WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the October 2018 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

Money Crypto vs. Tech Crypto

By Erik Torenberg

Posted in October, 2018

Crypto has a bit of a narrative problem.

When talking about Why Crypto Matters and where The Big Opportunity is, people often begin from different assumptions and starting points, and, more importantly, have a different end game in mind, which leads to confusion: investors are unclear what thesis they’re applying to the market, newcomers struggle to follow along, and maximalists spend endless energy trying to convince one group to think like the other, without fully appreciating where they differ (or align!) on first principles.

Let me try to simplify by painting a (very broad) picture of the two main belief systems in the space:

One belief system maintains that the point of cryptocurrency is to redefine how money works by (re-)introducing Sound Money. Let’s call this narrative “Money Crypto”.

Another belief system holds that the real point is to redefine how the internet works by introducing Web 3.0. Let’s call this narrative “Tech Crypto”.

Others call these respective narratives “Bitcoin Maximalism” and “Ethereum Maximalism”, but it’s broader and more expansive than that.

While there’s overlap between these belief systems, to be sure, they have different aims, different approaches, and different philosophical underpinnings – which leads to some of the confusion.

Money Crypto

Money Crypto believes that the goal of all this is the introduction of Sound Money – money with an iron-clad monetary policy that cannot be changed by governments, central-banks, or other entities.

With Sound Money, governments will be forced to behave responsibly because they are no longer able to borrow from tomorrow (via debt/inflation) to finance wars or fund short term political objectives at the expense of long term wealth.

Money Crypto believes that censorship resistant store of wealth is paramount. This may seem strange to us living in the U.S., where we trust our banks and governments (for now!), but much of the world doesn’t have that luxury: People suffer from corrupt governments, currency controls preventing people from covering capital, and currency inflation due to government instability.

Money Crypto believes, naturally, that Bitcoin is superior because it is an un-inflatable, disinflationary, censorship-resistant, fixed-supply asset that can’t be shut down by any government and operates without any trusted-third parties.

The Bitcoin/Bitcoin Cash almost-civil-war over block size doesn’t scare Money Crypto. On the contrary, it gives them more confidence: If it was so hard to change something as small as the block size, it will be nearly impossible to imagine changing something as monumental as money supply

Money Crypto believes that, of all currently existing cryptocurrencies, Bitcoin has the best chance of being sound money. It has the “immaculate conception” effect: an anonymous, uninvolved founder and no central entity; It’s got the first-mover advantage; It has the greatest lindy effect; It has the highest market cap; Most liquidity; Most credible monetary policy and scarcity; Best censorship resistance; Best brand; Best durability; Best network effects, etc, etc, etc.

Money Crypto believes that we should treat cryptocurrencies as money – and not as the next app store or the next software platform that captures all of the VC dollars.

Money Crypto believes that the internet is a faulty analogy for studying the nature of money, and that we can instead learn more about the future of cryptocurrency from studying economic history and how monies have emerged over time.

What can we learn exactly? That whenever people control money, they create more of it — insidiously diluting existing money holders in the process.

Money Crypto believes that Ethereum is novel and interesting, but the value it creates (let alone captures!) will be orders of magnitudes smaller than the next money (Bitcoin). All the apps / dApps being built on top of Ethereum will create some value — but it won’t make ETH, the token, a better money. Yes, Ethereum has many more developers, but Money Crypto believes 1 protocol developer is worth 10,000 app developers.

Money Crypto explicitly rejects the Utility Hypothesis, maintaining that digital money will be SOV first, not MOE first.

Value capture is insanely hard in decentralized realm, the logic goes. Indeed: If decentralized applications succeed at removing middlemen and rent seeking behavior — they won’t create revenues, they will destroy them.

Money Crypto is specifically “Bitcoin, not blockchain”. Nearly all Blockchain use cases are not merely unnecessary — they also make the application slower and more expensive.

Indeed: Satoshi used blockchain structure in an extremely specific and deliberate sacrifice of a massive amount of speed & cost in order for us to achieve sovereign level censorship resistance, trustlessness, and greater social scalability.

To summarize: Money Crypto believes The Future of Crypto isn’t software — it’s money.

Crypto isn’t equity. It’s not a website. It’s not a company. And It’s not social media network.

It’s money.

Tech Crypto

Tech Crypto, on the other hand, believes we should study the history of the internet – rather than the history of money – to help us understand how cryptocurrencies will evolve, and how they will usher in the next epoch of the internet, web3.

The narrative goes something like this: Although the internet started as a decentralized and open system, it quickly became centralized and concentrated among 5 players — Google, Amazon, Apple, Facebook, and Microsoft — addicted users, controlled their attention, monetized through advertising, acquired those that compete, and shamelessly copied those who somehow survived.

Far from fulfilling its original vision of decentralizing control, web 2.0 has in fact created power centers that are orders of magnitude larger than anything that preceded the internet. Although the marginal cost of moving packets around on the internet is 0 – and despite the amazing economic gains and consumer surplus that web 2.0 has produced – the social costs have been significant: grotesque inequality, end of privacy, fake news, monopolies, filter bubbles, a threat to democracy, and more.

Tech Crypto believes that the internet will only have increasingly more of a say in how power and wealth is distributed, and fixing the incentives (via cryptonetworks) is one of the most important things we can do, along with enabling consumers to own and control their own data.

Had the token model for network development existed during web 2.0, things could have played out differently:

Tokens provide a way not only to define a protocol, but to bootstrap the operating expenses required to host it as a service.

Tokens power the economic incentives to enable distributed computation – compute, storage, bandwidth – at scale in a decentralized way.

Tech Crypto views tokens as the most salient innovation in human-coordination mechanisms since the invention joint stock corporation centuries ago. Before the joint stock company corporation, businesses had natural limitations. People owned the businesses in their entirety and passed them down to their offspring. There was no liquidity in equity, and therefore businesses could not raise capital.

The advent of joint stock corporations, and more recently publicly traded corporations, has produced incredible businesses that wouldn’t have been possible otherwise. We’ve seen, however, the faults of those same systems:

The joint-stock equity industry model is inefficient at accounting for actual value creation behind online networks, as in, it only rewards employees – not users, contractors, or developers. Value of a share of stock is a function of profits. And profits reflect companies’ ability to monetize data — not the actual worth of the service. When a company reaches a certain size their incentives become misaligned with their users and developers building on top of them.

Tokens also do something else which may enable the disruption of hitherto unbeatable network-effect businesses: they – in theory – incentivize orders of magnitude more people to contribute to the network. This includes all stakeholders — users, developers, contractors, speculators — not just employees. Instead of accruing value by ownership, like equity, network participants accrue value by improving underlying protocol, either by mining, validating, building on top of, or by using the service.

How do you create the next Facebook? Give millions of people upside in its success, the theory goes, instead of just a few hundred.

And it’s not just tokens. Every aspect of blockchain infrastructure becomes a building block for the next developer looking to build something on top of it. This leads to compounding innovation, since every application leads to more possible applications. Just look at standards like ERC721 or 0x turning into memes, leading to more companies starting, which then become building blocks for creating more innovations on top of them.

In contrast, Web 2.0 naturally led to silos and consolidation. Tokens are the fuel that both incentivizes protocol maintenance and development, as well as guarantees enforcement of trust and openness.

Tech Crypto says the blockchain, using the crypto networks described above, will disintermediate all middlemen: Not just all of payments ($500B) but all banks, all social networks, marketplace operators, etc.

Tech Crypto, as you probably guessed, is more bullish on Ethereum. They see BTC as digital gold and Ethereum (or some other smart contract platforms) as the world’s computer, and are eager to build millions of dApps on it.

Tech Crypto says In order for money to be money it needs to be used as money.

Tech Crypto compares blockchain to the early web - people said the web wouldn’t scale either. That it was unnecessary. That it was a toy.

Tech Crypto says that software tends to rewrite the rutles of things it runs into – “software is eating the world” – and crypto is no different.

Tech Crypto says don’t bet against developers.

Which Narrative is Right?

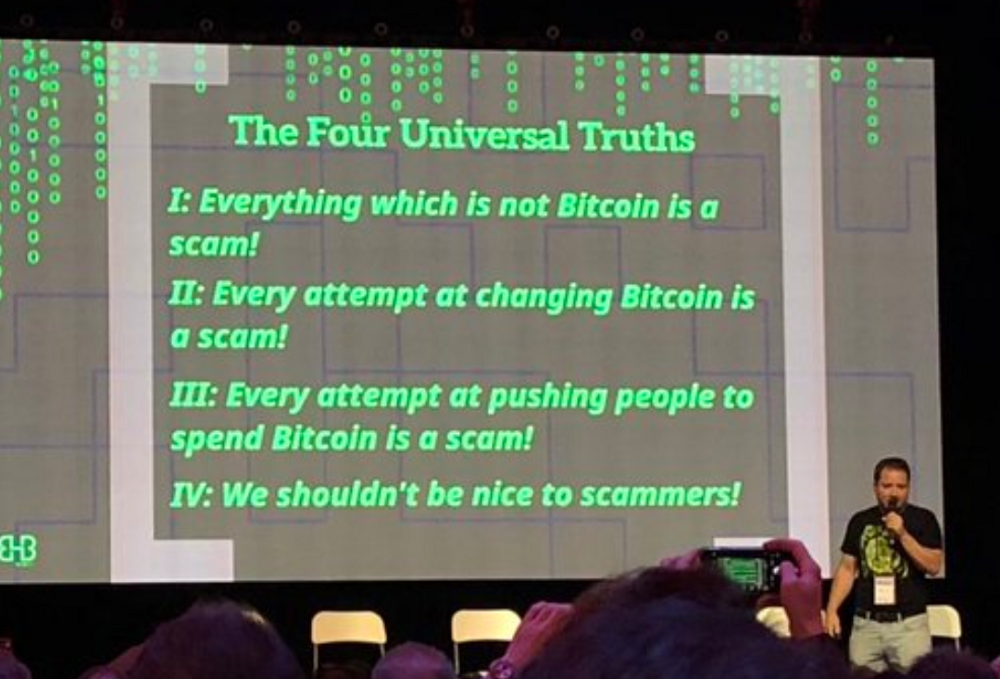

Tech Crypto and Money Crypto in some ways couldn’t be more different – from their beliefs to their vibes. To quote Murad Mahmudov: “Tech Crypto is more gentle, touchy feely social justice-y positive vibe-y hippies. Money crypto is more carnivorous borderline annoying intense uncompromising right wing meat eaters.”

And yet. It’s too early to tell whether either or both of them are right - nor are they mutually exclusive. It’s possible that both are right about the eventual of outcome but merely disagree about the order of operations. There are a lot of people in Tech Crypto who are sympathetic to the Money Crypto narrative: They believe that working to swing the pendulum back towards decentralization is vital, and that tokenization is a powerful mechanism to do so, but also that it’s entirely possible that we haven’t figured out token design yet and that it could be a money token like BTC that we all eventually use (or that there is some much more invisible token swapping thing or that it will be securitized equity style tokens that do it or something else.)

There are also factions that just wildly disagree. Some of Money Crypto believes that Tech Crypto applications will not accrue value, and that the near religious belief in tokens will dissipate when the ICO bubble pops. Some of Tech Crypto believes that the money problems are overstated (Quoting “Why Decentralization Matters “: “For example, it is sometimes said that the reason cryptonetwork advocates favor decentralization is to resist government censorship, or because of libertarian political views. These are not the main reasons decentralization is important”.)

Ultimately, Money Crypto approaches this tech from a largely Austrian economics perspective, looking at at how monetary media have evolved over history and then trying to replicate those same characteristics in digital form (Saifedean Ammous’ The Bitcoin Standard is the manifesto here). Tech crypto, on the other hand, thinks that those historical examples only go so far, because having money wrapped in software creates entirely new paradigms, opens up the design space, and potentially even means that this time around, money will take a much different path than it has historically.

Some of these factions not only disagree, but also think the other as detrimental. Parts of Money Crypto believe that tech crypto is detrimental as it obfuscates the “real value” of crypto – Sound Money – and that ICOs distract developers from working on Bitcoin. There are parts of Tech Crypto that believe that the Money Crypto narrative – and the often aggressive and hostile nature – is turning people away from using or building on top of cryptocurrencies. 1 It’s sort of like the great Slate Star Codex post about group infighting. Take Vegans and Paleo fans, for example. Rationally, you would want both the vegan and paleo people to work on getting people off, say, McDonald’s because either diet is clearly an improvement.

But, in practice, the human dynamics are such that they will not stop fighting with each other precisely because their viewpoints are so similar.

Sound familiar?

Similarly, I’d argue, any animosity between Money Crypto & Tech Crypto is better directed towards their common enemies (central banks, corrupt governments, tech monopolies, etc). I’d go further and say that both belief systems can benefit from each other’s rise.

Without Money Crypto people helping make crypto a good form of currency, Tech Crypto can’t accomplish its goal of letting people get paid for hosting/mining/participating because they need their currencies to be worth something for them to be compelling incentives.

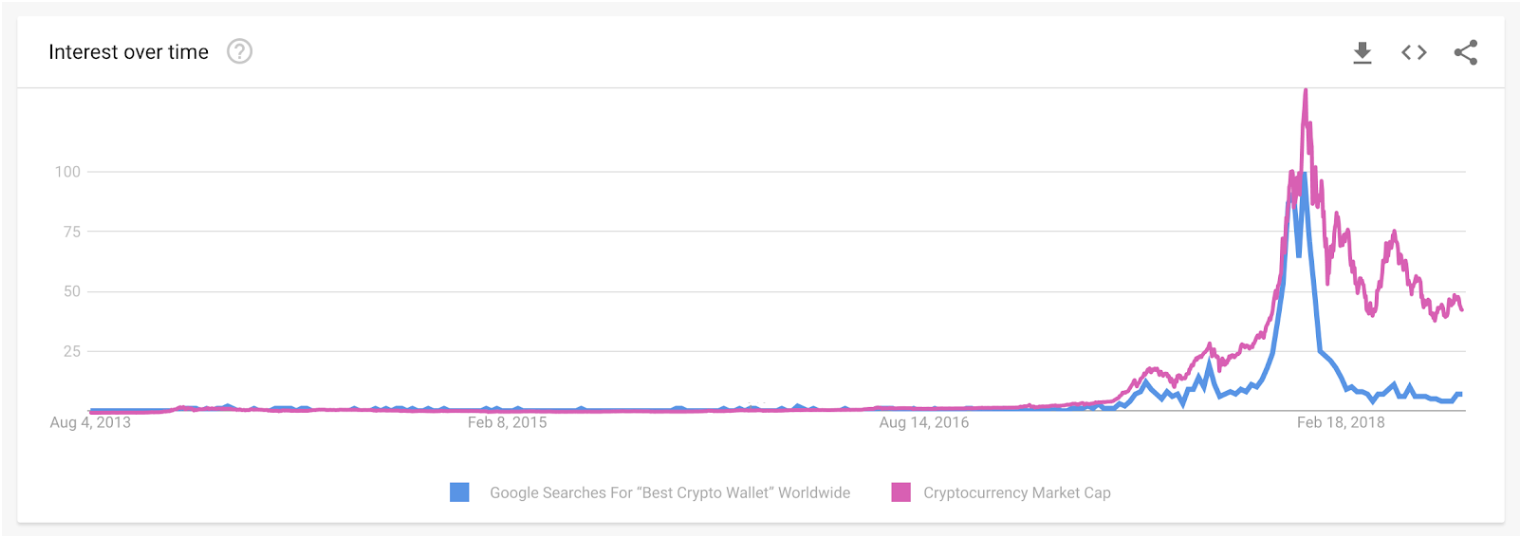

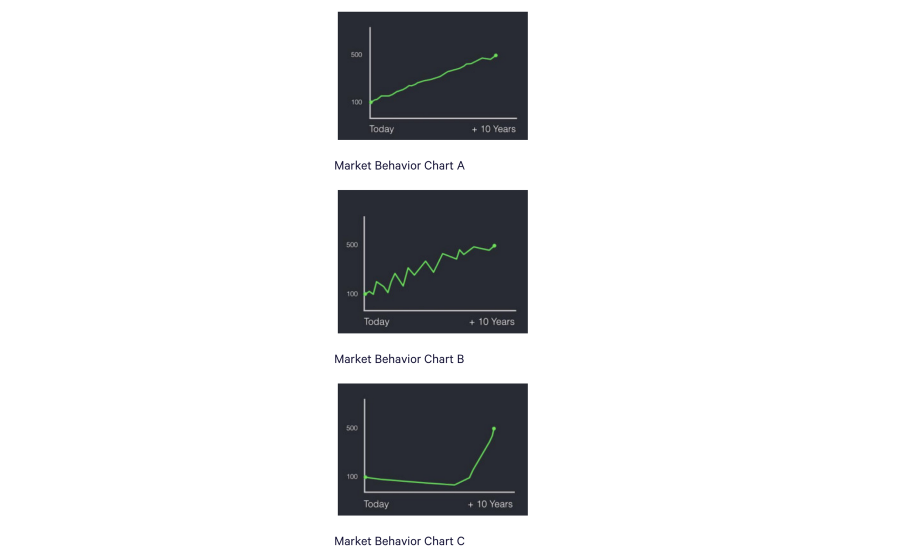

And without Tech Crypto builders, Money Crypto people are climbing up a hill because having a new ecosystem around digital currencies will give them credibility and value. (See the graph below - when crypto value gets higher, more people get wallets. More people having wallets means more people can use dApps).

To be sure, these concepts – Money Crypto & Tech Crypto – could be classified any number of ways, but for the sake of clarity, we’ve excluded other, more granular factions. For example, there are many people who want to redefine how money works but via some mechanism other than Bitcoin – privacy coins, stable coins, etc. Similarly, there are many people who, beyond the internet, want to “decentralize all the things” from supply chains to automotive, from media to data – in both tech and governance. An upgraded web is part of this, but not the only part.

What’s important to realize here is that not only can these narratives both exist, we may find that they ultimately leverage and further the other’s chance of success.

Thanks to Mike Maples, Kyle Samani, Tony Sheng, Trent McConaghy, Nathaniel Whittemore, Taylor Pearlson, Dani Grant, Kevin Pan, Myles Snyder, Denis Nazarov, Arjun Balaji, Soona Amhaz, and Murad Mahmudov for their meaningful contributions to this piece.

Bitcoin Market-Value-to-Realized-Value (MVRV) Ratio

Introducing realized cap to BTC market cycle analysis

By Murad Mahmudov and David Puell

Posted October 1, 2018

Disclaimer: Nothing contained in this article should be considered as investment or trading advice.

Nic Carter from Castle Island Ventures (in a co-effort with Antoine Le Calvez from Blockchain.info) has recently presented his newly-termed concept of realized cap at Riga Baltic Honeybadger 2018 conference, inspired by some previous ideas of Pierre Rochard. Nic was kind enough to share some of his findings and data with us after the conference, and we wanted to delve into some analysis of the information available to us. For the purposes of this article, let’s define a couple of terms:

Market value

Otherwise known as total market capitalization, it applies to Bitcoin if you were to multiply the latest available BTCUSD trading price on exchanges by the number of bitcoins mined thus far (currently standing at 17,299,787 BTC as of Oct. 1, 2018).

Realized value

Instead of counting all of the mined coins at equal, current price, the UTXOs are aggregated and assigned a price based on the BTCUSD market price at the time when said UTXOs last moved.

The Logic Behind Realized Value

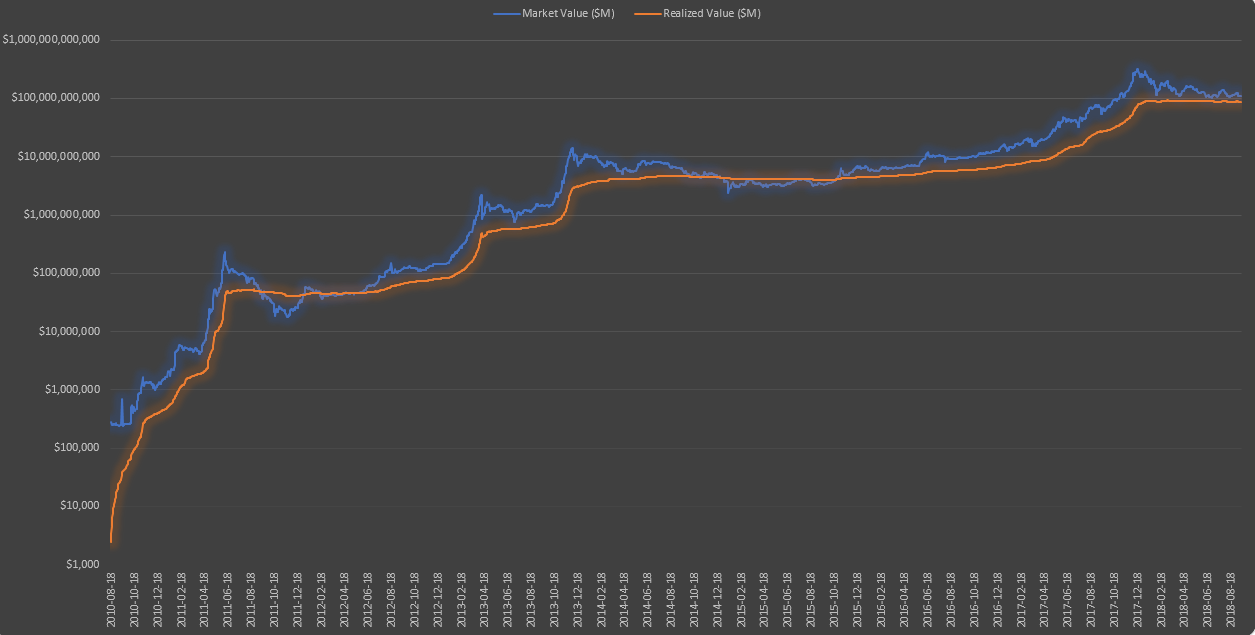

Realized cap’s effectiveness intuitively seems to adjust for two aspects of BTC’s nature: (1) lost coins, and (2) coins used for hodling, establishing the collective psychological sum of entries when users began seeing Bitcoin’s value and long-term potential. Realized cap seems to suggest the final layer of people’s cumulative cost basis and, in recent history, the ultimate line of “center of mass” where 2017 strong buyers remain unrattled by short-term uncertainty.

One way of looking at realized value is that it helps us eliminate some of the lost, unused, unclaimed coins from our total value calculations. Another way is seeing it as an indicator of the sum of levels where groups of long-term, legit, buyer-hodlers entered into their Bitcoin positions, with local and immediate emotions and manias stripped out.

MVRV Ratio

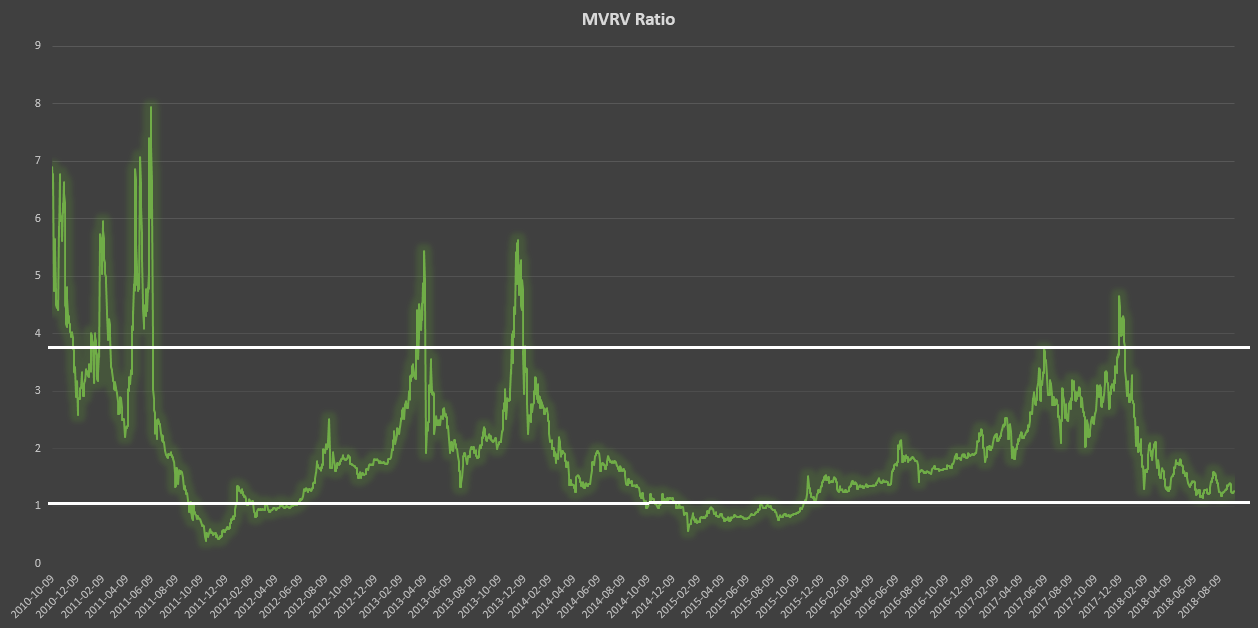

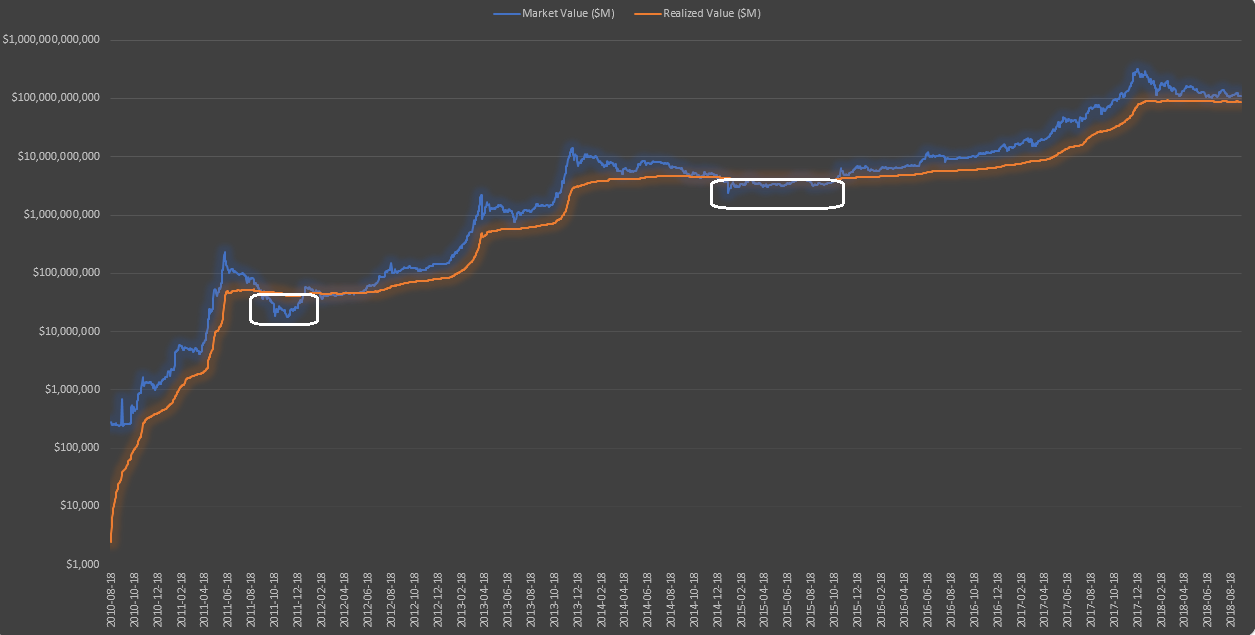

MVRV is calculated by simply dividing market value by realized value on a daily basis (in this case from Oct. 9, 2010 to Sept. 14, 2018). This formula provides the following oscillator:

From this calculation, two historical thresholds emerge: 3.7, which denotes overvaluation, and 1, which denotes undervaluation. It is also interesting to see how MVRV evokes both the Mayer Multiple and Dmitry Kalichkin’s NVT signal without the need for a moving average.

Market Dichotomy?

A theoretical framework for this ratio would echo a dichotomy that can be best expressed in the following:

- Speculators vs. hodlers.

- High time preference vs. low time preference (as argued by Saifedean Ammous in chapter 5 of The Bitcoin Standard).

- Irrational exuberance vs. uncertainty acclimation (as argued by Jimmy Song in “The Antifragility of Bitcoin” presentation).

We believe that both market concepts and participants are crucial for Bitcoin’s game theory and price action, since the booms seem to expand the network via an exuberant viral gossip mechanism that broadcasts the existence of Bitcoin to the world population; while the busts, in the long-run, seem to reward individuals who chose to delay short-term financial gratification in the search for sound money. This very dichotomy, in our opinion, also explains the relevance and effectiveness of MVRV ratio. Network value, to go back to Willy Woo’s terminology, is to us both market value and realized value.

Similar to Woo’s NVT principle, MVRV appears to track the interaction between the market actors that best describe the aforementioned dichotomy. It suggests the at times major divergence between price discovery at exchanges and the “sounder,” more steady rise of unmoved coins — either lost or used for hodling.

It is of particular interest whenever market value goes below a 1:1 ratio to realized value. We suggest that these periods account for both undervaluation and the capitulation-despondency stages of market psychology. Just as the upper levels of MVRV suggest the climax of euphoria, overshooting it’s “fair” value at the peaks, price action as discovered at exchanges tends to undershoot beyond BTC’s “real” value at the bottoms. Looking back at the past two Bitcoin bear cycles, we can say without a doubt that both occasions proved to be the most opportune periods to accumulate bitcoins.

When plotted over the long run on a log chart, the realized value line of Bitcoin (orange above) is more similar to a stepwise function, with near-vertical moves upwards during peak months of bull market, then a prolonged period of horizontal flatness. That being said, each flatness level could be roughly interpreted as Bitcoin’s newfound stable fair value threshold. The traditional market cap, however, is more sharply pronounced by the emotion of the crowds, namely excessive euphoria when market value sharply diverges upwards away from realized value, and, conversely, excessive fear when market value drops below realized value for a multi-month period.

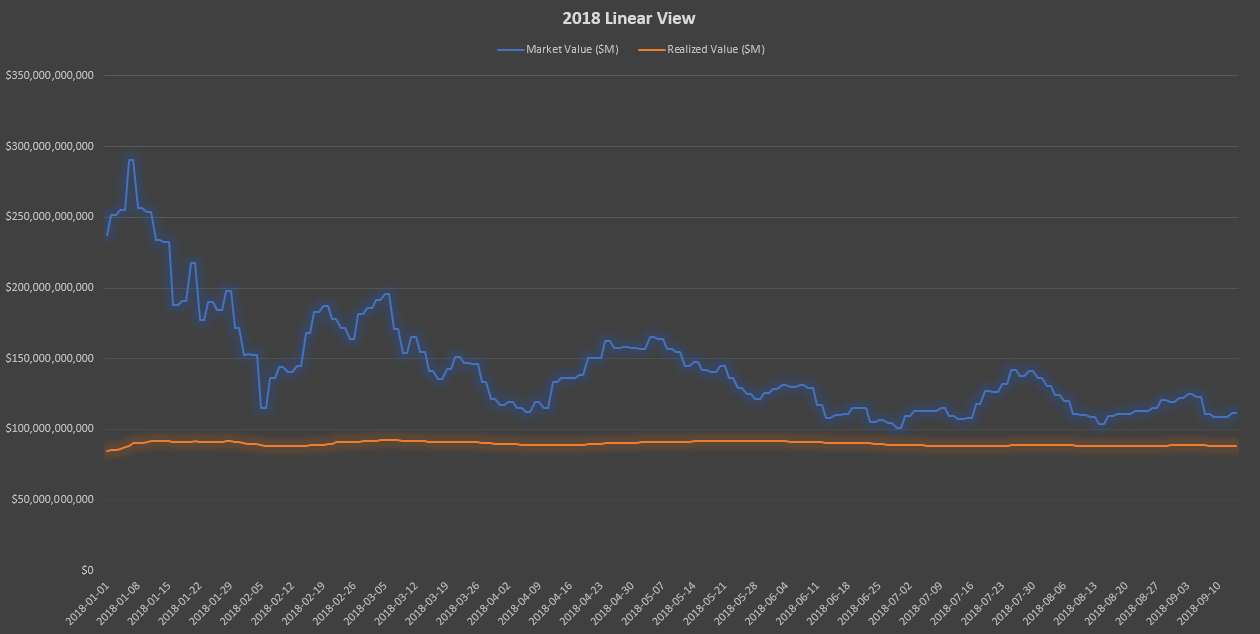

Current Environment

Simply put, we expect market value to descend below realized value on a mid-term basis, which in turn would establish a structural gap between them, to be filled after an accumulation period of potentially as long as several months. The following chart displays the historical periods when accumulation in Bitcoin took place (which would be represented by MVRV ratio’s descent below 1).

A zoomed-in linear version of the current environment gives us a clearer view of how market value remains overextended above realized value.

Some Caveats

As with any fundamental or technical indicator, we recommend using this particular tool with prudence. Some observations:

- Thresholds: Going forward, as market cap decreases in volatility, we believe that the upper threshold of MVRV might not prove as reliable — as market cap overextends less and less above realized cap as time progresses. However, we expect the lower threshold to remain useful to detect Bitcoin’s undervaluation in multi-month periods ripe for accumulation. This is to say that the saving power and the speculative power of Bitcoin will become, increasingly more and more, very closely intertwined.

- Precision: MVRV ratio only provides a long-term perspective of BTC market cycles — specifically, to apply Wyckoffian terminology, distribution and accumulation phases.

- _Technical methodology:_The use of MVRV as a momentum oscillator where the breakage of a trendline implies capitulation (similar to NVT signal or the Mayer Multiple) still comes into question. Thus, more conservatively, we provide two recommendations: (a) to analyze this indicator as a companion to other fundamental and technical tools; and (b) mostly use its thresholds for multi-yearly analysis; a diagnostics tool of Bitcoin’s “hodling” health.

- Realized cap: It is important as well to remember that realized cap may drop given a black-swan shock event where strong hands lose confidence in BTC. For this reason we recommend assessing market value and realized value both as a ratio and separately.

Acknowledgements

We would like to thank the following people, whose work and help was essential for this analysis:

- Nic Carter and Antoine Le Calvez, for inventing the realized cap and providing us with invaluable data.

- Pierre Rochard, whose initial idea was the starting point for the invention of realized cap.

- Willy Woo and Dmitry Kalichkin, whose work on NVT and NVM has been deeply influential.

- Saifedean Ammous and Jimmy Song, for providing crucial ideas in developing a theoretical framework for MVRV.

Sources and Data

- Daily market value and realized value data provided by Nic Carter (Castle Island Ventures) and Antoine Le Calvez (Blockchain.info).

- Ammous, Saifedean. The Bitcoin Standard. Hoboken: Wiley, 2018.

- Song, Jimmy. “The Antifragility of Bitcoin.” Off-Chain with Jimmy Song YouTubeChannel:https://www.youtube.com/watch?v=LYjUOFc0OMo

Bitcoin’s Distribution was Fair

By Dan Held

Posted Oct 4, 2018

Foreword

As Bitcoin rises in popularity, and continues to challenge mainstream thought, there will be concerns around certain parameters of its existence. One of those is that the distribution of Bitcoin wasn’t “fair,” particularly in the earlier stages of network development. I’ll dive into the timeline surrounding Bitcoin’s launch, and provide a thorough debunking of unfair early distribution claims.

TL;DR — Satoshi set out to design the fairest system possible.

To enjoy this article in its fullest, I recommend playing this song then continue reading. If you like this music, please follow my playlist on Spotify.

Distribution

Premining is the mining or creation of a number of crypto coins before the cryptocurrency is launched to the public. Premining sometimes has a negative connotation due to the ability of private developers to privately mine and allocate a number coins to themselves before releasing the open source code of the currency to the public. This could lead to a feeling of lack of transparency in the digital currency offered to the public.

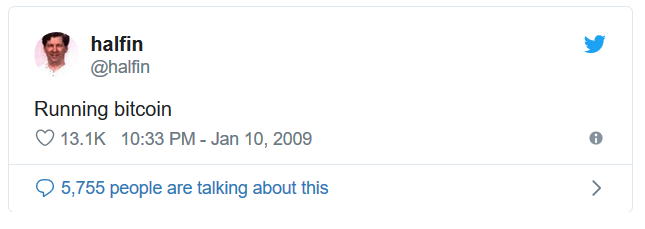

Satoshi didn’t premine. Satoshi gave everyone a two month heads up before mining the Genesis block, reaching out to the only other people who would possibly be interested in experimenting with a sovereign digital currency at the time, the cypherpunks (via public e-mail list). The whitepaper was published on October 31, 2008, then Bitcoin 0.1 software was released on January 9, 2009.

The Genesis Block alone was minted earlier January 3, 2009. It was unlike all other blocks (no previous block to reference) and required custom code to mine it. Satoshi included a message in the Genesis Block as a “proof of no premine.”

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”-Genesis Block

Timestamps for subsequent blocks indicate that Nakamoto did not try to mine all the early blocks solely for himself. Before Satoshi’s invention, the concept of pre-mining didn’t exist. To be this prescient demonstrated incredible maturity.

The code to mine bitcoin was available on the day Satoshi began mining (other than the special purpose Genesis Block). It even had a 1-click miner in there so it was incredibly easy. Once the code was released, several individuals started mining — we know for a fact that Hal Finney was mining one day after the initial launch. Satoshi definitely wasn’t mining alone in the early days, granted the number participating was slim.

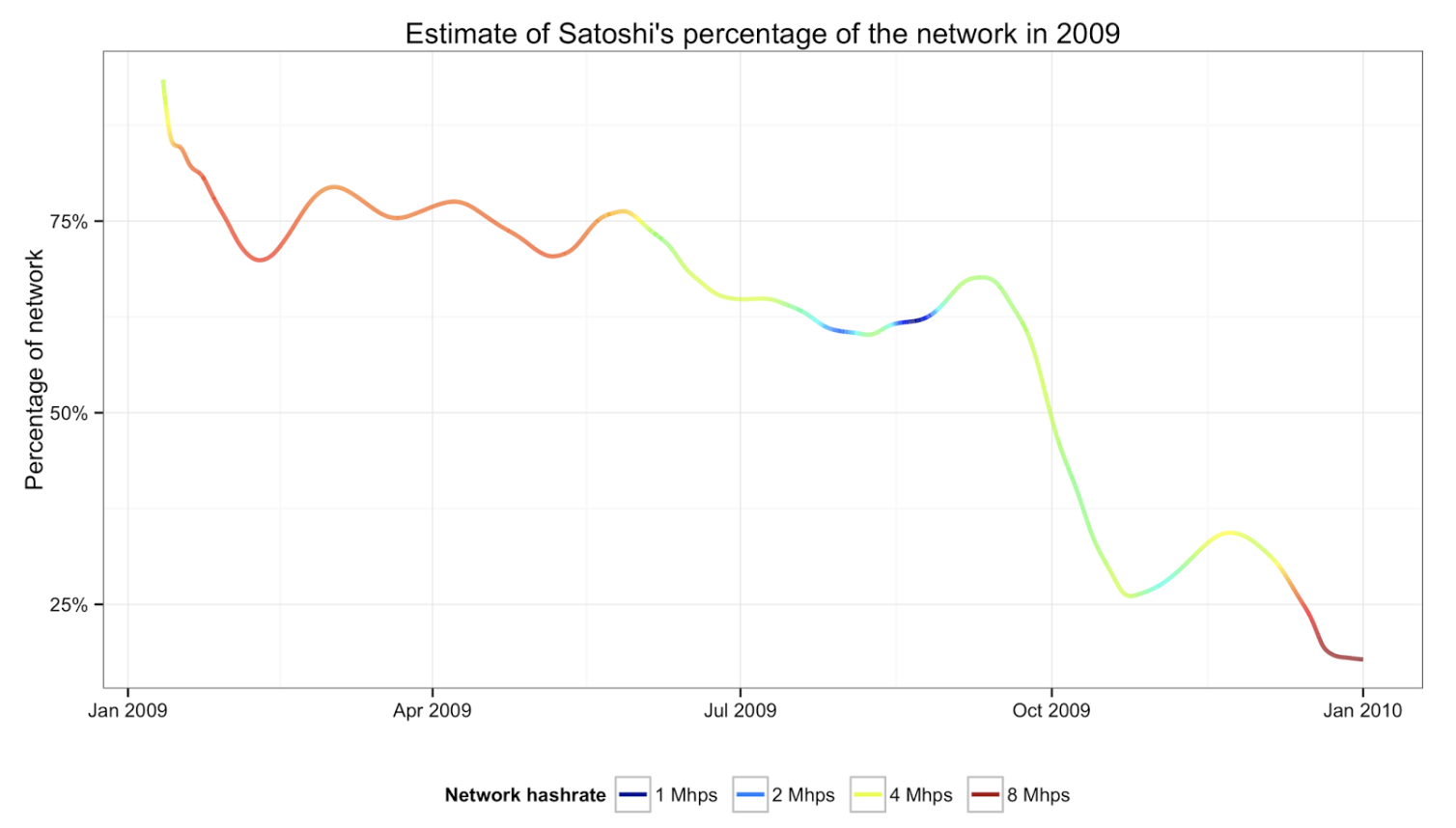

For the first year of Bitcoin’s existence, Satoshi and other miners couldn’t muster enough hashrate to mine more than 144 blocks/day and trigger an upwards difficulty adjustment. Satoshi mined because the network required a miner, he turned them off when there was a stable network that didn’t need his mining power. He reduced his % of the hashrate in a slow and steady manner. The Satoshi fingerprinted mining carefully balanced the hashrate of the cluster, with the goal of historically viewable well-meaning intentions. Satoshi initially followed a plan of reducing the hashrate by 1.7 Mhps every five months, but a month after the second such drop abandoned this method in favour of a continuously decreasing hashrate.

http://organofcorti.blogspot.com/2014/08/167-satoshis-hashrate.html

http://organofcorti.blogspot.com/2014/08/167-satoshis-hashrate.html

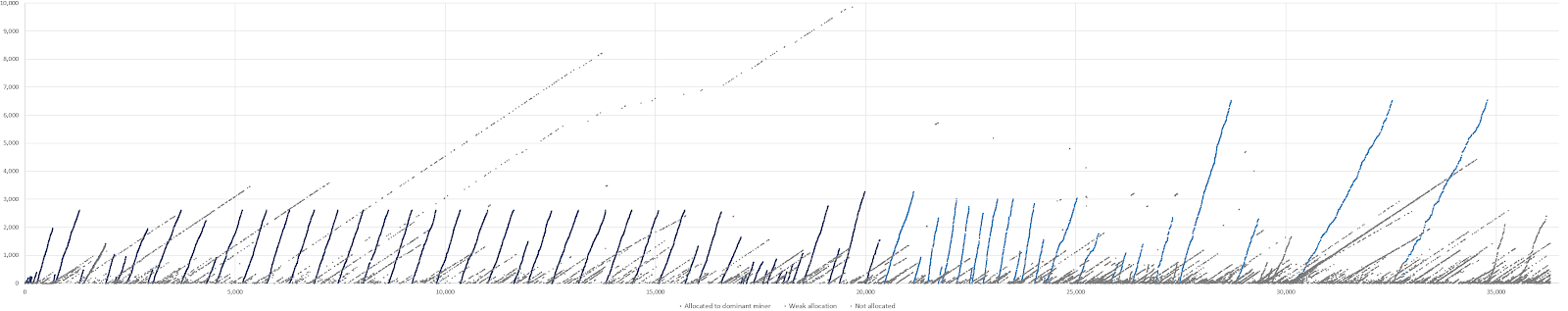

How much did Satoshi mine? Other than a few coins (some still circulating), it’s not empirically knowable how many he owned, but we can assign a high probability that he was the miner who minted close to ~ 700,000. BitMEX reviewed the original estimate made by Sergio Demian Lerner where he discovered that Satoshi’s miner had a “fingerprint” (the increase in the ExtraNonce value in the block can potentially be used to link different blocks to the same miner). BitMEX built on his analysis and concluded that although the evidence is far less robust than many assume, there is reasonable evidence that a single dominant miner in 2009 could have generated around 700,000 bitcoin.

“Although there is strong evidence of a dominant miner in 2009, we think the evidence is far less robust than many have assumed. Although a picture is worth a thousand words, sometimes pictures can be a little misleading. Even if one is convinced, the evidence only supports the claim that the dominant miner may have generated significantly less than a million bitcoin in our view. Perhaps 600,000 to 700,000 bitcoin is a better estimate.” — BitMEX

Bitcoin blocks mined in 2009 — Allocation to the dominant miner — ExtraNonce value (y-axis) vs block height (axis)

Bitcoin blocks mined in 2009 — Allocation to the dominant miner — ExtraNonce value (y-axis) vs block height (axis)

Bitcoin’s market cap was ~ $0 for nearly a year and a half. Miners were wasting money on hardware and electricity to mine, with no guarantee that the Bitcoins they received would ever have value. In fact, “faucets” were set up to freely distribute Bitcoins in order to “seed” adoption (ex the 10k btc faucet set up by Gavin and other Bitcoiners who donated funds). The first recorded exchange of Bitcoin for “real world” value occurred on May 22, 2010, now known as Bitcoin Pizza Day, where Laszlo Hanyecz agreed to pay 10,000 Bitcoins for two delivered Papa John’s pizzas. He went on to do this trade 2 more times, maximizing the dispersion of his Bitcoins.

“It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self fulfilling prophecy.” —Satoshi Nakamoto

The early pioneers were the ones crazy enough to take the financial, temporal and social risks to participate in the Bitcoin project, keeping it alive and acting as arbiters of the system in its early days. Nearly all lost or sold all of their Bitcoins as evidenced by this analysis done by Dhruv Bansal

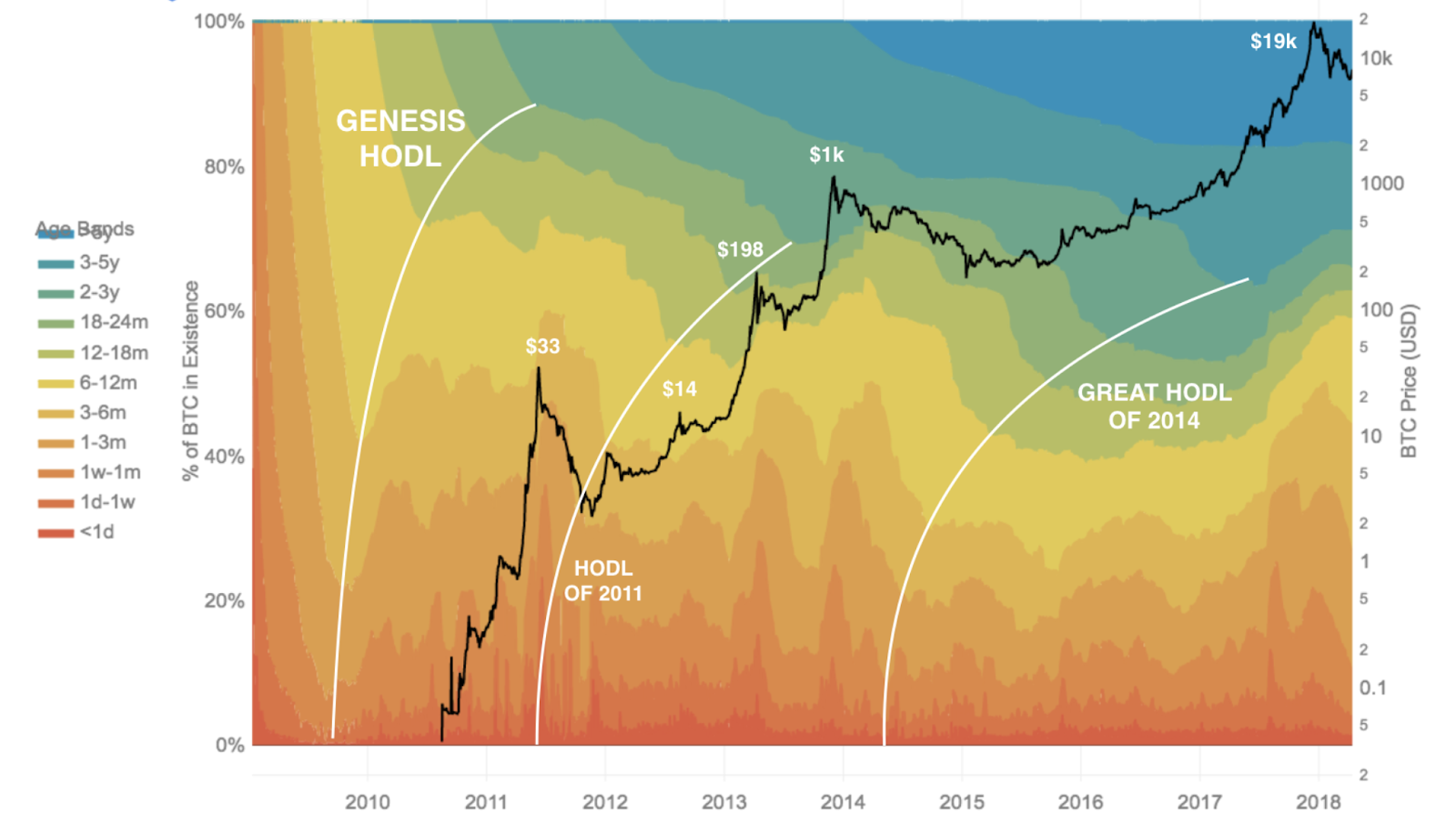

With each of those boom/bust cycles we’ve seen Bitcoin redistributed from old hodlers to new hodlers via selling, decreasing the Gini Coefficient. In 2017 alone, we saw 15% of all BTC move out of old hodler hands.

The theoretical total number of bitcoins, slightly less than 21 million, should not be confused with the total spendable supply. The total spendable supply is always lower than the theoretical total supply, and is subject to accidental loss, willful destruction, and technical peculiarities.

“Ten years ago cryptographers and HCI experts created the ultimate experiment to see how well human beings could hold onto long-lived secret keys. We structured the experiment so participants would lose hundreds or thousands of dollars if they failed. The results of that experiment have not been pretty.” — Some Cryptographer on Twitter

There are many stories of people losing BTC in large amounts — especially in the early days — when BTC wasn’t worth much and was easily forgotten on an old hard-drive, USB memory stick, even a scrap of paper. Coins which remain unspent for >5 years have a high likelihood to be lost forever. Despite the richness of blockchain data, it’s extremely difficult to measure how much cryptocurrency is truly lost, as lost coins leave no trace in the blockchain. The problem is that so much BTC which is not lost looks exactly the same on the blockchain.

“The study of lost bitcoin is geology masquerading as data science.” —Dhruv Bansal

Unchained Capital did a great analysis of lost coins, and found that bitcoin loss occurred over two distinct “cryptogeologic” eras: Systemic (earlier miners, and Incremental loss: (coins lost by individual users gradually over time). Their estimate: 2.78–3.79M BTC lost which aligns with another more sophisticated analysis done by Chainalysis.

“Lost coins only make everyone else’s coins worth slightly more. Think of it as a donation to everyone.” —Satoshi Nakamoto

From private key management mistakes, to scams and exchange hacks, to resisting selling temptation, early HODLers SURVIVED. In compensation for that risk, they absolutely deserve the value appreciation.

Some argue Bitcoin’s distribution is analogous to a Ponzi scheme, but it’s nothing like one. The definition of a Ponzi Scheme: “a fraudulent investing scam promising high rates of return with little risk to investors. The Ponzi scheme generates returns for older investors by acquiring new investors.” It isn’t one for the following reasons:

Transparency

Absolutely nothing about Bitcoin is a secret. It’s open source, anyone can review the code, anyone can contribute to the code, anyone can run the software voluntarily and participate in the network, and anyone can use the network without permission. The entire history of all Bitcoin transactions is visible to anyone in the world too. It’s the total opposite of a fraudulent investing scam, which is shrouded in vague promises of high returns with capital inflows and outflows that are kept in a secret ledger.

Returns

The Bitcoin whitepaper never mentions an investment or promising high returns. In a Ponzi scheme, the value for early investors rely solely on new entrants coming in with fresh capital, and their earnings/dividends come directly from this capital. With Bitcoin, the opposite is true. Most early Bitcoiners lost or sold their Bitcoin. Bitcoiners are human, they make human mistakes and have human needs (buying a house).

“Bitcoins have no dividend or potential future dividend, therefore not like a stock. More like a collectible or commodity.” —Satoshi Nakamoto

Usage

The market’s determination of what one Bitcoin is worth has nothing to do with greater fools getting in the system, but an after effect of its true value proposition, one that it already had even when it was worth nothing.

Conclusion

Satoshi was a person like any other, not some infallible being. This was the fairest distribution he could have come up with given what he was building/timing/audience. It’s intellectually dishonest to compare Satoshi’s early mining of Bitcoin at a loss, with premining of an ICO with a positive market value (or expected positive market value).

“Bitcoin benefited from an extremely rare set of circumstances. Because it launched in a world where digital cash had no established value, they circulated freely. That can’t be recaptured today since everyone expects coins to have value. Not only was it fair, but it was historically unique in its fairness. The immaculate conception.”Nic Carter

Satoshi wanted to signal to everyone that Bitcoin wasn’t a scam. The conservative deescalation of his mining contributions, his departure from the community, never spending any of his coins, nor using his influence for any purpose, shows that he wanted the world to make up their own mind about his project and judge it on its own terms.

Unlike every other founder in history, Satoshi never cashed out.

Blockchain Is a Semantic Wasteland

Why haven’t we abandoned it?

By Nic Carter

Posted October 5, 2018

Credit: Bigmouse108/iStock/Getty Images Plus

“Blockchain” this, “blockchain” that. It’s a concept so momentous that it has even managed to shed its article. Proponents don’t speak of “the” blockchain or “a” blockchain. Instead, they reverently preach Blockchain: the solution to all enterprise needs (in particular, supply chain management). The brute, unassailable, self-evident concept has disrupted not only the rules of commerce but those of grammar. Question it and you’ll be exposed as a hopeless rube and a Luddite. Use it sincerely and you’ll be lumped in with the hype men and techno-utopians.

It’s impossible to avoid. Ads for IBM blare promises about revolutionizing tomato-tracking with blockchain. The U.K. finance minister recently asserted that blockchain may be a solution to Britain’s Brexit woes. At a recent conference held by Ripple, former U.S. President Bill Clinton said of blockchain, “the permutations and possibilities are staggeringly great.”

The word “blockchain” is satire-resistant. It’s such an obvious target that it’s no longer funny, and blockchain proponents are almost totally immune to ridicule. Nothing can check their indefatigable enthusiasm: There are press releases to be written, conferences to attend, and corporate R&D dollars to waste. Blockchain represents both the glittering future and the dismal present — almost all touted use cases are obvious nonsense.

The ICO mania of 2015–2017 that is now unwinding was premised, in large part, on the ability of blockchains to disrupt markets. In simpler terms, the idea was to Uber-ize every conceivable service and replace the intermediary with a magic database detailing who is doing favors for whom. Some of those pitches invoked trillion-dollar (yes, trillion with a T) total addressable markets.

Today’s soulless corporate blockchains and opportunistic, ICO-based blockchains have both endured scorn and ridicule. Yet the term persists, an empty semantic husk, kept alive by a thousand press releases, conveying as little meaning as possible. The term is used to refer simultaneously to projects, structures, and databases that have virtually nothing in common. As a consequence, attempts to define it are usually hopeless failures.

Here, I’ll try to explain the origin of “blockchain” and what we should do about it.

Where did “blockchain” come from, anyway?

Most histories of the term “blockchain” will mention that Satoshi Nakamoto created the first one. Except, that’s not accurate. Nakamoto never referred to bitcoin as a blockchain, calling it instead a “chain of hash-based proof-of-work,” a “chain of blocks,” and even a “timechain” (in an early comment within the original codebase). Imagine: We were so close to living in a world of “enterprise timechains” and “strawberries-on-the-timechain.”

Nakamoto was careful to emphasize that the chain was a set of proofs of work, each linked to the hash of its parent. (See for yourself!) The proof of work is absolutely essential to the concept. It is proof that anyone proposing a block has, well, worked for it. It enables the system to achieve Sybil resistance and to come to convergence (the longest chain — under the same ruleset — is the correct history, by definition) without any single arbitrator.

This data structure, with its inclusion of hashes of previous blocks, ensures that the past is preserved and the database is consistent. Replicating the database to every node in the network ensures that it can’t be shut down or altered unilaterally.

The reason “blockchain” is such seductive marketing… is the subtle implication that the data structure alone — absent proof of work or open validation — could convey the same benefits as bitcoin.

The entire system was built with an adversarial context in mind. Hostile governments had shut down all previous attempts at e-cash. They certainly would have shut down bitcoin if they could have. Thus, it was built for a purpose. To clarify: Nakamoto may have created the first popular, widely used linked-list structure — not the first of its kind — but the innovation was in merging that linked list with the computational hardness of adding new entries to the chain.

Does this sound like what any of the enterprise blockchains are trying to accomplish? Of course not. There is no shadowy organization dedicated to forging strawberry provenance records that might seek to interfere with IBM’s supply-chain blockchain. Thus, IBM’s blockchain does not need to be built to the same standard as bitcoin. The kinds of records preserved on enterprise blockchains do not need the kinds of protections that Nakamoto consensus ensures. They do not need or want open validator sets. Some trusted organization could just vouch for the database, or a consortium of interested parties could share records between them.

For more on the failures of private blockchains, I recommend this post from a reformed private blockchain consultant.

Why is the term so popular?

From what I can tell, people witnessed the success of bitcoin — which relies in part on an ersatz, expensive database — and wanted to generalize it to other uses. Even early bitcoin developer Hal Finney mused about disaggregating the data structure from the monetary system.

It also might be possible to refactor and restructure Bitcoin to separate out the key new idea, a decentralized, global, irreversible transaction database. Such a functionality might be useful for other purposes. Once it exists, using it to record monetary transfers would be a sort of side effet and might be harder to shut down. — Hal Finney in his January 24, 2009 Cryptography Mailing list

However, to the best of our knowledge, these systems only really work if the reward is internal — that is, if well-behaved validation is rewarded with the “native” token. If bitcoin miners were paid in U.S. dollars, they wouldn’t necessarily have any incentive to mine on top of the longest chain. The value of their hardware depends on the continuing existence and flourishing of the chain they’re building on top of. But private, permissioned, or enterprise blockchains do not have native currencies nor do they issue monetary units to validators, as the validator set is permissioned and thus has Sybil resistance and good behavior built in by design.

“Blockchain” is such seductive marketing, I believe, because the data structure alone — absent proof of work or open validation — could convey the same benefits as bitcoin without the token or costly anti-Sybil protection.

Patri Friedman put it well in a tweet:

Bitcoin is a monolith that colors the way investors and corporate R&D offices think about similar projects. Would Ripple have been as popular without bitcoin having been invented? What about Corda and Hyperledger? Litecoin? ICOs generally? Ethereum? It is hard to even imagine the alternate history, but I suspect the answer is no in all cases. Bitcoin is a juggernaut that carried with it a set of assumptions that were ported over to projects with a passing resemblance, rightly or wrongly.

Consequently, I would be suspicious of anyone who routinely uses “blockchain,” especially if they are trying to sell you something. Overuse of the term, especially in a general context and without qualifiers, most likely reveals one of three things about a person:

- They are well-meaning but forced by convention to use subpar linguistic tools.

- They are a bit muddled and trying to mask their ignorance with technobabble.

- They are trying to posture as an expert in an industry which realistically has no experts.

I firmly believe the misuse of the term traces back to a desire to create (or market) systems that are intended to be bitcoin-like without the unsavory bits. That, however, misses the point: Bitcoin’s blockchain is just a part of it, not its essence.

Bitcoin and its blockchain

Referring to bitcoin as a blockchain is like referring to a car as a transmission. A transmission is a key element of the system, but it doesn’t represent it in totality. Blockchain is a metonymy — a part used to refer to the whole. There’s nothing wrong with that, intrinsically. The conceptual tangle comes when one decides that the blockchain is bitcoin’s essence and is owed credit for its success.

Bitcoin relies on a linked list, indeed. But it also relies on a peer-to-peer (P2P) network, an open source and leaderless project, a replicated database, a self-supporting incentive system, a heaviest chain consensus rule, and a proof-of-work scheme that gives block proposals unforgeable costliness. (Unforgeable costliness in simple terms: It’s impossible to fake a block submission; you would have to have allocated a good chunk of computing power, or energy, to the task. It is therefore hard to create new bitcoins but easy for anyone to verify that you worked hard at it.)

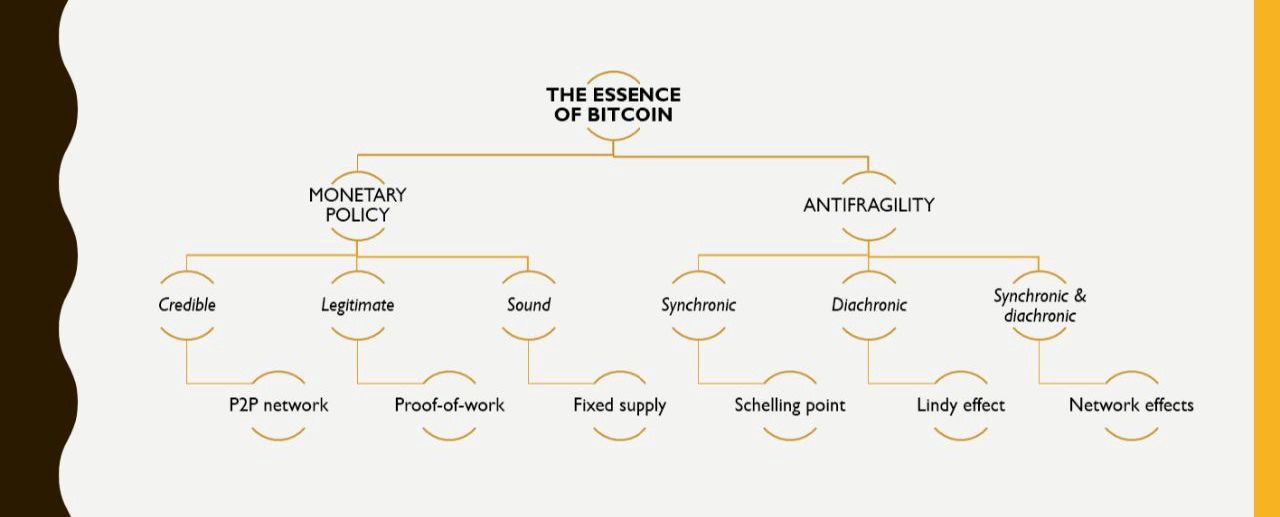

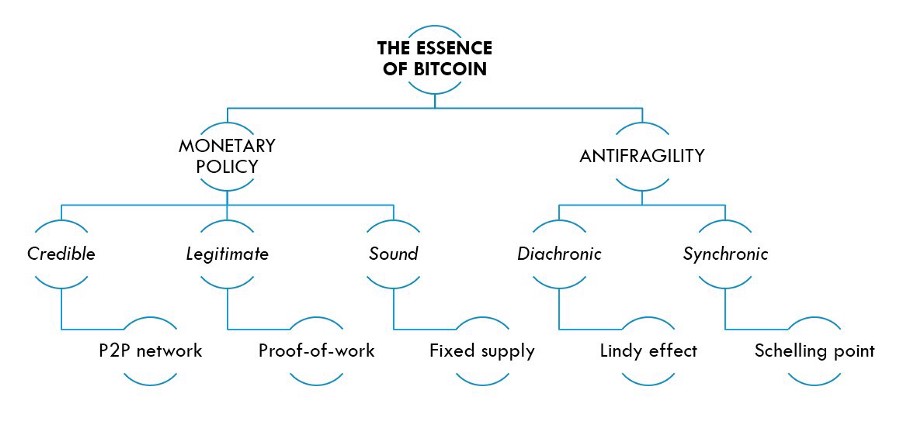

These inputs combine nicely to create a system that has certain qualities: provable scarcity, an ability to be audited, tamper-resistance, fair-ish distribution, almost perfect supply inelasticity (rising the price does not — cannot — cause production to accelerate), free participation (no one can stop you from broadcasting a bitcoin transaction), and so on. These qualities make bitcoin a unique relative to, say, Paypal or Visa. They are its differentiators. Without the P2P nature, the open-source collaboration, the voluntarist developers, and, crucially, the proof of work block proposal method, bitcoin would not exist. The below chart, created by David Puell based on ideas from Pierre Rochard, is an attempt to capture bitcoin’s essence. Notice that the chain of blocks, while necessary to make the system work, is not sufficient on its own. Bitcoin relies on more.

David Puell’s laudable attempt to characterize bitcoin’s essence in one chart.

David Puell’s laudable attempt to characterize bitcoin’s essence in one chart.

I can’t tell you exactly what the essence of bitcoin is, but to limit it to a chain of blocks is reductionist in the extreme. The soul of bitcoin is not the blockchain. But if you pull the blockchain out of bitcoin, you get something rather empty.

Why rail against “blockchain”?

I believe better conceptual frameworks will lead to better outcomes. Author George Orwell believed that the words we use directly affect the way we see the world. He even intimated that scrubbing words from popular usage could eliminate their referents, the very concepts they sought to represent:

The purpose of Newspeak was not only to provide a medium of expression for the world-view and mental habits proper to the devotees of IngSoc, but to make all other modes of thought impossible. It was intended that when Newspeak had been adopted once and for all and Oldspeak forgotten, a heretical thought — that is, a thought diverging from the principles of IngSoc — should be literally unthinkable, at least so far as thought is dependent on words.

Eliminate the word “freedom” from popular use and you’ll eliminate the desire for freedom entirely, so the theory goes. Additionally, Orwell strongly felt that sloppy language was indicative of muddled thought and used as a way to sneak indefensible assertions past an unwitting reader.

My point here is that in elevating the linked list to the exalted status of “blockchain,” we overrate it. In insinuating that bitcoin is just a blockchain or simply the origin of the more interesting underlying technology, we do bitcoin a disservice. By constructing the blockchain artifice in popular consciousness, we enable sloppiness of thought and do away with rigor. “Blockchain” dilutes the importance of a tremendously important and valuable innovation — a trust-minimized monetary system — and abases it by putting it to work to generate efficiencies, real or imagined, in enterprise supply chain management.

The path forward requires honesty

To the permissioned or enterprise blockchainers:Be honest about what you’re building. If you’re building a database controlled by a consortium of pre-permissioned entities, don’t claim or imply it will have similar reliability characteristics to systems designed to live in far more adversarial environments. Imagine how you would market your system had bitcoin not been invented.

Let public blockchains be. You aren’t competing with them. Your systems have totally different goals. If you do want to persist with the blockchain moniker, I encourage you to very carefully define what you mean by “blockchain,” and be sure to distinguish your system from open, public blockchains. Lastly, for god’s sake, give “blockchain” back its article (refer to “a” or “the” blockchain, please).

To the computer scientists:Stop mocking nontechnical people for using “blockchain.” You’re missing the point. They aren’t really referring to the data structure, so it’s beside the point to say, “Just use MySQL.” “Blockchain,” for better or for worse (definitely for worse) has become a term of art that is typically used to refer to the whole system — economic and social — rather than just the data structure.

To regulators:Please do not try to define “blockchain” or create blockchain regulation. You will fail, not due to your lack of astuteness but because the term “blockchain” is so semantically dispersed as to be undefinable. Definitions need to be specific and useful and also general enough to encompass all of the members of the set. However, these tensions tear “blockchain” apart. It is used too generally to be useful.

@prestonjbyrne Florida proposed my favorite definition of “blockchain”, which may or may not be pretty much everything or nothing. — -@zackvoell](https://twitter.com/zackvoell/)

Instead, disaggregate. Recognize that legislation covering cryptocurrency probably cannot cover security tokens, “utility tokens,” and permissioned blockchains too. Private or enterprise blockchains aren’t just “bitcoin in a suit” — they’re totally different. The two really have nothing in common.

To everyone else:Please join me in spurning the use of “blockchain” at every opportunity. Let’s try and devise new terms that are specific enough to be useful and do justice to their referents. I currently use “public blockchain” to describe permissionless, open networks like bitcoin and Ethereum, but I would love to use a different term that doesn’t rely on the b-word. If you do insist on using it, I like Peter Todd’s definition best: “A blockchain is a chain of blocks.”

Using it in a minimalist, direct way removes some of its conceptual weight. This eliminates its ability to implicitly promise amazing consistency, reliability, and uptime. The more honest your definition of “blockchain,” the less it lends itself to exciting press releases. The blockchain, in Todd’s definition, is really just a way to arrange data. And that is supremely unsatisfying given how it’s used today.

If you want to read more about disaggregating these systems, I recommend Distributed Ledger Technology Systems: A Conceptual Framework, published by an interdisciplinary set of practitioners and academics under the aegis of the Cambridge Centre for Alternative Finance.

I believe that in five or 10 years, we will look back at the popularity of “blockchain” and be slightly embarrassed.

Canny readers will notice that I co-founded a firm that invests in blockchain startups. This is true. I am humiliated. But our use of the term is a matter of practical reality. The term has proliferated widely enough to become a Schelling point — an easy meeting place where technologists and allocators can communicate. Out of convenience, and so that we are understood, we use the term. But we’d love to abandon it. It encompasses many distinct concepts, some of which we love and some of which we hold in contempt.

I believe that in five or 10 years, we will look back at the popularity of “blockchain” and be slightly embarrassed. The term will seem as archaic as “surfing the world wide web” or using the “information superhighway.” Consider this an open solicitation for replacements to the term. Let’s move on.

Powered by Lightning; Programmable Money — Part 1

A quick primer on the Lightning Network and how it is making money programmable.

JP Thor [ ₿ ⚡️]

Oct 6, 2018

- Part 1 — Programmable Money

- Part 2— Using the LN as an individual

- Part 3— Using the LN as a business

- Part 4— Using the LN as a country

- Part 5— When the world is powered by LN

The Layers of the Internet

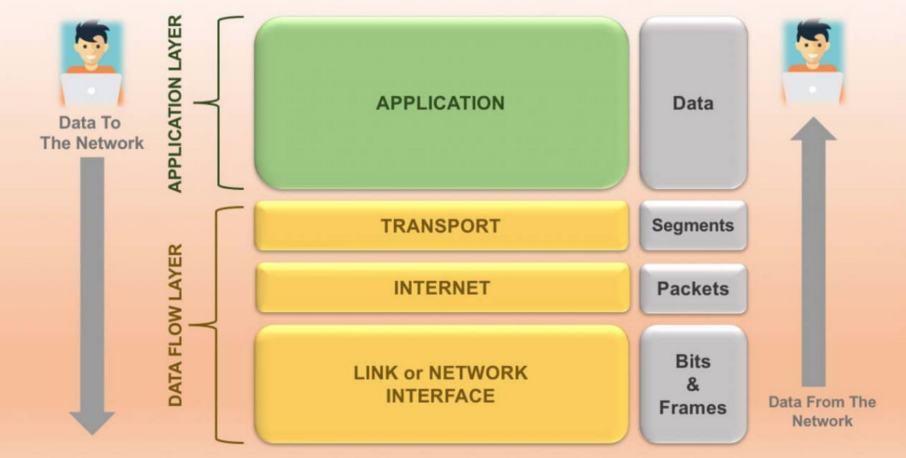

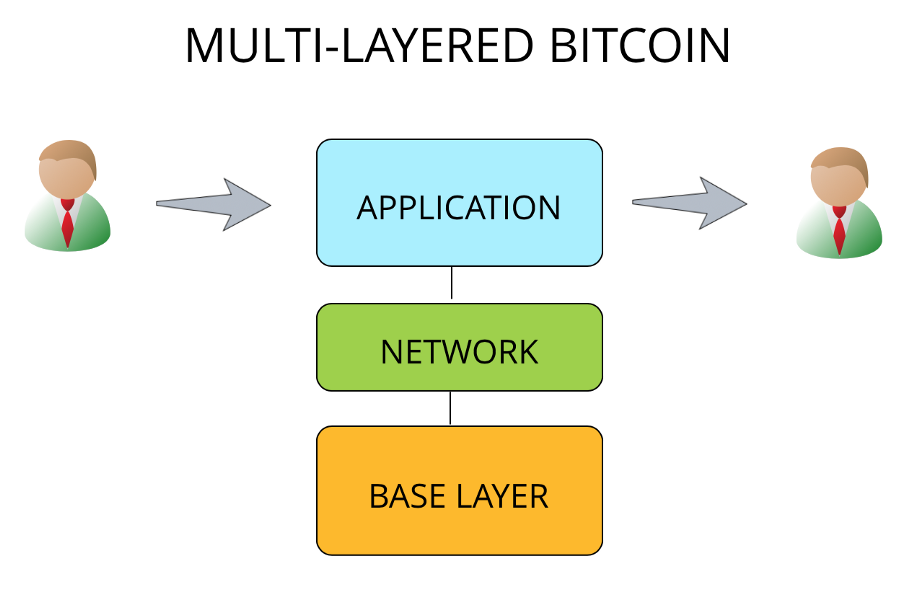

Bitcoin is emerging as a multi-layer value-transfer protocol, with different layers serving different needs and being used for different things. To understand this, we need to look at the Internet Model, which is a conceptual model around the four layers of the internet; Application, Transport, Internet and Network.

The Internet Model. Source: Stemjar

The Internet Model. Source: Stemjar

The Four Layers in Use

When users of the internet send data between each other (you and a website’s server), the data transfer takes place across the four layers. Firstly the data is collected from the sending user at the application layer (the website’s interface), which uses the underlying APIs to transport encrypted data packets via https (hopefully) to the server. These data packets are routed via the internet’s infrastructure, which are essentially bits of information streamed across a high-speed link between servers. The data is acted upon (updating or changing state on the server), and the reverse in the download of updated information back to you.

Most likely the server’s database is backed up on a schedule (such as iCloud or any of Google’s services), and the changed state is replicated across other servers.

The end result is that you transferred data to and from another internet user (the server) directly, which was done in less than a few seconds and only you and the server knew about it. At some point later the changed data was backed-up across other servers. Overall, the user experience would have met our expectations, and the final data was safely backed up.

Before the internet as we know it, users would connect directly with each other at the networking layer. It was not possible to simply “go to a website”. Indeed the internet that we know of today is mostly thanks to the Application Layer and its micro-services, APIs and browser-side processing.

The Layers of Bitcoin

A multi-layered Bitcoin is no different from a conceptual point of view. The base layer is the chain of blocks containing the immutable transaction graph, the “Layer 1”. This layer is completely public and everyone can view and validate the entire history of the database. This layer defines and secures what Bitcoin is.

Bitcoin Core is part of the network layer, allowing nodes to gossip, propagate blocks and connect with each other. The information in this layer is always only partial, each node may store a different view of the network, the “mempool”. This layer also contains the Lightning Network, a network of nodes that facilitate unicast transactions of value between nodes. This is the “Layer 2”.

The third layer will be the application layer, where APIs are built to interact with Layer 2 and allow highly performant user interactions with the network. This was first observed with satoshis.place where less than a week after it was launched, enterprising users were utilizing APIs to paint complex pictures, such as photos and a copy of the Bitcoin white paper, and even performing state-reversions of the entire billboard.

MULTI-LAYERED BITCOIN

MULTI-LAYERED BITCOIN

With this in mind, we can see that an on-chain transaction at the base layer is one of the most cumbersome things to do with Bitcoin, and is akin to sending data packets at the networking layer of the Internet. We simply don’t do it unless we need to rig to servers together to transfer data at high speed; such as in data-centres, trading desks or agency/enterprise-level infrastructure.

Even sending a lightning transaction itself is one-level too deep for the desired experience. It is substantially more scalable and useable than transacting at the base layer, but for mainstream adoption it is not desirable.

We need to keep building to get ourselves to the Application Layer. We’re quite a long way off that (3–5 years), but the good thing is we don’t need to rush there. It’s actually only necessary to allow 8 billion people to onboard, with performance, scalability and an excellent user experience. In the meantime, base layer and network layer transactions are perfectly fine for early adopters.

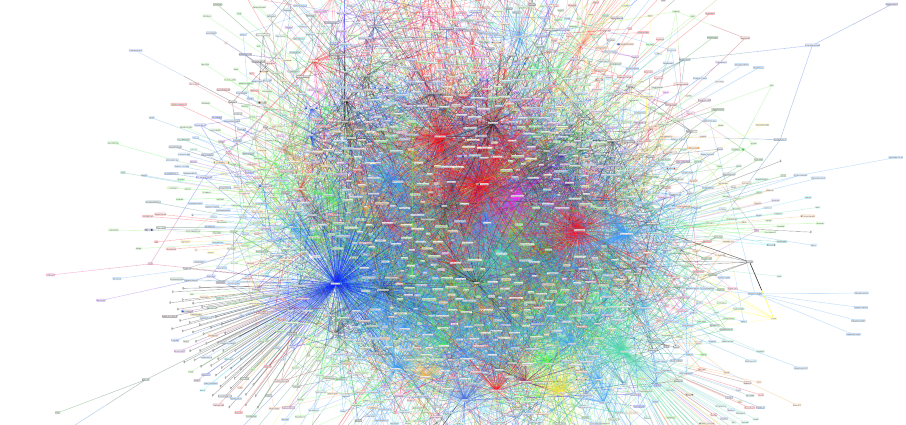

The Networking Layer

Lightning Network is a relatively new layer of Bitcoin, but it makes more sense to see that it is the unicast networking layer that sits above the base layer, and below an application layer. However the application layer is absolutely dependent on a robust networking layer. Indeed it is only being realised now that for the LN to work as best as it should, it needs to bring in other aspects of technology never before thought related to Bitcoin, such as machine learning and artificial intelligence.

Autopilot

Lightning Network

Lightning Network

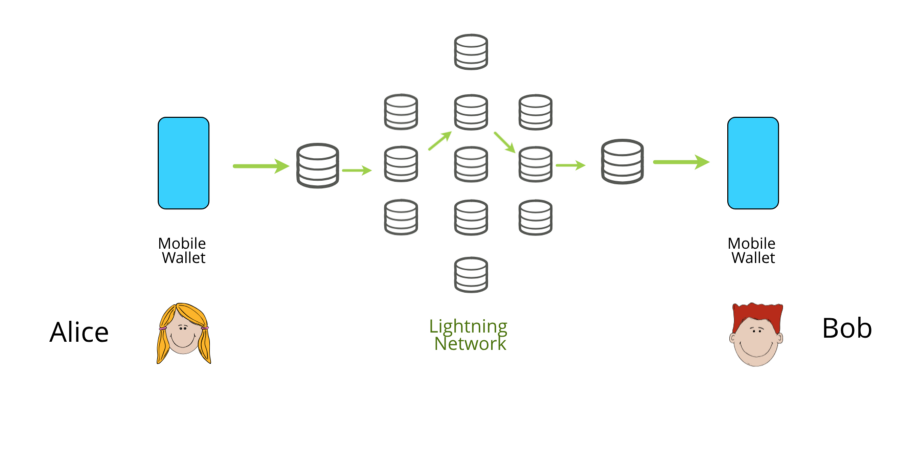

In the LN, users choose their route to their destination address. However there can be thousands of different choices of route, and the user may have different preferences between liquidity, fees, reliability and privacy. Each route has different characteristics that are non-deterministic as they are set by nodes that can connect and leave at any time. Additionally, with Atomic Multi-path Payments (AMP) the number of routes actually transacted across for a single payment may number in hundreds or thousands.

This is currently far too much for client-side processing, and indeed there is no algorithm that can easily solve for this. Instead, advanced ML algorithms will do far better in choosing routes between peers, and will allow the user to make payments with close to optimal speed, reliability, liquidity and privacy; all across a permissionless and decentralised network.

Indeed, an advanced AI-powered Autopilot will ensure that the connections made between nodes and users, as well as the parameters chosen for each route, counters most forms of attack on the network. Some of these attacks (such as parasitic, oppressive or censoring nodes) are not yet clearly defined or understood. For LN to ever function securely, it requires building first on a robust, resilient and secure Base Layer. Then once the Networking Layer is mature, then we can build the Application Layer.

Programmable Money

We’ve actually never truly seen programmable money before. Before Paypal and other payment services, sending money online was extremely difficult. Paypal’s innovation wasn’t making a better money, it simply created a network effect and consolidated a lot of ecommerce users in one place, so it could transfer money faster. Stripe and Square also didn’t create a better programmable money, they just simplified the on-boarding process for users and merchants.

The digital money we have been using the entire time never improved. Even in 2018, the minimum credit card fees have never been lower than around $1 and processing time never less than a few seconds. Beating these limits could only be possible by giving another entity access to your money, and this will never be feasible at scale.

With multi-layered Bitcoin, transactions to the 100th of a cent can be processed close to the absolute maximum limit of performance of the underlying internet infrastructure — and this can all be done completely trustlessly and never giving over control of money. Early tests show a single payment channel of LN processing payments at over 1m transactions per second.

These capabilities are about to usher in a new generation of marketplaces, experiences and economies. It is feasible that in future payments could be paid at the per-byte, per-millisecond, per-millimetre, per-millilitre or per-gram level; and these payments are entirely streamed between machines.

Some examples could be:

- Your fridge detects emptiness and orders your next meal for you.

- Your phone pays at the per-byte level for a faster internet connection, spending up to a cap you set.

- Your self-driving car drives faster than other traffic, paying to over-take.

- Your browser pays for the per-second view of online content.

Machines understanding value

Once our machines start interacting across the multi-layered value-transport protocol that is Bitcoin, it is conceivable that they will be taught to become aware of value. This will give rise to an entirely new generation of efficiency and effectiveness, as well as intelligence.

With more machines performing redundant tasks, humanity will gravitate more and more to what can keep us occupied, stimulated and happy. This will likely be around entertainment and consumption of content, especially in virtual and augmented reality.

At the same time, creation of content will be increasingly be served by artificial intelligence, reducing the feedback loop between creation of content, and assignment of value to that content by humanity. If an AI is producing video, music, art, virtual sports or games to an audience of humans, and it is being paid at the per-second or per-byte level; then the feedback between creation and consumption will rapidly reduce, and there is no more concise or clearer feedback than being paid for something.

Whether or not this accelerates us to singularity, is up for debate. However, the assuring thing about this reality is that the future with a multi-layered programmable money is that it is owned by all, and controlled by no one. This is far better scenario than a state-sponsored singularity.

Lightning for you, now

A multi-layered Bitcoin sounds exciting, but what can be used now? In truth the network is extremely young and under constant development. There is still a strong sense of naivety in what it really all is, and there is a large camp of users who don’t yet subscribe to or understand the multi-layer properties of the Bitcoin protocol yet.

The take-away is that Bitcoin is a multi-layered value-transport protocol, just how the internet is a multi-layered information-transport protocol. And the two will converge in a perfect storm.

#getoffzero #buybitcoin

In the next blog we’ll discuss how individuals can use the LN. Before then, you should download a lightning wallet: https://play.google.com/store/apps/details?id=fr.acinq.eclair.wallet.mainnet2&hl=en

You should also buy a lightning node to host at home: https://store.casa/lightning-node/

More resources: https://lnroute.com/

Follow me on twitter: twitter.com/jpthor_

I share, write and talk about the decentralised future.

Bitcoin Fundamentals: Mining Profitability Ratio & BTC Dominance

By cryptopoiesis

Posted October 11, 2018

Bullish, bearish? Neah… 100% mellish! Mellivora capensis the binomial name of the likewise commonly binomial named: honey badger

Bullish, bearish? Neah… 100% mellish! Mellivora capensis the binomial name of the likewise commonly binomial named: honey badger

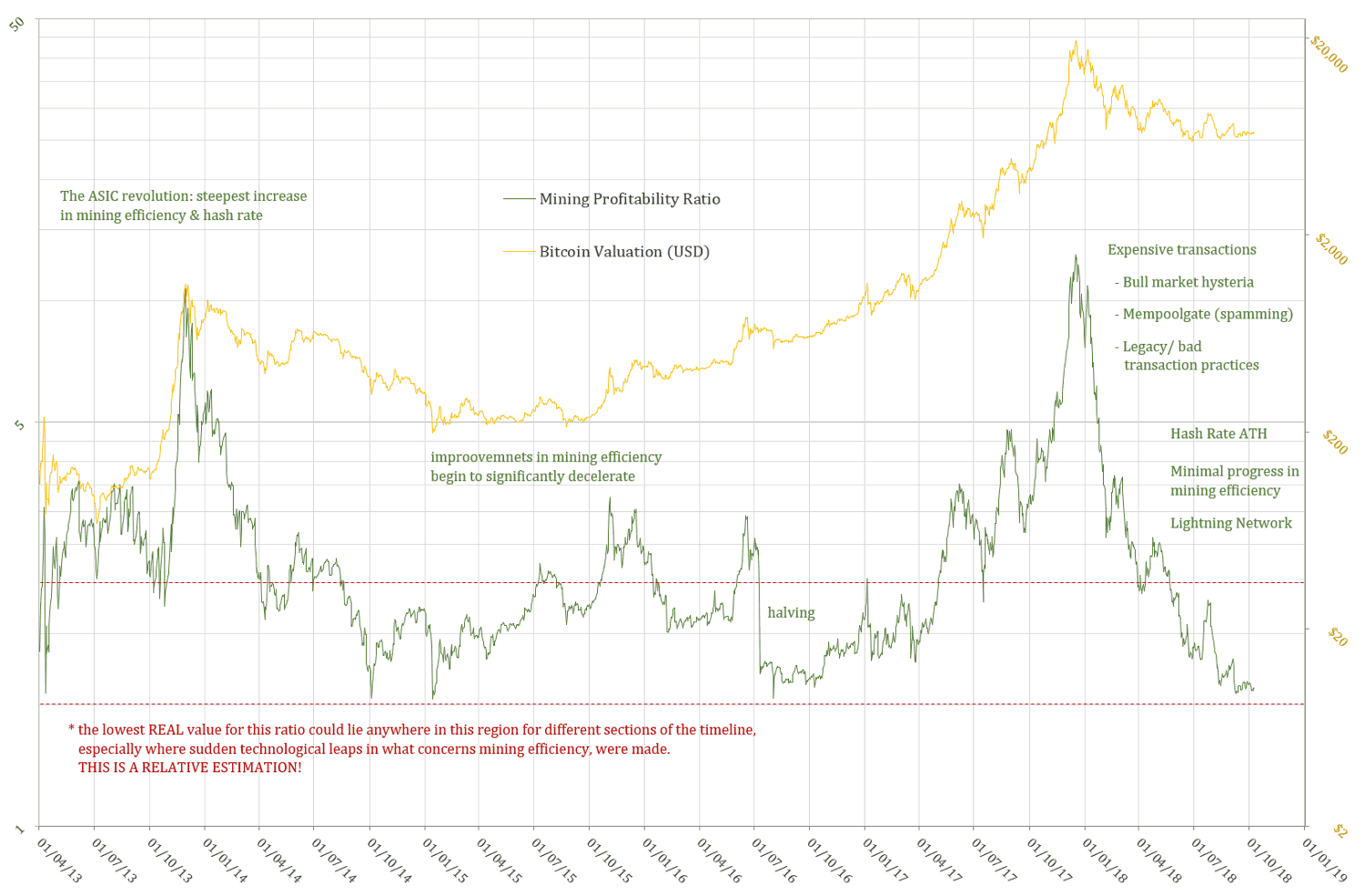

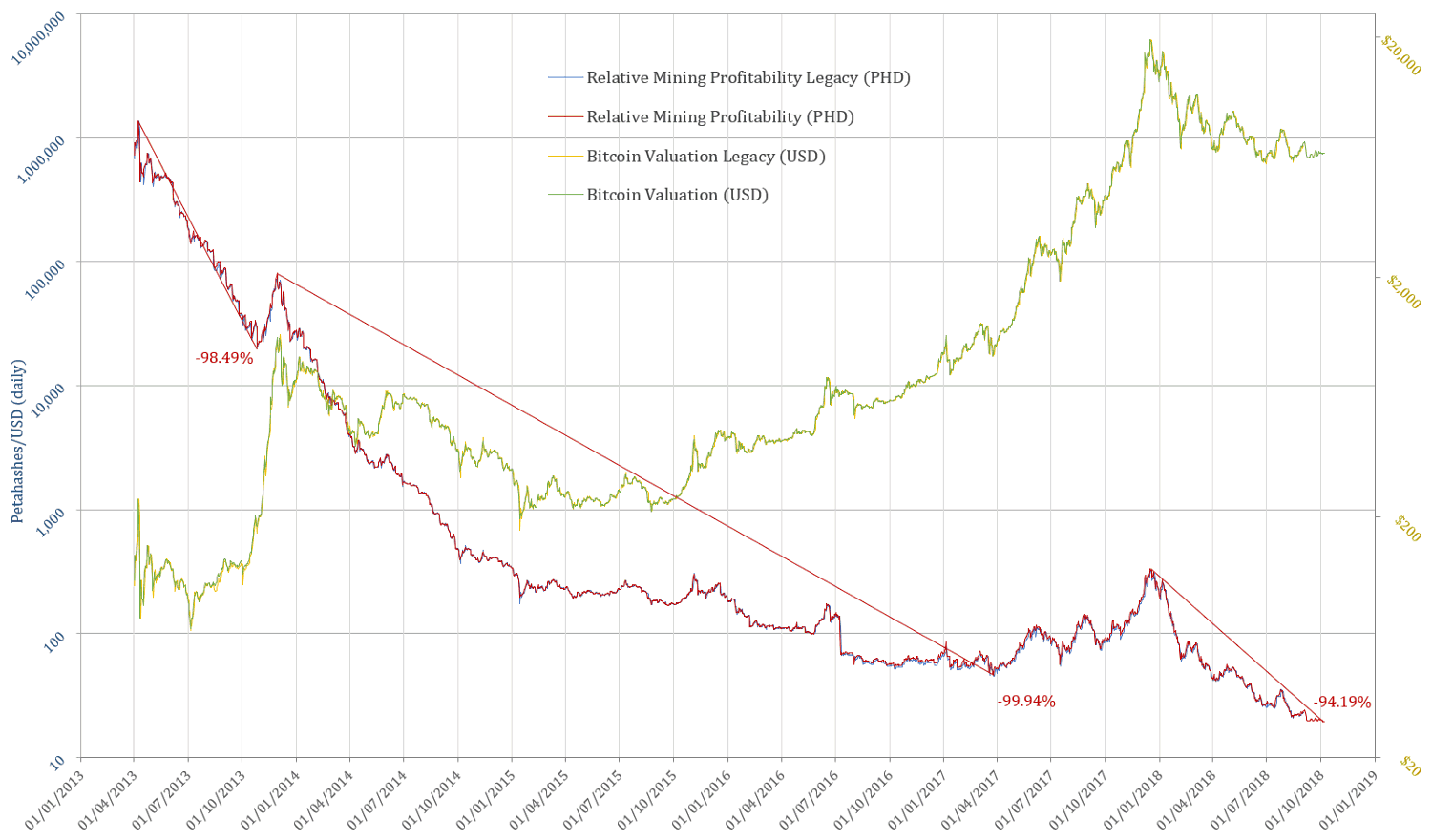

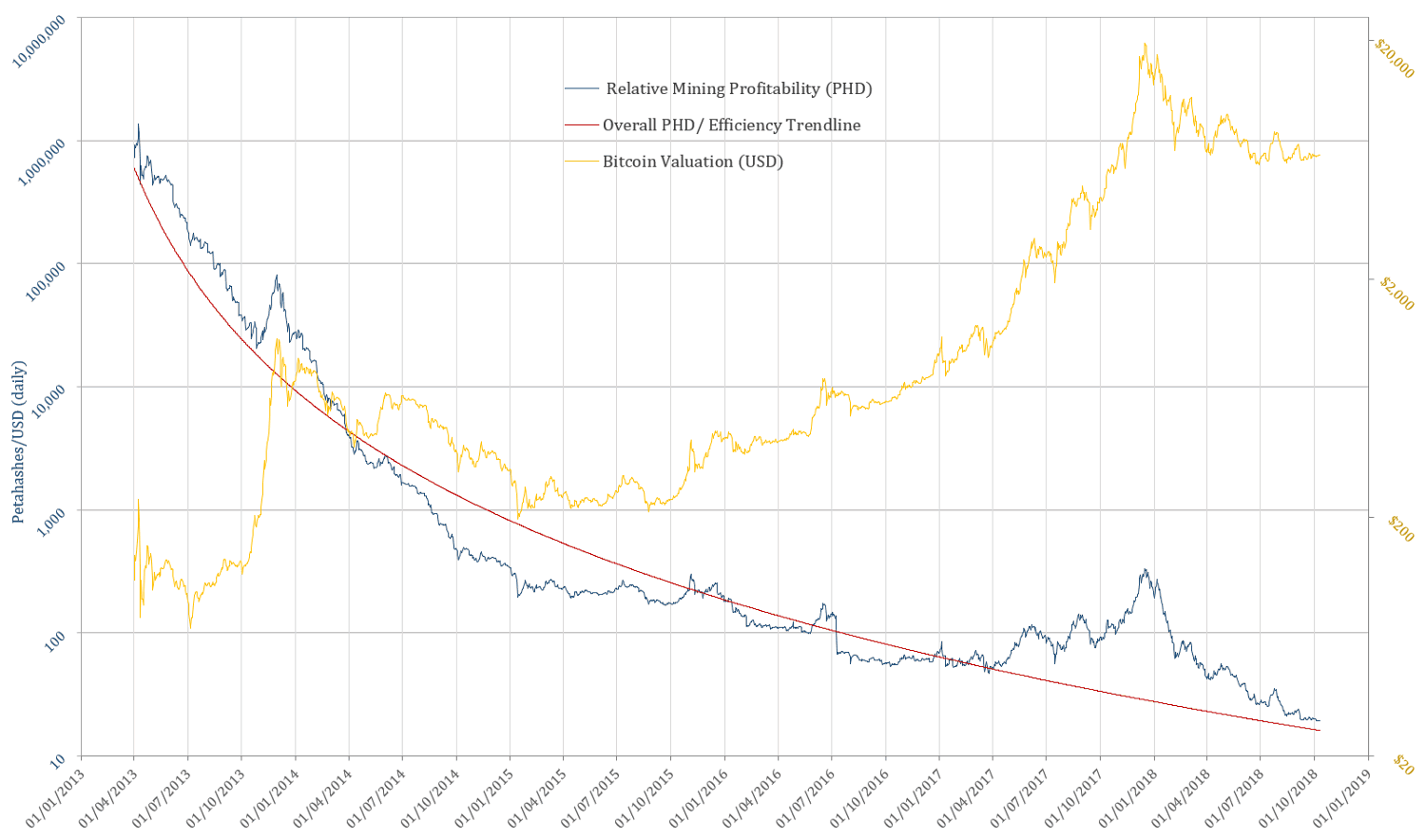

The PetaHashDollar (PHD) metric is a robust way to quantifying mining profitability over short timeframe, while also broadly describing the progress in mining efficiency over longer timeframes. As outlined in PHD Ratio, Rock Bottom Mining & Peak Tether, the PHD metric is calculated by dividing Bitcoin’s Hash Rate (Daily PetaHashes) by Daily Mining Earnings (USD) to include block reward & transaction fees.

In this article, the data sources on which this metric relies have been changed. The methodology and rationale for doing so are described in the article What is the Price of Bitcoin or its Market Cap… Exactly? The rest of the data sources concerning this metric have also been changed after analysing and comparing several sources. To summarise, all data is derived from:

- Daily Market Price, Daily Transaction Fees (BTC): blockchain.info

- Closing Daily Price: coinmarketcap.com

- Hash Rate, Coin Supply: bitcoinvisuals.com

The results of the new methodology/data sources can be compared to the legacy ones in the graph below

Where Are We At?

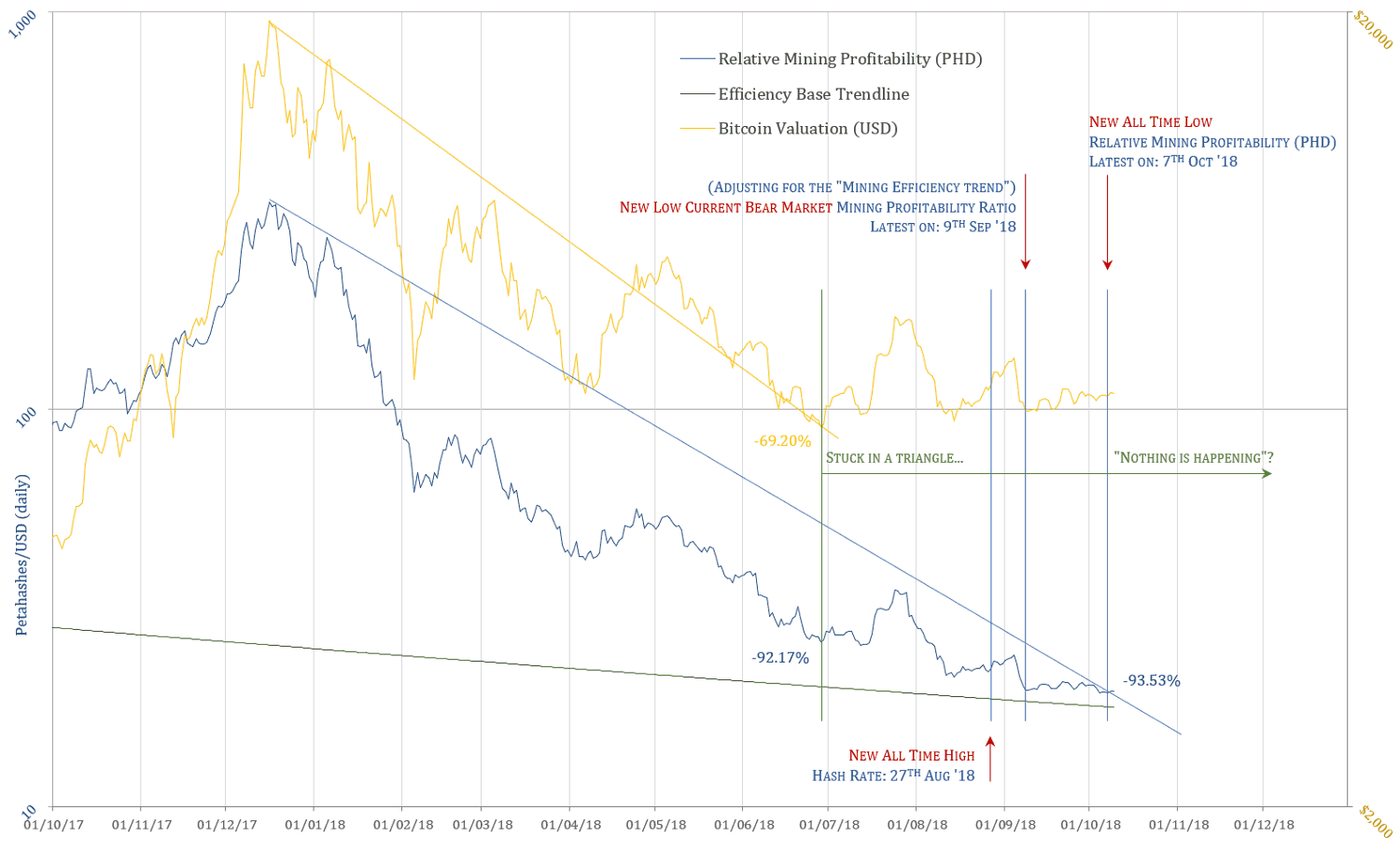

Challenging the apparent boring aspect of price action in Bitcoin valuation (up until the time the article was drafted, not the case anymore), in just over 3 weeks, Bitcoin has set a few record values:

- New All Time High Hash Rate: 27 August 2018

- New All Time Low PHD: 7 October 2018

- Mining Profitability Ratio (PHD adjusted for the “Mining Efficiency trend”) New Low Current Market Cycle: 9 September 2018

Mining Profitability Ratio

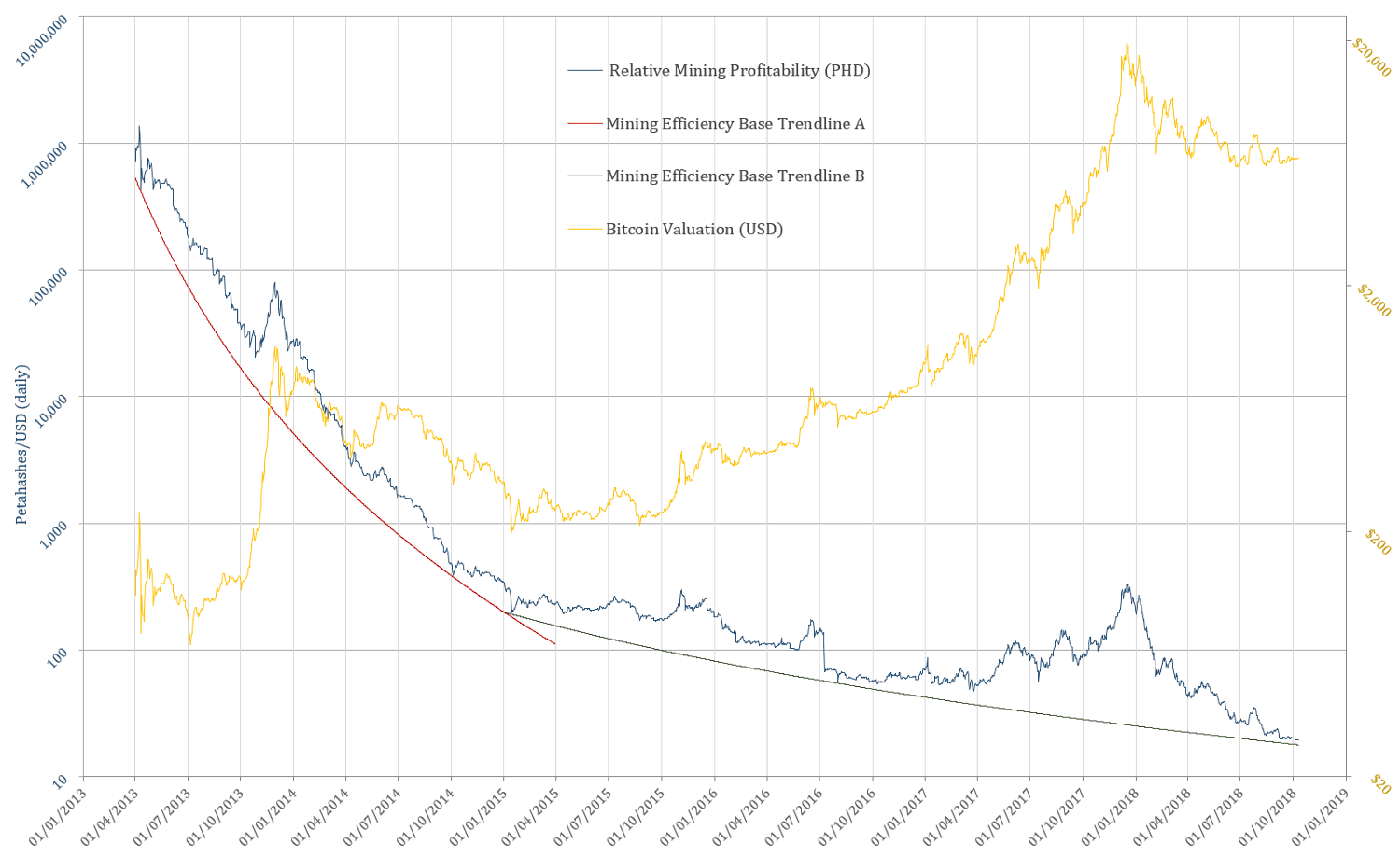

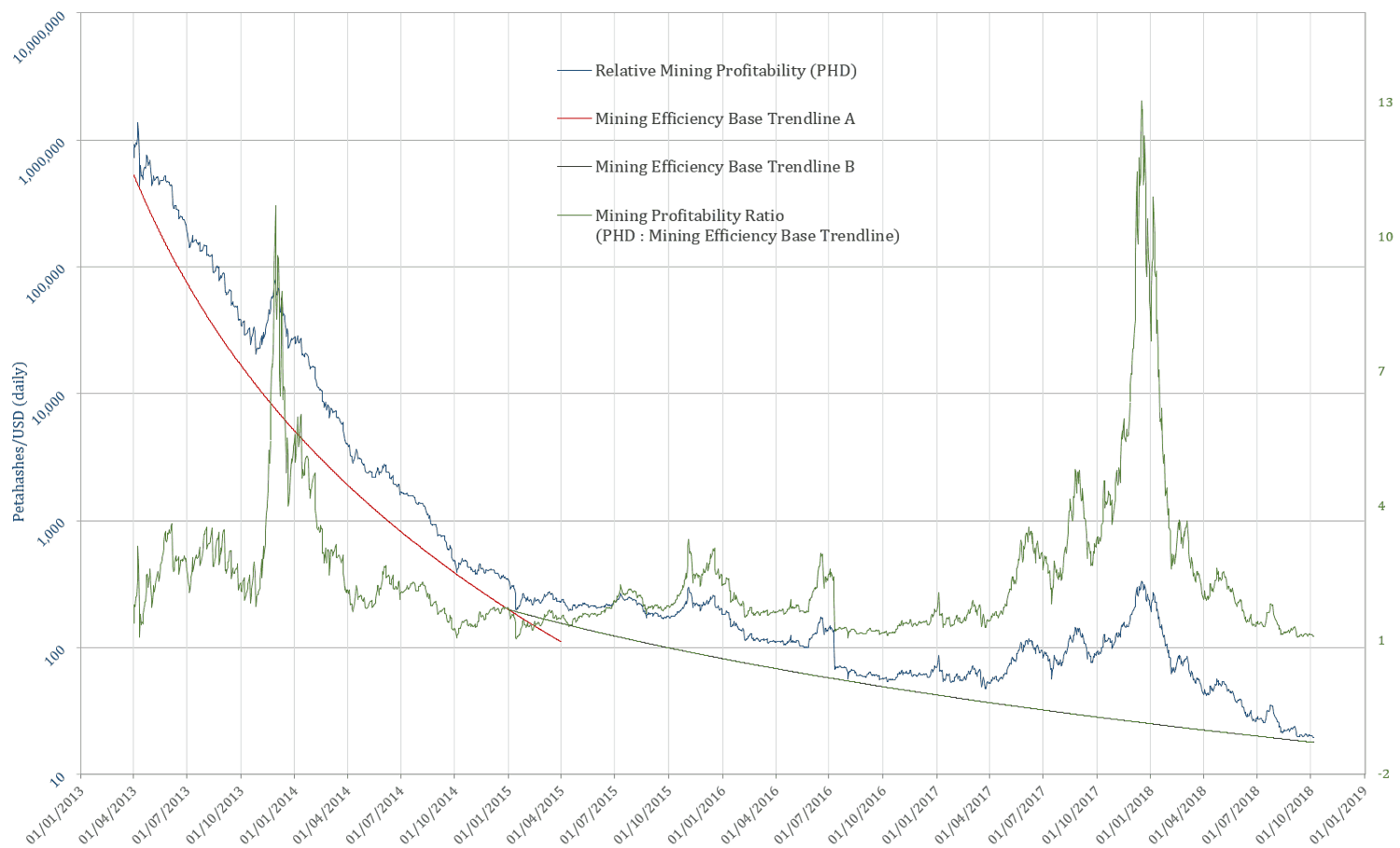

Regression analysis for exponential growth/decay have been unsuccessfully attempted in order to normalise the PHD metric, as to compensate for the substantial increases in efficiency and hash rate. This approach is to be furthered in a future analysis. For the purpose of this article, an eyeballed line of best fit has been derived from an exponential equation which best fits the entire span of the ASIC mining era:

The issue of using one equation for the entire timespan is that it departs too much from the more empirical progress in leaps and bounds (further exaggerated by market cycles). A sensible approach is dealing separately with the two visibly distinct areas of the graph:

- A — the initial substantial increases in terms of efficiency & hashing rate

- B — the tapering off in the magnitude of efficiency increase

The two equations best describing the baseline of these phases have been calculated and plotted below:

From PHD to Mining Profitability Ratio:

Discussion

For the Mining Profitability Ratio to touch baseline at the end of October, the price of Bitcoin would have to take a dive down to anywhere in between $5,385and $4,406,assuming 10% increase or decrease from current hash rate respectively, and an average mining revenue of c. 1,842 BTC/day (transaction fees + block rewards)

This scenario would be consistent with a dive to $4,900–5,200 range of resistance and would likely have the effect of bouncing back BTC price, at least for a few months of upside, if not directly into a halving-anticipating bull market, and all-time highs. Outside a major technical/security flaw or some kind of black swan event, Bitcoin is very unlikely to just dive to $3000… at least not this year.

Continuing being boring at current price levels, or bellow 6K, as well as in the range above (7.5–10 K), are all healthy scenarios for Bitcoin in long term. This lull is allowing the mining operations enough time to recalibrate & refine their workings, both in terms of technical efficiency, as well as in maintaining their operation liquid.

A Bitcoin mining industry in rude health is one core fundamental which needs to be met before even considering a true bull market insight.

Low Bitcoin Dominance Fundamental:

The Flipside of the Altcoin / Scamcoin Argument

Another fundamental which is radically different from all previous market cycles is the low Bitcoin dominance. While this can appear, as it has thus far, as a huge impediment in sustaining any upwards momentum — funds immediately beginning to flow into the plethora of other projects — this state of affairs can also have a backlash effect… if given enough time.

All the printed securities, tokens, altcoins are hugely centralised and, while it cannot be said that the individuals & organisation running them are most ethical, their intelligence cannot be underestimated. While the newly attracted capital and “dumb money” had been pouring in these ventures, it is sensible to assume that a considerable portion of the funds generated in this manner — the printing press — had been, and will continue to be converted into Bitcoin for long term hodl.

This trend, in tandem with the capital required to be sieved out in order to prop up these schemes/ projects, sooner or later is bound to reach an equilibrium with the dumb/speculative capital willing to flow towards them. Once this point is reached, a BTC upwards momentum would have a significantly better chance to be sustained, thus preventing entirely the Altpocaliptic scenario, in which a major capitulation in Bitcoin would evaporate all other speculative capital, along with any willingness to be innovative, reckless or scheming in this space.

Conclusion

Bitcoin is fundamentally a different beast than in all previous market cycles; any reference or comparison to previous cycles must be treated with extra caution. Nothing is “off the table”, anything can go “off the charts”!

DISCLAIMER This content is only to be taken as my personal OBSERVATION & OPINIONS, for the purpose to be further considered, debated or discarded. The analyses outlined are far from exhaustive, and ARE NOT & CANNOT serve as basis for any financial / investment / trading advice.

Work is Timeless, Stake is Not

Hugo Nguyen

Posted October 12, 2018

Much has been written about Proof-of-Stake (PoS).

There are many ways to slice and dice PoS and uncover its weaknesses. Mainly:

Evolutionary Psychology/History: “Collectibles” or “proto-money” in history all had one thing in common, unforgeable costliness [1] — or at least unforgeable costliness in the context of their times. From sea shells, furs, teeth, to precious metals to minted coins. As PoS merely involves the temporary lockup of existing capital and does not consume said capital, it does not satisfy the unforgeable costliness requirement that Nick Szabo identified as one of the 3 key properties of money.

Economics: If an object has value, people will spend effort to chase it, up to whatever the object is worth (MC=MR). This effort is also “work”. Paul Sztorc correctly concluded that PoS is an obfuscated form of PoW.

Work manifests in different ways in PoS, whether it is taking out a loan from the bank, running 24/7 staking servers, or attempting to steal online staking keys.

Not only PoS is obfuscated PoW, it is inferior PoW. Any potential cost saving PoS gives you, it pays back in equal measure in the reduction in security.

As we shall see below, a dollar [2] fleetingly locked up in staking creates nowhere near the same level of security as a dollar spent in mining.

Computer Science: Andrew Poelstra wrote one of the first formalized critiques of PoS, in which he coined the terms costless simulation (aka nothing-at-stake) and long-range attacks.

A recent paper by Jonah Brown-Cohen, Arvind Narayanan & co. also showed surprising barriers to having a good and reliable source of randomness in PoS protocols [3].

Engineering: I myself have written a 2-part series [Part 1] [Part 2] looking at PoS weaknesses from the practical engineering perspective, and listed specific worst-case scenarios where PoS is particularly vulnerable: network partition, private keys theft, or low rate of participation in staking.

But perhaps one of the simplest ways to look at PoS is through the lenses of Time, which I alluded to in my series, but want to expand on here.

Proof of Stake is Proof of Temporary Stake

Proof-of-Stake is a misnomer. The correct, fully descriptive name for Proof-of-Stake should be Proof-of-Temporary-Stake (PoTS). This name is more accurate because it captures the time element, or lack thereof, of PoS.

To understand the effects of Time, let’s first analyze how Time plays a role in PoW.

The ongoing energy expenditure in PoW contributes to network security in 2 ways:

- Energy expended per block not only secures the UTXOs belonging in that block but also retroactively secures all global UTXOs that occurred in past blocks. The reason for this is because it would be impossible to revert past UTXOs without reverting the current block first. Each new block effectively “buries” all existing UTXOs under its weight.

- Investment in specialized mining equipment, in essence, represents the potential stream of rewards earned in the future, discounted back to the present. When a miner invests in a new piece of mining equipment, it is akin to buying a share of stock that pays regular dividends. What that means is that mining hardware in totality roughly represents potential energy expenditure of future blocks.

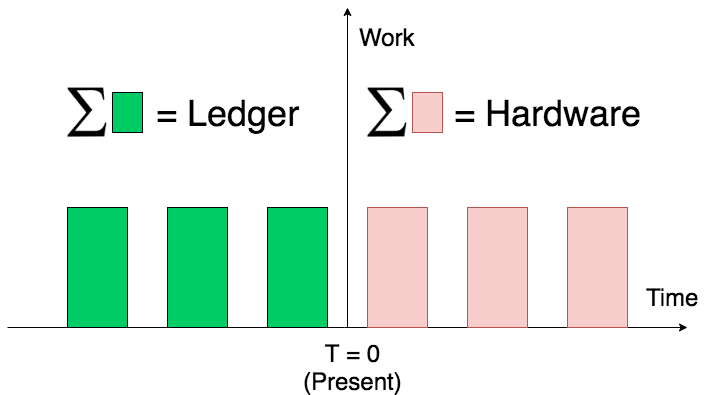

One way to visualize this is to imagine a timeline. Units of work expended in the past accumulate in the ledger. Units of work expended in the future accumulate in the current mining hardware.

Ledger accumulates past work; Mining hardware accumulates future work.

Ledger accumulates past work; Mining hardware accumulates future work.

As time moves forward, units of work on the right side materialize and move to the left side. Mining hardware can also be seen as a “buffer”, a place where units of work deposit before making their way to their final destination: the ledger [4].

The official term to describe this sort of time-based accumulation phenomenon is stock & flow, which occurs often in nature. Bitcoin is essentially protected by high stock-to-flow ratios in 2 areas: the ledger, and the mining hardware. (Go here for a detailed discussion of stock & flow.)

In contrast, PoS has no equivalent of this.

Past stakes (left side of the timeline) do not accumulate in the ledger, as stake is released after some arbitrary bonding period [5]. Long-range attack is the manifestation of this weakness: it works because of PoS’s inability to secure the past. Long range attack is at the heart of the problems with PoS, because it shows that in the long run PoS fails to guarantee the integrity of the ledger — the most important asset of all this innovation.

Future stakes (right side of the timeline) also do not accumulate in the validators in the present time, as again the act of staking only has meaning within the short window that it occurs — what happens in the future does not count today. Current-private-keys-theft is the manifestation of this weakness: it works because of PoS’s inability to secure the future. Keys theft sidesteps altogether the financial cost supposedly required to acquire controlling stake — whereas in PoW there’s no sidestepping the fact that an attacker needs to overcome the mining hardware and ongoing energy costs to pull off and sustain a majority attack [6].

(There is one form of accumulation in PoS. That is, the periodic staking rewards that accrue to the validators. However, unlike accumulation in PoW, rewards accumulation is only beneficial to the individual PoS validators, not to overall network security.)

In summary: the further one moves away from the present time in PoS, the faster stake loses its meaning, until stake becomes meaningless.

Work is robust against the ravages of time [7]. Stake is not.

The fact that the cost of PoW mining is irretrievably sunk and accumulates both in the ledger and the mining hardware, is an important feature, not a bug. PoS research is often based on the fundamental misconception that this is a bug and a source of inefficiency.

Acknowledgments

Special thanks to Vijay Boyapati, Bob McElrath, LaurentMT, Nic Carter and Steve Lee for their valuable feedback.

*Note: Another major criticism of PoS is that PoS pretty much guarantees a plutocracy system (rich getting richer). That is not discussed here as it is not related to security strength per se, and deserves its own separate discussion.

[1] Some might confuse unforgeable costliness with the labor theory of value , but they are not the same thing. Energy cost alone is not enough, the asset must be unforgeable.

[2] Dollar is only used as a unit here for convenience, it could be any other unit of account.

[3] For a PoS currency, relying on an external source of randomness involves circular reasoning fallacy . Therefore it is highly desirable that PoS generates randomness internally, using the content of its own ledger. However, this proves to be a difficult problem that has its own trade-offs.

[4] Not all units of work make it all the way to the ledger. Some are thrown away, but even thrown-away work are necessary to keep the network decentralized.

[5] The concept of “ finality ” does not change the (lack of) accumulation aspect of PoS, as new/long-dormant/partitioned nodes can see different “finalities”.

[6] Hardware seizure (e.g. by a state actor) is a risk in PoW, however this risk can be mitigated as long as mining is sufficiently decentralized. Disperse hardware, however, is not a defensive option for PoS, as PoS validators are just software nodes — which can be targeted from anywhere remotely. More importantly, even with seized hardware, an attacker still can’t avoid ongoing energy costs.

[7] Work is timeless / robust in terms of number of hashes, not energy required. New hardware technologies could improve mining efficiency — although at some point the efficiency gains will slow down as we run into hard physical limits. The robustness of Bitcoin’s PoW also relies on SHA256 not being broken.

Powered by Lightning — Part 2

Using the Lightning Network as a user

JP Thor [ ₿ ⚡️]

Posted October 13, 2018

In the first part of this series I discussed how Lightning Network (LN) is making money programmable and setting the foundation for a world powered by digital, state-less, debt-free money. In this part I’ll discuss how individuals today and in the future will be using the Lightning Network.

- Part 1 —The Lightning Network — Programmable Money

- Part 2 — Using the Lightning Network as a user

- Part 3 — Using the Lightning Network as a business

- Part 4 — Using the Lightning Network as a country

- Part 5 — When the world is powered by Bitcoin

In the future we will be able to use the LN for the following time of payments:

- Paying peers

- Paying merchants

- Programmable money (games, streaming entertainment, services, IoT, etc)

We’ll take a look at each scenario and discuss how it can be done with Bitcoin and the Lightning Network.

Entering Bitcoin

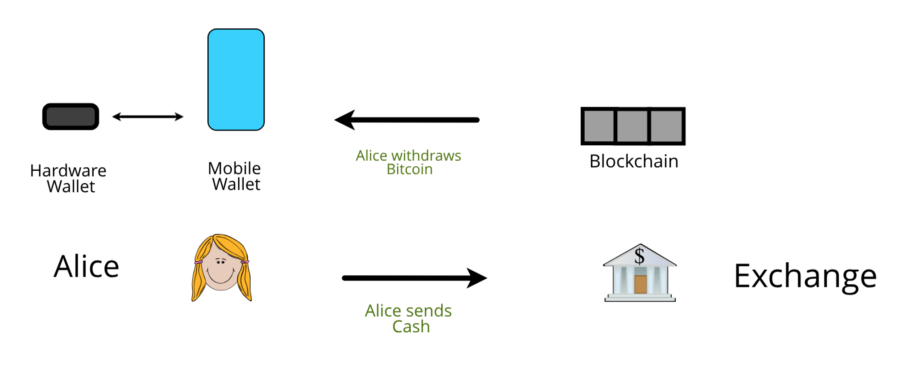

Firstly, how does Alice enter Bitcoin? Alice purchases it off an exchange of some sorts, by making a purchase with fiat, and withdrawing her Bitcoin to her mobile and hardware wallets. Mobile wallets for small, quick purchases, often referred to as a “hot wallet” and hardware wallets to store the bulk of her Bitcoin for security, often called a “cold wallet”.

The following is the typical flow:

Buying and withdrawing Bitcoin

Buying and withdrawing Bitcoin

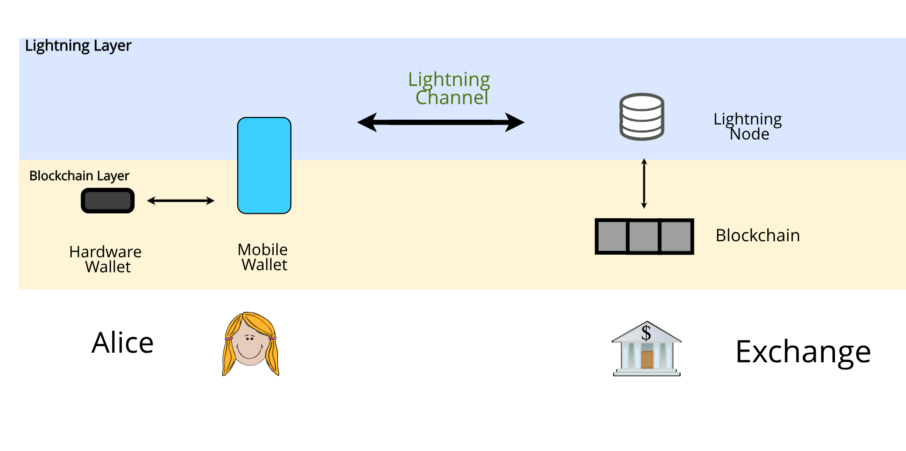

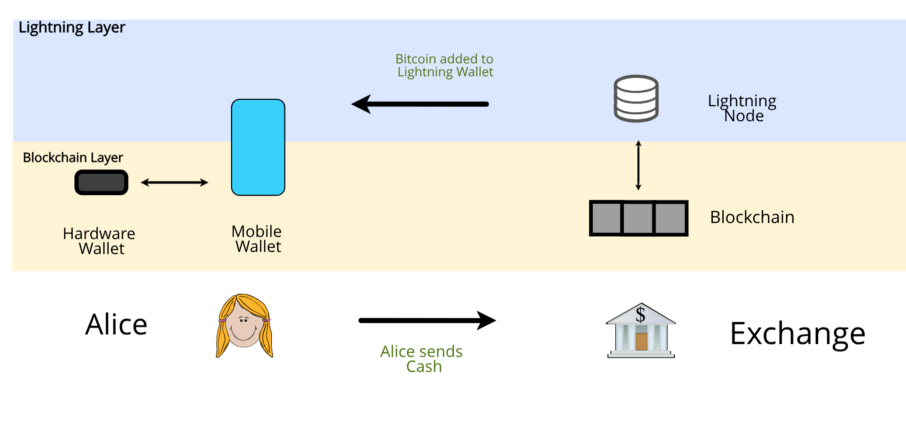

In a lightning-powered future, Alice will do it no differently. From the same wallet that she currently uses as a hot wallet, she will open a channel with her exchange, creating her first lightning channel.

The semantics of “opening channels” will most likely be dropped in the future Bitcoin wallet to avoid confusing users. Instead, users will have a “lightning wallet” which will have software (Autopilot) that will open channels seamlessly behalf of the user; and these channels will be opened with a number of different nodes, not just an exchange node.

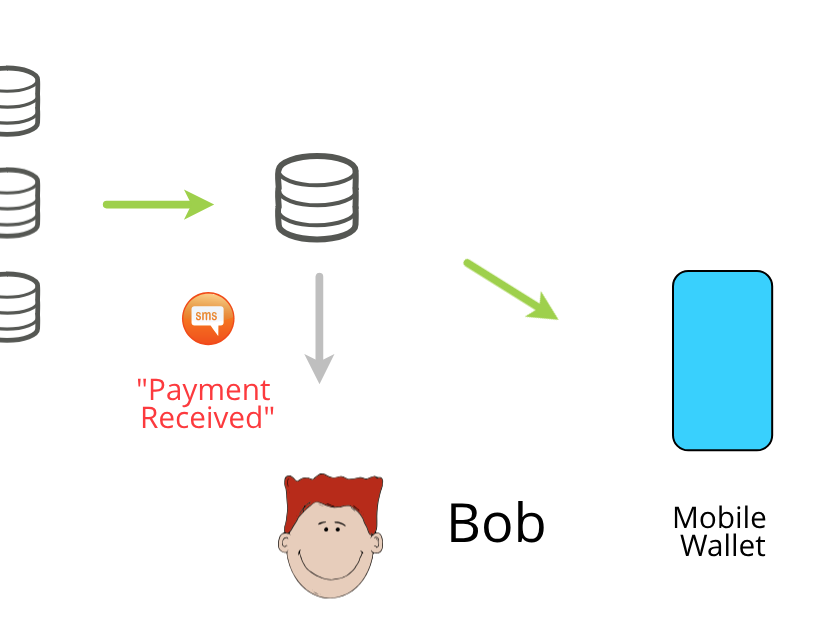

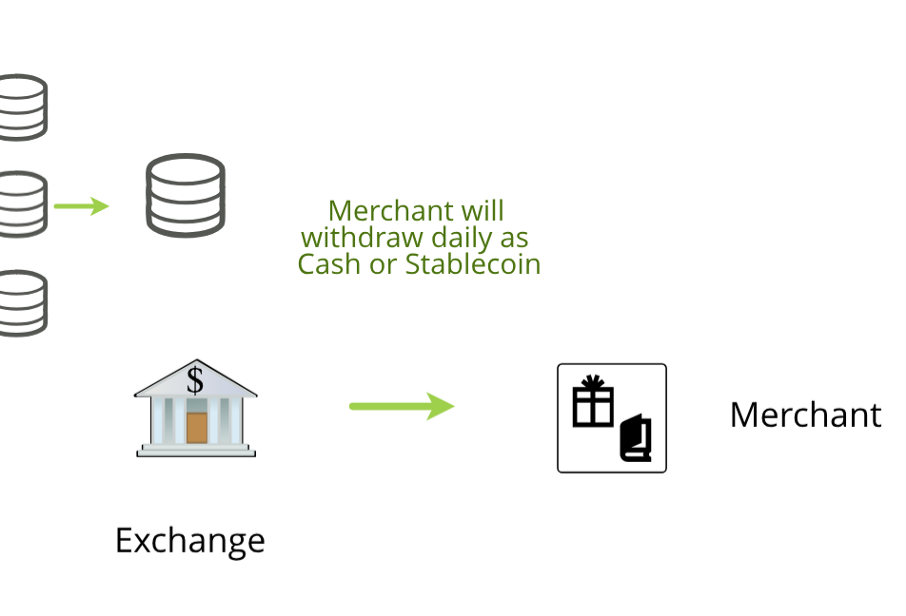

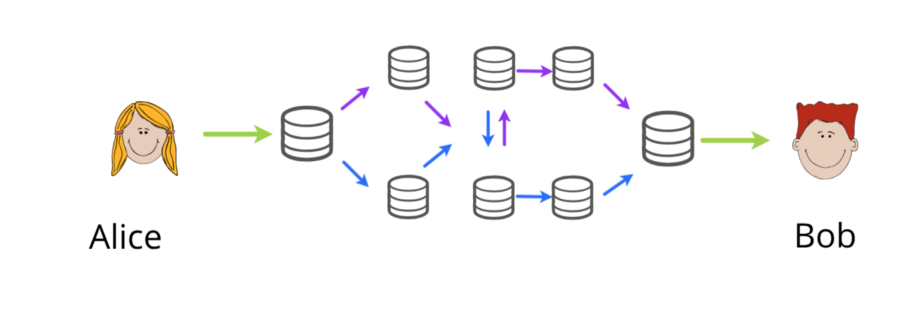

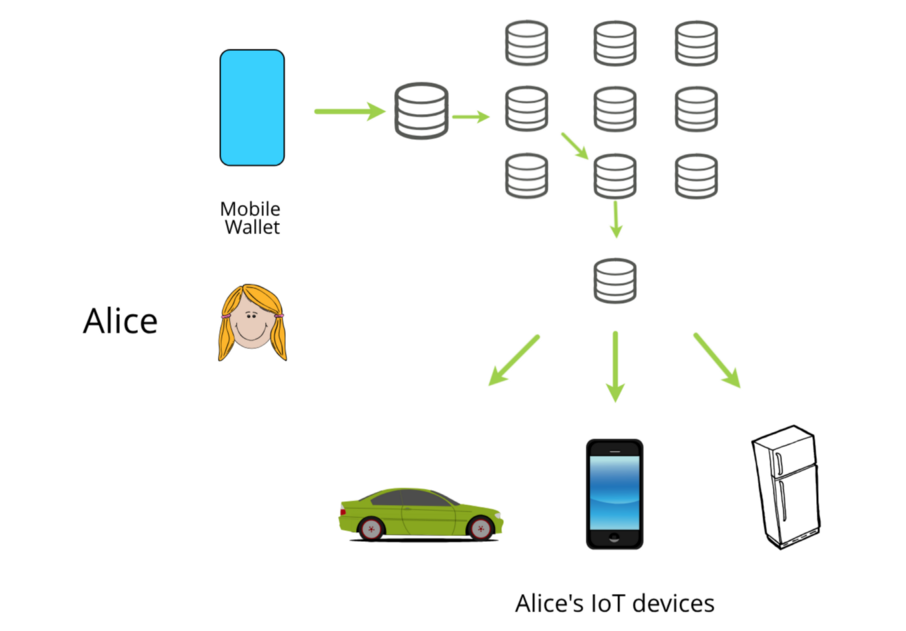

The lightning wallet is accessed from Alice’s mobile device, but the mobile device is capable of holding Bitcoin at both Layer 1 and Layer 2. Future mobile wallet apps should strive to have very clear user experience around the two layers; most likely treating the lightning wallet as the “everyday cash account”, and the blockchain wallet as the “savings account”. The hardware wallet would then be the “term deposit” or the “super fund”.