Bitcoin Correlation to Gold Jumps in 2020

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Bitcoin Correlation to Gold Jumps in 2020

By Gabor Gurbacs

Posted April 3, 2020

Quick take:

- Long-term, bitcoin correlations with traditional asset classes remain low.

- Short-term, the market sell-off induced by the COVID-19 pandemic increased bitcoin correlations with traditional asset classes—particularly gold, potentially hinting at bitcoin’s increasing safe-haven status.

- A small bitcoin addition to a 60% equity/40% bond blended portfolio significantly reduced portfolio volatility during the recent market sell-off. While there are no U.S. bitcoin ETFs available today, we believe such products may have significantly reduced volatility for 60% equity/40% bond blended portfolios.

Our analysis shows that bitcoin correlation to gold remains low long-term. However, during the most recent COVID-19 induced broad market sell-off, bitcoin correlation to gold has increased significantly.

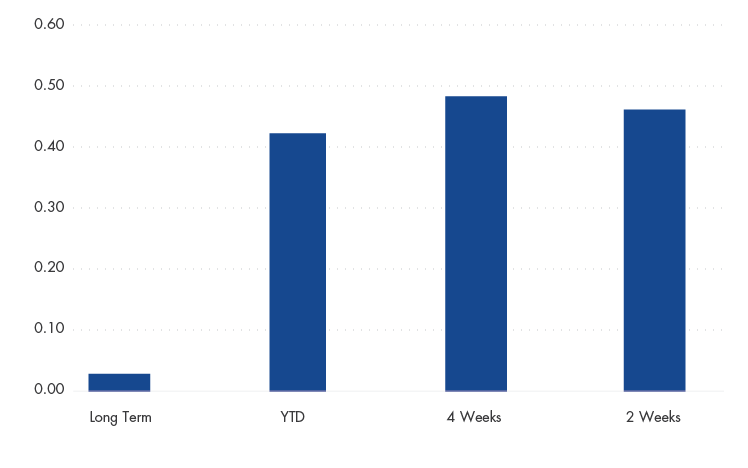

Bitcoin’s Correlation to Gold

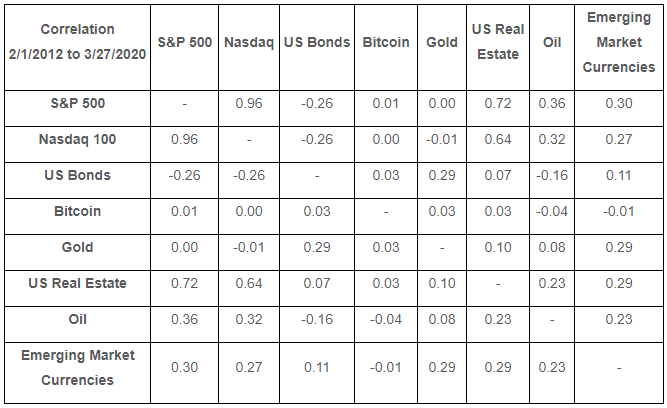

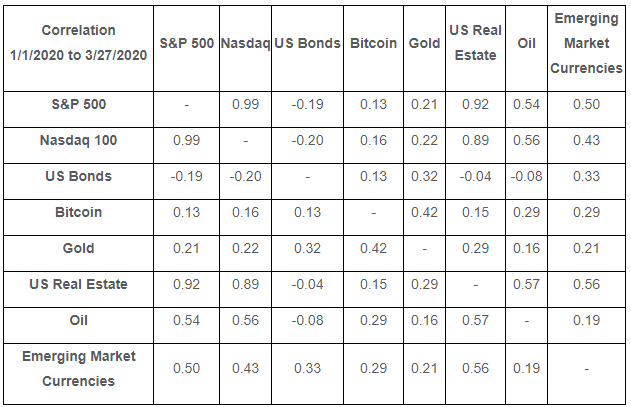

In The Investment Case for Bitcoin, we discussed how bitcoin may potentially increase portfolio diversification because of its low correlation to traditional asset classes, including broad market equity indices, bonds and gold. As shown in our year-end long-term correlation table, this thesis has held up well. Here we examine bitcoin’s correlation to traditional asset classes during the most recent COVID-19 induced market downturn and the months leading up to it. In our long-term study, considering correlation data between 2012 and late March 2020, bitcoin exhibits low correlation to traditional asset classes. Bitcoin falls into the -0.1 and 0.1 correlation range with most traditional asset classes.

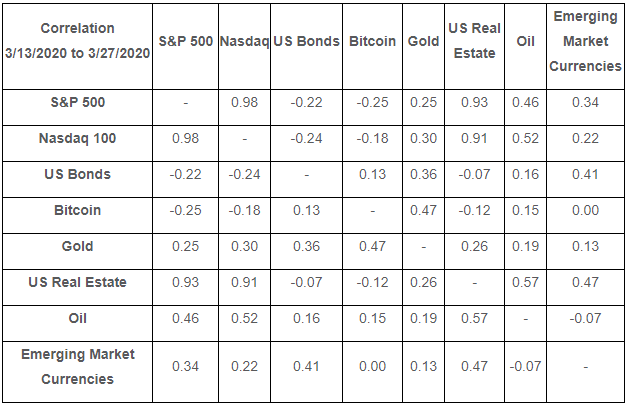

Looking at more recent correlation data, we note that bitcoin’s correlations with traditional asset classes have begun to increase during the COVID-19 induced global market sell-off. Most notably, bitcoin’s correlation with gold has reached levels never before seen. We believe this may further cements its relationship with what is commonly viewed as safe haven assets and may bolster its potential as “digital gold”. We also note that bitcoin correlations with U.S. bonds increased significantly. U.S. bonds historically served as safe-haven assets during equity market sell-offs. Specifically, from March 13 to 27, bitcoin’s correlation with gold was 0.47 and 0.13 with U.S. bonds while -0.25 with the S&P500, -0.18 with the Nasdaq 100 and only -0.12 with US real estate. Bitcoin showed no correlation with emerging market currencies and 0.15 with oil.

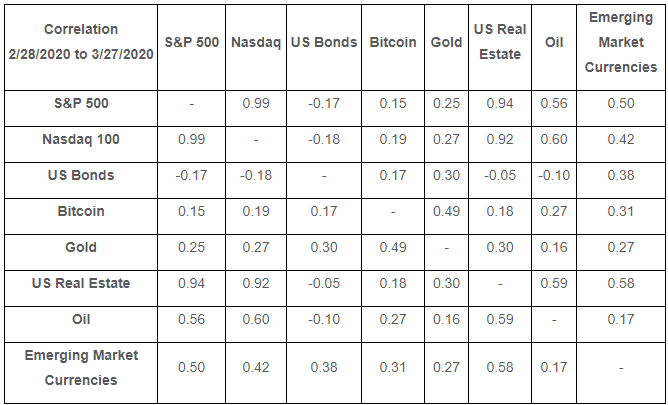

After expanding that timeframe to four weeks, bitcoin’s correlation with gold was 0.49, 0.17 with U.S. bonds, 0.15 with the S&P 500, 0.19 with the Nasdaq 100 and only 0.18 with U.S. real estate. Bitcoin showed a 0.31 correlation with emerging market currencies and 0.27 with oil.

Year to date, bitcoin’s correlation with gold was 0.42, 0.13 with U.S. bonds, 0.13 with the S&P 500, 0.16 with the Nasdaq 100 and 0.15 with U.S. real estate. Bitcoin showed a 0.29 correlation with emerging market currencies and 0.29 with oil.

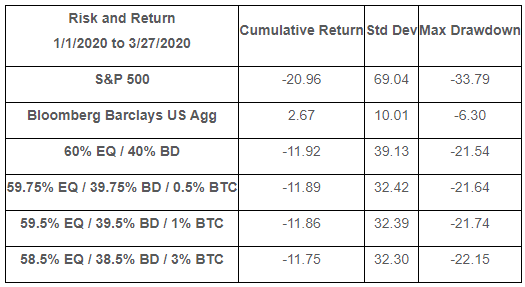

We also looked at the proportional addition of a 0.5%, 1% and 3% allocation to bitcoin to a 60% equity/40% bond blended portfolio. While YTD portfolio performance with a bitcoin allocation only held up slightly better than the 60-40 blend, we noted that a small addition of bitcoin significantly reduced the volatility (as measured by standard deviation) of the 60-40 blend.

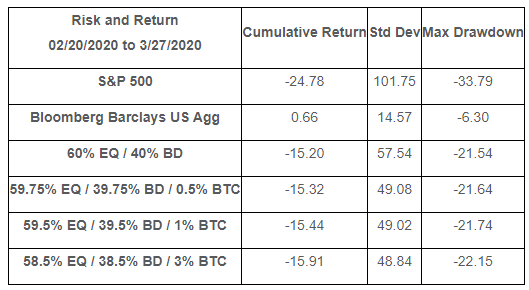

During the market selloff beginning on 2/20/2020, we saw that the volatility reduction of the bitcoin-included blended portfolio was even more pronounced than YTD figures.

We conclude that while long-term bitcoin correlations with traditional asset classes remain low, in the short-term, the COVID-19 induced market sell-off increased bitcoin correlations with traditional asset classes. In particular correlations with gold increased during the sell-off, potentially hinting to bitcoin’s increasing safe-haven status. We also note that a small bitcoin addition to a 60% equity/40% bond blended portfolio may help to reduce portfolio volatility during the recent market sell-off. While there are no U.S. bitcoin exchange traded funds (ETFs) available today, we believe such products may have significantly reduced volatility for 60% equity/40% bond blended portfolios.

Source for all tables: Morningstar. US Bonds is measured by the Bloomberg Barclays US Aggregate Index; Gold is measured by the S&P GSCI Gold Spot Index; US Real Estate is measured by the MSCI US REIT Index; Oil is measured by the Brent Crude oil spot price, Emerging Market Currencies is measured by the Bloomberg Barclays EM Local Currency Government Index.

DISCLOSURES This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities/financial instruments mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck. All indices are unmanaged and include the reinvestment of all dividends but do not reflect the payment of transactions costs, advisory fees or expenses that are typically associated with managed accounts or investment funds. Indices were selected for illustrative purposes only and are not securities in which investments can be made. The returns of actual accounts investing in natural resource equities, energy equities, diversified mining equities, gold equities, commodities, oil, industrial metals, gold, U.S. equities and U.S. bonds strategies are likely to differ from the performance of each corresponding index. In addition, the returns of accounts will vary from the performance of the indices for a variety of reasons, including timing and individual account objectives and restrictions. Accordingly, there can be no assurance that the benefits and risk/return profile of the indices shown would be similar to those of actual accounts managed. Performance is shown for the stated time period only. The S&P® 500 Index: a float-adjusted, market-cap-weighted index of 500 leading U.S. companies from across all market sectors. The Bloomberg Barclays U.S. Aggregate Bond TR Index: is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency). The Bloomberg Barclays EM Local Currency Government TR Index: is a flagship index that measures the performance of local currency Emerging Markets (EM) debt. Classification as an EM is rules-based and reviewed annually using World Bank income group, International Monetary Fund (IMF) country classification and additional considerations such as market size and investability. The MSCI US REIT Index: is a free float-adjusted market capitalization index that is comprised of equity REITs and represents about 99% of the US REIT universe and securities are classified in the Equity REITs Industry (under the Real Estate sector) according to the Global Industry Classification Standard (GICS®). It however excludes Mortgage REIT and selected Specialized REITs. The S&P GSCI Gold Index: Is a sub-index of the S&P GSCI, provides investors with reliable and publicly available benchmark tracking the COMEX gold future. The index is designed to be tradable, readily accessible to market participants, and cost efficient to implement. The MVIS CryptoCompare Bitcoin Index measures the performance of a digital assets portfolio which invests in Bitcoin. The MVIS CryptoCompare Bitcoin Index is the exclusive property of MV Index Solutions GmbH (a wholly owned subsidiary of the Adviser). The NASDAQ-100 Index includes 100 of the largest domestic and international non-financial companies listed on The NASDAQ Stock Market based on market capitalization. All S&P indices listed are products of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones®is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results