Crypto - Time to Take it at the Flood

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Crypto - Time to Take it at the Flood

By Rayne Steinberg

Posted April 4, 2019

The recent collapse in crypto assets from their high in December of 2017 has caused many to question the viability of crypto and blockchain, generally, and Bitcoin specifically. The overall market cap of the crypto ecosystem peaked at around $800 billion in January of 2018 and recently set a low of $100 billion in December of 2018. This is an 87% decline from peak, and a catastrophic result for any asset class. But what should investors make of it? And how should one approach it from here?

First, we have to contextualize the performance of crypto as an asset class. For these discussions, I will use Bitcoin as a proxy for the broader crypto market as it has the only meaningful return set.

Bitcoin - What Is It?

Let’s look at the Bitcoin boom-bust cycle through the lens of previous historical experiences. In order to do that, we have to determine what crypto/blockchain/bitcoin is. Bitcoin has attributes that overlap many areas. It has some qualities that are akin to a financial instrument, and others that compete more with currencies. Also, it is a new and disruptive technology. Also, it is an idea that advances decentralization and is a potential remedy for a financial system that is losing trust.

Bitcoin - The Asset Bubble

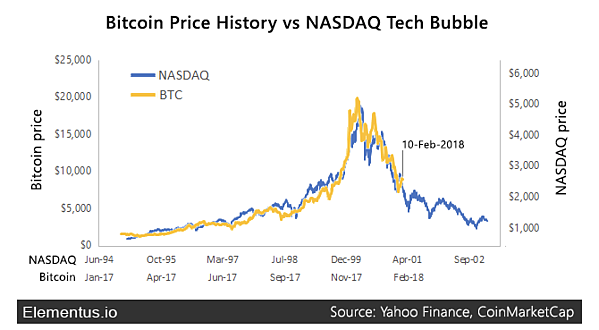

When we look at Bitcoin as an asset class, we can view the recent run-up and subsequent collapse in prices like any other financial bubble. Many have compared it to the technology stock bubble of the late 1990s. And the trends look remarkably similar:

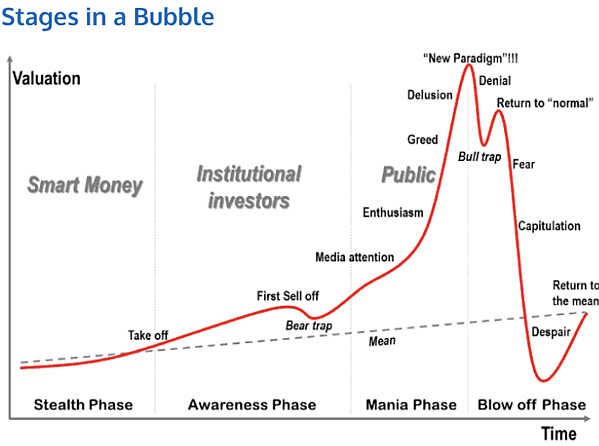

This is interesting but does not really tell us that much. There is a broad pattern that bubbles follow:

Source

Source

There have been many financial bubbles throughout history that have followed this pattern. If the recent volatility in Bitcoin was just a run of the mill asset bubble, we could dismiss it and move on. Bitcoin would have just now entered the end of the Blow Off Phase. But Bitcoin is more than just an asset class; it is a new and disruptive technology.

Bitcoin - The Disruptor

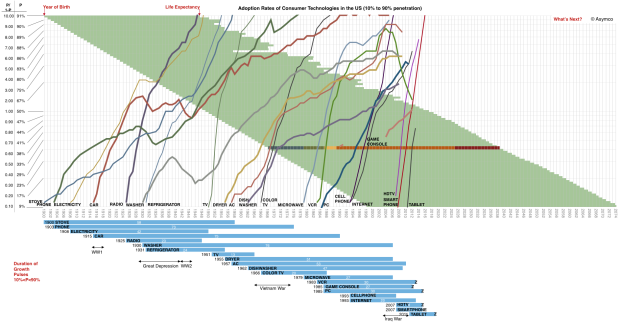

When we treat Bitcoin as a disruptive technology, there are many corollaries for us to consider. Asymco outlines the adoption cycle of all major innovations in the US from 1900 on:

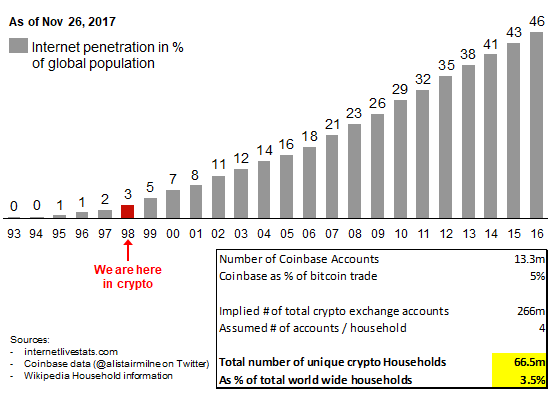

If blockchain is a revolutionary technology, it is important to know where it is in its life cycle. By most accounts, it is still, incredibly early innings. This comparison contextualizes it in relation to the internet and its rate of penetration:

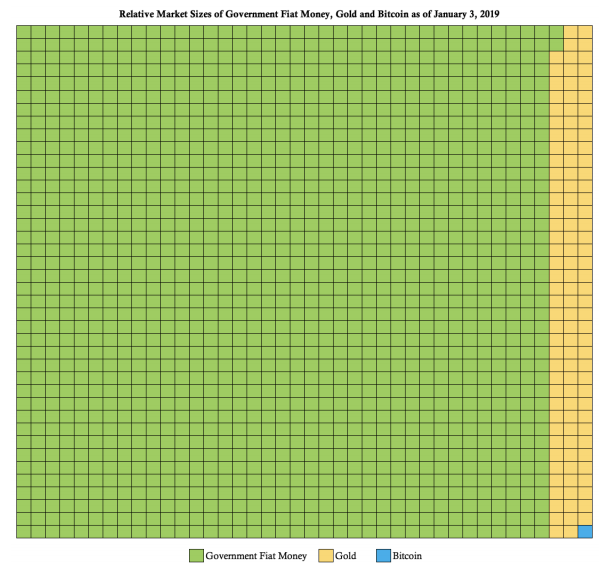

One can argue it is even earlier, as the above analysis is estimating user adoption where it mainly takes into account retail adoption. As Bitcoin is potentially a replacement for currency one could argue that the total market for Bitcoin is that of government fiat + gold. When looked at this way, Bitcoin is only 0.07% of that addressable market:

By any of these measures, Bitcoin is at the beginning of its adoption cycle, not the end. In addition to the technology, what is even more fundamental, is the animating idea behind it.

Bitcoin - The Idea

The idea of Bitcoin is more basic than its asset class and technology-like attributes. Robert Breedlove says Its “a momentous Innovation of the digital age. As such, it has many unique characteristics, properties and capabilities never before seen in a monetary technology:”

- Immutable Monetary Policy

- Digital Scarcity

- Absolute Scarcity

- Global Final Settlement System

- Self-Sovereign Network

- Stateless Money

- Revolutionary Social Contract Implementation

- Global Consensus

- Global Energy Buyer of Last Resort

- A New Form of Life

- Adaptive Security

- Adaptive Functionality

- Programmability

The revolutionary and society-changing nature of this idea is what makes it incredibly powerful and disruptive. This is the first technology that has the ability to halt, and perhaps reverse, our relentless drive towards centralization while still affording us of its benefits. And as an idea, it came into existence in response to the overreach of banks and governments during the financial crisis. The same policies that spawned it are being continued and amplified today. The idea of Bitcoin is much more similar to a sea-change in societal thinking, like the spread of a major religion or the reaction to one. And when thought of like that, it is incredibly early and it will take a long time for that idea to work its way around the globe.

What Do You Do?

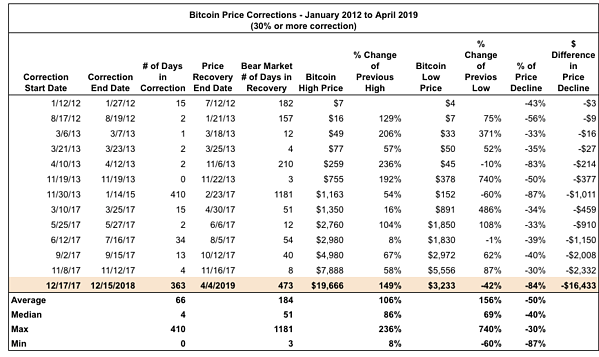

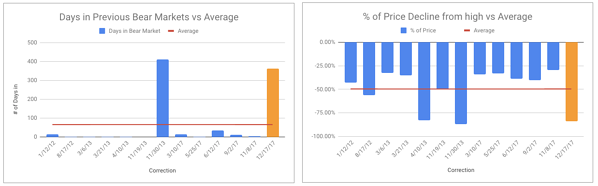

If the above is true, what does that mean in regards to the current price level of Bitcoin? Should we be buying or selling? Even if we agree with the thesis that this is a transformative technology and we are at the earliest stages, no one wants to suffer through more downside volatility than they have to. Let us contextualize this bear market as it relates to other Bitcoin downdrafts. I used Solomon Stavis piece From Bear to Bull, a Look into the Cycle of Bitcoin Prices as a place to start. From January of 2012, there have been 13 corrections of more than 30% in Bitcoin (including our current correction):

If we did put a bottom in on 12/15/2018 at $3,233, then this correction would have lasted 363 days with a max drawdown of 84%. This compares to an average length of 66 days for bear markets and an average 50% decline.

Source: Yahoo Finance, data as of 4/2/2019

Source: Yahoo Finance, data as of 4/2/2019

In both duration and severity, this correction is near the previous extremes.

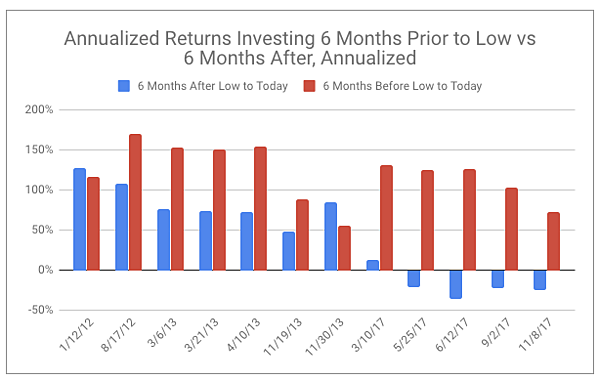

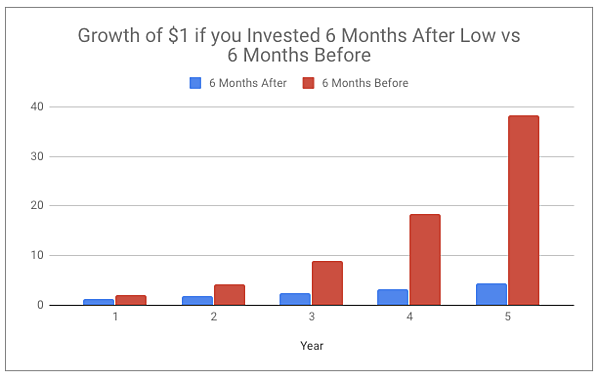

And what we are trying to determine is if this really is the bottom, or do we have more to drop? A better question is, is it better to be early or late. And by that I mean, if you feel you are near a bottom, would you prefer to invest before it bottomed or after? To add some color around this, I examined if you had invested 6 months before each of the previous lows, or if you waited until six months after.

Source: Yahoo

Finance, data as of 4/2/2019

Source: Yahoo

Finance, data as of 4/2/2019

The average annualized return for the after low set is 41%, an unimaginable return in any other asset class. The average annual return for the before the low investment is, however, an eye-popping 120%. When you look at the growth of a dollar invested at these respective rates, over 5 years, late grows to $4, and early grows to $38.

Source: Yahoo Finance, data as of 4/2/2019

Source: Yahoo Finance, data as of 4/2/2019

In this case, the early bird really does get the worm.

While this analysis is rudimentary, and the time series is short, the data does suggest its better to be early than late. As of 4/2/2019, Bitcoin is up 54% from the low on 12/15/18. If you believe the overall thesis for Bitcoin specifically and the crypto and blockchain space generally, you may not get another opportunity to enter at such an opportune time.

If Shakespeare’s Brutus were transported to a pension’s investment committee meeting where they are considering making an allocation to crypto, his famous words of action might be the best advice they could get:

There is a tide in the affairs of men, Which taken at the flood, leads on to fortune. Omitted, all the voyage of their life is bound in shallows and in miseries. On such a full sea are we now afloat. And we must take the current when it serves, or lose our ventures.