Bitcoin and the Rhythms of History

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Bitcoin and the Rhythms of History

By Brandon Quittem

Posted October 29, 2020

You’re living through a particularly potent period in history.

But you already knew that.

Since the 2008 Global Financial Crisis, we’ve been in what Neil Howe and William Strauss describe as a “Fourth Turning.” The final act in a drama that began on the heels of WWII.

Fourth Turnings are defined by the collective realization that “things are bad enough that we’re willing to actually do something about it.” The cement is wet and everything in the exterior world gets redesigned. Political, social, and economic structures reimagined.

“Sometime before the year 2025, America will pass through a great gate in history, commensurate with the American Revolution, Civil War, and the twin emergencies of the Great Depression and World War II.” - The Fourth Turning by Neil Howe and William Strauss.

This essay explores the Strauss–Howe generational theory through the lens of Bitcoin.

Common ailments of the day, namely economic inequality, failing institutions, cultural decay, and the rise of populism were all predicted (and are easily explained) by this theory.

Practically speaking, you’ll learn a new framework for understanding the world around you. It’s neither perfect nor precise. However, if you squint hard enough you might catch a glimpse of the future.

Sections

- Seasons of Time (Introducing Fourth Turning Concepts)

- Where Are We In The Current Cycle?

- Anatomy of a Fourth Turning (Crisis)

- Fourth Turnings of The Last 500 Years

- Supply and Demand of Order

- Lessons From The Previous Fourth Turning (1929-1946)

- Analyzing Our Current Fourth Turning (2008-2030?)

- How to Protect Yourself During a Fourth Turning

Author’s Note__: The first few sections are focused on summarizing the key concepts of The Fourth Turning. If you’ve already read the book, feel free to skip ahead for my analysis.

Seasons of Time (Introducing Fourth Turning Concepts)

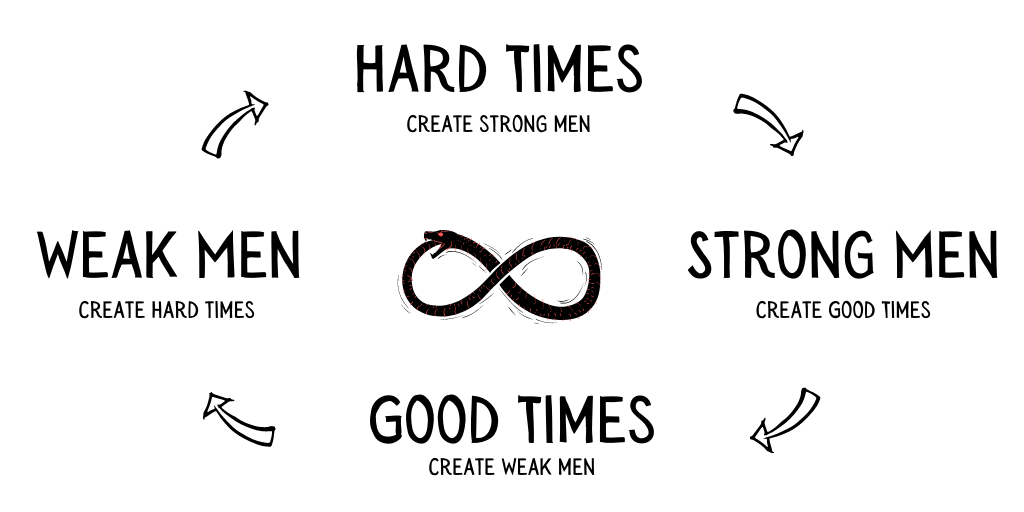

Modern humans view time as a linear phenomenon. A steady march of progress from a “worst past” to an “improved future.” However, life doesn’t progress linearly, instead, it follows a natural rhythm, a circle of life if you will.

Practically speaking, days, months, and years are simply convenient names given to the observable cycles in astronomy. The earth rotating on an axis, the moon around our earth, and the earth circumnavigating the sun.

Spring, Summer, Fall, and Winter. Life and death. The carbon cycle, the water cycle. We’re surrounded by natural cycles.

The wisdom of cycles is embedded in modern culture. Represented by common phrases like “history doesn’t repeat, but it rhymes,” and “there are decades when nothing happens, and weeks when decades happen.”

Ancient man observed a human cycle called the “Saeculum.” Which essentially means “a long human life” or roughly 90 years.

The original meaning was “the amount of time between an event happening (ex: founding a city) and when everyone who experienced that event had died.” At that point, a new Saeculum would start. According to legend, the gods allot a certain number of Saecula for every leader or civilization. For example, the gods allotted the Etruscans ten Saecula.

Each 90-year period (Saecula) can be divided into four stages (Turnings) each lasting approximately 22 years. These Turnings are often represented by the seasons (spring, summer, etc) or represented by the stages of life, namely youth, young adulthood, midlife, and old age.

The Four Generational Archetypes

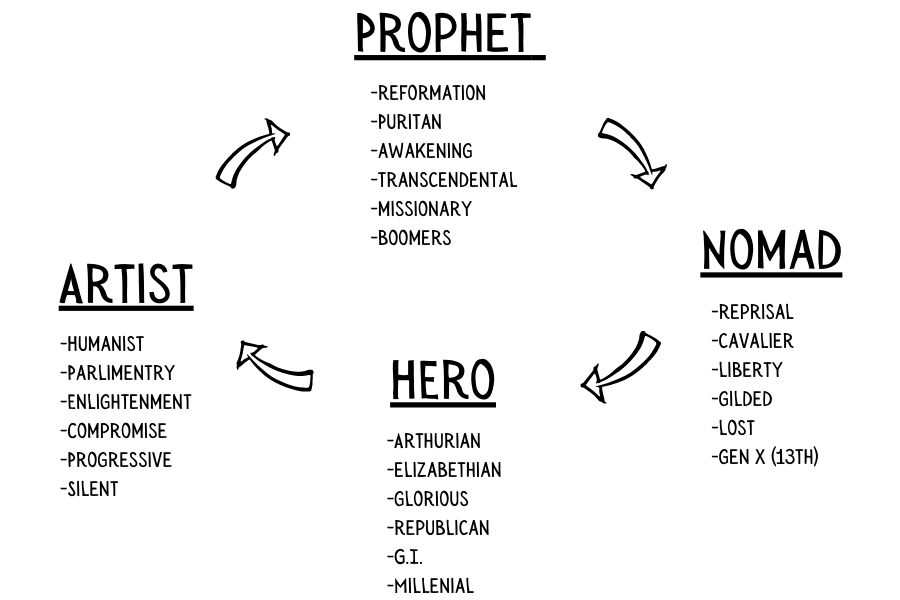

Each Turning has a well-defined mood that produces a well-defined generation of people. Each generation embodies one of four archetypes that appear in a specific, repeating order.

The full cycle (four human generations) takes roughly 90 years or one full Saeculum. Each archetype follows a similar script throughout history:

- **Prophet (Baby Boomers) – principled, yet narcissistic

**“Prophets grow up as the indulged, post-crisis children, come of age as the narcissistic crusaders of an Awakening, cultivate principle as moralistic midlifers, and emerge as wise elders during the next Crisis.” - **Nomad (Gen X) – Practical, yet unfeeling

**“Nomads grow up as under-protected children during an Awakening, come of age as alienated young adults, mellow into pragmatic midlife leaders during a Crisis, and age into tough post-Crisis elders.” - **Hero (Millennials) – Competent, yet unreflective

**“Heroes grow up as increasingly protected post-Awakening children, come of ages as the heroic young teamworkers of a Crisis, demonstrate hubris as energic midlifers, and emerge as powerful elders attacked by the next Awakening” - **Artist (Gen Z) – Caring, yet indecisive

**“Artists grow up as overprotected children during a crisis, come of age as the sensitive young adults of a post-crisis world, break free of indecisive midlife leaders during an Awakening, and age into empathic post-Awakening elders.

These generational trends are a natural, emergent, human phenomenon. We have well-defined stages of life and predictable human characteristics. Interestingly, we can observe this cyclical pattern going back 500+ years.

There is a symbiotic relationship between history and generations. The historic moment imprints itself onto the new generation. Then when that generation grows up it changes history. Repeat ad infinitum.

Each Saeculum is made up of Four Turnings

Just as generations follow cyclical patterns, each ~90-year Saeculum is composed of four well-defined stages called “Turnings” or “moods” that dictate how society responds to events.

Each Turning is defined by the constellation of generational archetypes in respective stages of life. Are the Hero archetypes still children or middle-aged managers? Are Prophets coming of age or are they elders controlling politics?

- First Turning (Rebirth/High/Spring) — 1946-1964

- Second Turning (Revolution/Summer) — 1964-1984

- Third Turning (Unraveling/Fall) — 1984-2008

- Fourth Turning (Crisis/Winter) —2008-2030?

The two most potent times in history are when Prophets and Heroes enter adulthood. Prophets come of age in Second Turnings and “cause a revolution” (eg: 60s Consciousness Revolution, Protestant Reformation) then two generations later the Hero generation “goes to war” during a Fourth Turning “crisis” (eg: WWII, Civil War, American Revolution, etc).

Throughout these generational cycles, history oscillates between classical opposing forces. Capital vs labor, liberty vs equality, isolationism vs expansionism. Again, driven by the constellation of generational archetypes at that point in time.

Humans have a tendency to rebel against the previous generation. This causes wild shifts in public sentiment. For example, the white-picket-fence 1950s sparked a backlash from the young Boomers who felt the culture was spiritually bankrupt. This led to the Consciousness Revolution.

Are some generations better than others?

The short answer is no. Each generation has strengths and weaknesses that must be balanced out by the others. This cycle serves as a guardrail ensuring humanity doesn’t spiral out of control.

If the Prophet archetype is in power too long (Baby Boomer/Missionary), society would decay and nothing would be built because everyone is selfishly focused on their own interior world. Sound familiar?

On the other hand, the Hero archetype (Millennial/GI) rebuilds our socio-political institutions. However, if society was led by the Hero archetype alone, everything would become too orderly, bland, lacking liberty, art, or a rich internal experience. Example: Nazi Germany rise to power.

Doesn’t technology drive changes more than demographics?

Most people assume technology is the primary force behind change. However, the Fourth Turning thesis claims the opposite. The cultural mood determines what technology gets built and ultimately adopted. Simply, the mood signals the unmet demands which will ultimately be satisfied by entrepreneurs.

New technology, or any specific catalyst for that matter, doesn’t guarantee a consistent outcome. Instead, our “response to a catalyst” is what drives change. Is society seeking change? Or hoping for stability after a period of chaos?

Our response to any catalyst is determined by which “Turning” we’re in.

Let’s explore two catalysts, the sinking of Lusitania and Pearl Harbor.

Both are similar events which resulted in dramatically different outcomes.

World War 1 started in 1914, right in the middle of a Third Turning. The Germans sunk the US Ship Lusitania in 1915. However, President Woodrow Wilson proclaimed the US would remain neutral. Americans widely supported this policy of nonintervention. It wasn’t until 1917, when the US commercial interests were being disrupted, that the US officially entered the conflict.

Fast forward to December 7, 1941, when the Japanese bombed Pearl Harbor. The U.S. declared war on Japan the very next day and the whole country rallied around the decision. This was a similar catalyst as Lusitania, however this time it was during a Fourth Turning which is when the people are primed for war.

Where Are We In The Current Cycle?

The Millennial Saeculum at a glance:

- First Turning (The American High) — 1946-1964

- Second Turning (Consciousness Revolution) — 1964-1984

- Third Turning (Culture Wars) — 1984-2008

- Fourth Turning (Millennial Crisis) –2008-2030?

Since 2008, America has been in the Fourth Turning (crisis) which is the final stage in a roughly 90-year cycle. In order to set the context, let’s rewind to the beginning of our current cycle, known as the “Millennial Saeculum.”

First Turning: The Great American High (1946-1964)

Lost generation enters elderhood / G.I. generation enters midlife / Silent generation enters young adulthood / Boomers enter childhood

Our current cycle began as we wrapped up WWII and America ascended to a global superpower. Everyone’s grown tired of fighting, civic duty reaches a peak as we rebuild back home. Soldiers returned from battle and wanted a “decent life.” Social movements stalled. Middle class grew and prospered. Increased peacetime government budgets were uncontroversial. Collectivist infrastructure flourished as we built suburbs, interstates, and (regulated) mass communications. Declaring an “end to ideology,” authorities presided over a bland, modernist, spiritually dead culture.

Second Turning: Consciousness Revolution (1964-1984)

G.I. generation enters elderhood / Silent enters midlife / Boomers enter young adulthood / Gen X enter childhood

Kicked off with urban riots and campus protests. Supercharged by anti-Vietnam War sentiment led by a rebellious youth. Even though they were given everything, Boomers led the revolution. They clashed with the bland “Leave it to Beaver” culture lacking anything resembling spirituality. This gave rise to feminist, environmentalist, and black power movements. We also saw the destruction of the nuclear family and a rise in violent crime. Peak chaos hit with Watergate in 1974 and passions turned inward towards “New Age” lifestyles and spiritual rebirth. The revolutionary mood expired when Reagan was elected for a second term, converting former hippies into selfish yuppies.

Third Turning: Culture Wars (1984-2007)

Silent enter elderhood / Boomers enter midlife / GenX enter young adulthood / Millennials enter childhood

An unraveling begins as society embraces the liberating cultural forces let loose by the boomer-led consciousness revolution of the psychedelic 60s. Personal satisfaction is high, and few national problems demand immediate action. Public is concerned about widening inequality, civic duty declines, and culture begins to diverge into competing value camps. Pervasive distrust of leaders and institutions, popular culture bends towards futuristic dystopia memorialized by Total Recall dysfunction, Robocop crimes, Terminator punishment, and Independence Day deliverance from evil. People can now feel the pain, but collectively we cannot yet do anything.

Fourth Turning: Millennial Crisis (2008-2030?)

Boomers enter elderhood / GenX enter midlife / Millennials enter young adulthood / Zoomers enter childhood

37 years after leaving the gold standard, Americans have experienced rising inequality, increased debt, and rampant inflation. Eventually, we have to pay the piper, and the time is nigh.

The 2008-2009 Global Financial Crises kicked off the Millennial Crisis, and the population finally demanded change. Occupy Wallstreet movement surged, Obama took office campaigning on “Hope and Change.” Society shifts away from individualism and towards collectivism marked by the rise of Social Justice Warriors, cancel culture, and policing speech. The crisis heats up in 2020 with the Covid pandemic, widespread economic depression, and riots erupting on the streets.

Anatomy of a Fourth Turning (Crisis)

During Fourth Turnings, the old social order combusts and gives birth to something entirely new. The ancients called this ekpyrosis, nature’s fiery moment of death and discontinuity.

Welcome to winter. A time of fire and ice. The supply of social order is still falling, but the demand for order is steadily rising. Although not required, Fourth Turnings historically end with total war.

“Pleasures recede, tempests hurt, pretense is exposed, and toughness rewarded” -Victor Hugo

While Fourth Turnings are not fun, this is not a doom and gloom prophecy. As a society, we need these moments of crisis. They serve as brush fires to clean out the decrepit institutions to make way for new growth. This generates buy-in from young people. Out with the old and in with the new. Optimistically, it’s a regenerative process allowing the cycle to continue.

Morphology of a Crisis (Fourth Turning)

- Catalyst (2008) – each crisis begins with an event (or series of events) that produces a sudden shift in the mood. 2008 global financial crisis, Occupy Wall Street, and Obama’s “Hope and Change.”

- Regeneracy (2012) – once catalyzed, society finds a new counter entropy that reunifies and re-energizes civic life. Rise of “Democratic Socialism,” Bernie Sanders’s popularity, “equal pay for equal jobs,” and Social Justice Warriors enforcing civic duty to ensure everyone is “equal” during hard times.

- Climax (2020?) – A crucial moment that confirms the death of the old order and birth of the new. Typically the climax is a war (WWII, Civil War, etc), but so far all we’ve experienced is the Covid Pandemic. Are we destined for war? War on the Virus, loss of liberties, riots, economic inequality becomes the hot topic, and Universal Basic Income begins.

- Resolution (2026?) – A triumphant or tragic conclusion that separates the winners from the losers, resolves the big public questions, and establishes the new order. This has yet to play out in our current cycle. Speculation: Overcoming Covid (or another, larger conflict), UBI lightens the mood, bootstrap a new global financial system.

Each Crisis ends with a “resolution period” which historically speaking is 3-5 years before a crisis concludes. We haven’t hit the resolution yet, but we’ll know when the mood transforms into one of exhaustion, relief, and optimism. We’ll see a resurgence of faith in humanity and authority, and society will yearn for a good and simple life.

“When you’re going through hell, keep on going” -Winston Churchill

Today’s oldest Americans recognize this mood from the previous Fourth Turning during the Great Depression and WWII. Cultural artifacts from the last Resolution period include “Somewhere over the rainbow” and the 1939 New York World’s Fair. A better future on the horizon, if we could only work together and make personal sacrifices.

Fourth Turnings of the Last 500 Years

During a Crisis, the outer world of power and politics is completely rearranged. The old paradigm dies making way for anew. Historically, Fourth Turnings have been settled with bloody conflicts. Are we destined for war sometime in the 2020s? Maybe not, but more on that later…

“History never repeats itself. Man always does.” ― Voltaire

What can we learn from previous Fourth Turnings?

Wars of Roses Crisis (1459-1487) — Kicked off with a fracturing of England’s most powerful families, the Lancasters (Lannisters) and the Yorks (Starks). Defined by a period of political turmoil, decades of conflict, and the crown changed heads six different times. Fun fact: This was the period George R.R. Martin based Game of Thrones on.

Transition: England entered the crisis as a traditional medieval kingdom; later emerged a modern monarchical nation-state.

Armada Crisis (1569-1594) — Newly Protestant England was threatened by the mighty Catholic Habsburgs. Lead to Assassination attempts on Queen Elizabeth, Francis Drake circumnavigating the globe with Spanish treasure, and eventually, the great Spanish Armada fell.

Transition: England entered the Crisis as a struggling heretical nation; later emerged as the global superpower with an expanding global empire.

Glorious Revolution Crisis (1675-1704) — Began with Bacon’s Rebellion, King Philip’s war, and escalating conflicts with the Algonquin Indians. Hit a crescendo with the Americans winning a decade long war against Canadian New France. Churchill described this period as having “changed the political axis of the world forever.”

Transition: English-speaking America entered the Crisis as a fanatical colonial backwater, and later emerged as a stable society whose education and affluence rivaled its former European home.

American Revolution Crisis (1773-1794) — Began with the Boston Tea Party, Samuel Adams “committees of correspondence,” arming local militias, and the signing of the Declaration of Independence. The “mood of emergency” calmed after the ratification of the Constitution.

Transition: British America entered the Crisis as a collection of violent, yet loyal, Colonies. Later emerged as the most ambitious experiment in Republican Democracy the world had ever seen.

Civil War Crisis (1860-1865) — Began with John Brown’s raid and Abraham Lincoln’s election which quickly led to Southern states seceding and the Civil War. Hit its climax during the Emancipation Proclamation and Battle of Gettysburg. Eventually concluding after Robert E Lee surrendered, and soon after the assassination of Lincoln. Uniquely, America didn’t feel optimistic after this crisis; instead, there was a feeling that a tragedy had simply run its course.

Transition: The United States entered the crisis as a racially divided agrarian republic, and emerged as an industrializing dynamo, battle scared yet newly dedicated to equal citizenship.

Great Depression and WWII Crisis (1929-1946) — Kicked off with the stock market crash, leading into the dust bowls and great depression. Attack on Pearl harbor ignited a unified public response leading to World War II. Crisis mood calmed down when the Axis capitulated, demobilized, and brought a surprising period of peacetime prosperity.

Transition: The US entered the Crisis as an Isolationist, fledgling nation; and later emerged a global superpower with industrial prowess, democratic institutions, and control over much of the world’s gold. New institutions include the UN, NATO, World Bank, IMF, Bretton Woods, etc.

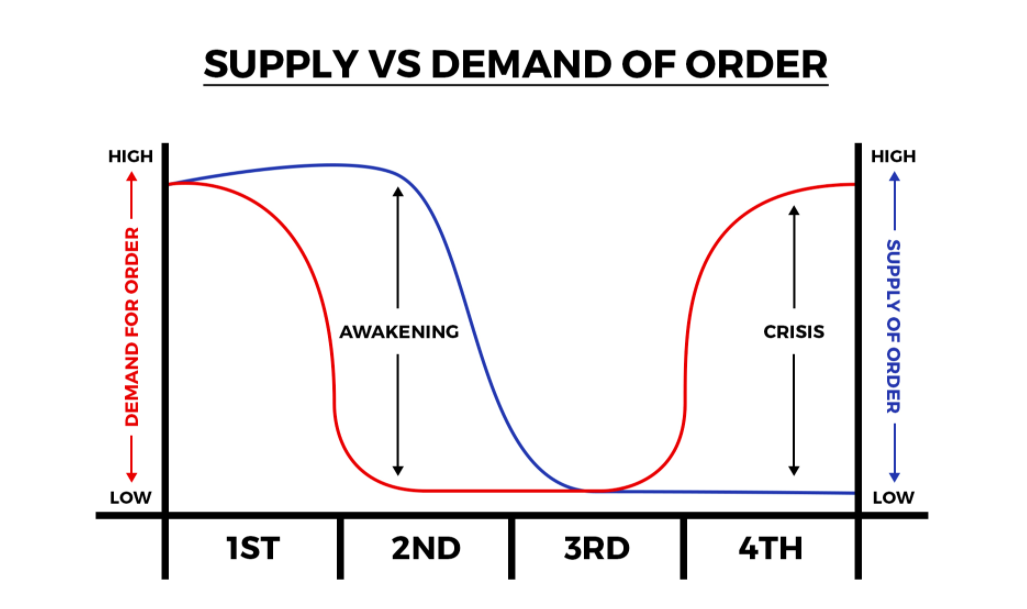

Supply and Demand for Order

The “supply and demand for order” in society fluctuates over time. Depending on the position of these two variables, you can determine the direction society is heading.

Chart designed by Nick Ward @nckbtc

The two most explosive points come when the gap between supply and demand for order is widest. Second Turnings produce an Awakening (internal change) and the Fourth Turnings produce a Crisis (external change).

During Third Turnings, called “unravelings,” we see both low supply and low demand for order. Everything is slowly falling apart but no one seems to care. Then after enough potential energy is stored during the Third Turning, the mood shifts. Fourth Turnings are a period when the supply of order is at rock bottom, but the demand for order starts rising.

After roughly 40 years of declining order, we’ve let our institutions crumble. It’s no secret that our governmental bodies, legal system, banking, healthcare, and education are derelict. Beginning around the 2008 global financial crisis, people increasingly realized how important our institutions actually are. The mood shifts and the demand for order rises.

What if our government was helpful? What if healthcare was great? What if our education system was incredible? This increasing demand for order juxtaposed next to failing institutions (low supply of order) catalyzes widespread structural change.

Lessons From The Previous Fourth Turning (1929-1946)

The previous Fourth Turning (1929-1946) has the most in common with our current situation. Join me for a stroll down memory lane.

“Those who don’t read history are doomed to repeat the mistakes of the past”

In response to the stock market crash of 1929 and the widespread economic hardship, the mood became one of desperation. Previously unthinkable policies (born out of the New Deal) gained popular support as Roosevelt led the greatest expansion of the Federal Government ever known. This was a natural consequence of implementing the Federal Reserve in 1913.

Social dynamics in the 1930s mirror today

Both the 1930s and the 2010s produced declining fertility rates, low migration to America, declining violent crimes, declining use of alcohol and tobacco, and many young people living with their parents.

This social dynamic is consistent anytime you have the “hero” archetype in young adulthood. For example, Millennials today and GI Generation in the 1930s.

The start of widespread deficit spending (The New Deal)

In 1933, Roosevelt issued Executive Order 6102 which “forbid the hoarding of gold coins, gold bullion, and gold certificates within the continental United States.” The stated reason for this desperate move was “hard times caused hoarding of gold, stalling economic growth and worsened the depression.”

Also in 1933, FDR kicked off his flagship program The New Deal which focused on three things: relief for the poor (and unemployed), recovery of the economy, and reforming the financial system to prevent another depression.

Since the crisis was so severe, progressive leaders and average Americans demanded the Fed take greater responsibility to “help the poor” and “prevent poverty.” The Social Security Act of 1935 birthed unemployment insurance, Social Security, and Welfare.

National Recovery Administration (NRA) was formed which sought to stabilize the economy by artificially fixing wages and prices, establishing production quotas to deter “dumping” of surplus inventories of products on the consumer market. Similarly, the Agricultural Adjustment Agency was created to curtail farm production in order to maintain higher farm prices.

The Federal Deposit Insurance Corporation (FDIC) was created to rebuild confidence in the banking sector. Now depositors could trust banks as their deposits were “insured.”

The Securities and Exchange Commission (SEC) was formed in response to public sentiment that “excessive speculation” led to the 1929 stock market crash and the subsequent great depression.

The tax rate for the highest earners soared from 25% to almost 63% by 1937 in an attempt to “soak-the-rich.” Blaming the rich is common during Fourth Turnings as the social consensus is led by the Hero Archetype (G.I. and Millenials) who reject individualism and fan the flames of populism.

Roosevelt goes full Keynesian

Roosevelt took office in 1932 claiming he would balance the federal budget. After the “Roosevelt Recession” of 1937-1938 was blamed on “a reduction in federal spending,” Roosevelt accepted the advice of British economist John Maynard Keynes.

Keynes argued that technically advanced economies would need either:

(i) Permanent budget deficits or (ii) Redistribution of income away from the wealthy to stimulate the consumption of goods and to maintain full employment.

The acceptance by the Roosevelt Administration of what became known as Keynesianism established the precedent of using deficit spending as a vehicle for promoting economic recovery in times of national crisis.

Big business leaders joined the Keynesian train (incentives win the day)

The obvious connection between deficit spending and economic expansion was not lost on many Americans, including business leaders who much preferred large deficits to Keynes’s alternative of massive redistribution of wealth through taxation as a way to sustain America’s prosperity in peacetime. As Charlie Munger says, “show me the incentives and I’ll show you the outcome.”

The 1940s and WWII

The period of tremendous fiscal spending continued into the 1940s to support the war efforts. Debt levels reached their peak but were quickly resolved after WWII due to America’s relative position of strength and the new monetary system (Bretton Woods)

WWII left the world in shambles, a typical process during Fourth Turnings. Now what? Time to rebuild while the cement is still wet.

Enter Bretton Woods: Bancor vs Gold-pegged USD

In an effort to put the financial pieces back together, world leaders gathered in Bretton Woods, New Hampshire to create a new global monetary system.

The two main proposals were:

- Bancor — Keynes championed the bancor system, a supranational settlement medium based on a basket of currencies. Under this system, no one could independently print more bancors, ironically similar to Facebook’s Libra.

- Gold-backed USD —Since the US was in a relative position of global power, they could create a gold proxy by pegging all U.S. Dollars to gold. This system was to be managed by the IMF and World Bank. The entire world can rest easy knowing U.S. dollars are “as good as gold.”

Obviously, they decided on a USD proxy for gold which only lasted about 25 years before Nixon closed the gold window pushing us into a strictly fiat system in 1971.

Besides a new monetary standard, both the IMF and World Bank were also created at Bretton Woods.

The seen and unseen

During Fourth Turnings, the global structures are torn down and rebuilt. These drastic measures seem warranted in the moment. However, each decision comes with a bouquet of seen and unseen consequences. This is often called the cobra effect which occurs when an attempted solution to a problem makes the problem worse. In other words, centrally planned institutions usually fail in managing complex systems.

Unintended outcomes aka “unseen consequences” of the previous Fourth Turning:

- National Recovery Administration – Intended to “manage the recovery.” Ultimately fixed prices, stifled competition and sometimes made American exports uncompetitive. Another reminder that central planning slows economic recovery.

- Agricultural Adjustment Act – Intended to improve food production. Ultimately paid farmers not to produce, raised food prices and kicked thousands of farmers off the land and into the unemployment lines.

- FDIC insurance – Intended to reduce the risk of bank runs. Ultimately taught bank customers they no longer need to shop around for a well-run bank. If the market doesn’t force banks to behave, they will take advantage of their position. This led to a moral hazard we’re still paying for 60+ years later.

- Keynesianism – Intended to avoid economic damages today, at the expense of tomorrow. Resulted in never-ending deficit spending and a pattern of ongoing currency devaluation which we may see come to a head in the 2020s.

- SEC (and other regulators) – Intended to “prevent” excessive market speculation. Ultimately got captured and now serves as an extension of the most powerful corporations (creating harmful monopolies that stifle innovation).

- Pensions and Social Security – Intended to quell social unrest, which can work when young people are producing enough to pay for the entitlements of the elderly. Ultimately as soon as demographics flipped, the mounting entitlements from a retiring boomer generation created a catastrophe.

It’s clear we’ve outgrown the infrastructure created between 1929-1946. As the cycle goes, it’s time to tear down the old world and build anew.

Does that mean we should just succumb to nihilism? No. Your actions matter as the results of this decade will define the next 100 years. However, you can be sure they’ll have unseen consequences for future generations to remedy.

Analyzing our Current Fourth Turning (2008-2030?)

Considering what we know about previous Fourth Turnings, here are the key trends to follow as society seeks to deconstruct existing institutions.

Domestic Politics, The rise of Populism, and Everyone’s a Socialist

2020 marks the widest partisan gap since the 1930s. People under 30 are predominantly left-leaning and those over 60 heavily lean right. To make matters worse, the most ideological generation in history (Boomers) controls politics.

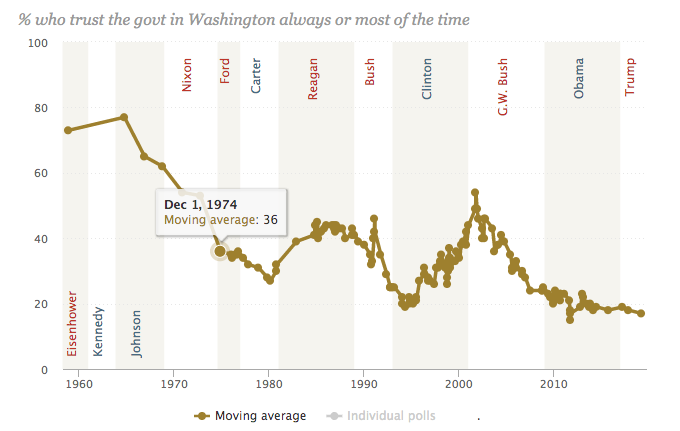

Trust in the central government is the lowest it’s been in the last century. In 1961, 80% of people said they “trust the Federal government to do the right thing.” In 2020, that number dropped to only 20% trust the Federal government.

Source: Pew Research

The people realize the socio-political infrastructure is not working and they’re grasping for a solution. This creates demand for a “strong man” leader to get us out of this mess.

People increasingly believe that collective action is the only way to make a civic change. This leads to popular culture demanding consensus instead of accepting individualism. Popular sentiment gets harnessed (Populism) as propaganda for the purpose of overtly reinforcing “good” conduct (cancel culture, etc). With the ability to make a change, leaders start exaggerating the bad stuff (instead of downplaying it like they do in Third Turnings).

Trump’s 2016 presidential victory is a symptom of the “crisis mood.” The people wanted change and Trump successfully captured the mood with a successful “drain the swamp” campaign. The rise of Bernie can be explained in the same way. The consolidation of power is guaranteed, but if we’re not careful we’ll fall into totalitarianism as we’re seeing around the world.

Just like FDR in the 1930s, America is doomed to repeat a decade of expanding the Federal government. In 2020 alone, we saw Universal Basic Income (“Trump Bucks”), business bailouts, yield curve control via QE, and more. Will this be enough? Not a chance. We’re just getting warmed up.

“By the end of this decade, the Fed’s balance sheet will be between $40T and $50T” - Felix Zulauf on The Grant Williams Podcast

Before the decade is over, Modern Monetary Theory (MMT) will run its course. We’ll see some combination of Universal Basic Income (via Central Bank Digital Currencies), college loan forgiveness, free healthcare, A New New Deal, Increased minimum wage, and more. The appetite for handouts will be insatiable.

What about the fiscally conservative party? There isn’t one. You wouldn’t expect helicopter money from the “fiscally conservative” party, but things are different in 2020. Everyone’s a Socialist now.

Foreign Affairs, Geopolitics, and Isolationism

Populism, and in many cases totalitarianism, is rising all around the world. Look no further than Maduro’s Venezuela, Duterte’s Philippines, Modi’s India, Xi’s China, the Yellow Vest Movement in France, and many more. This points to a global synchronization of these demographic cycles since WWII. In addition, this is the first time in history we’ve seen the world connected under a globally dominant reserve currency (USD). If every country is in a Fourth Turning simultaneously, the results could be explosive.

3rd Turnings produce relaxed borders, increased international travel, and waves of immigration. Fourth Turnings reverse all of that. Global trade as a percentage of global GDP peaked in 2008 and has been declining since. The pendulum is swinging towards isolationism.

Covid exposed our reliance on foreign imports, especially from an increasingly hostile China. Politicians will respond by incentivizing manufacturing in America and the market will support it.

America’s foreign policy will support global trade as long as it comes with no political baggage. A nice parallel to America’s foreign policy at the end of the 18th century:

“The great rule of conduct for us, in regard to foreign nations, is, to extend our commercial relations with as little political connection as possible.” -George Washington’s farewell address (1796)

Minimizing political baggage abroad is good for many things, including the fact that trade is more profitable than war.

The shift to isolationism will expose nations who are reliant on crucial foreign imports such as energy, food, and medicine. Combined with a slowing GDP and increasing sovereign debt, nation-states will flail in desperation. Expect more civil wars, hyperinflation events, deadly totalitarianism, and regional conflicts. Smart nations will start monetizing energy assets by mining Bitcoin and eventually buying it outright.

Optimistically, isolationism will increase the competition between nation-states. When countries compete for citizens, individuals win. Nations will increasingly compete for capital by selling passports and offering favorable tax treatment. Those with capital can shop around, those without are tied to the fate of their passport.

Protectionism, Demographics, and Entitlements

In the 1990s, America made a conscious effort to increase child-rearing efforts. The young gen Xers at the time were universally disliked by adults. They were the neglected bad boys, the Latchkey kids, as portrayed by Mikauley Caulkin in Home Alone. This produced a popular backlash in America resulting in the Millennial generation. Millennials were defined by a period of over-parenting, baby-on-board stickers, bike helmets, D.A.R.E. programs, and 13th place ribbons.

This mood of “protectionism” was not isolated to child-rearing. In fact, our central bankers and governments had a protectionist bias. The “can’t let anything fail” attitude created an economic environment where companies cannot fail, interest rates are suppressed, and the fed will backstop the economy with QE infinity. This pushed up boomer assets and left millennials with nothing to buy.

In 2020 we have top-heavy demographics. The Boomers are retiring which means entitlement liabilities are increasing steadily. Unfortunately, there isn’t enough value being produced by young people to pay for Boomer retirements.

“Long term productivity has slowed, this has driven entitlements from 4.7% of U.S. GDP in 1965 to 14.7% of GDP now….We need to shrink entitlements back as % of the pie and need to resolve it before we have a crisis. Unfortunately, though, I don’t see how we’re going to get out of this.” - Alan Greenspan, 2015 [source]

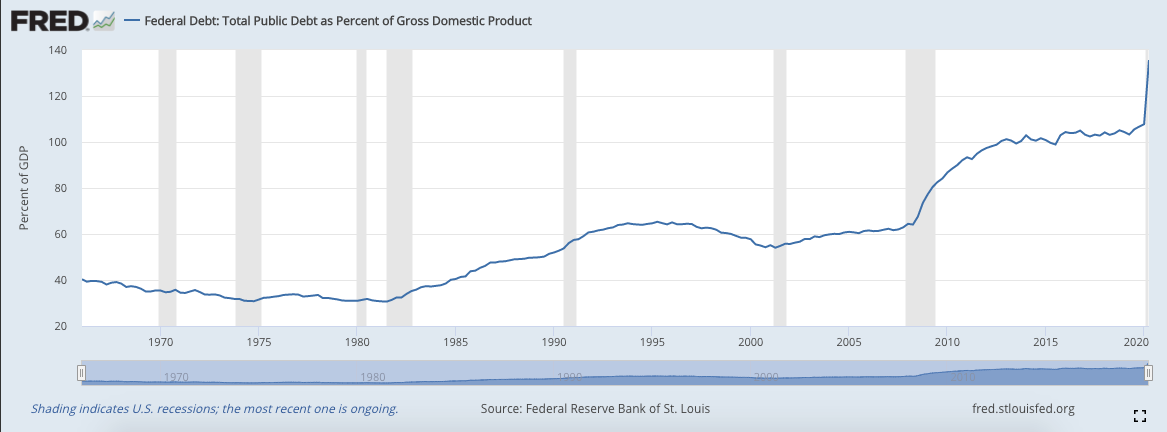

Due to these entitlements, America is forced to “print more or allow a revolution.” We’ve already seen a 22% increase in base money in 2020 alone. This brought the U.S. Debt-to-GDP Ratio to 135%. Not to mention the economy is slowing down. This means sovereign debt must continually increase, likely to unsustainable levels.

Source: Federal Reserve Bank of St Louis

In previous Fourth Turnings, wealth gets taken from the old and wealthy and given to the young and poor. However, wealth redistribution only eases social tensions temporarily, it doesn’t fix the underlying debt problem.

What do we do with all the debt?

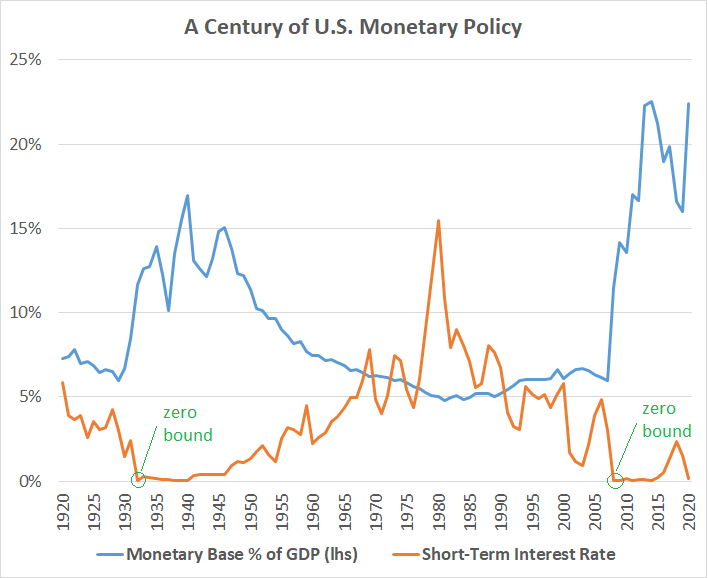

In Lyn Alden’s recent essay, she examines the fiscal and monetary policy of the last century. She explains Ray Dalio’s long term credit cycles and the inevitable monetary reset that follows. Interestingly this long-term credit cycle overlaps nicely with the 90-year cycles laid out in the Fourth Turning. Do demographics drive the long-term credit cycle or is it the other way around?

Notably, there is a major overlap with the 1930s-1940s and today. Both are Fourth Turnings that began with a monetary/banking crisis (1929 vs 2008) which led to interest rates being pushed to 0%. This makes central banks less powerful as their main tool (interest rate manipulation) is impotent.

Source: Lyn Alden

Soon after, America gets plunged into a spending/fiscal crisis marked by WWII and Covid-19 (potentially another conflict in the 2020s). With powerless central banks, the only option is massive government spending in the form of QE and UBI. Just like in the 1940s, this setup indicates an inflationary period and a high risk of currency failures coming in the 2020s. Although, we’ll likely see a couple of years of deflation first.

This brings us to the key question: what do we do with all the debt?

One option is a decade or two of austerity (think high taxes and low government spending). Highly unlikely since there is no political will for austerity.

Increase global GDP? Highly unlikely as the world is heading into a recession and the demographics are against us.

What about debt forgiveness? Since the Fed owns most of the student loan debt, they can simply press “delete” on their spreadsheet. Seems pretty likely under the circumstances and it would empower young people to start families and buy homes from boomers.

How about increasing taxes on the wealthy? During the previous Fourth Turning, the tax rate for the highest earners soared from 25% to almost 63% by 1937. This was known as “soak the rich” in the 1930s and a similar sentiment is gaining steam in America today. Seems inevitable as millennials take power away from aging boomers.

Our final option is to devalue the debt in real terms (inflation). This would likely be accomplished by Quantitative Easing (QE) and increasing the broad money base.

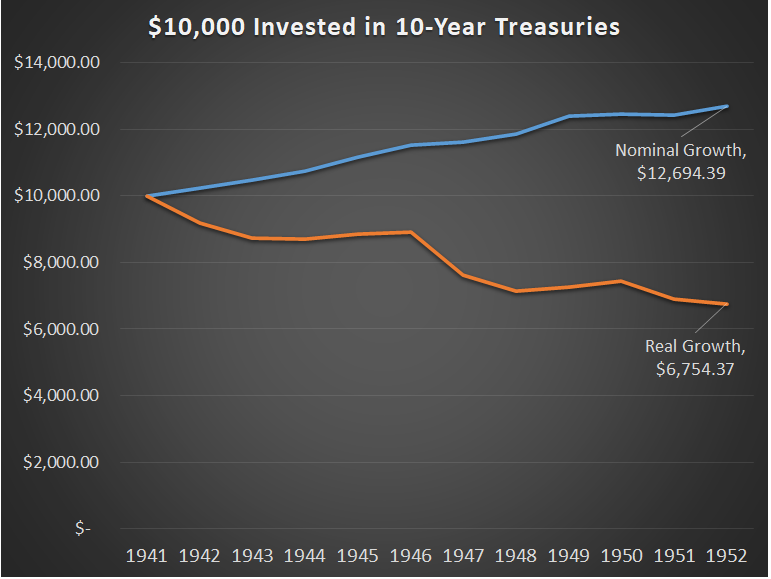

The federal reserve will now have an unlimited budget to buy as many assets (treasuries, corporate debt, and soon to be equities) as necessary to keep interest rates down. Practically speaking, that means anyone holding dollars or bonds will see negative real returns for the next decade. Again, just like the 1940s.

Source: Lyn Alden by way of Robert Shiller, Aswath Damodaran

At the same time, the government will increase the broad money base with various forms of government spending and UBI. Programs like a “New New Deal” and direct to individual UBI facilitated by a Central Bank Digital Currencies (CBDC) are likely.

What about hyperinflation?

As weak currencies break down, some will hyperinflate which draws more attention to Bitcoin’s value proposition. Volume taken from LocalBitcoins exchange shows that nations with weakening currencies lead to increased Bitcoin adoption.

How long before a nation-state moves heavily into Bitcoin? Venezuela already runs BTC Pay Server, Iran gives tax incentives to miners, Marshall Island tried launching their own ICO. The writing’s on the wall. Judging by incentives alone, smaller nations will adopt Bitcoin by 2030, likely sooner.

What about the United States? Although some Bitcoiners believe we’ll see hyperinflation with the USD, I’m skeptical. The USD is still in high demand globally and the U.S. has a relatively strong economy with relatively sound demographics. The USD won’t hyperinflate this decade, but it will be majorly devalued (along with all other currencies).

We haven’t seen enough Conflict yet

Every Fourth Turning in the last 500 years climaxed with a bloody conflict. Climaxes of previous Fourth Turnings include WWII, Civil War, and the American Revolution.

Does that mean we’re destined for total war in the 2020s?

Not necessarily. War represents a period of maximum urgency which mobilizes society for a specific purpose. We don’t necessarily need bloodshed, simply a catalyst on par with war. Wartime creates conditions needed to reboot society: increased centralized planning, populous willing to make sacrifices, easier to confiscate money from the wealthy, etc.

Four potential conflicts which may serve as the Climax of our current Crisis:

- Covid — is this big enough to mobilize the nation?

- Civil War — feels more likely by the day

- Total War — tensions rising with China, a battle over the future financial system could spark conflict

- Black Swan — unpredictable spark that would catapult the world into conflict (financial collapse, terrorism, cyber-attacks, etc)

In March 2020 I thought Covid would serve as our Climax to rally the troops through the dark night. We saw increased government spending, begging for the central government to manage the crisis, Universal Basic Income, business bailouts, and many people willing to give up liberties for the “greater good.”

However, the issue became politicized and created a wider gap between political party lines. Could Covid be the climax? Yes, it’s possible, but I fear we have a much bigger event on the horizon.

The Case for a Second American Civil War

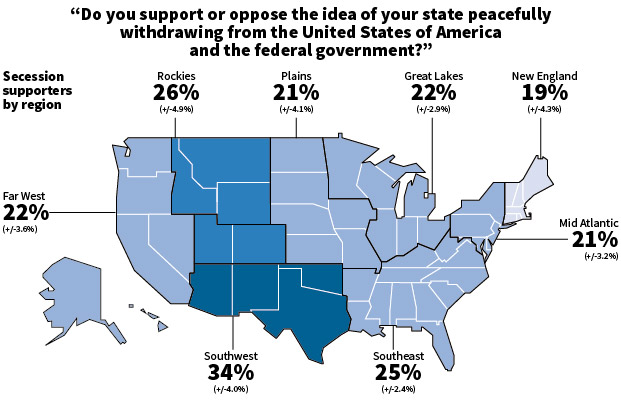

A 2014 poll showed that 23.9% of Americans support secession from the Federal Government. If they ran the same poll today, it would no doubt be higher. This is alarming because it only requires a strong minority to kickstart a conflict. For example, most people in the colonies didn’t support the American Revolution.

Source: Reuters poll data

We’re not doomed to see a repeat of the first American Civil War. Instead, they can materialize in all shapes and sizes. There doesn’t need to be a clear beginning, clearly defined sides, each with their own clearly defined goal. Instead, Civil wars are often a quagmire of different factions fighting over an ever-changing landscape.

Civil wars become more likely when the community that commands the greatest loyalty doesn’t necessarily align to the political or geographic boundaries. The biggest points of contention in America right now are Rural vs Urban, States vs Federal Government, and Red vs Blue.

Unsurprisingly, wartime is when humans create all the deadly weapons (ex: Project Manhattan). If America unravels into civil war, we’ll see new weapons developed and deployed on our own citizens. We’re already seeing a militarization of police, unmarked paramilitary troops occupying hot zones, increasing surveillance technology, spyware, Fed Coin being discussed, and attacks against encryption. Sadly, the state can cook up much worse things if the “need arises.”

If you want to understand the risks of a Second American Civil War, I recommend the podcast series It Could Happen here (2019).

Plan for the worst; hope for the best.

The Fulcrum of this Crisis: Individualism vs Collectivism

Each Fourth Turning resolves some deep point of friction in society. The previous one (1930s and 1940s) was rooted in a battle between capitalism and socialism. The next decade’s battleground will be Individualism vs Collectivism. At a glance, these concepts sound similar. The difference is the previous cycle was a fight over the means of production. State or Market? Our current cycle is a fight over “the culture.” Is individualism celebrated or condemned?

Collectivism is growing today (see: rising populism). If this continues, society will become a totalitarian nightmare. The trick is to get support for individualism (liberty) from collectivist minded people. This will shift the pendulum back towards freedom. As Matt Ridley says “Innovation is the child of freedom and the parent of prosperity.” In other words, freedom leads to innovation which leads to prosperity.

Free individuals can take on more risk, with less red tape, in an attempt to create value. Most fail (necessary sacrifice) but the few who succeed produce fruits enjoyed by society at large.

This point cannot be overstated during a Fourth Turning – when the temptation is to succumb to collectivism. As Naval has rightly pointed out, there are only two ways to coordinate societies at scale… by free markets or by force.Bitcoin acts as a novel institution that improves society’s ability to coordinate through free markets, rather than state-enforced violence.

Bitcoin is also a monetary asset outside anyone’s control. This contests the state’s monopoly on money and banking. Less state control empowers individuals to unleash latent creativity that would otherwise be stifled by government or cultural censorship. In other words, Bitcoin increases marginal productivity in society.

Bitcoin is the life raft during the great fiat flood

Bitcoin is our best hope for a peaceful transition to a new financial system.

Individuals can opt-out of their local currency by joining the Bitcoin life raft. Protect purchasing power, rather than go down with the sinking ship that is their state. This reduces conflict risk as fewer citizens become desperate.

As currencies collapse and resources become scarce, nations will become desperate which often leads to bloody conflict. Adopting Bitcoin early means states and individuals will benefit from Bitcoin’s price appreciation, increased economic opportunity, and a headstart in a new paradigm. In some cases, this may de-escalate conflicts by minimizing fallout from failed states.

Which country will announce they’ve been accumulating Bitcoin first? Hard to say.

All I know is you don’t want to be the last country to do so.

Is Bitcoin the Fifth Turning that finally breaks the cycle?

My original thesis for this essay was: Bitcoin will break the Fourth Turning cycle. However, after spending [a lot] more time with the material, I no longer believe that.

These generational cycles appear to be an emergent phenomenon foundational to human civilization. It “shouldn’t happen” but it does. Any technology, including Bitcoin, is processed on “higher layers” in the human stack.

Through this lens, the question becomes: “how will the current mood affect Bitcoin?”

Bitcoin is the Perfect Fourth Turning Money.

Bitcoin was born at the dawn of the Fourth Turning in 2009, at the peak of the global financial crisis. It was engineered for maximum survivability and grew up during a period of high volatility. Bitcoin is the perfect Fourth Turning money.

Our existing Fiat Financial system was born during peacetime, was sheltered by central bankers, and has never faced real adversity. Fiat is not well suited for the volatility of Fourth Turnings.

“Oh, you think the Fourth Turning is your ally. But you merely adopted the Fourth Turning; I was born in it, molded by it. I didn’t see the First Turning until I was already a man, by then it was nothing to me but BLINDING! The volatility betrays you, because it belongs to me!” -Bitcoin

Or as Andreas Antonopolous would say: Fiat is Bubble Boy trying to compete against the battle-hardened sewer rat that is Bitcoin.

How does BTC perform in this Fourth Turning?

In a world where central bankers are racing to devalue their currency, scarce assets win. Bitcoin is the most scarce asset in history and it’s still 50x smaller than gold. As Paul Tudor Jones said, “Bitcoin is the fastest horse.”

The stakes are high during Fourth Turnings and governments will intervene in markets in unpredictable ways. In other words, even if you make the right trade, the gamemaster might change the rules on you. Bitcoin is the least manipulable asset, it’s prudent to hold some.

It takes considerable effort to grasp Bitcoin and most people haven’t bothered. Current Bitcoin investors benefit from this information asymmetry. As the world wakes up to Bitcoin, it will become “the asset heard round the world.”

Will governments ban Bitcoin?

Some governments are hostile to Bitcoin today and others will be hostile tomorrow. Luckily, nations are in competition with each other. Banning Bitcoin in one jurisdiction creates an opportunity for another nation to attract that capital.

Bitcoin is really hard to attack head-on and failing to stop it could easily backfire. Optimistically, just like gold became accepted by the powers that be, Bitcoin might get a similar pass.

However, this doesn’t mean they won’t try to suppress Bitcoin. Be prepared for a repeat of the 1933 Executive Order 6102 (making self custody of gold illegal). Self custody your Bitcoin and encourage others to do the same.

Lastly, increasing isolationism will reduce the United States’ role as the world police and decrease intergovernmental cooperation. Increased competition is good for customers (citizens). Enterprising governments will offer favorable tax treatment for Bitcoiners, sell passports, and offer digital citizenship.

Millennials love Bitcoin, they just don’t know it yet

In 2017, Neil Howe, the author of The Fourth Turning, made a video explaining why he’s bearish on Bitcoin long term. Neil makes rookie mistakes like: “Bitcoin is anonymous and only good for illicit activity,” and “Bitcoin can’t be money because it’s not a commodity or government debt.” Not worth the effort debunking these claims for the Nth time.

Neil also argued that most Millennials won’t adopt Bitcoin because they’re community-oriented, want to trust strong central institutions, and they’re famously risk-averse. Neil thinks Millennials will avoid Bitcoin and adopt Central Bank Digital Currencies (CBDCs) because they’ll be regulated, transparent, accountable, and safe. Interesting critiques, but only partially true.

Neil’s right that millennials are collectivists and deeply desire to trust institutions. Millennials don’t want to “defund the state” or “separate money from state” or have unfettered free markets. An important point for Bitcoin evangelists to consider. However, Neil missed a few key points about Bitcoin. In short, Millennials love Bitcoin, they just don’t know it yet.

Bitcoin is based on principles of community, transparency (open ledger), equal opportunity for everyone in the economy. It’s the perfect institution upon which Millenials will reorient society.

Bitcoin is the most community-oriented monetary network in existence. Replace the old white guys at the Fed with software. Everyone can run a node. Consensus is king. Protocols over bureaucrats.

Millennials are definitely risk-averse. They won’t volunteer to be the first person buying Bitcoin, but they’ll avoid being last at all costs. Luckily for them, Bitcoin is becoming de-risked as public companies, famous people, and their friends adopt Bitcoin. Not to mention, Bitcoin is one of the only options for a positive real yield in the 2020s. Millennials can either adopt Bitcoin or have fun staying poor (as the meme goes).

To Neil’s credit, UBI delivered via CBDCs will be popular with millennials. However, millennials will also get more comfortable with a new monetary system and they’ll observe Bitcoin increasing in price relative to their Fed Coin. Ultimately, CBDCs will accelerate Bitcoin adoption.

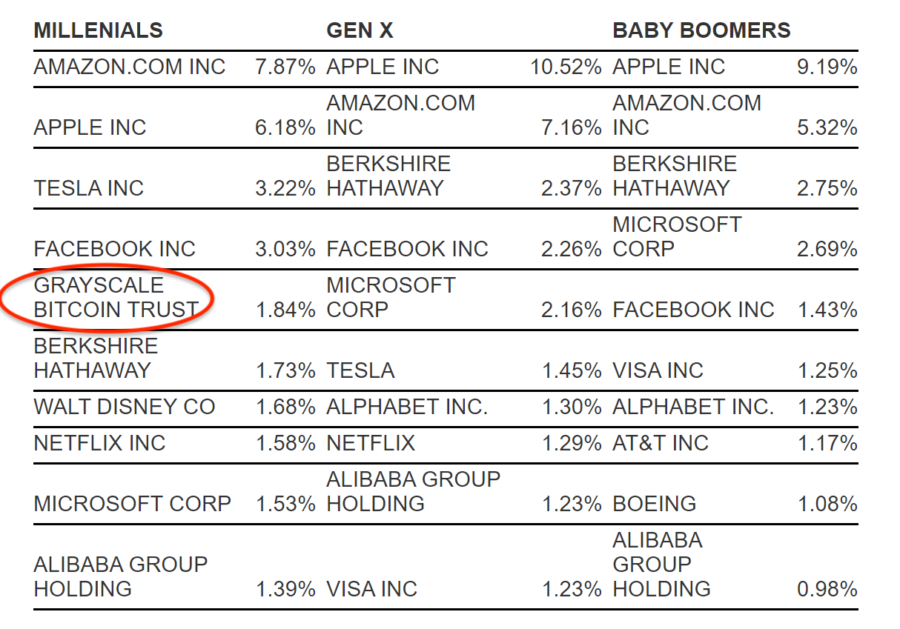

Finally, a quick look at some data. Unsurprisingly, 90% of Millennials prefer Bitcoin over Gold. Millennials also picked cryptocurrencies as their top long-term investment 9% of the time, triple the rate of Gen X. Charles Schwab published their top 10 holdings by generation in the chart below, again Millennials are leading the charge with the Grayscale Bitcoin Trust.

Source: Charles Schwab (emphasis mine)

Based on the current data we have and the reasons listed above, Bitcoin will be adopted by Millenials at an increasing rate over the coming decade.

Bitcoin as a treasury reserve asset

The chaos kicked off by Covid in 2020 served as a wake-up call. Everyone around the world is forced to reevaluate assumptions, hard conversations are being had, big changes being made. This shakeup led to individuals, companies, and governments reevaluating Bitcoin.

Notably, major corporations started adding Bitcoin to their balance sheet. Two narratives drive this decision: economics and ideology.

Michael Saylor, CEO of MicroStrategy, bought $425m worth of Bitcoin “not as a speculation, but rather a deliberate corporate strategy to adopt a Bitcoin Standard.” He sees fiat money like an ice cube melting between his fingers. Bitcoin is a way to protect the purchasing power of their treasury. A rational economic decision.

Jack Dorsey, CEO of Square, bought $50m worth of Bitcoin because it’s an “instrument of economic empowerment….which aligns with the company’s purpose.” This is a sound ideological decision.

Buying Bitcoin to support “economic empowerment” sends a very powerful message today as equality is being widely discussed. Not to mention, corporations feel the weight of economic uncertainty. Two separate threads, both leading to more Bitcoin ending up on corporate balance sheets. Corporate FOMO here we come.

At the time of writing, 3.74% of all Bitcoins are held on publicly-traded company balance sheets.

Can Bitcoin become too big to fail?

As of October 2020, Bitcoin’s market cap is around $250b. Impressive, but still a rounding error in the global financial system. With that in mind, Bitcoin has a lot of growing up to do. Many challenges yet to overcome. However, I remain optimistic.

The community coalescing around Bitcoin is unparalleled. But don’t take my word for it…

“Bitcoin has this enormous contingence of really, really smart and sophisticated people who believe in it….It’s like investing with Steve Jobs and Apple or investing in Google early.” - Paul Tudor Jones

“Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy.” - Michael Saylor

“The Bitcoin guys have a perspective on what the true liberation of America and humanity will be.” - Kanye West

In other words, if you bet against Bitcoiners, you’re going to have a bad time.

An increasing number of American politicians have publicly voiced support for Bitcoin. An optimistic sign for the future of Bitcoin.

Publically traded corporations owning Bitcoin reduces the chance of a state-level attack because doing so would crash the almighty stock market.

At a certain point, Bitcoin will have reached enough market penetration that dislocating it would be impossible.

Not to mention, Bitcoin held in self custody is really hard to confiscate. Orders of magnitude harder to seize than gold or marijuana, both of which survived state-level attacks.

Global reserve asset: What comes next?

The monetary system sits at the base of humanity. All other institutions reference the monetary layer making it the primordial institution.

In the previous Fourth Turning, we birthed the Bretton Woods system, the World Bank, IMF, United Nations, and much more. As the current fiat financial system starts to crumble, maybe it’s time for an upgrade.

In 2009, the head of the PBOC, Zhou Xiaochuan, called for reforming the international monetary system (citing Keynes bancor system). Since then, China has been publicly developing a central bank-backed digital currency.

In 2019, the Governor of the BOE argued for Central Bank Digital Currencies to replace the dollar. Then weeks before the 2020 presidential election, the IMF calls for a new Bretton Woods moment.

In other words, the global financial system is going to be rebooted. What will come out the other side? Central Bank Digital Currencies? Bancor 2.0? Libra? Return to a Gold Standard? Bitcoin Standard?

A return to the Gold Standard is nearly impossible today because the economy demands stimulus and gold forces austerity. There is no political will for austerity. Sorry, gold bugs. It’s not happening.

Libra or a similar “corporate money” seems to have taken a back seat for now. Not because it wouldn’t work, instead because governments are fighting back. As it stands today, big tech is the bad guy.

This leaves CBDCs, Bancor 2.0, and a Bitcoin standard left to discuss.

Central Bank Digital Currencies are inevitable.

Currently, central banks can only indirectly manage the economy by adjusting interest rates and QE. A clumsy approach that’s becoming less effective every year. Interest rates cannot be lowered further and QE isn’t very effective. This leaves fiscal policy as the solution available today (aka spend our way out of this mess).

Enter Central Bank Digital Currencies (CBDC). They’ll serve two purposes: enable central banks to manipulate the economy in more sophisticated ways and serve as a surveillance tool that would make Hitler, Stalin, Mao jealous.

CBDCs will enable the central banks to surgically manage the economy. They can simultaneously inject cash in one sector while taxing another (negative interest rates). They’ll deduct taxes automatically and send UBI payments directly from the Fed to the plebs.

This will give incredible power to central banks at the expense of liberty for individuals. This new digital dollar will spy on you and will only work at government-approved vendors. If the government doesn’t like your political views, they’ll turn your money off. This is the weaponization of behavioral economics through an all-powerful, closed-loop, financial system. Apparently, the banking class has no upper limit on hubris.

Whether we like it or not, all major countries are racing to create their own CBDC. By 2030, an entirely new financial system will be in place.

New Global Reserve Asset?

In a few years, all major nations will have successfully forced their citizens onto their CBDC system. Smaller nations will adopt regional CBDC standards.

How will nations settle between each other? Currently, this is done with gold, dollars, or U.S. treasuries.

One option is to create a new global reserve asset pegged to a basket of CBDCs, we can call this Bancor 2.0. Governments are incentivized to support this as it enables everyone to print money simultaneously without destroying their foreign exchange rates. This will lead to a major devaluation of the entire fiat system. This is the most likely outcome by 2030. Raoul Pal explores this in a recent video.

However, Bancor 2.0 comes with major execution risk and requires cooperation from major nation-states. Do governments have the technical chops to pull it off? Will they partner with Facebook to build the tech? Will competitive nations agree to terms for a Bancor 2.0? This plan is attractive to technocrats, but it’s not bulletproof. Even if Bancor 2.0 is implemented, Bitcoin’s uncompromising monetary policy will serve as the true barometer of success. In other words, all shitcoins trend to zero in Bitcoin terms.

Bitcoin is the most pristine collateral.

Bitcoin is the perfect settlement medium between nations. It’s scarce, verifiable, secure, publicly auditable, and resistant to capture. Most importantly, it doesn’t require trusting your counterparty.

The question becomes: is Bitcoin ready to serve as the foundation of a new global financial system? The short answer is not yet. However, competitors such as Bancor 2.0, aren’t ready either.

The Fourth Turning will end sometime around 2030. This leaves room for Bitcoin to continue its exponential path of adoption. While I fear Bancor 2.0 will be attempted, Bitcoin will be the future reserve asset of the planet. The only question is will Bitcoin be ready by 2030?

Author’s note: It would be poetic if Bitcoin became the global reserve asset in 2030, just in time for Bitcoin’s 21st birthday.

How to Protect Yourself During The Fourth Turning

The next decade will be chaotic and unpredictable. There will be many losers and a few big winners. So how do you protect yourself during a Fourth Turning? The short answer is to make yourself antifragile.

How to protect yourself during this Fourth Turning:

- Protect your wealth with Bitcoin (self custody) – Bitcoin cannot be seized, will likely increase in value, and you can travel anywhere with money stored in your head. Self custody is required to defend against a 6102-₿ type attack.

- Minimize debt – Don’t get wiped out by volatility. Fixed-rate mortgages are OK.

- Live below your means – Survive on one spouse’s income, invest the rest.

- Multiple sources of income – what happens if you lose your primary income? Invest in yourself, build skills for the future, find a side hustle.

- Acquire a second passport – Do not be locked into the fate of your jurisdiction. Useful for immigration, reducing tax burden, and peace of mind. Katie Ananina helps Bitcoiners acquire a second passport at Plan B Passports.

- Don’t be cancelable – If your income is independent of mob sentiment, being “canceled” will not sting so bad. Start a business, side hustle, or work for someone you trust.

- Don’t invest in politics du jour – Culture is not your friend. Opt-out.

- Be self-reliant – Grow food, defend yourself, have access to energy.

- Become more technical – Learn digital privacy, how to code, and Bitcoin.

- Become super literate – Avoid junk-food content. Read books and write essays. The more you read and write, the better you think, and the more effective your decision-making will be.

- Find community (citadel) – Individuals are vulnerable on their own, join a citadel. Build a community of like-minded people. Digital and Analog communities.

- Stay vigilant – Pay attention, be proactive, make a plan, stick to it.

First and foremost take care of you and yours during this tumultuous time. If you have extra bandwidth, build a better future. If you don’t step up, who will?

Will this Fourth Turning End in Tragedy or Triumph?

The chess pieces are set, but the game is not over.

Fourth Turnings, despite their unpredictable nature, present a rare opportunity to redesign society. We’re alive to witness the global power struggle to shape the future of humanity. Will this crisis end in tragedy or triumph?

Let’s face it, we’re tragically trending towards totalitarianism. And I’m not interested in being farmed by our fiat overlords.

Thankfully we have Bitcoin to serve as a protection against tyranny. A beacon of hope during the cold dark night.

By 2030, America will have completed this Fourth Turning and the global order will have been reshaped. Hopefully, we’ll begin the next Saeculum on a sturdy foundation enabling a new era of prosperity.

Better fasten your seatbelt because this decade defines the next 100 years.

. . .

Thank you for reading Bitcoin and the Rhythms of History.

- Follow me on Twitter @bquittem

- Please share this article with a friend

- Stack Sats at SwanBitcoin.com/Quittem ($10 free BTC after signing up)

- Signup to receive future essays by email

- Bitcoin accepted here: 3QpL5n3Cj3nW6QpRJMHV6hD1F2d9ST65jk

Acknowledgments

- Huge thanks to Neil Howe for writing The Fourth Turning. I’ve learned so much from your ideas and look forward to your upcoming book.

- Editors: Robert Breedlove, Mark Stephany, Justin Evidon, Lee, Steven Oustecky, Derek Waltchack

- Inspiration and mentions: William Strauss (deceased), Lyn Alden, Raoul Pal, Luke Gromen, Naval Ravikant, Robert Evans, Tuur Demeester, Pierre Rochard, Michael Saylor, Sahil Bloom, Cory Klippsten, NVK, Katie Ananina, Brady Swenson, Andreas Antonopolous, Matt Ridley, Grant Williams, Felix Zulauf, Kanye, Paul Tudor Jones, WTF happened in 1971, and anyone else I forgot 🙂

-

Creative Direction: Nick Ward helped with creative direction and the Supply vs Demand of Order chart

- Audio Version: Read by Guy Swann @ Bitcoin Audible

- Finally, thanks to everyone who sharpened my thinking through conversations on this topic over the last few months.