Tweet Thread: Chad money

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Tweet Thread: Chad Money

By Gigi

Posted September 19, 2020

1/ Now that the Chad money is coming in, let’s look at what moving to a bitcoin-denominated balance sheet might mean.

On inflows, outflows, balance sheets, and how a circular orange future might resolve the points of contention in Bitcoin.

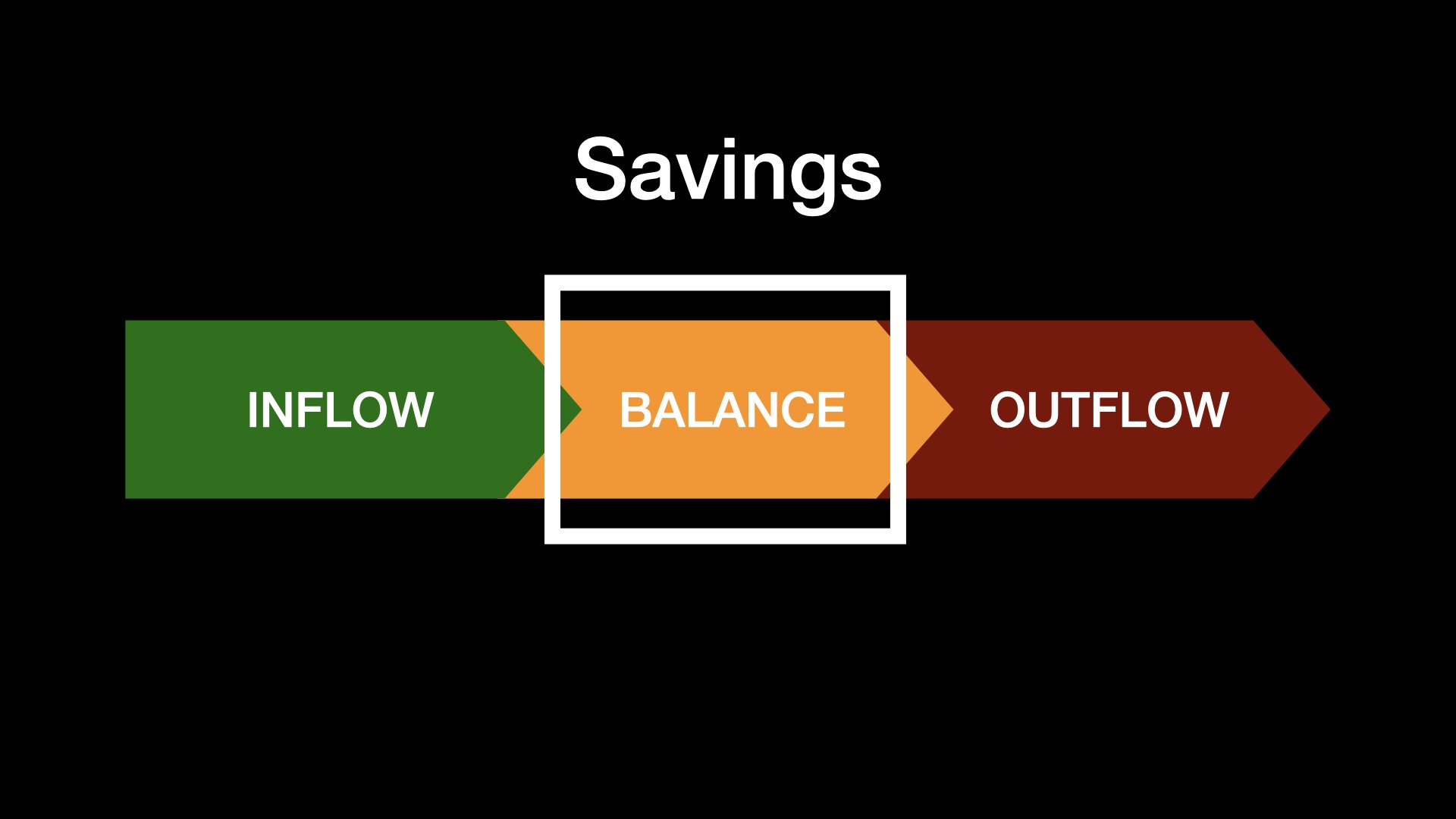

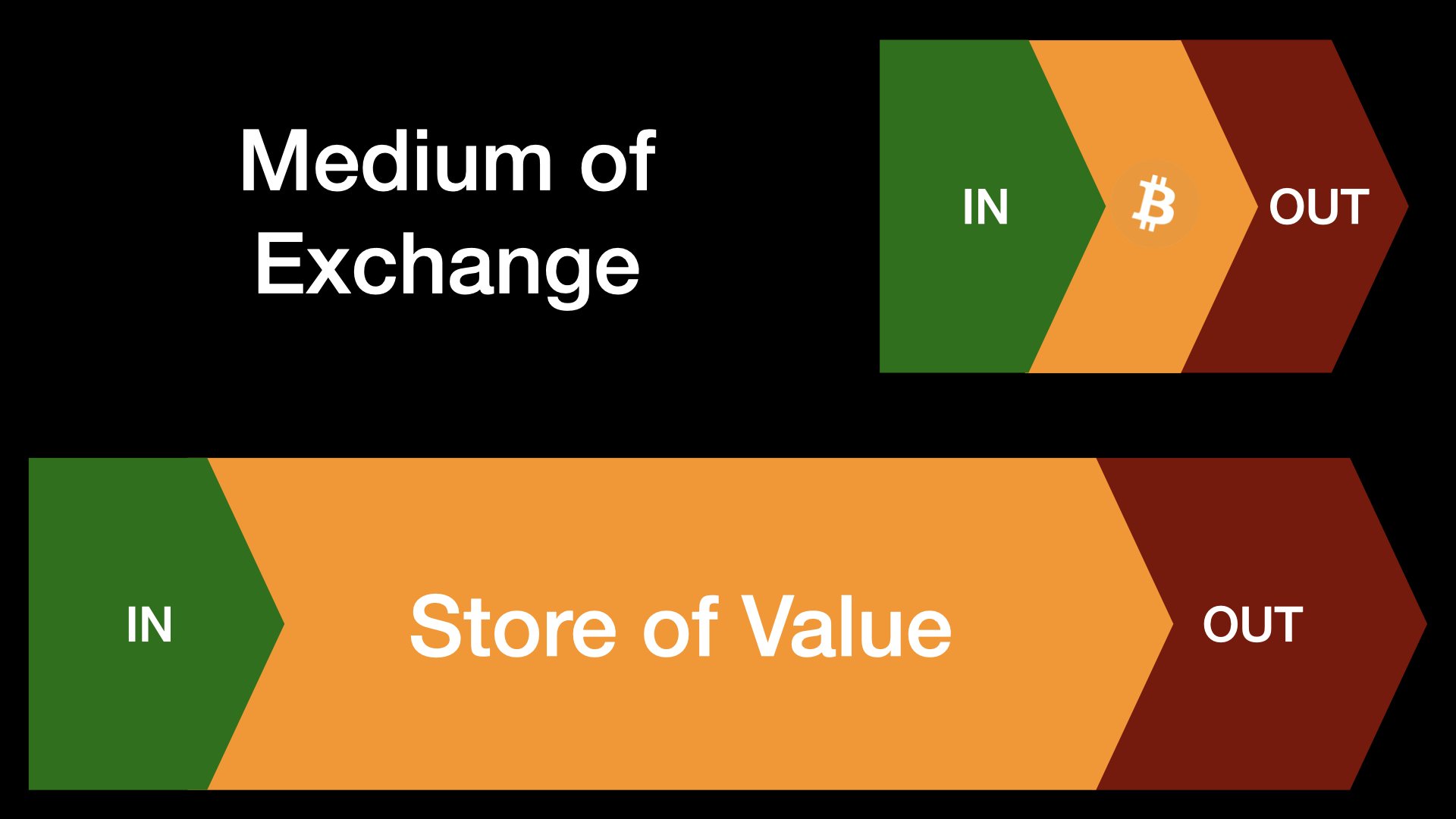

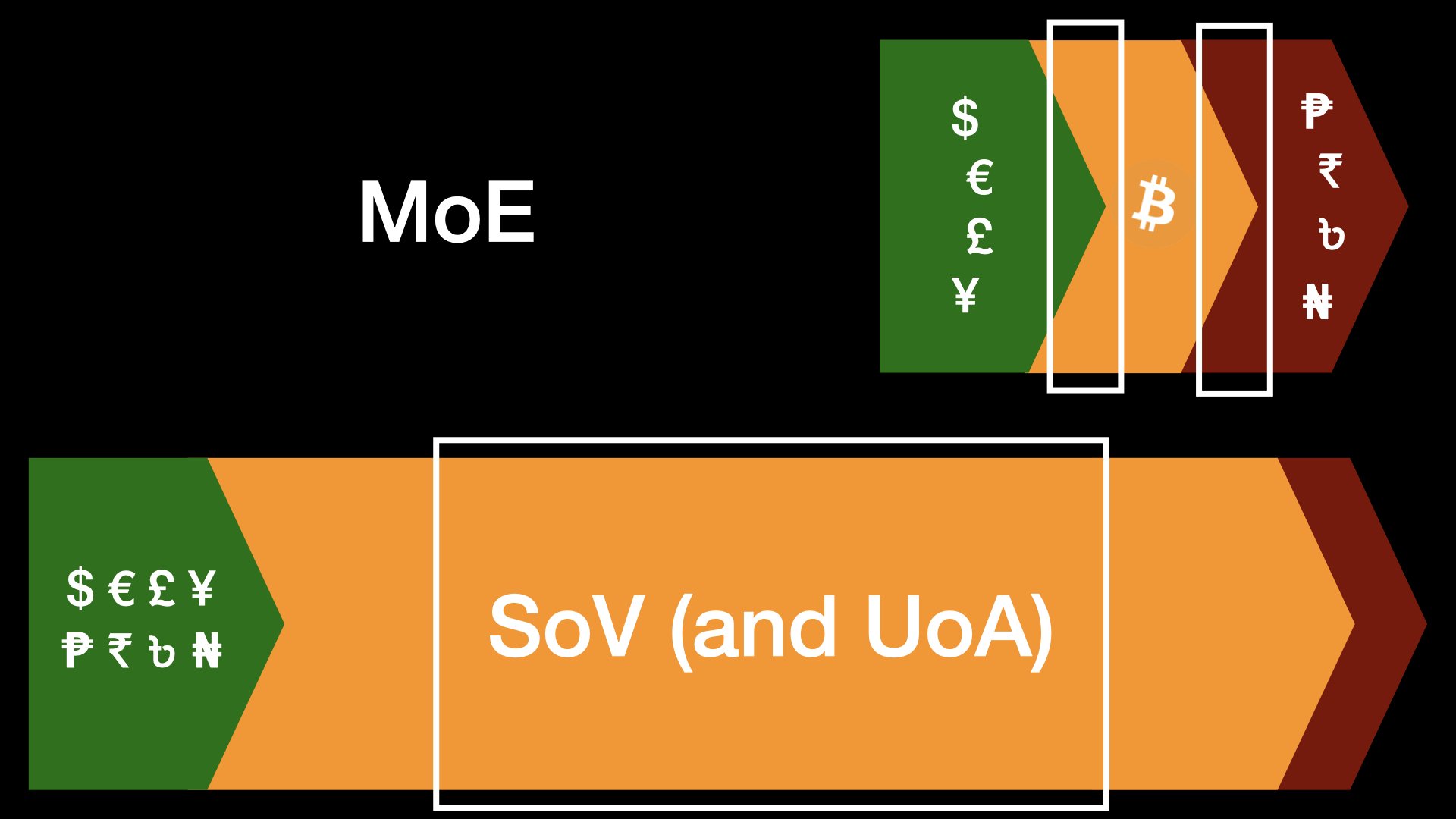

2/ In essence, every economic actor needs to have an economic inflow to survive. This is true for individuals, companies, and even states.

A healthy actor has more inflow than outflow, resulting in a positive balance. Spending is necessary for survival or growth.

3/ Most economic actors sell goods and services to generate inflow. Sooner or later, what they earn is spent again on other goods and services. A payment is simply a moment in time where one is given what is due for goods or services.

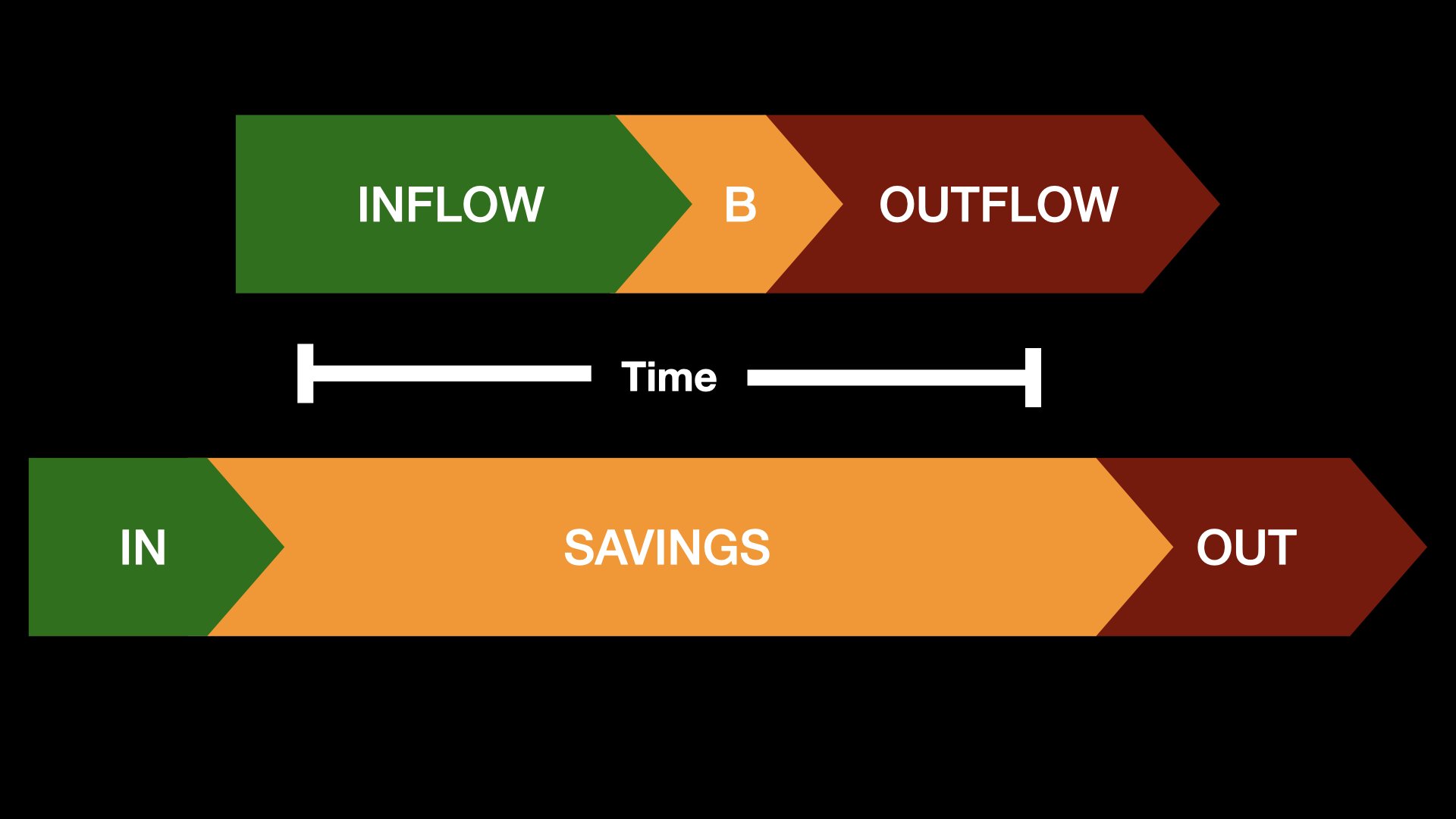

4/ Because the future is uncertain, you might want to hold some cash on your balance sheet. A better time to spend the money might arise, or you might need the money more than you need it now. You put something aside for a rainy day. These are your savings.

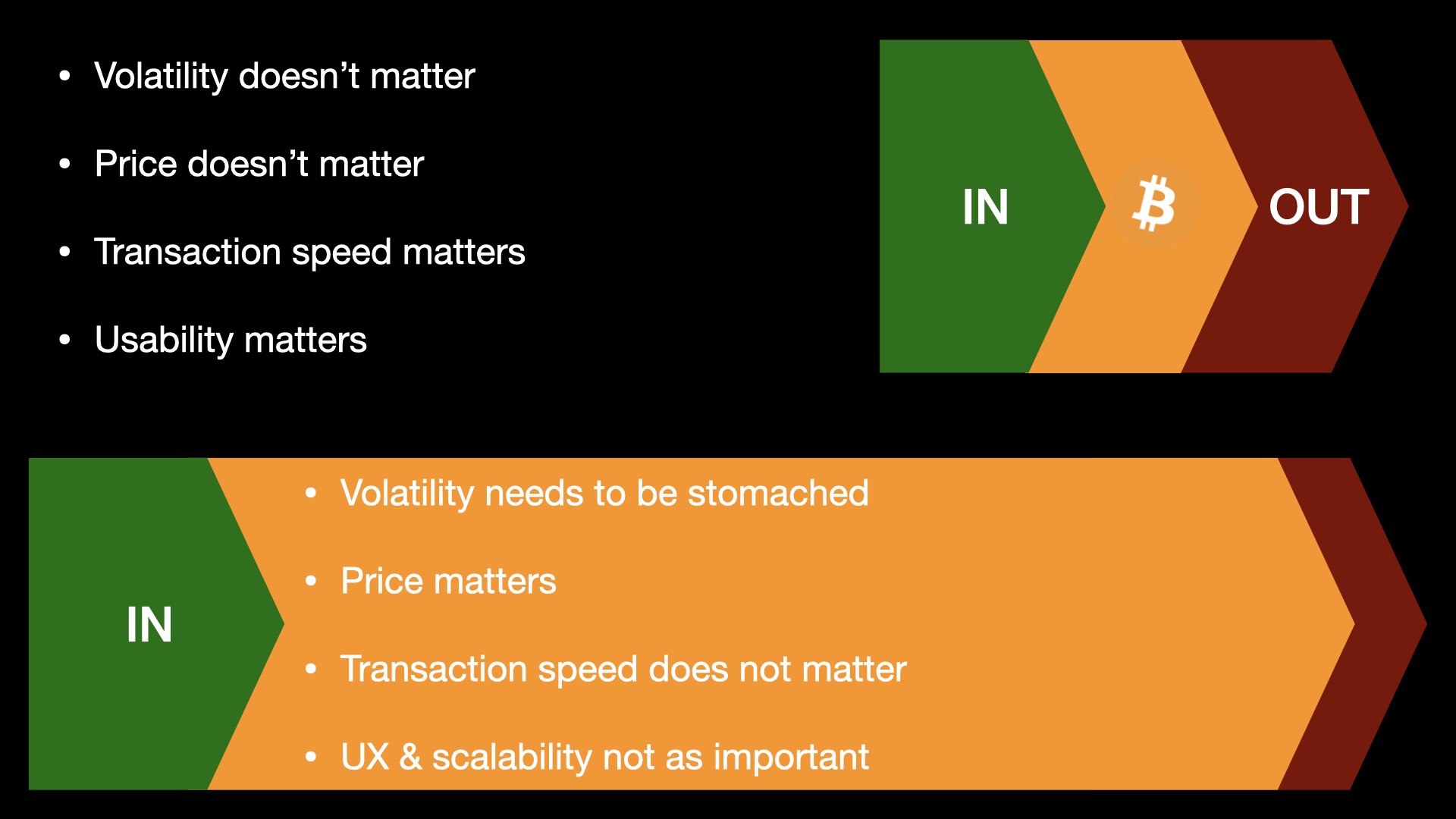

5/ Saving is simply the act of delaying spending. In the same way that you might want to save your dessert in order to savor it even more at a later point, you might want to save your money so you can put it to better use in the future.

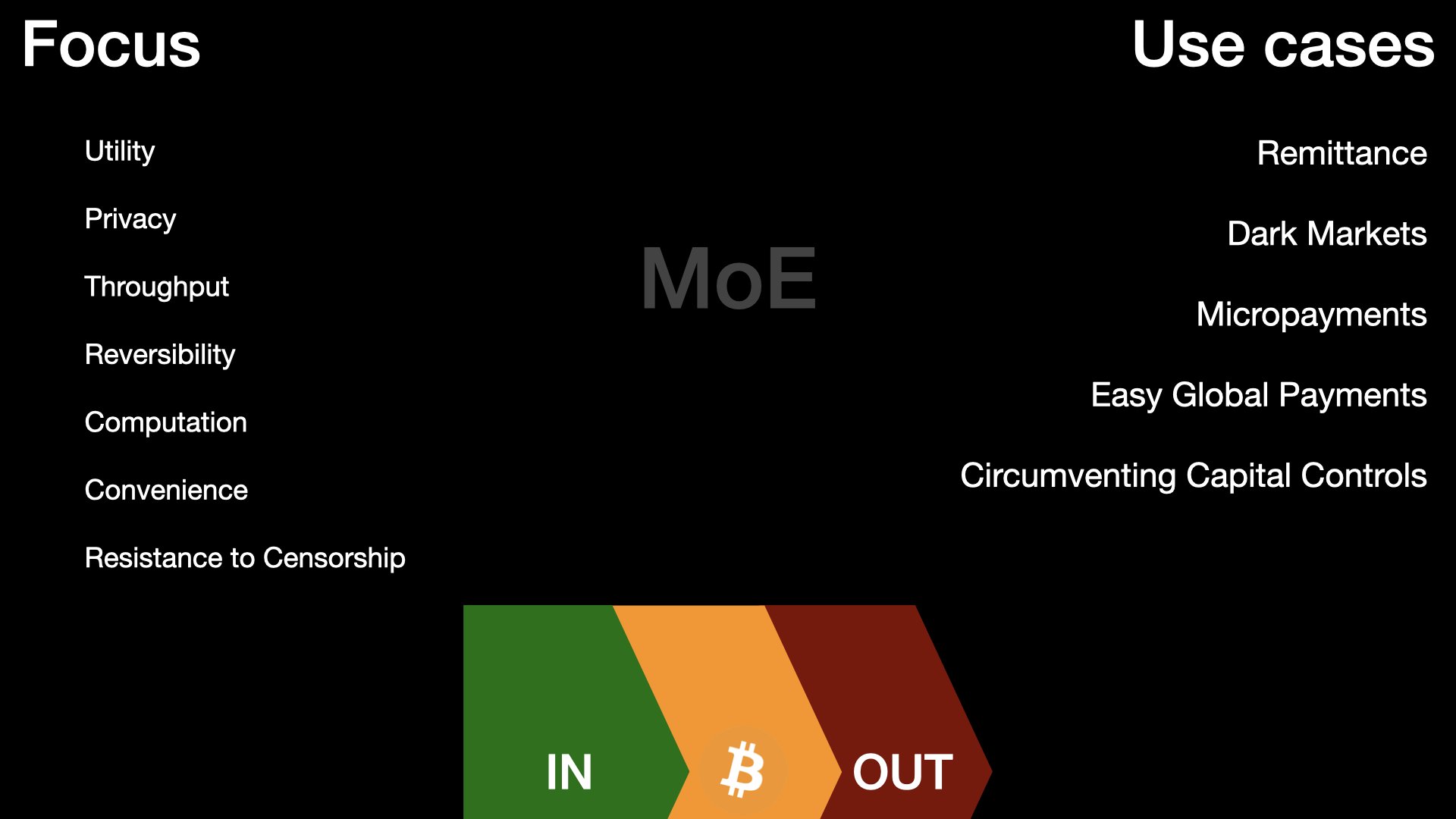

6/ In Bitcoin, this distinction is especially relevant because there continues to be tension around what Bitcoin is and what it is good for. Due to its resistance to censorship, confiscation, and inflation, bitcoin is useful for both payments and savings.

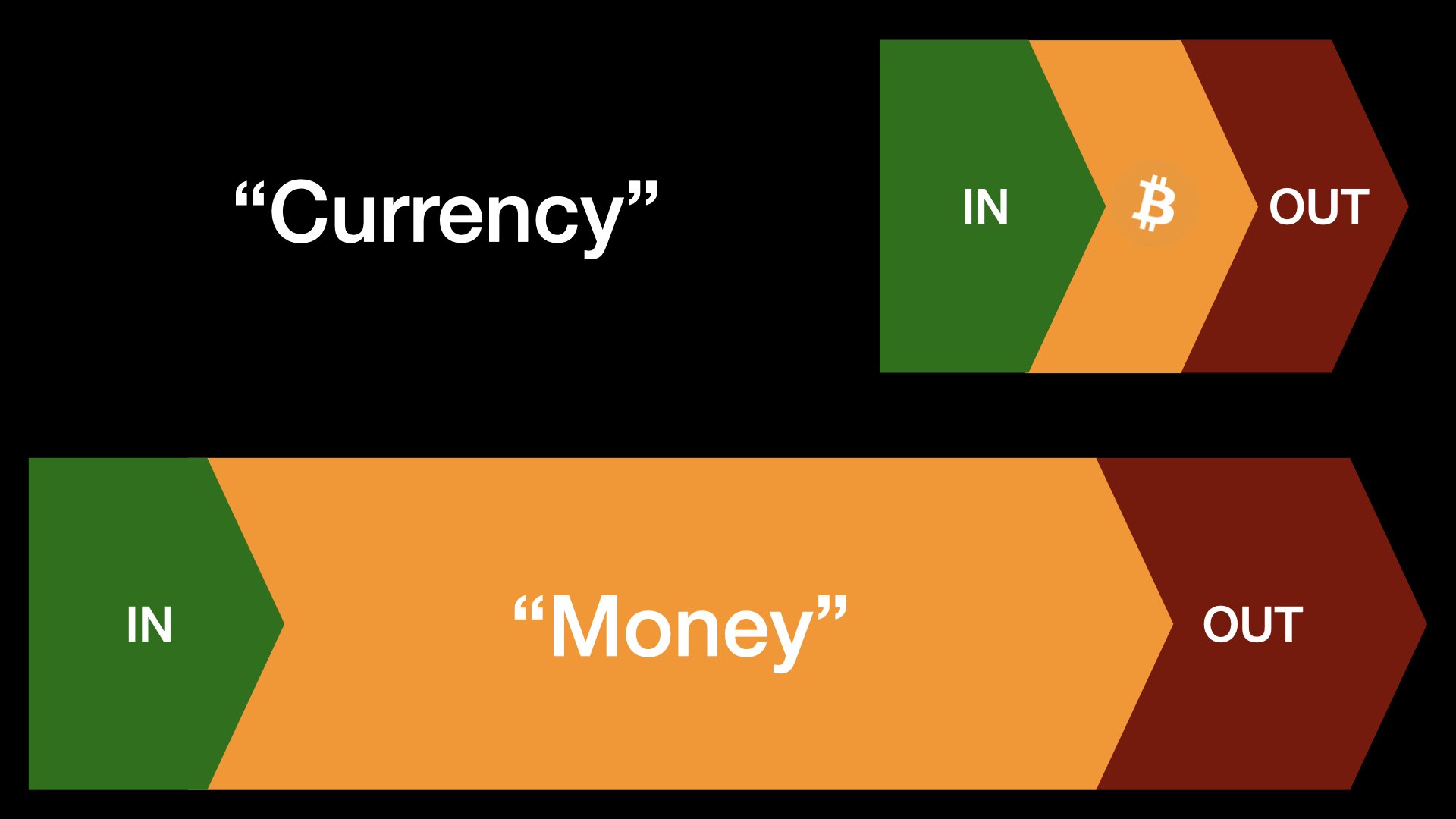

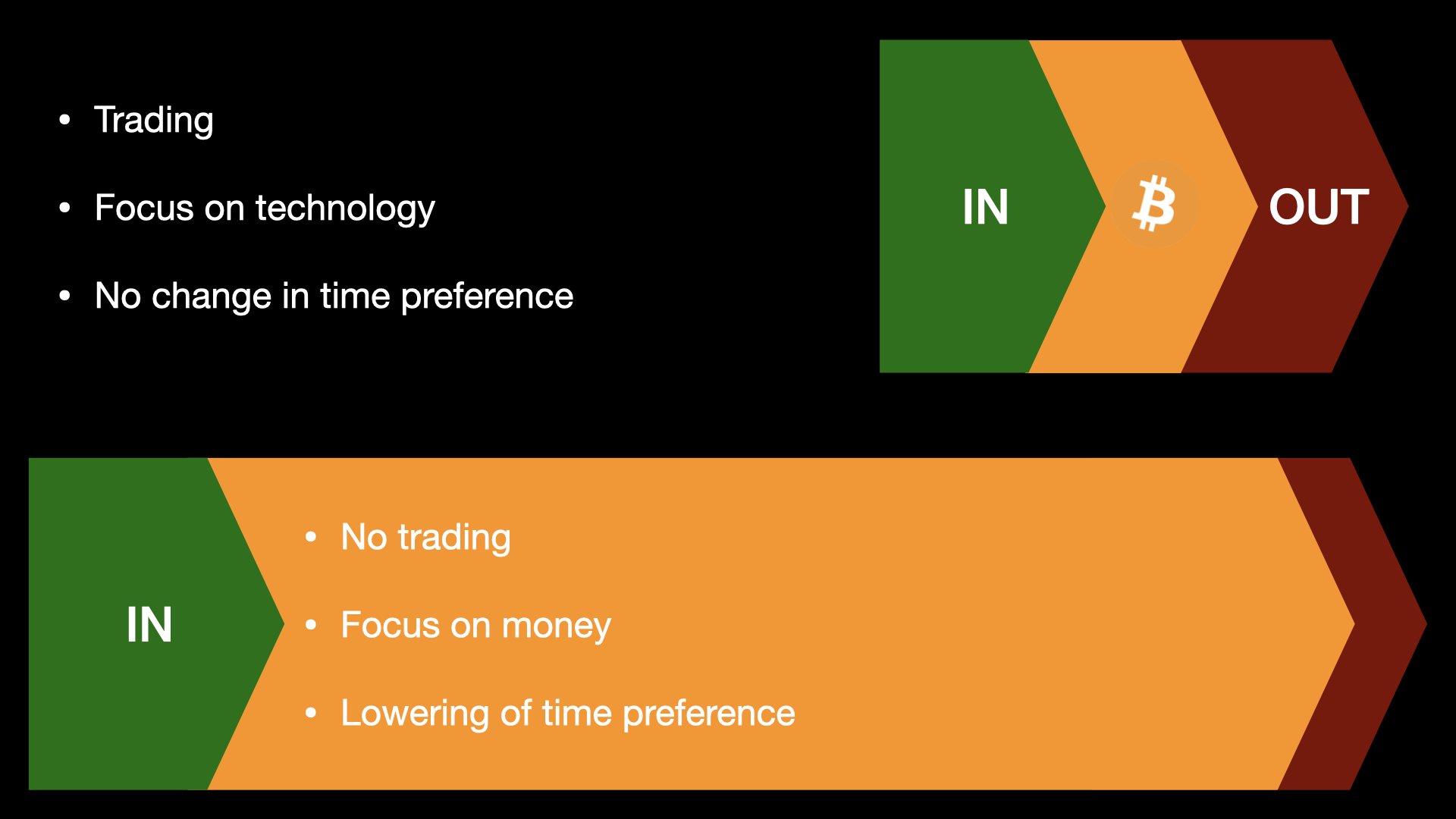

7/ Those who focus on the payments side of things often speak of “(crypto)currency” and emphasize the “medium of exchange” aspect.

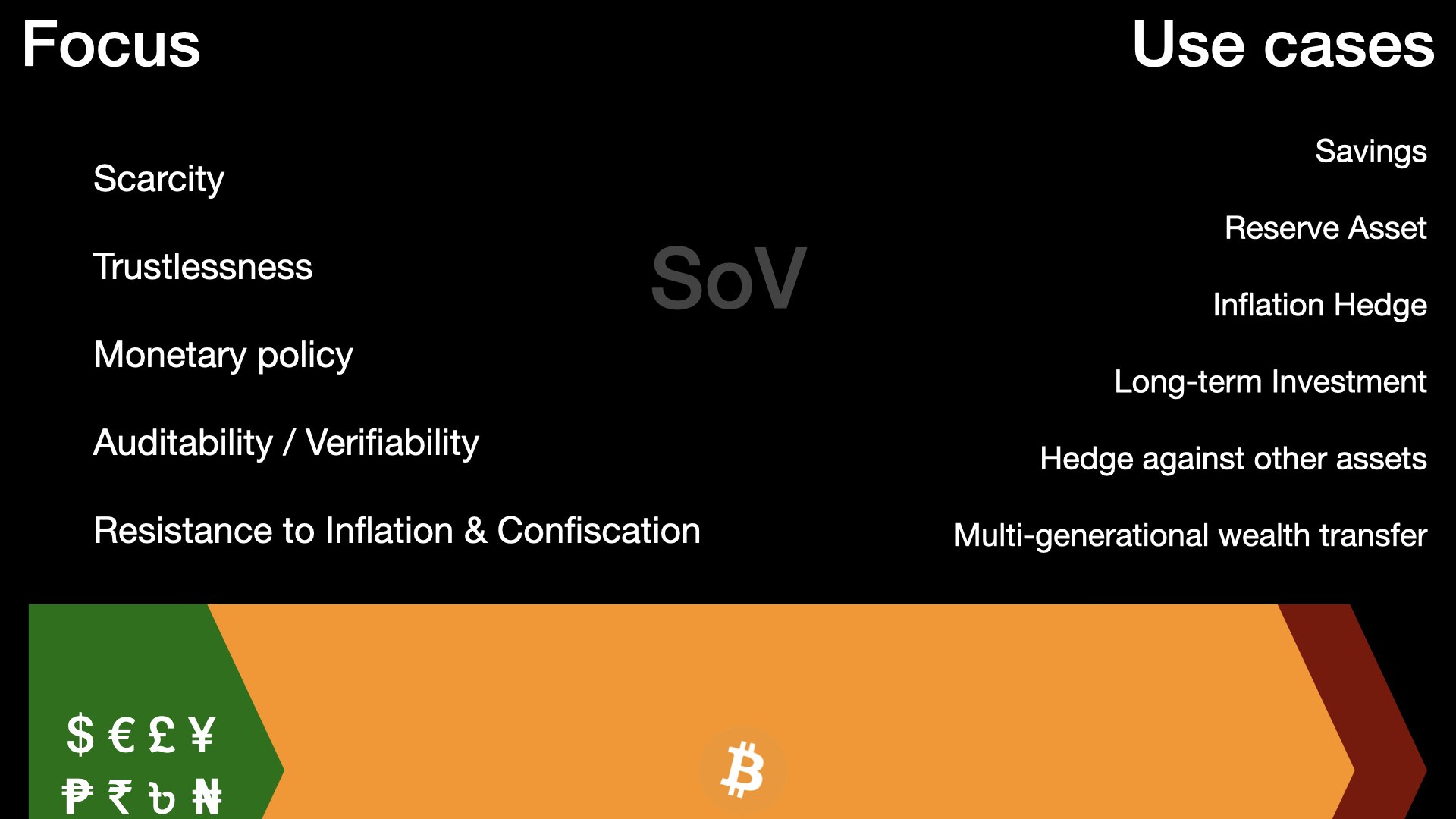

Those who focus on the savings side of things speak of “money” and emphasize the “store of value” aspect.

8/ The MoE crowd is mostly concerned about making exchange and payments easier. Bitcoin is seen as a tool to improve commerce. Focus: inflows and outflows.

The SoV crowd is mostly concerned about security and certainty, e.g. monetary policy and auditability. Focus: balance.

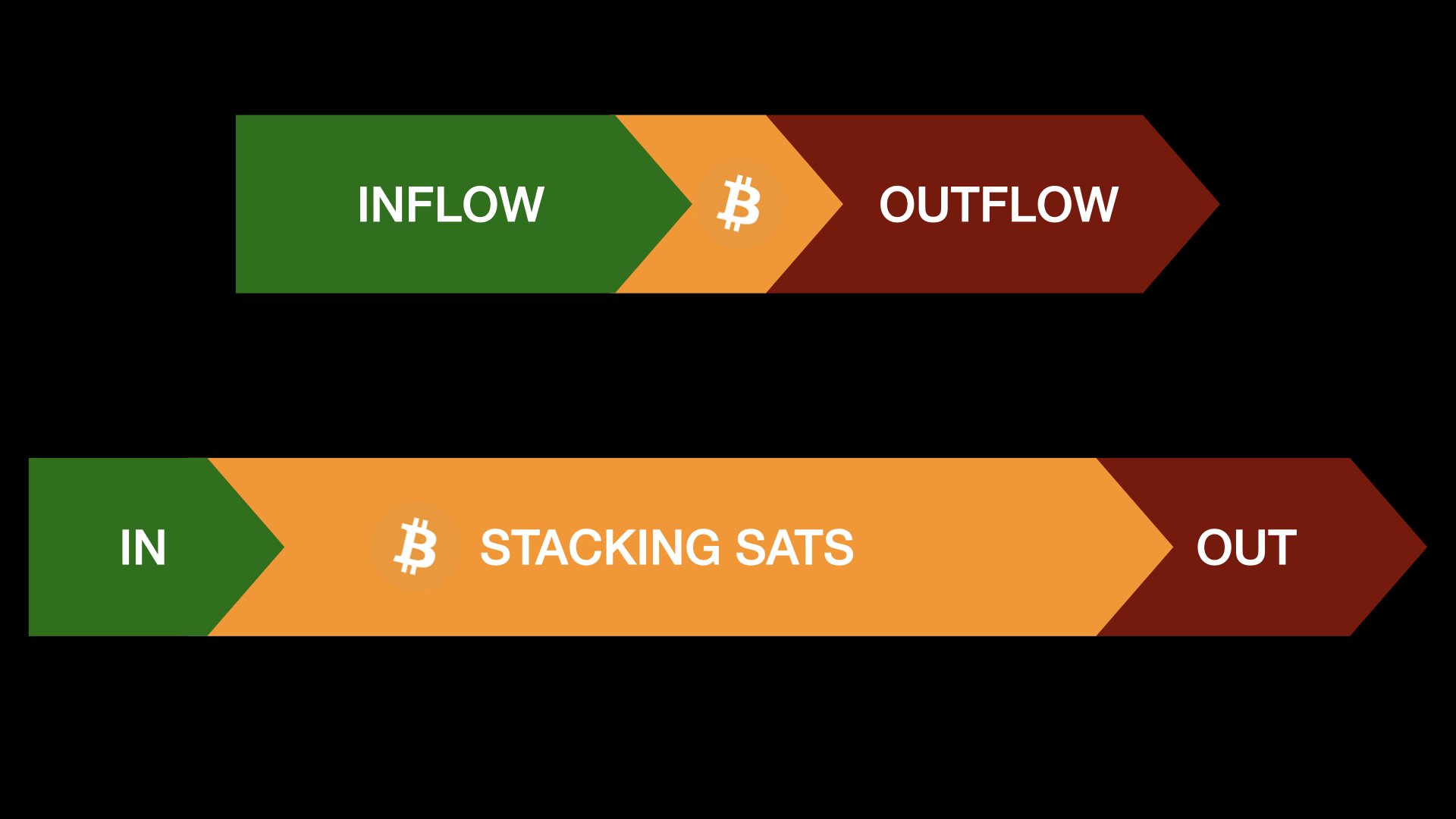

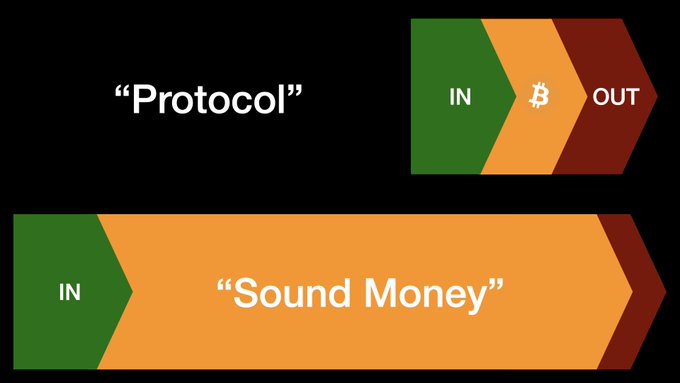

9/ Yes, Bitcoin is a protocol for value transfer. From this point of view, the value of BTC does not matter. Value in -> BTC -> value out.

But Bitcoin is also the soundest money we ever had. The realization and appreciation of this fact will be reflected in its buying power.

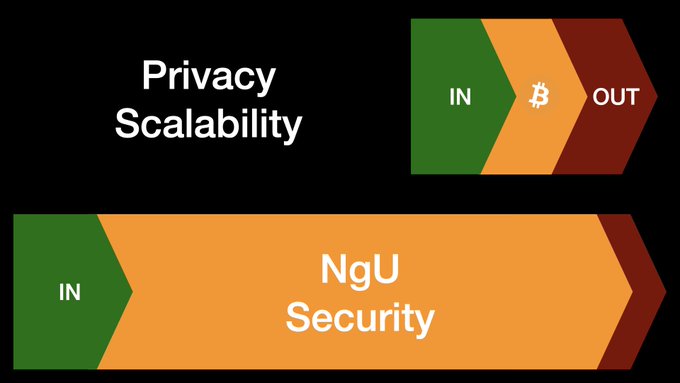

10/ Different focal points highlight different concerns. For the first, these concerns are around privacy and scalability. For the second, they are security and valuation (reflected in NgU).

11/ No bitcoin balance? Volatility and price don’t matter! Bitcoin is technology that needs to be improved.

Large bitcoin balance? Transaction speeds, UX, and scalability don’t matter that much! Bitcoin is sound money and could soon ossify.

12/ Medium of Exchange: remittance payments, dark markets, micropayments, cross-border payments, evading capital controls.

Focus on utility, privacy, throughput, and censorship-resistance.

13/ Store of Value: savings, (personal or company) reserve asset, inflation hedge, long-term investment, hedge.

Focus on scarcity, trustlessness, monetary policy, auditability, verifiability, resistance to inflation & confiscation.

14/ Currently, it seems to me that Bitcoin is a one-way street. Many people had to use bitcoin as a medium of exchange for one reason or another, fell down the rabbit hole, and are now bitcoiners that use it to save for the long term.

15/ A rising number of bitcoiners are all in, forcing them to spend some of their bitcoin. If 100% of your inflow is in bitcoin (or: no inflow, 100% BTC balance), you will have to spend sats on food, shelter, and other necessities. No matter how much you don’t want to.

16/ As more and more bitcoiners prefer to receive payments in bitcoin, more and more economic flows will be bitcoin-based. In other words: bitcoiners will be willing to part with their sats to pay other bitcoiners for goods and services. This is already happening (h/t @ctdl21).

17/ While still small, this circular economy is bound to grow. Everyone who ever did cross-border fiat payments knows how much of a hassle it can be. Bitcoin is frictionless, especially when going from bitcoiner to bitcoiner. Discounts of 21% will help too.

18/ Zooming out, the economy is still operating on a fiat standard. However, the number of individuals and companies that move towards a bitcoin standard is growing.

More HODL = more and larger bitcoin balance sheets. More AutoDCA = more fiat inflow / less fiat outflow.

19/ Earning and spending bitcoin is a natural thing once you drop fiat and bitcoin becomes the money of your choice. This is where SoV meets MoE and - once the orange circle is big enough - will eventually become UoA.

20/ As more people gravitate towards Bitcoin, more goods and services will gravitate towards a bitcoin economy. The Bitcoin Standard is coming, it just won’t happen overnight. It will happen one by one, individual by individual, company by company. Balance sheet by balance sheet.

21/ When all is said and done, bitcoin will be taken for granted just like electricity and the internet is today. What remains in the background is a beautiful orange circle of interlocking incentives. Settling transactions, block by block.

FIN/ Thanks to @michael_saylor for being such a Chad, and thanks to @pierre_rochard for letting me expand on this idea (and making me sell all my chairs). You can find Pierre’s presentation on Google Slides.