WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the September 2019 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

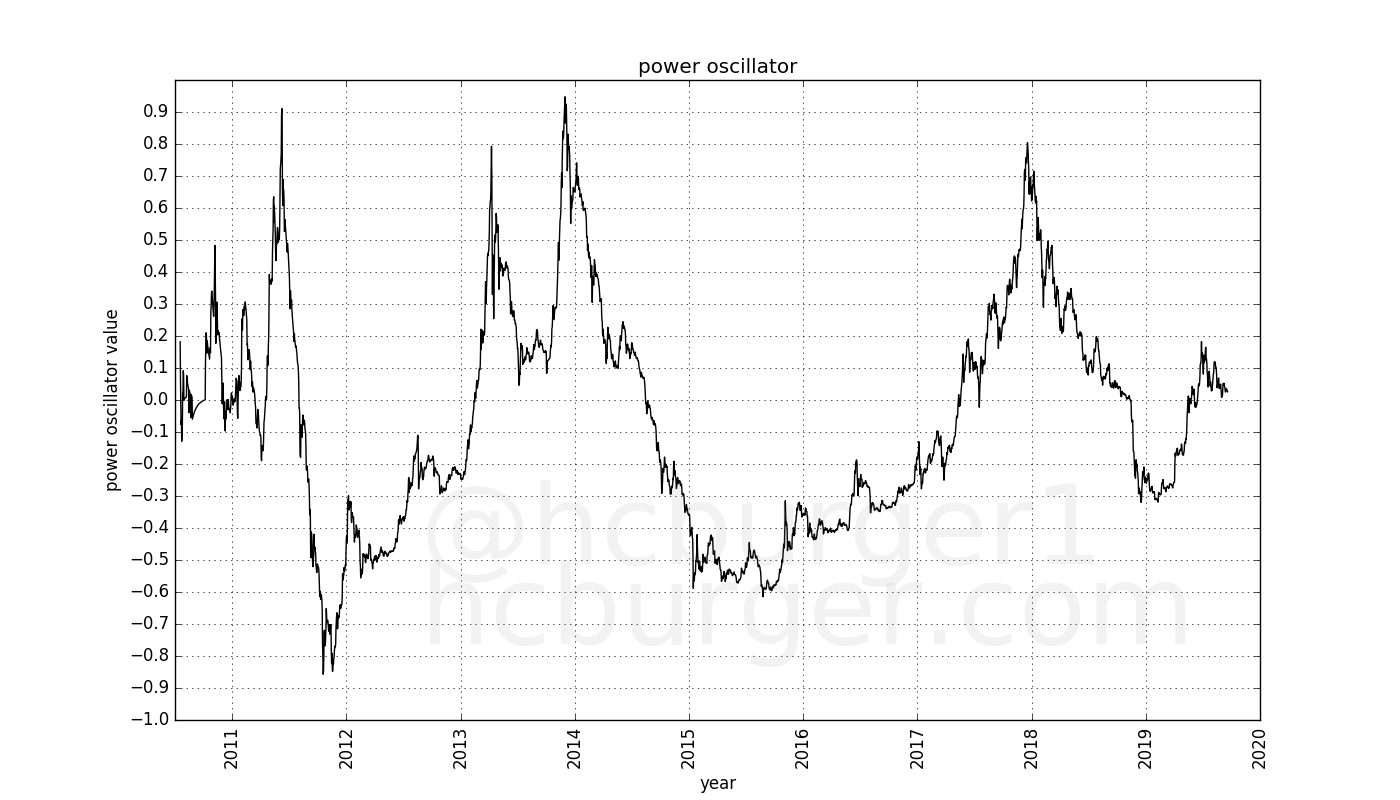

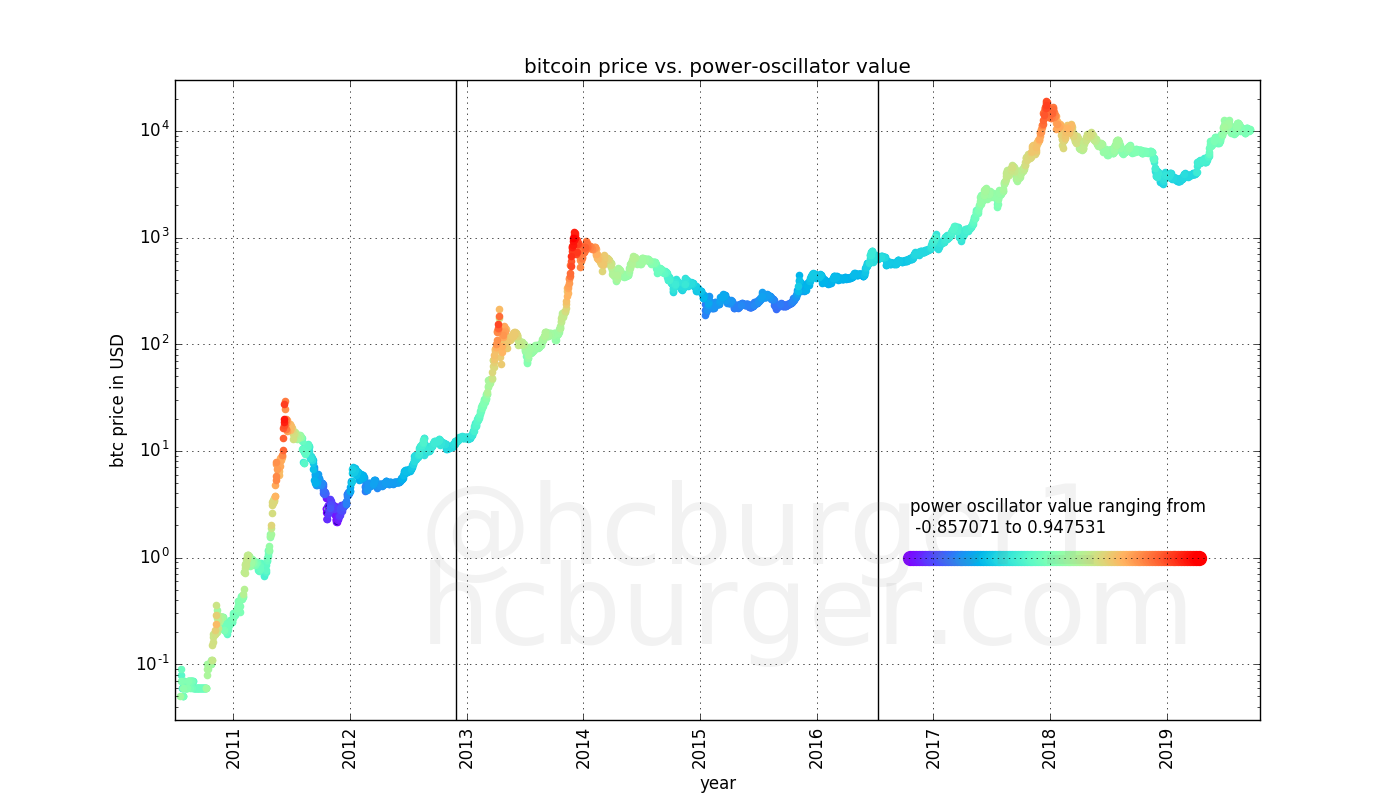

Bitcoin’s natural long-term power-law corridor of growth

By Harold Christopher Burger

Posted September 4, 2019

Disclaimer: This article is not financial advice.

With growing adoption of the cryptocurrency, its future price has been the subject of more and more speculation. Predictions are all over the board, with some economists like Nouriel Roubini predicting a price of 0 within five years, whereas John McAfee has famously predicted a price of $1 million per bitcoin by the end of 2020. Others have made predictions that fall within this very wide range [1].

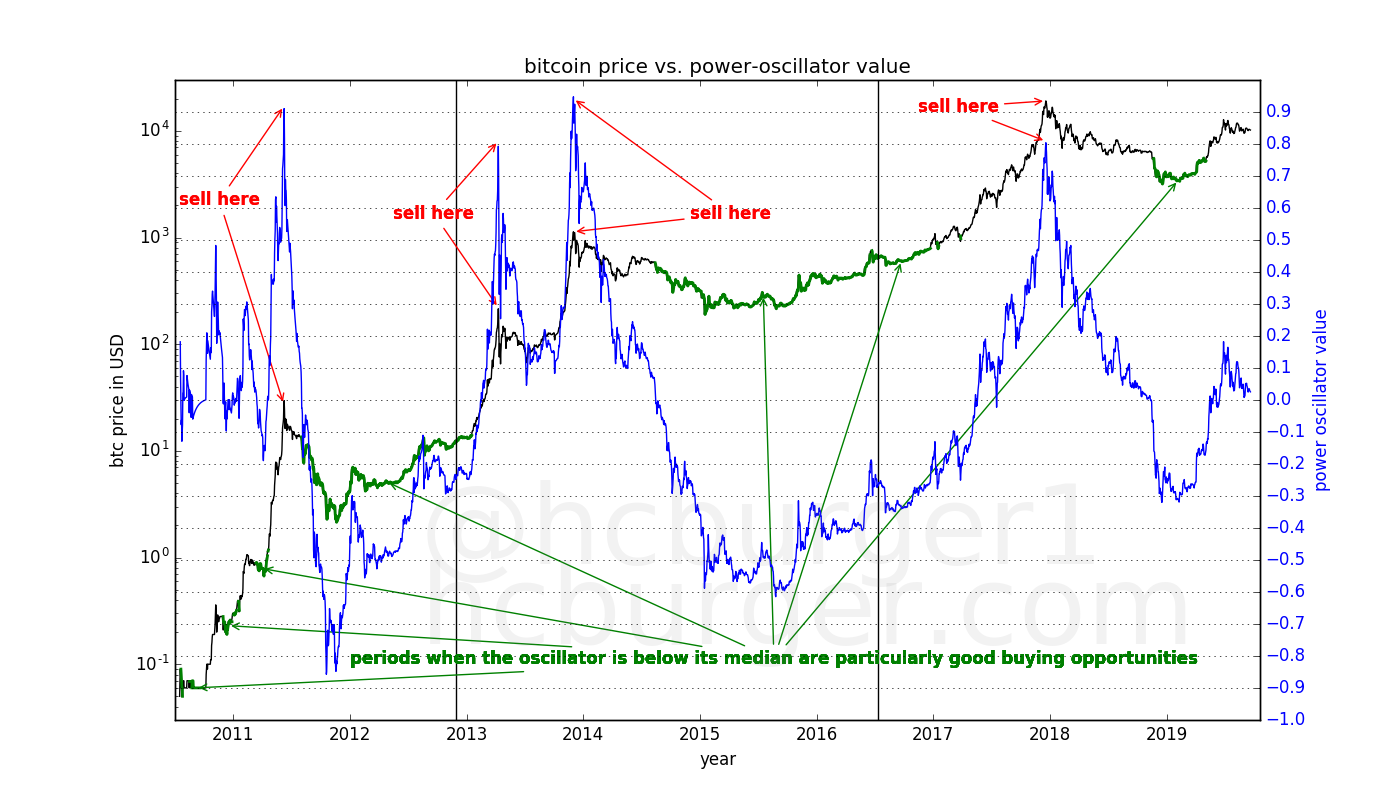

Overall, bitcoin’s price has risen very quickly since it’s initial inception in 2009 and has also been subject to booms and busts. The rapid rises and boom phases seem to encourage people like McAfee to make very optimistic predictions about the future price, whereas the busts seem to encourage some economists to predict a decline toward 0. In this article we look at the full price history of bitcoin and see that bitcoin’s price evolution can be understood as moving within a corridor which is defined by two power-laws based on time. While the idea of modelling bitcoin’s price using a power-law is not new, in this article we give more support to this idea and provide some additional interpretations.

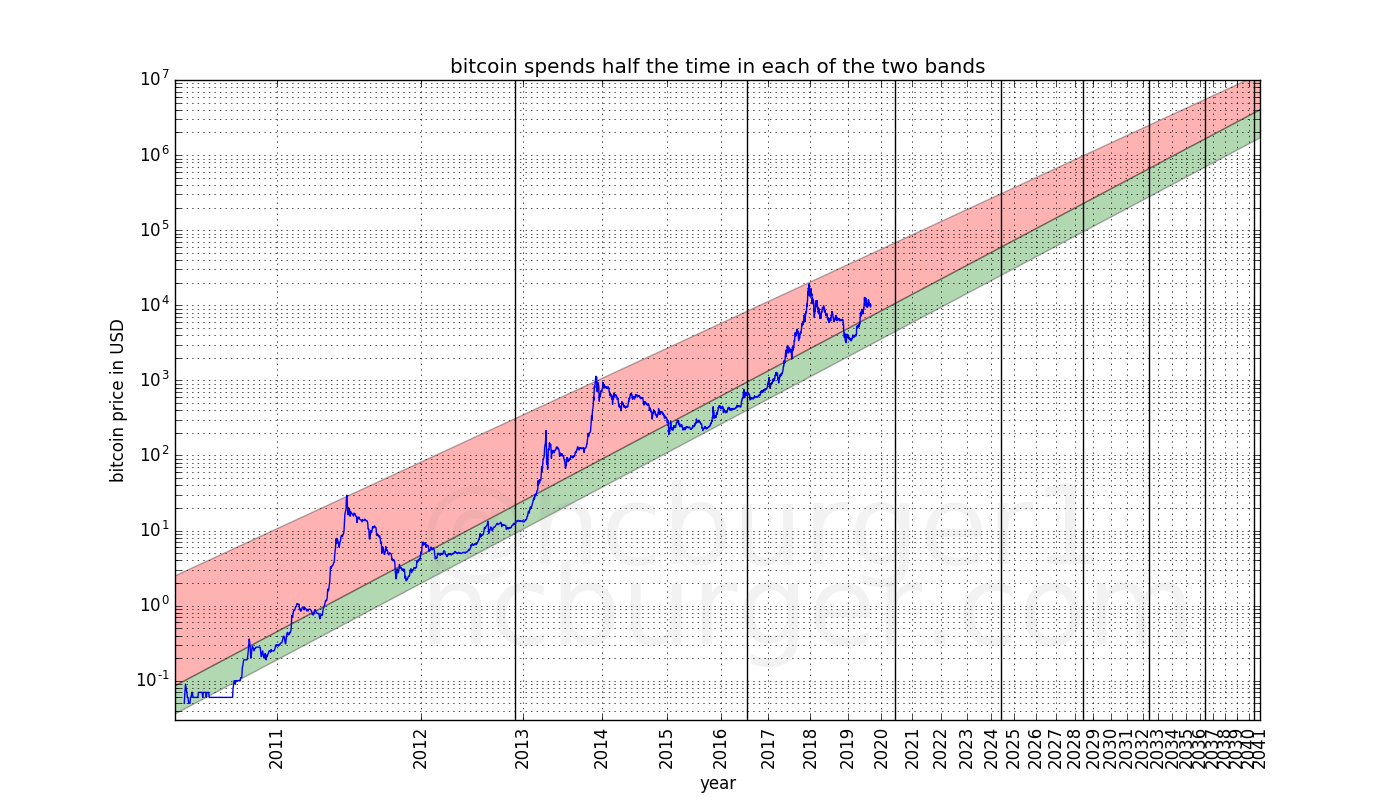

This model allows us to make broad predictions concerning the long-term future price of bitcoin, e.g.

- the price will reach $100 000 per bitcoin no earlier than 2021 and no later than 2028. After 2028, the price will never drop below $100 000.

- the price will reach $1 000 000 per bitcoin no earlier than 2028 and no later than 2037. After 2037, the price will never drop below $1 000 000.

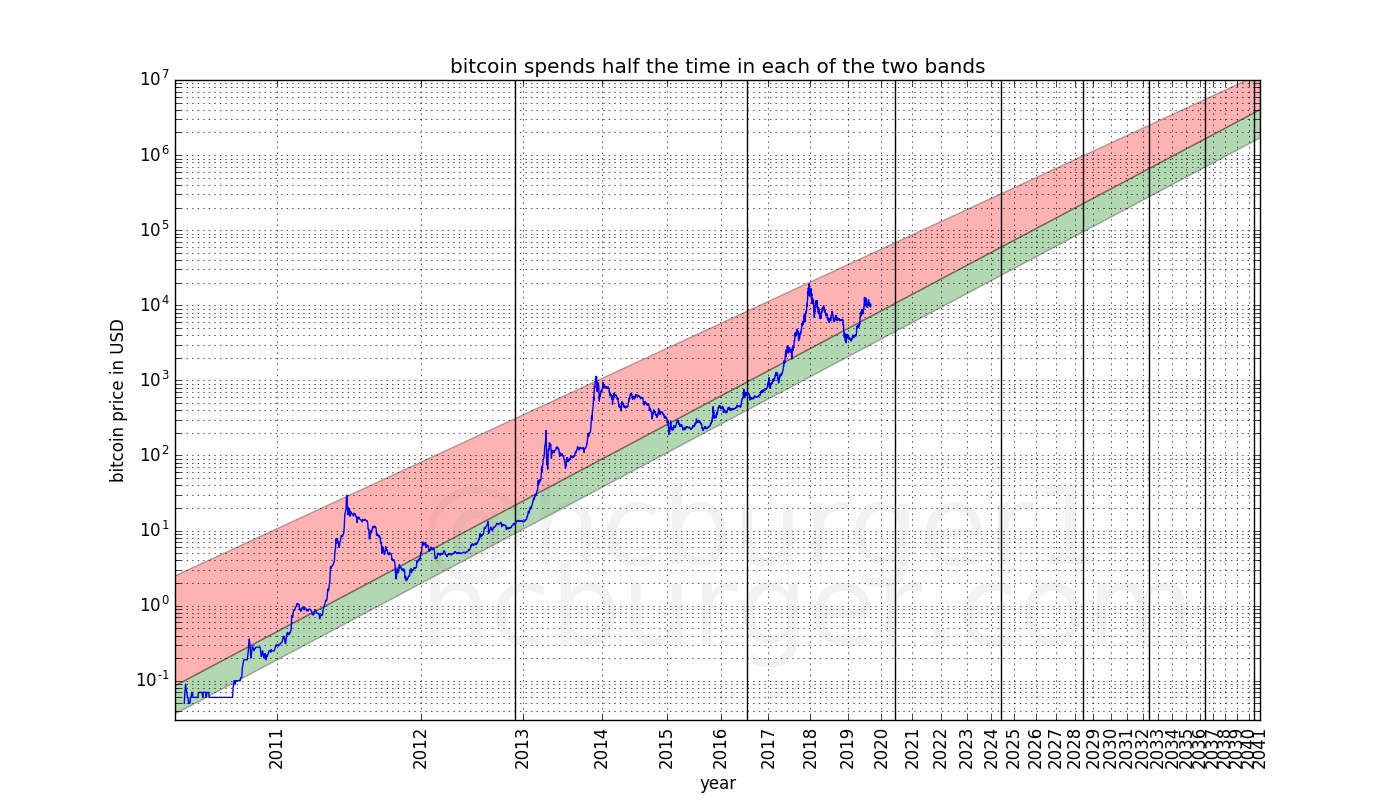

Furthermore, we will see that the price corridor can be divided into two bands, one which lies at the lower-end of the price predictions and is rather thin, the other one being much larger and lying at the higher-end predictions. Bitcoin’s price spends about equal amounts of time in both bands. This implies that large bubbles and busts are likely to continue to exist. The above predictions might seem very broad, but they are sufficiently precise to disagree with the predictions of some other people. This price model should also help determine good points to enter or leave the market.

I am quite confident that in the long-term, the price will indeed evolve approximately as stated in this article. In fact, I think it is more likely for these predictions to be too low rather than too high: I believe that bitcoin has more potential upside than downside to large exogenous shocks. But this article will not try to make any predictions regarding large exogenous shocks. Instead, we will assume that things continue “as usual”.

Different ways of looking at the price

The most interesting and amazing aspect of the price of bitcoin is that it went through many orders of magnitude within a few years. The first instance of a publicly listed price I could find was $0.05 per bitcoin on the Mt Gox exchange, on 17th of July 2010, but prior to that date, many bitcoins have changed hands for a much lower price, such May 22, 2010, when Laszlo Hanyecz paid 10 000 btc for two pizzas, which roughly corresponds to a price of only $0.0025 (0.25 cents) per bitcoin. At the time of writing, the price of one bitcoin hovers around $10 000, which is about 4 million times more than the price at which Laszlo Hanyecz valued them at the time.

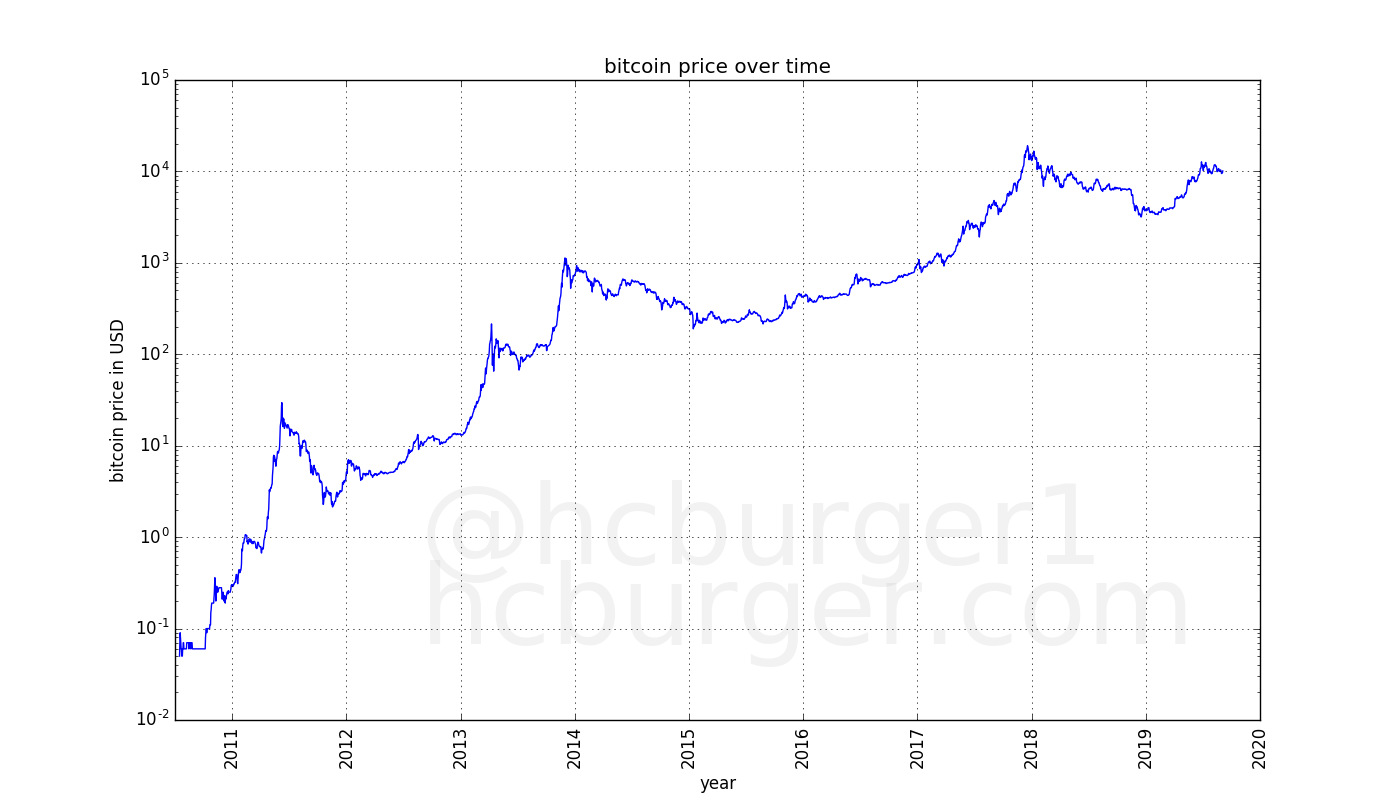

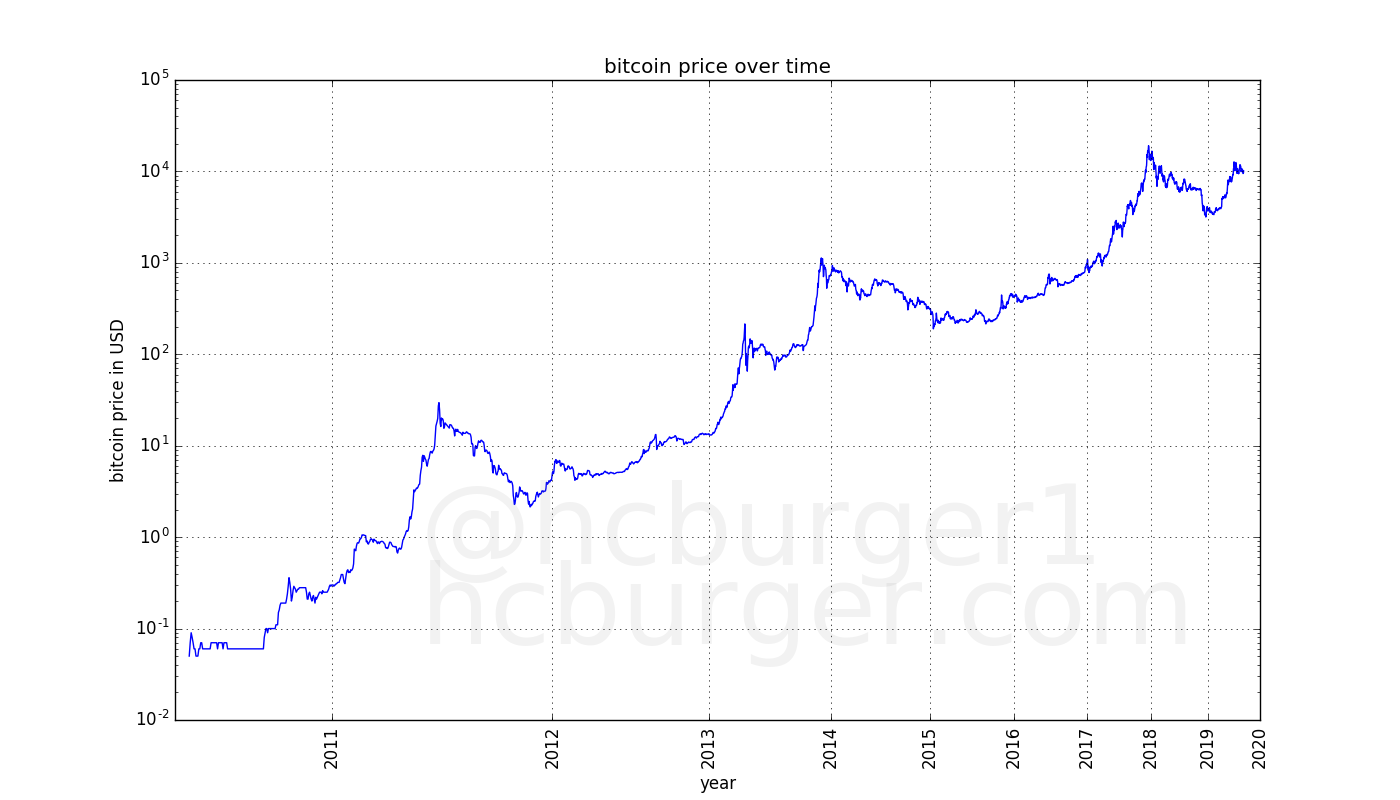

Going through so many orders of magnitude is unusual for a financial instrument, and indeed looking at at plot of the price of bitcoin over time might be somewhat confusing (if the price is represented in linear scale). The below is a chart of the price of bitcoin going from the 17th of July 2010 to approximately the time of writing. Similar plots can be found at any website which lists the price of bitcoin.

Any price swings close to the present are so large in magnitude compared to the price in the past, that past prices seem meaningless. However, to make sense of a long-term price trend, all past prices should have some importance. The reason for the above effect is that using a linear scale is inconvenient for anything that goes through so many orders of magnitude. Using a logarithmic rather than linear scale is more useful [2]. The logarithmic scale gives equal spacing from e.g. 0.01 to 0.1 as from 1000 to 10000. Seen in this way, the bigger picture of the price evolution of bitcoin becomes more visible:

What becomes apparent is that the rate of growth of the price of bitcoin seems to be slowing. The price went from $0.1 to $1 — a factor of 10 — in only a few months. Subsequent gains of a factor 10 came slower.

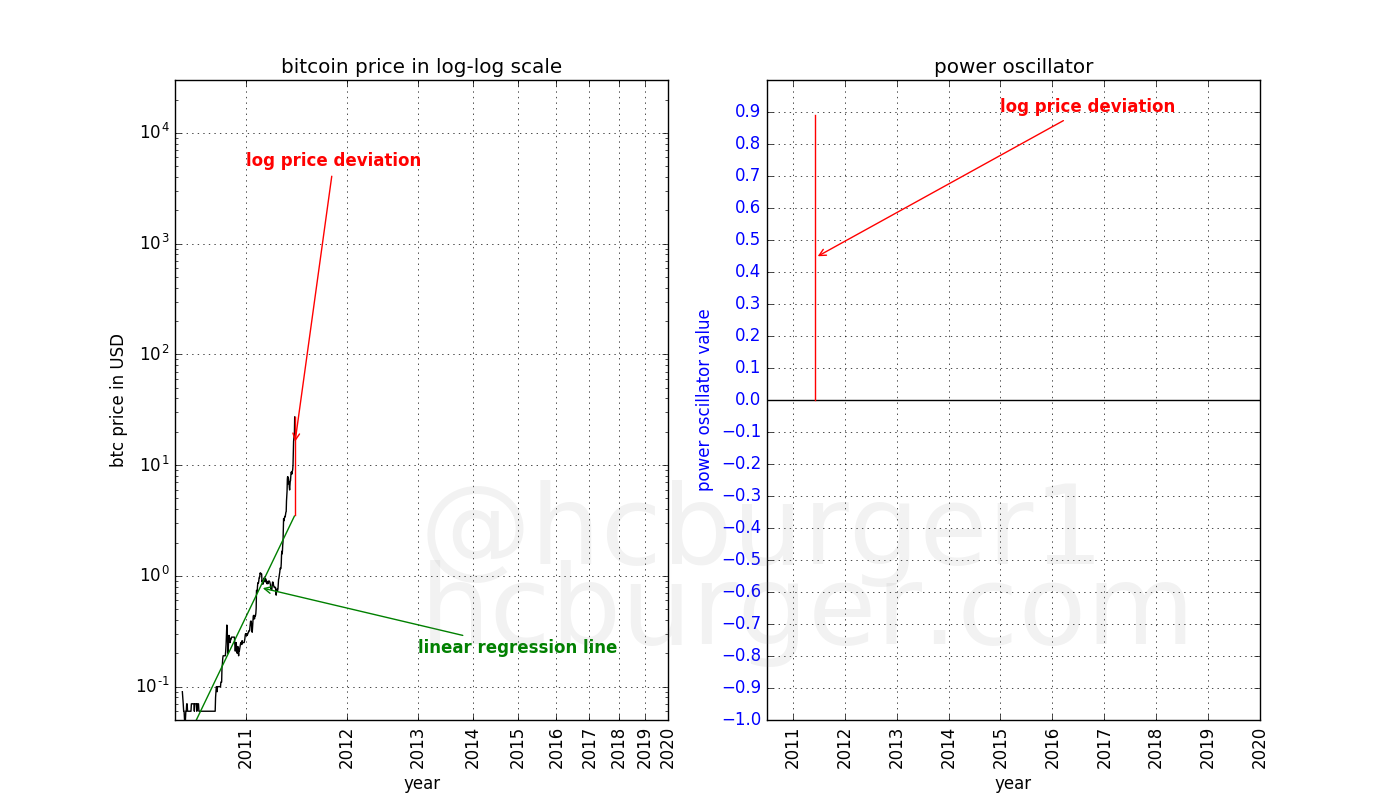

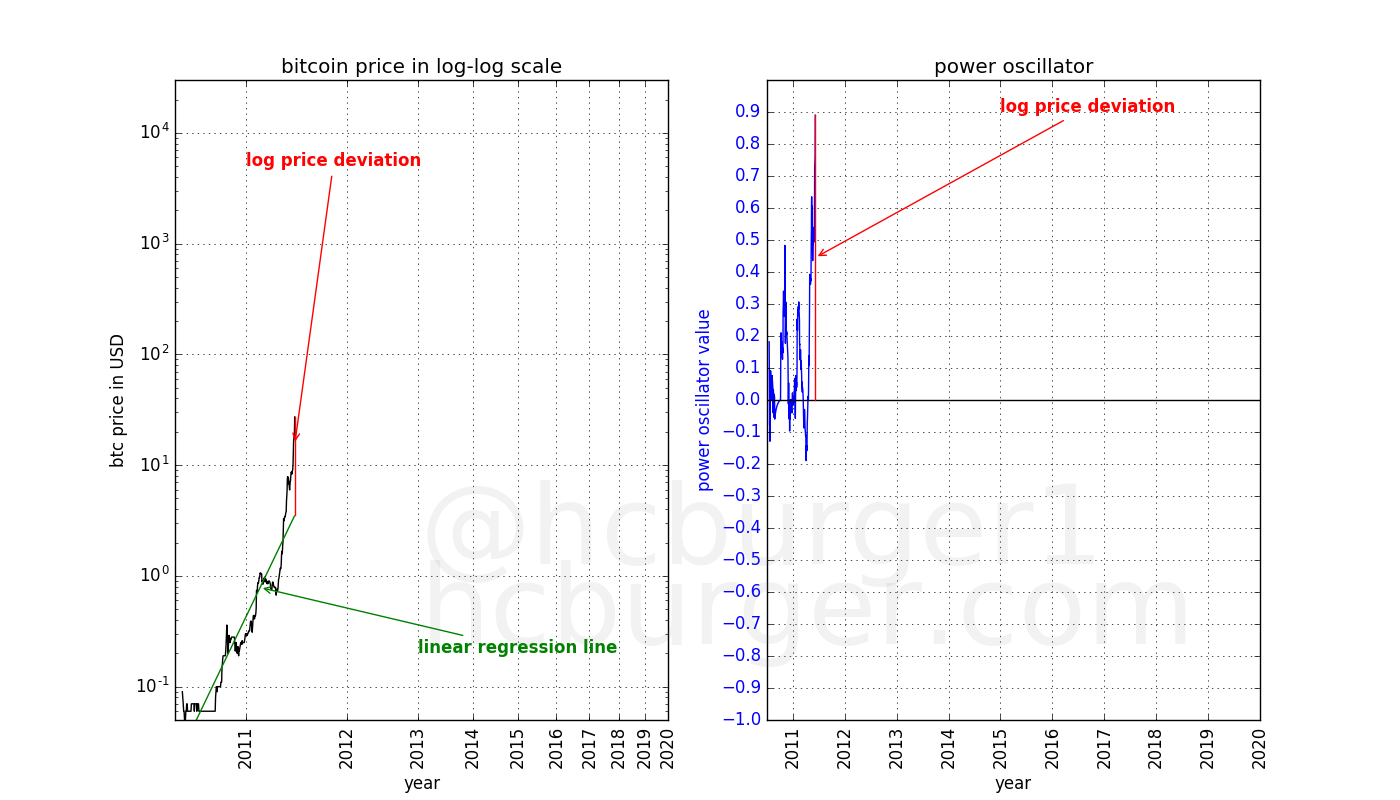

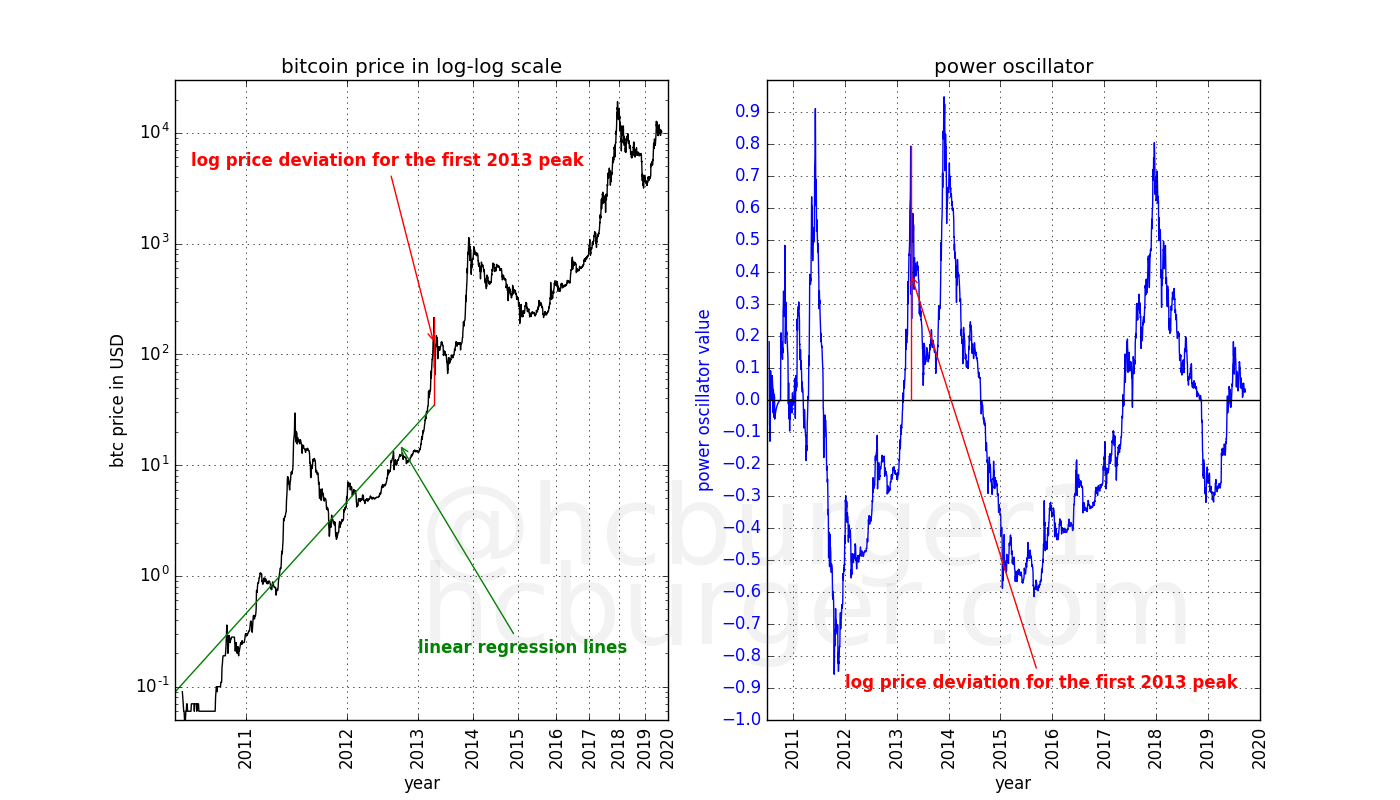

In the above plot, the price (y-axis) has been scaled logarithmically, but not the time (x-axis). Let’s see what happens when the x-axis is also scaled logarithmically, in a so-called log-log plot [3]:

Now the price curve looks remarkably linear!

Linear regression

Since this data looks so linear, let’s try to use linear regression on it [4]. This idea in itself is not new, e.g. I found a post on reddit which did exactly this [5].

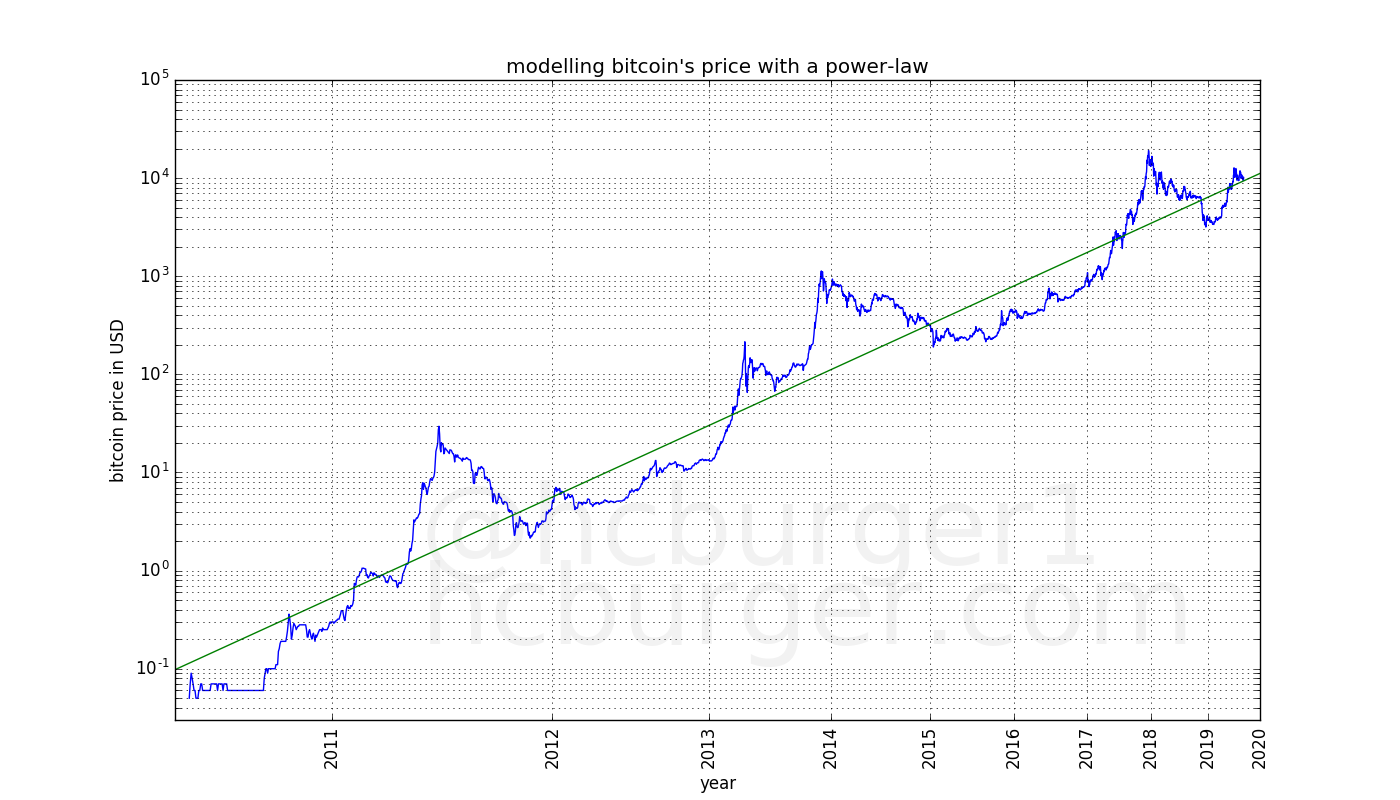

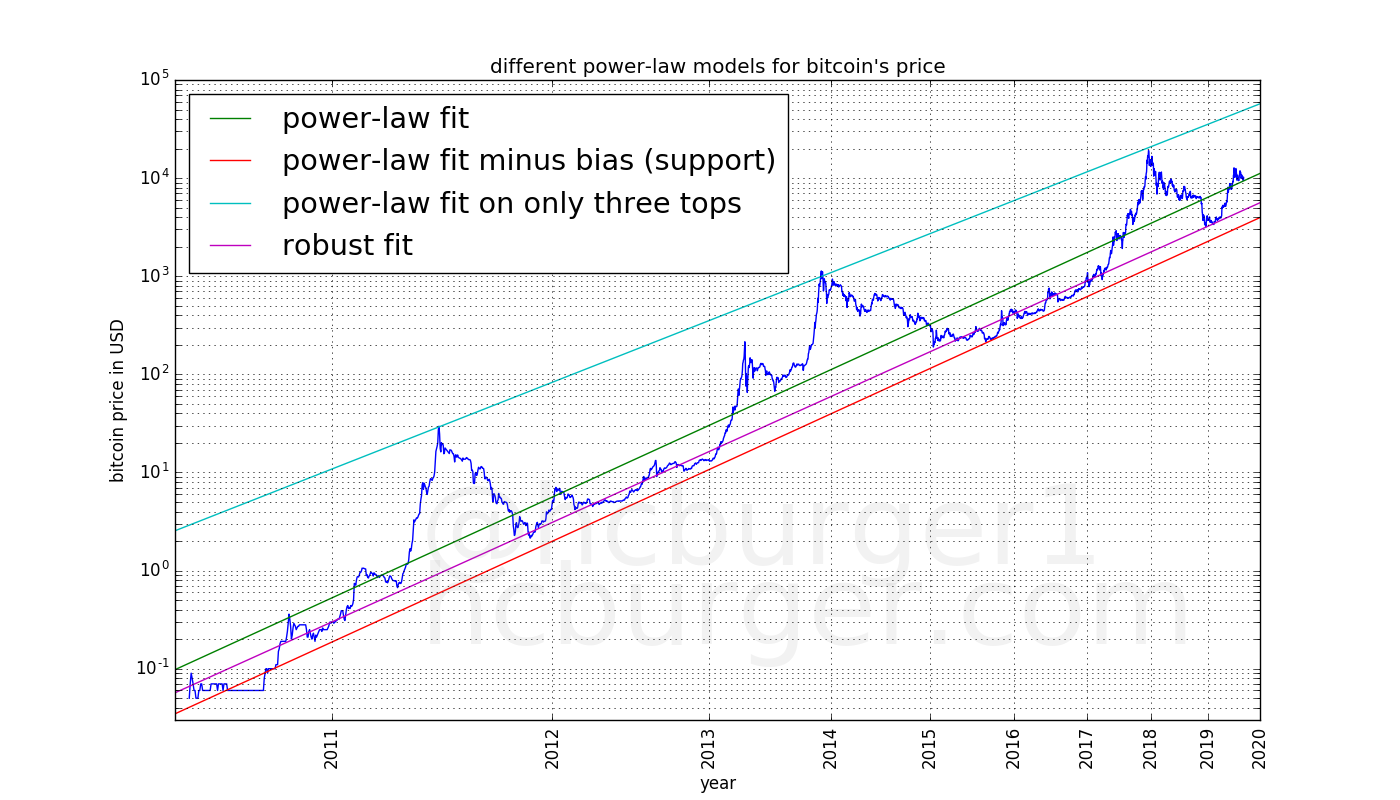

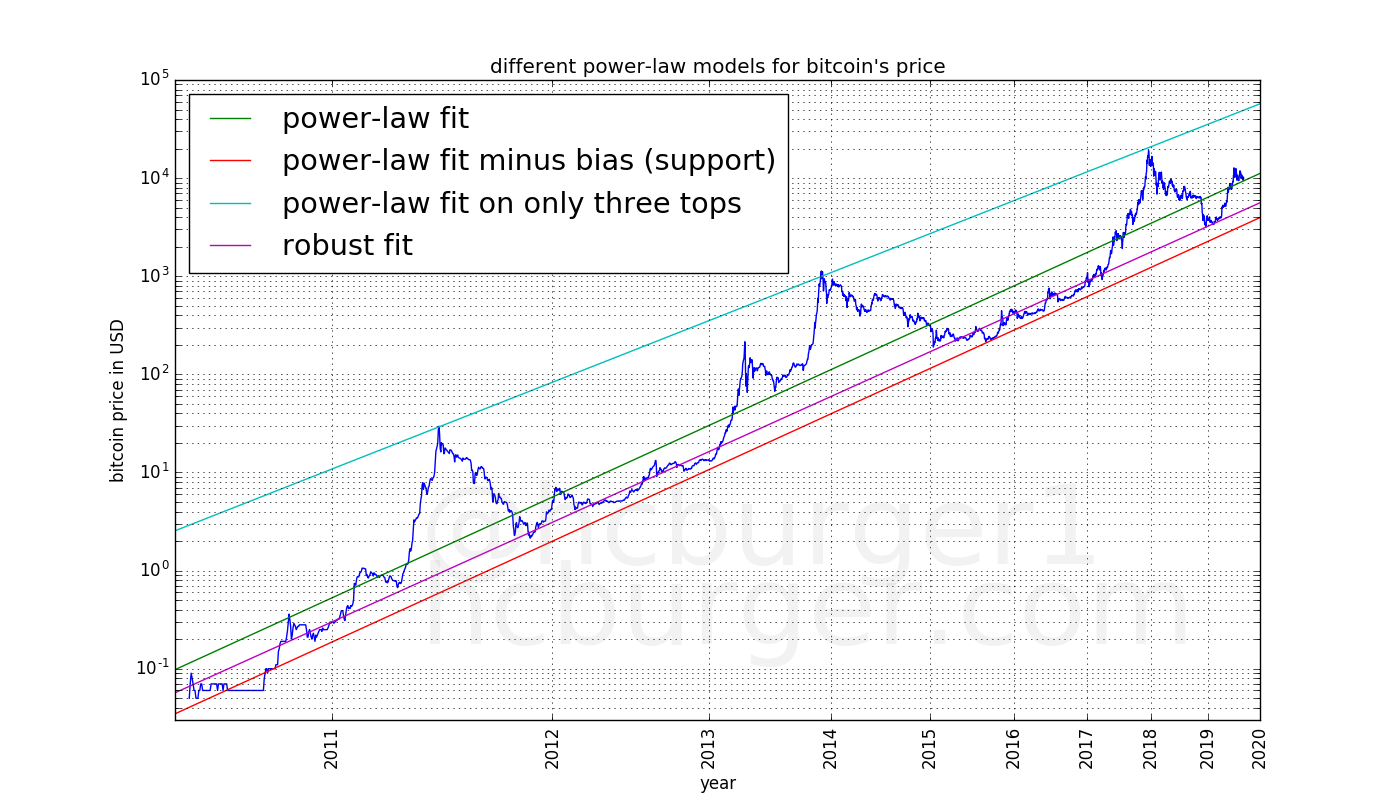

The green line is the result of linear regression. Linear regression gives us the following power-law to predict the price of bitcoin on a given day:

with a = -17.01593313 and the slope b = 5.84509376 with d the number of days since 2009.

Note: We obtain a power-law, which is non-linear because we did linear regression in log-space.

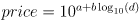

Visually, this fit works very well. It works well all the way back to the first prices that were listed by exchanges. Interestingly, the post on reddit was written about a year ago, and the results are still remarkably similar. Also, the coefficient of determination is high: 0.93139763, which gives us another indication that we have a good model fit [6]. We can look at how the coefficient of determination evolved over time. Surprisingly, the model tends to fit the data better as time goes by:

The x-axis represents the number of data points (days) used for the linear regression model, whereas the y-axis represents as a measure of goodness of fit. Bitcoin’s price fits the power-law better and better.

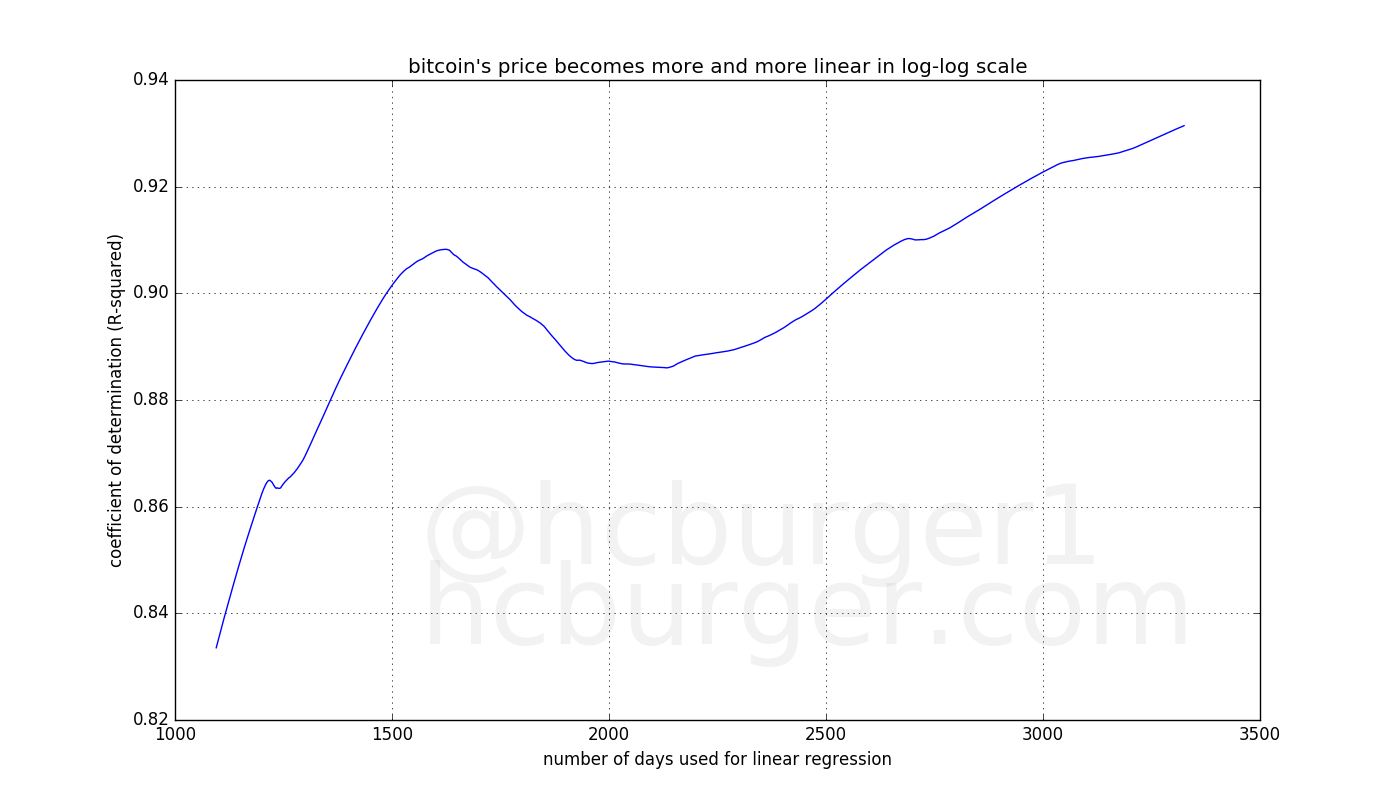

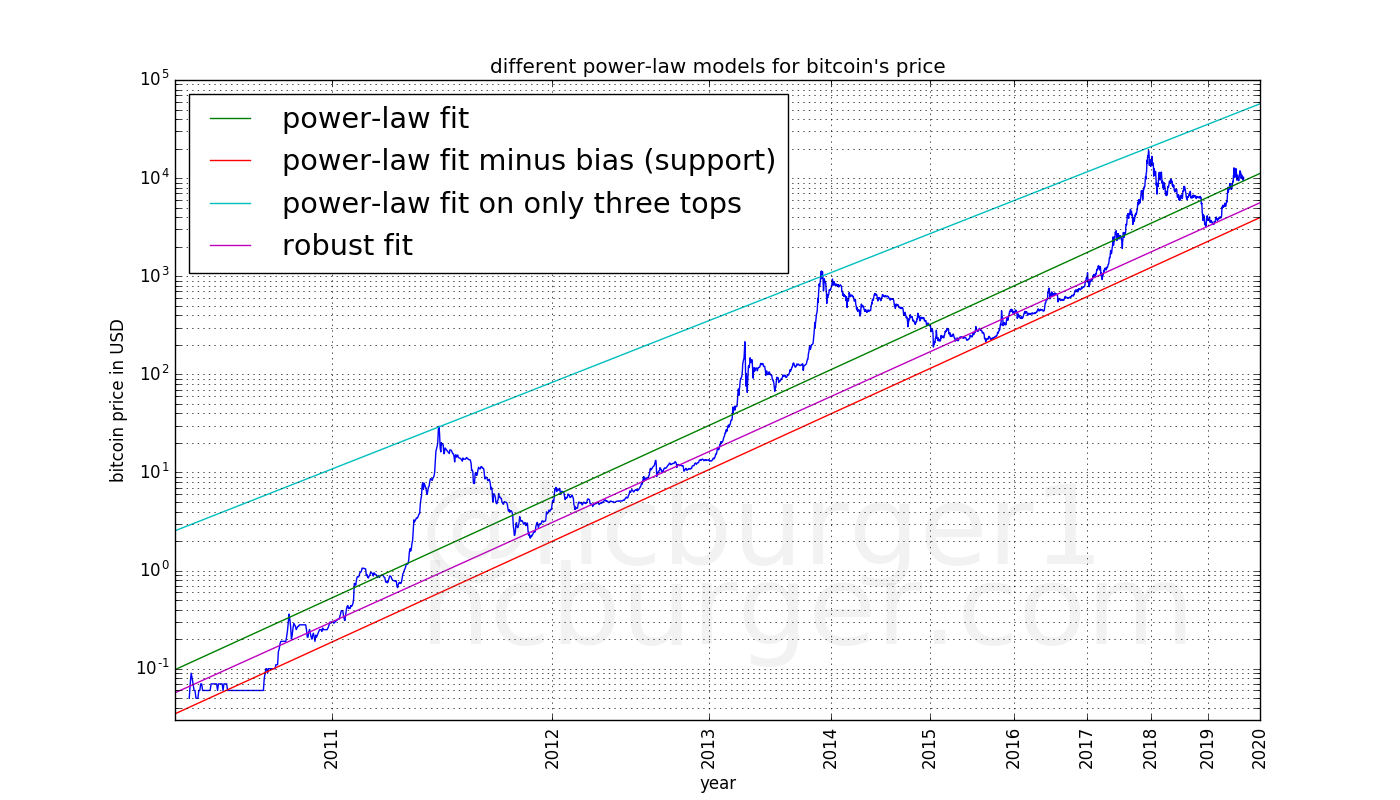

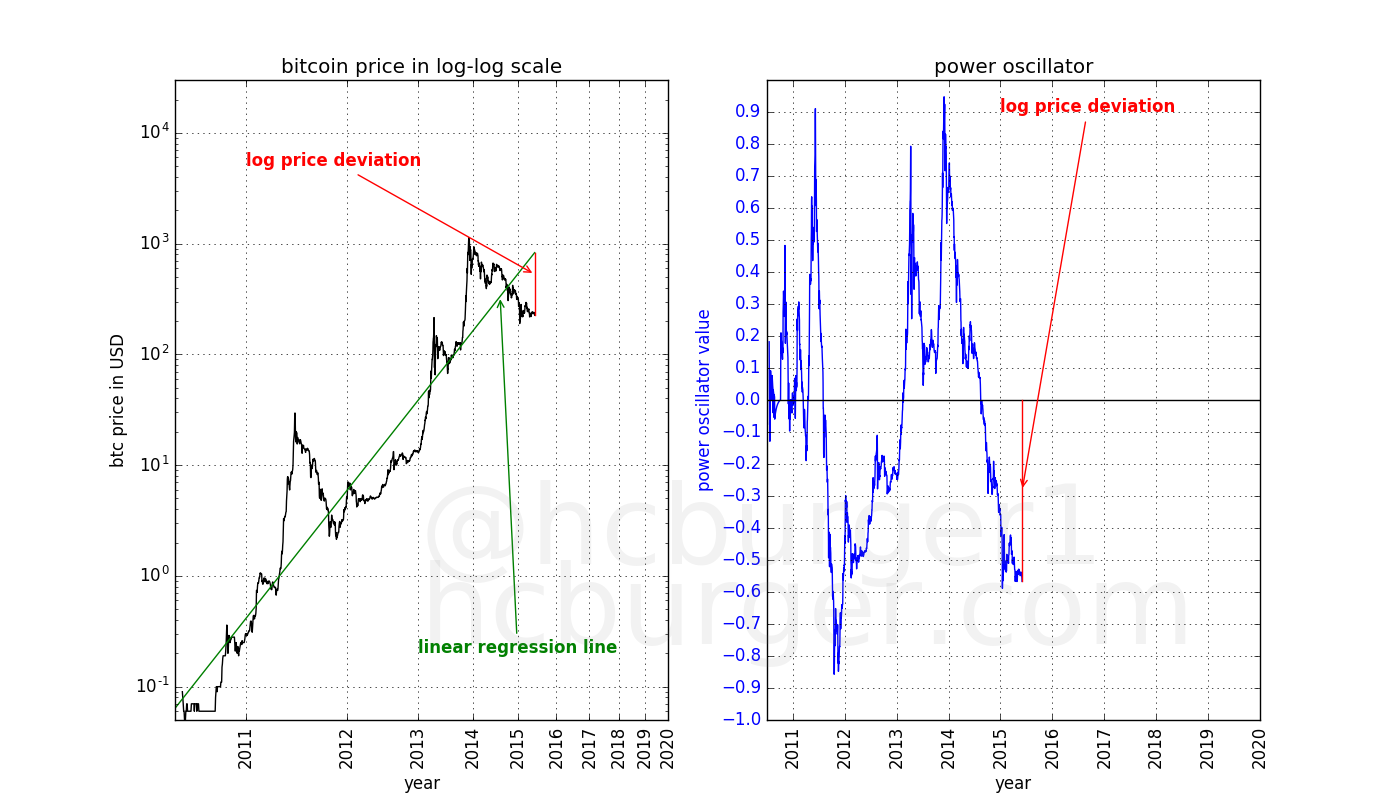

Let’s play around a bit more. If we move the above fit a bit lower (but do not change the slope), we find a support line which seems to work remarkably well: Except for one instance in 2010, the price has never breached this line:

There seems to be a fundamental level of support for bitcoin’s price which has historically followed a power-law.

We can also try to perform linear regression on only the three tops achieved in 2011, 2013, and 2017. Interestingly, this fit works very well: All three data-points are remarkably close to the line:

The market tops also seem to follow a power-law. If the next market top also follows this power-law, the market top will lie on this line. The slope of this power-law is 5.02927337, whereas the fit on all data gave us a somewhat larger slope of 5.84509376. This indicates a relative taming of bitcoin bull markets compared to the overall trend-line. This is perhaps expected, as the market matures and order books become deeper, one should expect less volatility.

We now have two power-laws between which the price of bitcoin moves: the lower support line, and the higher line defined by the three market tops.

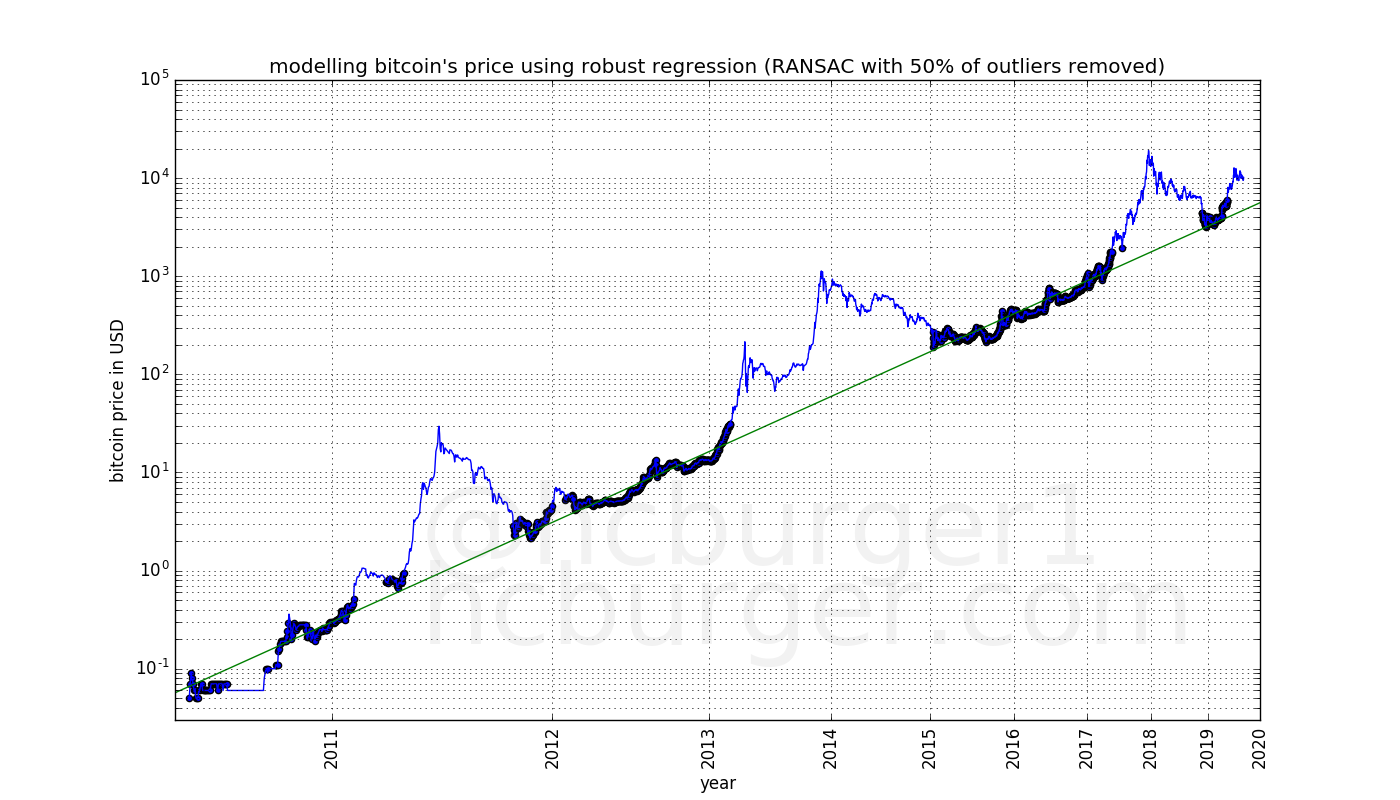

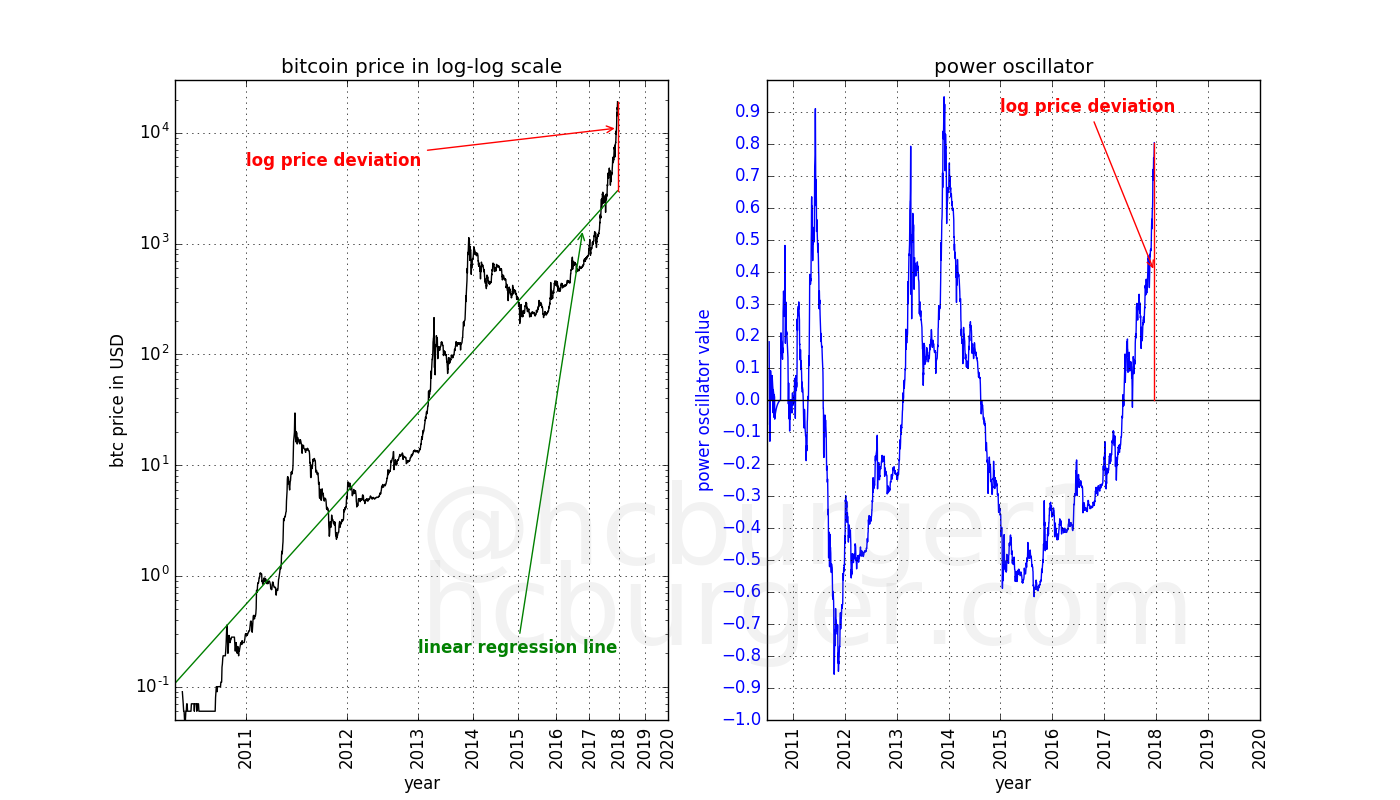

Now, let’s see which data points fit the model best. We are going to use random sample consensus, or RANSAC, which is an iterative form of outlier removal: First, linear regression is performed on all data points. Then, the data point which fits the data least well is removed, and linear regression is performed again [7]. We’re going to stop when 50% of the data points have been removed. This plot shows the result:

The data points that have been chosen by RANSAC are highlighted in this graph. It seems that there are two groups of data-points: Those that have been chosen by RANSAC are very close to the model fit. In the group of data points not chosen by RANSAC, the values are almost all above the model fit. In fact, some of them are much higher than the model fit. These data-points occurred mostly in bull markets. The price of bitcoin seems to follow two modes:

- the normal mode, during which the price is very well defined by a power law, and

- the bull mode, during which the price can be much higher than in normal mode and during which there is more price volatility.

The price spends equal amounts of time in each of the two modes.

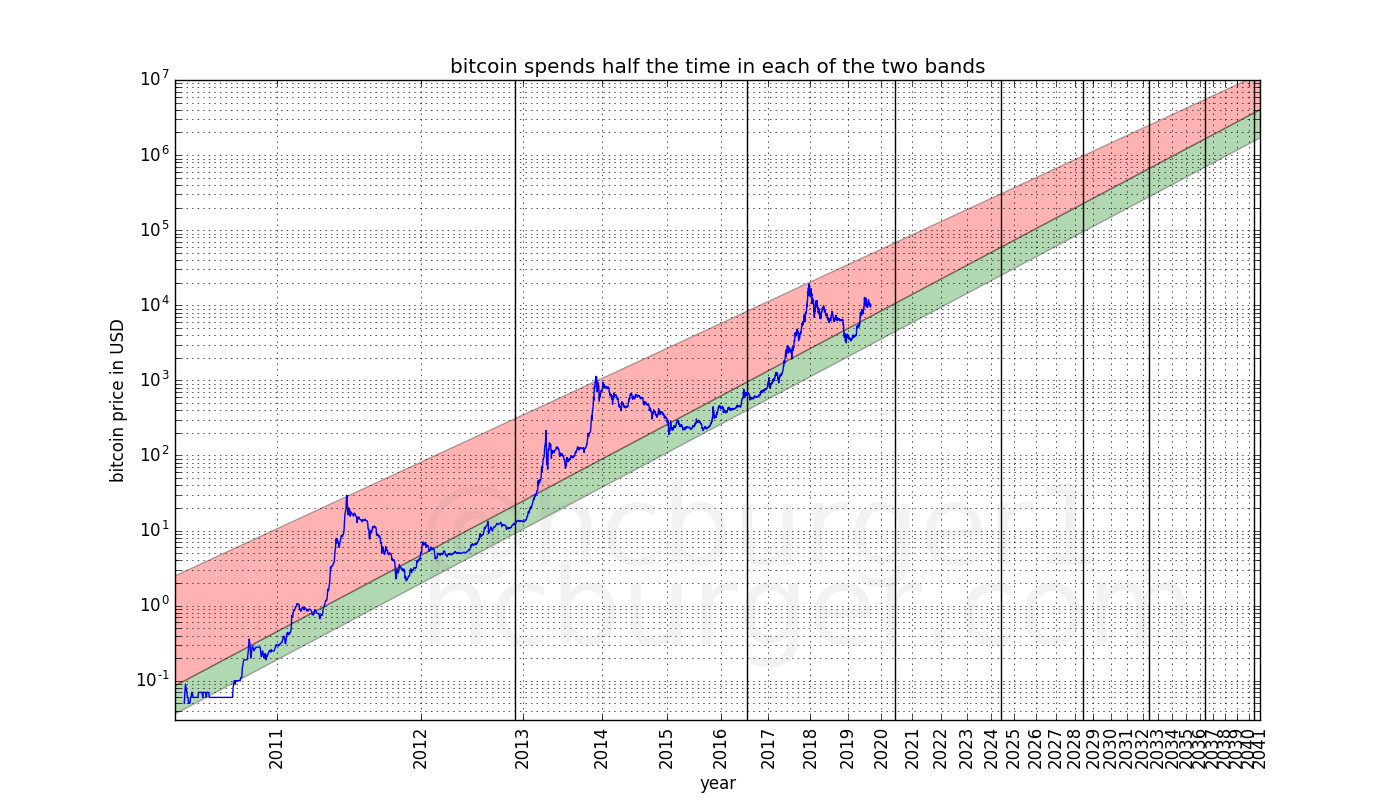

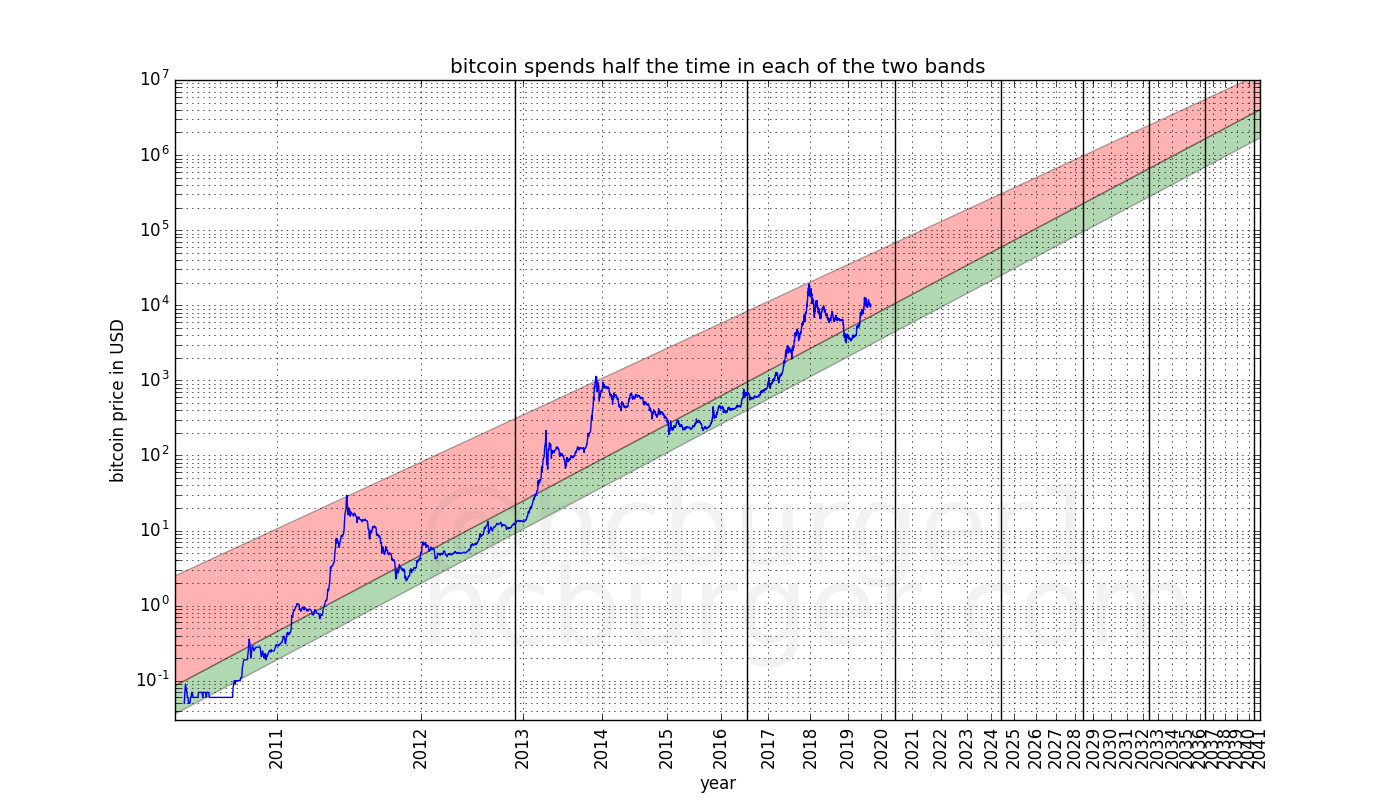

Finally, let’s combine all the previously mentioned model fits into one graph:

We see that the fit using all data and the result of RANSAC have very similar slope, but a slightly different offset. This is because the bull market prices have been mostly excluded as outliers by RANSAC.

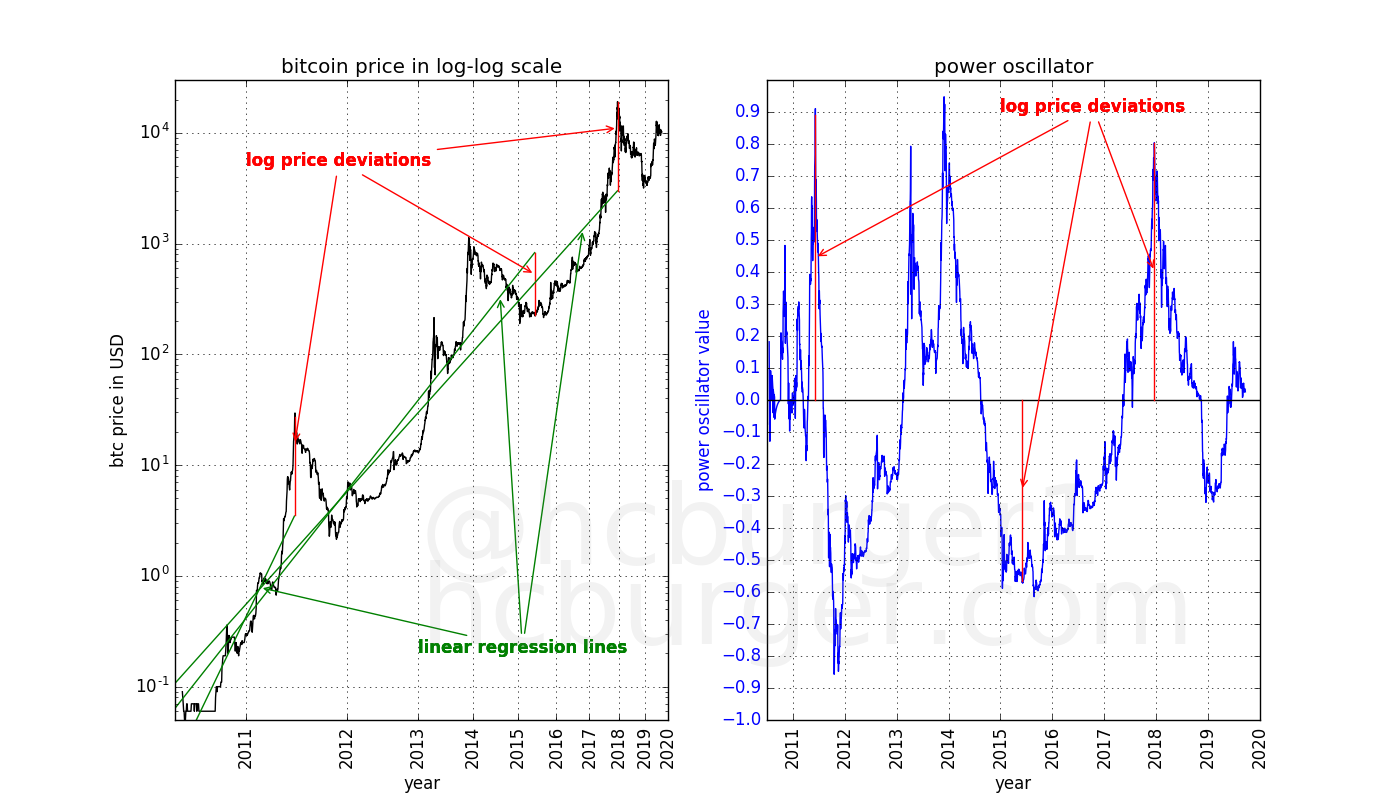

Model predictions

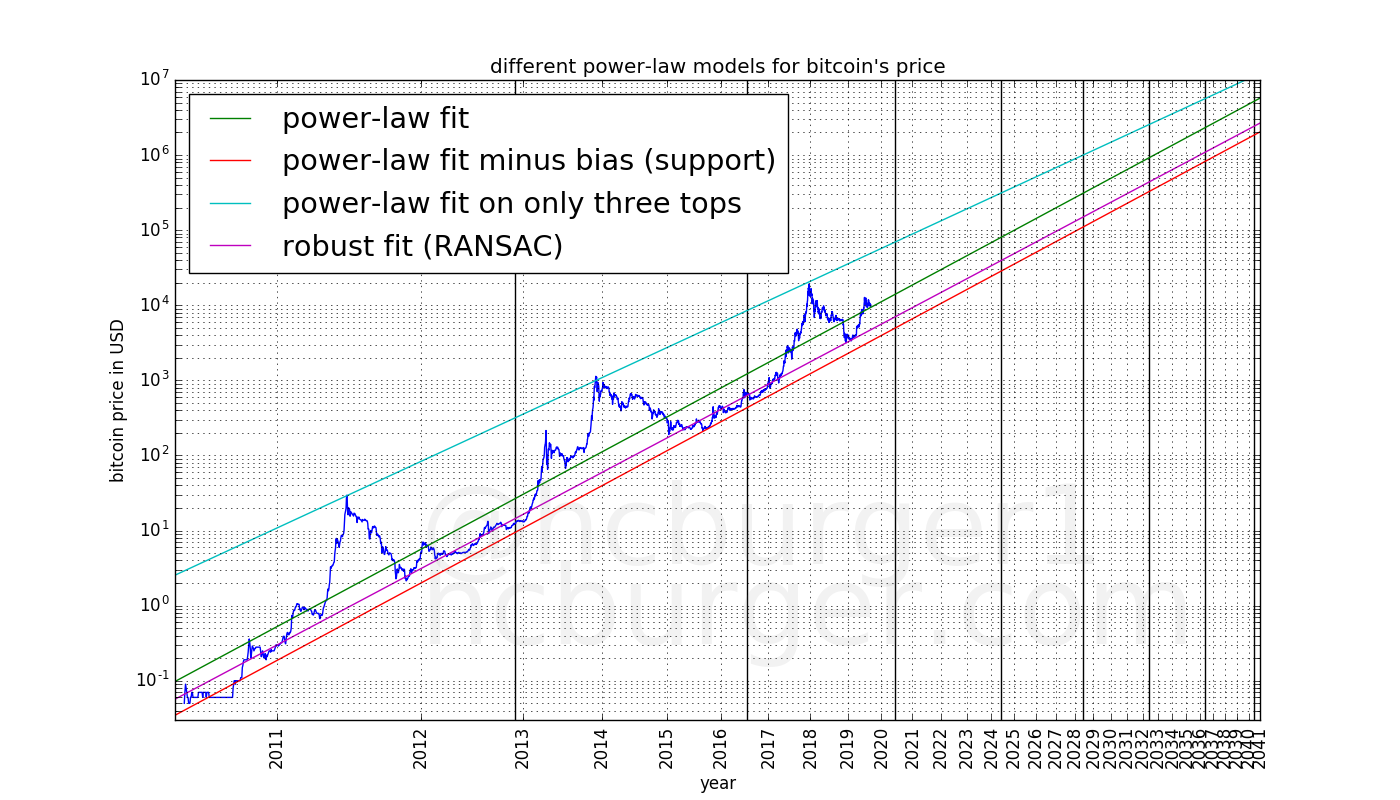

We now have various models to predict the future price of bitcoin. All we have to do is extend the graph:

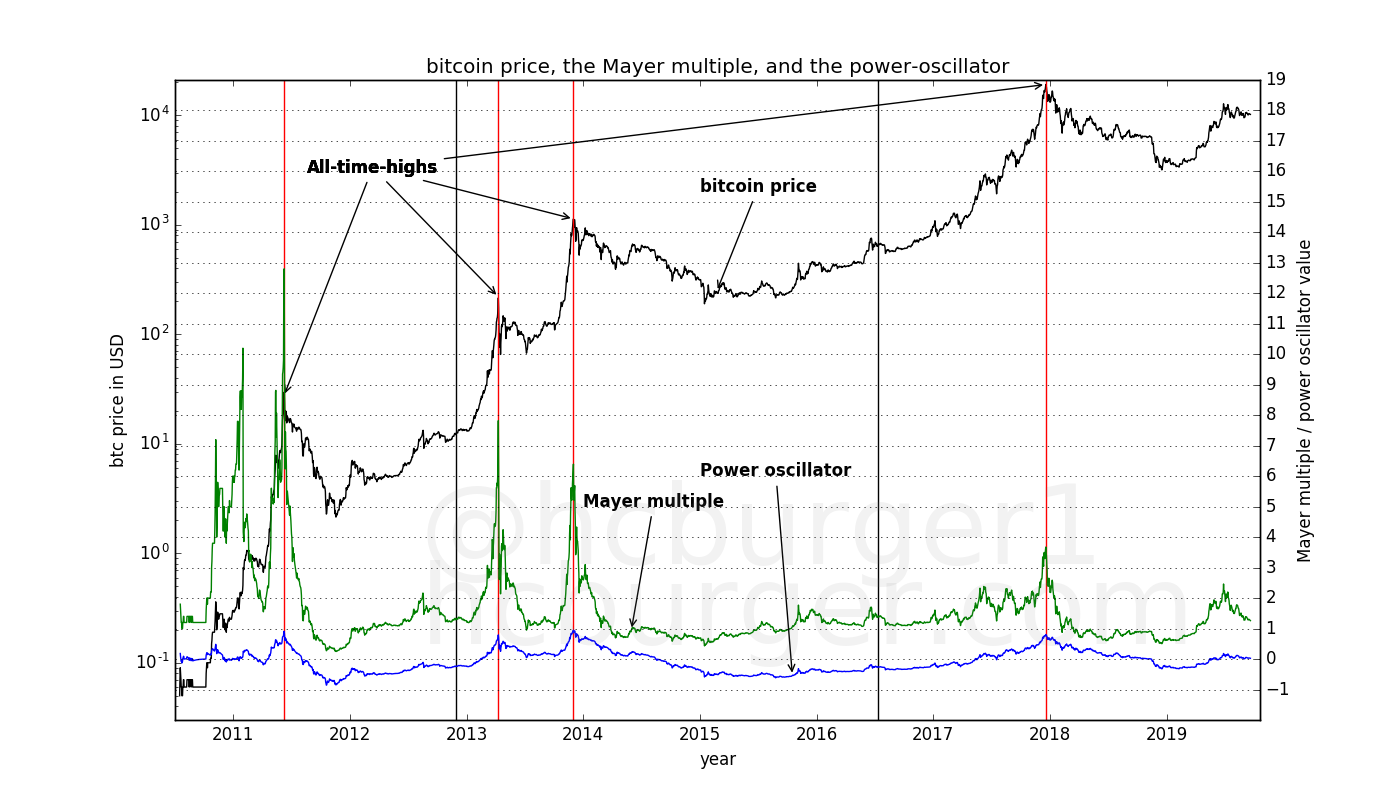

The model predicts that the price will move between the red support line and the blue top line. The purple robust fit / RANSAC line defines the center of the “normal mode”. The two past halvings as well as estimated future halvings have been marked with black vertical lines.

We can further divide this corridor into two bands, one corresponding to the “normal” mode and one corresponding to the “bull” mode. The price has so far spent half the time in the lower “normal mode” band, and the rest of the time in the higher “bull mode” band.

Interpretations

This power-law model predicts a continued, but slowing growth of the price of bitcoin. It also predicts reduced, but still large volatility in the future. It predicts that the price will not reach $100 000 before 2021, but it also predicts that the price will not be lower than $100 000 by 2028. It predicts that the price will not reach $1 000 000 before 2028, but also that the price will not be lower than that after 2037. The model predicts ever increasing prices, although at a slower and slower rate.

These predictions appear to be somewhat middle-of-the-road compared to other predictions. According to this model, McAfee’s famous prediction is far too optimistic.

The combination of the fact that the price corridor is rather wide combined with the fact that the rate of growth is slowing means that unlucky investors will have to wait longer and longer before their initial investment is safely recouped. E.g. investors who bought bitcoin at the top of the bubble in 2011 only had to wait about two years until 2013 for the price of bitcoin to recover permanently. However, investors who bought at the peak of the 2013 bubble had to wait about four years, until 2017, before the price recovered from that price and stayed above that price. The model predicts that the price point reached at the peak of the 2017 bubble might not be secured until the end of 2023, about six years later.

Until now, each four-year halving period had a bubble whose price was exceeded by the next period’s bubble. Due to the above point of slowing growth and corridor width, this is not guaranteed to continue to be the case in the future. As an example, the model allows the following scenario:

- A price of about $150 000 at the beginning of 2022, which is the next and fourth four-year period.

- A price that is lower than $150 000 until mid-2028, which is in the sixth four-year period.

Such a scenario would give bitcoin detractors ammunition for criticism, but is otherwise not something that should be especially worrisome, as long as one is prepared.

Why does bitcoin follow a power-law, and should we expect it to continue? The observation that bitcoin follows a power-law is admittedly ad-hoc. In addition, there are other factors than just time that should influence bitcoin’s price, such as its scarcity. However, bitcoin’s scarcity is programmatic and therefore also time-based. In is therefore not implausible for a simple time-based model to continue to hold true in the future. The fact that the power-law fit works better and better in terms of the measure in the log-log plot is an indication that this might indeed hold.

Conclusion

In this article we presented a simple time-based equations to model bitcoin’s price. It is remarkable that the equations are both 1. simple and 2. use time as the only variable, yet work remarkably well over a long period of time.

This model does not attempt to predict bull markets, which seem to occur periodically. However, bull markets are expected to fall within the corridor defined by this model.

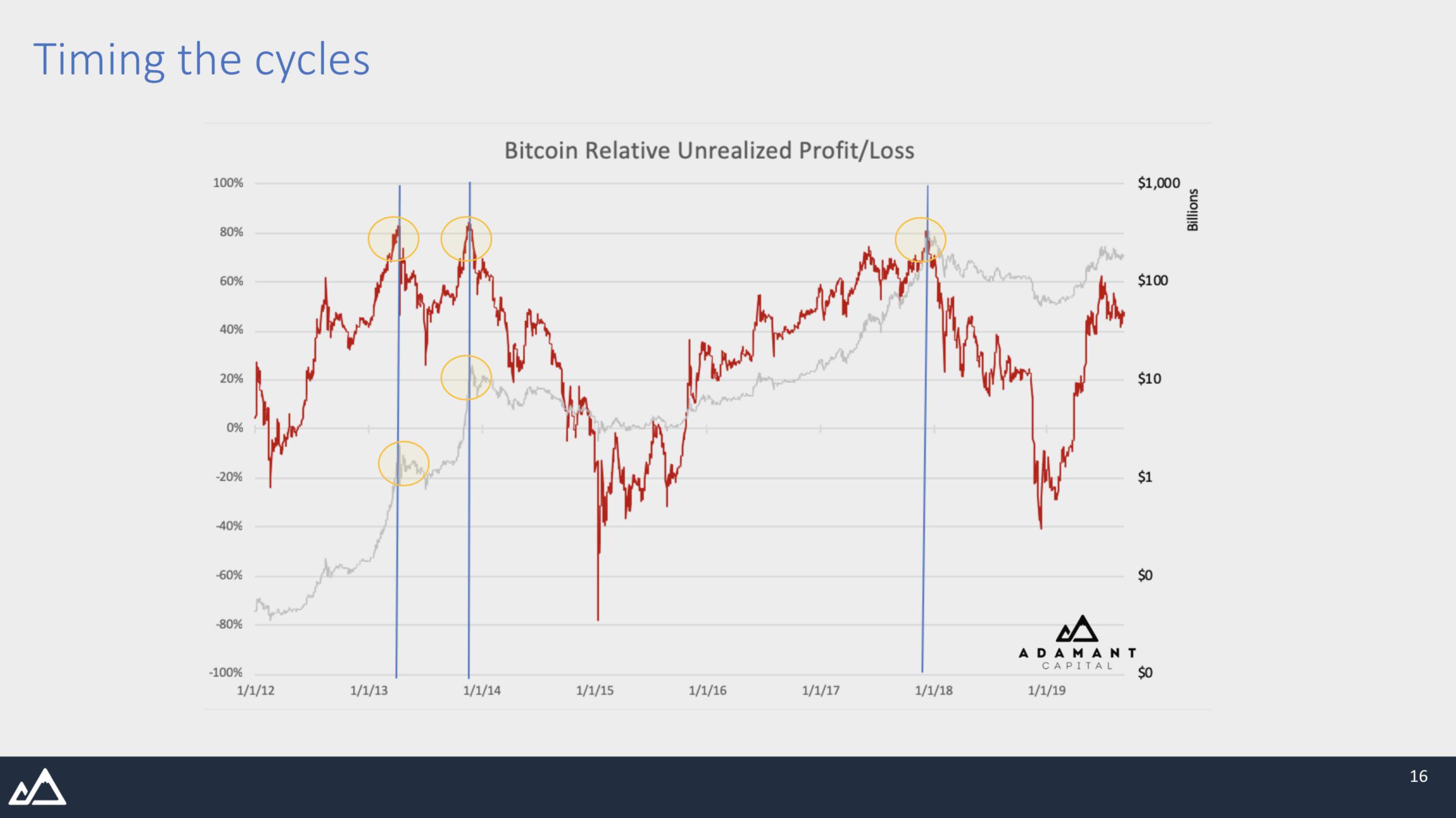

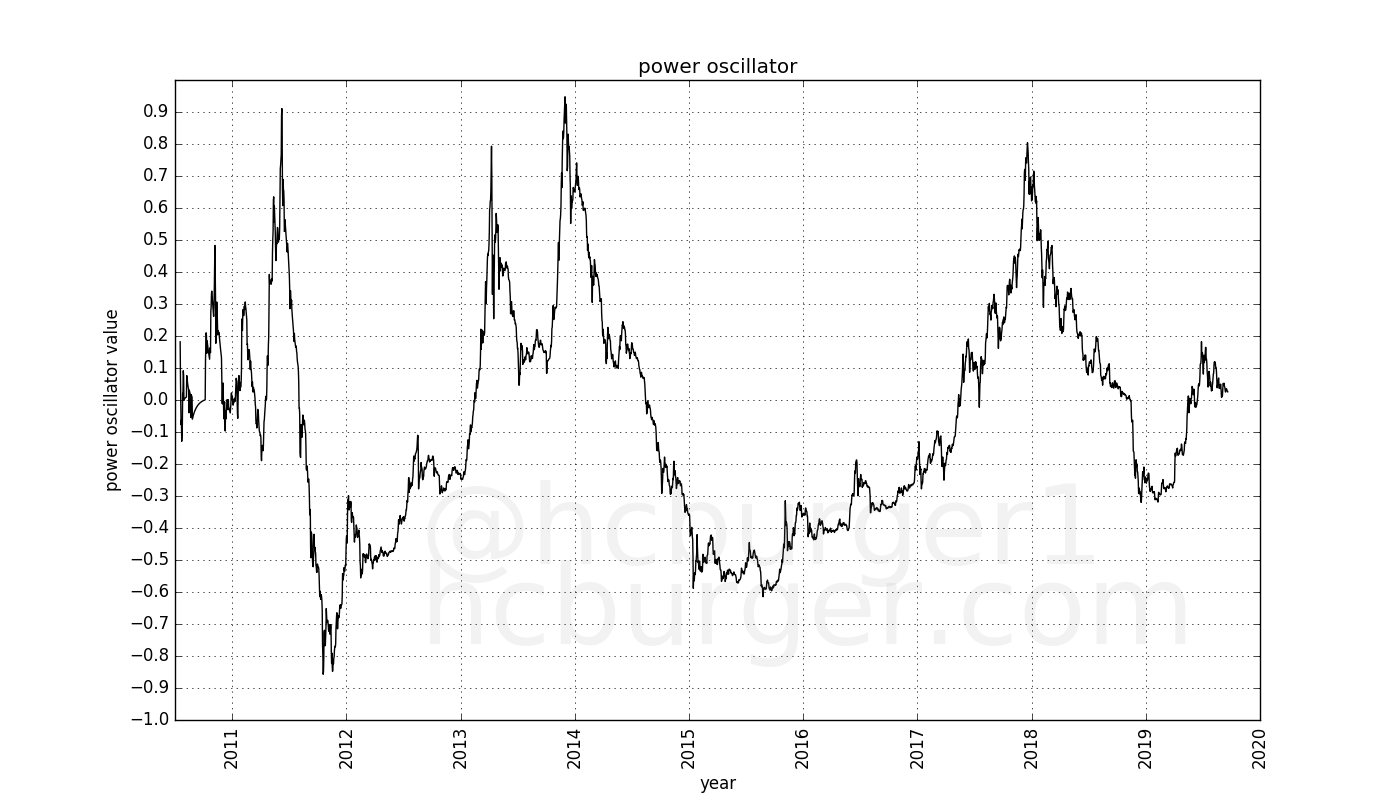

In an upcoming article, we will use a time-based power-law to attempt to find good points in time to enter and exit the market.

References

- https://blockonomi.com/bitcoin-price-predictions-2019/

- https://en.wikipedia.org/wiki/Logarithmic_scale

- https://en.wikipedia.org/wiki/Log%E2%80%93log_plot

- https://en.wikipedia.org/wiki/Linear_regression

- https://www.reddit.com/r/Bitcoin/comments/9cqi0k/

- https://en.wikipedia.org/wiki/Coefficient_of_determination

- https://en.wikipedia.org/wiki/Random_sample_consensus

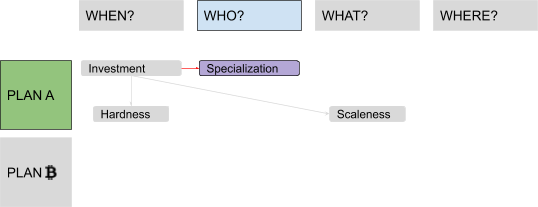

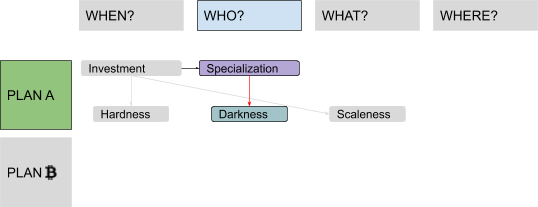

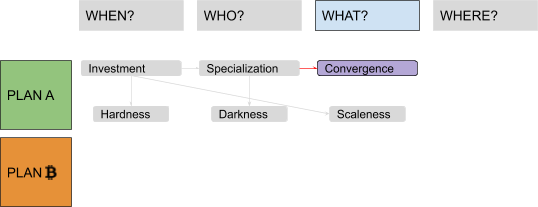

Bitcoin, Not Blockchain

By Parker Lewis

Posted September 6, 2019

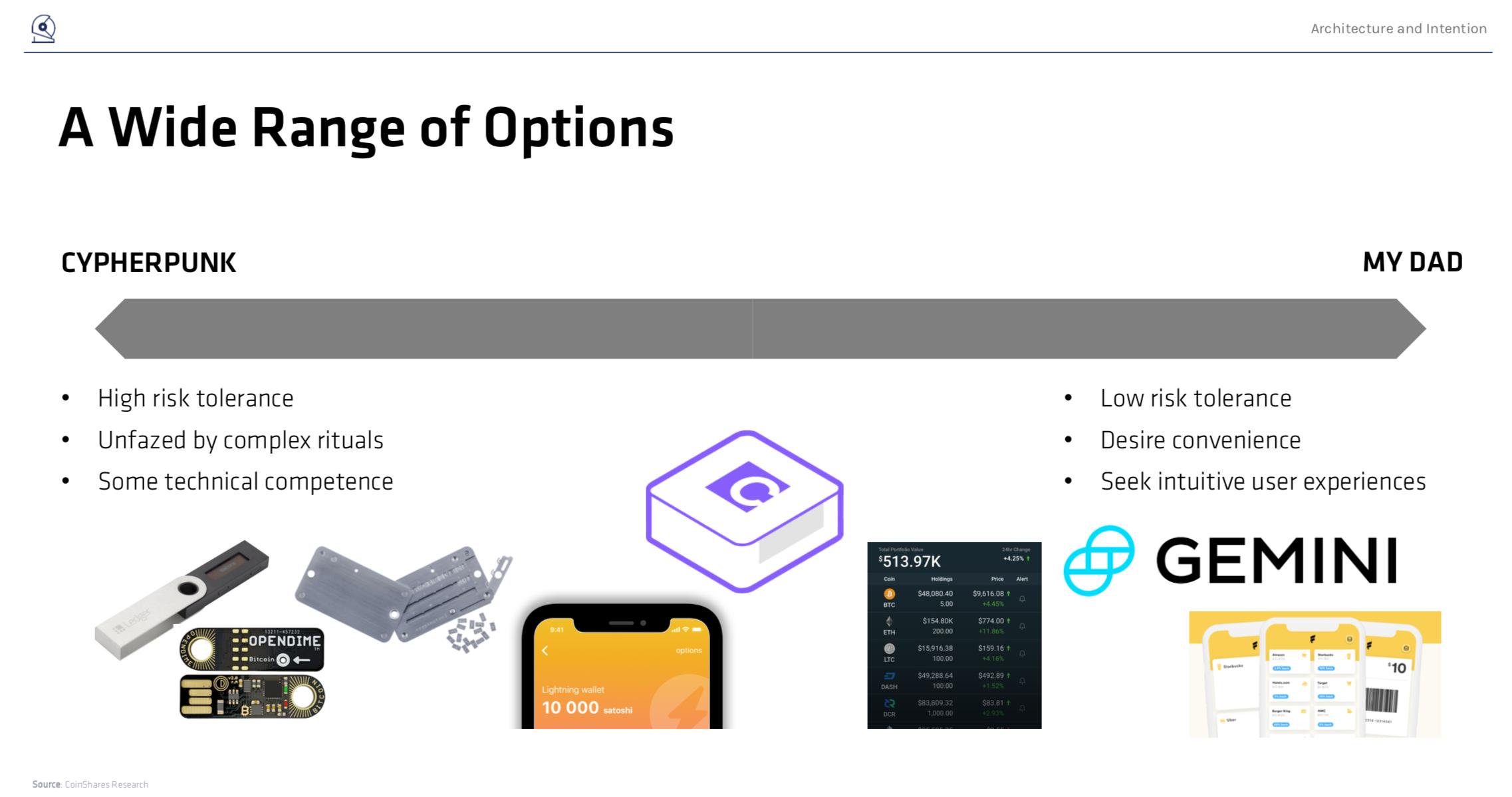

Have you ever heard a smart sounding friend say that they aren’t sure about bitcoin but they believe in blockchain technology? This is like saying you believe in airplanes but you’re not sure about the wings; and there’s a good chance that anyone who thinks that may not understand either. In reality, bitcoin and its blockchain are dependent on each other. However, if new to bitcoin, understanding how it works and parsing the landscape can be incredibly difficult. Frankly, it can be overwhelming; given the complexity and sheer volume of projects, who has the time to possibly evaluate everything? There is in fact a manageable path but you have to know where to start. While there are seemingly thousands of cryptocurrencies and blockchain initiatives, there is really only one that matters: bitcoin. Ignore everything else like it didn’t exist and first try to develop an understanding of why bitcoin exists and how it works; that is the best foundation to then be able to think about the entirety of everything else.

It is also the most practical entry point; before taking a flyer and risking hard-earned value, take the time to understand bitcoin and then use that knowledge to evaluate the field. There is no promise that you will come to the same conclusions, but more often than not, those who take the time to intuitively understand how and why bitcoin works more easily recognize the flaws inherent in the field. And even if not, starting with bitcoin remains your best hope of making an informed and independent assessment. Ultimately, bitcoin is not about making money and it’s not a get-rich-quick scheme; it is fundamentally about storing the value you have already created, and no one should risk that without a requisite knowledge base. Within the world of digital currencies, bitcoin has the longest track record to assess and the greatest amount of resources to educate, which is why bitcoin is the best tool to learn.

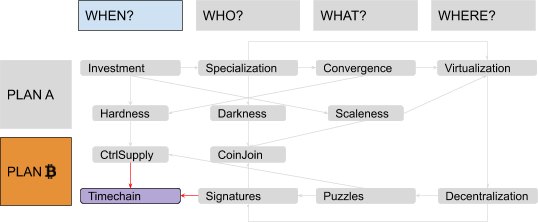

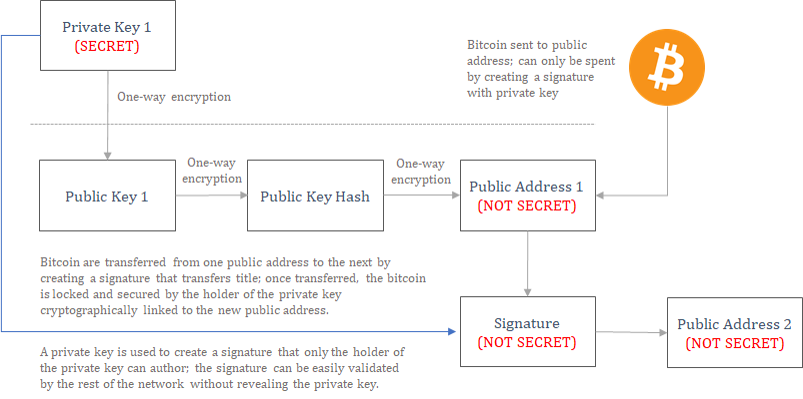

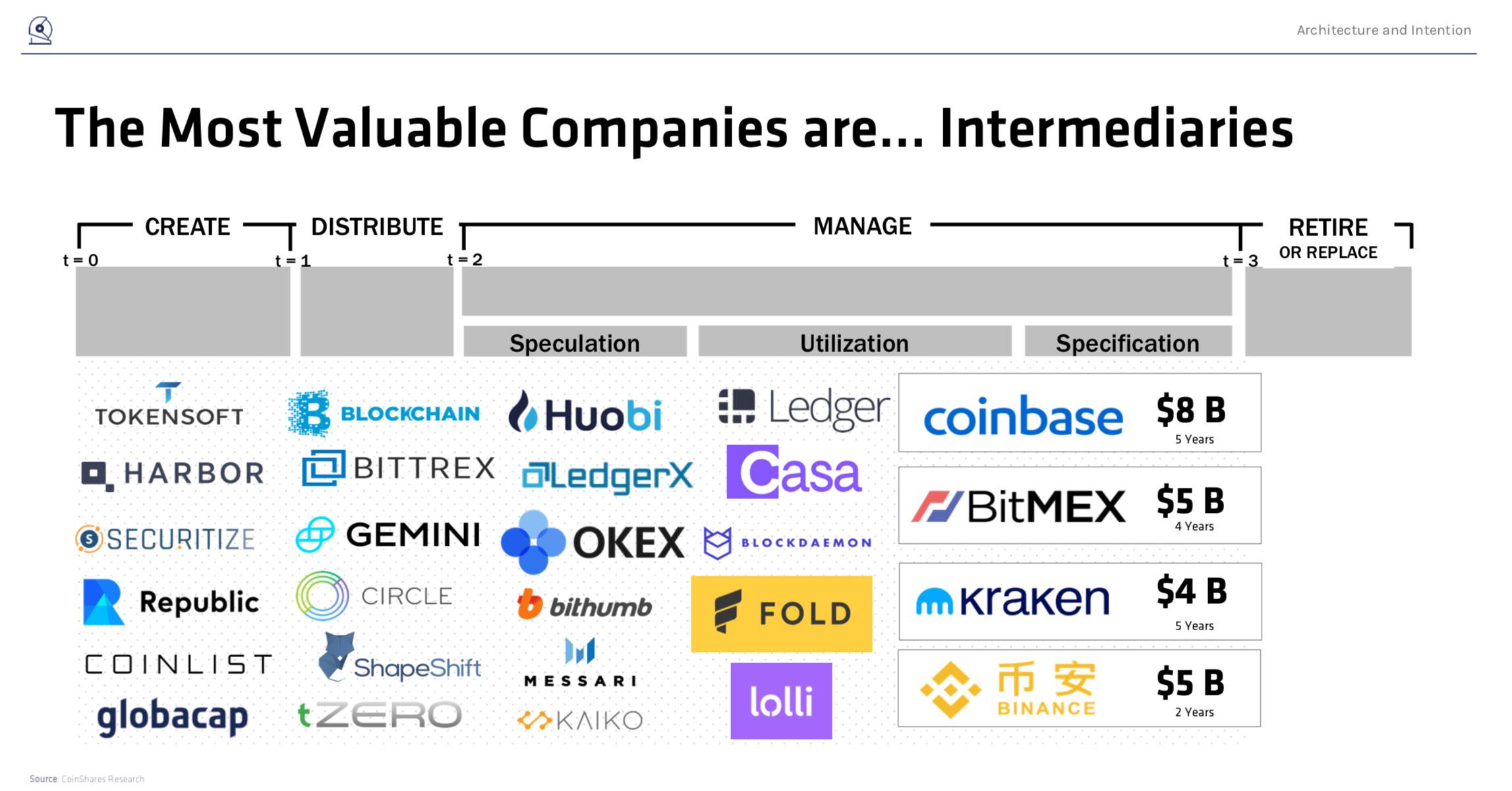

To start on this journey, first realize that bitcoin was created to specifically address a problem that exists with modern money. The founder of bitcoin set out to create a peer-to-peer digital cash system without the need for a trusted third-party, and a blockchain was one critical part of the solution. In practice, bitcoin (the currency) and its blockchain are interdependent. One does not exist without the other; bitcoin needs its blockchain to function and there would not be a functioning blockchain without a native currency (bitcoin) to properly incentivize resources to protect it. That native currency must be viable as a form of money because it is exclusively what pays for security, and it must have credible monetary properties in order to be viable.

Without the money, there is no security and without the security, the value of the currency and the integrity of the chain both break down. It is for this reason that a blockchain is only useful within the application of money, and money does not magically grow on trees. Yep, it is that simple. A blockchain is only good for one thing, removing the need for a trusted third-party which only works in the context of money. A blockchain cannot enforce anything that exists outside the network. While a blockchain would seem to be able to track ownership outside the network, it can only enforce ownership of the currency that is native to its network. Bitcoin tracks ownership and enforces ownership. If a blockchain cannot do both, any records it keeps will be inherently insecure and ultimately subject to change. In this sense, immutability is not an inherent trait of a blockchain but instead, an emergent property. And if a blockchain is not immutable, its currency will never be viable as a form of money because transfer and final settlement will never be reliably possible. Without reliable final settlement, a monetary system is not functional and will not attract liquidity.

Ultimately, monetary systems converge on one medium because their utility is liquidity rather than consumption or production. And liquidity consolidates around the most secure, long-term store of value; it would be irrational to store wealth in a less secure, less liquid monetary network if a more secure, more liquid network existed as an attainable option. The aggregate implication is that only one blockchain is viable and ultimately necessary. Every other cryptocurrency is competing for the identical use case as bitcoin, that of money; some realize it while others do not but value continues to consolidate around bitcoin because it is the most secure blockchain by orders of magnitude and all are competing for the same use case. Understanding these concepts is fundamental to bitcoin and it also provides a basic foundation to then consider and evaluate the noise beyond bitcoin. With basic knowledge of how bitcoin actually works, it becomes clear why there is no blockchain without bitcoin.

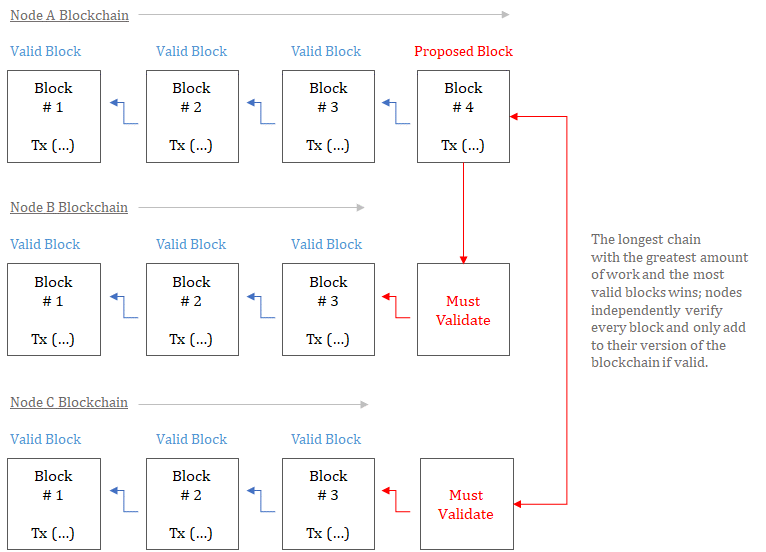

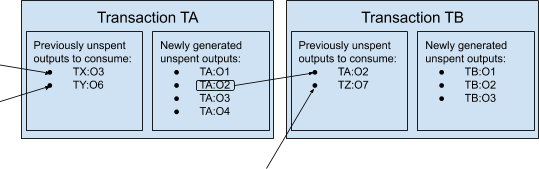

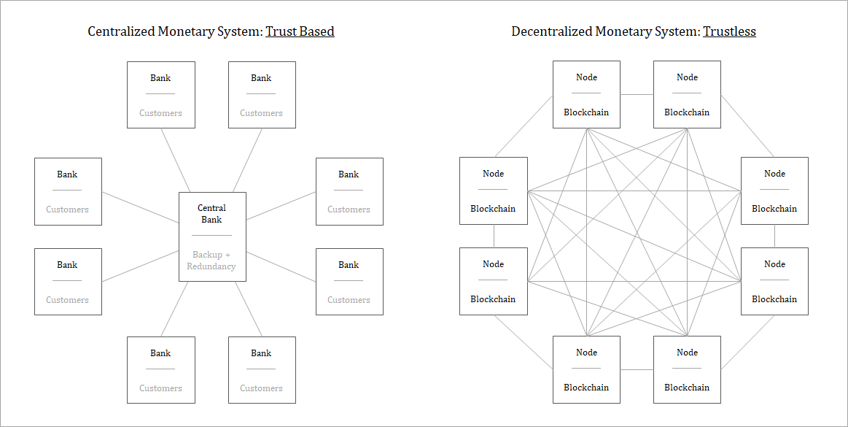

There is no blockchain

Often, bitcoin’s transaction ledger is thought of as a public blockchain that lives somewhere in the cloud like a digital public square where all transactions are aggregated. However, there is no central source of truth; there are no oracles and there is no central public blockchain to which everyone independently commits transactions. Instead, every participant within the network constructs and maintains its own independent version of the blockchain based on a common set of rules; no one trusts anyone and everyone validates everything. Everyone is able to come to the same version of the truth without having to trust any other party. This is core to how bitcoin solves the problem of removing third-party intermediaries from a digital cash system.

Every participant running a node within the bitcoin network independently verifies every transaction and every block; by doing so, each node aggregates its own independent version of the blockchain. Consensus is reached across the network because each node validates every transaction (and each block) based on a core set of rules (and the longest chain wins). If a node broadcasts a transaction or block that does not follow consensus rules, other nodes will reject it as invalid. It is through this function that bitcoin is able to dispose with the need for a central third-party; the network converges on the same consistent state of the chain without anyone trusting any other party. However, the currency plays an integral role in coordinating bitcoin’s consensus mechanism and ordering blocks which ultimately represents bitcoin’s full and valid transaction history (or its blockchain).

The basics of bitcoin: blocks and mining

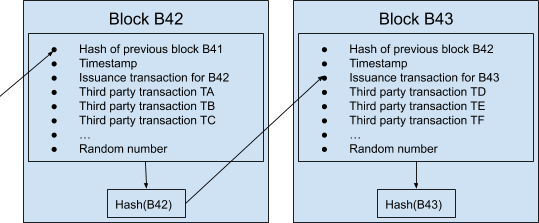

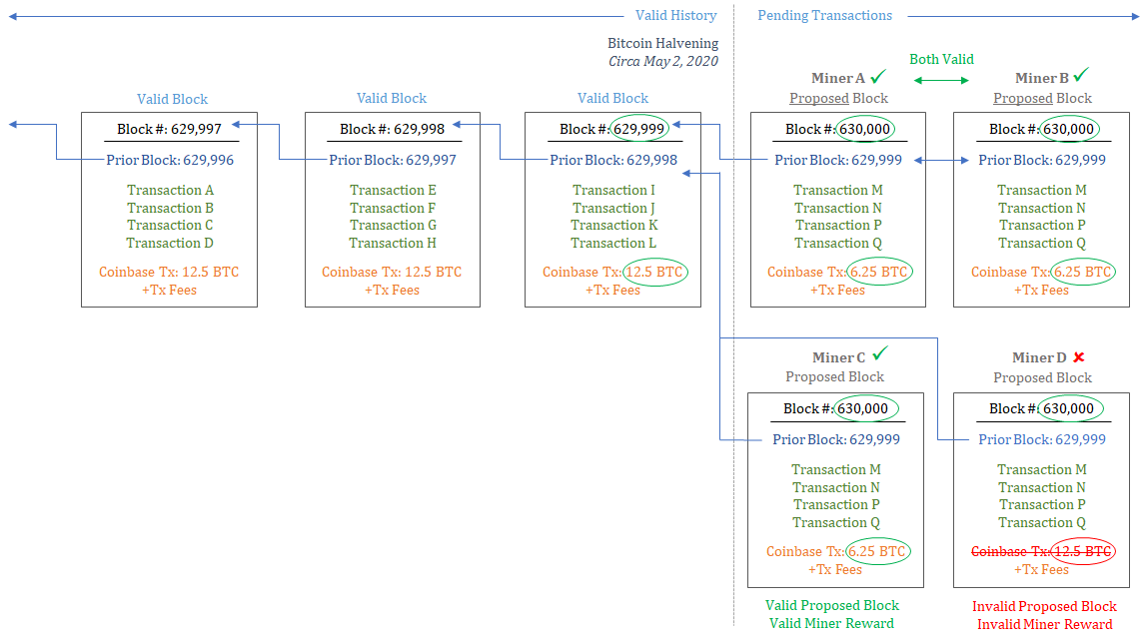

Think of a block as a dataset that links the past to the present. Technically, individual blocks record changes to the overall state of bitcoin ownership within a given time interval. In aggregate, blocks record the entire history of bitcoin transactions as well as ownership of all bitcoin at any point in time. Only changes to the state are recorded in each passing block. How blocks are constructed, solved and validated is critical to the process of network consensus, and it also ensures that bitcoin maintains a fixed supply (21 million). Miners compete to construct and solve blocks that are then proposed to the rest of the network for acceptance. To simplify, think of the mining function as a continual process of validating history and clearing pending bitcoin transactions; with each block, miners add new transaction history to the blockchain and validate the entire history of the chain. It is through this process that miners secure the network; however, all network nodes then check the work performed by miners for validity, ensuring network consensus is enforced. More technically, miners construct blocks that represent data sets which include three critical elements (again simplifying):

- Reference to prior block → validate entire history of chain

- Bitcoin transactions → clear pending transactions (changes to the state of ownership)

- Coinbase transaction + fees → compensation to miners for securing the network

To solve blocks, miners perform what is known as a proof of work function by expending energy resources. In order for blocks to be valid, all inputs must be valid and each block must satisfy the current network difficulty. To satisfy the network difficulty, a random value (referred to as a nonce) is added to each block and then the combined data set is run through bitcoin’s cryptographic hashing algorithm (SHA-256); the resulting output (or hash) must achieve the network’s difficulty in order to be valid. Think of this as a simple guess and check function, but probabilistically, trillions of random values must be guessed and checked in order to create a valid proof for each proposed block. The addition of a random nonce may seem extraneous. But, it is this function that forces miners to expend significant energy resources in order to solve a block, which ultimately makes the network more secure by making it extremely costly to attack.

Adding a random nonce to a proposed block, which is an otherwise static data set, causes each resulting output (or hash) to be unique; with each different nonce checked, the resulting output has an equally small chance of achieving the network difficulty (i.e. representing a valid proof). While it is often referred to as a highly complicated mathematical problem, in reality, it is difficult only because a valid proof requires guessing and checking trillions of possible solutions. There are no shortcuts; energy must be expended. A valid proof is easy to verify by other nodes but impossible to solve without expending massive amount of resources; as more mining resources are added to the network, the network difficulty increases, requiring more inputs to be checked and more energy resources to be expended to solve each block. Essentially, there is material cost to miners in solving blocks but all other nodes can then validate the work very easily at practically no cost.

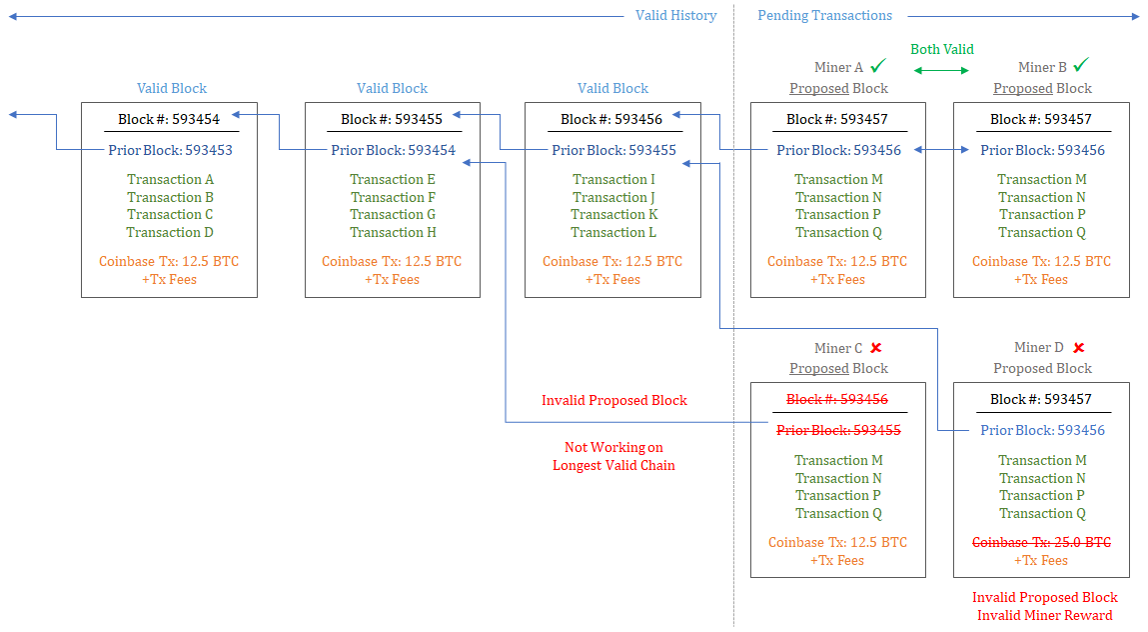

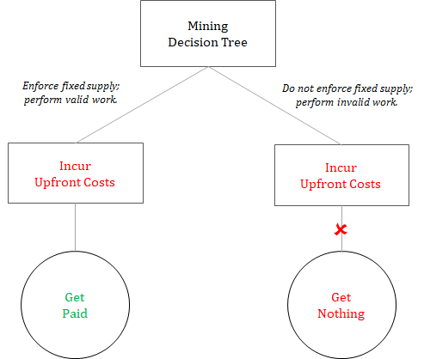

In aggregate, the incentive structure allows the network to reach consensus. Miners must incur significant upfront cost to secure the network but are only paid if valid work is produced; and the rest of the network can immediately determine whether work is valid or not based on consensus rules without incurring cost. While there are a number of consensus rules, if any pending transaction in a block is invalid, the entire block is invalid. For a transaction to be valid, it must have originated from a previous, valid bitcoin block and it cannot be a duplicate of a previously spent transaction; separately, each block must build off the most up to date version of history in order to be valid and it must also include a valid coinbase transaction. A coinbase transaction rewards miners with newly issued bitcoin in return for securing the network but it is only valid if the work is valid.

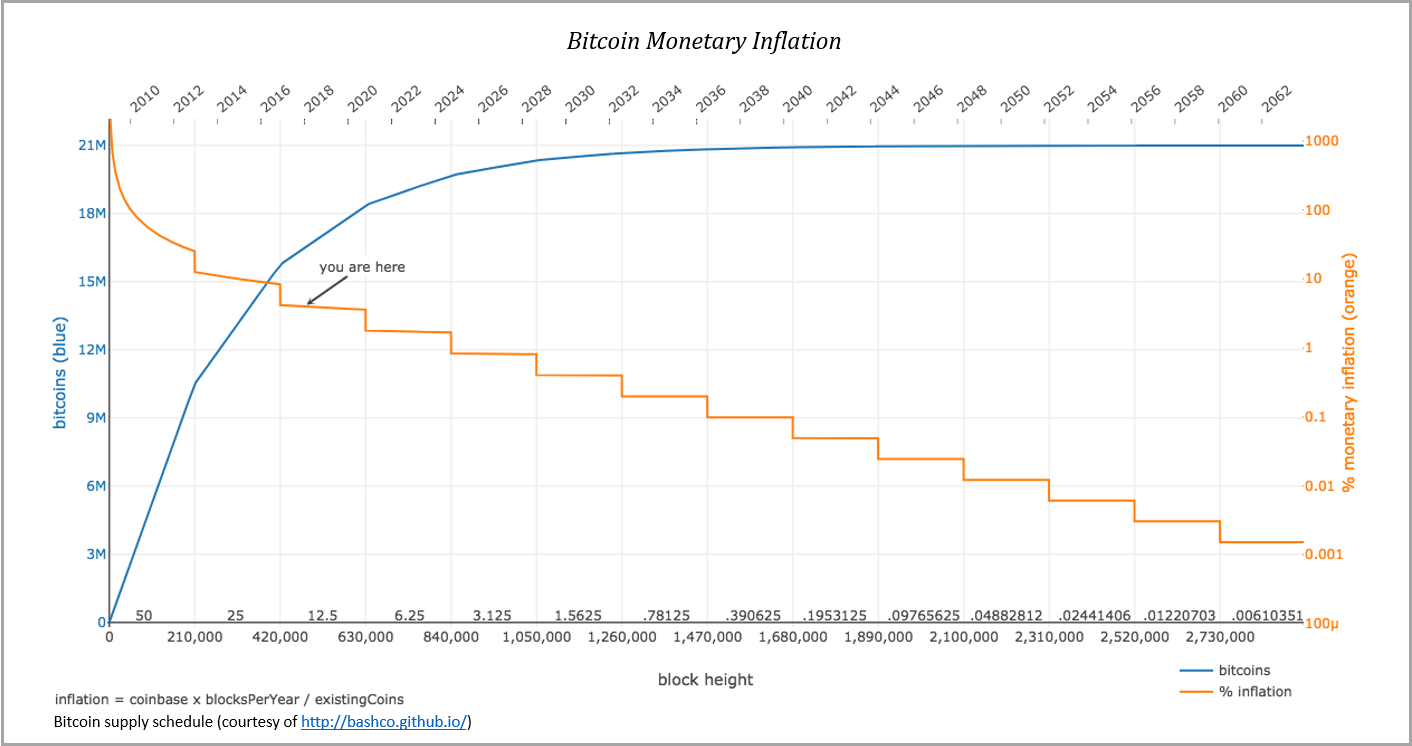

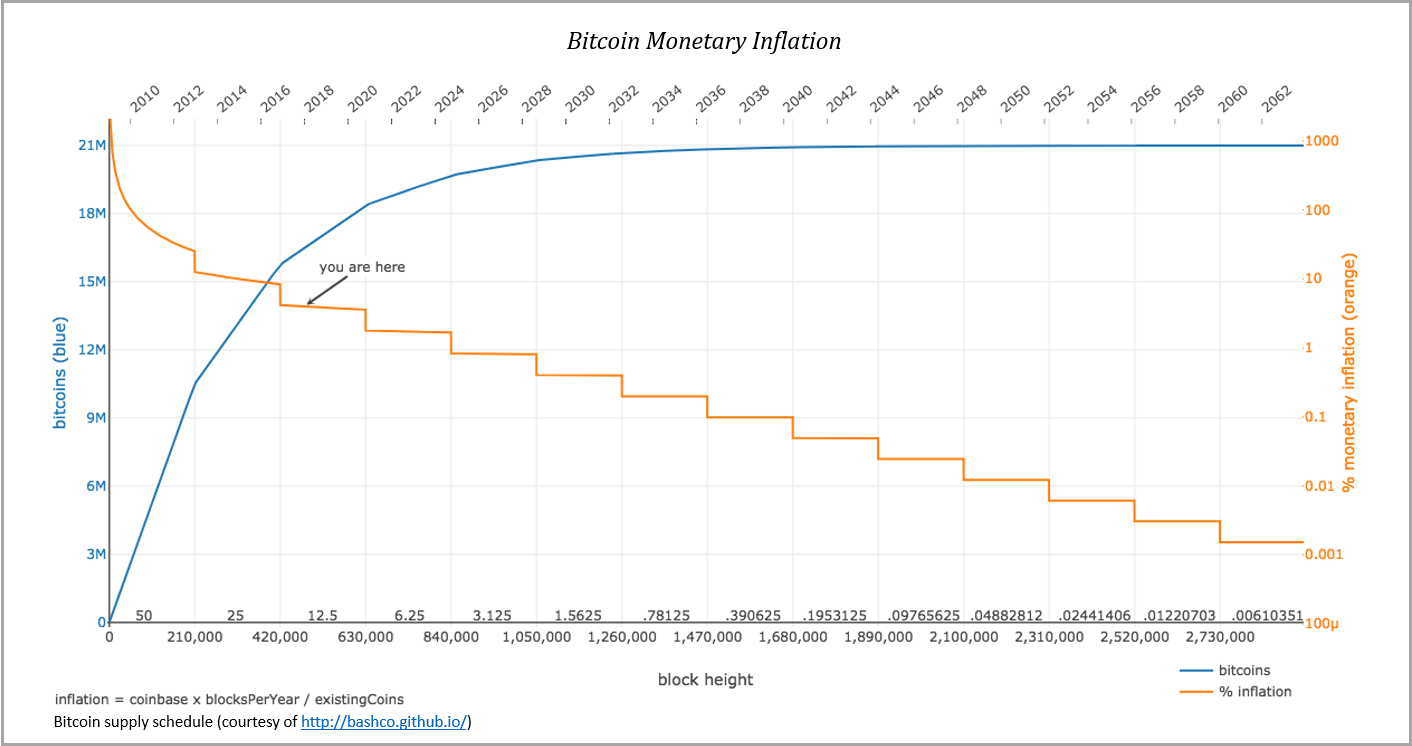

Coinbase rewards are governed by a predetermined supply schedule and currently, 12.5 new bitcoin are issued in each valid block; in approximately eight months, the reward will be cut in half to 6.25 new bitcoin, and every 210,000 blocks (or approximately every four years), the reward will continue to be halved until it ultimately reaches zero. If miners include an invalid reward in a proposed block, the rest of the network will reject it as invalid which is the base mechanism that governs a capped total supply of 21 million bitcoin. However, software alone is insufficient to ensure either a fixed supply or an accurate transaction ledger; economic incentives hold everything together.

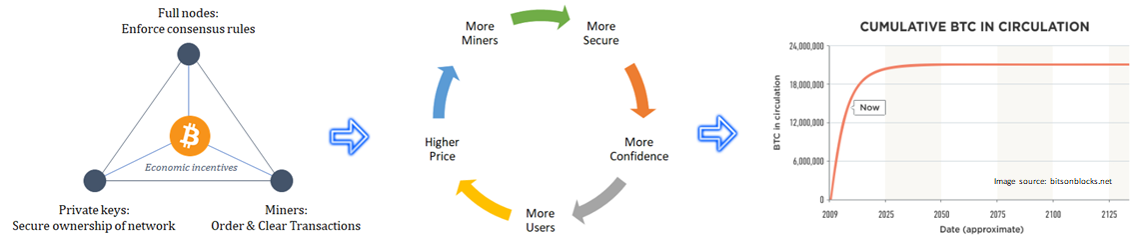

Consensus on a decentralized basis

Why is this so important? Within one integrated function, miners validate history, clear transactions and get paid for security on a trustless basis; the integrity of bitcoin’s fixed supply is embedded in its security function, and because the rest of the network independently validates the work, consensus can be reached on a decentralized basis. If a miner completes valid work, it can rely on the fact that it will be paid on a trustless basis. Conversely, if a miner completes invalid work, the rest of the network enforces the rules, essentially withholding payment until valid work is completed. And supply of the currency is baked into validity; if a miner wants to be paid, it must also enforce the fixed supply of the currency, further aligning the entire network. The incentive structure of the currency is so strong that everyone is forced to adhere to the rules, which is the chief facilitator of decentralized consensus.

If a miner solves and proposes an invalid block, specifically one that either includes invalid transactions or an invalid coinbase reward, the rest of the network will reject it as invalid. Separately, if a miner builds off a version of history that does not represent the longest chain with the greatest proof of work, any proposed block would also be considered invalid. Essentially, as soon as a miner sees a new valid block proposed in the network, it must immediately begin to work on top of that block or risk falling behind and performing invalid work at a sunk cost. As a consequence, in either scenario, if a miner were to produce invalid work, it would incur real cost but would be compensated nothing in return.

Through this mechanism, miners are maximally incentivized to produce honest, valid work and to work within the consensus of the chain at all times; it is either be paid or receive nothing. It is also why the higher the cost to perform the work, the more secure the network becomes. The more energy required to write or rewrite bitcoin’s transaction history, the lower the probability that any single miner could (or would) undermine the network. The incentive to cooperate increases as it becomes more costly to produce work which would otherwise be considered invalid by the rest of the network. As network security increases, bitcoin becomes more valuable. As the value of bitcoin rises and as the costs to solve blocks increases, the incentive to produce valid work increases (more revenue but more cost) and the penalty for invalid work becomes more punitive (no revenue and more cost).

Why don’t the miners collude? First, they can’t. Second, they tried. But third, the fundamental reason is that as the network grows, the network becomes more fragmented and the economic value compensated to miners in aggregate increases; from a game theory perspective, more competition and greater opportunity cost makes it harder to collude and all network nodes validate the work performed by miners which is a constant check and balance. Miners are merely paid to perform a service and the more miners there are, the greater the incentive to cooperate because the probability that a miner is penalized for invalid work increases as more competition exists. And recall that random nonce value; it seemed extraneous at the time but it is core to the function that requires energy resources be expended. It is this tangible cost (skin in the game) combined with the value of the currency which incentivizes valid work and which allows the network to reach consensus.

Because all network nodes independently validate blocks and because miners are maximally penalized for invalid work, the network is able to form a consensus as to the accurate state of the chain without relying on any single source of knowledge or truth. None of this decentralized coordination would be possible without bitcoin, the currency; all the bitcoin network has to compensate miners in return for security is its native currency, whether that is largely in the form of newly issued bitcoin today or exclusively in the form of transaction fees in the future. If the compensation paid to miners were not reasonably considered to be a reliable form of money, the incentive to make the investments to perform the work would not exist.

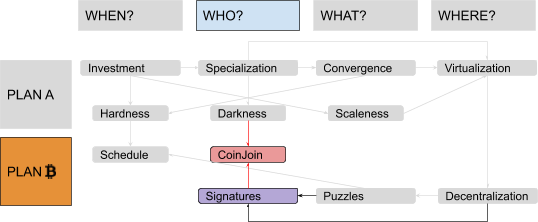

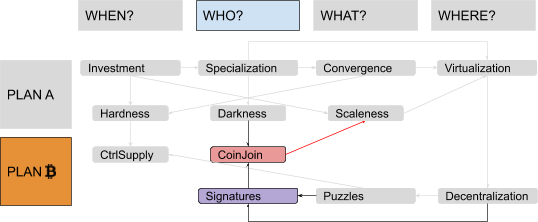

The role of money in a blockchain

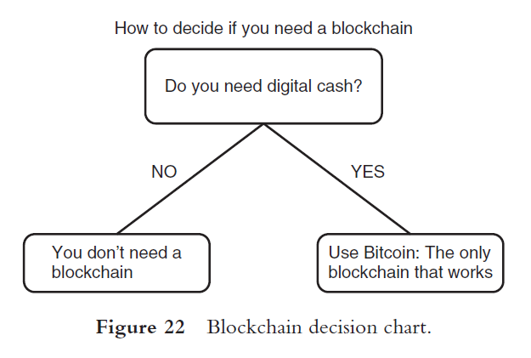

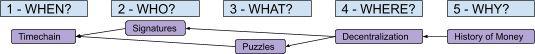

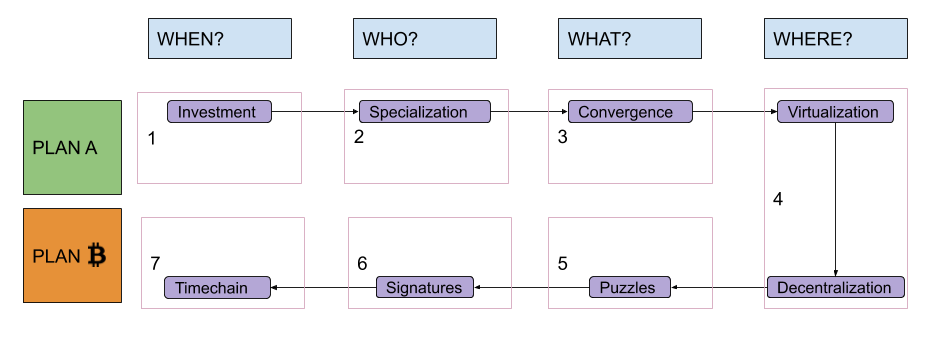

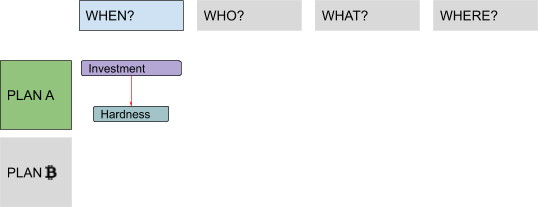

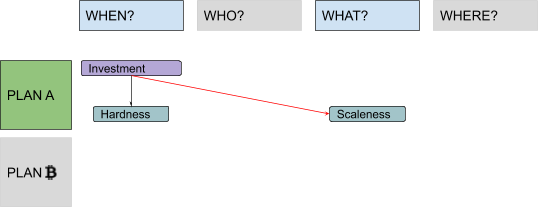

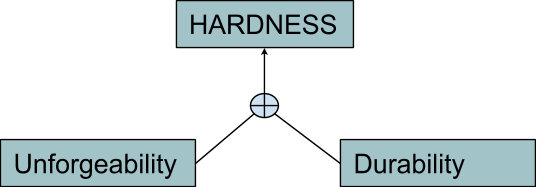

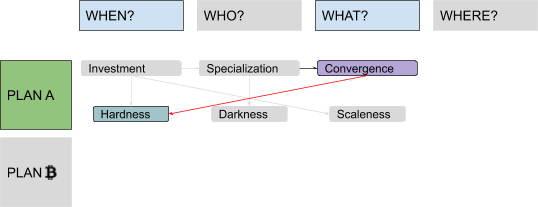

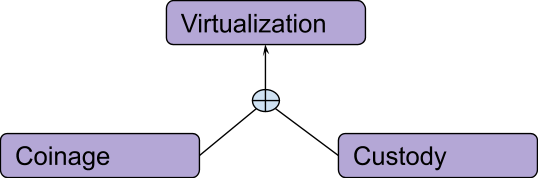

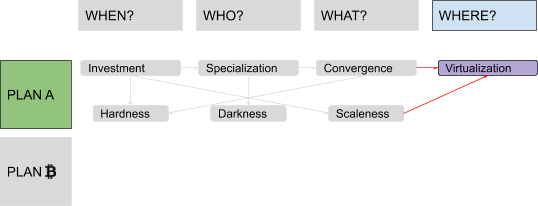

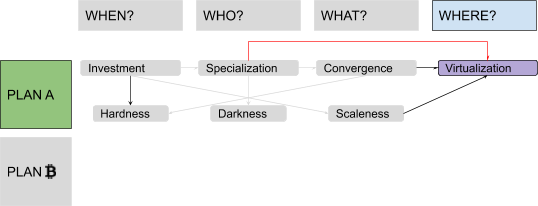

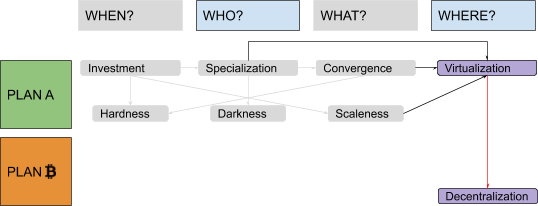

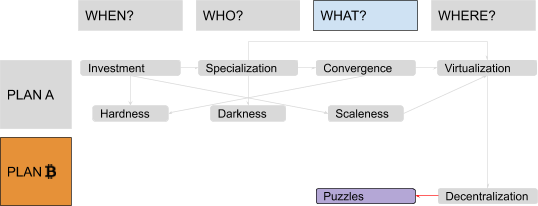

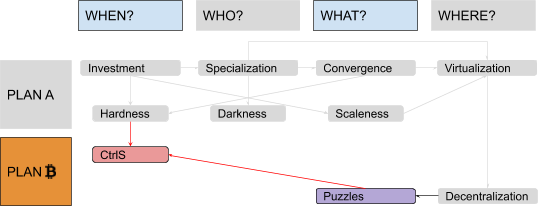

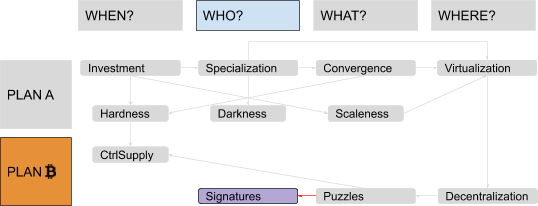

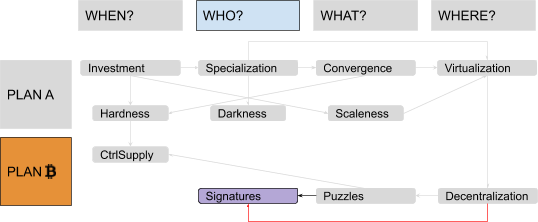

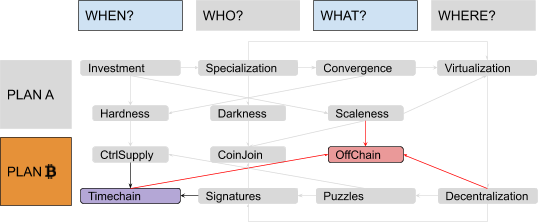

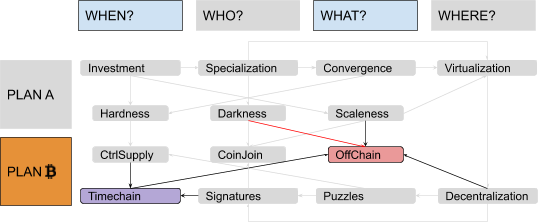

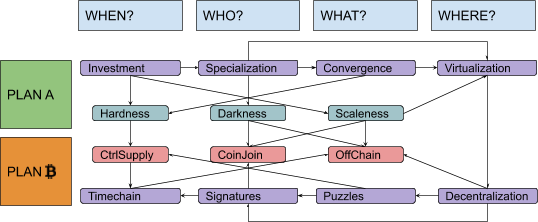

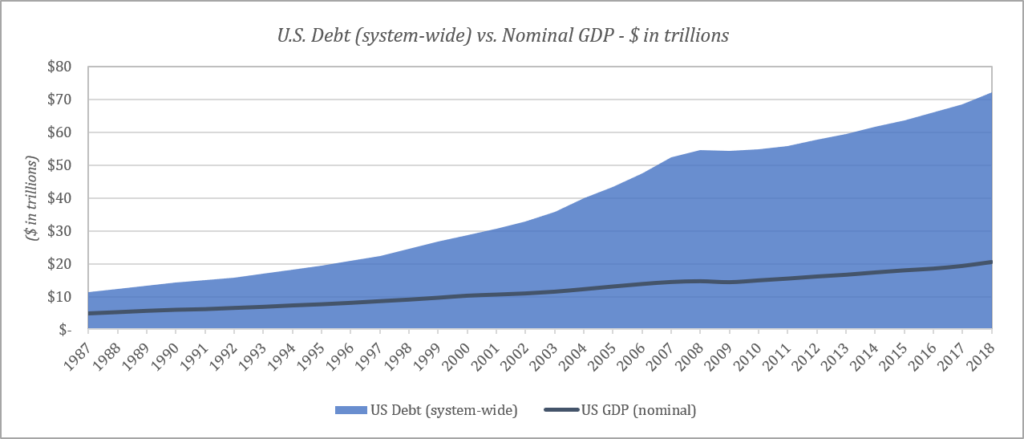

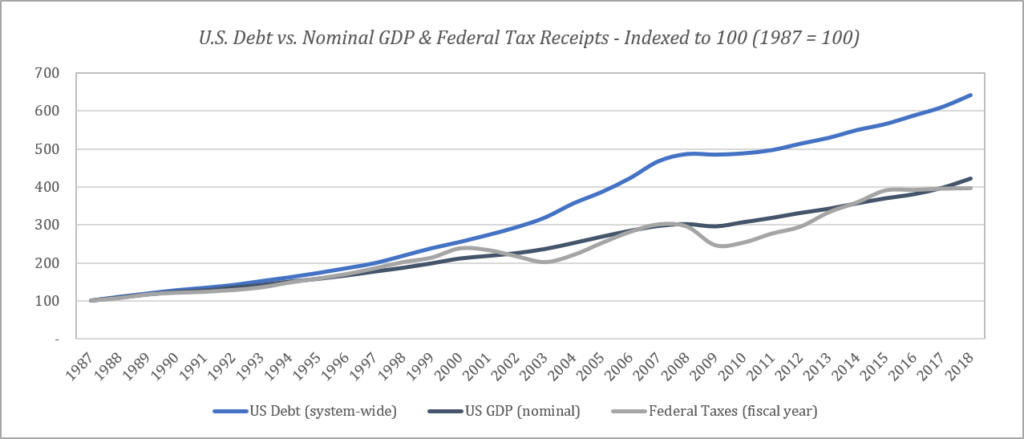

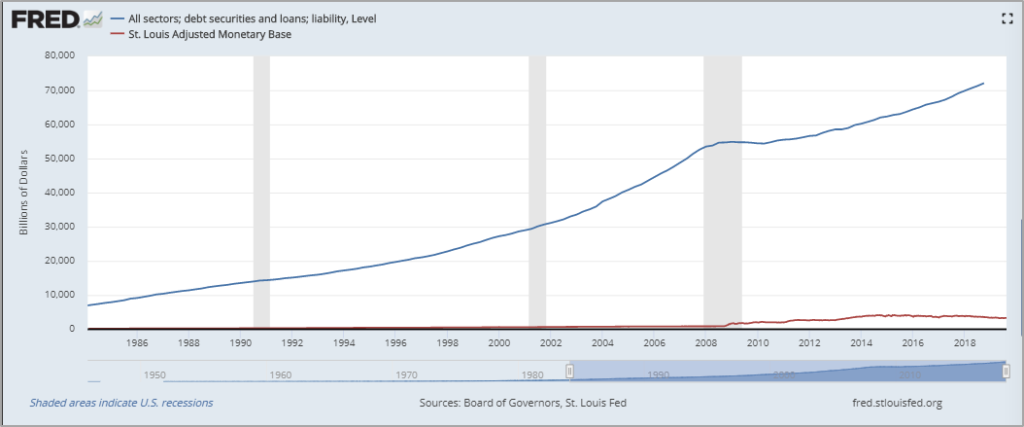

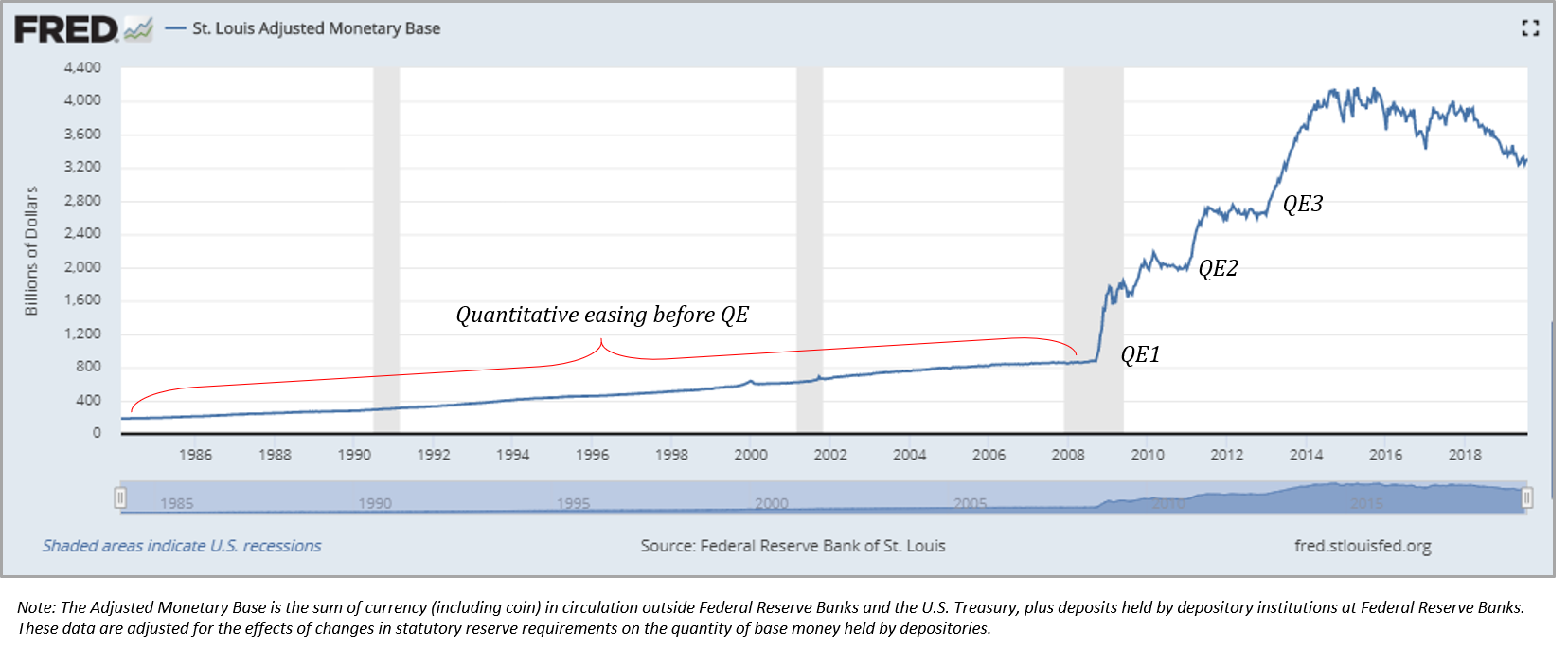

Recall from Bitcoin Can’t Be Copied, if an asset’s primary (if not sole) utility is the exchange for other goods and services, and if it does not have a claim on the income stream of a productive asset (such as a stock or bond), it must compete as a form of money and will only store value if it possesses credible monetary properties. Bitcoin is a bearer asset, and it has no utility other than the exchange for other goods or services. It also has no claim on the income stream of a productive asset. As such, bitcoin is only valuable as a form of money and it only holds value because it has credible monetary properties (read The Bitcoin Standard, chapter 1). By definition, this is true of any blockchain; all any blockchain can offer in return for security is a monetary asset native to the network, without any enforceable claims outside the network, which is why a blockchain can only be useful in connection to the application of money. The chart below from The Bitcoin Standard articulates this point:

Without a native currency, a blockchain must rely on trust for security which eliminates the need for a blockchain in the first place. In practice, the security function of bitcoin (mining), which protects the validity of the chain on a trustless basis, requires significant upfront capital investment in addition to high marginal cost (energy consumption). In order to recoup that investment and a rate of return in the future, the payment in the form of bitcoin must more than offset the aggregate costs, otherwise the investments would not be made. Essentially, what the miners are paid to protect (bitcoin) must be a reliable form of money in order to incentivize security investments in the first place.

This is also fundamental to the incentive structure that aligns the network; miners have an embedded incentive to not undermine the network because it would directly undermine the value of the currency in which miners are compensated. If bitcoin were not valued as money, there would be no miners, and without miners, there would be no chain worth protecting. The validity of the chain is ultimately what miners are paid to protect; if the network could not reasonably come to a consensus and if ownership were subject to change, no one could reasonably rely on bitcoin as a value transfer mechanism. The value of the currency ultimately protects the chain, and the immutability of the chain is foundational to the currency having value. It’s an inherently self-reinforcing relationship.

Immutability is an emergent property

Immutability is an emergent property in bitcoin, not a trait of a blockchain. A global, decentralized monetary network with no central authority could not function without an immutable ledger (i.e. if the history of the blockchain were insecure and subject to change). If settlement of the unit of value (bitcoin) could not reliably be considered final, no one would reasonably trade real world value in return. As an example, consider a scenario in which one party purchased a car from another in return for bitcoin. Assume the title for the car transfers, and the individual that purchased the car takes physical possession. If bitcoin’s record of ownership could easily be re-written or altered (i.e. changing the history of the blockchain), the party that originally transferred the bitcoin in return for the car could wind up in possession of both the bitcoin and the car, while the other party could end up with neither. This is why immutability and final settlement is critical to bitcoin’s function.

Remember that bitcoin has no knowledge of the outside world; all bitcoin knows how to do is issue and validate currency (whether a bitcoin is a bitcoin). Bitcoin is not capable of enforcing anything that exists outside the network (nor is any blockchain); it is an entirely self-contained system and the bitcoin network can only ever validate one side of a two-sided value transfer. If bitcoin transfers could not reliably be considered final, it would be functionally impossible to ever trade anything of value in return for bitcoin. This is why the immutability of bitcoin’s blockchain is inextricably linked to the value of bitcoin as a currency. Final settlement in bitcoin is possible but only because its ledger is reliably immutable. And its ledger is only reliably immutable because its currency is valuable. The more valuable bitcoin becomes, the more security it can afford; the greater the security, the more reliable and trusted the ledger.

Ultimately, immutability is an emergent property, but it is dependent on other emergent network properties. As bitcoin becomes more decentralized, it becomes increasingly difficult to alter the network’s consensus rules and increasingly difficult to invalidate or prevent otherwise valid transactions (often referred to as censorship-resistance). As bitcoin proves to be increasingly censorship-resistant, confidence in the network grows, which fuels adoption, which further decentralizes the network, including its mining function. In essence, bitcoin becomes more decentralized and more censorship-resistant as it grows, which reinforces the immutability of its blockchain. It becomes increasingly difficult to change the history of the blockchain because each participant gradually represents a smaller and smaller share of the network; regardless of how concentrated ownership of the network and mining may be at any point in time, both decentralize over time so long as value increases, which causes bitcoin to become more and more immutable.

Bitcoin, not blockchain

This multi-dimensional incentive structure is complicated but it is critical to understanding how bitcoin works and why bitcoin and its blockchain are dependent on each other. Why each is a tool that relies on the other. Without one, the other is effectively meaningless. And this symbiotic relationship only works for money. Bitcoin as an economic good is only valuable as a form of money because it has no other utility. This is true of any asset native to a blockchain. The only value bitcoin can ultimately provide is through present or future exchange. And the network is only capable of a single aggregate function: validating whether a bitcoin is a bitcoin and recording ownership.

The bitcoin network is a closed loop and an entirely independent system; its only connection to the physical world is through its security and clearing function. The blockchain maintains a record of ownership and the currency is used to pay for the security of those records. It is through the function of its currency that the network can afford a level of security to ensure immutability of the blockchain, which allows network participants to more easily and consistently reach consensus without the need for trust in any third-parties. The cumulative effect is a decentralized and trustless monetary system with a fixed supply that is global in reach and accessible on a permissionless basis.

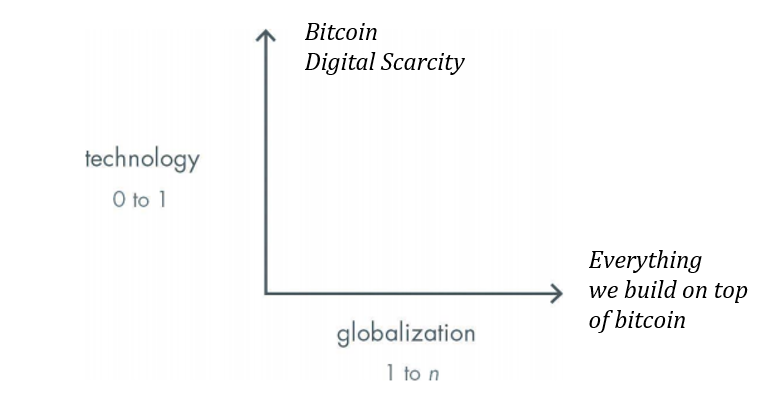

Every other fiat currency, commodity money or cryptocurrency is competing for the exact same use case as bitcoin whether it is understood or not, and monetary systems tend to a single medium because their utility is liquidity rather than consumption or production. When evaluating monetary networks, it would be irrational to store value in a smaller, less liquid and less secure network if a larger, more liquid and more secure network existed as an attainable option. Bitcoin is valuable, not because of a particular feature, but instead, because it achieved finite, digital scarcity. This is the backbone of why bitcoin is secure as a monetary network and it is a property that is dependent on many other emergent properties.

A blockchain on the other hand is simply an invention native to bitcoin that enables the removal of trusted third parties. It serves no other purpose. It is only valuable in bitcoin as a piece to a larger puzzle and it would be useless if not functioning in concert with the currency. The integrity of bitcoin’s scarcity and the immutability of its blockchain are ultimately dependent on the value of the currency itself. Confidence in the aggregate function drives incremental adoption and liquidity which reinforces and strengthens the value of the bitcoin network as a whole. As individuals opt in to bitcoin, they are at the same time, opting out of inferior monetary networks. This is fundamentally why the emergent properties in bitcoin are next to impossible to replicate and why its monetary properties become stronger over time (and with greater scale), while also at the direct expense of inferior monetary networks.

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take them violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.” -F. A. Hayek

Ultimately, a blockchain is only useful in the application of money because it is dependent on a native currency for security. Bitcoin represents the most secure blockchain by orders of magnitude. Because all other blockchains are competing for the same fundamental use case of money and because bitcoin’s network effects only continue to increase its security and liquidity advantage over the field, no other digital currency can compete with bitcoin. Liquidity begets liquidity and monetary systems tend to one medium as a derivative function. Bitcoin’s security and liquidity obsoleted any other cryptocurrencies before they left the proverbial gates. Find me a cryptocurrency that comes close to bitcoin relative to security, liquidity or the credibility of its monetary properties, and I will find you a unicorn.

The real competition for bitcoin has and will remain the legacy monetary networks, principally the dollar, euro, yen and gold. Think about bitcoin relative to these legacy monetary assets as part of your education. Bitcoin does not exist in a vacuum; it represents a choice relative to other forms of money. Evaluate it based on the relative strengths of its monetary properties and once a baseline is established between bitcoin and the legacy systems, this will then provide a strong foundation to more easily evaluate any other blockchain related project.

To learn more, I suggest reading, The Bitcoin Standard (Saifedean Ammous), Inventing Bitcoin (Yan Pritzker) and Mastering Bitcoin (Andreas Antonopolous), probably in that order.

Next week: to be determined…

Thanks to Will Cole, Phil Geiger and Adam Tzagournis for reviewing and providing valuable feedback. Also thanks to Saif, Yan and Andreas for their books which are incredible resources.

Views presented are expressly my own and not those of Unchained Capital or my colleagues; if you would like to subscribe to weekly releases, please click here.

Mainstream Media of Exchange

By Knut Svanholm

Posted September 6, 2019

What is a Medium of Exchange? A monetary good is often described as a Store of Value, a Medium of Exchange and a Unit of Account. But what do these mean and in what order are they important for a monetary good to succeed, short term and long term? It all depends on the depth of one’s analysis.

Let’s rewind to the dawn of civilized society. Money hasn’t really been invented yet and good old barter is the only means of trading there is. I will give you my three goats if you give me your cow. If the receiver of this proposal values three goats more than one cow, an exchange occurs. This is at the very core of all human interaction that isn’t violent. Both parties believe that they stand to gain something from the interaction. If this wasn’t the case, no interaction would have taken place. But how can I know that one or more of my three goats won’t be used as barter in another exchange of which I’m not a participant? I can’t and neither can anyone else, except the new owner of these bearded omnivores. They are by definition a Medium of Exchange. So is everything else. Every physical thing that anyone has ever claimed ownership of can be used as a Medium of Exchange. The good’s usefulness as such however, is another matter.

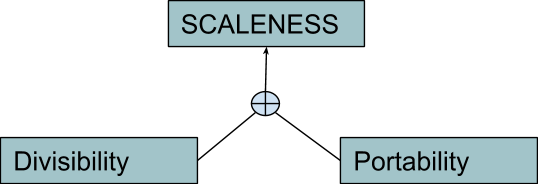

A goat is hardly considered to be a very effective form of value bearing asset by anyone. Let’s examine why. In order for a good to be a useful Medium of Exchange it needs to be portable, divisible, fungible and not easily confiscatable but it also needs to be able to store value, at least short term. Storing value is the trickiest part since what anyone finds valuable is entirely subjective. This is easy to forget. In what order the other monetary properties are important depends on how, where, why and when the supposed exchange takes place. A car, for instance, can be considered relatively portable if it works and the potential buyer is within an acceptable range but it’s not very divisible and quite easy to confiscate. In-game gold or Monopoly money on the other hand is very divisible and portable but not very fungible since it’s almost exclusively attractive to those playing a very specific game at a very specific point in time. These examples might seem arbitrary and insignificant to any real world economy, but the truth is that the only thing separating money from other goods as media of exchange is its usefulness as such.

In order for anyone to accept something as payment for another thing they need to be confident that this something will not lose its value anytime soon. This is the one key property that any method of payment must hold. An apple can be bought for a certain amount of money but no one would accept apples as payment for a new car since the apples would rot and lose their value well before he could exchange them for something else. What everyone seems to have forgotten is that the same is true for fiat money. Your Dollars or Euros won’t rot overnight but they will rot over a couple of decades. No one stacks money in their mattress anymore because of this. Inflation deprives us of the ability to store value long term. Because of this, every decision made by every politician, every merchant and every entrepreneur is corroded by short term thinking. Human progress is equipped with a damper and we’re not as progressive, effective or innovative as we could be. All because of our inability to resist the urge to dilute our money supply. The temptation to counterfeit has existed as long as money has and no civilization has ever been able to stop it. On the contrary, we’ve been very inventive when it comes to inventing excuses for this behavior.

Enter Bitcoin. A monetary entity that no human can alter or even influence at this point. A very divisible token directly linked to the most fundamental thing of value the universe has to offer — energy. A means of converting energy into a part of the worlds only digital pie, of which no more than 21 million (times a hundred million) slices can ever be cut. A portable, divisible, fungible and not easily confiscatable form of money that exists and proves its superiority to the existing system every day. So why isn’t Bitcoin particularly popular as a Medium of Exchange? Will it ever be and, more importantly, does it really matter? To answer this, we must dive a little deeper into the subject. Bitcoin is a very good Store of Value from a personal perspective. You acquire an amount and that amount stays the same no matter how long you keep it. More importantly, that amount will represent the same part of the whole sum of bitcoins that can ever exist no matter how long you keep it. If you want your specific amount of bitcoins to buy you a “lambo”, all you have to do is wait for someone to be willing to sell you a “lambo” for that amount. This might take a while (or it might not) but if Bitcoin just manages to keep on doing what it does, this day will happen. It is only a matter of time because, unlike “lambos”, bitcoins are scarce. Very scarce. Even absolutely scarce, which is a property of an asset that mankind has never encountered before. More and more people realize this which is why they’re reluctant to sell their bitcoins. The newly minted bitcoins that are mined every day need to be sold in order for the miner’s business models to work but the ones that are already in circulation tend to stay where they are because people value them a lot higher than what the current price in dollars or euros happen to be.

A good Medium of Exchange needs to be able to store value. The better it stores value however, the less likely people are to exchange it for something that isn’t likely to store value as well. Bitcoin’s value has such a large potential upside that people refuse to exchange it for frivolous things such as coffee or even mass produced cars. Contrary to what one might think, this doesn’t make it a bad Medium of Exchange. Quite the opposite. How often a Medium of Exchange is used is not the correct metric to look at when trying to measure its usefulness as such a medium. This misses the point. What should be measured is said medium’s ability to buy you as much or more than you bought it for at some point in time. Bitcoin is the only tool available that practically guarantees this. Fiat money, inflation and the ideas of John Maynard Keynes have distorted our perception of what money ought to be so much that we believe that how convenient it is to buy coffee with it, is the most important thing about it.

Looking only at the merchant adoption and spread of acceptance metrics, Bitcoin still seems to be struggling quite a lot. In reality, this is a non sequitur and has little to do with the actual success and functionality of the network. The price of a bitcoin, as shown by ticker widgets and market cap websites, represents the lowest current price that anyone is willing to accept on an exchange market. Only a very few bitcoin owners are willing to accept this price and most of them are waiting for a better opportunity. Bitcoin is indeed a currency, but it behaves very differently in comparison to all other currencies that preceded it. The fact that people are reluctant to use bitcoin for everything but a few, very important transactions is a proof of bitcoin’s monetary superiority rather than anything else. So forget about coffee, forget about whether you franchise burger joint accepts bitcoin and start focusing on what you can use this tool for. Bitcoin is a true grassroots revolution and it grows from the ground up, not the other way around.

Tweetstorm: 21 Charts

By Hans Hauge

Posted September 10, 2019

I’ve heard people say that being involved in Bitcoin is a game of speculation. Some say it’s all about FUD, FOMO, Fear and Greed or following the crowd. I call BS. Let’s look at the data! Here are 21 Bitcoin charts from @coinmetrics that tell a different story.

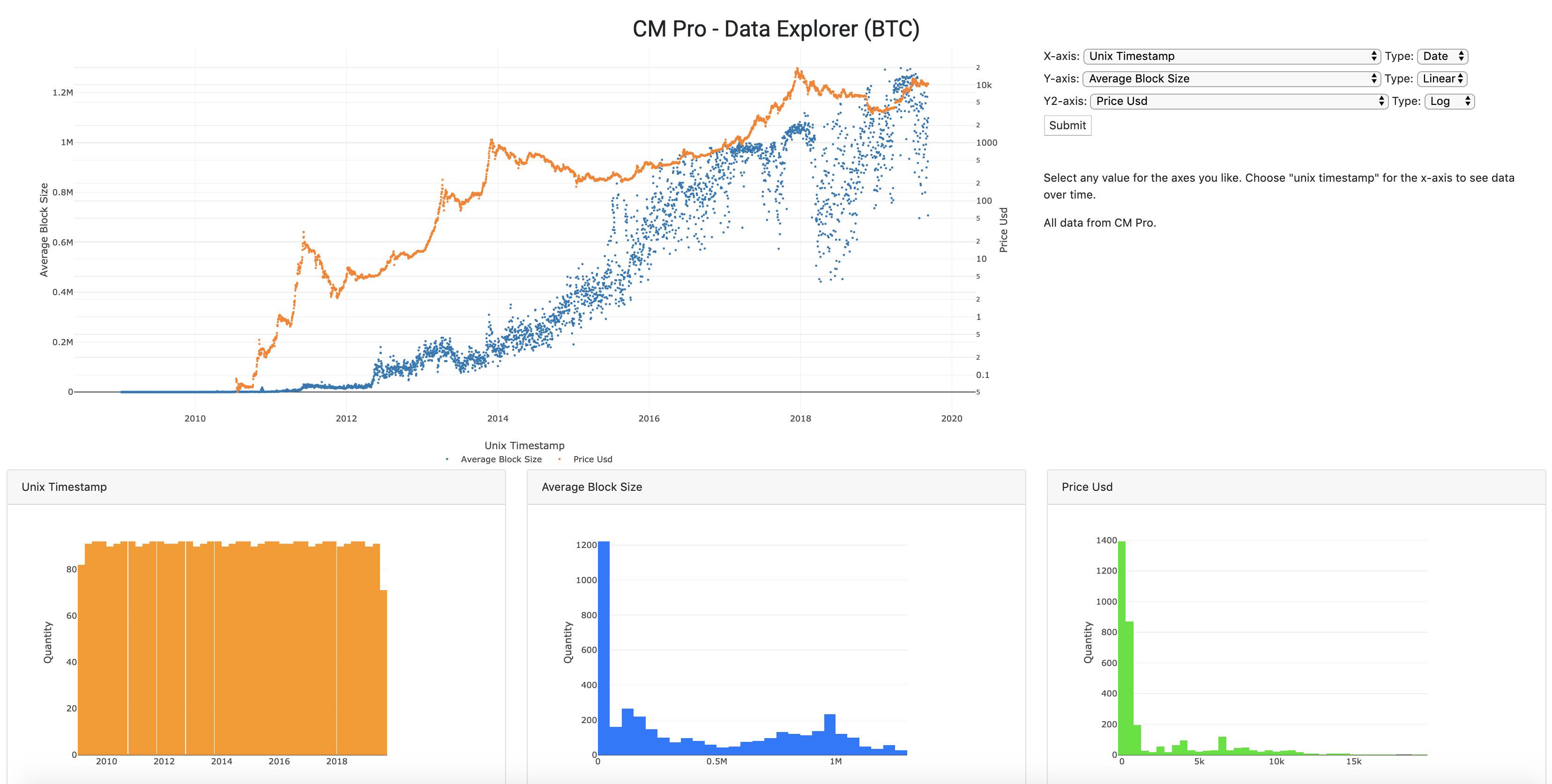

The amount of data being stored on the blockchain has been increasing constantly, regardless of the price. Why do people want to transmit data on the Bitcoin blockchain? It’s all about trust and the ability to transfer value without asking permission!

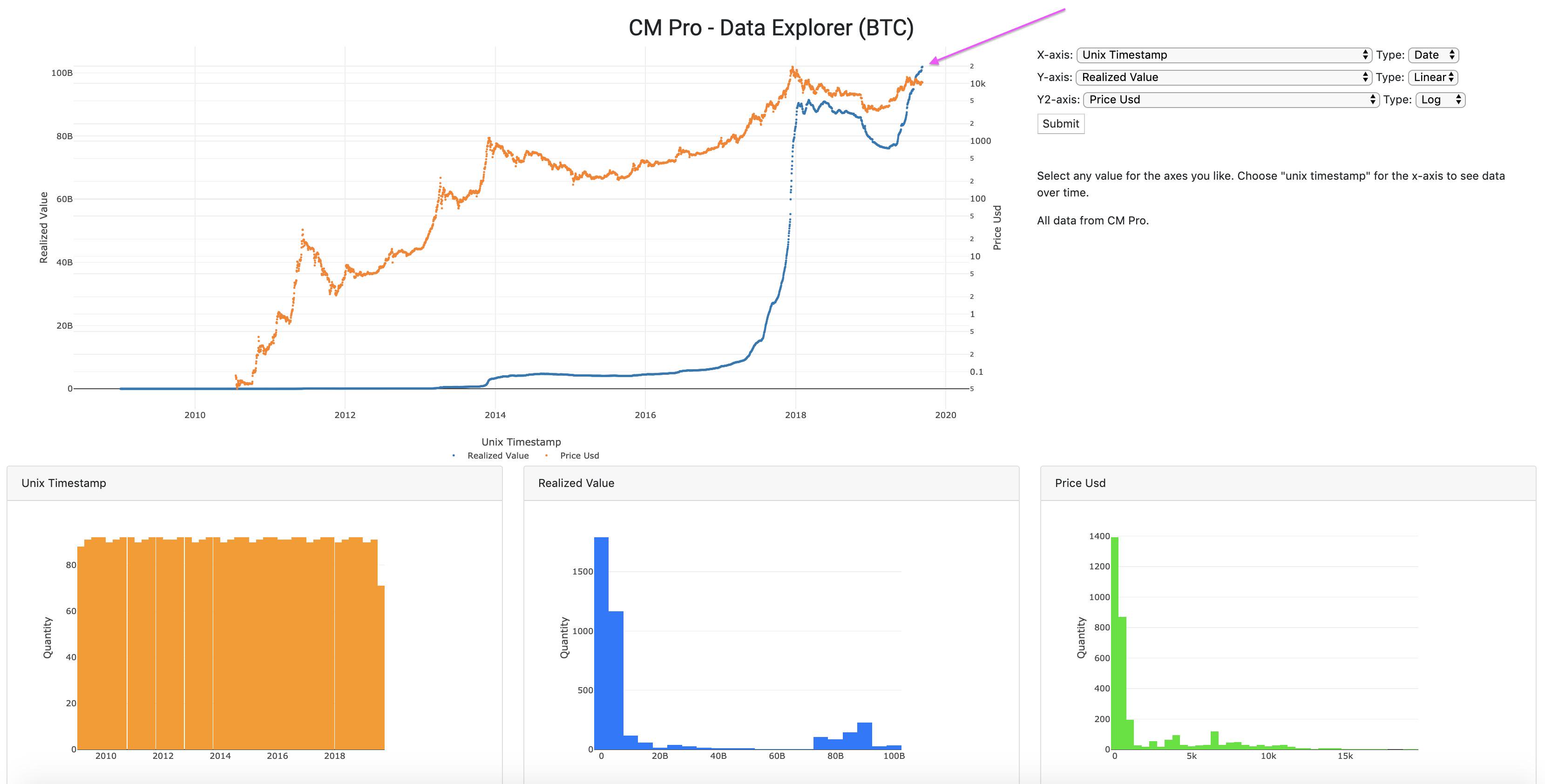

Realized value is at an all-time high. This is the amount the coins are worth the last time they were moved. Look at that momentum…

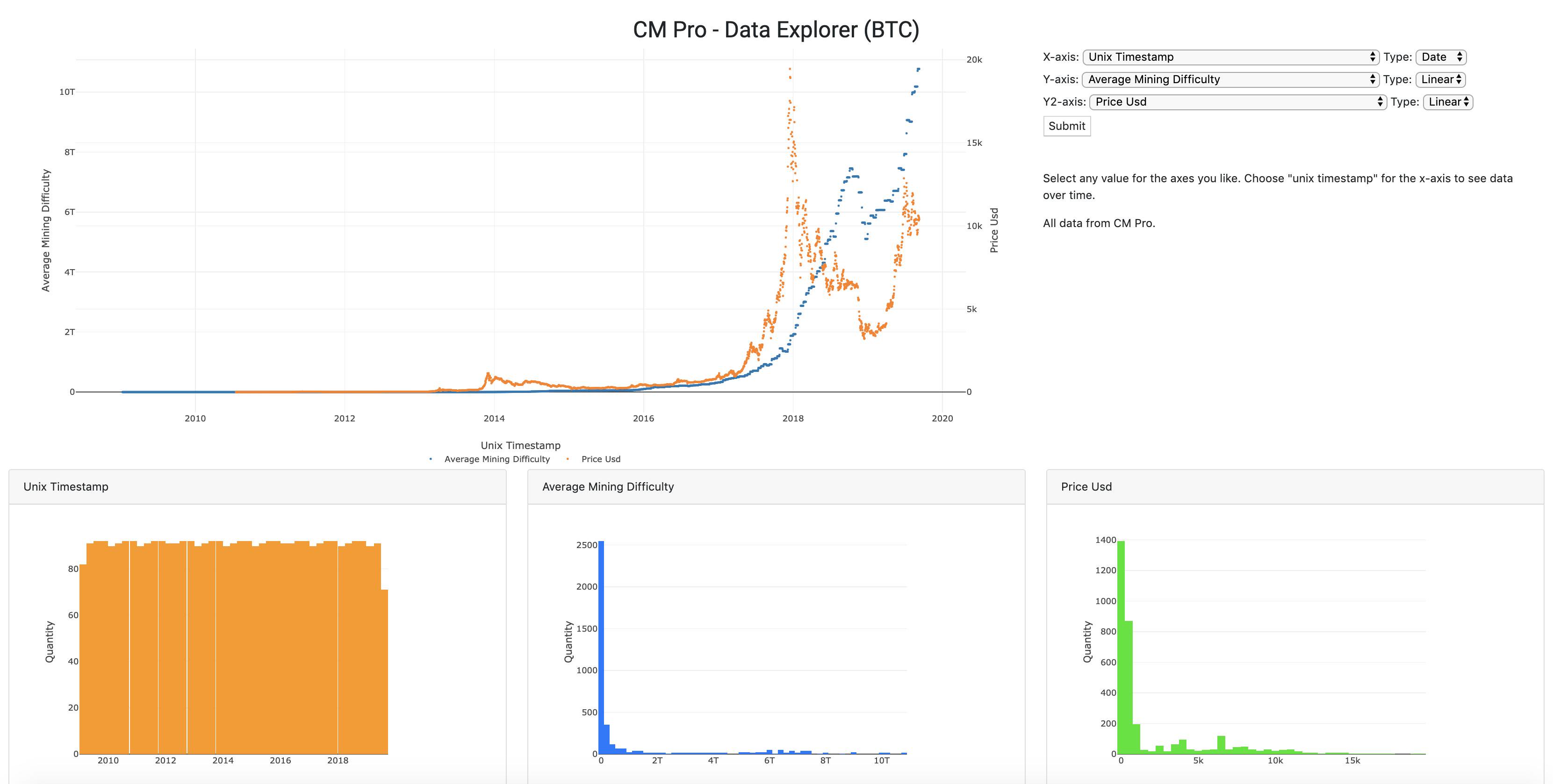

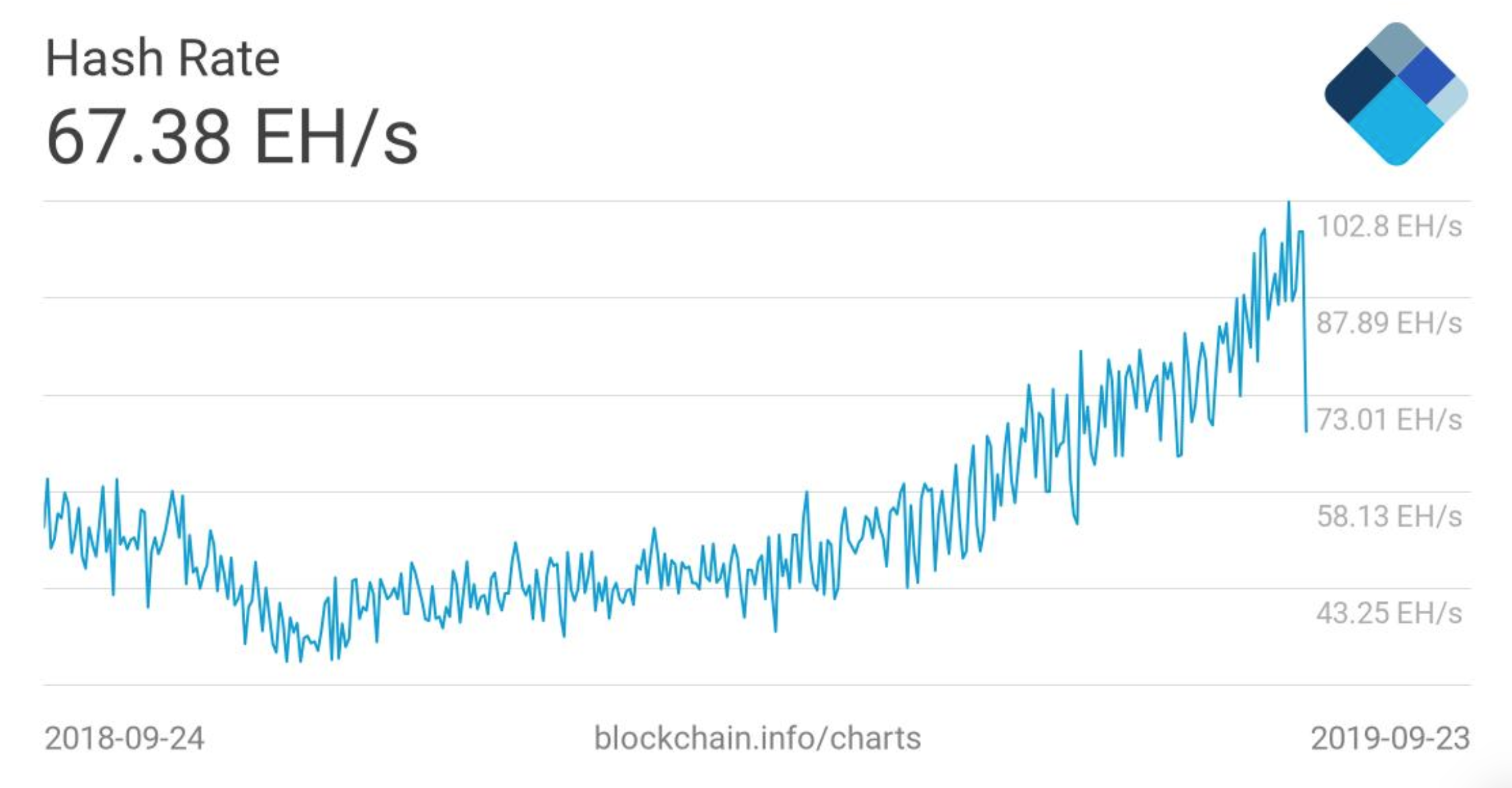

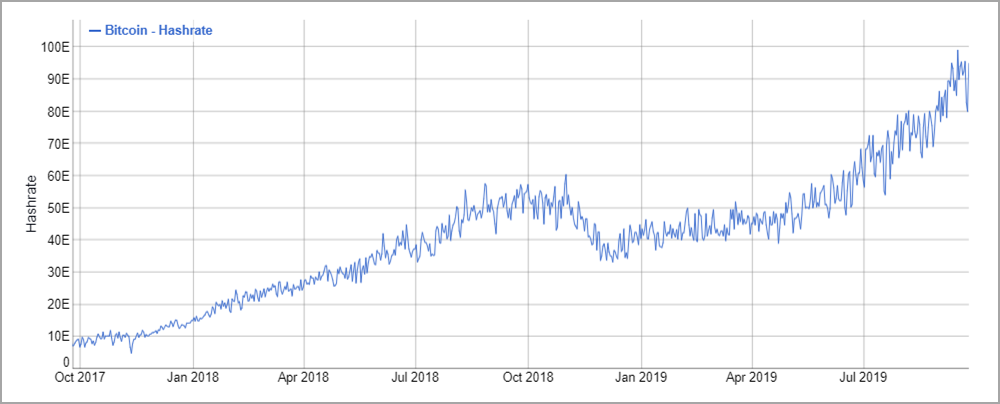

Look at the current mining difficulty. This represents an immense investment in infrastructure for the future of Bitcoin. Do the miners look worried to you? I estimate this represents at least a $10B investment in CAPEX and look at the growth…

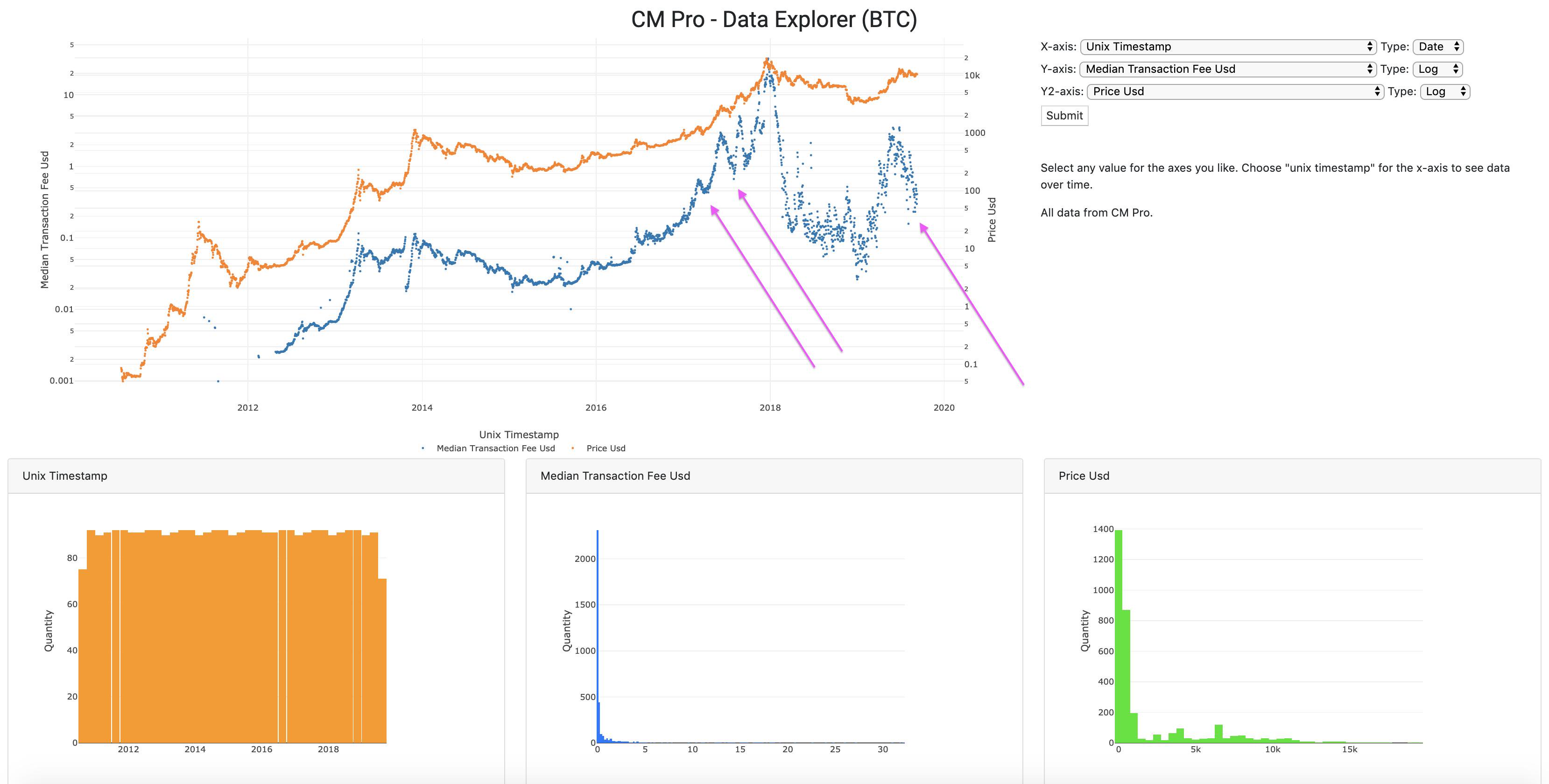

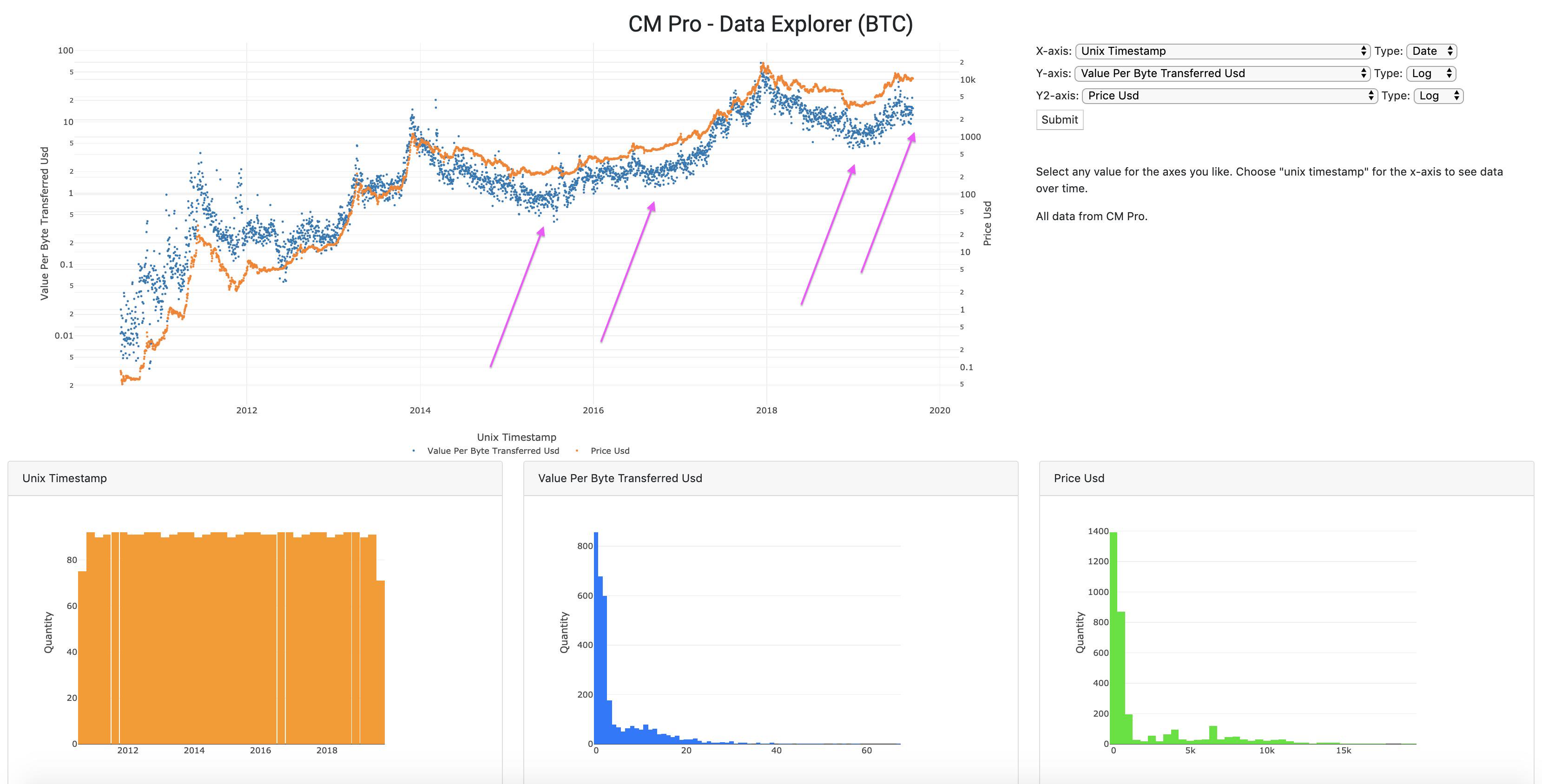

Check out the median transaction fee pull-back. The same thing happened in the last bubble. The price at those arrows on the left was $1k and $2.6k, which seemed high at the time. In retrospect, de nada.

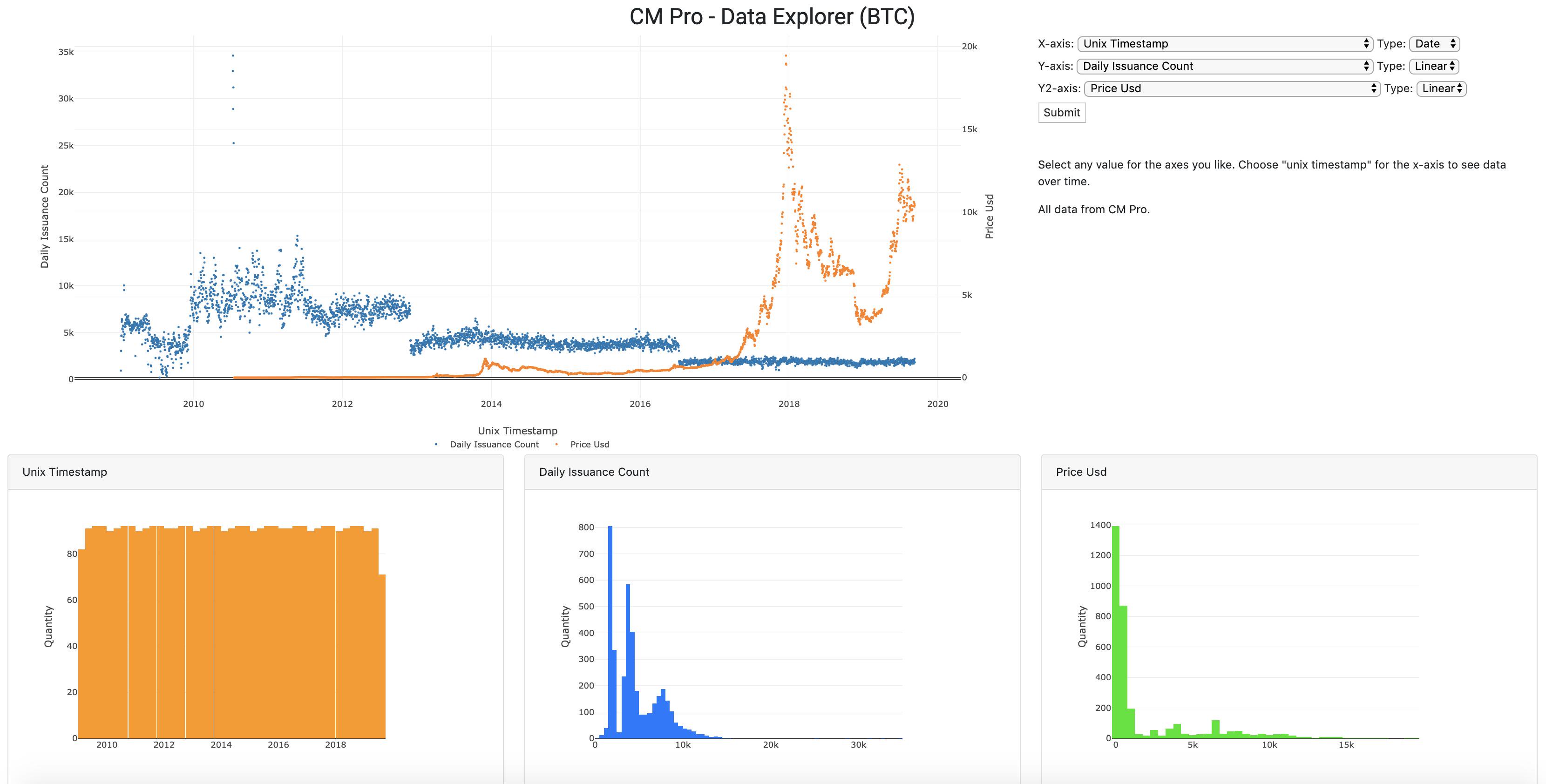

Daily issuance count, look at the decline. This reduction in new supply fuels one of the most basic laws of economics, which most commonly applies to commodities, Supply and Demand. If the supply gets squeezed and the demand keeps increasing, well…

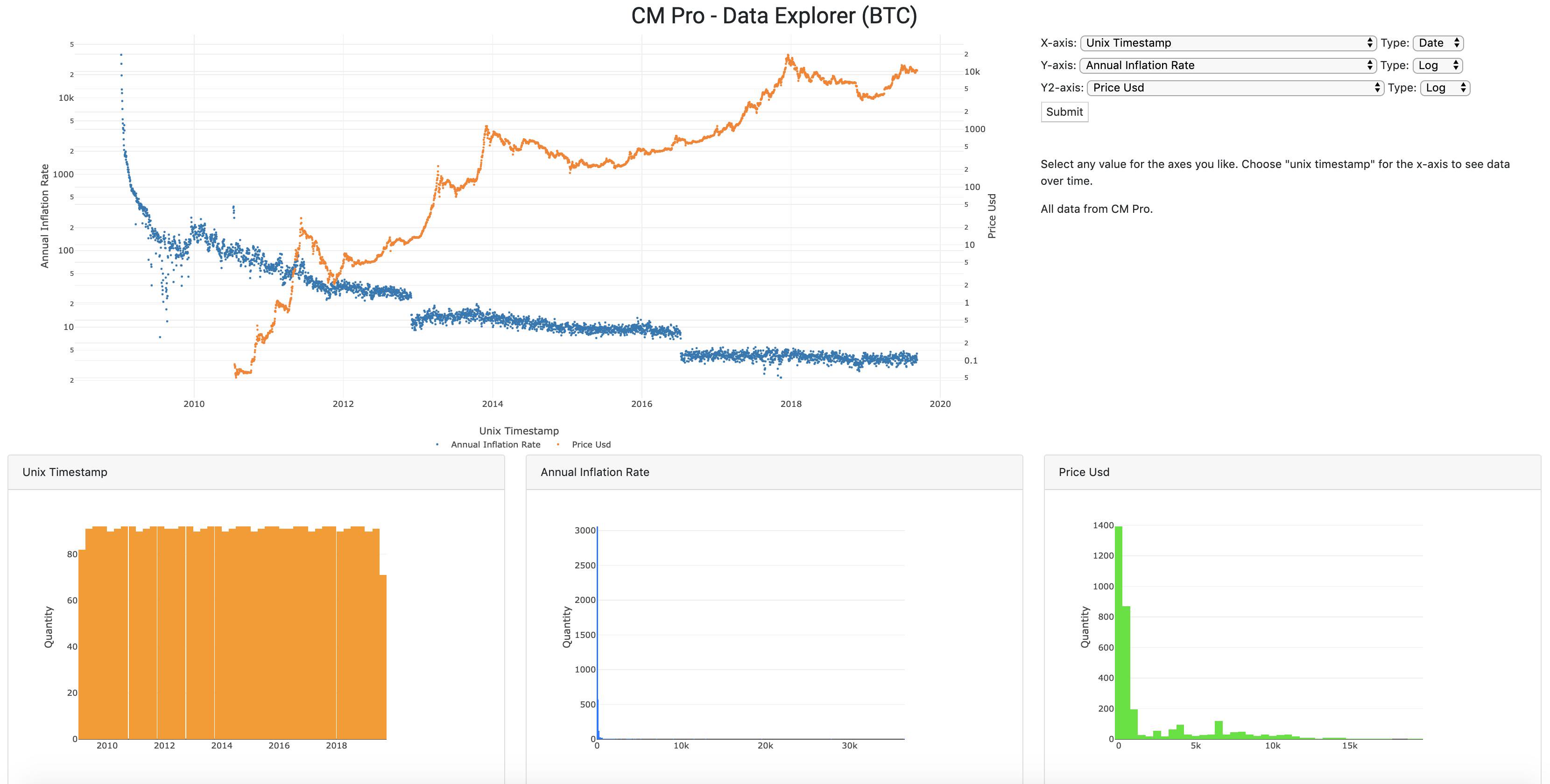

Here’s another view that takes into account the circulating supply. This is the Annual Inflation Rate. Who’s ready for the next halving?

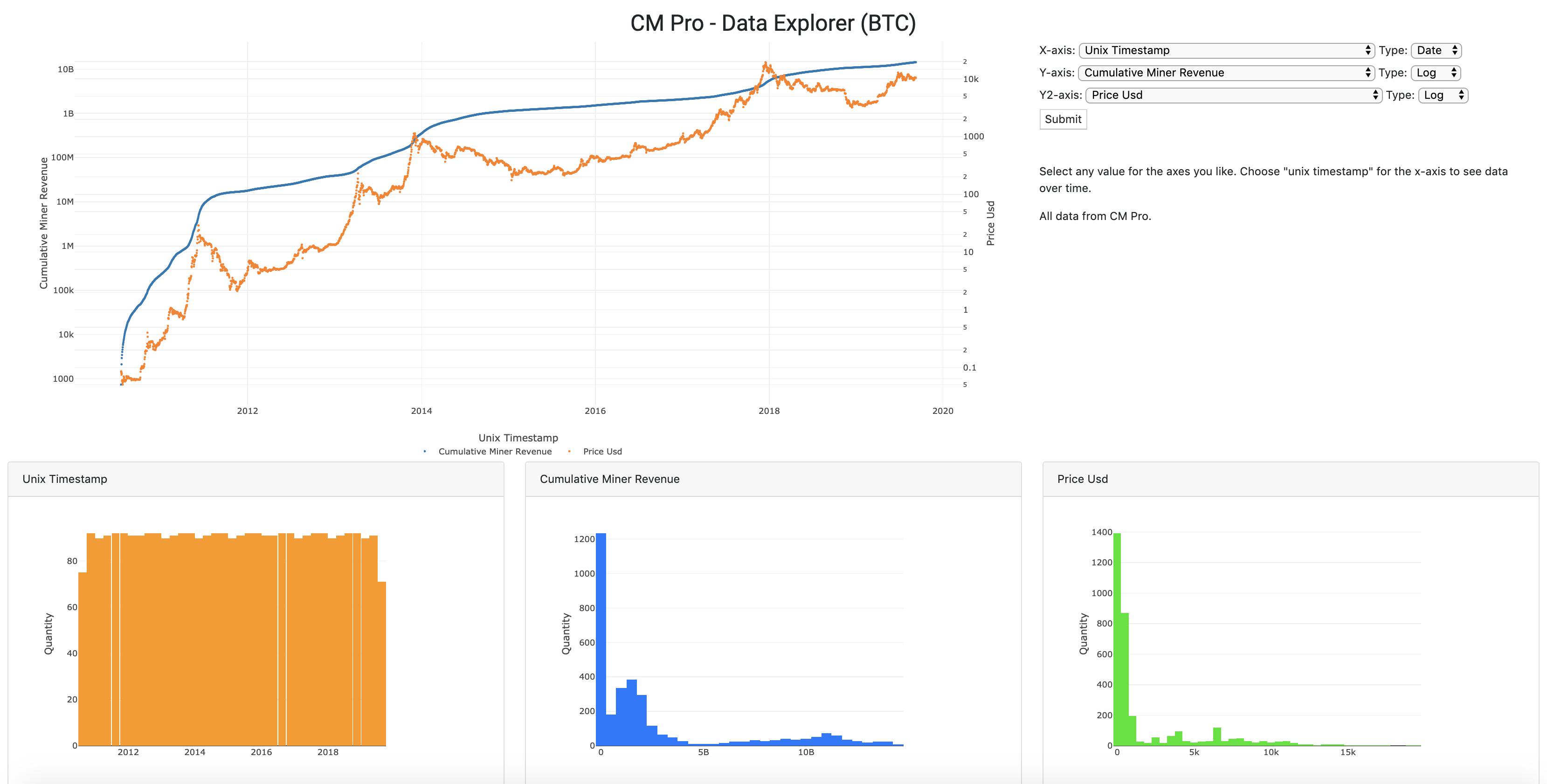

We talked about the miners earlier. What’s driving that increase in difficulty? If you answered “Revenue growth for the industry in Log(Log()) scale” you get a gold star!

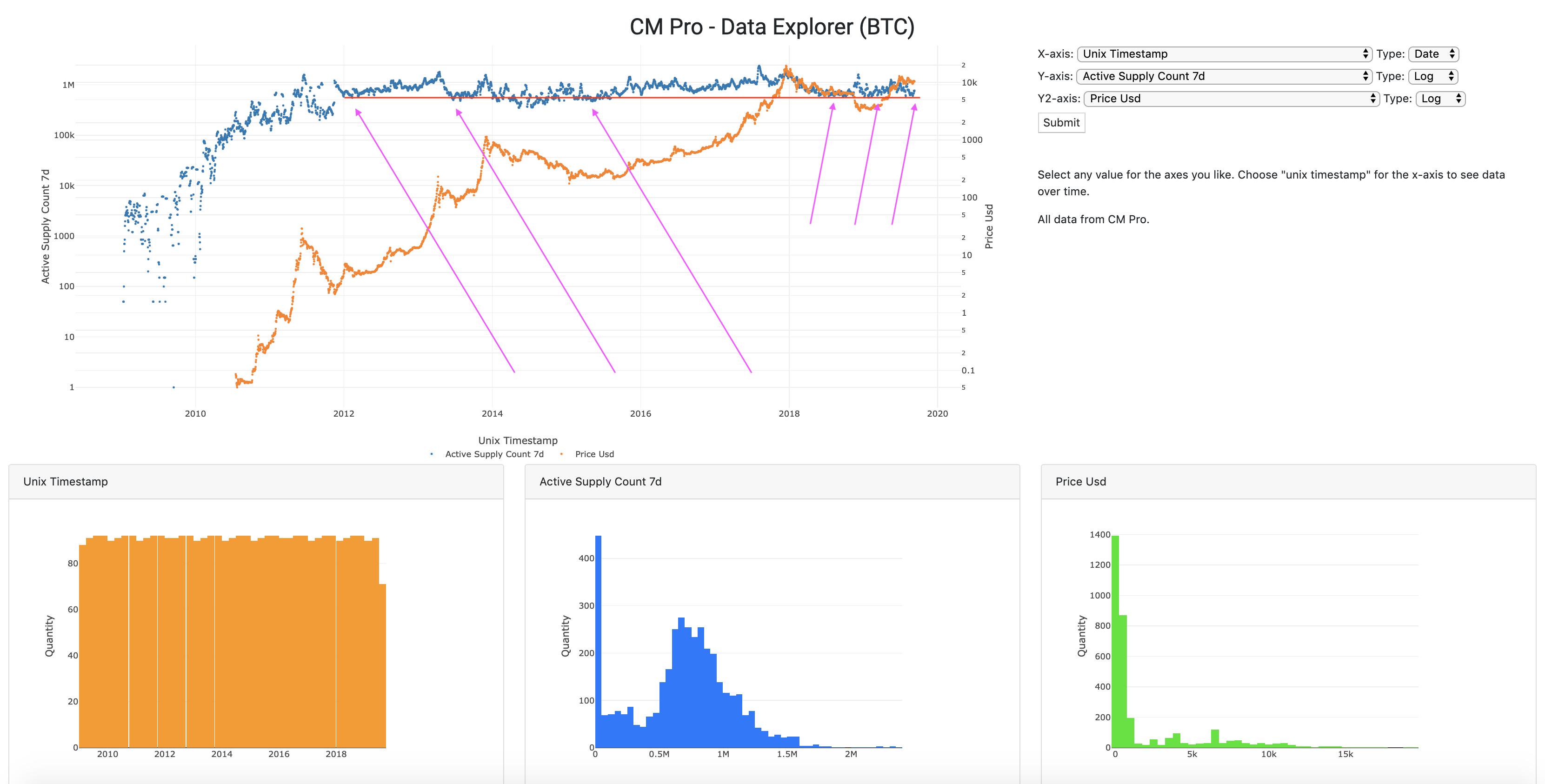

Let’s turn our attention to the active supply over the last seven days. This gives us unique insight into the behavior of Bitcoiners, specifically if they’re holding or trading. When the blue line touches the red line, there’s more HODLing going on, bullish in a bull market.

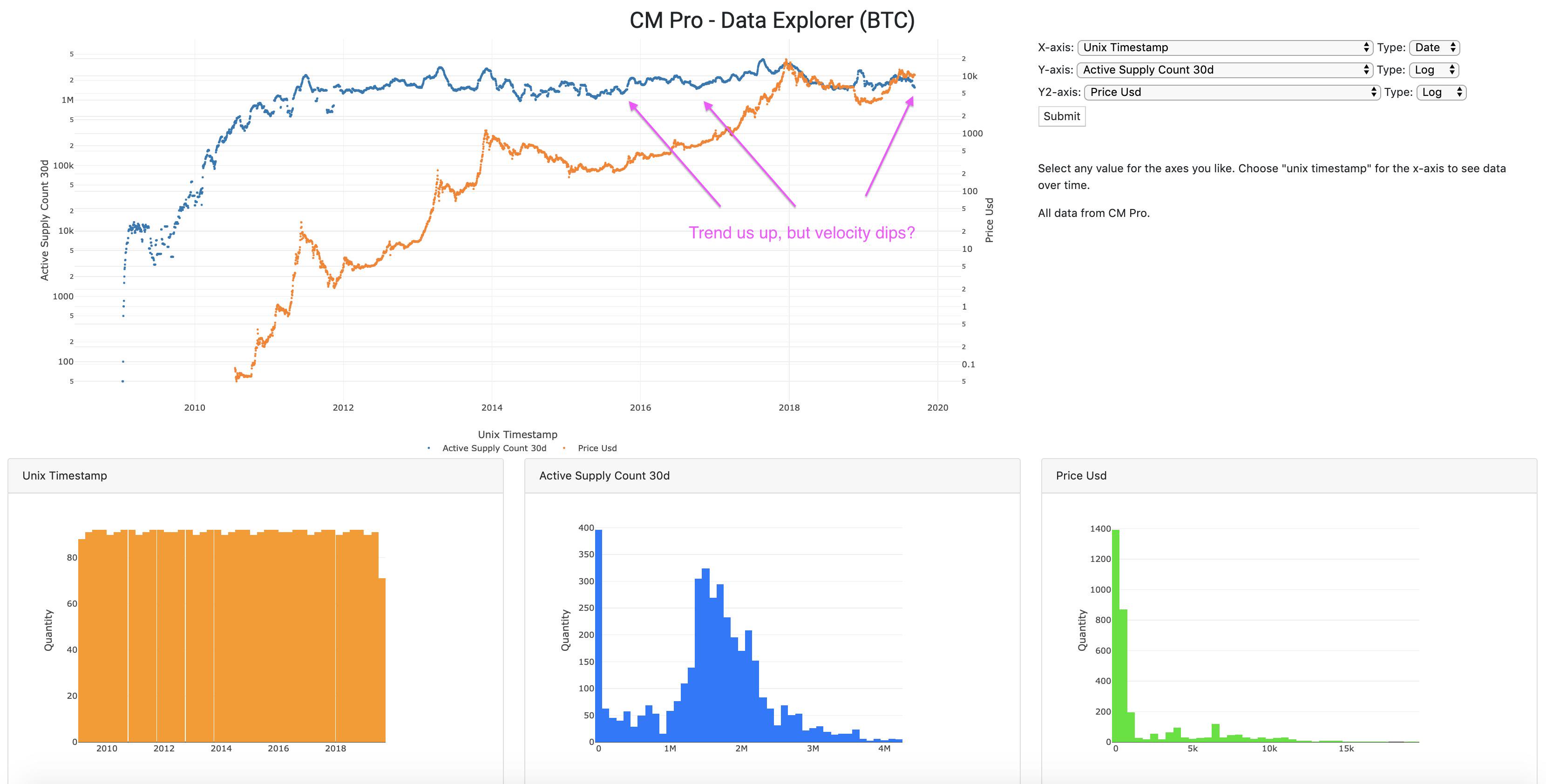

If we substitute the 30 day count for the 7 day, we get an even better picture. In the middle of a bull market, we see velocity drop. Why? This is the calm before the storm…

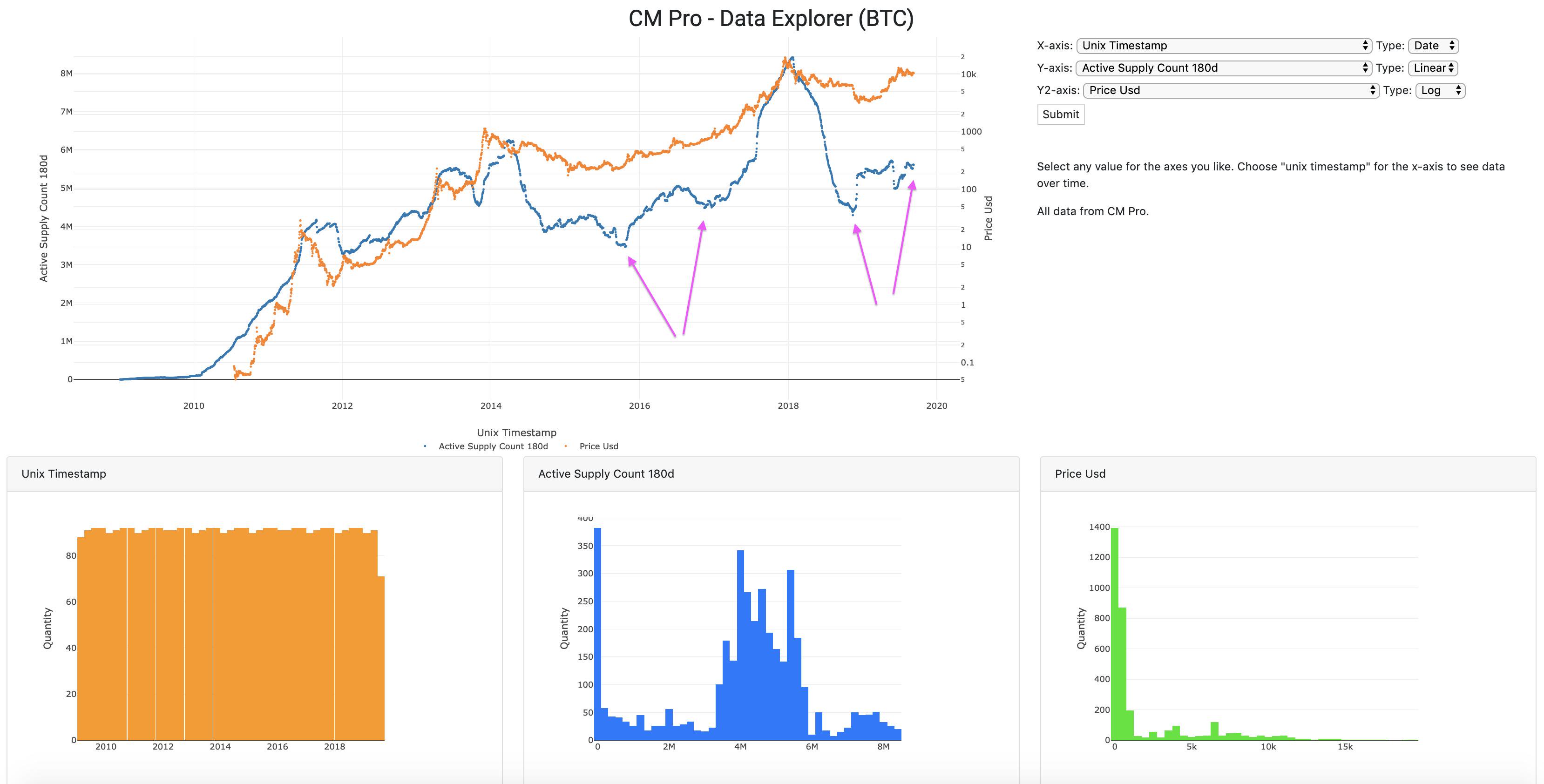

Now look at this, expanding to 180 days. One - Bottom of the cycle, Two - Second chance to buy in, Three - Moon. 2017 - the price in floor two fell from the $700 range to the $500 range; 2019 the price fell from about $14k to where we are now, near $10k. Same Bitcoin, 20x bigger.

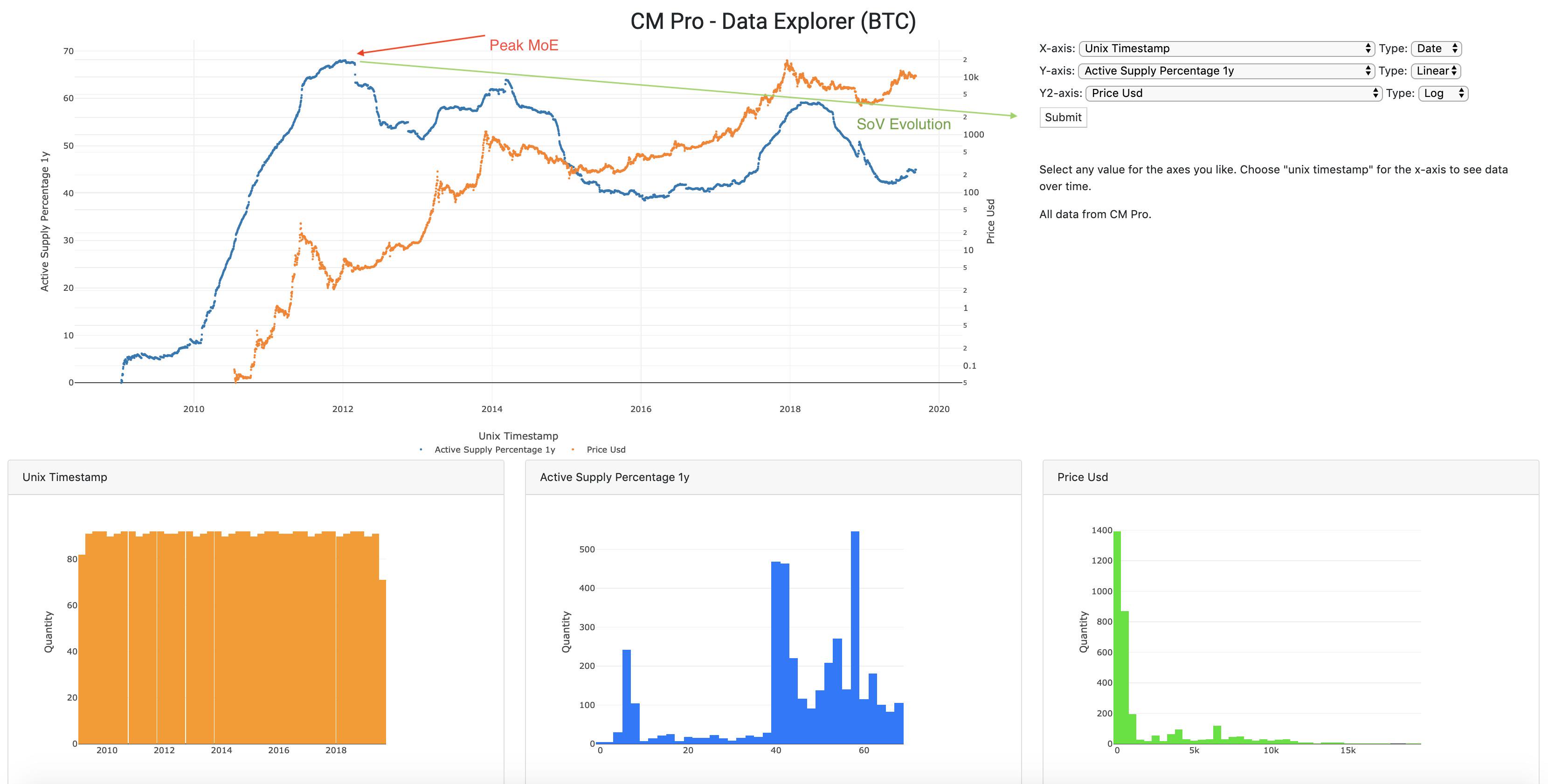

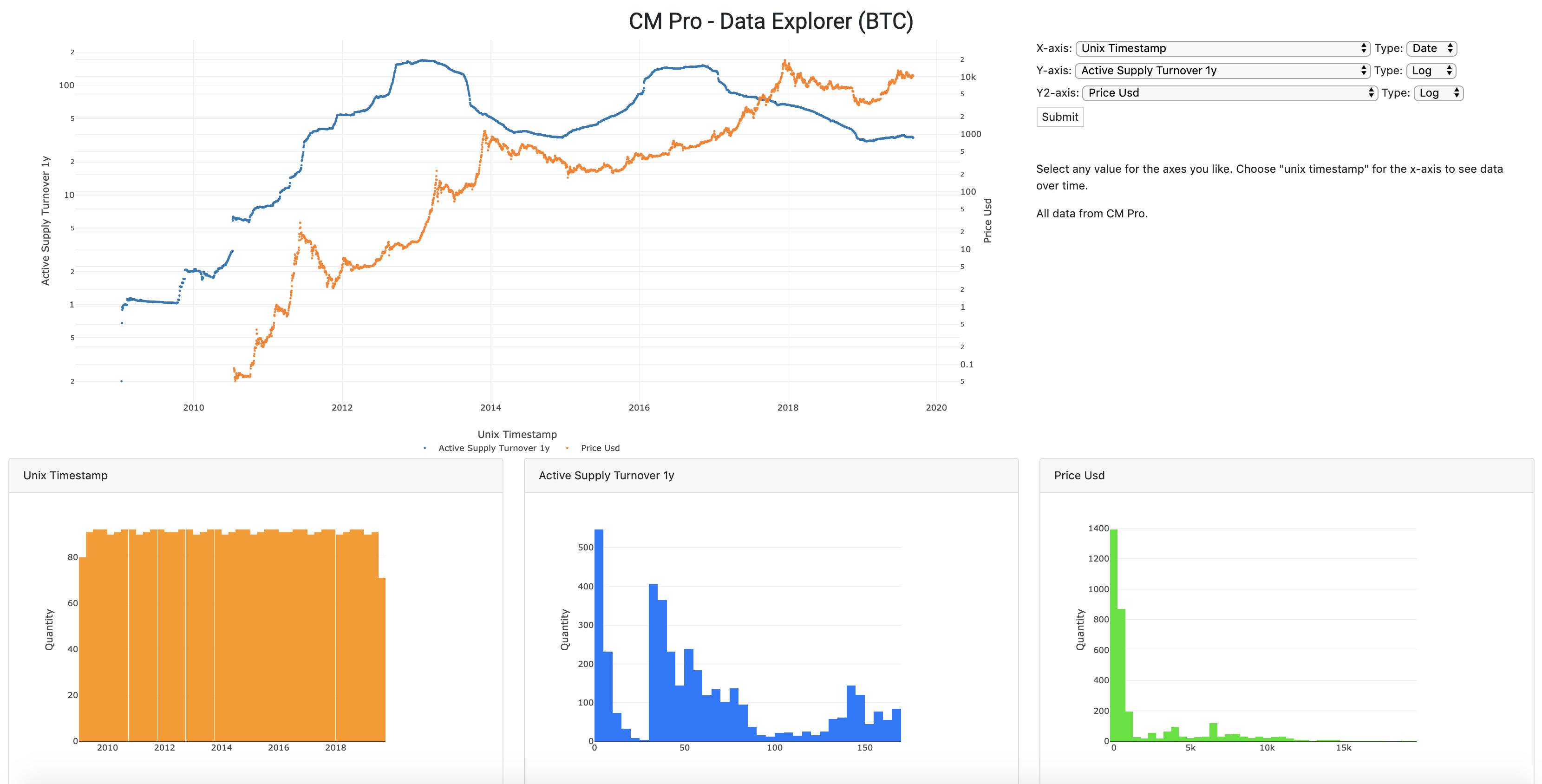

Waxing philosophical for a moment, I suggest Bitcoin is evolving from a Method of Exchange that can store value to a SoV that can be exchanged. As the market value increases, look at the change in the active supply percentage over the trailing 1y.

Coming back to the “two chances to enter” model for a moment, isn’t it a bit spooky how history looks like it’s repeating itself? Check out the value per byte transferred below. Got your ticket to the moon yet?

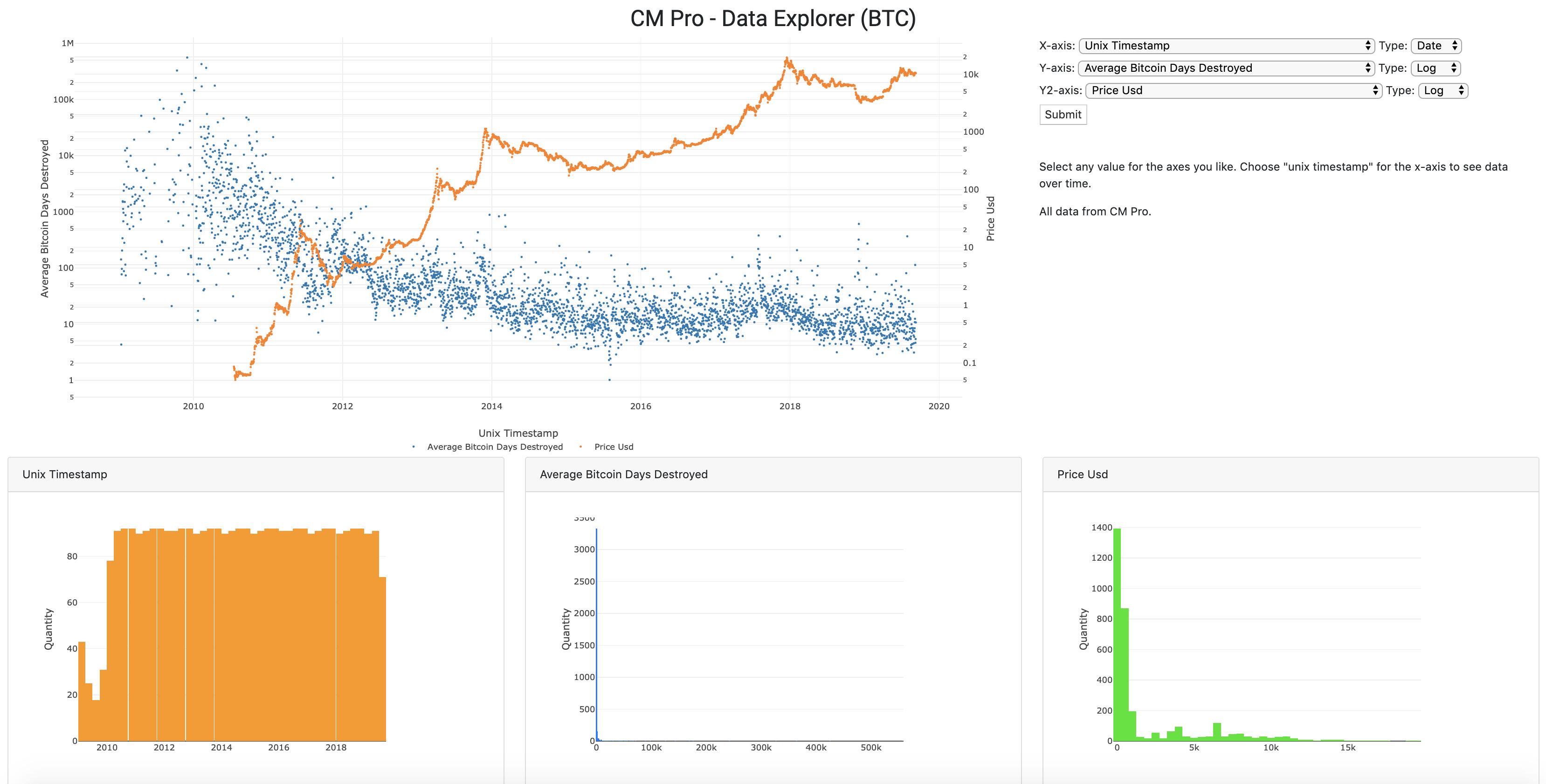

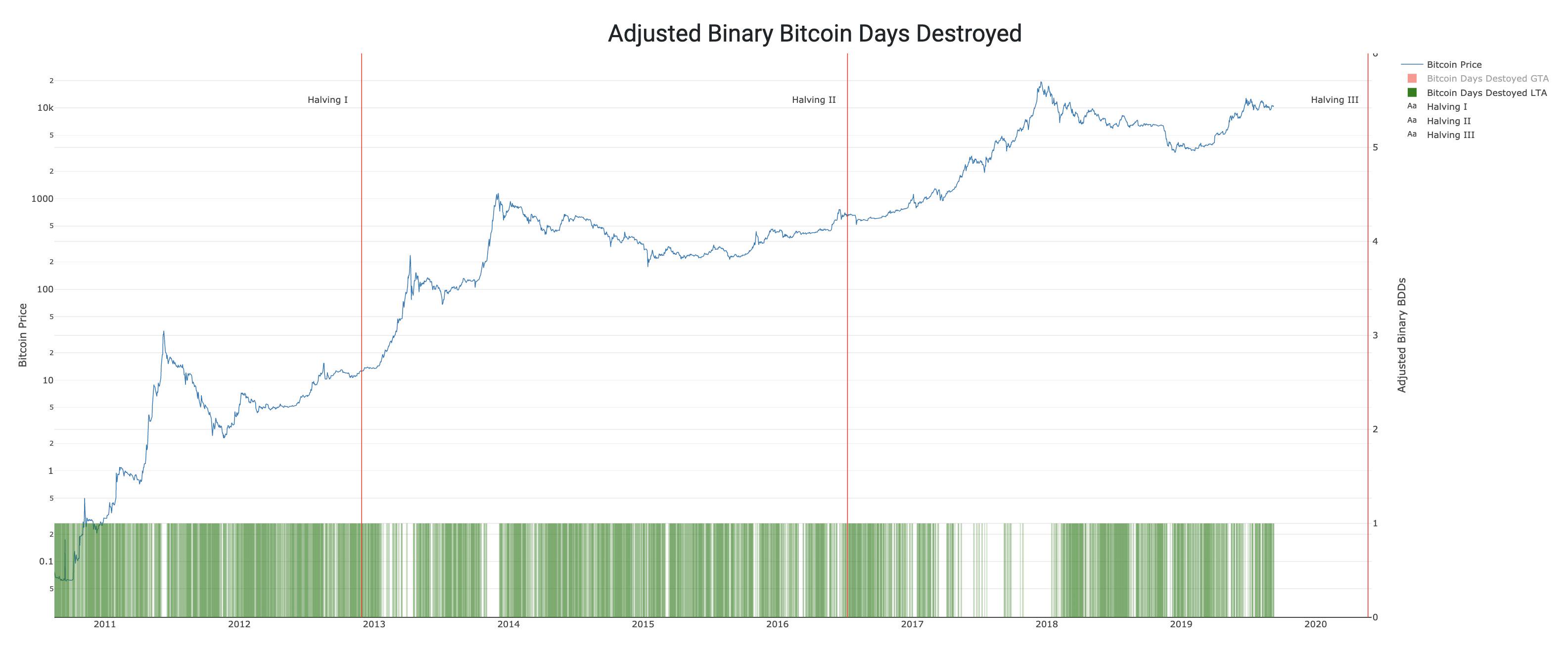

I normally talk about Bitcoin Days Destroyed in the sense of the TOTAL number or the adjusted figure (total / circulating supply). But, if we look at the average there is a constant decline. The longer you HOLD, the less you want to FODL paradoxically. Bitcoin Singularity?

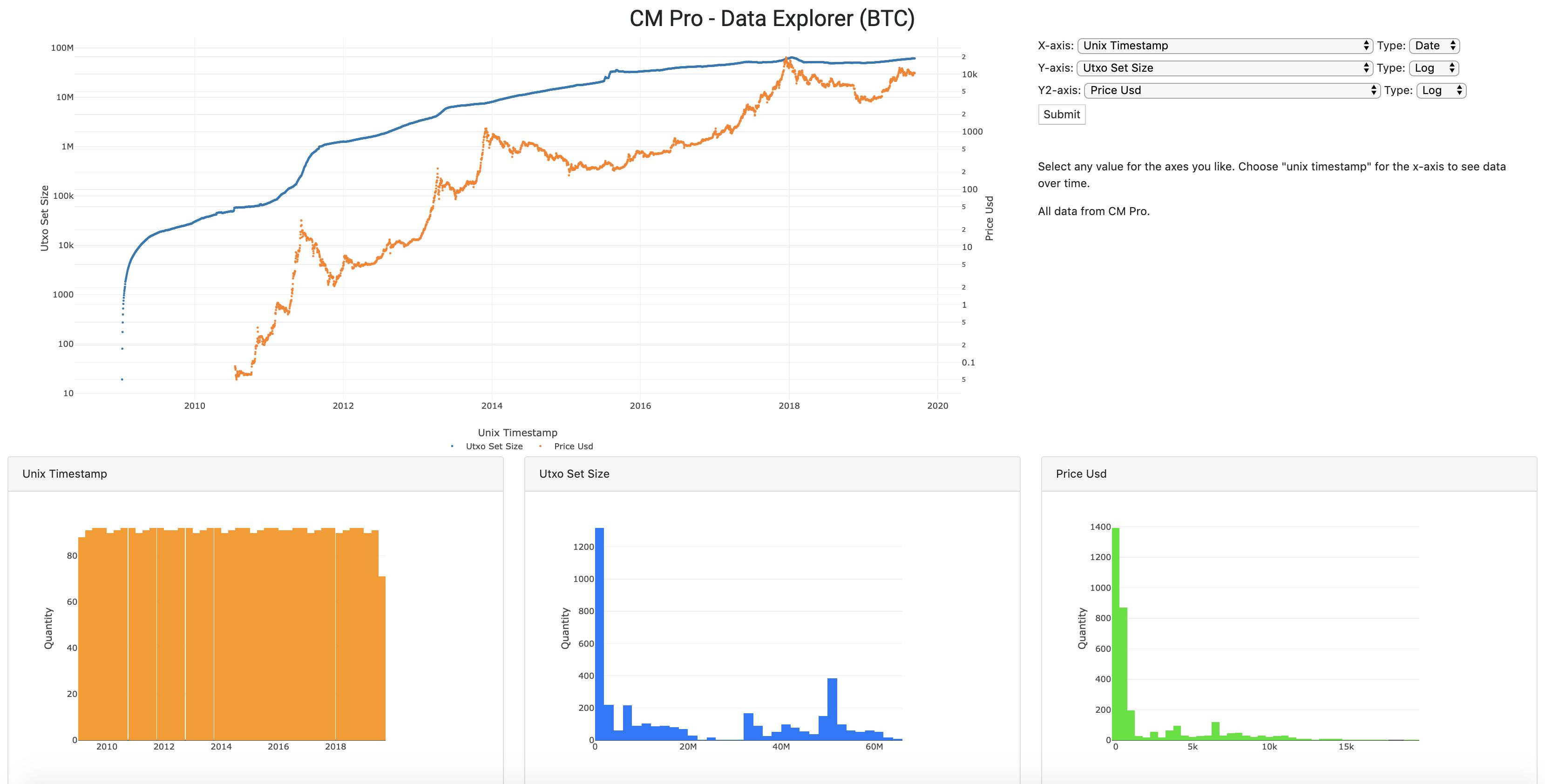

We talked about supply, now let’s look at demand using the UTXO set size as another way to conceptualize the participants in the Bitcoin network. Look at the growth here. This is getting very close to an all-time high as well.

In inventory management, turnover is a good thing because it shows you’re moving your product. But with Bitcoin, we have to consider that an increase in HODLing means Bitcoin is transitioning into a Store of Value as I mentioned before. Inventory turnover also supports this view.

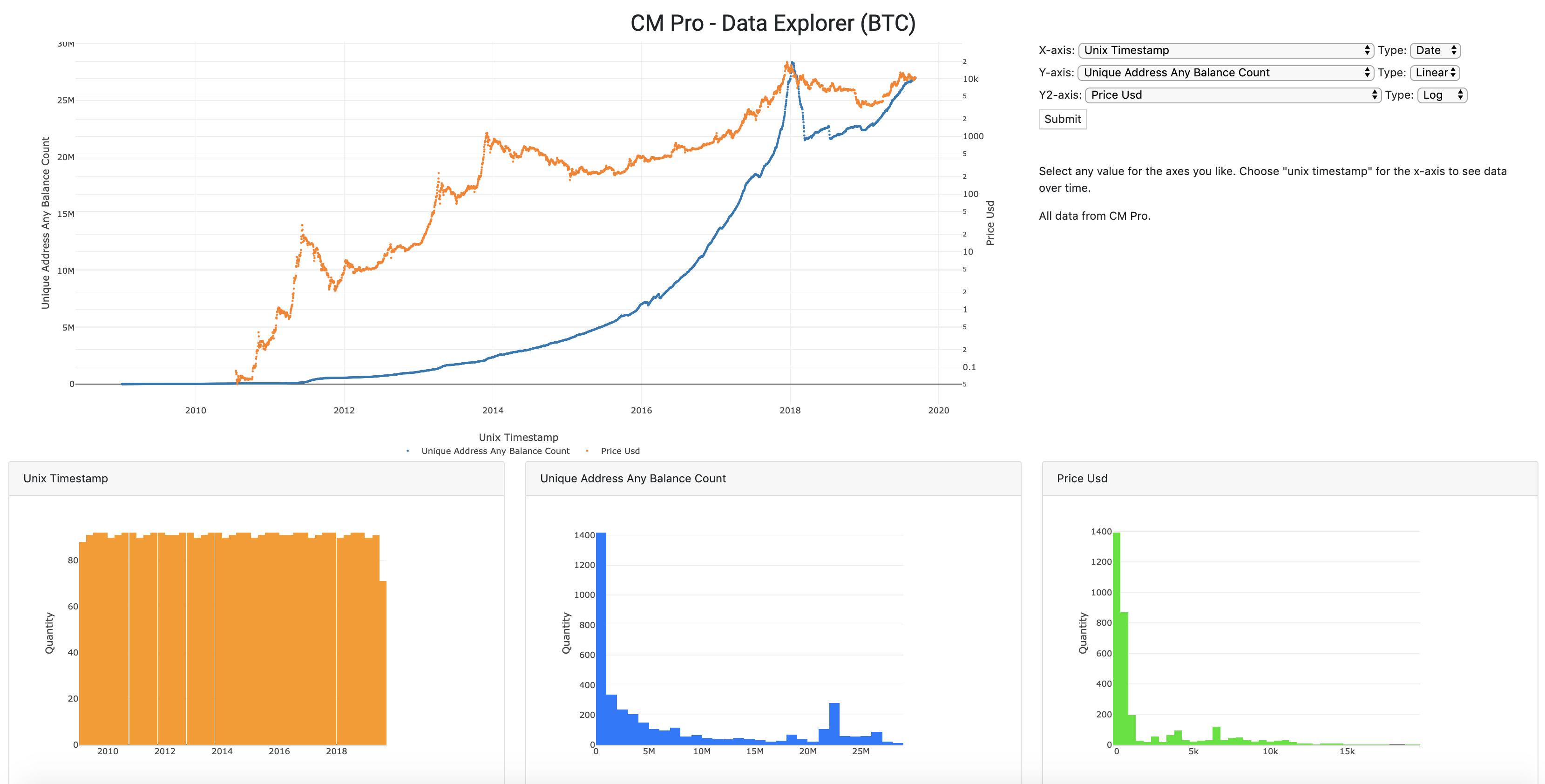

Back on the demand side again for you Econ nerds, we can also look at the number of unique addresses that hold ANY balance of Bitcoin. Also, this is near an ATH.

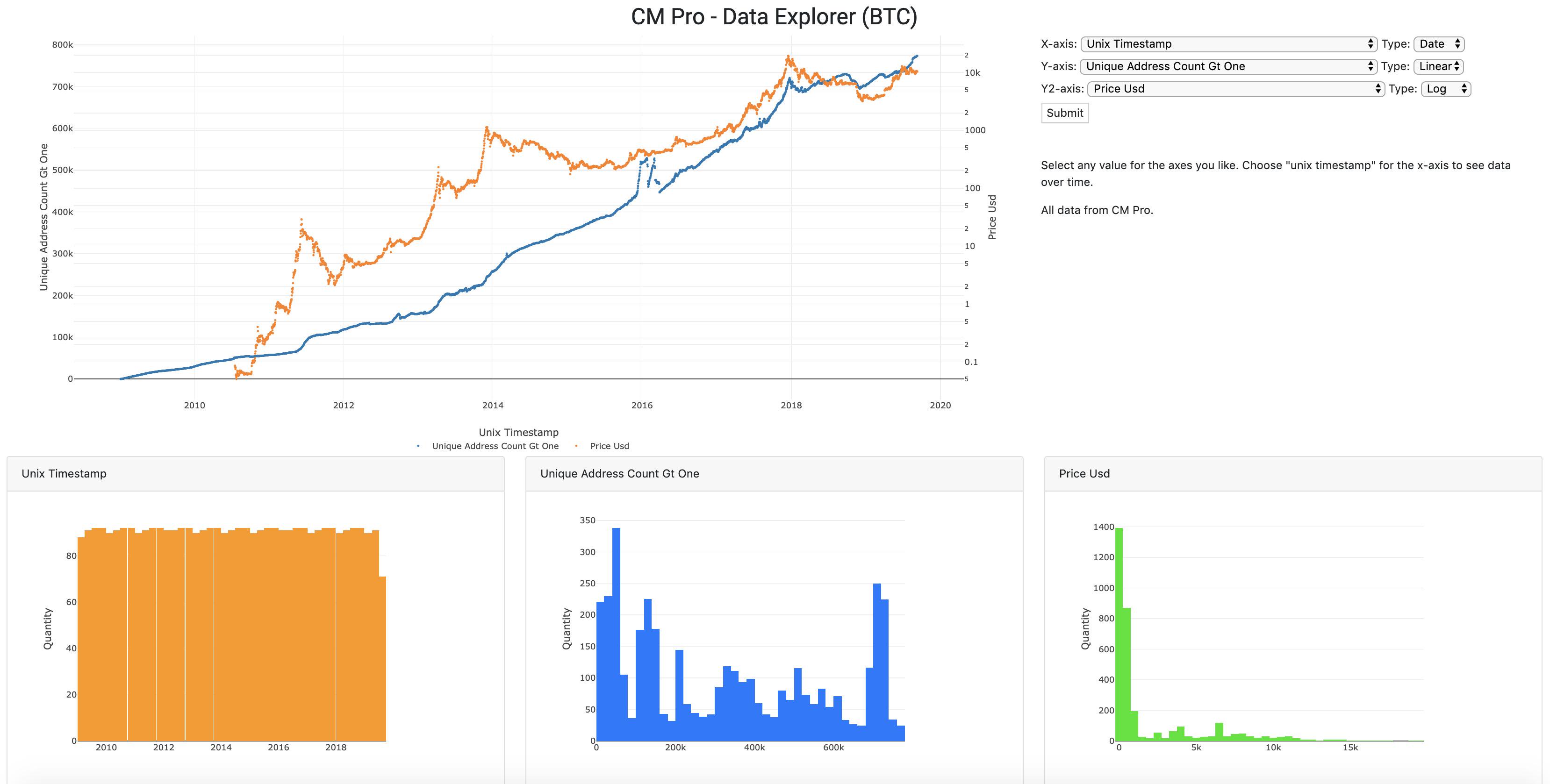

If we ask “How many addresses have at least 1 BTC” the answer would be in the blue line below. This figure IS at an all-time high (as of yesterday). The virus is spreading!

SOPR has reset to the “around 1” level. Last time we saw this the price was around $5k. Now we have SOPR around 1 at $10k. To me this speaks of the lower risk to entry. @renato_shira can correct me if I misunderstand.

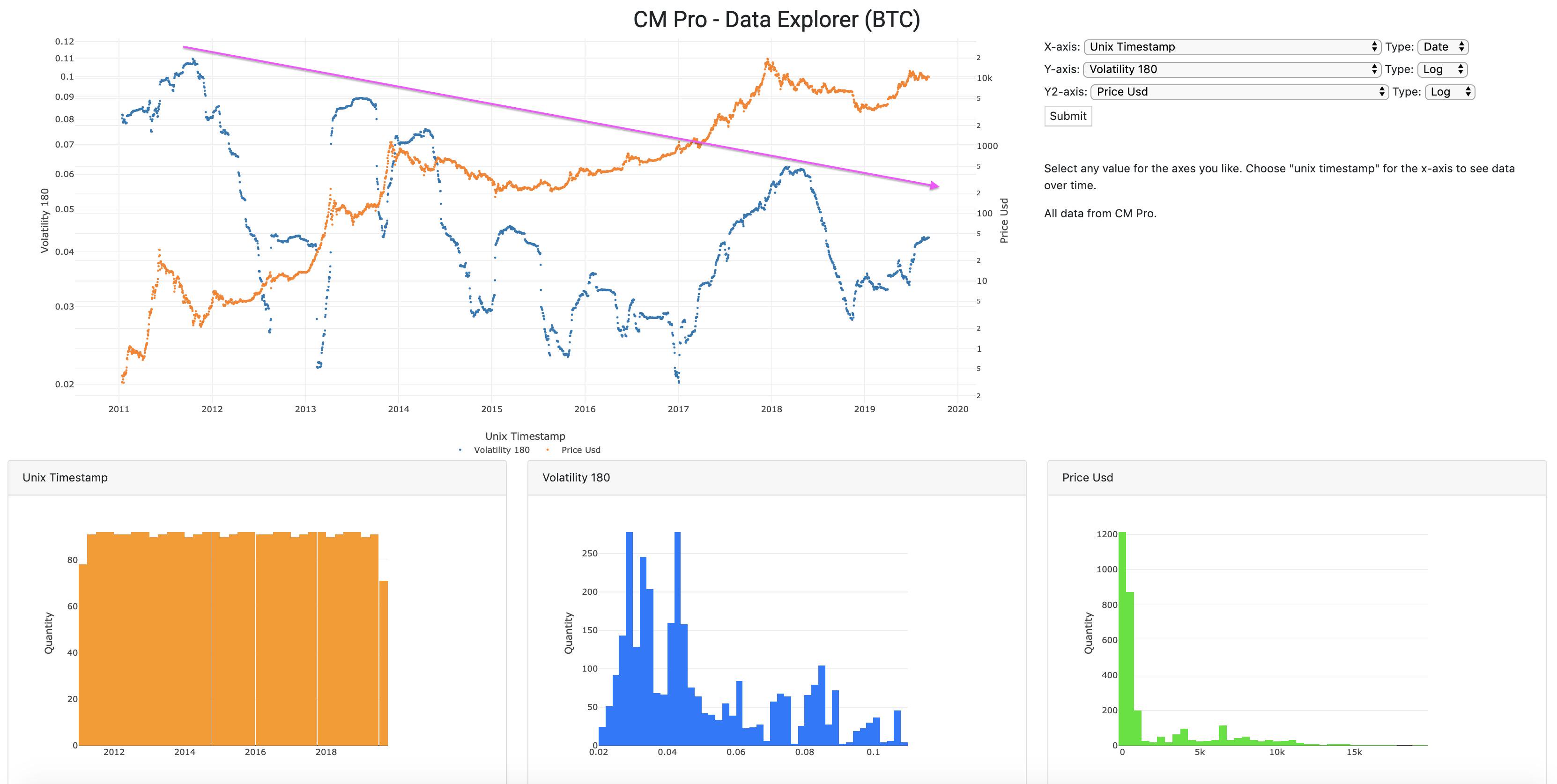

And of course volatility is decreasing over time in log scale. NBD. Majority of the volatility to the upside but let’s not mention that.

Another view of Bitcoin Days Destroyed, Adjusted Binary BDD. Green bars are LESS than average on an adjusted basis. Unless you see a white gap, we’re not at the top of a bubble. It’s just data.

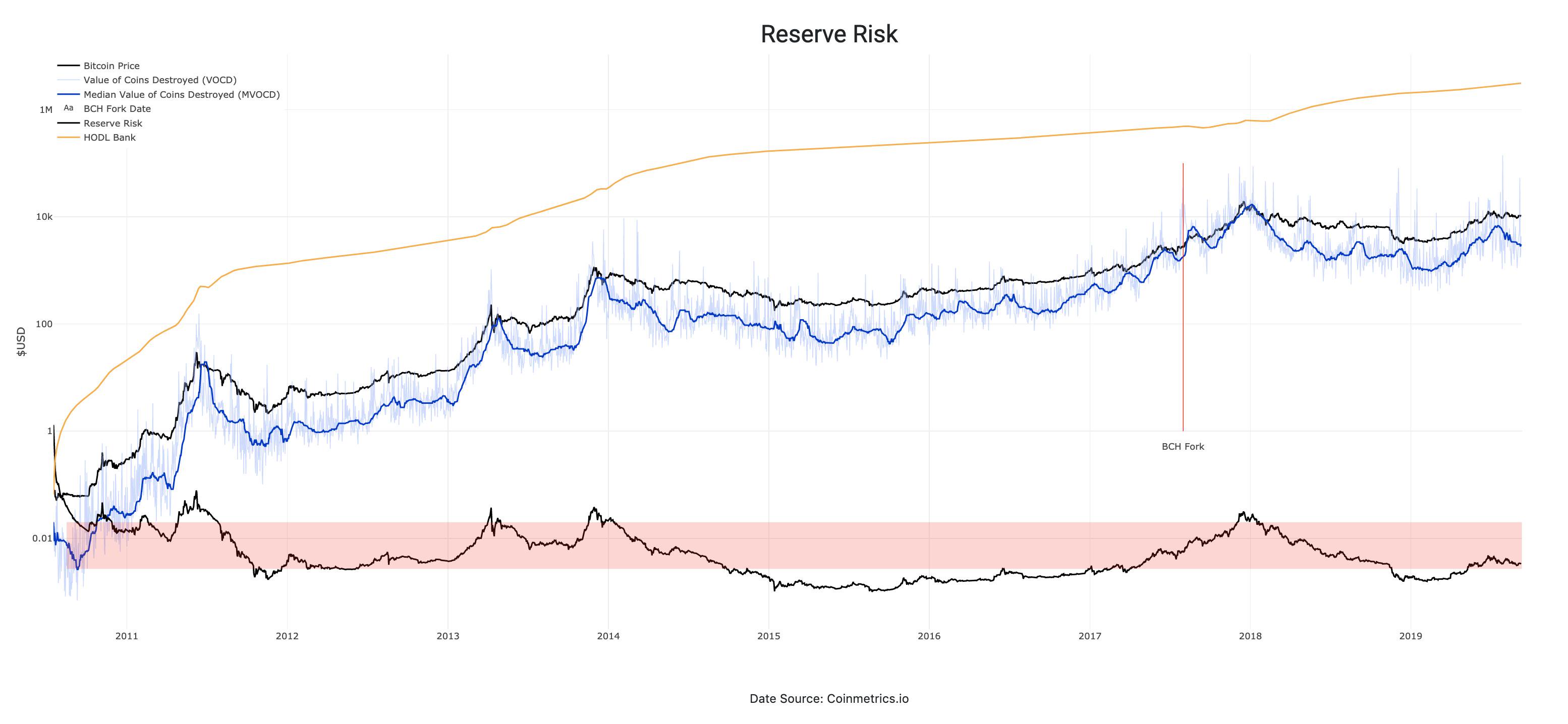

And lastly, Reserve Risk which answers the question “how much risk to I take on by entering now?” I rest my case.

Floor on Bitcoin’s risk less interest rate

By Tamas Blummer

Posted September 11, 2019

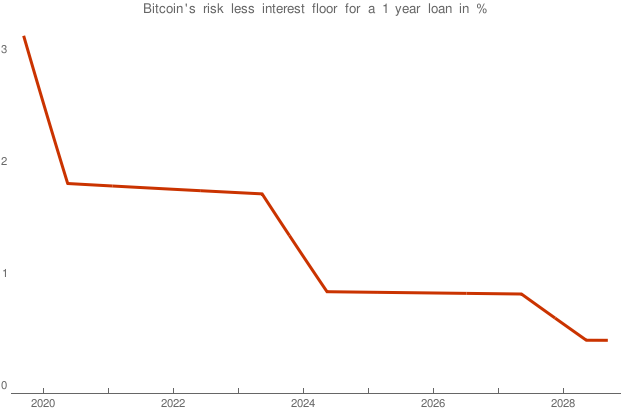

There is a floor to Bitcoin’s risk less interest rate determined by its mining schedule.

Risk less interest is an income one gets paid in a deal that can not go wrong. This sounds like investors’ wet dream, but there is a real world example of it in the fiat money world, the treasury bonds.

Since the government may print any amount, it will never default on a loan denominated in its own currency. The interest may not have the expected purchasing power, but it is certain that both interest and nominal amount will be paid.

A rational investor would not lend money for less interest than what can be received risk less, hence this rate builds a floor for interest rates for loans of comparable term.

Is it possible to earn risk-less interest in Bitcoins? Yes, e.g. with products that implement the side memory pattern, that I described on the Bitcoin developer list. If someone pays you to lock your Bitcoins to a contract for a time period, then you earn risk less interest. Locking means you forgo the opportunity of spending them until a later time point. The income is risk less since you certainly regain control of the Bitcoins in the future.

What rate of risk less interest should an investor demand in Bitcoin?

Interest generally is expected to compensate for diminishing purchasing power while you are not in control of the funds, if it would not, why doing it? Many take it for granted that Bitcoin’s purchasing power will increase with time, and there is a good chance for that, but only a chance. Certain is that the number of Bitcoins in circulation is increasing. This means if everything else would stay the same then Bitcoin’s purchasing power would diminish with the rate of the dilution through mining.

Dilution is not insignificant and is compute able thanks to Bitcoin’s deterministic issue schedule. Miners currently earn 12.5 Bitcoins for a block and 6 blocks are expected to be produced in an hour. This means 1,800 Bitcoins are produced every day. These new Bitcoins dilute the value of those already in circulation, 17,929,350 at this moment.

This means a current dilution rate of 1,800/17,929,350 = 0.01004% per day that would be roughly 3.6% p.a. if we would ignore the halving, which we should not. See a precise calculation of forward rates below.

A rational investor should require at least a compensation for this dilution when negotiating an interest rate. Therefore the dilution rate acts as a floor to risk less interest.

Since dilution is deterministic, we may calculate the floor to forward risk less interest rates in the future. I did the work for you for the next ten years.

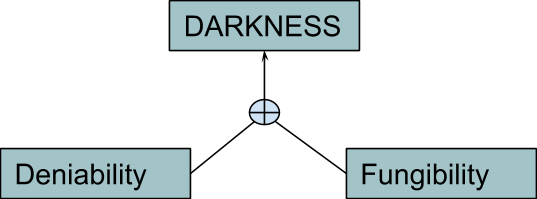

The Encrypted Meaning of Crypto

A very short etymology of the semantic hell that is ‘crypto’

By Erik Cason

Posted September 11, 2019

Kairos — the personification of opportunity, luck and favorable moments. Also presented as a favorable opportunity opposing the fate of Man.

Kairos — the personification of opportunity, luck and favorable moments. Also presented as a favorable opportunity opposing the fate of Man.

The term crypto has a complex and deep history that reaches much father back then the recent development of the science of cryptography. The written word itself goes back for at least two and a half millennia, though its existence has been much longer. Through the use and abuse of the word over this time, crypto has shrouded and concealed its meaning to all except for the most astute observers. Personally I am the most guilty of this robbery of language; having continued the legacy of bankrupting the term, widely referring to everything in the crypto-currencies ecosystem, asset, token, DeFi, DLT, etc. as simply ‘crypto’. Why? Because I love that it further encrypts the meaning of the word itself, leaving it deeper in obscurity. This leaves the individual to wrestle with the question of what ‘crypto’ really means, and if they are to try to decipher it, or allow for its true name to remain hidden to them. Either way, in the words of Satoshi Nakamoto,

“If you don’t believe me or don’t get it, I don’t have time to try to convince you, sorry.”

However, I’ll take a shot at trying to convince folks because I believe this technology is messianic, and all seekers should have an opportunity to discover the truth. To understand what crypto is, and to take it seriously; there must be a deep hermeneutical process that is undertaken to allow for a sincere engagement of what crypto-graphy means in order to allow for a new form of value-ability to come into view. The real ontological discover that lies hidden at the core of this technique of power goes beyond any law, and allows for any person to use this power to protect them when nothing else can.

The origins of ‘crypto’

Coming from the ancient greek word κρυπτός (krúptō), roughly meaning, ‘I conceal’, crypto in the last century has been generally understood as being a prefix for a concealed political motive such as a crypto-facist, or crypto-communist. However, it also is a prefix for ‘of relating to cryptography’, such as crypto-suite or crypto-currency. The linguistic obfuscation here is of particular interest to us, because it allows for a much more radical form of power to lay hidden at the center of ‘crypto-assets’ through its encrypted meaning. What is particular about bitcoin, and crypto-currencies in general, is that they have given rise to a new kind of political character: crypto-anarchists. Crypto-anarchists are not of the same linguistic character that ‘crypto-facist’ or ‘cryptography’. Crypto in crypto-anarchy is referring to using cryptography as the base tool for organizing an anarchist (i.e. no laws) society. Crypto-anarchism is not attempting to the concealment of its objectives of creating anarchism; at least not initially. And to be clear, I’m not speaking of the childish ‘destroy & enjoy’ kind of false anarchism portrayed in the media, but that of the linage of Prodhorn, Bakuin, Goldman, Rocker, and so many others. Anarchism is the radical freedom of individuals through the decentralization and the diffusion of power through various non-state organizations. Through the total empowerment of individuals against the state, anarchism is the third way between communism and fascism that we must demand, and is our only hope for a future free against tyranny, despotism, and panopticism we live under today.

The concealment of crypto

Tim May knew of this linguistic pun when he coined the term crypto-anarchist, and had the following to say about it:

I devised the term crypto anarchy as a pun on crypto, meaning “hidden,” on the use of “crypto” in combination with political views (as in Gore Vidal’s famous charge to William F. Buckley: “You’re crypto fascist!”) and of course because the technology of crypto makes this form of anarchy possible. The first presentation of this term was in a 1988 “Manifesto,” whimsically patterned after another famous Crypto Anarchy and Virtual Communities manifesto. Perhaps a more popularly understandable term, such as “cyber liberty,” might have some advantages, but crypto anarchy has its own charm, I think.

Charming indeed. However, because of the semantic hell that is crypto (as in the crypto-currency ecosystem), the very meaning of what crypto-anarchy is has transmuted it into something not well-understood by most involved in the field of crypto-currencies. Over the last thirty years we have lost the key to this scripture which has created the nonsense vacancy of the term ‘crypto’ as we see it today. The metaphysical meaning of crypto has encrypted its meaning to shitcoiners, nocoiners and everyone in between for greedy, high-time preference bullshit tokens that are devoid of real value. Funny enough, these are the very people who are crypto-anarchist in the deepest sense of the word. They help propel this ecosystem deep into the heart of financial Troy, sincerely believing the gigantic horse of blockchain was a gift from the Gods. And it is. They just don’t realize that crypto is a gift from the New Gods, not the old ones. They don’t understand that this technology is uses cryptography as a tactic to organize people on anarchist lines, using cryptography to directly shield the bodies of any involved. They simply see ‘blockchain’ (a semantic hell in its own right) as another iteration of state power — of finding new laws, and ‘better’ regulation with more panoptic violations. They lack the fundamental understanding of why the explosive power of cryptography is at the heart of these systems. They lack the understand that cryptography’s fundamental objective is to protect one from ANY advisory at any cost — including all law, militaries, and tax agencies. They fail to see that the fixed supply cap of bitcoin, the proof-of-work scheme, and pseudo-anonymity are not technical issues, but politcal ones. Adversarial thinking is inherently anarchist, and cryptography has always bared the signature of this at its heart. This is why cryptography has always been a military tactic first, as it has always existed outside of the bounds of law, and existed in only the field of war long before the word cryptography was even produced. It is important to remember that anarchism has always influenced and served the original ideas of those who would later become the cypherpunks. Chaum’s 1985 paper Security Without Identity: Transaction Systems to Make Big Brother Obsolete points directly to this. It was one of the first papers that understood and connected governmental control of money with the security state, and how the technology of encryption could make big brother obsolete. Later in 1992, Tim May distilled these values into the ‘Crypto-anarchist Manifesto’, which opens with the following:

A specter is haunting the modern world, the specter of crypto anarchy. Computer technology is on the verge of providing the ability for individuals and groups to communicate and interact with each other in a totally anonymous manner. Two persons may exchange messages, conduct business, and negotiate electronic contracts without ever knowing the true name, or legal identity, of the other. Interactions over networks will be untraceable, via extensive rerouting of encrypted packets and tamper-proof boxes which implement cryptographic protocols with nearly perfect assurance against any tampering. Reputations will be of central importance, far more important in dealings than even the credit ratings of today. These developments will alter completely the nature of government regulation, the ability to tax and control economic interactions, the ability to keep information secret, and will even alter the nature of trust and reputation.

Shortly after this was written, the first of the Crypto Wars started and the struggle to break cryptography out of its militarized cage was initiated. Through the valiant and heroic efforts of these great men (of whom, many are still contributing today), and their personal direct struggle against agents of the state, they managed to expropriated the greatest and most powerful technology of defensive asymmetrical warfare in the history of mankind from the military-industrial complex and let it out into the world to complete its messianic task.

The meaning of Crypto without the decryption key

Flash forward 30 years, now ‘crypto’ has completely broken out of its militarized cage, and there is no power on earth which can stop it. However, with the spectacular number of ‘crypto’ projects out there, so much noise has been created that the meaning of crypto itself has been lost, and has encrypted the actual meaning of crypto to itself. The apex of this kind of insanity has to be the Facebook’s shitcoin Libera project. Those who are responsible for the most systematic violations of privacy that have ever been conceived or could even be imagined, now want to take those steps further; this under the idiotic guise of ‘crypto’ once again. This is of the greatest ironies because while society may now have all of the radical tools that May theorized about 30 years ago to liberate ourselves from the camps of the state, we have been made blind to the real power that we have access to because of the semantic abyss we have fallen into. Our lack of class consciousness and the historical context that has got us here, has every blockchain bro proudly patting each other on the back, chained to their blocks of oppression in the darkness of Plato’s Cave. As I warned in The Poverty of Tokens, crypto-assets can become a panoptic nightmare of privacy violations when blockchains becomes mutable, pre-mined, non-anonymous. They no longer have any of the majesty, consanguinity, or consensuality of real crypto assets like bitcoin, nor could they ever offer such assurances. Bitcoin can offer these kinds of assurances because it is not asking one to stake proof on trusting the system. Bitcoin demands that everyone check the work and not to trust, but to verify. Satoshi took the hermeneutics of value in the digital age very seriously, and bitcoin is what was produced from that angst. If we are to reclaim the term crypto from its inane semantic dribble (which I am not convinced we should — I think it is better this way), then we must have a deep understanding of the etymology of the word crypto, and how it has been used historically. Crypto has always been about the form of power which is now enshrined within the modren science of cryptography. It has always been about the capacity to conceal, and to hold secrets for oneself, and how such a secret generates power. Crypto is about the whole historical ark of the last 2,500 years in which this written term κρυπτός has been utilized as a tactic of self-protection through concealment. From steganography and the first shift ciphers of Cesar in ancient Rome, to the ciphers devised by Francis Bacon and Vigenère in the middle ages, to crypto’s premier as a full science with Kerckhoffs’s principle in La Cryptographie Militaire; crypto has always been about power! It is a form of power that is created through the concealment of information. It is only in the last century and a half that it has become an explicit material science lobotomized of its origins, purpose, and mysticism to serve only the state, and its great machines of death. Crypto is about the power of privacy, and the form of power that is decrypted when the concealment of information is verified and guaranteed beyond the law of any and all men. But so long as ‘crypto’ remains a vacuous slogan used by every piece of shit blockchain thought up, crypto will continue to be a nascent term concealing its true meaning and its messianic potential.

Tweetstorm: How do you know it’s not too late to buy Bitcoin now?

By Hasu

Posted September 12, 2019

A common question that precoiners have is, “How do you know it’s not too late to buy bitcoin now?”

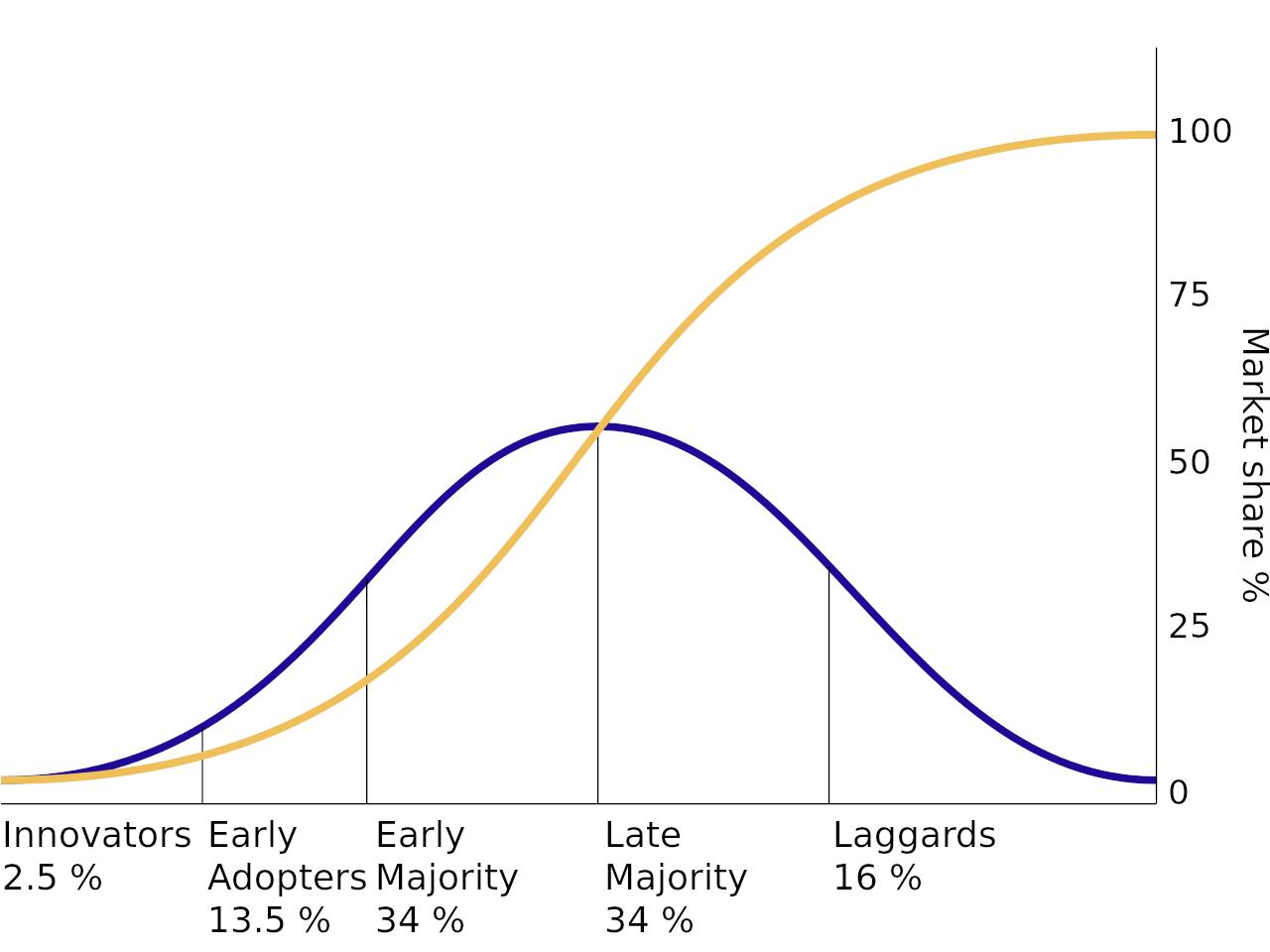

They still assume Bitcoin follows the value/adoption curve of a pyramid scheme - a system that needs to sustain itself with new buyers and collapses if those ever run out.

The question seems reasonable: Once Bitcoin is widely adopted, the future value from speculation will indeed be zero. But that ignores half the picture - where has that speculative value gone? And does it mean that earlier buyer now have an incentive to sell?

The EV of a pyramid scheme decreases the later we are in the adoption cycle. But the EV of a network good like money increases, as it becomes more useful the more people own it.

What was seen as speculative value during the earlier adoption stages was merely the discounted use-value of later stages. In the beginning, Bitcoin had no use-value. In the end, Bitcoin has only use-value.

Because Bitcoin becomes more useful the later in the adoption cycle we are, there is never a point where the marginal buyer can lose from adopting it. Only the value for the marginal buyer will come less from people finding it useful later than from himself finding it useful now.

To wrap around to the initial question, a potential investor should ask himself whether a mature Bitcoin system is genuinely useful to him and others.

If the answer to that is positive, there’s no reason to expect the system to unwind as more people join.

Bitcoin Astronomy

By Dhruv Bansal

Posted September 13, 2019

The desire to travel far away and start a new currency will become a powerful driver of human expansion into space.

Earth will run on bitcoin, but colonies on Mars, the outer planets, and distant stars will not. Though faraway colonies will value and trade bitcoin, they will choose to launch, defend and use their own local blockchains. This pattern of replication is an inevitable consequence of hyperbitcoinization and the physical limitations inherent to any blockchain that respects the finite speed of light.

Speculating about the future is always indulgent and never a science, but speculation about tomorrow helps us better understand today. There is a fascinating and rich history of speculation about bitcoin astronomy that we extend and explore in this series. Our aim is to present blockchains and the social, political, & economic structures they produce, as fundamental forces in the universe, on par with evolution, the production of entropy, and the passage of time.

This article focuses on Mars, the Red Planet, and speculates about the economic revolution we foresee occurring there. What happens on Mars will eventually be replicated across the solar system and beyond. But we begin with Earth, in the not-too-distant future, in a post-hyperbitcoinization era.

Hyperbitcoinization on Earth

What does a hyperbitcoinized future Earth settling nearby planets look like? It’s probably a mix of works such as these, but with more bitcoin:

|

|

|

|

| Settlement, terraforming, and revolution on Mars | Conflict between Earth, Mars, and minor powers of Sol. | Rich people will definitely move to space. | A world without nations but a powerful belief in digital reality. |

Imagine it: 100 years from now, bitcoin is a global currency used by all people. Individuals mostly transact on one of several second layer lightning networks. Large transactions still occur on the chain, though usually through aggregation mechanisms. Third and fourth layers also exist: the Internet becomes a bootstrapped mesh network with nodes settling on the lightning network as they store data and push bandwidth. Many powerful global corporations are replaced by inter-operating protocols, all distributed and market-driven, settling to BTC. In a hyperbitcoinized world, bitcoin is not just the foundation of the world economy; it’s the unit of account for new distributed infrastructures of computing, telecommunications, identity, etc.

Hyperbitcoinization is not limited to affecting financial, computer, and social networks. Many other industries will change both in relation to, and independently from, this trend. 20% of world energy production will go to SHA256 hashing because the industries of bitcoin mining and power generation will have merged. The environment is significantly degraded in the future, but it’s not because of bitcoin. Bitcoin mining in 2019 is already utilizing greener energy sources than other industries, and the continued rapaciousness of bitcoin miners for energy will turn out to be the reason fusion power is successfully commercialized, a delicious irony.

In parallel with technological and cultural change will be political revolution. Climate, refugee, and other crises combined with new politics born from new distributed technologies will have transformed the squabbling cathedrals of today’s nations and corporations into a chaotic global bazaar of local polities and loose-knit federations. Empires may still exist, in places, but this is an age of city states.

Humanity started reaching out into space in the 20th century and is doing so again in the 21st. If Elon Musk is successful, we will begin to colonize Mars in the next 20 years. Fast-forward another century: how large could Musk’s Mars colony be?

A century is a very long time, enough to master fusion and deploy macroengineering marvels such as space elevators (and not by nation-states, but by distributed, public corporations chartered through bitcoin). These advances will enable waves of settlers to flee environmental degradation on Earth in search of a better life on Mars. The population of Mars sometime in the 22nd century could easily number in the tens or hundreds of millions.

Will these Martian millions be using bitcoin?

Bitcoin on Mars

Mars will be the first large human colony sufficiently far away for significant light-lag to occur in communications with Earth. This lag will begin as a challenge for explorers, grow into an inconvenience for colonists, and, finally, become a membrane separating two cultures.

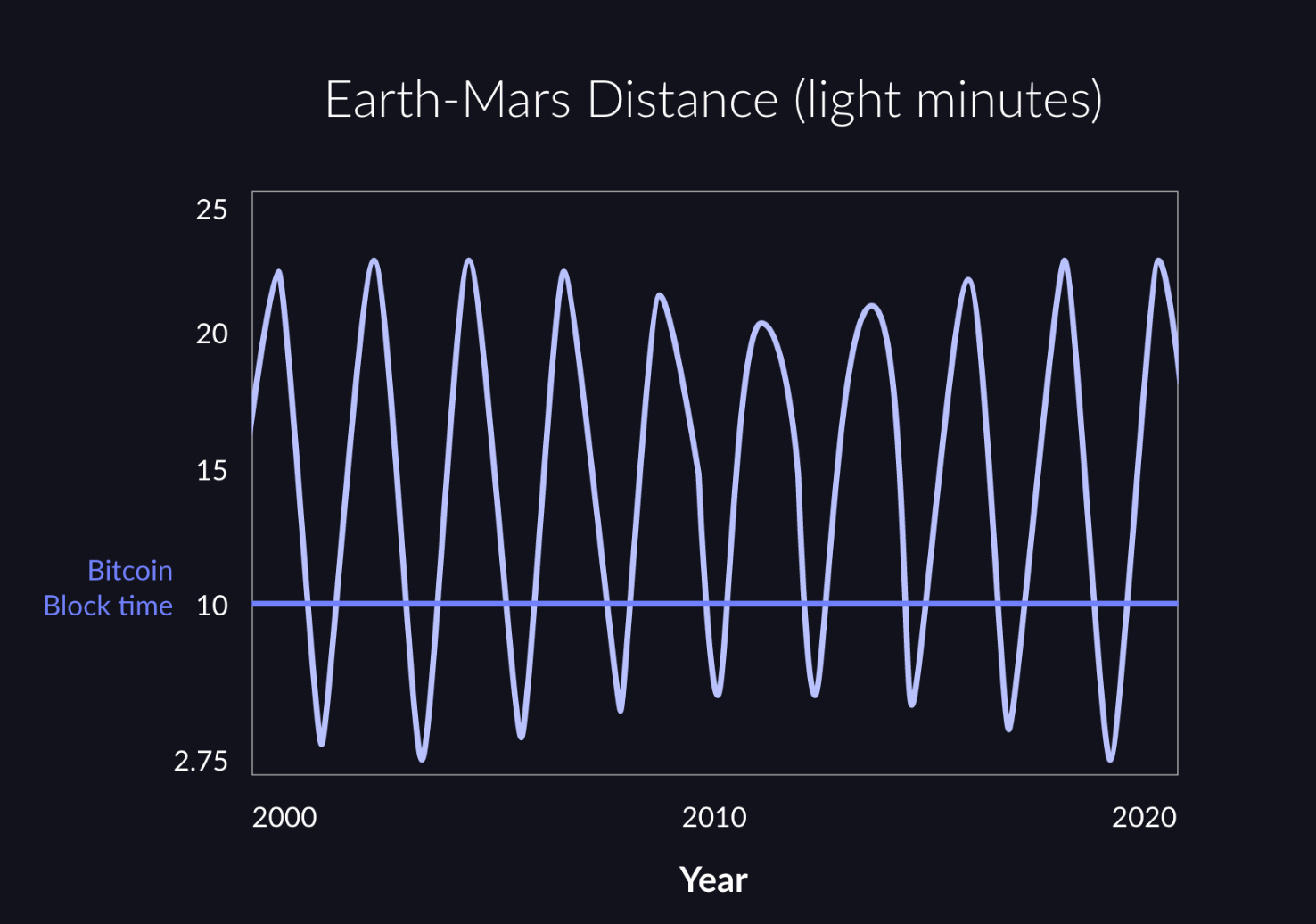

Mars is between 3 & 22 light-minutes away (12.5 light-minutes on average), meaning a round-trip signal time of between 6 and 44 minutes (25 minutes on average). The bitcoin block time is only 10 minutes. (Source)

Mars is between 3 & 22 light-minutes away (12.5 light-minutes on average), meaning a round-trip signal time of between 6 and 44 minutes (25 minutes on average). The bitcoin block time is only 10 minutes. (Source)

Communication between Earth and Mars will certainly still be possible, though networking primitives will be very different than those of today’s Internet (or even the Internet of the then-Earth). A laser-powered, market-driven telecommunications network of relayers and amplifiers will crisscross the inner solar system, trading bandwidth over time and distance for BTC. But there will still be challenges caused by the unavoidable delay inherent to all Earth-Mars communication. Bitcoin users and miners in particular will be affected because of their great distance from Earth and its center of hash:

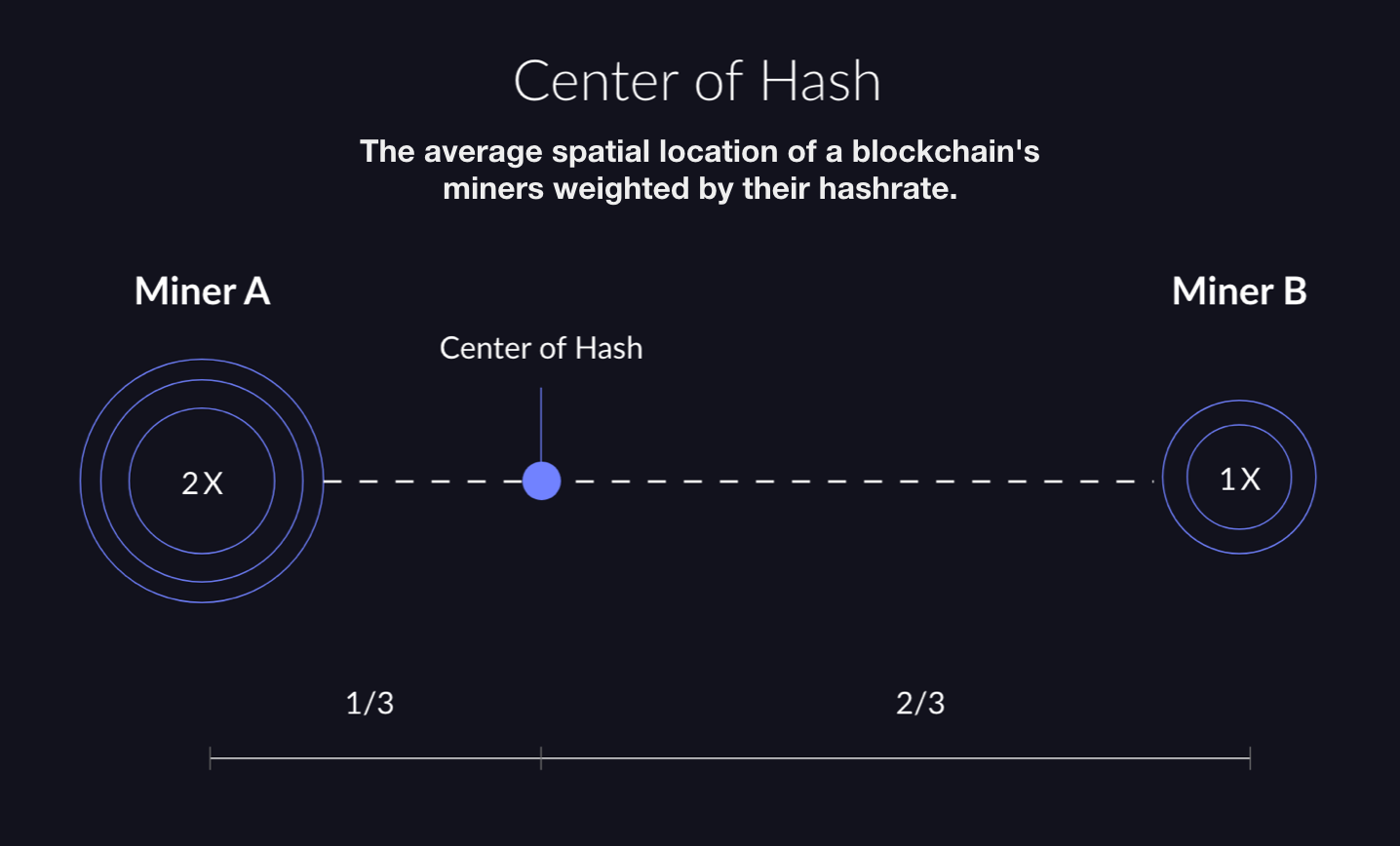

Imagine two miners A & B separated a distance apart. Miner A has twice the hashrate of miner B. Their center of hash will be located at a point in space 1/3 of the distance between them, closer to miner A. A similar calculation can obtain the center of hash for many miners at various hashrates distributed over a large volume of space. Compare to center of mass.

Imagine two miners A & B separated a distance apart. Miner A has twice the hashrate of miner B. Their center of hash will be located at a point in space 1/3 of the distance between them, closer to miner A. A similar calculation can obtain the center of hash for many miners at various hashrates distributed over a large volume of space. Compare to center of mass.

Bitcoin’s center of hash today is somewhere near the center of the Earth, perhaps a bit closer to China. This may change as humanity expands and bitcoin miners set up in orbit or on Luna. But bitcoin’s center of hash is likely to always remain within a few light-seconds distance of the center of the Earth. This will have deep consequences for the future expansion of human civilization.

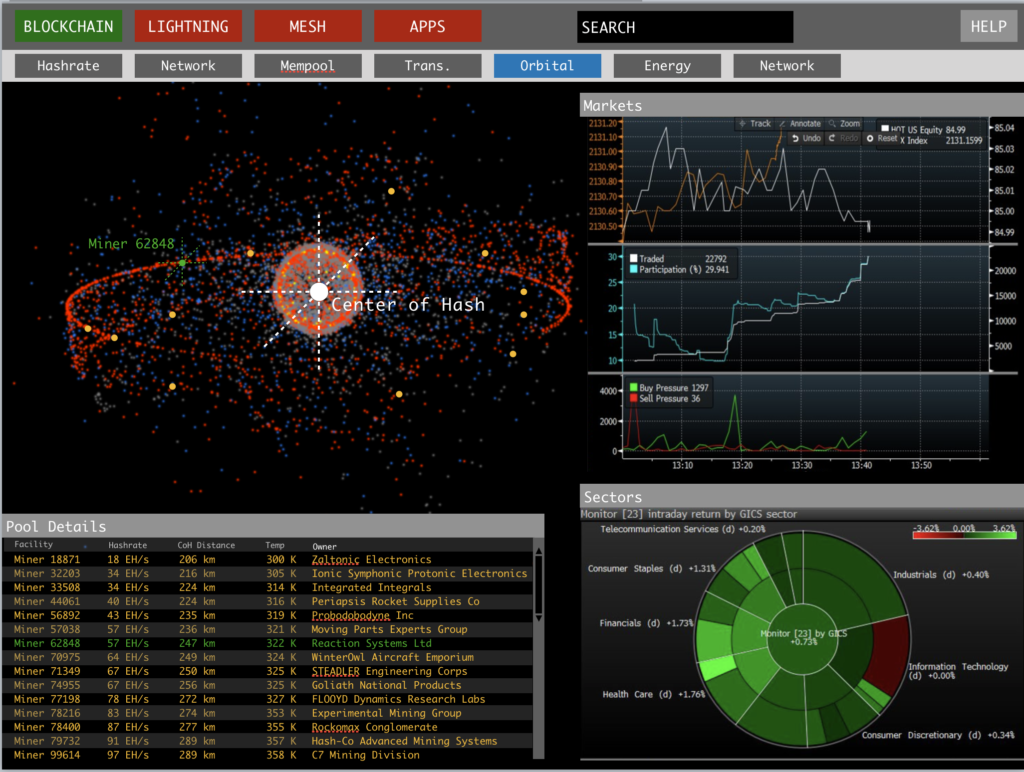

Screenshot of a Bloomberg terminal in 2130. Bitcoin’s center of hash is near the Earth’s center, slightly shifted towards the location of Moon which hosts 15% of all bitcoin miners. (Source)

Screenshot of a Bloomberg terminal in 2130. Bitcoin’s center of hash is near the Earth’s center, slightly shifted towards the location of Moon which hosts 15% of all bitcoin miners. (Source)

Martians will be able to use bitcoin

A Mariner Valley feed store, circa 2130. All prices are in $atoshis per kilogram. The economy of Mars will initially run on bitcoin. Martians can hold and transact in bitcoin as well as on the higher layer lightning networks.

A Mariner Valley feed store, circa 2130. All prices are in $atoshis per kilogram. The economy of Mars will initially run on bitcoin. Martians can hold and transact in bitcoin as well as on the higher layer lightning networks.

Martians will be able to use bitcoin, lightning networks, and higher layers of the bitcoin ecosystem, but Martians will suffer various small disadvantages compared to Terrans because of their distance from bitcoin’s center of hash.

Firstly, hodling is using: anyone can use bitcoin just by owning some BTC. The first hodler to step on Mars will bring bitcoin to that rusty world. In this way, even though bitcoin’s center of hash is bound to Earth, its reach encompasses the universe.

But Martians can do more than silently hodl. They can run full nodes to help sustain local copies of the blockchain on Mars. They can also transact in bitcoin with each other or with Terrans simply by transmitting signed bitcoin transactions, though they’ll have to wait up to 22 additional minutes for their signals to arrive at the center of hash on Earth.

Most transactions in this era aren’t occurring on the blockchain, but on lightning networks. Martians will be able to use lightning networks, but as Clark Moody points out, they have to take particular care to guard against fraud because of their distance from the center of hash. One tactic might be to choose long lock times for the channels they create and use to route. This may sound like a lot of work, but in a hyperbitcoinized future, the lightning network is old technology; software will handle this constraint behind the scenes.

As Mars grows, so will its lightning network, its third and fourth layers, and their connections to Earth. Martian lightning nodes will earn fees from routing transactions, and Martian disk and server farms will locally cache all the best content from meshflix and apps from the dapp store for Martian use. Yes, there will be constant inefficiency due to Mars’ distance from the center of hash, but for the most part, Martians users will feel as well-integrated into bitcoin and its higher layers as Terrans do.

What about Martian miners?

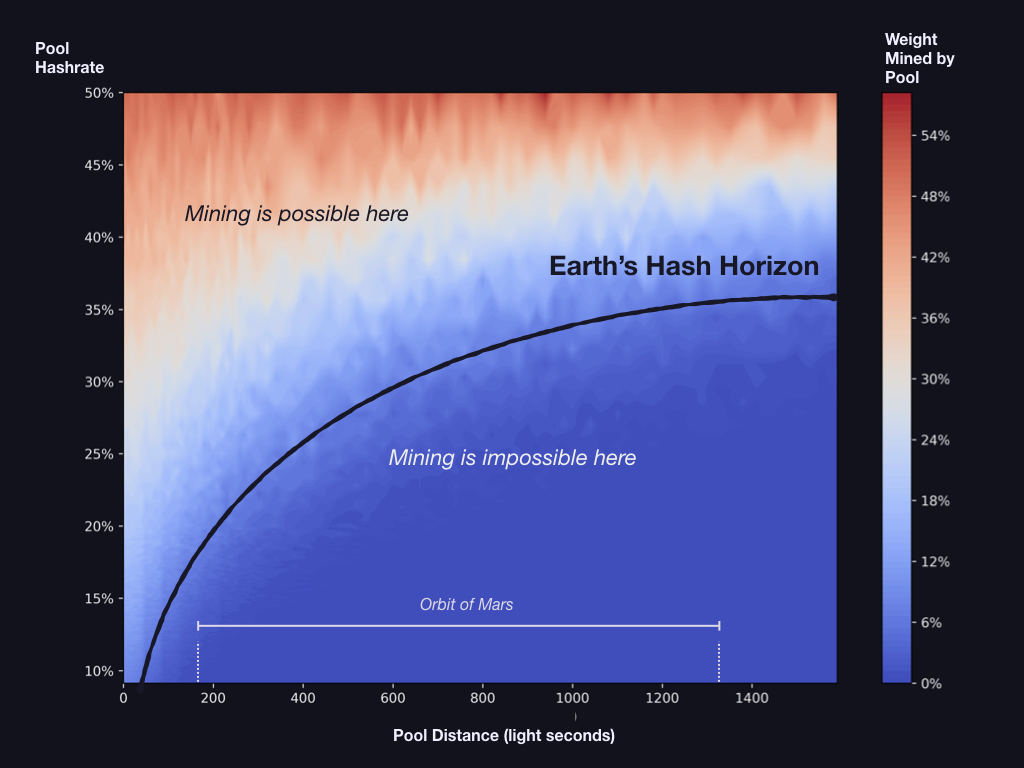

Bitcoin mining will not be possible on Mars