Bitcoin: A Bold American Future

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Bitcoin: A Bold American Future

Reimagining America’s National Security Approach

By Conner Brown

Posted March 23, 2020

America’s future is in question. Public and private debt are rising to record levels and economic growth remains stagnant. Despite unprecedented fiscal and monetary intervention after the financial crisis, results have been disappointing. The American people do not need accounting tricks or more debt, but true innovation. Thankfully, Bitcoin provides a way forward.

Instead of falling behind other developed nations, America should lead the world in embracing this monetary evolution and reap the benefits for years to come. With bold action and investment, Bitcoin will secure American dominance into the 21st century. This article will lay out the American case for Bitcoin across multiple dimensions — creating a modern day gold rush to lift our country out of debt and into prosperity and safety.

As a framework for discussion, I’ll be using America’s most recent National Security Strategy as a guide to demonstrate how Bitcoin should considered fundamental to America’s National Security Innovation Base.¹ Bitcoin will help:

- Rejuvenate the Domestic Economy (NSS p.18)

- Lead in Research, Technology, Invention, and Innovation (NSS p.20)

- Embrace Energy Dominance (NSS p.22)

Let’s begin with our current financial outlook.

The Dangerous Game of Debt

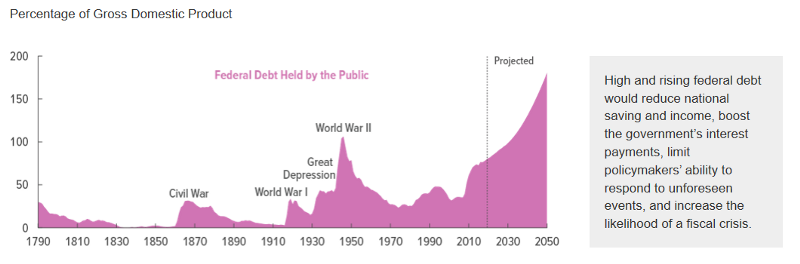

The United States’ financial position is dire. Federal Reserve Chairman Powell recently referred to our financial outlook as “an unsustainable path.”² The Congressional Budget Office confirms this warning. “Because of the large deficits, federal debt held by the public is projected to grow, from 81 percent of GDP in 2020 to 98 percent in 2030 (its highest percentage since 1946). By 2050, debt would be 180 percent of GDP — far higher than it has ever been.”³

Figure from CBO’s latest Annual Report.

Figure from CBO’s latest Annual Report.

Federal debt is only part of the story. Debt levels are unprecedented across multiple areas of the economy. Municipalities, private debt, corporate debt, and ballooning future liabilities add up to astonishing levels. A recent report by AB Bernstein calculated U.S. total indebtedness to be close to a whopping 2000% of GDP.⁴

To make matters worse, these numbers depend on America’s decade of expansion to continue indefinitely. As Hoisington Investment Management noted in a recent letter to investors, “deterioration in economic conditions would lead to a quick worsening in the [debt to GDP ratio], pushing the debt ratio further into uncharted waters, even without new fiscal measures that would likely be enacted in such circumstances.”⁵ With declining global growth and heavy impacts from COVID-19, this position is close on the horizon.

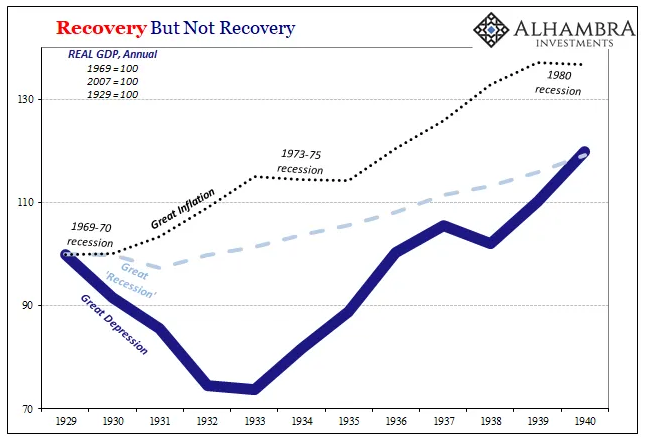

Papering over our problems with debt cannot continue. Hoisington further noted, “the declining marginal revenue product of debt reconfirms that excessive debt usage is triggering the law of diminishing returns, which results in weaker growth in real GDP.”⁶ Our approach is self-defeating. With such high levels of debt, our economic growth is lagging significantly behind previous recoveries. We simply will not be able to borrow our way out of this.

America’s GDP recovery following the three worst recessions of the last century. Chart by Jeff Snider.

America’s GDP recovery following the three worst recessions of the last century. Chart by Jeff Snider.

The consequences are serious. Not only will an increasing debt burden harm the prosperity and well-being of average Americans, our debt will heavily impact national security. The 2018 National Defense Strategy held: “without sustained and predictable investment to restore readiness and modernize our military to make it fit for our time, we will rapidly lose our military advantage, resulting in a Joint Force that has legacy systems irrelevant to the defense of our people.”⁷

“The force does not get hollow by the flip of a switch, but by inadequate resourcing.”— Adm. William E. Gortney

Across all services, our military is experiencing “force degradation resulting from many years of underinvestment…and the negative effects of budget sequestration (cuts in funding) on readiness and capacity.”⁸ These findings led the 2018 Military Strength Index to rate American military readiness as “marginal” across all divisions of the armed forces.⁹

The U.S. Air Force fleet is the smallest, oldest and “least ready that it’s been since its founding in 1947”, with the average plane being in service for over 30 years.¹⁰ Our Navy’s capabilities to build, upgrade — and most importantly — repair ships are quickly falling behind.¹¹ Other crucial American capabilities, such as deterrence, are also in question. On average, our ICBMs are 40 years old as China and Russia are building state-of-the-art infrastructure.¹²

While it is commonly known that America has the largest military in the world, the reality is our forces and infrastructure are aging. Other great powers are able to build on new foundations, while America will need significant resources to repair, maintain, and modernize legacy systems with decades of technical debt. To make matters more complicated, America’s forces play an unparalleled role in protecting trade routes, international stability, and global crisis response.

The last financial crisis brought us deep military budget cuts through sequestration. If the United States does not solve its debt problem, a future round of much deeper cuts is inevitable.

To keep our global influence strong, we must take action now. Ever-increasing debt will only accelerate our economic decline and hollow out our security capabilities on all fronts.

Remembering the Golden Years

While deeply unsettling, America’s financial position is neither unprecedented nor hopeless. Dr. Lacy Hunt notes that America had another similar episode in the 1830’s where Americans took on large amounts of debt to finance early steamship lines, canals, speculation and over-consumption.¹³ This ultimately ended with the financial crisis of 1837 and brought on a recession that lasted for several long years. But suddenly, “a very fortuitous event occurred…the discovery of gold in California.”¹⁴

The gold rush — an unexpected opportunity — pulled the U.S. out of financial distress and generated strong demand for our burgeoning transportation sector. New research refers to this period as “America’s First Great Moderation.”¹⁵ The 1848 gold rush created unmatched economic success in American history with 16 years of strong, sustained growth. As Americans scrambled for gold, this period marked a “transportation revolution” with strong gains in productivity from expanding roads, canals, railroads and global shipping routes.¹⁶ New technologies paved the way for this innovation such as more powerful steam engines, faster railroads, and the telegraph.¹⁷

This initial windfall also brought secondary effects throughout the economic foundations of America. Greater labor connectivity and transportation efficiency led to major gains across multiple sectors such as ship building, manufacturing, international trade, and agriculture.¹⁸ Such developments brought in large amounts of foreign investments in American companies, further extending the cycle of stable economic growth.¹⁹

The external nature of the gold rush was key — internal solutions of more debt would have only worsened the ongoing financial malaise. The gold rush thus provides an excellent blueprint for how a fortuitous event can spur critical changes across an economy. Bitcoin, a remarkably similar external stimulus, can do the same for America today.

The Bitcoin Redemption

America needs to spark a second gold rush. Just as the gold rush provided the incentives necessary to revolutionize our transportation infrastructure, Bitcoin can provide the same dramatic changes to our energy infrastructure.

First, let’s begin with a brief explanation of what Bitcoin is. Bitcoin can be thought of as a form of digital gold that can be sent over the internet. It is the first verifiably scarce digital asset. Instead of a being controlled by a single entity, Bitcoin uses a decentralized global network of peer-to-peer computers. With this architecture, two individuals can send and receive bitcoin without trusted intermediaries.

Bitcoin’s novel structure gives it unprecedented characteristics. It is more scarce than any physical resource, infinitely divisible, teleporting, instantly verifiable, and cryptographically secured. With over a decade of continuous operation, Bitcoin has established itself as a peerless form of storing and communicating value.

Like other resources, new bitcoins are created through a process of mining. This involves expending electricity to secure the network and receiving a payout of freshly minted coins in return. However, unlike traditional mining, Bitcoin mining can be done anywhere electricity is available. The implications of this radically new design are staggering. For the first time, energy producers can tap into a global market for energy anywhere in the world.

With this in mind, let’s turn to our current energy landscape.

Turning Waste Into Wealth

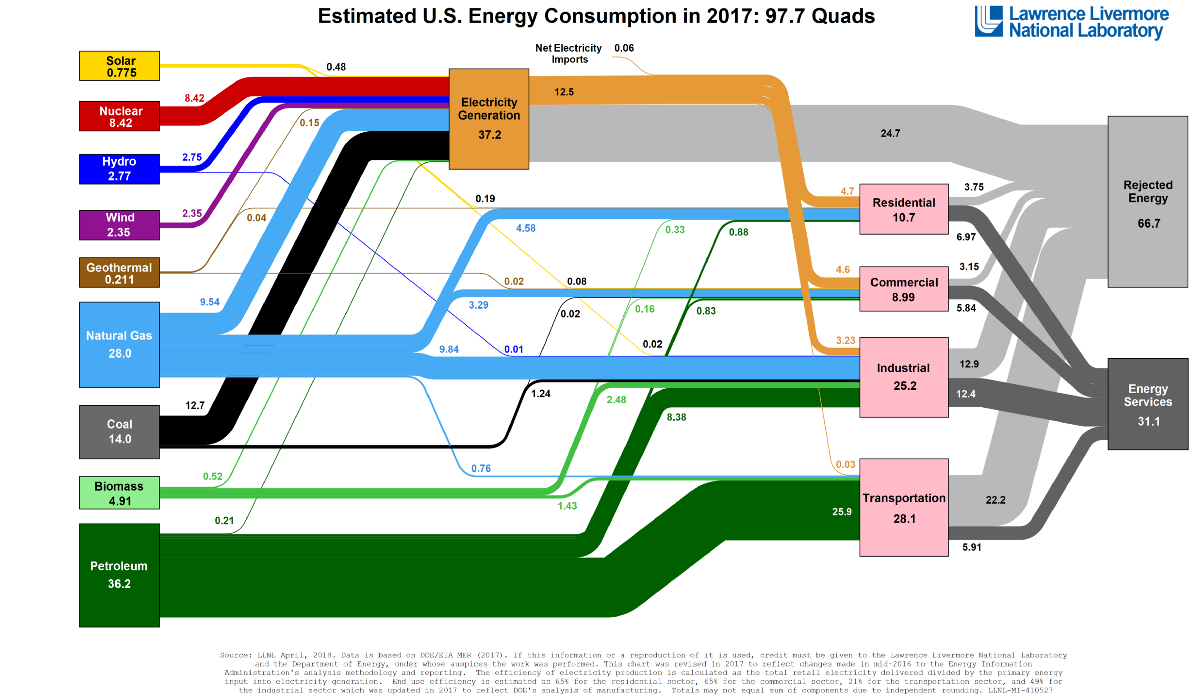

America has an energy problem — waste. Below is a chart from the Lawrence Livermore National Laboratory.²¹ Each year they produce a chart showing just how much is wasted in our energy production. Notice that rejected energy accounts for around two-thirds of all electricity generation. This is energy that is produced but ultimately does not go to useful work. The amount wasted annually is around 66.7 quadrillion BTU’s (“quads”) of energy. For perspective, that is the energy equivalent of wasting 2.3 billion metric tons of coal every year.

To make matters worse, this number has been increasing on a relative basis over time. In 1970 LLNL found our proportion of rejected energy was around 48%.

To make matters worse, this number has been increasing on a relative basis over time. In 1970 LLNL found our proportion of rejected energy was around 48%.

While much of this waste comes from inefficient appliances, transportation systems, and industrial processes, the largest share of rejected energy comes directly from electricity production itself, around 24.7 quads. This is precisely where Bitcoin can make a difference. By converting that wasted energy into Bitcoin, our energy producers will be more cost-efficient and energy-efficient without increasing emissions.

This is possible because no power plant is perfectly efficient. Excess capacity must be generated to meet demands that are constantly fluctuating from season to season, day by day, and hour by hour. To deal with this otherwise wasted energy, a grid equipped with Bitcoin miners could fluctuate with behind-the-meter demand and mine Bitcoin with excess reserves. If there was an energy intensive event (i.e. an especially hot afternoon), that excess capacity could be automatically allocated from the miners to the rest of the grid. The U.S. could lead this effort with 1) grant programs for plants to upgrade their systems, 2) tax incentives for plants mining with wasted energy, or 3) direct development and provision of mining technology.

The secondary benefits for economic growth are staggering. Increasing the efficiency of energy companies could drive the costs of energy to much lower rates. This would bring new power plants and energy suppliers online and could accelerate advances in energy technology, such as micro-reactors. As Ayers and Warr carefully argue in their book, The Economic Growth Engine, economic growth for the past two centuries has been driven largely by the declining effective cost of energy.²² Their empirical analysis suggests the effect of energy efficiency, known as Jevon’s Paradox, is the key driver for increased economic output. After examining many developed economies, they found that each economy’s growth was directly stimulated by recent gains in energy efficiency. They conclude that new dramatic developments are needed in energy production, otherwise prolonged global depression is “a serious risk.”²³

Some early adopters are making this a reality with Bitcoin. Greenidge Power Plant in New York State have started testing Bitcoin mining to increase their station’s efficiency in off-peak times. Their efforts are already generating around $50,000 of extra revenue per day at minimal costs to the plant. This drives home a powerful concept:

Bitcoin does not waste energy — it consumes energy waste.

This is precisely the paradigm shift for energy efficiency and production that Ayers and Warr call for. It’s hard to comprehend how powerful an impact Bitcoin could have on the energy sector, and the economy more broadly. Transforming our power grid, establishing new forms of energy production, and reshaping electricity markets across the country would be a true energy renaissance. This dramatic shift would bring a myriad of economic benefits such as reducing household and business costs, creating many new well-paying jobs, and strengthening our global competitiveness. Federal officials have underscored this approach. Secretary of Energy Mark Menezes recently championed the importance of advanced projects that “enhance energy productivity…supporting the competitiveness of the entire U.S. manufacturing industry.”

Meeting these economic objectives could easily lead to further secondary benefits through a stronger consumer, more foreign investment, sustained economic growth, and a robust, long-term profit motive for advanced energy technology.²⁵

Lastly, there is the Bitcoin itself. If the United States strategically built a significant position in Bitcoin (i.e. 250,000+ BTC) before announcing plans for Bitcoin mining, the returns could be astronomical. A serious initiative by the U.S. would send a global message about Bitcoin’s value and potential. Exchange rates would multiply overnight. By leading rather than following, America can create a windfall for our nation with the stroke of a pen.

Orange is the New Green

The recent collapse of the OPEC+ negotiations sent markets tumbling and America’s energy sector into a financial spiral. This dramatic event and others like it (such as last year’s attacks on Abqaiq) highlight the continued importance of establishing American energy independence.

Despite decades of effort, America’s economy is still heavily reliant on foreign fossil fuels. As the backbone of our economic system, depending on potential adversaries to supply our energy needs is a dangerous situation. Our current position leaves us vulnerable to foreign instability, market manipulation, attacks on supply infrastructure, as well as accidents and natural disasters. While a complete reduction in foreign energy imports is a tall order, Bitcoin can make significant gains by paving the way for renewable energy.

Sustainable energy like wind, solar, and nuclear are abundant. Nuclear energy alone could power the earth for hundreds of thousands of years with available supplies. The challenge for these resources is how expensive they are, especially when competing with existing infrastructure. However, Bitcoin mining presents the opportunity to quickly bootstrap renewables by turning excess capacity into profit.

The reasoning is as follows: when creating a new power plant, large amounts of excess capacity must be built into the system, especially with intermittent renewables such as wind, water, and solar. This excess enables a plant to reliably meet a location’s future energy needs, peak demands, and population growth. While this excess is typically factored into the cost of producing new renewable capacity, Bitcoin erases these costs. Rather than having excess capacity go to waste, new renewables could start using their energy for Bitcoin production from day one. Furthermore, Bitcoin miners are perfect for providing _demand-side flexibility, _an essential aspect of renewable viability.²⁶

The potential for Bitcoin-powered renewables is already evident in China. A 2019 report by Coinshares found that approximately 75% of Bitcoin mining comes from renewable energy sources, much of which stems from newly created hydroelectricity.²⁷ These new revenue streams have brought power plants online which otherwise would not have been economically viable given existing population density.

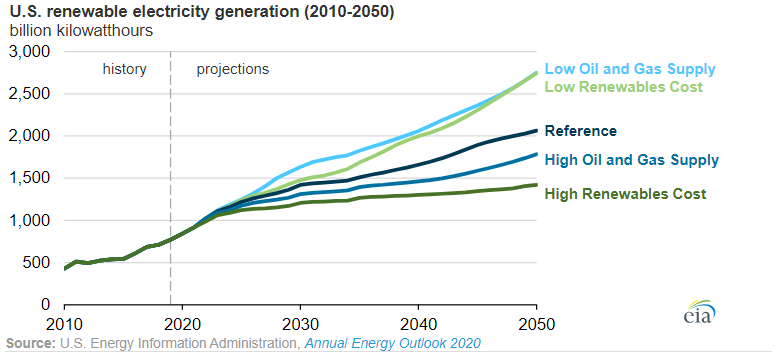

These field results match studies conducted by U.S. Energy Information Administration. Their latest Energy Outlook Report finds that lower cost is directly associated with a faster renewable transition.²⁸ As costs for renewable generation fall due to Bitcoin profits, renewable production will rapidly gain market share over imported fossil fuels.

The benefits of this bootstrapping effect are two-fold. First, cheaper renewables provide a clear path to energy independence. With a profitable and viable strategy for renewable energy, America could quickly begin its transition away from foreign fossil fuels and towards greater energy security.

Second, Bitcoin is a major victory for environmental sustainability. While many eco-advocates simply focus on reducing consumption, the best path to sustainability is vigorously pursuing profitability for clean energy. Once they are cost competitive, markets will create the proper incentives to bring new renewables into existence. Thus Bitcoin is a major step towards solving environmental sustainability domestically as well as signaling to other international actors on how to build competitive renewable grids.

Going green with Bitcoin not only helps the environment, but keeps us secure from foreign actors. Other countries are already beginning to take advantage of these benefits for their own energy markets. America should lead the way and set the stage for a renewable energy revolution that will shock the world.

Final Thoughts

Just a few months ago, Treasury Secretary Steve Mnuchin publicly declared Bitcoin to be “an issue of national security.” On this point, he could not be more correct. Bitcoin is a serious issue for our financial, energy, and environmental security. Each of these alone merit serious attention, but together they are one of the most important decisions facing us for years to come.

America is a nation of people who work hard, dream big, and never give up. The United States has the unprecedented opportunity to usher in a new era of prosperity, reigniting U.S. economic growth, building a strong base for funding our armed services, and firmly establishing American energy independence. It is time to embrace who we are and forge our own future with Bitcoin. A special thanks to Karina for helping polish this up.

Footnotes:

- Department of Defense, National Security Strategy of the United States of America,2017, p. 18–24, www.whitehouse.gov/wp-content/uploads/2017/12/NSS-Final-12-18-2017-0905-2.pdf

- @CSPAN. “ Fed Chair Powell: “The federal budget is on an unsustainable path with high and rising debt.” Twitter, 3 Nov. 2019, www.twitter.com/cspan/status/1194676593366577153?s=20

- Congressional Budget Office, _The Budget and Economic Outlook: 2020 to 2030, _2019, www.cbo.gov/system/files/2020-01/56020-CBO-Outlook.pdf

- Cox, Jeff. “Real US debt levels could be 2,000% of economy, a Wall Street report suggests” CNBC, 9 Sep. 2019, www.cnbc.com/2019/09/09/real-us-debt-levels-could-be-a-shocking-2000percent-of-gdp-report-suggests.html

- Hoisington Investment Management, Quarterly Review and Outlook Fourth Quarter 2019, _14 Jan. 2020, _www.hoisingtonmgt.com/pdf/HIM2019Q4NP.pdf

- Id.

- Department of Defense, _National Security Strategy Summary, _2018,dod.defense.gov/Portals/1/Documents/pubs/2018-National-Defense-Strategy-Summary.pdf

- The Heritage Foundation, _Heritage 2016 Index of US Military Strength, _2016, p. 12, www.ims-2016.s3.amazonaws.com/PDF/2016_Index_of_US_Military_Strength_ABOUT_EXECUTIVE_SUMMARY.pdf

- The Heritage Foundation, “Executive Summary”, 30 Oct. 2019, www.heritage.org/military-strength/executive-summary

- Gregg, Sharon.“Trump overstates military spending and readiness in face of Iran conflict.”, The Washington Post, 6. Jan. 2020, www.washingtonpost.com/us-policy/2020/01/06/trump-overstates-military-spending-readiness-potential-iran-conflict-looms/

- Hawkings, William. “The Navel Industrial Base is in Worse Shape Than You Think.” U.S. Naval Institute, Aug. 2019, www.usni.org/magazines/proceedings/2019/august/naval-industrial-base-worse-shape-you-think

- Mark Gunzinger, Carl Rehberg, and Gillian Evans. “America’s Endangered Nuclear Deterrent: The Case for Funding Two Critical Capabilities.” War on the Rocks, 23 Apr 2018, www.warontherocks.com/2018/04/americas-endangered-nuclear-deterrent-the-case-for-funding-two-critical-capabilities/

- Townsend, Erik. _Dr. Lacy Hunt: The Bond Bull Market is NOT over! _Lacy Hunt, Macro Voices, 24 May 2018.

- Id.

- Joseph Davis and Marc D. Weidenmier. “AMERICA’S FIRST GREAT MODERATION” National Bureu of Economic Research_, _Working Paper 21856, 2016, www.nber.org/papers/w21856.pdf

- _Id. _at 15.

- _Id. _at 14.

- Id. at 16.

- Rawls, James J., and Richard J. Orsi, editors. A Golden State: Mining and Economic Development in Gold Rush California. University of California Press, 1999, p. 287, http://ark.cdlib.org/ark:/13030/ft758007r3/

- For a great introduction to how bitcoin operates, I recommend this video https://www.youtube.com/watch?v=bBC-nXj3Ng4 Additional resources can be found at https://www.lopp.net/bitcoin-information/getting-started.html

- https://flowcharts.llnl.gov

- Ayres, Robert and Warr, Benjamin. The Economic Growth Engine: How Energy and Work Drive Material Prosperity. 2010.

- Id.

- “Department of Energy Awards $187 Million to Strengthen U.S. Manufacturing Competitiveness” Department of Energy, 10 Feb. 2020. https://www.energy.gov/articles/department-energy-awards-187-million-strengthen-us-manufacturing-competitiveness

- For further research on the benefits of energy production see, Kümmel. The Second Law of Economics: Energy, Entropy, and the Origins of Wealth. Laitner, 2013. “Linking Energy Efficiency to Economic Productivity: Recommendations for Improving the Robustness of the U.S. Economy.” Khan, 2012. The Long-Term Energy Efficiency Potential: What the Evidence Suggests.

- International Renewable Energy Agency, _DEMAND-SIDE FLEXIBILITY FOR POWER SECTOR TRANSFORMATION, _Dec 2019. https://www.irena.org/publications/2019/Dec/Demand-side-flexibility-for-power-sector-transformation

- Christopher Bendiksen and Samuel Gibbons. “The Bitcoin Mining Network” Coinshares Research. May 2019, https://coinsharesgroup.com/assets/resources/Research/bitcoin-mining-network-june-2019-fidelity-foreword.pdf

- Energy Information Administration, Annual Energy Outlook 2020, 2020, https://www.eia.gov/outlooks/aeo/