policy for two main reasons. The first is the lack of an axiom that distinguishes between policies aiming at correcting naturally occurring human behavior, meaning human behavior that is not substantially modified by the current policy arrangement, and policies aiming at correcting perceived policy failures, or at least at modifying or replacing the current policy arrangements. We call this causal direction of harm. Combined with the mechanism by which harm is brought about, it creates what this research dubs the fundamental causal story. The direction of the causality of harm is mentioned in her framework, but it is done in a trivial and anecdotic manner: it is only mentioned that causal stories can be applied to both individual behavior or policies. For instance, the difference between intentional causes and inadvertent causes which both would consider the current policy to be the source of the problem would be that, under intentional cause, the policy would be considered a deliberate conspiracy and, under inadvertent causes, the policy would be considered to have unintended consequences. Because causal direction is not clearly conceived as a defining characteristic along which an additional axiom can be derived, her categories are not mutually exclusive.

The second problem is that the distinction between accidental and mechanical causal stories is not particularly useful for drug policy. Stone proposes that causal politics is “centrally concerned with moving interpretations of a situation from the realm of accident to one of the three realms of control”, which are mechanical, intended and inadvertent causes. As discussed earlier, policy aims at the modification of behaviour, thus for an issue to be considered as a political problem, human action must be present as an element in the causation of harm. Thus, at minimum, accidental causes must be given some kind of intent and be brought into mechanical causes for policy intervention to be possible. Mechanical causes usually refer to machines, trained animals, “brainwashed people”, or any form of intervening agent, that bring about someone’s will indirectly. The intervening agent is the cause of harm, but it bears no responsibility for intent. The consequence is intended, although the action that brings about that consequence is done by the proxy of the agent. The central tenant of the mechanical cause being the inanimate or animate intervening agent, “things that have no will of their own but are designed, programmed, or trained by humans to produce consequences”, we face a predicament about the classification of causal stories relating to drugs and drug policy. Indeed, the particularity of drugs, and especially naturally occurring drugs such as cannabis, is that they are inherently intervening agents. Drug related harms which justify policy intervention are almost exclusively portrayed as having drugs themselves being the intermediary agents, or the primary source of harm. Similarly, natural drugs do not cause any harm unless they are an intervening agent in a causal relationship: usually, they cause harm only when they are consumed. This distinction is important in the strategic framing of policy problems: problems that have to do with “natural” phenomena must be framed as mechanical cause if the invocation of government power is to be justified. However, because the human element of consumption is an inevitable part of drug related problems, the possibility of control is inherent. The criteria of the possibility of control is thus of no use to this research.

Additionally, she describes the main focus of mechanical causation as defining the “exact nature of human guidance or control”, but the criteria for assessing that nature seem to be regarding the intent rather than guidance. She herself highlights this by using the case of malnutrition as examples of two mechanical causal stories that differ on the degree of human guidance. The “liberal” story would argue that people are not aware of the consequences of eating junk food, the intervening agent that brings about harm, or eat junk food as an unavoidable consequence of dealing with a limited budget. The “conservative” story would argue that people know the consequences of malnutrition but actively decide to pursue it anyway. This research argues that this distinction is not fundamentally different than the one caused by a difference in intent. The mechanical causal story is not mutually exclusive with the inadvertent and intentional causal stories.

It is not surprising to see that the categories are so permeable with each other. Stone’s argument rests on the fact that problem definitions are used in a strategic manner to push blame and responsibility onto somebody else and to challenge existing distributions of power and resources. Problems definitions, under that conception, are not constraints for rational decision making but instruments to further a group’s interests. She claims that, “in the struggle over problem definitions, the side will seek to stake out the strong positions but will often move into one of the weaker position”. Regardless of whether the move from intentional to inadvertent causality is out of strategic considerations or because of genuine intellectual change, it remains that these two categories are too permeable to justify the characteristic deadlock of drug policy. The permeability of categories with each other, as well as the lack of a clear axiom for the causal direction, can be resolved by considering these criteria of problem definition as separate levels of problem definition.

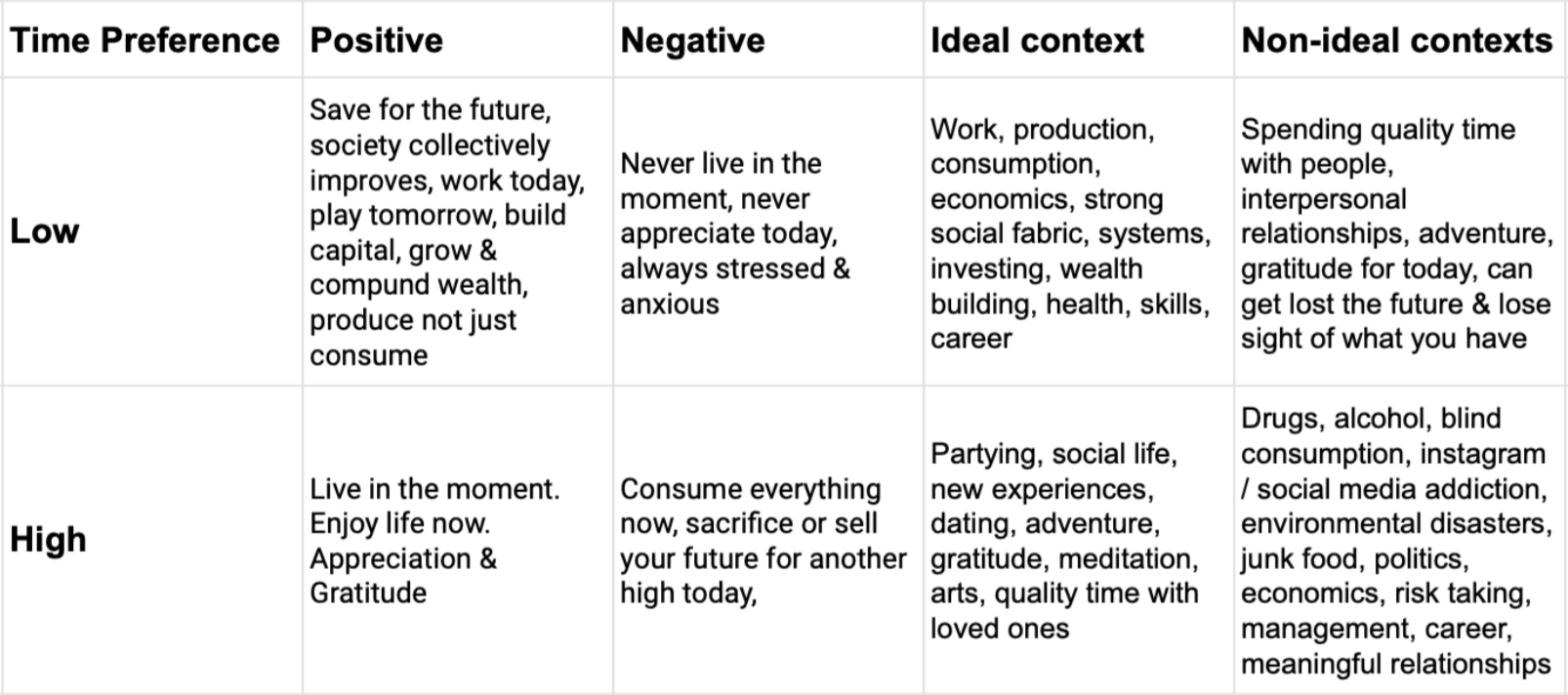

A HIERARCHICAL MODEL TO ANALYZE FRAMES

In order to understand how the stability of drug policy is achieved in the U.K., we need to identify the different frames present in that policy area. As stated above, we will use problem definition as the defining element of the frame. The explanatory power of our model rests on the idea that the causal categories mutually exclusive. To show why frames are impermeable to one another, we must also identify the smallest common denominator among different frames as the extent to which compromise is possible. In other words, we are looking for the specific differences in problem definition that make their implied policy solutions irreconcilable. The novelty of the analytical framework that we propose is that by using hierarchically organized, mutually exclusive axioms that we believe to be the defining elements of problem definition, we will arrive at a series of templates for potential problem definitions of any given issue. Policies being the solution that naturally evolves from a problem definition, compromise is conceived as the point to which different frames will support a policy while potentially disagreeing on technical aspects such as policy tools. If, in any given policy area, conflict is limited to frames that nevertheless imply the same policy logic, policy stability will occur.

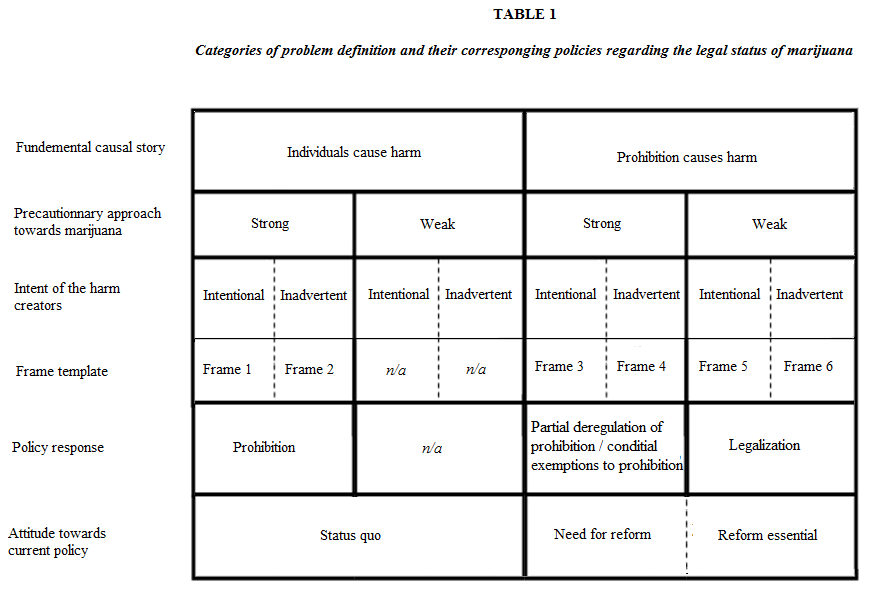

To do so, our model is supported by three axioms: fundamental causal story, precautionary approach towards cannabis and intent of the harm creators. The axioms are hierarchically organized according to their priority. This enables us to achieve categories that are mutually exclusive while also identifying a possibility of three levels where distinctions between frames can be made. Our model is visually represented in Table 1. The model is to be read vertically. The three axioms are represented on the left: the first one is fundamental causal story, the second one is precautionary approach towards cannabis and the third one is intent. The criteria for the axioms are presented corresponding horizontally aligned boxes: the fundamental causal story is determined by the causal direction of harm. The precautionary approach is divided as either weak or strong, and the intent is divided as either intentional or inadvertent.

The thick vertical lines represents irreconcilability, while permeability is shown by dotted lines. As Table 1 shows, irreconcilability is present

- At the fundamental causal story axiom between the “individuals cause harm” and “prohibition causes harm” categories

- At the precautionary approach towards cannabis axiom between the “weak” and “strong” precautionary approaches

- At the frame level between frames 1–2, frames 3–4 and frames 5–6, as well as between frames 3–4 and frames 5–6

- At the policy response level between each of the policy responses

- At the attitude towards current policies level between status quo and reform

Permeability, represented by a dotted line, is shown in Table 1 to be present

- At the intent axiom between intentional and inadvertent causes

- At the frame level, between frame 1 and frame 2, between frame 3 and 4 and between frame 5 and frame 6

- At the attitude towards current policies level between “need for reform” and “reform essential”

Each policy response is compatible with two frames, which highlights that the essential aspects of policy will be determined according to the two first axioms of problem definition. Between the two frames that correspond to a policy response, the permeability means that they will agree on the policy’s logic and objectives, while disagreeing on specific policy tools or rhetorical arguments according to the indent. This highlights the importance this research concedes to correctly identifying frames not solely on the particular policy technicalities or according to the rhetoric or discourse with which it is presented to the public. The permeability between “the need for reform” and “reform essential” means that at this level, there is agreement about the need for reform, albeit to different degrees. This means that frames 3, 4, 5 and 6 can show common ground, at the maximum, in their desire for change.

The reader will note that out of a possibility of 8 problem definitions, only 6 are presented. Indeed, where frames 3 and 4 should theoretically be, we have left the category as void, as well as the policy response that would have corresponded. Our framework is designed, first, for analysing the specific frames related to the regulation of harmful substances or activities, in this particular case cannabis. It is also designed to analyse frames in a policy area where the problem has already been recognized politically and dealt with via a policy, which has remained unchanged for a long period of time. There cannot be any problem definition that has a weak precautionary approach towards cannabis while still concentrating on individuals being source of the problem since the current policy, prohibition, has a strong precautionary approach towards cannabis. These categories are thus inherently self contradicting and are bound to be void, but they are nevertheless portrayed in the framework for the sake of symmetry. While it is possible to concede that these categories may have been filled by frames based on religious or moral principles which might warrant an exception to a weak precautionary principle as a basis for prohibition, the interpretation of problems would be based on beliefs that are inherently irreconcilable with rational argument.

If cannabis was a new drug, thus creating opportunity for new problem definitions in a policy area where the problem has not already been dealt with by a policy, our first axiom would be of little use and would potentially have to replaced by a “cannabis causes social harms” axiom divided by a straightforward yes/no variable. There would nevertheless be void categories in the “individuals do not cause harm” subdivision because it is highly unlikely that a problem definition that supports that no harm is being done would have a strong precautionary approach towards cannabis, provided there is a minimum of intellectual consistency involved. This element is a purposeful addition to our framework in order to accurately reflect the reality of frame conflicts, and we have not so far found any reason to believe that it would consist of a conceptual flaw.

The multi-level structure of the framework