WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the December 2018 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

br

Skeptic’s Guide to Bitcoin: Unpacking Bitcoin’s Social Contract

A framework for skeptics

By Su Zhu and Hasu

Posted December 3, 2018

This is part 2 of a 4 part series. See additional articles below

- Part 1 Skeptic’s Guide to Bitcoin: An Honest Account of Fiat Money

- Part 2 Skeptic’s Guide to Bitcoin: Unpacking Bitcoin’s Social Contract

- Part 3 Skeptic’s Guide to Bitcoin: Bitcoin and the Promise of Independent Property Rights

- Part 4 Investing in Bitcoin

Illustration: engraving by Abraham Bosse via Wikimedia

Illustration: engraving by Abraham Bosse via Wikimedia

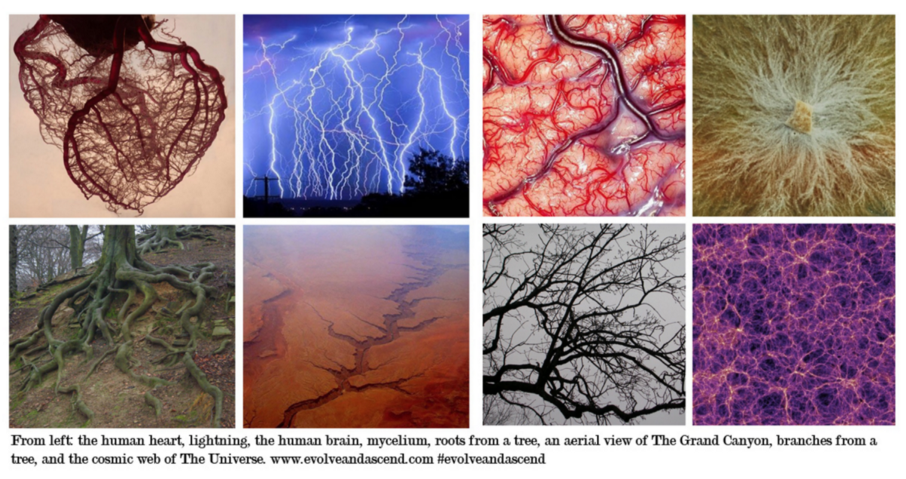

Bitcoin is a novel social and economic institution. It is so different from our existing institutions that we should be skeptical and ask as many hard, pressing questions as we can before trusting it with any economic value. Some answers will only reveal themselves with time (or Lindy, as the cool kids say), but that doesn’t mean we can’t come up with theories or frameworks. One such framework that has helped me a lot in understanding bitcoin is social contract theory.

First, fiat money is the result of a social contract: The people give the state control over the supply and other vital functions of money. The state, in turn, uses that power to manage the economy, redistribute wealth, and fight crime. But many don’t realize that bitcoin works through a social contract as well.

The social layer and its rules are the heart of bitcoin.

And that social contract framework can be used to answer some essential questions: Why did bitcoin come into existence? Who decided its properties? Who controls it today? Can a critical bug kill bitcoin?

Social Contract Theory

Social contract theory starts with a thought experiment: It assumes a hypothetical state of nature full of violence, that is unbearable for people to live in. Driven by a desire to improve their situation, they come together and collectively agree to empower Leviathan, the sovereign government, to protect them. Each gives up some of their freedom (to, you know, steal, and murder and stuff) while the Leviathan is granted the power to create laws, enforce them, and protect the people from violence.

But the theory is not constrained to the relationship between the people and the state. We can apply the same thought experiment to economics. If enough people are unhappy with the barter economy, they can collectively agree to use money, credit, or something else to improve the quality of their trading.

The process of money or credit happens implicitly. Every person asks the question of what outcomes they prefer and how they can achieve them. If many people in a society want the same outcome, we can call the result a “Schelling point” or social contract.

Money as a Social Contract

Throughout history, governments that controlled money have abused their power in all kinds of ways: They confiscated accounts, blocked certain people or groups from transacting, and printed more money and inflated the supply—sometimes to the point of hyperinflation.

Whenever governments crossed a line in abusing their power, the people lost trust in the social contract that granted the government this power. They returned to an agreement that preserved most of the benefits (having a common medium of exchange, store of value, and unit of account) without the worst of problems (government abuse): a commodity money.

Money presents an important lesson: The larger and more valuable a social institution gets, the more it attracts others to seek control over it.

The problem with the new commodity money contract, however, was that it turned out equally unstable. Let’s take, for example, the gold standard. Physical gold was too inconvenient to divide, move, and store. So people quickly invented another layer on top of it and traded with representative paper money, while the physical gold no longer moved. Because paper money is easy to produce, there had to be a trusted central party to watch over the supply. From there it was a small step for governments to decouple the value of the paper money from the underlying commodity to establish fiat money once again.

Herein lies a valuable lesson: You can agree you’re in a terrible situation and you can agree you want to change it, but the resulting social contract is only as strong as it is credible. Without a stable institution to enforce it, a contract loses the trust of the people and falls apart.

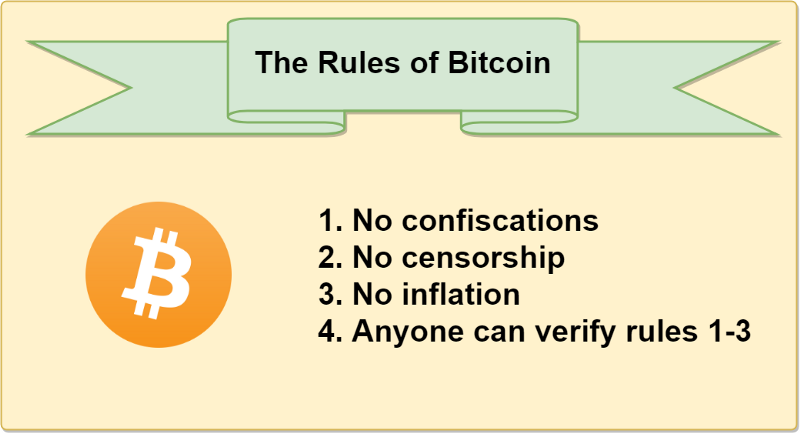

The Rules of Bitcoin

When Satoshi Nakamoto invented bitcoin, he did not invent a new social contract. Satoshi did something else—he leveraged technology to solve many problems of past implementations and implemented the old contract in a new and better way. He settled on the following rules:

- Only the owner of a coin can produce the signature to spend it (confiscation resistance)

- Anyone can transact and store value in bitcoin without permission (censorship resistance)

- There will only be 21 million bitcoins, issued on a predictable schedule (inflation resistance)

- All users should be able to verify the rules of bitcoin (counterfeit resistance)

Bitcoin as a New Form of Social Institution

Money presents an important lesson: The larger and more valuable a social institution gets, the more it attracts others to seek control over it. So the institution needs protection, which it can only get from that other powerful entity: the state. Over time, protection turns into control and then into abuse. When the social institution loses its benefit for the people, it is replaced by a new institution, and the cycle starts over again.

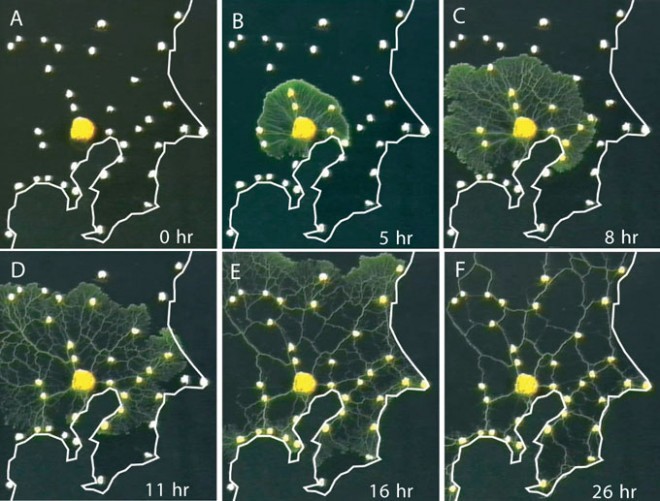

Satoshi attempted to break this vicious cycle in two ways: First, instead of getting its security from a powerful central party (like a government), bitcoin creates a hypercompetitive market for its own protection. It turns security into a commodity and the security providers (miners) into toothless commodity producers. And, second, Satoshi found a way for these competing security providers to come to consensus over who owns what at any given time.

The bitcoin protocol automates the contract agreed upon on the social layer, while the social layer determines the rules of bitcoin, based on the consensus of its users. They are symbiotic: Neither of them would be sufficient without the other. The social layer and its rules are the heart of bitcoin. But the protocol layer makes them enforceable for the first time, while simultaneously making the social contract more credible to outsiders.

Seeing bitcoin as a social contract, enabled and automated by a technical layer, has many benefits. And it can help us answer the philosophical questions about bitcoin.

Seeing bitcoin as a social contract, enabled and automated by a technical layer, has many benefits. And it can help us answer the philosophical questions about bitcoin.

Who Can Change the Rules of Bitcoin?

The rules of the contract are decided and renegotiated continuously on the social layer. The bitcoin protocol implementation only automates them. Bitcoin, as a computer network, comes into existence when many people run bitcoin implementations on their computers that follow the same set of rules (think of them as speaking the same language).

You stay in the network as long as you follow the same set of rules as everyone else. If I were to change the rules of bitcoin unilaterally on my local computer, it would not affect the rest of the network—it only gets me evicted because we no longer understand each other (I now speak a different language).

The only way to change the rules of bitcoin is to propose a change to the social contract. Every such proposal has to be voluntarily accepted by other people in the network because it only becomes a rule if enough people actively include it in their local ruleset. Convincing millions of people is an incredible amount of (grassroots) work and practically rules out any contentious changes, which could never get broad social consensus. This is why the bitcoin network can be upgraded in ways that reflect the wish of its members but is at the same time incredibly resilient to changes from bad actors.

Can a Software Bug Kill Bitcoin?

In September 2018, a software bug arose in the most popular implementation (local ruleset) of bitcoin. The bug had two potential attack vectors: It allowed an attacker to shut down other people’s bitcoin clients (making it so they could no longer verify the rules, breaking the counterfeit resistance) and to potentially spend the same bitcoin twice (breaking the rule of inflation resistance).

Bitcoin developers quickly fixed the bug by providing the network an updated ruleset that closed these possible attack angles. While the bug was found in time and was never exploited by an attacker, it left some people asking: How much damage could it have done? Would the bitcoin network have to live with the inflation once it happened, effectively breaking the trust in that rule?

Social contract theory can answer that with a resounding “no.” Bitcoin’s rules are made on the social layer, and the software only automates it. Where the social contract and the protocol layer diverge, the protocol layer is wrong—always. A failure of the protocol layer to temporarily enforce the rules of the contract has no permanent bearing on the validity of the contract itself.

The bitcoin token itself has no value. The value exists purely on the social layer.

Instead, here is what would have happened: The potential bug exploit would have been mended by reorganizing the blockchain in a way that undoes the damage done by the attacker. That would have split the bitcoin network into two networks, each having their own token: one with the bug and one without it. Every bitcoin owner would have an equal number of tokens in each network, but the value of these tokens would be exclusively determined by the market, i.e., how much the next person was willing to pay for them.

At this point, it’s important to understand that the bitcoin token itself has no value; it’s nothing more than a number in a ledger. The value exists purely on the social layer. Hence, it is also social consensus that decides which of the two tokens, going forward, would receive economic support. It’s likely that all economic value would migrate to the new, mended network.

When the bitcoin software successfully automates the rules of the social contract, the two layers are synchronized. And when the software temporarily goes out of sync, it always has the social contract as a guiding beacon of light to return to. This most recent bug will not have been the last. Social contract theory gives us assurance that bugs can happen and don’t threaten the social institution of bitcoin.

Do Bitcoin Forks Endanger the No-Inflation Rule?

Another famous philosophical question centers around the concept of “forks.” Since bitcoin’s software is open-source (allowing users to verify that their ruleset does what it says), anyone can copy it and make changes. That is called “forking.” But, as established earlier, these changes are only made to the protocol layer, not the social layer. Without changing rules on the social layer first, the only result from forking bitcoin is that you evict yourself from the network.

If you wanted to fork bitcoin—and not have the new network die immediately—you would have to fork the social contract first. You would need to convince as many people as possible that your ruleset is better for them, so they update their rules together with yours. These kinds of forks are scarce and hard to pull off because they require the buy-in of thousands of people. Using this process to create value is akin to running a presidential campaign as a financial investment.

Again, the key is in understanding that all value for tokens is purely a social construct. The tokens do not have any value; they receive their value from social consensus. Forking the protocol doesn’t equal forking the social contract, so the new token is worthless by default. In the rare case that the social contract itself splits (like when bitcoin cash split off from bitcoin), you end up with two weaker social contracts—each agreed to by fewer people than the old one.

Money in general and Bitcoin in particular can be seen as social contracts between people in society. Bitcoin is not a new contract either; it’s just a new implementation of a contract that can be traced back hundreds of years. In comparison to previous attempts, the bitcoin implementation is a dramatic improvement because it creates a hypercompetitive market for its own security. Bitcoin’s social layer and the protocol layer are mutually reinforcing, and their relationship gives us insight into little-understood concepts like rule changes, forks, or protocol bugs.

The “Bitcoin mining death spiral” debate explained

By Arjun Balaji

Posted December 4, 2018

Quick Take

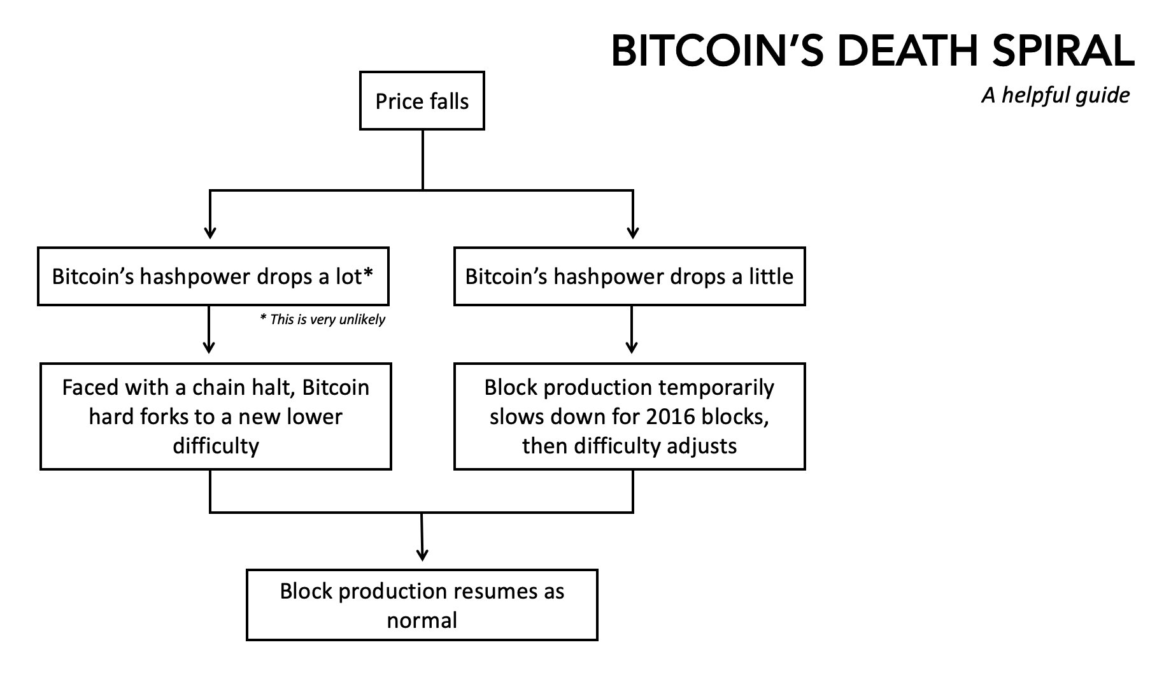

- Bitcoin is not going into a miner-induced death spiral

- In an extremely unlikely scenario if hash rate dropped a lot, miners can be kept running by increasing fees

- If that wasn’t enough, as a last resort, there could be an emergency fork to manually lower difficulty

Bitcoin is not going into a “mining death spiral.”

Now that we’ve gotten that out of the way… rather than fear-mongering, The Block is committed to clarifying comments and concerns posed by crypto-fund managers and enthusiasts alike with level-headed technical clarity.

The case that Bitcoin is going into a miner-induced death spiral is intuitively compelling: Bitcoin prices drop materially, eventually marginally profitable miners shut off, ad infinitum, until all the miners are gone and no one mines Bitcoin (cue: Bitcoin is dead, redux).The argument is crutched on a few core assumptions often relied on by critics: $BTC would have to trade sub-$1000, with hash rate dramatically dropping off before the difficulty adjustment, the variable representing the difficulty of mining a new Bitcoin block. Miners, who are strictly rational short-term, would then choose to shut off all their miners or mine alternative cryptocurrencies rather than take losses mining Bitcoin unprofitably.

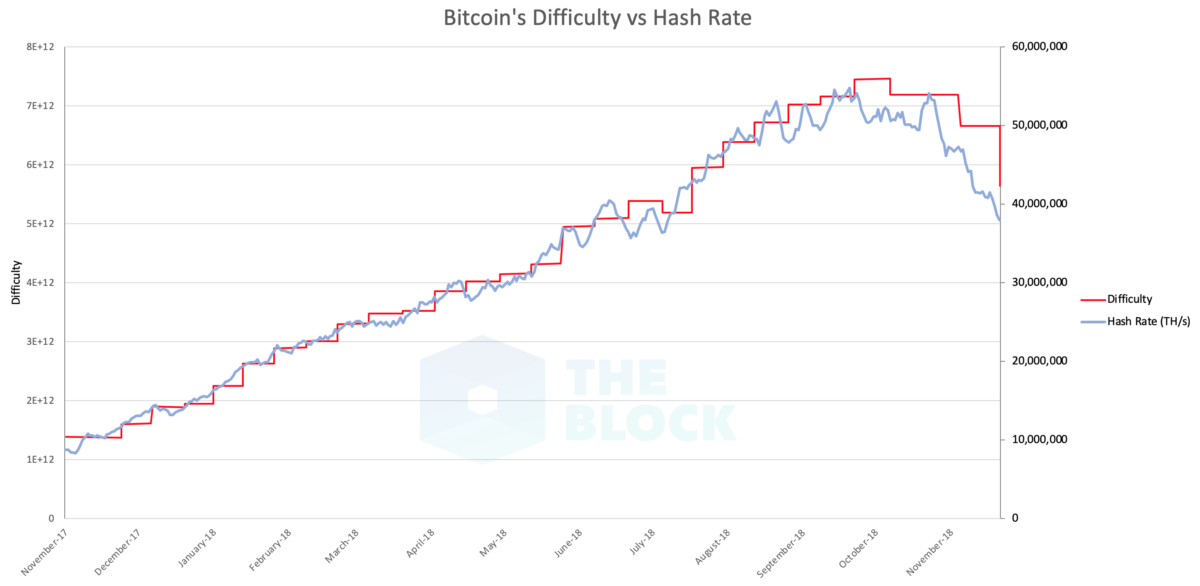

For context, Bitcoin’s difficulty adjustment doesn’t happen every two weeks. The difficulty of mining a Bitcoin block is naturally adjusted by the system every 2016 blocks, which probabilistically averages to two week intervals.

This tends to follow the hash rate, as seen below:

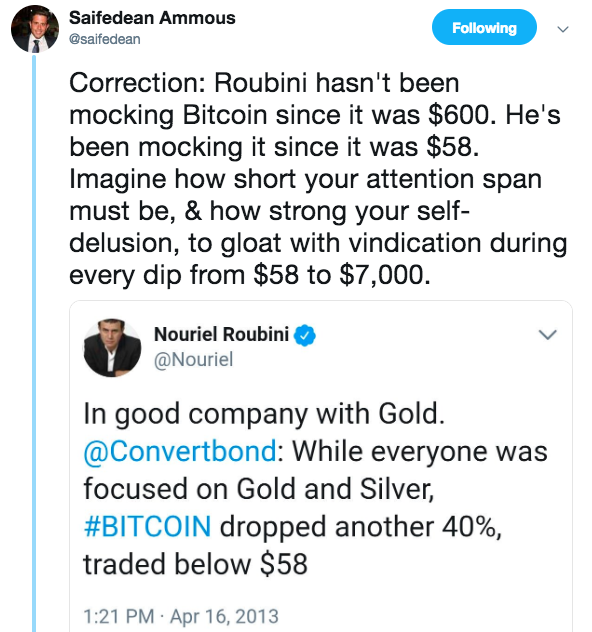

The biggest issue with the mining death spiral case is that we’ve seen this before. The narrative was first entertained on Bitcointalk forums as early as 2011. More recently, there was a resurgence in the ASIC era with the last cycle of Bitcoin mania. As now Messari CTO Dan McArdle noted in a January 28th, 2015 tweet: “What happened to everyone arguing that price-drop -> miners leaving -> systemic incentive fail spiral? Did it not happen after all? #duh”

Of course, while industrialized mining has changed the landscape materially, the fundamental game theory Bitcoin relies on have not. Bitcoin analyst Nic Carter elegantly explains the possibilities:

Before the proposed death spiral, Bitcoin could have an emergency fork to a manually adjusted lower difficulty (to speed up the process to the next natural adjustment). Of course, this is very undesirable and should be considered a last-resort.

The third possibility and likely possibility isn’t covered on Nic’s original chart out of simplicity: when hash rate drops off precipitously in between difficulty adjustments, higher fees can serve as a market-funded incentive to force miners to stay on.

Prior to proclaiming Bitcoin’s demise due to the death spiral, it’s important to understand a few common misconceptions about miners and their relationship with the difficulty adjustment:

- The “break-even cost of mining” is much lower for many miners than is often quoted by analysts (who focus on the average miner). Many of the most profitable miners have a “cost per Bitcoin” (opex + capex) that asymptotically approaches 0. This is the combined result of heavily-subsidized electricity (often free or even negative-cost) and extremely low cost of ASICs for the largest miners, who are often vertically integrated or receive favorable deals from hardware manufacturers.

- Similar to producers in other markets (e.g., traditional commodities), miners have a set of constraints that may rationally force them to mine at a loss — this is a situation accounted for by miners. These constraints include long-term power purchase agreements, hardware purchase agreements, facility leases, and other financial arrangements. With these constraints and strategically-planned cash reserves, miners can mine at a loss for an extended period.

- Contrary to mining other commodities, where mining at a loss results in sustained price suppression (due to increased supply in the market), rational miners want to mine Bitcoin to accelerate the time to the next difficulty adjustment (which more accurately reflects the “real” difficulty of mining). The miners that endure a crypto “bear market” are at a massive competitive advantage, as we saw with miner consolidation in the last market cycle.

The nuances of Bitcoin’s game theory — the fee market, miner incentives, etc. — are often mis-understood and mis-represented with appeals to narrative, rather than historicism and pragmatic analysis.

Be better than the narrative. Disclosure: Arjun Balaji is an analyst, engineer, and technical advisor to The Block. He founded Shomei Capital and holds bitcoin.

Beware of Lazy Research: Let’s Talk Electricity Waste & How Bitcoin Mining Can Power A Renewable Energy Renaissance

Bitcoin mining update — Part 2 of 2

By Christopher Bendiksen

Posted December 6, 2018

This is part 2 of a 2 part series

- Part 1 An Honest Explanation of Price, Hashrate & Bitcoin Mining Network Dynamics

- Part 2 Beware of Lazy Research: Let’s Talk Electricity Waste & How Bitcoin Mining Can Power A Renewable Energy Renaissance

If you’re reading this, then perhaps you’ve read the latest CoinShares Research report on the bitcoin mining network, my previous commentary on creation costs, or even better: both!

Or maybe you haven’t read either and came straight for the hot sauce.

Either way, at this point you probably haven’t missed it: the hottest narrative in the anti-Bitcoin playbook is the environmentalist attack on Proof-of-Work (PoW) consensus algorithms. Exhibit A:

Oh dear…

Oh dear…

While it’s encouraging that Bitcoin detractors are clearly running out of ideas, it is nevertheless a powerful narrative — especially for younger generations whose future prosperity not only rests on the reintroduction of sound money, but also on a relatively benign global climate.

Thus we feel compelled to address this narrative with data and methodologies that hold up against both internal and external scrutiny. In our view, this is more than can be said for most (not all) of the research underpinning the narrative that we hope to debunk, once and for all.

Bitcoin is boiling the oceans!

You’ve surely heard it. Where did this idea originate?

As with many dubious claims, it shouldn’t come as a surprise that much of it is underpinned by a single, leisurely researched source: Digiconomist.

In fact you’d be hard pressed to find many articles in the press pushing the environmentalist, anti-PoW narrative that do not link back to that one source. But hey, can you really blame them in today’s sound bite media environment? Research is hard and time consuming.

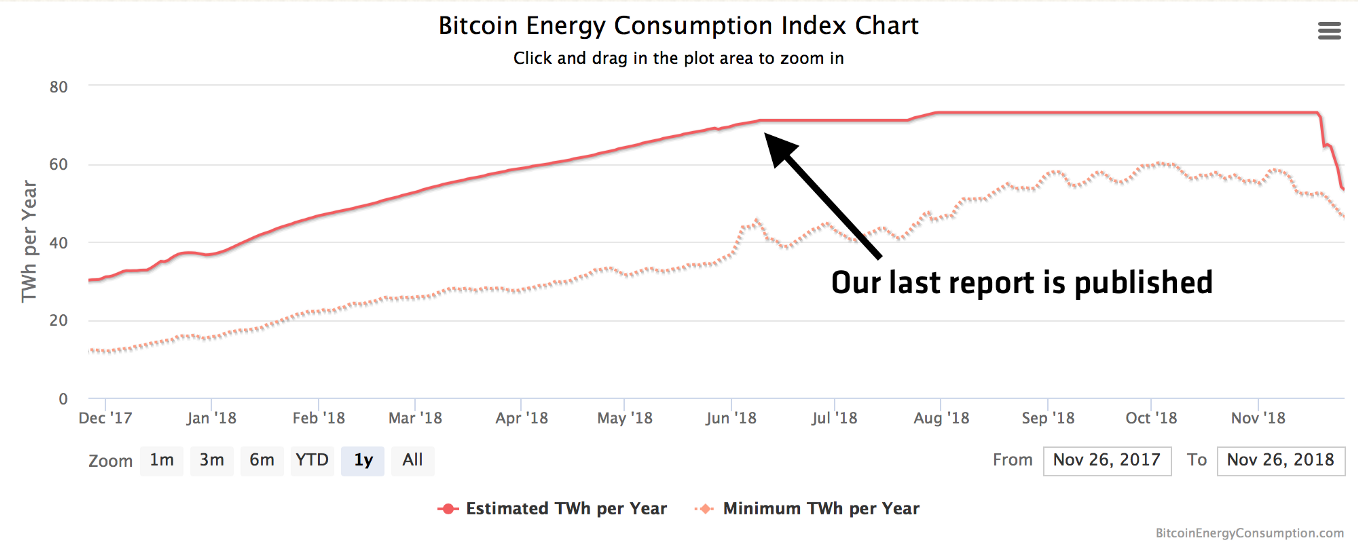

Without spending too much time on Digiconomist, I cannot avoid pointing out that within days of releasing our last mining report — which offered a more granular methodology for estimating the total power draw of bitcoin miners — and after being called out in no uncertain terms by Nic Carter on Twitter, the Bitcoin Energy Consumption Index on the website mysteriously flatlined even though the hashrate continued growing. Strange.

Screenshot of the Digiconomist website.

Screenshot of the Digiconomist website.

I also need to give some praise here though: it takes courage to admit you were wrong. I respect that.

For any journalists who happen to read this — please consider your sources before treating their unsubstantiated opinion as fact in your coverage!

The typical anti-PoW argument

So let’s reconstruct the environmentalist argument, which usually goes something like this:

A1 — Bitcoin mining is highly energy intensive.

A2 — The vast majority of bitcoin miners are located in China.

A3 — Bitcoin miners in China are mostly using dirty, coal-based power.

C1 — Bitcoin mining has a comparatively extreme carbon footprint.

C2 — Bitcoin is bad.

The first assumption is true, we all know that. It’s one of the fundamental reasons the Bitcoin network is so incredibly secure!

The second assumption used to be true, and is still not that far from the truth — but it’s inaccurate nonetheless. (For the sake of this post we’ll call it true, because it doesn’t really matter all that much.)

The third assumption however, is false, which ruins both conclusions.

How do we know that? Because unlike certain other frequently cited sources, we actually did the research. And to be clear, this was grueling, backbreaking research.

As of writing, we’ve now spent over a year getting to the bottom of this claim, and it wasn’t easy by any measure.

We’ve talked to everyone that would talk to us, and pestered those that wouldn’t. Rejections left and right. Our mining analyst Samuel Gibbons has trawled every forum, every message board, every channel, every press release, every public company release and every news article we could find. Some in English, many in Chinese.

So I completely understand the temptation to use hypothetical top-down assumptions for these calculations, I really do. Especially if it fits a certain narrative that one wants to push. I mean, if it looks like it could make sense, who would actually take the time to check, right?

Well, we did check and feel confident that this assumption has been soundly proven wrong. As such, we hope the assertiveness is scaled back a few notches while the methodologies are revisited and more work invested in the process.

And while we’re on the subject, we’ll be the first to admit — our results likely have significant error margins (although we chose to use assumptions that should place us at the conservative end of this margin and not the other way around). We would appreciate any additional efforts directed towards double- and triple-checking these conclusions.

Poor research — whether the result of lazy ignorance or outright dishonesty — works to everyone’s detriment. We need higher quality research in this space.

The reality of Bitcoin’s energy mix

Bitcoin mining is mainly driven by renewable energy — hydro (by far the largest component), solar, wind and geothermal. Period.

In fact, we’ve estimated the lower bound of renewables penetration in the bitcoin mining energy mix to be 77.6%.

We actually think it’s significantly higher than that, but in the name of defensible conservatism, we won’t say what that number is.

Everyone seriously involved in bitcoin mining already knows this — and has known for years — but it’s been surprisingly hard to quantify so we’ve kept our heads down in case we were all somehow wrong. The mining industry is notoriously secretive which makes it exceptionally tough to find or extract quality data.

So how’d we do it?

First, we decided to turn the commonly employed top-down methodology on its head and go bottom-up instead.

This means that instead of picking a single or couple mining units and using their specs as a proxy for the entire network — essentially pretending the entire network is simply a multiple of the same unit(s) — we went the other way around and figured out approximately how many units of each mining hardware exist in the current network .

Over the last year we painstakingly assembled a model of all mining gear produced in quantities exceeding 1000 units. We collected performance specs, volume weighted average purchase prices, batch sizes and total deployment numbers.

From that dataset we calculated that the bitcoin mining network currently draws approximately 4.7 GW, or 41tWh on an annualised basis.

At the time of writing, this figure is falling — and has been since late September. The estimate also includes a 20% excess for cooling, a figure we consider highly conservative.

For reference, there are approximately 85m PlayStation 4, 40m Xbox One and 15m Nintendo Wii U consoles distributed among global households (see our report for full list of sources). Their weighted average gameplay power draw is approximately 120W.

Assuming these gaming systems are played on a modern 40’’ LED TV drawing only 40W, for 4 hours a day, and idling for 20 hours a day, at a weighted average of 10W, they alone draw more power (4.9GW) than the entire bitcoin mining network.

This doesn’t even consider the renewables penetration in their energy mix, which assuming they are globally distributed, is a measly 18.2%.

As Dan Held would implore: somebody call the electricity police!

Here’s another one for ya.

Here’s another one for ya.

You were talking about renewables though?

I was indeed. This was a tough nut to crack. And while we searched and prayed for shortcuts to quantify the renewables penetration in the energy mix of miners, there is none. So we had to do it manually.

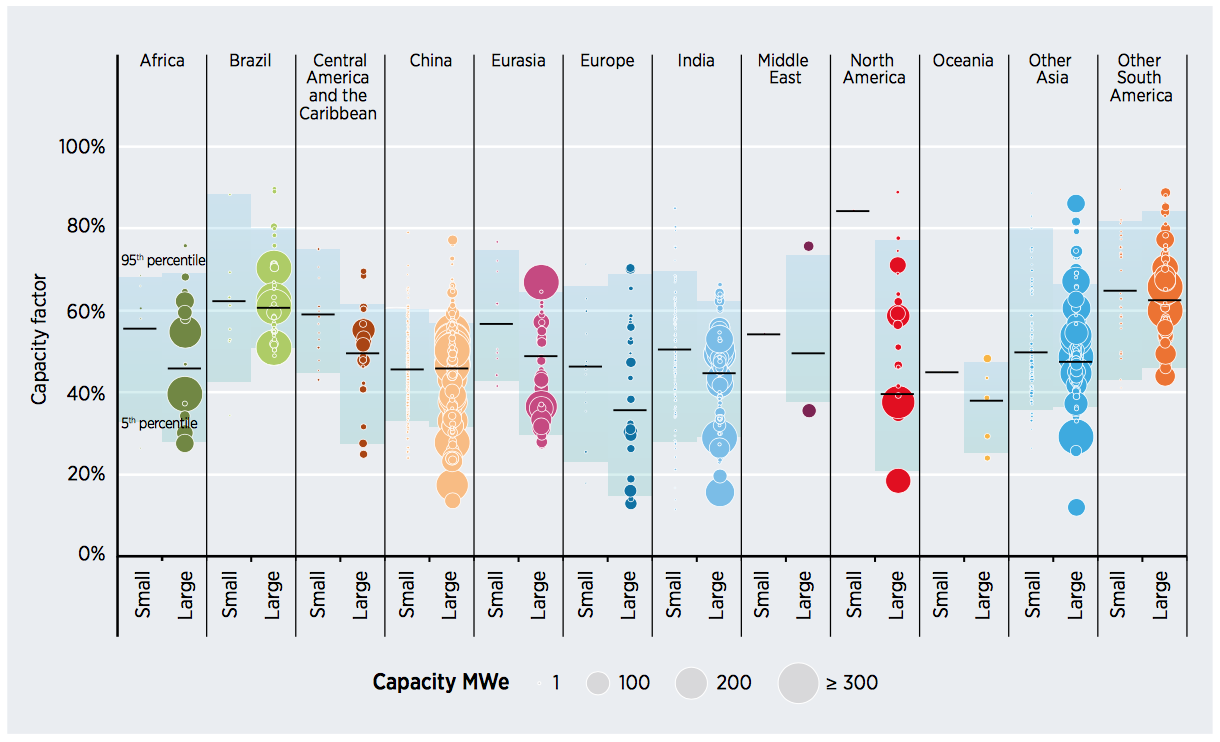

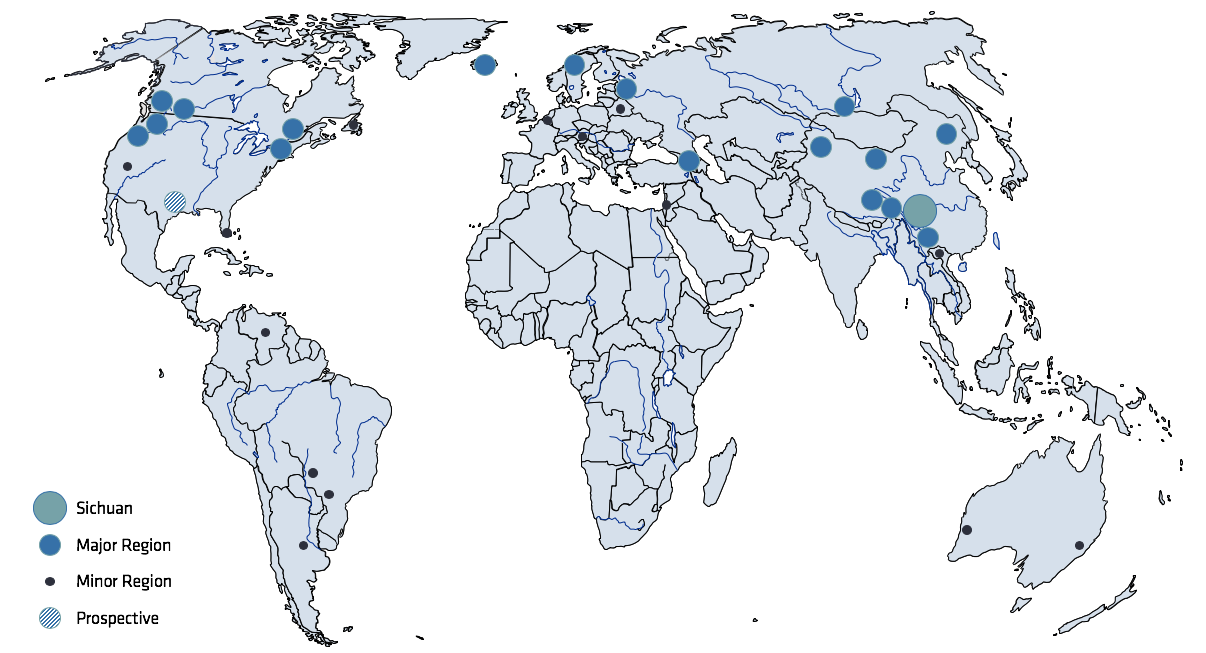

Over that same year, we also mapped out every relevant global mining region. The result looks like this (full source list in the report):

We then teamed up with some friends at Three Body Capital, who were able to source provincial-level curtailment rates and renewables penetrations in China. We combined this with publicly available renewables data for the non-Chinese regions and thus were able to arrive at a lower bound for the renewables penetration. What did we find?

Not only does the Bitcoin network consume much less power than its detractors claim, it is mainly driven by renewables — 77.6% lower bound versus global avg. of 18.2%

By inference, Bitcoin is therefore ‘cleaner’ than almost every other industry.

(I know I keep saying this, but for a full overview of our numbers and figures, please check out the paper itself)

Doesn’t this just displace other demand onto fossil electricity?

The short answer: for wind and solar, possibly — but this is only if miners that rely on them wish to mine 24/7 and are located in fossil-dependent regions(miners like that might exist, but are rare in the industry).

For hydro, this is much less of a concern. And here’s why:

In reality, there is really no clean separation between electricity sources on the grid. Overly simplified*, every producer contributes their production to the same grid, from which all demand is drawn.

(*Sidebar — this is not technically true as there are often incompatible and/or semi-isolated grids operating in areas that you would assume were economically integrated from an electricity standpoint)

Assuming this was the case for simplicity’s sake, then you could argue that Bitcoin simply displaces other competing demand onto fossil fuels.

While this may seem reasonable on the surface, in reality it is not so straightforward. The reasons for this are slightly complicated, but it roughly comes down to a matter of geography and physics.

I will restrict this discussion to hydro power as this is the largest component of global renewables generation and an even bigger component of Bitcoin mining. Most of this also applies to geothermal power which suffers from many of the same geographical issues as hydro.

Working with nature

Hydro power, while awesome, comes with the enormous drawback that you cannot build it wherever you want.

This should be obvious. The most productive hydropower is often found where there’s a combination of powerful rivers in mountainous terrain or highlands. Most humans, however, live in lowlands where it’s easier to grow food.

Fossil fuel power plants are therefore built close to the population centres they are intended to serve. Hydro plants, on the other hand, must be built where nature produces the prerequisite conditions to sustain them, which is often far away from demand centres.

This issue persists in China, the US, Siberia, Scandinavia, and Central South America: the best areas for hydro development is simply not where most people actually live.

For example, in the United States most hydro power is generated in — you guessed it — the mountains. More specifically, it is largely produced in the Columbia River basin of the Pacific North West, which according to the EIA, provided 44% of all hydroelectric power in the US in 2012.

Americans, however, do not tend to live in the mountains — they live predominantly on plains in California, around the Gulf of Mexico, Mississippi Basin and along the East Coast.

This causes a problem. You simply cannot transmit electricity from the Pacific Northwest to California, Texas, or the East Coast while maintaining the same cost profile.

Why not?

Whenever electricity is sent through a medium, electrical resistance will cause the medium to heat up while consuming some of the electrical power (unless the medium is a superconductor). This is how incandescent light bulbs and many electrical heaters work — it is also the reason your computer gets hot.

The EIA lists transmission losses for High Voltage Direct Current (HVDC) lines at 3% per 1000 km, versus 7% per 1000 km for High Voltage Alternating Current (HVAC) lines.

HVAC is cheaper than HVDC and is normally used for short distances, whereas the latter is more expensive and used for longer distances. Lest you get the wrong idea though, they are both expensive, just one even more so than the other. Also, transmitting power over long distances often involves a bit of both.

HVDC lines act as ‘superhighways’ of power transmission and run along certain highly trafficked routes, while HVAC ‘access roads’ connect them to the wider region. Further driving up the cost — nobody wants them nearby. They’re ugly, and some people believe they cause all sorts of exotic pathological conditions.

The best locations for hydro plants are not necessarily well-connected to this transmission network—or even anywhere near it — and there are other factors limiting the economic viability of building new transmission lines such as mountain ranges or national parks. This makes remote power plants particularly vulnerable to transmission losses.

Transmission losses effectively increase the cost of electricity as you transport it away from its source.

Electricity prices can be seen as a spectrum, increasing as you move further away from its sources. The cheapest price is always right at the power plant, which is precisely why Bitcoin miners cluster as close to their sources as possible.

Stranded hydro

Often then, before hydro power can reach large population centres, transmission losses can make its price rise above that of competing fossil or nuclear power plants.

The net effect is that a significant amount of hydro power becomes stranded,meaning some of its potential output cannot be sent to demand centres while retaining a competitive price.

While this is unfortunate from an environmental standpoint, consumers tend to prefer cheap electricity to expensive electricity (for obvious reasons).

We can gain some insight to the overall usage of already installed hydro power plants by looking at their capacity factors._According to the International Renewable Energy Agency, global hydro capacity factors between 2010 and 2016 were 49%, meaning that global hydro plants _on average produced at less than half of their capacity.

Now this does not necessarily mean that out of the total global installed hydro power capacity of 1,121 GW, more than half is wasted (for comparison, remember that the Bitcoin network currently draws 4.7 GW, or 0.4% of that).

Plants may be built to accommodate variable daily demand peaking with human waking hours, or seasonal supply of water peaking with cyclical rainy seasons. This is also one of the reasons we chose to use annual net power produced — not installed capacity — in our calculations, as the latter skews the numbers in favour of renewables.

Wasted hydro

That being said, there are still multiple sources that do suggest that enormous amounts of hydro power is actually wasted (by simply letting water flow over the dams) every year.

The magnitude in China alone is staggering. According to Reuters, citing the provincial governor Ruan Chengfa, in Yunnan Province alone 30 TWh of hydro power is wasted every year. Again, the entire Bitcoin mining network draws an annualised approximate 41 TWh at current rates.

Things are not much better in neighbouring Sichuan — home of an estimated 42% of all Bitcoin hashpower — where another Reuters article explains that the province’s total hydro capacity of 75 GW (versus Bitcoin’s 4.7 GW draw), is more than double the capacity of its grid! The implication being that power on the order of hundreds of TWh are wasted every year.

By the way, if you’re curious how this economic quagmire came to be, first consider the information asymmetry between central planning committees and the distributed free market; then go read this excellent pieceby our colleagues at BitMEX Research.

But wait, there’s more

I’ll preface by saying that we have not been able to conclusively prove this thesis (yet), but it has been postulated by other researchers and deductive reasoning suggests it is indeed true.

While there is anecdotal evidence supporting it (sources in report) and we would prefer harder proof before we claim this to be conclusive, consider the following:

Because bitcoin mining is highly mobile compared to overall power demand, it might actually be a boon for global stranded renewables. Whereas traditional industrial and residential power demand is largely geographically captive — be it by proximity to cities, resources, transport links or whatever other factors determine the location of such entities — bitcoin mining can be undertaken pretty much anywhere.

As discussed above, nature-driven energy production is necessarily bound to where natural energy sources are located. Unlike fuel-based generation, they cannot be placed wherever demand is strongest and fuel can be sourced. This is important for two reasons.

- High voltage grids are expensive to construct, which means they are only economically viable if the size of the generating plant(s) is large enough. The farther away the power plant is, the more expensive the grid connection will be.

- Long-range energy transmission incurs losses for producers as a significant percentage of the electricity is lost to heat dissipation during grid transmission. This effect worsens with distance.

Combined, these two factors have a dampening effect on renewable energy development. Rivers, deserts and windy spots are where they are and cannot be moved. Building up renewables projects to the necessary scale required for grid connection is capital intensive and often prohibitively risky if unconnected to cornerstone demand.

This means that some of our most promising sources of renewable energy remain untapped due to their remote locations.

Again, this energy is effectively stranded.

We also see this problem in projects that are already built. For various reasons, many renewables projects today are significantly under-utilised. Most often because: (a) they are located far away from large demand centres; (b) previous cornerstone clients have moved or shut down; or (c) the anticipated demand never materialised as hoped.

These projects generate electricity supplies in excess of demand, which forces down the price of excess supply, especially immediately around the power plant .

Such projects act as magnets for bitcoin miners. Unlike traditional industries, bitcoin mining is highly mobile and both can and must move to wherever power is cheap. All miners need is an internet connection and roads in — almost all modern power generation developments have both.

Bitcoin mining can thus serve as the cornerstone demand for the lowest cost renewables, wherever they may be. This both reduces the need for government subsidies and increases profitability.

Increased profitability makes reinvestment more attractive, which in turn can increase the scale of projects. Larger scale projects may then enable grid connection.

As soon as these projects are connected to legacy industries or retail demand, they will tend to bid prices up closer to regular market prices and bitcoin miners will be forced to move on to the next project.

Bitcoin mining is a relentless race to the lowest electricity costs and therefore — as explored by Dan Held and Nic Carter — acts as an electricity buyer of last resort.

In this manner, bitcoin mining — which offers the possibility of immediate electricity monetisation independent of grid connection — can play a vital part in the renewables development cycle.

The Takeaways

- Contrary to what you’ve heard in the media, bitcoin mining is not an environmental disaster. In fact, it is one of the cleanest billion-dollar industries on the planet.

- The combined total bitcoin mining network draws less power than global gaming consoles running 4 hours per day.

- Bitcoin mining is mainly powered on renewable energy, at levels more than four times higher than the global average (>77.6% vs ~ 18.2%).

- Every year, enough hydro power is wasted in Yunnan and Sichuan alone to power the Bitcoin mining network many times over.

- Bitcoin miners are highly mobile and can therefore serve as cornerstone demand for low-cost stranded renewables.

- By increasing profitability and lowering reliance on subsidies, bitcoin mining can positively contribute to the development and scaling of renewable energy projects wherever conditions are the most favourable.

Disclaimer

Please note that this Blog Post is provided on the basis that the recipient accepts the following conditions relating to the provision of the same (including on behalf of their respective organisation).

This Blog Post does not contain or purport to be, financial promotion(s) of any kind.

This Blog Post does not contain reference to any of the investment products or services currently offered by members of the CoinShares Group.

Digital assets and related technologies can be extremely complicated. The digital sector has spawned concepts and nomenclature much of which is novel and can be difficult for even technically savvy individuals to thoroughly comprehend. The sector also evolves rapidly.

With increasing media attention on digital assets and related technologies, many of the concepts associated therewith (and the terms used to encapsulate them) are more likely to be encountered outside of the digital space. Although a term may become relatively well-known and in a relatively short timeframe, there is a danger that misunderstandings and misconceptions can take root relating to precisely what the concept behind the given term is.

The purpose of this Blog Post is to provide objective, educational and interesting commentary. This Blog Post is not directed at any particular person or group of persons. Although produced with reasonable care and skill, no representation should be taken as having been given that this Blog Post is an exhaustive analysis of all of the considerations which its subject matter may give rise to. This Blog Post fairly represents the opinions and sentiments of its author at the date of publishing but it should be noted that such opinions and sentiments may be revised from time to time, for example in light of experience and further developments, and the blog post may not necessarily be updated to reflect the same.

Nothing within this Blog Post constitutes investment, legal, tax or other advice. This Blog Post should not be used as the basis for any investment decision(s) which a reader thereof may be considering. Any potential investor in digital assets, even if experienced and affluent, is strongly recommended to seek independent financial advice upon the merits of the same in the context of their own unique circumstances.

This Blog Post is subject to copyright with all rights reserved.

Thanks to CoinShares.

Skeptic’s Guide to Bitcoin: Bitcoin and the Promise of Independent Property Rights

A framework for skeptics, part 3

By Su Zhu and Hasu

Posted December 13, 2018

This is part 3 of a 4 part series. See additional articles below

- Part 1 Skeptic’s Guide to Bitcoin: An Honest Account of Fiat Money

- Part 2 Skeptic’s Guide to Bitcoin: Unpacking Bitcoin’s Social Contract

- Part 3 Skeptic’s Guide to Bitcoin: Bitcoin and the Promise of Independent Property Rights

- Part 4 Skeptic’s Guide to Bitcoin: Investing in Bitcoin

Photo by Thought Catalog on Unsplash

Photo by Thought Catalog on Unsplash

In the second part, we showed how Bitcoin is a novel social and economic institution. But the question remains: Who is going to use it? Is there a place for Bitcoin among other institutions, and if so, where is it? Is Bitcoin just a terribly inefficient competitor to PayPal and Visa, like the media wants you to believe, or something more?

To put Bitcoin on the map with other institutions, let us first understand why humanity built social institutions in the first place.

Humans don’t scale. Sure, we can learn, but we can’t upgrade our brains and bodies like we can upgrade the hard drives and processors in our computers and machines. In fact, our physical and mental capacities have remained virtually unchanged since we roamed the earth as hunter-gatherers. Instead, we scale through cooperation. All scientific breakthroughs, all increases in productivity and prosperity, can be traced back to our ability to cooperate with each other.

Cooperation has a Scaling-Problem

But because our world is fundamentally uncertain, cooperation doesn’t come easy for us. We spend massive amounts of efforts on predicting how other people are going to react to our actions, and if those actions could affect us negatively.

When we can’t reliably predict the behavior of others, our lives become a prisoner’s dilemma. Should we cooperate with someone else to hunt down a stag, or stick to a rabbit which we could hunt alone? How can we trust him not to hit us over the head with a club and steal the stag? The path for humanity to “scale” and prosper is to find a way to break these prisoner dilemmas and cooperate anyway.

Game theory gives us two solutions to the prisoner’s dilemma. The first is to turn the one-time-game into a repeated (or “iterated”) game. If you and your potential hunting partner meet again tomorrow, you are more likely to behave, as each of you has to worry about the other’s retaliation. But such repeated social interactions — or experience — are only possible with a limited group of people at the same time, as proposed by the anthropologist Robin Dunbar.

Dunbar’s number is a suggested cognitive limit to the number of people with whom one can maintain stable social relationships. It’s proponents assert that numbers larger than this generally require more restrictive rules, laws, and enforced norms to maintain a stable, cohesive group.

Cooperation through Institutions

The second rule, which Dunbar alludes to, is to “tie our own hands” and restrict ourselves from taking negative options that could hurt others. One such way is by adopting a shared morality and making sure these rules are socially enforced. But for groups that exceed Dunbar’s number, we need institutions.

The most basic of all institutions is a monopoly of violence. By empowering a specialized group of people to a focus on protecting your town, you can more easily engage in productive enterprises because you don’t have to worry if you can protect the fruits of those enterprises. Establishing a strong and benevolent monopoly on violence also strengthens the shared morality and formalize it to a formal legal system. The rules become more credible, after all, if there is a party strong enough to overpower any individual and make sure no one is “above the law”.

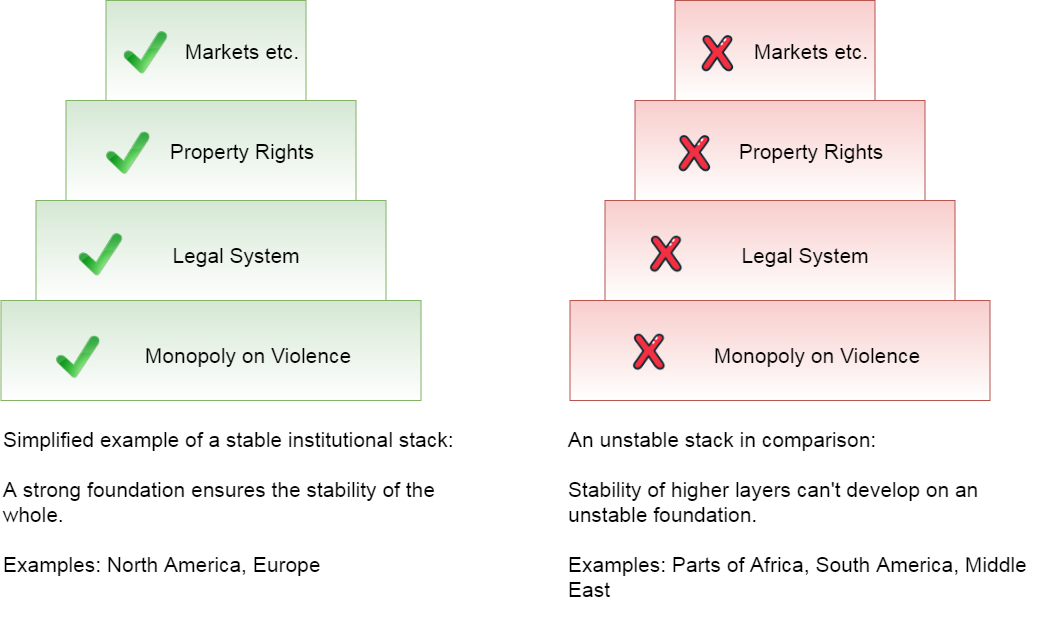

On the shoulders of the monopoly on violence and the legal system, rests the most important institution of all: the right to private property. A private property system, protected by the state, gives you the exclusive right to your own resources and to use them as you see fit. Research has found that prosperity and property rights are inextricably linked.

Property Rights

Having well-defined and strongly protected property rights is the basis for all higher institutions: Markets are match-making systems between buyers and sellers that allow for specialization and the division of labor, while money allows for the creation of accurate price signals to producers and consumers.

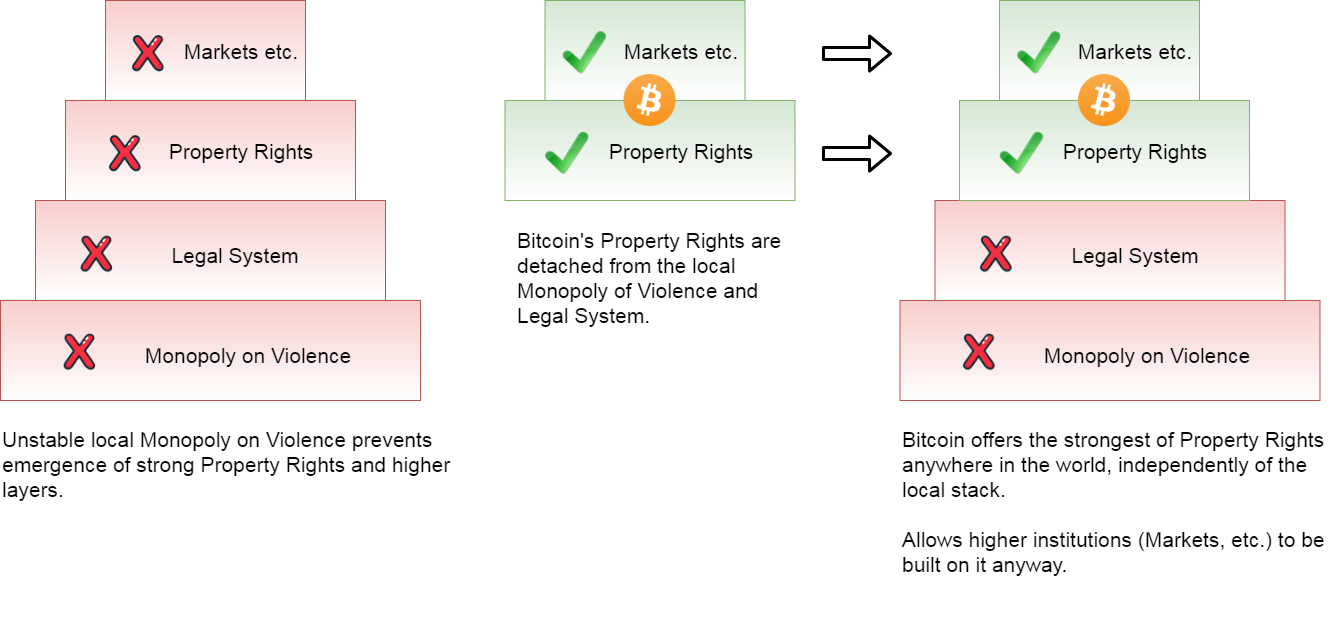

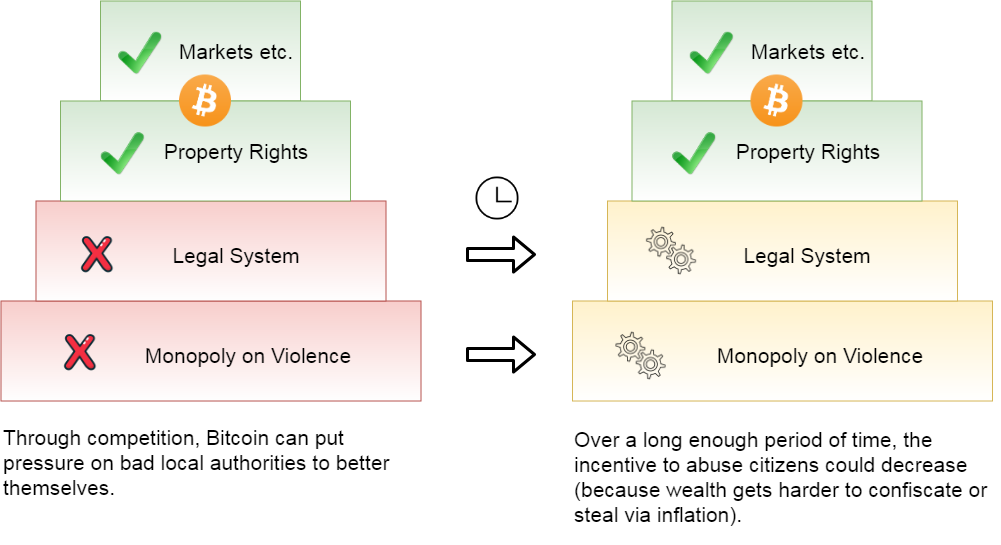

We need a monopoly on violence to have a legal system, and we need a legal system to have property rights. We need property rights to have markets and firms, and we need markets and firms to have capitalism. It is through the invention of new institutions, each building on the existing ones, that civilization advances. Here is a simplified image of the institutional stack:

By streamlining human interactions, social institutions break the prisoner’s dilemma and have us worry less about being harmed by others. The resulting increase of mutual predictability allows us to extend our trust to strangers and enable cooperation beyond Dunbar’s number.

The Bitcoin Institution

If we see bitcoin as a novel institution, which rights does it unlock? Let’s remember the rules of the Bitcoin social contract: Anyone can use the bitcoin network without permission (no censorship) and only he who owns money can spend it (no confiscation). Further, there is no central party that can print more money ahead of schedule and steal purchasing power from others (no inflation). Finally, anyone can verify that the rules are being followed before they accept a payment (no counterfeiting).

Do these rules stand the test of reality? In his excellent paper “How Bitcoin functions as property law”, Eric D. Chason states that “Satoshi Nakamoto has created a form of property that can exist without relying on the state, centralized authority, or traditional legal structures.”

I will go one step further and say that the bitcoin network, and, by extension, its money token enable the highest form of property rights of any socio-economic institution in the history of man.

A New Era in Property Rights

That is the key innovation of Bitcoin: It detaches property rights from the legal system and the monopoly on violence. For the first time, we can have property that does not rely on a local authority to enforce and protect. It is easy to conceal, defend, divide, move, and verify — all by yourself, granting you the highest level of personal sovereignty.

Property rights used to depend firmly on other layers of the social institution stack, specifically the monopoly on violence and the legal system. If the bottom of this stack is shaky, you cannot have strong property rights. But because Bitcoin stands entirely on its own, it can bring the highest level of property rights to anyone in the world, no matter the quality of their lower-level institutions, the government or legal system.

Bitcoin unlocks a different dimension of value. In the same way that boats unlocked transport over water, and airplanes through the air, Bitcoin unlocks a new, alternate layer to store and move value — as the first native digital asset. It is the ability to exist solely in that digital world, from which Bitcoin derives all of its properties. It cannot be attacked in the physical space the way that physical assets can.

The implications of this will only reveal themselves over time, but we can already speculate who bitcoin maybe be tremendously useful for:

- Anyone living in places with weak local property rights

- Anyone subject to discrimination from the existing financial system

- Anyone living in places with a weak local currency, with high (risk of) inflation

- Anyone looking to store or move meaningful amounts of value (the highest value requires the highest amount of security)

Using Bitcoin gives these people the ability to cooperate more effectively, increase their productivity and, as a result, their prosperity. It allows them to save money for the future, to build capital that can be invested in more productive enterprises and let them partake in global trade with others all around the world.

Progress through Competition

Bitcoin can also benefit those who never use it. As a hedge against central bank error, it makes the global financial system more resilient. Ironically, it can also improve other monetary and property systems around the world. What? Yes, that is the effect that competition has on a market. If you are a customer of Apple, you benefit from Samsung releasing a new phone, because it forces Apple to improve the quality of their product to stay competitive.

As a result, we could witness a quality improvement in monetary and property systems, because bitcoin opened the door for competition and created a market. This also shapes our understanding of what Bitcoin is NOT: a competitor to VISA or PayPal. It competes with local governments, legal systems and property rights — the fundamental layers of the existing stack — not with the payment processors that sit on top of it.

Civilization scales through cooperation, but cooperation between strangers is inherently hard. Social institutions can solve this prisoner’s dilemma and allow us to cooperate on a larger scale. At the bottom of the stack, we need a stable and benevolent monopoly on violence, to enforce the rules of the legal system and establish property rights. Until now, it was impossible to have strong property rights in places with a weak local government. Bitcoin does not depend on the existing system in any way and can give us the highest form of property rights, no matter who and where we are.

Acknowledgments

I want to thank Yassine Elmandjra, Nic Carter and Miles Suter for their contributions.

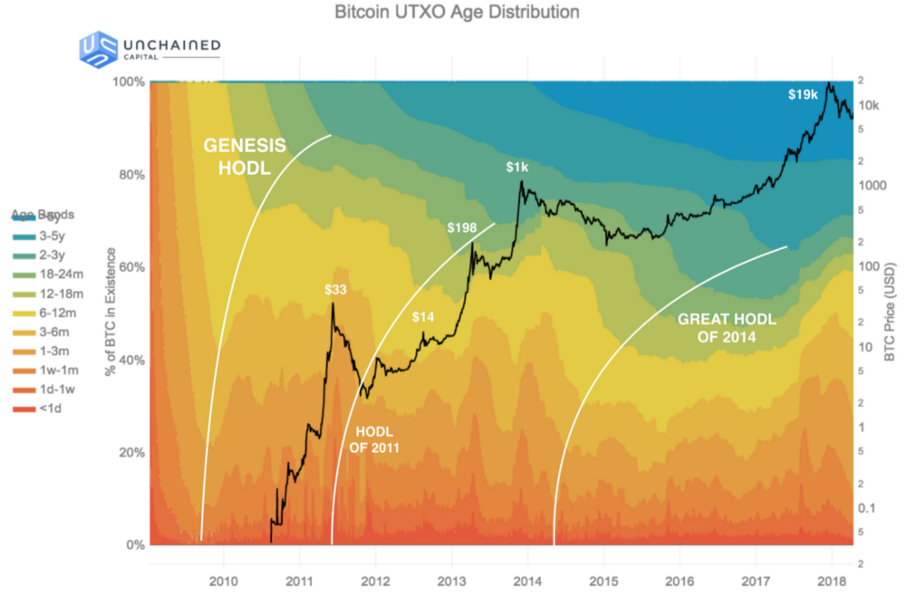

Introducing Realized Capitalization

By the Coinmetrics Team

Posted December 14, 2018

The motivation for the creation of Realized Cap was the realization that “Market Capitalization” is often an empty metric when applied to cryptocurrencies. Market Capitalization, borrowed from the world of equities, is calculated for cryptocurrencies as

circulating supply * latest market price

However, unlike with equities, large fractions of cryptocurrencies tend to get lost, go unclaimed, or become otherwise inert through bugs. By design, there is no Depository Trust and Clearing Corporation which keeps track of everyone’s stock certificates. So when tokens or virtual coins get lost, they stay lost. In Bitcoin, this means that roughly 15% of supply is assumed to be permanently lost and out of circulation. Market Cap does not consider these nuances, instead aggregating the value of all coins ever mined and assessing them at the last market price.

We wanted to create a measure that reflected this, at least for UTXO chains. Our design goals were as follows:

- De-emphasize lost coins

- Where possible, maximize generalizability (so reduce reliance on idiosyncratic adjustments)

- Do not deviate from Market Cap by more than a single order of magnitude

The eureka moment came when Pierre Rochard asked for data on a historically-weighted UTXO market cap for Bitcoin. This was mentioned to Coinmetrics engineer Antoine Le Calvez, who figured out an appropriate methodology and also dubbed it “Realized Capitalization.” (It was previously called “Effective Cap”.) Realized Cap seemed to fit the bill:

- It reduces the contemporary impact of long-lost coins

- It is trivially generalizable to UTXO chains, and, with some effort, generalizable to account chains

- It doesn’t deviate from Market Cap by too much

- It is automated: it doesn’t require (much) human oversight or intervention

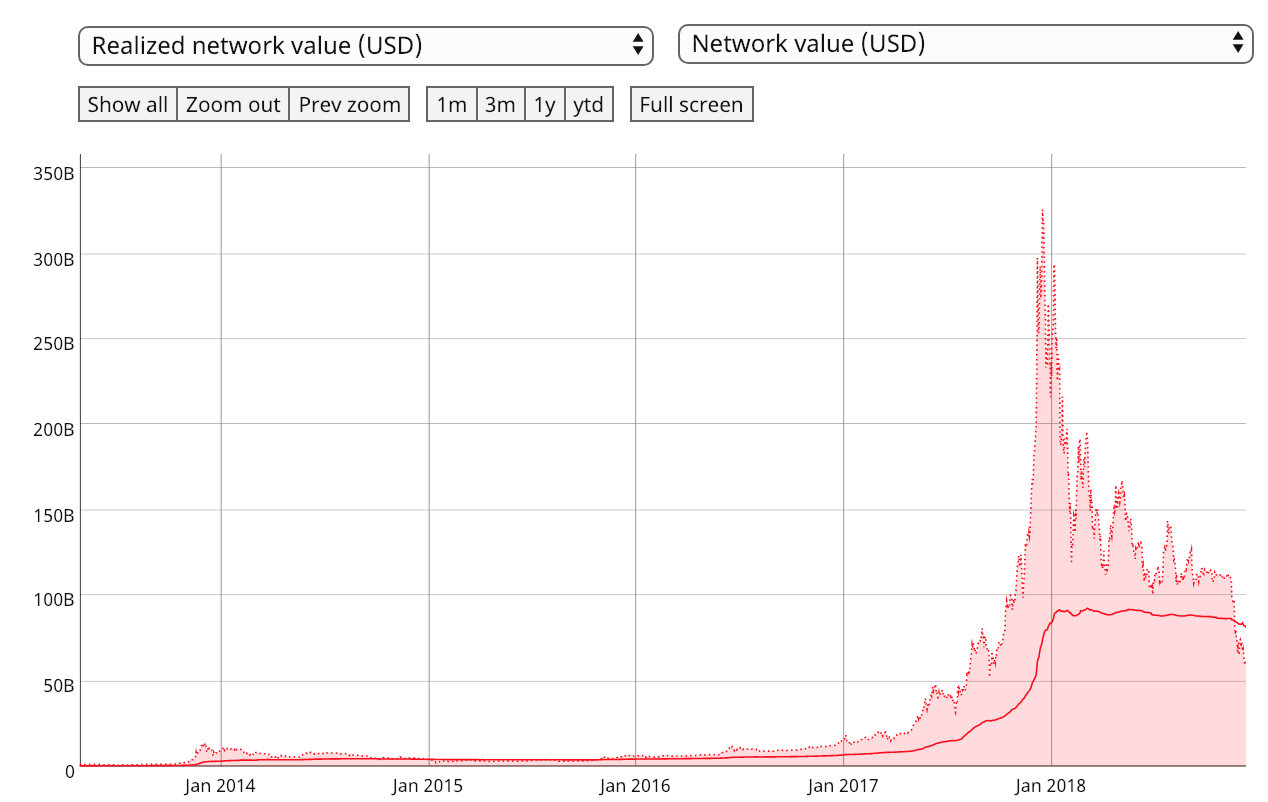

When we first worked out the numbers in September, Bitcoin’s Market Cap was $115 billion and its Realized Cap $88 billion. That seemed to make sense. Deriving new metrics from scratch is always tricky, so they need to pass the smell test too. Realized Cap seemed to do just what it said on the tin: weight coins according to their actual presence in the Bitcoin economy. It is one of a new generation of economic measures which hybridizes market and on-chain data.

Of course, exotic new measures are not without risks. There are a few challenges here: dealing with deep-cold-storage coins, interpreting Realized Cap for coins with little turnover, and generalizing it to account based coins.

First, imagine Satoshi’s ~ 700k-1m coins really were just in deep storage, and our dear leader was planning on spending them all on Bitcoin’s 10th birthday – Jan. 03 2019. In that case, Realized Cap would be seriously underweighting the economic weight of Bitcoins in circulation, since it prices those long-lost coins at 2009 values… of $0 per BTC. Realized Cap has a hard time differentiating between truly lost/abandoned coins and coins that are merely in yearslong deep cold storage. However, even the coldest of storage schemes do require periodic awakenings – to renew a multisig scheme, to take advantage of a fork, or to cash out a portion. So many of these accounts will have some amount of churn anyway.

Another issue is Realized Cap on smaller chains. Outside of the industry “blue chips,” there are many chains with relatively little turnover. This poses a challenge for Realized Cap, as it is the sending of new coins that triggers the upwards (or downwards) revaluation at a new price. One common phenomenon we observed was price spikes, with many coins getting sent back and forth to exchanges, and an increase in Realized Cap, followed by a slow, low-velocity grind down where Realized Cap hardly moves. In this case the high Realized Cap was more of an artifact of the low turnover rather than a fair reflection of the network’s pricing.

So how is Realized Cap calculated?

The realized cap attempts to improve on the market cap by trying to discount coins that might be lost. Its crux is to value different part of the supplies at different prices, instead of using the daily close as market cap does.

For UXTO coins, this consists in valuing outputs at the price at the time of their creation. For example, for a UTXO currency of supply 10 and market price of $10, its market cap would be $100. But if the UTXO set is as follows:

| Value | Time of creation | Price at time of creation | USD Value at time of creation |

|---|---|---|---|

| 8.3 | 2009-02-01 | $0.00 | $0.00 |

| 1.2 | 2011-03-17 | $1.00 | $1.20 |

| 0.5 | 2018-11-15 | $10.00 | $5.00 |

Its realized cap would be $0.00 + $1.20 + $5.00 = $6.20 or 6.2% of its market cap as 83% of the supply hasn’t moved for years.

Extension to account based chains

Extending this metric to account based coins is a bit more complex. Instead of a list of unspent coins, the state in this case is represented as a list of accounts:

| Account | Balance |

|---|---|

| 0xabc | 8.3 |

| 0xdef | 1.2 |

| 0xfad | 0.5 |

Compared to the UTXO model, it is not possible to always assign a time of creation to a balance which makes assigning it a price, and thereby a value, hard.

Let’s take an example transaction history for an account and see what methods can be used to accurately value its balance. We’ll assume the current time is 2018-11-01 and the market price is $150.00

| Time | Change in balance | Price at time | Balance |

|---|---|---|---|

| 2015-08-01 | +1,000.00 | $0.01 | 1000.00 |

| 2016-02-01 | +100.00 | $10.00 | 1100.00 |

| 2017-05-01 | -50.00 | $50.00 | 1050.00 |

| 2017-12-17 | -100.00 | $1200.00 | 950.00 |

| 2018-04-01 | +20.00 | $200.00 | 970.00 |

From this data, several approaches can be used to value the balance:

Last movement price

We use the price at the last movement on the account: here $200.00, this gives a realized balance of $194,000.

This values accounts when they are active at all on the network. However, if someone sends dust to a lost account, its whole balance is re-valued at the current market price.

Last outgoing movement price

To avoid lost accounts being re-valued when someone sends money to them, we can use the price of the last time it had an outgoing movement (defaulting to the creation of the account if no outgoing payment).

In our case, this price is $1200.00, the realized balance would be $1,164,000.

Virtual UTXO

One downside of using the last movement price is that an account which has a very high balance and sends a tiny amount out would trigger a re-valuation of the whole balance at market price.

While it’s the desired effect (after all, we just want to discount lost coins), it is unfair to UTXO based chains where the whole balance of an address is not taken into account for the realized cap, but just the coins used.

To reduce this undesirable effect, we can simulate a UTXO set for account based systems:

- each incoming payment creates a new coin attached to the account, the coin is valued at the price of the movement

- each outgoing payment triggers a coin selection on the coins attached to the account, the change is valued at the current market price

Let’s replay the example account’s history while maintaining this virtual UTXO, the coin selection we’ll use is largest coins first:

| Time | Change in balance | Price at time | Balance | Virtual coins | Realized balance |

|---|---|---|---|---|---|

| 2015-08-01 | +1,000.00 | $0.01 | 1000.00 | (1000.0 at $0.01) | $10.00 |

| 2016-02-01 | +100.00 | $10.00 | 1100.00 | (1000.0 at $0.01), (100.00 at $10.00) | $1,010.00 |

| 2017-05-01 | -50.00 | $50.00 | 1050.00 | (100.00 at $10.00), (950.00 at $50.00) | $48,500.00 |

| 2017-12-17 | -100.00 | $1200.00 | 950.00 | (100.00 at $10.00), (850.00 at $1200.00) | $1,021,000.00 |

| 2018-04-01 | +20.00 | $200.00 | 970.00 | (100.00 at $10.00), (850.00 at $1200.00), (20.00 at $200.00) | $1,025,000.00 |

This gives this account a realized balance of $1,025,000.

Using Realized Cap on Coinmetrics

Right now, Realized Cap is only available for UTXO chains – we are still refining it for account-based chains.

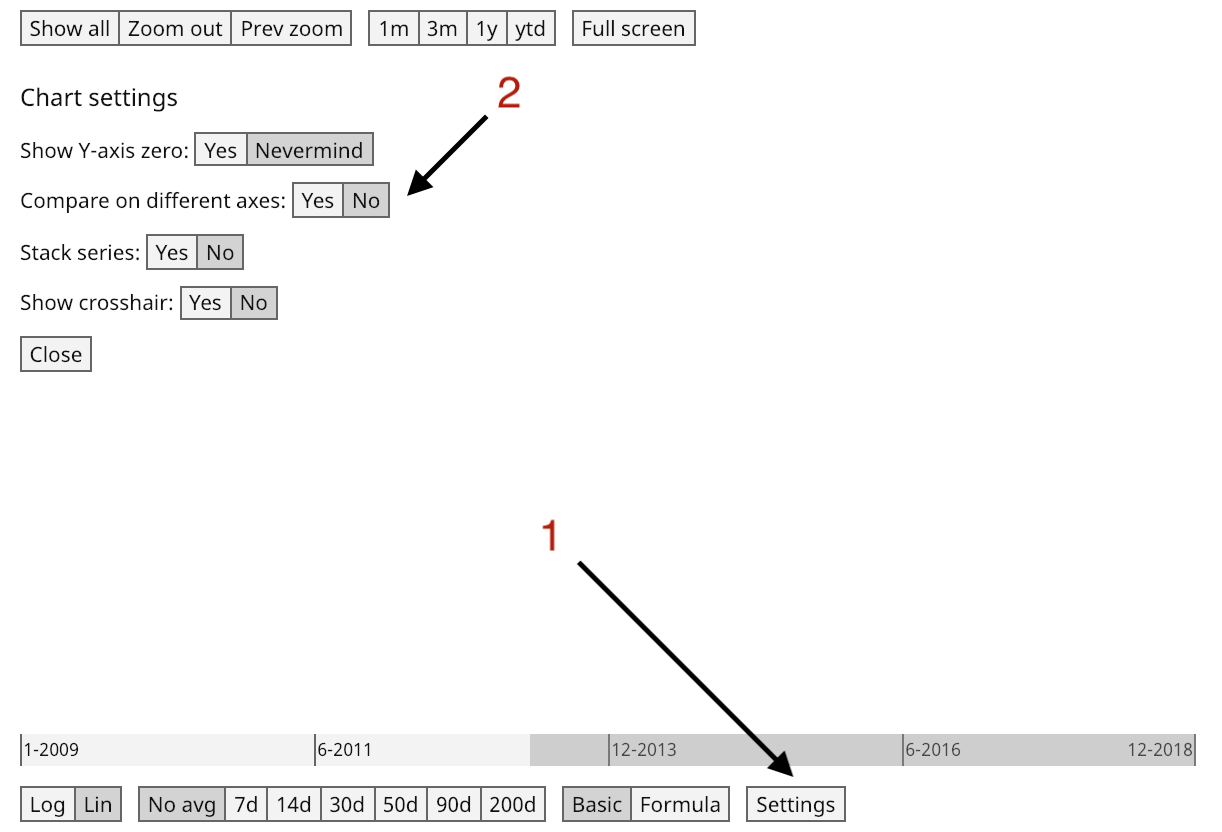

For charting, you can find it on the chart as Realized Network Value (in keeping with our naming convention of using “Network Value” rather than Market Cap). If comparing Realized Cap to Market cap, we recommend hitting settings and selecting no on Compare on different axes.

This lets you create nice comparisons like this:

Bitcoin realized network value (solid red line) and network value (shaded area). Link here Keep in mind that on our charts builder page, the command for realized cap is

Ticker.realizedCapUsd

You can also create a ratio of the two.

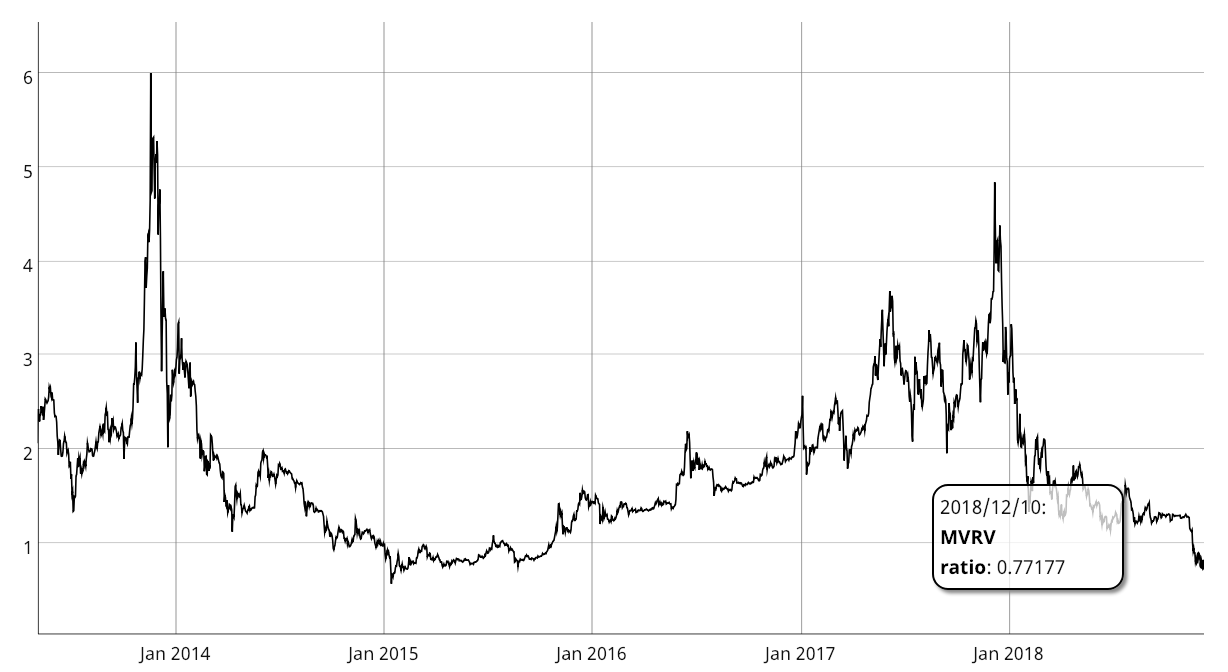

Market cap to realized cap ratio The reasoning behind the ratio has been explored by Murad Mahmudov and David Puell here.

Market cap to realized cap ratio The reasoning behind the ratio has been explored by Murad Mahmudov and David Puell here.

Who Controls Bitcoin Core?

By Jameson Lopp

Posted December 15, 2018

The question of who controls the ability to merge code changes into Bitcoin Core’s GitHub repository tends to come up on a recurring basis. This has been cited as a “central point of control” of the Bitcoin protocol by various parties over the years, but I argue that the question itself is a red herring that stems from an authoritarian perspective — this model does not apply to Bitcoin. It’s certainly not obvious to a layman as to why that is the case, thus the goal of this article is to explain how Bitcoin Core operates and, at a higher level, how the Bitcoin protocol itself evolves.

The History of Bitcoin Core

Bitcoin Core is a focal point for development of the Bitcoin protocol rather than a point of command and control. If it ceased to exist for any reason, a new focal point would emerge — the technical communications platform upon which it’s based (currently the GitHub repository) is a matter of convenience rather than one of definition / project integrity. In fact, we have already seen Bitcoin’s focal point for development change platforms and even names!

- In early 2009 the source code for the Bitcoin project was simply a .rar file hosted on SourceForge. Early developers would actually exchange code patches with Satoshi via email.

- On October 30 2009, Sirius (Martti Malmi) created a subversion repository for the Bitcoin project on SourceForge

- In 2011, the Bitcoin project migrated from SourceForge to GitHub

- In 2014 the Bitcoin project was renamed to Bitcoin Core

Trust No One

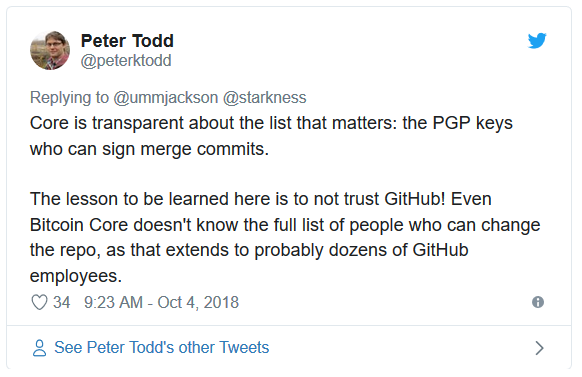

While there are a handful of GitHub “maintainer” accounts at the organization level that have the ability to merge code into the master branch, this is more of a janitorial function than a position of power. If anyone could merge into master it would very quickly turn into a “too many cooks in the kitchen” scenario. Bitcoin Core follows principles of least privilege that any power bestowed to individuals is easily subverted if it is abused.

From an adversarial perspective, GitHub can not be trusted. Any number of GitHub employees could use their administrative privileges to inject code into the repository without consent from the maintainers. But it’s unlikely that a GitHub attacker would also be able to compromise the PGP key of a Bitcoin Core maintainer.

Rather than base the integrity of the code off of GitHub accounts, Bitcoin Core has a continuous integration system that performs checks of trusted PGP keys that must sign every merge commit. While these keys are tied to known identities, it’s still not safe to assume that it will always be the case — a key could be compromised and we wouldn’t know unless the original key owner notified the other maintainers. As such, the commit keys do not provide perfect security either, they just make it more difficult for an attacker to inject arbitrary code.

The Keys to the Kingdom

At time of writing, these are the trusted PGP fingerprints:

71A3B16735405025D447E8F274810B012346C9A6 133EAC179436F14A5CF1B794860FEB804E669320 32EE5C4C3FA15CCADB46ABE529D4BCB6416F53EC B8B3F1C0E58C15DB6A81D30C3648A882F4316B9B CA03882CB1FC067B5D3ACFE4D300116E1C875A3D

These keys are registered to:

Wladimir J. van der Laan <laanwj@protonmail.com> Pieter Wuille <pieter.wuille@gmail.com> Jonas Schnelli <dev@jonasschnelli.ch> Marco Falke <marco.falke@tum.de> Samuel Dobson <dobsonsa68@gmail.com>

Does this mean that we are trusting these five people? Not quite. Keys are not a proof of identity — these keys could potentially fall into the hands of other people. What assurances do you really get if you run the verify-commits python script?

python3 contrib/verify-commits/verify-commits.py Using verify-commits data from bitcoin/contrib/verify-commits All Tree-SHA512s matched up to 309bf16257b2395ce502017be627186b749ee749 There is a valid path from “HEAD” to 82bcf405f6db1d55b684a1f63a4aabad376cdad7 where all commits are signed!

The verify-commits script is an integrity check that any developer can run on their machine. When executed, it checks the PGP signature on every single merge commit since commit 82bcf405… in December 2015 — over 3,400 merges at time of writing. If the script completes successfully, it tells us that every line of code that has been changed since that point has passed through the Bitcoin Core development process and been “signed off” by someone with a maintainer key. While this is not a bulletproof guarantee that no one has injected malicious code (a maintainer could go rogue or have their keys stolen), it reduces the attack surface for doing so enormously. What are maintainers and how did they attain this role? We’ll dig into that a bit later.

Layered Security

The integrity of Bitcoin Core’s code must not rely solely upon a handful of cryptographic keys, which is why there are a multitude of other checks in place. There are many layers of security here to provide defense in depth:

Pull Request Security

- Anyone is free to propose code changes to improve the software by opening a pull request against the master branch on bitcoin/bitcoin.

- Developers review pull requests to ensure that they are not harmful. Anyone is free to review pull requests and provide feedback — there is no gatekeeper or entrance exam when it comes to contributing to Bitcoin Core. If a pull request gets to the point that there are no reasonable objections to it being merged, a maintainer makes the merge.

- Core maintainers set this pre-push hook to ensure that they don’t push unsigned commits into the repository.

- Merge commits are optionally securely timestamped via OpenTimestamps

- The Travis Continuous Integration system regularly runs this script to check the integrity of the git tree (history) and to verify that all commits in the master branch were signed with one of the trusted PGP keys.

- Anyone who wants to can run this script to verify the PGP signatures on all of the merge commits going back to December 2015. I ran it while writing this article and it took 25 minutes to complete on my laptop.

Release Security

- Gitian deterministic build systems are run independently by multiple developers with the goal of creating identical binaries. If someone manages to create a build that doesn’t match the builds of other developers, it’s a sign that non-determinism was introduced and thus the final release isn’t going to happen. If there is non-determinism, developers track down what went wrong, fix it, then build another release candidate. Once a deterministic build has succeeded then the developers sign the resulting binaries, guaranteeing that the binaries and tool chain were not tampered with and that the same source was used. This method removes the build and distribution process as a single point of failure. Anyone with the technical skills can run their own build system; the instructions are here.

- Once the Gitian builds have completed successfully and been signed off by the builders, a Bitcoin Core maintainer will PGP sign a message with the SHA256 hashes of each build. If you decide to run a prebuilt binary, you can check its hash after downloading and then verify the authenticity of the signed release message with the hashes. Instructions for doing so can be found here.

- All of the above is open source and auditable by anyone with the skills and desire to do so.

- Finally, even after going through all of the above quality and integrity checks, code that is committed into Bitcoin Core and eventually rolled into a release is not deployed out onto the network of nodes by any centralized organization. Rather, each node operator must make a conscious decision to update the code they run. Bitcoin Core deliberately does not include an auto-update feature, since it could potentially be used to make users run code that they didn’t explicitly choose.

Despite all of the technical security measures that are implemented by the Bitcoin Core project, none of them are perfect and any of them can theoretically be compromised. The last line of defense for the integrity of Bitcoin Core’s code is the same as any other open source project — constant vigilance. The more eyes that are reviewing Bitcoin Core’s code, the less likely that malicious or flawed code will make it into a release.

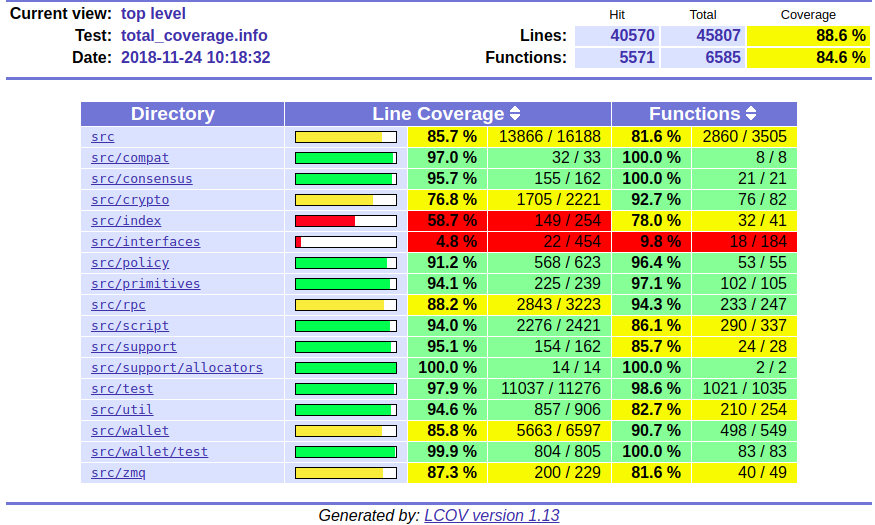

Code Coverage

Bitcoin Core has a lot of testing code. There is an integration test suite that runs against every PR and an extended test suite that runs every night on master.

You can check the code coverage of the tests yourself by:

- Cloning the Bitcoin Core GitHub repository

- Installing the required dependencies for building from source

- Running these commands

- Viewing the report at ./total_coverage/index.html

Alternatively, you can view the coverage report Marco Falke hosts here.

Code Coverage Report

Code Coverage Report

Having such a high level of test coverage means that there is a higher level of certainty that the code functions as intended.

Testing is a big deal when it comes to consensus critical software. For particularly complex changes, developers sometimes perform painstaking mutation testing — that is, they test the tests by purposely breaking the code and seeing if the tests fail as expected. Greg Maxwell gave some insight into this process when he discussed the 0.15 release:

“The test is the test of the software, but what’s the test of the test? The software. To test the test, you must break the software.” — Greg Maxwell

Free Market Competition

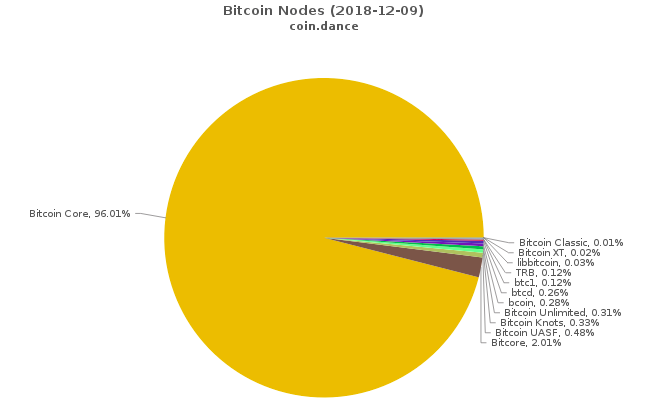

BitMEX wrote a great article about the ecosystem of Bitcoin implementations. There are over a dozen different Bitcoin compatible implementations, and even more “competing network” implementations. This is the freedom of open source — anyone who is dissatisfied with the efforts of the Bitcoin Core project is free to start their own project. They can do so from scratch or they can fork the Core software.

At time of writing, 96% of reachable Bitcoin nodes are running some version of Bitcoin Core. Why is this the case? How can Bitcoin Core have near-monopoly status over the network of nodes if the effort required to switch to another software implementation is minimal? After all, many other implementations provide RPC APIs that are compatible with, or at least highly similar to Bitcoin Core.

I believe that this is a result of Bitcoin Core being a focal point for development. It has orders of magnitude more developer time and talent backing it, which means that the code produced by the Bitcoin Core project tends to be the most performant, robust, and secure. Node operators don’t want to run the second best software when it comes to managing money. Also, given that this is consensus software and the Bitcoin protocol does not — and arguably can not — have a formal specification because no one has the authority to write one, it’s somewhat safer to use the focal point implementation because you’re more likely to be bug-for-bug compatible with most of the rest of the network. In this sense, the code of the development focal point is the closest thing to a specification that exists.

Who Are the Core Developers?

People who are unfamiliar with the Bitcoin Core development process may look at the project from the outside and consider Core to be a monolithic entity. This is far from the case! There are frequent disagreements between Core contributors and even the most prolific contributors have written plenty of code that has never been merged into the project. If you read the guidelines for contributing you may note that they are fairly loose — the process could be best described as “rough consensus.”

Maintainers will take into consideration if a patch is in line with the general principles of the project; meets the minimum standards for inclusion; and will judge the general consensus of contributors.

Who are the Bitcoin Core maintainers? They are contributors who have built up sufficient social capital within the project by making quality contributions over a period of time. When the existing group of maintainers believes that it would be prudent to extend the role to a contributor who has exhibited competence, reliability, and motivation in a certain area, they can grant commit access to that person’s GitHub account. The lead maintainer role is for someone who has oversight over all aspects of the project and is responsible for coordinating releases. It has been voluntarily passed along over the years:

- Satoshi Nakamoto: 1/3/09 -2/23/11

- Gavin Andresen:2/23/11 -4/7/14

- Wladimir van der Laan:4/7/14 — present

Acting as a Bitcoin Core maintainer is often referred to as janitorial work because maintainers don’t actually have the power to make decisions that run contrary to the consensus of contributors or of the users. However, the role can be quite taxing due to the extra attention from the ecosystem at large. For example, Gregory Maxwell gave up his maintainer role in 2017 for personal reasons, likely due to the public pressure he experienced during the scaling debate. Wladimir wrote a thoughtful post about the stress of being a Core maintainer and why it was appropriate to remove Gavin’s commit access, which upset a lot of people.

Similarly, when Jeff Garzik was removed from the GitHub organization, he and others were upset about it, but he had not contributed to Core in two years. Leaving his GitHub account with write access to the repository was providing no benefit to the project — it was only creating a security risk and violated the principle of least privilege to which Wladimir referred in his post.

Others may look at Core and believe it to be a technocracy or ivory tower that makes it difficult for new entrants to join. But if you speak to contributors, you’ll find that’s not the case. While only a dozen people have had commit access over the years, hundreds of developers have made contributions. I myself have made a few small contributions; while I don’t consider myself a “Core developer” I technically am one. No one can stop you from contributing!

One of the most difficult things for people to wrap their mind around seems to be that the focal point for Bitcoin development is not simply the structure that is defined by the Bitcoin Core GitHub account. While Bitcoin Core has some structure (it uses centralized communications channels in order to coordinate), the project itself is not subject to being controlled by any of its participants — even those who have escalated privileges on the GitHub repository. While it is technically possible for a maintainer-organized coup to hijack the GitHub repository, censor dissenting developers, and perhaps even maintain the brand name of “Bitcoin Core,” the result would be that Bitcoin Core would stop being the development focal point. Developers who disagreed with the actions of the maintainers would simply fork the code and shift their work to a different repository over which the Bitcoin Core maintainers had no administrative privileges.

Even absent a “coup” per se, if a controversial change did somehow make it into Core, some developers would fork the software, remove the controversial change, and make it available for users. You could argue that this is exactly what happened when Amaury Sechet forked Bitcoin Core and removed the Segregated Witness functionality to create Bitcoin ABC. Alternatively, if Core rejects proposed changes that some people want, developers can fork it and add those changes. This has happened many times, such as when:

- Mike Hearn forked Core to create Bitcoin XT

- Andrew Stone forked Core to create Bitcoin Unlimited

- Jeff Garzik forked Core to create BTC1

Forking the code is easy. Shifting the focal point of Bitcoin development is hard — you must convince contributors that their time is better spent contributing to a different project.

It’s also hard to convince many people that users do not blindly follow Bitcoin Core’s changes — this may be a self reinforcing belief, because if users don’t participate in the consensus process by staying aware of their options, they are ceding some of their power to developers. However, the power of the users was exercised during the UASF (User Activated Soft Fork) movement of 2017. An anonymous Bitcoin developer using the pseudonym shaolinfry proposed BIP 148, which would force miners to activate Segregated Witness functionality at a block height that would occur near August 1. However, BIP 148 proved to be too controversial to be adopted by Bitcoin Core, so shaolinfry forked Core and made “Bitcoin UASF” software available. This software implementation gained a nontrivial amount of traction and seemed to create sufficient pressure to convince miners to adopt BIP 91 to activate the fork before the BIP 148 deadline.

In my opinion the best Bitcoin Core contributors are those who practice extreme ownership. Case in point — while John Newbery did not write the code that contained this particular consensus bug, he feels responsible for not preventing it from being merged via careful review and for not finding it later while writing test cases.

We are all Satoshi.

Visualization of Bitcoin Core development

Contributing to Bitcoin Core

It can feel daunting to start contributing to Core, though there are plenty of resources available to help aspiring developers. The guidelines for contributing can be found here though you may wish to start off with Jimmy Song’s gentle introduction:

Core developer Eric Lombrozo also penned a piece about understanding how changes take place within the Core repository:

Alex B. wrote an excellent article about the philosophy behind Bitcoin development — anyone who wants to become a serious contributor can save themselves a lot of time by reading this.