Why is Bitcoin Valuable?

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Why Is Bitcoin Valuable?

By Taylor Pearson

Posted January 8, 2019

On almost every dimension, Bitcoin is worse than it’s centralized counterparts like Paypal or Chase.

This is true not just of bitcoin but almost all decentralized cryptocurrency protocols.

They are slower, more expensive, harder to scale, and offer worse user experiences.

So why is bitcoin valuable? Why are other decentralized applications valuable?

Transactions on the Bitcoin network are unstoppable. If I have an internet connection and agree to pay the network’s fee, nothing can stop me from sending Bitcoin to anyone I want.

That is to say, bitcoin is censorship resistant.

What is Censorship Resistance and Why Would It Make Bitcoin Valuable?

Cryptography is one of the very few fields in the 21st century1 which continues to heavily favor the defender. Using cryptography, an average person can defend themselves from even governments and large companies.

Ross Ulbricht, the founder of the illicit Silk Road marketplace, was never cracked cryptographically by the FBI. In fact, they had to wait to arrest him until he was at a public library with his computer open where they could snatch it before he was able to close it and lock the computer cryptographically.

This asymmetry in favor of the defender, sometimes called the defender’s advantage, is a key property of cryptocurrencies, such as Bitcoin. Using the most powerful computer in the world, it would take .065 billion billion years to crack a person’s private Bitcoin key. 2

That makes it sufficiently difficult to crack an individual’s private key, but what about taking down the network?

For starters, the bitcoin network is the most powerful computer network in the world.3 In 2015, it was 11000 times faster than the top 500 supercomputers combined so there is no single entity which controls more computing power.4

The bitcoin network is the most powerful computer in the world because it pays so-called “miners” in bitcoin to lend computing power towards securing the network. As the price of bitcoin increases relative to fiat currencies, miners receive higher fees, incentivizing them to devote yet more computer power, which makes the network more powerful and creates a positive feedback loop.

As of November 16, 2017, the cost of building a supercomputer powerful enough to corrupt the bitcoin ledger (also known as a 51 percent attack) would be around $3.14 billion in hardware and $5.6 million in electricity every day.5

There is also a game theory component here.

Because the vast majority of bitcoin users believe the network is only valuable, if it remains decentralized; a 51% attack would likely mean that as soon as the attacker gained control of 51% of the network, it’s value would drop to zero.

More significantly, if you you had 51% of the hashpower you stand to make ~$15–20M per day mining honestly. So, even if you have dishonest ambitions, it’s more profitable to just play by the rules.

This combination of the defender’s advantage and the positive feedback loop in mining creates a property called censorship resistance.

Censorship resistance means the cost of trying to censor, steal, or otherwise coerce is so high as to be impractical bordering on (but not reaching) impossible. In the case of bitcoin, anyone who wants to steal your bitcoin from your bitcoin wallet by cracking your private key or to perform a 51% attack would have to bring such an enormous amount of computing power to bear that it would cost far more to steal the bitcoin than to simply buy it themselves.

All other asset classes, like fiat currencies, precious metals, and real estate, are easier to destroy or seize than a cryptocurrency such as bitcoin. They do not enjoy the same asymmetric defender’s advantage and the censorship resistance it affords.

Why might this matter?

Protect Yourself From Governments and Companies

The most common way that the defender’s advantage is discussed in the context of bitcoin is citizens protecting themselves from irresponsible or malicious governments and companies.

With all of the crazy things going on in the world, the demand for censorship-resistant wealth storage is high and growing. Current markets which exist largely because of their censorship resistant properties include the gold market (est. $6 trillion)6 and the offshore banking industry (est. $20 trillion)7

Citizens of countries like Argentina and Venezuela have been quick to adopt Bitcoin as a savings vehicle because their economic history made the value of censorship resistance more obvious.

Due to poor governance, the inflation rate in Venezuela averaged 32.42 percent from 1973 until 2017. 8

Argentina was even worse; the inflation rate there averaged 200.80 percent between 1944 and 2017. 9

Both countries also have a history of politicians seizing the private property (land, companies, etc.) of political opponents or even seemingly arbitrary targets.

Censorship-resistant wealth storage in general, and bitcoin specifically, may sound like a strange libertarian or anarchist perspective if you’ve grown up in a stable country.

Since WWII, the developed world has lived through a remarkably peaceful and stable era, but that has not always been the case and is not true everywhere even today. So even if the idea of censorship resistance sounds crazy to you, it’s worth considering that about $26 trillion dollars (in the form of gold and offshore banking) thinks censorship resistance is pretty important. 10

However, let’s skirt the libertarian doomsday planning scenarios and assume you are an upstanding citizen in a stable country. Is the censorship resistance created by the defender’s advantage present in cryptocurrency still important and valuable under more “normal” political conditions?

To see why that could be the case, we need to take a brief detour to Bell, California, circa 1993.

How to Make $787,000 per year as a Small Town Mayor

Robert Rizzo served as mayor of the city of Bell, California from 1993 to 2010.

When he left his office in 2010, he was earning $787,000 a year. For context, the President of the U.S. earns $400,000 a year, and the Governor of California earns $200,000.

How was the mayor of a 35,000 person town able to make nearly $1 million per year?

After his election in 1993, Rizzo held a special vote to make the city of Bell a charter city.

The vote meant Bell was no longer subject to the scrutiny (and accountability) of state legislators. This was done under the pretense that local leaders (like Rizzo) knew what was better for Bell than faraway state politicians.

The vote didn’t take place alongside state or general elections, where people would be voting anyway, but in a special election. Of the 36,000 residents of Bell, only 400 (1% of residents) voted in the election where the charter passed.

Effectively, the provision made Rizzo a dictator who could then proceed to cook the books.

Rizzo was elected on the promise to balance the budget, and balance the budget he did. He raised the property tax to 1.55%, higher than almost anywhere else in Los Angeles County — including affluent suburbs like Beverly Hills and Malibu.

This generated an enormous budget surplus for Rizzo, which he gradually used to give himself raises of 15% each year, going from the $72,000 salary he got when he took office in 1993 up to $787,000 by the time he left in 2010.

Rizzo was not a warlord — he was an elected official in a city within one of the most historically stable, democratic countries in the world

Selectorate Theory: Democracy Is Censorship Resistant

Bell’s temporary case of near-despotic rule is a good case study for understanding politics and power dynamics through Selectorate Theory.

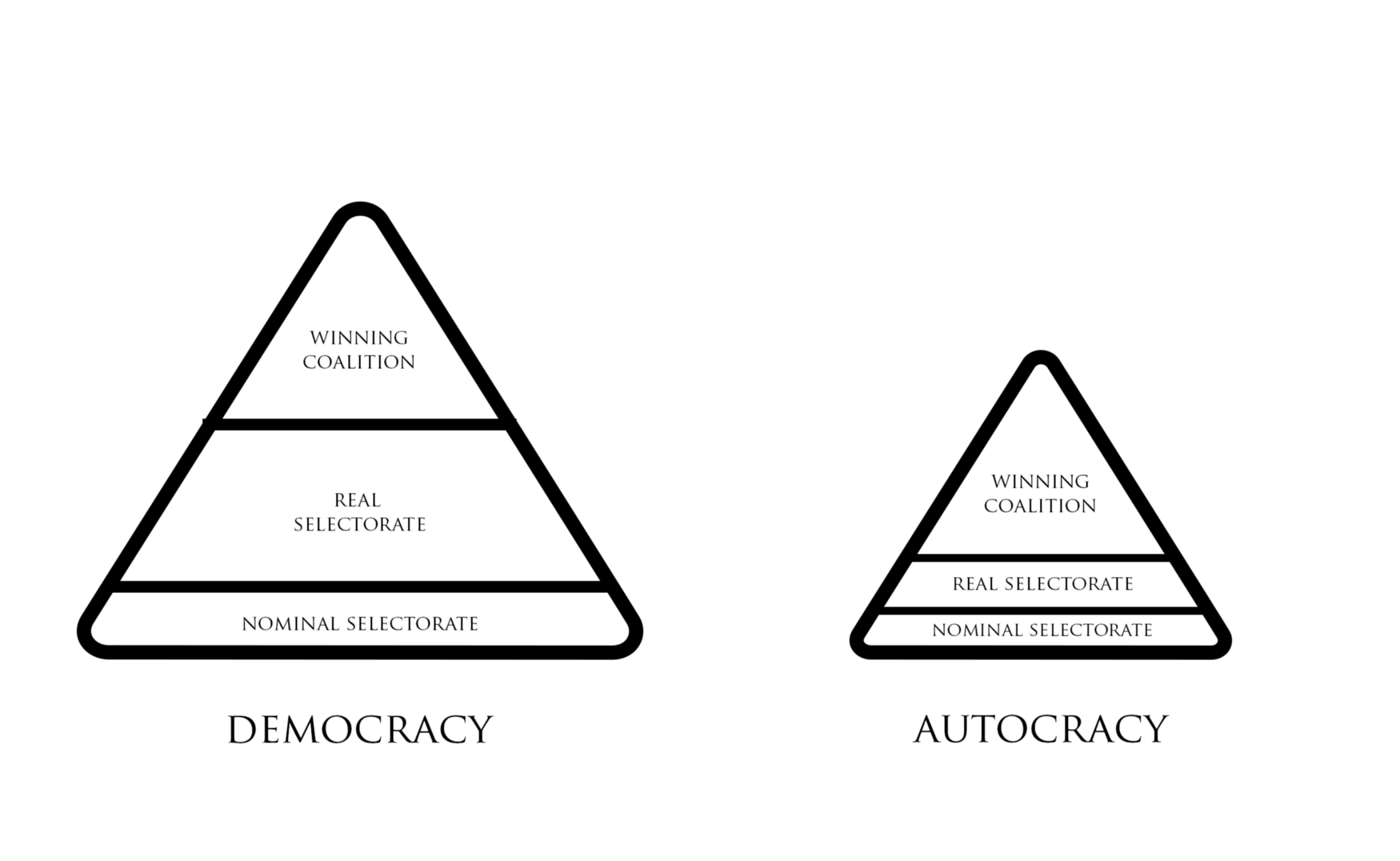

Selectorate Theory breaks down the political landscape into three tiered categories of those who have the power to ‘select‘ the final outcome of a given election.

The three sections of the Selectorate are:

- The nominal selectorate — everyone who can, nominally, influence the outcome. In the city of Bell’s case, this is the city’s sum of Registered Voters.

- The real selectorate — the group that actually chooses the leader. In Bell’s case, this was those who actually voted during the special election.

- The winning coalition — the subset of the real selectorate whose decisions are truly influential. In Bell’s case, this was the six city council members and Rizzo himself.

In a U.S. presidential election, the same categories might look like this:

- The nominal selectorate — all eligible registered voters.

- The real selectorate — the people who actually voted (or, one could argue, the electoral college).

- The winning coalition — major media, influential public figures (talk show hosts, prior presidents, celebrities, social media influencers), and high-level campaign staffers.

Selectorate theory undermines how democracy is taught in a high school government class: that everyone has an equal say in the form of “one person, one vote.” It gives a more accurate framework that having more followers on social media, viewers of your TV show, or money to buy political ads makes someone more able to influence the outcome of an election than a person who can merely vote.

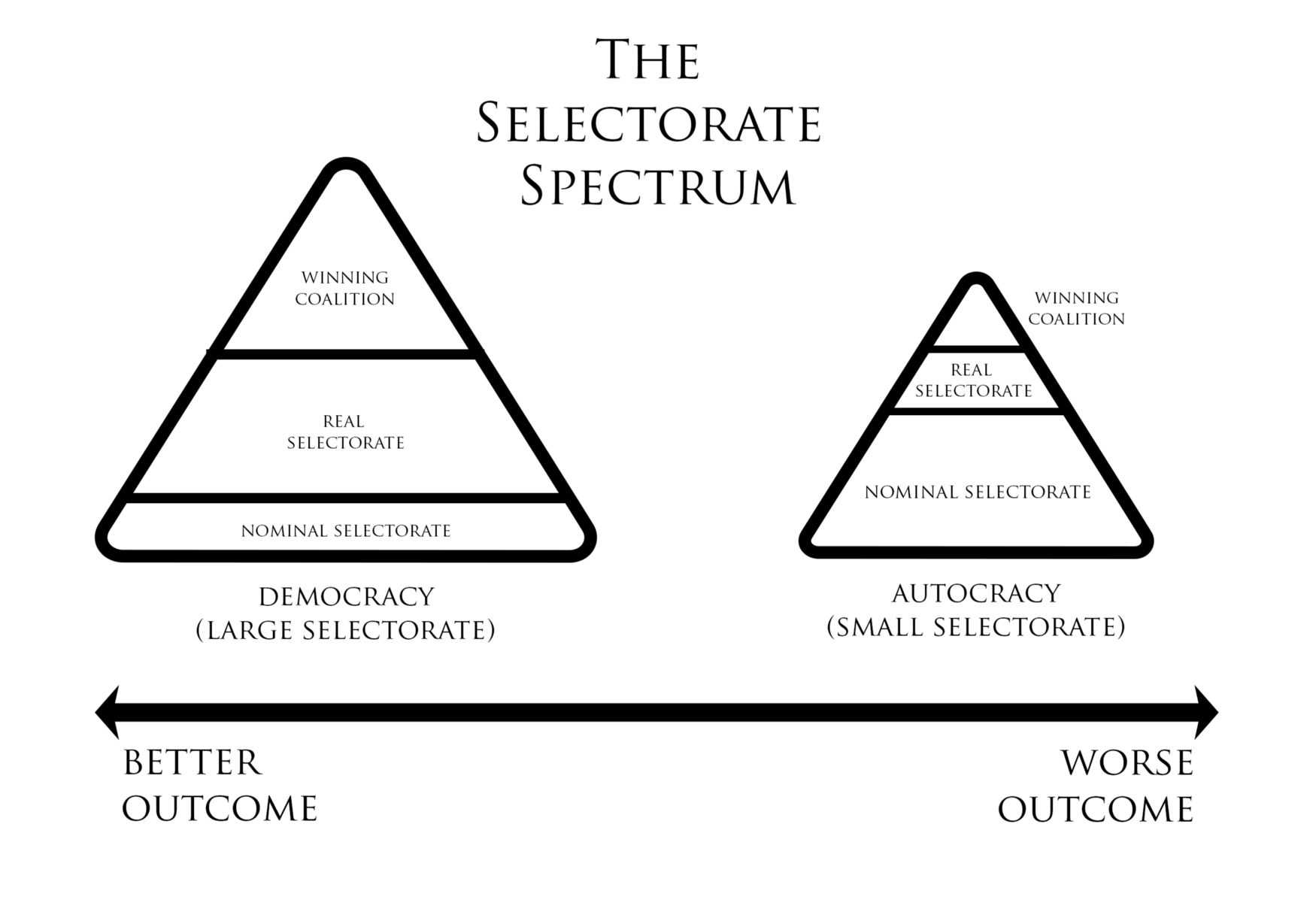

The lesson of Selectorate Theory and the case of Rizzo is that what matters isn’t who the individual running the system is but the distribution of the selectorate.

An autocrat or dictator will try to keep the selectorate as small as possible and the winning coalition and real selectorate as small a segment of the selectorate as possible so they are easy to control. In a democracy, the selectorate is much larger, making the power each individual has greater than in an autocracy.

An autocrat or dictator will try to keep the selectorate as small as possible and the winning coalition and real selectorate as small a segment of the selectorate as possible so they are easy to control. In a democracy, the selectorate is much larger, making the power each individual has greater than in an autocracy.

Democracy is a better form of government than autocracy, not because presidents are intrinsically better people than dictators, but simply because presidents have to appease a larger selectorate.

Specifically, the larger the selectorate is, the more distributed agency and power is throughout the system.

In an autocratic regime, the winning coalition is likely to be a group of a dozen or fewer individuals, like the city council members in Bell or the warlords that help a dictator maintain power. The real selectorate would likewise be a relatively small percentage of the total populace, like the few voters in Bell’s case or the warlords top lieutenants.

In a democratic regime, the winning coalition is likely to be much larger:thousands or tens thousands of individuals. The real selectorate is likewise much larger than in an autocratic regime.

If you have a small selectorate and small winning coalition, it’s relatively cheap to bribe, threaten, or otherwise coerce the winning coalition to do what you want. Rizzo bribed the city council officials with huge raises, and autocrats can threaten to kill disobedient warlords.

When you have a larger selectorate and larger winning coalition, it’s more expensive to use coercion to get or maintain power. And so democratic leaders have to build consensus and make compromises which, on average, leads to a better outcome.

It’s not that you can’t buy political power in a democracy; it’s just much more expensive than buying political power in a dictatorship. Said another way, individuals in a democracy are more censorship resistant and have a greater defender’s advantage than in an autocracy.11

2017 was an interesting test of this. In the first year of his presidency, Trump attempted to make various types of sweeping reform, but in the end, he got almost nothing done. Because of how the U.S. government is organized, a president needs the cooperation of a large number of civil servants to enact meaningful change, and if they can’t build that consensus, they can’t get very much done.

Despite criticizing many parts of the press, he has not actually succeeded in censoring them. Compare this to the more autocratic regimes of Putin’s Russia and Xi Jinping’s China which have succeeded in censoring the press.

In the case of Bell, California, Rizzo was able to pull off the heist by using a special election to reduce the winning coalition to six individuals on the city council whom he could more easily coerce.

The same dynamic is true of many other ways people are organized. Just like a country, a company with a small selectorate is more likely to be corrupt than a large one. They have different size winning coalitions and selectorates, and the size of those (roughly) correlate to the quality of outcomes.

Why is Bitcoin Valuable: Cryptocurrency and Democracy

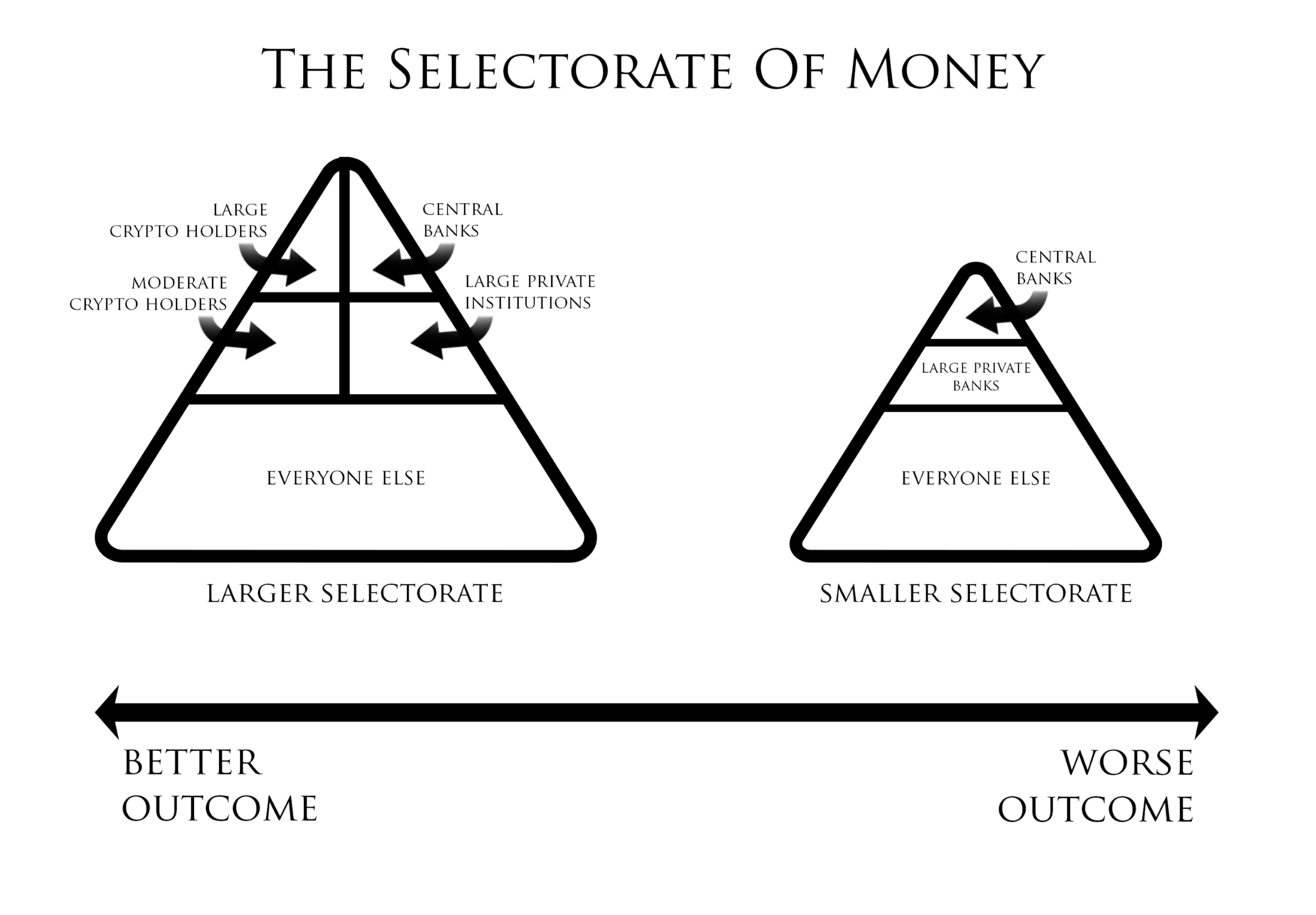

The censorship resistance afforded by cryptography is a potentially significant development because it offers a mechanism to enlarge the selectorate of money. In this way, it’s not unlike democracy.

Democracy allowed individuals to vote on what they define as good government, disintermediating the King and enlarging the selectorate of government.

The promise of the censorship resistance property of Bitcoin is that it will allow individuals to define for themselves what sound money is,disintermediating the bankers and enlarging the selectorate and winning coalition of money.

What might this mean?

The Selectorate of Money 13

The selectorate of money. Cryptocurrency enlarges the selectorate of money in much the same way that democracy enlarges the selectorate of government. This does not make it a perfectly fair system but suggests a more equitable distribution of power than we have now.

A 2015 story on Argentina described how many individuals are effectively operating outside the national banking system and benefitting from the censorship resistance of bitcoin:

A German customer had paid the [Argentine] musician in Bitcoin for some freelance compositions, and the musician needed to turn them into dollars.Castiglione, [a money changer], joked about the corruption of Argentine politics as he peeled off five $100 bills, which he was trading for a little more than 1.5 Bitcoins, and gave them to his client. The musician did not hand over anything in return; before showing up, he had transferred the Bitcoins — in essence, digital tokens that exist only as entries in a digital ledger — from his Bitcoin address to Castiglione’s. Had the German client instead sent euros to a bank in Argentina, the musician would have been required to fill out a form to receive payment and, as a result of the country’s currency controls, sacrificed roughly 30 percent of his earnings to change his euros into pesos. 14

The power the bankers and government had because they controlled the only way to change currency is lost.

In the 1990s, the Argentine peso was pegged to the U.S. dollar. That meant the Argentine government guaranteed that you could always change one Argentine peso for one U.S. dollar. If you had 1,000 Argentine pesos in your bank account, you could walk into the bank and ask for $1,000 U.S. dollars and they’d hand it over.

By 2001, the peg had become unsustainable for a number of reasons, and the government of Argentina abandoned it. As a result, the exchange rate went into freefall, 15 decreasing by 75% in the course of a year.

Imagine if you looked at your bank account and the value had gone down by 75 percent over the course of a year and you hadn’t spent a dime of it. That’s effectively what happened in Argentina.

Imagine if 10% of the wealth in Argentina was stored in a censorship resistant cryptocurrency like bitcoin at that time. This would have given that faction (a much broader one than just bankers and high government officials) a seat at the table on major economic decisions that they did not have in the past.

The same dynamics are true of the 2008 Global Financial Crisis. Had cryptocurrency existed, it would have given more people more say in how the crisis was handled.

I want to be clear that I am not saying “all bankers are evil.” I am saying that a larger winning coalition and a larger selectorate, on average, leads to better outcomes, and bitcoin’s censorship resistant property creates that larger selectorate and winning coalition for money.

Not all dictators are evil — some really are benevolent — but if you had to choose to spend the rest of your life in an autocratic country or a democratic one, which would you pick? It’s possible that you pick an autocratic country with a benevolent dictator which does far better than a democratic one, 16 but history is pretty clear that, on average, democracies produce better outcomes for their citizens than autocracies.

The hope is that In the same way having a large selectorate in a democracy forces presidents to behave better in order to retain power, having a large selectorate in the realm of money would force better behavior on bankers if they want to retain power.

Even in this optimistic scenario, cryptocurrency is not a panacea. There is still a “winning coalition” of miners, large holders, and developers which exert more influence than the average individual. But it is a larger group than we have now, and as the ecosystem expands beyond just Bitcoin to other cryptocurrencies, it has the potential to grow larger. 17

But democracy is no panacea either. It is, as Churchill said, “the worst form of government except for all those other forms that have been tried.”

In the same way, cryptocurrency may be the worst form of money except for all the others that have been tried.18

Or Not…

An important and valid counterpoint is that cryptocurrency wealth is just as centralized and we are merely trading the old selectorate of money for a new, but no more inclusive selectorate.

There is good evidence for this. Estimates suggest that as few as one thousand people own 40% of Bitcoin. That’s not a wildly different number then what the current system looks like.

In this view, the “bitcoin revolution” is like most of the revolutions preceding it where we simply traded our old overlords for new overlords.

The open-source, forkable nature of cryptocurrency give me hope that this will not be the outcome.

Historically, it was possible to use different currencies for different purposes. While you may have been required to use a certain national currency to pay taxes, you might use a locally issued bank note for the purpose of trading in your village and you might use specie (gold and silver) to store value in a way that could not be debased if the King got into too much debt. In other words, there was a competitive market for currency for most of it’s history.

It was only in the late 18th century that this competitive market collapsed these into a single currency backed by national governments which outlawed other currencies to make it easier to levy taxes.

Because of their open-source, forable nature, cryptocurrencies bring back the possibility of different currencies being used for different use cases and force currencies to compete for users. The monetary selectorate can make its opinion known by buying, selling, hoarding or dumping various coins as they see fit.

While bitcoin has been the dominant cryptocurrency to date, constant competition from other cryptocurrencies will force bitcoin to compete.

In this way, the open-source and forkable nature of cryptocurrency allows individuals to choose between competing currencies themselves, truly moving power to the users and not just the high-net worth holders, core developers or mines of any particular cryptocurrency.

Censorship Resistance Will Enlarge the Selectorate of Everything

The property of censorship resistance which makes it enlarge the selectorate is not just limited to the realm of money.

Money may just be the first application.

The combination of censorship resistance with the ability to fork cryptocurrency protocols means this shift in power structure through an enlarged selectorate will happen across many different industries and fields.

Imagine if Facebook, instead of being a private company, were a public blockchain that anyone could fork?

Right now, user’s data is deleted or censored by a small group of individuals at Facebook. There is no censorship resistance for a Facebook user. You either accept the rules dictated to you or don’t use the platform.

But if Facebook were on the blockchain, users and anyone capable of forking the protocol could become part of the selectorate and be capable of exerting influence.

Given Uber’s treatment of its drivers, Uber on the blockchain has obvious appeal. Drivers would become part of the selectorate and able to exert meaningful influence.

The dynamics could play out in similar ways with Amazon, Twitter, Google, etc.

Censorship-resistance doesn’t mean just preventing some transactions or eliminating the voice of some participants, it means a system which is difficult to manipulate for the ends of small cabals. That’s true in politics, money, and media among others.

Applying blockchain or decentralization to everything will not be a panacea.In the same way we failed to foresee many of the negative implications of social media and mobile phones in the early days, there will undoubtedly be problems with public blockchains.

One that is already apparent is that censorship resistance gives more power to individuals regardless of their motives. Some of the largest beneficiaries so far have been terrorists, hate-groups, drug traffickers, and other illicit actors.

But I return to Churchill’s idea here: cryptocurrency may be the worst form of power distribution except for all the others that have been tried.

As with all my writing, this essay represents an inquiry rather than a definitive answer. Feedback, thoughts, and criticism are appreciated. You can find me in the comments here, on Twitter or email me at my first name at taylorpearson dot me.

If you would like to read more about why blockchain technology matters and more information behind why bitcoin is valuable in the first place, check out Money, blockchains, and social scalability, A Letter to Jamie Dimon and Why Decentralization Matters.

P.S. All our Bitcoin and cryptocurrency research is helped made possible by our sponsors: Kraken is a cryptocurrency exchange where you can buy, sell and trade cryptocurrencies like Bitcoin and Ethereum. Kraken is consistently rated the best and most secure cryptocurrency exchange and is where I go any time I need to make a trade. Start Trading on Kraken today. For the seasoned traders, Kraken offers Cryptowatch which lets you trade on every exchange from your price charts and never miss a market move with SMS alerts. If you’re planning on holding any meaningful amount of cryptocurrency, you should be doing it on a hardware wallet. Storing cryptocurrency in an online “hot” wallet leave it vulnerable to theft. I use and recommend the Trezor hardware wallet, which helps protect your assets by storing your private key offline. Start protecting your assets today.

Footnotes

- It’s actually the only field that I can think of. If you know of any others, please let me know.

- This calculation is based on older data, but I believe is still within a couple of orders of magnitude of being correct. Even if it’s off by three orders of magnitude, it would still take longer to crack someone’s key than the universe has been in existence. This video is another helpful resource. If you have more up to date calculations, I would love to know about it.

- Bitcoin Hashrate and Bitcoin Network Speed

-

A more precise, technical clarification of this point was offered by an editor though the basic point “The bitcoin network is really really powerful” stands.

His comment in full:

“Current [January 2018] Bitcoin network hashrate is ~ 16M terahashes/second. A “hash” is a specific sequence of logical operations conducted in mining. Supercomputers are usually measured by FLOPS — floating point operations per second, basically arithmetic with real numbers (scientific modeling of the physical world being a chief application of traditional HPC). There is no direct conversion between a hash and some number of flops — they are doing fundamentally different things at the CPU level. Hashing is also done by ASICs these days, special-built CPUs which are narrowly optimized to only hash, not general purpose CPUs as in your PC’s mobo. But one can still make a heuristic approximation; say 1 hash = 1⁰⁵ flops. So current Bitcoin network hashrate ~ 1.6 YOTTA FUCKING FLOPS. Top supercomputers are ~10s of petaflops. So Bitcoin is 1⁰⁸ (100 million) times more powerful than the most powerful supercomputer. It’s a weird comparison b/c FLOPS are NOT hashes, but there it is.”

- Making Sense Of Cryptoeconomics

- Just How Big Is The Gold Market?

- Why There Is Value In Cryptocurrency

- Venezuela Inflation Rate

- International Monetary Fund and Argentina Inflation

- In a 2017 report, Credit Suisse estimated Global Wealth at $280 trillion meaning censorship resistant stores of value (gold and offshore banking) account for nearly 10% of global wealth. Source.

-

I know I am using democracy a little fast and loose here, but I am using it in the sense of a democratic republic where there is an explicit bias toward respecting basic individual rights, supermajority requirements for doing potentially nasty things, constitutions, etc.

- See here and the paper here.[/note]

Currently, the selectorate of money is a relatively small group.One of the lessons from 2008 global financial crisis was that a relatively small number of individuals have a relatively large amount of influence on the global financial system.

A 2011 paper, “[The network of global corporate control](https://arxiv.org/abs/1107.5728)” attempted to put some rough numbers to how small that group is and how large their influence extends. They found that 147 companies own interlocking stakes of one another and together control 40% of the wealth in the global financial network. A total of 737 companies control 80% of the wealth in the network.

This group forms something like an autocracy of money.Power is concentrated in the hands of a relatively small group.

The censorship resistance of cryptocurrency offers a mechanism to enlarge the selectorate of money by making it prohibitively costly to seize, devalue, or otherwise attack.A large and powerful entity (be it a company, nation-state, or another individual) cannot take someone else’s bitcoin or attack the network without spending far more than they would gain because of the asymmetric advantage offered by cryptography.

In the same way that democracy enlarges the selectorate of a government by making governance more censorship resistant, the censorship resistance offered by cryptocurrencies like bitcoin could enlarge the selectorate of money and shifts power towards a broader base of individuals.[12](https://taylorpearson.me/why-is-bitcoin-valuable/#easy-footnote-bottom-12-9104)[_Source_](https://arxiv.org/pdf/1107.5728.pdf)_. This analysis is not perfect but I think shows the central point that a relatively small number of individuals exercise a great deal of influence over a large amount of the financial system._

- Source — How Bitcoin is Disrupting Argentina’s Economy

- Source — Argentine Great Depression

- Though there are many valid criticisms, Lee Kuan Yew’s work as Singapore’s Prime Minister for three decades is an example of how much progress can be made by a benevolent and competent autocratic leader. The number of counterexamples of malicious or incompetent autocratic leaders is too high to mention.

- [Some would argue that bitcoin wealth is just as centralized as other forms of wealth with reports that 1000 people own 40% of all the bitcoin available.

_In this case we are simply trading our old overlords for new overlords. This may be true but the open-source, forkable nature of cryptocurrency suggests to me that this is not the likely outcome. (more below)_

- Adam Ludwin’s Open Letter to Jamie Dimon acknowledges censorship resistant but is more dubious of the societal effects. I recommend it as a good counterpoint to the argument I make here.