WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the October 2020 Journal PDF Donate & Download the October 2020 Journal ePUB

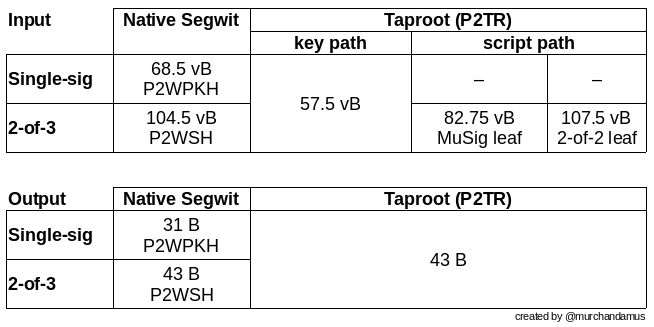

2-of-3 inputs using Pay-to-Taproot

By Murch

Posted August 18, 2020

The Bitcoin community has been abuzz for a few years about bringing Schnorr signatures to Bitcoin. Since then, the idea has evolved into three formal Bitcoin Improvement Proposals: ‘BIP340 — Schnorr Signatures for secp256k1’, ‘BIP341 — Taproot: SegWit version 1 spending rules’, and ‘BIP342 — Validation of Taproot Scripts’. Respectively, they define a standard for Schnorr signatures in Bitcoin, introduce the Taproot construction, and formalize the new Script v1 instruction set. Taproot also iterates on the previous proposal of Merklized Alternative Script Trees (MAST).

There are two ways of spending a pay-to-taproot (P2TR) output. The first way is called key path spending. P2TR funds are locked to a single public key with the full output script amounting to _‘

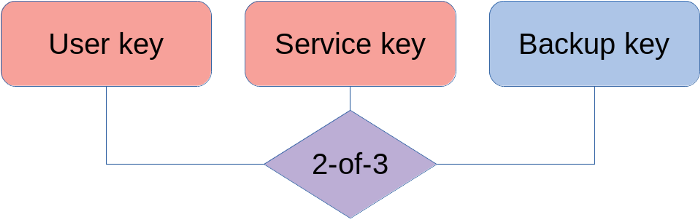

Under the hood, the public key is a composition of an inner key and the Merkle root of a Taproot tree (the inner key is tweaked with the Merkle root). The inner key can optionally be a composite itself, for example multiple public keys aggregated via the MuSig scheme. These compositions are possible due to Schnorr signatures being linear.

The second way of spending a P2TR output uses one of the Taproot leaves. We call this script path spending. First, the existence of the leaf needs to be proven which is done by revealing the inner key, the Merkle path to the Taproot leaf, and the script encoded in the leaf. Then, the spending conditions of the leaf’s script are fulfilled.

The remainder of this article explores the input costs of 2-of-3 multisig Taproot constructions. Some familiarity with the details of the proposals is helpful. Check out the Taproot overview and the excellent summary of the three BIPs by the Bitcoin Optech Group if you are looking to refresh the details.

The multisig user story

We are looking at a wallet construction using three keys held by two or three parties. The first key is held by the user, the second key is held by the service provider, and the third key is a backup key either held by the user or a key recovery service. We are assuming that the first two keys are hot and can be used in an interactive signing scheme as employed by MuSig. The backup key may be held cold e.g. on an air-gapped system in which case interactive signing should be avoided.

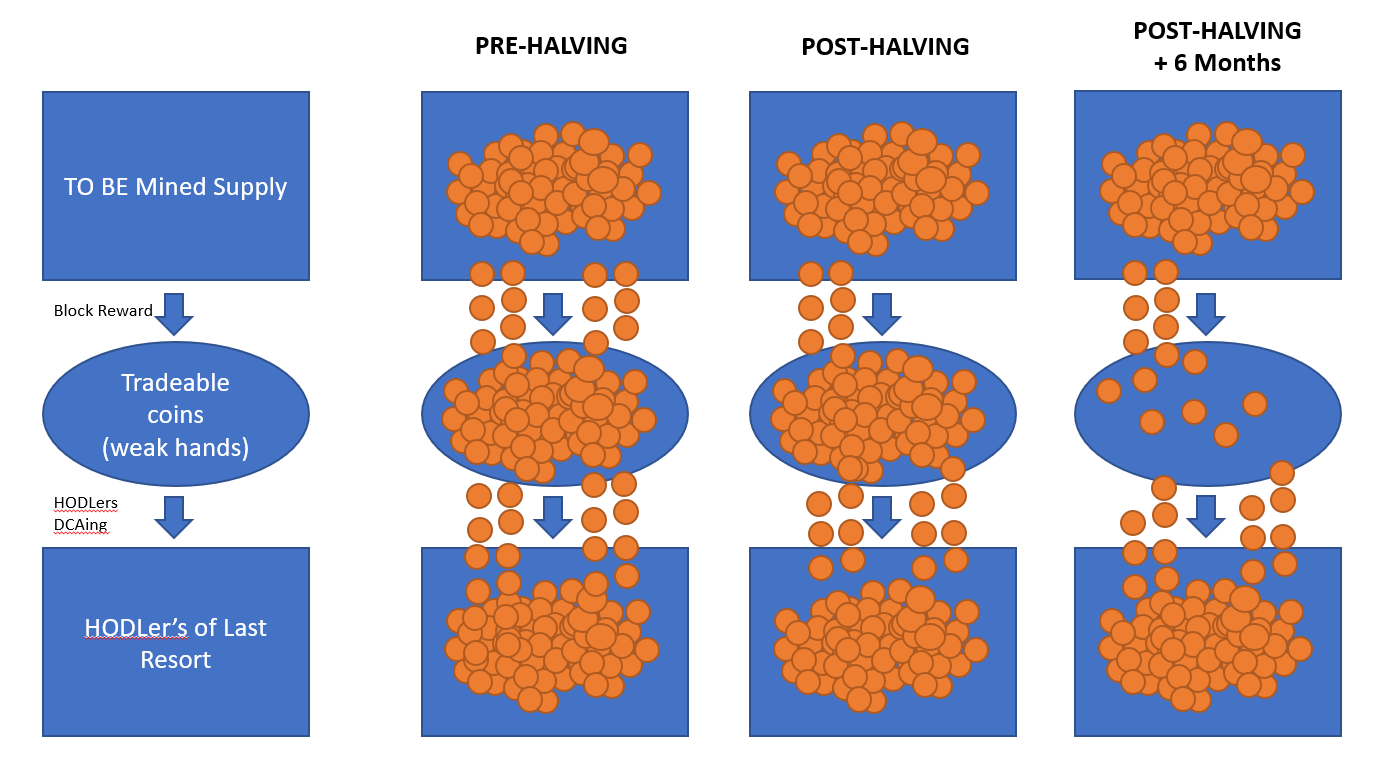

2-of-3 multisig with two hot keys and one (optionally) cold key

2-of-3 multisig with two hot keys and one (optionally) cold key

Classically, a 2-of-3 multisig address is constructed in the form of a pay-to-scripthash (P2SH) output of the form _‘2

The most likely spending option with the two hot keys is encoded as an aggregated key in the key path. The two backup spending options are put into leaves of the script tree.

The most likely spending option with the two hot keys is encoded as an aggregated key in the key path. The two backup spending options are put into leaves of the script tree.

Key path spending costs

In the general case, all parties agree on a course of action and collaborate to use the key path. This is the most cost-effective way to spend a P2TR output and allows multiparty spenders (and other complex spending conditions) to be indistinguishable from single-sig spenders.

Costs of key path input

An input commits to a specific unspent transaction output (UTXO) which is defined by the transaction that created it and the position in that transaction’s output list. The UTXO entry provides the spending conditions to be satisfied by the spender. An nSequence field allows encoding replaceability, and the witness provides the spender’s authentication. In the case of the key path this is a single Schnorr signature which in some cases may actually consist of multiple aggregated signatures.

* outpoint (txid:vout): 32 vB+4 vB

* scriptSig size: 1 vB

* nSequence: 4 vB

* count witness items: 1 WU

* witness item size: 1 WU

* signature: 64 WU

32+4+1+4+(1+1+64)/4 = 57.5 vB

Control Blocks

When a fallback to the backup key is necessary, the existence of the Taproot tree must be revealed. If there is only a single leaf, the spender provides only the inner key. Tweaking the inner key with the hashed leaf results in the public key. In sum, the data necessary to prove the existence of a script path is called the control block.

Depth 0 control block

* Length of control block: 1 WU

* Header byte (script version, sign of output key): 1 WU

* Inner key: 32 WU

1+1+32 = 34 WU

In case of two leaves, additionally the first hashing partner for the Merkle path must be revealed:

Depth 1 control block

* Length of control block: 1 WU

* Header byte: 1 WU

* Inner key of root key: 32 WU

* Hashing partner in tree: 32 WU

1+ 1+ 32 + 32 = 66 WU

Script path spending cost

The below costs are in addition to the above costs of spending via the key path.

Script path spend assuming 2-of-2 MuSig leaf (hot backup key)

When the backup key is on a networked system, e.g. an HSM, and can participate in a multi-roundtrip signing process, we can make use of MuSig to aggregate the two public keys.

* script size: 1 WU

* script “

57.5+(1+34+66)/4 = 82.75 vB

Construction with 2-of-2 OP_CHECKSIG (cold backup key, no MuSig)

In the case that the backup key is offline and a human would have to make multiple trips employing USB sticks or QR codes, saving roundtrips may take precedence over saving a few bytes. Instead of an aggregated public key, we use a non-interactive multisig construction.

* second signature: 1 WU+64 WU

* script size: 1 WU

* script “

57.5+(1+64+1+68+66)/4 = 107.5 vB

Discarded approach: single leaf with 2-of-3 script

It turns out that a single 2-of-3 leaf in lieu of the two 2-of-2 leaves is both more costly and less private.

* +2nd sig: 1+64 WU

* +1 empty witness item: 2 WU

* Length of script: 1 WU

* Script “

57.5+(1+64+2+1+104+34)/4 = 109 vB

Conclusion

Upper bound of input and output sizes for single-sig and 2-of-3 multisig.

Upper bound of input and output sizes for single-sig and 2-of-3 multisig.

The described 2-of-3 multisig scheme achieves input sizes of 57.5 vbytes for a key path spend, 82.75 vbytes for the leaves using a hot backup key, and 107.5 vbytes for non-interactive backup spends. This results in a fee reduction by 45% for 2-of-3 inputs when switching from P2WSH to P2TR spending. In the uncommon case of a recovery transaction, the cost is negligibly increased for cold keys. Single-sig users are also incentivized to switch to P2TR as they save 11 vbytes on each input — the output cost is externalized on the sender.

Thanks to Gloria Wang.

Thinking Beyond BitMEX: DLCs

By Shinobi

Posted October 1, 2020

Well, firstly I want to say that as of right now the official BitMEX announcement is effectively “We disagree Mr. Government, and intend to fight your charges. For now we will continue normal operations.”

Fucking. Chad.

It’s going to be an epic showdown, and I don’t need to explain to anyone the hypocrisy behind this with the recent FinCEN Files dropping. This very well could wind up being a case of people avoiding US friendly jurisdictions, continuing to run a BTC (which can’t be shut down) only business, and going “What are you going to do about it?” Really the only points of attack for the US are 1) DNS, 2) the physical servers, 3) actual people who hold private keys. Honestly who knows how it plays out in the end, but it’s going to be an interesting test of how a lean BTC only business can really stand up to the government going “verboten.”

Let’s entertain for a minute though they lose. The domain is seized, the servers are reachable by US authorities, BitMEX throws in the towel. Then what?

Do we throw in the towel too?

DLCs + Statechains

BitMEX takes your BTC, it custodies it, it acts as a price oracle for the market, and resolves positions customers have entered into (as well as facilitates transferring them).

Bitcoin can be “custodied” in statechains. DLCs can be placed on top of Statechains. Price oracles can be agreed upon indexes that trusted parties sign off on computed from public auditable price data. The only real need for something conventionally centralized is an orderbook to aggregate outstanding offers and contracts in a place where order matching can occur efficiently.

The reality is that something like BitMEX could be effectively coordinated by a trust worthy message board operator with everything else coordinated by federated statechain operators and price oracle entities that wouldn’t even know who is using them. Ultimately if BitMEX goes down there are more streamlined alternatives for similar open access no KYC market places.

A lot of thought in this space is centered around decentralized exchanges in the spot market sense, such as Bisq and HodlHodl. But futures exchanges are important too. Not only are they used by so called degenerate traders to amplify positions on spot markets, they are also used by businesses with real operating or capital costs priced in fiat dollars. Degenerate 100x trading is not the only reason for censorship resistant and private futures markets, there are many legitimate reasons for needing such financial hedges. Also, it’s morally frankly no one else’s business if you do want to gamble like a degenerate on 100x leverage.

Custodying money and making payments are not the only thing that Bitcoin opens the to door to decentralizing to different degrees.

The Chad Battle Ahead

Worst case possibilities and counter moves aside, BitMEX seems to have every intent to continue operating normally and fight the indictments against them and specific members. Let’s just say this will be very interesting.

I’m not going to speculate on strategy here accept delineating the above dynamic of:

Really the only points of attack for the US are 1) DNS, 2) the physical servers, 3) actual people who hold private keys.

We’ll see how this works out in the long term, but how it happens blow by blow is going to be a very interesting test of how resilient a conventional company running on just BTC can be against government disapproval.

Also…it would be a real shame if BitMEX survived and started playing with things like statechains and DLC oracles…a real shame…

The Way of the Digital Citadel

By Yuri de Gaia

Posted June 26, 2020

Before building physical citadels, our efforts may prove more fruitful elsewhere—in the digital realm.

The word citadel is becoming so common among bitcoiners that even newcomers use it. People just get it: why fight the monstrosity that the modern nation-state is when you can start your own?

Satoshi did not blog about the evils of central banking, petition the government to review the monetary system or run for office to “change the system from the inside”. He created Bitcoin.

Similarly, opting out of the current social system and creating your own community based on shared principles may prove a lot more effective. It has been done before and it can be done again. If various groups around the world start forming citadels, chances are that at least one of them will get it right. And thus, a blueprint for many more will be available. Like with many things in life, the success of any such project depends on practice, not theory.

Is it possible, however, to start a citadel without having access to a piece of land? What if a group of individuals have already found each other in various corners of the Internet but are currently scattered around the world without an immediate way of getting together physically? I think such a group is already half-way there. Many physical outposts will be preceded by their digital counterparts. This is the way of the digital citadel.

A Digital Country

We are used to thinking of countries as physical locations with defined borders and the State apparatus as its governing body. My definition of the citadel suggests that some landmass is required, too. A lot of our citadels, however, will be newly formed communities based on shared principles and values rather than common territory, history, religion or ethnicity. While the search for the perfect lot of land continues (which may take a while), it is entirely possible to organize most aspects of the citadel life elsewhere—in the digital realm.

Online communities are common these days. Cat lovers, car aficionados, carnivores and bitcoiners regularly meet on Internet forums, in chat rooms and video-conferences. These groups are usually formed based on specific common interests. In the physical realm, meetups represent a similar idea. But our interest lies on a higher level. A meetup of steak lovers in Singapore, generally, assumes that all the participants are residents of the Singapore city-state, but not all Singaporeans are steak lovers. What we want to build is not just an interest-specific group, but an online version of Singapore, a digital country.

Individual vs Collective

First things first. What are the characteristics of classic nation-states?

“As a political model, the nation-state fuses two principles: the principle of state sovereignty, first articulated in the Peace of Westphalia (1648), which recognizes the right of states to govern their territories without external interference; and the principle of national sovereignty, which recognizes the right of national communities to govern themselves.”—Encyclopaedia Britannica

The current model, as we can see, incorporates two things: territory and the right to self-governance. We do not have the former. The latter, however, is within reach. When we talk about being able to govern ourselves, we imply collective self-determination.

The idea of collective self-determination seems to stand against individual self-determination. In anarcho-capitalist and Austrian economic circles it is often a sensitive topic. Give up some of your individual freedoms in favour of a group and you find yourself walking on thin ice. Collectivism! In my view, however, the two concepts are not mutually exclusive. The issue deals with two properties: tradeoffs and scale.

The formula is simple: the larger the scale of the group, the more tradeoffs you need to make to exist within it.

Imagine a world in which individual self-determination is all we have: eight billion self-sufficient individuals going about their business in complete independence. It is quite hard to picture because such a scenario is impossible. The moment you start a family or become friends with someone, this total freedom disappears. Suddenly, you find yourself making concessions in order to keep the relationship. Stop seeing other women if you are to have a solid marriage; sacrifice work and hobbies to spend time with your children; change your spending habits to make sure your family is well off. Such tradeoffs are already quite significant, and we are only talking about a small-scale collective unit: family, the nucleus of society.

What about your neighbourhood? Village? Town? Country? Per the formula given (and common sense), your freedom wanes with scale. There is nothing bad about it, though. Social interactions are all about tradeoffs and concessions. What matters is the ability to choose the tradeoffs that you are willing to make. And this is precisely what the classic nation-state lacks. Instead of being a service provider and protector, it reaches its ever-growing tentacles into every aspect of your daily interactions, micromanaging your life—all without your consent.

But:

“Collective self-determination need not mean outright statehood. It could mean instead some form of autonomy or self-government within another state.”—Nationalism, Self-Determination and Secession

If a group of individuals enters into a relationship whereby they agree to follow a pre-determined set of rules, including tradeoffs and concessions characteristic of communities, we get collective self-determination. With its own hierarchy, traditions and culture, such a community engages in self-government. In Defense of the Citadel Meme provided a few examples, such as the Amish. The issue with existing self-governing collectives is that they do not have their own territory. Normally, they are located within other nation-states, and no matter how much they would like to secede and go about their business separately, the host state is unlikely to give up any of its landmass—not because it does not have any to offer, but because it will set a dangerous precedent.

Our digital citadel, therefore, is an Internet-based collective with no physical territory, organized and entered into voluntarily, the relationships in which are governed by a contractually binding set of rules.

What would set a digital citadel apart from other online communities?

As mentioned, our collective is more akin to a digital country rather than an interest-based community. Video-gamers, anime lovers and even vegans are welcome as long as they agree to follow the rules.

Personally, I would like to see the following attributes.

The Characteristics of a Digital Citadel

Being a digital country, our citadel must possess certain features that regular countries have enjoyed throughout history. At the same time, we are attempting to improve upon the legacy system, so a few innovative approaches must be expected, too.

Government

As Hierarchy is part of Natural Order, we cannot do away with a government. However, rather than having Government, a modern amorphous entity spelled with capital G, there will be a government—a clearly defined managing body consisting of a limited number of known individuals. As I am a proponent of private government, i.e., leaders who have direct ownership of the citadel’s assets, such a country may be referred to, classically, as a kingdom, a principality or an equivalent from other cultures. A more modern name may be used or devised, including citadel itself, but traditional descriptions are very Lindy.

This government will play a very limited role. The king, like the people, will be under the law. The law, in this case, is a set of universal immutable rules that fit on a single piece of paper. As the head and proprietor of the state, the monarch only acts as a judge, not a legislator, the vast majority of relationships in the country being subject to private law. As counter-intuitive as it sounds, it is a kingdom of sovereign individuals.

Symbolism

Starting with small clans and ending with supra-national entities, organized people have always preferred to distinguish themselves in many ways. The use of banners and flags dates back to antiquity. In my opinion, a proper country must have a flag, a coat of arms with a motto, a national anthem, a cultural icon, national colors and some abstract symbols. In a monarchy, the head of state himself usually serves as a symbol of the nation and may make use of the dynasty’s seal or stamp, which is also associated with the country.

Traditions

I believe that to unite a group of people long-term, there needs to be a common goal shared and revered by all the population. This goal must span decades or, preferably, centuries or even millenia. United around the common vision, the people of the citadel will find purpose and meaning in their lives. Being a part of something larger than yourself and directly contributing to the grand plan—this is what is missing in many people’s lives today.

To further promote unity, national traditions are required. Various events, celebrations, commemorations, competitions will elevate the spirit of the nation and invoke pride in the population.

Traditional values, such as family, community and discipline must be promoted from the young age to ensure that the citadel only grows stronger with new generations. As a root generation, we may not be perfect, but we all know that the future lies with our children.

With time, traditional art, music, theater and even fashion may develop that will reflect in outer forms the inner state of the citizens’ minds. This cultural heritage will pass from generation to generation and strengthen the bond between the people of the nation.

Contract

While the above points are not entirely new, the following is what makes a digital country different from the rest.

Unlike in traditional countries where you are bound by an invisible social contract, participation in the citadel is voluntary. Citizenship is represented by a real contract between you and the operating entity. Whether the head of state is a monarch or a President aided by a board of directors, you will never be his subject, but a member of the organization. Citizenship is membership.

As soon as you feel that you do not share the nation’s common goal, do not like its ethos or simply found a better alternative, vote with your feet. Leave. At the same time, if you choose to stay, you must abide by the laws of the citadel and expect to be kicked out if you refuse to do so. This way, management is incentivized to provide the best conditions possible to existing and potential members, and members are incentivized to be good citizens. It is as fair as it can get.

A New Renaissance

Finding a place to belong is an issue that many individuals across the world share. These rootless men would give everything to become part of something meaningful and ambitious, a place to which they could dedicate their lives. A digital citadel, a kingdom that is everywhere and nowhere at the same time, populated by real people with a shared vision of the future may be just the place.

Imagine taking a walk along a street of a foreign city and stumbling upon a person wearing a traditional dress with the insignia of your kingdom. A smile and a warm greeting will surely ensue. Before you know it, he introduces you to other citizens who live in this city. Your stay has just become a lot more pleasant.

It is not a protest or a movement. It is a new culture, a rebirth of traditional values adapted to the modern world. And some day, with enough effort, we may be able to find a piece of land or two upon which our cities will be erected. Thus will start the great consolidation, the unification of the scattered nation.

A New Renaissance is not coming by itself. It must be brought about. Do we have what it takes to make it happen?

SNARKs and the future of blockchains

By Ruben Somsen

Posted October 3, 2020

SNARKs are often seen as a magical panacea to “solve” scaling. While SNARKs can provide incredible benefits, the limitations need to be acknowledged as well — SNARKs can’t solve the existing bandwidth constraints that blockchains are facing today.

This article is meant to demystify SNARKs by giving a (relatively) simple overview of what they can and can’t do for blockchains. We’ll look at how its functionality in relation to blockchains can be concisely summarized as Non-Interactive Witness Aggregation (NIWA). If you understand how Bitcoin works, you’ll be able to understand this article.

It should be noted that SNARKs are still very much an area of active research. Many SNARK variants either aren’t efficient enough to prove complex statements, have proof sizes that are impractically large, or require a trusted setup. That said, a lot of progress has been made over the years, and it’s expected that we’ll continue to see improvements in the coming decade. This article is written in anticipation of such improvements, even if it may not be practical today.

What is a SNARK?

A SNARK is a construction that allows you to efficiently validate a result, given a rule set and a starting point. The inputs that led to the result are not revealed (“zero knowledge”). Confused already? This simple chess example will explain.

Chess example

- Rules: The chess rule set

- Start: Starting position A of the board

- Result: New position B of the board

The regular way of proving that the game validly transitioned from position A to B is to simply reveal all the moves and checking whether they were valid. SNARKs can do the same thing, but better:

- The set of moves does not have to be revealed (private, less data)

- Verification is more computationally efficient

There is one caveat — SNARKs tend to be computationally expensive to create. This can however still be worthwhile in systems where many people wish to validate the same result, such as blockchains. Only one person needs to put in the effort to create the SNARK, increasing verification efficiency for everyone.

Blockchain example

- Rules: The full node software

- Start: The block header & UTXO set hash at time A

- Result: The block header & UTXO set at time B

Similar to our chess example, the regular way of validating the transition would be to start with the UTXO set (all unspent transactions) at time A, receive all the blocks, and update the UTXO set all the way until we reach time B. With a SNARK, none of this data would be needed to prove validity. In fact, if time A is set to the genesis block (empty UTXO set) and time B is set to now, then the entire chain can be validated without receiving any of the historic data.

It’s important to note that for time B the entire UTXO set is required, as opposed to just the UTXO set hash. While this data is not strictly required for proving validity, we also care about availability. If all you had was the UTXO set hash, then while you know a valid state exists, you wouldn’t actually know what that state is. This would mean you can’t spend any coins, because you don’t have the data that allows you to prove that a specific UTXO is part of the set. In the chess analogy, you would have a hash of the new board position, but don’t actually know what that position is, so you can’t continue to play the game.

Note that whoever made the SNARK (presumably miners) would have this data (as it’s needed to create the SNARK in the first place), but they could potentially choose to withhold it from you.

The SNARK blockchain

In order to guarantee that everyone can spend their coins, all the data that’s needed to update the UTXO set must be communicated with each block. You’ll need to know which UTXOs were spent (inputs) and which were newly added (outputs). This is so-called non-witness data.

The validity of the transition can be verified by a single SNARK, replacing all witness data (scripts, signatures), and taking up almost no bandwidth. The relationship between inputs and outputs would not be apparent — a block would look like one big coinjoin transaction. The bulk of the data would be non-witness data.

Contrary to popular belief, SNARKs can’t solve the fundamental issues behind light clients or non-federated sidechains, because non-witness data must always be downloaded. Full nodes have the crucial ability to reject a valid SNARK if non-witness data is missing, whereas if a light client neglected to download non-witness data, it could mistakenly consider a chain with missing data valid. If even a single piece of non-witness data is withheld by miners, nobody would be able to create new blocks with valid SNARKs, except for those specific miners, turning it into a permissioned system.

SNARKs consume witnesses

SNARKs for blockchains can perhaps best be summarized as enabling the following function:

Non-Interactive Witness Aggregation (NIWA)

I use the term “witness” here liberally. In Bitcoin, the witness is the data inside a transaction that proves whether a specific UTXO is allowed to be created. But over time, this UTXO (non-witness data) becomes a witness of its own when it gets spent. When 1 BTC gets sent from Alice to Bob to Carol, Bob’s transaction is a witness to the transfer from Alice to Carol. In the same vein, all spent transactions since genesis are witnesses to the current UTXO set.

Also note that a SNARK is in itself a witness. If each individual transaction is validated by a SNARK, we can also NIWA these SNARKs into a single SNARK per block. And because outputs become witnesses the moment they are spent, we can even take unconfirmed but already spent outputs in the mempool and aggregate them as well. Alice to Bob to Carol becomes Alice to Carol, achieving non-interactive transaction cut-through. This can be especially powerful when a single UTXO with many branching off-chain transactions is forced on-chain, such as may be the case for Lightning Channel factories.

In short

We’ve summarized the core functionality of SNARKs for blockchains with NIWA. Any witness data can be non-interactively aggregated by a SNARK. The non-witness data that remains is a direct reflection of the state of the system — the UTXO set. While SNARKs can achieve amazing things such as allowing you to catch up from genesis by merely downloading the UTXO set and a single SNARK, or non-interactively aggregating sequences of unconfirmed transactions into a single transaction, there still remains a need to publish all non-witness data for each new block in order to allow all nodes to update their UTXO set. The fundamental bandwidth constraints of blockchains are therefore not solved by SNARKs.

Thanks to Sanket Kanjalkar for the helpful discussion and comments.

NIWA in action. SNARKs consume witnesses and are also a witness of their own. SNARK eat SNARK.

NIWA in action. SNARKs consume witnesses and are also a witness of their own. SNARK eat SNARK.

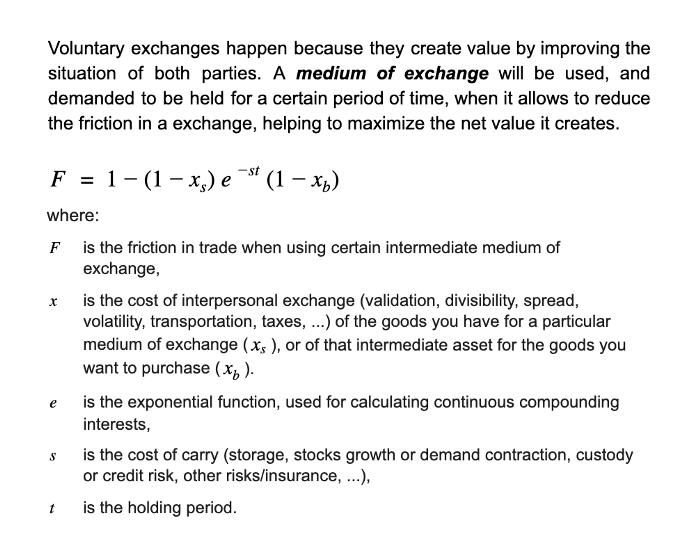

The “intrinsic” value of Bitcoin (II)

By Manuel Palavieja

Posted October 5, 2020

I am quoting the word “intrinsic” because I don’t think it is an appropiate term to refer to value as I explained here. That being said, in this post I’ll stick to the definition of intrinsic value normally used in finance.

Bitcoin is a medium of indirect exchange, whether its intended use is short term (payments) or long term (store of value), but in both cases it is a medium of indirect exchange for different holding periods. Therefore, Bitcoin is a tool for exchange, and all tools derive its value from the costs they save. Let’s find out with an example:

If I am offering 1 kilogram of tulip bulbs in exchange for a hammer, that’s because the hammer is more valuable to me than the tulip bulbs. We can express the the raw value I will get from that exchange using the following simplified¹ formula:

Raw Value = Value(hammer) - Value(tulips)

But doing an exchange through barter is very expensive in time and other resources as it will be hard to find someone that offers a hammer in exchange for 1kg of tulip bulbs. The cost of the exchange will probably be greater than the Raw Value², so it may never take place. In order to optimize the value I get from the exchange, I can use a medium of indirect exchange (let’s call it “X”), and I will choose the one that maximizes the total value for the expected time (“t”) needed to complete the exchange:

Net Value = Value (hammer) - Value (tulips) - Costs (X) * t

How does Bitcoin fit into the above? Easy: Bitcoin is objectively the asset with the intrinsic qualities that render the lowest costs of carry of all available assets, which makes it very convenient for long term exchanges compared to its alternatives (public debt, fiat or gold), those qualities are:

- Lowest dilution costs (gold global stock grows 2% annually)

- No counterparty risk costs (risk of default or inflation)

- Cheap to store and secure (easy to hide, difficult to confiscate)

A more suitable example for Bitcoin would be to exchange my services as a consultant during my young years for a nice home at the beach for my retirement. Nevertheless, there is currently another important cost in Bitcoin which is the cost of its price volatility. However, price is just an exchange ratio, and as such it is extrinsic to Bitcoin. Price volatility is a sign of the market assessing the intrinsic qualities of Bitcoin, testing and vetting if those qualities are for real or not, which is a long process as we all know. After all, very few, if any, get Bitcoin at the drop of a hat.

This post is inspired on Fernando Nieto’s extremely valuable insights, which can be summarized, in a much rigorous way that I did in this post, with the following formula:

¹ For didactical purposes this is a simplification of Fernando Nieto’s formula.

² “Exchange is an economic good” Chapter 1 - Currency Theory, Bondone 2012

Introducing CBEI: A New Way To Measure Bitcoin Network Electrical Consumption

By Tyler Bain

Posted October 19, 2020

There have been many claims in recent years that bitcoin and the miners securing the network via SHA-256 proof of work use an unconscionable amount of energy. But what data are these claims based on, are the source calculations using flawed or sound approaches and assumptions? How much electrical power does the network draw and how much electrical energy has the Bitcoin network used historically?

Methodologies And Misconceptions

Due to the vast, globally distributed topology of the Bitcoin network, the amount of electrical power and energy that miners consume isn’t exactly verifiable, instead it must be estimated. Among the energy consumption hysteria over the previous few years, a surprisingly large number of reputable sources have weighed in and attempted to estimate Bitcoin’s network energy consumption in more level-headed and data-derived ways:

- University of Cambridge, Judge Business School (JBS)

- The International Energy Agency (IEA)

- Electric Power Research Institute (EPRI)

- Coin Center

- CoinShares

- Marc Bevand

- Hass McCook

- Alex de Vries

- Myself

Estimation methodologies seem to fall into two major categories: economics-based approachesrooted in financial assumptions, as well as physics-based approaches planted in engineering principles. These two estimation approaches were thoroughly compared and contrasted at BTC2019.

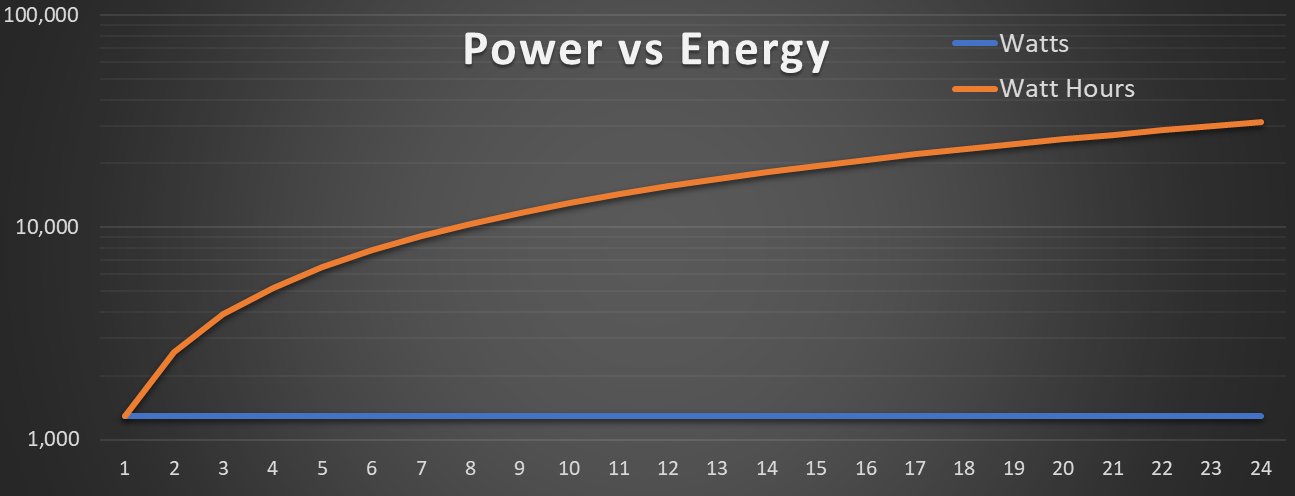

It’s important to understand when digesting all of these yearly usage estimations that electrical consumption is typically measured in two ways: instantaneously (power, watts, kilowatts, etc.) and that same instantaneous power measurement integrated over time (energy, joules, kilowatt-hours (kWh), etc.)

Small Bitcoin miners draw about 1,300 watts of power and use about 31,200 watt hours of energy over a 24-hour period.

The Problems With Economics-Based Network Energy Estimations

Economics–based approaches that estimate the Bitcoin network energy consumption generally assume perfectly rational market behavior, and can easily be manipulated with a few input variable misassumptions.

In theory, the Bitcoin mining industry is rational, profit maximizing and perfectly competitive: mining marginal revenue should tend to equal marginal cost (MR = MC). Meaning, on long enough time horizons, the market should find an equilibrium, where the cost of energy consumed in a unit of bitcoin’s production should be roughly equivalent to the unit’s market value at the time of minting. This calculation methodology can be distilled as, “How much can Bitcoin network miners afford to spend on electricity?”

Typically, these types of estimations are too dependent on a single volatile variable: the market exchange price of bitcoin. Below is a quick, simplified example of this type of estimation:

[MR] = [MC]

[(Blocks/Day)*(Reward/Block)*(BTC Price) ]=[(kWh/Day)*($/kWh)]

[(Blocks/Day)*(BTC/Block)*($/BTC)]/($/kWh) = (kWh/Day) = Energy/Day

Let’s try this estimation. Bitcoin blocks are generated roughly every 10 minutes — a rate of 6 per hour, or 144 every day. Currently, a single bitcoin block contains 6.25 BTC of coinbase block subsidy; that’s 37.5 BTC per hour, or 900 newly-minted bitcoin rewarded to miners daily. With bitcoin’s current market exchange price of about $10,750 at the time of this writing, that is roughly $9,675,000 earned per day that bitcoin miners have available to spend on electricity.

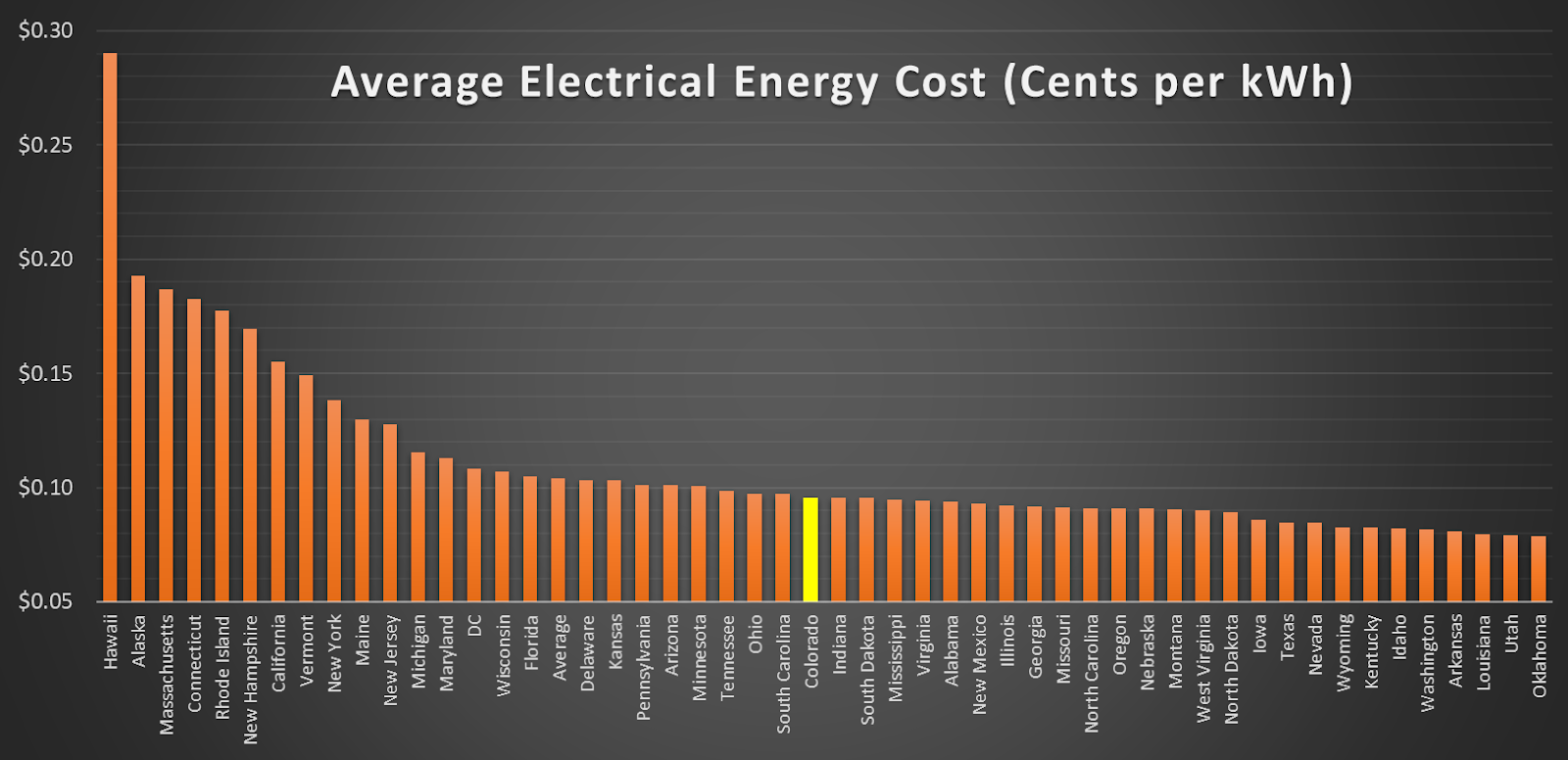

Average U.S. electrical costs in cents per kWh by state, per EIA data

[(144)*(6.25/Block) * $10,750] / ($0.10/kWh) = (96.75 GWh/Day)

This amount of daily energy equates to roughly 35.3 TWh of yearly usage that the bitcoin miners could afford to consume, if we take a snapshot today and assume constant bitcoin price for a year and U.S. average electrical costs.

While this method is overly reliant on bitcoin price, it is also heavily dependent on the assumed electrical energy cost for miners. The calculations and conclusions of this kind of estimate can be drastically different or even manipulated depending on the assumptions used as inputs: energy costs ($/kWh) and the price of bitcoin ($/BTC).

Here we used the average U.S. electrical cost of $0.10/kWh. However, in the U.S., electrical costs actually vary seasonally, from state to state, city to city and, in some cases, neighborhood to neighborhood. Global electrical costs have the same incongruence. This isn’t even including wide-ranging industrial, commercial or residential electrical energy rates, adding even more sources of error to these economics-based estimation techniques. And, in fact, this calculation’s heavy energy price dependence has yet another flaw: some miners’ high in ingenuity have near-zero fuel cost as they harvest excess, otherwise wasted, inaccessible or curtailed energy sources.

This quick exercise highlights, in my opinion, why this type of economics-based estimation approach is a gross oversimplification fraught with the following issues:

- Bitcoin mining, hash rate and, therefore, network energy consumption isn’t as responsive to sudden price movements as these economics-based estimation methods are.

- The economics-based model claims energy usage is cut in half along with network miner rewards after each bitcoin block reward halving cycle, which is every 210,000 blocks or about four years, while difficulty and proof-of-work-based data disproves this.

- This type of model assumes a single average global energy cost ($/kWh); electrical energy costs vary widely by region, seasonally and even by energy source.

- This is likely to be an upper-bound estimation.

The Benefits Of Physics-Based Network Energy Estimations

Physics–based network energy estimation approaches, on the other hand, tend to be a very rigorous type of “running of the numbers” that the Bitcoin community is accustomed to.

These methods use independently verifiable on-chain difficulty, proof-of-work data and original equipment manufacturer (OEM) -published heat rate specifications to more accurately estimate historical energy inputs into the bitcoin mining system. The physics estimation attempt may best be described as a “bitcoin stoichiometric ratio unit analysis calculation:”

Bitcoin Difficulty (Unitless) → Bitcoin Hash Rate (Daily Average TH/s)

Daily Average Hash Rate (TH/s) → Yearly Hashes (TH/Year)

Yearly Hashes (TH/Year) * Yearly Hash Heat Rate (Joules/TH) = (J /Year)

Energy Per Year (Joules/Year) → (kWh/Year) → (TWh/Year) → (ktoe/Year)

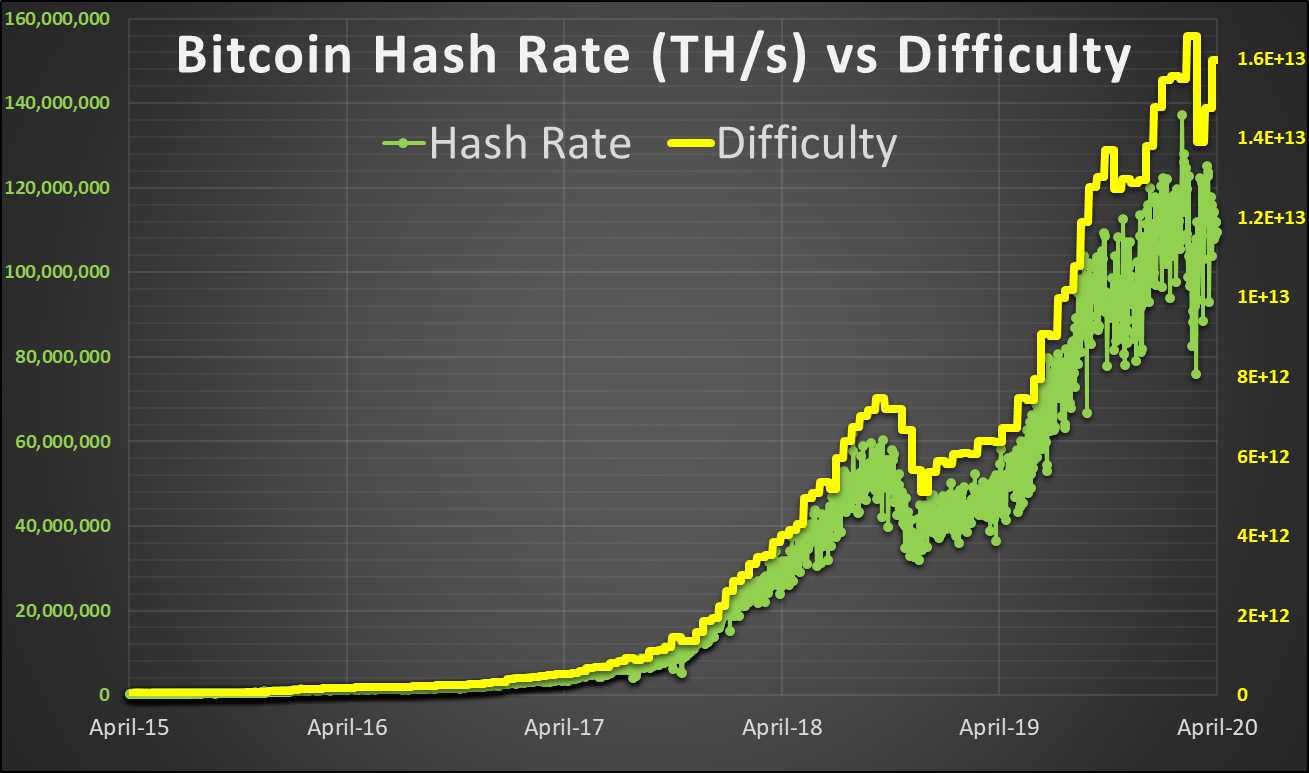

So, let’s try out this style of estimation using bitcoin proof-of-work difficulty data and OEM-published data. Bitcoin network difficulty self-adjusts once every 2,016 blocks, or roughly once every two-week period. This difficulty adjustment is to compensate for block production speed discrepancies and, thus, network hash rate fluctuations.

Bitcoin network hash rate (Th/s) compared to difficulty, April 2015 to April 2020.

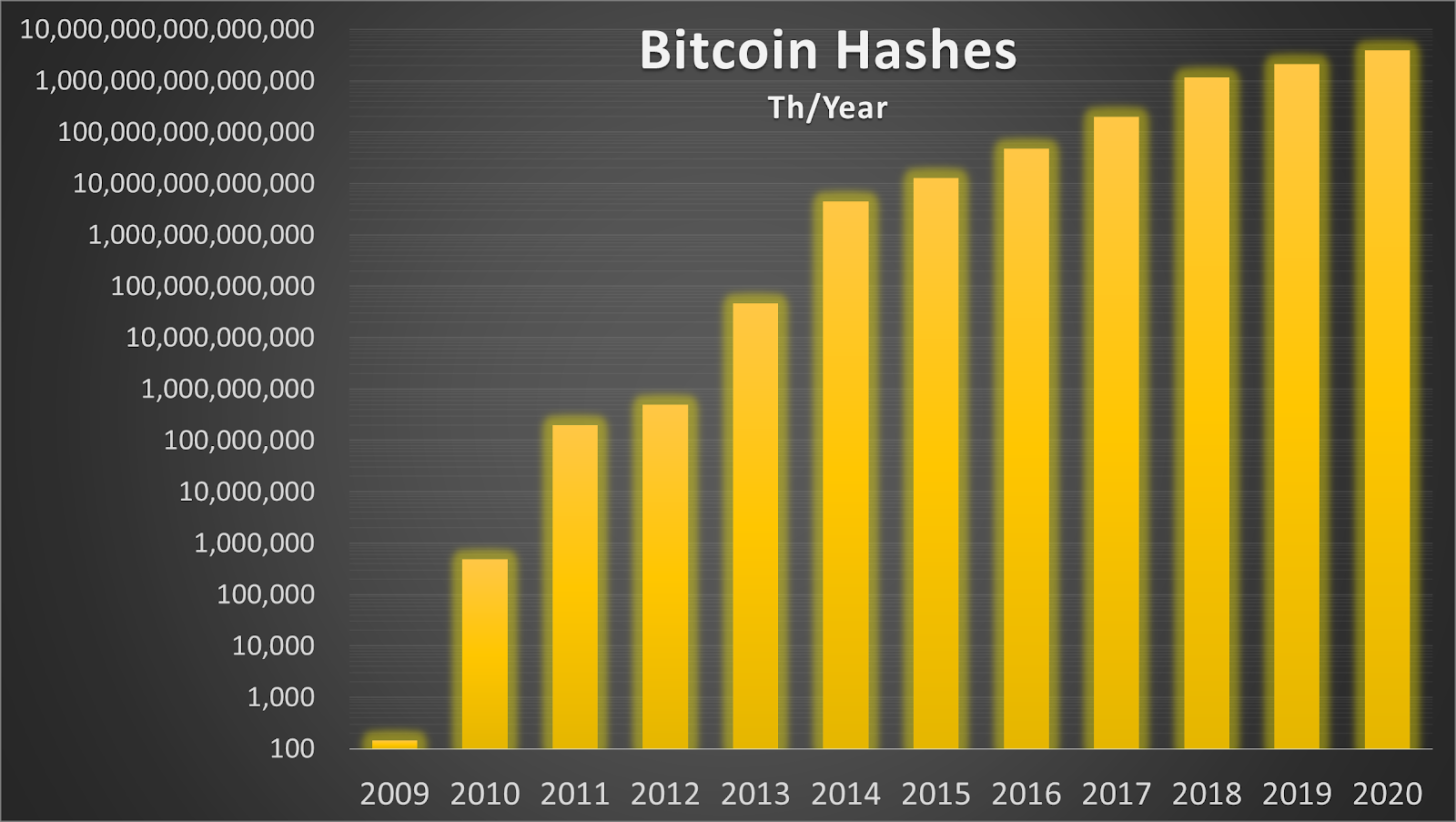

This difficulty and proof-of-work relationship allows us to derive an estimate for network hash rate based on the block production rate and the associated difficulty level. From the amount of work done at the various difficulty levels over the previous decade, we can roughly estimate the amount of SHA-256 hashes computed per year on the Bitcoin network, shown below in terahashes per year (Th/year) or a trillion hashes per year. We can also do this same type of exercise with daily data to produce more granular calculations (spoiler: keep reading).

Estimated total Bitcoin network terahashes by year.

Bitcoin is on pace to have roughly 3,934 yotahashes computed on the network in 2020 or about 3,934 septillion hashes (“yota” and “septillion” are the largest of the Scientific International (SI) prefixes to date, (10²⁴)),

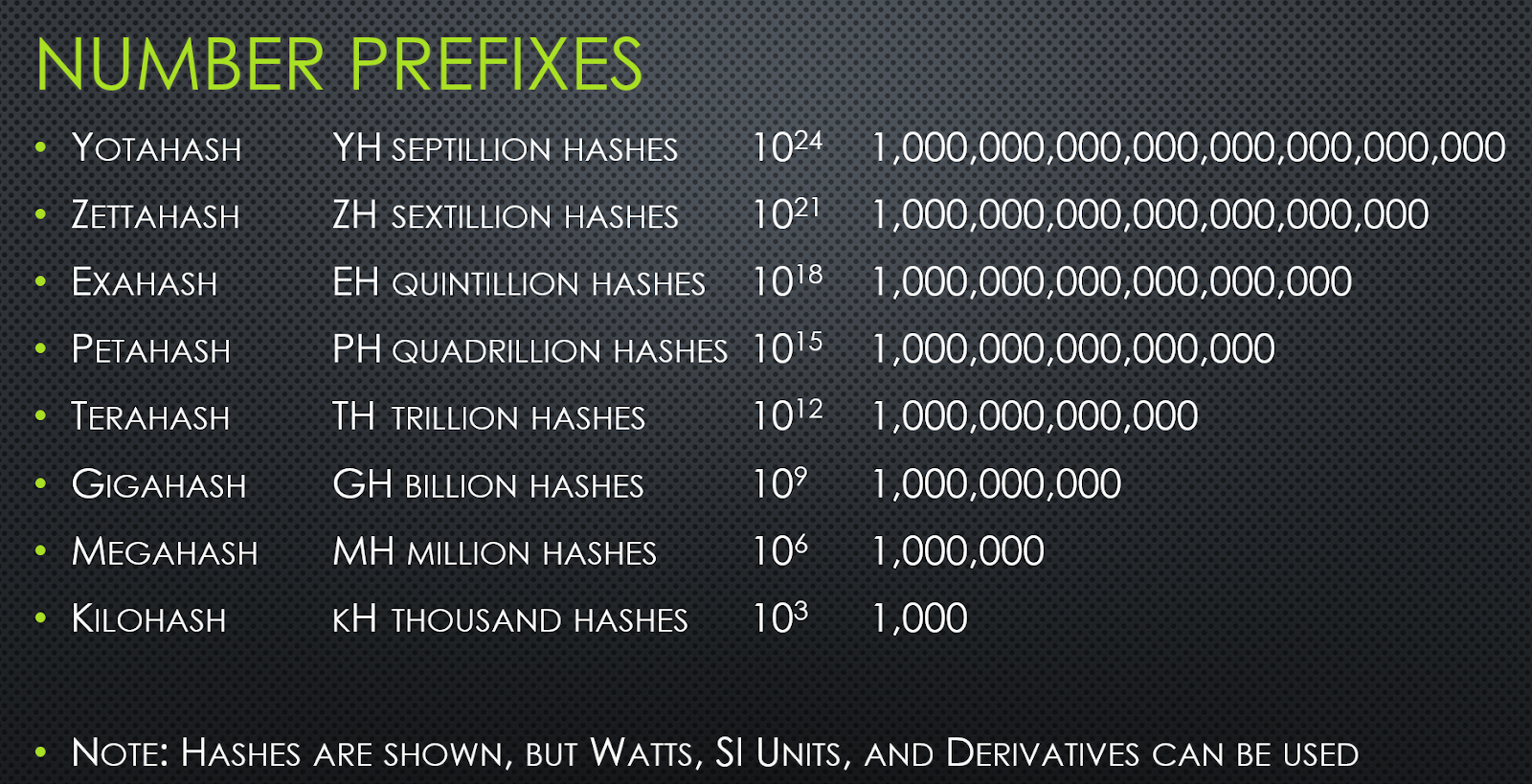

Scientific International (SI) unit prefixes, based on NIST data here.

Now that we have an estimation for the amount of hashes per year, next we must compile mining rig efficiency data over the past 11 years to understand how much energy would have been required to produce that amount of work.

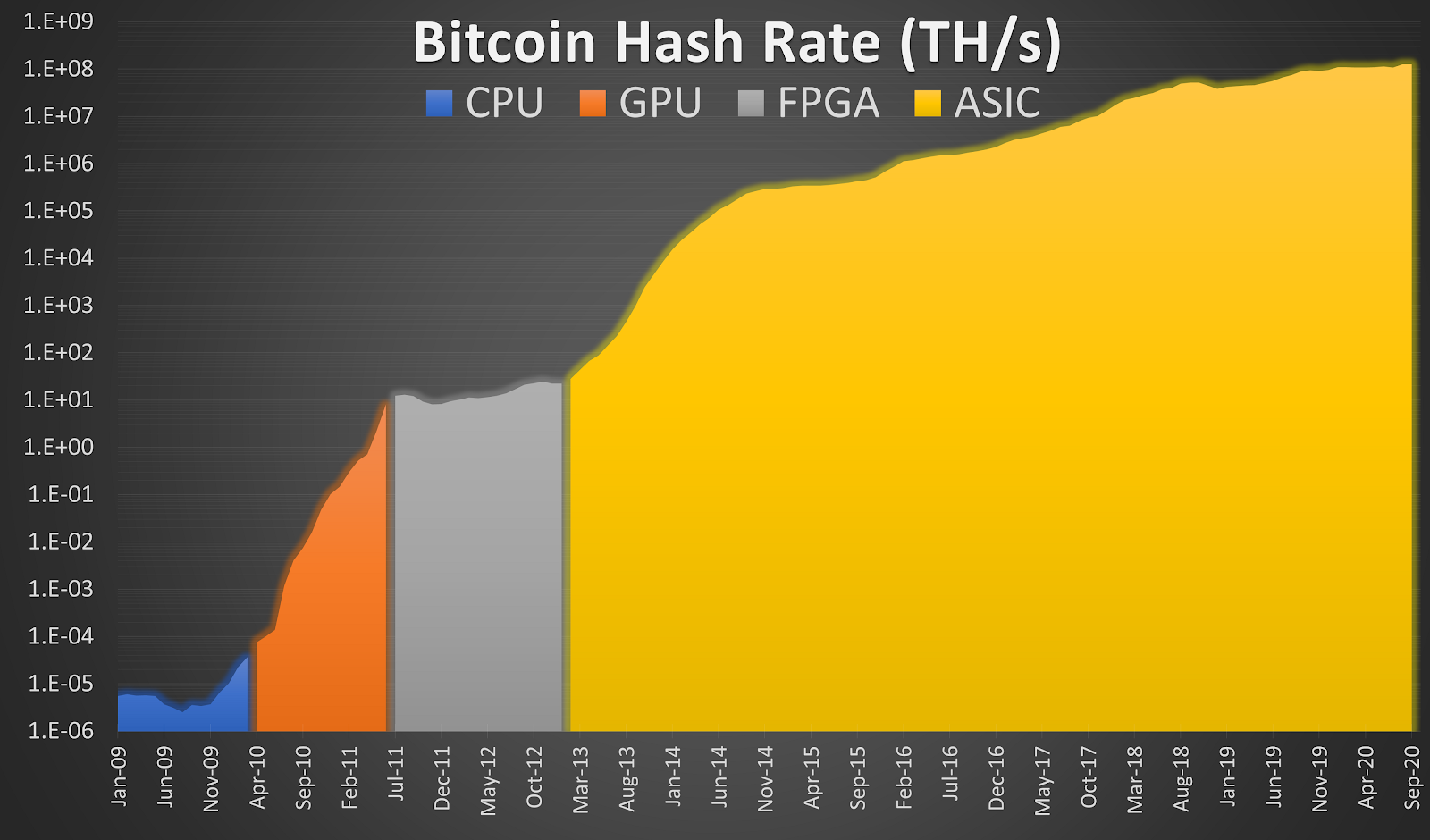

Here it is important to understand the different types of mining equipment that have provided work toward the Bitcoin blockchain over the years. Each era and year has distinctly different proof-of-work efficiency characteristics, which change the network’s energy consumption values over time. From the humble beginnings of the Bitcoin genesis block being built by work derived from CPUs (central processing units), to blocks eventually being constructed with GPUs (graphics processing units), then on to FPGAs (field programmable gate arrays), and finally ASICs (application-specific integrated circuits) the Bitcoin network has evolved at a stunning pace.

Bitcoin network hash rate colored by general device type eras, in terahashes per second.

Important note:efficiencyis defined as useful work performed over energy expended to complete that work (terahash/joules — Th/J). However, ASIC original equipment manufacturers typically cite a type ofheat rate specification, or the inverse of efficiency, showing energy expended over useful work (joules per terahash — J/Th).

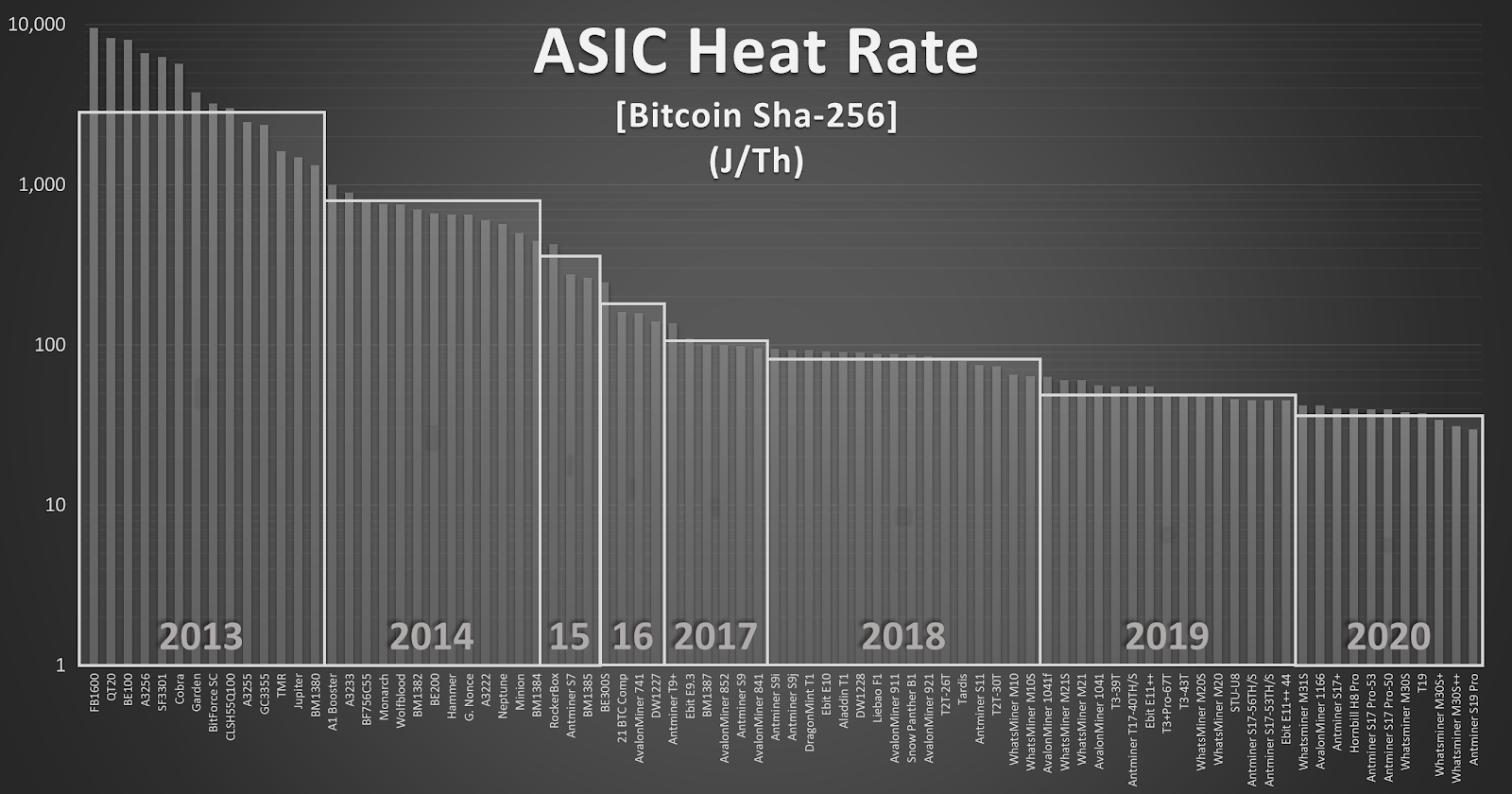

As you can see in the log scale chart below, over the past eight years, bitcoin mining ASICs’ heat rates have been steadily marching lower every year, meaning network mining efficiency has been increasing.

Manufacturer published SHA-256 ASIC energy per hash heat rate in joules/terahash by bitcoin mining rig.

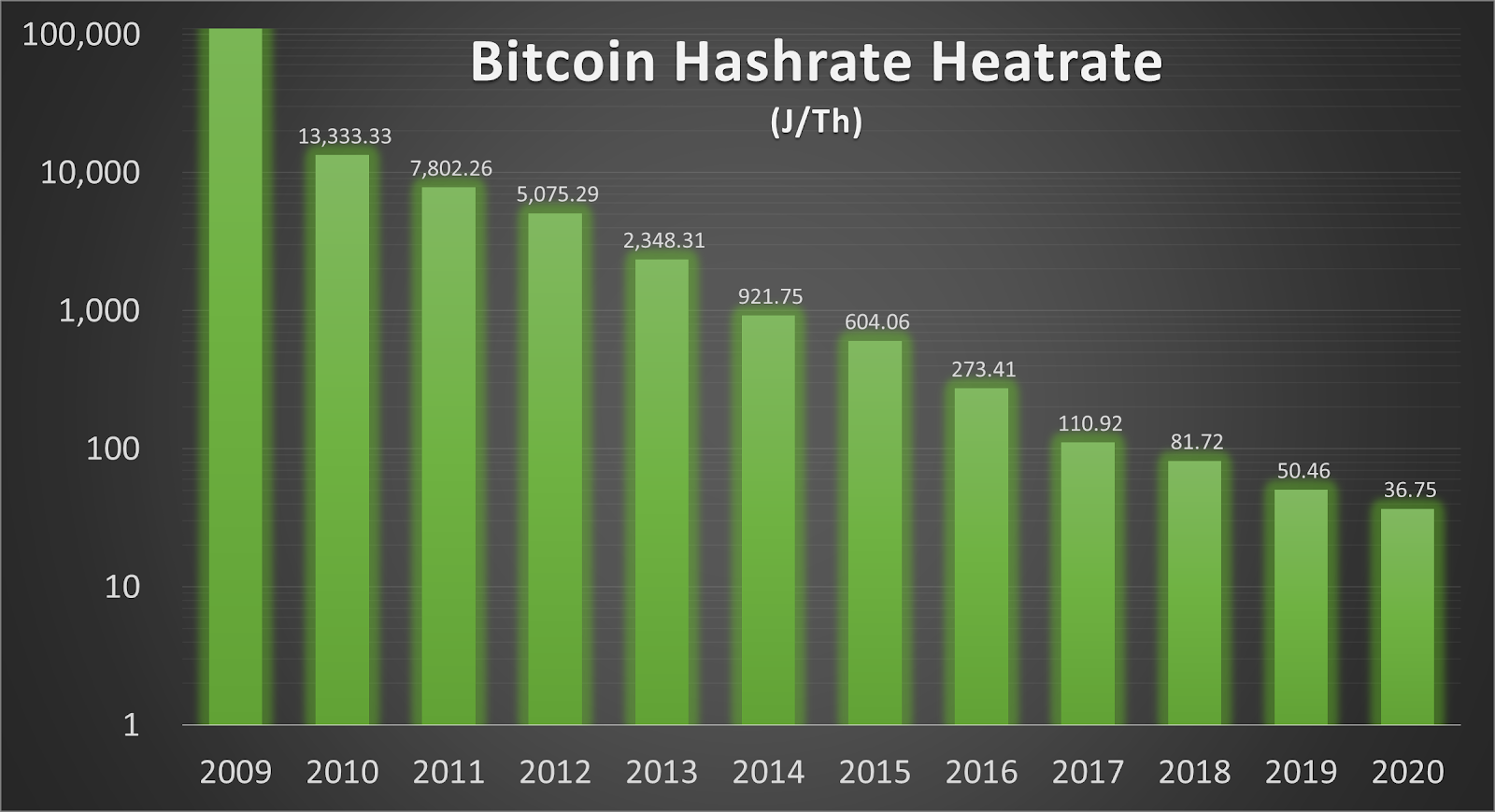

Translating this data into an average yearly heat rate (chart below) shows a similar steep decline during the entire history of bitcoin mining. CPU, GPU and FPGA benchmarks along with published OEM power usage data was used to estimate 2009 to 2012 network average heat rate. ASIC miners announced in 2020 were visualized above and below to show the continued decrease in hash heat rate, but they were discarded from the energy estimations as they are not yet publicly available.

Bitcoin mining equipment average yearly heat rate, the inverse of efficiency (j/Th)

So, now that we have compiled all of the necessary data (yearly hashes and yearly hash heat rate), let’s combine them via an engineer’s attempt at bitcoin mining energy stoichiometry:

Yearly Hashes (TH/Year) * Yearly Hash Heat Rate (Joules/TH) = (J /Year) See Also

Energy Per Year (Joules/Year) → (kWh/Year) → (TWh/Year)

Simply multiply the yearly work completed (terahash/year) by the yearly estimated heat rate (in joules/terahash) for miners on the system and you arrive at a joules/year estimation. We will convert from joules/year to kWh/year (a kWh is equal to 3.6 megajoules) and below those yearly energy estimates are charted.

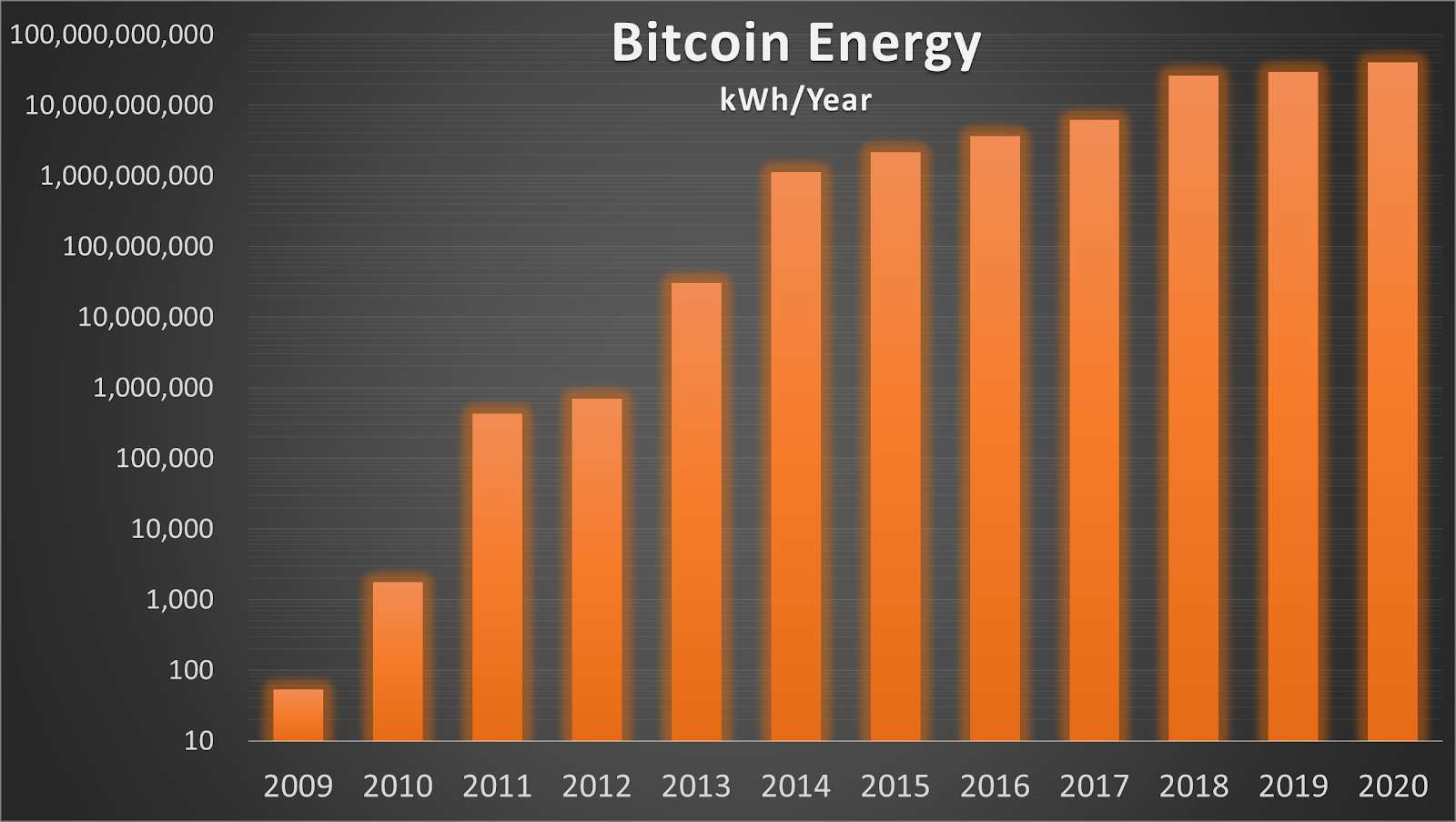

Yearly estimates For Bitcoin network energy consumption, in kWh

However, this physics-based estimation method also has some issues:

- The quantity of active miners by level of efficiency isn’t known, and this physics-based model assumes equal participation from all miner models available on the market by year released.

- This model also uses a step function for yearly heat rate data as in input. That yearly data abruptly changes at the first of each year, a gradual heat rate decline would be more realistic as older miners steadily retire and new ones fire up.

- It assumes old miners retire after a year, which is also unlikely as equipment life cycles are now ranging for two or more years.

- This is likely to be a lower-bound type of estimation.

Comparing Different Network Energy Estimations

Where do these yearly energy consumption estimates fall among the previously-cited calculation attempts? Interestingly enough, both of our calculations, even using drastically different methodologies and with all of the shortcomings discussed above — the economic-based estimation (35.3 TWh) and the physics-based estimation (40.17 TWh) — are very similar in value. They also fall within the range of a variety of other popular estimations from noteworthy individuals, entities and institutions shown in the chart below. That all of these estimations are fairly similar in magnitude lends credibility to the various different estimators as well as the wide variety of methodologies and different assumptions used.

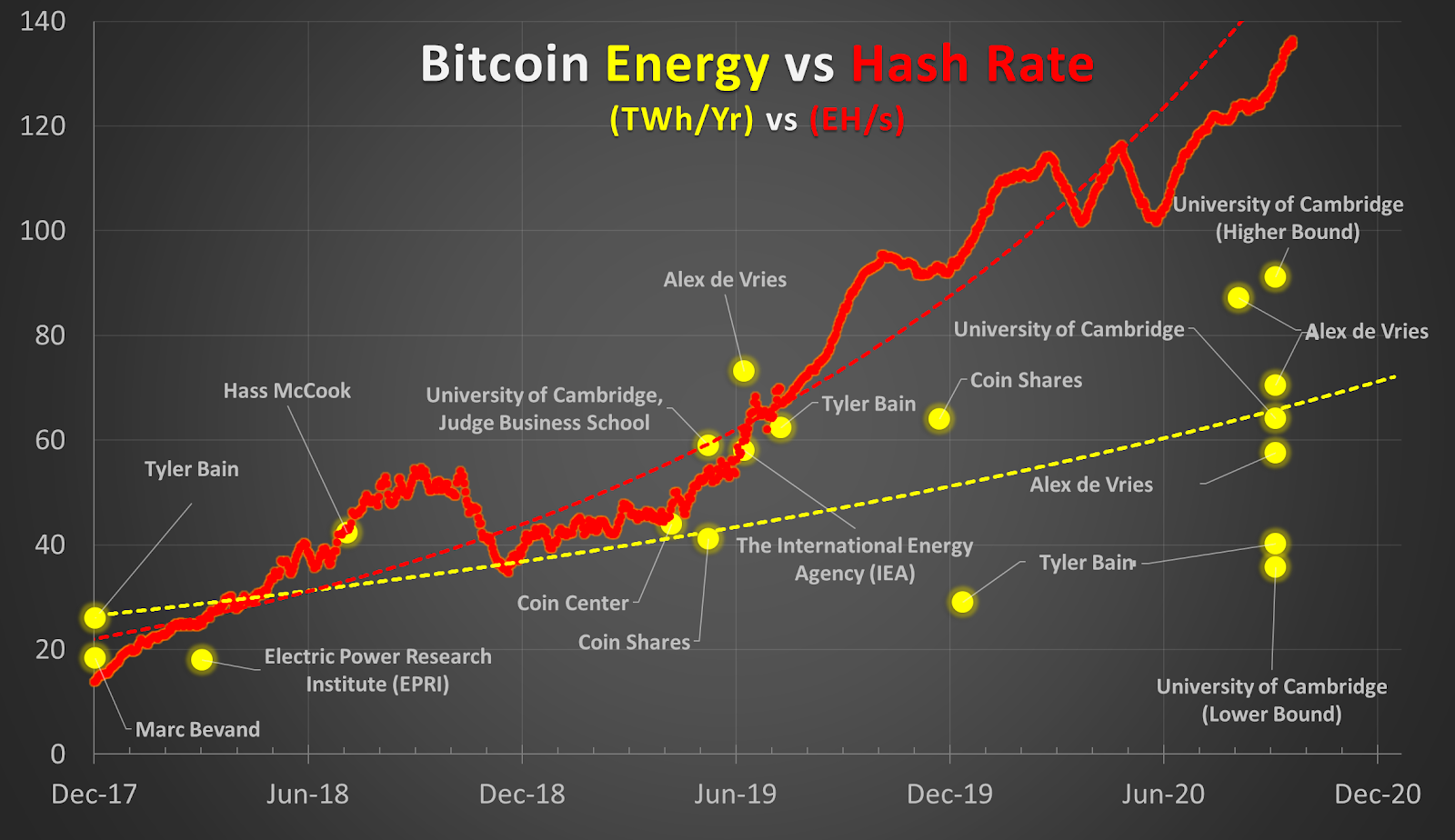

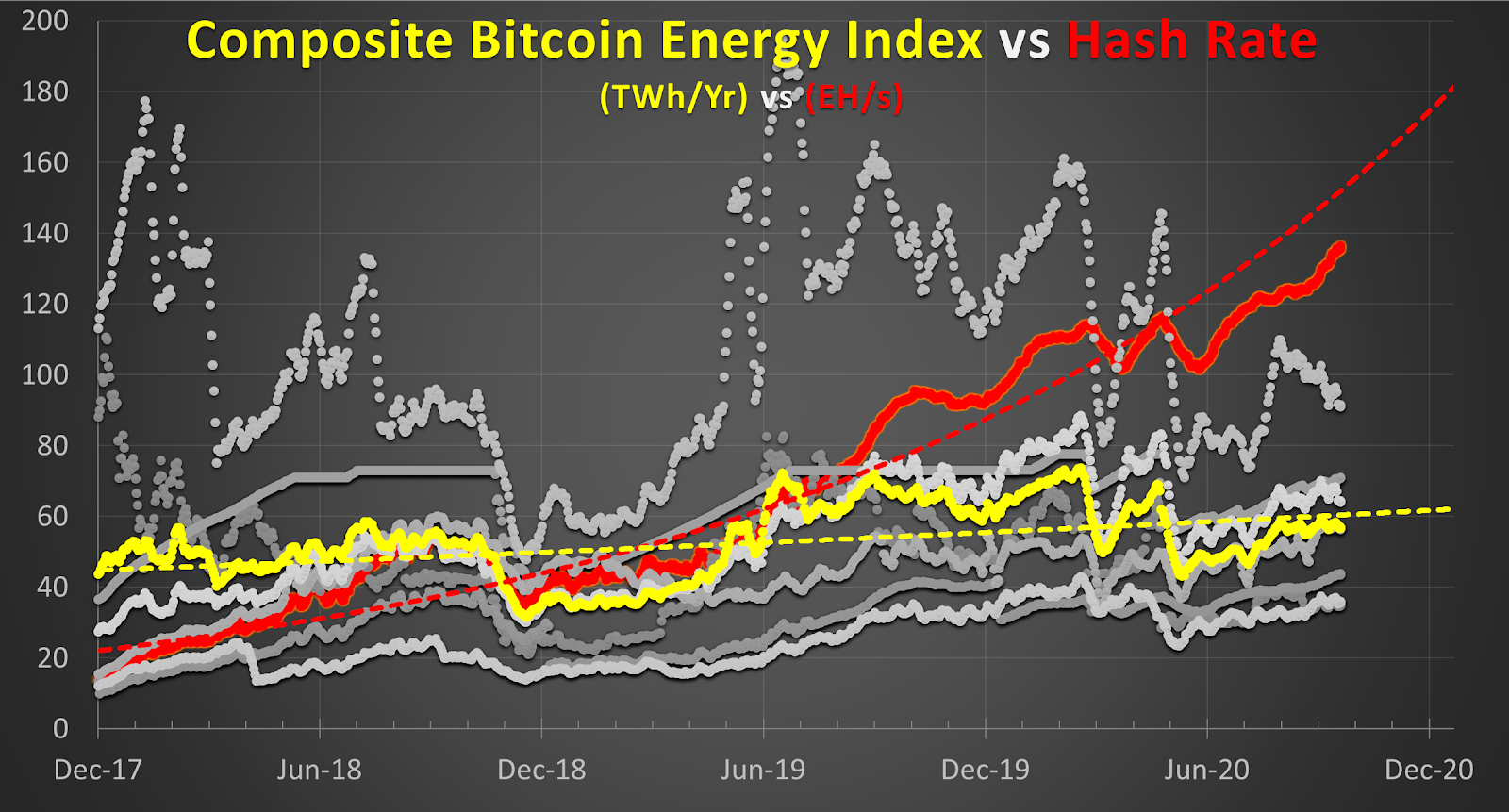

Noteworthy below: it appears that the Bitcoin network hash rate (EH/s) is beginning to decouple from the general yearly energy (TWh/year) estimation trend. This may be due to the decreasing heat rate of SHA-256 ASIC mining equipment if the estimate is physics based, or due to the halving and price stagnation if the estimate is economics based.

Bitcoin network hash rate (EH/s) and yearly electrical energy (TWh/year) estimates from various sources

This chart above shows yearly energy estimation snapshots at time of publishing in TWh/year, but a few of these sources (University of Cambridge [C-BECI] and Alex de Vries [D-BECI]) actually publish these yearly estimates on a daily graph going back a few years. This gets back to the previous energy vs. power discussion: logic should prevent plotting yearly energy estimations on a daily axis.

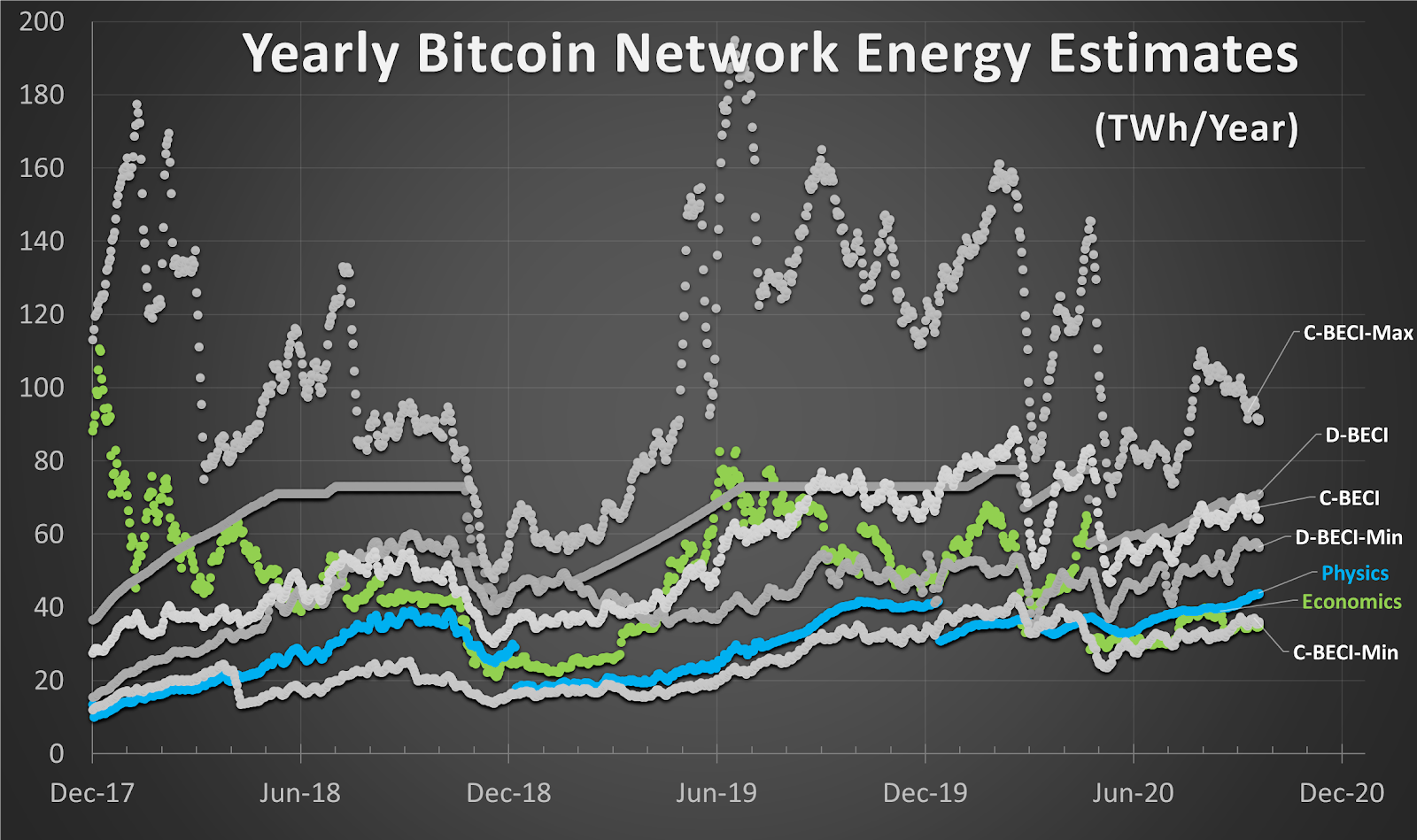

Regardless, I thought it would be worth comparing these published estimates with our above calculations using more continuous time series data going back to late 2017 (the previous market all-time high). The economic and physics calculations, the Cambridge estimates, as well as Digiconomist‘s results are all fairly similar in magnitude over time, again adding some peer review and validity to these different estimation techniques.

A yearly energy estimation comparison (TWh/year)

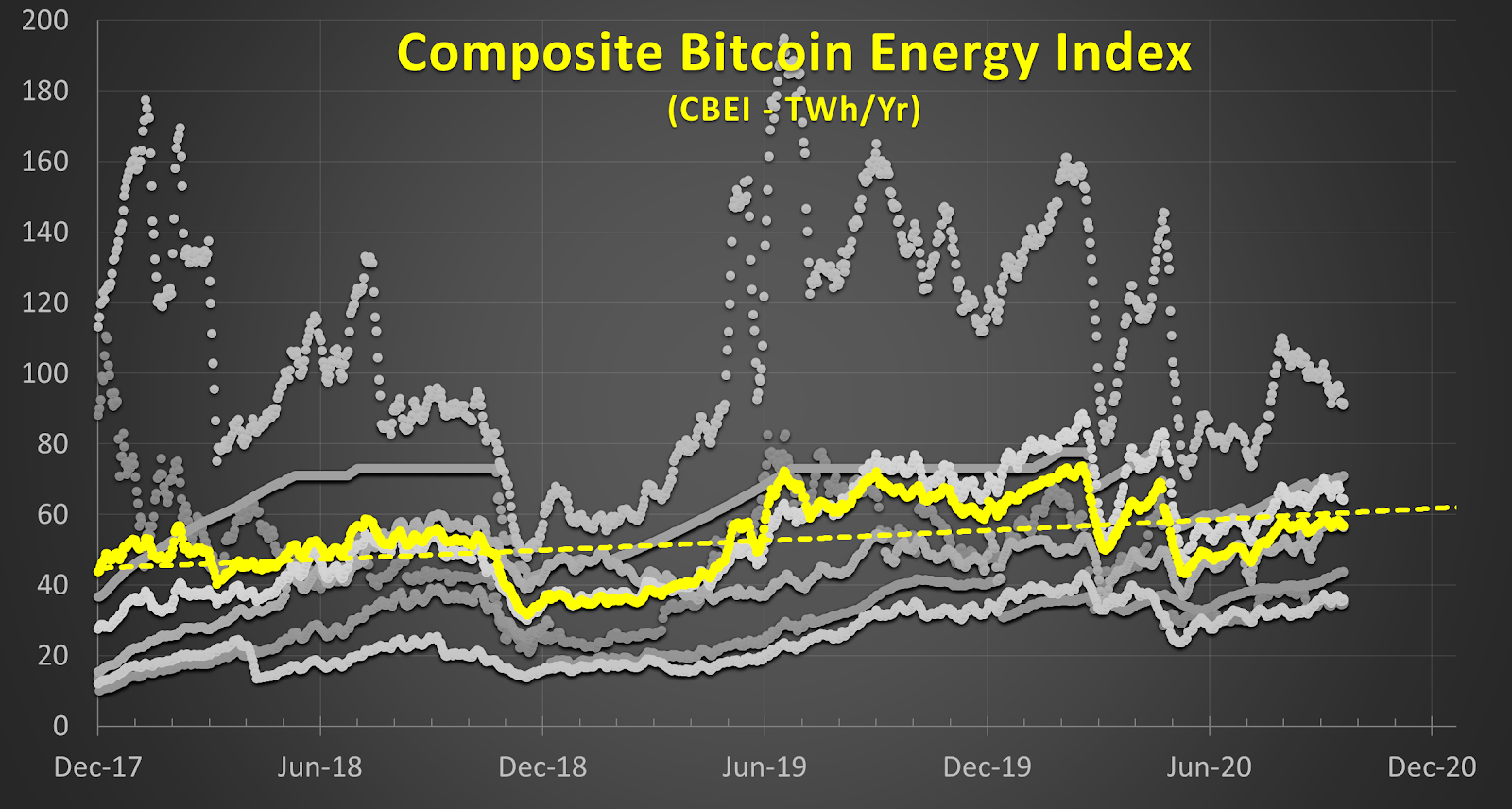

Our above estimation methodologies appear to align nicely with the other various daily interval yearly energy estimates, so they were averaged together to create a sort of Composite Bitcoin Energy Index (CBEI) as shown below in TWh/year. Each of these estimations have different assumptions, varying levels and sources of inaccuracy, and thus their composite may be more accurate. This composite of estimations (CBEI) has just recently retested the 60 TWh threshold for total yearly Bitcoin network energy consumption.

A yearly energy estimation average, Composite Bitcoin Energy Index (CBEI)

How does this composite energy index compare to Bitcoin network hash rate over time? The CBEI shows a similar decoupling as hash rate and energy around early 2019 with hash rate continuing to rise and energy consumption staying relatively steady as ASIC heat rates and bitcoin mining incentives have shrunk.

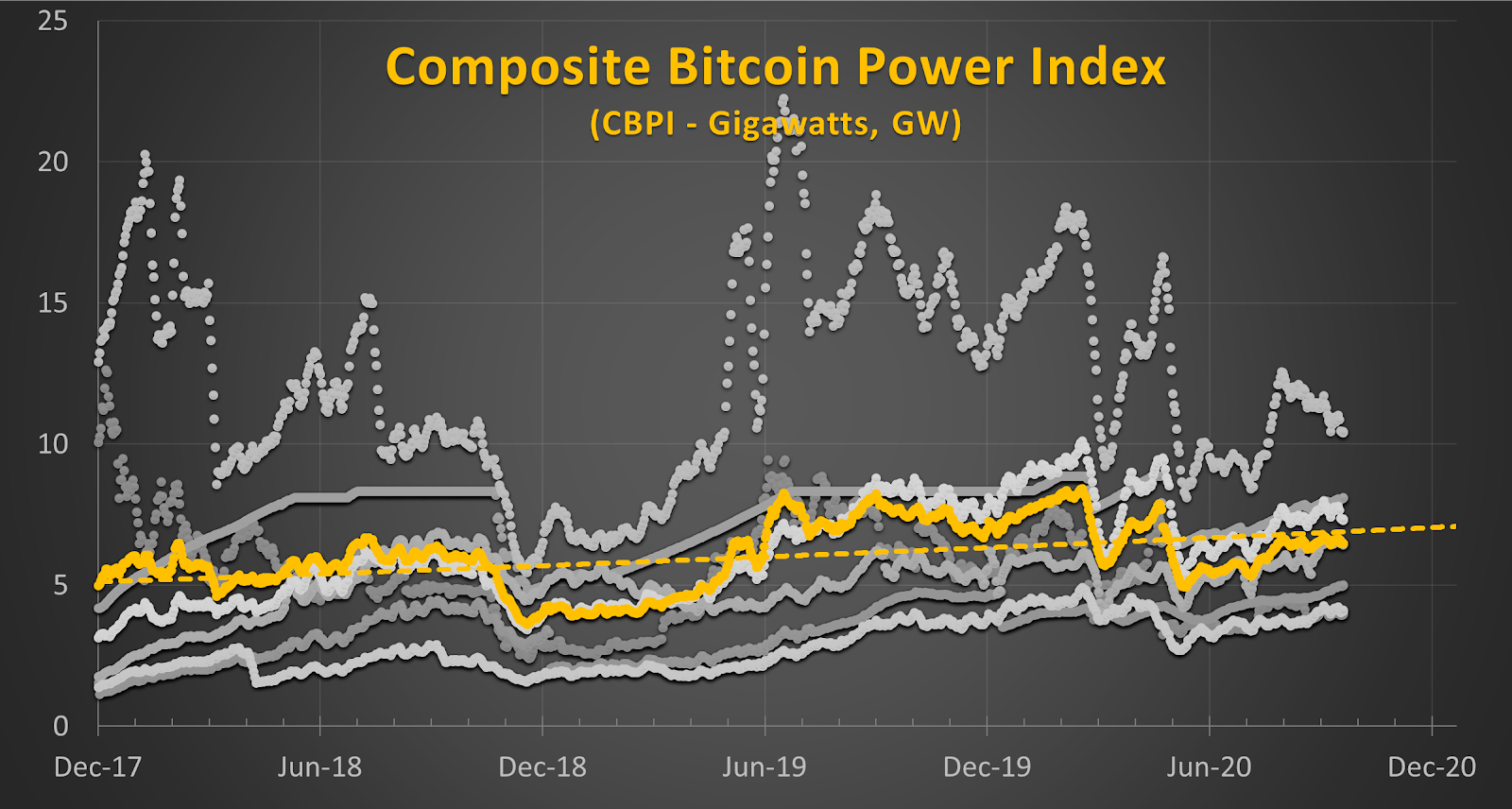

Interestingly, snapshot bitcoin consumption estimations are commonly extrapolated for an entire year, expressed as an energy value in TWh/Year without supporting time data or evidence. Daily network power estimations would be much preferred to all of these yearly energy consumption estimates plotted on a daily chart. The chart crime in this case is the egregious graphical error that makes folks massively misinterpret the data: yearly energy estimates graphed on a daily axis. So, I took the liberty of converting these daily interval estimates into a daily power estimation chart to correct for these above chart errors that force data misinterpretations.

I present the Composite Bitcoin Power Index (CBPI) compiled from the D-BECI and Minimum, the C-BECI Maximum, Minimum and Estimated, as well as our above economics- and physics-based estimates.

This CBPI composite estimates for Bitcoin’s instantaneous electrical usage as expressed in watts, the unit of electrical power. The CBPI peaked recently at nearly 7.58 GW, or about 6 DeLorean time machines at 1.21 Gigawatts (or should I say jigawatts?).

CBPI In Context

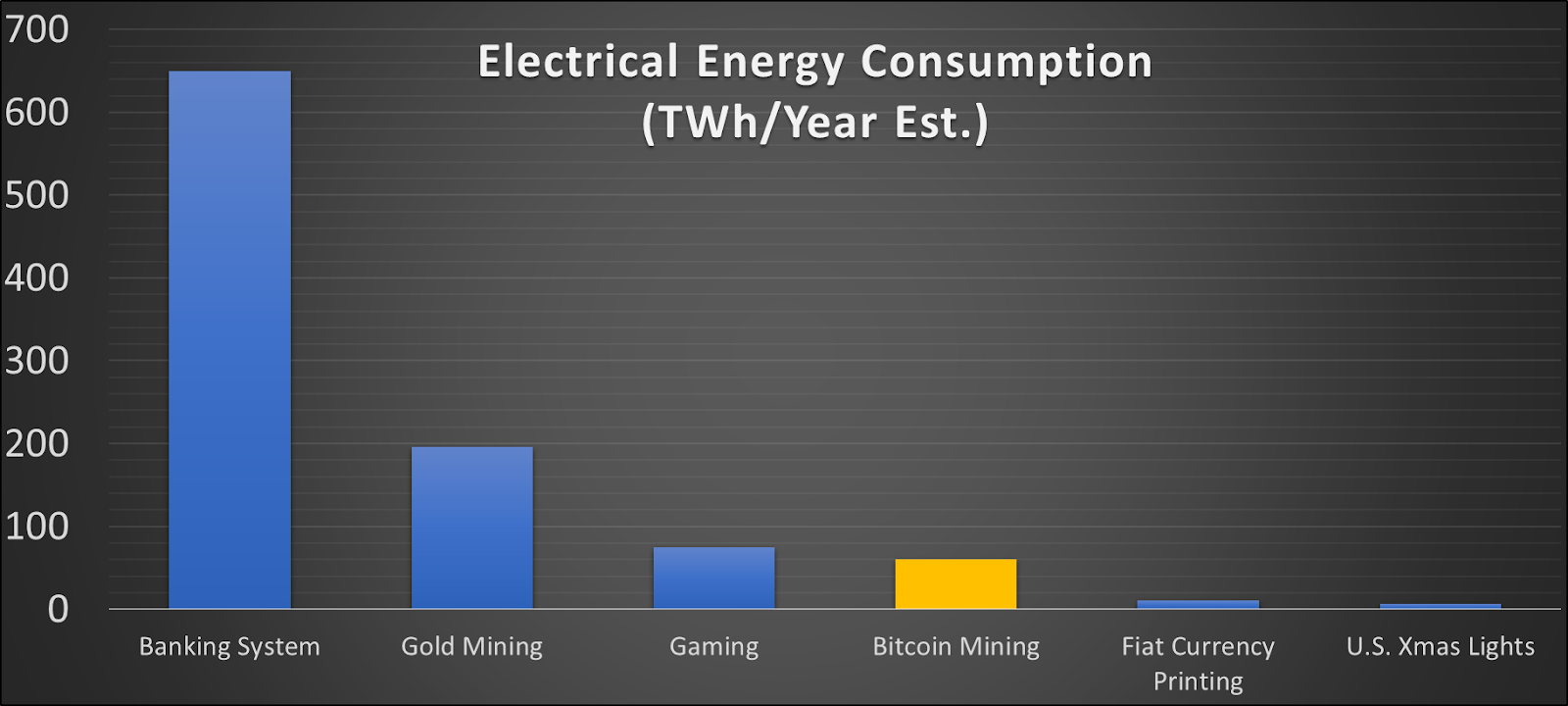

Energy values that large are difficult to digest, especially in a yearly context, so let’s put these estimations in perspective with some quick comparisons:

- 650 TWh/year consumed by the banking system

- 200 TWh/year used in gold mining

- 75 TWh/year used on PC and console gaming

- 60 TWh/year on bitcoin mining (CBEI)

- 11 TWh/year used on paper currency and coin minting

- 7 TWh/year used on Christmas lights in the U.S.

A comparison of our index to other popular energy usage estimates.

Based on our estimations above, the Bitcoin network consumes roughly 40 to 60 TWh/Year or around 0.15 percent of global yearly electricity generation (26,700 TWh) and only about 0.024 percent of global total energy production (14,421,151 ktoe). (A ktoe is also a unit of energy: a kiloton of oil equivalent, 11.36 MWh.)

So, Bitcoin energy consumption today is only a very tiny portion of what many consider to be a significant civilization-level problem: ever-increasing human energy consumption. Check out interesting solutions to this problem outlined a century ago by Nikola Tesla. As recently as September 2020, a study claimed that nearly 76 percent of the Bitcoin network is powered by clean energy sources. Also, remember that once Einstein discovered mass-energy equivalence and humanity harnessed the energy embedded in the atom, energy for the advancement of mankind has become materially abundant.

Bitcoin as an Antidote to Despair: A Psychological Formulation

By Aaron Clendenin

POsted October 21, 2020

One of my favorite axioms in the practice of psychotherapy is that, “All behavior is multi-determined,” meaning there are multiple forces or inputs exerting pressure or influence into the ultimate expression of any given behavior. As far as we can tell there are very few, if any, behaviors that occur from a singular cause. One might argue that an involuntary motor reflex could be the exception to this general rule but the conditions would still be a factor and environmental determinants are typically considered as part of individual behavioral analyses or empirical tests of behavioral models. If a pharmacological agent was given to deaden the nerve or nervous system, then you would get a blunted or absent response. What is happening biochemically and electrically in the body from that agent is an environmental determinant with regard to the reflexive behavior.

Another quick but powerful example is the subjective experience of hunger and the desire to eat food (target behavior). Obviously, consuming some form of nutrition to sustain life is a foundational biological drive for survival but, even still, hunger and the subsequent food-seeking behavior can be controlled within certain limits. We don’t have to eat as soon as we feel hunger. Just saying, it seems like a lot of people don’t know this and need to hear it. Or maybe they do know and are just unfortunate slaves to their impulses, lacking a well-developed prefrontal cortex of executive functions (analyzing, planning, predicting, initiating, self-monitoring, organizing, and inhibiting) that regulate personal behavior. I digress you might say, but perhaps not. We’ll come back to that later.

The experience of hunger and the subsequent behavior of eating is not a pure stimulus-response function (strict behaviorism) It is a stimulus-organism-response chain (cognitive-behavioral orientation) through which we have the ability to affect the present experience and the likely outcomes in some way. When conceptualizing complex human behavior in an attempt to define relationships and identify relevant and proximate causes, one can quickly begin to move into the realm of reductio ad infinitum. So if you accept my general premise that human behavior is very complex and has multiple determinants, then we can move forward.

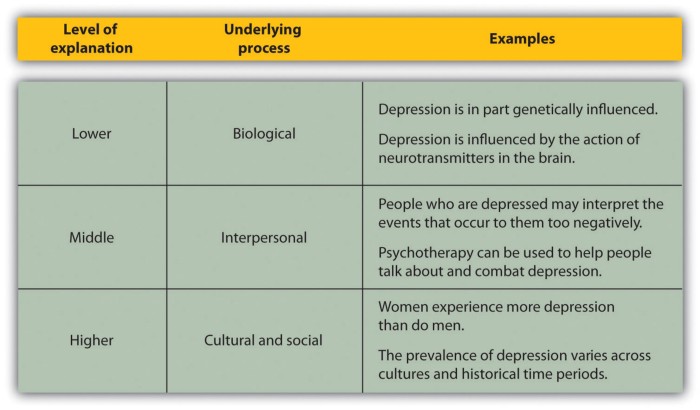

Here is a table on Levels of Explanation with a partial list of factors that makes the same point…

…multiple determining factors related to the construct we call depression that manifests as a syndrome (cluster of pathological symptoms).

One final point of housekeeping, if we were observing someone who is depressed, we might say, “How are they behaving?” (in total) and we would go on to describe what we see that are typical patterns of behavior found in people who are depressed. These patterns can also be broken down further into individual or distinctly identifiable behaviors. All of this is “behavior” so it is necessary to jump up and down the levels sometimes for the sake of simplicity, as you can see by my long introduction to get us here. This piece is a conceptual article grounded in well-established psychological principles and findings, my own career practicing as a therapist in addictions and mental health, and my personal experience with Bitcoin. It is an attempt to bring together ideas that have been bouncing around my head since going down the Bitcoin rabbit hole over the last year. Please take it is as such.

Back to psychotherapy and behavior change…very often through the course of therapy, positive gains are achieved simply from helping clients enlarge their perspective on their own motivations and helping them view or reevaluate their own behavior through various lenses or possible interpretations. This phenomenon is called insight and, I would argue, it was the founding principle on which the field of psychotherapy began, at least the modalities of psychotherapy that facilitate the client’s participation in the process of self-healing. Other therapies have been developed that do not need to invoke client awareness but those are usually for more specialized purposes. I am more focused here on the individual as an intentional participant as such in the healing process.

One of the foundational researchers in our current understanding of depression is Martin Seligman from the University of Pennsylvania. He first posited the theory of learned helplessness as an explanatory model of depression. His pivotal research program for developing this theory is noteworthy to briefly review: Dogs were placed in an electrified box. They were given a mild electrical shock but could escape to the other side which they did. Then a barrier was put up so they could not escape to the other side when shocked. After enough trials (experiences), they stopped trying to escape when shocked even after the barrier was removed. Essentially, they had learned that their efforts were futile and gave up on finding a solution. The more scientific and behaviorally technical way to articulate this model is stated: Repeated exposure to uncontrollable and aversive environmental stimuli leads gradually to the belief that the aversive situation is inescapable and a sense of helplessness ensues regarding the situation.

So it is with many people who find themselves in a state of despair. Merriam-Webster defines despair as “loss of hope,” “utter loss of hope,” or “hopelessness.” Despair and clinical depression are not equivalent concepts but they are intertwined in the cognitive and emotional realms. In fact, when assessing someone for suicide risk, asking them about hope is a key part of the formulation. What positive things do they have to live for, like family relations or a significant event coming up? Do they have other positive plans for the future? How could they imagine things getting better? Tellingly, the diagnosis of Major Depressive Disorder has as its first criteria in the DSM-5: “Depressed mood most of the day…by subjective report (e.g feels sad, empty, hopeless).”

I have worked with many depressed clients over the years and I have been depressed myself at one point in life. It is not hyperbole to say the phenomenology (personal subjective experience) of hopelessness is all-consuming. It is insidious and pervasive. It cuts right down to the soul of the individual and affects their perceptions, memory recall, worldview and future outlook, and much of their ability to think rationally or self-regulate in almost all domains of life. I think, in a very real sense, when one loses hope they lose “everything.” In that hopeless state of despair, they have lost their potentiality, not in an absolute sense maybe but at least in the belief of any possibility of positive likely outcomes for future improvements to their situation. Therefore, they have lost their future, at least phenomenologically, in the present moment. You could call it the spiritual death of the self…unless hope is restored.

Learned helplessness was a major contribution to our understanding of depression but all scientific theories and findings have limitations and needs for elaboration, refinement, and/or disconfirmation. Building off learned helplessness theory, Abramson and colleagues developed the hopelessness theory of depression. In short, learned helplessness failed to explain why some people got depressed and some didn’t. Hopelessness theory added an attributional component. The contention in hopelessness theory is that the attribution (explanation) of the stimuli and circumstances makes a difference in the experience. A related concept to these two theories is the difference between external versus internal locus of control. Am I mostly a victim of my circumstances or can I effect significant change in my life despite whatever circumstances happen to be?

In reviewing other cognitive and interpersonal models of depression going back to the origin of modern psychology, the common thread seems to be some cognitive component of attribution/interpretation. Freud viewed clinical despair/depression as emanating from a deep anxiety, a distressed reaction of the psyche to a mismatch between desires and attainments. In fact the DSM-I had as the diagnostic nomenclature “Depressive Reaction” referring to this type of etiology, depression acting as a defense mechanism for the underlying anxiety triggered by challenging life circumstances. Jung similarly viewed it as a spiritual crisis, broadly speaking. Dr. Viktor Frankl who suffered through the Nazi concentration camps and later developed Logotherapy, based on finding meaning in one’s life and through one’s suffering, developed the simple equation of D=S-M. Despair equals Suffering minus (without) Meaning. Our contemporary cognitive-behavioral terminology also speaks of cognitive dissonance which is the mismatch between one’s desires and/or values and their actual behavior which then causes distress in the person.

Unfortunately in many of the therapeutic disciplines, we have moved further away from the interpretation of lived experience and the functions of our reactions into a symptom identification model as we have been forced to “economize” and use “brief, solution-focused” treatments based on dwindling resources and fiat money standards of care, much of it driven by insurance companies and HMOs as many have written about elsewhere. Nevertheless, what has not changed is that how we interpret and explain things to ourselves and the actions we take with the knowledge or insights that we have determine, to a very large extent, our likely outcomes. Personal responsibility and self-agency are inescapable and fundamental in the behavior change and healing process if we are to obtain any approximation of the life we desire.

Another instrumental theory in psychology has been social learning theory developed by Albert Bandura. Social learning theory built off the previous behaviorism of classical and operant conditioning but added that 1) mediating processes occur between stimulus and response and 2) behavior is learned from the environment through observation. Two key concepts in social learning theory are self-efficacy and expectancies. Self-efficacy, according to Bandura, is “how well one can execute courses of action required to deal with prospective situations.” I would elaborate on this for the reader and say that self-efficacy has both cognitive and emotional elements incorporated into it. It is a self-appraisal about an ability in a given area and a general feeling that corresponds to that ability-based appraisal. Expectancy is simply this: I engage in a specific behavior and I expect a likely outcome or a probabilistic range of outcomes. So, expectancies and self-efficacy inform and interact with each other. Self-efficacy is more categorical whereas expectancies are specific to discrete behaviors.

In substance use research, it has been discovered that children as young as three and four years old have expectancies about alcohol consumption. Preschoolers can’t read or write sufficiently so a fill-in-the-blank interview format is used. An example item would be, “When mommy drinks wine she (acts)… silly, giggles a lot, falls down, gets sad, dances around, cries sometimes, forgets to brush my teeth, and similar items that reflect the behavioral chain of likely possibilities. This was an important discovery because it showed that we begin to develop expectancies very early in life for a range of human behaviors that we are not directly engaging in ourselves while we still have very limited understanding of the world around us. Those expectancies also later shape our decision-making about engaging in those behaviors and even the interpretation of experiences if we happen to engage in those specific behaviors. What’s more, the actual biological and social effects of alcohol consumption and surrounding events then shape our ongoing expectancies and, very often, change the expectancies that we developed much earlier in life, by either overturning them or amplifying them, depending on the experience and our interpretations. Like I said, “simple” human behavior is very complex.

The astute reader will be able to generalize the likelihood that this phenomenon is also present from a very young age in how we relate to money and the financial conditions of our immediate environment and the world at large. I have very little knowledge about computer science but I think it is fair to say that expectancies are part of the informational code in our human operating system. They are always there below the user interface keeping the system running but also vulnerable to bugs and glitches and hacks which can disrupt the functioning, slow the system down, or cause it to crash if not maintained properly.

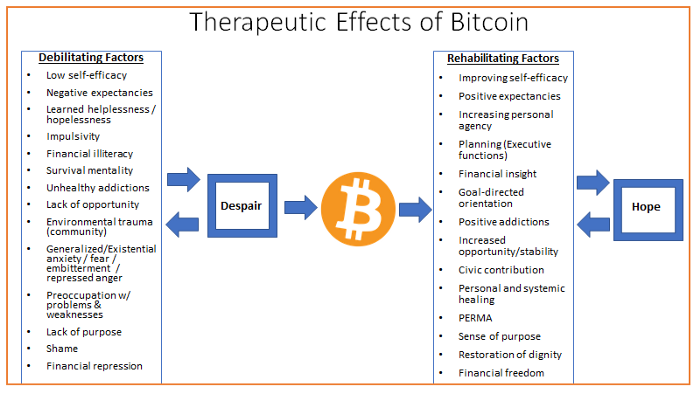

Why this is relevant to despair and hopefulness is that most of our positive emotion is experienced in pursuit of meaningful goals. Self-efficacy to effect change in a specific domain of life is the lynchpin on which much of our motivational capacity depends if one is to continue to strive for better days and persist in the face of adversity. If I extrapolate my own experience, I would say that the specific behavior of buying Bitcoin has the potential to change our expectancies about future likely outcomes, within certain parameters if conditions continue to be met, as is always true when we interact with a dynamic, ever-changing environment. The main condition over the medium- and long-terms would have to be that Number (continue to) Go Up, though I think there are many other potential benefits in the future that fall into the category of unknown unknowns. I agree with others in this space that Bitcoin has the power to act as a larger healing force on our world for a variety of reasons and one pathway of that change is through the psychological effects it has on individuals. When we see these same effects in the course of practice, they are typically described as “therapeutic” because they are moving the individual from a relatively undesirable state toward something more functional that predicts improved chances of success and better long-term outcomes.

As disturbing as the dog-zapper studies from the 60’s and 70’s might be to our modern sensibilities, Dr. Seligman went in a new direction later in his career and began to study what makes people excel. What helps people thrive? How do you Live Your Best Life as the saying goes? Instead of focusing on problems and just coping with life, how do we transcend not just our typical deficits and problems, but consequentially our preoccupation with deficits and problems — our unhealthy, heightened vigilance to threats and pain as conceptualized in evolutionary psychology. Simple but long overdue, this shift led to a focus on strengths and virtues instead of problems and weaknesses. Thus, the sub-discipline of Positive Psychology was born and has been contributing to the scientific literature and improvement of many lives for the past two decades. You can get a fuller review of the history and research findings at positivepsychology.com but the essential elements to answer the big questions posed above are: 1) Positive emotions, 2) Engagement, 3) Relationships, 4) Meaning, and 5) Accomplishments (PERMA). To me, this kind of thinking seems to naturally align with Jeff Booth’s work in outlining a future of deflationary abundance. We need a new cultural mindset to adequately interface with a new monetary paradigm and, like so many other forces that seem to be converging, this is yet another piece of the puzzle that has emerged at a serendipitous time in space.

In developing his model of relapse prevention, Marlatt emphasized that a significant factor in recovering from chemical addictions was to develop healthier “positive addictions” as a replacement, activities such as exercise, healthy eating, meditation, recreation, or new hobbies. This might seem like common sense to many of us but the importance is not readily apparent at the outset to many in recovery. Those individuals who struggle to find and cultivate these replacements have a much tougher go, on average. Yes, it is good to subtract negative things from our lives but then a void exists. It must be filled with something functional, positively reinforcing, and self-sustaining if we are to be successful over the long term.

Below, I share a conceptual model with known and accepted psychological concepts and systemic effects describing my experience and what I observe in others with their experience of Bitcoin, along with some additional hypothesized variables that could be gleaned from the clinical research literature. Admittedly, it is an incomplete representation but it is my first attempt at a psychological formulation of how Bitcoin might be an antidote to financial despair. I’m not trying to launch a research program though others might find that worthwhile. Yet, I believe the overall concept is sound. Additionally, it would not be surprising to see positive effects in one or more of these variables facilitate positive spill-over effects into others (health, relationships, community, etc.), which happens quite frequently in practice with the generalization of therapeutic effects.

I read somewhere that culture is the personality of a nation. Like many of you, I feel like our cultural personality is decompensating, which is an old psychiatric term used to describe an acute breakdown in effective psychological functioning. However, if people see that our broken monetary system can be fixed or, at least, that they can have an effective solution to somehow “opt out” or improve their long-term financial situation regardless of government corruption and manipulations, then they might have hope. Ultimately, hope acts as a force multiplier. What financial value can be generated by a country or a world full of hope?! On some level, hope is what keeps civilization moving forward. When you have hope, you have everything because it contains all future potential. What is the stock-to-flow ratio of hope?! I say hope must continue its steady climb upward just like bitcoin, regardless of circumstances.

Saving in Bitcoin gives an individual hope about their personal financial situation and about the potential collective improvement of the world in which they live. It has the ability to change expectancies about likely outcomes, on balance, from negative to positive. It can improve self-efficacy for successfully navigating a complex world full of pits and vipers. It can invoke a person to plan for the future as they increase financial insight and find meaningful engagement in a local or virtual community. Finding some form of long-delayed success can alleviate shame for many and ameliorate feelings of anxiety and anger as they find dignity restored. These benefits also allow a greater sense of personal agency over the direction of one’s life and can ripple out into greater civic contribution if one is so inclined.

I don’t think it solves all problems but it does have the possibility to address many of our current temporal concerns. As I’ve read articles and interacted on FinTwit in the Bitcoin community, what has struck me the most was how much hope seems to be generated by this technology and this community toward finding solutions and improving the lives of so many people. I have experienced that hope myself for my own financial future and the future of my children. So, I felt like this was important and I might have something to contribute. This thing that we are experiencing together and hoping for is definitely worth fighting for.

Carl Rogers described an integrated person as “unified within him/herself at all levels and with low discrepancy between the present self and the desired self. The optimal functioning of a person occurs when the various aspects of a person are integrated into a relatively harmonious organization.” Rogers is also noteworthy for developing client-centered therapy which is, above all else, tasked with treating every person with “unconditional positive regard.” This tenet of Rogers’ therapeutic positioning is now accepted as standard best practice in all psychological therapies and forms the basis of the recently codified trauma-informed approaches. It is the ultimate respect for the dignity and sovereignty of every individual.

Why is this same standard of dignity and sovereignty not granted to us in the management of our personal lives in the financial sphere? Unless we address this deficit in our cultural personality, we will continue to persist in a state of dis-ease and dis-integration. I think there is much to be gained as we advance by buttressing the philosophy and economics of Bitcoin with established psychological principles, research findings, and ethics. Hopefully I have demonstrated, at least in part, that if we were to take the best aspects of traditional psychotherapy and modern psychological science to design a money that is compassionate, healing, and equitable, which promotes the best opportunity for human well-being and optimal psychological functioning, then Bitcoin is that money. We may even wonder if this technology is one of the keys to true social justice that so many are looking for but continue to misdiagnose because the core issues are masked below the symptoms?

References

Bandura, A. (1977). Social learning theory. Englewood Cliffs, NJ: Prentice Hall.

American Psychiatric Association. (2013). Diagnostic and statistical manual of mental disorders (5th ed.).

Marlatt G.A. & Gordon J.R., editors. (1985) Relapse Prevention: Maintenance Strategies in the Treatment of Addictive Behaviors. New York: Guilford Press.

https://www.thenewatlantis.com/publications/the-neuroscience-of-despair

https://www.merriam-webster.com/dictionary/despair

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5299163/

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4594954/

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4689589/

https://www.researchgate.net/publication/285420438_The_psychologically_integrated_person_and_the_parameters_of_optimal_functioning

https://positivepsychology.com

Home On The Range

By .615

POsted October 21, 2020

Dystopian Dreams

If you are reading this, then you likely know the origin story of the Bitcoin Citadel concept.

In 2015, a time traveling anon from the year 2025 posted on Reddit (edited in 2019) a vision of the future in which hyperbitcoinization has resulted in a grossly dystopian world. In this future, anyone who obtained bitcoin prior to 2020 through luck, virtuous stacking, or online shitposting became exceedingly rich while the rest of the world was left begging for scraps. Instead of working to solve problems for the world, the few bitcoin rich have cloistered themselves from the many bitcoin poor in walled cities.

This vision of the future was latched onto by many bitcoin hodlers primarily because of its aggressive price predictions which seemed to be playing out – until 2019 came and went. Others were taken in by the idea of protected Bitcoin only communities that would serve as islands of prosperity in the event of societal collapse.

Much like the term Bitcoin Maximalist, the citadel concept was adopted in spite of its negative connotations.

What was once an admonishment of future actions has become a battle cry for hodlers large and small. Many Bitcoiners now believe that it may be essential to either build their own fortified dwellings or join forces with like-minded individuals in larger citadels to protect their physical and digital assets.

At best, the original Reddit post was weak disaster porn, and the idea of a walled city isolated from the world seems like a one dimensional vision for the future. A gradual then sudden collapse of the current global world order is certainly a possibility, but even in this scenario, it is likely that the future will be more nuanced than any dystopian fantasy has imagined.

While preparing for worst case outcomes is important, more can be gained from focusing time, energy, and efforts on building a world that you would want to live in.

If one merely survives a Mad Max style future, or worse yet, thrives at the expense of others, what’s the point?

Voluntary Means

With these thoughts in mind, a slightly different conception of a Bitcoin citadel can be imagined.

Instead of beginning with a worst case scenario as the foundation, this vision aims to build a circular Bitcoin economy and community from the ground up within the existing system. The concept brings together elements of fraternal organizations, for-profit corporations, intentional communities, and idealistic visions for the maintenance and preservation of the Bitcoin protocol.

What is left out are preconceived notions about how such an organization should be governed or how any of its members will want to live.

The most successful citadels will be those which grow organically and operate with as little centralization as possible.

Respecting the individuality and autonomy of all is how this revolution in personal responsibility, money, culture, and industry will begin. If a Bitcoin Renaissance is on the horizon, it must have some space to take hold and flourish.

The example which follows is a rough proposal for a voluntary association of Hodlers of Last Resort which will ultimately coalesce into a functioning citadel. After beginning as a virtual association it is envisioned that it will eventually morph into a physically based citadel.

This concept, and its formation model, could be applied to virtual citadels, physical citadels, and hybrid models which operate in both the physical and virtual worlds. Likewise, the methods of forming and funding the citadel could be scaled up or down depending on the size and scope each citadel is aiming to achieve.

By sharing this, it is intended for everything that follows to be open source in nature. While I would love to engage with anyone interested in further refining the concept, I would be equally happy to see others run with the idea and make it work for their own locality – let a thousand citadels bloom.

HODLERS OF LAST RESORT

Mission

To unite hodlers of last resort and plan for a future where Bitcoin is the standard.

Goal 1:

Form a Voluntary Association of Hodlers of Last Resort

In the beginning this will be a voluntary and decentralized membership association comprised of those willing to eventually commit a portion of their bitcoin hodlings to fulfill a common set of goals. The return for each member will be creating something of lasting value and possibly increased personal wealth from the ownership stake. Initiation will be managed via a Lightning Torch which is to be passed to bitcoiners who are viewed by their peers as being “Hodlers of Last Resort”.

The following are some answers to the common questions of Who, What, Why, When, and How. The question of Where will be addressed in Goal 3.

Who is a Hodler of Last Resort (HOLR)

Technically, this determination will be at the discretion of each invitor/invitee in the chain. But the general idea is someone who is committed to advancing the technology and adoption of bitcoin, hodling their bitcoin for the long-haul, and preserving bitcoin for the ages. It is also important that each invitee be respected by other bitcoiners.

What is Required for Membership/Ownership

The first requirement of membership is to be bestowed an invite by a peer. Once the invite has been accepted, the member should work towards refining the concept and furthering the goals of the association. Ultimately, members will be required to commit an agreed upon amount of bitcoin to an association managed Multisig Wallet. These funds will provide the seed capital for future operations. Issues relating to continued membership, governance, and the return of deposited funds should be discussed and agreed upon in advance of the initial funding.

Why Should Anyone Do This