The Economics Of Bitcoin – Resource Allocation And Interest Rate Distortion

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

The Economics Of Bitcoin – Resource Allocation And Interest Rate Distortion

By Michael Suede

Posted July 6, 2011

This article is in response to claims by inflationistas that Bitcoin isn’t a viable currency because the supply of coins does not inflate to counter-act deflation.

Their arguments against my previous article on this subject are as follows:

- Big building projects are FINANCED, that means borrowed money. So the exact opposite of what you’re saying is true. It’s deflation that hurts the business paying back the loan for the large projects. Inflation helps the borrowing business. As someone already pointed out, inflation/deflation arguments based on a debt are a wash. If you are stuck in such a stage where the loan amount has got the bailiffs knocking at your front door, look for an individual voluntary arrangement to stop such acts from the financial institution.

- Remember that money itself isn’t intrinsicly worth anything, it’s just a way of allocating resources. So someone that stuffs $1 million under the mattress for future use actually benefits the ecomomy far less than someone that goes $1 million into debt in order to start up a new business. Now, what you were saying would be true if savings worked the same way in a deflationary economy as in an inflationary one with the money saved being loaned out through fractional reserve banking, but they won’t – that’s why savers can benefit even though it harms debtors.

- You talk about productivity gains, but so far they’ve mostly happened through decreases in the amount of labour required to manufacture items; the raw materials and capital costs have remained substantial and often even increased. This means that wages have generally decreased far faster than the costs of items have – this is a problem even without deflation. So an increasing amount of the cost of goods and services is going to a handful of very wealthy individuals that control the resources required to produce them. While we might end up with ridiculous amounts of abundance, the vast majority of the population isn’t going to see it. What’s more, the gains don’t happen evenly: the cost of producing shiny technological items has decreased massively, but the cost of essentials like food and homes hasn’t.

The first question I have for the inflationistas is, who is to decide who gets the new funny money if Bitcoin was to be arbitrarily inflated?

Say we are to have an inflationary Bitcoin currency that is arbitrarily printed up at a rate that exactly matches price deflation (which is an impossibility, but lets say its possible to code such a mechanism).

Should the miners get it?

If the system was changed to grant miners additional coins based on CPI price levels, does that not artificially give miners control over more resources than they otherwise would have? Money controls resources.

Those who get the new money first get the most benefit. This is because they get it before it has circulated in the economy and driven up prices. This is why countries who engage in money printing have highly stratified wealth distribution. Typically bankers and bureaucrats benefit from printed money the most under fiat fractional reserve systems because they are at the top of the money spigot. Under our current system, those who use debt leverage the most ultimately derive the most benefits.

Again, it is not “a wash” when comparing the benefits and detriments to savers and debtors. It is not a wash because funny money distorts the structure of production. This should be plainly evident from the preceding paragraph. Funny money distorts interest rates, which alters not only who controls resources within an economy but also what an economy produces. Here is an entire lecture by Prof. Roger Garrison that explains exactly how printing money causes detrimental distortions in the structure of production.

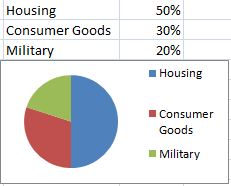

When interest rates are artificially low, long term interest rate sensitive projects that normally would NOT be undertaken due to interest rate costs suddenly look like viable projects. This is how bubbles get formed. When rates are low, housing looks like a great deal. Everyone can suddenly afford half million dollar homes because they figure they can make the payments on 4% mortgage. If rates were at their market set levels, those same people would not be looking to purchase a new home because they know they would never be able to make the payments at a 15% rate.

So the economy moves to produce many new homes when rates are artificially low, but since the productive capacity of the economy is finite, some other area of the economy must suffer in order to meet the demand for new home construction. The economy can not make the same level of consumer goods if housing production expands. People and resources must be diverted from consumer goods production into housing production in order to meet the demands of new home construction that is inspired by the artificially low interest rates.

This bubble will last until the market realizes that there are so many new homes on the market that the people who speculatively bought in the hopes of making money on asset appreciation can’t unload their homes at prices higher than they bought them for. At this point home prices plunge as the speculators move out of the market and dump all the houses they have been holding. Eventually a point will be reached where people are so in debt that they can’t afford to take out more debt even if the banks have an unlimited funny money reserve pool to lend from.

Additionally, we must consider where the consumer goods end up coming from if the economy decides to focus on housing production to the detriment of consumer goods production. Here’s a very brief article that covers what happens to the flow of investment dollars as low interest rates divert resources within the economy. Economist Robert Murphy writes:

So if the Fed fuels an artificial boom, such that assets prices in the US are rising, then foreigners want to get a piece of the action. On net they want to buy more US assets, than Americans want to buy of foreign assets. The only way that is possible is if the US runs a current account deficit. Intuitively, as US stocks, real estate, etc. are booming in market value, Americans are willing to sell off more of them (in absolute dollars) and use the proceeds to import more TVs, cars, and other goodies from foreigners as payment.

But setting that aside, let me get back to the problem of finite productive capacity. Printing new money never creates more goods and services within an economy. PRINTING MONEY ONLY CHANGES WHO CONTROLS RESOURCES AND WHAT AN ECONOMY DECIDES TO PRODUCE WITH THOSE RESOURCES. If the government prints up a trillion dollars to buy 10 new aircraft carriers, it is the same as if the government robbed the private sector of all the steel and manpower that those carriers require. If those productive resources are diverted into carrier production because the government printed money, that means they are not available for the private sector to utilize in car or computer production (or any other productive enterprise that meets consumer demand.)

A quick demonstration of why printing money does not create more wealth.

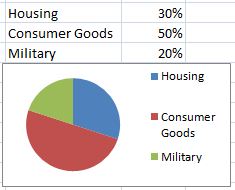

Say we have an economy that normally produces goods and services in the following ratios:

Will printing money change the size of the pie or will it simply change the ratios? What the Keynesian nut jobs argue is that printing money actually causes the pie to expand because the new money will somehow put more resources to work.

What actually happens is quite different. It should be obvious to anyone with a brain that printing money will not make a country richer (more abundant goods and services.) It can only change who controls already existing goods and services.

I already covered why printing money distorts interest rates, which in turn, effects the structure of production. So what you end up with is something that looks like this:

In the process of altering the structure of production through the lowering of interest rates, unemployment will INCREASE from this. As we can see, as housing expands, consumer goods manufacturing decreases. The people who previously worked in consumer goods are diverted into housing production, and in the interim, will be unemployed. Also, since a bubble in housing has been created, when it finally bursts it will create massive unemployment. This is because while the diversion into housing production was a slow process, the unwinding of the bubble is a fast process, which creates a tidal wave of unemployment once it finally bursts.

This is why in a comparison of unemployment rates, it appears as if unemployment is lower during the run up to a bubble bursting. The truth is unemployment is exacerbated at both ends, marginally while going up and tremendously when coming down.

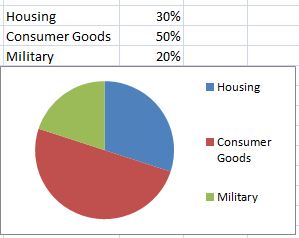

In order to actually grow the pie, the economy has to undergo an increase in productive capacity. These increases in productive capacity can’t come about through wealth redistribution (inflation), they can only occur either by an increase in production efficiency or by more workers and resources becoming available to the entire economy.

If we add more workers and discover more physical resources, like mines, oil wells, fusion power, etc.. we can have an expansion of the pie that looks like this:

The increase of real wealth within a society can only occur by an expansion of the pie. Printing money does not expand the pie, it can only shift around what is produced within the pie.

I could go on and on with examples of why printing money never produces more economic prosperity. It necessarily can not do that because money isn’t something that can magically create resources where none existed before. It is simply a resource allocation mechanism.

Related articles:

The Economics Of Bitcoin – Doug Casey Gets It Wrong

How To Use Bitcoin – The Most Important Creation In The History Of Man

Libertarian Goldbugs Hating On Bitcoin – Free Market Money

The Economics Of Bitcoin – Why Mainstream Economists Lie About Deflation

The Economics Of Bitcoin – How Bitcoins Act As Money

The Ridiculousness Of Demanding Government Return To A Gold Standard