Bitcoin Investment Cases

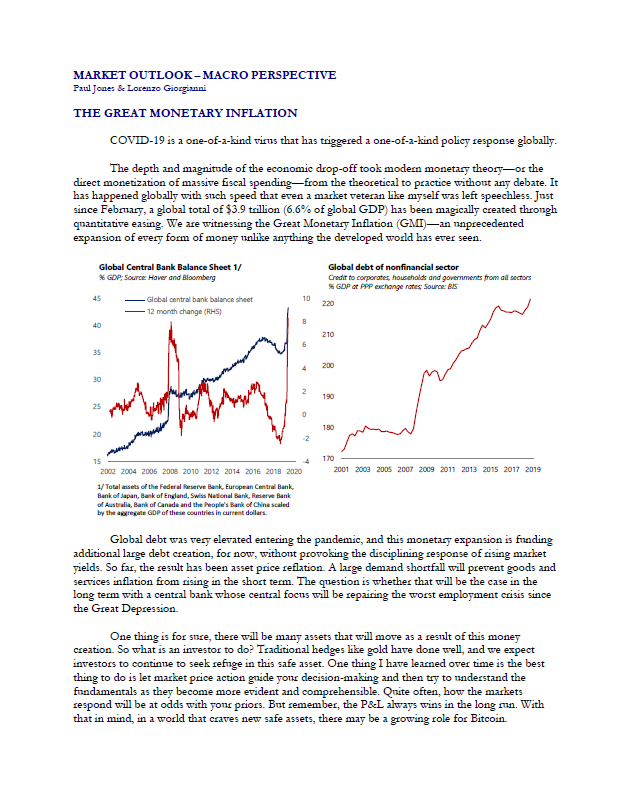

This is a collection of writings on the Investment Case for Bitcoin. They are both institutional papers & presentations as well as selected posts from individuals. Share this with friends, family, and colleagues that you care about.