Tweetstorm: The Bitcoin Reformation

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Tweetstorm: The Bitcoin Reformation

By Tuur Demeester

Posted November 7, 2019

1/ The main thesis of “The Bitcoin Reformation” is that there are four fundamental parallels between the Protestant Reformation and the present day, which could signal profound societal and economic changes ahead.

2/ This is the TL;DR version of a 13 page report. This tweetstorm shares the essence but strips away the little historical details that made it so fun to research and write. Check it out here: https://docsend.com/view/ijd8qrs

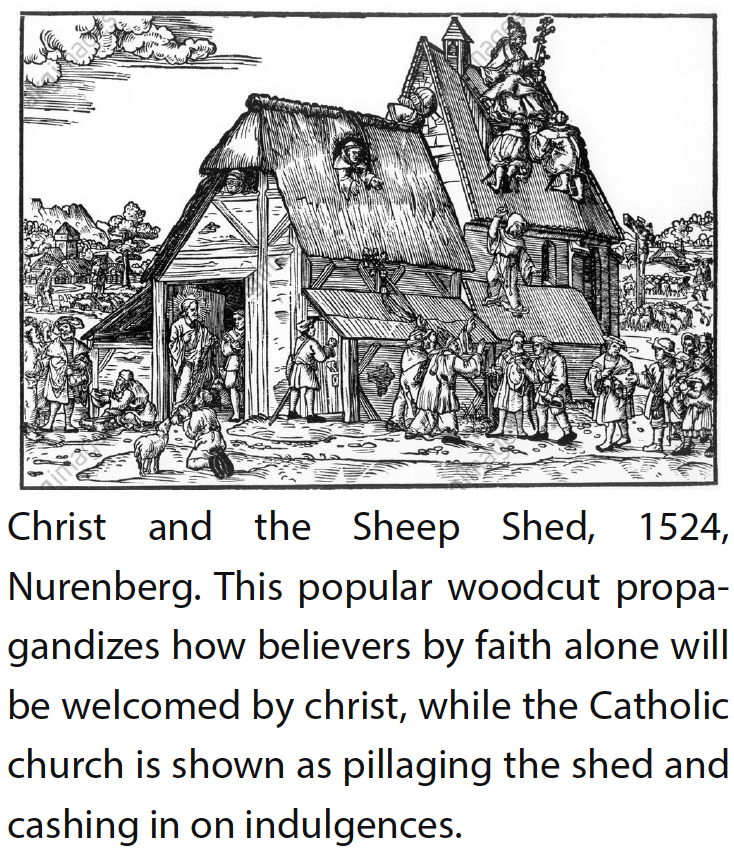

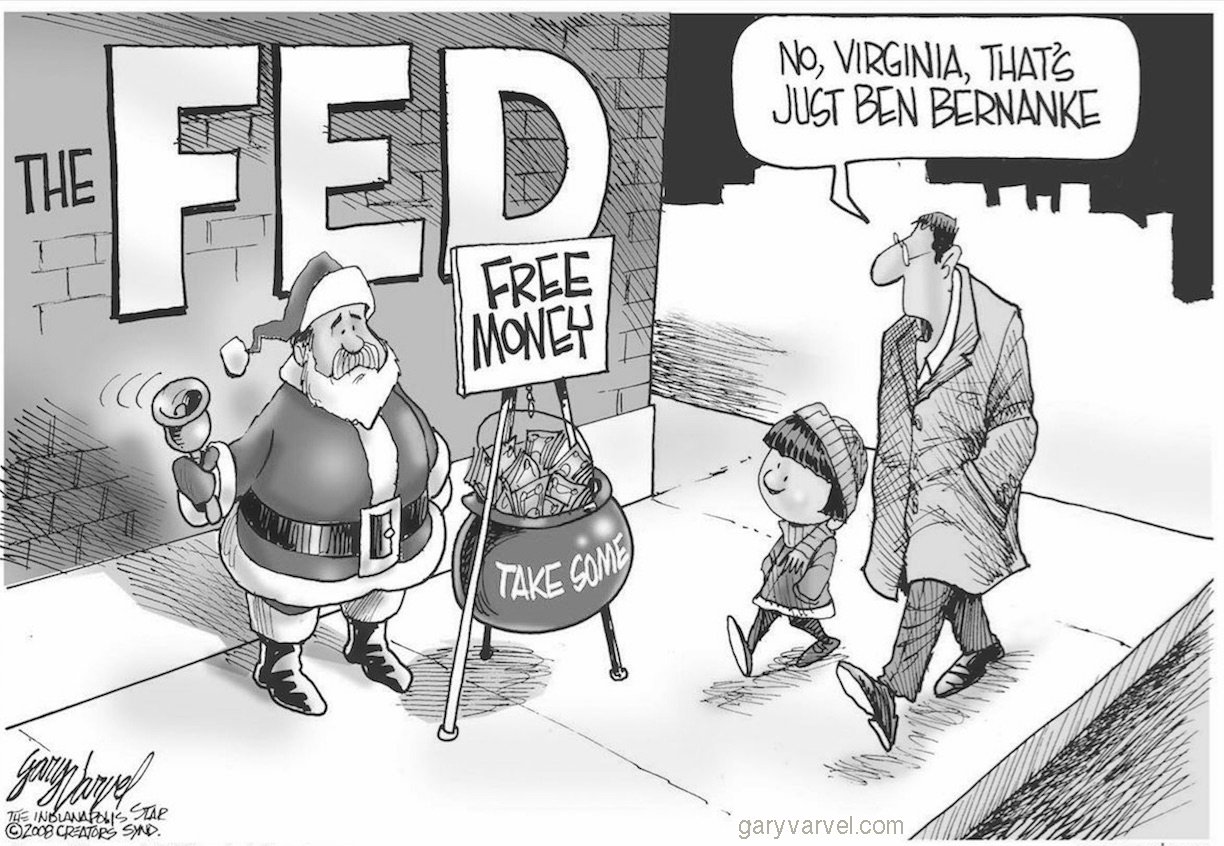

3/ The Protestant Reformation was a multi-generational conflict (16th-17th C.) that produced the separation of church and state, and which profoundly reshaped the economies of Europe and the New World. Today, bitcoin suggests that it’s possible to separate money and state.

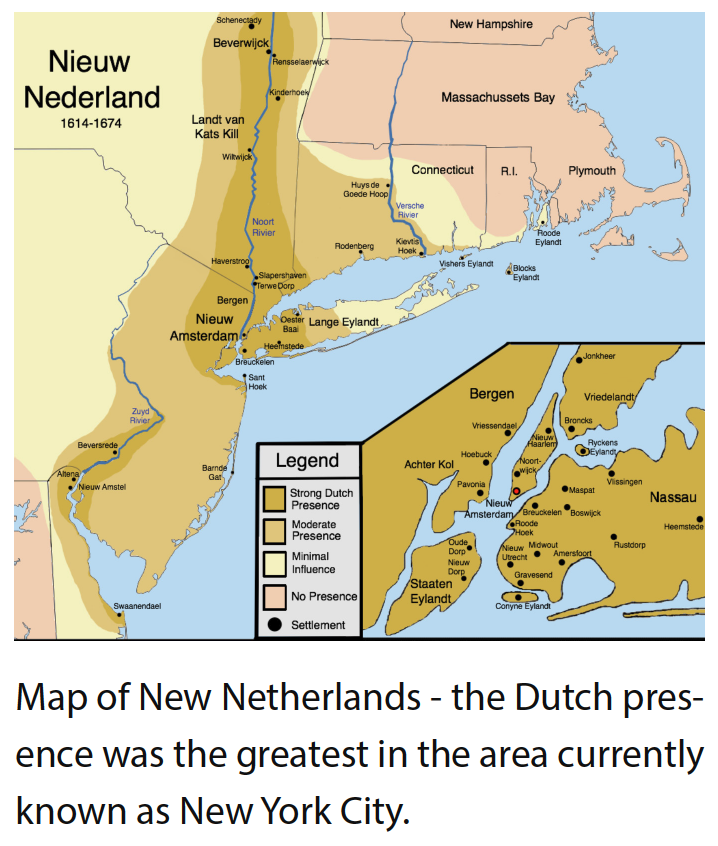

4/ Aside from the four general Reformation parallels, our report also suggests that there are significant similarities between the innovative economy of 17th century Netherlands and the bitcoin economy today. This may give us insight into what’s coming for bitcoin.

5/ Here are a few of the conclusions:

6/ So let’s dig in. What are the four requirements of a reformation?

7/ First, we need a painful status quo in the form of a rent-seeking monopolistic service provider. In the 16th century that was the Catholic Church, today that is the financial system of fiat money and central banking.

8/ The service provided by the Church was access into heaven (for which it charged money by selling indulgences). The service provided by the financial system today is access to “financial heaven” (for which it charges money in the form of inflation tax).

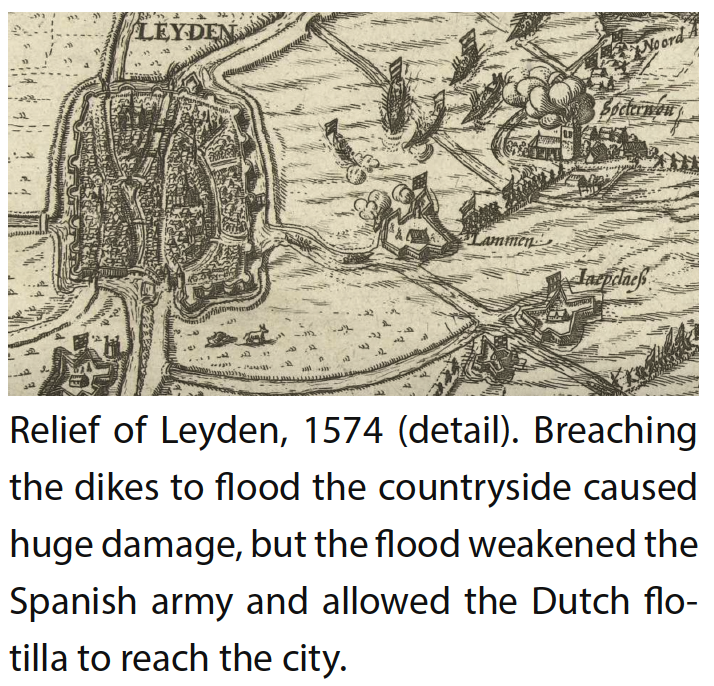

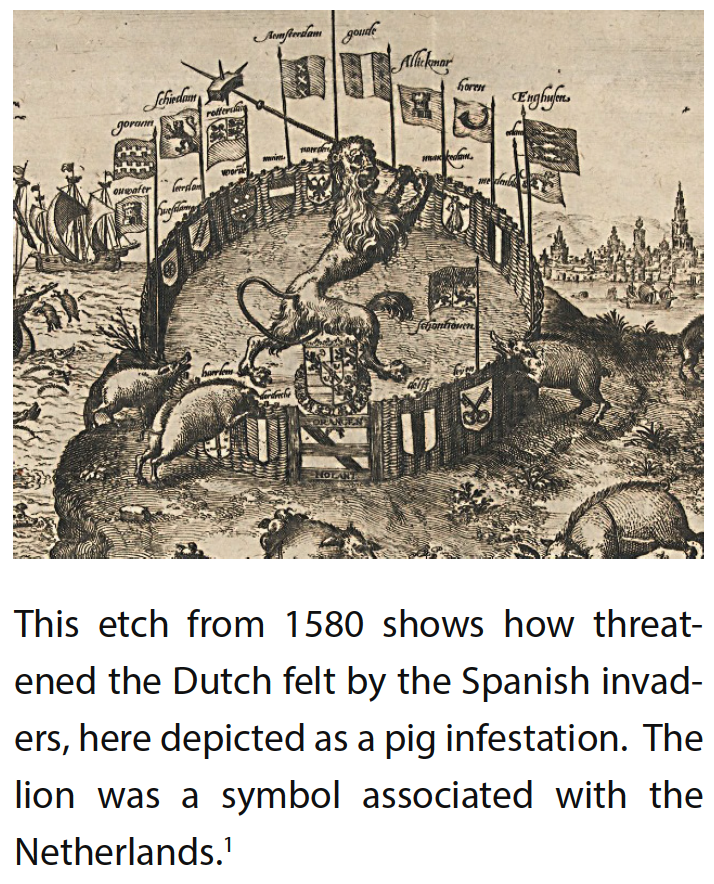

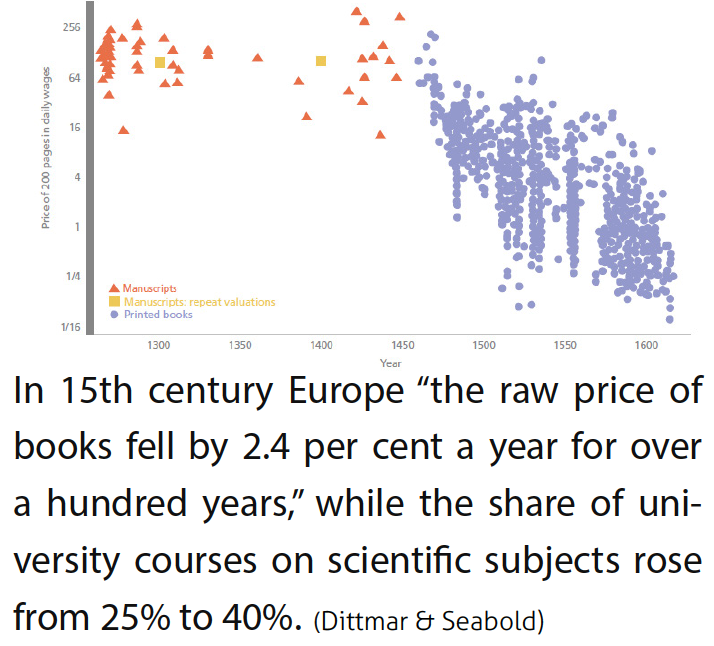

9/ The second requirement for a reformation is a technological revolution, which acts as a general accelerant in the battle of ideas: it lowers the cost of both information and travel.

10/ The most important 16th century innovations were in the area of maritime exploration, international business, and of course the printing press, which, in one century, lowered the price of a book from a full year’s wage to the equivalent of a chicken.

11/ The current-day technological revolution is digital: telecommunications, computation, data storage, open source software, cryptography, and of course the internet. The cost of 1 Mb/s bandwidth dropped by 99% in 20 years, from $100K to under $10.

12/ Third, we need people who have something to fight for. In the 16th century that was the merchant class, today that is the millennial generation who don’t trust the financial system and who are heavily invested in technology.

13/ And the final requirement for a reformation is for the rebels to have credible strategies of defense. The Dutch protestants mastered water as a defensive moat against invasions, the millennials have cryptography at their disposal.

14/ Another parallel are the memes! The Protestants had slogans voicing their resolve to cut out the Church as a middle man:

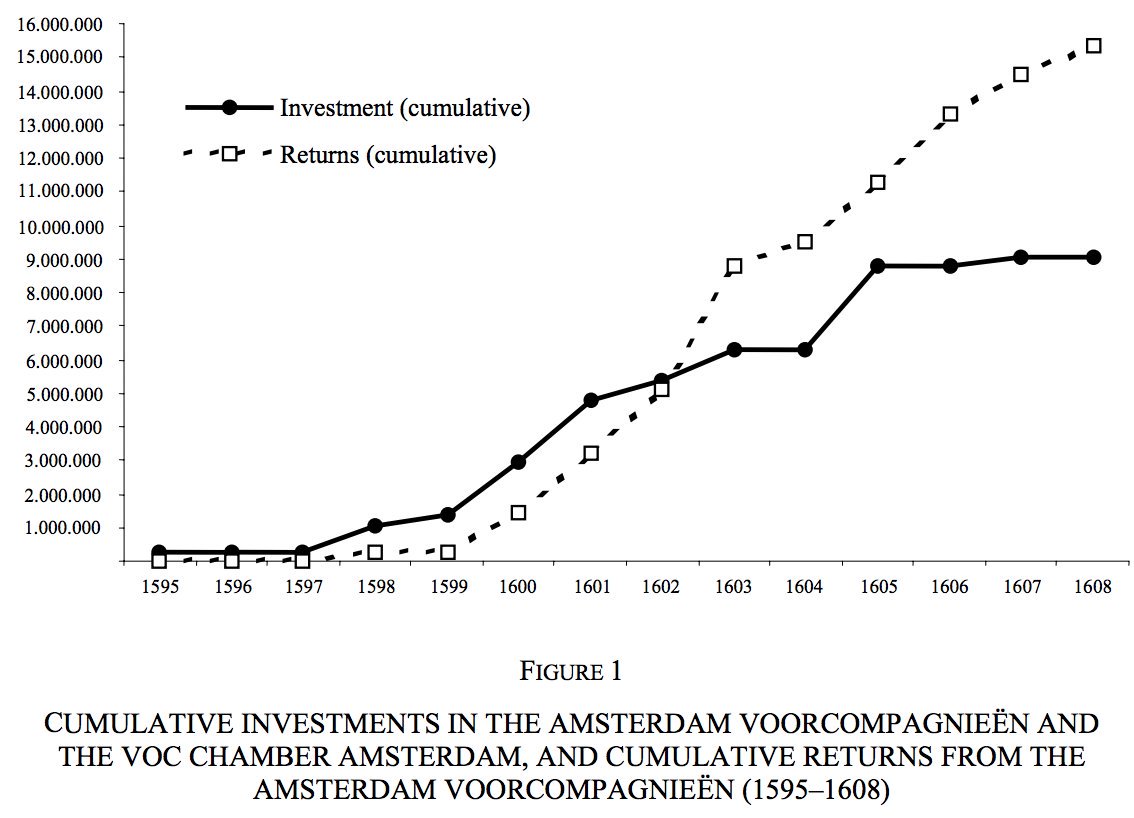

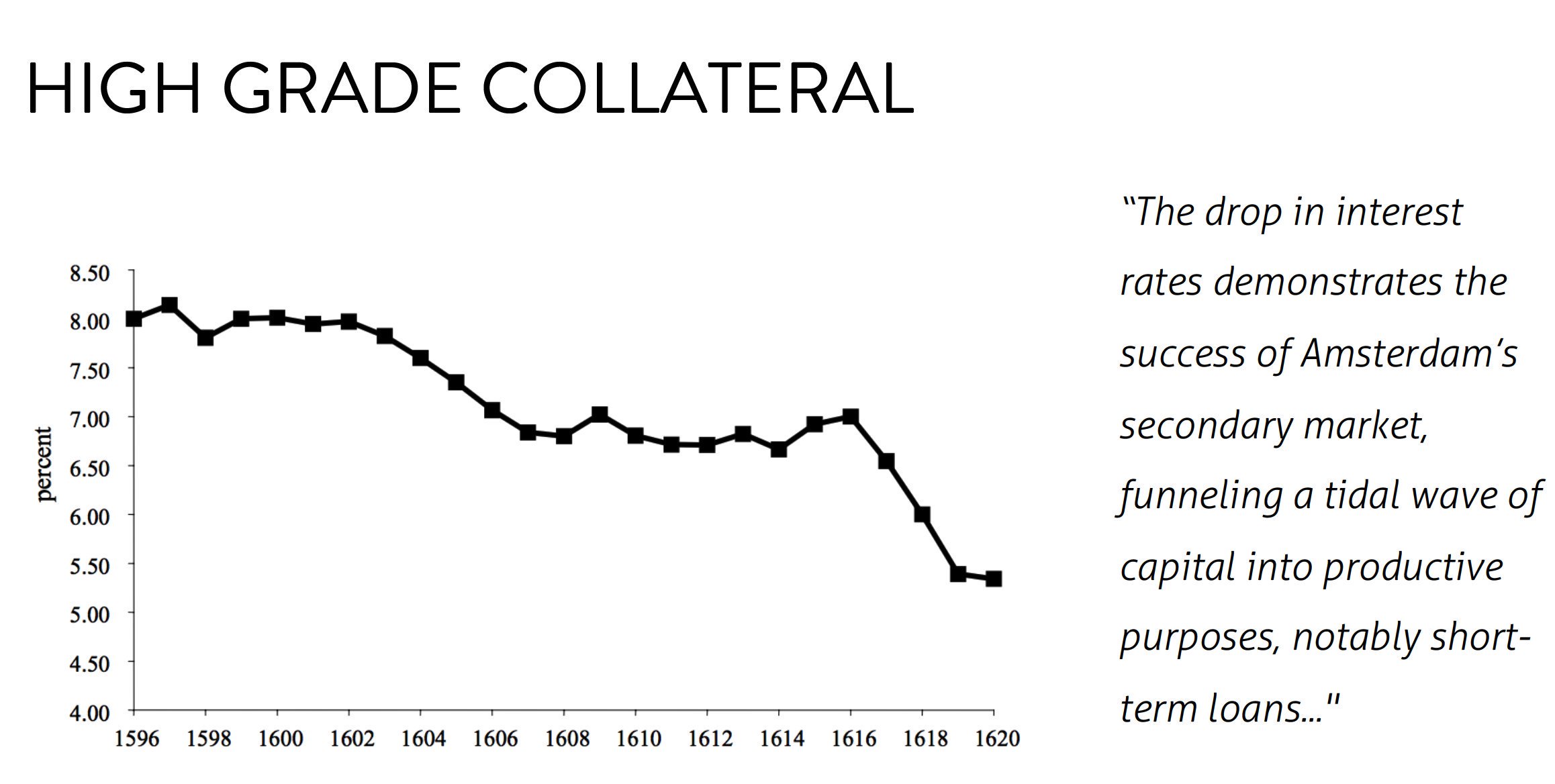

- Sola Fide (faith alone is enough, no need for a priest), and

- Sola Scriptura (the bible is enough, you can now read it in your own language).

15/ Bitcoiners also have slogans which underscore their resolve to cut out trusted third parties:

- Vires in Numeris

- Don’t Trust, Verify

- Not Your Keys, not Your Bitcoin

- HODL

16/ Over to the parallels between the financial economy of the Dutch Golden Age and that of Bitcoin today.

17/ The Dutch perfected deposit banking, with the world famous Amsterdam Wisselbank. We see echoes of heir staunch emphasis on security in bitcoin banking today, which is innovating with trust-minimized solutions such as collaborative custody.

18/ 16th-17th century maritime trade was risky but lucrative, which was the perfect breeding ground for the insurance sector. In the bitcoin economy we are seeing (proto-)insurance arrangements that resemble Dutch practices.

19/ The world’s first IPO was the East India Trading Company (VOC). Its shares were so liquid and desirable that they were widely used as collateral. Bitcoin is showing similar characteristics, and so may form the base collateral for deep lending and derivatives markets.

20/ Finally there’s a parallel between how the Dutch accessed capital via annuities, and IEO tokens today which give bitcoin exchanges access to capital. Our report predicts bitcoin based mutual life insurance, which is the next evolutionary step after annuities.

21/ The report’s conclusion: “Once in a while, the puzzle of circumstance fits together in a peculiar way… allowing for a spectacle of chain reactions that profoundly reshapes society. This happened 500 years ago, and it may be happening once more.”

22/ We’ve added a four page chronology of the Protestant Reformation as an appendix. This should help better place the report’s analysis in its historical context.

23/ Thank you! Once more, here is the link to read “The Bitcoin Reformation”: https://docsend.com/view/ijd8qrs