Bitcoin is a Demographic Mega-Trend: Data Analysis

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Bitcoin is a Demographic Mega-Trend: Data Analysis

By Spencer Bogart

Posted April 30, 2019

What follows is data and analysis from a survey of American adults regarding general sentiment toward Bitcoin — the survey was conducted by Harris Poll, on behalf of Blockchain Capital, from April 23–25, 2019 and consisted of a representative sample of 2052 American adults. The survey was an augmented version of one we ran in October 2017 (we added a few questions).

For context and because it’s material in considering the results, the survey in October 2017 was conducted in a bull market — Bitcoin was up over 800% YoY — whereas the most recent survey, in April 2019, was conducted in a bear market — price was down roughly 75% from all-time highs.

We suspect that the difference in market environment between the two surveys would have a negative impact on Bitcoin sentiment in the most recent survey. Despite the bear market, the data shows that Bitcoin awareness, familiarity, perception, conviction, propensity to purchase and ownership all increased/improved significantly — dramatically in many cases.

The results highlight that Bitcoin is a demographic mega-trend led by younger age groups.The only area where older demographics matched younger demographics was awareness: Regardless of age, the vast majority of the American population has heard of Bitcoin.

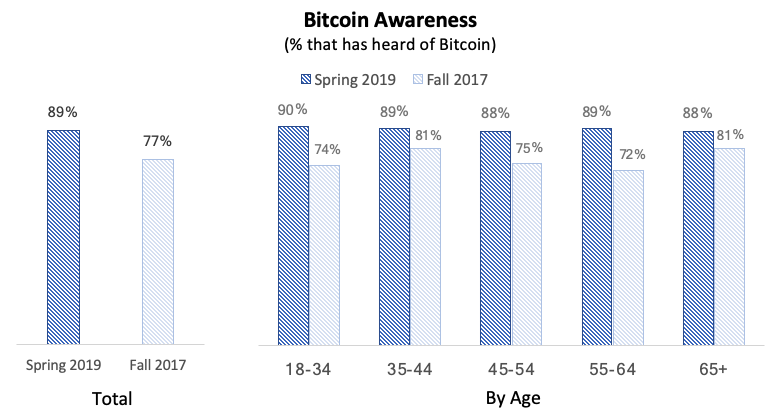

Awareness

The percentage of people that have heard of Bitcoin rose from 77% in October 2017 to 89% in April 2019.

Awareness of Bitcoin is strong across all age groups — those aged 18–34 have the highest rates of awareness at 90% and those aged 65+ have the lowest at 88%.

Overall, the percentage of people that have not heard of Bitcoin fell by more than half — from 23% in October 2017 to 11% in April 2019.

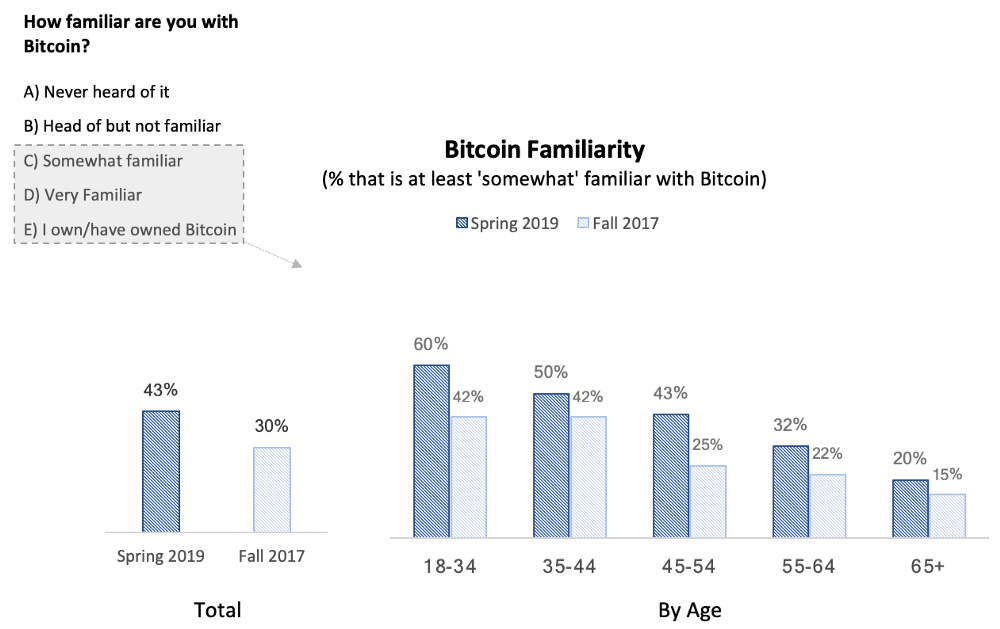

Familiarity

The percentage of people that are ‘at least somewhat familiar’ with Bitcoin rose by nearly half — from 30% in October 2017 to 43% in April 2019.

Among those aged 18–34, a full 60% described themselves as at least ‘somewhat familiar’ with Bitcoin — up from 42% in April 2019. Relative to older segments of the population, those aged 18–34 are 3x as likely to be at least ‘somewhat familiar’ with Bitcoin as those aged 65 and over.

The natural follow-on question is how perception is affected by rising awareness — as people become more familiar with Bitcoin do they think of it more positively or negatively?

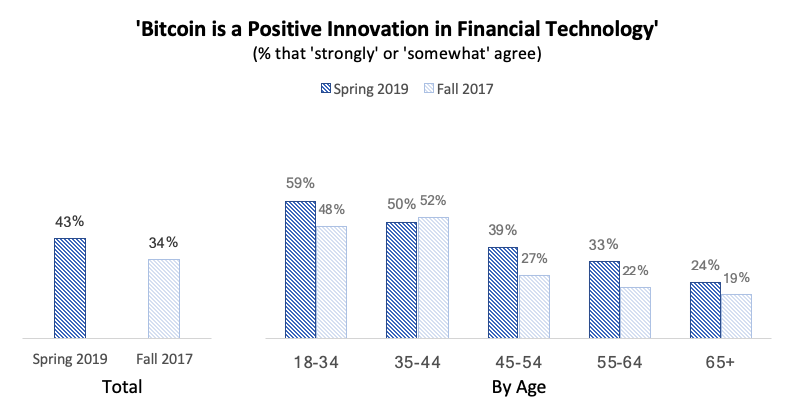

Perception

The percentage of people whom ‘strongly’ or ‘somewhat’ agrees that ‘ Bitcoin is a positive innovation in financial technology’ rose 9 percentage points — from 34% in October 2017 to 43% in April 2019.

Younger demographics were most inclined to have a positive view of Bitcoin: 59% of those aged 18–34 ‘strongly’ or ‘somewhat’ agree that ‘ Bitcoin is a positive innovation in financial technology — up 11 percentage points from October 2017.

But even if an increasing percentage of the population has a positive perception of Bitcoin, does that translate to increased conviction in future adoption?

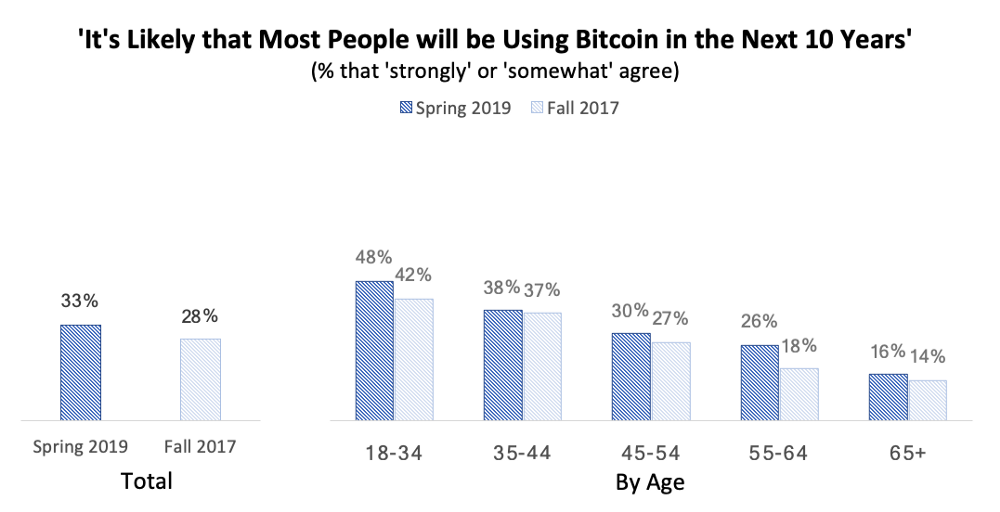

Conviction

The percentage of people that ‘strongly’ or ‘somewhat’ agrees that ‘ most people will be using Bitcoin in the next 10 years’ rose 5 percentage points — from 28% in October 2017 to 33% in April 2019.

Younger demographics have the most conviction in adoption over the next 10 years: Nearly half (48%) of those aged 18–34 ‘strongly’ or ‘somewhat’ agree that ‘it’s likely most people will be using Bitcoin in the next 10 years’— up 6 percentage points from October 2017.

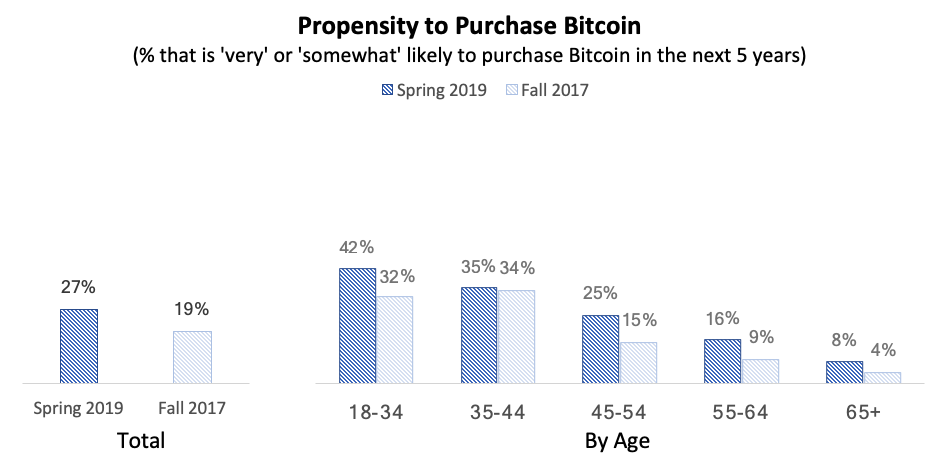

Propensity to Purchase

Despite the bear market, the percentage of people that indicated they are ‘very’ or ‘somewhat’ likely to buy Bitcoin in the next 5 years rose by nearly half— from 19% in October 2017 to 27% in April 2019.

Younger demographics appear most inclined to purchase Bitcoin: 42% of those aged 18–34 said they are ‘very’ or ‘somewhat’ likely to purchase Bitcoin in the next 5 years — up 10 percentage points from 32% in October 2017.

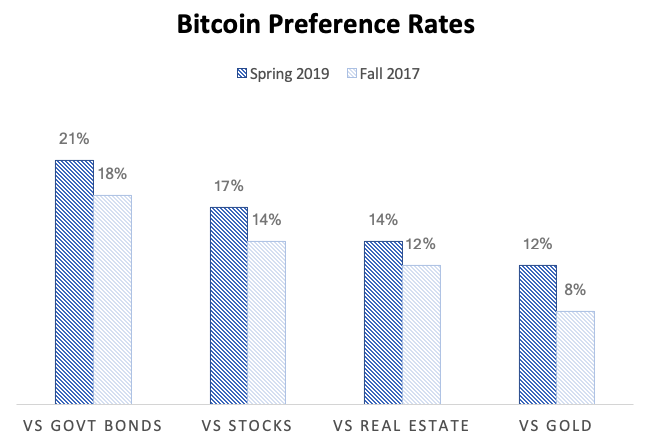

It’s also helpful to consider how people think about Bitcoin relative to other investable assets.

When asked which they’d prefer to own $1k of:

- 21% of people said they would prefer Bitcoin to government bonds— up from 18% in October 2017

- 17% of people said they would prefer Bitcoin to stocks — up from 14% in October 2017

- 14% of people said they would prefer Bitcoin to real estate— up from 12% in October 2017

- 12%of people said they would prefer Bitcoin to gold — up from 8% in October 2017

Focusing on those aged 18–34, when asked which they’d prefer to own $1,000 of:

- 30% said they would prefer Bitcoin to government bonds — flat from October 2017

- 27% said they would prefer Bitcoin to stocks — flat from October 2017

- 24%said they would prefer Bitcoin to real estate — up from 22% in October 2017

- 22% said they would prefer Bitcoin to gold — up from 19% in October 2017

Said differently, among those aged 18–34: Nearly 1 in 3 prefers Bitcoin to government bonds, more than 1 in 4 prefers Bitcoin to stocks, nearly 1 in 4 prefers Bitcoin to real estate and more than 1 in 5 prefers Bitcoin to gold.

The biggest increase in preference rate for Bitcoin was relative to gold — perhaps the byproduct of Bitcoin’s growing acceptance as ‘digital gold’.

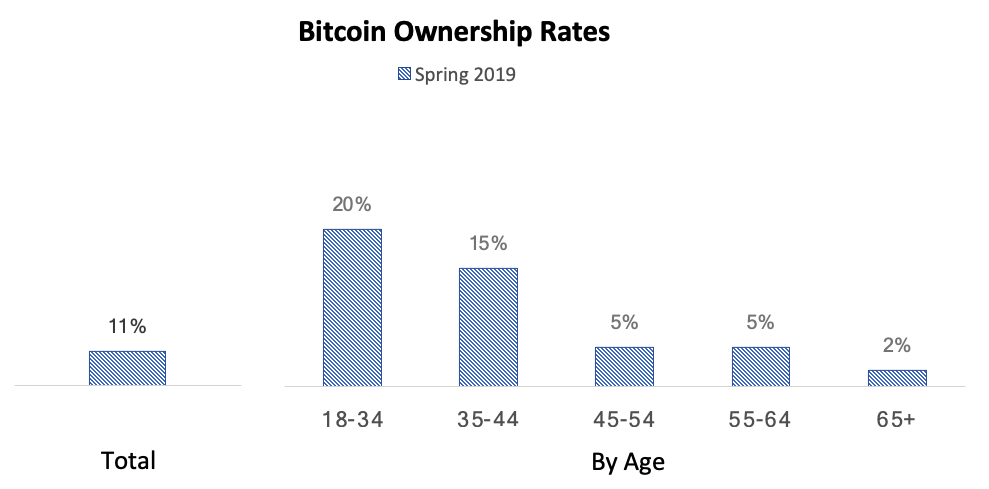

Ownership

In total, 11% of the population owns Bitcoin — including 20% of those aged 18–34 and 15% of those aged 35–44.

To help put the millennial proclivity to Bitcoin in perspective: Only 37% of people under 35 are invested in the stock market (source) — so the data point that 20% of those in the same group own Bitcoin is particularly surprising.

Ultimately, Bitcoin is a demographic mega-trend: Younger demographics are leading in terms of Bitcoin awareness, familiarity, perception, conviction, propensity to purchase, and ownership rates.

Blockchain Capital, founded in 2013, is one of the oldest and most active venture investors in the blockchain industry and has financed 75+ companies and projects since its inception. Our mission is to help entrepreneurs build world-class companies and projects based on blockchain technology. We invest in both equity and tokens and are a multi-stage investor. Blockchain Capital also pioneered the world’s first ever tokenized investment fund and the blockchain industry’s very first security token, the BCAP, in April of 2017.

Sign-up for our monthly newsletter at the bottom of this site: http://www.blockchaincapital.com/

Thanks to Derek Hsue.