WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the July 2020 Journal PDF Donate & Download the July 2020 Journal ePUB

There will be bitcoin.

By Steve Barbour

Posted June 23, 2020

Black, digital gold.

Black, digital gold.

The future of bitcoin mining is oilfield.

There is no greater quantity of stranded and wasted energy in the world than there is in oilfield.

Some quick facts:

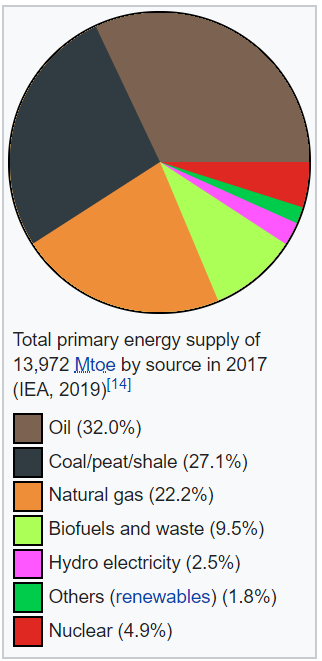

- Natural gas flaring volumes reported to be 145 billion cubic meters in 2018, representing approximately 5% of total natural gas production globally. [Source: World Bank]

- Venting and flaring volumes are largely under reported by oil and gas producers, volumes likely significantly higher. I can also attest to this fact from direct field experience. [1]

- Economically stranded gas wells represent a massively growing liability. I wrote about this here: [2]

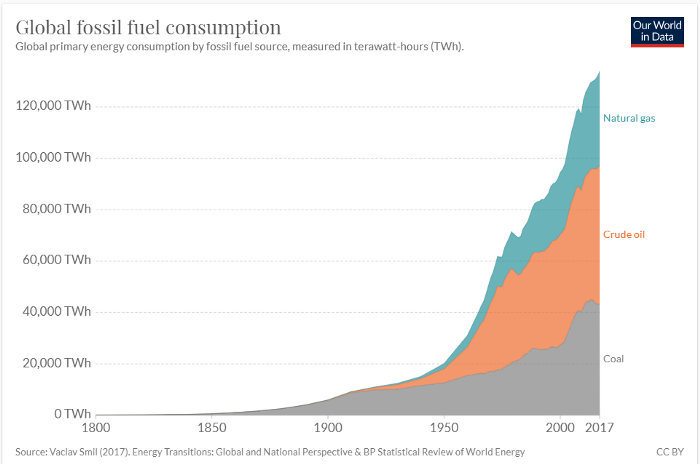

- Oil and gas still accounts for the lions share of energy produced annually:

Oil and gas continues to dominate the global energy production mix.

Oil and gas continues to dominate the global energy production mix.

No, sweetheart, oil and gas is not going away.

Let’s just get this fact straight first.

It has become increasingly fashionable in recent years to bash oil and gas as being “dirty”, despite there being no actual “cleaner” alternatives that scale or do not rely on fossil fuels and their seemingly endless useful byproducts.

The error they make is to overlook how integral and essential fossil fuels are to every aspect of daily life. Literally nobody in the first world can do basically anything without using fossil fuels, it is built into all of our infrastructure.

You’d think this wouldn’t need an explanation but apparantly for some people it’s easy to forget that roads are paved in oil.

Despite the feel good narratives to the contrary, fossil fuels are the basis of modern human civilization now and for the foreseeable future. It’s time we all accept that and focus on how to make better use of our limited resources.

Oil and gas production continues to grow.

If you look at the data the only time we ever see a flattening or decline in annual boe production is when there is an economic recession. E.g. early 2000’s, 2008–2009 and likely 2020 numbers will soon show the same. But they are typically small, insignificant blips in the grand scheme:

Despite the last few decades of cave-dwelling academics and the brain-dead media conglomerates incorrectly predicting and hyping the decline of the oil and gas industry, it turns out that oil and gas production is correlated to consumer demand and not with feel good, ‘clean-tech’ narratives. Who could have thunk it?

The data shows no signs of oil and gas demand slowing, in fact the very opposite appears to be the case as third-world countries propel themselves to first-world, populations continue to grow and people continue to spend more money on more goods, bigger houses and longer vacations.

Consumerism is alive and well my friends, they are literally banking on it.

Grid miners will lose market share.

To date bitcoin mining has been dominated by cheap grid energy, largely that located in China due to a significant oversupply of hydro-electric capacity. This has simply been very low hanging fruit enabled by massive capital misallocation by the Chinese State — dams built to accommodate demand that has yet to surface.

Generally, Utility companies who control the grid welcome bitcoin miners in the same way that any business welcomes new demand for their product. However, when bitcoin miners start competing with the core customer base for the energy, things may get… hairy.

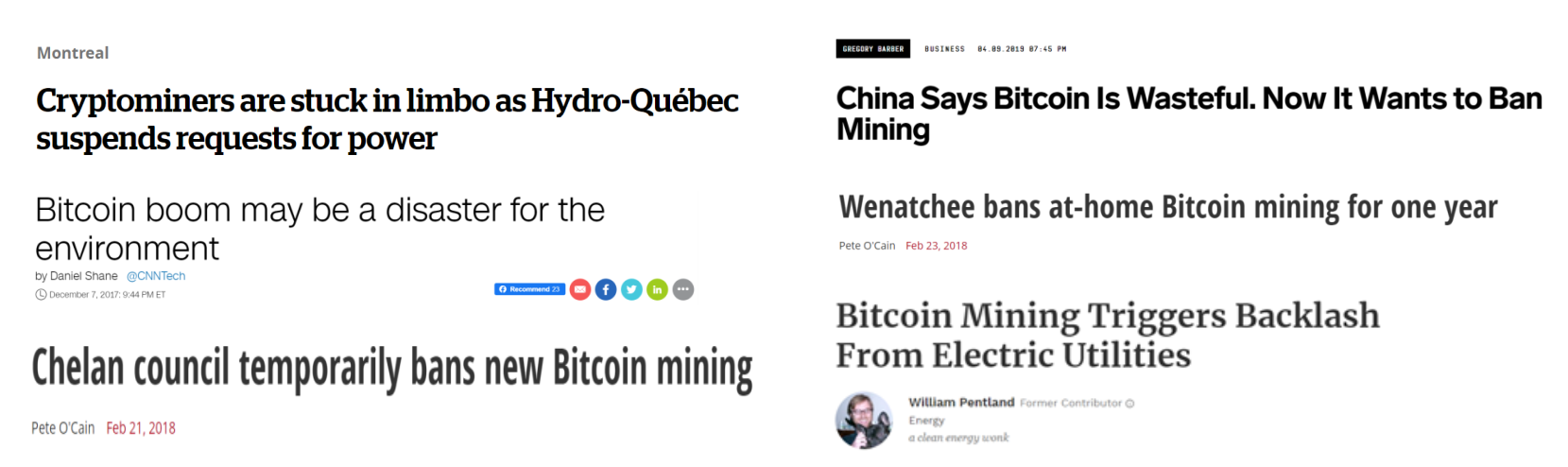

Miners getting #rekt by Utilities / Politicians.

In most jurisdictions energy projects are largely subsidized by government grants, tax incentives or other forms of financial subsidies (*cough-low-interest-rate-financing-enabled-by-monopoly-money-printing-cough*).

The reason these projects are socialized with taxpayer money is to attempt to bring affordable energy to the taxpaying residential, commercial and industrial customers. These projects often require enormous capital and the end users get many years to decades to pay out the investment.

Indeed, regulations protect the taxpaying end-users by preventing utilities from jacking up prices (utilities are generally monopolists, after all). The point is that Utilities that are subsidized by taxpayers / financiers will therefore give the taxpaying base the priority and preferred pricing for the energy, it is their mandate to do so.

This means we should expect increased discrimination against bitcoin miners by utilities and politicians going forward.

What, do you think that they are going to shut off power to residential areas when the next bitcoin bull run and subsequent mining hysteria causes grid overload? Nope. They’re going to go after miners by jacking up electricity prices at the very least. We’ve already seen it many times and we’re barely out of the gate.

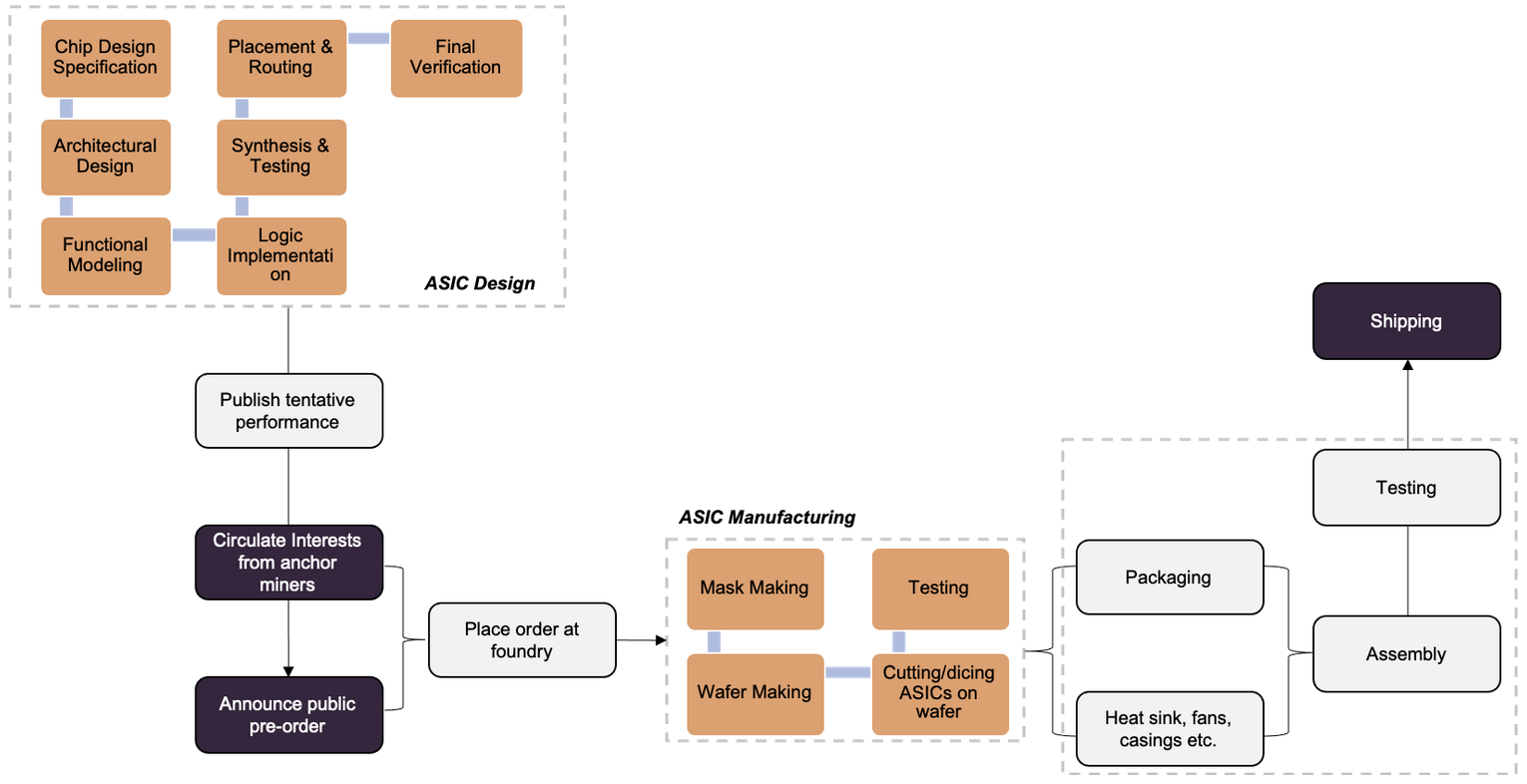

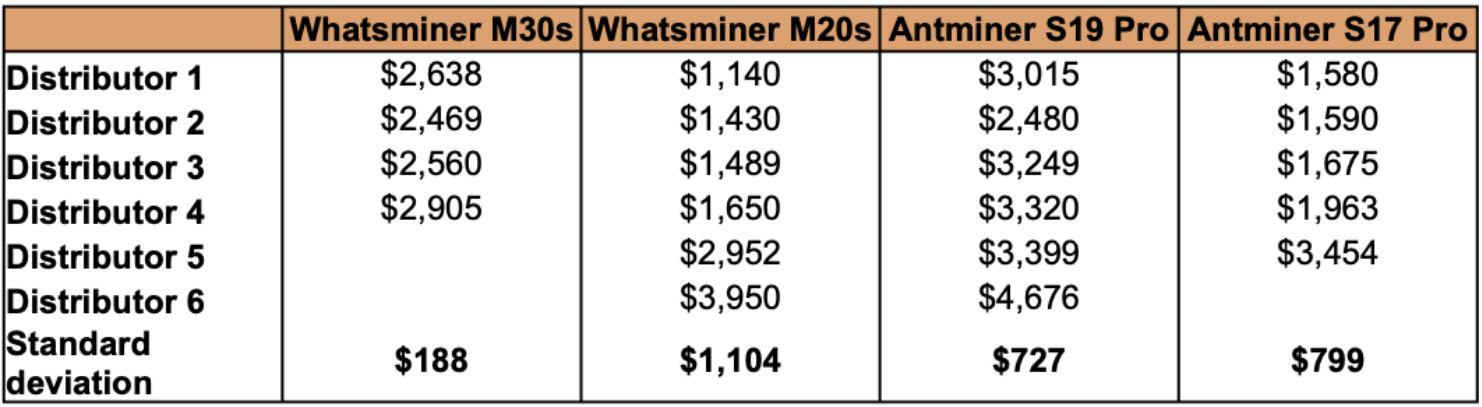

Lets also not forget that mining is possibly the easiest “job” on the planet, simply plug a computer in the wall and you’re “working”. The barrier to entry for grid mining is so low that competition will inevitably continue to drive up energy prices for grid miners. With ASIC’s becoming cheaper and cheaper due to rapid hardware commoditization, it is only getting easier for everybody to join the race for the next block.

And I won’t even touch on how the black market bitcoin miners who steal power, don’t pay taxes, bribe politicians and circumvent other costs that white market miners have to comply with and become disadvantaged by third party rules.

It is simply not going to be an easy road ahead for grid mining.

Why oilfield and not renewable energy?

There is a popular meme about how bitcoin mining is good for renewable energy advancement. The logic is that the large % of wasted or curtailed energy related to wind or solar farms can be instead used the operate bitcoin mines and therefore improve the project life-cycle payout by monetizing the energy that would otherwise be wasted.

This is certainly true for existing renewable projects in which capital has already been sunk, but as for driving new renewable projects? I have my doubts.

Yes, energy demand directly at the source is great for renewable energy and helps them become more efficient, but the same also applies to all energy sources. Energy demand also makes coal, natural gas, diesel and nuclear more efficient as well.

A bitcoin mine is effectively a “smart” load bank. “Dumb” load banks are already widely used in practically all power generation industries to help regulate load for a variety of needs and applications, sometime intermittently and sometimes continuously. For example, load banks are often used to keep large reciprocating engines above a minimum load to prevent them from being damaged from carbon build up, etc.

Controlling load is generally useful for all power generation technologies, so there’s probably not enough evidence yet to say if mining does more for renewable sources relative to the alternatives. Considering I know of very few mines that exclusively use wind or solar energy, I have my doubts.

Regardless, my biggest issue with this meme is that bitcoin mining simply does not solve the energy storage problem that plagues wind and solar energy sources.

The entire purpose of large scale renewable projects is to displace fossil fuels like coal and natural gas off the grid. Adding a bitcoin mine to a solar or wind farm does not do anything to meet this goal because both wind and solar energy still cannot respond to grid demand. The reason for this is because they have no associated energy storage mechanism that is practical (generally speaking). They produce electricity only when the wind blows or the sun shines and a bitcoin mine does nothing to make the sun shine any harder when the grid demands it, so the grid still relies on some means of stored energy (i.e. fossil fuels).

We could argue that the solar and wind farms just need to be oversized for the expected energy demands of the grid, but that simply represents massive capital waste and up-front carbon emissions and defeats the purpose entirely.

I simply do not see how a bitcoin mine helps renewable energy displace fossil fuels, which is the only point of large scale renewable energy projects in the first place.

Subsidies mean unsustainable

Then there’s the matter of subsidies, perhaps the elephant in the room on this topic. Renewable projects require massive subsidies to fly and do not actually make economic sense to pursue otherwise (which means they are anything but “green”, but I digress).

If bitcoin mining does not meaningfully displace the reliance on reliable fossil fuel energy stores then logic follows that bitcoin mining only makes sense to help existing wind and solar projects improve pay back rather than drive new capital to be deployed into new wind and solar projects.

But if this is the case then we have to ask — why would the State continue to subsidize renewable energy projects with taxpayer dollars if it ends up simply subsidizing bitcoin miners while failing to significantly displace fossil fuel sources?

And, maybe the greater question, why would the State subsidize bitcoin miners when bitcoin is literally anti-State money that competes with their ability to conduct seigniorage?

Last I checked businesses and organizations don’t usually like subsidizing their competition.

Conclusion

As a demand on energy directly at the source, bitcoin mining helps all energy producers operate more efficiently.

With the majority of the worlds energy continuing to come from fossil fuels, along with the majority of wasted and stranded energy sources, I’m going all-in on bitcoin mining being dominated by fossil fuel producers in the next few decades and beyond.

And to be honest I feel really good about it. There is absolutely nothing dirty about fossil fuels, just like there is nothing dirty about human civilization.

I want humanity to find more efficient energy technologies as much as anybody, but I do not believe that denigrating oil and gas workers for doing the work in which we hire them. Oil and gas projects are paid partially by you and your own consumption habits, mind you.

Until we have actual alternatives to oil and gas that scale we should all be working together and help our current energy producers innovate and operate more efficiently.

Bitcoin is simply another tool on our belts.

❤ Steve

Bitcoin: A Global Standard of Value

By Paul Knight

Posted February 1, 2020

Wences Casares, in an interview with Laura Shin, said this about bitcoin:¹

If Bitcoin succeeds, it will become a global standard of value and a global standard of settlement. Gold was the value and gold is the one that resembles most Bitcoin in that it wasn’t controlled by any one country and it was truly apolitical. The way Bitcoin is apolitical.

If I want to compare the square footage of the first cabin my grandfather had in Patogonia back in 1940, with the square footage of some grandparent of yours Laura, who came to the US and had a cabin or a house somewhere. It’s very easy to compare the square footage. Your father had a house that was 1500 square-foot and my grandpa had one that was 1000 square-foot. [But] when we want to compare how much they paid for it, even if we have access to exact amount they pay, we have to adjust that number to compare them. And we can adjust them to inflation. And in inflation we have to choose the inflation of the currency that we’re using or we can turn it into some other, into gold at the time. There are many different ways we can adjust it and in choosing the way we we’re going to use, is somewhat subjective and therefore the final number is somewhat subjective. Where the result being that the comparison that we are doing of value is a very subjective comparison and it shouldn’t be. It should be as objective as comparing square footage.

And today we can’t do that and I think a world in which Bitcoin succeeds, it’s one in which Bitcoin becomes this non political and objective measure of value. That when you ask for things that matter globally like the price of a currency, the currency is priced in Bitcoin and commodities are priced in Bitcoin and an international trade is done in Bitcoin. It doesn’t mean that any currency in the world disappears. It just means that the meta currency that connects all of those currencies is now a non political currency. With non political value and with non political settlement. Where absolutely anyone can settle in that currency on a Sunday at 2:00 AM with anyone. And that’s new. That has never happened before and it will be very powerful.

The concept of a global standard of value is intriguing, especially considering the role time plays in changing the things we value and the games governments play against one another in manipulating their currencies. In Wences’s example above, we should be able to compare the values of two different houses at two different times just as we can compare their square footages. But this isn’t the system we have today. As Saifedean Ammous said in his book The Bitcoin Standard, allowing currencies (measures of value) to float as they do today is like “attempting to build a house with an elastic measuring tape whose own length varied every time it was used.”

These concepts of values and standards have been rolling around in my head as I’ve been thinking what I’m actually buying when I buy bitcoin. How much value (or scarcity, unforgeable costliness², utility, or collectibility) am I buying per bitcoin? How does that compare to other assets?

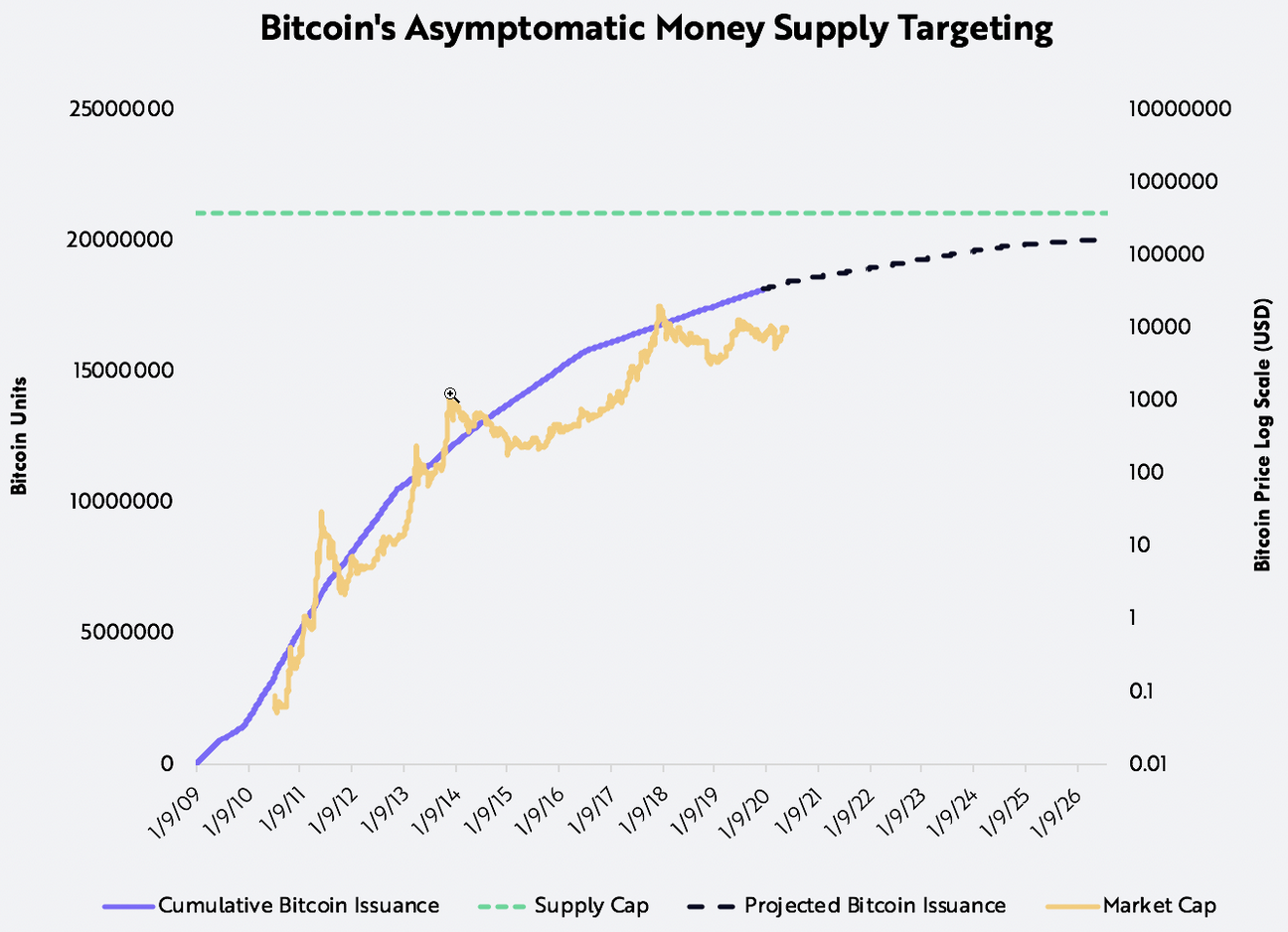

The theoretical supply limit of bitcoin is fixed at 21 million. To date, approximately 18.2 million³ bitcoins have been mined. It is estimated that approximately three million bitcoins have been permanently lost⁴, leaving a current supply of 15.2 million bitcoins. A single bitcoin, then, represents approximately 1/15,200,000 = 0.00000657% of the current total supply. That number will get smaller at a fixed schedule until the theoretical supply limit of bitcoin is reached, estimated to occur in the year 2140.

Now that we have a number that represents a specific proportion of this scarce asset, we can ask ourselves, “If I owned an equivalent proportion of gold (ie, an equivalent percentage ownership of the total above ground supply of gold) how much would that be worth?” Let’s do the math.

Total above-ground supply of gold: 6,824,531,328 ounces⁵

Valuation: $1,592 per ounce

1 Bitcoin <=> 0.00000657% x 6,824,531,328 ounces x $1,592 per ounce

1 Bitcoin <=> 449.2 ounces of gold x $1,592 per ounce

1 Bitcoin <=> $715,058 of gold

Given that 1 bitcoin represents 0.00000657% of the total bitcoin stock, if one wished to purchase an equivalent share of gold’s stock they would need to buy 449.2 ounces (or 28.1 pounds) of gold at a price of $715,058.

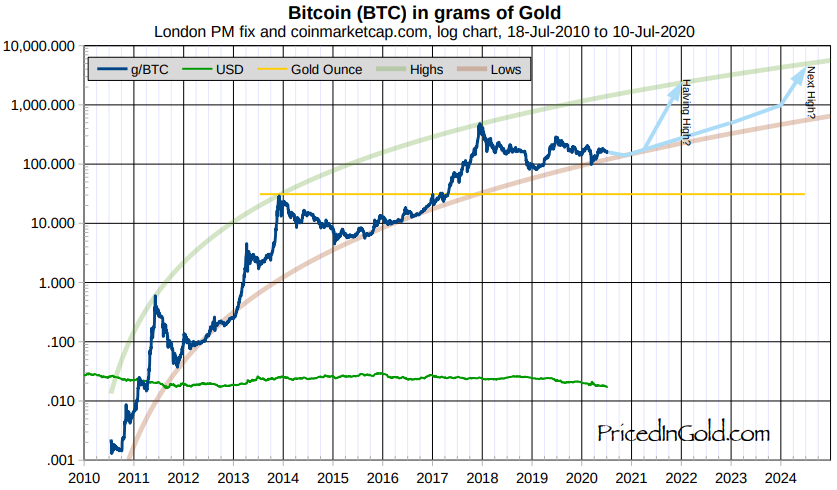

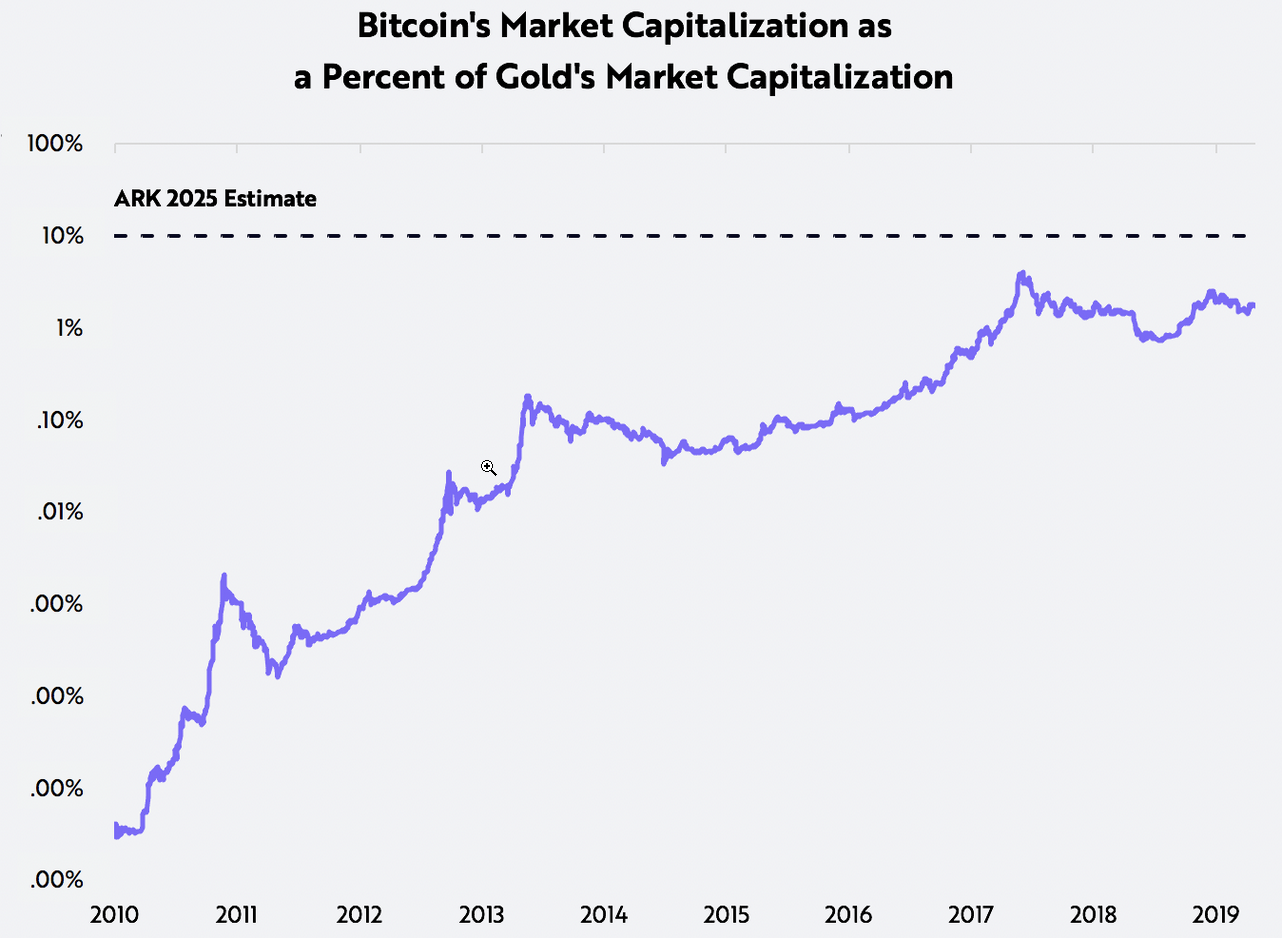

This observation is useful if we think of bitcoin as digital gold. If we argue that bitcoin possesses similar if not superior properties to the metal, then we can see that, at bitcoin’s current valuation of $9,400 per bitcoin, it is dramatically undervalued relative to gold by some 76 times. If bitcoin is to attain a status and worldwide recognition as digital gold, we can see that its USD price has a lot of room to the upside.

But what about other assets of limited supply? And assets that aren’t as readily comparable to bitcoin? Let’s look at U.S. cropland.

Supply: 253,700,000 acres⁶

Valuation: $4,130/acre⁷

1 Bitcoin <=> 0.00000657% x 253,700,000 acres x $4,130 per acre

1 Bitcoin <=> 16.7 acres x $4,130 per acre

1 Bitcoin <=> $68,960 of U.S. arable cropland

Again, we find that, relative to U.S. cropland— a limited, hard asset — bitcoin is undervalued. This comparison is meaningful if we want to compare bitcoin to the limited land area within the U.S., but we may want to explore other types of land, because not all land is of equal location, utility, or disposition. We’ll do this in a few paragraphs.

But now notice that we have assigned two different assets, gold and cropland, values in similar terms, that of net scarcity through bitcoin. This allows us to easily compare the two assets with a simple ratio of one to the other. The result ($715,058/$68,960=10.3) is the realization that we (as the total market of buyers, the generators of demand) place a higher premium on the inherent value of gold than we do on the inherent value of cropland. Gold has a monetary premium approximately 10 times higher than that of cropland. Gold’s value density is greater than that of cropland’s.

Before using bitcoin as a standard of value in this way (a standard of scarcity), it was impossible to directly compare gold to land. Gold is priced at $1,592 per ounce and cropland at $4,130 per acre. But we cannot directly compare ounces of metal to acres of land. To say that an acre of arable land is worth 2.6 ounces of gold is a useful metric if we place all other items in terms of gold. But the inherent value of gold fluctuates over time which is caused by market cycles, changing preferences, and ad hoc changes in the gold stock (the true scarcity of gold is ultimately unknowable). An ounce of gold today may or may not carry the same inherent value as an ounce of gold 100 years ago or 100 years from now. Instead, I propose that a better intermediary is to use a common unit of scarcity.

“Scarcity is money’s most important property. If supply of the unit of measure were constantly and unpredictably changing, it would be very difficult to measure the value of goods relative to it, which is why scarcity, on its own, is an incredibly valuable property. While the value of the underlying measurement unit may fluctuate relative to goods and services, stability in the supply of money results in the least amount of noise in the relative price signal of other goods.” — Parker Lewis⁹

We could pick any number we’d like for this unit of scarcity: one percent, or 10 percent, or 12.64298 percent. The actual number doesn’t matter, we just have to use it consistently and define it as the standard. So what number do we choose?

The scarcity of bitcoin is a universally recognized and secure fixture of scarcity. Because of its framework and infrastructure, Bitcoin can be the yardstick of value. Think of this in a similar way of how the meter was originally defined in terms of the circumference of the Earth. When the meter was established, it was pegged to something tangible (at least conceptually tangible). The Earth is a tangible and conceptual basis of physical dimension; Bitcoin can serve the same purpose for value.

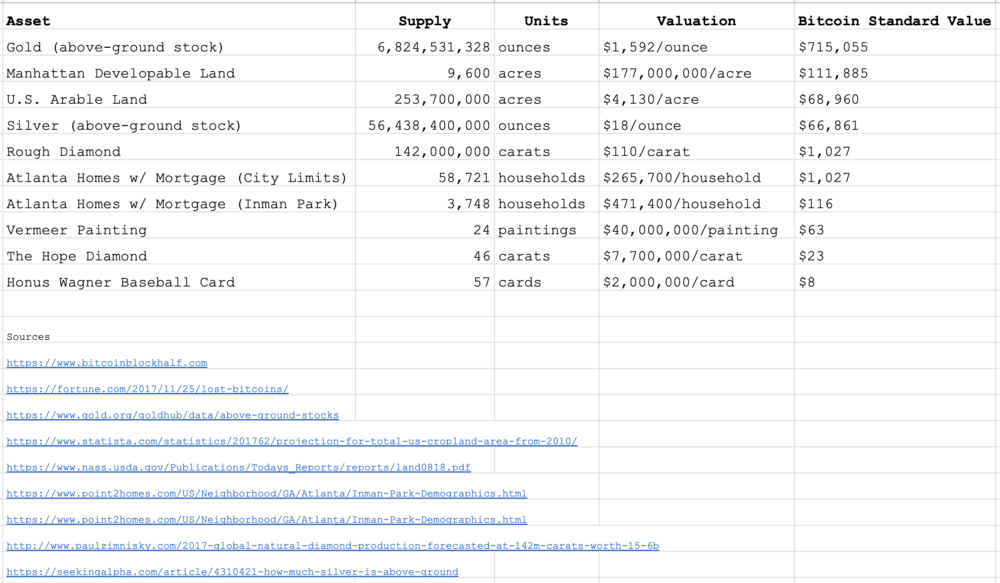

Assets Priced in Bitcoin Scarcity

When disparate assets are assessed relative to bitcoin, they can then be compared directly to each other, their units cancelling out leaving only a magnitude. This magnitude is an expression of relative value. Using our new bitcoin yardstick, the table below compares various assets.⁸

Table comparing various assets, their nominal valuations and inherent (ie, Bitcoin) valuations.

Many interesting observations can be made from the above table:

- Of the assets listed, gold has the highest value density.

- While the price-per-acre of land in Manhattan is over 42,000 times more expensive than that of U.S. farmland, the actual value density of Manhattan land is only 1.6 times that of farmland ($111,885/$68,960=1.6). The market values Manhattan land higher than farmland, but, as it turns out, not unreasonably so.

- Owner occupied homes with mortgages within Atlanta city limits are 10 times more valuable than those within the specific neighborhood of Inman Park, even though Inman Park homes are almost twice as expensive in nominal USD terms as the average Atlanta home. Said another way, it is more important (more valuable) to the market to be within the city of Atlanta than it is to be within a particular neighborhood; that value comes out as a monetary premium on the average lesser-priced home.

- Rough diamonds carry a monetary premium of 44 times that over the famed Hope Diamond. While there is only one Hope Diamond, there are very few entities that could purchase such a stone; alternatively, there are millions of carats of rough diamonds with millions of buyers willing to pay a premium to have a small piece of the stock.

- Atlanta homes and rough diamonds share equal inherent values ($1,027 unit of scarcity).

- Honus Wagner baseball cards are the least valuable items on the list $8 while the market collectively gives the work of dutch master painter Johannes Vermeer a premium of eight times $63 over the most treasured of all baseball cards. That said, one could ask: O_nly eight times? What might that say about our culture?_

Analyses like these can help an investor weigh the current value of bitcoin and make educated best guesses about where it might be headed, but it can also allow us to compare the relative values of everything in our lives. This paper proposes that Bitcoin represents a secure and stable standard by which we can weigh these values. But like the actual supply of gold, the actual supply of available bitcoins is unknowable because the exact number of lost bitcoins is ultimately unknowable. Therefore, to make Bitcoin a true standard, we can use the knowable, theoretical supply limit to arrive at the following: 1 bitcoin / 21,000,000 bitcoins = 0.00000476%. This is the new, universal constant of value, and can be applied to all assets of limited supply.

But Value Is Subjective

But wait, you protest. Isn’t value subjective? And doesn’t it change over time? Yes, value is subjective on a micro level and it does indeed change over time. The subjectivity of value is constrained on the micro level. We like to think that we are unique creatures operating independently as free-thinking individuals. The reality is we’re more like ants: our collective preferences and decisions agglomerate together to form quite a singular thing we call the Market. The Market is where a few dozen (or million or billion) buyers and sellers meet at the margin and decide what something is worth. Sure you might buy the blue sweater and I might buy the red one (a reflection of our respective individualities), but the Market has determined that blue is in and red is out and so, a week later, my red sweater shows up on the clearance rack for 50% off while your blue sweater is displayed in the store window priced at a substantial premium. That’s value; and it changes over time.

Let’s take a Vincent van Gogh. Back in his day, few people valued his artwork and were only willing to pay a few hundred Francs for it. But what does that actually mean? How do we, modern purveyors of US dollars, make sense of that? How do Francs compare to US dollars? How do their respective inflation rates compare? Perhaps we could figure it out by comparing those few hundreds francs to the cost of living at the time to our cost of living today, but what was their standard of living? And how does that compare to ours? There are so many questions as to how the painting was valued that it makes it impossible to paint an accurate picture.

Now let’s assume that M. van Gogh had instead priced his paintings in bitcoin and that a buyer had paid 0.001 bitcoin for a single painting. And let’s further assume that, today, the same painting just sold for 2,000 bitcoin. With everything pegged to bitcoin then and now, all the earlier questions we had of local currency and standard of living is already discounted in the price paid in bitcoin. Bitcoin, through its fixed supply, is the full representation of relative value at any given time. While the painting became more valuable relative to everything else over time, value is a zero-sum game: value was pulled away from something else and directed toward the van Gogh painting because the painting became more valuable at a much larger rate than all the other goods and services one can purchase at any given moment. Our bitcoin yardstick can act as a measure for value, allowing us to see with precision how we (the market) assign value, assess how that changes over time, and help lead us away from something nominal toward something more absolute.

This is a working paper. I welcome any and all comments and contributions. Thank you.

Footnotes:

- https://unchainedpodcast.com/xapos-wences-casares-on-how-bitcoin-makes-a-fairer-world/

- https://nakamotoinstitute.org/shelling-out/

- https://www.bitcoinblockhalf.com

- https://fortune.com/2017/11/25/lost-bitcoins/

- https://www.gold.org/goldhub/data/above-ground-stocks

- https://www.statista.com/statistics/201762/projection-for-total-us-cropland-area-from-2010/

- https://www.nass.usda.gov/Publications/Todays_Reports/reports/land0818.pdf

- Note on the calculation of Manhattan’s developable land: I subtracted Central Park from the area of Manhattan (figures obtained from Wikipedia), then multiplied the remainder by 70% to account for streets and parks. This left me with about 9,600 acres of developable land. I then applied this to the total land valuation obtained here: https://www.sciencedirect.com/science/article/abs/pii/S0166046217300820

- https://nakamotoinstitute.org/mempool/bitcoin-is-not-backed-by-nothing/

Freedom Money – Bitcoin and the First Amendment

By Hector Rosenkrans

Posted July 4, 2020

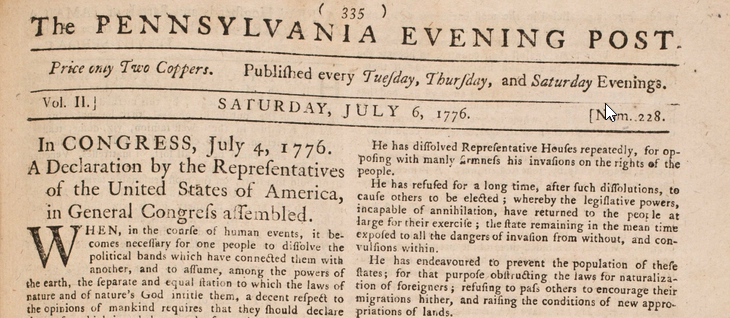

The Declaration of Independence was first made public in the Pennsylvania Evening Post

Living in 2020 means witnessing a revolution in our tools of communication. The last time this kind of shift happened was with the invention of the printing press, where individuals were empowered to freely communicate, share ideas, and organize with each other. The press put the power of the written word, from the Bible to the Federalist Papers, into the hands of ordinary people, and lead to both the Reformation and the American Revolution. The farmers of the Constitution understood this deeply, and enshrined these ideals atop our most important legal framework.

Freedom of the (Printing) Press

As the cornerstone to the Bill of Rights, the First Amendment lays out the core freedoms central to the idea of America. Our rights to speech, assembly, and religion are fundamental to our humanity. Recognizing this is a prerequisite to to sustain a government of the people, by the people, and for the people.

Freedom of the press is critically important as well, and it relies on technology for their realization. Freedom of speech empowers anyone to ask hard questions of their elected officials and powerful institutions, but we need technology to make their answers available to the public. Freedom of the press ensures that information can be published on a blog or in a newspaper, and broadcast over TV, radio, and streaming services.

At their core, the freedom of speech relies on the right to leverage technology to coordinate ideas and actions among individuals at scale. The printing press granted us ability to economically copy and distribute the written word at massive scale. Ideas from the Gutenberg Bible to the Common Sense were widely distributed, and could be interpreted by anyone who could read. The soft technology of the written word was turbocharged by the hard technology of mechanical innovation, and led to the revolutions that lifted the world into modernity.

Digital Speech

With the advent of the internet, we have exponentially improved on the power of the printing press. Overhead costs to reproduce ideas have again fallen to fractions of their previous levels. More importantly, instantaneous world-wide distribution of anything that can expressed on a screen went from impossible at any cost to practically free. For a brief period of time, speech was freed at global scale for anyone with access to the internet.

Unfortunately, freedom of speech that transcends borders has come at a cost. Our traditional methods for filtering quality ideas from gossip have broken down. Worse still, they have been replaced with algorithms trained to optimize for our attention at any cost. Competition for advertising revenue has driven an arms race for our time, leading to sensational headlines, click-bait, and constant ‘nudges’ from our pockets. The reason for this battle is that the world of networks, power accrues to scale, creating winner-take-all markets in information. In the wake of the Web 2.0 wars, we are left with a few large companies in nearly complete control of our tools of communication.

In the process of winning their respective networks, these companies have accrued an incredible set of data about our daily lives, enabling levels of surveillance and potential censorship unimaginable in the wildest dreams of a Stasi or SS officer. Google has recognized this growing responsibility since the early days of 2000 and 2001 when their “Don’t Be Evil” motto was introduced. Their decision to remove this language from their core message is troubling.

Overtime the risk that these tools will threaten liberty compound. Legal pressure from governments, political pressure from the mob, and economic pressure from advertisers and investors could push Facebook, Google, and others to decisions that threaten our freedoms. Today we are protected only by promises. America’s founders deeply feared the monopolist’s power, but they could not have imagined that the biggest threat to freedom would come from companies that can monopolize communications, rather than a government that monopolizes force.

A Revolution in Privacy

The Internet scaled our tools of communication over the past 30 years at an unprecedented clip and has dominated our popular understanding of computers. At the same time, another technology revolution has been quietly playing out in parallel. The development of strong public key cryptography began in secrecy in the 1970s at GHCQ, the NSA’s British cousin, and was made public in 1976.

The importance of cryptography for everyday use is increasingly clear. We can now arm ourselves with tools to protect our ideas and our data at minimal cost, exposing them only to who we chose. In the era of mass communication and mass surveillance, free expression but automated censorship, strong and open cryptography returns power to individuals. We have the ability to restore the freedoms defined in the First Amendment to their full potential, but this time in an even more connected, open, and inclusive world.

The role of Bitcoin

While public key cryptography protects our ideas and information, it doesn’t help with the content filtering problem that led to data monopolists in the first place. Markets and prices are the most effective tools for discovering value and quality, but only when the underlying money using to measure economic reality is stable and predictable.

Bitcoin solved this by creating a kind of money that operates on the same infrastructure and protocols as the internet itself, but cannot be freely printed like dollars or copied like click-bait. While technical limitations of ensuring trust in the system have prevented rapid integration at scale, steady progress is happening every day. Centuries after the invention of the printing press, we have finally found a method to store and exchange value using the same tools we use to store and exchange ideas.

Internet money will enable us to use markets to discover and filter valuable new ideas, without relying on a central authority or algorithm with its own motives. Bitcoin is fully open, ensuring the system that can be trusted by people with radically different ideas and cultures. It has the ability to serve as a common language that facilitates both trade and communication around the world.

Bitcoin offers far more than a break from the legacy financial system. It’s a protocol enabling digitally native value. For America, breaking away from England was just the first step, she had to prove to the world that she could effectively govern herself and honor her professed values. Building trust is a massive challenge that takes time and patience, most people are happy to subject themselves to the convenience of central authorities an go about their lives. But when they work, open ideas offer a blank slate build a better world.

Masters and Slaves of Money

By Robert Breedlove

Posted July 5, 2020

Money is a tool for trading human time. Central banks, the modern-era masters of money, wield this tool as a weapon to steal time and inflict wealth inequality. History shows us that the corruption of monetary systems leads to moral decay, social collapse, and slavery. As the temptation to manipulate money has always proven to be too strong for mankind to resist, the only antidote for this poison is an incorruptible money — Bitcoin.

Counterfeiters are Slavemasters

“Knowledge makes a man unfit to be a slave.” —Frederick Douglass

In ancient western Africa, _aggry beads—_small, decorative glass beads—were used as money for many centuries. Of uncertain origins, these beads were a means of wealth transfer between people in trade (as money) and across generations (as dowries or heirlooms). When European explorers appeared in Africa in the 16th century, it was quickly apparent to them that aggry beads were highly valued by African locals. Since glass-making technology in Africa was primitive at the time, aggry beads were difficult to produce and, therefore, reliably scarce relative to other goods—a monetary property which supported their market value.

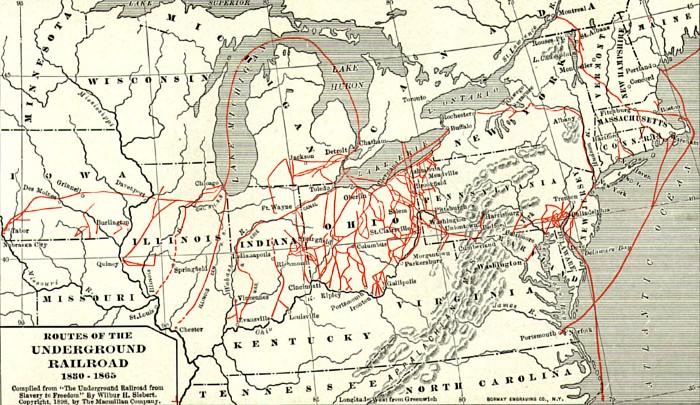

Back in Europe, glass-making technology was more sophisticated; counterfeit beads virtually identical to aggry beads could be mass produced at a low cost. Seizing the economic opportunity, many crafty Europeans soon began arranging expeditions to western Africa, shipping in huge quantities of (indistinguishably counterfeit) aggry beads expertly fashioned in European glass-making facilities. This scheme was one of the first known large-scale money counterfeiting operations in the world. What followed this seemingly innocuous exportation of glass beads was a multi-decade plundering of African wealth, natural resources, and—ultimately—time.

As European ships arrived on African shores, many with hulls packed full of glass beads, locals readily traded their hard-earned assets for what they believed were precious aggry beads. Spanning the course of decades, this trading of real assets for counterfeit beads facilitated a surreptitious confiscation of African wealth by Europeans—a slow-motion criminal episode that crippled African society for centuries to come. Aggry beads would later become known as “slave beads”; as newly impoverished Africans became desperate, some were forced to sell themselves or others as slaves to their European usurpers. Slave beads—one of history’s many monetary systems weaponized by counterfeiters—became instrumental in the multi-century trans-Atlantic slave trade.

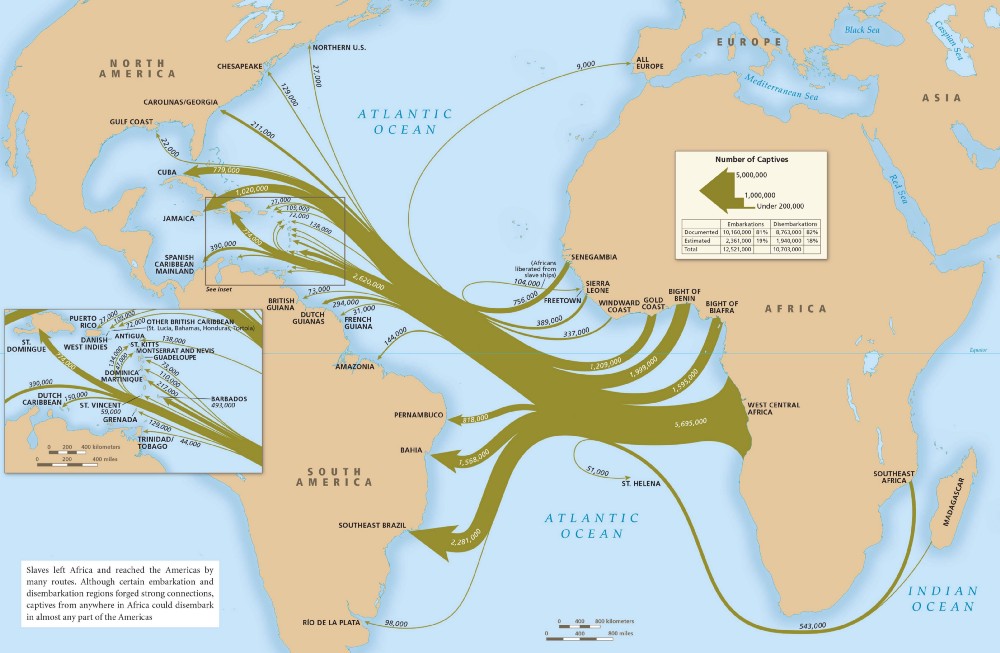

Over the course of 365 years, over 12.5M slaves were transited from Africa to Europe and the Americas.

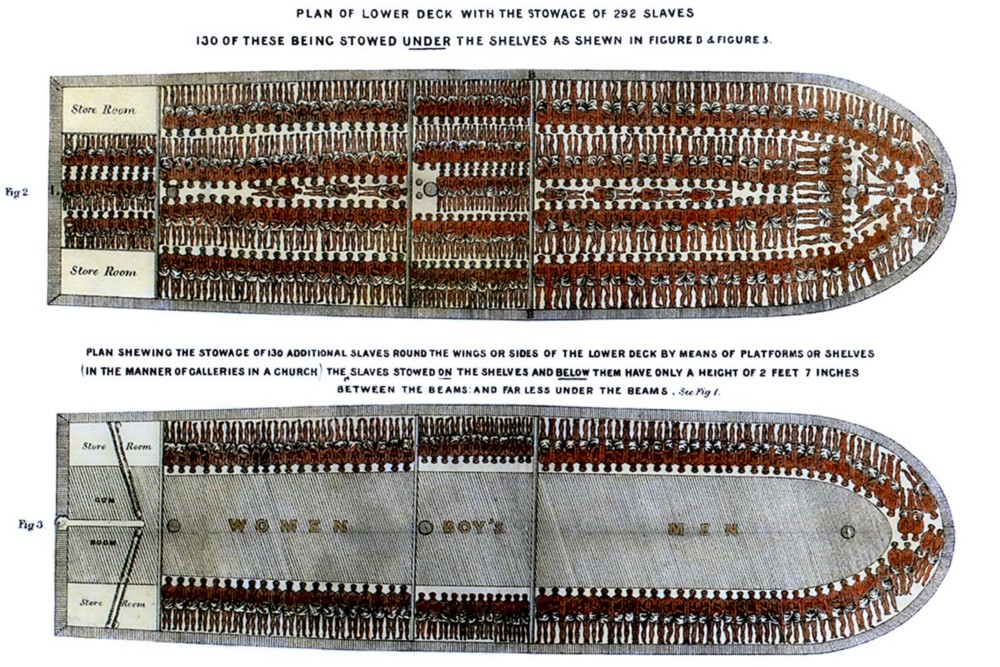

In a barbaric irony of history, ships landing in Africa stuffed with (counterfeit) aggry beads later departed for European and American shores with full payloads of precious human cargo. Inhumane and unforgivingly precise, masters of these slave ships packed their hulls tightly with African slaves, just like the glass beads that were used to purchase their captive human cargo in the first place.

Like the counterfeit aggry beads used to purchase them, African slaves were packed tightly inside the hulls of ships for transit to Europe and the Americas.

Unfortunately, this pillaging of wealth was not an isolated episode. Cloth strips were another form of money used in ancient Africa, which became a well-established transactional medium over many centuries of dealing with Muslim traders from the north. Local African tribes soon began producing these cloth strips—known colloquially as panos—but were outcompeted by the more efficient production methods employed by the Portuguese. A perversely profitable economic arrangement ensued, in which the Portuguese used panos to purchase African slaves who were then put to work producing the very cloth strips with which their freedom was stolen. As Scottish historian Christopher Fyfe described this dreadful trade relationship:

“Some of the slaves were weavers by profession, and wove the cotton into country cloths as they had done on the mainland. New elaborate patterns of North African type were introduced, and from the middle of the 16th century Cape Verde panos [cloth strips] were regularly exported to Guiné to be exchanged for slaves.”

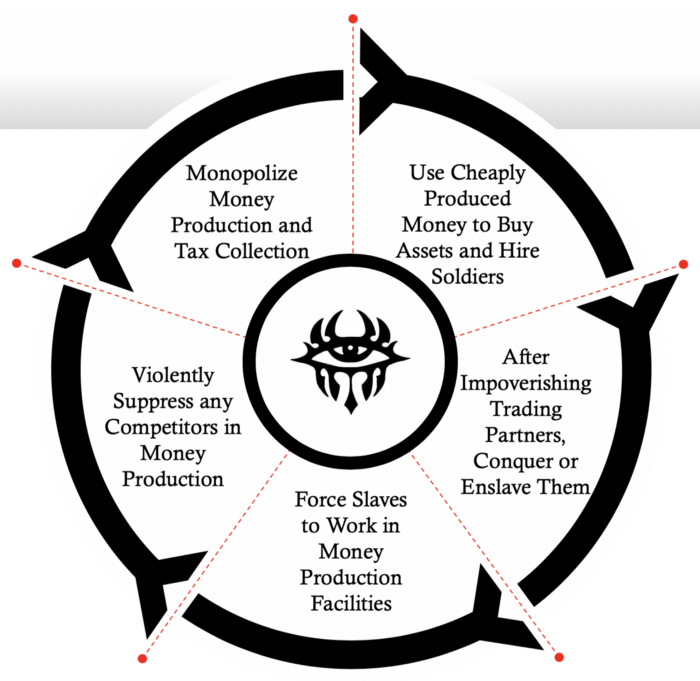

Lured by a virtually limitless profit potential, Portuguese panos producers soon established a state-sponsored monopoly called the Grão Pará and Maranhão Company, which mandated the use of its warehousing and trading-post operations for all financial flows denominated in panos. This company enforced the use of panos for tax payments, to forcibly denominate slave trade contracts, and to hire soldiers. To name just one similar, non-coincidental example today: the US government enforces the use of dollars for tax collections, as legal tender, as the nominal currency for contracts on oil (the energy slave of modernity), and as the international reserve currency (the infamous “exorbitant privilege”).

Events strikingly similar to aggry beads and panos are playing out today throughout the global economy: the US dollar in your pocket, the one you sacrificed so much to obtain, was recently mass-produced by the US government with a (near-effortless) keystroke. In the same way Europeans had access to superior glass-making technology that gave them the ability to counterfeit money at a low cost, or the Portuguese monopolized panos production, central banks have an exclusive privilege to produce money at near-zero cost, enabling them to confiscate wealth from all users of dollars at will. Although less visible and overtly violent, central banks today carry out operations using the same weaponized methods of theft as those wielded by wily Europeans against unsuspecting Africans.

Histories of human action related to aggry beads and panos hold important lessons for societies suffering under central banking: those who can monopolize money production become de facto currency counterfeiting operations that steal human labor in perpetuity. When free market forces are manipulated, producers gain an asymmetric ability to set prices without regard to customer preferences, thereby converting economic democracies into dictatorships, and freedom into tyranny. For money, this implies monopolists can acquire human time (aka labor) in the marketplace at an unfair price. Said differently: money monopolists can steal human time—a malevolent power that effectively makes them slavemasters.

An exclusive right to produce money without regard for competitive market pressures is an apparatus of enslavement—a vile privilege that monopolists can only preserve through deception and violence.

Counterfeit aggry beads and panos were weapons used to acquire human time; acts which led to the direct theft of 12.5M human lives between 1501 and 1806 (and the indirect theft of their progeny). The trans-Atlantic slave trade was a slow-motion holocaust on Africans; roughly 2M died in transit through the infamous Middle Passage, and those who survived spent the rest of their waking lives toiling away, or bearing children to replenish their slavemaster’s stock. Quantifying this atrocity from an economic perspective (not counting those born into slavery): assuming the average slave could labor 5,000 hours each year for 40 years, the staggering total time stolen amounts to over 2.5T (2,5000,000,000,000) hours, or 6.8B hours stolen per year for 365 years (source link).

The trans-Atlantic slave trade was a travesty as gruesome as it was gigantic; if only money production monopolies had faced free market competition, this horror of human history would not have reached such a colossal scale. In (non-violent) market competition, producer actions are guided by the preferences of customers: a dynamic that drives low prices and technological innovation. Absent this accountability, producers are incentivized to do anything necessary to expand their market share—up to and including violent coercion. Simply, market pressures keep people honest: as such, the structures of markets and moralities are mutually intertwined.

Markets, Sovereignty, and Morality

“To be moral, an act must be free.” ― Murray N. Rothbard

Competition is a natural process of discovery: in sports, it is the way we discover which team is more competent in any single game; throughout an entire season of play, repeated competition is how we discover which team is best overall. In free markets, competition is the set of games played to discover “satisfactions of wants”: each entrepreneur places “bets” (investments of capital, money, and time) as they attempt to prove their competitors wrong in the marketplace by delivering better, faster, or cheaper solutions to the problems their customers want solved. Market competition is the catalyst of honest work and true progress for civilization. As the American pragmatists said: “truth is the end of inquiry”—in this sense, the free market may be thought of as a setting of continuous inquiry that zeroes-in on truth. The ideas competition generates, which withstand its sustained entrepreneurial inquisition, are our best approximations of truth—as William James said:

“Any idea upon which we can ride … any idea that will carry us prosperously from any one part of our experience to any other part, linking things satisfactorily, working securely, saving labor; is true for just so much, true in so far forth, true instrumentally”

Pragmatically, truth is difficult to distinguish from that which is most useful. In forums of free exchange, truth is generated in the form of accurate prices, useful tools, and individual virtue. Prices dynamically represent market participant concurrences on relative exchange ratios, a derivation of countless trade decisions across time. A tool with superior usefulness is the manifestation of mankind’s sharpest present knowledge for solving a specific problem. Put another way: as entrepreneurs inquire about the nature of reality through experimentation, the tools they produce—and the knowledge structure with which these tools are configured—adapt according to customer preferences until one or a few favored solutions become market dominant. Virtue and competitive competency are the character traits infused into successful entrepreneurs that manage to survive the constant economic pressures holding them accountable for profit generation. This truth-seeking function of free markets is inherently iterative: prices, tools, and virtues are constantly changing according to market conditions.

“Points” in market-based games of discovery are denominated in money — the tool used to calculate, negotiate, and execute trades most effectively. Market competition is the process that keeps producers honest: when it is suppressed through coercion or violence—as it is within “legal monopolies”—truth becomes distorted into inaccurate prices, low-quality tools, and individual wickedness. For money producers, monopolization means dishonest producers become counterfeiters and gain a (deceptive and violent) dominion over human time.

Stealing human time through currency counterfeiting led to the the auctioning of slave labor.

Stealing human time through currency counterfeiting led to the the auctioning of slave labor.

Contrary to conventional wisdom, money is not “the root of all evil,” it is actually just a tool for trading time (or labor)—the means by which market participants signify sacrifices and successes to one another across the history of economic transactions. Like all tools, money has no independent morality of its own. Tools are amoral, meaning they can be used for both good and evil purposes alike. The moral outcome of using a tool is inextricably dependent on the intention of its user. Money is a temporal trading tool, but (as we’ve seen) it can also be wielded maliciously to steal time, in the same way a hammer can be used to build a house or bash a skull.

More accurately, money—along with its precursors action and speech—is “the root of all sovereignty”: the authority to act in the world as one sees fit. Sovereignty — a word etymologically associated with monarchy, money, and royalty — refers to the locus of supreme power in the sphere of human action. According to Natural Law, sovereignty inheres within the individual, as each person must consciously decide what actions to take, despite any exogenous influences they may face. An inner sanctum of sovereignty’s generative source lives within each of us — an inviolable principle of reason known as the logos. An interface layer between the primary domains of experience—order and chaos—the logos is the defining feature of humanity: our ability to tell and believe stories is what distinguishes man from animal. Victor Frankl calls this interiorized space the “last human freedom”:

“The last of the human freedoms: to choose one’s attitude in any given set of circumstances, to choose one’s own way. And there were always choices to make. Every day, every hour, offered the opportunity to make a decision, a decision which determined whether you would or would not submit to those powers which threatened to rob you of your very self, your inner freedom; which determined whether or not you become the plaything to circumstance, renouncing freedom and dignity…”

From sovereignty, we derive the word reign, which commonly refers to a period of royal rulership. Most of us now live in an era well-past submission to a royal family, and our civilizational conception of sovereignty has been steadily decentralizing over time, moving closer to a clear reflection of Natural Law. As Jordan Peterson charts this historical progression:

“First of all, the only sovereign was the king. Then the nobles became sovereign. Then all men became sovereign. Then came the Christian revolution and every individual soul, impossibly, became sovereign. That idea of individual sovereignty and worth is the core presupposition of our legal and cultural systems, so we all walk around acting as if every one of us is a divine centre of logos. We grant each other the respect of individual citizens who are sovereign and are equal before the law.”

At the foundation of Western Civilization today is the precept that the sovereignty of the individual is held higher than the state: an embodied belief at the heart of legal principles such as habeus corpus, the presumption of “innocent until proven guilty,” and freedom of speech rights.

Freedom of speech is essential to a peaceful society, as our ideas must be free to clash and resolve conflicts so that our bodies don’t. Speech arose in humans as a direct result of our evolutionary development: once a vertical stance was adopted by our ancestral primates, our visual field was expanded, and our hands became more adept at manipulating the natural environment since they were no longer needed for locomotion. Newly outfitted with opposable thumbs, we developed a dexterity that enabled us to particularize the natural world in useful ways—like sorting things, counting, and making tools. Fine musculature in the face and tongue evolved alongside this precision of hand, giving rise to spoken language, which complemented the hand’s ability to categorize the world, and the mind’s ability to comprehend it (even our internal dialogue is composed of speech). An ability to manually reconfigure the world reinforced our abstractive capacity to do so verbally, thereby forming a feedback dynamic between these two defining faculties of man. This co-evolution of craftsmanship and verbal articulation led naturally to trade, and (quite simply) the most exchangeable thing in any trading society is its most important tool—money.

Seen this way, money is a direct derivation of action and speech: all three of which are essential media for sovereign self-expression. In this sense, money may be considered a form of speech in and unto itself—the language of value. Placing limitations on the use of this language (the purpose of central banks) is commensurately catastrophic to restricting the freedom of speech (which can lead to absurdities like illegal numbers). Free speech digs the grave for despotism, whereas its suppression is the trademark of totalitarian regimes. Indeed, the first effort of every aspiring dictator is always to restrict the voice of dissent—to darken the light of inquiry radiating from the logos. The 20th century had many logos-suppressing dictatorships, we will name two:

“In 1917, the Russian Bolsheviks moved to limit freedom of speech the very day after the October coup-d’état. They adopted the “Decree on the Press,” which shut down any newspapers “sowing discord by libelous distortion of facts.” Similarly, only a few months after coming to power in 1933, German National Socialists started to burn books, and the Ministry of Propaganda introduced strict censorship.

Logos (λόγος) is a Greek word that means “ratio” or “word”—the principle at the core of interpersonal communications, which are largely conducted via words and prices (which are exchange ratios expressed in monetary terms). Both words and prices are “categorical comparatives,” protocols for encapsulating, comparing, and communicating different aspects of reality — herein lives the power of the divine logos to render order from chaos. In language, consider how all words only have meaning relative to one another: all definitions are comprised of other words. In markets, the intersection of subjective supply and objective demand is the price: a dynamic figure reflecting the consensus of the collective logos on any particular good’s exchange value for any other good (for simplicity, expressed in the common language of economic numeracy: money).

For money, governments corrupt the pricing mode of comparative expression by constantly violating the supply of money (via inflation) while simultaneously compelling its demand (via legal tender and tax collection laws). Distorting natural price discovery, a manipulation of the collective logos, is equivalent to perverting the vox populi—the voice of the people. George Orwell once said: “If liberty means anything at all, it means the right to tell people what they do not want to hear.” An inability to speak the truth (with words), or prove others wrong in the marketplace (with prices), is the death of liberty; as the 20th century so painfully taught us, restricting the logos is a slippery slope toward totalitarianism. Free expression in all forms is antecedent to proper moral action.

In Soviet Russia, freedom of speech was suppressed and dissent was punished. Independent political activities were not tolerated, whether these involved participation in free labour unions, private corporations, independent churches or opposition political parties.

In Soviet Russia, freedom of speech was suppressed and dissent was punished. Independent political activities were not tolerated, whether these involved participation in free labour unions, private corporations, independent churches or opposition political parties.

Like speech, money lacks an intrinsic morality of its own. However, its economic character does influence moral standards—as Buddha taught us: “Money is the worst discovery of human life, but it is the most trusted material to test human nature.” Honest money encourages righteous action, and dishonest money induces moral hazard. To comprehend money’s impact on morality, consider the (hypothetical) case of a winemaker living in a centrally banked economy. He knows that his central bank recently doubled the money supply by printing trillions of dollars to “save the economy,” and is now faced with three options:

- Continue selling his wine for $20, knowing that the value of each dollar has declined 50% due to inflation*

- Water down his wine or use cheaper ingredients, thereby decreasing the production cost and the quality of his wine, but continue selling it for $20

- Double the selling price of his wine to $40, to get the same value for his wine denominated in post-inflation dollars

*For simplicity, we will ignore the spatiotemporal unevenness of inflation.

If the winemaker chooses the first option, he incurs a 50% loss. If he decides to water down his wine, he defrauds his customers by selling them an inferior product. If he doubles his price to maintain quality, he risks losing customers to less honest competitors who are willing to compromise on quality. Since diluting wine with water is difficult to detect (for non-connoisseurs) and offers an immediate financial gain, all winemakers face strong incentives to defraud their customers when inflation strikes (a cause of wine scandals). In a similar vein, monetary inflation incentivizes sellers across all industries to deceive their customers. Inflation imposes the temptation of larceny onto seller’s hearts, forcing them to weigh financial wellbeing against moral integrity. In this way, inflation is an infectious disease to society’s moral fabric. Inflation-resistant money, then, is an antidote to an afflicted social morality. In this (critically important) sense, Bitcoin—the only money with a 0% terminal inflation rate—is the cure for many of the moral cancers riddling our world.

Inflation is a great immiseration on the soul of humanity—a source much moral sickness worldwide.

Inflation is a great immiseration on the soul of humanity—a source much moral sickness worldwide.

Money is a source of great temptation, as it can be considered the “list of who owns what,” since money can (by definition) be used to buy anything in the marketplace. When a singularly privileged group (a monopoly) can create money out of thin air, they can amend this “list of who owns what” arbitrarily, and have a powerful incentive to do so to their own benefit. This “money as an ownership ledger” angle sheds light on the underlying impetus for central banking—an institution which arrogates itself as “master of the list” with an exclusive privilege to advance the interests of its private shareholders, even at the expense of enslaving everyone else.

Since everything in the marketplace requires sacrifices of human time to produce (even land needs hands to sell), we can say that money is human time emblematized. In the same way a stock certificate is title to company capital, money is title to human time; people sacrifice time earning money which they can then spend on commensurate sacrifices from others. Clearly, a tool that can command human time is an object of great temptation, as it is a potent source of power (defined by physics as work over time). A lust for power is the motivation of most warfare—typically involving attempts to forcibly acquire capital, food, or territory. And a lack of power is closely related to unhappiness, which makes its consolidation alluring—as Philo Judaeus said:

“No slave is really happy, for what greater misery is there than to live with no power over anything, including oneself?”

Money has always been a critical piece of mankind’s notions of sovereignty and slavery. When naturally selected by free market processes, money is a culmination of the collective logos: a synthesis of individual self-sovereign expressions. But natural money has been hijacked by artificial tyrants: the reason we call states “sovereigns” today is only because they are the gangs that hold most of the world’s freely chosen money — gold.

The So-Called Sovereign States

“I did not know I was a slave until I found out I couldn’t do the things I wanted.” —Frederick Douglass

For over 5,000 years, precious metals have been favored as money since they best fulfilled its five properties: divisibility, durability, portability, recognizability, and scarcity. Gold came to reign supreme because of all the monetary metals, it was the most scarce. Scarcity is arguably the most important property of money, as without an assurance of supply limitation, someone always gives in to the temptation to inflate and steal the value stored therein (see: aggry beads, panos cloth money, or fiat currencies today).

Governments have always interceded in the market for money to commandeer gold coinage and warehousing operations, both of which sought to improve the divisibility, portability, and recognizability properties of money by issuing standardized coins or warehouse receipts. By monopolizing these “certification function” businesses, the state shifted the burden of trust from transacting parties onto itself. States throughout history have always made it their (exclusive) business to certify the value (weight or fineness) of money (coins or bars) and money-substitutes (paper warehouse receipts). Remember: insulation from competition interrupts the truth discovery process engendered by free markets; for this reason, trust placed in any monopoly always ends up shattered.

Government exists to protect property rights: a purpose it defiles by monopolizing and counterfeiting money.

Government exists to protect property rights: a purpose it defiles by monopolizing and counterfeiting money.

All national currencies began as paper promises for real money. Today, these currencies are no longer redeemable for real money, and instead have been transformed into perennially unfulfilled promises called fiat currencies. Governments require societies (a restriction of the collective logos) to transact in these money-substitutes and reserve the exclusive right to manipulate their supplies as a means of siphoning wealth (aka stealing time) from citizens. In effect, fiat currencies are uncollateralized debts undergoing slow-motion default while their use is forced on society. All the while, central banks continue to hoard the real money—gold—and perform final settlement with one another in this authentic, free-market-selected medium of exchange.

Seen this way, _“_printing money” actually refers to currency counterfeiting—the production of false promises, as currencies are no longer tied to real money. Said simply: fiat currency is a living lie. Regardless of whether you consider it a tool or a weapon (depending on the subjectivities of user intentionality), manipulating money supplies is objectively useful for only one thing: inflicting wealth inequalities (by stealing time). As G. Braschi puts it: “Every tool is a weapon (if you hold it right).” As a means of gaining an advantage in contests of will, currency counterfeiting is a weapon.

In war times, belligerent nations have made attempts to counterfeit opponent currencies to cause hyperinflation. For example, Nazi Germany had plans to bomb England with counterfeit bank notes to sabotage their economy. And in Imperial Japan, the Noborito Laboratory experimented with currency counterfeiting operations as an economic subversion strategy. In peacetimes, currency counterfeiting is the exclusive domain of the central bank, whose “expansionary monetary policy” increases the money supply by, say, 7% per year—that is, stealing only 7% of dollar-holder wealth (an accumulation of time-savings) each year via counterfeiting operations.

Of course, when circumstances become too uncertain, market participants naturally flock back to the trust-minimization of physical gold, since money-substitutes are (at best) promises to receive money in the future, they are vulnerable to default. Unlike fiat currencies, gold is an expression of the collective logos, not compulsion from a counterparty. The self-declared “sovereign” state is a business model built on the confiscation of self-sovereign monies like gold and silver. The superior monetary properties of gold made it the most valuable form of self-sovereign money in history, a reign it has maintained since before the founding of ancient Egypt.

The Great Pyramids

“There are two ways to conquer and enslave a country. One is by the sword. The other is by debt.” —John Adams

Ancient Egypt is the archetypal tyranny in the Bible. Egypt is renowned for its Great Pyramids, monoliths which were built on the backs of slave labor. Indeed, the grandeur of these constructions owes a major debt of gratitude to the many slaves whose time was stolen by the Pharaohs—masters of Ancient Egypt. To gain a glimmer of understanding as to just how arduous the construction process was for even a single Great Pyramid, consider this data point from the book Heroes of History by Will Durant:

“According to Herodotus… the pyramid itself required the labor of 100,000 men through twenty years.”

Many slave hours went into building the Great Pyramids, but history has even worse pyramid schemes…

Many slave hours went into building the Great Pyramids, but history has even worse pyramid schemes…

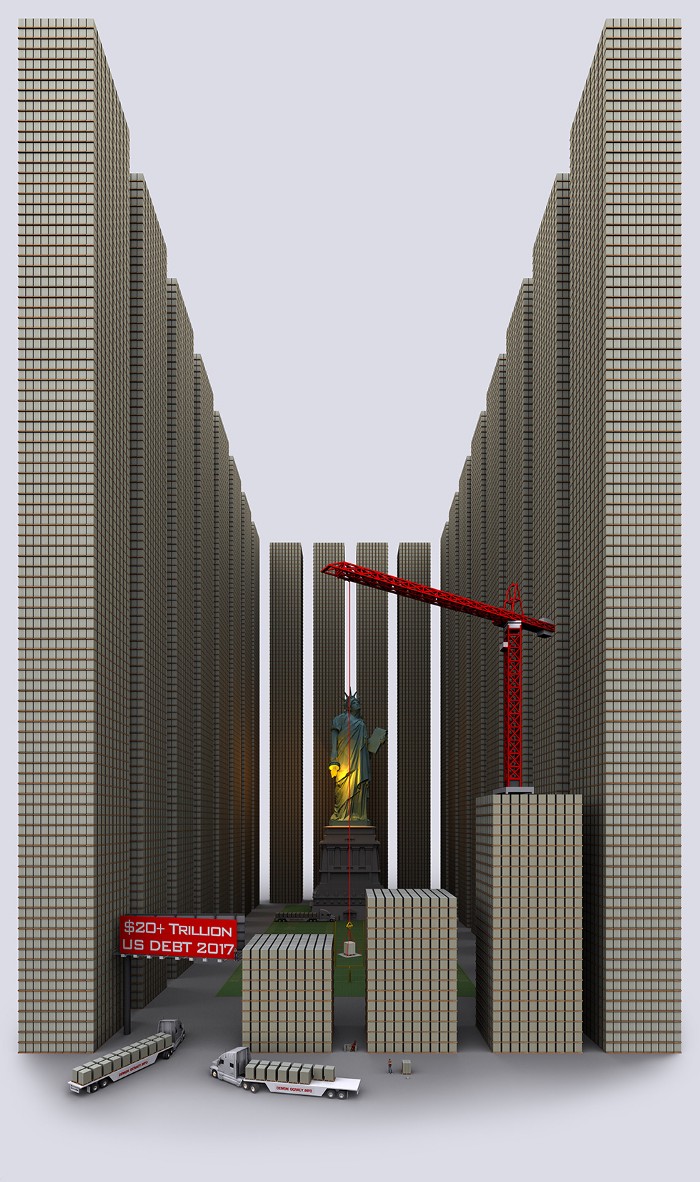

To quantify this time-theft from Egyptian slaves more precisely, again assuming that each slave spent 5,000 hours per year engaged in manual labor, a workforce of 100,000 slaves building for 20 years equals 10B hours of time stolen. A staggering amount of man hours condemned to the brutality of physical bondage during the construction of a single Great Pyramid, but (terribly) still less than the time stolen by the greatest pyramid schemes in human history—fiat currencies. As Henry Ford foretold:

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

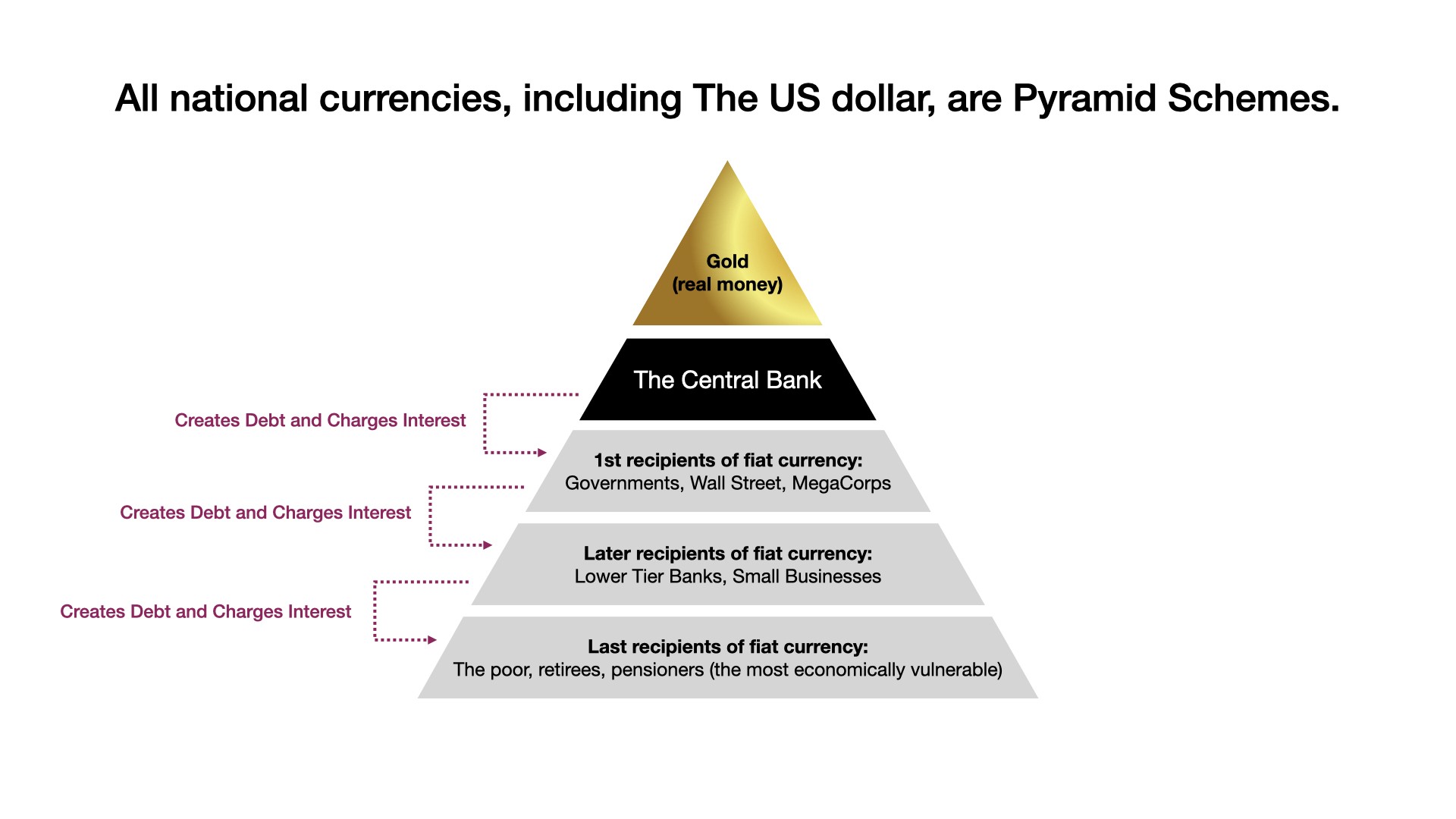

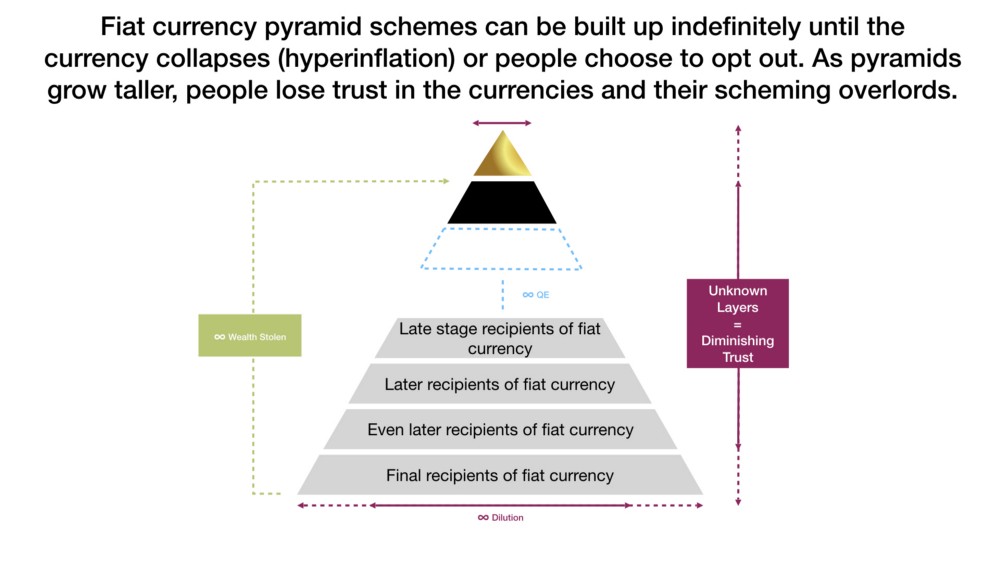

A pyramid scheme is an investment scam based on a hierarchical setup of network marketing, in which higher layer participants profit at the expense of those lower down. Fiat currencies are pyramid schemes erected by central banks, who restrict access to and suppress the price of gold, which would otherwise outcompete their inferior currencies on the free market, since gold is reliably scarce and holds its value across time. The use of fiat currencies is compelled via legal tender and tax laws. It may be hard to believe that the world’s most popular currency is a pyramid scheme, but the symbology of the US dollar tells its own story:

Novus Ordo Seclorum is Latin for “New order of the ages” — this symbol appeared soon after the founding of The Fed: perhaps it refers to the new system of slavery implemented under the monicker of “central banking.”

Novus Ordo Seclorum is Latin for “New order of the ages” — this symbol appeared soon after the founding of The Fed: perhaps it refers to the new system of slavery implemented under the monicker of “central banking.”

After a long-game legerdemain by governments, these pyramid schemes came to dominate the world. Fiat currencies are debt-based money-substitutes controlled by central banks, which impose these monetary networks on users and suppress all competition in the market coercively or violently (similar to the Grão Pará and Maranhão Company). Most despicably, it is the poorest people in society—who (by necessity) hold the majority of their wealth in fiat currency—that are most victimized by this fraudulent system.

At the pinnacle fiat currency pyramid schemes is gold: a technology selected as money by the cumulative free choice (the collective logos) of countless entrepreneurs throughout history. Paper currency abstractions of gold were introduced purely to make it more convenient for exchange, not to replace it. Over time, the option to redeem currency for gold was eliminated, giving governments full control over currency scarcity, and therefore an unlimited capacity to confiscate wealth from their citizens by compromising its supply.

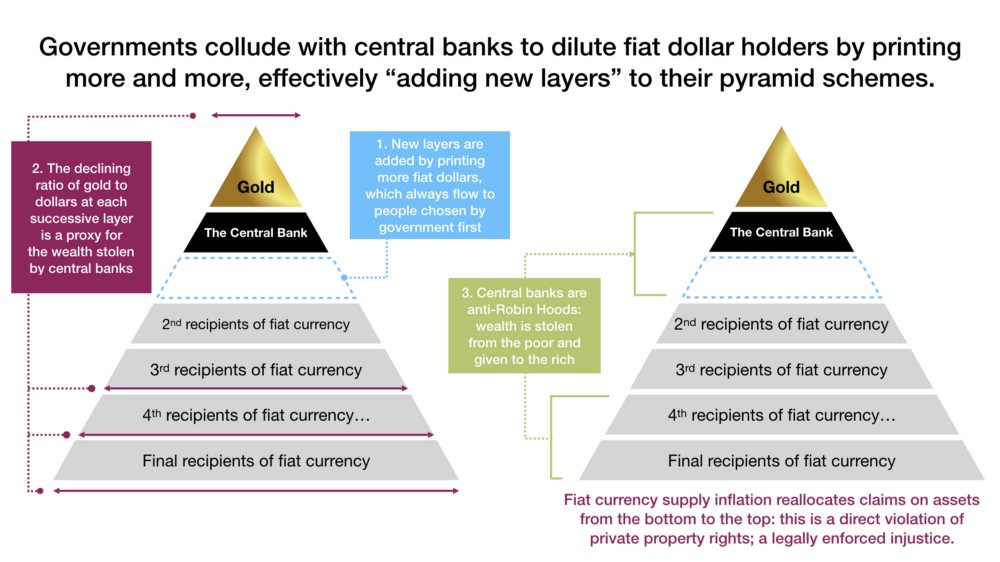

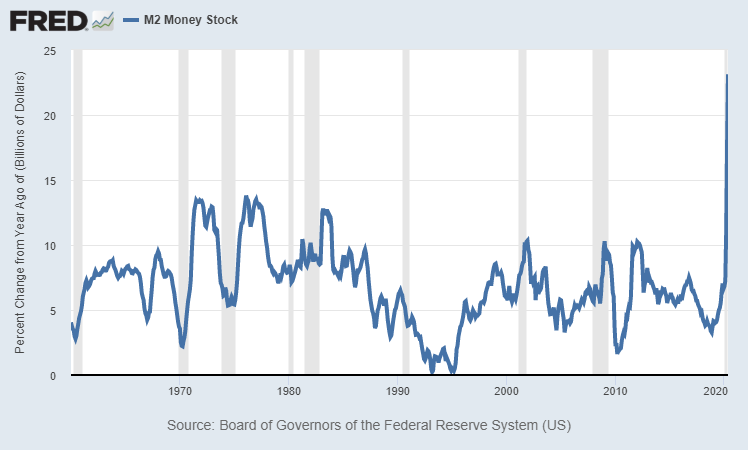

In effect, every time a new unit of fiat currency is printed (euphemistically called “quantitative easing” or QE by central banks), new layers to the pyramid scheme are laid from the top down, and the inflationary costs are externalized onto those using fiat as a store of value. Worse still, each unit of fiat currency is leveraged, so that one unit is multiplied by several orders of magnitude by the time it becomes part of the broad money supply. Looking at The Fed as a specific example: after netting service fee revenue for itself (to fund its operations and a 6% annual dividend to its undisclosed shareholders), The Fed uses the new fiat dollars to purchase US government debt. Freshly printed (more accurately, electronically generated) fiat dollars are then doled out at the discretion of government bureaucrats, who (unsurprisingly) tend to favor the bankers, corporations, and lobbyists that pay for their political campaigns. Detestably, this dynamic reallocates wealth from the poor to the rich (Robin Hood would be ashamed).

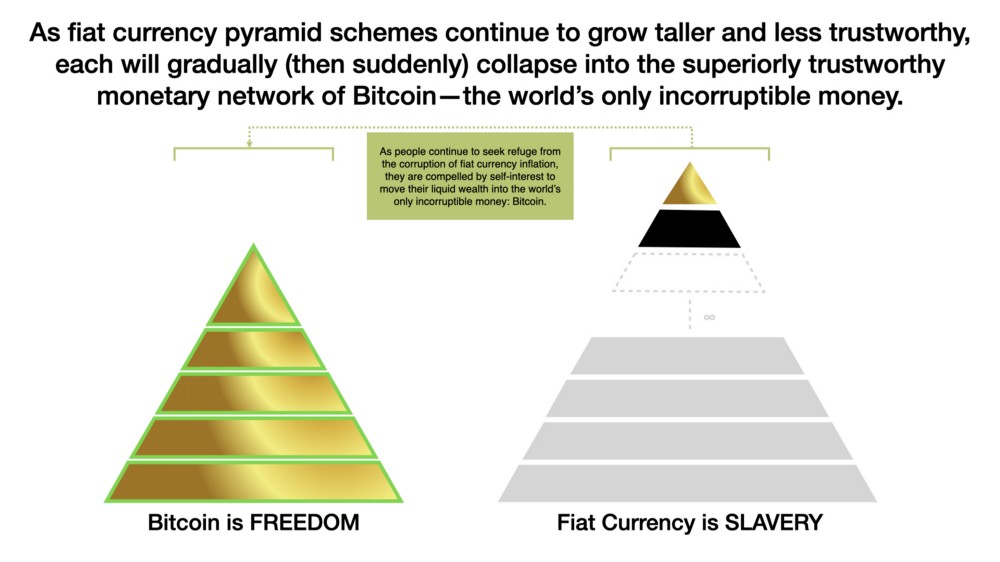

So long as people remain sufficiently passive yet productive, these pyramid schemes can be built ever-higher, and continue to operate as a weapon of wealth extraction (time-theft) for their political perpetrators. However, since there are no free lunches in this universe, this fiat currency supply expansion cannot continue forever. As layers continue to accumulate in round after round of QE, and people are implicitly taxed harder and harder through price inflation, trust in the currency becomes diminished. Like Hemingway said about bankruptcy, this happens gradually at first, then suddenly as inflation gives way to hyperinflation: a total meltdown of the economic trust money is intended to facilitate in the first place. At this point, the “central bank master” has pushed his “fiat-slave citizens” too hard, as they finally reach the edge of their economic livelihoods.

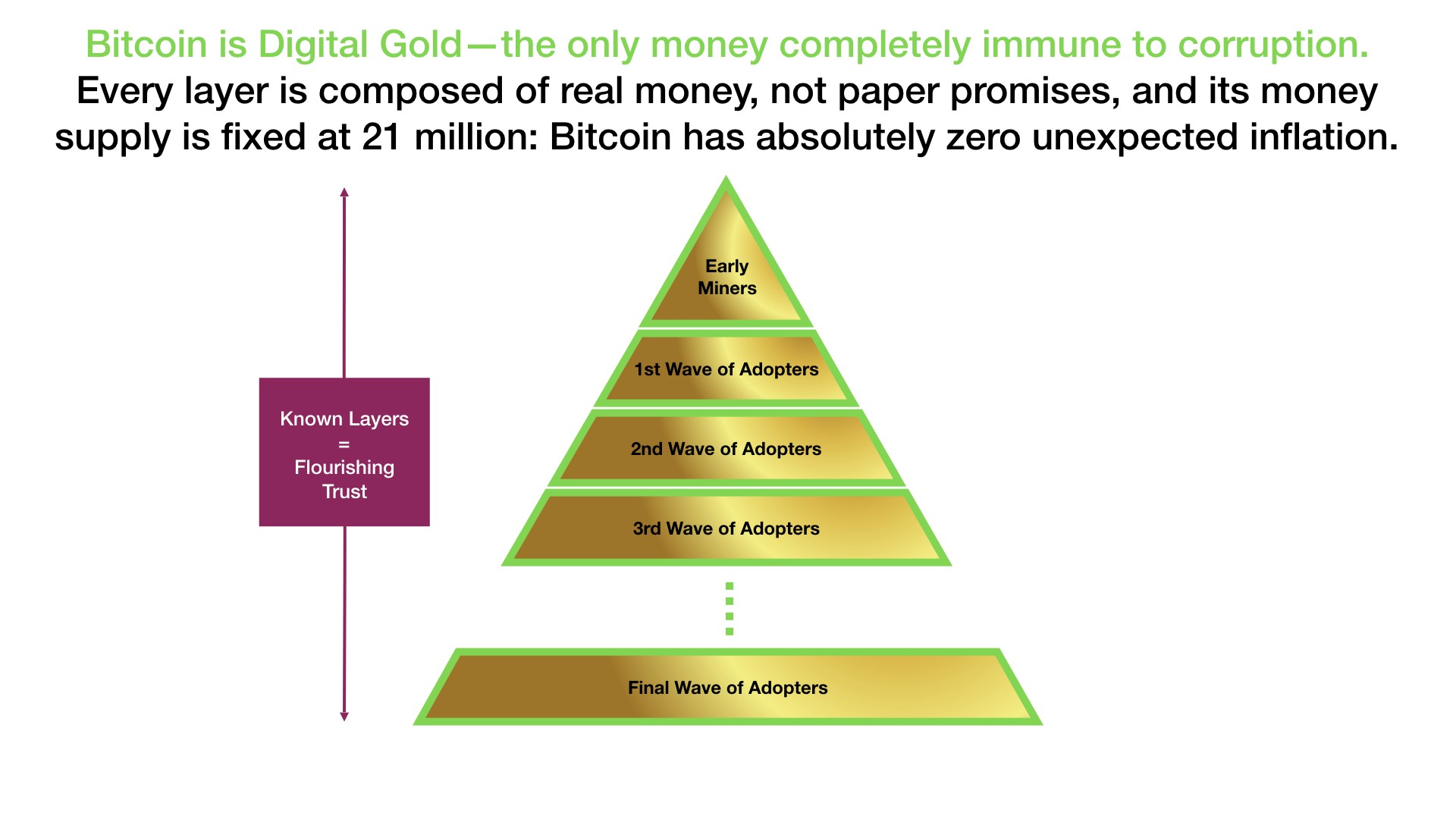

Fortunately, thanks to Bitcoin, these financial pyramid schemes can no longer be shielded from direct competition (as they are from gold). All fiat currencies are critically dependent on the ability of central banks to subdue competition—the discovery process that would otherwise disrupt their illusion. Owning 20% of the global gold supply gives central banks significant influence over its price, which they actively suppress in the paper markets. Without intervention, fiat currencies would quickly collapse to the superior value proposition of gold as money, as people always favor a money that holds its value across time (by remaining scarce). In this regard, Bitcoin—the world’s only “digital gold”—represents a major breakthrough: a monetary technology that is disruptive to gold, resistant to competitive suppression by central banks, and the one-time discovery of an absolutely scarce money.

All monies exhibit a multi-level marketing valuation dynamic: for Bitcoin, early adopters benefit disproportionately by anticipating later adoption by others (the Bitcoin economic bootstrapping process is characterized by a virtuous cycle). But unlike the unknowable supplies of fiat currency pyramid schemes, Bitcoin has a universally known supply. For fiat currencies, the “early adopters” are perpetually those with access to the printing press; a positional asymmetry (a political privilege) that makes the game unfair.

A more symmetrical system, Bitcoin is uniquely characterized by [perfect information](https://en.wikipedia.org/wiki/Perfect_information#:~:text=In%20economics%2C%20perfect%20information%20(sometimes,utility%2C%20and%20own%20cost%20functions.)meaning that all market participants can see the rules that govern it, verify that that there will never be more than 21 million units, and determine precisely when each will be produced—meaning all unexpected supply inflation for Bitcoin is optimized for holders at absolute zero. Perfect information is a prerequisite to the economic concept of perfect competition: an ideal (yet unattainable) market condition where competitiveness is entirely unhampered by unnecessary regulations and wealth generation is maximized. A great promise of Bitcoin is to pull global markets closer toward this state of perfection by separating money and state.

Laid in layers of permanence, this “digital gold” pyramid outshines the inherent uncertainties of fiat currencies. Since money is “insurance against uncertainty,” its demand is centered on the relative certainty of its monetary properties; and Bitcoin optimizes for all five: it exhibits the divisibility, durability, portability, and recognizability of pure information; and the scarcity of time. Like death and taxes, the certainty of “21 million bitcoin” is a concept that cannot be refuted. Coupled with the incentive to front-run future adoption of this digital, absolutely scarce, and theft-proof money makes Bitcoin a game-theoretic gravity-well that the market for money simply cannot escape. Paradoxically, it is precisely this inescapability that is leading to the liberation of more and more fiat-slaves worldwide.

Symbolized by its fixed height in the image above, the absolute scarcity of the Bitcoin monetary pyramid increasingly outcompetes fiat currency pyramid schemes as they grow comparatively taller and less trustworthy through supply expansion. Eventually, these proverbial “houses of cards” collapse into the full transparency and certainty of Bitcoin. Whether it is understood or not, in the sphere of money, the known serves as protection from the unknown.

Viewed this way, we have much to be hopeful for in the world, as there is finally an incorruptible alternative to the completely unethical system of central banking. Bitcoin is honest money freeing the world from the falsehood of fiat currency. In a transcendental sense, Bitcoin may actually be what the ancient alchemists spent centuries pursuing: the incorruptible substance—called the lapis philosophorum in archaic texts—that would serve as an antidote to the corruption of the world. As Jordan Peterson wrote of alchemy in his profound book Maps of Meaning:

“The sequence of the alchemical transformation paralleled Christ’s Passion, paralleled the myth of the hero and his redemption. The essential message of alchemy is that individual rejection of tyranny, voluntary pursuit of the unknown and terrifying — predicated upon faith in the ideal — may engender an individual transformation so overwhelming that its equivalent can only be found in the most profound of religious myths…The lapis philosophorum is “agent of transformation,” equivalent to the mythological redemptive hero — able to turn “base metals into gold.” It is, as such, something more valuable than gold — just as the hero is more valuable than any of his concrete productions.”

Alchemical methodologies were “proto-science”: experimental processes practiced for thousands of years that were foundational to the later development of the scientific method (even Isaac Newton was an alchemist). As a school of thought, alchemy was a “fork” off of The Church premised on the belief that redemptive knowledge could be found in the laboratory of nature (a heretical concept at the time). Standing at the vanguard of human technological achievement, existing as the only money characterized by a manipulation-proof supply, and inspiring earnest transformations in the lives of true believers, perhaps Bitcoin actually is the lapis philosophorum pursued by alchemists for centuries—the incorruptible substance giving rebellion to state tyranny and, in doing so, bringing mankind closer to God. Bitcoin is the truth, and by one definition, God is expressed in the truthful speech that rectifies pathological hierarchies. Or as Benjamin Franklin said:

“Rebellion to tyrants is obedience to God.”

Like freedom, love, and truth—God is timeless. I am not talking about a “guy in the sky” here: the ancient idea from Genesis is that God is the force that freely confronts the chaos of potential with courage, truth, and love to convert it into good and useful order. Being made in the image of God, we are all sovereign individuals imbued with the logos, a self-generating power responsible for our ability to harmoniously reconfigure the natural world into good and habitable space. Our future is seeded in our imaginations, a reality we call forth by freely exercising the logos in thought, speech, and action. The logos is the divine spark intrinsic to us all; realizing that words can only miss the mark of spiritual truth, we can venture to say: God is the anti-entropic principle eternally propagating through all life. As G.K. Chesterton said:

“A dead thing can go with the stream, but only a living thing can go against it.”

To most truthfully embody the divine principle of the logos individually, and more closely approach the timelessness of God collectively, we must triumph against the evil forces that steal our time secretively and constantly.

Stealing Time

“There is one kind of robber whom the law does not strike at, and who steals what is most precious to men: time.” —Napoleon Bonaparte

Many mistakenly blame capitalism for the myriad economic problems in the world. However, at the heart of every modern economy is an institution of socialism: the central bank. In a primitive sense, the first man who dug a hole to shelter himself from the weather was the first capitalist, and the man who violently encroached on his tiny territory for his own selfish purposes was the first socialist. Capitalism simply means everyone has exclusive rights to the fruits of their own labor; in other words, everyone owns their own time. True capitalists are free to trade any valuables they invest their time to create (goods, services, or knowledge) with other self-owned people doing the same. Socialism, on the other hand, entails that governments (aka other people) own a (greater or lesser) portion of your time; the “pound of flesh” they take through conscription, taxation, and inflation.

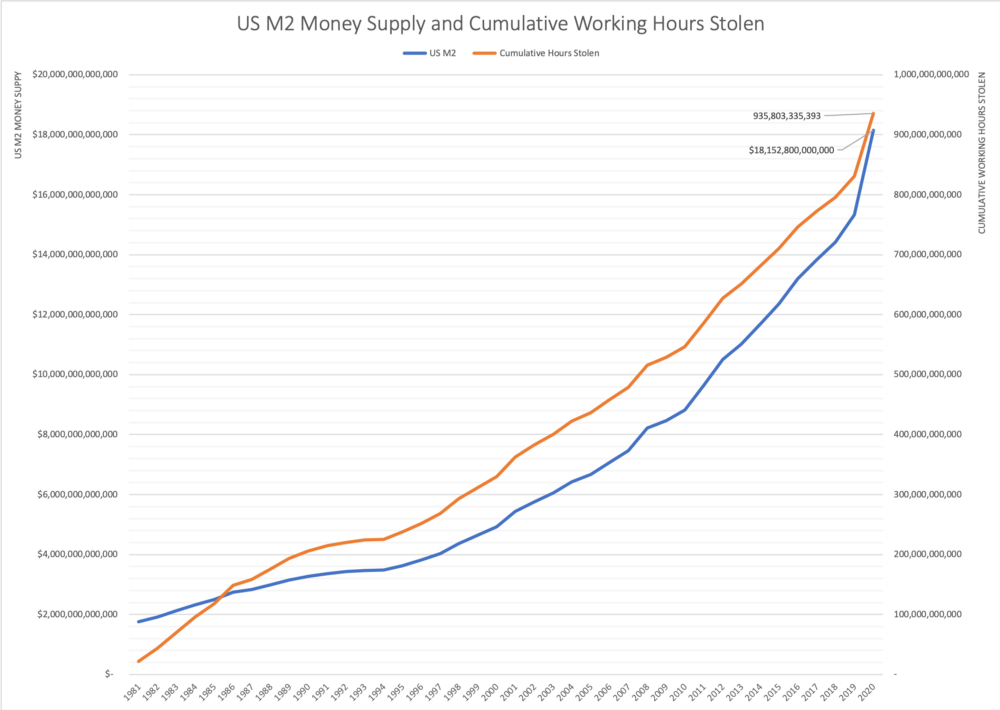

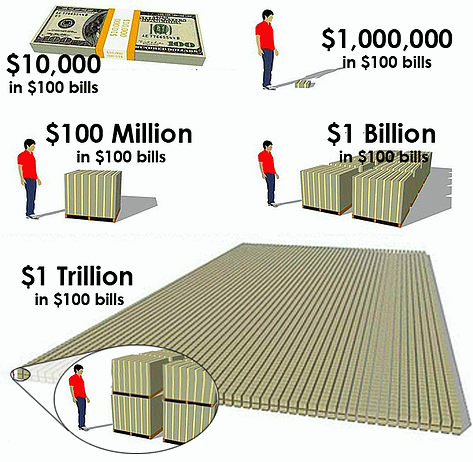

Socialistic fiat currency is the lifeblood of state tyranny: to comprehend just how colossal the central banking system of time-theft has become, let’s take a close look at The Fed. Using annual wage data from the social security administration, changes in US M2 money supply, and assuming 2,000 average annual working hours per worker, we arrive at some startling figures. By dividing the growth in USD supply by the average hourly wage each year in dollars, we calculate a proxy for the hours stolen from society through USD supply expansion (source link).

“Printing money” is currency counterfeiting and the theft of human time—in a word, slavery.

Stealing an average of 7.6% working hours per year since 1981, bureaucrats at The Fed have managed to scalp nearly one trillion hours off the backs of hard working people. Assuming each person works an average of 2,000 hours per year, this is equivalent to enslaving 11.7M people for 40 years straight. This implicit taxation via inflation is in addition to all explicit taxes imposed by the US government—all of which are acts of outright socialism. Unless transactions are made by consensual and willing market participants, then exchange is extortive—this is a central tenet of free market capitalism.

Time stolen by The Fed since 1981 is 341% more per year than the trans-Atlantic slave trade. With 23.4B hours stolen annually, The Fed could (in theory) build 2.3 Great Pyramids each year. In terms of absolute human time stolen per year, fiat currency is the largest pyramid scheme and institution of slavery in human history.

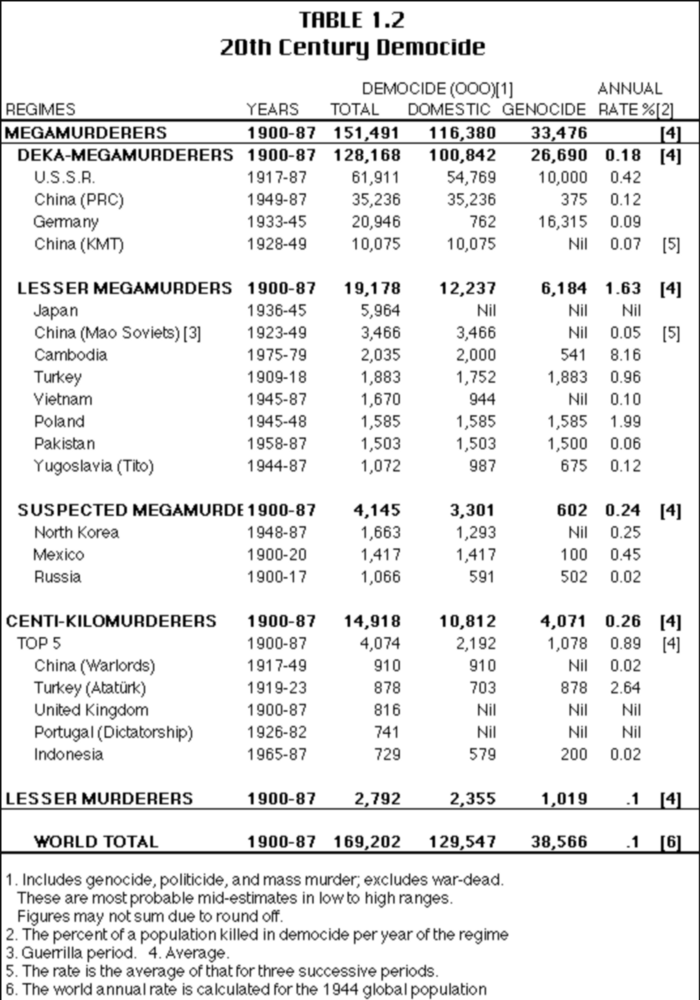

When we stop conceiving of central banking as an economics story, and start to see it as a crime story, we are beginning to get the true picture. Capitalism is established in truth (hard work, delayed gratification, and honest trade), whereas socialism is founded in falsehood (bureaucratizing, propagandizing, and theft). Like counterfeit aggry beads and panos, counterfeit dollars are also used to mobilize military efforts, which (before fiat) required explicit taxation or borrowing to finance. Socialistic money is the stealth funding source of evil: it has been used to finance every dictator, world war, and internment camp in human history. In the 20th century alone, fiat-currency-funded-governments murdered over 169M people—a modern mega-atrocity called democide:

A table quantifying murders by governments from 1900–1987 in millions: 169,202,000 victims of democide.

History is clear: enforced enactment of the fiat currency lie worldwide leads to loss of life on a monstrous scale. Said simply: socialism is fraud, and those who remain silent on the truth of central banking are complicit in its criminality. As Nassim Taleb succinctly states this ethic:

”If you see fraud and do not say fraud, you are a fraud.”

The central planning of money is not a new idea. In Marx’s 1848 Manifesto to the Communist Party, measure number five reads: “Centralization of credit in the hands of the state, by means of a national bank with State capital and an exclusive monopoly.” Straight out of Marx’s playbook, there is nothing capitalist at all about central banking; it is an anticapitalist organization, so let us speak of it truthfully: central banking is monetary socialism—an institution of financial slavery. Further, Karl Marx was a known racist; his socialistic system of central banking is solely designed to extract wealth from those the state deems to be “inferior.” It is little surprise, then, that an institution centered on Marxist philosophy has mutated into a racist slavemaster.

Slavemasters seek to steal the benefits of work without making the requisite sacrifices. Across trading societies, gold was favored as money because it required “proof of work” to obtain: an unforgeable costliness that could not be counterfeited, and therefore self-represented the collective sacrifices made to procure it. Work is a noble pursuit, as it carries us closer to the timelessness of God, since all innovations are just productivity enhancers — instruments for accomplishing greater results within the same expanse of time. Theft is the opposite: a twisting of the moral fabric of reality to serve the present ego in defiance of the eternal God. Attempts to twist reality in this way always snap back to devastate those who try: our only salvation from this deceit is the truth.