A Peaceful Protest - Opt-Out, Buy Bitcoin

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

A Peaceful Protest - Opt-Out, Buy Bitcoin

By Adam Pokornicky on New Money

Posted June 8, 2020.

I came to Bitcoin from a unique perspective back in 2012, looking for something better after watching bankers destroy our economy then receive bailouts and bonuses for their noble work. The Federal Reserve(the Fed) had just begun its unprecedented experiment in printing money and quantitative easy, and I had grown cynical towards a crony form of capitalism that was normalizing bad behavior by rewarding failure and underwriting wealth extraction from the poor and middle class to the rich through money printing and easy money policies.

Article 1 of our constitution, explicitly gives the power to print money to Congress. Controlling the money supply is indeed our government’s job. However, for those unfamiliar, President Woodrow Wilson signed the Federal Reserve Act into law on Dec. 23, 1913, three years after a bunch of shady bankers like J. P. Morgan, William Rockefeller, and their associates, went on a fake secret hunting trip to Jekyll Island off the coast of Georgia where they conspired to create a central banking cartel for private bankers that would later come to control the issuance of the U.S. money supply.

The Federal Reserve was sold to the public with a promise to end the threat of recessions and depressions but the fact of the matter is that most people have little understanding of what it actually really does. There is no mention of a central bank in any of America’s founding documents because the founders of our country knew what would happen to the economy and the workers in this country if control of the supply of money was put in the hands of a few “trusted” bankers. Thomas Jefferson once said:

“If the American people ever allow the banks to control the issuance of their currency, first by inflation then by deflation, the banks and corporations that grow up around them will deprive the people of all property until their children wake up homeless on the continent that their fathers occupied.”

If this doesn’t sound familiar then you’ve either been in a coma or have been living under a rock for the past decade. In past issues “What is Money” and “The Cantillon Effect”, I’ve described how printing money works, how it decreases your purchasing power while greatly benefit the rich and powerful who are closest to the money created. (re: NOT YOU!).

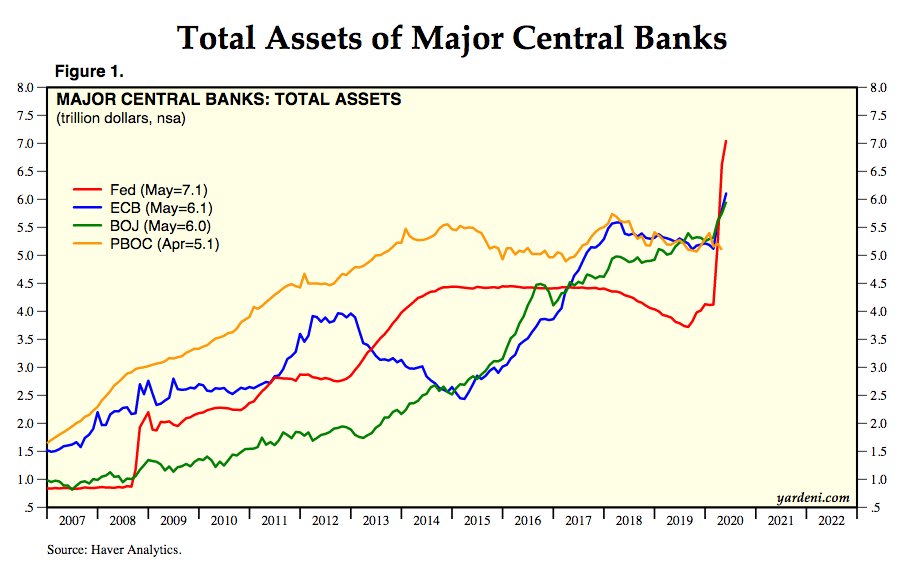

As a quick reminder, let me describe to you one way that the Federal Reserve is inherently oppressive to the workers in this country. Every time the Fed creates money and pumps it into the economic system, the value or purchasing power of each dollar you own goes down because the money supply is inflated. Each dollar in existence gets diluted by all the new dollars created. For example, since 2008, the US federal reserve has expanded their balance sheet from .8T to 7.1T. In actual terms, this means they have “inflated” that fiat monetary base supply of currency by 21.9% ANNUALLY over that 11 year period of time.

How is this oppressive? The money goes straight into the hands of the people holding assets giving them more wealth and power to encumber us while only a trickle comes down into the lower-income sections of the economy where a majority of the population exists. This phenomenon is called the Cantillon Effect which I described in a recent post as the uneven expansion of the amount of money. Under our current system of modern central banking, money is created and injected into the economy through the credit route and first affects financial markets. Cantillon explained that the first ones to receive the newly created money see their incomes rise whereas the last ones to receive the newly created money see their purchasing power decline as consumer price inflation comes about.

In the case of a monetary expansion, the ones who profit from it are the ones who are closest to the money. “Close to the money” in this case means everyone who can access the money right at the beginning, i.e. big companies, banks, hedge funds, ultra-wealthy individuals, etc. They get loans and make investments. Prices then start to rise on goods and services that are absolute essentials to life (ie. Healthcare, Housing, Food, Education) even though the majority have not profited from the increase in money at all. In sum, the purchasing power of those furthest away from the top drops the most. The result is a redistribution from the poor to the rich.

Where does this inequity show up the most? Specifically in the wealth gap between black and white Americans. Of the 1.2 million households in the top 1 percent, 96.1 percent are white. While there are many factors at play that have relegated Black Americans to second-class status, with far fewer opportunities to achieve good health, political influence, prosperity and security than other Americans, the magnitude of this problem is highlighted by the significant gap in median wealth held by Black families ($17,000) and White families ($171,000)—a ratio of 10 to one.

American Inequality Didn’t Just Happen. It Was Created.

Economist Joseph Stiglitz wrote in a recent book the following which touches on many crucial points regarding the system and economy we find ourselves trapped in:

“American inequality didn’t just happen. It was created. Market forces played a role, but it was not market forces alone. In a sense, that should be obvious: economic laws are universal, but our growing inequality— especially the amounts seized by the upper 1 percent—is a distinctly American “achievement.” That outsize inequality is not predestined offers reason for hope, but in reality, it is likely to get worse. The forces that have been at play in creating these outcomes are self-reinforcing.”

“Inequality is the result of political forces as much as of economic ones. In a modern economy government sets and enforces the rules of the game—what is fair competition, and what actions are deemed anticompetitive and illegal, who gets what in the event of bankruptcy, when a debtor can’t pay all that he owes, what are fraudulent practices and forbidden. Government also gives away resources (both openly and less transparently) and, through taxes and social expenditures, modifies the distribution of income that emerges from the market, shaped as it is by technology and politics.”

The perversion of our system didn’t occur overnight but the mutation likely began in 1971 when the U.S. dollar was taken off the gold standard, severing the relationship between money backed by something and money backed by nothing. This is when the country began its long transformation from an industrial empire to a financial one, where asset inflation, rent-seeking, and debt-serfdom subjugate Americans in their own country in a gross form of Financial Feudalism.

Debt Serfdom and How the Wealthy Use Debt

My good friend Michael Krieger wrote about “Financial Feudalism” in a post earlier this year, where he broke down how Debt is the primary weapon used against the masses.

Krieger went on to describe how most people understand the societal effects of excessive debt from a basic level where individuals in the bottom half of our population essentially have no choice but to borrow in order to participate in the economy as constructed because the cost of so many things has been inflated way beyond the capacity of most people to purchase them outright. Because wage growth is woefully struggling to keep up with the soaring costs of fundamental things such as shelter, healthcare, and higher education, it requires many to take on debt defensively, just to get by and avoid falling down the socioeconomic scale.

As a result, he notes, “rather than empowering people, it turns them into modern-day indentured servants endlessly stuck on a hamster wheel with little to no hope of getting off. This is not an accident, it’s a tried and tested tool which, when combined with incessant mass media propaganda, is an effective way of creating a submissive, confused, and desperate underclass.”

He continues to explain how for wealthy individuals, the opposite occurs. If you are fortunate enough to own your home, have a high paying job, enough savings that you have an investment portfolio, can pay for healthcare premiums, vacations and/or pay for your kid’s college in cash without making a dent, then debt becomes something else entirely. Debt’s no longer an anchor holding you down, instead, it becomes a tool to increase wealth in the form of leverage.

Krieger masterfully explains how the opposite occurs for the wealthy and how a large portion of wealth inequality over the past several decades can be traced back to this systemic interclass weaponization of debt. If you are wealthy and connected, you have virtually unlimited access to cheap debt, just as the private bankers on their fake hunting trip designed it. This access is used to make leveraged bets on all sorts of stuff, but primarily real estate and financial assets such as stocks and bonds.

He concludes by showing the gross juxtaposition of the haves and have not, describing how most Americans either struggle to earn enough income to get by a week-to-week basis while other white-collared cubicle monkeys strive to earn extra income to diligently add to their 401k. Meanwhile, bankers and hedge fund managers who have taken on massive leverage to amplify such bets made generational fortunes while creating nothing of value as their corporate executive counterparts use access to extremely cheap debt and financial engineering to consolidate their competition, buy back stock and reward themselves through generous stock option plans while looking at their employees as a line item between revenue and profit.

If it’s not clear by now, Central Banking is nothing more than socialism for billionaires, policies that are enforced on us by unelected officials whose decisions implementing central economic planning have no accountability and zero public debate. Why aren’t our politicians doing anything about it? Well, at this point it should be pretty obvious. With the DC political class being captured by big money from billionaires and corporations who benefit from central banking, politicians have no incentive to do anything that benefits citizens at the expense of the overlords that fund their existence. You, of course, will get a few breadcrumbs along the way like the mirage of voting every 4 years or a $1200 check to keep you in check while the overclass continues to loot away and consolidate wealth and power.

With wealth inequality expanding and income inequality continuing to get worse, it’s no secret that the wealthiest, typically white people, are getting wealthier while blacks and Hispanics continue to lose the little relative wealth they have. According to an analysis by Prosperity Now and the Institute for Policy Studies, the racial wealth divide is hollowing out America, particularly for persons of color, with black households expected to have a net worth of ZERO by the year 2050.

While the murders of George Floyd, Breonna Taylor, and Ahmaud Arbery highlight the racial injustice and police brutality black Americans live with every day, systematic inequality as a result of structural racism seen through housing policies, education, employment discrimination, the drug war, decriminalization, and debt-serfdom creates a damaging cycle of wealth inequality that is failing them, only to be compounded by central banking that keeps all of the above in place while literally stealing their money.

A Peaceful Protest: Plan ₿, Opt-Out for something better

When a system oppresses you and fails you in so many different ways, the most natural forms of push back are through protests, civil disobedience, strikes, and boycotts.

It is the latter that I believe offers individuals, especially the black community and those who believe that #blacklivesmatters, a non-violent and effective way to push back against the state and the system that oppresses it by boycotting it with their money. Bitcoin doesn’t see color. Its messaging system heuristics don’t care nor can care if you are black, brown, female, or fabulous. Its apolitical nature doesn’t see algorithms or names, leveling the playing field for anyone involved. It gives every single individual the pure ability to interact with the protocol to leverage the network to succeed and make it work for you.

Opting out of the money of the State and the oppressive structures it supports is a powerful form of boycott. Embracing a new form of system and doing it with your money is a peaceful protest. The focus of any boycott or strike is to pressure bad actors to change behavior. If you don’t want to protest violently, you can accomplish it through your actions with your money.

While protests around the country have galvanized support across the nation for wholesale changes to the violent and unchecked force the police use towards black people and the very citizens that pay them to serve and protect, there is an increasingly large number of the population that is so broken, agitated and destitute from decades of economic inequality and economic hardship that want to use this moment to be heard too. While riots are the voice of the unheard, for any successful change to happen, we most certainly cannot allow destruction and violence by opportunists and looters derail the message. We must constantly be thinking about non-violent and effective ways to push back and rise up against a system that is rigged with the deck stacked against them. Watch this short clip from the #BlackLivesMatters rally in LA over the weekend

If you are tired of politics going round and round and feel stuck between elections cycles and division driven by media and political class or the binary choice of burning it down or having the military babysit us un curfew and Marshall law, what do you do?

By buying Bitcoin, you can voice your displeasure and cripple the money printing machine which gives power to the bad guys and actively steals it from you while distributing it to other people at an extraordinary rate that we can’t do anything about. By buying Bitcoin you are funneling money into something that stands for something better. This reduces the potency of the USD, the weapon of inequality, through an alternative system that operates in a different away. This is exactly what we need to do.

As a community, Bitcoiners are effectively united in a global movement or boycott against state-controlled money. By owning Bitcoin and having a stake, you are naturally participating in a peaceful vote against the dominant financial system by moving your money away from it. Your vote and your protest become meaningful ways to fight a broken, corrupt, destructive system. The price of Bitcoin going up in value creates a price signal that something is wrong. And if that money goes up as more people join the movement, you end up building wealth in the process.

While profit motive certainly drives many towards Bitcoin, I can tell you first hand there is something far deeper and more fundamental that drives Bitcoiners too — “the possibility of building a parallel, reliable financial system which is functional, open, and independent of governments or unaccountable corporations.” (Nic Carter, A Most Peaceful Revolution)

If the internet was a country, its currency would be Bitcoin

Thanks to Bitcoin, we now have a non-sovereign, hard-capped fixed supply, decentralized, free-market global currency that anyone can participate in. No one controls it and no one can print it. With Bitcoin, you are taking back power because you know the rules of the protocol and you understand the inflation rate. You are taking back control because now you are the one that can spend it without permission. It’s money that’s the antithesis to the money that is oppressing and has undeniably made the most progress towards the separation of money and state. The idea of stateless money that anyone can choose to participate in, is one of the most extraordinary creations in human history, offering possibilities for us as humans that never existed before.

While you can be certain governments and their banker overlords won’t be giving up their money printing addiction any time soon and the resulting power and control that comes with it, we finally have other options and can choose to opt-out while still be able to pay for things and conduct global transactions. Why does this matter? While people spending and transacting is currently not being censored by the state, it could change down the road. If you’re an activist, caught in protest, or associate with groups the government deems hostile, you can quickly become a persona non grata and be cut off from society, similar to Wikileaks in 2012. This makes Bitcoin even more valuable as censorless free speech money in a world where free speech has become more threatened and civil liberties continue to be cracked down on.

Anyone can buy Bitcoin right away. You don’t need to be rich or flush with extra cash to buy Bitcoin and get off zero. Because Bitcoin can be divided into 100mm micro-units called Satoshis, you can get started with as little as a $1 and can continue to save and stack sats(a term for stacking small units of Bitcoin) over time. But opting out and getting off zero is critical. From a technology aspect, the more people adopt Bitcoin there will eventually be a threshold or “Tipping Point” out there somewhere where we can leave that old system behind and have control of the money. Once we have control of the money, we can decide amongst ourselves how to allocate it and better our communities and lives around us. Fix the money, fix the world.