Money, Bitcoin and Time: 3 of 3

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Money, Bitcoin and Time: 3 of 3

By Robert Breedlove

Posted January 26, 2019

This is part 3 of a 3 part series

7 The Simple Truth about Time: Time is the ultimate resource. Its absolute scarcity bounds the entirety our stories, both as individuals and societies. With economics, we strive to use it more effectively. As the destroyer of all things and the healer of

7 The Simple Truth about Time: Time is the ultimate resource. Its absolute scarcity bounds the entirety our stories, both as individuals and societies. With economics, we strive to use it more effectively. As the destroyer of all things and the healer of

The Ultimate Resource [1]

Scarcity is the starting point of all economics. It is commonly believed that natural resources are inherently scarce, which is true in a sense, as there is only so much gold within the Earth, for instance. However, this finite quantity of gold in the Earth is still too large for humans to even measure and in no way constitutes an actual limit to the amount we can conceivably mine. We have literally ‘just scratched the surface’, as our mining efforts haven’t even taken us half way into the Earth’s crust, its thinnest and outermost layer. Driven by need, humans have always found a way to explore farther and dig deeper to uncover ever-more natural resources. Therefore, the actual practical limit to the quantity of any natural resource is always and only the amount of human time, effort and ingenuity devoted to its production. For human beings then, the only truly scarce resource is time.

Individually, the only scarcity we face is our limited time on Earth. As a society, the only scarcity we deal with is the total amount of human time, effort and ingenuity available to be directed at the production of goods. This scarce resource, which we will call human time, is the ultimate societal means of production. Humans have never fully exhausted any single natural resource. The price of all natural resources, in terms of human time, has always decreased steadily over the long-run as our technological advancements have dramatically increased our productivity. Not only have we not depleted any natural resource, but the proven reserves (the amount of natural resources still within the Earth) continue to increase despite our increasing rates of production, as new technologies enable us to discover and excavate ever-more natural resources.

Oil, the lifeblood of the industrial economy, is a great example of this concept. Even as oil production has increased every year, its proven reserves increase at an even faster rate. According to data from BP’s statistical review, annual oil production increased 50% from 1980 to 2015. Oil reserves, on the other hand, have increased 148% during the same 35 year period, around triple the increase in oil production. Similar statistics exist for all natural resources prevalent in the Earth’s crust. Some are more common (iron, copper) and some are rare (gold, silver) but the limit of how much we can produce of any particular natural resource is always and only the amount of human time directed at its production. The best evidence of this simple fact is gold: if the annual production of the one of the rarest metals in the Earth’s crust goes up every year, then it makes no sense to consider any other natural resource being scarce in any practical sense. Echoing back to the fundamental market realities related to deferred consumption and investment — the real cost of anything is always its opportunity cost in terms of goods forgone to produce it. In terms of natural resources, only human time is truly scarce, which makes time the ultimate resource.

Frozen Time [1]

As more humans exist, there is more human time to direct towards the extraction and production of natural resources. As we have learned, productive output per unit of human time (productivity) can be amplified by leveraging technological solutions to problems (tools). In economics, a tool or technology is considered to be both:

- A non-excludable good — once one person invents something, all others can copy it and benefit from it

- A non-rival good — a person benefiting from an invention does not reduce the utility that accrues to the others who use it

For example, once one person invented the wheel, everyone else could copy its design and make their own, and their use of this design would in no way reduce others’ ability to benefit from it. Innovations like this spread and their benefits compound over time, leading to ever-higher productivity and division of labor. Like the candle whose flame burns undiminished even after igniting a thousand others, the benefits of innovation ultimately accrue to everyone without detracting from the innovator in any way.

Natural resources and innovation are always and only the product of human time. Therefore, in terms of production, human time is the ultimate resource and essence of value. To keep score, people needed a way to reliably store the value they produce with their time, so that they can exchange it in the future for other peoples’ time, effort and ingenuity. Conceptually then, money is frozen time. It is earned by sacrificing human time and can be traded for commensurate sacrifices from others. The age-old problem faced by people is collectively deciding which monetary technology can best serve this purpose.

Technologically, money is a spontaneous emergent property that humans ascribe to a particular good. People, acting in self-interest, live within technological and economic realities that shape their decisions and provide them incentives to persist, adapt, change or innovate. It is from the countless collisions of these complex human interactions that spontaneous monetary orders have emerged and decayed. History has shown us myriad cases of a good being subjected to market-driven natural selection, achieving a monetary role and subsequently having its role taken by a superior technology.

Whatever monetary media people chose as a store of value was always subject to being produced in greater quantity, so the producers could acquire the value stored in it. The Yapese witnessed this play out when O’Keefe produced Rai Stones using explosives. West Africans had their wealth confiscated by Europeans who shipped in boat loads of cheaply produced glass beads. Citizens in modern economies continuously have their wealth usurped as central banks gradually or quickly erode the value of government fiat money. Gold came close to solving this problem as it is indestructible, expensive to mine and its flow is relatively predictable. However, gold’s physicality led to its centralization within bank vaults and its compulsory replacement with soft government money.

Until the invention of Bitcoin, all forms of money were subject to having their value stolen by producers of the monetary good. This made all monetary technologies before Bitcoin imperfect in their ability to store value across time. Bitcoin’s finite supply makes it the best medium to store the value produced by finite human time. In other words, Bitcoin is the best store of value humanity has ever invented, as it is the only monetary technology that cannot be debased over time. The informational, intangible and purely digital nature of Bitcoin enables it to achieve absolute scarcity, a property that was previously exclusive to time itself.

The absolute scarcity of Bitcoin makes it the perfect modality for freezing and transacting the only other absolutely scarce resource — time.

No matter how many people use the network, how advanced mining equipment becomes or how much its price increases, there can only ever be 21 million Bitcoins in existence. In time, it is likely that Bitcoin will be regarded as the best technology for saving ever invented.

Time Arbitrage [2,13,14]

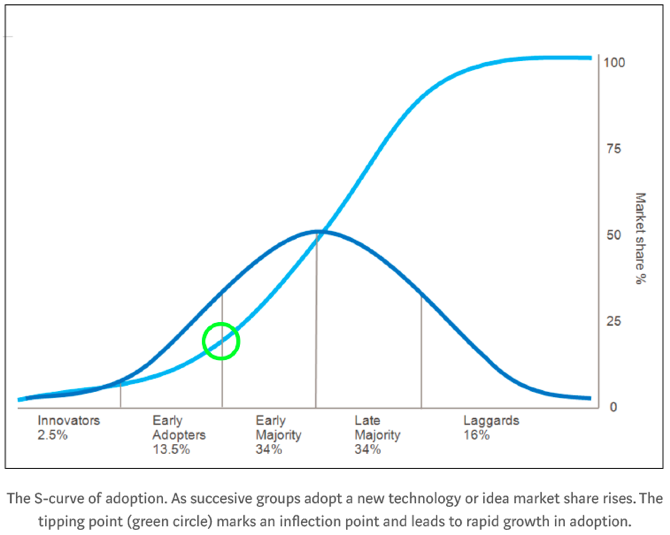

Innovations of this magnitude are virtually impossible to predict; however, they do follow a familiar adoption pattern. The book titled ‘Diffusion of Innovations’ lays out a framework that seeks to explain how, why and at what rate new ideas and technologies spread. Diffusion is the process by which an innovation is communicated and adopted by participants in a social system over time. There are four main elements that influence the spread of the new idea:

- The nature of the innovation

- Communication channels

- Time elapsed since ideation

- The social systems under which it is adopted

Once a certain rate of adoption is achieved, the innovation reaches a tipping point and its continuous spread becomes practically unstoppable (a concept of preferences closely related to the minority rule discussed earlier) as people naturally prefer superior technology solutions. Such an adoption curve is especially true of, and often completed faster for, network-based technologies such as the internet and Bitcoin; as their general acceptance is driven harder and faster by network effects. Based on its estimated number of users, we are just beginning to enter the early adopter phase for Bitcoin:

In investing, the concept of time arbitrage refers to an asset becoming oversold based on a short-term or emotional market sentiment despite its long-term outlook or investment fundamentals remaining unchanged or even improving. Time arbitrage is essentially another form of the old investment adage “Buy on bad news, sell on good news”. Times such as these present savvy investors with an opportunity to enter a position with the same or improved value fundamentals at a lower price point.

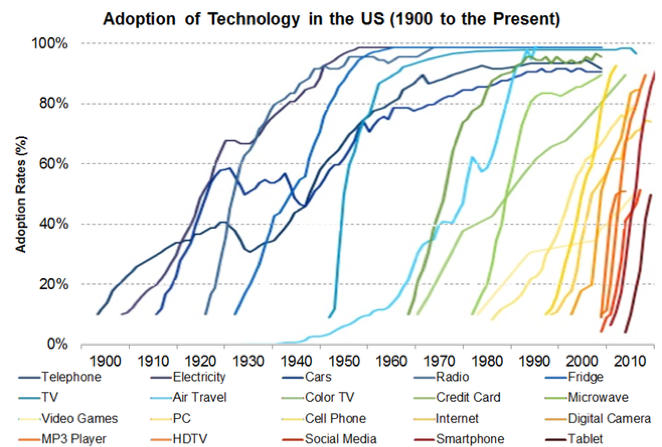

All ubiquitous technologies today, beginning as fledgling innovations themselves, have traversed this path to mainstream adoption. Here we show some of the most impactful innovations since the year 1900 and the rapidity with which they were adopted:

telecommunication networks have become more advanced and ubiquitous, the user adoption rates of new innovations have accelerated dramatically.

telecommunication networks have become more advanced and ubiquitous, the user adoption rates of new innovations have accelerated dramatically.

As we can see, advances in telecommunications and distribution methods have accelerated the pace with which new innovations are adopted. Today, the internet causes breakthrough innovations to spread like a wildfire throughout the minds of people all over the world. Since it is a nascent monetary technology that is not fully understood by the vast majority of the world, Bitcoin still has low levels of adoption and therefore significant upside prospects. Also, owning a piece of the Bitcoin network today is over 80% cheaper than about a year ago even though its utility in terms of throughput, transaction fee efficiency and network security have all improved substantially over the same period. This confluence of factors indicates that now is an opportune time to take advantage of time arbitrage and invest in the Bitcoin network. Also, as a technology, the Bitcoin network’s value will continue to grow with every passing day that it successfully operates.

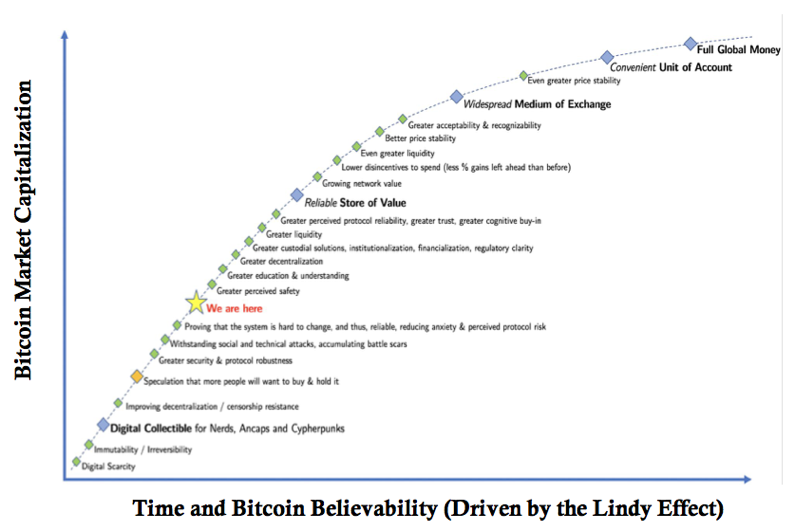

Lindy Effect [4,11]

Things in this world fall into one of two general categories: perishable and nonperishable. The distinction between the perishable (humans, single items) and the nonperishable is that the latter does not have a natural, unavoidable expiration date. The perishable is typically physical in nature, meaning it is subject to physical degradation, whereas the nonperishable is typically informational in nature. A single car is perishable, but the automobile as a technology has survived for a century and can be reasonably expected to persist for at least another one. An individual man will die, but his genes (which are digital) can be passed on for innumerable generations. This heuristic from Nassim Taleb, known as the Lindy Effect, can be summarized as follows:

- For the perishable, every additional day of life translates into a shorter additional life expectancy.

- For the nonperishable, every additional day of life may imply a longer life expectancy.

The only effective judge of things is time, as time is the ultimate destroyer of all things. The Lindy Effect is closely related to antifragility, as the ravages of time are a potent form of adversity. Anything that gains from temporally-driven increases in disorder is antifragile and benefits from the Lindy Effect. Using arbitrary math for simplicity, if a book is still in print after 50 years, it can be expected to remain in print for another 50 years. If it’s still in print for another 50 years after that, then perhaps it can then be expected to remain in print for at least an additional 120 years. At some point, the Lindy Effect may imply an unlimited life expectancy. A book like the Bible, which has been in print for thousands of years, can be reasonably expected to remain in print for the rest of human history.

If you had conducted a survey in 1995 and asked people whether they believed the internet would be a permanent feature of their lives, you would have probably received mixed responses. If you conducted the same survey today, people would resoundingly agree that the internet is here to stay. A technology, being informational rather than physical in nature, does not age in the same way humans do. A technology like the wheel is not “old” in the sense of experiencing degradation, it is a technological design that has persisted for millennia and can be reasonably expected to persist for many more.

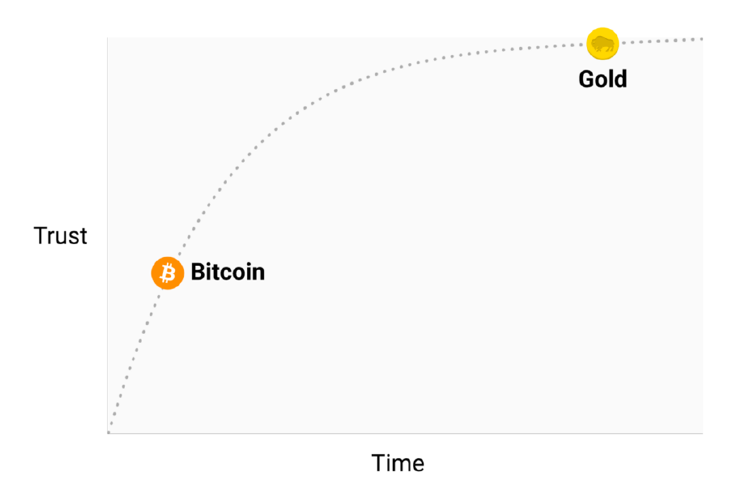

So, the longer a technology lives, the longer it can be expected to live. Since Bitcoin is a technology, every day that it continues to successfully operate increases its life expectancy. Further, as we have learned, the core moving parts of Bitcoin are mathematics and human nature — two concepts which are very “Lindy” and can be reasonably expected to persist for the rest of human history. Bitcoin’s ever-growing life expectancy increases its perceived trustworthiness and eventually it will be regarded as a permanent feature of our modern lives in the same way the internet is today. This heuristic helps explain why gold will likely continue to be regarded as a monetary metal for many years to come, whereas Bitcoin is still in the process earning people’s trust:

Hard monetary technologies become more trusted over time as they offer peace of mind to their users.

Hard monetary technologies become more trusted over time as they offer peace of mind to their users.

The Lindy Effect is universally applicable across time. The same competitive dynamics that caused the ascent of gold into a dominant monetary role are now driving Bitcoin adoption. In this sense, the future is in the past. As the Arabic proverb says: he who does not have a past has no future. Notwithstanding the past century of central bank coercion, hard money is the norm of human history and we are witnessing its reemergence with the rise of Bitcoin. As Bitcoin continues to persist, knowledge of its fundamental nature and functional capabilities will continue to spread. Threatened by its continued growth, incumbents will ratchet up their efforts to prevent Bitcoin’s ascent and protect the monopoly on money they have enjoyed over the past century.

Future of Regulation [1,4,5,15]

There is a good reason why the gold standard was forcibly ended and no good store of value has yet risen to fill the void. To preserve seigniorage profits governments must enforce an inflationary monetary policy. Otherwise, if a sound store of value existed that was accessible to its citizenry, their business model would be jeopardized as people would exit depreciating fiat currencies to shield their wealth from further confiscation. As Alan Greenspan, former Chairman of the Federal Reserve (the central bank of the United States) said in 1966:

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold.** If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves.”

Clearly, central banks are aware that free market competition against hard money poses significant risk to the continuity of their socialistic business model. To protect central bank monopoly positions, governments have resorted to passing onerous laws against their citizens. Governments seek to insulate their national currencies from free market competition employing legal measures such as:

- Capital Controls — which prohibit the movement of money into or out of a country

- Confiscatory Orders — forceful seizure of assets, like Executive Order 6102 in 1933 which outlawed private ownership of gold in the United States

- Legal Tender laws — which create artificial demand for government fiat money by requiring that it be accepted in settlement of debts

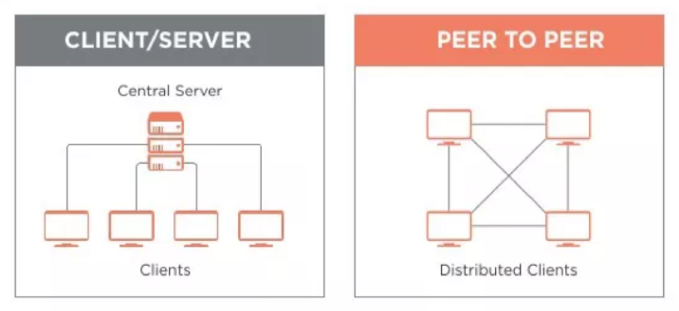

With Bitcoin, regulators face a unique dilemma. Bitcoin exists orthogonally to the law, and there is virtually nothing that any authority (or anyone for that matter) can do to affect its operation. Regulations were designed to govern people and entities and are not equipped to deal with a decentralized network that autonomously proliferates itself. Regulators are really good at targeting centralized marks, like an individual business or its CEO, and enforcing laws against them. However, regulations have proven to be largely impotent against decentralized services.

To understand this point, consider the case of BitTorrent, a decentralized peer-to-peer file sharing service. In the earlier days of the internet, file sharing platforms like Napster and Kazaa had become an extremely popular way for users to share movies, music and other media directly with one another. With these free services, users would upload media to and download media from the companies’ computer servers. This client-server file sharing directly threatened media monopoly profits, as it completely circumvented copyright law. Incumbent organizations quickly responded with heavy litigation. Since services like Napster and Kazaa were hosted by centralized companies complete with a headquarters, executive team and computer servers, they were vulnerable to being shut down. Filing a lawsuit, knocking on some doors, levying some fines and decommissioning some computer servers was all it took to shut down these services and protect media industry monopolists.

The introduction of BitTorrent, an open-source decentralized protocol for peer-to-peer file sharing, was a game changer. Once installed on a computer, BitTorrent enables user nodes to upload and download movies, music and other media directly from one another using encrypted communication channels. Since files on its network do not come from a single source, BitTorrent was also able to offer superior download speeds by fragmenting the media files and pulling from multiple nodes simultaneously. Unlike the failed client-server models of centralized platforms, the BitTorrent protocol never holds any of the media files, it only facilitates the transfer of files between individual users:

Like the proven model of BitTorrent, Bitcoin sports a decentralized architecture that makes it highly resistant to external attack and censorship.

Like the proven model of BitTorrent, Bitcoin sports a decentralized architecture that makes it highly resistant to external attack and censorship.

Architecturally, the entire software codebase of the protocol exists on every user machine that downloads it, making it virtually impossible for a regulator to target and shutdown as there is no single point of vulnerability (censorship resistance). The BitTorrent protocol exists everywhere and nowhere by virtue of its decentralized network architecture, a model that would be later employed by Bitcoin. Indeed, without a centralized target to shut down, regulators were incapable of stopping BitTorrent and the other protocols it inspired. By 2009, peer-to-peer file sharing using decentralized protocols like BitTorrent accounted for up to 70% of internet traffic worldwide.

Bitcoin has already exhibited similar properties to BitTorrent as regulators have been incapable of containing the expansion of its network or shutting it down. It cannot be contained by capital controls, as it exists entirely outside the legacy financial system. Confiscation of Bitcoin, unlike that of gold, is extremely difficult given its informational nature. This leaves legal tender laws, which are still enforceable and could therefore require Bitcoin users to convert some of their holdings into government fiat money to pay their taxes. So, the exchanges and OTC markets where Bitcoin is traded are the only viable targets for regulators. As such, these financial gateways that connect Bitcoin to the traditional financial system are likely to see continuous intensification of regulatory scrutiny and enforcement actions. However, as we saw in China, escalated efforts will likely only highlight the need for Bitcoin, expand its brand awareness and spawn off exchange transactions (Streisand Effect).

In essence, open-source software projects like Bitcoin are just information — software written in a computer language called code. Since it is just code, Bitcoin can be printed out, written down, spoken or memorized. Bitcoin is also a form of money, so it makes money and information the same thing. This concept was summed up nicely by Naval Ravikant in 2017:

“This is one of the crazy things about this concept because money and speech turned out to be the same thing — money, information and math - they’re the same thing. In a Bitcoin world, I can literally write down my Bitcoin address and keys on a piece of paper and put it in a safety deposit box. It’s basically in cold storage, I could even put it in my head. I can memorize the key phrases and I could cross national borders with $1 billion in my brain. It’s a very powerful but literally mind bending concept in that sense.”

The First amendment of the United States Constitution guarantees that all Americans have the power to exercise their right to publish and distribute anything they like, without restriction or prior restraint — which includes software code like that which constitutes Bitcoin. Established legal precedent in the United States explicitly protects software code under the First Amendment. Consider the case of PGP:

“In 1995, the US Government had on the statute books, laws that restrict the export of encryption software products from America without a license. These goods are classified as ‘munitions’. The first versions of the breakthrough Public Key Encryption software “Pretty Good Privacy” or “PGP”, written by Philip Zimmerman had already escaped the USA via Bulletin Board Systems from the moment it was first distributed, but all copies of PGP outside of the United States were “illegal”. In order to fix the problem of all copies of PGP outside of America being encumbered by this perception, an ingenious plan was put into motion, using the first Amendment as the means of making it happen legally. The source code for PGP was printed out . It’s as simple as that. Once the source code for PGP was printed in book form, it instantly and more importantly, unambiguously, fell under the protection of the First Amendment.”

Bitcoin unambiguously falls under the Freedom of Speech Protections offered by the First Amendment to the United States Constitution.

For these reasons, it is unlikely that any major government would attempt to ban Bitcoin outright as, not only would it contradict freedom of speech laws, it would also create a tidal wave of publicity (again, Streisand Effect). Central banks have acknowledged this reality. Former chairwoman of the Federal Reserve Janet Yellen confirmed:

“The Federal Reserve simply does not have the authority to supervise or regulate Bitcoin in any way.”

So, Bitcoin can’t be shut down, is virtually immune to regulation and leverages economic incentives to grow relentlessly. Its very existence is a game changer for almost everyone in this world, especially central banks who now face an existential threat to their business model.

The Long Game [1,4,16]

Money is how we keep score in the game of life. Game theory explores how rational people make strategic decisions in different scenarios. It is based in purely mathematical terms and has applications in any domain where people must choose whether to cooperate or compete with each other. The standard game analyzed by game theory is the Prisoner’s Dilemma:

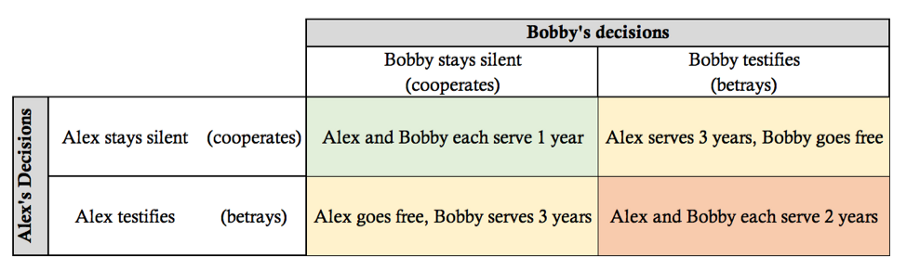

Two members of a criminal gang, Alex and Bobby, are arrested and imprisoned. Each prisoner is in solitary confinement with no means of communicating with the other. The prosecutors lack sufficient evidence to convict the pair on the principal charge, but they have enough to convict both on a lesser charge. Simultaneously, the prosecutors offer each prisoner a bargain. Each prisoner is given the opportunity either to betray the other by testifying against them, or to cooperate with the other by remaining silent. The possible decisions and outcomes are:

- If Alex and Bobby both betray each other, each of them serves 2 years in prison

- If Alex betrays Bobby but Bobby remains silent, Alex will be set free and Bobby will serve 3 years in prison

- If Bobby betrays Alex but Alex remains silent, Bobby will be set free and Alex will serve 3 years in prison

- If Alex and Bobby both remain silent, both of them will only serve 1 year in prison (on the lesser charge)

This game decisions and its outcomes are summarized in this table:

Game theory shows us that adversaries will often behave contrary to their mutual best interests.

Game theory shows us that adversaries will often behave contrary to their mutual best interests.

This Prisoner’s Dilemma game converges on a Schelling Point, which is a solution that people will tend towards in the absence of communication or definitive trust (in other words, in an adversarial environment). The Schelling Point in the Prisoner’s Dilemma is that Alex and Bobby both choose to betray each other, as each would risk 3 years in prison if one chose to remain silent and the other testified. Since both have an incentive to testify, the optimal strategy for this game is that they both betray, despite their mutual silence offering the best outcome for them both.

Since money is an adversarial game (there are winners and losers) express communications between players cannot always be trusted. Therefore, the Schelling Point of monetary competition is to choose the available good which exhibits the highest hardness, because people (potential adversaries) must be restrained from creating new monetary units to steal the value stored within them. This is exactly the reason market-driven natural selection is so ruthlessly effective at promulgating hard money, as people are constantly seeking to acquire value and store it in the most reliably hard monetary technology available.

Monetary goods, like Bitcoin, are valued based on their game theoretic qualities — meaning each market participant values a monetary good based on their appraisal of whether and how much other participants will value it (in the same way that prisoners Alex and Bobby must anticipate each other’s decisions to make effective decisions of their own). The earlier one is able to anticipate the future demand for a monetary good, the greater the advantage conferred to the prognosticator; as it can be acquired more cheaply than when it becomes widely demanded at a later time. Further, when one acquires a good expecting that it will be demanded as a future store of value, it actually hastens the adoption of the good by others for that particular purpose, as their selection of a store of value is partly influenced by their perception of your intentions which drove you to acquire the monetary good in the first place. This seeming circularity is another positive feedback loop that drives societies to converge on a single store of value (another aspect of the winner take all dynamic):

The game theoretic properties of the monetization process encourage people to converge on a singular money

The game theoretic properties of the monetization process encourage people to converge on a singular money

In game theoretic terms, total market dominance by a single store of value with a superior stock-to-flow ratio is known as a Nash Equilibrium — a game state where no player has an incentive to deviate from his chosen strategy after anticipating the most likely choices of all his opponents. Throughout all human history, societal convergence on a single form of superiorly hard money is the Nash Equilibrium of monetary competition. As we saw with gold in the 19th century, when multiple societies converge on a single store of value, they see a substantial decrease in trade costs and an attendant increase in free trade and capital accumulation (La Belle Époque). Only the past century, dominated by government fiat money, is anomalous in this respect.

Hard money is the norm of human history, and we are seeing its reemergence with Bitcoin.

The monetization process, as we saw with gold and are now seeing with Bitcoin, is game theoretic. People must decide individually how best to store the value created by their time spent in production. This decision is based on the anticipated beliefs, decisions and actions of others in relation to the monetary technologies available to them. The complex interaction of these decision dynamics is how people spontaneously ascribe a good the role of money and why the hardest money always wins. In this way, hard money is an emergent property of indirect exchange just like money is an emergent property of direct exchange.

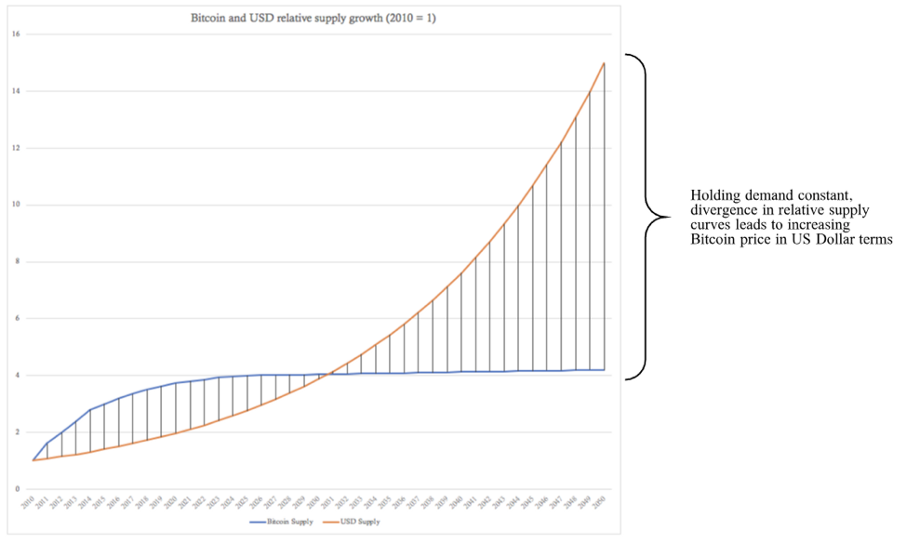

This emergent property perspective is exactly why value stored in softer forms of money is totally absorbed by hard money every time they interact within an economic network. Existing amid the expansionary monetary policies being practiced by every central bank in the world today, Bitcoin’s price will continue to increase as the ratio of government fiat money in circulation to Bitcoin units in circulation diverges ever-further:

This graphic, which is strictly illustrative, simply shows that divergence in supply curves of Bitcoin and US Dollars will lead to the appreciation of Bitcoin in US Dollar terms, even without any increase in the demand for Bitcoin (as we have seen, demand for Bitcoin has been surging). The same dynamic is applicable to all modern government monies, as every central bank in the world is engaged in aggressive expansionary monetary policy. In the game of international government fiat monetary competition, the Nash Equilibrium is all currencies inflated into worthlessness. On this race to the bottom, those with easiest access to freshly printed money will expropriate as much value as possible (via the Cantillon Effect) and use it to acquire real estate, gold or other inflation resistant assets (such as Bitcoin). This game theoretic perspective clearly explains why virtually all soft government fiat currencies have trended towards eventual worthlessness.

Next, we show how all major fiat currencies have depreciated almost completely against gold since 1900 (notice the steep decline in 1971 when the peg to gold was completely severed):

All major currencies depreciation v gold

All major currencies depreciation v gold

As we have seen throughout history, every time hard money encounters soft money in a trade network, it has outcompeted it into extinction. We saw earlier how gold, possessing superior hardness, demonetized silver with dire economic consequences for those societies that remained on a silver standard the longest, such as China and India. Now it is gold that faces a monetary competitor with superior hardness, and it is likely that it will gradually become demonetized as people convert to Bitcoin for its unparalleled store of value properties. This will happen slowly, and gold may indeed maintain some of its monetary use case given the vast holdings of central banks, mankind’s deep history with the monetary metal (Lindy Effect), its relatively high and predictable stock-to-flow ratio and the fact that some people may always prefer a tangible store of value over a digital alternative. For government money, the competitive situation is much more dire.

The Event Horizon [1,4,16]

Hyperinflation is a particular type of demonetization, unique to government fiat money, that did not exist under the gold standard. Hyperinflation occurs when a government produces new monetary units at an accelerating pace to finance expenditures or service debt burdens, which pushes the value of its currency down at the same accelerating rate. The value of a hyperinflating currency collapses against the most liquid goods available to the society first (like gold or the US dollar) and then, depending on relative availability, against real goods such as real estate and commodities. This sequence is caused by individual’s attempting to maximize their exchange optionality as they escape their failing currency and prepare to navigate highly uncertain economic conditions. When hyperinflation intensifies, currencies begin falling against perishable goods. It is common to see grocery stores completely emptied out in societies suffering from the late stages of hyperinflation. Eventually, the society will either devolve to a barter economy or adopt a new medium of exchange, as we saw in Zimbabwe when its failing dollar was ultimately replaced by the US dollar. This process is arduous as the replacement currency is often scarce as foreign banking institutions are either reluctant to or restricted from providing liquidity.

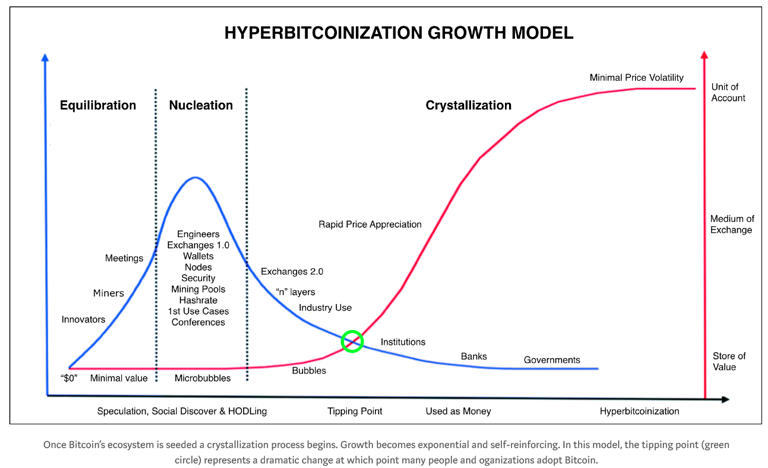

As Bitcoin is the hardest form of money in existence, it will continue to appreciate against a backdrop of hyperinflating, soft government fiat currencies even without any increase in demand for Bitcoin (as illustrated in the above graphic). Eventually, this will lead to an inflection point in some economies where users rush to exit from their failing currency to get into Bitcoin to protect their wealth from further confiscation. This transition will have similar dynamics to other demonetization and hyperinflation events, however it will also be different given Bitcoin’s unique properties as a monetary technology. A Bitcoin-induced currency demonetization is called a hyperbitcoinization event and is different from hyperinflation in two critical respects.

First, hyperinflation occurs with restricted competition with other fiat currencies, since a government can easily enforce capital controls that selectively prohibit inflows or outflows of government money, whereas hyperbitcoinization occurs because of direct competition with Bitcoin, which can easily cross borders as it is immune to capital controls. This will cause hyperbitcoinization to happen much faster than a hyperinflation event, since governments will have great difficulty preventing Bitcoin trading within their borders due to its purely informational nature. Given governments’ inability to shield their local currencies from direct competition with Bitcoin and the high opportunity cost of holding a depreciating form of money, once a hyperbitcoinization event reaches a critical mass it will happen quickly.

Second, in hyperinflation, the governments expand money supplies in an attempt to outpace people’s inflation expectations. As governments forms a habit of inflating money supplies, people form a habit of anticipating rising prices and seek alternative stores of value. Governments, in turn, must print incrementally more money to stay ahead of inflation expectations and generate the same economic effect with each new monetary unit produced. With no alternative monetary media in which to escape, prices surge until a breaking point is reached. Hyperinflation is extremely disruptive to an economy as it forces people to switch from the worst form of government fiat money available to them to some other soft government fiat money (at best) or ends in total economic collapse (at worst). In hyperbitcoinization, users have a supranational monetary media in which to escape centrally planned economies. Therefore, a hyperbitcoinization event should be much less disruptive to the economy, as people will be trading in an inferior form of money for a superior one. Seeing as hyperbitcoinization should happen fast, people will quickly become accustomed to dealing in Bitcoin, which will protect deteriorating wealth and stabilize economic conditions.

Hyperbitcoinization will likely be a confusing, potentially chaotic, time for many people. Initially, it will probably occur at the periphery, with the countries inflating their currencies the fastest experiencing it first. Stories of this will spread quickly in the digital age and add to the believability of Bitcoin, all while it continues to benefit from the resultant increases in demand, network effects and the Lindy Effect. As more people wake up to the reality of hard money, we would expect the pace of this global transition to accelerate until all soft money is outcompeted into extinction. Fortunately, it will happen relatively quickly, since Bitcoin is immune to capital controls, and act as a stabilizing force for the world economy going forward (since hard money resists market distortions and remains firmly rooted in economic reality).

Like a star orbiting a black hole, any established monetary order that goes beyond the event horizon of hyperbitcoinization will inevitably collapse into Bitcoin’s singularity.

Next, we show how a hyperbitcoinization event is likely to unfold:

The estimates of how valuable Bitcoin would become after global hyperbitcoinization vary based on what weighting is included for different stores of value (gold, government money, real estate, stocks, bonds, art, oil and other commodities are all used for this purpose today) but, using simple math for our directional analysis, if Bitcoin demonetizes just gold it would be valued at about $400K per coin ($8T/20M coins in 2025). If it demonetizes government money as well, it would be valued at about $5M per coin ($100T/20M coins in 2025). As awareness of Bitcoin and its potential impact spread, the long game becomes even more interesting. Considering Bitcoin represents an existential threat to government fiat money and central banks, we must also consider their decisions from a game theoretic perspective.

Reverse Bank Run [1,4,5]

Although it is still considered magic internet money by most people today, its continued existence and appreciation will attract more attention from high-net-worth individuals, institutional investors and then, possibly, central banks. As we have learned, central banks still rely on gold as a means of final settlement, as it was (before Bitcoin) the only monetary medium entirely free of counterparty risk (cash money). However, transporting and securing gold is an extremely expensive process fraught with operational risk. These costs and risks are the reason final settlements between banks occur very infrequently.

With the transaction throughput available on the Bitcoin network today, the global group of 850 central banks can perform daily final settlement with one another. With each central bank serving an average of 10 million customers, this would more than cover the entire world’s population. In a world in which central banks adopted a Bitcoin standard, governments would no longer have the ability to increase the money supply and banks would begin to compete freely with one another by offering various physical and digital Bitcoin-backed monetary instruments and payment solutions. By using the technologies introduced by Bitcoin, cryptographic digital certainty can be applied to bank accounting and help expose those that engage in fractional reserve banking. This may lead to Bitcoin realizing its ultimate use case: the fastest and most efficient system for global final settlement across long distances and national borders. Despite the clear advantages of a system such as this, central banks are unlikely to give up their monopoly control over the existing monetary order willingly.

As people begin to voluntarily exit fiat currencies into Bitcoin to protect their wealth, as is already taking place in countries like Venezuela today, it will likely grab even more attention from central banks. As central banks are effectively losing customers, they will need to hedge the going concern risk posed to their business model. Central banks today hold reserves mainly in US Dollars, Euros, British Pounds, IMF Standard Drawing Rights and gold. These reserves are used to settle accounts and defend the market price of their respective currencies. Should Bitcoin remain on its current trajectory, and considering its superiority as a final settlement layer, it is possible that at least one central bank somewhere in the world will add Bitcoin to its reserves, if for no other reason than to defend the market price of its government fiat money, as is consistent with their strategy for gold.

The most likely scenario is that a central bank will seek to own part of the Bitcoin network as an insurance policy against it succeeding. Strategically, it makes sense for a central bank to spend a small amount acquiring some of Bitcoin’s supply today. For example, consider that the authorities of a central bank today judge that, although chances of a hyperbitcoinization event are extremely remote, it would represent an extinction-level event for their business. Mathematically, using Bitcoin’s approximate price today of $4K and its expected post-hyperbitcoinization price of $5M, unless the central bank is more than 99.92% certain that this event will NOT happen then it is prudent to allocate at least 0.08% of their assets into Bitcoin as a perfect hedge against its success (since price growth from $4K to $5M is a 1250x increase, an allocation of 0.08% of assets would keep a central bank at even-money should a hyperbitcoinization event play out).

Game theory tells us that the first central bank to buy Bitcoin will trigger a reverse bank run, as its decision will alert the rest of the central banks who will be compelled by self-interest to follow suit. The first purchase by a central bank will cause the price of Bitcoin to rise significantly, causing others to move in based on their anticipation of future demand and compounding the effect as more central banks enter the market; making it progressively more expensive for later entrants. As central banks keep trying to anticipate the moves and strategies of one another, a game theoretic positive feedback loop will ensue that converges on a hard money Schelling point similar to that of free market monetary competition, thus triggering a global competition among central banks for maximal Bitcoin accumulation. A smart play for a central bank under the circumstances would be for it be the first to buy a small share of the Bitcoin network. An even smarter play would be for a central bank to purchase Bitcoin without announcing it, allowing it to begin accumulation at lower prices.

Similar to the transition to the gold standard in the 19th century, network effects would eventually take hold as more central banks bought some Bitcoin, increasing its liquidity and making it more marketable, thus creating ever-larger incentives for other central banks to join. After a sufficient minority of central banks have purchased part of the Bitcoin network, the minority rule will reach its final step and begin imposing the immutable rules of Bitcoin on the established monetary order. Once this reverse bank run on Bitcoin became public knowledge (as tends to happen easily in the digital age), it would be the ultimate seal of legitimacy for Bitcoin adoption and would add even more force to its ascent in the marketplace as this global game of Bitcoin accumulation would reach a fever pitch. Even at the largest scales of the financial system, Bitcoin converts individual self-interest into the growth of its network.

You may find this prospect hard to believe. About 25 years ago, handheld touchscreen supercomputers with wireless global interconnectivity were hard to believe too. Change keeps happening faster and faster. Remember, each central bank will value Bitcoin based on its appraisal of whether and how much other central banks will ultimately value it. As they will all be conducting the same strategic analyses, they will undoubtedly realize the dilemma they face — either ignore Bitcoin and watch it continue to outcompete and accelerate the failure rate of fiat currencies thereby loosening their control over the established economic order or choose to adopt Bitcoin as a reserve asset and trigger a game of accumulation against other central banks and legitimize it as an asset which will culminate in the loss of their monopoly position in the market for money. Operating in an adversarial environment, game theory tells us that so long as Bitcoin continues to operate in its current form, central banks (like the prisoners Alex and Bobby) will eventually be faced with strategic choices such as these to protect their own interests. At some point, the substantial advantage imparted to the central bank that moves first will become an overwhelming incentive to at least one, causing it to be the first to make its move, thereby triggering the reverse bank run on Bitcoin.

A Path to Prosperity [1–16]

Making predictions is risky business, wrong answers are innumerable, and the right answer is singular. Accurate predictions are rare. By weaving together historical knowledge and awareness of current trends, one can develop a perspective on what technological innovations are possible. The biggest mistakes people make when making such predictions are:

- Forming an opinion on the innovative potential without considering it deeply (Blockbuster quickly reaching a decision to pass on buying Netflix for $50M)

- Disregarding an innovation because it contradicts a closely held worldview (Kodak refusing to accept the disruptive potential of digital photography as they spent 100 years building a business model centered on chemical film)

- Overlooking an innovation because it is too small or threatens a position of power (major newspapers refusing to develop an online presence early on)

Practicing a beginner’s mindset and reasoning from first principles is critical for effective foresight. Pulling together everything we have discussed in this paper, we will now propose a potential path forward for Bitcoin based on the historical competitive dynamics of money, current macroeconomic trends and game theory. We will start from the inception of Bitcoin:

- Bitcoin is first perceived as an internet toy for cryptographers (Minority Rule — Step 1)

- Its rapid price increase makes a small group of people rich, engages free market fanatics and brings media attention. Its hyper-volatile price presents itself early (Hodlers of Last Resort — Layer 1).

- The media, financial and tech establishments — having failed to buy Bitcoin early and benefit from its meteoric rise — denounce it as a Ponzi scheme, the MySpace of Cryptocurrencies and the greatest bubble of all time (Streisand Effect).

- A large number of scammers jump onto the Bitcoin hype-train and create their own cryptocurrencies claiming to be superior though lacking critical qualities including decentralization, security and immutable governance. Bitcoin’s serendipitous first mover advantage, multi-sided network effects and its brand awareness fueled by the Nakamoto creation myth preserves its market dominant position.

- Retail investors, venture capitalists and hedge funds — lacking understanding of monetary economics and applying inappropriate valuation models — invest into other cryptocurrencies, creating more noise and confusion as the prices of these altcoins increase at a rate higher than

- Well-connected venture capitalists and hedge funds are given discounts on the investments only to then dump much of what they bought onto retail investors.

- Given their high correlation to Bitcoin and lacking utility, the world watches as the bear markets continue to wipe out more and more alternative cryptoassets as most fail to deliver any useful product, although some succeed in other market spaces. Features that are proven in the market by other cryptoassets are subsumed by Bitcoin (Decentralized Network Archetype). Bitcoin price volatility persists but annual low prices continue to ascend relentlessly (Holders of Last Resort — Layer 2).

- Trust in Bitcoin increases over time (Lindy Effect) and its market price continues its upward yet volatile trajectory (Fractal Wave Patterns).

- People, burned in the altcoin craze, witness and learn about Bitcoin’s undisputed superiority across all monetary characteristics, especially its hardness (Holders of Last Resort — Layer 3).

- On the eve of and during the next bull markets, Bitcoin’s absolute scarcity and antifragile characteristics exacerbate investor FOMO (Game Theoretic Positive Feedback Loop). Some investors are inevitably caught in the subsequent Bitcoin price crash (Fractal Wave Pattern)(Hodlers of Last Resort — Layer 4).

- Hyperinflating fiat currencies are further contributing to the adoption of Bitcoin as it becomes the only means of preserving wealth for many people, making Bitcoin a legitimate store of value. Governments scramble to try and enforce capital controls and create propaganda against Bitcoin, just like they did to gold in the 20th century. Capital controls prove to be impotent and the propaganda against Bitcoin incites internet and media narratives that regard it as a tool for freedom (Antifragility). Government dissent highlights the need for Bitcoin in the first place (Streisand Effect).

- Investors and high net-worth individuals are convinced to allocate a small portion of their assets into Bitcoin to capture further growth, hedge against inflation and increase the risk adjusted returns of their traditional portfolios (Minority Rule — Step 2)

- Increases in demand for Bitcoin necessarily involve a reduction in demand for fiat currencies, causing even higher inflation rates (Gresham’s Law). At great expense and effort, governments messily issue their own cryptocurrencies but fail to relinquish control over monetary policy, which makes them uncompetitive against Bitcoin (Market-Driven Natural Selection). Governments covertly attempt to attack the Bitcoin network, which only strengthens it (Antifragility). Media coverage about Bitcoin shifts towards its use as hard money (Skin in the Game) and its importance for prosperity (Hodlers of Last Resort — Layer 5).

- Activists share the message that soft money creates social inequality (Soul in the Game) by disproportionately taxing the poorest via inflation (Cantillon Effect). This message spreads fast in a world of ever-more crashing fiat currencies and people rush to exit their local currencies for the safety of Bitcoin, triggering the first hyperbitcoinization events (Hodlers of Last Resort — Layer 6). Bitcoin mining hardware becomes commoditized and many citizens join mining pools (Decentralized Network Archetype)(Skin in the Game).

- Central banks, in an attempt to adapt to the new conditions and hedge going concern risks, quietly start to accumulate Bitcoin as a reserve asset, consistent with their gold strategy. A former central bank employee leaks a confidential strategy document regarding Bitcoin (Soul in the Game) which triggers other central banks to begin purchasing Bitcoin, causing its price and perceived legitimacy to increase at an accelerating rate (Game Theoretic Positive Feedback Loop)(Final Fractal Wave Pattern)(Hodlers of Last Resort — Layer 7).

- Bitcoin’s market capitalization reaches tens of trillions in US Dollar terms. Bitcoin’s volatility subsides as both its market capitalization and liquidity are larger than ever (Mature Hard Money).

- Early Bitcoin investors are now sitting on significant unrealized gains and are willing to part with some of their Bitcoin to pay for their purchases. With its purchasing power stabilized, the opportunity cost of transacting with Bitcoin is diminished and its use as a Medium of Exchange increases.

- With the world more digitized than ever before, people increasingly demand to be paid in Bitcoin now that it has proven to be a good store of value given its disinflationary, and later deflationary, monetary policy (Schelling Point)(Hodlers of Last Resort — Layer 8).

- With the addition of highly performant transaction layers, Bitcoin’s use as a Medium of Exchange becomes a widespread. Bitcoin, functioning as the core of a new innovation wave called the TrustNet, is christened as a momentous innovation.

- As more consumers and merchants become accustomed to transacting in Bitcoin, it gradually becomes used as a Unit of Account.

- Due to the emergence of a superior, uninflatable monetary standard, people increasingly store their wealth in Bitcoin rather than fiat currencies (Minority Rule — Step 3)(Hodlers of Last Resort — Layer 9).

- Central bank monopolies on money are described by historians as a relic of the past. Bitcoin is regarded as the catalytic innovation behind the separation of money and state. A free market for money is now the defining feature of free market capitalism (Nash Equilibrium).

This path to full global money will take Bitcoin through many stages:

Time Will Tell

All time beyond the present is unknown. All predictions should always be taken with a grain of salt. The future is uncertain, and the end can always be near. Anyone who claims they can tell you what is going to happen in the future is wrong. All we can do is study the patterns of the past and use them as our map to navigate the ever-advancing territory of the future.

In a free market, hard money has always outcompeted soft money into extinction. Hard money has been the norm throughout all of human history, except for the past 100 years in which we have been coerced into using soft government fiat money. Societies operating on hard money systems optimize for the allocation of the ultimate resource, human time, which increases prosperity for everyone.

In the digital age, markets are increasingly interconnected. Bitcoin is digital cash money. It is a new social institution that lives in accordance with its own laws. Its core components are human self-interest and mathematics. Bitcoin is the hardest monetary technology in history. Will it continue to outcompete and win the throne of full global money?

Only time will tell.

Synthesized Works & Further Reading

- [1] The Bitcoin Standard: The Decentralized Alternative to Central Banking by Saifedean Ammous (a masterful work on which much of this essay is based)

- [2] The Rational Optimist by Matt Ridley

- [3] Skin in the Game by Nassim Nicholas Taleb

- [4] The Bullish Case for Bitcoin by Vijay Boyapati

- [5] The Age of Cryptocurrency by Paul Vigna and Michael J. Casey

- [6] Sapiens by Yuval Harari

- [7] Bitcoin is a Decentralized Organism, Part 1 and Part 2 by Brandon Quittem

- [8] PoW is Efficient by Dan Held

- [9] The Fifth Protocol by Naval Ravikant

- [10] Unpacking Bitcoin’s Social Contract by Hasu

- [11] Antifragile by Nassim Nicholas Taleb

- [12] Letter to Jamie Dimon by Adam Ludwin

- [13] Placeholder VC Investment Thesis Summary by Joel Monegro and Chris Burniske

- [14] Diffusion of Innovations by Everett M. Rogers

- [15] Why America Can’t Regulate Bitcoin by Beautyon

- [16] Hyperbitcoinization by Daniel Krawisz