WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the June 2019 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

- 9-20-2019 Additional content has been added to this journal.

- Statechains: Non-custodial Off-chain Bitcoin Transfer

- The Political Theology of Crypto

- The Sovereign, the Subject, and Crypto-power

Satoshi’s Rebuttal of Modern Monetary Theory

By Jack Purdy

Posted June 3, 2019

What is money?

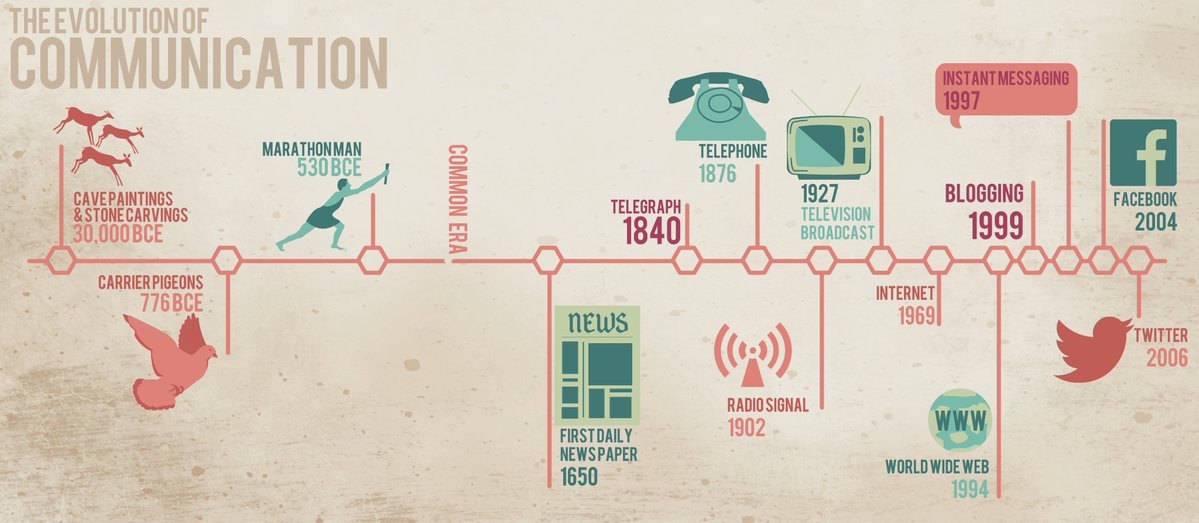

For something so pervasive in our day-to-day lives, it is unfortunate that people don’t ask themselves this question more often. Most people simply equate money with those pieces of paper stamped with faces of dead people, for that is what fulfills their preconceived notion of money — they buy groceries (means of exchange) at different relative prices (unit of account) with money saved in their checking account (store of value). It’s really no surprise then that the nature of money isn’t frequently questioned, as these pieces of paper have been all most people have known to be money for their entire life.

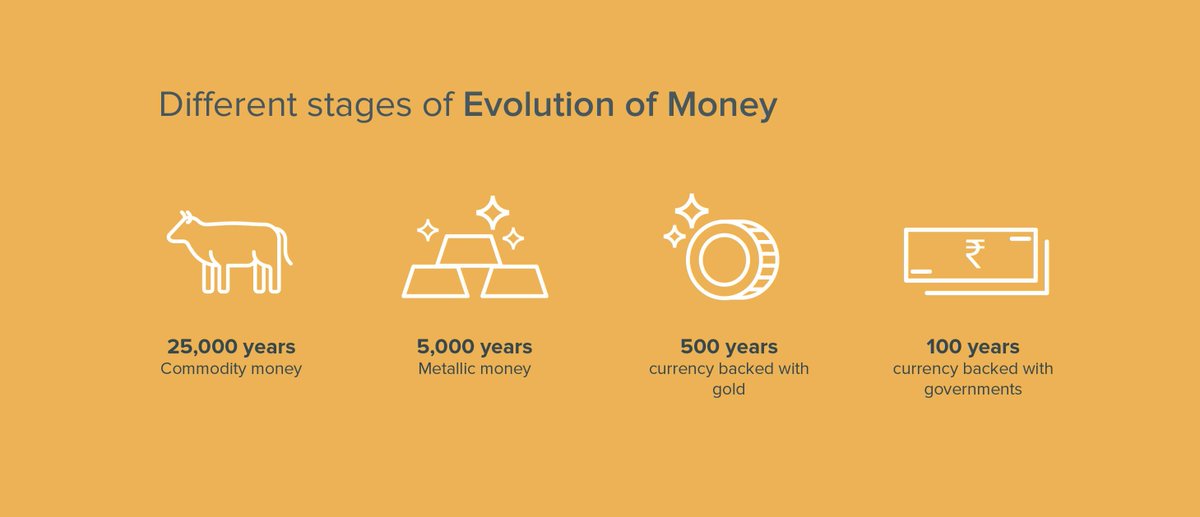

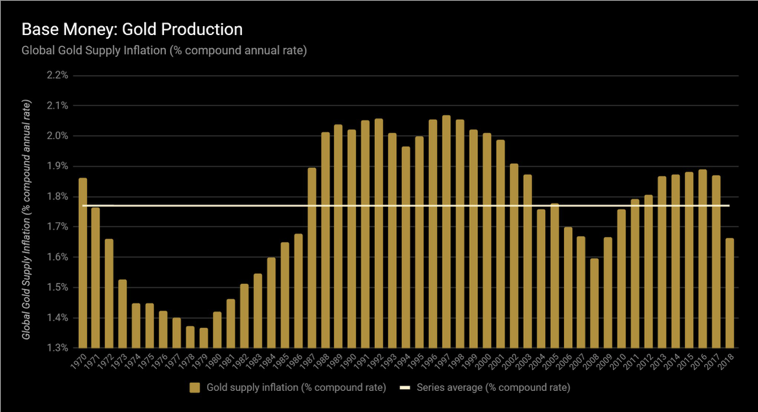

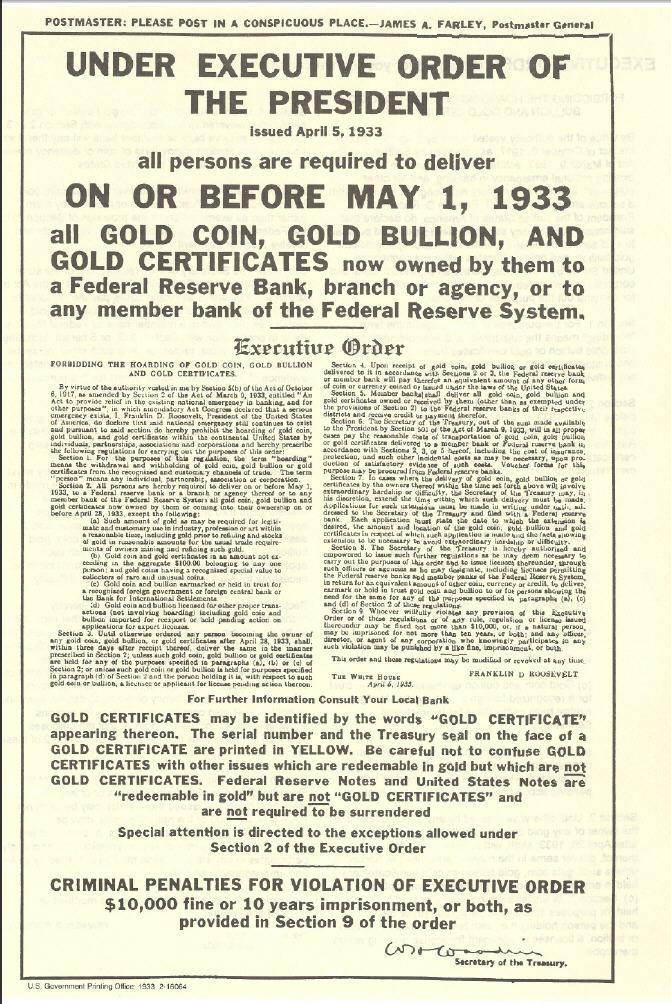

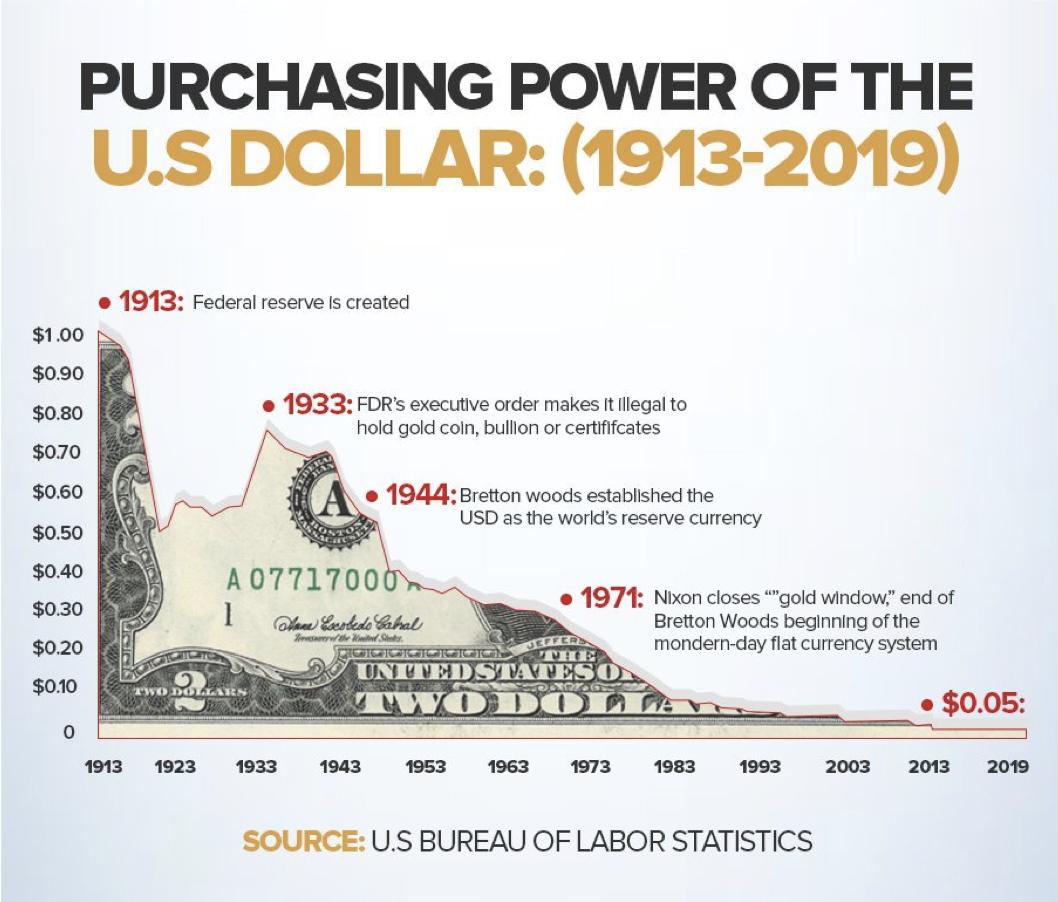

This hasn’t always been the case. Today’s sovereign money is — in the grand scheme of monetary history — an experiment. The U.S. dollar in its current form has been around for less than a century. Dollar bills used to be freely redeemable paper representations of gold until FDR suspended their convertibility and outlawed private gold ownership. Nixon later solidified the lack of any hard backing to the dollar when he ended the Bretton Woods System that fixed the dollar to gold in international markets. While most people wouldn’t notice any difference — after that day they went from transacting using a millennia old commodity to the “full faith and credit” of the United States.

Modern Day Monopoly Money

This notion of using “fiat” — money that exists by government decree — is still a relatively new concept. And not only has it not endured the tests of time, but it has demonstrated a propensity for mismanagement. After Germany went off the gold standard post World War 1, for instance, it took less than a decade for hyperinflation to set in and their economy to collapse. From Zimbabwe to Argentina, there have been countless examples of fiat money failing spectacularly.

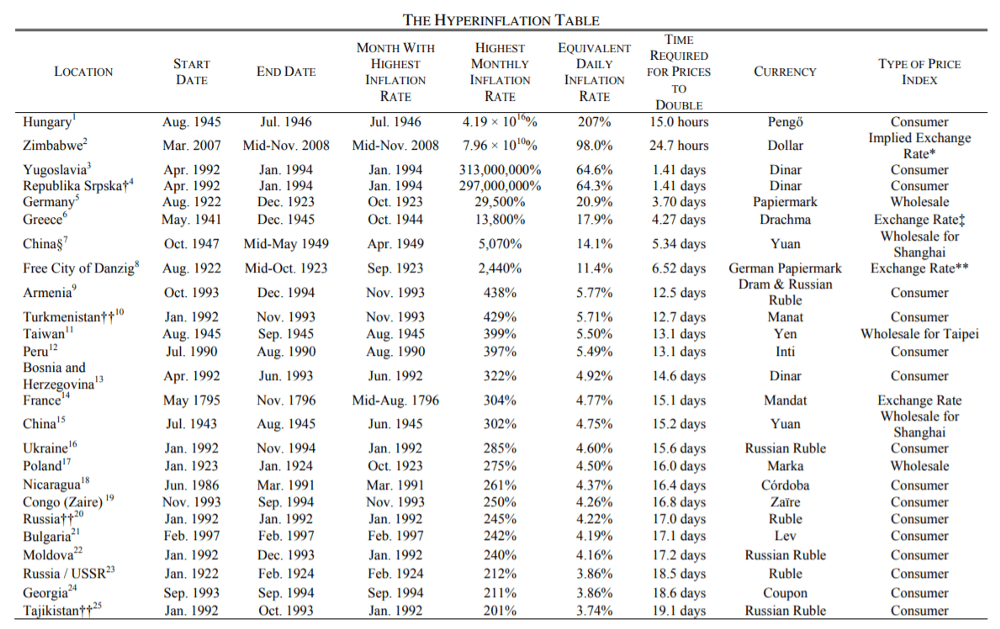

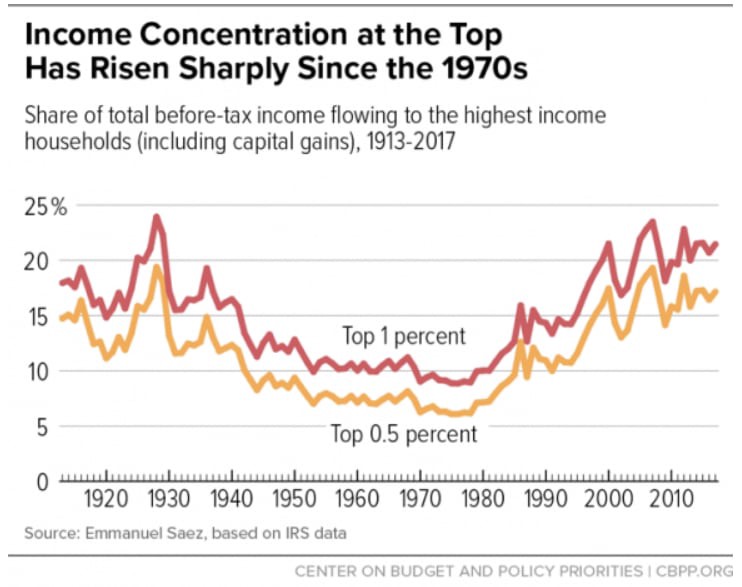

Hanke & Krus, World Hyperinflation Table

Hanke & Krus, World Hyperinflation Table

Often these are cases in which the absolute worst case occurred: the complete collapse of money led to economic ruin.

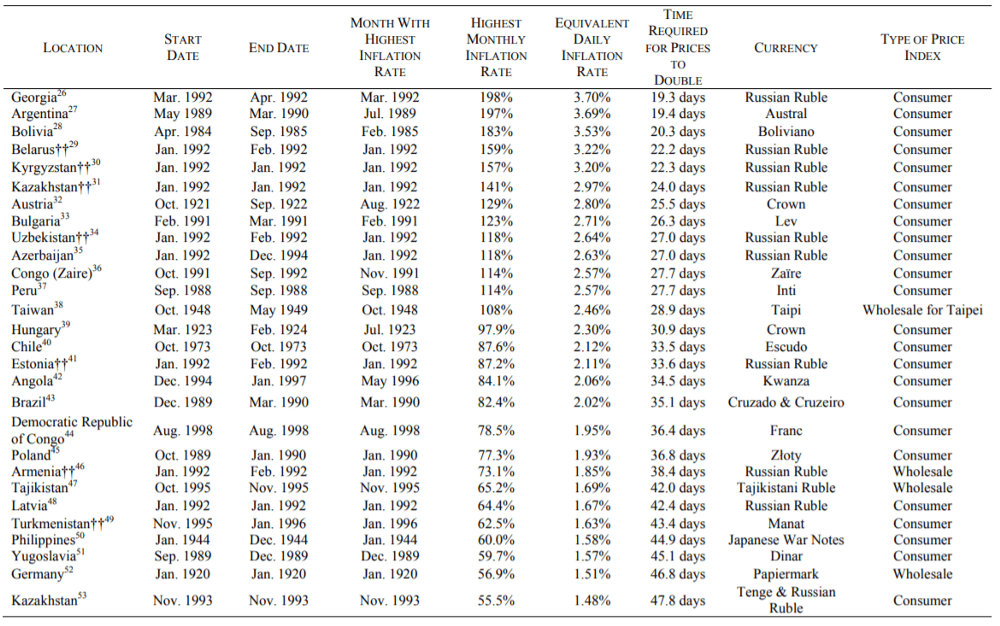

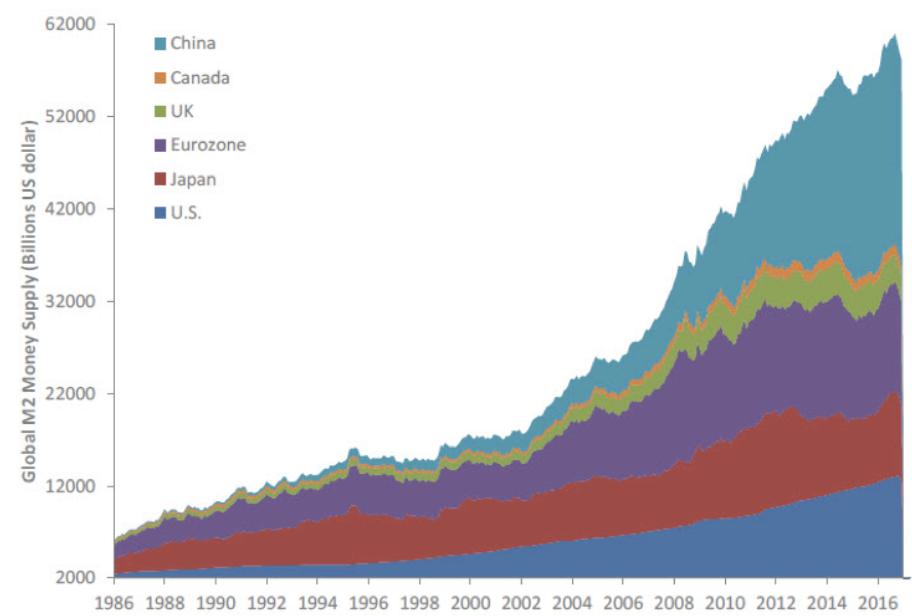

The threat of hyperinflation is always present in fiat systems, but many developed nations have been able to manage their monetary systems to avoid this type of collapse. The USD is just one example. Since its departure from the gold standard, the U.S. has maintained its status as a world power despite massive increases in the national debt and M1 money supply.

Many argue that the dollar is our leading export, and it is evident the U.S. Government has not been shy when it comes to its power of money creation. This has resounding implications for everyone using the USD.

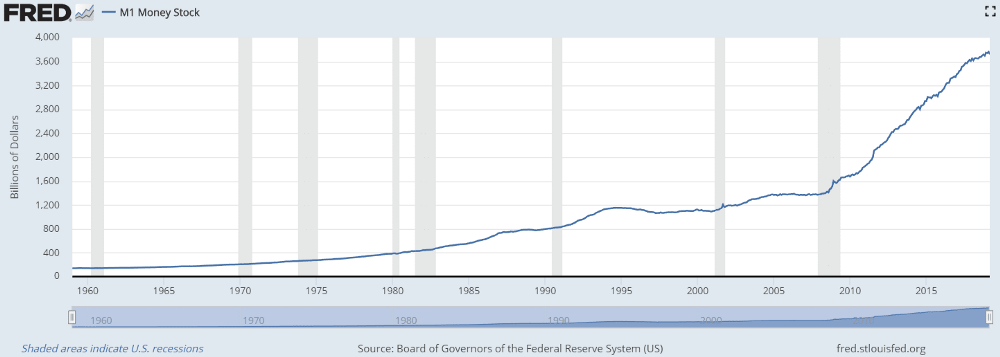

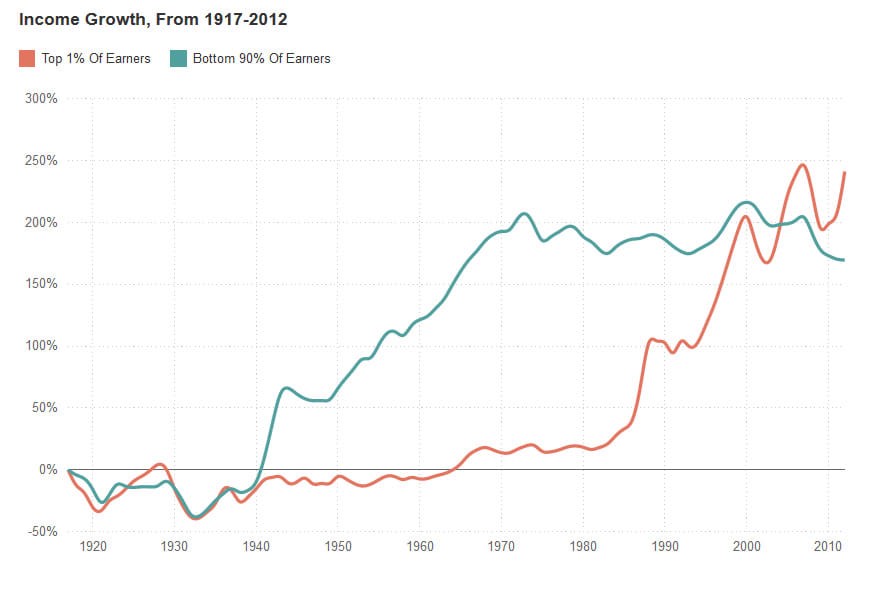

Holding fiat means that you are continuously losing value, and in order to “beat” inflation you have to create a diversified investment portfolio. The wealthy can plow their money into equities, real-estate and commodities which bubble up from all the easy money, while those without access to these investments see their purchasing power decline. This is a classic case of the rich getting richer and is attributable to inflationary monetary policies.

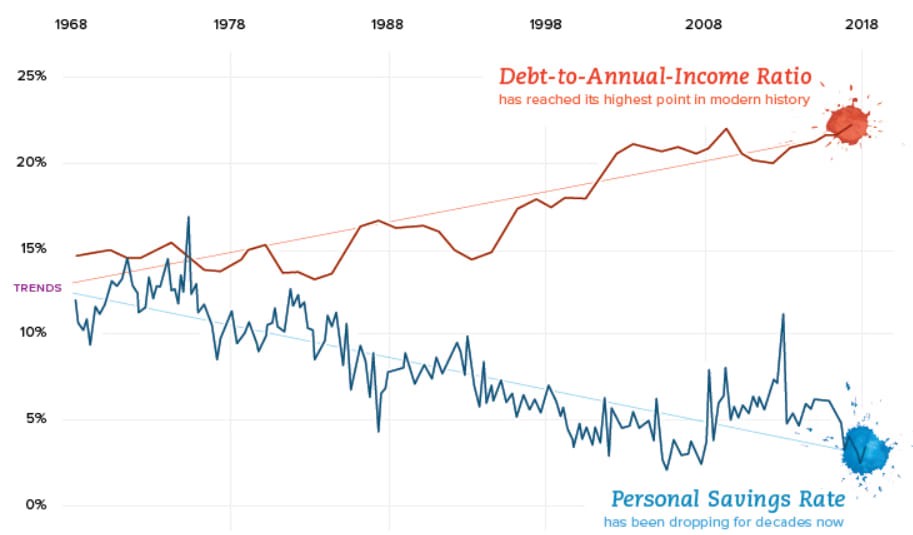

Notice the chart below and what happens right around 1971… when fiat money was born in the U.S. (Source: Center on Budget Policy, NPR)

Since you know your dollar will be worth less tomorrow than it is today, you are incentivized to have a “high time preference” and to spend more now.

If you don’t have the money to spend, but lots of money is generally available, you might take out debt because you know those goods you want/need will only cost more tomorrow. Inflationary regimes lead to more spending, less saving and larger indebtedness as we see today in a society drowning in debt.

This begs the question, what other forms of money have succeeded for longer periods of time?

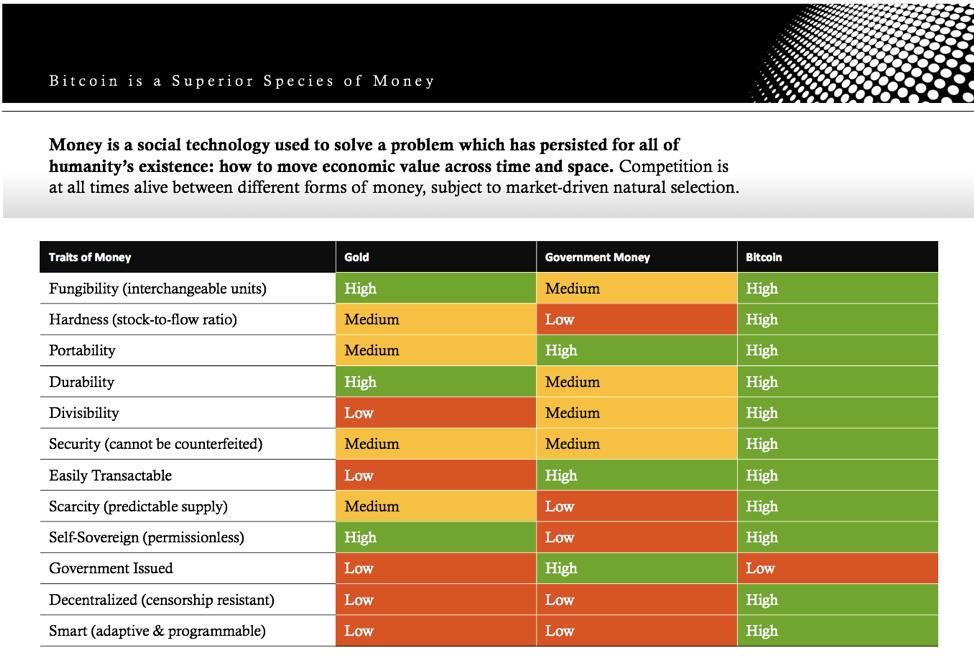

The obvious answer is gold, and most people are familiar with its use as money but haven’t given much thought to why. In addition to gold, humans have also used other commodities such as shells or Rai stones to transact because they held certain desirable characteristics. To varying degrees they were:

- Secure from loss/theft

- Scarce, difficult to counterfeit

- Easily measurable/divisible

Over time goods that held these desirable characteristics outlived others. (Insert obligatory Nick Szabo article on the origins of money)

The Not So Modern, Modern Monetary Theory

While the idea of valuable commodity money makes sense to some, most of the conversation today is gravitating towards a school of thought with a diametric viewpoint, known as Modern Monetary Theory (MMT).

The foundations of this viewpoint, known as Modern Monetary Theory (MMT), date back to the early 20th century with George Knapp’s The State Theory of Money. This theory directly contradicts the prior notion that money holds value due to its desirable characteristics. Knapp argues that “money is a creation of law” and derives its value from the State, and its requirement that taxes be paid in their native currency.

The degree of “moneyness” is a result of acceptability, with the ultimate form of acceptance as payment to the government. This theory (also known as Chartalism) was further refined in The Credit Theory of Money by A. Mitchell Innes, which postulates money is a liability imposed by the State to measure obligations. When you buy groceries you are taking on debt and measuring it with that fiat. Currency acts as an IOU so the grocer then has a debt owed to them with which they can again redeem for something valuable using the currency. This seems to suggest that money has no intrinsic value, directly rejecting the prior idea of sound commodity money. The market is no longer a place where goods are exchanged but simply a clearing house for settling debits and credits.

While the sound money view says humans began with barter and transitioned to using goods with desirable characteristics to transact in order to solve the double coincidence of wants, the Chartalist view says we progressed from shells to gold coins to fiat as a result of finding more efficient means to track debt. This explains the desire to transition away from the gold standard since redemptions of paper notes for gold coins are merely the exchange of one form of obligation for another that’s identical in practice. The notion of an asset backed currency is one in which the government’s flexibility to control the money supply is restricted.

Subscribing to this Chartalist view of money leads one to arrive at some interesting policy conclusions.

In today’s world, only sovereign governments claim this ability to impose liabilities on others because they can create demand by requiring taxes to be paid in that same government liability. Therefore a government has no need to balance its budget and spending can greatly outpace tax revenue since the difference can be covered by the creation of more money — i.e. debt.

MMT economists believe that governments can create as much debt as they want so long as there is adequate demand for their currency from state imposed obligations. In theory, governments can finance themselves strictly through issuing currency until inflation rises to a point where taxes need to be levied to increase the demand side of money to keep pace with supply.

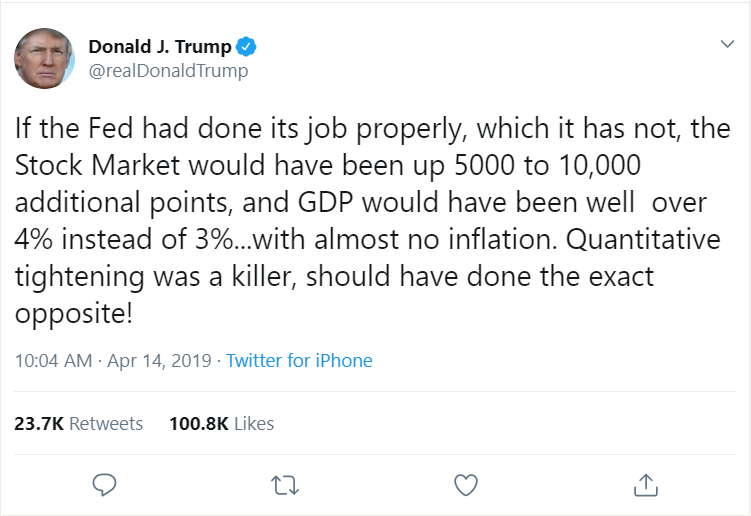

If that’s too much of a mouthful, former Fed Chairman Alan Greenspan sums it up:

“The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default.”

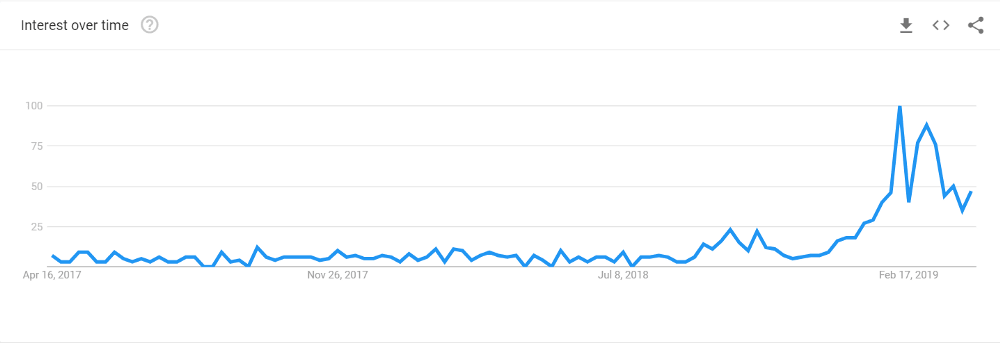

Google search trends for “Modern Monetary Theory

Google search trends for “Modern Monetary Theory

MMT in the 21st Century

While the underpinnings of MMT are not new, there has been a strong resurgence of these ideas in recent years from both sides of the political spectrum. The modern belief is that the government can run perpetual deficits to fund wars or pay for universal healthcare. If these policies don’t work as intended and lead to financial distress, they can simply print more money!

On paper the Chartalist view of money might make sense. You look around the world and every form of money with mainstream adoption is required by the State to be paid in taxes. Therefore, one could conclude that what makes it valuable is this requirement. However, a truly competitive market has not been possible to challenge the hegemony of fiat money. Every attempt from liberty dollars to E-gold was shut down by the government. The State has and will go to great lengths to maintain financial control over its citizens.

Enter Bitcoin

This all changed a decade ago, when pseudonymous author Satoshi Nakamoto wrote the Bitcoin White Paper and released his monetary experiment to the world that fundamentally challenged the core beliefs of MMT. The decentralized nature of Bitcoin meant that even if the State wanted to shut it down, it would be an incredibly difficult project to kill at a certain scale. This new form of money was able to exist out in the wild, allowing for the first time the possibility of a true competitor to fiat money.

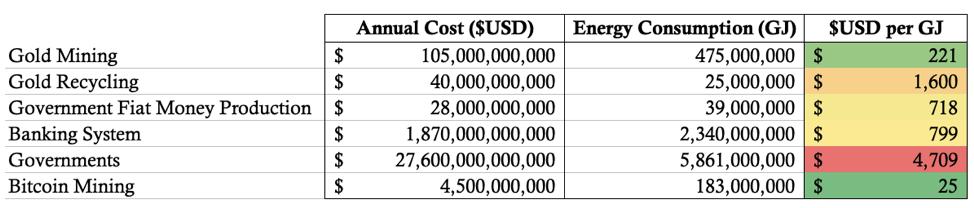

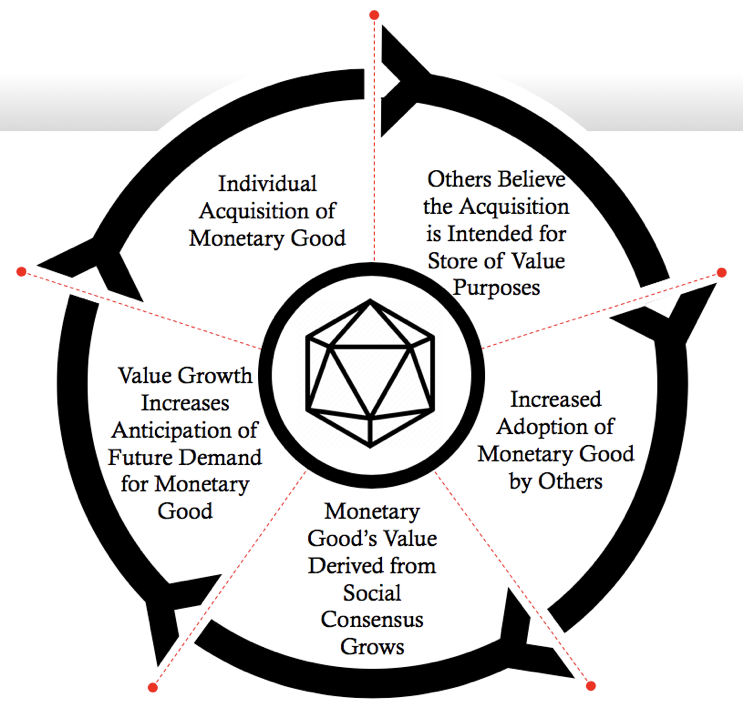

Recall that the Chartalist belief is that money has value because of its acceptability by the State. This thinking would lead one to believe that an asset looking to be used as currency should not be desired unless it can be used to pay taxes. Yet, despite not operating as legal tender, it has led to millions of people across the world demand it for its desirable characteristics. Bitcoin has built a robust social contract with its users and for that reason has a network value of ~ $160 billion, nearly a million active addresses, and $17 million being spent every day to secure the network (data from OnChainFX). This contract is described in the following:

- Only the owner of a coin can produce the signature to spend it (confiscation resistance)

- Anyone can transact and store value in bitcoin without permission (censorship resistance)

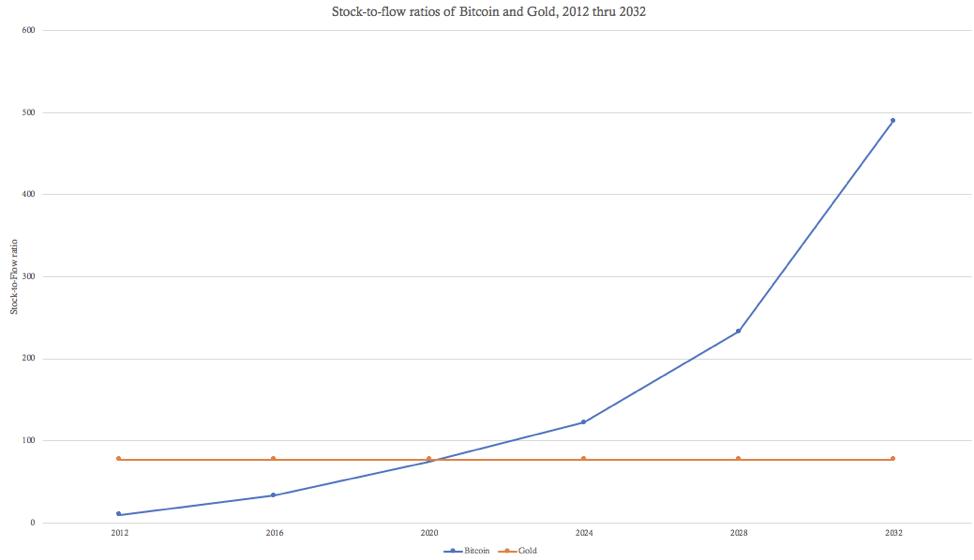

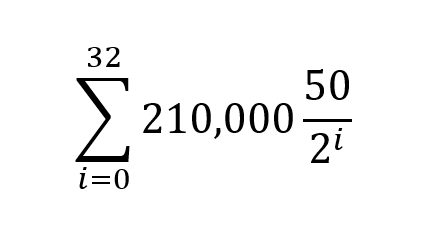

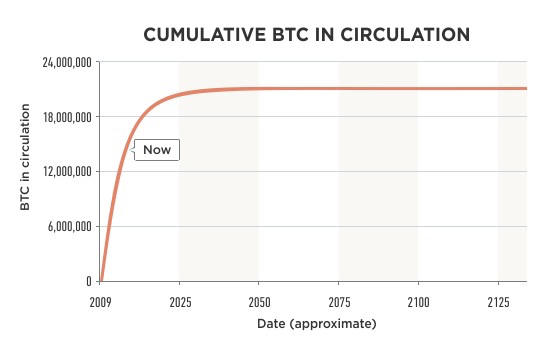

- There will only be 21 million bitcoins, issued on a predictable schedule (inflation resistance)

- All users should be able to verify the rules of bitcoin (counterfeit resistance)

These unique features are what have allowed the unlikely outcome of Bitcoin’s relative success.

Not because it is accepted by the State. Not because it is an effective means of tracking debt.

So What?

If you rebut the core assumptions upon which an argument is made, then you have destroyed the argument. MMT argues that money isn’t valuable because of its characteristics, yet bitcoin has accrued value and achieved usage solely because of them. Since people value money for its inherent nature, in the long-run money that is susceptible to be printed at the whims of the government won’t be as successful as one that is not. We’ve seen this play out in extreme situations where nations abuse their money creating abilities and their currency becomes worthless as users adopt more sound money. In a world absent free-market competition besides fiat, this has traditionally been the U.S dollar.

However, now that Satoshi has introduced Bitcoin, those living in places where modern monetary policies are rampant can now opt for an alternative. The U.S. dollar has long been a safe haven asset, but if these policies continue unobstructed that could change. (Note: The next Bitcoin halving will lower inflation below the U.S. target rate) This will not likely be an expedient process, money is a social construct that takes decades if not centuries to become entrenched in everyday life. But if you recognize the second and third order effects of fiat money and its abuses, then you should be open to the sound money alternative that is Bitcoin.

Tweetstorm: Bitcoin rescues the human

By Conner Brown

Posted June 3, 2019

Bitcoin rescues the human.

The pursuit of rationality has attempted to achieve objectivity in all forms of knowledge by removing the subject.

The common refrain is that academic thought is only useful if pesky human biases are removed.

While incredibly useful in some domains, this has devastating consequences in the social sciences.

Unbridled rationality has led academics to believe they can perfectly engineer society by reducing citizens to the right variables and controls.

This exploded in dramatic fashion through the totalitarian regimes of Hitler, Stalin and Mao (to name a few). Killing millions in the pursuit of objective utopia.

We can see similar trends today in China’s social credit systems—reducing citizens to compliance algorithms.

While less serious, this thinking is also a cornerstone in our present monetary systems.

Central banks around the world actively try to engineer a financial system better than the billions of interrelated ideas, desires, and values in the marketplace.

Institutions such as the FOMC attempt to reduce infinitely complex human networks to predictable curves.

The world is not so simple—the financial meltdowns of the past 100 years are plenty proof.

Such arrogance results in inequality, stagnation, and crisis.

Bitcoin returns an essential subjectivity to our social order by providing a constant, predictable money that individuals can rely on to honestly communicate their subjective preferences.

Our money supply will no longer be controlled by a small group of men huddled around a table, attempting to read the monetary tea leaves.

Instead, rates and credit will be set by the sum total of interactions—with each actor pushing and pulling to reach a human balance.

Long bitcoin, short the central bankers 🤠

Tweetstorm: Touchpoints

By Vijay Boyapati

Posted June 4, 2019

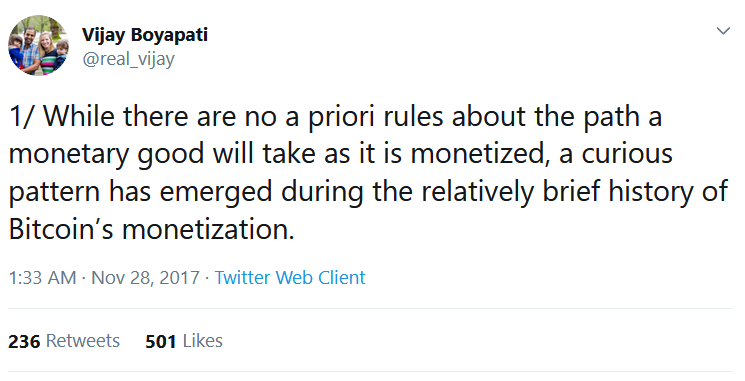

- How many times did you have to hear about #Bitcoin before you were ready to acquire some or, at least, explore its significance? This number of “touchpoints” is an important factor in the process of Bitcoin’s monetization. Let’s explore the idea of touchpoints in a thread: 👇

- We now know that the process of #Bitcoin’s monetization is occurring in a series of hype cycles where the magnitude of each cycle is defined by the people “reachable” in that cycle. Which people defined the prior cycles? 👇

thread link

thread link - The first hype cycle in the #Bitcoin market was dominated by cryptographers and cypherpunks who were already primed to understand the importance of Satoshi Nakamoto’s groundbreaking invention.

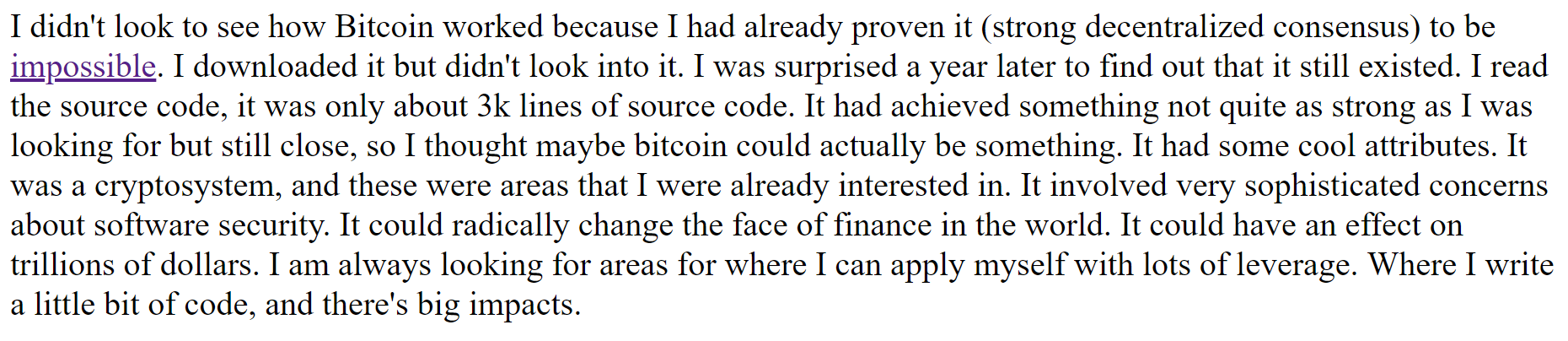

- But even among the cohort of cryptographers and cypherpunks primed to understand #Bitcoin, some of the most brilliant required multiple touchpoints before being convinced that Satoshi was onto something. Consider the words of Core developer Gregory Maxwell:

- I was personally part of the second hype cycle which attracted those with an ideological affinity for #Bitcoin’s freedom promoting potential (libertarians). But it took many touchpoints for me to recognize its importance (I’m a slow learner).

- Luckily for me, I had a very high opinion of the two people who evangelized #Bitcoin to me (one of them had been my co-founder in a @YCombinator startup). And they were planting seeds in fertile ideological ground. But what if I had no ideological affinity?

- One lesson to take away is that if a person is not reachable in a particular hype cycle, there is almost no point is trying to convince them of #Bitcoin’s importance. As best they would view it as a quick trading opportunity

- To be “reachable” to #Bitcoin’s potential most people will typically have to have heard about it multiple times from multiple people that they trust. One sign that a new group will become reachable is that a respected person in the group becomes an evangelizer to the group.

- Consider, for example, Superbowl winning left tackle @RussellOkung. A well respected pro-bowl player is now evangelizing #Bitcoin to his fellow players in the #NFL. Some will pay attention to Okung and begin evangelizing it in turn, priming more and more NFL players.

- Another way a person can be primed is if they made a small allocation to #Bitcoin (or received it as a gift) and saw that grow in a prior cycle. They will already be awake to the financial potential of a larger allocation and more receptive to learning more.

- However, for those who are ideologically opposed to #Bitcoin there is no number of touchpoints that will convince them of its importance. Think of people like @paulkrugman or @Nouriel. They will be walking around with wheelbarrows of worthless fiat before owning bitcoins.

- So when explaining #Bitcoin to friends, family and colleagues get a sense of how “primed” they already are. Have they already heard of it? Are they curious or dismissive? Are they ready for a tiny allocation, or are they ready to take the leap?

- In the coming hype cycle, the people most ready to increase their allocation to #Bitcoin are those who were already curious about it and perhaps had made a small allocation to it in the prior cycle. They are ready to be activated in the next bull run and will define its size

Tweetstorm: Money is the most important field

By Hasu

Posted June 6, 2019

Money (not finance) is the most important field in the world today and will be for at least 20 years.

Why? 99% of history is written in 1% of the time. We are in the early phases of another 1% where the medium-term future will be written (what Neil Howe calls “The 4th Turning”.)

Money is ripe for a paradigm shift, but the direction of that shift is still undecided. There are currently forces pulling into several directions, with the extreme ends being hyper-control of money (MMT) and removal of all control of money (Bitcoin.)

While in most of history local governments have issued money, many private producers will be able to compete in the future. Networks like Bitcoin are constructed from the ground up to resist, while private firms like Facebook are effectively sovereign to nation-states.

These changes in money could move the world closer to utopia or dystopia, depending on what your values are. The only outcome that seems certain today is that money will fragment as more and more producers enter the market and increase the options for consumers manyfold.

Much has been written about money being a winner-take-all or -most market, but I don’t really believe in that. As the costs of storing different monies as well as exchanging between them decreases, consumers automatically put more focus on other properties.

Consolidation into one money assumes a world where custody and exchange are the biggest sources of friction for money. In reality, the friction just changes its form. The walled gardens of supranational networks like Facebook will replace the walled gardens of national economies.

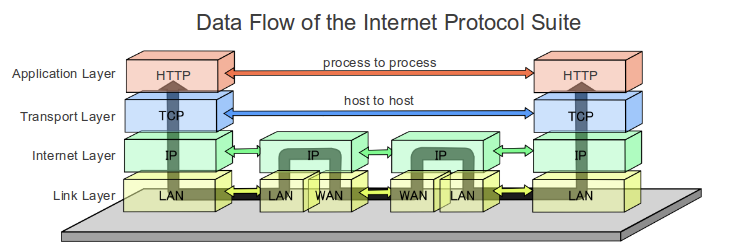

The biggest friction might come in the fragmentation of the internet itself. In the same way that the unipolar world order and US-protected free trade are ending, the internet itself will almost certainly break into several shards between China, Russia, and the West.

We may be using different money in every shard and yet another money that is entirely trustless (bitcoin?) between them. The design space for money today is magnitudes greater than it has ever been, so history isn’t really a guide for us.

It’s hard to wrap your head around how easy it is to participate in the Cambrian explosion of money, whether we end up with one large winner in the end or several medium-sized ones. Hell, Bitcoin was created by, at most, a small group of people that is still anonymous today.

This shift will produce winners and losers. One loser could be (supporters of) big government. The large governments we have today are only possible because a) seigniorage from inflation and b) control over the financial system encourages people to honestly report their income.

If private money allows people to dodge taxes at low risk, this behavior will eventually normalize. This may be the tipping point in the growth of government that causes a mean reversion. Thus, private money will further accelerate the rise of the individual over the collective.

The biggest winners when all has been written will be the people in Emerging Markets. Local money has long been a layer-3 institution. Stable money needs stable property rights needs a stable monopoly on violence. But no more.

Soon, individuals can import their money directly via the internet without relying on the government-provided bottom layers at all. Combine that with digital goods and p2p services making up more and more of the world GDP, and we could see a democratization of trade and capital.

In sum, these are the reasons I have committed myself to the private money space, which, I fully believe, will turn into one of the biggest and most powerful industries in the world. It is on us to shape what values that industry will be built on.

The Golden Ratio Multiplier

Unlocking the mathematically organic nature of Bitcoin adoption

By Philip Swift (@PositiveCrypto)

Posted June 17, 2019

Disclaimer: Nothing contained in this article should be considered as investment or trading advice.

As Bitcoin continues to progress on its adoption journey, we learn more about its growth trajectory.

Rather than Bitcoin price action behaving like a traditional stock market share price, we see it act more like a technology being adopted at an exponential rate.

This is because Bitcoin is a network being adopted by society, and because it is decentralised money with limited supply, its price is a direct representation of that adoption process.

There are a number of regression analysis tools and stock to flow ratio studies that are helping us to understand the direction of Bitcoin’s adoption curve.

The new tool outlined in this paper brings an alternative degree of precision to understanding Bitcoin’s price action over time. It will demonstrate that Bitcoin’s adoption is not only following a broad growth curve but appears to be following established mathematical structures.

In doing so, it also:

- Accurately and consistently highlights intracycle highs and lows for Bitcoin’s price.

- Picks out every market cycle top in Bitcoin’s history.

- Forecasts when Bitcoin will top out in the coming market cycle.

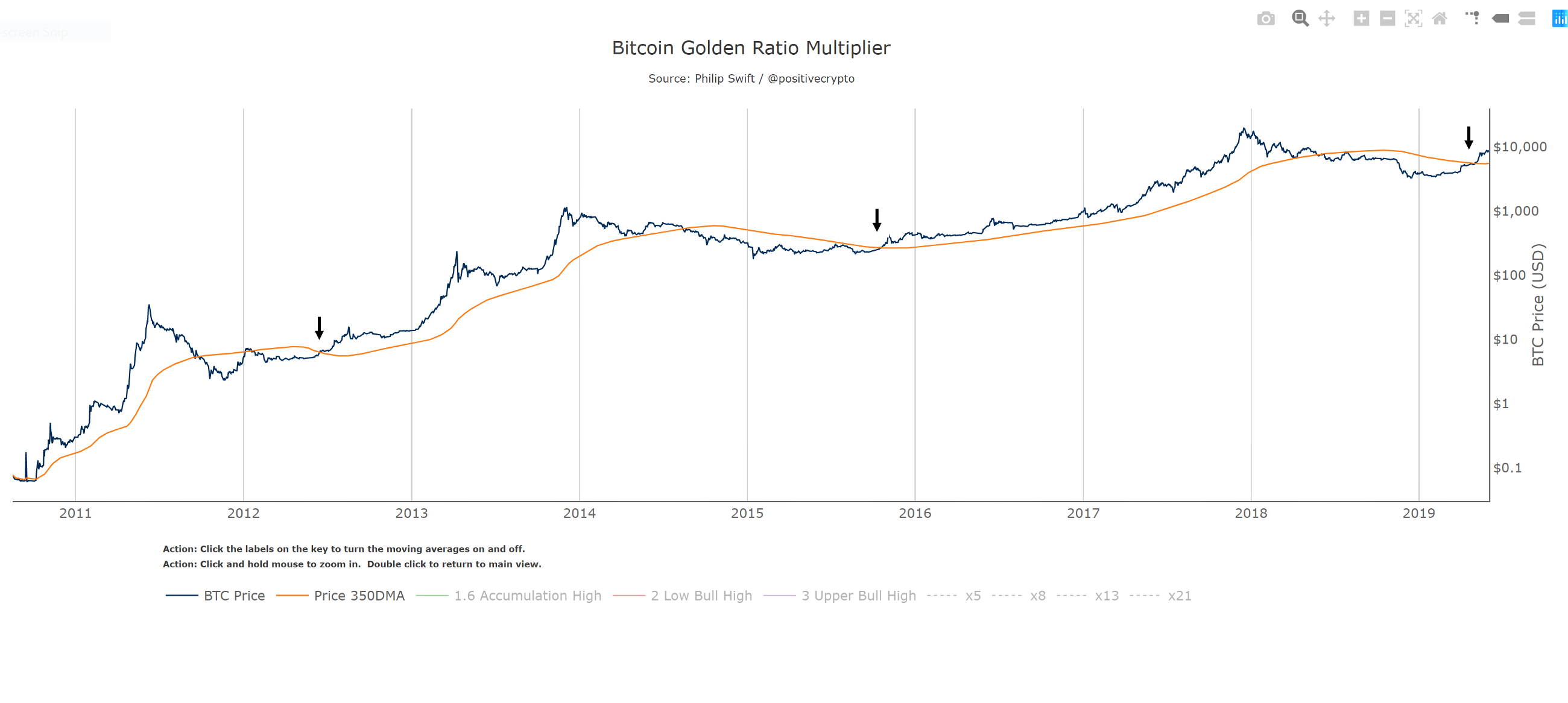

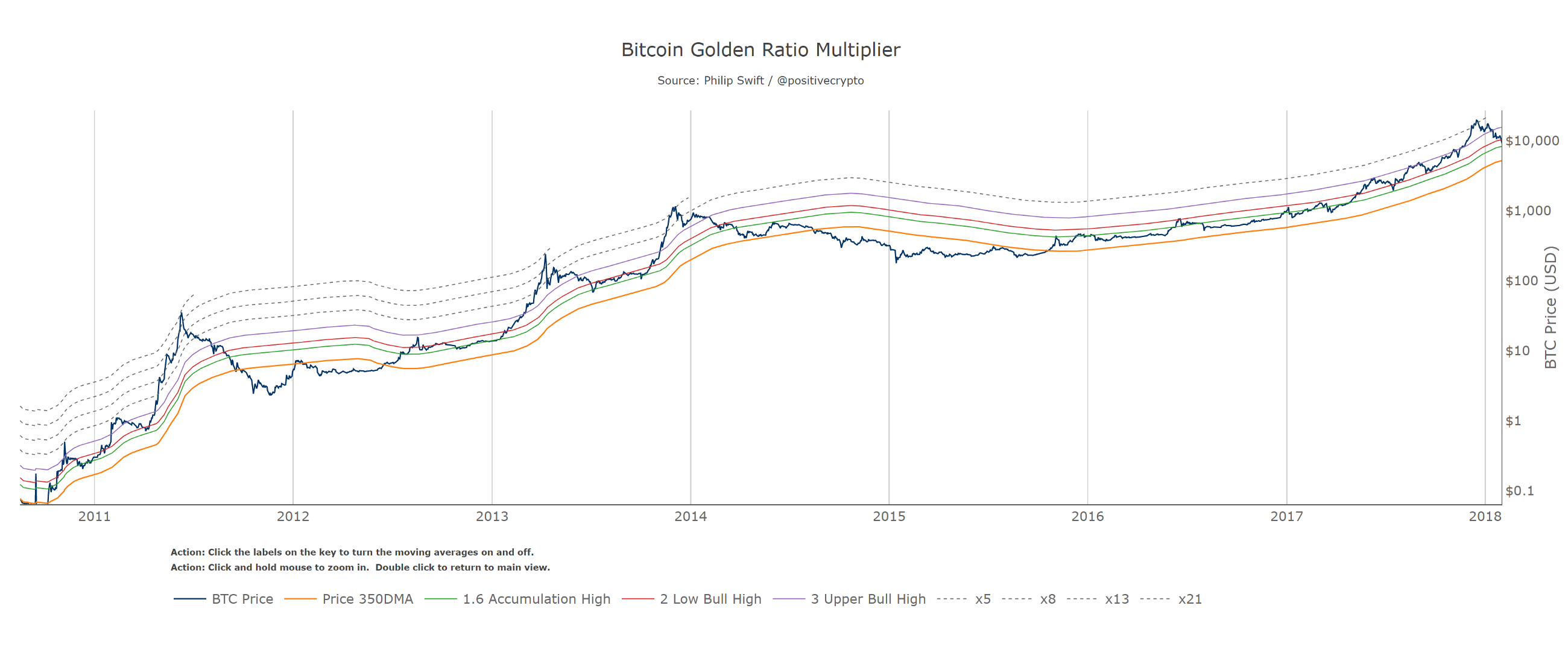

To begin, we will use the 350 day moving average of Bitcoin’s price. It has historically been an important moving average because once price moves above it, a new bull run begins.

The new insight comes when we multiply the 350 day moving average (which we will refer to as the 350DMA) by specific numbers. Those mathematically important numbers are:

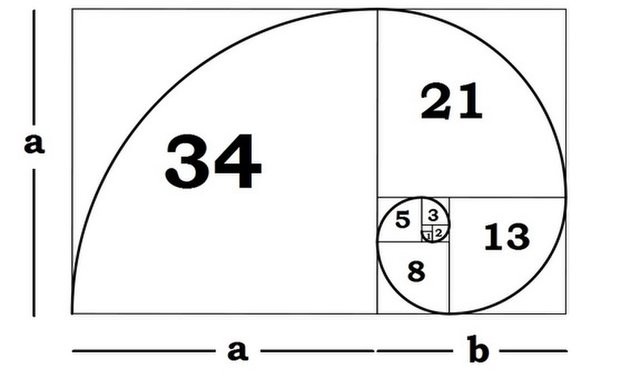

The Golden Ratio = 1.61803398875

Fibonacci Sequence = 1, 1, 2, 3, 5, 8, 13, 21…

You can use these hyperlinks if you need a refresher on the importance of the golden ratio or Fibonacci sequence in nature and mathematics. But we see them consistently throughout life whether it is in the pattern of how plants grow, the structure of hurricanes, or even trader behaviour in financial markets.

Building the cyclical layers

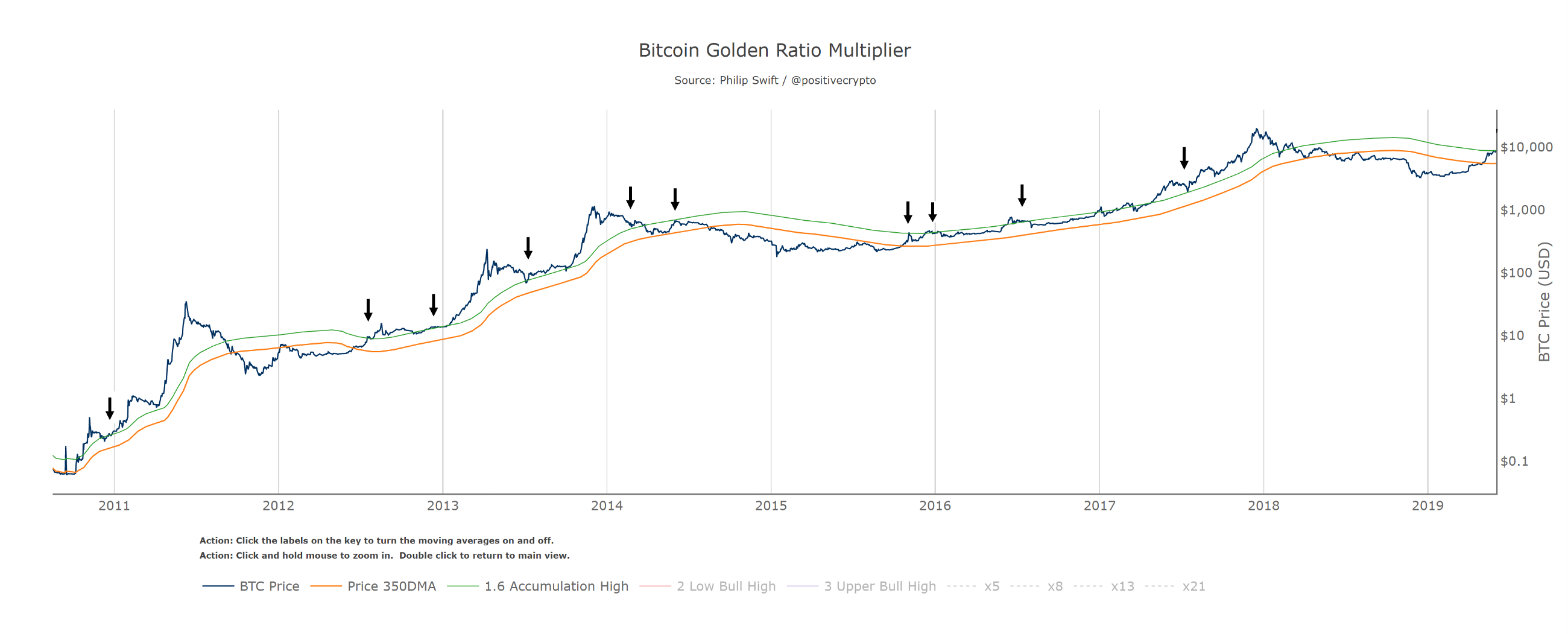

We will start with the Golden Ratio of 1.6 (rounded here to one decimal place).

If we take the 350DMA (orange line) and multiply its value by 1.6, we create a new line above it, the 350MA x 1.6 (green line).

We then discover in the chart below how this newly created green line has in fact acted as support and resistance throughout Bitcoin’s history, examples of which are highlighted by the arrows on the chart:

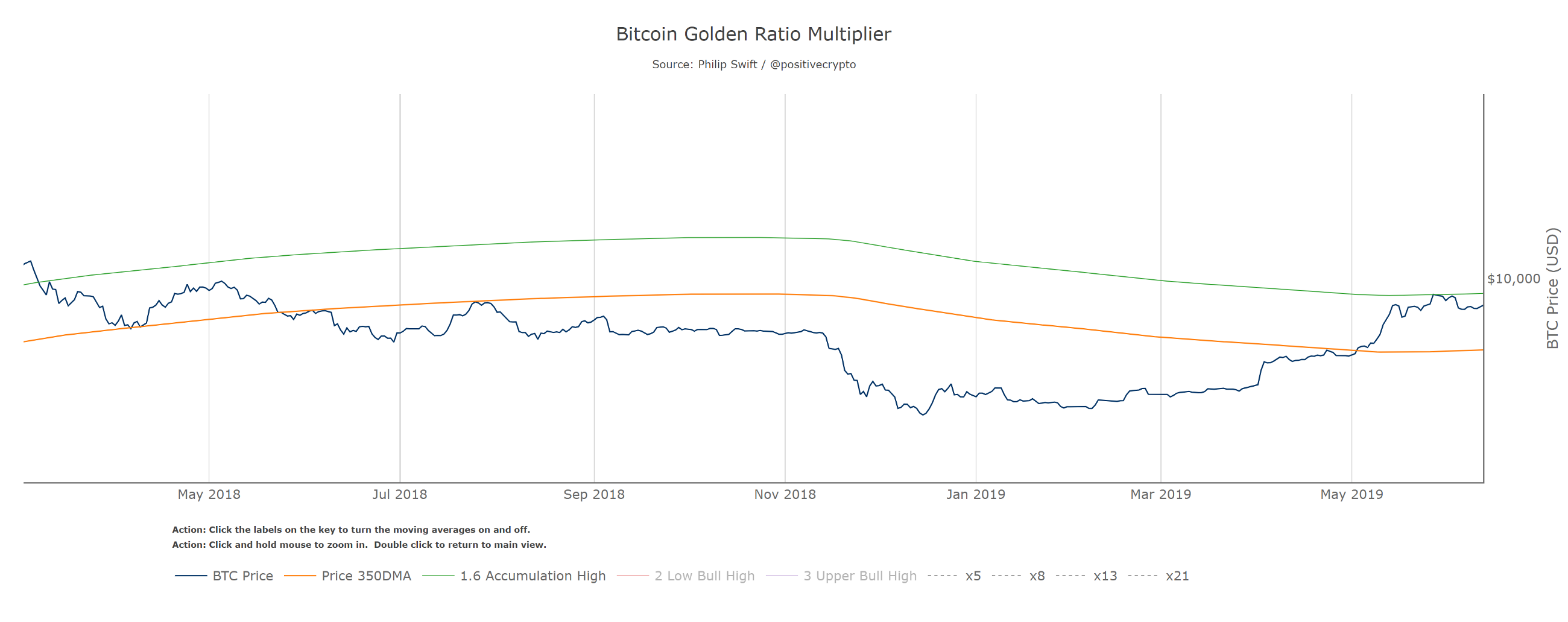

It is also worth noting that the 350DMA x 1.6 line acted as resistance in the parabolic price move from the Dec 2018 low. Rejecting price perfectly on the first touch and causing a $1,500 pullback before approaching it again and likely breaking through at the time of writing:

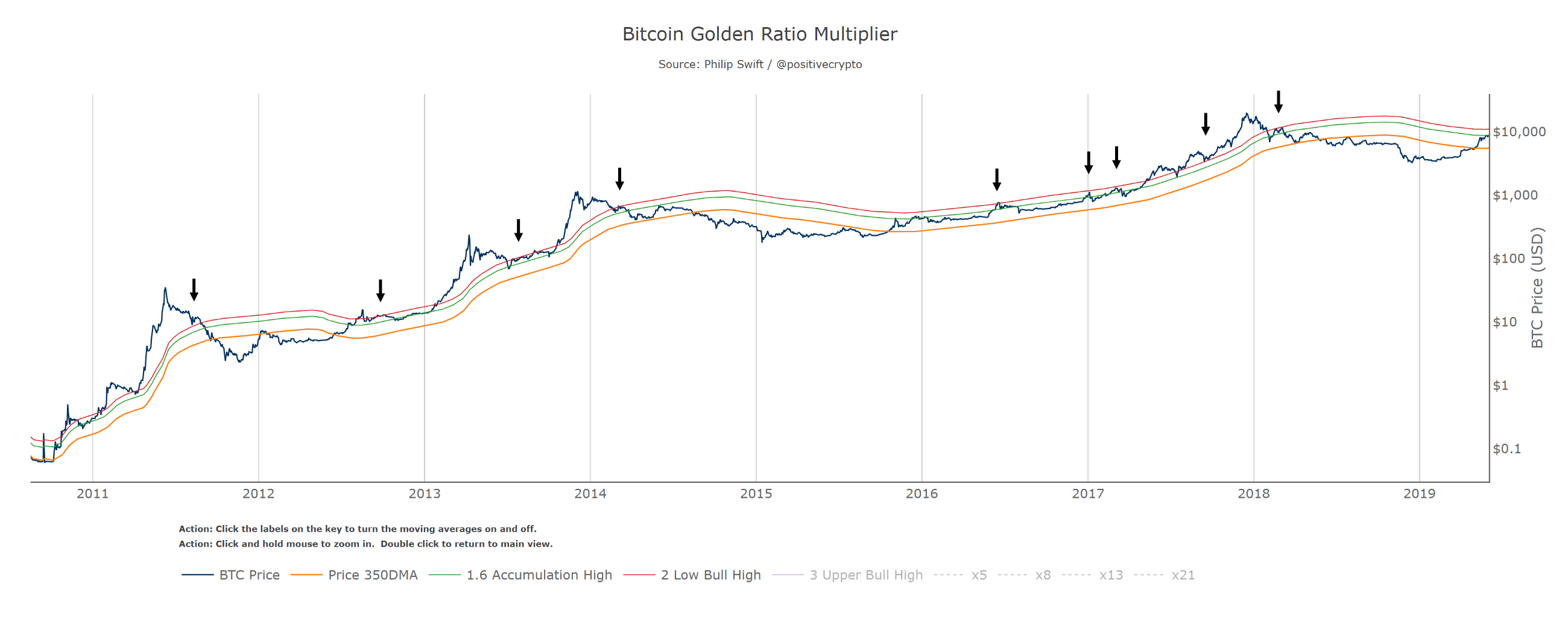

Things become more interesting when we then start to multiply the 350DMA by each number in the Fibonacci sequence: 1, 2, 3, 5, 8, 13, 21, etc.

Given that multiplying the 350DMA by 1 would not change its value, we start with the next number in the sequence, which is 2.

So we multiply the 350DMA by x2. Which is the red line in the chart below:

Again, the arrows highlight examples of where we see it act as a major level of support and resistance throughout Bitcoin’s history. As a trader or investor this, as well as the other multipliers, makes a potentially very useful short term take profit signal when price first reaches it.

The next number in the Fibonacci sequence is 3. So now we multiply the 350 day moving average by 3.

350DMA x 3 is the purple line in the chart below.

We see it acted as particularly strong resistance towards the upper stage of the 2017 bull market, with price unable to break above it on 5 separate occasions:

Using those three moving average lines (350DMA x 1.6, x2, x3) has allowed us to pick out almost every single intra-cycle price high in Bitcoin’s history.

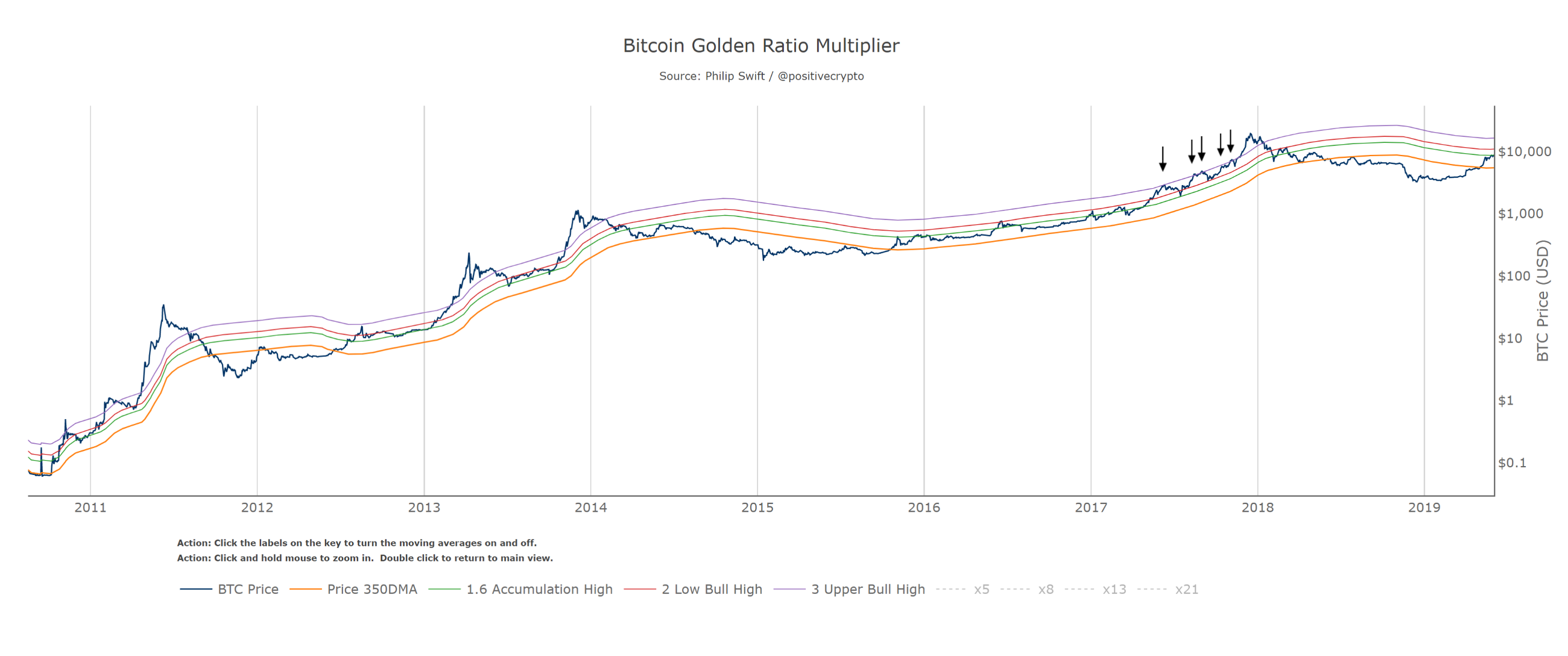

The next numbers in the Fibonacci sequence are 5, 8, 13, and 21.

Remarkably, when we use these multiples of the 350 day moving average, they pick out each of Bitcoin’s market cycle tops going all the way back to the first price bubble in 2011. They are shown as dotted lines here:

Bitcoin price action obeying Fibonacci multiples of the 350 day moving average

350DMA x21 = 2011 top

350DMA x13 = 2013 top

350DMA x 8 = 2014 top

350DMA x5 = 2018 top

Practical application

As with any indicator, the Golden Ratio Multiplier should not be used in isolation, but it does offer a risk management opportunity. Using the previous cycle as an example, if one had bought the breakout at the 350DMA and then taken profit the first time price reached the x1.6, the x2, and the x3, buying back lower each time, that would have been a very successful investment strategy. One could then have sold the top of the market as price touched the 350DMA x5.

If Bitcoin’s market cycle tops continue to follow this declining Fibonacci sequence, then the next market cycle top will be when price hits the 350DMA x3 (purple line).

Why does price obey these levels?

We know that Bitcoin goes through multi-year market cycles which are driven by over-optimism and over-pessimism. The 350DMA appears to be particularly relevant to those market cycles as to date it has been the axis that the cycles have rotated on.

Given that market psychology (of over-optimism and over-pessimism) is a major factor driving these market cycles, it is plausible that part of the reason why Fibonacci multiples of the 350DMA are so important is due to how herd mentality responds to price action:

In many cases, it is believed that humans subconsciously seek out the golden ratio. For example, traders aren’t psychologically comfortable with excessively long trends. Chart analysis has a lot in common with nature, where things that are based on the golden section are beautiful and shapely and things that don’t contain it look ugly and seem suspicious and unnatural. This helps to explain why, when the distance from the golden section becomes excessively long, the feeling of an improperly long trend arises.

Understanding Fibonacci Numbers. Dima Vonko, Investopedia, 2019

Whatever the reason, the tool highlights the cyclical nature of Bitcoin adoption and the flattening of its growth trajectory on a log scale.

Bonus: picking market cycle tops to within 3 days

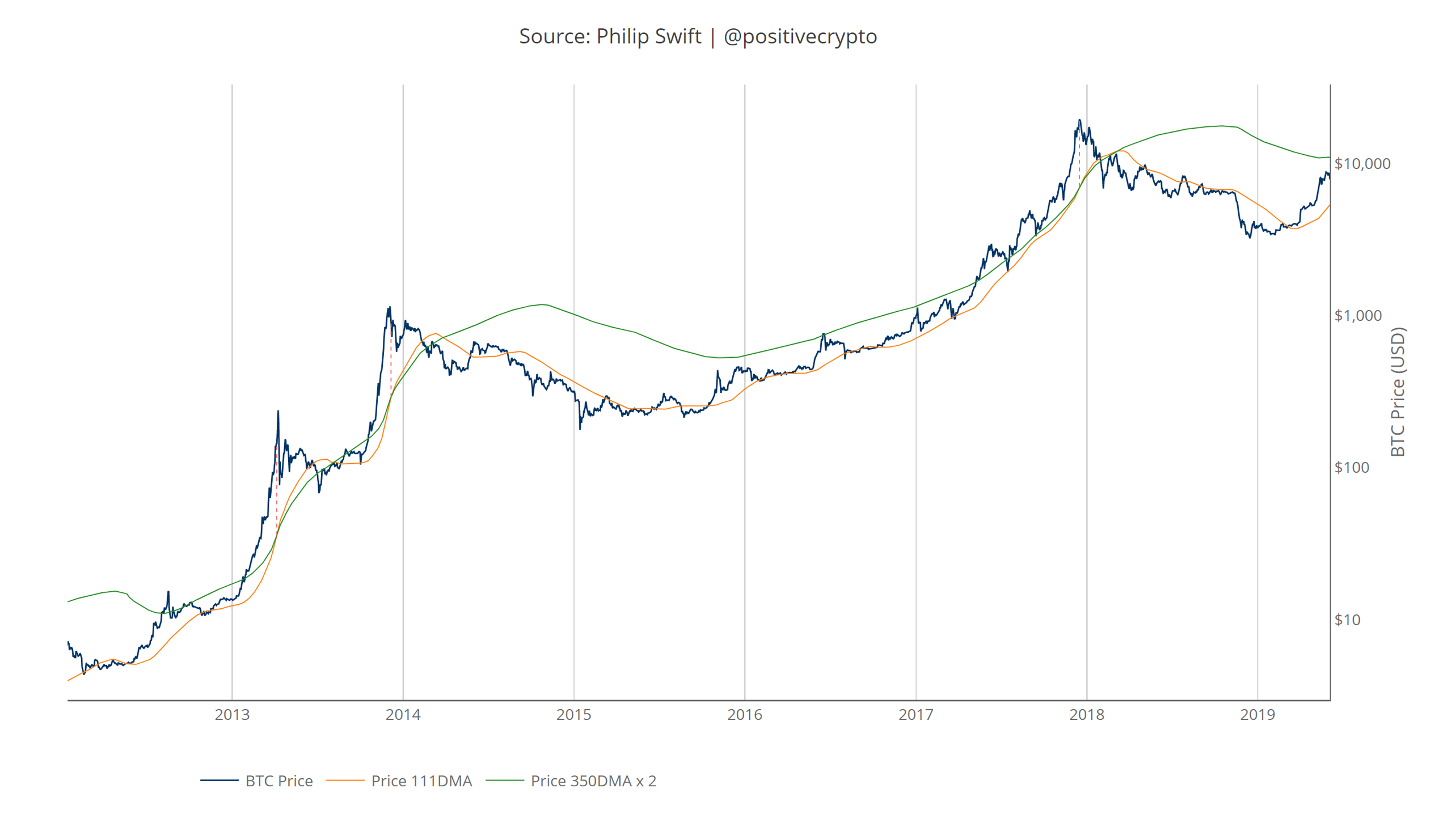

Using the x2 multiple of the 350 day moving average along with the 111 day moving average provides us with a different market cycle indicator.

When the 350DMA x2 crosses below the 111DMA, Bitcoin price peaks in its market cycle. Over the past three market cycles, this has been accurate to within three days of Bitcoin price topping out:

This will be something worth monitoring in the latter stages of the coming bull run.

It is also of interest to note what 350 / 111 equals:

350 / 111 = 3.153

Which is very close to Pi.

Pi = 3.142

It is, in fact, the closest we can get to Pi when dividing 350 by another whole number.

Conclusion

The Golden Ratio Multiplier will be a useful investment tool in this coming market cycle for identifying areas of take-profit as price approaches the multiplier levels of 350DMA x1.6, x2, and x3.

Assuming the Fibonacci sequence countdown continues to play out, the 350DMA x3 will signal the top of this coming market cycle.

The tool can also signal market tops when used alongside the 111DMA.

But arguably more powerful than these investment and trading benefits is the ability to demonstrate how Bitcoins adoption, and therefore our herd behaviour as humans, is following mathematical structures.

Via its price action, Bitcoin is offering us the opportunity to view free market adoption in real time, revealing how humans adopt at scale. Which is a beautifully humbling phenomenon to observe.

Thanks to Willy Woo for his assistance with the Golden Ratio chart layout aesthetic.

To use the live chart of the Golden Ratio Multiplier follow me on Twitter where there is a link to it in my bio. It is free to use and doesn’t require sharing any personal data. I’ll be sharing more tools via Twitter in the coming months.

There Can Be Only One

By Tamas Blummer

Posted June 18, 2019

Network effect is a weak argument for Bitcoin’s value. There is a stronger one: There can only be one definition of time with computation.

An argument against Bitcoin’s value is that alternate crypto currencies, also known as “shitcoins”, exhibit the same digital scarcity within their own network. Pundits add up market cap of Bitcoin with shitcoins to come up with a market cap of “crypto”.

Some think the existence of shitcoins defies Bitcoin’s scarcity and show that Bitcoin can be copied and multiplied and consequently Bitcoin and all crypto is worthless.

It is pointless to argue against this with the network effect of Bitcoin, as the question is not if Bitcoin could be replaced with a better version of itself, but if scarcity can be achieved at all by a design similar to Bitcoin.

Similar to Bitcoin?

A shitcoin could be considered similar to Bitcoin for many reasons. Some consider ZuckBuck similar, because … whatever.

The similarity that really matters is the mechanism that creates scarcity. In Bitcoin’s case it is the Nakamoto consensus built on proof of work (POW).

Many shitcoins experiment with alternate consensus algorithms, such as BFT, POS, POET, governance or any combination of them. The ability to prove work is ultimately constrained by physics and available resources. Those alternatives to POW use strictly more assumptions hence the scarcity they achieve is of lower reliability, quality.

We will soon see if the quality of scarcity offered by Zuck is deemed sufficient by the masses and hence ZuckBuck manages a “flippening” against fiat in the daily uses of buying likes or in-app gadgets in facebook and related apps.

Our quest is however not for a good enough scarcity for some use case, but that of ultimate digital scarcity, which would give rise to highest value.

Proof of Work

Different qualities of scarcity are with us already. There are less guarantees for scarcity of fiat than that of gold. The marginal supply of fiat changes at the will of bureaucrats, that of Gold is limited by natural reserves and work invested.

A doubt of Gold Standard could be articulated as: Other precious metals exhibit very comparable physical properties, hence they are as good as gold, therefore supply of “hard money” is not constrained by gold supply.

The world however operated on Gold Standard and not on Precious Metal Standard. Those promoting an alternate Silver Standard experienced heavy losses in the process of consolidation.

It seems that although several precious metals are eligible through their physical properties and supply of all of them is constrained by work, only one became the standard to store value.

Scarcity through POW

There is a striking parallel between work in gold mines and in Bitcoin mines. The resulting product proves work performed. POW is not unique to Bitcoin. POW is used by countless shitcoins. Do shitcoins that also use POW undermine digital scarcity?

Digital scarcity based on POW does not require that Bitcoin, as we know it today, becomes the only one, but that only one POW coin is desired by all. Like there can only be one Highlander, one immortal swordsman.

POW Standard or Bitcoin Standard ?

To keep its emission schedule Bitcoin requires the proof that miner did (busy-)wait a time span (expected 10 minutes) before producing a new block. The proof is the result of a computation.

Alternate proofs of wait, such as POET suggested by e.g. Intel could deliver a lower quality of scarcity, but POW makes no compromises. POW is a method of measuring time with computation.

The difficulty adjustments based on timestamps are only there to periodically adjust for time measurement errors, the actual tool of time measurement is the computation itself.

Time measurement with computation is only reliable if the executed computation is irreducible and all resources capable of its computation are deployed to that task.

Fragmenting computing resources across competing time chains however will not achieve the reliability of one time chain that uses all resources. The Bitcoin Standard will arise as a consequence of aiming for the best quality of time chain.

I anticipate on the long run a convergence to a single time chain, that is likely a descendant of Bitcoin as we know.

There are many choices of irreducible computation, and double-SHA256 of Bitcoin is not one. See midstate or ASICBoost. A better time chain would have a simpler POW that is provably irreducible. One that can be evaluated on the least simple machine, a cellular automaton as in NKS to exclude any chance of shortcut. A time chain with such POW would give us the most precise measurement of time with computation.

Bitcoin bites the bullet

Some of its most puzzling tradeoffs explained

By Nic Carter

Posted June 19, 2019

In the matter of reforming things […] there is a paradox. There exists in such a case a certain institution or law; let us say, […] a fence or gate erected across a road. The more modern type of reformer goes gaily up to it and says, “I don’t see the use of this; let us clear it away.” To which the more intelligent type of reformer will do well to answer: “If you don’t see the use of it, I certainly won’t let you clear it away. Go away and think. Then, when you can come back and tell me that you do see the use of it, I may allow you to destroy it.” – G.K. Chesterton, The Thing: Why I am a Catholic

What’s wrong with Bitcoin is that it’s ugly. It is not elegant. –Gwern Branwen , Bitcoin is Worse Is Better

It is sometimes said that there are no free lunches in cryptocurrency design, only tradeoffs. This is a frequent refrain from exasperated Bitcoiners seeking to explain why hot new cryptocurrency probably can’t deliver 10,000 TPS with the same assurances as Bitcoin.

Today, as hundreds of alternative systems for permissionless wealth transfer have been proposed and implemented, it’s worth contemplating why exactly Satoshi built Bitcoin as s/he did, and why its stewards oriented the project in such a deliberate way.

Here I’ll argue that its features were not arbitrarily selected, but chosen with care, in order to create a sustainable and resilient system that would be robust to a variety of shocks. In many cases, this required choosing an option which appeared unpalatable on its face. This is what I mean by biting the bullet. It is evident to me that that, when faced with two alternatives, Bitcoin often selects the less convenient of the two.

This is confusing to many — hence “I just heard about Bitcoin and I’m here to fix it” syndrome — but when long-term consequences are taken into account, the design considerations often make sense.

As a consequence, Bitcoin is saddled with a variety of features which are cumbersome, onerous, restrictive, and impair its ability to innovate, all in service of a longer-term or more overarching goal. In this article I’ll cover a few of the tradeoffs where Bitcoin opted for the unpopular or more challenging path, in pursuit of an ambitious long-term objective:

- Managed/unmanaged exchange rates

- Uncapped/capped supply

- Frequent/infrequent hard forks

- Discretionary/nondiscretionary monetary policy

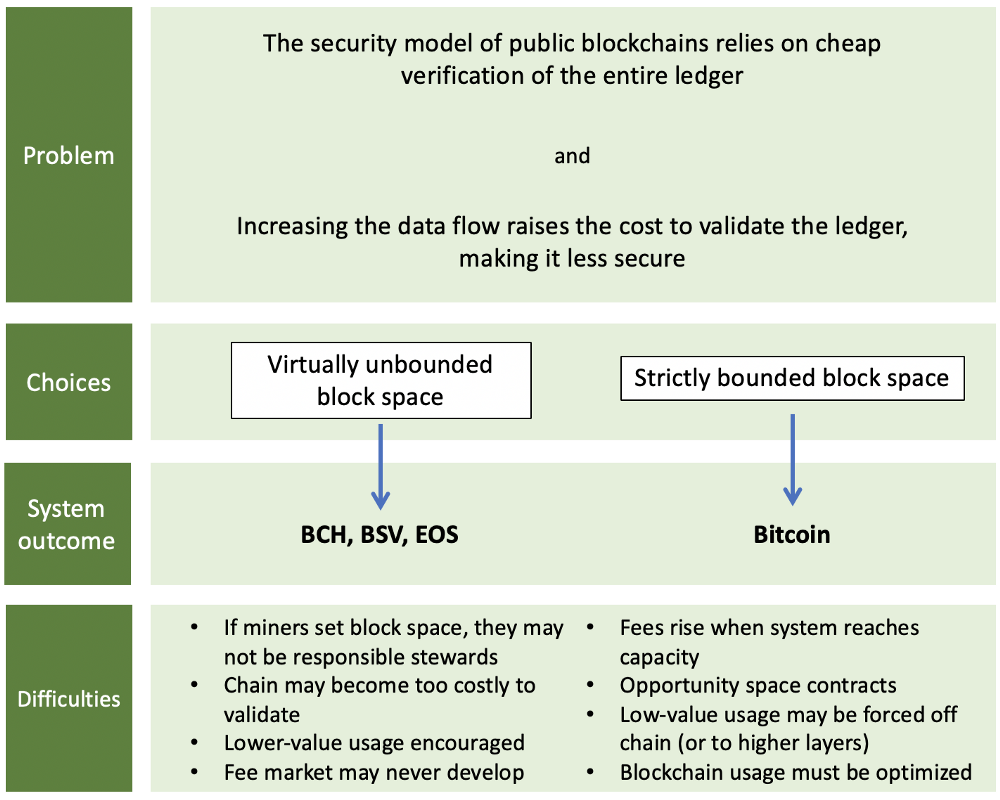

- Unbounded/bounded block space

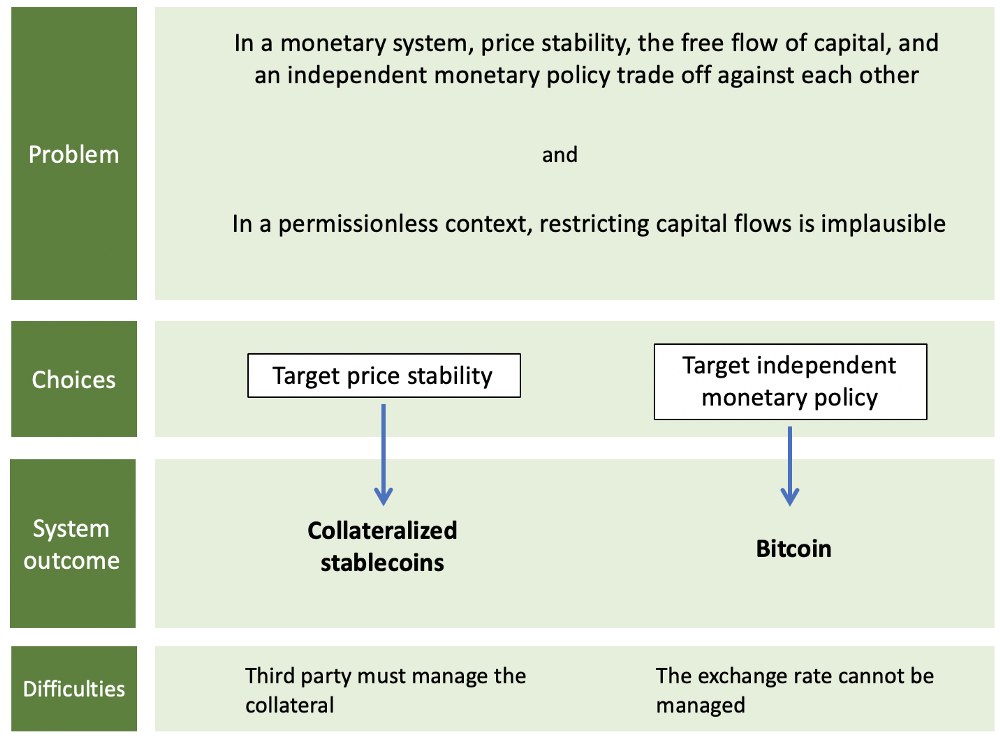

Managed/unmanaged exchange rates

One of the commonest critiques of Bitcoin, often emanating from central bankers or economists, is that it is not a currency because it lacks price stability. Typically, the mandate of central bankers is to optimize for relatively stable purchasing power (although currency depreciation at two percent a year is considered tolerable in the US) and other objectives like full employment. Lacking any mechanism to manage exchange rates, Bitcoin is considered a priori not a currency. Implicit in the conventional view of what constitutes a sovereign currency is some notion of management; just ask Christine Lagarde:

For now, virtual currencies such as Bitcoin pose little or no challenge to the existing order of fiat currencies and central banks. Why? Because they are too volatile, too risky, too energy intensive, and because the underlying technologies are not yet scalable.

Or Cecilia Skingsley, deputy director of the Swedish central bank:

I have no problem with people using [bitcoin] as an asset to invest in, but it’s too volatile to be used as currency.

Of course, Bitcoin’s volatility cannot be managed; against the backdrop of a scarce supply, price is almost exclusively a function of demand. Bitcoin is almost perfectly inelastic in its supply, and so waves of adoption manifest themselves in gut-wrenching price gyrations. This contrasts with sovereign currencies where the central bank pulls various levers to ensure relative exchange rate stability.

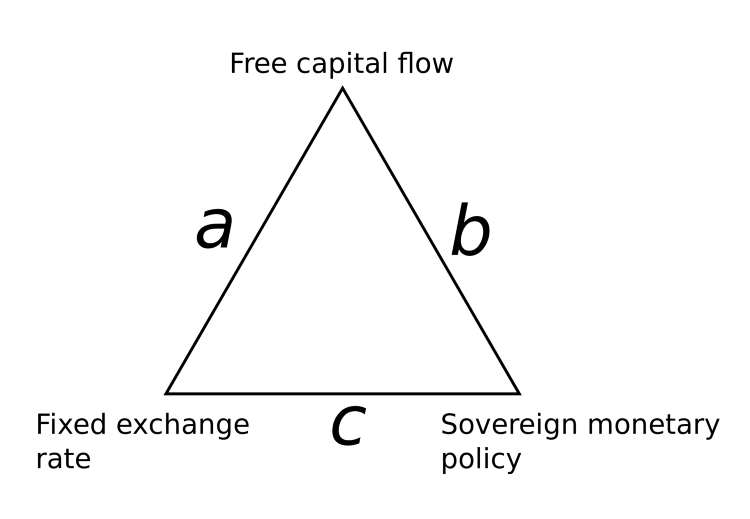

The tradeoffs inherent in monetary policy are often expressed as a trilemma, where monetary authorities can select two vertices but not all three. To put this another way, if you want to peg your currency to something stable (usually another currency like the US dollar), you have to control both the supply of your currency (sovereign monetary policy) and the demand (the flow of capital). China is a good example, taking side C: the Renminbi is soft-pegged to the dollar and the PBoC wields sovereign monetary policy; these necessarily require the existence of capital controls.

The ‘impossible trinity’ of monetary economics

The ‘impossible trinity’ of monetary economics

The Bank of England was infamously reminded of this constraint in 1992 when Soros and Druckenmiller realized that its peg with the German Deutschmark was fragile and could not be defended in perpetuity. The BoE had to admit defeat and allow the Pound Sterling to float freely.

A more contemporary example of this constraint is Hong Kong’s current travails with its currency which is soft-pegged to the US dollar. Unfortunately for Hong Kong, the US dollar has strengthened considerably in recent years, and so the monetary authority has been faced with the unenviable challenge of meeting an appreciating price target. A capital outflow from HK to the US has compounded the difficulty.

Hong Kong selected option A on the graphic, giving up monetary authority in exchange for a free flow of capital and a pegged exchange rate. If they lose the peg they will regain monetary sovereignty (the ability to untether their interest rate policy from the US Fed’s) while retaining open capital flows.

So there is an inescapable tradeoff when it comes to monetary policy. No state, no matter how powerful, is immune to it. If you want to index your currency to that of another state, you either become its monetary vassal, or you undertake the herculean task of stopping your citizens from exporting funds abroad.

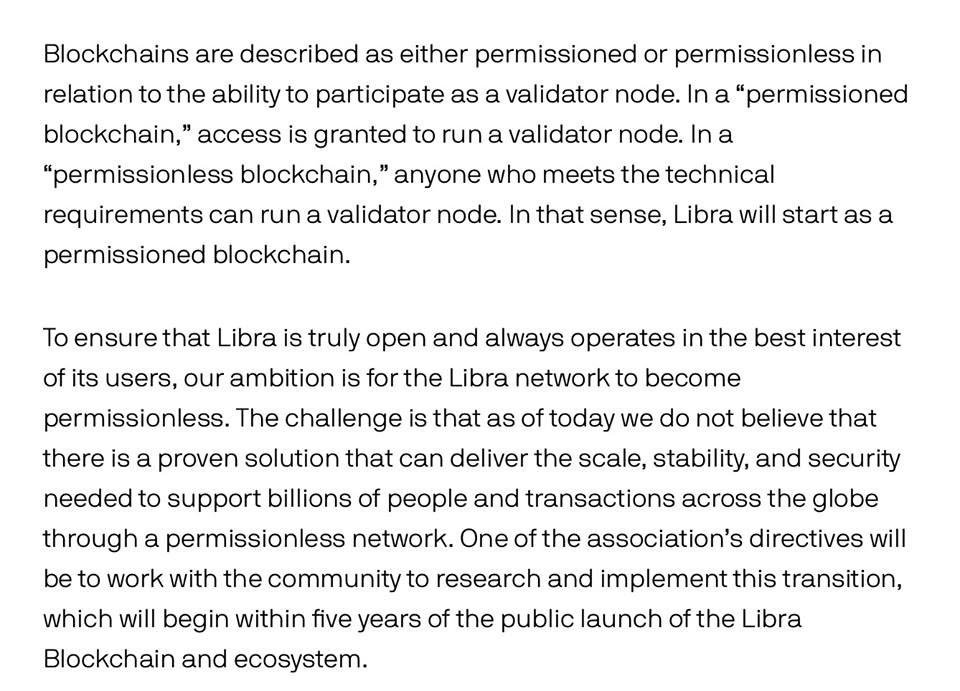

So to a monetary economist, the fact that Bitcoin cannot manage its exchange rate should be quite unsurprising. It is an upstart digital nation, designed to render capital easily portable (so capital controls are out of the question), and has no authority capable of managing a peg. Bitcoin is able to exercise extreme supply discretion thanks to its asymptotic money supply targeting, but has no mechanism whatsoever to control capital flows, and naturally has no central bank to manage rates. Compare this to Libra, Facebook’s new cryptocurrency, backed by a basket of sovereign currencies. Arguably, it can never become truly permissionless, as some entity must always manage the basket of securities and currencies backing the coin.

Bitcoin bites the bullet by letting its exchange rate float freely, opting for a system design with no entity tasked with managing a peg and with sovereign monetary policy. Volatility and future exchange rate uncertainty is the price that users pay for its desirable qualities — scarcity and permissionless transacting. The bullet bitcoin bites is an unstable exchange rate, but in return it frees itself from any third party and wins an independent monetary policy. A decent trade.

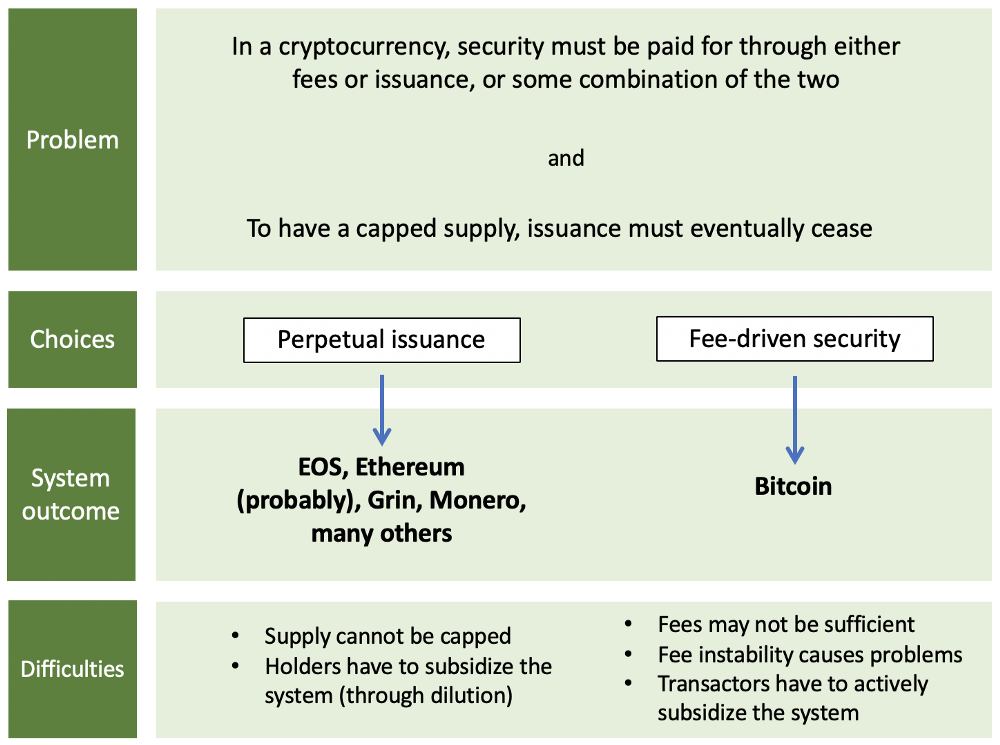

Uncapped/capped supply

One of the most heated debates within the cryptocurrency industry is whether it is possible to have a genuinely finite supply or not. This tends to turn on one’s view as to whether fees or issuance should pay for security in the network. So far, no permissionless cryptocurrency has found a cost-free way to secure the network (unless you believe what the Ripple folks have to say…). Since, all things equal, holders benefit from less issuance rather than more, if you believe that transaction fees can suffice to pay for security, you might find a fee-driven security model preferable.

Indeed, Satoshi believed that Bitcoin would have to wean itself from the subsidy and transition entirely to a fee model in the long term:

The incentive can also be funded with transaction fees. […] Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction feesand be completely inflation free.

Ultimately, the choice in a permissionless setting, where security must be paid for, is quite stark. You either opt for perpetual issuance or you concede that the system will have to support itself with transaction fees.

Given the popularity of perpetual issuance systems in new launches, a rough consensus appears to be emerging that attaining sufficient volume for a robust fee market to develop is too challenging an objective for an upstart chain.

However, Bitcoin, in typical bullet-biting fashion, selects the less palatable of the two choices — capped supply and a fee market — in order to obtain a trait its users find desirable: genuine, unimpeachable scarcity. Whether it will work is to be determined; Bitcoin will have to grow its transaction volume and transactors will have to remain comfortable paying for block space in perpetuity. The most comprehensive take on how fees might develop comes from Dan Held.

Bitcoin’s Security is Fine Fears over the declining block reward are overblown blog.picks.co

While no one quite knows how Bitcoin’s fee model will shake out, the fact that Bitcoin has a robust fee market already with fees accounting for about nine percent of miner revenue (at the time of writing) is encouraging.

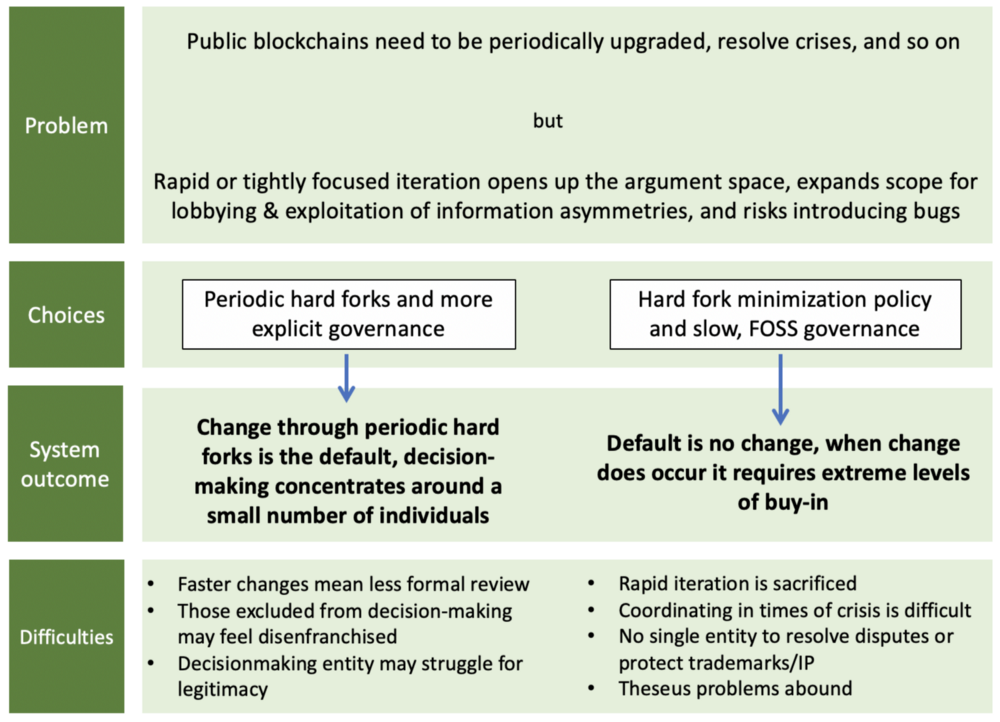

Frequent/infrequent hard forks

The frequency of forking among cryptocurrencies tells you a great deal about their design philosophies. For instance, Ethereum was positioned as the more innovative counterpart to Bitcoin for a long time, as it had certain advantages like a (functioning) foundation, a pot of money which could be used to finance developers, and a social commitment to rapid iteration. Bitcoin developers, by contrast, have tended to de-emphasize development through forks and generally aim to proceed through opt-in soft forks, like the SegWit upgrade. (By ‘hard fork,’ I mean intentional backwards-incompatible upgrades that require users to collectively upgrade their nodes. In a hard fork situation, legacy nodes might become incompatible with the new ruleset.)

In my opinion this often comes down to fundamental conflict of visions in how development should be organized; Arjunand Yassine cover the topic well in their essay.

A Conflict of Crypto Visions Why do we fight? A framework suggests deeper reasons medium.com

As stated, some cryptocurrency developers have adopted a policy of regular hard forks to introduce upgrades into their systems. A regular hard fork policy is virtually the only way to frequently upgrade a system where everyone must run compatible software. It’s also risky: rushed hard forks can introduce covert bugs or inflation, and can marginalize users who did not have sufficient time to prepare. Poorly-organized hard forks in response to crises often lead to chaos, as was the case with Verge and Bitcoin Private. Major blockchains like Ethereum, Zcash, and Monero have adopted a frequent hard fork policy, with Monero operating on a six-month cadence, for instance.

Forking with frequency is, as with many of the design modes in this post, expedient, but it comes with downsides. It tends to force decision-making into the hands of a smaller group — because the slow, deliberative governance style that characterizes Bitcoin Core is ill-suited to rapid action — and it introduces attack vectors. Developers in charge of forking can reward themselves and their inner circle at the expense of users; for instance, by creating a covert or explicit tax which flows to their coffers, or altering the proof of work function so it only works with hardware they own. As with everything in the delicate art of blockchain maintenance, concentrating power comes at a cost.

Something to note is the fact that all blockchains which are more decentralized in their administration suffer from so-called Theseus problems. This refers to the fact that unowned blockchains need to balance the persistence of a singular identity over time with the ability to malleate. I discuss the topic at length here:

Ultimately public blockchains that have no single steward that is responsible for resolving disputes have to face these problems of Theseus. So the option on the right is a painful one. But again, it is a tradeoff that Bitcoin is happy to make.

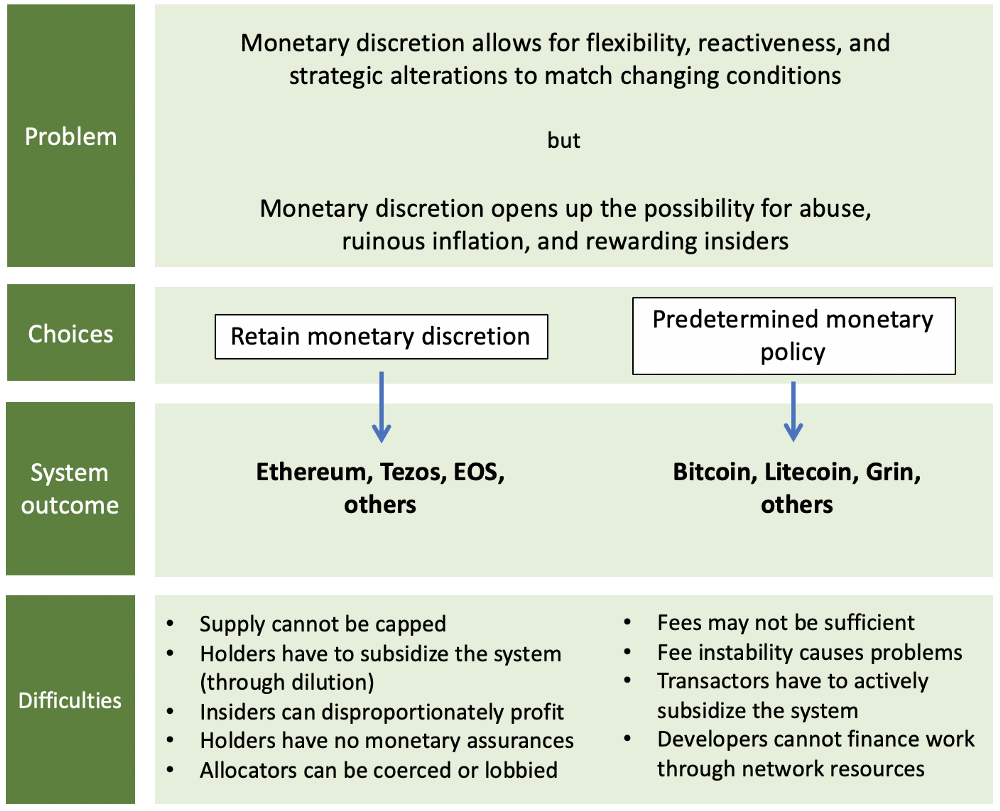

Discretionary/nondiscretionary monetary policy

If you are an artist or engineer, you may have noticed that restriction is the mother of creativity. Narrowing the design or opportunity space of a problem often forces you to discover an innovative solution. In more abstract terms, if you have more available resources, you are less likely to be careful with how you deploy them, and more likely to be profligate.

Russian composer Igor Stravinsky said it well:

The more constraints one imposes, the more one frees one’s self. And the arbitrariness of the constraint serves only to obtain precision of execution.

There is a small but burgeoning literature reinforcing this phenomenon. Mehta and Zhu (2016) investigate the “salience of resource scarcity versus abundance,” finding:

[S]carcity salience activates a constraint mindset that persists and manifests itself through reduced functional fixedness in subsequent product usage contexts (i.e., makes consumers think beyond the traditional functionality of a given product), consequently enhancing product use creativity.

Examples of this phenomenon abound. In venture financing, over-funding a startup often paradoxically leads to its failure. This is why startups are encouraged to be lean — it imposes discipline and forces them to focus on revenue generating opportunities rather than meandering R&D or time wasted at conferences. In more mature companies, an excess of cash often leads to wasteful M&A activity.

I would venture that the same phenomenon holds in the context of nations with regards to their monetary policy. If it is easy to raise capital through dilution (this is essentially how inflation works for sovereign governments), it is easy to finance wasteful ventures, like overseas conflicts. Similarly, in cryptocurrency, discretionary inflation is often presented as a positive — it is often bundled with governance and it gives developers the ability to finance operations, marketing, and so on. Quite simply, enabling discretion in monetary policy creates a profound abundance that the project administrators can exploit. This however comes with drawbacks: it opens the door to rent-seeking, exploitation, and wealth redistribution, all of which harm the long-term integrity of the project.

In many cases, monetary discretion — the ability to inflate supply at will when required — is presented as an innovation relative to Bitcoin. But to me, it simply recaptures the model espoused by dominant monetary regimes: a central entity retaining discretion over the money supply, periodically inflating it to finance policy initiatives. As we have seen in places like Venezuela and Argentina, governments tend to abuse this privilege. Why would cryptocurrency developers be any different?

Bitcoin’s predetermined supply, a product of its radical commitment to resisting monetary caprice, is its solution to the problem. A grotesque, arrogant solution, to many opponents, but one that is critical to the design of Bitcoin. By holding this variable fixed, and iterating around it, Bitcoin aims to provide lasting, genuine scarcity and eliminate humans from decision-making altogether. This may come at a great cost. Opponents deride Bitcoin’s “high” fees, although stable fee pressure will be ultimately necessary for security as the subsidy declines. And unlike nimbler projects, Bitcoin cannot fill its coffers from the spoils of inflation.

I’ll note that some of the projects in the left hand column have not actually arbitrarily inflated supply to achieve policy objectives, but they have essentially written that possibility into the social contract — that supply is a lever which can be pulled if the stakes warrant it.

It is quite simply convenient to reinsert monetary discretion into the system to finance the acquisition of mercenary developers, acquire hype with marketing, and support the operations of a single corporate entity which can allocate resources. I would argue that this is the wrong tradeoff, and the emergent, non-centrally controlled model is more resilient in the long term. If there is capital allocation, there must be an allocator, and they can always be pressured, perverted, coerced, or compromised. Bitcoin bites the bullet by doing away with inflation-based financing, choosing to live or die on its own merits.

Unbounded/bounded block space

The block space debate can also be understood in similar terms to the restricted/unrestricted point made above. The argument for bigger blocks tends to rely on the system potential if only more block space can be made available — interesting, data-heavy use cases, greater adoption, lower fees, and so on. The block space conservationists within Bitcoin staunchly resist this, arguing that a marginal improvement in usability imposes too great a cost in terms of making validation expensive.

The standard proposal in forks of Bitcoin like Bitcoin Cash or BSV is that miners, not developers would set the blocksize cap — well above Bitcoin’s effective ~ 2 mb cap (the 1 mb cap is a myth). However, this is problematic, as block space is an unpriced externality. It doesn’t cost anything to a miner to raise the cap. In fact, larger miners may prefer larger blocks as they disadvantage smaller miners. However, an ever-growing ledger — with all the increased costs of validation that accompany it — imposes a very real cost on verifiers, node operators who want to verify inbound payments and ensure that the chain is valid. Miners’ incentives are not aligned with the entities that their block sizing affects.

Faced with this externality, Bitcoin opts for what might appear an unpalatable choice: initially capping the block size at 1 mb, now capping it at 4 mb (in extreme, unrealistic cases — more realistically, about 2mb). The orthodox stance in Bitcoin is that bounded block space is a requirement, not only to weed out uneconomical usage of the chain, but to keep verification cheap in perpetuity.

Additionally, simple observations from economics make it clear what the outcome of an uncapped block size will be. Since there is a virtually unlimited demand to store information in a replicated, highly-available database, blockchains will be used for storage of arbitrary data if space is sufficiently cheap. The problem here is that the data stored exerts a perpetual cost on the verifiers, as they have to include it in the initial block download and buy larger and larger hard drives in perpetuity. (Ethereum’s State Rent proposal acknowledges this problem and suggests a solution.)

Bitcoiners, far from lamenting ‘high’ fees, embrace them: making ledger entries costly renders a certain breed of spam expensive and unfeasible.

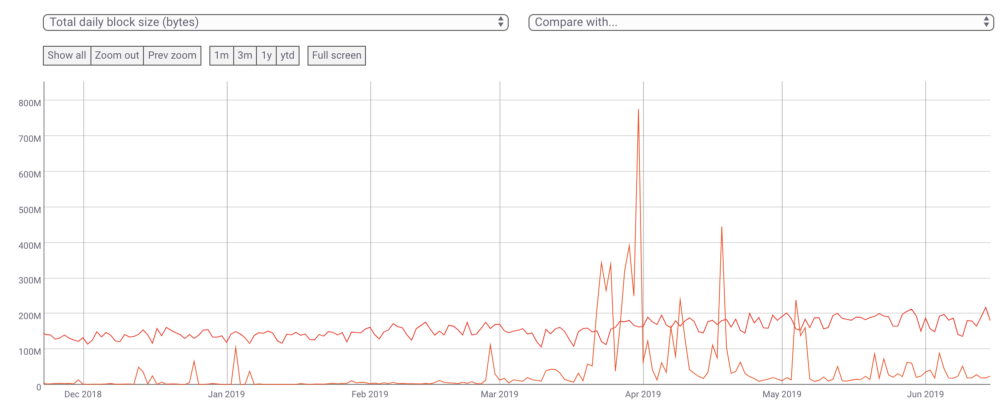

In chains which commit to completely opening up block space like BSV, you end up with a baseline level of low usage (BSV averages <10k daily active addresses, compared to Bitcoin’s 800k+) and occasional inorganic spikes as the chain is injected with data, making validation very difficult in the long term.

Bytes transmitted on chain per day in Bitcoin (red) vs BSV (orange). Coinmetrics

Bytes transmitted on chain per day in Bitcoin (red) vs BSV (orange). Coinmetrics

The case of EOS is an interesting one. Given that block space was made fairly cheap (even though it is technically ‘priced’ with an elaborate system of network resources), EOS had a lot of uneconomical, or spam usage. This is partly because the incentives to create the illusion of activity on chain were high, and the cost to do so was minimal.

So you had millions and millions of ledger entries created through the weight of economic incentives (to promote the chain or certain dApps), burdening the chain with borderline spam. This has had very real consequences. In EOS today, for instance, it is a badly-kept secret that running a full archive node (a node which retains historical snapshots of state) is virtually impossible. These are only strictly necessary for data providers who want to query the chain, but this is an example of a situation where maintaining the canonical history of the ledger becomes prohibitively difficult through a poor stewardship of network resources.

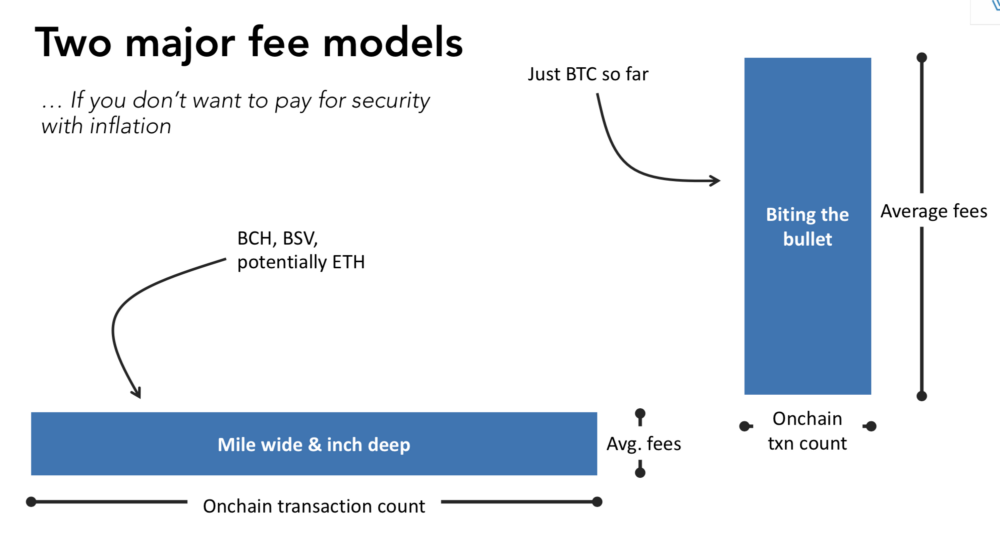

Lastly, the block space debate comes down to a question of sustainability. For a blockchain to be able to charge fees, users must value the block space. However, if block size is completely unbounded, it stands to reason that block space will be worthless. How much would you pay for a commodity that is infinite in supply? By capping block space, Bitcoin is able to sustain a market for ledger entries which will one day replace the subsidy to miners provided by issuance. Opponents contest that increasing the block size allows for more and more usage, which will eventually manifest itself in fees.

Slide from my talk at the MIT Bitcoin Expo: video here

I call this the ‘mile wide and inch deep’ model of the fee market. Empirically, this hasn’t been borne out so far, and backers of low-fee, payment-focused cryptocurrencies may well have their hopes extinguished if a consortium chain like Libra eats up the market for payments.

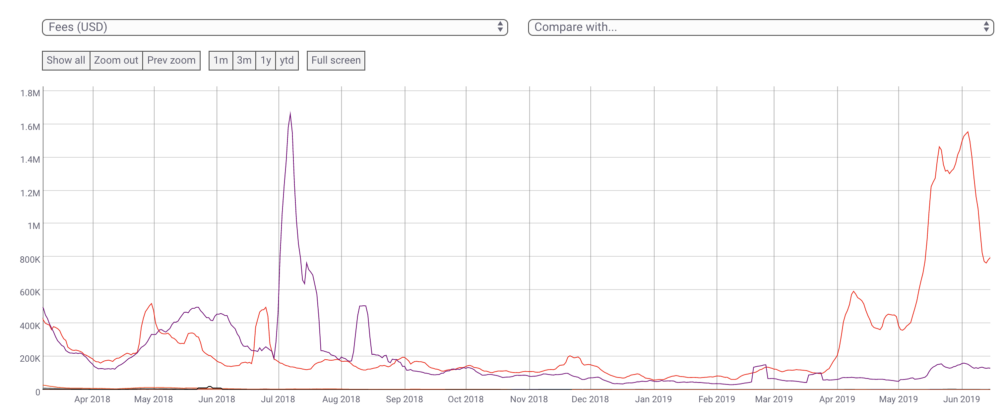

Daily fees (USD) paid to miners for a variety of top blockchains. Coinmetrics

Aside from Bitcoin and Ethereum, no asset even registers on the chart. Only Litecoin can muster over $1k per day in fees. BCH, BSV, Dash, Zcash, Monero, Stellar, Ripple, and Doge are all in the hundreds of $ /day range (chart). This does not bode well for the sustainability of coins which plan to reduce their issuance on a schedule like Bitcoin’s. Currently, no chains aside from Bitcoin and Ethereum appear equipped to enter a regime where fees provide the majority of validator revenue. So pricing block space and allowing a market to develop, although painful in terms of fees, is a critical feature of Bitcoin.

If there’s anything I hope to communicate with this post, it’s that design features of Bitcoin that appear odd, ugly, or broken tend to have good justifications beneath the surface. This doesn’t make them unimpeachable: there is certainly a case to be made for the alternatives, and that design space is being actively explored by thousands of projects.

Satoshi was not an all-seeing savant, and s/he certainly failed to anticipate some of the ways the system would develop, but the tradeoffs that ended up in Bitcoin are generally quite defensible. Whether they are absolutely correct remains to be seen. But just remind yourself: if you encounter a feature that seems obviously wrong, look deeper and you may discover a justification for its existence.

Thank you to Allen Farrington and Matt Walsh for the feedback.

Bitcoin Average Dormancy

New Views of a Classic On-Chain Metric

By David Puell & Reginald Smith

Posted June 20, 2019

Download Reginald’s research paper: Bitcoin Average Dormancy

Disclaimer: Nothing here should be considered trading or investment advice.

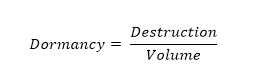

So what is average dormancy (or simply, “dormancy”)? First proposed by this article’s co-author Reginald Smith in 2018, it has not been given enough attention relative to its importance as one of the foremost metrics of BTC’s long-term economic health. In summary, dormancy is the average number of days destroyed per coin transacted in any given day, as per the following formula:

Here, destruction equals the total number of coindays destroyed, and volume equals the total number of coins transacted through the blockchain (and not at exchanges). This ratio describes the average number of days each coin transacted remained dormant, unmoved. The higher the dormancy, the older the coins transacted that day are on average, and the more old hands are releasing their bitcoins into circulation. In other words, average dormancy refers to spent or realized destruction relative to transactions.

Fearful Symmetry: Accumulation and Distribution

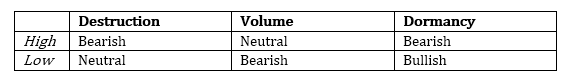

As pointed out in dormancy’s original paper, on-chain destruction and on-chain volume equate to being perhaps the two most important metrics of Bitcoin’s economic state; the reason being that, especially when compared as a ratio such as dormancy, they describe the state of what smart money is doing in the market at any given time—accumulation or distribution. Based on first principles, the following assumptions emerge:

- Accumulation describes the act of smart money (last-resort buyers) taking cheap coins from dumb money (panic sellers), while distribution describes the act of smart money (old hands) releasing expensive coins into the hands of dumb money (bag holders). Accumulation occurs at market bottoms and distribution occurs at market tops.

- Destruction describes the actions of mostly a single market actor: old hands selling or spending their bitcoins. Volume describes the actions of two market actors: buyers and sellers dealing with investor flows at different prices.

- High destruction is bearish (old smart holders releasing coins into circulation) and low destruction is neutral (since in itself it implies holders are maintaining their position but not necessarily that buyers are coming in). High volume in itself is neutral (high number of transactions between both buyers and sellers) and low volume is bearish (confirming no demand for the asset as per a lack of buyer’s activity). From the above, the following simplified matrix emerges:

Dormancy integrates all these narratives into a single metric, by comparing both ratio components at all times, and displaying them in a simple oscillation by which, on a trending basis, high dormancy is bearish and low dormancy is bullish.

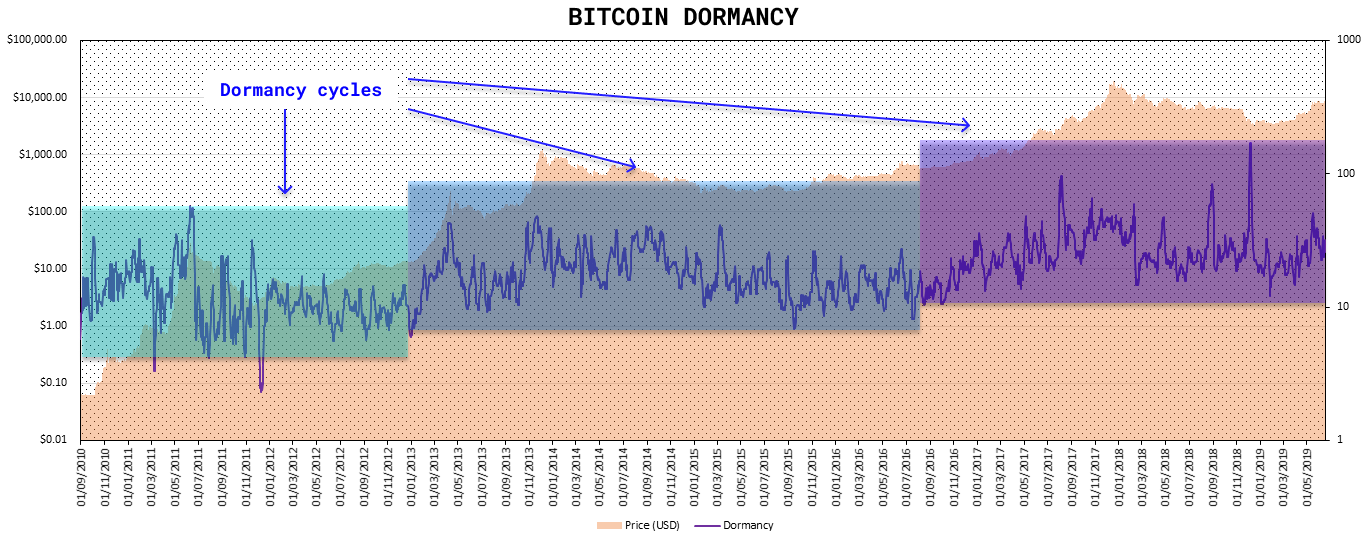

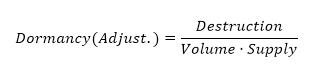

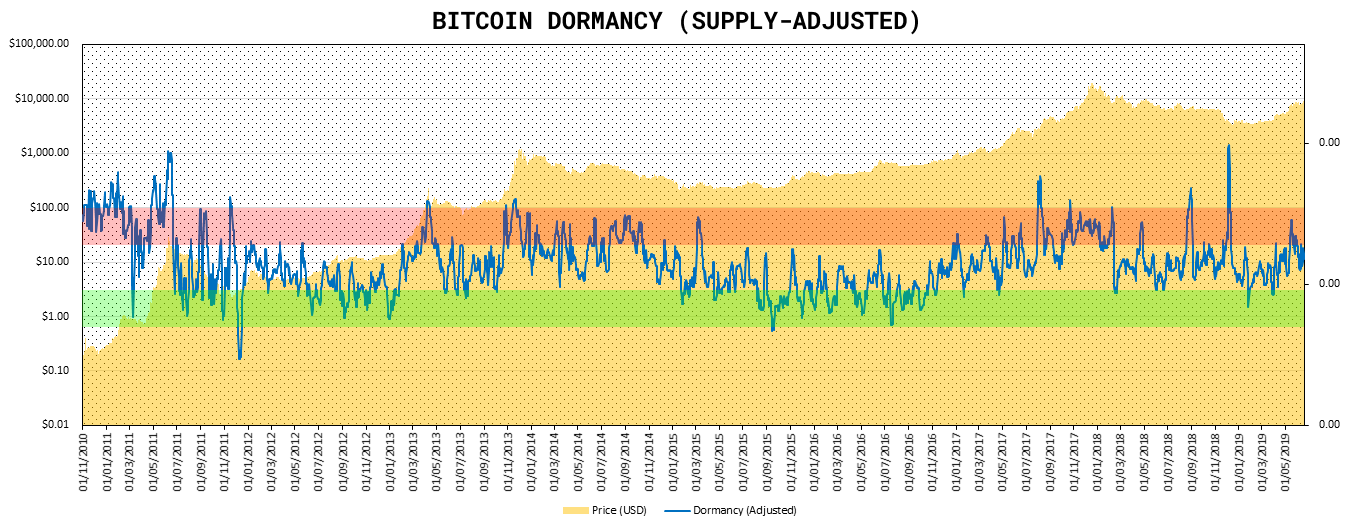

Supply-Adjusted Dormancy

Since the age of the market allows for an ever-increasing amount of destruction (the numerator of average dormancy), adjusting for supply (an increasing creation of minted coins) in the denominator seems to provide a clearer, more proportional historical oscillation that helps best visually detect the health of the market — or, in this case, dormancy per coin, calculated as follows:

This formula produces the chart below:

DUA Ratio (by Reginald Smith)

Just as with pure transaction volume and its variants like NVT Ratio, NVT Signal, or Network Momentum, the dormancy concept has opened the door into a new inflow of indicators for long-term Bitcoin market diagnostics. What follows are two examples of this.

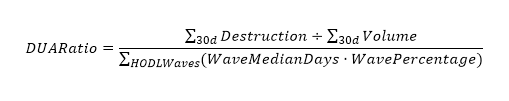

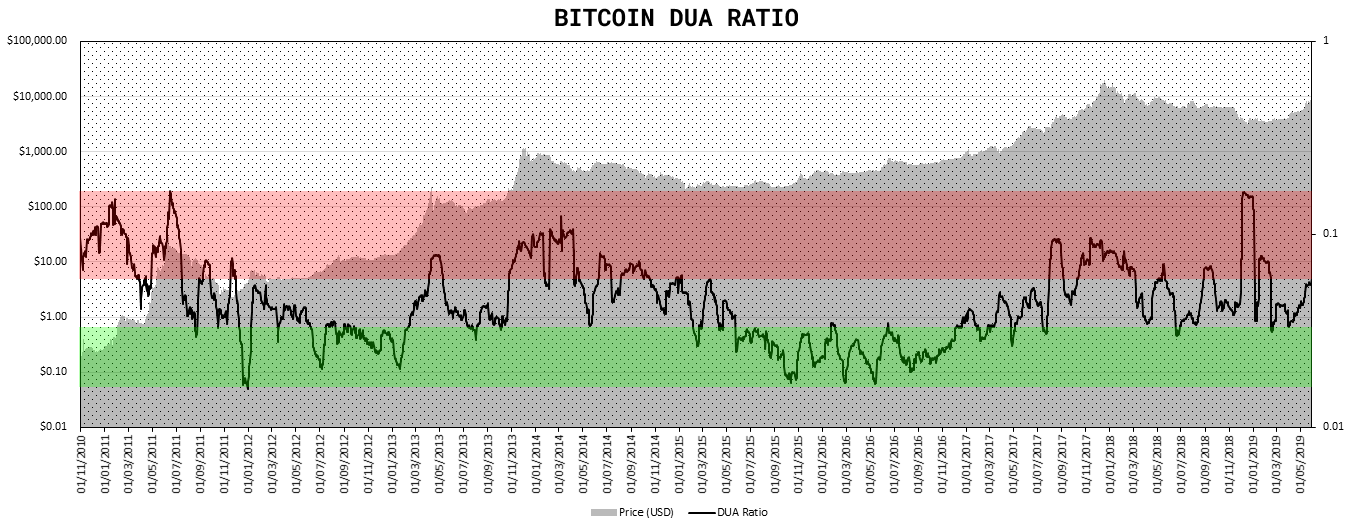

Dormancy-to-UTXO-Age Ratio measures the relation between dormancy and the average age of all UTXOs at any given time, calculated by taking the ratio of average dormancy of the last 30 days between the average of all HODL waves in existance, as follows:

In which median days represents the median time of the HODL wave age band, and wave percentage represents the percentage of UTXOs in any given age band. In this particular case, both coindays destroyed and on-chain volume are aggregated throughout 30 days to smooth out the dormancy numerator.

Since dormancy measures the average holding time of continuously on-chain trading Bitcoin, the average age of UTXO, which includes bitcoin both in the HODL and lost states, is always longer — so average dormancy is always less than the average age of UTXOs. Therefore, the ratio is always less than one.

In periods where long-term holders accumulate (HODL) Bitcoin, the average dormancy is low and the average age of UTXO increases, lowering the ratio. When long-term holders offload their holdings to short-term traders, the average dormancy increases and the average age of UTXO decreases, raising the ratio. This tool is therefore useful in identifying market trends that often lead to HODL waves detecting periods of bitcoin selling by long-term holders in bull markets, and then re-accumulation after the onset of the bear market when the UTXO average age begins to rise and dormancy once again drops.

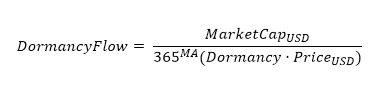

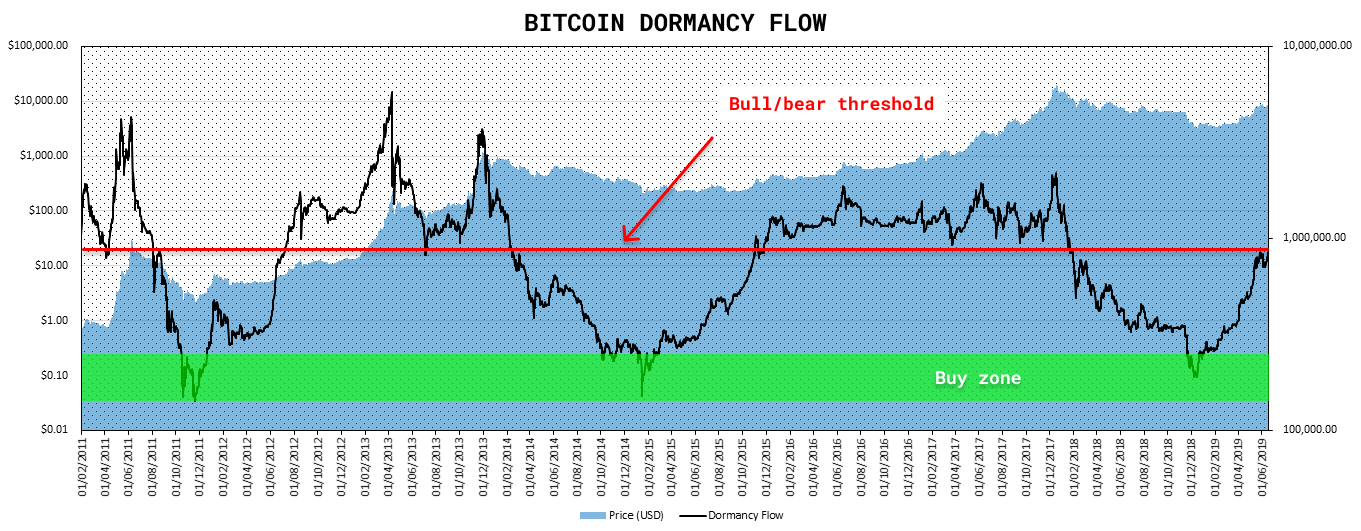

Dormancy Flow (by David Puell)

Another attempt at capturing phases in BTC’s market cycles, dormancy flow is calculated by dividing current market capitalization by annualized dormancy value (USD), as follows:

Dormancy flow provides the following chart, ideal for both bottom-catching historical global lows and assessing whether the bull market remains in relatively normal conditions:

Whenever network value remains high relative to the yearly moving average of its realized dormancy in USD, the bull market can be considered as “healthy,” since price remains high relative to the market’s annualized spending behavior. Whenever dormancy value overtakes market capitalization at lowest longitudinal levels, the market can be considered in full capitulation — a good historical buy zone.

Caveats

- Destruction (dormancy’s numerator) is prone to false signals on daily variance. The most prominent example of this is last December, when the Coinbase exchange moved nearly 5% of Bitcoin’s total supply. To avoid misinterpreting these false positives, it is recommended to best use dormancy by looking at continuous trends in the oscillator (smoothed by medians or moving averages) as opposed to its daily noise.

- Just like with NVT and other on-chain metrics, dormancy should be viewed with an increasing caution for major fundamental shifts in detecting on-chain activity. Several recent or future developments in the Bitcoin ecosystem will ultimately contribute, at different stages and in different degrees, to a loss of power in the signals provided by these indicators. Examples of this may include: concentration of speculative liquidity in BitMEX and other exchanges, new custody solutions for institutions, the Lightning Network, sidechains, among others.

Acknowledgements

Many thanks to Willy Woo, Adam Taché, and Murad Mahmudov for their invaluable input and support in the improvement of this piece.

Sources and Data

- Smith, Reginal D. “Bitcoin Average Dormancy: A Measure of Turnover and Trading Activity.” Ledger, February 2018.

- CoinMetrics.io : Coindays destroyed, transaction volume, supply, and price data.

- Unchained-Capital.com: HODL waves data.

Authors

- Reginald Smith, independent researcher.

- David Puell, Head of Research @Adaptive Capital.

Bitcoin is the Antivirus (Mushroom Medicine) — Part 3/4

By Brandon Quittem

Posted June 20, 2019

- Part 1 - Bitcoin is a Decentralized Organism 1/4

- Part 2 - Bitcoin is a Social Creature

- Part 3 - Bitcoin is the Antivirus

- Part 4- To Be Posted

We’ve all heard the incredible potential of a Bitcoin future. I’m certainly on board for sound money and social scalability.

However, this drama will take decades. What if Bitcoin doesn’t survive long enough to realize it’s full potential?

Thankfully Satoshi learned from failed attempts at private money. Bitcoin’s genetic code was engineered for maximum survivability.

In this article, we’re going to explore the fertile macro environment and Bitcoin’s survivability through the lens of fungi.

Honey Bees, Varroa Mites, and Mushroom Medicines

In 1997 a curious Mycologist by the name of Paul Stamets observed a unique behavior demonstrated by honey bees. The bees went out of their way to consume water containing mushroom spores. “Hmm that’s interesting” thought Paul.

15 years later, Paul started to connect the dots. Honey bees were dying at an unprecedented rate due to colony collapse disorder (CCD). The bees were dying in part, by infestations of Varroa Mites which transmit deadly viruses such as Deformed Wing Virus and Lake Sinai Virus.

Chemicals used in modern agriculture poisoned the bees so their immune systems are too weak to fend off the Varroa Mites. As bees travel around they spread the Mites to all nearby bees leading to a 70% decline in Bee populations since 2005.

Who cares about the bees?

Bees are a bedrock species responsible for pollinating a large percentage of our food sources (avocados, almonds, etc). If we lose the bees, there are countless downstream effects such as lost jobs, destroyed ecosystems, and reduced food security.

Back to our mycologist Paul, who in 2012 made a monumental realization: fungi are known to support immune systems — the bees must have instinctively known to drink the fungal water. Paul tested his hypothesis and soon after demonstrated that using a simple antivirus “mushroom medicine,” we can reduce the effects of Deformed Wing Virus / Colony Collapse by 80%.

Our current monetary regime is the Varroa Mite

Our current central banking based monetary regime is just like the pesky Varroa Mites attacking our financial markets.

- Varroa Mites are hard to kill — fiat currency regimes benefit from a monopoly on violence

- They spread viruses on everything they touch — market distortions, cronyism, regulatory capture

- Negative downstream effects — capital misallocation, increased time preference, limits human productivity, increases risk of catastrophe.

Bitcoin is the antivirus (mushroom medicine) that “saves the bees.”

Bitcoin (mushroom medicine) prevents the spread of our destructive financial hegemony (Varroa Mites) which will usher in a new era of human achievement (saving the bees has secondary effects such as ensuring food security).

Heading into the Great Unknown

We’re heading into a period of uncertainty never before witnessed by our civilization. The fiat money experiment is on shaky ground and our social systems are beginning to break down.

Globally, we’re facing unprecedented debt-to-GDP levels. The Fed, European Central Bank, Bank of Japan, and the Bank of England now appear to “own a fifth of their governments’ total debt.” Central banks are running out of moves.

In a last ditch effort, European Central Banks are pushing negative interest rates. Are we really going to allow the hegemonic banking system to CHARGE depositors for storing our digital fiat in their insecure panopticon banks?

How about China?

China’s real estate market is shaky and long overdue for a correction. Capital controls and seeking yields in a cooling economy have led to inflated real estate prices in China. What happens when the market corrects and everyone rushes for the door? Better have a plan ₿.

And the US?

The US is currently over $22 Trillion in debt, however don’t expect the US to default on their obligations. Former Fed chairman Alan Greenspan said “the United States can pay any debt because we can always print money to do that.”

In an enlightening article titled This is Water, Ben Hunt explains how artificially suppressed interest rates (easy money) lead to decreased productivity and a zombification of our financial markets. This same pattern foreshadowed the 08/09 financial collapse.

Social structures are showing weakness

Countries around the world are seeking to eliminate physical cash. Cash is a fundamental tool for privacy and is a requirement to maintain an open society. Without physical cash (or Bitcoin), citizens are at the mercy of the financial surveillance machine. A slippery slope indeed.

Can’t forget China’s Social Credit System. Soon China’s surveillance technology will be exported all around the world.

Young people don’t trust their governments or financial institutions. 40% of Americans cannot afford an unexpected $400 expense. No wonder potential Democratic nominee Andrew Yang is gaining steam in the polls while campaigning for Universal Basic Income.

An uncertain future is a perfect substrate to breed extremism. Democratic Socialism, Modern Monetary Theory (MMT), Negative Interest Rates Policy (NIRP), the war on cash, widespread consumerism, and mounting student debt are merely symptoms of a derelict regime.

Our legacy institutions are simply not equipped to deal with the complexity of the information age.

Current attempts to fix the political-economical machine from the inside are unironically powered by the “waste heat of war machine” (h/t Vinay Gupta). We need a systemic change. Something cut from a different cloth.

What if a sound money regime (Bitcoin) is an antidote to the madness?

It is my hope that in the future, we’ll look back on our current “fiat banking experiment” with disgust. How could we live under such an archaic regime for so long?

Just like fungi transforms dead and dying organic matter into new life, Bitcoin will transform our decrepit banking system into a robust financial foundation upon which new growth can occur.

The Great Filter of Cryptocurrencies

Can bitcoin survive long enough to reach its full potential?

Cypherpunks, Anarchists, and Voluntarists have been trying to create private, non-government money for a very long time. In fact, modern attempts date back more than 30 years, since the early days of Chaumian Ecash, to E-gold, and B-Money.

Despite moderate success of private money before Bitcoin, eventually they were all shut down by overreaching governments and/or business interests.

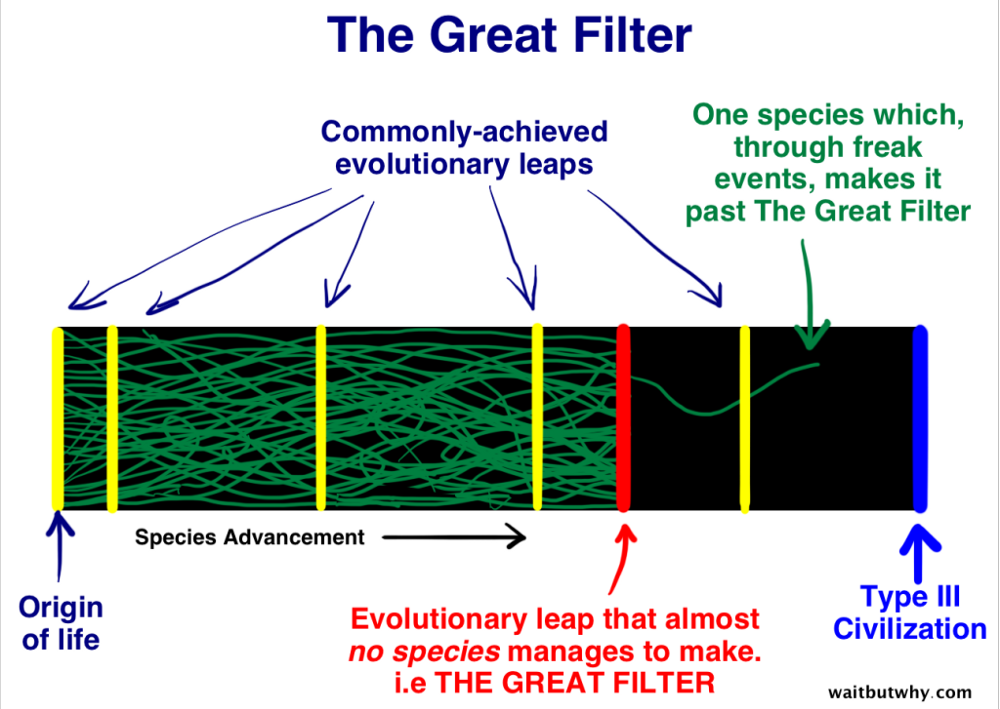

The Great Filter Theory

The Great Filter theory was developed after noticing our lack of success finding intelligent life in the universe. Where is everybody?

The theory predicts: during life’s evolutionary process, there are some obstacles that are extremely unlikely or impossible for to overcome. That obstacle is “The Great Filter.”

For example, what if every time an advanced civilization created nuclear bombs it ended up destroying itself? In this scenario, it might be statistically improbable to survive long after inventing nuclear weapons.

(Source: The Fermi Paradox by Tim Urban which is my favorite blog)

(Source: The Fermi Paradox by Tim Urban which is my favorite blog)

For Cryptocurrencies, The Great Filter is surviving nation-state level attacks.

Bitcoin is the only monetary species that has a chance of surviving the great filter. More on this below.

Why would a nation-state or entrenched business want to attack a competitive form of money?

In short: he who has the gold, makes the rules.

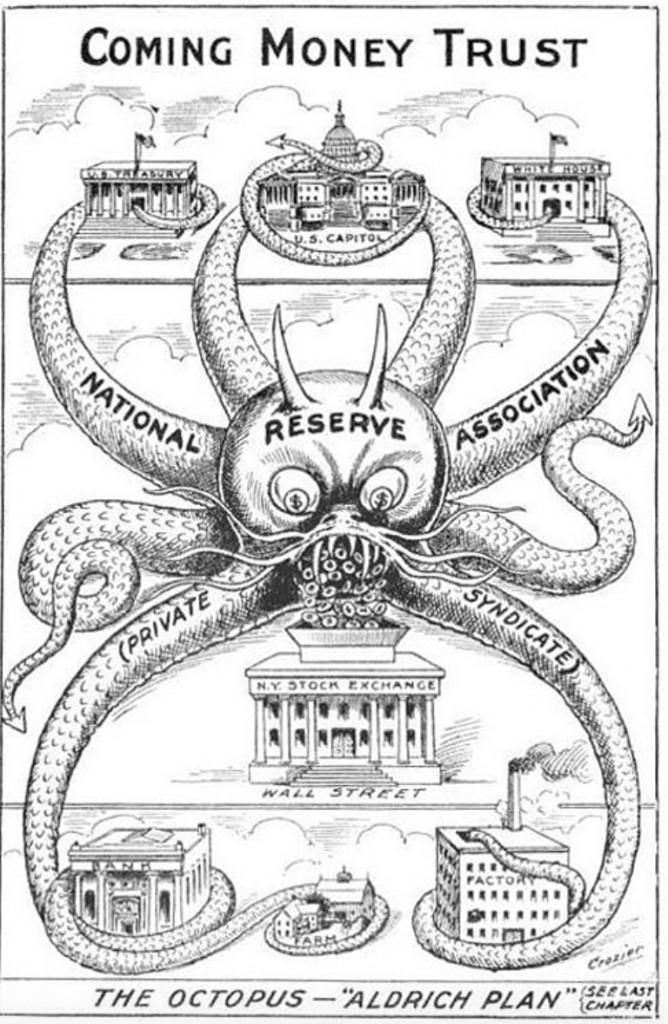

The two main benefits of controlling the money supply are the ability to inflate the money supply (shadow tax) and the Cantillon effect .

The Cantillon effect describes the uneven expansion of the money supply. When the central bank prints new money, those closest to the money (banks and big corporations) profit from new “cheap money.” By the time the rest of the population receive the new money, price inflation has already begun.

The Cantillon effect results in a wealth redistribution from the poor to the rich.

The government goes to great lengths to protect their monopoly

Like E-gold in the 1990s, any competing cryptocurrency can thrive in times of peace. However, when sufficiently agitated, those in power will lash out to protect their interests. History is littered with examples.

Between 2006–2008, the US government expanded the definition of the ‘money transmitter license’ (under the Patriot Act) to target E-gold. In its peak, E-gold was processing over $2B worth of purchases per year. Unfortunately, the US government took advantage of the centralized nature of E-gold, busted down the door, and shut it down.

Moral of the story? Governments do not like competition.

In fact, Congressman Sherman from California recently called for a complete ban of Bitcoin. Sherman is surprisingly enlightened. He understands Bitcoin’s true mission: Creating a new global base money that cannot be weaponized by the global superpower du jour.

Today in Congress Rep. Sherman called for a bill to ban all cryptocurrencies. This is why Coin Center is needed in DC now more than ever. -@coincenter

Time For a New Strategy: Be Unstoppable

In 1984, famous Austrian Economist, Friedrich August von Hayek, unknowingly laid the foundation of Bitcoin’s evolutionary strategy: be unstoppable.

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.” —Friedrich Hayek

With chilling foresight, Hayek predicted Bitcoin some 25 years prior.

Satoshi obviously read Hayek and he understood “The Great Filter of Cryptocurrencies”

In 2009 Satoshi Nakamoto released an implementation of Hayek’s “unstoppable money.” From day one, Bitcoin was engineered to survive “The Great Filter.”

“A lot of people automatically dismiss e-currency as a lost cause because of all the companies that failed since the 1990’s. I hope it’s obvious it was only the centrally controlled nature of those systems that doomed them. I think this is the first time we’re trying a decentralized, non-trust-based system.” — Satoshi Nakamoto

In order for the full potential of Bitcoin to be realized, it needs to be so resilient that even nation state level actors cannot successfully kill Bitcoin. This meant preventing any party from having full control over the system.

Parallels with Fungi: the most resilient species on our planet

Ancient mushrooms called Prototaxites

Ancient mushrooms called Prototaxites

Over 1.3b years of evolution, fungi have perfected the art of staying alive. Unlike plants, fungi do not rely on sunlight, instead they find/create their own food. Fungi do not have a centralized point of failure making them resilient to attacks. When sufficiently perturbed, fungi steal genetic code from their ecological neighbors (Horizontal Gene Transfer).

Since complex life evolved on our planet, we’ve experienced 5 great extinction events where 75–96% of all life on earth perished.

During each cataclysmic event, fungi inherited the earth due to their anti-fragile nature. In an effort to survive “the great filter,” Bitcoin mimics effective evolutionary strategies observed in the fungi kingdom.

Can Bitcoin Survive “The Great Filter?”

How could you kill bitcoin? Turn off the internet? Make it illegal to use? Tax it to hell?

Any cryptocurrency that cannot (feasibly) survive a nation-state level attack is pointless. Simply delaying their inevitable demise.

Satoshi designed the Bitcoin super-organism to survive “The Great Filter” and to resist corruption. This lofty goal kick-started an evolutionary path separating bitcoin from all the other cryptocurrencies and “blockchain projects.”

Does this mean Bitcoin is guaranteed to survive the great filter?

Not necessarily. It’s impossible to know until the day it suffers a coordinated attack by a state-level actor. However, Bitcoin is the only existing cryptocurrency that stands a chance. Let’s explore some positive trends in Bitcoin’s survivability toolbox.

- Bitcoin is unregulatable. No one person or entity in charge. Code is free speech. Each country has their own competing jurisdiction.

- Game theory protects Bitcoin from a global coordinated attack. Nation states compete with each other. Unlikely to see top nations cooperate. If the US bans BTC, China has incentive to adopt. Nations not benefiting from the current USD regime have incentive to adopt BTC.

- Bitcoin’s PoW protects the ledger with an “energy shield.” By anchoring Bitcoin to real economic value (energy), the only way to change the ledger is to “re-do all the work” aka spend the same amount of money in the form of electricity. h/t @danheld