WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the April 2018 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

Bitcoin Post-Maximalism

By Paul Sztorc

Posted April 7, 2018

Has something happened to “Bitcoin Maximalism”? Is Bitcoin “Qwerty” (established and standardized) or “Esperanto” (impractical and perfectionistic)?

Israel is a scattered sheep;

--Jeremiah 50:17

Why Bitcoin Maximalism

In the past I’ve been very dismissive of Altcoins, and endorsed the philosophy of “Bitcoin Maximalism” (that Bitcoin is all you need).

Here were three of my biggest reasons:

- Network Effects – In the past, Bitcoin had 90+% of the crypto market, and the remaining 10% was distributed among many terrible projects. Thus, Bitcoin’s network effect effectively shielded it from competition.

- Utility – With a few important exceptions, no Altcoin offered anything new to the user. Instead, the alternative explanation (that the Altcoin-creators were just taking people’s money) was overwhelmingly accurate.

- Sidechains – I assumed sidechains would be eventually invented. At which point, they’d absorb features of rival blockchains.

The first reason, in particular, has not held up well over time.

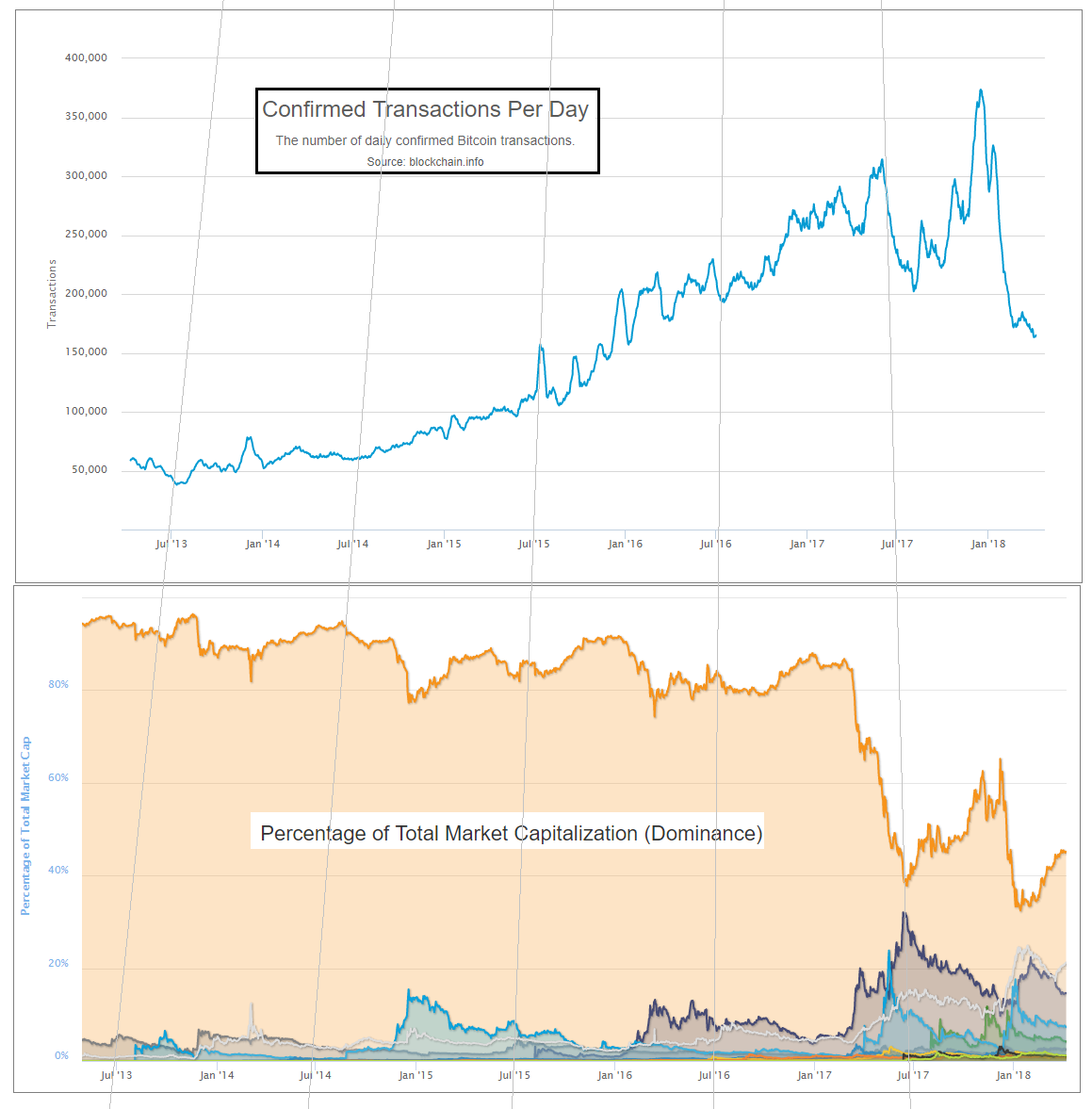

1. Network Effect Collapse

The market share (among investors) of “Bitcoin Core” (the healthiest candidate) has fallen to 45% or so.

Many people, myself included, believe that this downturn is only temporary. But as new data rolls in, it is time to take seriously the alternative theory: that the “network effect shield” has departed – or at least significantly weakened. These data are: that it has now been over two years since Bitcoin was last above 90%; it has been 12 months since it was above 80%; it has been under 50% for 7 of the last 12 months, including the most recent three months; during which it reached its all-time low (of 32%, under a third).

Most perplexing is the relentless, stable, multi-year progress of the “Others” category. This is a direct challenge to the logic of network effects.

Furthermore, many of Bitcoin strongest defenders have jumped ship, and a few of these are even socially secure enough to admit so openly. Roger Ver, indefatigable promoter and angel investor, owner of the Bitcoin.com domain, now favors Bitcoin Cash. Brian Armstrong, CEO of the $1B Unicorn company Coinbase (which occasionally has the most-downloaded smartphone app), now favors Ethereum.

Reasons 2 and 3 have not done as well as I’ve hoped, either.

2. Rising Altcoin Utility

The Altcoins of today do offer their users a real value proposition – two in fact.

Value Prop 1 – Cheap Blockspace

At minimum, Altcoins offer users “cheap blockspace”.

Some users rely on “round trip” transactions. I define these as situations where:

- User wants to buy something, for (say) $20.

- User then spends $20 on “crypto”, and immediately spends that crypto on their desired end-product.

- The merchant receives the crypto and immediately sells it for $2 For such txns, cheap blockspace is ideal.

Furthermore, services (ShapeShift, Poloniex, et al) have evolved to make these markets user-friendly and liquid. It is now easier than ever to accept currency from “exotic blockchains” for payment. These days, if you can accept one crypto, you can accept them all.

Value Prop 2 – New Ideas

Today’s Altcoins do more than just offer cheap payments.

They also offer permissionless innovation. Certain ideas, such as Monero, Siacoin, Namecoin, and Zcash, cannot efficiently be tested in any other way. Many ideas that I originally felt were laughable, such as Dash’s “marketing budget”, have nonetheless proven to be effective1.

Of course, these experiments should have been done on sidechains (which we will turn to in a moment).

In Comparison to Bitcoin

As to the first value proposition (cheap payments), much has already been said. I have written an article with my nuanced views on the subject.

More important is to discuss the second value proposition. For, while the Altcoins try 1001 new ideas a day, (most bad, but occasionally one or two good2), Bitcoin instead has retreated into an overcautious and highly-pretentious paternalism. I can count on three hands, the number of times I have been personally given the “we need to make sure the airplane doesn’t crash” metaphor, by extremely-senior members of our industry. Somehow, these people are oblivious to the fact that [1] they don’t own the plane in question, [2] it is being flown via remote control, from the ground, and [3] the plane’s owner can freely make a near-infinite number of copies. It is not so much a passenger-laden plane, but a flight simulator virtual-reality videogame.

The Altcoin ideas are judged, appropriately, by the user. Bitcoin, in contrast, is now tending to choose its ideas based on how impressive they are to other members of a pseudo-academic pseudo-bureaucracy. The emphasis is not on scientific progress, it is instead (I am sorry to say) on racketeering – in other words, on generating a need for “experts” (ie, paid consultants), and building a justification for an endless series of prestigious “conferences” (ie all-expense-paid “parties” in exotic locations).

Let me be more constructive with my criticism.

A scientific environment requires certain features, including: a tolerance for dissent, an appreciation for discussion, a rejection of arguments-from-authority, and an optimistic outlook (one that we can make “win win” improvements to situations through better ideas, rational debate, and criticism).

Above all, a scientific environment requires Karl Popper’s demarcation for science: that in addition to looking for confirming evidence of theories, we must try to falsify (ie, break) our favorite theories. Altcoins represent one method of falsification – trying the idea and watching to see if it fails. Sidechains are an even better method. “Peer Review” is only science if the peers are helping the author meet some objective external criterion (ie, one that exists independently of the peers and their opinions). Otherwise, peer review becomes a self-referential popularity contest. The point, since so pervasively and consistently misunderstood, bears repeating: Peer review is supposed to be a cheaper realistic “simulation” of reality. It is not a popularity contest!

Unfortunately, for the significant questions3, the atmosphere of science is departing from Modern Bitcoin.

A Contempt for Measurement

One smoking gun is the reaction of both LargeBlockers and SmallBlockers to the idea of fork futures.

Futures prices, (unlike “tweets” or “conference presentations), have the unique ability to speak for everyone, and not just their author. For that very reason, they have the unique ability to singlehandedly predict the fate of any fork4.

Despite this, there was no interest in creating such markets. When they were created anyway, the losing side refused to acknowledge them as legitimate. When I proposed a way of making them more legitimate, the losing side was not interested!

This disinterest parallels the shameful behavior concerning the “bitcoinocracy” numbers – the evidence changed for, and then against, the SmallBlockers, and so they shifted from rejecting, to endorsing, and finally to rejecting the legitimacy5 of this empirical evidence.

This is a root and branch rejection of the value of experimental testing. Very shameful. It acts to establish a “technocracy” of ruling bureaucrats (again: accountable to each other, and not to the customer). It exploits the power in the remaining network effects, and uses it to enable a monopoly – in other words, uses it to ensure that dissatisfied customers have no recourse.

Partisan Media

As the scientific atmosphere declines (and, please, do not confuse science with engineering), standards of discourse have declined as well. Today, it is impossible to express any view on “scaling” without it being immediately pigeonholed into a “Republican” (SmallBlocker) or “Democratic” (LargeBlocker) category. We even have our own RNC and DNC, and our own party leaders and campaign managers. Any project or solution which attempts to be “non-partisan” might as well be a third party candidate seeking election. One can even be “found guilty” of listening to the wrong Bitcoin show or attending the wrong conference. But a real scientist, embracing falsifiability, would be sure to attend conferences given by people he or she doesn’t agree with.

Instead we have two different flavors of a dystopian One Party State – authoritarianism on the right, and on the left a kind of “intellectual communism” where everyone gets a trophy for their ideas, no matter how dumb these ideas are (especially the low standards of Classic / Unlimited leading to assert(0) bugs etc etc).

Clever Altcoiners have noticed these deficiencies (and the insecurities they inspire) and exploited them. Buterin, for example, is careful to back the minority side in the BTC BCH conflict; and Dash started up a meme about their “governance” solution (whatever that was) to profit off of dissatisfaction with Bitcoin governance. One can dismiss these maneuvers are mere campaigning, but they are only possible because of real flaws that actually exist in the Bitcoin community.

3. Sidechain Apathy

Finally, what of the hope that sidechains tech will obliterate the Altcoins?

No one alive is in a better position to answer than I. After Blockstream gave up on sidechains in 20156, I wrote my own idea in November of that year. It remains, to this day, the only concrete proposal for P2P sidechains, let alone the only implementation. I’ve presented on sidechain theory and risks, and at Scalings II and III (the II presentation was a small “WIP” and these were not recorded, I believe).

My view is that the scaling conflict is important, and that sidechains are the best way to resolve it. In fact, my current view is that sidechains are the only way to resolve the conflict. This is because the disagreement is actually about “node costs”, and not about transaction throughput.

Blockchain technology is inherently “consensus”-based. But since each person is different, there is a limit to how large a community can grow before there is infighting. Sidechains resolve these issues.

The Problem of Low Interest

Despite this, interest in Drivechain has consistently been low, among Democrats and Republicans alike. Democrats (supposedly) control >50% of the hashpower, and could unilaterally gain a blocksize increase by adding sidechains. But they are not interested. MimbleWimble, originating deep in Republican territory (#bitcoin-wizards), now plans to launch as an Altcoin.

What explains this profound apathy for sidechains?

I will first give some prudent reasons (ie “happy” reasons), and then what I believe to be the “real” reasons.

A. Prudent Reasons

Here are some simple and, at first glance, believable reasons for sidechain apathy.

1. Sidechains Are Hapless / Useless

Perhaps sidechains are just a bad idea? And, since there’s no point wasting time talking about a useless feature, people rightly don’t talk about it.

I think that the causality here is reversed: people become disinterested first, and this disinterest drives them to make lazy, error-prone comments.

First, I can’t find any evidence that sidechains are a bad idea – I give a lengthy defense of drivechain (currently the only sidechains proposal) in this video and in my FAQ. Instead, there is profound evidence of bad claims that sidechains are a bad idea – most critics admit that they made no effort to understand the idea before criticizing it7.

However, more fundamentally, even if drivechain were bad, it is a soft fork. So, it can be freely and completely ignored by disinterested users. And it actually cannot be prevented if miners decide to use their hashrate to unilaterally activate it.

So I don’t see how talking about it could be a waste of time. If bad, it should be talked about, because it is unpreventable. Criticisms shouldn’t be of it, they should only be of the opt-in-ers.

So a better explaination is that the “bad idea –> therefore disinterested” causality must be reversed, I think. The trust is “disinterest –> therefore ignorant comments”.

2. Sidechains Are Inherently Boring

Perhaps sidechains are inherently boring.

But this does not square with the attention they get from Bitcoin Media, and their disruptiveness to the competitive landscape and to people’s investments.

3. People are Busy

Perhaps people are just too busy with everything that is going on.

But this explanation would apply equally well to every new idea. And drivechain is a very old idea, it is much older than SegWit and the spec was published in Nov 2015.

And there is no “moral” or “religious” objection to talking about sidechains, either. I can get principled developers to review the code, if I pay them. Disinterested third parties have also offered to pay for drivechain code review, with some success.

So the potential for interest in sidechains is there, but the inherent interest is just disproportionately low.

So, then, why is that? Here I present what I feel are the “real” reasons.

“Real” Reasons

4. Reputational Downside / Different Risk Profile

Crypto-commentators care a lot about their reputation8, as it can lead to lucrative job offers (in every sense – paid well and no work required), access to capital, invitations to luxurious conferences, and personal fame/prestige.

Moreover, BTC-professionals take pride in their work (as they absolutely should).

And thus, no one wants to be on the hook for a “BTC disaster”.

And sidechains, along with their benefits, do present a scary new risk. Unlike the “code risks” in, for example, P2SH or CLTV, these risks can not be systematically hunted down and eliminated. So, commentators may see themselves as in a similar situation to the FDA [in the US], or an academic IRB: they will be disproportionately blamed if something goes wrong, but will not disproportionately benefit if everything goes well.

These risks are freedom-enabling, and entirely opt-in. But who knows if the YouTube Audience / VC Investors / Program Committee / etc will see it that way? Instead it pays to “care” about the user’s funds, especially very loudly and at no cost to oneself.

5. Training One’s Replacement

For existing Bitcoin Core developers specifically, the above position might be taken even further.

Instead of the example of the FDA commenting on a drug, we might instead give an example where some of the world’s most prestigious doctors are asked to comment on a “magic infinite health pill” that was invented by a non-doctor.

It is a clear conflict of interest – if society adopts the pill, the doctors will be out of a job. But we wouldn’t expect these sophisticated doctors to object so directly! Instead, we would expect them to resort to various pretexts – they would say “Well, we had better make sure that this pill is absolutely safe before we tell everyone to take it”. Even though by the time that absolute safety is established, many people will have likely died needless deaths.

Hence it really is true that the scaling debate is “about control”. Since sidechains take control away from current elite Core developers, we would expect them to oppose sidechains.

6. Extreme Polarization

Human disputes, of all kinds, will reliably collapse onto a single dimension. This is why, in America, those who are “pro-choice” also tend to be “pro-Union”, despite those positions being objectively unrelated. This is simple math: a large unified group has the muscle to sequentially crush a set of smaller uncoordinated groups.

Those who are audacious enough to vote third party have a vague awareness of this, and usually know that they are “throwing their vote away” and hurting their own causes. If you join one of the two major groups, your influence will be very small. But if you join neither it is likely to be zero.

A LargeBlock sidechain is a competitor to both the LN (favored by Republicans) and a hardfork blocksize increase (favored by Democrats). Each party campaigns on a platform where they are the wisest (or, more accurately, they “have” the wisest) and they know what’s best.

Thus, to support a largeblock sidechain would be to oppose the party leadership. But as I’ve just explained, this leads to one being rejected by one’s own party, and being unable even to join the rival party. So commentators (wisely) downplay their interest in a sidechains solution. Today, nearly every person, and every media outlet, has allowed themselves to be captured exclusively by one party.

7. Free Rider Problem

This one is very simple. The free rider problem is a one of immense practical importance.

For Altcoins, of course, there is no free rider problem, because there are alt-owners who profit (disproportionately to everyone else) from the success of the Altcoin.

But with sidechains, we have a situation where someone must do the work, at some cost to themselves, and yet the benefits are diffused across all Bitcoin owners.

But this problem is common to all Bitcoin R&D, so I don’t see why it should apply especially to sidechains.

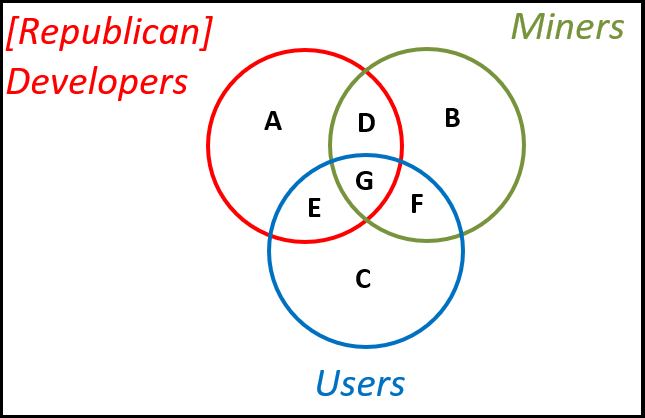

Misaligned Incentives in Bitcoin Generally

Incentives in Bitcoin are not always perfectly aligned.

Below I present some Bitcoin ideas/events/projects, and sort these into the groups that support them: Miners, Users, and [Republican] Developers.

Alignment

G – All Bugfixes; “Scaling Bitcoin” 1 and 2; CheckLockTimeVerify; Fraud Proofs (?)

Some Alignment

D – High txn fee-revenues9 (see here); the unending scaling conflict (think 1984 “War is Peace”, and govt ‘racketeering’)

E – Lightning Network (miners prefer on-chain); “Scaling Bitcoin” III; Blockstream/ChainCode/etc; soft forks (miners prefer hard, although I honestly don’t know why)

F – Decentralized Sidechains (devs prefer bitcoin-dev-based permission, and federation/subscription); SPV/SPY Mining (devs prefer FIBRE)

Less Alignment

A – Federated/subscription-based sidechains ; “Scaling Bitcoin IV” ; high txn fee-rates (?)

B – [SegWit-Incompatible] ASICBoost (although I/others strongly dispute the relevance); SegWit2x Project (users prefer 1x, according to data from futures markets)

C – Low fee-rates; The SegWit UASF; Fork Futures; Spinoffs/Altcoins (empirically)

I could have included more groups, especially “Industry”, “Democratic Developers”, and “Cults of Personality”, but of course a two-dimensional figure simply cannot capture all of that. My point is that incentives do not always align.

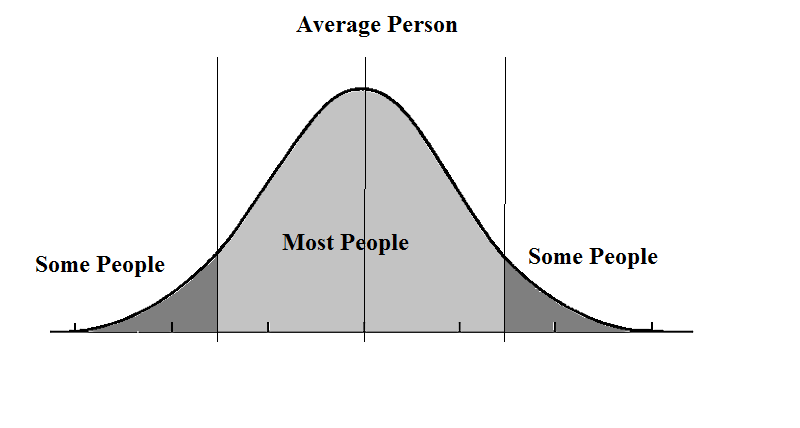

Network Effects as “Rule of the Average”

Qwerty and Esperanto

For better or for worse, the dumb people of the world form an intransigent minority, because they literally cannot appreciate good ideas. This is one reason why we are stuck with the QWERTY keyboard, for example (even those who type in Dvorak are doing so on a QWERTY keyboard layout). English is the international language, despite being awkward and hard to learn – Esperanto, in contrast, is very easy to learn but is spoken by no one. If you disqualify Esperanto, then consider French: it is easy to learn (compared to English), and was once the international language of diplomacy, once learned internationally by the upper classes and backed by a powerful nation. Yet today they all speak English in Quebec.

The fact of the matter is that anything with network effects is going to ultimately be ruled by the middle of the bell curve: the average people.

“Think of how stupid the average person is, and realize half of them are stupider than that.” – George Carlin

The Centrality of Timing

In these analyses, timing is important: every project starts with zero users, so networks effects are small (and meritocratic effects dominate). But as time goes on, the project will attract more users, and so the network effects will become more important. Eventually, the network effects outweigh the meritocratic effects.

Now, I’m just guessing here, but I think we have reached the post-expert phase. Anyone who can compare the 2018 TNABC to even the TNABC a year earlier will discover that the knowledgeable folks are vastly outnumbered. (And by “knowledgeable”, I mean “knows what a private key is”.) And, if the playing field is too ambiguous, these un-knowledgeables are going to glue the future to whatever shiny object can attract their attention first10.

Secondly, the marginal meritocratic effects do not seem to be that significant. By this, I mean that the “Bitcoin vs Altcoin” differences are very tiny compared to the “Bitcoin vs Traditional Money” differences. Someone who needs financial sovereignty must abandon modern fiat currencies, but whether they transact in BTC or LTC or ETH will make no difference to them, and investors will need to invest in whichever money is the most recognizable. The differences in node cost, or in privacy, are not as relevant (most lay users care about neither)11.

Conclusion

In a video discussion that accompanies today’s articles, Daniel Krawisz advised me to deploy Drivechains on both BTC and BCH (by hard forking one or both if necessary). But he did not advise me to also add drivechain to Bitcoin Gold or Diamond etc.

It struck me as good advice – “Post-Maximalism” doesn’t need to mean “Altcoin Pluralism” – instead it can just mean “two competing Bitcoins”. So we don’t need to go from 1 to infinity, we can stop at 2. And perhaps we only stop at 2 for a short time, before returning back to 1 (for example if sidechains do, in fact, eliminate Altcoins).

The emphasis on two competing projects reminded me of Karl Popper’s argument in favor of a two-party state. He argues that a system can become healthy, as long as the losing team becomes desperate upon their loss, and willing to take risks and make changes. Pretty good advice!

Update (16.04.2018)

Sergio Demian Lerner correctly points out that he did write a drivechain BIP+code in 2016. It had pros and cons relative to mine, some of which the two of us discussed together at Scaling Milan in late 2016 (he definitely helped improve our work).

He also finishes my unfinished 7th point, by reminding us that Altcoins/ICOs can draw away sidechain talent. But this does not happen as easily for SegWit or P2SH.

It also occured to me that working on sidechains is probably perceived as disloyal to Bitcoin. After all, what you’re really saying is that you want the freedom to leave this party, and go start your own party somewhere else. That’s bound to insult the current party-hosts, to some extent. So we can understand why they wouldn’t put sidechains on top of their list (although it is certainly a little presumptuous/creepy that they do not).

Footnotes

- As Nassim Taleb says in his most recent book, “Rationality does not depend on explicit verbalistic explanatory factors; it is only what aids survival, what avoids ruin … Rationality is risk management, period.” Many Bitcoin supporters today have switched from being pro-Taleb to militantly anti-Taleb, and I think they’ve switched without even realizing it. ↩

- Again, we know that they are objectively good, by Taleb’s criterion. ↩

- By “significant questions”, I mean: “How do we protect Bitcoin from arbitrary changes via a hard fork?”, “How do we handle situations where stakeholders disagree?”, “How do we prevent an Altcoin from competing with [ie replacing] Bitcoin?”, “Can we find a block size solution that works for everyone?”. For trivial, non-controversial matters, we may still see some scientific features. ↩

- See “if a miner would rather hold B2X, they could earn it four times faster by mining B1X and trading it for B2X” by Dan Robinson here. ↩

- It was always better than nothing but highly flawed, as I discuss in the Fork Futures article. The point is that people’s reaction to it should not depend on their political position, when in reality it depended strongly. ↩

- I feel it necessary to explain that Blockstream has two projects which it repeatedly claims are sidechains but which actually are not. They are not sidechains because they lack the distinctive feature –the “two way peg”– and as a result neither can be used functionally as a sidechain (ie, Bitcoin users cannot opt in to new innovative features). The two projects are “Elements” and “Liquid” – the first is just an Altcoin (in precisely the same way that LTC, XCP, and ETH are Altcoins), and the second is just a multisig wallet. In fact, the phrase “federated sidechain” is nonsensical: the major innovation behind all “chains” (especially Bitcoin itself) is mining, and mining is distinctive because it lack a set of signers. — — A few brave people spoke openly about their utter shock and confusion. But most people made a strong effort to mask their disappointment. ↩

- In fact, many of the comments are so bad, and come from people who are [in non-sidechain contexts] relatively smart and reasonable, that I think “preemptive disinterest” can be the only explanation. For example, Luke Dashjr and Matt Corallo on bitcoin-dev did not see that “most PoW chain” is equivalent to “most $$ spend on chain”, despite the fact that this is just one inferential step (indeed, a single multiplication operation) away. Jorge Timon still does not understand that sidechains are supposed to be optional – these are sidechain paper co-authors! Peter Todd insisted that sidechains be compared to his (nonexistent and, I believe, flawed) “client side validation” project, somehow not realizing that “client side validation” [ie, “opt in validation”] is exactly what sidechains do. — — If these people were putting in their best effort, and the resulting commentary were this bad, we would be forced to determine that all of the critics were just hopelessly unintelligent. And I do not believe that that is the case. ( LargeBlocker critiques of sidechains, of course, are even worse. Not to belabor the point, but technical critique is not their forté. ) ↩

- Again, disturbingly, this is one of NNT’s indicators for an IYI. And I’m afraid that I do think it applies here – remember that we have a situation where people are being assessed by their peers, and not by their customers. ↩

- Unfortunately, Bitcoiners often use the word “fees” to refer to two different concepts (of, occasionally, opposite meanings). On one hand, “fees” are the “fee rate”, the “satoshi per byte” scalar that an economist would call “the price”. But in other instances, “fees” is used to refer to “the value [PPP] earned by a miner for mining a block, if we exclude the block subsidy” – this is what economists might call “total revenue”. On a standard supply-demand curve, the first is a coordinate on the y-axis, and the second is a two-dimensional area multiplied by an exchange rate. ↩

- From what little I’ve heard (which is very little indeed), it seems that technologists (especialy cryptographers) are making the same mistakes they made earlier with the internet itself, and for the same reasons. The mistake is to dogmatically embrace the principles of “independence”, and especially to neglect the principles of “inter-dependence”. Many of the Internet’s earliest adopters believed that the Internet would ultimately take on a form that was much more private, more “flat” and more decentralized than it is today. But it has today’s shape in order to achieve maximum usability and convenience. While “the stacks” were taking shape, dogmatic cryptographers were, in a sense, asleep at the wheel. While GMail and Facebook were growing, they were busy virtue signaling to each other about to make perfect email encryption. In my experience, elite cryptographers are very similar to the rest of us: they care about winning the esteem of their peers, and not as much about “making the world a better place” (although they know that they must pretend, convincingly, to be interested in MtWaBP, or they know to just turn their brains off when it comes to the matter). Thus they will proudly refuse to interact with the real world, regarding “persuadability” to be an attack vector or (worse) a character flaw. But in network-effect-related matters such as these, “persuadability” is just another word for “rational decision making”. So these technologists mask their ineptness in faux stoicism; fiddling out impressive-seeming tunes to each other while Rome burns (but the tunes will be “about” fire prevention, of course). For success, we must find the technologists who do not care about the opinions of other technologists. ↩

- And privacy is far less relevant in crypto than it is in fiat, because confiscation is impossible (the extortionist may kidnap the victim, but must still persuade him/her to part with the coins – the victim can still choose to withhold the coin. This seemingly-trivial distinction is, I think, underappreciated. The victim may [if imprisoned] retain his option to cut a special deal with the prosecution, or with specialist lawyers or corrupt politicians. Or else they may still send [or bequeath] coins to friends/family. When police confiscate physical cash, the victim has no negotiating leverage. Users who do care about privacy will always be able to use mixing techniques. These include the simple ability to repeatedly send coins to oneself, imparting plausibile deniability. ↩

The Many Faces of Bitcoin

By Murad Mahmudov & Adam Taché

Posted April 10, 2018

To nocoiners, gold-bugs, and Keynesians, the cryptocurrency space is best seen as a parasite infecting millennials with technobabble, forcing them to spout economic gibberish, and sucking them into believing the pipedream that a crypto-anarchist society could exist. To believers in the technology, cryptocurrencies represent an escape from the imprisonment of the traditional financial system in which they are forced to participate by being born; a system which has been plagued by inflationary monetary policy, monopoly by nation-states on money creation, malinvestment, and debt. To believers, cryptocurrencies are a starting point to rebuild honesty and a true measure of value in society among borderless, apolitical and decentralized systems.

The most prominent and powerful of the cryptocurrency communities — the Bitcoin community — has fractured into multiple factions based on desires for various directions to take the protocol and tribalism over different projects altogether. This article will explain some of the current motives driving these ideologies and try to express the reasoning behind this schism.

Although this article will be split into four main sections, there is certainly some overlapping thought between individuals who espouse these theories. The two schools of thought which we outline initially — bitcoin, first and foremost, as a store of value, and bitcoin cash as digital cash — are typically considered more mainstream, whereas the last two — Bitcoin as catalyst for something John Nash called “Ideal Money,” leading to bitcoin-backed fiat currencies, and finally, looking at Bitcoin from the perspective of information theory — are less commonly known.

Four Theories About Bitcoin

Bitcoin was the first decentralized cryptocurrency ever created. It was released in 2009 as the culmination of nearly two decades of discourse on the key concepts within the cypherpunk community. It was cited by the anonymous founder(s) Satoshi Nakamoto to be inspired by Bitgold by Nick Szabo and B-Money by Wei Dai, two earlier attempts by well-known members at creating functional electronic currency.

Most individuals within the Bitcoin community envision an endgame where an implementation of Bitcoin will be a massively adopted cryptocurrency that is both a store of value and a medium of exchange. They see bitcoin eventually being the predominant global currency. However, the ideology then diverges sharply on on how this can be accomplished, and which priorities should take precedence along the way.

Bitcoin As Money

Bitcoin presents us with an opportunity to reinvent gold, or even rethink money for the digital future. A number of economists have suggested that it may be more appropriate to evaluate items based on their degree of moneyness. According to this thinking, it isn’t that something either is or is not money; on the contrary, many items can play a monetary role and some items can play this role more effectively than others. In a number of ways, bitcoins have a high degree of moneyness. They are more portable, durable, divisible, and scarce than both gold and government fiat currency.

As of today, bitcoins can best be described as digital commodities with monetary properties. According to the Bitcoin Maximalist interpretation of monetary history, it is likely that a new, scarce form of money would evolve roughly along the following lines:

- Collectible

-

- Store of Value

-

- Medium of Exchange

-

- Unit of Account.

Proponents of bitcoins as digital cash believe that utility should initially take precedence over store of value, and prioritize attaining the medium of exchange role before store of value by making payments as cheap as possible.

Those who believe bitcoin will become the future global monetary standard ascribe current volatility to the fact that bitcoin is undergoing the process of monetization, and that a global cognitive shift is slowly occurring. In their view, despite great volatility, the long-term parabolic ascent of the price is a testament to more and more people believing in a future world where Bitcoin is widely used.

Crypto-Austrians who consider themselves Rothbardians, such as author Saifedean Ammous, believe that bitcoin’s disinflationary nature and cap on supply makes it the most sound money ever invented. They believe that bitcoin, with its fixed monetary supply, is the only fair form of money, as well as one which allows for the most efficient capital allocation by individuals and most efficient price signalling by the market as a whole.

Many individuals in this group are against the idea of fractional-reserve banking and consider it to be fraudulent. They believe that a fractional-reserve banking system is unlikely to emerge atop bitcoin, as bitcoins lack the physical centralization of gold, which forced settlements and clearance to necessarily pass through centralized choke-points, allowing governments to have complete control over the money supply, transmission, and the monetary regime at large. The governments had so much control that they were able to get rid of the gold-standard (which was organically chosen by the market over centuries) and introduce their own fiat standards, not backed by any commodity.

These individuals believe that fractional-reserve systems are simply unsustainable in the long run without lenders of last resort, which do not inherently exist in Bitcoin, and that people would be unwilling to accept bitcoin-substitutes in the market.

Those in the “Free Banking” wing of the Austrian school, such as George Selgin and Lawrence White, believe that bitcoin’s strictly fixed-supply and lack of lenders of last resort do not technically prevent a competitive system of fractional-reserve banks and entities arising atop bitcoin, or in an economy where bitcoin is the defacto monetary standard.

It is clear that there is a chance that bitcoin can, at the very least, emerge as a mildly volatile digital commodity, a store of value akin to digital gold. However, doubts remain whether it will transcend the raw store of value role and achieve low enough volatility to become a global medium of exchange and a unit of account.

Some believe that, due to its strictly inelastic supply, bitcoin is unlikely to be stable in its purchasing power anytime soon, if ever, and that people prefer for their day-to-day currency to be stable in purchasing power. These people have expressed excitement about the emergence of cryptocurrencies with more flexible and self-regulating monetary policies built in. For example, stablecoins aim to peg their market value against another form of value, such as the USD or a basket of goods, using an algorithmic central bank.

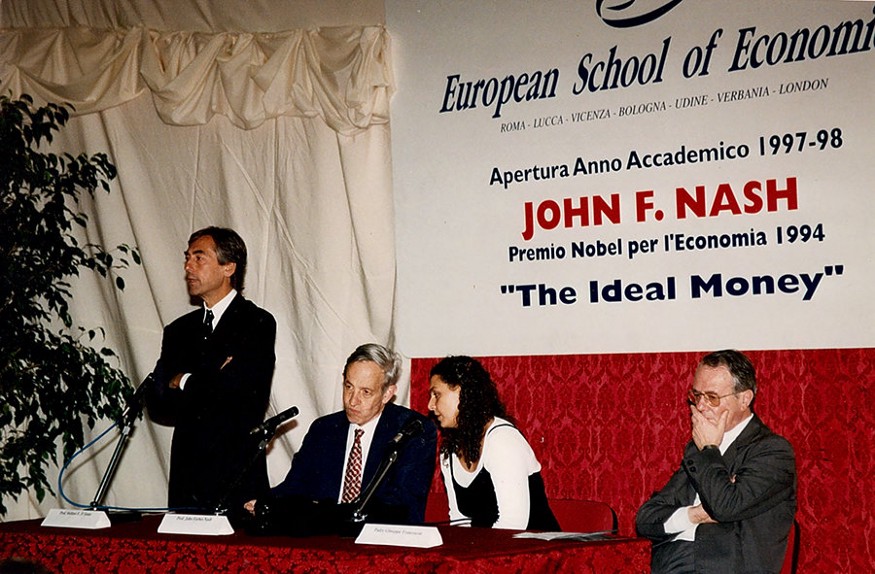

Others believe that, despite bitcoin’s strictly inelastic supply, bitcoin is a perfect solution to John Nash’s Ideal Money proposal that he worked on for over fifty years. Nash, a Nobel Laureate in Economics, proposed that central banks could inflation-target their currencies against an apolitical index to achieve international relational stability of all state currencies. In response to increasing demand for bitcoin, some believe banks will value target their currencies against bitcoin as a basis for the standardization of the value of money.

Deflationary Death Spiral

Mainstream, Keynesian, and Monetarist economists have expressed concerns with Bitcoin’s fixed-supply. They fear the possibility of harsh deflationary pressures if bitcoin becomes the predominant currency through the process known as hyperbitcoinization.

Their fear is that the inability to expand the money supply would result in bitcoin’s purchasing power growing by 2–3% per annum, roughly in line with the growth rates of global economic output. Some have expressed concerns that deflationary economics might reduce aggregate demand in the present and the near-term, result in excessive savings and hoarding of money, and produce less consumption, investment and entrepreneurial risk-taking by individuals.

Austrian economists believe that the fears associated with a deflationary form of money are overblown and that the ‘deflationary spiral’ is a myth. Austrian’s counter the Keynesian and Monetarists concerns that the delay in spending doesn’t last in perpetuity by reminding them that this spending is merely delayed into the future. People will now have a lower time-preference and that instead of buying “useless” things with their “hot potato” decaying money, they will turn their attention to long-term productivity.

They also believe that business profit margins will not be hurt because not only would product prices, but also business costs, deflate at the same rate, leaving the profit margins unchanged. Austrians believe that deflation is absolutely normal, and absent central control on the money supply, both capitalism and technology are naturally deflationary phenomenons. This can be seen in the less-regulated electronics industry, where increased storage/memory/compute capacities are becoming cheaper every year.

According to Austrians, it is the central bank inflationary fiat printing that exacerbates recessions and business cycles, as the perpetually-decaying money embeds the citizenry constant anxiety and stress, resulting in not well though-out investments and expenditures, collectively referred to as ‘malinvestment’. These malinvestments are typically inefficient allocations of capital, which are unlikely to result in personal gains, societal gains, productivity, or capital stock.

First Theory: BTC as a tamper-proof store of value.

Tenets: Sound Money. Set-in-stone monetary policy. Full-node affordability. Sovereign-grade censorship-resistance. Maximized decentralization and security.

Individuals that fall within the Bitcoin-as-sound-money camp generally believe BTC is the only legitimate cryptoasset, with everything else ranging from being entirely useless at best to blatant scams at worst. Commonly called Bitcoin Maximalists, they desire “sound money” by the Austrian Economic School definition, that cannot be inflated away or be at risk of confiscation, as the case was in 1933 when Executive Order 6102, issued by Franklin D. Roosevelt, made hoarding gold illegal in the United States.

These individuals believe that, for the foreseeable future, the goal of the Bitcoin project isn’t to facilitate the buying of coffee, but to become “high-powered” money, an even better form of gold. They claim it to be a digital asset superior to physical gold due to a truly limited supply and more deflationary emission. They also claim that, if used properly, it is unseizable, unhackable, arbitrarily unprintable, and is an attempt to engineer a superior form of money. Bitcoin is often discussed as a settlement network where the raw block space is not meant to facilitate small-value individual transactions. It is believed, rather, that its usage is for settling transactions of a larger value, where fees are less of an issue. This would likely include once-in-a-while settlement transactions of secondary payment solutions, for example, settling millions of Lightning Network payments in one finalizing transaction on the blockchain.

Although there are many brilliant concepts that were first brought together in Bitcoin, many Bitcoin Maximalists believe the mining difficulty adjustment may be the most ingenious, as it allows for true digital scarcity that is tied to the external, physical world. Saifedean Ammous is one of the most vocal and prominent BTC Maximalists, and in his new book, The Bitcoin Standard, he states that it is Bitcoin’s high stock-to-flow ratio coupled with its untamperable monetary policy that will eventually make it both the most attractive and the most robust store of value.

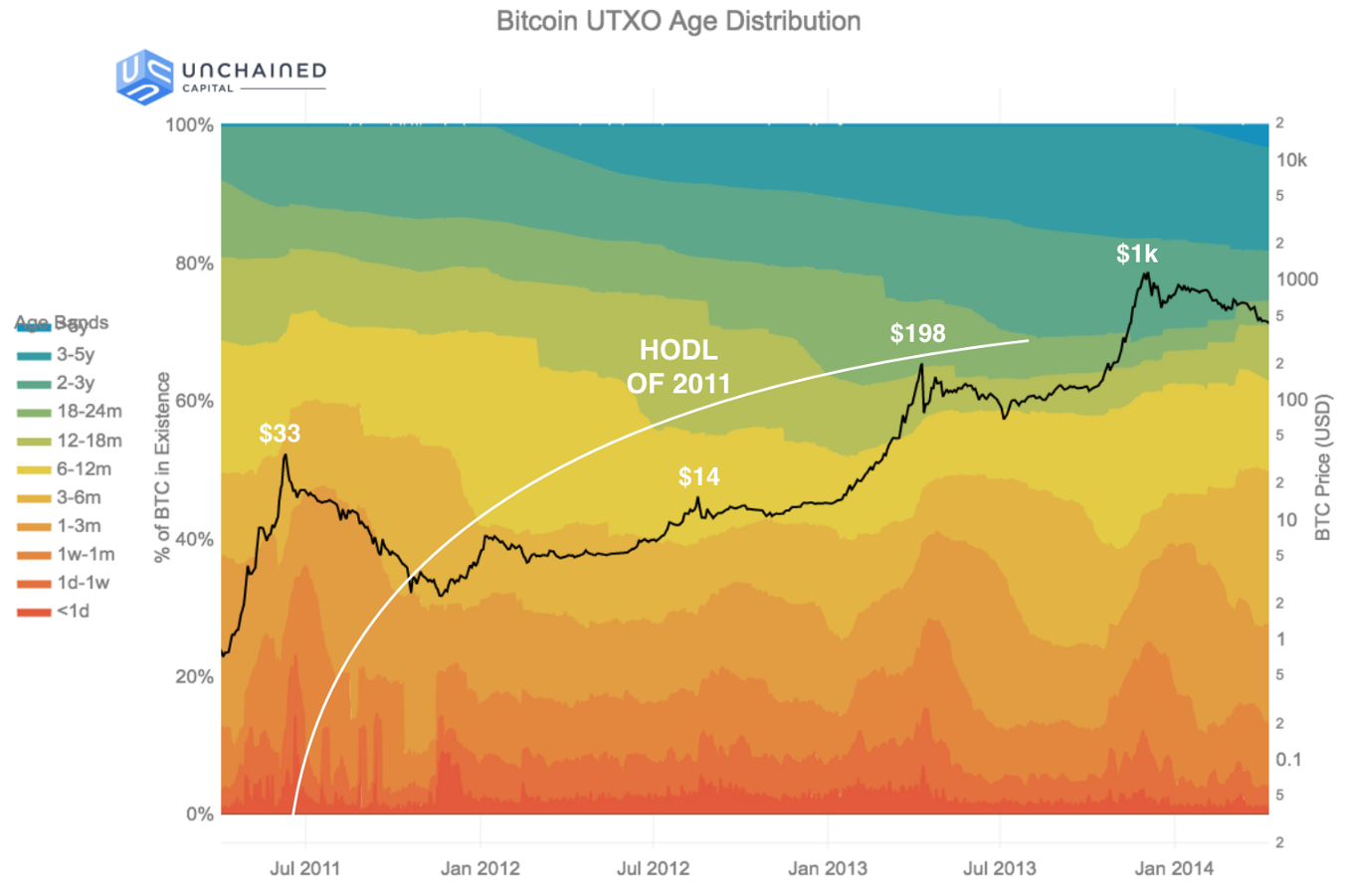

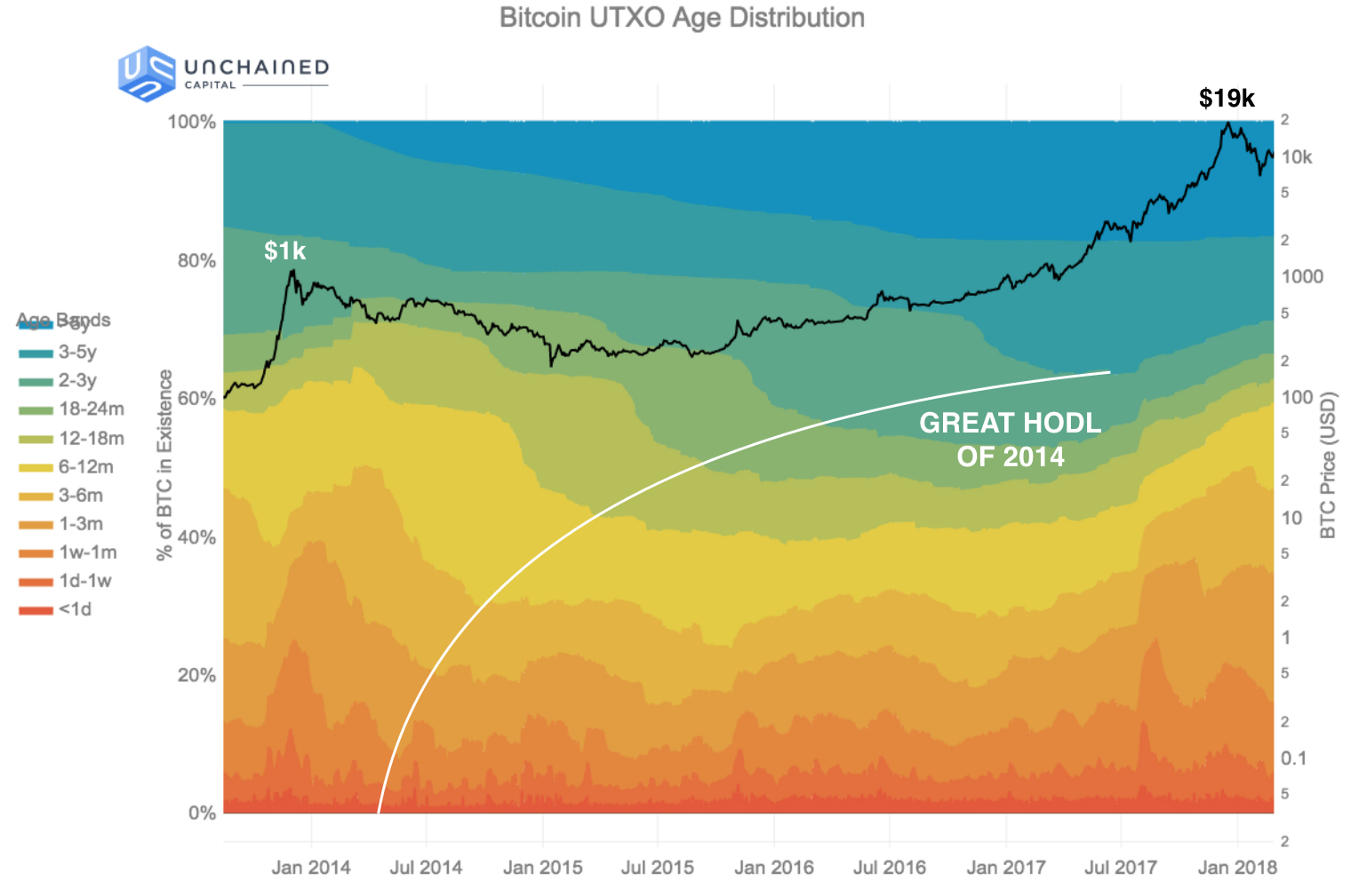

As of now, most bitcoin holders insist on not spending, a common statement being, “it would be foolish to spend when the price can still increase by a factor of 100x or more.” Instead, many are hoarding the asset, which has become known colloquially as “hodling.” For them, hodling is the main use case of Bitcoin during the time before the Tipping Point. The positive feedback loop of hodling and the price increasing encourages an ever-growing army of hodlers. This army in turn collectively increase both the value of the asset and the desirability to hoard it, as supply available on the market becomes increasingly scarcer.

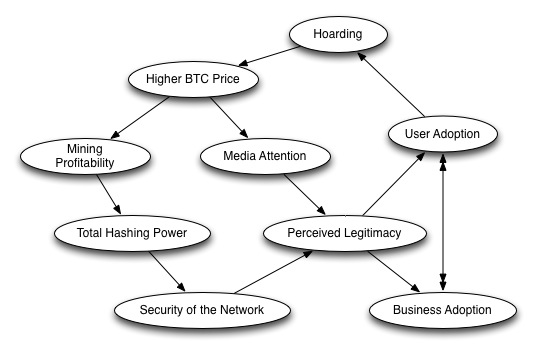

This logic is nicely illustrated by Pierre Rochard in the diagram below to show that hoarding may create a positive feedback loop to increase the BTC price, resulting in increased mining profitability, hashing power, user adoption, and more.

Bitcoin Market Components

Bitcoin Market Components

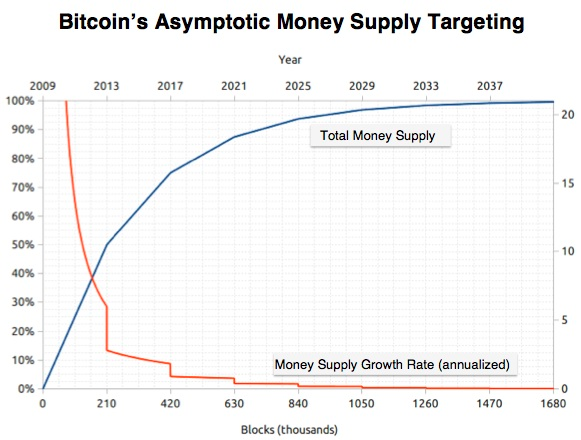

Bitcoin Maximalists hold the opinion that the key element of Bitcoin is the money it represents, rather than technology behind it. They cite Bitcoin’s “perfect monetary policy” (illustrated in the graph below) combined with the Lindy Effect due to first-mover advantage to explain why BTC will become and remain the dominant currency. The caveat being: Bitcoin must maintain its status as a peer-to-peer, decentralized system which produces a new block randomly, roughly every ten minutes. These Bitcoin Maximalists believe that as long as this is done, eventually hyperbitcoinization will occur, resulting in BTC being the dominant currency in existence.

In terms of monetary policy, Bitcoin Maximalists tend to believe that the hyper-deflationary total money supply of Bitcoin gives it the best monetary policy of any existing asset, and fractional reserve banking is rotten to the core. They prioritize saving and capital accumulation as opposed to superficial consumption. They believe, in line with Austrian school economists, that government meddling, especially with the money supply, causes malinvestment, makes interest rates artificially low, and enriches a select few at the expense of many.

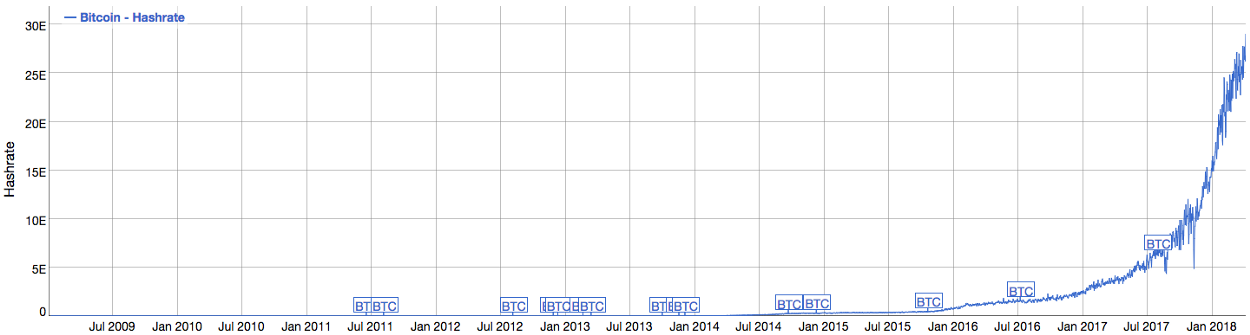

Bitcoin Maximalists believe that bitcoin as sound money is to be accomplished through maximizing both the collective and individual security within the system. Currently, the Bitcoin blockchain is by far the most difficult to tamper with of any cryptocurrency in existence, based on hashrate alone. As of April 2018, it is estimated that transactions in Bitcoin are currently secured by confirmations from a network of computing power that produces over 29 exa-hashes per second. This rate is estimated based upon the mining difficulty, which has approximately tripled in the last six months and has grown every year since the release of Bitcoin in 2009.

Bitcoin Hashrate (as of April 2018)

Bitcoin Hashrate (as of April 2018)

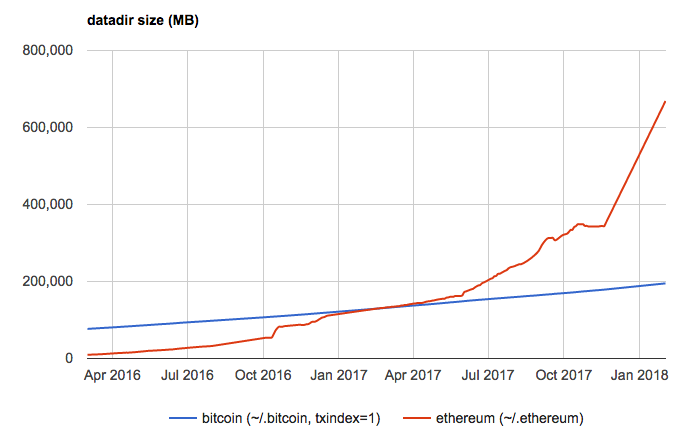

Bitcoin Maximalists believe that the network hires miners to do one specific job: mine the blocks that full nodes determine to be valid. Thus, they believe users are in control of what Bitcoin validates, not miners. To facilitate this, Bitcoin Maximalists emphasize that users should attempt to be self-sovereign by controlling their own private keys and verifying their own transactions by running full nodes. By minimizing block size and data stored on-chain, users can still manage to run full nodes even on low-bandwidth connections. There are currently over 9000 reachable full nodes among over 100,000 total, which all store copies of the Bitcoin blockchain.

Bitcoin Core is the most dominant open source project that uses the Bitcoin protocol. The developers currently responsible for Bitcoin Core are primarily focused on supporting the Lightning Network and other payment channels. They also support CoinJoin for privacy, and are developing more support for side-chains as future second-layer or even third-layer solutions for payments emerge, MAST, and Schnorr signatures and signature aggregation in order to maximize how efficiently block space is used on the Bitcoin blockchain. They are also looking into implementing confidential transactions, potentially using Blockstream’s Elements Project. There is also a proposal to implement confidential transactions as a softfork, using segwit.

Second Theory: BCH as peer-to-peer Digital Cash

Tenets: Peer-to-peer, censorship-resistant, borderless cheap transfer of value, without middlemen. High on-chain throughput and on-chain utility. Set-in-stone monetary policy.

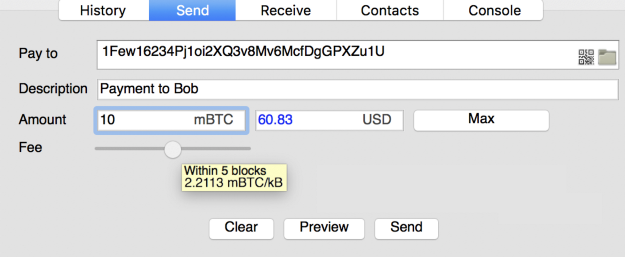

The members of the Bitcoin Cash community believe that Bitcoin should have unrestricted block sizes in order to facilitate peer-to-peer payments without bounds, and that Satoshi’s original intention was to create a peer-to-peer electronic currency, as opposed to something like digital gold. They generally cite the title and abstract of the Bitcoin whitepaper as proof of their correctness, as well as Satoshi’s statements regarding a phased-in approach to increase the block size, among other writings. These supporters generally believe that the Bitcoin system should not be a settlement layer solely for those who can afford to pay increasing fees, such as banks and other wealthy entities. They are completely against that use case for technological and ideological reasons, and they want to see most activity on-chain.

The implementation of Bitcoin that these individuals prefer is called Bitcoin Cash. It aims to gain adoption as a medium of exchange before becoming a store of value by keeping blocks large enough for nearly infinite transactions to take place. It aims to allow all users to transact on-chain, including those who may be underbanked or unbanked, some of whom earn as little as the equivalent of 2 dollars a day.

This Bitcoin fork to an alternate implementation was the result of increasingly differing opinions on the technological and social directions the Bitcoin community should head. One example is the disagreement between prominent developers on the implementation of a protocol change implemented in February of 2016, referred to as replace-by-fee. Bitcoin and Bitcoin Cash supporters clashed on this point of contention: some siding with Mike Hearn’s replace-by-fee counterargument, and some in favor of 0-confirmation transactions to allow for instantaneous payments to maximize utility of Bitcoin, and allow it to essentially be used the same as cash. The side in favor of bitcoin as cash often cites Satoshi’s vending machine example as reasoning for this always being desirable within the system. Still, others believe in researching alternative methods altogether instead of relying on controversial 0-confirmation transactions.

Bitcoin Cash supporters believes that a cryptocurrency can only become the dominant currency in existence if it is primarily used in a transactional capacity. Therefore, instead of encouraging hoarding within the community, they maintain that a certain percentage of an individual’s bitcoin cash should be used for spending each month, and some encourage constantly replenishing the spent BCHs. By doing this, they hope to encourage the adoption of Bitcoin Cash as a payment system by incentivizing as many merchants as possible to accept the currency. This seems to be rooted in a desire to smash the nation-state monopoly on money and create a closed loop, with people earning Bitcoin Cash, spending Bitcoin Cash, and merchants paying suppliers and employees Bitcoin Cash.

Bitcoin Cash choose not to add segregated witness to their implementation and believe that full nodes that receive and validate transactions but do not mine are irrelevant to the base security of the system. Instead, they believe that hash power is the only thing that can determine the direction of Bitcoin. They believe that miners are the only true full nodes: serving as competing entities, forming a consensus state and generating new blocks. They believe it is normal for large mining farms to arise in such a system, and as supporting proof, they often cite Satoshi Nakamoto’s server farm post.

In “Proof of Work as it relates to the theory of the firm,” Bitcoin Cash supporters describe the system as a multi-leader-follower Stackelberg game where miners serve as rational actors controlling hash power. Under this type of Stackelberg game, miners are to be in constant, non-cooperative competition with each other to maximize profits by optimizing their efficiency in generating new blocks by handling their quantity of hashrate.

In the medium-term roadmap, Bitcoin Cash developers plan to re-enable certain scripts included in Bitcoin transactions, known as op-codes, which would allow for more utility with smart contracts. They want to launch tokenization on-chain over the next year as an upgraded version of Colored Coins, through a competition for a five million pound prize. The goal being to both increase merchant adoption of the cryptocurrency and consume alternative smart contract platform use cases by unlocking the full ability of scripts in Bitcoin. They also plan on launching on-chain privacy through Oblivious Transfers.

A paper investigating Bitcoin Cash as infrastructure for internet commerce discusses miners being divided into specific task groups without modifying the underlying Bitcoin protocol. For example, processing nodes could reference a limited subset of the blockchain, others could store the complete blockchain, others could be for monitoring, and still others for propagating information. The paper also introduced distributed autonomous corporations as systems that live on additional layers to allow for more efficient information propagation. These corporations could also be autonomously verified for integrity by third-parties. The paper goes on to describe hypothetical fast payment networks which would operate through on-chain assurance contracts for merchants to pay for “preferentially propagated transactions,” and be operated by distributed autonomous corporations. The paper also proposes that distributed autonomous corporations could be used for double-spend monitoring to allow merchant rejection of consumer payments within seconds, or in time for vending machine to stop from releasing an item.

Bitcoin Cash supporters view it as more than a simple payment system; for example, some view Bitcoin as a robust dual-stack pushdown automaton(2PDA) from the alt-stack and main-stack present in the Bitcoin scripting language. As discussed in this video from a Bitcoin Cash supporter conference, it is hypothetically possible that Bitcoin can operate as a Universal Turing Machine, which means Bitcoin would allow any computable functions to operate as a script executed on-chain. Some computations, such as cellular automata, would require multiple transactions.

In another Bitcoin Cash paper, a Bitcoin Cash supporter states that an unbounded single-tape turing is analogous to an unbounded blockchain, and can store a genetic algorithm that will be able to provide Turing Complete results on any given mathematical problem. Therefore, the paper posits, the eventual result of Bitcoin Cash will be to create the Church-Turing-Deutsch Principle Machine, as described by David Deutsch in his 1985 paper“Quantum theory, the Church-Turing principle and the universal quantum computer” which states “every physical process can be simulated by a universal computing device.”

Third Theory: Bitcoin is a catalyst for Josh Nash’s Ideal Money

Tenets: Apolitical store of value. Mining difficulty as solution to John Nash’s theoretical Industrial Consumer Price Index. Idealized settlement layer between central banks issuing their own currencies.

A niche number of individuals, the most prominent of whom posts under the names Juice (Medium) and SoakerPatoshi (Twitter), generally agree with the Bitcoin Maximalist thesis that Bitcoin is likely to become the new modern Gold Standard, and that it is likely that it becomes a massive, global asset, trillion-dollar asset. However, they have a different view with respect to the endgame. This group believes that even if bitcoin grows such that is surpasses the market cap of gold, nation-state backed fiat currencies will nevertheless remain. Instead of causing the collapse and disruption of that fiat money, Bitcoin will instead act as a catalyst to force central banks to manage their fiat currencies in a more responsible manner.

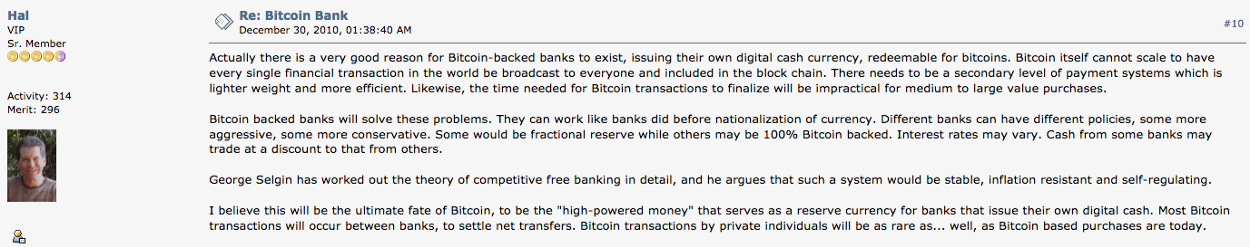

This possibility was initially thought of by Hal Finney, who is best known for being an early Bitcoin developer, being the first person to transact with Satoshi Nakamoto, and being a developer of the secure communication method known as Pretty Good Privacy. He posted on the bitcoin forums his thoughts about hypothetical Bitcoin banks in 2010.

Hal Finney on Bitcoin Banks

Hal Finney on Bitcoin Banks

John Nash, a Nobel Prize economist who made significant contributions to game theory such as the Nash Equilibrium and Bargaining Problem, believed that although Keynesian economic policies were, in theory, intended to be for solely noble objectives and general welfare of the people, in practice these policies simply gave governments the ability to literally print money, collecting seigniorage by way of inflation of the money supply. Nash often likened Keynesians to Bolshevik Communists, as he saw that both groups gave credence to the notions of a centrally managed system and a lack of transparency surrounding decisions, especially with regards to the nation-state’s currency issuance.

Nash wrote that by discussing inflation targeting, central banking officials are essentially revealing that is possible to control inflation by controlling the supply of money. Central banks, in their calculations, use a cost-of-living index made up of domestic prices for goods in a given region of their nation-state. Nash introduced a notion he called the Industrial Consumer Price Index, or ICPI, which would provide an international standard for value comparison of goods via a formula incorporating differing prices of goods in a variety of locations.

Nash believed that a return to the Gold Standard was sub-optimal, because he believed that technological changes resulted in increasing unpredictability of the future cost of gold production. He also considered the locations of gold mines to not be “politically appealing” nor ideal, and that a return to the Gold Standard would arbitrarily enhance the economic importance of those particular areas.

Nash’s Ideal Money proposal, in a nutshell, is an idea that although we cannot design a perfectly stable money, a money that approaches ‘stable’ would also approach a limit that would be comparable to an optimally chosen basket of commodity prices. While an ICPI would be a step on the path towards Nash’s vision of an Ideal Money, pegging a currency to the ICPI is not a solution, as it could fluctuate with major technological breakthroughs, and the subsequent readjustment could also be prone to political pressures.

Currently, global reserve currencies face the Triffin Dilemma, resulting in a conflict of interest between short-term domestic and long-term international objectives, such as a desire to increase inflation to spur economic growth, versus keeping a strong domestic currency with stability of purchasing power. Nash believed that money would be stronger if it were put on a stage of competition where it must compete to survive, and improve itself. Nowadays, however, currencies don’t really compete in a typical way like that which results in better products over time, but rather, they compete in a race to devalue. For Nash, rather than focusing on the utility of money for everyday transactions, of paramount importance was for the global economy to arrive at the same incorruptible value standard.

Bitcoin is seen by some as the catalyst for the evolution of global monetary systems toward something that would resemble in stability to an optimally chosen basket of commodity prices. Some believe that Nash’s writings from 1960’s may have even predicted the emergence of something like Bitcoin. Nash wrote: “Here I am thinking of a politically neutral form of a technological utility. To be quite respectable, in a Gresham-advised sense, money needs only to be as good as other material commodities that might be hoarded.”

Coincidentally, over the last several years, a global consensus over the nature of Bitcoin has slowly been converging on phrases like “digital gold”. Bitcoin has all the characteristics to acquire a global monetary premium, much the same as gold. The relation between scarcity and new supply is actually more important than scarcity of supply. In the next several years, bitcoin’s stock-to-flow ratio, the relation of its scarcity to its new supply, will drop below that of gold. Bitcoin’s annual inflation will continue to decrease. Many believe that during this time, bitcoin will draw growing interest as an inflation hedge from many around the world.

It is plausible that if Bitcoin continues seeing infrastructural improvements and growing place in the market, central banks and fiat currencies will themselves be forced to compete with Bitcoin in the future for relevance. It is likely that citizens of nation-state will put pressure on their central bank to print less money of a superior quality, resulting in a slower rate of inflation. If this were to occur, Bitcoin would likely usher similar effects to what an ICPI basket would achieve, without ever implementing an actual ICPI. This would force fiat currencies closer to Nash’s vision of Ideal Money. Nash’s goal is believed by some to be near, as Bitcoin represents competition to the nation-state control of money for the first time in centuries.

Fourth Theory: Bitcoin is an information and energy black hole that will result in the evolution of traditional money

Tenets: Perfect information markets and computational markets. Bitcoin is fractal and the sum of its forks. Peer-to-peer, censorship-resistant, borderless, cheap transfer of value, without middlemen. High on-chain throughput and on-chain utility.

“Bitcoin isn’t money. It’s past money, which is scary because it’s actually a new paradigm. We’ve never had access to perfect market information before, so the concept of money will have to evolve to fit reality, not stay the same because legacy deems it so.” — anonymous

Bitcoin forks

Bitcoin forks

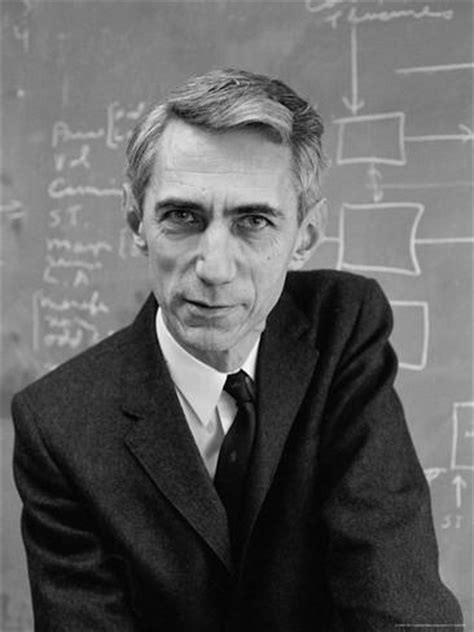

There is also a niche number of individuals, the most prominent of which are George Gilder, author of a number of books on the monetary system and capitalism, Andrew DeSantis, former engineer at the Bitcoin startup 21.co, now earn.com, and Mark Wilcox, Chief of Strategy at Nyriad, that discuss Bitcoin primarily as interpreted by Claude Shannon’s information theory. In simplistic terms, information is defined as surprise under information theory.

Claude Shannon, the founder of information theory

Claude Shannon, the founder of information theory

This group believes Bitcoin is a breakthrough in information theory because it allows anyone to conduct verifiable, timestamped, tamper-proof and transparent transactions without any third parties. Information theory says creativity requires a stable medium to experience fractal growth, and these individuals view Bitcoin as an extremely stable medium for doing so. In Knowledge and Power, Gilder argues “it takes a low-entropy carrier (no surprises) to bear high-entropy information (full of surprisal).” This camp also agrees with Bitcoin’s deflationary policy because they view capitalism and technological progress as a fundamentally deflationary system.

Similarly to Bitcoin Cash supporters, these individuals favor pushing Bitcoin to its limits to maximize the utility of an open data layer, and they are not fond of a future of Bitcoin where throughput is limited so that all users can verify their own transactions with a full node. This group views one use case of Bitcoin as an oracle machine to prove that a specific piece of data existed at a given point in time, and the bitcoin scripting language as much more dynamic than Ethereum due to the parallel nature of Bitcoin in comparison to the current serial execution forced by contracts on the Ethereum platform.

This group views Bitcoin as a platform to re-build computer software and the web upon. For example, they are interested in the parallels between Ted Nelson’s Project Xanadu, the first hypertext project, and Bitcoin. Project Xanadu was envisioned to bring about a highly interconnected, parallel universe of documents for reading, writing, and learning through hypertext, “non-sequential writing — text that branches and allows choices to the reader, best read at an interactive screen” that was to operate through worldwide distributed servers and facilitate micro-transactions across the web.

As discussed in “Blockchain Control Flow,” Ethereum has made design decisions that allow the network to have control over contract execution, and thus users’ money. Wilcox writes “For a peer-to-peer network to be politically decentralised, it needs to have decentralised control, so we should at all times try to keep control completely in the private section.” He also writes that the “limitations” of Bitcoin as cited by Vitalik Buterin in the Ethereum Whitepaperare protections not limitations.

Individuals within this camp generally have negative opinions towards the Lightning Network and other secondary-layer solutions. DeSantis states the “Lightning Network makes the base chain strict, or predictable,” and thus reduces Bitcoin’s information theoretic value by constraining experimentation space and reducing the chances of surprise discovery. Wilcox views the Lightning Network “as a scam designed to function as an abstraction layer between you and the miners.”

When Wilcox discusses transaction processing, he is referring to verifying a transaction and hashing it into the merkle tree. Transaction processing can refer to almost anything, and he proposed a thesis that the same economic incentives that allowed Bitcoin’s hashrate to grow exponentially over the last nine years could be used to exponentially grow transaction processing, which is currently done serially on a CPU.

Nyriad, the company Wilcox co-founded, created the Nsulate for the Square Kilometre Array project, the world’s largest radio telescope. The Nsulate innovatively uses the GPU as a storage controller and makes processing and storing data the same thing. It has built in blockchain support through cryptographic hash algorithms, which would allow miners to process transactions in parallel.

Many of Wilcox’s arguments, therefore, are based on seeing Bitcoin as a platform to enable competitive general purpose computational markets where users and companies submit transaction puzzles via scripts for miners to compete to solve using GPUs and write-on chain to seek rewards. Transaction puzzles can mean nearly anything here, from deep learning to CRISPR searches. With computational markets in Bitcoin, a user looking to submit computations to miners will care a lot about efficiency, to get the most computation per unit of reward they are including in a puzzle, and hashrate, to ensure system they are submitting to is as secure as possible.

Wilcox and DeSantis typically argue against the traditional supply and demand outlook of economic markets for blockchains. Wilcox discusses the implications of Proof of Work for transaction processing and scalability in his blog, including Fundamental Misconceptions. Computational markets sitting atop Bitcoin are particularly likely to expand if they prove to achieve cheaper and more efficient computation than established behemoths of the industry.

Source: Twitter

Source: Twitter

Conclusion

The four schools of thought presented in this article do not necessarily contradict one another, and, in fact, oftentimes overlap. In particular, the First Theory — Bitcoin being like a digital gold — and the Third Theory — Bitcoin leading to Nash’s Ideal Money — run pretty much in parallel to one another, with the key difference being that the latter states that fiat currencies survive and adjust, while the former states that hyperbitcoinization will disrupt fiat currencies entirely, with everyone eventually demanding payment for their goods, services, and labor in bitcoin.

Similarly, the Second Theory — Bitcoin Cash being a dominant peer-to-peer digital cash — and the Fourth Theory — Bitcoin being the key element in further developing information theory — have many of the same supporting points and arguments, with the key difference being that the latter is not fork-biased and believes that any possible fork that can happen, will happen, and they will compete against each other.

Thanks to armor123123 and others for giving us feedback on earlier versions of this post.

Meditations on Fraud Proofs

By Paul Sztorc

Posted April 14, 2018

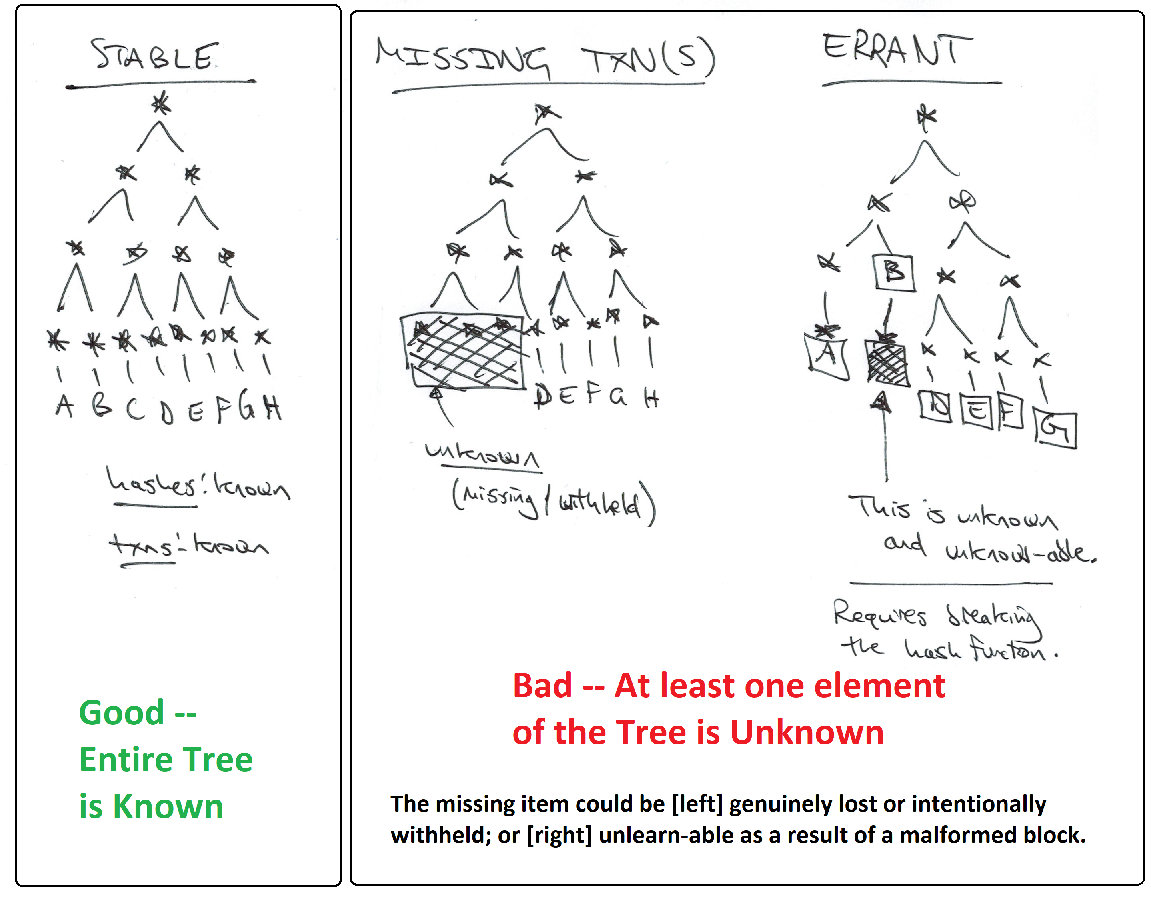

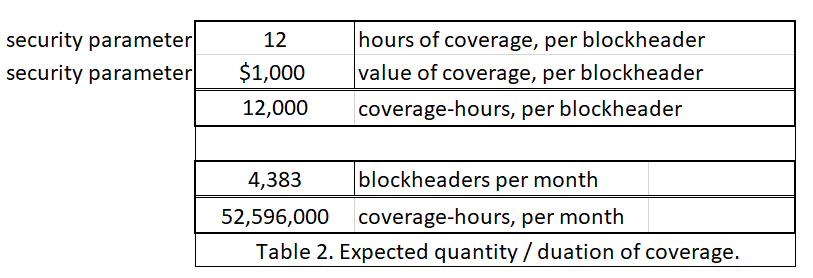

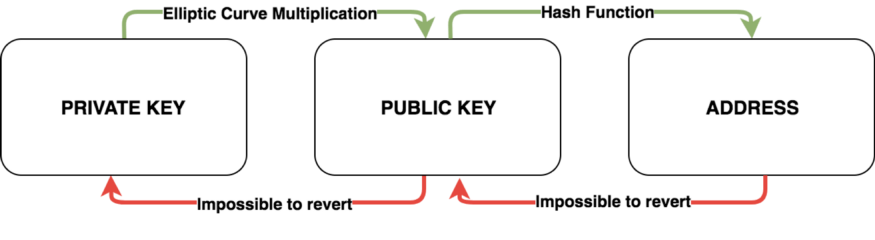

Toward a coveted O(log(n)) blockchain validation, for (?) ~ $50 a month. Plus: compensation for full nodes. Fraud proofs are a very complex, nasty business.

But if you would to learn my thoughts, sit here by the river and we may meditate together.

( River art by Benihime Morgan)

( River art by Benihime Morgan)

tl;dr

- Fraud Proofs allow “SPV nodes” to have similar security to “full nodes”. SPV nodes are very easy to run and scale much better.

- Here, I require an “SPV+ mode”. Whereas regular SPV requires headers only (~4 MB per year), this mode also requires the first and last txn of each block (~115 MB per year).

- “SPV+ nodes” must have a payment channel open with a full node, or a LN-connection to a full node.

- “SPV+ nodes” will have to make micropayments to these full nodes. To validate every single block, I estimate these payments to total ~ $50 a month.

- From there, it is just a few new OP Codes, one [off chain] rangeproof, and a second “SegWit”-like witness-commitment trick.

1. Background

A. Making Bitcoin More Like Physical Gold

Bitcoin is designed to rival gold. And in many ways, BTC is far superior, but one deficiency is when it comes to receiving money– how do you know you’ve been paid? With physical gold it is straightforward – as simple as any other hand-held exchange. But with Bitcoin (a digital collectible) your guarantee of ownership is much more abstract.

Satoshi’s solution was a fancy piece of software, “Bitcoin”, that tells you when you’ve received money.

But this is an infinite regress! What is the software doing?

Well, the software has a unique way of synchronizing with other instances. Kind of like Dropbox, but where your files would never have version control issues. It asserts its own synchronicity. “Knowing you have been paid” and “knowing you are synchronized” are the same thing!

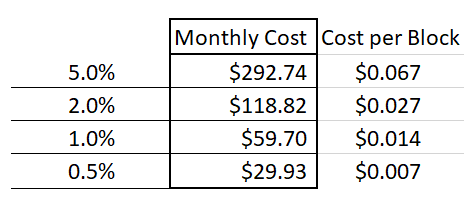

Satoshi’s whitepaper advocates two different ways of ‘knowing you have been paid’:

- [Positive, Traditional] Run the software and wait until you are fully synchronized.

- [Negative, Experimental] First, run a ‘lite client’ which would strategically synchronize some “easy parts” only. And then be on the lookout for ‘alerts’.

The first is the so-called “full node”, and it relies on positive proof– you are shown X, and when you see the X you known that you’ve been paid. The second is the so-called “SPV Mode”1 and it additionally relies on negative proof– you are not shown Y, but if you were to see a Y, you would know that you have NOT been paid. This Y is called an “alert” in the whitepaper, but today it is known as a “fraud proof”.

B. Theoretical Support for Alerts

To me, the most interesting aspect of the negative proof method (ie, ‘alerts’) is that it resembles the way our world actually works in most respects.

Consider these examples:

- We don’t try to always make murders 100% impossible. But, if someone experiences a murder, we go to great lengths to catch the murderer (and establish their guilt in court, and punish him/her).

- We don’t try to make “bad businessmen” 100% impossible. But, if there are incompetent businessmen, we expect that they will eventually go out of business or be bought out, and thus replaced with someone more appropriate. If there is too much of a conflict of interest, we use tort law or regulation (to get rid of what we don’t want).

- We don’t [even] publish scientific research as though it were 100% error-free. Instead, we make it maximally open to later criticism and future correction.

- We don’t try to prevent judicial corruption 100%. But we do require all legal proceedings to be written down, and be audit-able by the public and by future legal scholars.

- We don’t try to “know everything”. But we expect to be able to “look it up” in a book/website, and we expect that specialists will correct those references over time.

In general, we have a kind of standing assumption that everything is satisfactory. And when severe-enough errors pop up, we act to correct them.

But, otherwise, in the real world, we find it far too difficult to 100% validate every single thing.

C. Theoretical Problems with Alerts

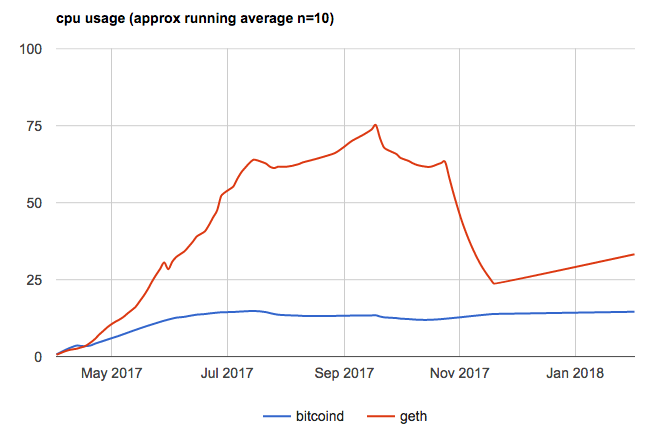

The problem with alerts is that Satoshi never actually implemented them, as you can see from this tweet from Eric Lombrozo last month.

Here are some of the outstanding puzzles:

- DoS Resistance: Bitcoin full nodes are robust to DoS thanks to huge asymmetries in proof of work – namely, that it takes ~10 minutes to make a block but far less than 10 min to validate one. However, is this the case for alerts? Do they have PoW? Who pays for it? If not, what prevents a malicious agent from spamming innumerable false alerts at all times, making any true alerts un-discoverable?

- Proving a Negative: a malicious/negligent miner can just discard parts of the block. But, even more extreme, a miner can actually mine a block without knowing anything about what is inside of it! If these “unknown” parts of the block contain bad txns, how can we ever learn about it? If no one can learn of them, how can we warn others?

The first problem asks us to find a spam-resistant signal that is not the blockchain itself – we will solve it using Payment Channels.

The second problem asks us to draw our [very scarce] “auditing attention” to specific parts of the block – we will do this by allowing people to claim that they do, in fact, know the entire block (all sections included), and by allowing those people to back up this claim with an audit.

2. The Problem

A. SPV Mode

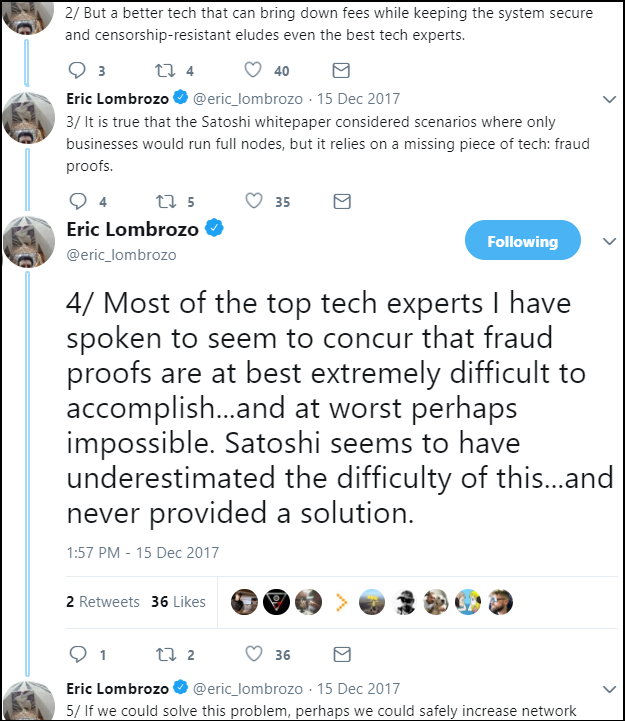

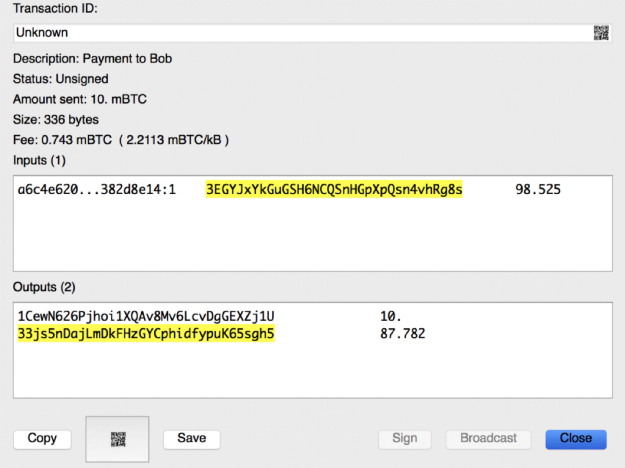

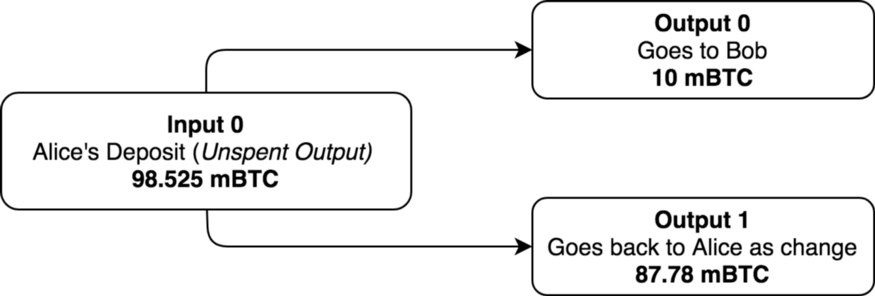

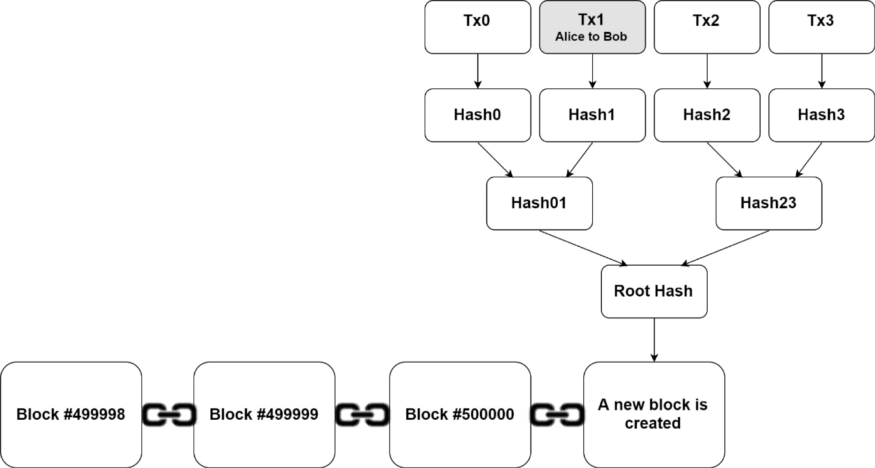

Satoshi’s SPV Mode (whitepaper section 8) observes that:

- Bitcoin block headers are very small (4 MB per year) and easy to validate, regardless of how many txns each block contains.

- It is very easy to demonstrate that a block contains some item “X” (as this requires only “X” itself, the block’s header, and a valid Merkle Branch containing both).

For those who are unaware, consider this example:

Imagine that we have three Bitcoin headers: headerA, headerB, headerC.

Each header contains a hashMerkleRoot: hA, hB, hC, respectfully.

Is [Tx] in any of these blocks? [header A] , [header B]

Yes, because h( [tx] ) = ht , and

h( ht, hs1 ) = hi1

h( hi1, hs2 ) = hi2

h( hi2, hs3 ) = hA

ht is the hash of the transaction [Tx].

hs1, hs2, hs3 are the Supplied Hashes, given by the Full Node ("Fred").

hi1, hi2 are intermediate hashes, calculated by SPV user ("Sally").

In practice, no one can link hA to anything other than h(hi2, hs3). In turn, no one can link hi2 to anything other than h( hi1, hs2 ), ..., and no one can link ht to anything other than [tx].

The Merkle Branch (the “supplied headers”, as well as information about their order and position) is small and grows at the coveted log(n) rate. The payer can easily obtain/produce it, and they can easily send it to you while they are sending the transaction itself. So it is quite negligible.

Which means that this demonstration suggests that, in order to “know you’ve been paid”, only the Bitcoin headers are needed. And the headers are very easy to obtain.

So SPV mode seems to suggest unlimited throughput, at tremendous ease.

B. The Problem with SPV Mode

The catch, is that you can never be sure if a given 80-byte header really IS “a Bitcoin header” or not.

The only way you can know that, is if you examine its contents in full. If a single invalid or double-spent transaction is hiding in there somewhere, the block will be invalid (or if the block is “flawed” in any other way, see “Block Flaws” below).

C. The Good News

While one cannot know if an 80-byte header is a Bitcoin header, we fortunately can validate the proof-of-work on a header. By simply hashing the header we can check it against the current difficulty requirement.

(And headers are so kind as to themselves contain a critical pair of information: the difficulty requirement itself, as well as the timestamp information – each can be used to check the other).

So, we can check that hashing effort has been expended, but not that the hashing was done on a worthy target. If you were buying a box of chocolates as a gift, and you had Matthew the Miner go to the store and purchase them for you, then our situation would resemble one where you could easily verify that Matt spent $300+ on the chocolates, but you can’t know if the chocolates in question taste any good or even if they contain any actual chocolate.

D. Positive and Negative Proof, Revisited

You could eat all of the chocolate yourself, which would give you “positive proof” that each and every chocolate was delicious.

Or else you might rely on “negative proof”, perhaps by reasoning as follows: “This box of chocolates is tamper-resistant, and it does not seem to be tampered with. And this product have a brand associate with it, and my country enforces laws protecting brands/trademarks. This brand is purchased by many, and so, if the chocolates were of unreliable quality, I would probably find a news story (or bad Yelp reviews, etc) if I looked. In fact, I have looked for such a story but haven’t found one.”

Another example is a money back guarantee. Imagine you are shopping for a car (an item of uncertain quality, just like our newly-found but unexamined Bitcoin block), and three competitors (call them “A”, “B”, and “C”) each offer to sell one to you. Perhaps you are most interested in Car C.

Positive proof would be driving Car C for thousands of miles and having various mechanics check each piece of the car, and report back to you with problems.

Negative proof would be to observe that Competitors A and B each offer a legally-binding money back guarantee if their cars break down in the next 40,000 miles; but Competitor C does not make such a guarantee. This is negative proof that C is of low quality.

For Bitcoin Fraud Proofs, we need something that always shows up if the block is valid, but never shows up if it is invalid. (Or vice-versa.)

In game theory this is called a “separating equilibrium” in a “signaling game” (or more precisely a “screening game”), where the fraud-proof-senders are of two types, “Honest”-type and “Dishonest”-type, and we are trying to cheaply screen them for dishonesty.

E. Our Requirements

We need a way to promote “block flaws” in our attention. And ideally it must do so quickily (ie, “before transactions settle” ie “before 6 confirmations”, or [to be safe] within 20 or 30 minutes).

Specifically, the following must happen:

- “Sally” (SPV node) gets paid, in BTC, for something. Her counterparty shows her his txn, and she can see that her txn appears valid.

- Sally wants to know that her txn has 6 confirmations, without running a full node. So she first downloads all Bitcoin headers, and second asks for a Merkle Branch that contains both [1] her txn and [2] a recent header. She gets one, but unfortunately for her [and little does she know]: the header is invalid for some reason. …

- Simultaneously, “Fred” (Full node) must become aware that something is amiss. Specifically: that a block contains one or more “flaws” (see below).

- Fred must have an incentive to provide some kind of warning (ie, the “alert”).

- In all other cases, Fred must have a disincentive to provide these warnings (ie, no “false warnings” … no warnings when there is actually nothing to worry about).

F. Classes of Block Flaw

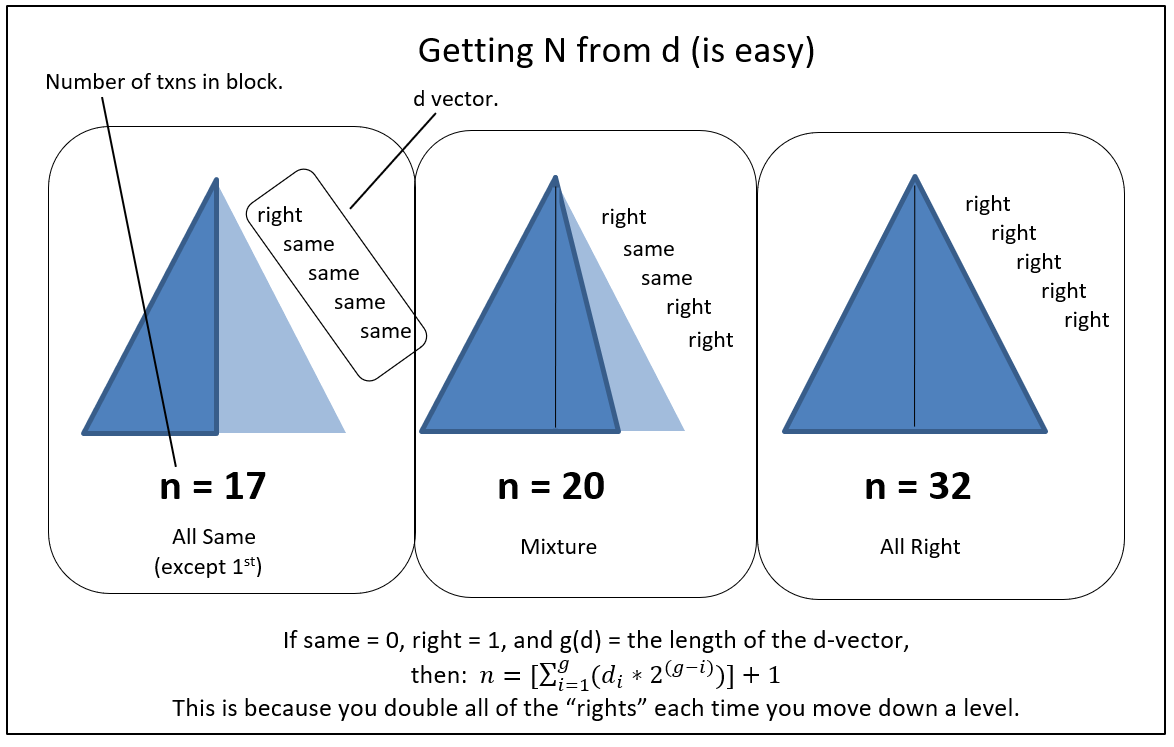

A block can be flawed in many ways (see validation.ccp, especially “CheckBlock”). I have arranged them into four classes:

- “Class I” – Bad Txn (invalid txn, doublespent txn, or repeat txn).

- “Class II” – Missing block data (the Merkle Tree “neighbors” of Sally’s txn are unknown and undiscoverable – this could be intentional or accidental).