Bitcoin’s Value Proposition – Is It Truly the Best Currency?

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Bitcoin’s Value Proposition – Is It Truly the Best Currency?

By BTChap on The Bitcoin Reserve Journal

Posted March 22, 2020

Why bitcoin is the king of the hill when it comes to hard money.

Disclaimer: Opinions expressed in this article do not constitute investment advice from Bitcoin Reserve.

How Bitcoin stacks up against traditional currency and possible new competitors

The hype about Bitcoin is sometimes overwhelming and presumably difficult to understand from a conventional investor’s point of view. So, let us try to unravel that mysterious “internet money” for the interested reader. Bitcoin’s most important difference, in comparison to other currencies that operate within the conventional banking system, is the way in which payments are transferred. Payments by credit card or smartphone are made via banks, which in turn settle with each other via a system operated by a central bank. With Bitcoin, on the other hand, payments are processed via a distributed ledger - a decentralized database in which all transactions are recorded permanently. If a transfer is pending, someone has to check whether the paying party has a sufficient Bitcoin balance and subsequently needs to arrange the transfer of funds to the payee. But who is this “someone”? Bitcoin, for the first time in financial history, relies solely on volunteers running the infrastructure to maintain the network and pays them in newly created Bitcoin.

So how can the hype about Bitcoin be explained?

Bitcoin is new. In order to comprehend its disruptive effects on today’s financial industry and banking system, it’s important to examine the aspects of Bitcoin’s value proposition. During the financial crisis of 2009, an anonymous person or group by the pseudonym of Satoshi Nakamoto published the Bitcoin whitepaper as no less than a counterproject to the traditional financial system. Thus, Bitcoin was born and designed during a financial crisis, and it is the only asset that was built with a particular emphasis on its resilience to wither such a situation.

History has shown that its resilience against continuous attacks is staggering, considering its constant exposure to assaults by individuals, groups of people or even governments within the last ten years of its existence. In fact, it can be viewed as the world’s largest honeypot for hackers. In this hostile environment, the Bitcoin protocol has proved its resilience repeatedly as the Bitcoin blockchain itself has never been successfully hacked throughout its entire existence. This is not true for Bitcoin exchanges, however, which are hacked on a regular basis. Thus, it is of utmost importance for the interested investor to invest in an adequate storage method.

Another side effect of those constant attacks was the stoic calm acquired by early investors. Those early adopters believed in Bitcoin’s superiority over any other asset, but is this mindset justified, or are those people merely naive idealists?

The two concepts powering Bitcoin’s popularity

This steadfast belief in the Bitcoin protocol is based on two simple concepts. They may seem trivial at first glance, but when these two points are understood, it is possible to understand how a currency, which is not backed by any government, could achieve such a meteoric rise. Those two concepts are:

- There are only 21 million bitcoin.

- You cannot create a better Bitcoin.

Let us elaborate on both statements since they are anything but trivial.

Concept 1: There are only 21 million bitcoin

There will only be 21 million Bitcoins in existence. This is engraved in Bitcoin’s source code and cannot be changed by anyone. This “hard cap”, or maximum supply, is one of the main reasons for Bitcoin’s price valuation. Bitcoin is thus the most deflationary currency humanity has ever seen. In a centralized economy, the currency is issued by a central bank at a rate that is supposed to match the growth of the number of goods. The monetary base is controlled by a central bank, which can increase the supply by issuing more currency. The resulting distribution of capital is interesting, to say the least.

Here’s all the money in the world, in one chart

Bitcoin is a proverbial drop in the bucket.

Bitcoin today just represents the proverbial “drop in the bucket” of the global financial system – albeit with all its advantages (very high risk/reward ratio) and risks (high volatility, possibility to manipulate the price, etc.). Since Bitcoin represents a fully decentralized monetary system, no central authority regulates its monetary base. Instead, the currency is created by the miners at a fixed and predefined rate, and transactions are verified by the nodes of this peer-to-peer network. Everyone can participate without the need to register at a higher level, making the network truly decentralized and democratic. The Bitcoin protocol defines how the currency will be created and at what rate. This boundary condition was established at Bitcoin’s creation in 2009 and cannot be changed. Any Bitcoin transaction that is generated by a malicious user and does not follow the rules postulated by Satoshi Nakamoto in 2009 will be rejected by the Bitcoin network. As a result, Bitcoin represents the most deflationary currency known to humankind and enables verifiable, and thus trustless, transactions between two entities without any intermediary. This property makes Bitcoin a serious contender to become the world’s reserve currency.

Concept 2: You can’t create a better Bitcoin

But how about just creating a new, superior cryptocurrency? Well, that is not possible either. The reason is simple: no government will allow anyone to take away their monetary sovereignty - ever.

In today’s market, if a cryptocurrency files to be listed at a currency exchange, the exchange requires the founder of the currency to reveal its identity to comply with Anti-Money Laundering (AML) laws, among other requirements. By doing so, the single point of attack of the digital currency would be revealed to everyone, basically enabling state actors to enforce changes in the project.

Take Facebook’s Libra currency project, for example. Of course, legislators will want to protect customers and thus will treat the Libra organization as a bank, which is backed by its shareholders, such as Facebook. Facebook would in turn be regulated like a bank – something the organization will definitely not want. So, the Libra project will hardly be a reality, a view shared by many powerful leaders such as the Bank of France’s Governor Francois Villeroy de Galhau. Bitcoin is a different beast altogether - no government in the world is able to change the rules of the Bitcoin protocol, or ban its use. Thus, Bitcoin is the ultimate store of value.

A possible alternative to Bitcoin? Digital central bank money

Alternatives to privately issued digital currencies are those issued by central banks, which are basically tokenized fiat currencies. Projects like these are under investigation by many central banks and should soon be available (e.g. in China, where the digital currency will be operated by the Chinese central bank). To what extent this concept is supposed to differ from existing fiat currencies - especially in a country where most payments are already being made via smartphones - is unclear. If one wants to protect wealth from devaluation by inflation, it makes no sense to hold fiats - tokenized or not - as was made clear by the PRC Central Bank a few weeks ago. In that instance, the bank injected capital equaling Bitcoin’s market cap into the economy to maintain the market’s liquidity in the face of the coronavirus outbreak (see link).

Current global currency and policy challenges that Bitcoin overcomes

As the PRC Central Bank example shows, a tokenized fiat currency can and will be manipulated and respectively inflated by the respective governments to react to such situations. Bitcoin is different altogether - no single person is ever able to change the protocol and subsequently inflate supply. This makes it the number one choice if you want to stop inflation from eroding your wealth.

Since inflation is an issue not only in China but also in the US, in the EU, and particularly in many smaller economies, it is just a matter of time until a growing number of people will want to secure their wealth. This will trigger a vicious cycle of monetary devaluation, increasing capital outflow from fiat currencies, higher Bitcoin valuation and so on, which can result in bank runs and eventually the collapse of the conventional banking system. This will not start in the big economies but rather in small ones like Venezuela, Argentina, and Lebanon, where the local currency is already weak and the incentive to adapt Bitcoin is higher than in the EU, China or the US. As soon as this chain reaction is set in motion, however, it will increasingly affect larger economies and intensify itself, which will eventually result in a global bank run. This effect can only be prevented by governments and central banks if the fiscal policy is changed fundamentally, by making moves like reintroducing the gold standard. This global reorientation of central bank policy is considered highly unlikely by the author, since it would render debt repayment almost impossible at the current state of national debt in even the largest economies.

Now that you understand the unique selling points of Bitcoin, let us focus on the current problems many millennials face today, which make them a group especially well-positioned to invest in and adopt Bitcoin.

The Cantillon Effect and its impact on millennials

Richard Cantillon’s original thesis outlines how rising prices affect different sectors at different times and suggests that time difference effectively acts as a taxing mechanism. In other words, the first sectors to receive the newly created money enjoy higher profits as their pay increases, but general costs are still low. On the other hand, the last sectors in which prices rise (where there is more economic friction) face higher costs while still producing at lower prices. As Milton Friedman taught us, because the real economic variables are still the same in the long run, the price of inflation is paid for by a “tax” on the sectors with more friction, which subsidizes more time-responsive sectors.

In our modern economy, the Cantillon Effect is at play with a stratified socioeconomic impact, favoring investors over wage earners. This effect is an ever-growing fuel for increasing global wealth inequality, which particularly affects millennials - the first generation that is likely to be less wealthy than its preceding generation. The results are unrest and protests in several Latin American countries such as Chile and Argentina, as well as in Spain, Italy, and, of course, France.

Negative interest rates

There is another incentive to get exposure to Bitcoin: short and medium turn. The European Central Bank (ECB) will not end the time of asset purchasing programs or negative interest rates, as Christine Lagarde made clear during her introductory statement as head of the ECB.

This results in an interesting effect: if investors are facing negative interest rates, the price for scarce goods (real estate, gold, Bitcoin, art, etc.) is in theory infinite as you can earn interest for taking a credit. This is unheard of in the history of humankind.

Within the last 3,000 years, there has never been such a time where you would have been paid to take out a loan. The result of that policy is absurd. A Danish bank, for example, launched the world’s first mortgage with negative interest rates. Another development was the introduction of Austria’s infamous 100-year bond. Buyers of such bonds are speculating on a century of rock-bottom interest rates, which is interesting considering that the present Republic of Austria was founded in 1918 and has only existed for 102 years. Whether the described developments are rational or sustainable, it’s up to the readers to decide.

Banks also face another challenge – it is becoming increasingly difficult to earn capital in a low interest rate environment, as there is the threat of high penalties for depositing capital with the central banks. These costs are increasingly passed on to the customers, who in turn are confronted with the problem that they are expected to pay increasingly higher fees for depositing savings with the bank. It is unlikely that this can be conveyed to a customer, and the author assumes that this effect alone will lead to an increase in interest in Bitcoin.

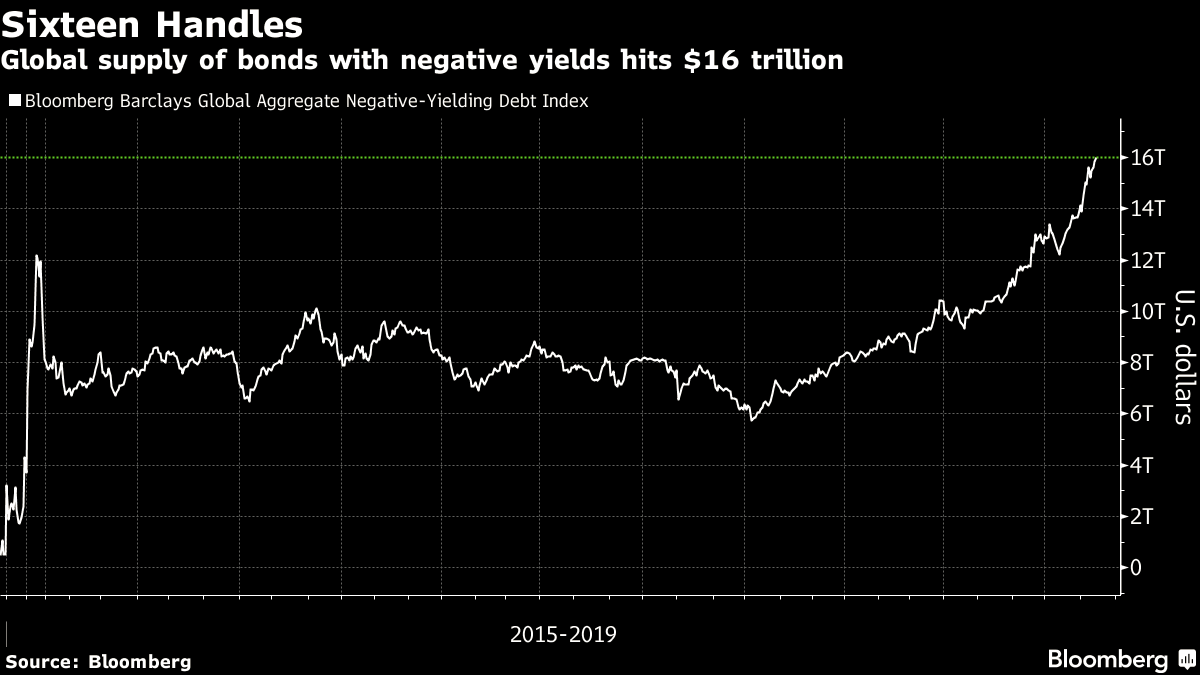

Another absurdity of today’s financial system, that is likely hard to comprehend for the average person, is the existence of negative yielding bonds. An unimportant niche? Well, we are talking about a total global supply of bonds with negative yields of 16 trillion US dollars. Bitcoin’s market cap at the moment is $170.2 billion US dollars, or less than 2% of the global supply of bonds, just for reference.

Global supply of bonds with negative interest rates (Source)

Global supply of bonds with negative interest rates (Source)

Debt

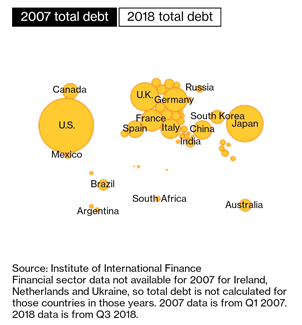

All the world’s largest economies are facing an increasing amount of debt. This is a looming catastrophe scenario, which central banks are trying to counteract by stacking ever-larger amounts of gold. Global debt levels are up 50% since the global financial crisis in 2009.

Global debt development from 2007 to 2018

Global debt development from 2007 to 2018

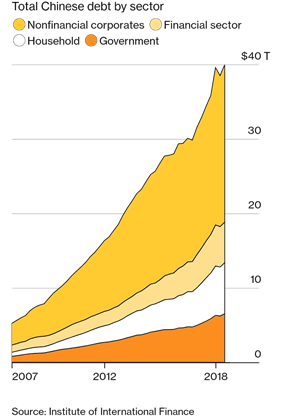

This fact becomes particularly striking if one looks at companies in China:

Overall, China’s total debt has increased sevenfold since the crisis. Due to the constant money infusion by the government and due to its deficit spending, many unprofitable companies are kept in business, which would otherwise be bankrupt. The problem of Chinese “Zombie companies” has been recognized for some time, but the government must keep those companies alive and keep annual GDP growth at a certain level to prevent social unrest. This is the Achilles heel of the Chinese Communist Party and the only threat to its power – a vicious cycle of money printing and amassing debt, which wealthy individuals might want to escape from sooner rather than later.

The downside of Bitcoin: Circumventing sanctions, enabling money laundering and financing terrorism

As of today, the US Dollar, the Renminbi and the Euro all play a far greater role in financing nefarious activities than Bitcoin does. However, there is one thing to keep in mind:

“If only good actors value a currency the currency has no value at all.”—Anonymous

This quote puts it nicely. If a global, decentralized currency is to compete against currencies like EUR or USD, it must be immutable and immune to censorship or government interference. This is not a bug of the Bitcoin protocol but a feature. No government on the planet is able to prevent a Bitcoin transaction from happening, which gives the participants in the network total and absolute sovereignty over their capital. This is critical for a currency to become a true global reserve currency.

Today, the US is able to exert a significant amount of economic pressure on any country using the US Dollar for settlements (e.g. by enforcing sanctions on them if they do not agree with some political decisions in those countries). Recent examples include sanctions against Russia, Iran, Pakistan, and the EU because of Nord Stream 2 and an ever-growing list of countries that do not obey to the will of the US President. This excessive sanctioning by the US slowly starts to erode other countries’ trust in the dollar as settlement currency.

America’s aggressive use of sanctions endangers the dollar’s reign

Its rivals and allies are both looking at other options

The affected countries need to look for an alternative currency to settle their trades in. Since the countries in question may not necessarily want to trade in the currency of the respective partner, and since both currencies could be manipulated by the opposite side, it is desirable to have an asset with predetermined issuance by an algorithm that can´t be manipulated at hand. In addition, the transaction can be monitored literally in real time from any device that has access to the internet. Those properties make Bitcoin a truly neutral settlement layer between parties and even nation states in the future, which represents a big step towards its adoption as a global reserve currency.

In addition, Bitcoin’s transaction fees for cross-country settlements are low, as was famously shown by a transaction worth $1 billion which cost the transacting party a fee of 0.065 Bitcoins or $690 at the time of the transaction.

The same transaction in gold would be far more expensive; we are talking about 19.9 metric tons at the current exchange rate (as of 27.1.2020). The logistics of such a transaction would be challenging, to say the least, and certainly impossible to achieve for 700 USD. The cost for safe storage of 20 tons of gold is not included in this calculation but shouldn’t be neglected either.

Conclusion: Is Bitcoin the ultimate reserve currency?

Many of the issues addressed here will probably not hold immediate relevance for an institutional investor, but they will have an impact on Bitcoin’s price mid- and long term. Mid- to long-term, we will not only see Bitcoin adoption by millennials but also high-net-worth individuals, troubled Third World countries, rogue states, and governments that will want to circumvent sanctions.

Other use cases will be central banks backing their currency with Bitcoin to brace for a “Black Swan Scenario” or pension funds that have the obligation to maintain their depositors’ purchasing power. It is important to note that every single reason pointed out above could just be the catalyst for other effects to unravel. Capital will inevitably gravitate towards the hardest money available, depriving people holding onto the weaker currency from their wealth and leaving them vulnerable to the people controlling the harder currency – a situation humans have experienced countless times throughout history. Examples include glass beads, shell money, or rai stones. The Dollar, Renminbi, Euro and Ruble are the glass beads of the 21st century.

But is that true? Let’s look at Bitcoin’s performance in 2019 alone in comparison to other assets:

- Bitcoin + 96%

- Oil + 36%

- Nasdaq 100 + 16%

- S&P 500 + 13%

- Commodities + 9%

- Bonds + 3%

- Gold + 1%

Bitcoin outperformed any conventional asset, which is interesting considering that the NASDAQ 100 and the S&P 500 benefited significantly from the Fed’s money infusion. Actually, that growth is largely attributed to the liquidity provided by the Fed in conjunction with the Cantillon Effect covered above.

An interesting side note is the fact that, by the year 2250, a single Bitcoin will be worth $1 million, based on USD inflation alone if it prevails at current levels. In the not so distant future, central banks might even be forced to add Bitcoin to their assets to protect the Dollar, Euro, or Ruble against devaluation. It is interesting to see the Russian Central Bank increasing its gold holdings since 2005, and it would be naive to think central banks would not know about Bitcoin’s potential. However, it would be equally naive to assume they would admit a purchasing program.

Many people tend to forget one thing today: Fiat money is not as stable as it is perceived - Germany alone has had four different currencies in the last 120 years. In contrast, Bitcoin could offer the stability and assurance that other currencies fail to provide.

Author’s contact: btchap@aikq.com