Cryptocurrency: The Canary in the Coal Mine

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Cryptocurrency: The Canary in the Coal Mine

What Crypto Can Tell Us About Macro Markets in 2019

By Jill Carlson

Posted Jan 1, 2019

Over the last quarter, the market has rejected risk assets across the board in a sudden reversal of the year’s trend. The S&P 500 erased its 9% gain over a matter of weeks in October. The Nasdaq index retraced from an 18% gain to end the year down 5%.

But no market has felt more pain recently than that of cryptocurrencies. The aggregate market cap of cryptocurrencies, which topped out at $830 billion last January, has since crumbled to $130 billion. Much of this unwind has occurred only in the last two months, with the crypto market as a whole getting marked down over 40% quarter-to-date.

The cryptocurrency market is admittedly miniscule relative to other asset classes. Cryptocurrency (no matter how big the drawdown) is unlikely to have any impact on broader markets any time soon. Bitcoin has demonstrated no substantial correlation to any other asset, whether equities or gold. Nonetheless, what has been happening with this nascent asset class over the last year may reveal some important macro trends.

Two years ago, at the end of 2016, the cryptocurrency market stood at $15 billion in value. Trading volumes across all cryptocurrencies hovered in the double-digit millions. What led to the asymptotic spike in prices over the course of 2017? While it may be possible to point to certain headlines and technology developments as catalysts, most would probably dismiss the phenomenon as a speculative bubble. They may not be wrong in this characterization, but they may also miss the macro context in which all of this occurred.

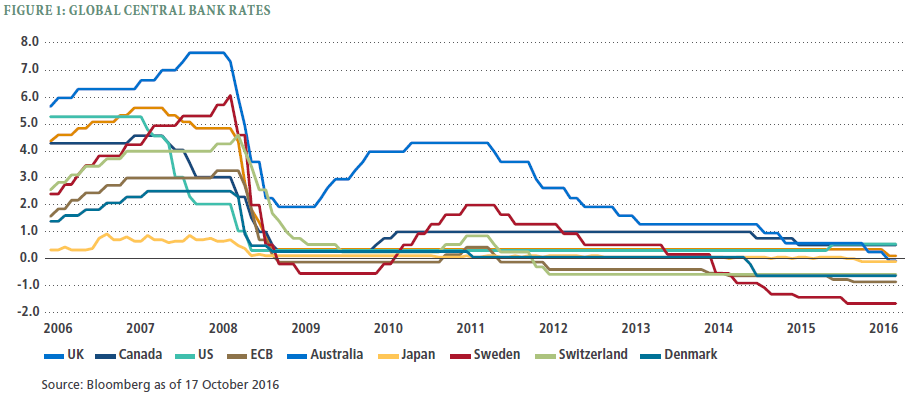

We have seen many search for yield trades play out over the last 8 years. With central banks around the world pumping liquidity into the economy, traditionally risky assets have seen their premiums sucked out of them. Emerging markets stocks, bonds, and currencies have benefited from this trend. High beta equities, most notably in the tech sector, have boomed with the FAANG stocks leading the way. This trend has also driven money further out along the risk spectrum into alternative asset classes, ranging from art to cars to venture capital.

With rates like these, who needs hedges? Image from Pimco’s 2016 Negative Interest Rate Report. https://global.pimco.com/en-gbl/resources/education/investing-in-a-negative-interest-rate-world

With rates like these, who needs hedges? Image from Pimco’s 2016 Negative Interest Rate Report. https://global.pimco.com/en-gbl/resources/education/investing-in-a-negative-interest-rate-world

The cryptocurrency boom of 2017 may have been the illogical conclusion of this global search for yield. It certainly followed this trend, starting as money poured into the relatively lower beta cryptocurrencies (like bitcoin and ethereum). Over time capital found its way into brand new assets as well, the products of initial coin offerings (ICOs) into which investors dumped an estimated $20 billion in the last year and a half, often with little in the way of investor rights or protections. Talk about “risk on”…

But the story has changed since then. If you bought bitcoin at the peak last December and sold today you would be realizing an 80+% loss. Many of bitcoin’s brethren, including many ICOs, have performed far worse with some cryptocurrencies getting marked down 95+% this year. The last major legs lower of this correction in October and November have coincided with the broader market sell off.

Perhaps cryptocurrency, the last mover on the way up, is the leading indicator of a broader market fall. If the cryptocurrency boom of 2017 was partly the result of the longest expansionary period the economy has seen in a century, perhaps the bursting crypto bubble of 2018 is the canary in the coal mine that the search for yield has run its course.

The recent downturn across asset classes has been blamed on a global growth slowdown, rising interest rates, and continued political uncertainty. Whether this plays out in 2019 remains to be seen, but if it does, it will manifest first as capital leaves what it perceives to be the riskiest assets.