The Halving or Halvening

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

The Halving or Halvening…

By Aleksander Svetski

Posted April 14, 2020

A philosophical overview

NOTE: This was mostly written in Jan, prior to Corona really breaking out, so I’ll add a section near the end about how that impacts things…and no…Corona will not delay the halving😉

It was always about fixing THE MONEY.

It was always about fixing THE MONEY.

There is an event coming up, which happens every four years (or 210,000 blocks in Bitcoin speak), that many people have been talking about.

It’s known as the Halvening, or the Halving, depending on who you ask. In fact, many have said we should call it the Halfining in honour of Hal Finney, a computer scientist, Cypherpunk and the earliest proponent of Bitcoin other than Satoshi himself (unless Hal was actually Satoshi).

If you’ve heard of it, it’s probably been via some great models built by quantitative analysts such as PlanB and his “S2F” (stock to flow) model, which we will discuss below & link to, but the angle of this article is more fundamental, and an exploration of what the halving represents.

This event is significant, not only in the Bitcoin ecosystem, but on a global scale, as the Bitcoin “social experiment” continues against a backdrop of monetary & fiscal excesses, cheap, abundant credit, soaring asset prices, worldwide political tensions, and most recently, the new coronavirus which has blatantly uncovered the fragility of our over-leveraged system.

The global norm has become one of “more, more, more”, “now, now, now” and “blind excess” with complete disregard to the consequences, costs, ethics & sustainability of the decisions we make today, all which come at the expense of the future.

Bitcoin, and its hardcore proponents, stand almost alone as a pillar of low time preference, built on a foundation of scarcity & transparency, in which the future is not so heavily discounted over an “easy” or “cheap” present.

This upcoming halving event is incredibly symbolic.

It’s a philosophical divergence to the madness of modern times, and it is history in the making.

The Zeitgeist of our time

So what is the halving and what does it really represent?

I believe it represents the growing zeitgeist of our time. It’s a defining moment in history where an entire generation will have the opportunity to rise up, and in the process of claiming their own sovereignty, influence the direction of, and pave the way toward a future that can last.

A future where we stop robbing our kin, their kin and the planet for the blind excesses of the present.

Bitcoin is the ONLY thing halving, whilst everything else in the world is doubling, tripling and expanding without regard to it’s cost.

Fundamental laws of nature & the universe tell us that every action has a reaction, and all decisions come with a cost. When we pay those costs is a function of how long we may be able to kick the can down the road, but ultimately, the road too comes to an end, and when it comes time to pay the piper, those who have to foot the bill may find that there’s nothing left to pay with.

With Bitcoin, we have a chance to fork the road ahead, and then create an alternative end to the path we’re currently on.

Bitcoin and the up-coming halving represents so much more than just some “opportunity to make a bunch of money”. It represents a difference in the core philosophy of how the world unfortunately runs today. It’s a reversion back to appreciating that which is precious, scarce and unique.

Life is precious because it ends. We know day, because we have night. Scarcity has and always will be the defining characteristic of life, and of anything that we value. It’s at the core of how we’ve evolved to understand value, and without it, we lose a big part of what makes us human.

Bitcoin brings scarcity back to the most important human invention (money) and forms a basis upon which we can build a society for us all to value, today and into the future.

A low time preference

Time preference is an economic term, that in the last few years of Bitcoin, has been popularised in circles outside of economics, and almost become a meme (well; it’s definitely a meme amongst bitcoiners, and now spreading beyond).

We can probably thank Saifedean Ammous for that. His book, The Bitcoin Standard is a must read and gives a much fuller explanation of time preference, although I will touch on it here.

Time preference relates to how you value time, and on what temporal scale you prefer to operate on.

It’s best understood via a simple example.

Having a low time preference means:

- You think long term

- You value the future over the present

- You try to leverage/invest time & energy today to have more in the future

Having a high time preference is the opposite:

- Thinking & planning is for the short term

- Now is more important than the future

- Live for today, figure out the future later

Both actually have their place, but in very different contexts, and as with all things in life, one can take each to the extreme, where they can experience detrimental effects.

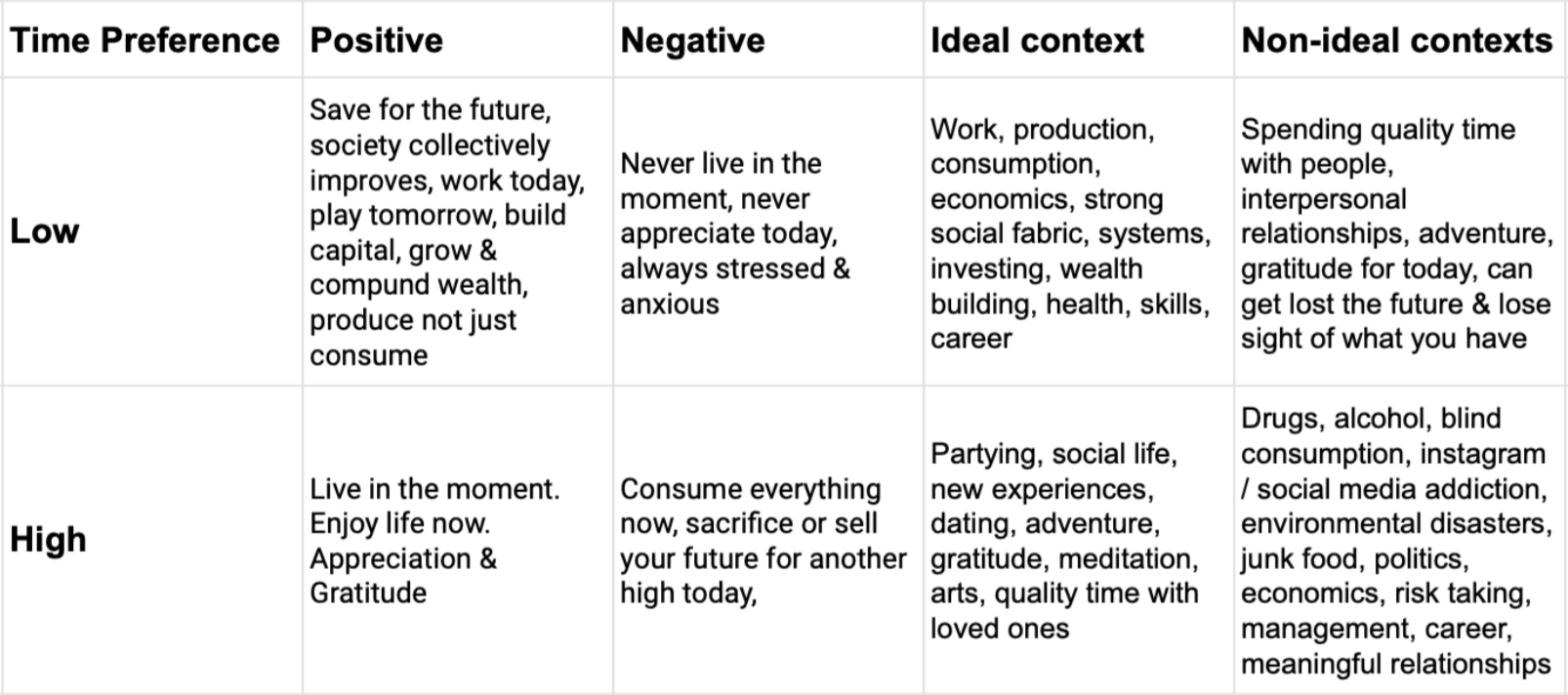

The below is a view of the benefits & draw backs of a different time preference, and a rough idea of how context may change the way one should approach it.

Some trade offs with time preference.

Some trade offs with time preference.

It’s important to note that no rule in life is absolute. For example, with time preferences, one can actually still live in the moment & enjoy today, whilst having a low economic time preference, which will help ensure the capital, resources, and options for a better tomorrow (not just for yourself, but for society as a collective).

This is the game of life. Knowing how to behave & when.

The problem we have today is that economically, we are not given a choice. At scale, society is skewed toward a high-time-preferenced-consume-at-all-costs infrastructure that is not only burning us out, but robbing our future generations of their chance at prosperity.

Economics is the mechanism via which we (humans & society) function at scale. At a collective level, the preference should be low, assuming we want to have a better future. This is a noble goal, and one the so-called “leaders” of today have no concept of.

Greed

As our friend Gordon Gecko said; “Greed is good”.

It’s a fundamental human drive, not only for reasons of survival, but for thriving. Prosperity is inherently linked to greed, but when left unchecked, it can completely skew time preferences & collectively lead us to ruin (ie; the path we’re currently on).

It is & it does. But….

It is & it does. But….

The problem with greed unchecked, is that power concentrates, and those who’ve managed to amass it can construct the system in a way where they have an unfair advantage (again, like our current crony-socio-capitalist system). This is very much a problem with today’s version of “the state” and the medium via which society functions (money & economics).

Things have gone awfully awry, and the only way to fix it is to make changes at the base. Anything we do at the top or on the surface is just playing musical chairs, or games of intellectual sophistry.

If we want a future where freedom is respected, property & prosperity remain rights, and where the best in each of us is rewarded — the economic system needs to change. That can only truly be done at scale with an economic tool like bitcoin.

Something that has no owner, but is owned by us all. Something that cannot be changed, cannot be compromised, and cannot be bent to anybody’s will. Something that grows, from nothing into something, not by decree, but by its very merit.

This is why Bitcoin is the check and balance to the blind excess running rampant in the world today.

It’s the antidote to a consumption-focused high-time-preference society that’s always chasing the next hit.

It’s the contrarian philosophical viewpoint that represents sense, stability, sanity & transparency in a world that’s lost its moral compass.

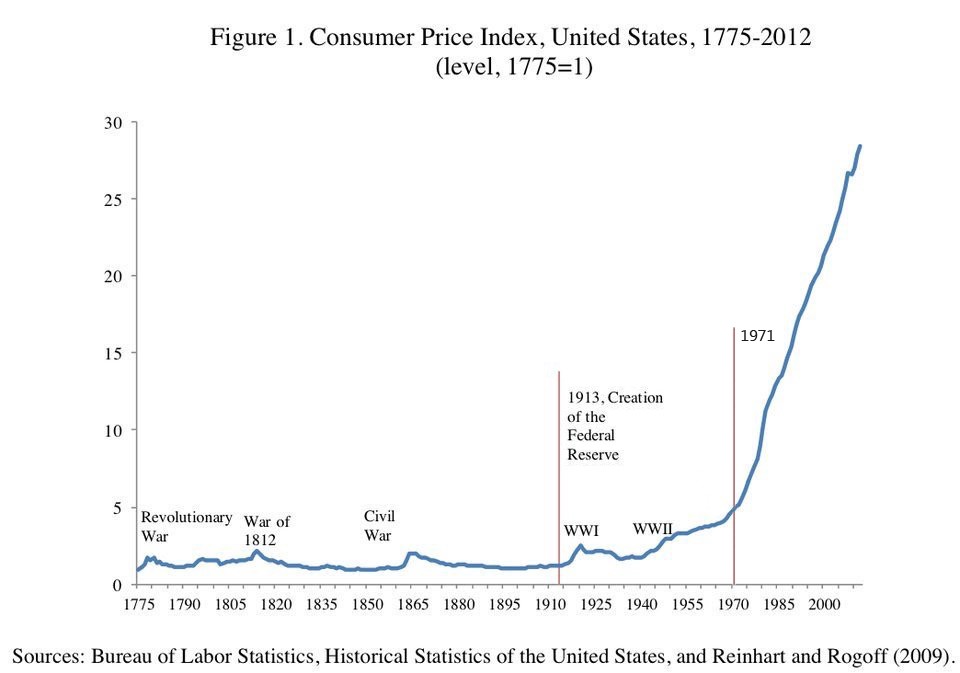

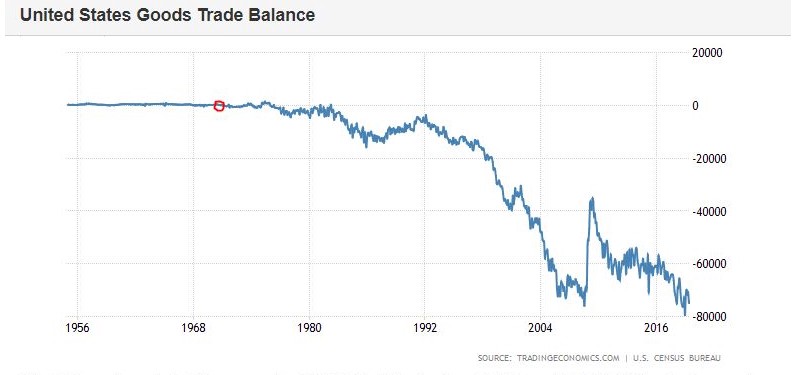

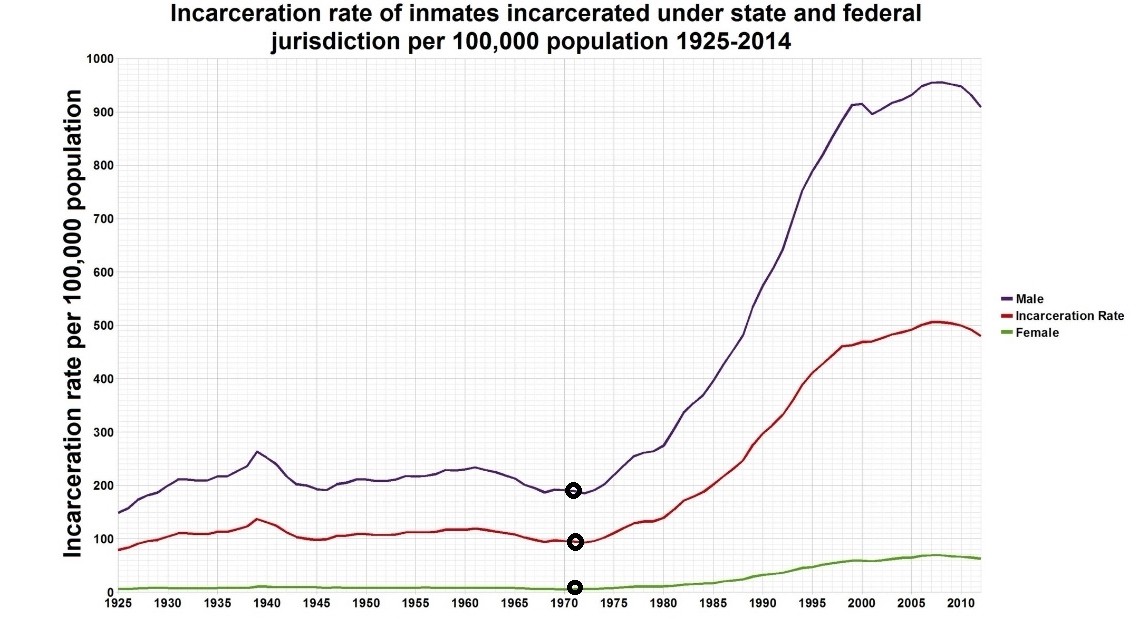

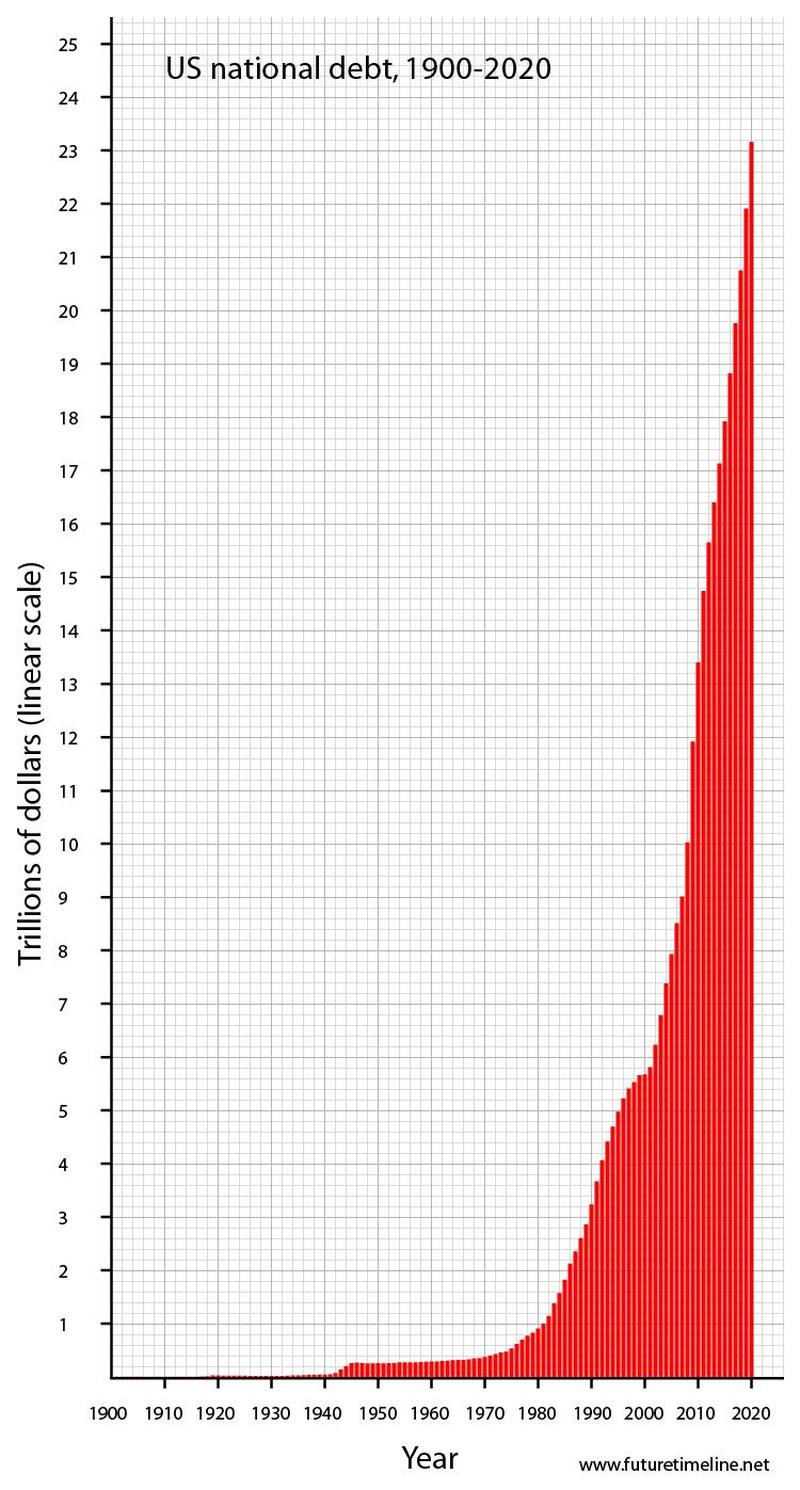

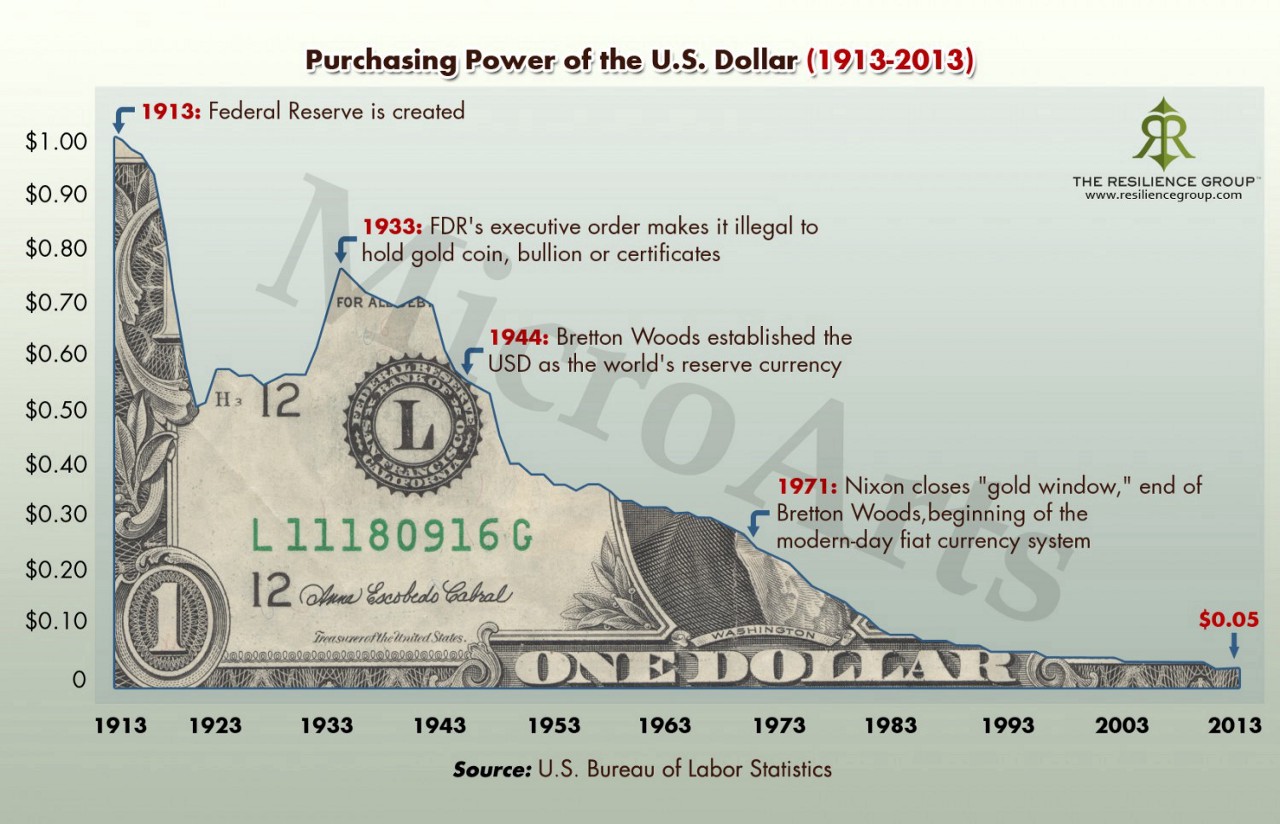

It’s the antithesis to the Keynesian madness, best exemplified by charts such as these:

All courtesy of wtfhappenedin1971.com

And one which, since this Corona cluster fuck, is going to make the RHS of the chart look like the LHS very shortly:

In our desire for abundance, we’ve vilified scarcity — and in the process eroded our notion of value.

It’s sad, but luckily, there’s a lifeboat → and it’s called Bitcoin. But before we go there, let’s understand scarcity a bit.

Scarcity & Value

Scarcity is inherently linked to our understanding of value.

Let’s use a quick set of examples.

- Family

- Trinkets

- Art

- Time (although fungible)

Why do you care about (value) your friends & family so much?

Heard the saying: “You only have one mother / father / brother / sister”?

Your family members & friends are unique. They are something you cannot replace, duplicate or just “print” more of.

We value them because they’re inherently & verifiably scarce.

The same goes for a special trinket handed down to you by your great grandparents (as an example). It’s rare / scarce / unique. Or art. We all know why a piece of art goes up in value once the artist dies.

*Corona Update* A more recent example of “things we value” include masks or hand sanitiser. Hospital beds, ventilators, trained staff? Yep; if you think value has nothing to do with scarcity; think again.

How about the most scarce (fungible) resource we know of?

Time.

We all know we can’t make more of it. We all know of adages like “you can’t make more time”.

It’s the same concept, although time is a little different because the aforementioned items / people / etc are not fungible. Time is more akin to energy, or money as a unit or resource that is both scarce and fungible, and that we (at least the more intelligent of us) value highly.

If as you read this, you consider how much you personally value time, then you should ask yourself the same re: Bitcoin.

Scarcity is at the core of “value”, and it’s evident when we analyse something like money:

For something to maintain “value” over time it must be scarce

Value, always ties back to scarcity, in some way. And unfortunately, in a world where we’ve lost our sense of scarcity, we’re also losing our sense of value (as relative & subjective a term as that may be).

We’ve not learnt the lesson, and have spread the ideology to many other areas of life. An approach which is not sustainable as it erodes the foundation upon which true value is built.

But again, my hope is that Bitcoin bucks this trend, and inspires the world to think in a new vein once again.

Let’s move onto things more tangibly related to the halving. If you’ve enjoyed this topic, you can read more here:

Supply & Demand Basics

Systems with feedback loops function by finding equilibrium when different forces interact.

They help regulate each other much like a governor does on a steam train, or a thermostat on an air conditioner.

Supply and demand are one of these systems and it drives the most important element of an economy, ie; information, or as you may more broadly know it; price.

In fact, supply & demand are probably the central pillar for a system [society] of collaboration amongst market participants [free people], at a micro level and [fractally] through to macro levels.

Price is the key piece of information that not only results from a complex, interconnected set of inputs in a functional economy, but is also (and simultaneously) the carrier of said information, in yet another form of feedback-loop-driven-system.

Saifedean Ammous has a great section in his book, where he discusses how price is the mechanism via which a market will re-stabilise the production of Copper after a natural disaster.

Markets & their information superhighway (price) are incredible things, and I urge you to study them further.

How does this relate to Bitcoin and the halving? Well…

Bitcoin is unique, not only in this world, but anywhere else we look because it exists at a time when demand for a unconfiscatable, uninflatable & uncensorable asset is increasing, and all the while, its supply schedule is tightening.

This is unprecedented.

In a world of fiat, excess debt, inflation eroding our purchasing power, multiple asset bubbles (the everything bubble), inability to find yield anywhere, the never ending chase of marginal yield, the now “muh exponential” coronavirus and every other bit of insane chaos, people’s desire to hold something that’s finite & defined will continue to increase.

This demand, as it continues to rise, will put further pressure on a system whose supply faucet is ever decreasing.

The only “give” in the system is price, and the pressure is upward. Significantly upward.

This cannot be stressed enough.

Fixed Supply Asset.

Bitcoin is the world’s first “fixed supply” digital asset.

The closest analogy I can think of in the physical sense is land. You can’t just “make more of it” and as a result, as both global population & wealth grow, the inherent value of scarce land increases.

We’ve never had a digital corollary to this.

Traditionally, any digital item has been able to be copied or duplicated ad-infinitum. There was no cost to do so.

Bitcoin fundamentally changed this and not only gave us “digital scarcity” but something far more important, ie; monetary & information scarcity.

This is a profound concept when you really take a moment to think about it.

Aside from “time” or “energy”, Bitcoin is actually the only fixed supply, fungible unit that exists, and the fact that it was designed to be a form of money and now exists in a time of not only blind excess, but exponential chaos & monetary expansion, what lies ahead for it will be unlike anything we have seen in humanity’s entire history.

Bitcoin, Not Shitcoin

Bitcoin is extremely unique, for many reasons. We’ve done our homework, and it’s why Amber is a Bitcoin-Only company.

The one concept I’ll touch on here is the idea of digital scarcity.

By definition, digital scarcity can only happen once, and it occured with the advent of Bitcoin.

Bitcoin’s protocol and network has ossified around this strict definition of scarcity in the form of a fixed supply cap, and as a result, the market has imbued it with & reinforced its value as a scarce asset.

The community have optimised for this supply cap and it’s become Bitcoin’s core tenet, whilst all other copy-cat-crypto’s have optimised for elements that the market clearly doesn’t value, ie; transaction throughput, transaction speed, [apparently] decentralised applications, world computers, or whatever other farfetched ideas.

Bitcoin and the bitcoin community understood that it’s architecture was, from the beginning, about censorship resistance via decentralisation for the purpose of delivering an un-inflatable, un-confiscatable and uncompromisable form or money.

The fact that Bitcoin is now too entrenched, and so widely held, with so many stakeholders at so many different levels (ie; users, holders, node operators, developers, miners, exchanges, wallets and more) means that the core rules are now a social consensus which cannot be changed.

Those core rules include:

- 21m bitcoin

- 10min Blocks

- Halving every 210,000 blocks (~ 4yrs)

Along with some more technical ones that are outside the scope of this article.

This idea, this consensus, these always on, always verifiable rules are what make Bitcoin Bitcoin, and why no shitcoin can ever change that.

You can copy everything from Bitcoin, but you cannot turn back time, you cannot go back to 2008 & let the cat out of the bag again, you cannot re-plant the seed and disappear (thank you Satoshi). You cannot replicate the historical record. It’s done.

Ubiquitous, verifiable digital scarcity is a one-time event, and Bitcoin is the result.

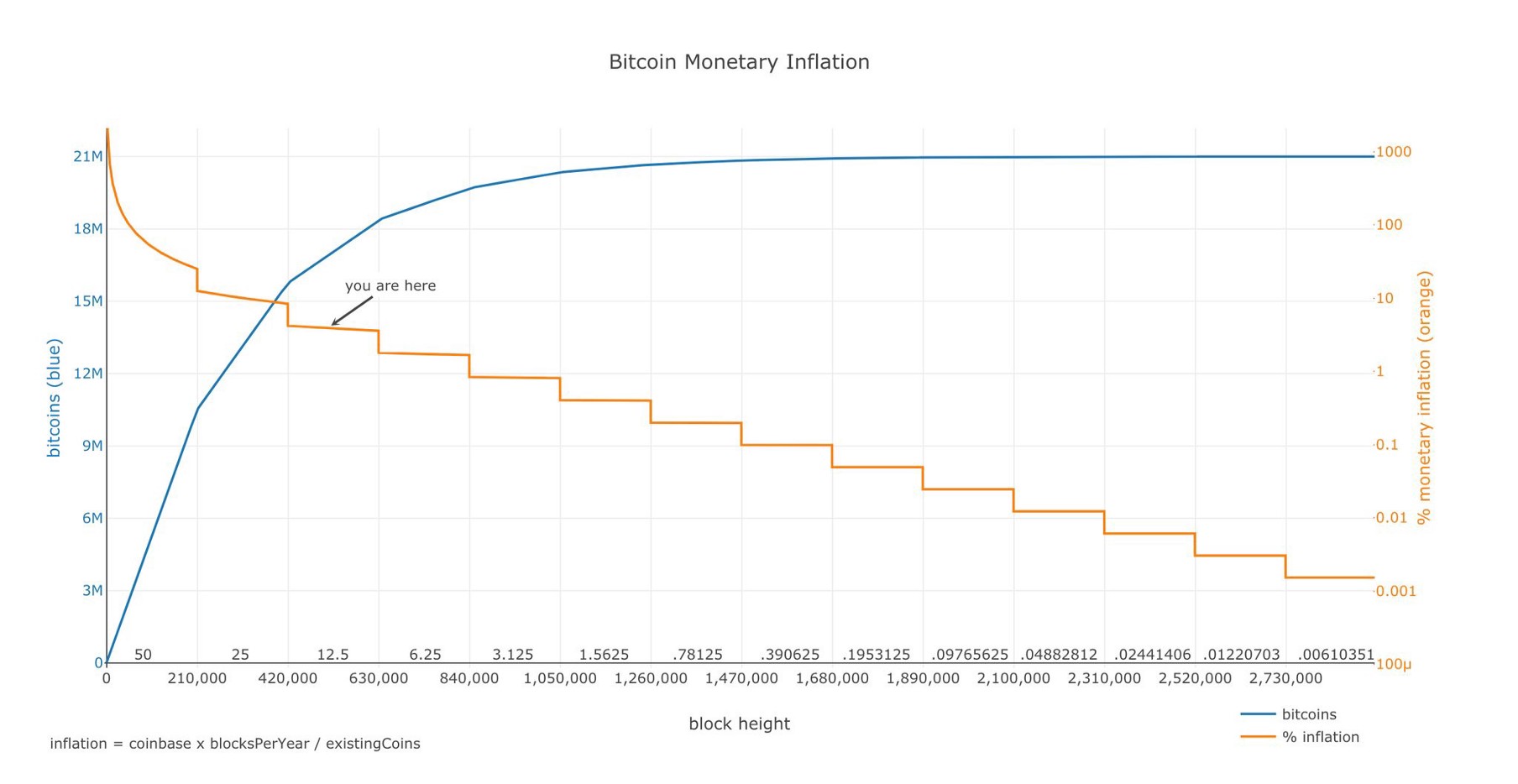

Stock to Flow

I won’t spend much time here, because PlanB’s work does it far more justice.

Modeling Bitcoin’s Value with Scarcity

But suffice it to say, there is some form of correlation (and/or causation) between bitcoin’s stock to flow ratio, and its price.

In simple terms, stock to flow just means the ratio between how much “stock” is currently available / on hand, and how much “flow” or new stock is being produced.

To date, Gold has had the highest stock to flow ratio of just about any element or unit we know of — at least in a monetary / commodity sense, and that’s largely thanks to the fact that we’ve been hoarding it & storing it for thousands of years.

Bitcoin is about to catch up to Gold’s ratio, and it’s only been around for 11yrs. This is a significant thing to come to terms with.

It’s taken >5000yrs of accumulating Gold to reach a stock to flow ratio of 62. That means it would take another 62yrs of mining to produce as much Gold as we apparently have in reserve. For reference, Silver is said to be at around 22.

Bitcoin is at 27 right now, and will double to 54 in less than 6wks. The higher that number, the greater the scarcity.

Now…The (very critical) difference between Bitcoin and Gold (or any other commodity for that matter) is that no matter how many years one “mines” Bitcoin, its total supply is pre-determined. There’s no catching up. And furthermore, that supply schedule will continue to tighten.

Here’s the halving, in action;

- 2009 — Bitcoin mining rewards start at 50 BTC per block

- 2012 — The first Bitcoin Halving reduces mining rewards to 25 BTC

- 2016 — In the second Halving, mining rewards go down to 12.5 BTC

- 2020 — This halving will now bring us down to 6.25BTC every 10min.

- 2024 — After this halving, Bitcoin will have the highest stock to flow ratio that we know of.

- 2140 — The 64th and last Halving occurs and no new Bitcoin will ever be created

Just to blow your mind a bit, the last Bitcoin will take more than 30yrs to mine. Yes. THIRTY years.

Here’s what this schedule looks like in a graph:

This is an unprecedented development in the history of humanity. Do not take it lightly.

This is an unprecedented development in the history of humanity. Do not take it lightly.

I’ve said it enough times now, but this is not only significant because there’s a chance to “make some money”. This is significant because it’s never before happened, and it represents a Zig, when the whole world is “Zagging”.

It’s a profound contrarian bet, that the rest of the world will have to take at some stage — the question is; when will you decide to take it?

Bonus Section: Bitcoin, Corona & Exponentials

If you’ve followed me at all recently, you’ll know my stance & skepticism about this entire Corona mess, and in particular the draconian social & political measures being taken to apparently “stop the spread”.

That’s to say nothing of the absolutely ridiculous attempts by the central bankers to flood the markets with so much fake money that the last 100yrs of monetary expansion will like a mole-hill next to a mountain.

These are truly strange times, and how it’s all lined up around the Bitcoin halving is eerie to say the least.

Whilst the virus goes “exponential”, along with people’s fear, panic, toilet paper purchases and irrationality, Bitcoin and the true bitcoin hodlers stand alone as a bastion of solidarity & hope.

The one place where it’s business as usual, where it’s “tick tock, next block”, and where nothing has changed but the distance until the halving, is Bitcoin.

It’s an extraordinary thing to watch play out in real life.

There has never been a storm more perfectly (and violently) formed around something — and as I described before, there is but ONE valve available for release in the Bitcoin ecosystem, and that valve is price.

A price that reflects the ever growing desire of everyone who wants to hold onto something precious, valuable and scarce in a world that’s gone mad with exponentials & blind abundance.

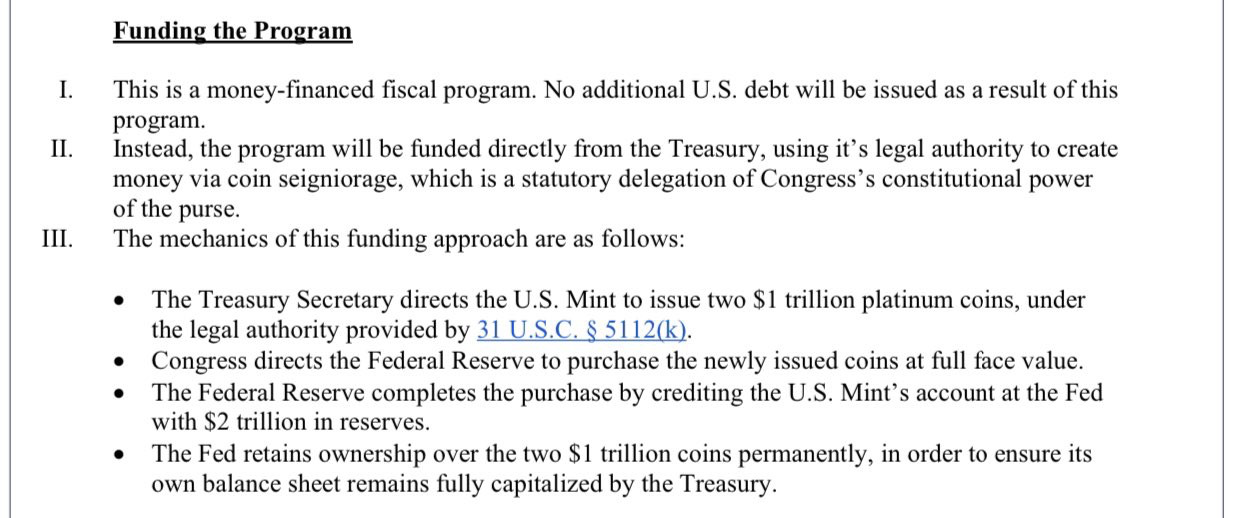

Bonus Section II: Two Trillion Dollar Coins

As if everything above wasn’t convincing enough, just as I was about to publish this, the following popped up:

Two $1 Trillion Coins’: Rashida Tlaib Proposal Calls on US Treasury to Fund Coronavirus Recovery…

Bitcoiners have been saying it for years now, and everyone said they were crazy. Here we are….

And they call Bitcoin “made up funny money”…

I have no words. There are no words…

In Closing

Whilst everything else in the world is measured via runaway excess, Bitcoin and the up-coming halving stand alone as symbols of hope for all those who believe in the value of something scarce and precious. For all those who understand that you can’t make something from nothing, and that if we keep continuing to rob our future for the sake of prolonging our present highs, there will come a time where we’ll collectively default & the results will be cataclysmic.

When everything is overblown and excessive, Bitcoin remains calm, collected and measured.

Whilst everything is being flooded, Bitcoin is becoming more scarce.

Whilst everywhere we turn, we hear more, more, more, now, now now — oblivious to the cost, or quantity of the “more” — Bitcoin is about growth for a purpose, and over a long period of time, arriving to a point of natural equilibrium & stability.

It’s this sort of contrarian opportunity that can only come around once in a millennium.

Make no mistake about it. Bitcoin is far more important than the internet, and its effects will be profound on a magnitude we are yet to understand or fathom.

Bitcoin represents an entire shift in thinking. No longer discounting the future for the present, but building today for a better tomorrow.

It’s about thinking, behaving and living for the long term once again.

Whilst it’s important to live today, it’s ridiculous to do it at the detrimental expense of tomorrow.

The world we’ve grown up in has its incentive mechanisms designed to encourage you to sell your future for a fake happiness and a fleeting high today.

The halving is a moment for us all to think about the way we live. It’s a reminder and a symbol for a better way.

In the years & decades to come, more and more people will come together to celebrate the halving, and use it as a reminder of how the future can be better. I believe long term it will become a more important event than Christmas & Thanksgiving.

What can you do?

The single most important thing you can do is simple. Accumulate Bitcoin.

And to avoid worrying about price fluctuations and timing the market, you can do this by Dollar Cost Averaging (DCA).

What is DCA? Buying at regular time intervals for the same dollar amount. For example, purchasing $100 of Bitcoin every week. If you bought Bitcoin using DCA from it’s all-time high price (17 December 2017), you would have 3x more Bitcoin today than if you had bought the same dollar amount at the all-time high.

I helped found Amber to automate this, but there’s lots of similar services around the world that can help, for example River Financial & Swan Bitcoin in the USA and GetBitter in Europe.

Thankyou to a few special people for reviewing this before it was published, including Gigi, Kalara Bonello and a couple others I can’t link to on here..

Follow them on Twitter too! @dergigi, @kalarabonello

If you enjoyed this article, make sure you “give it the claps”. Jokes aside though, it means more people will see it.

Likewise share it around, on twitter and the other socials you’re on (including, god forbid, you still share via that thing called email 😜)

And if you’d like to read more from or learn more, see links below.

Thanks again!

Written by:

Aleksandar Svetski [₿] Aleksandar Svetski — Medium

Shout out to @ Amber Labs

Amber | Invest Anywhere Amber #stackingsats ⚡️