Bitcoin’s Habitats

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Bitcoin’s Habitats

How Bitcoin is surviving and thriving between worlds

By Gigi

Posted March 1, 2020

As I have argued previously, Bitcoin is a living organism. But where does this organism live, exactly? As with many questions in the world of Bitcoin, exact answers are hard to come by. Living things have fuzzy edges: beginnings and endings are hard to pin-point, differentiation is more-or-less arbitrary, and what was classified as a wolf today might evolve to be a dog tomorrow.

Bitcoin has no rigid specification, no absolute finality, no fixed development team, no final security guarantees, no scheduled updates, no central brain, no central vision, no kings, and no rulers. It is a decentralized organism, organically evolving without central planners. The lack of any centralization is the source of Bitcoin’s beauty, it’s organic behavior, and it’s resilience.

Bitcoin is everywhere and nowhere, which makes figuring out where this thing lives a daunting task. However, it turns out that there is a space it lives in. Multiple spaces, as we shall see.

The Habitats of Bitcoin

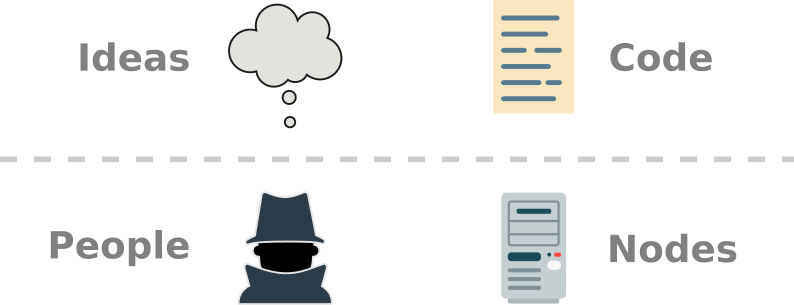

While classifying the habitat of a decentralized organism isn’t trivial, we can look at the constituents of Bitcoin to make the task a bit easier. As outlined in the last article of this series, Bitcoin lives across domains, with one foot in the purely informational realm (ideas and code) and one foot in the physical realm (people and nodes).

An awareness of Bitcoin’s environment(s) might help to better understand this new form of life. No organism can be meaningfully studied in isolation, and Bitcoin is no exception. As Alan Watts pointed out, one has to be aware of the basic unity every organism forms with its environment.

“For the ecologist, the biologist, and the physicist know (but seldom feel) that every organism constitutes a single field of behavior, or process, with its environment. There is no way of separating what any given organism is doing from what its environment is doing, for which reason ecologists speak not of organisms in environments but of organism-environments.” Alan Watts

With that in mind, let’s take a closer look at the organism-environment(s) we are dealing with. As outlined above, Bitcoin’s ideas and code inhabit one realm, and Bitcoin’s people and nodes inhabit another. To stick with tradition, let’s call the physical realm “meatspace” and the purely informational realm “cyberspace” — even if, as always, the lines might be fuzzy around the edges.

The “soul” of Bitcoin, so to speak, lives in cyberspace. There, Bitcoin absorbs useful ideas and incorporates them into its code. As with all living things, something is useful if it helps an organism to survive. While Bitcoin has various self-regulatory mechanisms to react to the environment, new ideas may be necessary for survival if changes are drastic enough.

The “body” of Bitcoin, like all bodies, is living in meatspace. Nodes, hard drives, cables, and other things come together in an intricate dance, pushing around electrons, changing zeros to ones and vice-versa, making sure that Bitcoin’s heart beats about a thousand times a week.

Living things have an interest in staying alive, and the Bitcoin organism is no exception. Bitcoin found an ingenious way to ensure that it stays alive: it pays people, as Ralph Merkle pointed out. People — and increasingly, organizations — are incentivized to keep it alive. They shape the physical world to Bitcoin’s liking, feed it energy, renew its hardware, and update its software to keep it alive.

The fact that Bitcoin pays us to keep it alive opens up a third space: a space of financial transactions, value, and mutual beneficial exchange. Let’s call this space “finspace.”

To understand finspace, we will have to examine the other side of this coin. So far, we only examined the side with an uppercase B: the Bitcoin network. But there is also bitcoin — with a lowercase b — which is the unit of value itself, brought into existence by every copy of the ledger.

These bitcoins, while deeply embedded in the amber of the ledger, are traded worldwide on various markets and marketplaces. And since these bitcoins — and their value — are critical for Bitcoin’s survival, we will have to recognize finspace as the third space this strange beast lives in. Note that finspace, strangely enough, is solely inhabited by bitcoin with a lowercase b.

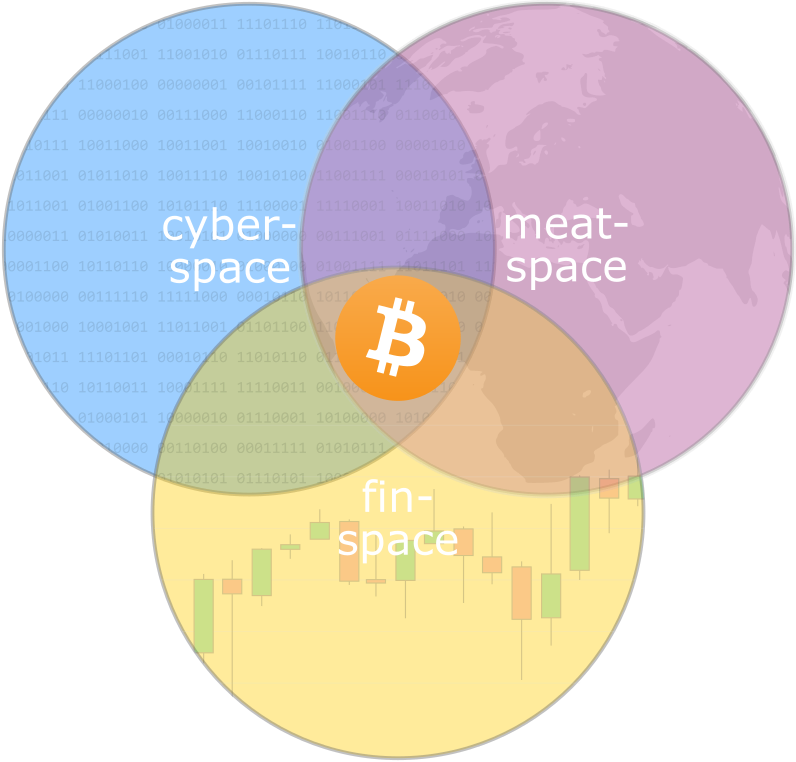

In total, we can identify three distinct environments which the Bitcoin organism inhabits:

- Cyberspace: the world of ideas and code.

- Meatspace: the world of people and nodes.

- Finspace: the world of value and markets; the world of dollars and sats.

Understanding these habitats becomes increasingly important, especially as the climate in one — or more — heats up.

The Climates They Are A-Changin’

The three spaces outlined above — cyberspace, meatspace, and finspace — have different restrictions; different climates, so to speak. In short: they operate under different rules. Once these rules change drastically enough, people will say that “the political climate is heating up” and reports on “the coming financial climate” will be written. Citizens will be unable to speak and act freely. If things change drastically enough, people will rise up in protest, or, if all else fails, flee.

Cyberspace: While we don’t have precise words for it, it is obvious that the climate in cyberspace has changed quite drastically in the last two decades or so. The idealistic, utopian ideas which were the foundation of most of the internet were perverted by the advertisement-driven surveillance companies which are the giants of today.

People and politicians are slowly waking up to the strange reality we are living in: the fact that Facebook can manipulate moods and sway elections is as disturbing as the fact that Google knows you better than you know yourself. Edward Snowden showed that the most paranoid netizens were right all along: everyone in cyberspace is under constant surveillance, without suspicion, by default.

While the western world does not immediately feel the repercussions that come with living in a constant state of surveillance, Chinese citizens are gathering first-hand experience with each passing day.

In the western world, the consequences are advertisements which range from annoying to spooky. In China, the consequences are frozen bank accounts, an inability to buy train or plane tickets, elimination of creditworthiness, automated fines for trivial offenses, and more. Voicing the “wrong” opinion — online or not — can lead to restricted access to schools, hotels, and jobs. And after ruining your life with the flip of a bit you will be publicly named as a bad citizen and the government will take away your dog. If that doesn’t sound dystopian enough for your taste I bet that it will be in a couple of years. Remind yourself that this is only the beginning.

In the “free” world, things are more subtle. Multiple efforts are underway to curb net neutrality, the very cornerstone of the internet. Legislation is being passed which is inherently incompatible with the laws of cyberspace. It seems like the last battle of the Crypto Wars is yet to be fought as politicians are calling for “responsible encryption” and the ban of certain CAD files. Companies are in charge of the speaker’s corners of cyberspace and are making arbitrary decisions on what can be uttered by whom and what is off-limits.

Bitcoin knows no borders, no jurisdictions. However, it has to conform to the laws of cyberspace — and if these laws change, e.g. if large parts of the world block Bitcoin traffic and/or the usage of TOR, the Bitcoin organism will have to adapt.

Meatspace: Meatspace climate differs wildly from jurisdiction to jurisdiction. Some bastions of freedom still exist, but once you try to board an international flight it becomes obvious that your right to privacy and your freedom to bring a bottle of water with you are null and void.

Protests across the globe indicate that the powerless are fed up with the powerful, who do everything they can to stay in control and solidify their positions of influence.

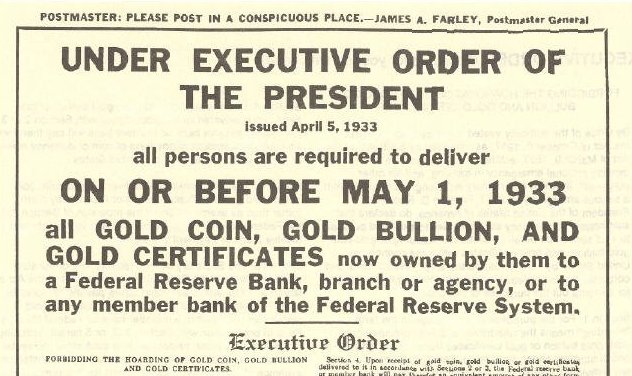

History shows that governments do not shy away from using their power. In 1933, Executive Order 6102 was signed, effectively forcing the whole population of the United States to hand over their gold and gold certificates to the government.

Yes, seizing bitcoin is way harder than seizing gold — in some cases even impossible. But it would surprise me if those who currently control our money — the governments and central banks of this world — would simply roll over and let Bitcoin march on unhindered. Governments have a monopoly on violence, and they are able and willing to abuse this violence in their own interest.

With Bitcoin, however, people can flee a country with their wealth intact. While this is definitely not easy, and not something I would wish on anyone, it is now possible.

Finspace: Where should I even begin? The current, debt-based financial system has an appetite for printing money which is beyond belief. Quantitative Easing (QE), Negative Interest Rate Policies (NIRPs), currency wars, hyperinflations, and a looming recession are just a few of the recipes of the global instability soup which is currently brewing.

The current financial system seems so far removed from common sense and reality, that all the jargon in the world won’t be able to stabilize this house of cards. People know that our money is broken, which is why they flee to buying real estate, stocks, and all kinds of complicated financial constructs to preserve their wealth. In the current system, you have to be an investment expert just to hold your value.

And we haven’t even talked about the looming recession, and the virtual inevitability of the next financial crisis yet. Yes, governments might be able to kick the can down the road by printing ever more money. But no road is endless, and the experiment which is fiat money will come to an end, one way or the other.

How bitcoin will react to a catastrophe in finspace is anyone’s guess. Some people might flee from their failing fiat currency into bitcoin, using it as a risk-off asset. Others might sell bitcoin to buy something they consider more stable, such as real estate or land. A rising number of people will identify bitcoin as the best money we ever had, shunning other assets and other monies on the quest to stack as many sats as they can.

However it might play out, Bitcoin is the cure for many of the current system’s ills. It is hard money which doesn’t devalue over time. It is an incorruptible system which forms the basis of a new financial reality.

“It can’t be changed. It can’t be argued with. It can’t be tampered with. It can’t be corrupted. It can’t be stopped. It can’t even be interrupted.” Ralph Merkle

In addition to the above, it seems to have many indirect effects. It lowers the time preference of those who use it. It incentives users to have better personal and operational security. It incentives individuals and companies to have better digital hygiene. It propels the development of chip manufacturing and encryption technology.

While Bitcoin definitely influences its environments and vice-versa, how Bitcoin reacts to drastic changes is yet to be seen.

Migration

Bitcoin lives on the internet, as Ralph Merkle points out. The internet, however, is not a necessary requirement for Bitcoin to work. Bitcoin is text — pure information — and every system capable of transmitting (and storing) information is a potential habitat for the Bitcoin organism. The internet just happens to be the most suitable habitat which currently exists, since it is the most efficient system to transmit information we have to date.

Cyberspace: The Bitcoin organism could migrate to other environments, and multiple efforts are underway which enable Bitcoin to spread to places where access to Internet infrastructure is limited or non-existent. As of this writing, Bitcoin transactions (and LN invoices) have been sent via radio waves, mesh, and satellite networks — just to name a few. All of these can be seen as Bitcoin conservation efforts, so to speak.

Whether we will see the migration of Bitcoin to another system in the decades and centuries to come depends, in essence, on whether the internet will remain a suitable habitat or not. If the online climate changes drastically enough, we might see the migration to even more resilient, less restrictive environments.

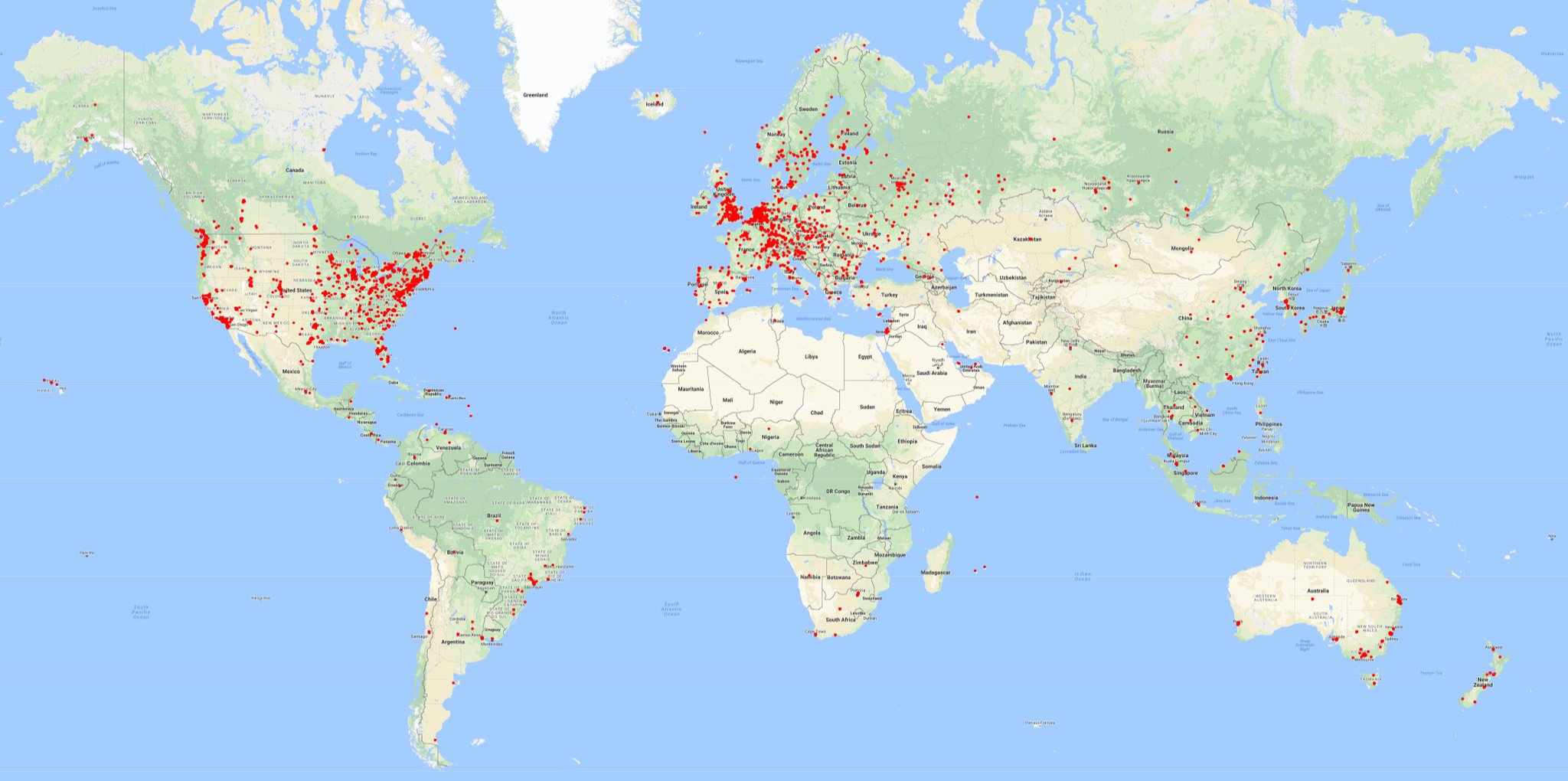

Meatspace: We can already see that mining facilities pop up where energy is cheapest or even stranded. In essence, mining is done where it makes the most sense — economically speaking. The same is true for running nodes. If people can run nodes at low risk and near zero marginal cost, they will. Thus, visualizing Bitcoin on a map, nodes and mining facilities migrate geographically from unfriendly places to friendlier places over time. Unprofitable mining facilities will shut down, profitable mining facilities will go online. The same, again, is true for nodes.

Public bitcoin nodes. Source: /u/SondreB

Public bitcoin nodes. Source: /u/SondreB

Increasingly, people will migrate to jurisdictions which are more favorable to their bitcoin holdings. And if you want to start a Bitcoin company, you might also move to a jurisdiction which is more favorable to you and your future business.

Finspace: In the last 10 years, many people decided to buy bitcoin, effectively feeding the Bitcoin organism by investing in it. This capital allocation will continue as more people understand the nature of this beast, and the ultimate goal of Bitcoin: the separation of money and state.

What investors describe as portfolio balancing and allocation of capital can be seen as a migration of value from worse assets to better assets; from bad stores of value to better stores of value. Bitcoin, being the ultimate asset in terms of portability, verifiability, divisibility, scarcity, and unseizability, will continue to suck up value and grow in the process.

Conclusion

Bitcoin lives at the intersection of three spaces: meatspace, cyberspace, and finspace. These spaces have different laws, different rules, and different climates. To fully understand any organism, we must not only look at the organism itself, but examine the organism-environment holistically.

Because of its decentralized nature, Bitcoin is able to overcome many, if not all obstacles in its environments. It can migrate to favorable jurisdictions in meatspace, use different transportation and storage media in cyberspace, and feed on the instability of other asset classes in finspace.

Whatever the future may bring, Bitcoin is equipped to survive and thrive in the various environments it lives in. It is remarkably resilient — well adapted to survive any coming storm, however perfect it may be.

Further Reading

- Proof of Life by Gigi

- The Sovereign Individual by James Dale Davidson and William Rees-Mogg