WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the October 2019 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

Bitcoin Equals Freedom

By Ross Ulbricht

Posted September 25, 2019

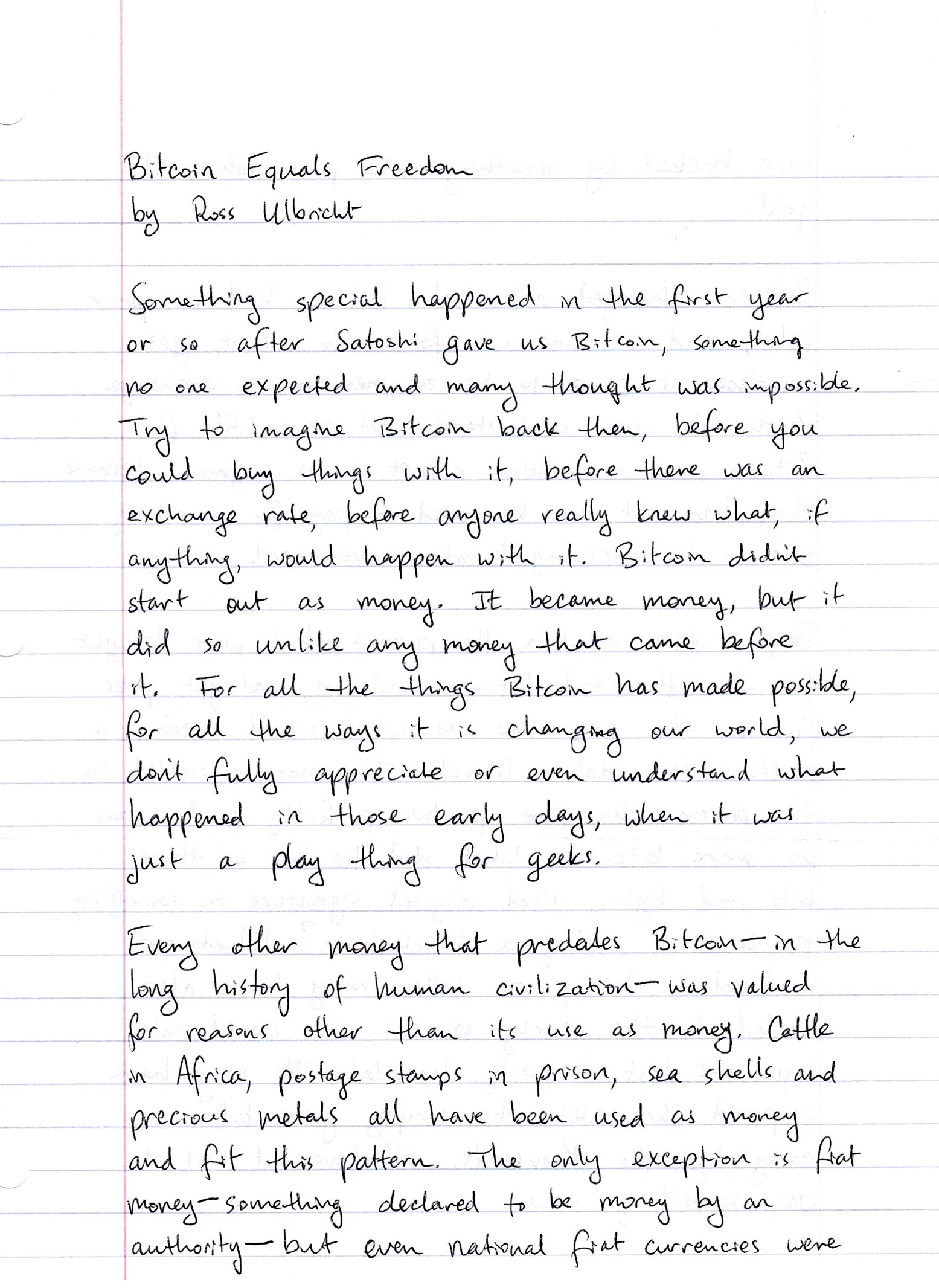

Something special happened in the first year or so after Satoshi gave us Bitcoin, something no one expected and many thought was impossible. Try to imagine Bitcoin back then, before you could buy things with it, before there was an exchange rate, before anyone really knew what, if anything, would happen with it. Bitcoin didn’t start out as money. It became money, but it did so unlike any money that came before it. For all the things Bitcoin has made possible, for all the ways it is changing our world, we don’t fully appreciate or even understand what happened in those early days, when it was just a play thing for geeks.

Every other money that predates Bitcoin — in the long history of human civilization — was valued for reasons other than its use as money. Cattle in Africa, postage stamps in prison, sea shells and precious metals all have been used as money and fit this pattern. The only exception is fiat money — something declared to be money by an authority — but even national fiat currencies were once backed by something with prior value, like gold.

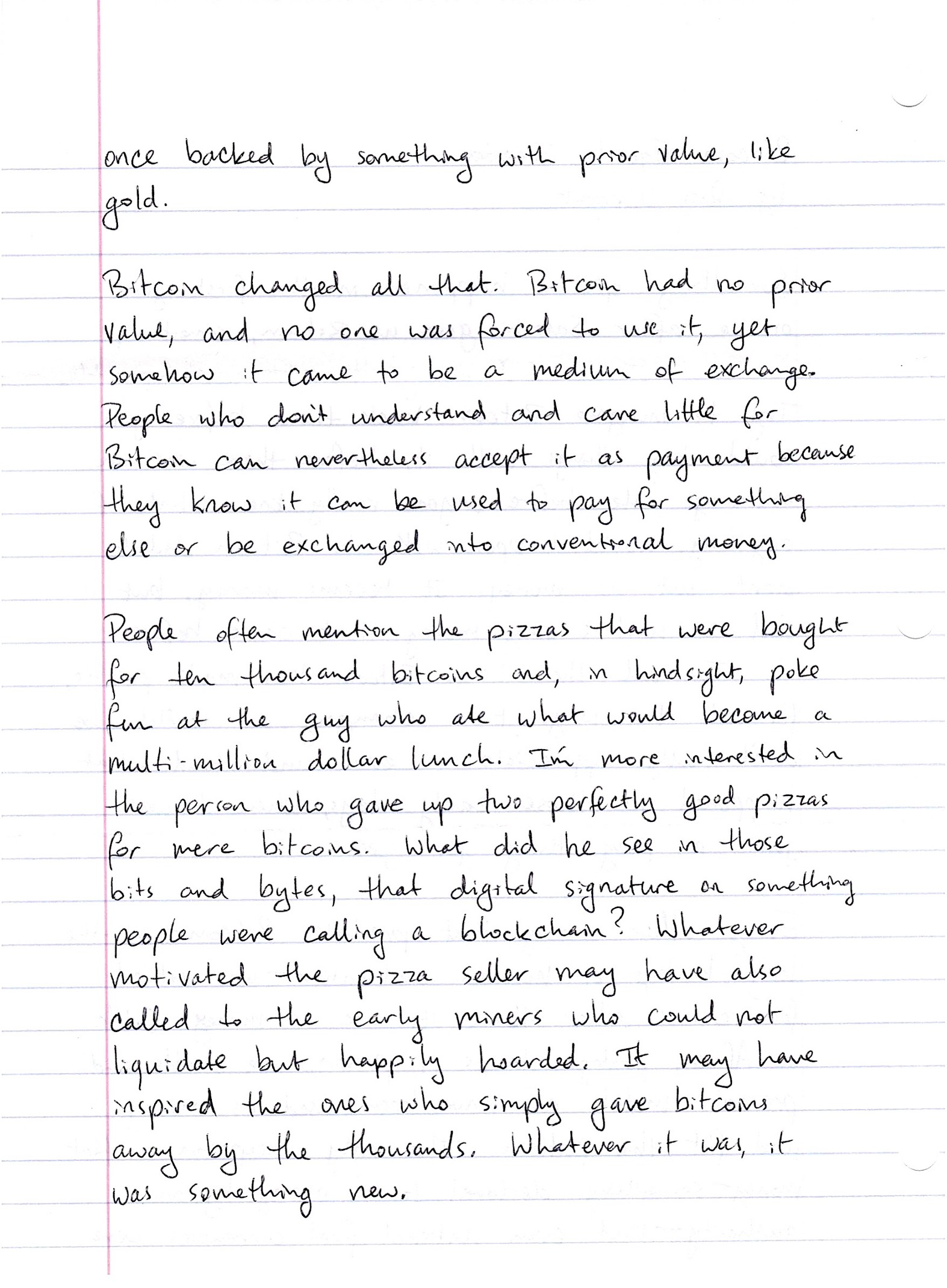

Bitcoin changed all that. Bitcoin had no prior value, and no one was forced to use it, yet somehow it came to be a medium of exchange. People who don’t understand and care little for Bitcoin can nevertheless accept it as payment because they know it can be used to pay for something else or be exchanged into conventional money.

People often mention the pizzas that were bought for ten thousand bitcoins and, in hindsight, poke fun at the guy who ate what would become a multi-million dollar lunch. I’m more interested in the person who gave up two perfectly good pizzas for mere bitcoins. What did he see in those bits and bytes, that digital signature on something people were calling a blockchain? Whatever motivated the pizza seller may have also called to the early miners who could not liquidate but happily hoarded. It may have inspired the ones who simply gave bitcoins away by the thousands. Whatever it was, it was something new.

Classical economics says exchange won’t happen unless both parties value what they are getting more than what they are giving up. So where did the value come from? Bitcoin should never have gotten off the ground, but it did. Even a new product has some kind of value to it, and early adopters are taking a risk that they won’t get their money’s worth, but they still expect to gain from the exchange.

The early adopters of Bitcoin, on the other hand, had no way of knowing that we do now. All they had was a dream, a conviction and enough infectious enthusiasm to bootstrap a digital contrivance into a multi-billion dollar phenomenon we are only beginning to see the effects of.

I’ll tell you what I think happened, but the truth is no one knows. It is like magic that Bitcoin could somehow come from nothing, and without prior value or authoritative decree, become money. But Bitcoin did not appear in a vacuum. It was a solution to a problem cryptographers had been struggling with for many years: How to create digital money with no central authority that couldn’t be forged and could be trusted.

This problem persisted for so long that some left the solution to others and dreamed instead of what our future would be like if decentralized digital money did somehow come to be. They dreamed of a future where the economic power of the world is accessible to everyone, where value can be transferred anywhere with a key stroke. They dreamed of prosperity and freedom, dependent only on the mathematics of strong encryption.

Bitcoin was therefore birthed onto fertile ground and was recognized by those that had been waiting for it. This was an historic moment for them, far more important than pizzas or electric bills run up from mining. The promise of freedom and the allure of destiny energized the early community. Bitcoin was consciously, yet spontaneously taken up as money while no one was watching, and our world will never be the same.

Tweetstorm: On making Bitcoin easier

By Beautyon

Posted October 1, 2019

You can use your iPhone or Droid to do many wonderful things without knowing anything about how they work or who built the software. Billions of people do this trillions of times a day. Why does anyone think billions of people are going to read a book to know how to use Bitcoin?

The idea that people need to know the theories behind Bitcoin or who wrote it is absurd. This artificial requirement and recommendation is only for the extreme stratospheric reaches of the global elite (Bitcoin Twitter) but not for the public, who shouldn’t be required to think.

All consumer electronics are similarly layered with generations of innovation and super complex concepts and techniques. The “Smart TV” is a perfect example. https://youtube.com/watch?v=yZV46Q_yTs0 what this represents is incomprehensible to all but a tiny handful of experts yet millions use it.

For Bitcoin to succeed, it too must packaged in a way that removes the need for anyone to understand how it works. There is nothing wrong with this, and it will be a difficult task to achieve. Rest assured it will get done, because the need for Bitcoin is greater than you think.

Once people experience just how simple it is to send money with Bitcoin, they’ll never EVER return to the horrific experience of dealing with banks and their terrible, horrible, invasive, insulting, broken tools and services. And you don’t need to have read Hayek to know that!

Reddit Response: Question on the Vulnerability of Bitcoin

By Greg Maxwell

Posted October 5, 2019

I think questions like this are ultimately the result of a fundamental lack of understanding about what Bitcoin is doing.

The problem Bitcoin is attempting to solve is getting everyone everywhere to agree on the same stable history of transactions. This is necessary because in order to prevent users from printing money from nothing the system must have a rule that you can’t spend a given coin more than once– like I have a dollar then pay both alice and bob that dollar, creating a dollar out of nothing.

The intuitive way to prevent that excessive spending is to decide that first transaction that spends a coin is valid and any additional spends are invalid. However, in a truly decentralized system “first” is actually logically meaningless! As an inescapable result of relativity the order which different parties will perceive events depends on their relative positions, no matter how good or fast your communication system is.

So any system that needs to prevent duplication has to have a way to artificially assign “firstness”. Centralized systems like ripple, eos, iota, blockstream liquid, etc. just have a single party (or a virtual single party) use its idea of whatever came first and everyone else just has to accept its decision.

A decentralized system like Bitcoin uses a public election. But you can’t just have a vote of ‘people’ in a decentralized system because that would require a centralized party to authorize people to vote. Instead, Bitcoin uses a vote of computing power because it’s possible to verify computing power without the help of any centralized third party.

If we didn’t have the constraint that this system needed to work online, then you could imagine an alternative where consensus could be determined by people presenting large amounts of some rare element. … but you can’t prove you control osmium online, it appears that computing power is the only thing that can work for this purpose online.

When people talk about “51%” all they’re really talking about is people rigging that election, so that they can override what everyone previously thought was the accepted order of transactions with a new order that changes some of their payments from one party to another.

With this understanding maybe you can see that the concern doesn’t even depend on a single person having too much of the hash-power. The attack would work just as well if there were 100 people each with an equal amount and a majority of them colluded to dishonestly override the result.

Also, any mechanism that would let you prevent one party (much less a secret collusion) from having too much authority would almost certainly let you just replace mining entirely. The only known way to do that is to introduce centralization and if you’re willing to do that it’s trivial, if you’re not it appears impossible. People have cooked up 1001 complicated schemes that claim to do it without introducing centralization, but careful analysis finds again and again that these fixes centralize the system but just hide the centralization.

I think people obsess far too much about “51%”– it has some kind of attractive mystery to it that distracts people. If you’re worried that someone might reorder history using a high hash-power collusion– just wait longer before you consider your transactions final.

A far bigger risk to Bitcoin is that the public using it won’t understand, won’t care, and won’t protect the decentralization properties that make it valuable over centralized alternatives in the first place. … a risk we can see playing out constantly in the billion dollar market caps of totally centralized systems. The ability demonstrated by system with fake decentralization to arbitrarily change the rules out from under users is far more concerning than the risk that an expensive attack could allow some theft in the case of over-eagerly finalized transactions.

The Monetary Case for Bitcoin

By Ben Kaufman

Posted October 5, 2019

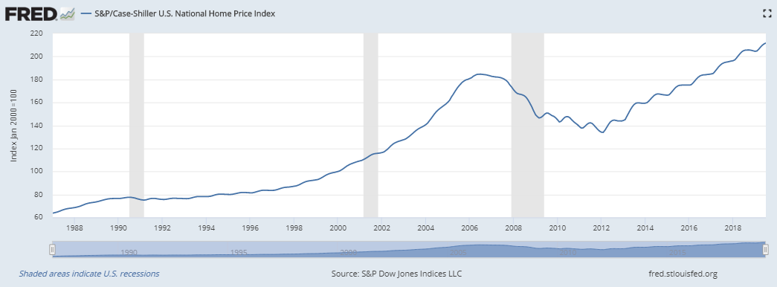

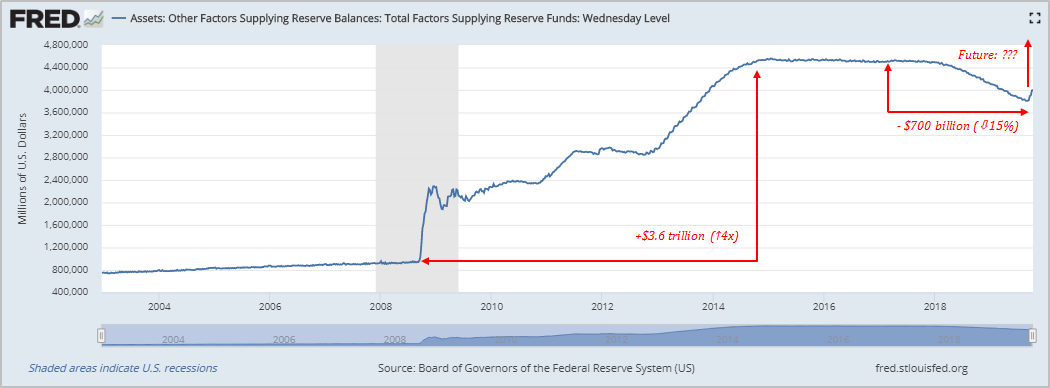

The introduction of Bitcoin to the world ten years ago as a new monetary system sparked new interest in the field of monetary economics. After a century of fully nationalized money production systems, and about five decades of an irredeemable national paper money standard, the battle for sound money seemed to be long lost. A return to gold, even within the circles of Austrian and free-market thinkers, became an increasingly less practical approach, and it seemed there was little left to do but wait for the inevitable collapse of the contemporary system, to which we arguably came close several times.¹ The fight in the intellectual arena was seemingly over as well, both from the academic view and the general public acceptance. With very few exceptions, such as with the case of Friedrich Hayek, most prominent economists acknowledged by public endorsement were followers of the Keynesian monetary approach. Thus endorsing monetary nationalism², and the enactment of legal tender paper money, as both a cost-efficient alternative to gold and as a device for government financing and “fine-tuning” of the national economy.

At the same time, while the public and academic fights for sound money could be declared lost, the rise of new technology has opened up a new frontier, and the search for a digital monetary alternative began. A small unorganized group, composed mainly of individual computer scientists and cryptographers, called Cypherpunks, started looking into the new possibilities computer networks and cryptography could provide for liberating people, which included the effort of creating open digital money. With the pioneering works of David Chaum (DigiCash) with digital payments, and with such various later research and practical initiatives, most notably of Adam Back (HashCash), Wei Dai (b-money), Nick Szabo (BitGold) and Hal Finney (RPOW), the attempts at introducing digital cash started piling up. These efforts, though nonetheless interesting for their merit, all failed to either deliver a working system or gain sufficient traction to have any considerable impact on monetary affairs.

The introduction of Bitcoin, around late 2008, can arguably be marked as the most important turning point in monetary affairs since 1971, when the collapse of the Bretton Woods system occurred and led us to the irredeemable paper standard of today. Though not at all immediate, the growth of Bitcoin as a new form of money started to accelerate. Now, about ten years after its inception, it regularly makes it to the news headlines and has even reached US Congressional discussions. The wild success of Bitcoin consequently drew a lot of attention to the area of monetary economics and reignited the lost battle for sound money.

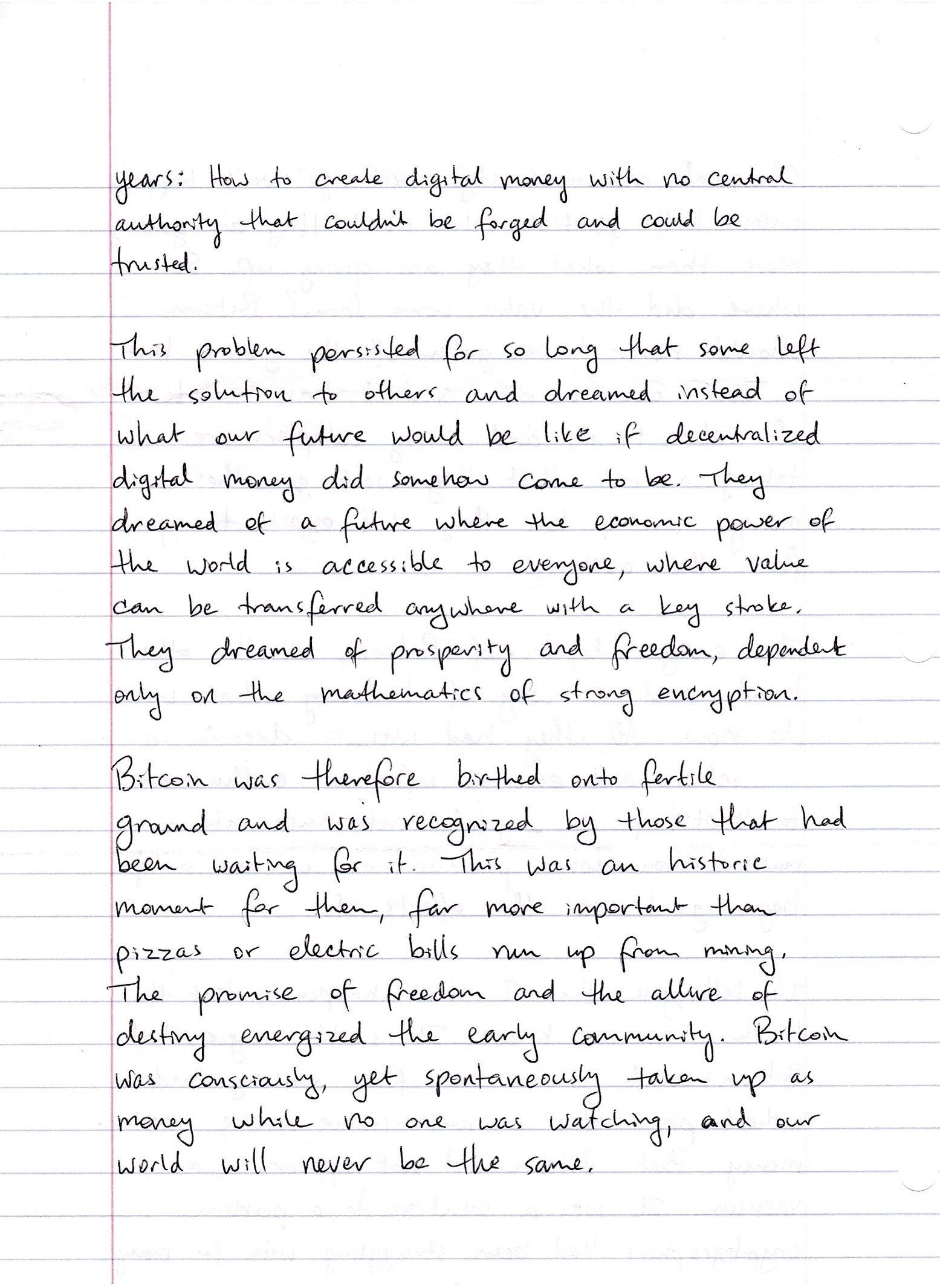

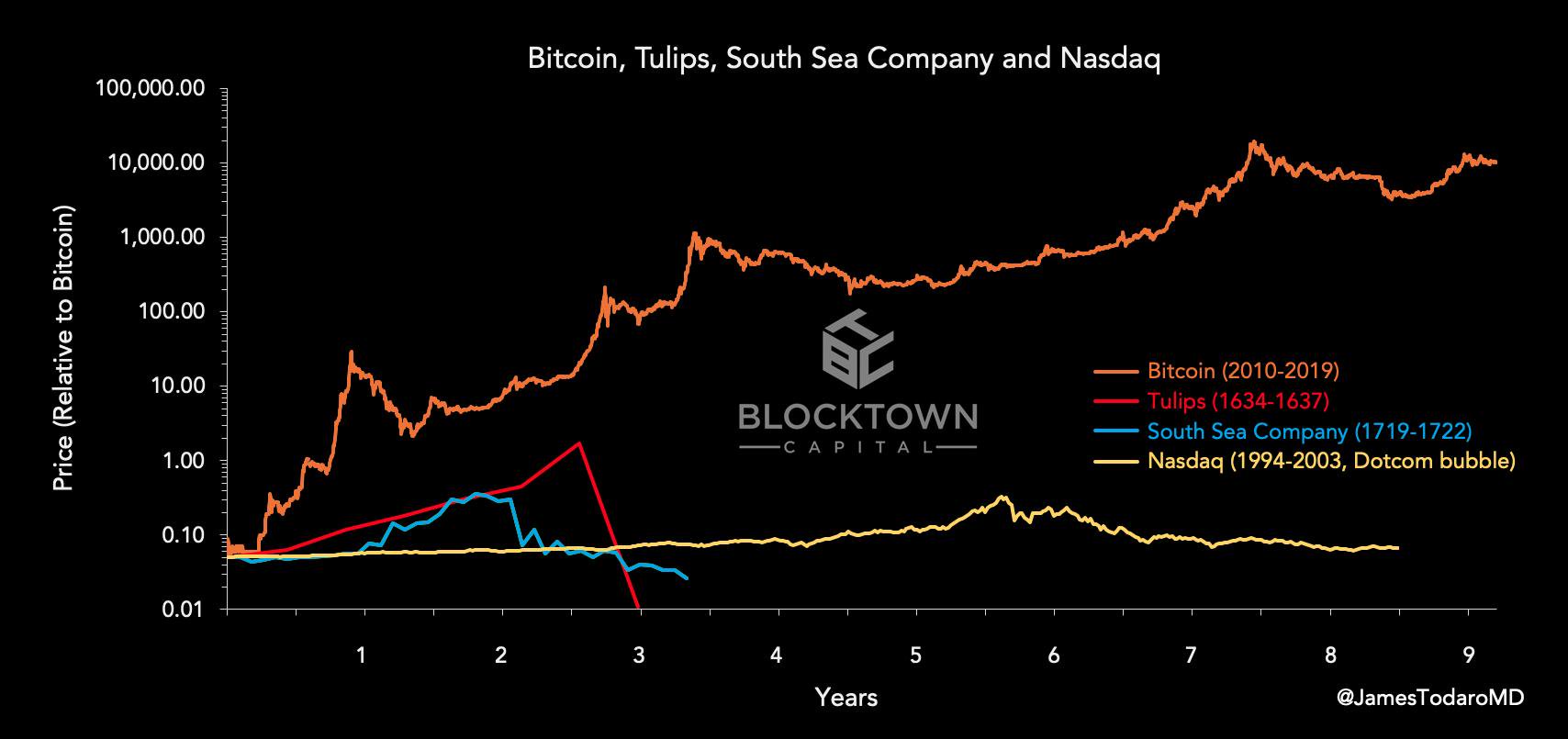

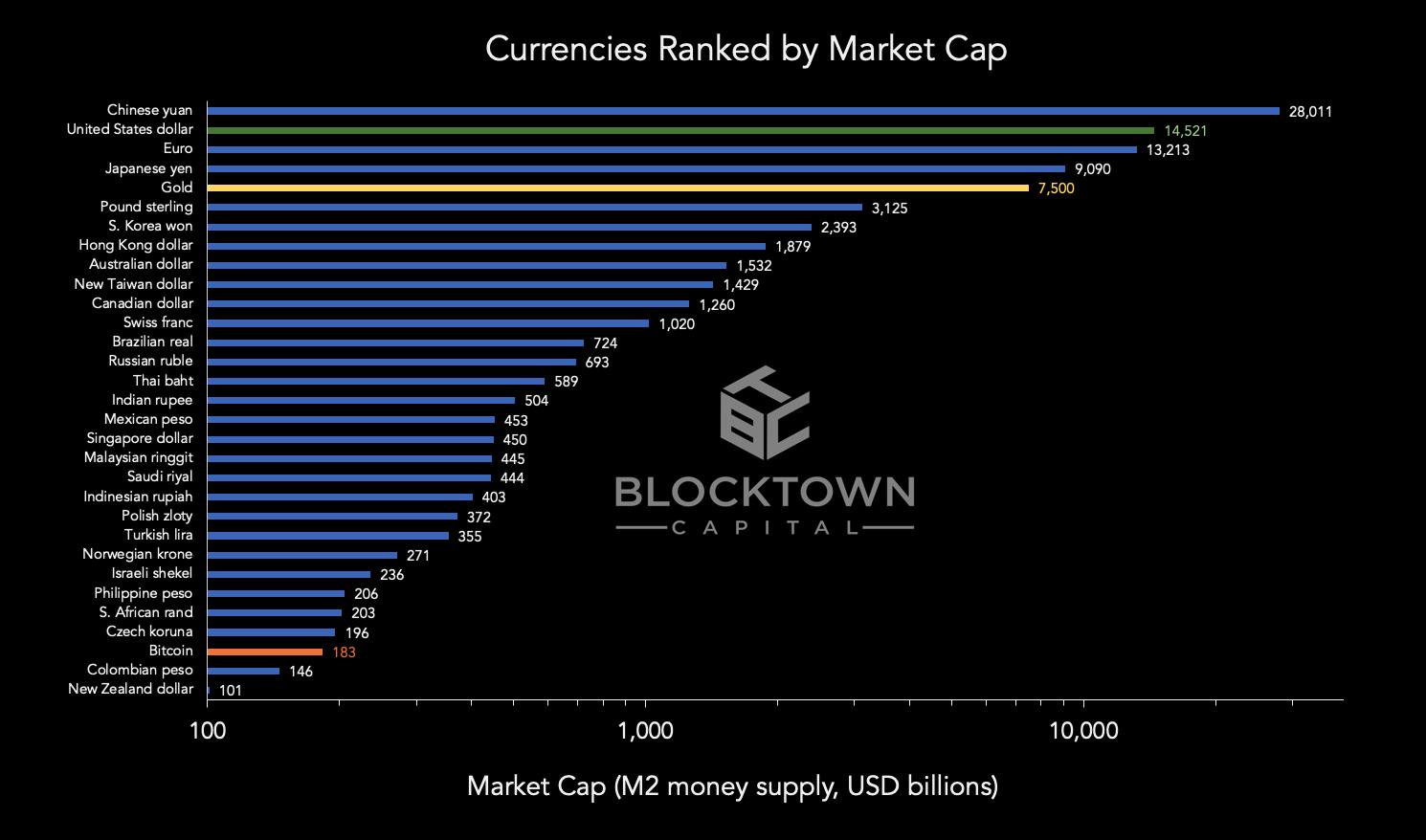

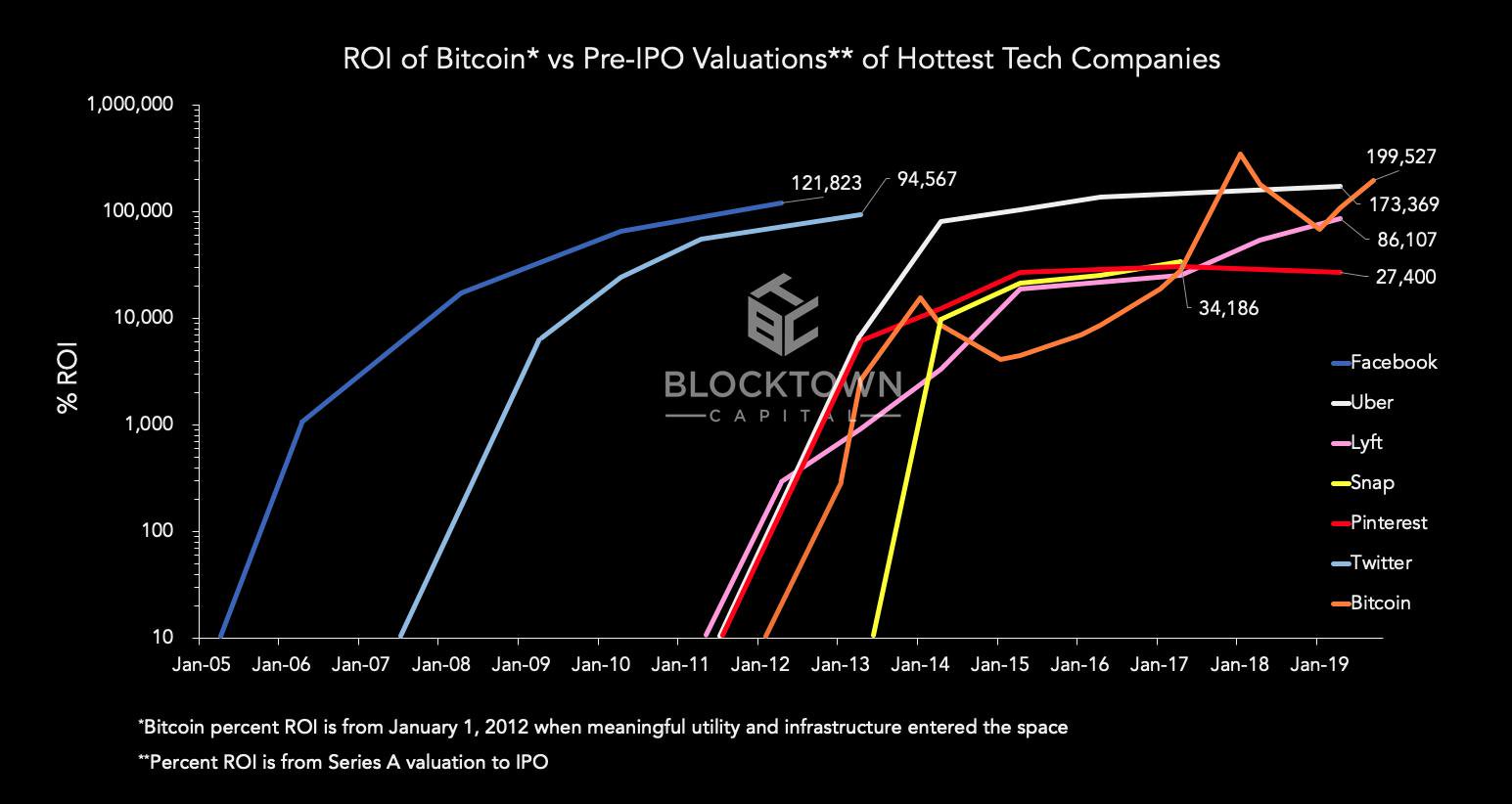

At first, Bitcoin received but insignificant attention and skeptical reactions from both sides, which considered it to be no more than a bubble or a passing trend. However, as time passed, and with Bitcoin growth accelerating with each passing year, it started receiving some attention, making its intellectual allies and rivals. From all economic schools, the phenomenon of Bitcoin seemed to be compatible only with the theory of the Austrian school. There, it is currently still debated with strong enthusiasm between its many supporters and skeptics. On the other hand, within all other economic schools, Bitcoin is still considered mostly as a bubble, a “market irrationality” or a trend about to collapse. The incompatibility of Bitcoin, as money not backed by the authority of the government, with their economic theories in general and their ideas on monetary economics in particular, blinded them to the mere possibility of new money like Bitcoin emerging. Despite the rather small (but growing) support, and strong opposition from the academic circles, Bitcoin has continuously progressed and established its monetary status as more economically significant than many national currencies.³

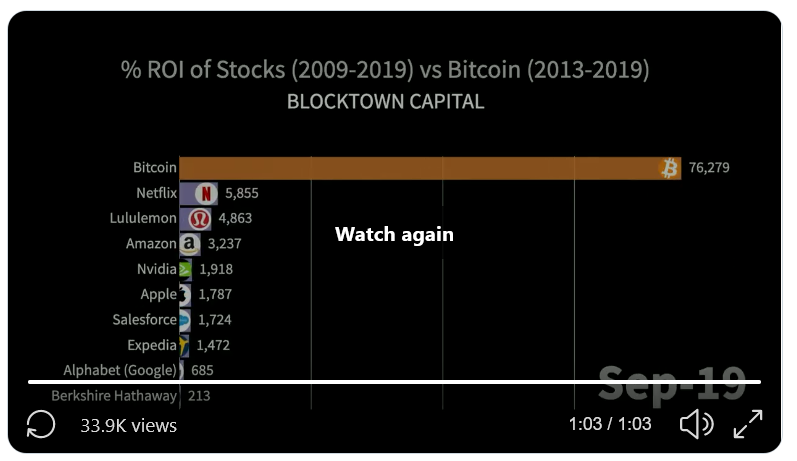

The market cap of Bitcoin compared to other national currencies and precious metals. Source: https://cryptovoices.com/basemoney

The market cap of Bitcoin compared to other national currencies and precious metals. Source: https://cryptovoices.com/basemoney

At this point, it has become clear that Bitcoin can no longer be ignored, but should rather be studied and investigated thoroughly. It seems that understanding its nature may expose both the reasons for its success, and a rough expectation for what its future holds. Throughout the previous two articles⁴, I outlined some of the foundations for understanding the economics of money, its nature and substance, from the perspective of the Austrian school. We started by looking into the nature of money as the most saleable commodity, that which imposes the least economic costs on its holders for future exchange. We then continued by exploring the various factors influencing the saleability of commodities, and therefore their likelihood to emerge as money on the market.⁵ In this article, we shall utilize this understanding and apply it to the case of Bitcoin, exploring the case for Bitcoin from the view of monetary economics.

Bitcoin’s Monetary Properties

The common monetary properties influencing the suitability of a commodity to be money, such as its divisibility, portability, and durability, are usually inherent to the physical composition of the commodity itself. The physical limitations resulting from this have affected the specific substance of money to a large extent throughout the years. For example, the physical limitation of dividing gold into small enough denominations as to be used for low-value transactions prevented its (physical) use in many exchanges, forcing people to resort to such less valuable metals as silver and copper, and later also to money certificates.

The emergence of Bitcoin as the first digital form of money allowed us to bypass those “physical” limits of money, and scale them to the almost non-existing limits of the digital realm. Understanding how Bitcoin allows us this improvement of monetary properties requires a basic understanding of how it works, and how Bitcoin is digitally represented. Bitcoin, in its “rawest” form, is a piece of software which automates the achievement of consensus over the ownership of (the conditions under which one is allowed to spend) units of Bitcoin. In other words, Bitcoin in this raw form is a list of spendable amounts and the conditions for spending them.

Since Bitcoin, unlike previous monetary assets, is not based on physical ownership, but on the consensus on its spending conditions, we should separate our discussion of its limitations into two consensus layers. The first, which is commonly termed the “on-chain” layer, is the global consensus layer which we just described, and we may think of it as the ultimate source of truth for determining ownership over Bitcoin units. From its nature as a global consensus layer, binding for all its participants, it is relatively rigid and restrictive. Thus it provides us with a somewhat moderate degree of improvement in terms of the monetary properties. For example, the divisibility of Bitcoin here is limited up to a single “satoshi,” which is equivalent to a hundred millionth of a Bitcoin. The process of division itself requires changing the spending conditions assigned to the associated units, meaning they need to be “spent” to divide them. We may notice that, despite the unit size limitation, it is possible to scale it, if necessary, through a change in the global consensus mechanism. Such changes, though extremely hard and costly to perform, are nonetheless feasible, and provide us with a certain level of improvement to the asset itself as new needs arise over time.⁶ The ability to change those technical monetary properties of the asset is an unprecedented capability which Bitcoin introduced, and already gives it a significant advantage over its predecessors.

The second, called the “off-chain” layer, utilizes the nature of Bitcoin both as a consensus-based digital asset, and as programmable software, allowing cooperating individuals to create a “subset” of the consensus of Bitcoin, and to transact within that subset using various mechanisms. If we look at the portability of Bitcoin as an example, while it is unarguably cheap and easy to move between physical locations, the transfer of actual ownership (change in spending conditions) of Bitcoin on the on-chain layer is somewhat constrained, allowing roughly about 600,000 final settlements (ownership transfers) per day. However, as transactions are usually made between cooperating entities wishing to make the transaction go through, the off-chain layer allows them to use various constructions for achieving consensus. Thereby, it enables them to scale the transaction capacity to the nearly infinite limits of the physical movement of electronic data. There are many options for such constructions, a lot of which are currently under research and development, with each of them offering widely different tradeoffs for the transacting entities. Prominent examples are the “Lightning Network,”⁷ which offers trustless and instant transactions, with mostly some liquidity limitations, and “sidechains” such as “Liquid,” which provide benefits like high-speed and confidential transactions, and asset issuance with the tradeoff of introducing trust in a federation of trusted entities which manage the consensus subset for their clients.

In conclusion of the analysis of the monetary attributes of Bitcoin, we see how the transition of the monetary asset from the physical into the digital realm allows us not only for unprecedented improvements but also a high level of flexibility in the monetary properties of the asset. Therefore, we may conclude here that Bitcoin, from the perspective of its “inherent” properties, is unprecedentedly superior to all its predecessors. With this in mind, it seems that Bitcoin deserves a further investigation of its suitability as money. We will thus continue with what is probably the most controversial and innovative aspect of Bitcoin, its production and supply.

Bitcoin Production

Before Bitcoin, the challenge of producing digital money on the market seemed almost impossible from the view of monetary economics writers. Prof. Jörg Guido Hülsmann, an Austrian economist focusing on monetary economics expressed this widespread belief in one of his books. He states that “an economic good that is defined entirely in terms of bits and bytes is unlikely ever to be produced spontaneously on a free market.”⁸ Coincidentally, he published this on October 2008, two months after the whitepaper of Bitcoin was first published, and about three months before the first bitcoins came into existence.

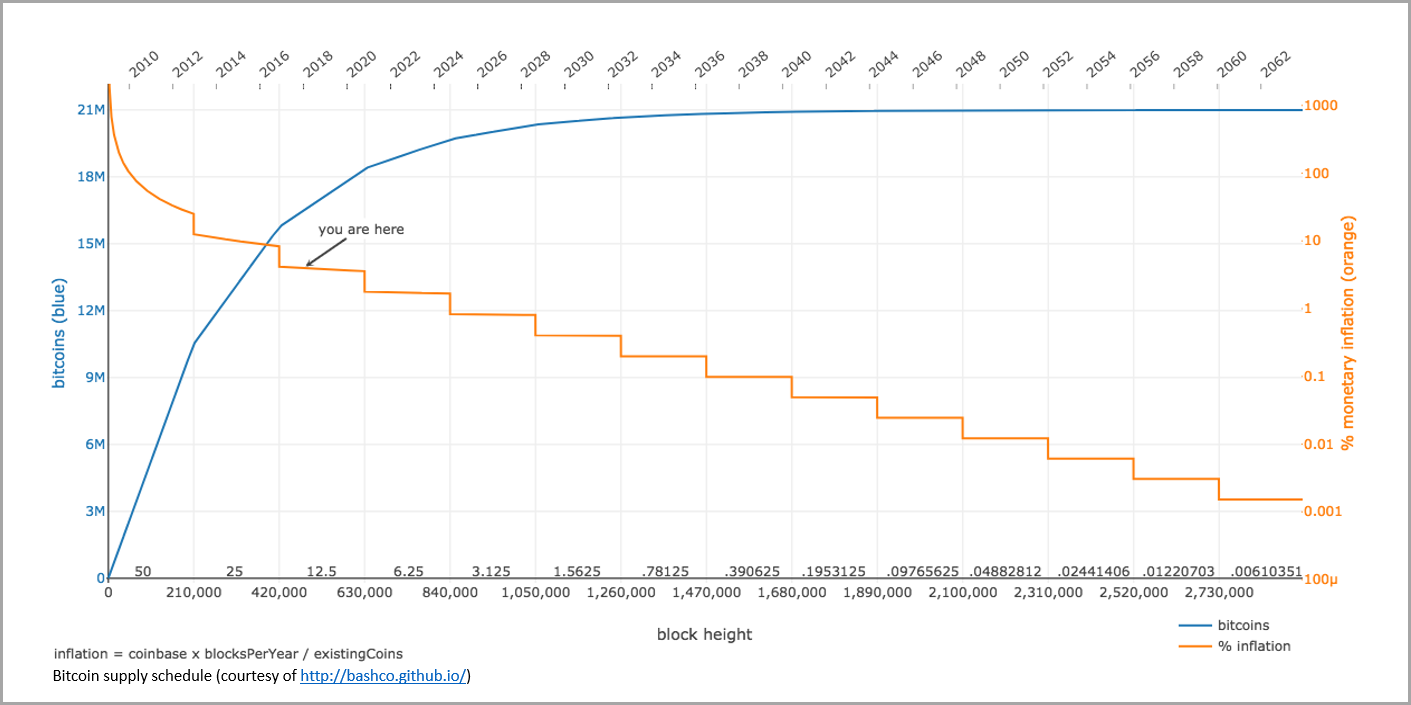

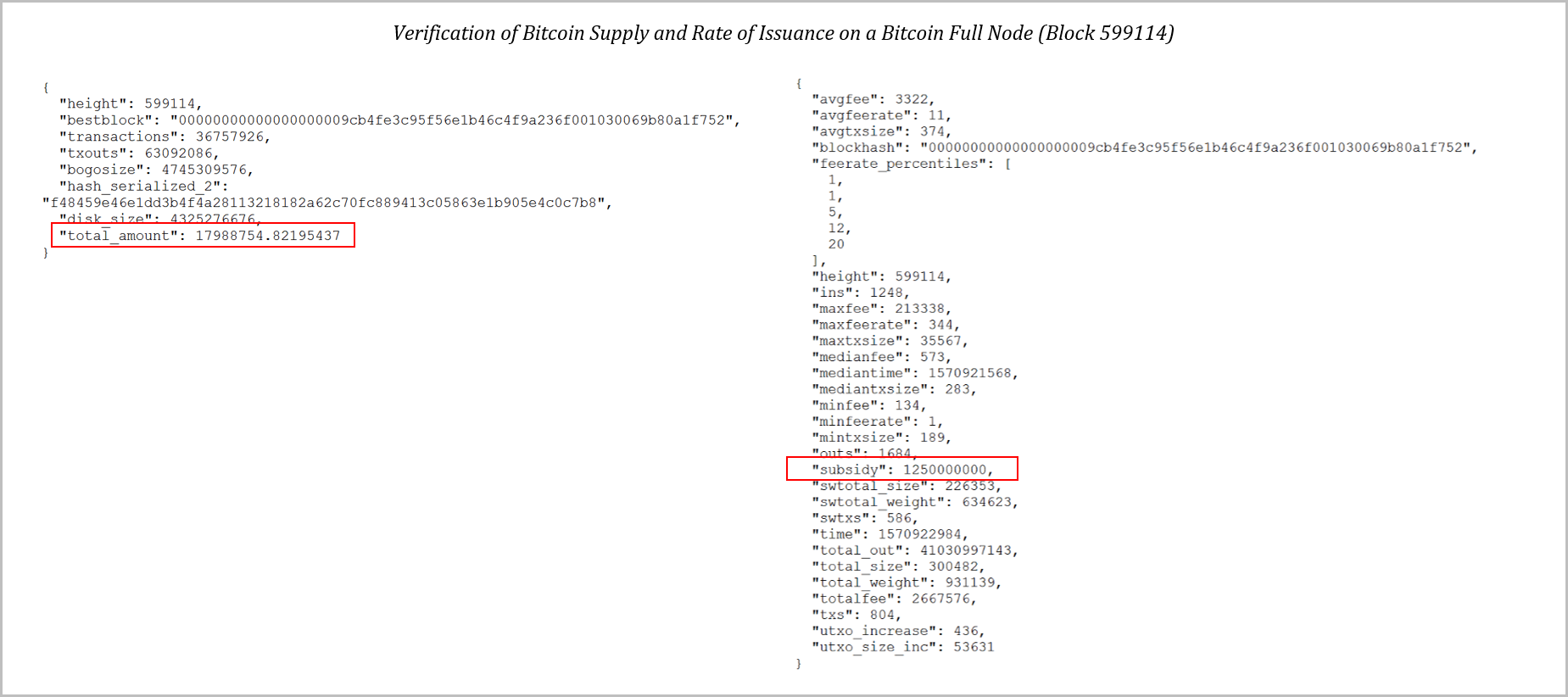

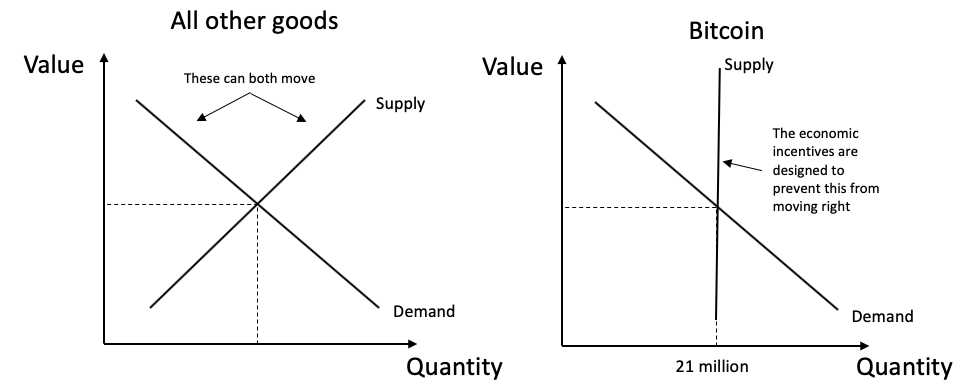

The invention of Bitcoin indeed required finding a solution to what was up to that point an unsolved problem, the ability to produce digital scarcity with controllable supply (solving the “double spending problem”), without depending on a trusted entity. The creator of Bitcoin solved this by introducing the mechanism now commonly referred to as “Nakamoto Consensus,”⁹ which is the solution for the discussed problem. The basic idea is to have an open competition between computers over finding a solution to a mathematical challenge. This challenge is similar to a random lottery in the sense that the only known way to find a solution is through random guessing, and the chance for discovering a solution remains the same for every guess. This process requires the expenditure of computation power, which is mostly limited by the availability of energy for the computing machines. Adam Back has initially proposed a similar process as part of the HashCash system in 1997. Bitcoin works similarly to that proposed mechanism, but a critical point where Bitcoin improves over this proposal is with the ability to set a strict schedule for the production of new units. Bitcoin achieves this by using a peer to peer consensus network (which we discussed above) to enforce and validate the monetary rules and schedule, and an automatic periodical adjustment to the computational work needed for producing new units which adjusts the difficulty of the challenges, and thus the speed of production as to match the schedule.

Unlike previous monetary assets, such as gold, silver and seashells, which relied on particular physical limitation and scarcity for their production, and also unlike the current fiat paper monetary system, which relies on a trusted issuer (the central bank) for the production of money, Bitcoin relies on a purely mathematical system for its production. This characteristic allows for an objective and universal way for auditing the validity of a unit of Bitcoin and enables a fair and open competition on its production. Anyone is free to participate (and stop participating) in this competition by expending computation power, having a probabilistic chance to produce Bitcoin directly proportional to the computation they spent.

Money Production and Externalities

Historically, the production of the substance of money was always costly, both from a direct and indirect perspective. Cattle for example, which were used as money in lots of nomadic societies, were expensive to raise (“produce”) and resulted in some entirely unexpected externalities, mainly due to the great need for graze-lands required for growing them.¹⁰ Gold, as another example, is also very costly to produce, as its mining process requires filtering out many tons of dirt just to obtain a small quantity of it. Its externalities are quite unpleasant as well, as the military seizure of gold mines and the dangerous and sometimes forced labor it involves present us with multiple economic and ethical issues.

Marco Polo was perhaps the first to introduce the seemingly impressive concept of paper money, which he observed in China, to the western world.¹¹ Since he made that discovery, the appetite of rulers, bankers and intellectuals for easy money has been continuously growing. The first European experiment with easy paper money was when in 1661 the Swedish central bank, Stockholms Banco, started issuing banknotes. The practice then led to the bankruptcy of the bank just three years later, but this failure seems to have only increased the desire for more such experimentations on the part of rulers and bankers. As for intellectuals, the desire to make the production of money more “efficient” was evident from the very beginning of the field of political economy. The idea indeed finds support with such early economists as Adam Smith and John Law, which saw the use of precious metals as an inefficient process.¹² They, along with many other economists, especially from our current time, sought to make money production cheaper, thus more efficient, by replacing its substance with such cheap alternatives as paper. They believed that such an alternative monetary system could function just as well as that of precious metals, only with a fraction of the production costs. This difference between the production costs and the “face-value” of the money is what we may term as “easy” money, which we should distinct from “hard” money. Thus from this superficial point of view, the difference is that easy money has seemingly insignificant costs for its production, while hard money is expensive to produce.

The problem with easy money, and the reason which such theoretical supporters of it as David Ricardo opposed its implementation¹³, is its externalities, the hidden costs and risks which it involves. It is well known and agreed that truly easy money could never emerge on the free market. That is because, for any commodity, market participants will be willing to increase their production and its costs up to the point where it is no longer profitable to increase production. This means that if we were to attempt and install an easy monetary system on the free market, the market participants would start producing it in such quantities as to make the value of each money unit roughly equal to its production costs, canceling the intended “efficiency” of the easy money. Thus, all attempts to introduce an easy money system required the state to assign a monopoly privilege over money production to a specific entity, commonly known as the central bank. With the market participants legally prevented from participating in money production, supporters of easy money believed they could successfully reduce the costs of money production to the mere printing costs of paper notes.

However, this almost obsessive look on the direct and highly visible costs for money production has blinded those economists to the many non-obvious costs easy money imposes. First, and probably the most obvious concern, which was expressed by Ricardo, was the risk for the abuse of the system. From the many hyperinflation scenarios to the less notable moral hazards,¹⁴ the trap of easy money introduced various risks and was abused many times by those in a position to do so. This issue alone should make the trap of easy money clear. It gains small efficiency while introducing fatal risks and many points of moral hazard. However, there are two more aspects where the fallacy of cheap money is exposed.

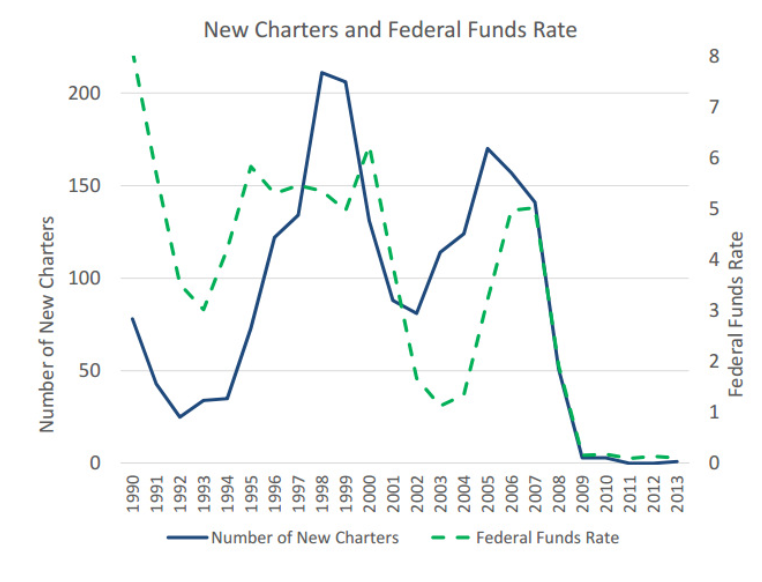

The second aspect we may look at is the actual costs of operating such a system. With the large bureaucracies typical to all public institutions, and with hundreds of thousands of central bank workers, it is hardly disputed that the supposedly “cheap” and efficient paper money system of today is really more efficient compared to hard money.¹⁵ Along with this consideration, we should also note that the production of gold for monetary purposes still continues to a large extent. Therefore, these extra costs of the cheap money system come mostly in addition to, not instead of, the costs of the previous hard money one. The issue gets even worse when we understand the important fact that while regulations excluded market participants from direct money production per se, those will still expend as many resources as is still profitable on forecasting and influencing the policies of the central banks. The supporters of easy money have evidently failed to take into account the willingness of market participants to still make the most out of money production, and the jobs of many analysts, economic forecasters and lobbyists are the results of this indirect inefficiency of easy money.

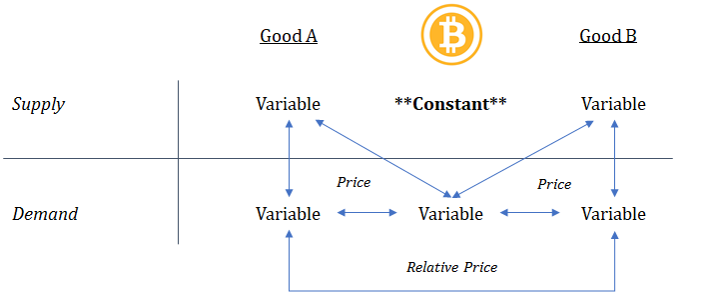

The third and most critical issue that easy money causes is the manipulation of the market process. The market uses money as a tool for resource allocation, with money holders directing the market according to their needs and demands. However, when using easy money, its producer (the central bank) has the power to disproportionately influence the allocation of resources. In fact, we can say it practically takes control over the market, as it can cheaply create money for itself to direct resources as it wishes. Thus, in an easy money economy, the power to allocate resources shifts from the market to those who control the central bank. This distortion of the market gradually shifts the entire economy into indirect central planning. Combined with the moral hazards involved with cheap money production, this process accelerates even further, with the ensuing destructive consequences of economic central planning, disguised under the pretense of a market phenomena.

Easy money, as we see, does not reduce the costs of money production, neither does it make it more efficient in any other sense. The only function it fulfills is to reduce the directly visible costs of money production, while disproportionately increasing the hidden, non-obvious ones. We can draw two main conclusions from this analysis. The first and more obvious one, is that easy money is not only inefficient but may even be destructive due to its risks and externalities. Second, we can notice here that we should aspire to have the process of money production be obvious and transparent, as to minimize such risks and unexpected externalities.

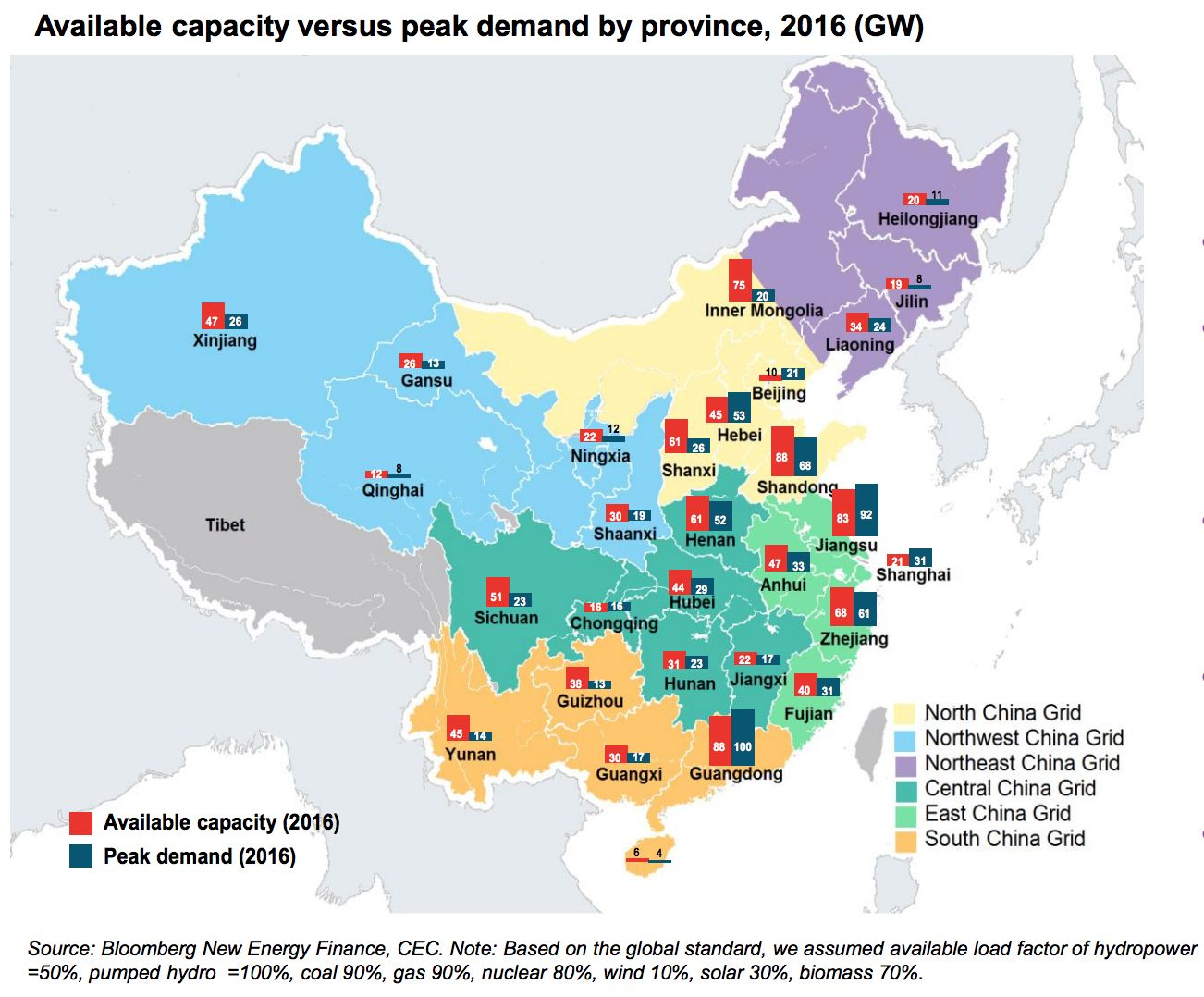

When looking at Bitcoin, one of its remarkable features is its process of production. The most significant and costly part of producing Bitcoin, as discussed above, is the process of turning energy into electricity, and converting this into computational power. While all types of production require the use of energy, most other processes require applying it in very indirect methods, and more importantly, at highly specific locations. The production of gold, for example, requires both extensive human labor and many complicated types of machinery, but more importantly, it requires miners to apply them at particular locations (gold mines). Thus, gold not only requires many complications for its production process, but it also limits the ability of people to produce it to specific locations. The production of Bitcoin, on the other hand, allows anyone, anywhere in the world¹⁶, where there is an untapped energy source, to use it to produce Bitcoin. This unique production process of Bitcoin has three main advantages we shall discuss here.

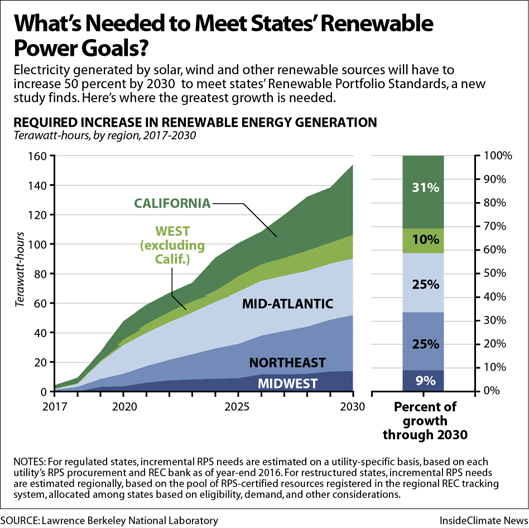

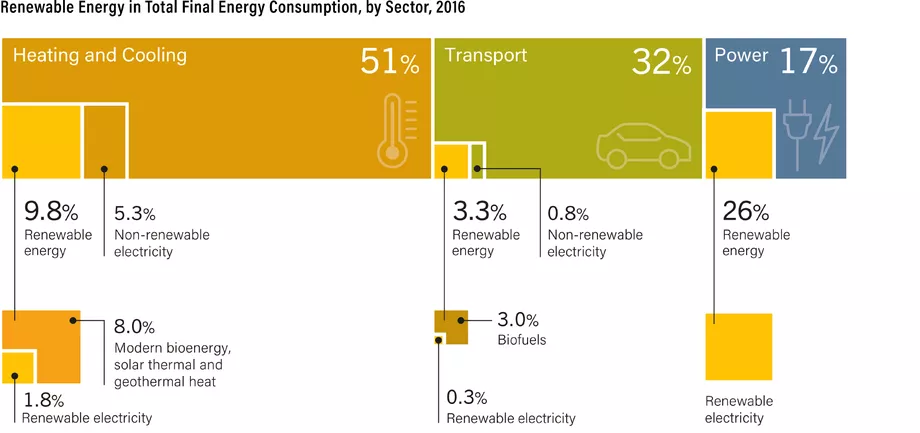

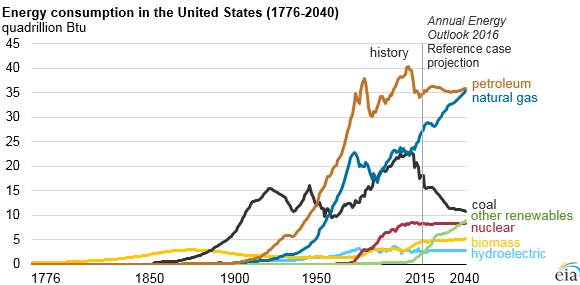

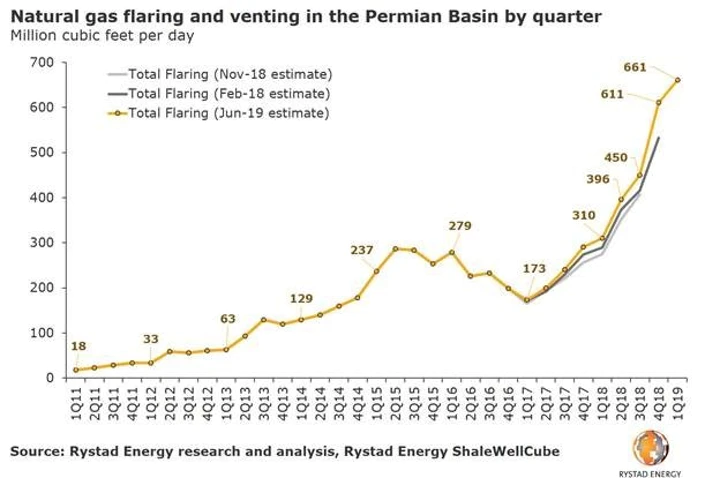

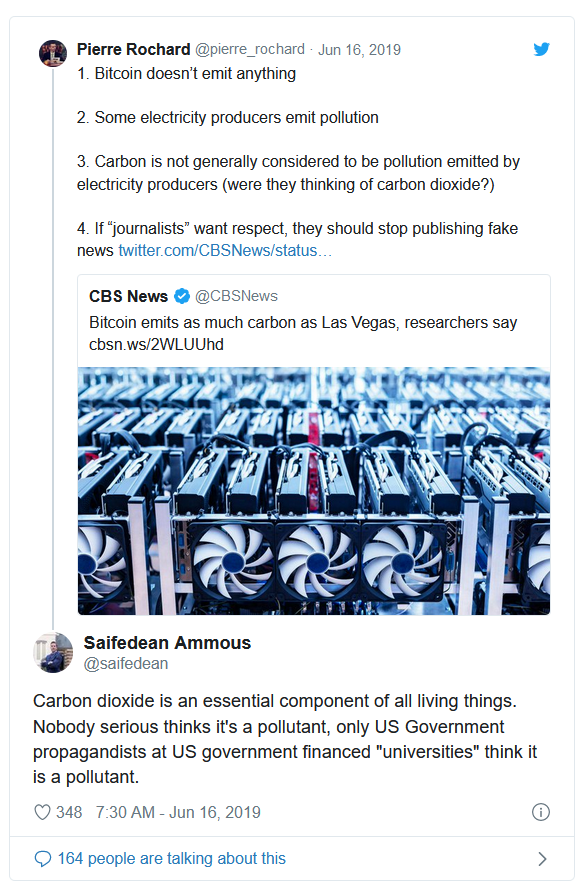

First, it makes the competition for money production more fair and open than ever, removing many spatial constraints and allowing for a truly efficient process of market competition. Second, by making the process of production so simple and straightforward, Bitcoin reduces the hidden costs and externalities involved in the process of money production. This reduction of externalities makes the system much more robust overall and allows us to understand its consequences better. Third, the production of Bitcoin, by removing spatial limitations, allows the utilization of energy sources which were previously unusable due to such spatial considerations. The ruthless competition in Bitcoin production forces its producers (often called miners), to minimize their costs as to be more efficient than their competitors. This competition requires them to constantly seek for the most efficient energy production process, which will minimize their successive production cost, and it appears, both theoretically and in practice, that this most efficient source is to be found in renewables. The energy naturally available from these sources, such as sunlight, water, wind, and many others, is much cheaper than traditional sources as it is both so plentiful and mostly unused. While transportation costs of such energy limit its viability for many daily purposes, the production of Bitcoin has no such spatial limitations. Thus, the production of Bitcoin promotes the profitable funding and development of renewable energy and incentivizes progress in the field of energy production.¹⁷ It is thus no surprise to find out that most of the energy used for Bitcoin production likely comes from renewable energy sources¹⁸, making Bitcoin production probably one of the cleanest sectors of the economy.

We may summarize here that, as for the reasons discussed above, the production of Bitcoin seems to be the most desirable process for money production we may have. The fact that it is hard money, combined with its simple and transparent production process, open and direct competition, and seemingly positive externalities makes it largely superior to any of its predecessors. The second important consideration, which is typically linked to the production process of money, is the issue of its supply and is our next point of discussion.

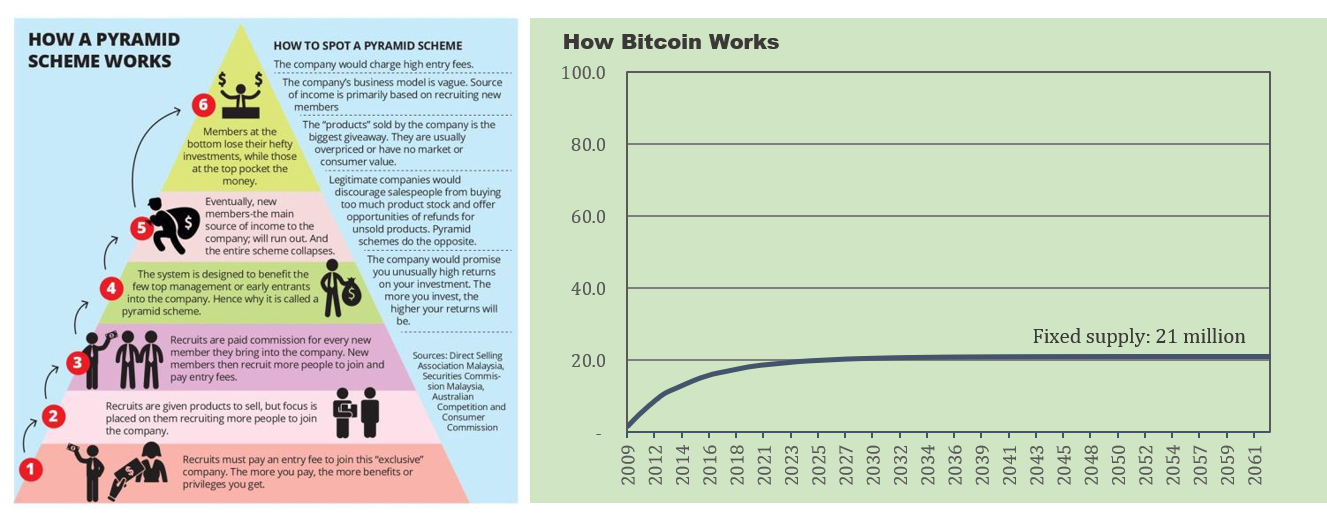

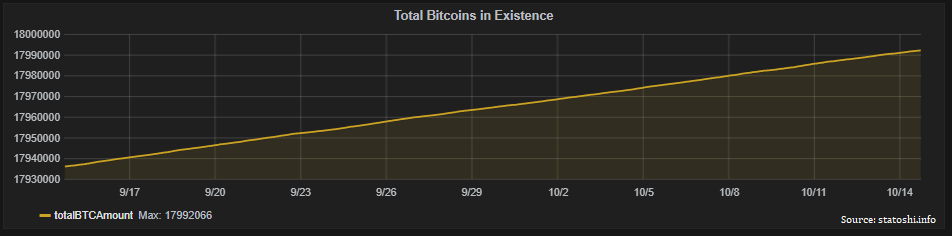

The Supply of Bitcoin

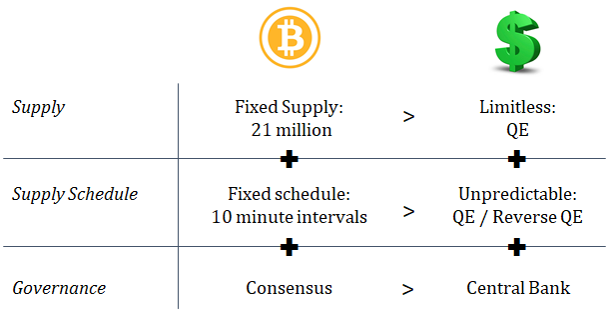

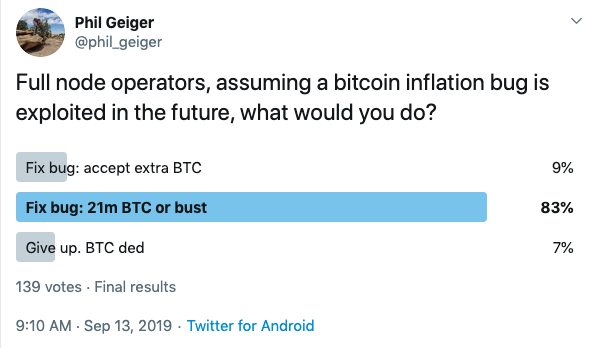

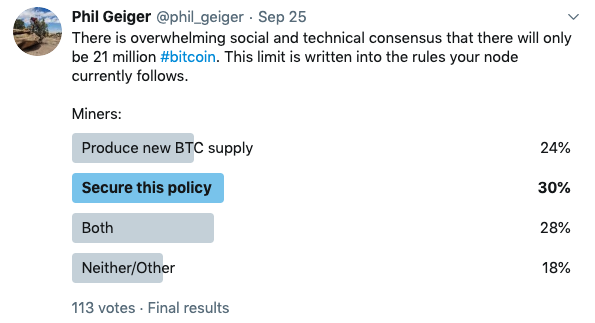

The nature of Bitcoin as a software-based asset means that its supply, unlike previous natural monies¹⁹, is under the ultimate control of its users. It is, in fact, a critical part of its consensus rules, and is capped at roughly 21 million Bitcoin units. This is usually termed as the “monetary policy” of Bitcoin and is enforced by the economic activity of each participant of the Bitcoin network. The decentralized nature of Bitcoin as a peer to peer network means there is no central entity authorized to dictate the monetary policy of Bitcoin. So while it is theoretically possible to change this policy, such a change in practice does not seem to be likely or even possible, thus it is not considered within this article.

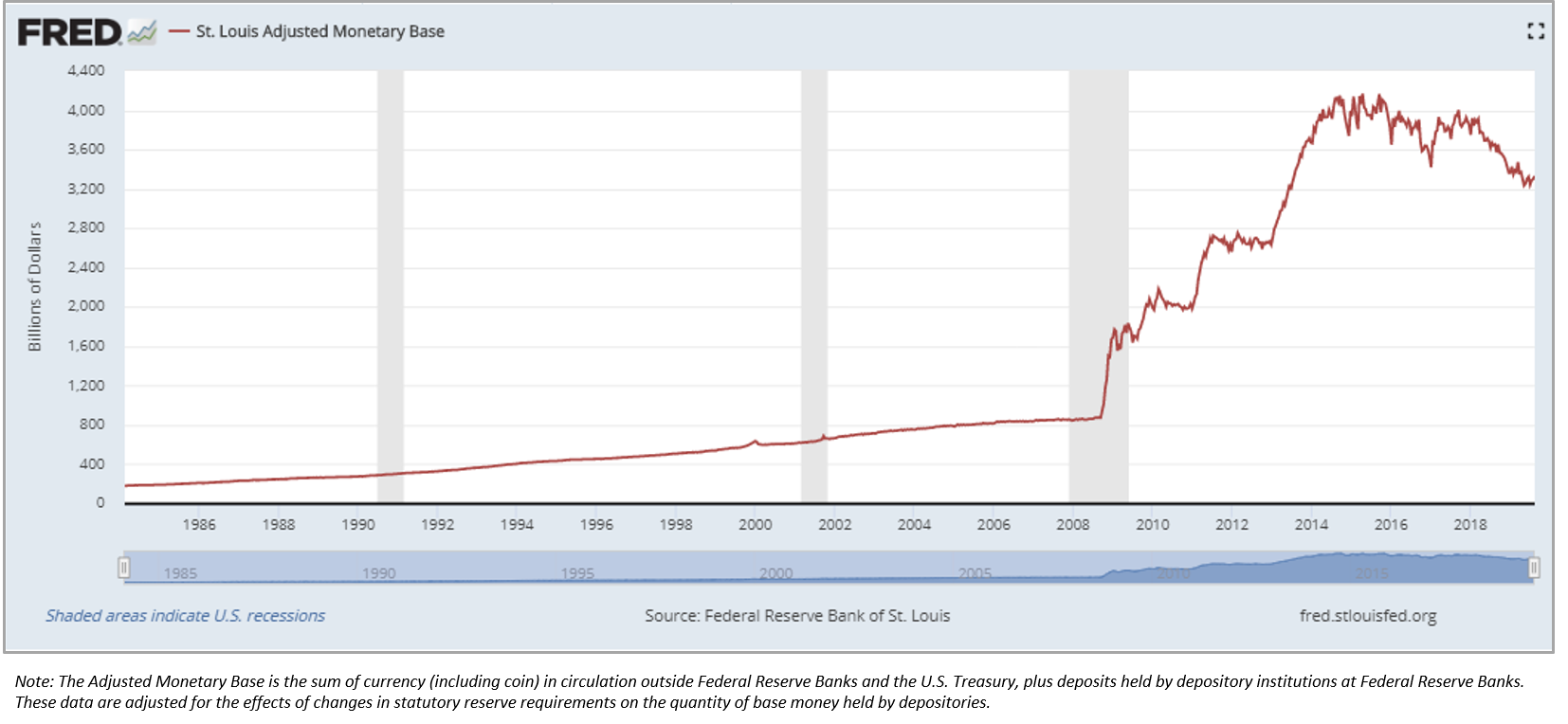

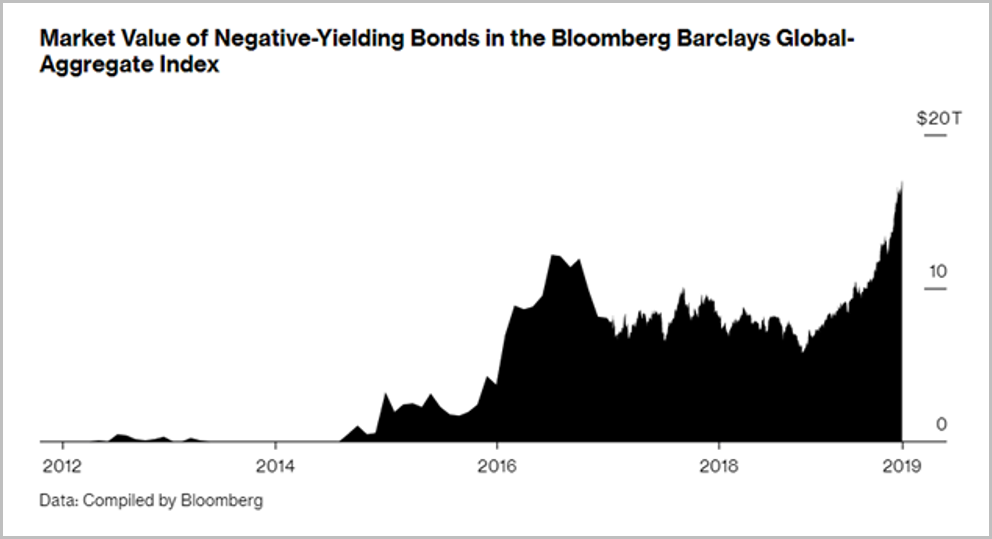

This policy of Bitcoin is in sharp contrast with the prevailing policies enacted by the central banks of today. These institutions, from their very inception, have been pursuing policies of constant expansion of the money supply. These expansionary policies tend to be justified as necessary for the “common good” as they supposedly allow the government, and its “highly qualified” economists, to promote economic growth, reduce unemployment, and combat the business cycle. A task at which they have failed quite miserably for the last hundred years, during which those problems seems to have only further aggravated.²⁰ Within the present discussions, the monetary policy of Bitcoin is usually deemed to be quite radical in the eyes of most. Many critics of Bitcoin have claimed that this lack of an “elastic” monetary policy, that is a policy which may be modified according to the alleged needs of arising circumstances, prevent Bitcoin from ever seeing any meaningful adoption.

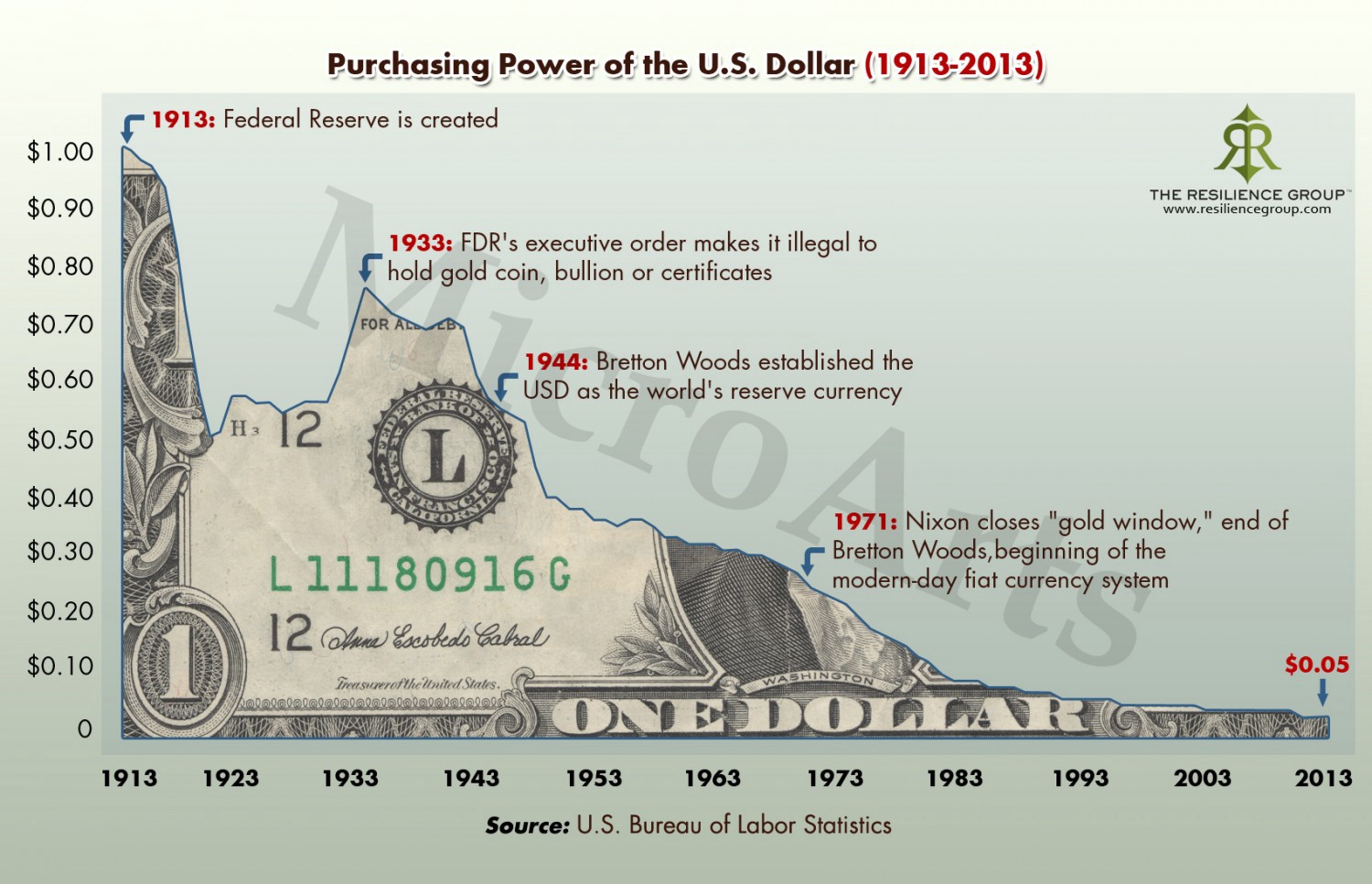

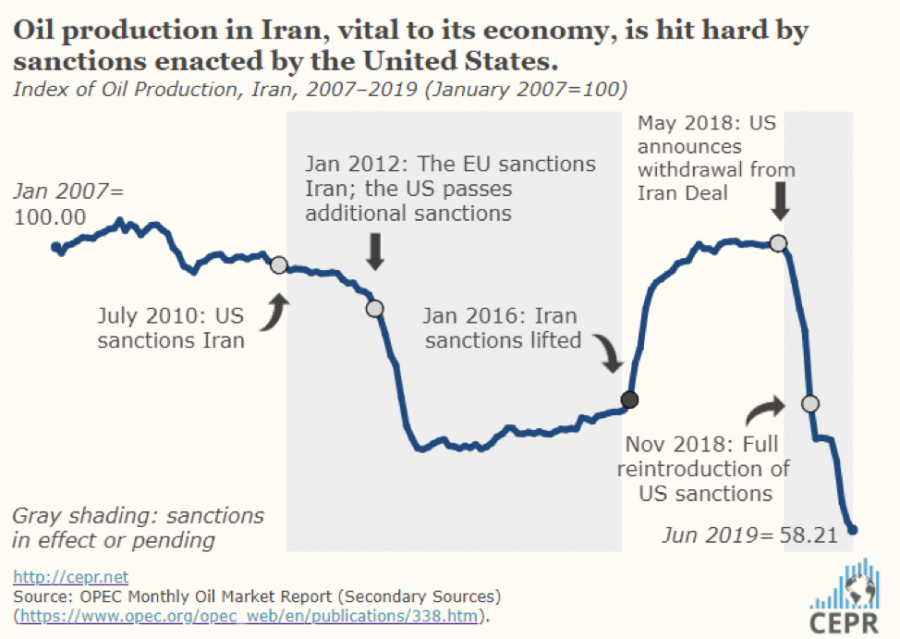

However, the notion of a need or even a necessity of an elastic policy has started to gain notable support only around the last hundred years. It is, therefore, a relatively new one compared to the thousands, or arguably tens of thousands, of years where money existed.²¹ Furthermore, when inspected more closely, the modern experiment with an elastic monetary policy, enacted and managed by central banks, have failed to achieve any objectives it has set to itself.²² The list of those broken promises from our central bankers includes the inability to tame the business cycle, a failure to maintain consistently low unemployment rates, and a complete failure to preserve the value of the money and the general price level.²³

Purchasing Power of the U.S. Dollar (1913–2013). During this period, the USD lost at least 95% of its purchasing power.

Purchasing Power of the U.S. Dollar (1913–2013). During this period, the USD lost at least 95% of its purchasing power.

The case for an elastic monetary policy, which many take for granted today as a necessity of money, is quite unconvincing in view of its actual merits and results. This goes without even mentioning its utterly indisputable failures before this modern attempt.²⁴ Moreover, this claim gets even weaker when we take into account the more than 50 economic collapses caused by hyperinflation just in the last century, which could not occur if not to the presence of elastic monetary policy.²⁵ ²⁶

A full critique of the ills of modern central banking, and the errors on which their theories lie upon is out of scope for this article. The interested reader can find references to such works in the footnotes.²⁷ For our present purposes, we shall focus on the most notable arguments for why an elastic monetary policy is undesirable, and why Bitcoin’s limited supply serves for its advantage over its predecessors. Let us start by first exploring the idea of a “need” for an elastic monetary policy. As mentioned above, in light of its empirical failures, and when considering the impressive success of the gold standard which prevailed during La Belle Époque, and ended around the time of the establishment of the Federal Reserve System, there seem to be no empirical grounds for an actual “necessity” of elastic monetary policy. However, despite the lack of evidence for such necessity, one may still argue that such a policy would generally be desirable. Thus, we shall now turn to investigate this question further.

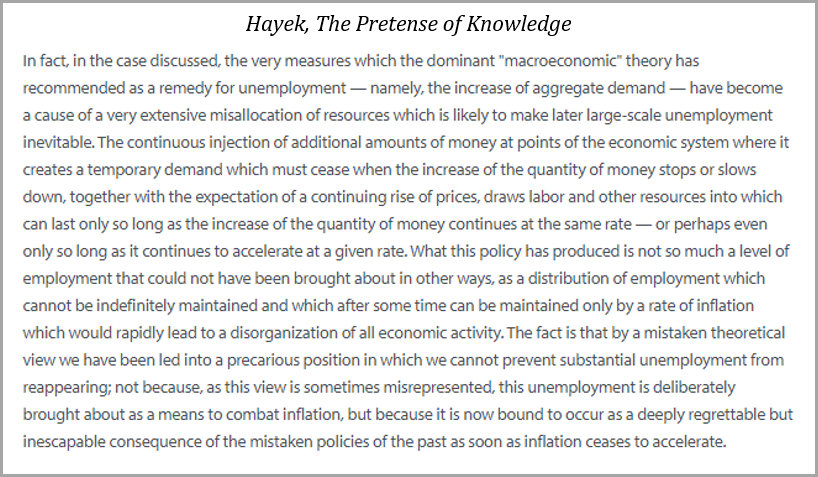

With our prior discussion of easy money, which in principle is money with such elastic monetary policy, we have already articulated some of its ills. Those include severe moral hazard and the potential risk of abuse and ruin of the system. We shall now skip these stated issues and focus on an additional, more general argument against this policy type, which deals with the epistemic errors of such central planning of the supply of money and credit.²⁸

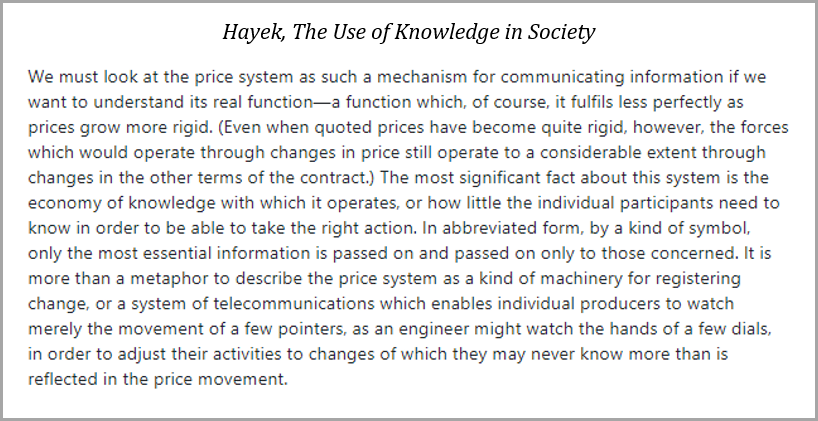

Let us suppose that those in charge of the monetary policy have managed to resist all temptations for abusing it and are doing their best to help the economy. They may have at their disposal insurmountable amounts of data and information of supposedly relevant metrics. Their task is then to use all this knowledge and insights to adjust prices as to induce people to make economic decisions according to what they (the central planners) believe will have the most positive effect on the economy. In other words, they use their influence over the supply of money and credit in the economy to regulate such behaviors as prices and unemployment rates. The task of these central planners is then to predict the influence possible monetary policies might have on the parameters they wish to adjust (CPI, unemployment, etc.), and pursue the most “optimal” option of them.

However, this means they need not just predict the consequences of their actions, but also any reactions to these, and therefore any further reactions to those consequences as well. All attempts at predicting and modeling the most optimal monetary policy, even under the assumption that there exists such an optimal one, will fail from the very nature of the economy, which is a complex of individuals acting, and most importantly reacting, at an attempt to provide for themselves. The actions and reactions of humans are by themselves mostly unpredictable, but attempting to predict the repercussions of such reactions to changes, and the consequent reactions to the changes caused by those prior reactions must be considered ludicrous.²⁹

The inability of central bankers to make predictions of the economy is even more visible when we consider the limitations of the data which they can possess. Within the realm of social phenomena in general, and economic phenomena in particular, the outcome is dependent to a large extent on all human actions involved in forming them. While we know how to measure certain parameters with high precision, we have no ability to measure many other facts relevant to the economic actions of individuals. Hayek explained this limitation of knowledge with the example of prices and wages, saying: “Into the determination of these prices and wages there will enter the effects of particular information possessed by every one of the participants in the market process — a sum of facts which in their totality cannot be known to the scientific observer, or to any other single brain.”³⁰ This lack of access to such many important facts caused most economists to completely ignore their significance, in Hayek’s words again: “they [economists] thereupon happily proceed on the fiction that the factors which they can measure are the only ones that are relevant.”³¹ Central bankers, as we see, necessarily start their task with a highly incomplete picture of the past and present. Thus, their efforts to predict economic results are doomed to fail from the beginning, as even if they had proper methods to derive predictions from data, it is impossible for them to account for all data influencing human actions, and as we saw, every single action may potentially have a disruptive effect on the entire process.

The only prediction I can confidently make is that central bankers, as they continue to meddle with the supply of money and credit, will continue to produce unexpected behaviors, and as a result will miserably fool themselves with their efforts to predict — Bitcoin is a financial bet on this exact prediction. As long as the monetary policy is elastic, we are guaranteed to suffer from such epistemic errors and prediction failures, and economic crises will inevitably ensue. The economy is an interdependent system, and any artificial intervention will cause unexpected byproduct results, whose influence will get further aggravated with further interventions. For more than a hundred years, economists have tried to plan the supply of money, and with every intervention, another crisis ensued. It might then be the most appropriate time to face this failure, admit that the economy is too complicated for a central planner to predict, and let individuals make their own decisions as to form the complete picture from their actions.³²

We have by now cleared the concerns regarding the inelastic monetary policy of Bitcoin, and proved it to be superior to an elastic policy. However, one could argue that a static inflation schedule, for example of 2% per year, could still be a viable option instead of a capped limit.³³ While it is probably true that Bitcoin could still work well even without a strictly limited supply, such inflation seems to be undesirable and even harmful. Monetary inflation, while not necessarily harmful per se, has highly non-linear and complex effects, with influence that which, as we saw, we cannot fully predict. The urge of some to tinker with such a complex system which they do not understand, or worse, believe themselves to understand, is at most not harmful, but may easily become destructive. Furthermore, if we investigate deeper, there seems to be no justification for expansionary policy in the first place.

When we understand the nature of money, and its emergence on the market, such inflation seems to be very undesirable. Money emerges based on its ability to reduce the costs of exchange, and an important factor for that is its ability to maintain its value over time. It is well known that an increase in the supply of money dilutes the value of each unit, its purchasing power, and thus imposes higher costs for using it in delayed transactions. An inflationary policy could thus hamper the adoption of Bitcoin, by making it less useful for transacting, and would not give us any benefit.³⁴ To the contrary, an inflationary policy could reduce the accuracy of economic calculations, and would also reduce cash savings and encourage spending, which in a previous article, we already proved undesirable.

Throughout this part, we looked at the basics of the production process of Bitcoin and into its monetary policy. We discussed the idea of money production and its externalities, and how Bitcoin as hard money has the preferable production process out of all. We explored the trap of easy money, and more specifically, that of having an elastic monetary policy, and showed how Bitcoin managed to avoid getting into such issues. Finally, we have also seen how the actual hard policy taken as the rule of Bitcoin, a finite, limited supply, serves to its advantage and promotes proper economic incentives for savings and capital accumulation, while also serving as a reliable measurement for economic calculations.

Up to now, we have explored the “inherent” characteristics of Bitcoin, and as we have so far reached very positive conclusions. We shall continue going deeper into the monetary case for Bitcoin by moving to explore the external factors influencing the substance of money, and how Bitcoin deals with them.

Legislating Bitcoin

In a previous article, we have singled out three prominent external factors affecting the adoption of a monetary substance: legislation, societal structure, and epistemic considerations. We will now turn to inspect each of those factors and attempt to understand how they affect Bitcoin as money, starting here from the legislative aspect.

Even a shallow inquiry into the demise of the use of precious metals as the common monetary substance will reveal to us that it was the influence of legislative authorities which brought upon this demise. With the initial monopoly status granted to gold over other precious metals in most countries, and its further centralization under the control of central banks, the legislative authorities have influenced the specific choice of metallic money. With this centralization of power, they were later able to effectively confiscate gold holdings (Executive Order 6102)³⁵, preventing any everyday use of them. The last link of our money to gold was then finally broken with Executive Order 11615, issued by President Nixon in 1971.³⁶ This order ended the long transition process from metallic money into an irredeemable paper standard. This most recent example exposes us just how strong can the influence of the legal authorities be over our choice of money, and with the contemporary system of sovereign currencies, those authorities do not seem to like the idea of being challenged by Bitcoin.

Though the legal challenges Bitcoin is up to seem incredibly hard indeed, this is precisely what it was designed for. Bitcoin, from its very beginning, was created with the Cypherpunk ethos of liberty and freedom, and the use of cryptography in achieving liberation from oppression. Those challenges for Bitcoin are precisely the reason for its creation in the first place. For more than half a century we have been living under an oppressive fiat paper monetary system, and any attempt to implement a competing system was shut down.³⁷ In contrast, Bitcoin was built with all those past failures in mind and was designed to survive such threats. As its creator explained:

“A lot of people automatically dismiss e-currency as a lost cause because of all the companies that failed since the 1990’s. I hope it’s obvious it was only the centrally controlled nature of those systems that doomed them. I think this is the first time we’re trying a decentralized, non-trust-based system.”³⁸

The production and maintenance process of Bitcoin is highly open and provides financial incentives for participants matching the actual demand for using Bitcoin, through the payment of transaction fees.³⁹ The mechanism of storing Bitcoin with private key cryptography makes it resilient to confiscation attempts. Along with the insistence on keeping verification costs extremely low, we can see how these are all design choices aimed at making Bitcoin survive, and even thrive, wherever economic and financial oppression is present.

This “legislation-resilient” nature of Bitcoin is so strong and robust that one US Congressman, Patrick McHenry, even went as far as to call Bitcoin an ‘Unstoppable Force.’ Continuing that “We [the government] should not attempt to deter this innovation; governments cannot stop this innovation, and those that have tried have already failed.”⁴⁰ While there are many other legislators, who do not share this view, this bold statement emphasizes the idea of Bitcoin, and the mission of those it gathered behind it. We may not know yet whether Bitcoin will truly be capable of standing up to the legal challenges and governmental pressures it is likely to face, but if one thing is clear, it is that Bitcoin is our best shot at it. This legal resistance of Bitcoin is probably its most significant improvement over previous sound monies and is where its real advantage lies.⁴¹

Now assuming that governments understand the difficulty in stopping Bitcoin, there is the possibility of them choosing to use it, because of the financial incentives it provides them. Even though they removed the use of gold as money from our daily lives, governments, mainly through their central banks, are still massively accumulating it in increasing quantities, with roughly 17% of the total above-ground gold stocks under their possession.⁴² When Bitcoin becomes significant enough, there is a chance that governments will purchase it as a gold alternative, monetizing it for their international monetary affairs, or as a hedging tool to “store value”.⁴³ Another option for governments to monetize the success of Bitcoin is through participation, whether direct or indirect, in its mining operations, as they control many of the most plentiful sources for energy production. Such mining operations would benefit both the states as another source of income and also help Bitcoin, which utilizes the higher energy invested in its mining for securing its network. While such acts on behalf of governments do not seem likely in the short or medium terms, the option remains very plausible for the long run.

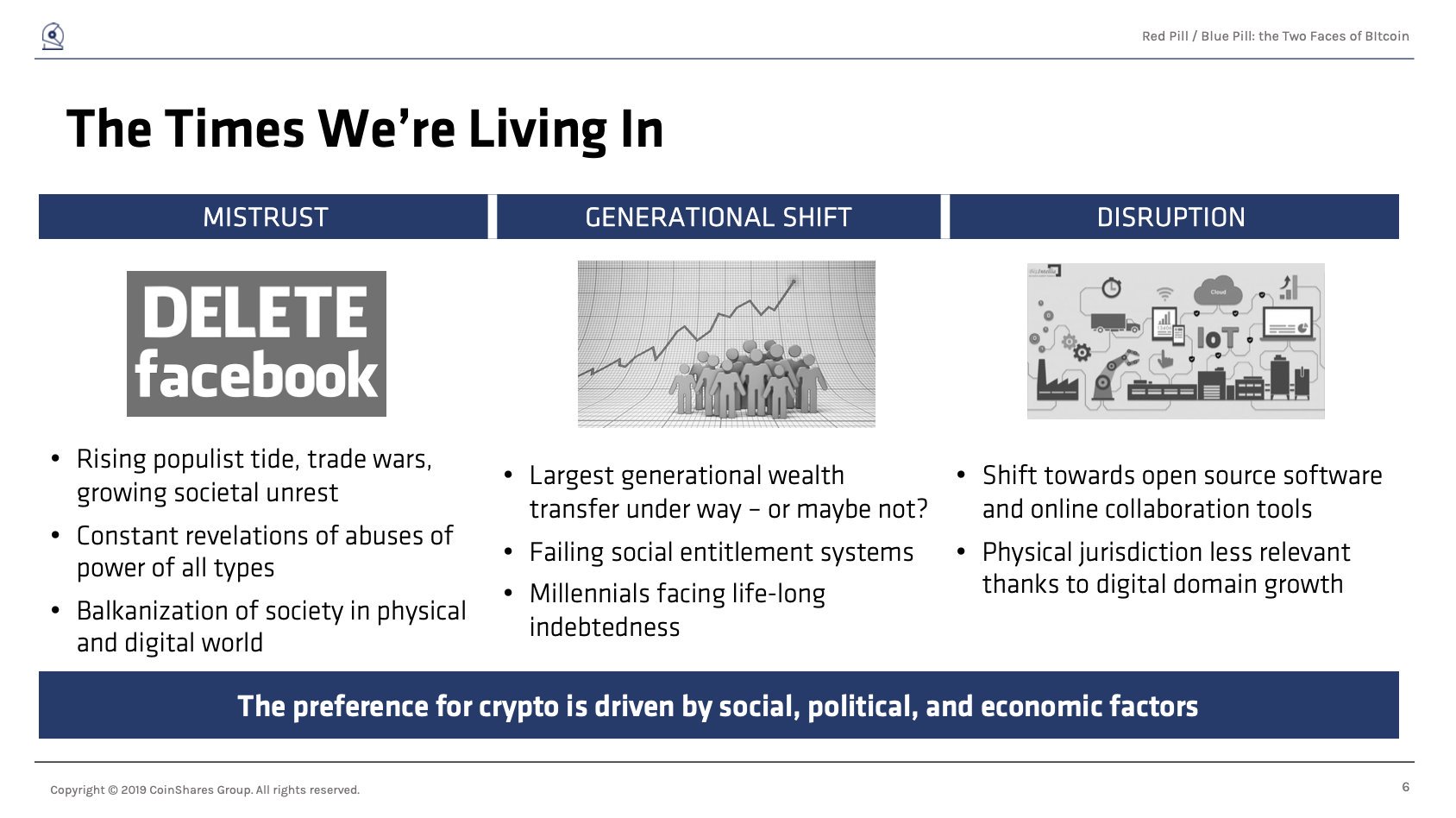

Social Globalization and Bitcoin

The second significant external factor we have identified is that of the prevailing social structure, with the contemporary one being a trend towards globalization and international cooperation. Understanding the needs such transition of society brings with it is highly important to understand what is the proper money to serve such a society. Society today is shifting into urbanization at a high pace, with most of the world’s population living in urban cities.⁴⁴ The role that the Internet plays in our daily lives becomes increasingly more significant as well. With more than 4 billion Internet users⁴⁵, the effect that this technology has on society seems to surpass most previous inventions in the extent of its reach and impact.

Though society is more connected than ever, the world is in a severe state of monetary disintegration on a level unseen in hundreds of years. While in the past most currencies were simply different weights of precious metals, thus accepted almost universally in commerce, today we have hundreds of incompatible paper currencies, disintegrating the world’s market and hurting the global division of labor. Any social cooperation over most state borders now requires monetary exchange between multiple currencies. This imposes additional costs while complicating and distorting economic calculations, and requires trusting more financial institutions. To this issue, we may add the problem of transactions settlements. Due to the costs and regulations of moving currencies across national borders, such settlement is highly expensive and requires the centralized process of going through multiple intermediaries.

With the shift of society into a globally interconnected one, and with ever-increasing amounts of electronic transactions done worldwide, the need for money native to the digital environment grows ever stronger and larger. Settling payments with strangers, without trusting financial intermediaries or the central banks which issue the currencies, is currently an impractical process. Furthermore, such a process simply cannot be implemented with any monetary system we have ever had, up to Bitcoin. As a completely electronic commodity, Bitcoin allows for settlements anywhere in the world, without the need for trusted clearance of payments. It does not require expensive international physical shipments and is easy to store and use from anywhere with minimal costs. Looking at the modern structure of society, there seems to be a genuine need for trustless, natively digital money, and this is likely to promote Bitcoin’s adoption as “the decentralized alternative to central banking”.⁴⁶

Understanding Bitcoin — The Epistemic Barrier to Bitcoin Adoption

Our final consideration to discuss before we can conclude our investigation is of the third notable external factor influencing the substance of money, the epistemic one. Unlike previous monies, like gold, furs or cattle, Bitcoin has no “practical” use beyond its monetary use. In this regard, it is similar to collectible monies, such as wampums and various seashells, and in this specific regard also to the present fiat paper money. In a more conventional, though not economically accurate term, it has no “intrinsic value.” Debating whether such intrinsic value is necessary, or more accurately if it exists at all, is out of scope and irrelevant here.⁴⁷

What is essential for us, for understanding the epistemic barriers for Bitcoin, is that because of the lack of such widespread practical use, and unlike the (arguably) natural beauty of seashells⁴⁸, or the legislative promotion of paper fiat money, there is nothing which promotes the use of Bitcoin, thus its initial accumulation, beyond its monetary use. Thus, we may say that there are only two forces promoting the adoption of Bitcoin, the “economic” and the “epistemic”, without any “indirect utility” playing a role. What I call here the economic force of Bitcoin is what we have discussed thus far, and is concerned with the economic incentives for using Bitcoin, and the benefits which it provides over legacy systems.

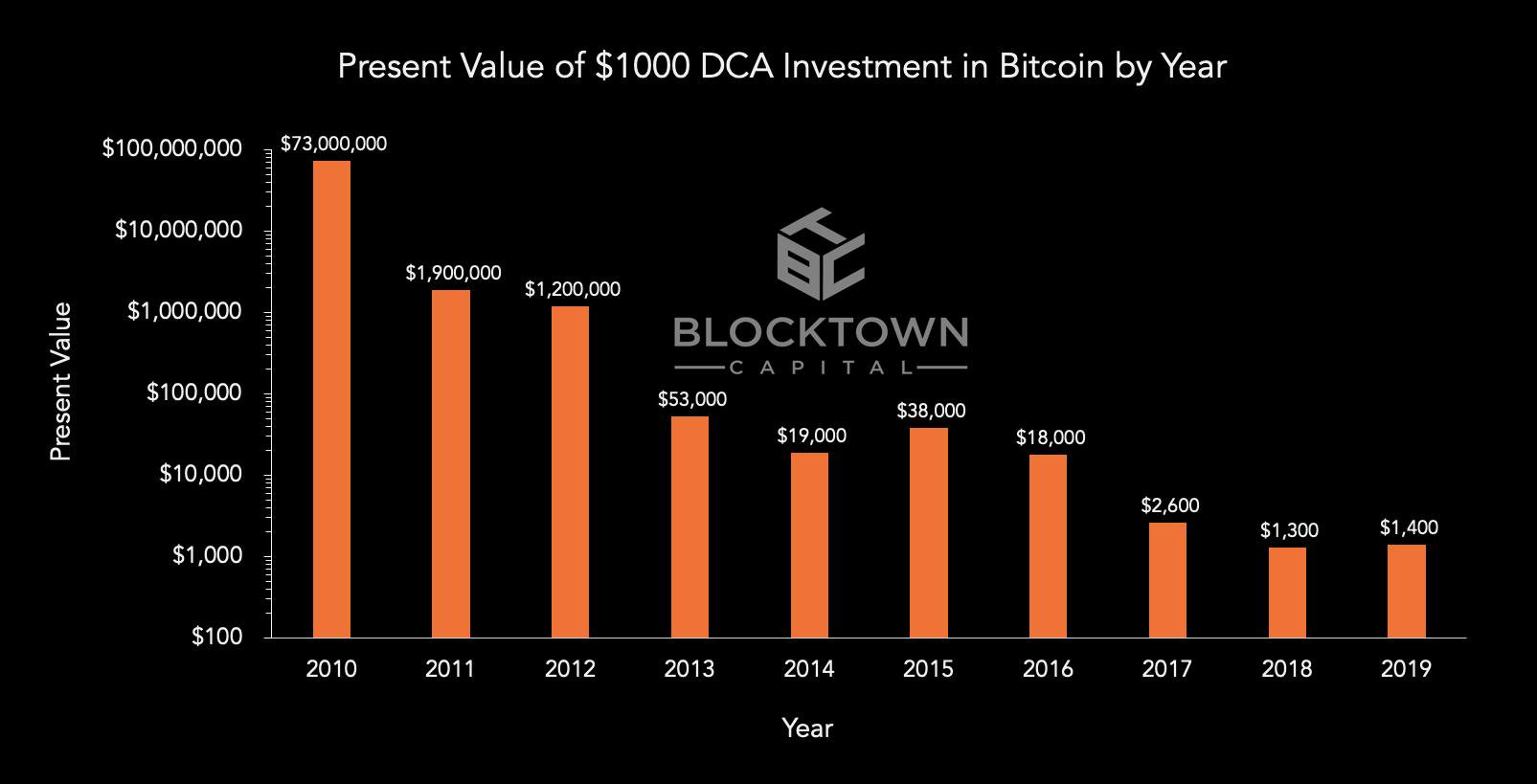

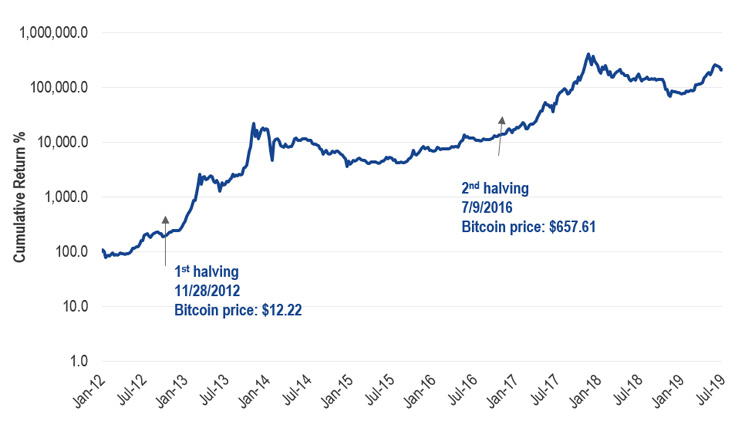

The second, “epistemic” force, deals with our understanding of money in general, and Bitcoin in particular, and with the use of our knowledge in guiding our economic decisions. That is, the more we understand money, its origins, and nature, the better our decisions will be in this regard. The epistemic force I discuss here is thus the motivation of using Bitcoin which does not come from a direct and immediate (or expected to be immediately available) benefit of Bitcoin, but from that which is expected to eventually come from understanding Bitcoin and its advantages. While in the very beginning of Bitcoin I believe most of its holders have participated purely due to the epistemic motive, I think that, as for today, the economic force is what tempts most people to come, but the epistemic is what motivates them to stay. This process is mostly evident during the “supply shocks” (halvings) of Bitcoin, after which we have so far witnessed Bitcoin’s price drastically increasing. This increase in price (economic force) draws masive attention towards Bitcoin, but after the hype fades away, what keeps many still interested is the understanding of Bitcoin and its vision (epistemic force). However, a true adoption of Bitcoin is likely to happen only when the economic force of Bitcoin is so strong as to make the epistemic one (of understanding Bitcoin) unnecessary for making people use it as part of their daily lives.

This last subject I find the most important in the article, as unlike the others, this is the only one where I see Bitcoin at a significant disadvantage. While for gold, its established history of thousands of years of monetary use tends to be a sufficient substitute for understanding why it works so well, Bitcoin enjoys no such luxury. On the other hand, fiat paper money, whose “established history” is flooded with failures and economic collapses manage to pass this epistemic issue by providing direct funding for the academic economics department and also serving as their most significant employment option. Fiat money then provided such academics with highly respected, influential, and well-paying jobs, and they, in turn, produced the epistemic base for such a monetary system and certify it with their “credentials.” In contrast, Bitcoin, being hard money, has no budget for producing such “scientific base” for itself, and does not provide economists with such influential jobs, but mostly replace their current workings. It is no surprise, therefore, to find out that very little has been written in favor of Bitcoin, especially in academic circles, as mentioned in the opening here.

Without sufficient resources for understanding money and Bitcoin, the only force promoting its adoption would be the economic one. Even if it could be sufficient alone, it will certainly not work well enough, and a transition into Bitcoin would seem unlikely before the contemporary system collapses upon itself, making a transition highly unpleasant, and unnecessarily so. However, the more resources for understanding Bitcoin that exist, and the better people understand the reasons for Bitcoin, the faster they will act to adopt it, and thus the sooner and smoother the transition into using it may be.

Today, with more than a century of central banking, the general understanding of money is entirely flawed, and even more so in most academic discussions, where they still believe they can “fine-tune” the economy with their complex mathematical models and inflation targets. The last crisis of 2008 has shaken the trust in the current system, and rightly so, but most alternatives offered to the public for understanding money have only aggravated the errors of the contemporary system. Statements like “money is whatever the state decrees as such,” or “money is just a shared illusion” are now very common, even among many Bitcoin supporters, and this only shows how extensive the work of explaining Bitcoin and money is. The point here and the purpose of this article is to show just how important it is to explain money in general, and Bitcoin in particular, to others in order to make it succeed as a truly peaceful revolution.⁴⁹

Conclusions — The Emergence of Bitcoin

The last ten years have been some of the most interesting to observe from the perspective of monetary economics. During this period, we got to witness the first monetary good which was invented, rather than discovered, by the free market, and the astonishingly fast process of its monetization. What started as seemingly just another ill-fated proposal on the Cypherpunks’ mailing list⁵⁰ has grown into a fully functioning monetary system actively serving millions of people worldwide. Throughout this article, we went through the common factors which influence the saleability of money, therefore its adoption on the market, and examined how Bitcoin fares compared to its predecessors. Now, to come full circle with our analysis of Bitcoin, we shall briefly take an overall look at Bitcoin’s process of emergence, from its early beginning to how it how it may proceed in the future.

When Bitcoin just launched, and for the first few months of its existence, it had no price, and was transacted mostly for testing the software. The “zero to one” moment of Bitcoin was when in October 2009, its first exchange rate was published and it first became valuable in exchange. Soon after, its few early adopters started exchanging it, breathing life into the system by giving Bitcoin its initial price. As they were willing to spend money to bring Bitcoin to life, while almost no one knew what Bitcoin was going to become, they must have been motivated enough just from the vision of Bitcoin’s potential. Thus Bitcoin started circulating not from another “useful” utility, nor by authoritative decree, but from the voluntary actions of its early adopters which valued the opportunity of creating a new monetary system — more than the money they had to spend to facilitate a reality of Bitcoin’s visionary potential.⁵¹

Going a bit forward, while Bitcoin had some exchange value, the number of exchange opportunities which were available for it was quite small, as the demand for it as a medium of exchange had only just began to coalesce. This means that people initially had to wait a substantial amount of time, compared to the established paper money, to exchange it. That is, they had to hold it to adopt it. Here lies the main reason why the hardness of Bitcoin and its limited supply was, and still is, crucial for its success. Without a hard inelastic policy, the uncertainty which would accompany holding Bitcoin, due to the risk of monetary inflation and consequent depreciation, would be too high and would prevent it from seeing any meaningful adoption.

The monetary hardness of Bitcoin is what allows people to confidently hold it, knowing their wealth will not be diluted. In addition, its limited supply means that as its adoption grows, Bitcoin will necessarily become more valuable, without suffering the negative effect of inflation which would reduce its value. Therefore, the limited supply of Bitcoin, by itself, provides a strong economic incentive to adopt and hold it for those who understand its superiority as a monetary asset, and thus expect the demand for it to increase with time. Satoshi himself understood this very well, writing:

“Instead of the supply changing to keep the value the same, the supply is predetermined and the value changes. As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as users increase, the value goes up.”⁵²

As for today, Bitcoin is circulating at a much higher velocity than in the past, with many more exchange opportunities for it. However, there is still a very long way for Bitcoin if it is to become a widely used monetary system. The process of monetization, like all other phenomena of social cooperation, is a non-linear process accelerating and benefiting from each additional use. Thus, the velocity of Bitcoin and its use in day to day manner shall not be expected to become substantial in the very near future but should accelerate when inspected in the long term. Looking at the progress it made so far, there seems to be a good reason to believe Bitcoin will succeed to achieve such “critical mass” needed for reaching sufficient acceleration of growth and becoming common money throughout the world.

Currently, the two domains where Bitcoin grows most significantly are within the realm of the Internet, where it has “home advantage,” and in countries that lack minimal economic freedom. In the latter domain, within countries such as Turkey, Iran, and Argentina, we can see how Bitcoin provides some degree of immediate relief from the economic oppression imposed on those who live there. The tighter capital controls get, and the higher the inflation rate goes, the more significant becomes the benefit of using Bitcoin as a government-resistant alternative. Therefore, while we cannot know with certainty how Bitcoin will grow, it seems likely that the emergence of Bitcoin as money will continue largely within economically oppressed countries, whose citizens need Bitcoin to protect their wealth the most, and will continue to increase most substantially where economic crises arise. It appears that, at this stage, Bitcoin is a free market good, which demonstrates its value proposition most effectively in the absence of free markets. Authoritarian attempts to restrict it only promote its use, and thus it seems that Bitcoin truly deserves to be called an antifragile money.

[1]: The crises of the 1980s and 2008 are notable examples of such collapses which seem like they could easily turn catastrophic to the system. [2]: Friedrich A. Hayek: “By Monetary Nationalism I mean the doctrine that a country’s share in the world’s supply of money should not be left to be determined by the same principles and the same mechanism as those which determine the relative amounts of money in its different regions or localities.” — “Monetary Nationalism and International Stability” (1937), page 4. [3]: See both the chart below and further relevant metrics produced by Crypto-Voices here. [4]: The Nature of Money and The Substance of Money. [5]: The principles for our analysis of money here are rooted in the works of Carl Menger. Most notably, his “Principles of Economics” (1871), chapter VIII, and “On the Origins of Money” (1892). [6]: Such changes, though hard to coordinate and perform, have been previously made to the Bitcoin protocol after sufficient consensus was reached. See BIP16 (P2SH) and BIP141 (Segregated Witness) as prominent examples of such changes, which improved the monetary properties of Bitcoin by adding consensus rules to the protocol, a method known as “soft-fork”. [7]: See the following website for an extensive list of resources for learning more about the Lightning Network: https://www.lopp.net/lightning-information.html [8]: Jörg Guido Hülsmann, “The Ethics of Money Production” (2008). [9]: For a more thorough definition of the problem and the solution, the Nakamoto Consensus, see the Bitcoin whitepaper. [10]: See the following article, by Bezant Denier, for a historical examination of these externalities: https://www.bdratings.org/l/war-externalities-of-livestock-money/ [11]: Thomas Wright, “The Travels of Marco Polo, the Venetian” (1854), especially page 168. See also this short thread for a brief lookout over Polo’s recordings of paper money, and this blog post for a more elaborate treatment. [12]: For some historical record on the thought of paper by from those writers see Jörg Guido Hülsmann, “The Ethics of Money Production” (2008), pages 79–81, Robert Minton, “John Law: The Father of Paper Money” (1975). [13]: David Ricardo, “The High Price of Bullion, a Proof of the Depreciation of Bank Notes” (1810) [14]: For an economic view on moral hazard see Jörg Guido Hülsmann, “The Political Economy of Moral Hazard” (2006). [15]: See Milton Friedman, “The Resource Cost of Irredeemable Paper Money” (1986). [16]: With the existence of various data transmission mechanisms, with a notable example being the Bitcoin satellite launched by Blockstream, there is a virtually no barrier for participating in the Bitcoin mining process from anywhere in the world. [17]: See this article by Daniel Wingen on the production process of Bitcoin and how it may positively affect the environment and sustainable energy production. [18]: See CoinShares mining analysis for more information: https://coinshares.co.uk/bitcoin-mining-cost/ See also this 2 part series of posts on their blog: https://medium.com/coinshares/an-honest-explanation-of-price-hashrate-bitcoin-mining-network-dynamics-f820d6218bdf https://medium.com/coinshares/beware-of-lazy-research-c828c900b7d5 [19]: Jörg Guido Hülsmann: “We may call any kind of money that comes into use by the voluntary cooperation of acting persons ‘natural money.’” — “The Ethics of Money Production” (2008), page 24. [20]: A good example for this miserable incompetence can be seen with these two quotes from former U.S. Federal Reserve Chair Janet Yellen, which in 2017 stated that: “I hope that it [financial crisis] will not be in our lifetimes and I don’t believe it will be,” and less than a year later, she expressed quite a different sentiment, saying that: “I’m not sure we’re working on those things in the way we should, and then there remain holes, and then there’s regulatory pushback. So I do worry that we could have another financial crisis.” [21]: On the history of money see Nick Szabo, “Shelling Out” (2002) [22]: See this article by Mark Hendrickson on the 100 years long failure of the Federal Reserve at achieving any of its goals. [23]: During the time of existence of the Federal Reserve, the USD has lost at least 95% percent of its purchasing power. [24]: See for example the Yuan of 13th century China, the Assignat in France, and the Continental currency in America. [25]: Here you can find a list of 58 hyperinflation collapses of the last century. [26]: Though there was a recorded case of hyperinflation during the Roman empire, which used metallic money, this is still compatible with what is said here as the fault in such cases is still attributed to the severe debasement of the money by governments of that time, an action which equates to their “monetary policy” in present terms. [27]: For such criticism see: Jesús Huerta de Soto — “Money, Bank Credit, and Economic Cycles” (2006), Jörg Guido Hülsmann — “The Ethics of Money Production” (2008), Friedrich A. Hayek — “Denationalisation of Money: The Argument Refined” (1990), Murray N. Rothbard — “What Has Government Done to Our Money?” (1963). [28]: For a brilliant critique on this grounds see Friedrich A. Hayek, “The Pretence of Knowledge” (1974). [29]: An appropriate treatment of the errors of the use of predictions and models in complex domains in general and in economics in particular can be found in the works of Nassim N. Taleb. [30]: Friedrich A. Hayek, “The Pretence of Knowledge” (1974). [31]: Friedrich A. Hayek, “The Pretence of Knowledge” (1974). [32]: In relation, see Friedrich A. Hayek, “The Use of Knowledge in Society” (1945). [33]: Though as for today, Bitcoin do have monetary inflation, this is merely a temporary phase which distributes the initial ownership over bitcoins, and as we saw, is done in accordance to a strictly defined schedule. We may therefore ignore this initial inflation and discuss the long term, permanent policy of Bitcoin, which is a constant supply. [34]: For a full critique on inflationary monetary policy see Ludwig von Mises, “The Theory of Money and Credit” (1912), chapter VII part 3 — Inflationism. [35]: Executive Order 6102 issued by President Franklin D. Roosevelt on April 5, 1933, prohibited the “hoarding” of gold, and effectively ordered the confiscation of most private gold reserves. [36]: Executive Order 11615 issued by President Richard Nixon on August 15, 1971, as part of what is called the “Nixon shock”, cancelled the convertibility of the USD to gold. [37]: Notable examples are e-gold, shut down in 2008, and Liberty Reserve shut down in 2013. [38]: Satoshi Nakamoto in response to a comment on the P2P Foundation Forum. [39]: On how transaction fees help Bitcoin defend itself against the state, see this post by Eric Voskuil. [40]: https://cointelegraph.com/news/bitcoin-an-unstoppable-force-us-congressman-tells-crypto-hearing [41]: This legal resistance also had to be accompanied with a sufficient improvement in the monetary properties in order to be effective, as to prevent centralization risks of holding it. See the following article by The Bitcoin Observer for further explanation on that. [42]: https://www.gold.org/about-gold/gold-supply/gold-mining/how-much-gold [43]: The following article, “The Bullish Case for Bitcoin” by Vijay Boyapati, articulates the possibility of such scenario in more details. [44]: https://ourworldindata.org/how-urban-is-the-world [45]: https://wearesocial.com/blog/2019/01/digital-2019-global-internet-use-accelerates [46]: Saifedean Ammous, “The Bitcoin Standard: The Decentralized Alternative to Central Banking” (2018) [47]: On that subject in relation to Bitcoin, see Conner Brown, “Bitcoin Has No Intrinsic Value — and That’s Great.” [48]: In his article “Shelling Out: The Origins of Money”, Nick Szabo propose the possibility that our natural attraction to such collectibles, which we attribute to their “beauty”, is not merely “accidental”, but is an instinct developed from their usefulness as primitive money. [49]: See Nic Carter, “A Most Peaceful Revolution”. [50]: Besides Hal Finney, most reactions Satoshi initially received were very skeptical, see the original discussion on The Cryptography Mailing List. [51]: See this beautiful short piece by Ross Ulbricht called “Bitcoin Equals Freedom”. [52]: Satoshi Nakamoto in response to a comment on the P2P Foundation Forum.

Special thanks to Ben Prentice (mrcoolbp), The Bitcoin Observer (festina_lente_2), Bezant Denier (bezantdenier), Thib (thibm_) and Daniel Wingen (danielwingen) for all the feedback I received from their reviews, comments, and suggestions which helped me shape this article.

Crypto without Criticisms

How Anarchism Without Adjectives Can Point Towards a Method of Unifying Crypto

By Erik Cason

Posted October 7, 2019

Anarchism without adjectives was a form of anarchism developed in the late 19th century a few decades after anarchism split with communism in 1872 over authoritarianism and the use of the state in creating a stateless society. While anarchist were unified in their idea of a stateless society and the need to create it without the state, there was no consensus on how this was to be done, so a number schisms developed within anarchist movement itself. From individualist anarchist, to anarcho-syndicalist and anarcho-communist, there were many different flavors of what a stateless society could look like under the banners of anarchism. In response to the petty narcissism of small differences between various anarchists, anarchism without adjectives rejected specific forms of anarchism for a synthesis of operable praxis. It wanted to focus on what worked, rather than the ideology of what they thought would work.

The great advantage of this strategy is it creates a revolutionary front through the praxis of revolutionism first. It synthesizes all revolutionary tendencies, solidifying them into a primacy of solidarity around the organization of the revolutionary struggle itself. This is how the I.W.W. one of the largest and most revolutionary unions to ever be created functioned was through a synthesis of many revolutionary traditions under the umbrella of ‘one big union.’

Drawing from the history that allowed for anarchist to create such a revolutionary movement that was able to threaten the very foundation of the state, we can again create such an organization through unify crypto under a similar banner. Through the creation of one big union people realized that rights were not something that were meant to be protected by the state, but were something that people must defend for themselves together. Through the tradition of ‘An injury to one is a concern of all,’ crypto renews this same revolutionary struggle into the digital age, with concern to the digital rights of all.

Satoshi Nakamoto gave us a form of money that the state can never control. We need to take this seriously if we are to use this form of money, and everything that has come after it as part of our arsenal in the secret war that is taking place to free humanity from the shackles of fiat money and the state’s totalitarian economic control. We need allies if we are going to win in our various struggles against whatever masters may have claimed us for themselves. Through taking this idea of anarchism without adjectives and applying it to crypto, we can find a new form of synthesis; or syndicalism, that can help weave our revolutionary movement together.

Crypto without Criticism, but Critiques

Now I want to be clear, crypto without criticism should not mean crypto without critiques, nor should it mean that we accept fungable tokens, stablecoins, or other shitcoins that are really panoptic statist ledgers, and not crypto at all. What this strategy acknowledges is that bitcoin, while being revolutionary in its own right, and containing the messianic potential to end law and destroy the Westphalian state as we know it; there is still a great possibility that it could fail, or even worse, be seditiously compromised. Every one of us must be vigilant, thoughtful, and apply adversarial thinking to each step of our process in order to ensure that the revolutionary nature at the center of what is being done is never compromised. By very nature of what crypto is, we cannot have any single point of failure, which is why we must be open to other projects and the potential merits (or failings) they may offer.

Bitcoin unequivocally is one of the greatest invention of humanity. There is no question that what Satoshi Nakamoto created has radically changing the world, and has opened a new horizon for human freedom and action. It is even quite possible that bitcoin is messianic, and that Satoshi is the prophet of a novus ordo seclorum that will liberate us from the old law, and allow for us to enable something totally new in its place–but only time will tell. While I zealously have given myself to the cause, and believe Bitcoin to be the most revolutionary vehicle that we have, I still cannot call myself a maximalist (majoritist maybe).

We must be open to the possible that Satoshi is a statist, that a deep reorg 51% attack will happen, the core devs are all somehow compromised, or there is something fundamentally broken in the bitcoin code. We must be open to the worst possibilities in order to create redundancy, to build our ranks, and educate people about the possibility of freedom from fiat, however that may come. Only through creating a robust collective movement that is focused on building and using the revolutionary technology of crypto without anyone’s permission for whatever purpose it may be, will be able to create the revolutionary movement that can finally win the freedom and liberty to which we are entitled.

The political objective of what crypto is, how it functions, and why it creates power is of the utmost importance and we must ensure that the technologies of the future really are ‘crypto’ and not something else. As I warned in the poverty of tokens, there is a real risk of creation a panoptic nightmare of unparalleled proportions if we run the risk of deploying broken ‘crypto’ that isn’t crypto at all.

Through the tradition of anarchism without adjectives, we can create a movement for crypto without criticism. A movement which can be ideologically committed to the values that represent crypto, while also offering valid critiques of each crypto projects and their weaknesses. It is only though such intellectual exchange, inquiry, and explanation will we be able to understand one another, and create a space in which we can work together.

The Startup Government

By Tim Draper

Posted October 10, 2019

Preface. Tribalism to globalism.

The Startup Religion. We have a particularly diverse student body at Draper University, and in the program, the students are asked to do challenging projects in teams. As a result, they build extraordinarily tight bonds with each other. Most of them overcome biases that they may have held before entering the school.