WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the May 2020 Journal PDF Donate & Download the May 2020 Journal ePUB

Cover Art by Van

A big thank you to Van for allowing me to use your work on the cover of this month’s journal. Van is part of the crypto art movement and is exploring digitally scarce artwork through NFT platforms. Visit Van’s website for more information.

Van is a digital artist and graphic designer from Italy with an interest in abstract digital art, whose work showcases new ways to mix and blend design and art with a touch of bright contrast colors.

Bitcoin is Common Sense

By Parker Lewis on Unchained Capital

Posted May 1, 2020

AUDIO VERSION BY Bitcoin Audible

“Perhaps the sentiments contained in the following pages, are not yet sufficiently fashionable to procure them general favor; a long habit of not thinking a thing wrong, gives it a superficial appearance of being right, and raises at first a formidable outcry in defense of custom. But the tumult soon subsides. Time makes more converts than reason.” – Thomas Paine, Common Sense (February 24, 1776)

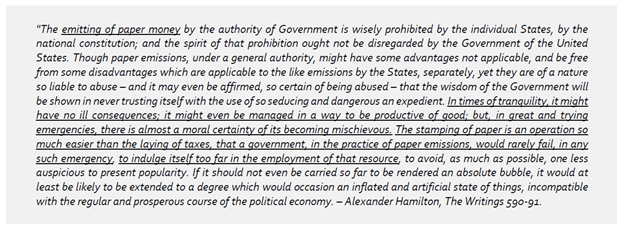

These were the opening remarks of Thomas Paine’s call for American independence in early 1776. At the time, a declaration of independence was far from a certainty, but in Paine’s view, there was no question. It wasn’t a debate; there was only one path forward. Still, he understood that public opinion had not yet caught up and naturally remained anchored to the status quo, with a preference for reconciliation rather than independence. Old habits die hard. The status quo has a tendency of being defended, regardless of merit, merely by its anchoring in time to the way things have always been. However, truths have a way of becoming self-evident in time, more often due to common sense rather than any amount of reason or logic. One day, the truth is more likely to smack you in the face, becoming painfully obvious through some firsthand experience which opens up a perspective that otherwise would not have existed. While Paine was undoubtedly attempting to persuade an undecided populous with reason and logic, it was at the same time an appeal to not overthink that which stands in opposition to what is already self-evident.

In Paine’s view, independence was not a modern-day IQ test, nor was its relevance confined to the American colonies; instead, it was a common sense test and its interest was universal to “the cause of all mankind,” as Paine put it. In many ways, the same is true of bitcoin. It is not an IQ test; instead, bitcoin is common sense and its implications are near universal. Few people have ever stopped to question or understand the function of money. It facilitates practically every transaction anyone has ever made, yet no one really knows the why of that equation, nor the properties that allow money to effectively coordinate economic activity. Its function is taken for granted, and as a result, it is a subject not widely taught or explored. Yet despite a limited baseline of knowledge, there is often a visceral reaction to the very idea of bitcoin as money. The default position is predictably no. Bitcoin is an anathema to all notions of existing custom. On the surface, it is entirely inconsistent with what folks know money to be. For most, money is just money because it always has been. In general, for any individual, the construction of money is anchored in time and it is very naturally not questioned.

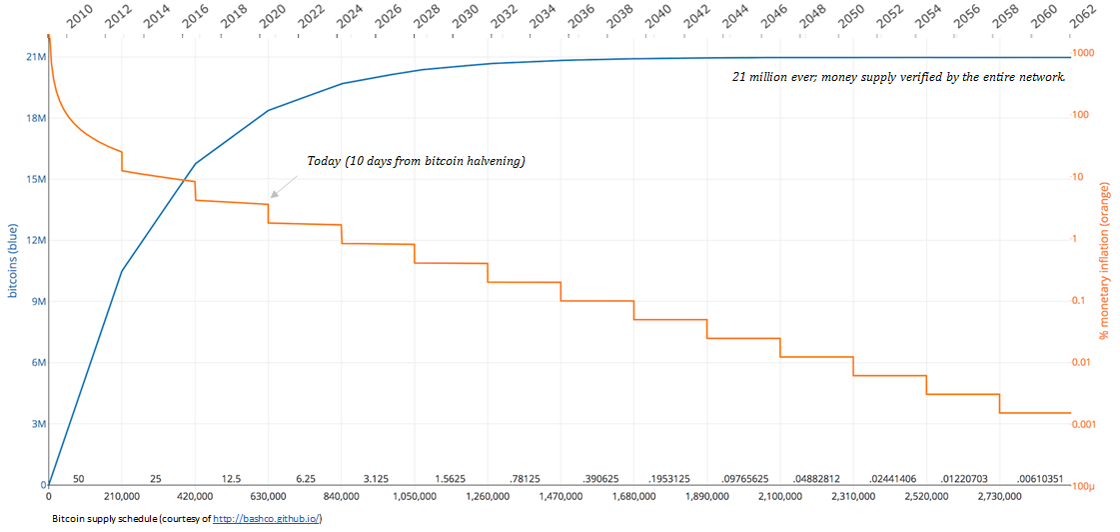

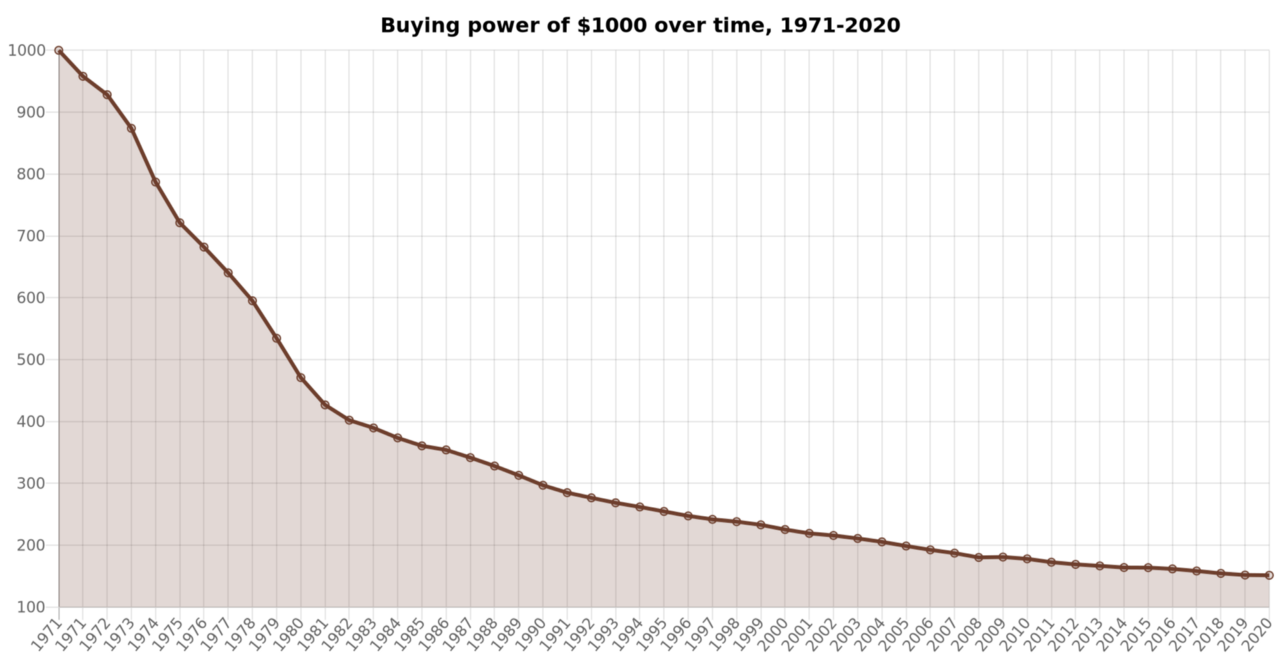

But enter bitcoin, and everyone suddenly becomes an expert in what is and isn’t money, and to the fly-by-night expert, it certainly is not bitcoin. Bitcoin is natively digital, it is not tied to a government or central bank, it is volatile and perceived to be “slow,” it is not used en masse to facilitate commerce, and it is not inflationary. This is one of those rare instances when a thing does not walk like a duck or quack like a duck but it’s actually a duck, and what you thought was a duck all along was mistakenly something entirely different. When it comes to modern money, the long habit of not thinking a thing wrong, gives it a superficial appearance of being right. In all perceived-to-be successful applications today, money is issued by a central bank; it is relatively stable and capable of near infinite transaction throughput; it facilitates day-to-day commerce; and by the grace of god, its supply can be rapidly inflated to meet the needs of an ever-changing economy. Bitcoin has none of these traits (some not presently, others not ever), and as a result, it is most often dismissed as not meeting the standards of modern-day money. This is where overthinking a problem can cripple the highest of IQs. Pattern recognition fails because the game fundamentally changed, but the players do not yet realize it. It is akin to getting lost in the weeds or failing to see the forest through the trees. Bitcoin is finitely scarce, it is highly divisible and it is capable of being sent over a communication channel (and on a permissionless basis). There will only ever be 21 million bitcoin. Rocket scientists and the most revered investors of our time could look at this equation relative to other applications in the market and be confounded, not seeing its value. While at the same time, if posed with a very simple question, would you rather be paid either in a currency with a fixed supply that cannot be manipulated or in a currency that is subject to persistent, systemic and significant debasement, an overwhelming majority of individuals would choose the former all day, every day.

On bitcoin: “It’s probably rat poison squared” – Warren Buffett

“Bitcoin – there’s even less you can do with it […] I’d rather have bananas, I can eat bananas” – Mark Cuban

Money Doesn’t Grow On Trees

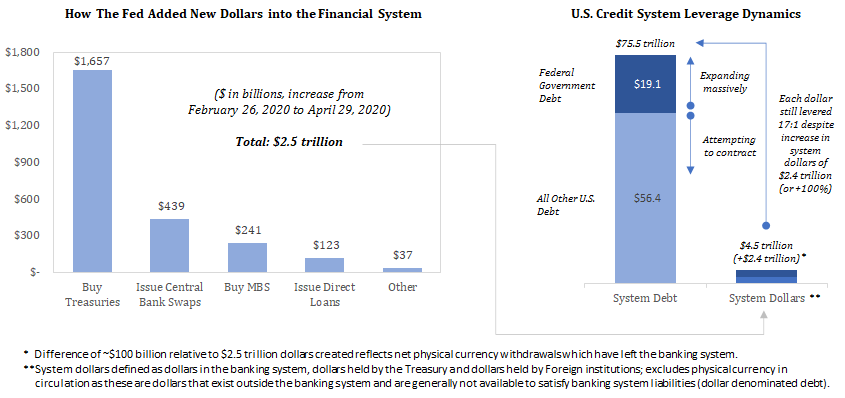

As kids, we all learn that money doesn’t grow on trees but on a societal level, or as a country, any remnant of common sense seems to have left the building. Just in the last two months, central banks in the United States, Europe and Japan (the Fed, ECB and BOJ) have collectively inflated the supply of their respective currencies by $3.3 trillion in aggregate – an increase of over 20% in just eight weeks. The Fed alone has accounted for the majority, minting $2.5 trillion dollars and increasing the base money supply by over 60%. And it’s far from over; trillions more will be created. It is not a possibility; it is a certainty. Common sense is that deep feeling of uncertainty many are experiencing that says, “this doesn’t make any sense” or “this doesn’t end well.” Few carry that thought process out to its logical conclusion, often because it is uncomfortable to think about, but it is reverberating throughout the country and the world. While not everyone is connecting the equation to 21 million bitcoin, a growing number of people are. _Time makes more converts than reason. _Individuals don’t have to understand how or why there will only ever be 21 million bitcoin; all that has to be recognized in practical experience is that dollars are going to be worth significantly less in the future, and then the idea of having a currency with a fixed supply begins to make sense. Understanding how it is possible that bitcoin has a fixed supply comes after making that initial connection, but even still, no one needs to understand the how to understand that it is valuable. It is the light bulb turning on.

For each individual, there is a choice to either exist in a world in which someone gets to produce new units of money for free (but just not them) or a world where no one gets to do that (including them). From an individual perspective, there is not a marginal difference in those two worlds; it is night and day, and anyone conscious of the decision very intuitively opts for the latter, recognizing that the former is neither sustainable, nor to his or her advantage. Imagine there were 100 individuals in an economy, each with different skills. All have determined to use a common form of money to facilitate trade in exchange for goods and services produced by others. With the one exception that a single individual has a superpower to print money, requiring no investment of time and at practically no cost. Given human time is an inherently scarce resource and that it is a required input in the production of any good or service demanded in trade, such a scenario would mean that one person would get to purchase the output of all the others for free. Why would anyone agree to such an arrangement? That the individual is an enterprise, and more specifically, a central bank expected to act in the public interest does not change the fundamental operation. If it does not make sense on a micro level, it does not magically transform into a different fundamental fact merely because there are greater degrees of separation. If no individual would bestow that power in another, neither would a conscious decision be made to bestow it in a central bank.

Everything beyond this fundamental reality strays into abstract theory, relying on leaps of faith, hypotheticals and big words that no one understands, all while divorced from individual decision points. It is not that one individual is more trusted than another or one central bank relative to another; it is simply that, on an individual level, no individual is advantaged by someone else having the ability to print money, regardless of identity or interests. That this is true leaves only one alternative, that each individual would be advantaged by ensuring that no other individual or entity has this power. The Fed may have the ability to create dollars at zero cost, but money still doesn’t grow on trees. It is more likely that a particular form of money is not actually money than it is that money miraculously started growing on trees. And at an individual level, everyone is incentivized to ensure that is not the case. While there is a long habit of not thinking this particular thing wrong, the errant defense of custom can only stray so far. Time converts everyone back into reality. At present, it is the Fed’s “shock and awe” campaign contrasted by the simplicity in bitcoin’s fixed supply of 21 million. There is no amount of reason that can replace an observed divergence in two distinct paths.

Defending Existing Custom

“There’s money and there’s credit. The only thing that matters is spending and you can spend money and you can spend credit. And when credit goes down, you better put money into the system so you can have the same level of spending. That’s what they did through the financial system (referencing QE in response to the past crisis) and that thing worked.”– Ray Dalio, CNBC September 19, 2017

Basic Bitcoin Common Sense

There is No Such Thing as a Free Lunch

As more people become aware of the Fed’s activities, it only begins to raise more questions. $2,500,000,000,000 is a big number, but what is actually happening? Who gets the money? What will the effects be and when? What are the consequences? Why is this even possible? How does it make any sense? All very valid questions, but none of these questions change the fact that many more dollars exist and that each dollar will be worth materially less in the future. That is intuitive. However, at an even more fundamental level, recognize that the operation of printing money (or creating digital dollars) does nothing to generate economic activity. To really simplify it, imagine a printing press just running on a loop. Or, imagine keying in an amount of dollars on a computer (which is technically all that the Fed does when it creates “money”). That very operation can definitionally do nothing to produce anything of value in the real world. Instead, that action can only induce an individual to take some other action.

Recognize that any tangible good or service produced is produced by some individual. Human time is the input, capital production is the output. Whether it is software applications, manufacturing equipment, a service or an end consumer good, all along the value chain, an individual contributed time to produce some good or service. That time and value is ultimately what money tracks and prices. Entering a large number into the computer does not produce software, hardware, cars or homes. People produce those things and money coordinates the preferences of all individuals within an economy, compensating value to varying degrees for time spent.

When the Fed creates $2.5 trillion in a matter of weeks, it is consolidating the power to price and value human time. Seems cryptic but it is not a suggestion that the individuals at the Fed are consciously or deliberately operating maliciously. It is just the root level consequence of the Fed’s actions, even if well intentioned. Again, the Fed’s operation (arbitrarily adding zeros to various bank account balances) cannot actually generate economic activity; all it can do is determine how to allocate new dollars. By doing so, it is advantaging some individual, enterprise or segment of the economy over another. In allocating new dollars that it creates, it is replacing a market function, one priced by billions of people, with a centralized function, greatly influencing the balance of power as to who controls the monetary capital that coordinates economic activity. Think about the distribution of money as the balance of control influencing and ultimately determining what gets built, by whom and at what price. At the moment of creation, there exists more money but there exists no more human time or goods and services as a consequence of that action. Similarly, over time, the Fed’s actions do not create more jobs, there are just more dollars to distribute across the labor force, but with a different distribution of those holding the currency. The Fed can print money (technically, create digital dollars), but it can’t print time nor can it do anything but artificially manipulate the allocation of resources within an economy.

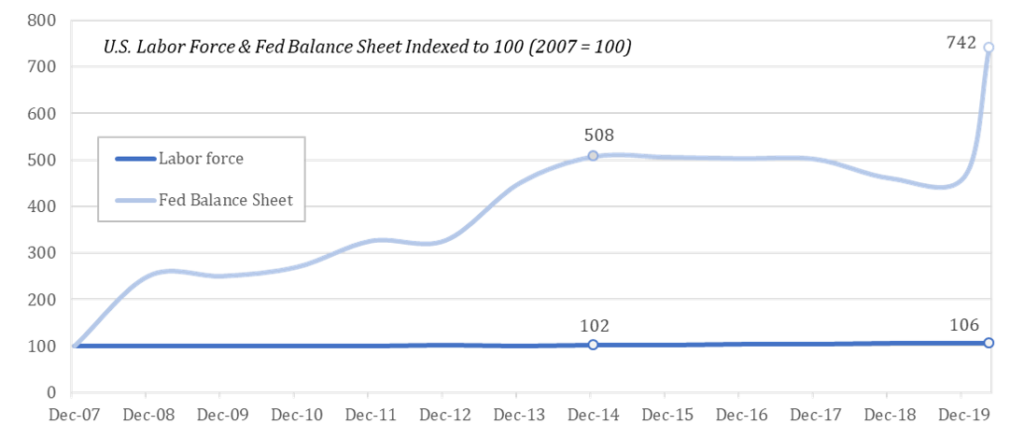

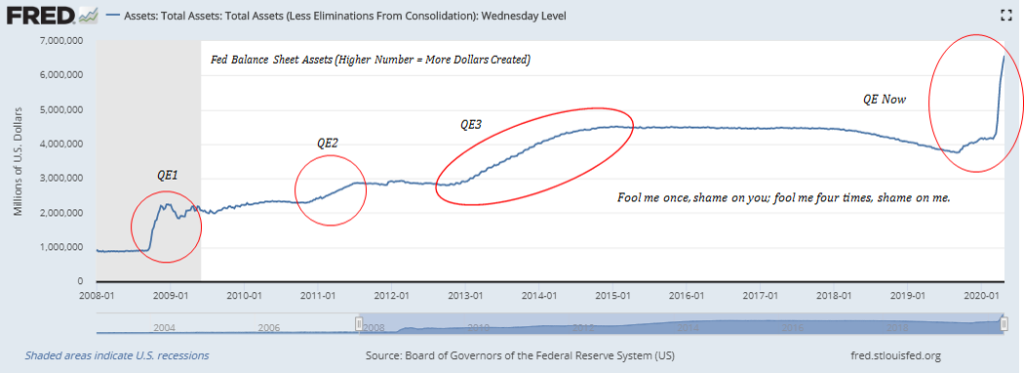

No Free Lunches, Just More Dollars

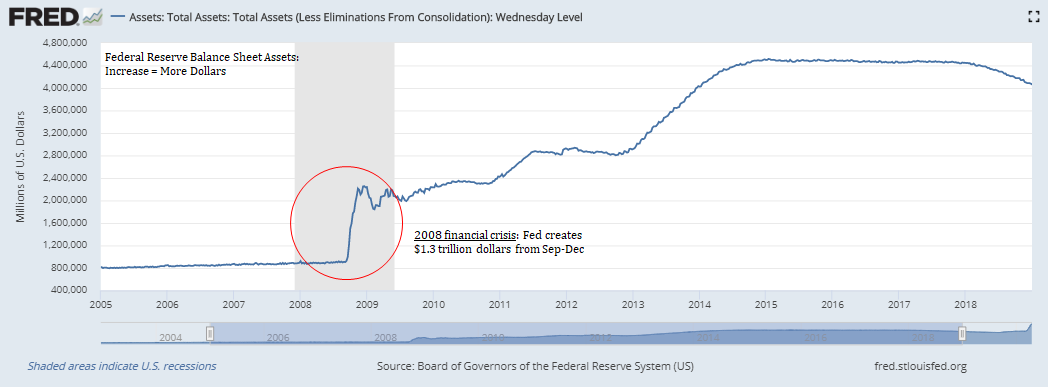

Since 2007, the Fed balance sheet has increased seven-fold, but the labor force has only increased 6%. There are roughly the same number of people contributing output (human time) but far more dollars to compensate for that time. Do not be confused by impossible-to-quantify theory concerning the idea of a job saved versus a job lost; this is the U.S. labor force, defined by the Bureau of Labor Statistics as all persons 16 years of age and older, both employed and unemployed. The inevitable result is that the value of each dollar declines, but it does not create more workers, and all prices do not adjust ratably to the increase in the money supply, including the price of labor.

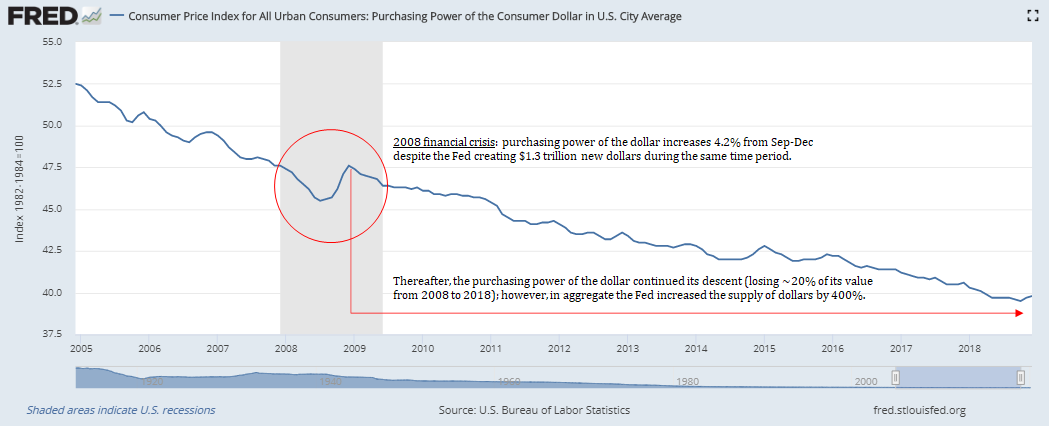

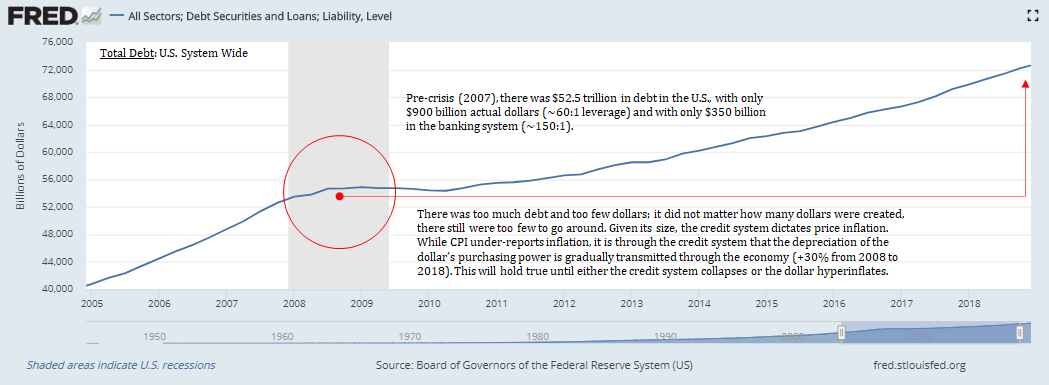

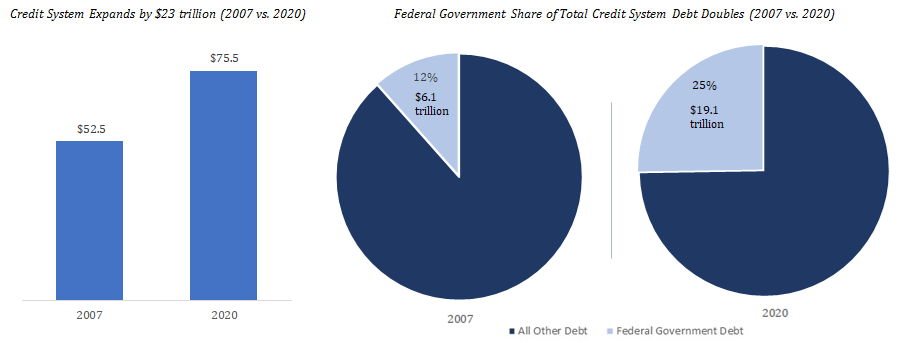

In a theoretical world, if the Fed were to distribute the money in equal proportion to each individual that held the currency previously, it would not shift the balance of power. In practical application, the distribution of ownership shifts dramatically, heavily favoring the holders of financial assets (which is what the Fed buys in the process of creating new dollars) as well as those with cheap access to credit (the government, large corporations, high net-worth individuals, etc.). In aggregate, the purchasing power of every dollar declines, just not immediately, while a small subset benefits at the cost of the whole (see the Cantillon Effect). Despite the consequences, the Fed takes these actions in an attempt to support a credit system that would otherwise collapse without the supply of more dollars. In the Fed’s economy, the credit system is the price setting mechanism as the amount of dollar-denominated debt far outstrips the supply of dollars, which is also why the purchasing power of each dollar does not immediately respond to the increase in the money supply.

Instead, the effects of increasing the money supply are transmitted, over time, through an expansion of the credit system. The credit system attempting to contract is the market and the individuals within an economy adjusting and re-pricing value; the Fed attempting to reverse that natural course by flooding the market with dollars is, by definition, overriding the market’s price setting function, fundamentally altering the structure of the economy. The market solution to the problem is to reduce debt (expression of preference) and the Fed’s solution is to increase the supply of dollars such that existing debt levels can be sustained. The goal is to stabilize the credit system such that it can then expand, and it is a redux to the 2008 financial crisis, which provides a historical roadmap. In the immediate aftermath of the prior crisis, the Fed created $1.3 trillion new dollars in a matter of months. Despite this, the dollar initially strengthened as deflationary pressures in the credit system overwhelmed the increase in the money supply, but then, as the credit system began to expand, the dollar’s purchasing power resumed its gradual decline. At present, the cause and effect of the Fed’s monetary stimulus is principally transmitted through the credit system. It was the case in the years following the 2008 crisis, and it will hold true this time so long as the credit system remains intact.

How the effects manifest in the real economy is very complicated, but it does not take any sophistication to recognize the general direction of the end game or its foundational flaws. More dollars result in each dollar becoming worth less, and the value of any good naturally trends toward its cost to produce. The marginal cost for the Fed to produce a dollar is zero. With all the bailouts from both the Fed and Congress, whether to individuals or companies, someone is paying for everything. It is axiomatic that printing money (or creating digital dollars) does nothing to generate economic activity; it only shifts the balance of powers as to who allocates the money and prices risk. It strips power from the people and centralizes it to the government. It also fundamentally impairs the economy’s ability to function as it distorts prices everywhere. But most importantly, it puts the stability of the underlying currency at risk, which is the cost that everyone collectively pays. The Fed may be able to create dollars for free and the Treasury may be able to borrow at near-zero interest rates as a direct result, but there is still no such thing as a free lunch. Someone still has to do the work, and all printing money does is shift who has the dollars to coordinate and price that work.

The Moon is a Harsh Mistress, by Robert Heinlein

“Gospodin,” he said presently, “you used an odd word earlier–odd to me, I mean…”

“Oh, tanstaafl. Means there ain’t no such thing as a free lunch. And isn’t,” I added, pointing to a FREE LUNCH sign across room, “or these drinks would cost half as much. Was reminding her that anything free costs twice as much in long run or turns out worthless.”

“An interesting philosophy.”

“Not philosophy, fact. One way or other, what you get, you pay for.”

Bitcoin is Common Sense

Among its perceived flaws as a currency, bitcoin is viewed by many to be too complicated to ever achieve widespread adoption. In reality, the dollar is complicated; bitcoin is not. It becomes very simple when abstracted to the least common denominator: 21 million bitcoin; and who controls the money supply: no one. Not the Fed or anyone else. At the end of the day, that is all that matters. Bitcoin is in fact complicated at a technical level. It involves higher level mathematics and cryptography and it relies on a “mining” process that makes very little sense on the surface. There are blocks, nodes, keys, elliptic curves, digital signatures, difficulty adjustments, hashes, nonces, merkle trees, addresses and more.

But with all this, bitcoin is very simple. If the supply of bitcoin remains fixed at 21 million, more people will demand it and its purchasing power will increase; there is nothing about the complexity underneath the hood that will prevent adoption. Most participants in the dollar economy, even the most sophisticated, have no practical understanding of the dollar system at a technical level. Not only is the dollar system far more complex than bitcoin, it is far less transparent. Similar degrees of complexity and many of the same primitives that exist in bitcoin underly an iPhone, yet individuals manage to successfully use the application without understanding how it actually works at a technical level. The same is true of bitcoin; the innovation in bitcoin is that it achieved finite digital scarcity, while being easy to divide and transfer. 21 million bitcoin ever, period. That compared to $2.5 trillion new dollars created in two months, by one central bank, is the only common sense application anyone really needs to know.

Exhibit A – Dollar Supply

Plus Exhibit B – Bitcoin Supply

Equals Exhibit C – Purchasing Power of Bitcoin Relative to Dollars

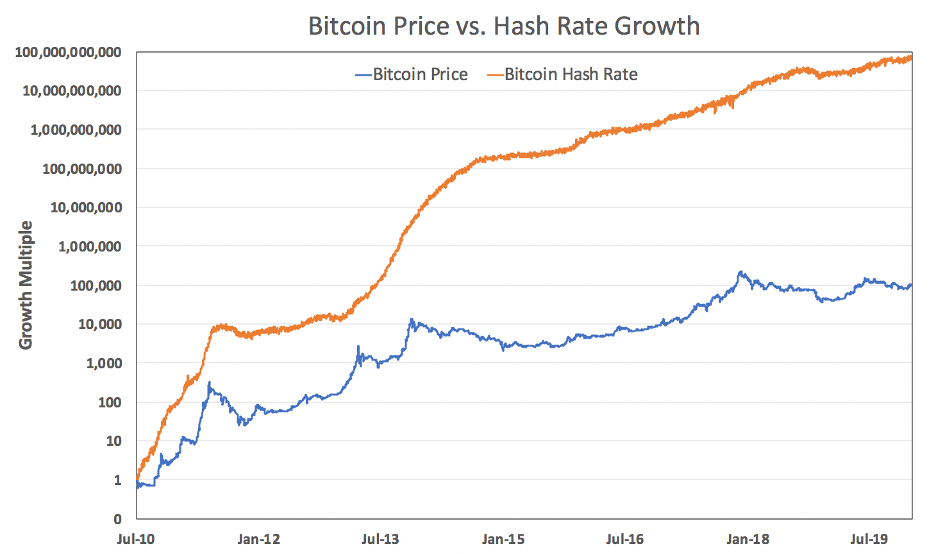

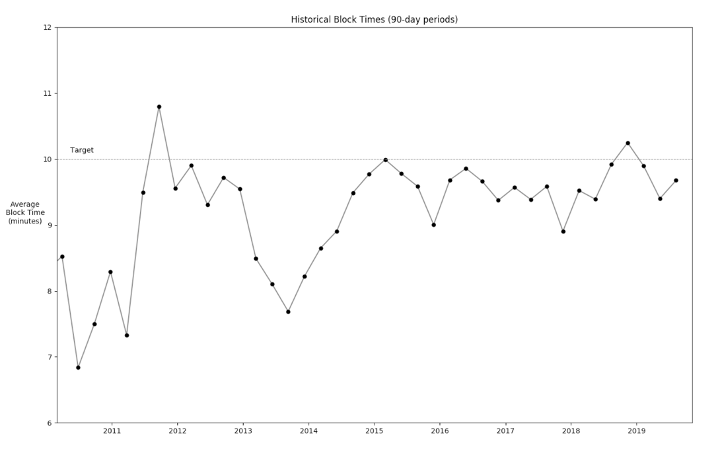

There is a lot happening in the background, but these three charts are what drives everything. People all over the world are connecting these dots. The Fed is creating trillions of dollars at the same time the rate of issuance in bitcoin is about to be cut in half (see the bitcoin halvening). While most may not be aware of these two divergent paths, a growing number are (knowledge distributes with time) and even a small number of people figuring it out ultimately puts a significant imbalance between the demand for bitcoin and its supply. When this happens, the value of bitcoin goes up. It is that simple and that is what draws everyone else in: price. Price is what communicates information. All those otherwise not paying attention react to price signals. The underlying demand is ultimately dictated by fundamentals (even if speculation exists), but the majority do not need to understand those fundamentals to recognize that the market is sending a signal.

Once that signal is communicated, then it becomes clear that bitcoin is easy. Download an app, link a bank account, buy bitcoin. Get a piece of hardware, hardware generates address, send money to address. No one can take it from you and no one can print more. In that moment, bitcoin becomes far more intuitive. Seems complicated from the periphery, but it is that easy, and anyone with common sense and something to lose will figure it out; the benefit is so great and money is such a basic necessity that the bar on a relative basis only gets lower and lower in time. Self-preservation is the only motivation necessary; it ultimately breaks down any barriers that otherwise exist.

The stable foundation that underpins everything is a fixed supply which cannot be forged, capable of being secured without any counterparty risk and resistant to censorship and seizure. With that bedrock, it does not require a lot of imagination to see how bitcoin evolves from a volatile novelty into a stable economic juggernaut. A hard-capped monetary supply versus endless debasement; a currency that becomes exponentially more expensive to produce compared to a currency whose cost to produce is anchored forever at zero by its very nature. At the end of the day, a currency whose supply (and derivatively its price system) cannot be manipulated. Fundamental demand for bitcoin begins and ends at this singular cross-section. One by one, people wake up and recognize that a bill of goods has been sold, always by some far away expert and never reconciling with day-to-day economic reality.

With bitcoin as a backdrop, it becomes self-evident that there is no advantage either in ceding the power to print money or in allowing a central bank to allocate resources within an economy, and in the stead of the people themselves that make up that economy. As each domino falls, bitcoin adoption grows. As a function of that adoption, bitcoin will transition from volatile, clunky and novel to stable, seamless and ubiquitous. But the entire transition will be dictated by value, and value is derived from the foundation that there will only ever be 21 million bitcoin. It is impossible to predict exactly how bitcoin will evolve because most of the minds that will contribute to that future are not yet even thinking about bitcoin. As bitcoin captures more mindshare, its capabilities will expand exponentially beyond the span of resources that currently exist. But those resources will come at the direct expense of the legacy system. It is ultimately a competition between two monetary systems and the paths could not be more divergent.

Bananas grow on trees. Money does not, and bitcoin is the force that reawakens everyone to the reality that was always the case. Similarly, there is no such thing as a free lunch. Everything is being paid for by someone. When governments and central banks can no longer create money out of thin air, it will become crystal clear that backdoor monetary inflation was always just a ruse to allocate resources for which no one was actually willing to be taxed. In common sense, there is no question. There may be debate but bitcoin is the inevitable path forward. Time makes more converts than reason.

“You can fool all the people some of the time, and some of the people all the time, but you cannot fool all the people all the time.” – Abraham Lincoln

“These proceedings may at first seem strange and difficult, but like all other steps which we have already passed over, will in a little time become familiar and agreeable: and until an independance is declared, the Continent will feel itself like a man who continues putting off some unpleasant business from day to day, yet knows it must be done, hates to set about it, wishes it over, and is continually haunted with the thoughts of its necessity.” – Thomas Paine, Common Sense

Views presented are expressly my own and not those of Unchained Capital or my colleagues. Thanks to Will Cole and Phil Geiger for reviewing and for providing valuable feedback.

Citadels and Pandemics

By Yuri de Gaia

Posted March 25, 2020

An overview of how a citadel would act in case of a global emergency, like a pandemic.

With the ongoing COVID-19 pandemic and a global financial collapse, it is interesting and, often, frightening to watch how various governments react to the event. As covered in Perspective Matters_, _the spread of the virus is used by opportunistic elites to grab more power. This is not unexpected. At the end of the day, just like the purpose of the police is not to “serve and protect” but rather enforce the law, the purpose of the government is not to provide social services, but to exert control over the population. Any crisis is an opportunity to do so. A question arises, then: How would a citadel deal with such a situation? My thoughts are below.

Asteria’s Measures

First and foremost, you must remember that Asteria, our model citadel, is a private for-profit entity that has contractual obligations before its citizenry (as opposed to an invisible social contract in nation-states). Therefore, any abnormal measures must be covered in the Force Majeure Clause of the service agreement. This means that, upon signing up, a prospective citizen gives his consent to such measures voluntarily.

Secure Borders

Being a sovereign entity or, at the very least, a special administrative zone, Asteria has strong borders. In our case, it is an island, so Nature herself provides the necessary separation from the outside world. As walls are not needed, watchtowers and border control posts are enough to secure the city from intruders. As seen from the examples of Singapore and Hong Kong, city-states, being smaller and more centralized, have the advantage of fast decision making and execution of new directives. In case of a real pandemic, Asteria will have no trouble locking down its borders at a moment’s notice. Nobody goes in, nobody goes out.

Quarantine

While quarantine is, arguably, not the best solution for flu-like pandemics, resulting in far more damage to the lives of people than the actual disease might claim, it may be necessary in plague-esque scenarios. Again, the city’s small size and efficient governing body is able to make swift changes to day-to-day lives. They do not have to be as harsh as those in Singapore, but you must understand that, when fear is instilled in people’s minds, their rational faculties are no longer operational.

Market-Based Solutions

Except for the core services of the citadel, as defined in the contract, the majority of the activities in Asteria are market-based. Free enterprise is what propels the city to new heights at an accelerating pace. This concerns medical facilities and scientific labs. In a genuine laissez-faire manner, there is no need to wait for a government edict to start working on possible solutions to the pandemic. In light of self-interest and that of the citadel, which is a cherished home, multiple teams will start working on test kits and possible cures as soon as they hear the news.

“Hong Kong, Japan, and Singapore all developed their own tests for Covid-19 as soon as the genetic sequences for the virus were published, and ramped up production of the materials necessary for those tests. (That’s a sharp contrast with the US, which still doesn’t have enough tests for nationwide use, and may actually be running out of the materials necessary to make them.)”—Wired

Emergency Supplies

As Asteria is a financial success today and cares a lot about the future, it takes care to stockpile at least 3 years’ worth of provisions in disaster storage facilities. If the city has to be isolated for prolonged periods, the citizens will have enough food and water to survive. Being an island nation helps procure fresh seafood, of course, but prudent minds do not rely on Just-in-Time logistics.

Emergency Fund

Besides food and water, Asteria’s management company is smart enough to have put aside an emergency bitcoin fund. This money allows the city to purchase any goods or services that it may lack during the pandemic. If a test kit or a cure is developed elsewhere, Asteria can use the funds to bid a high enough price to be one of the first in line to receive the product, as is her responsibility before the citizenry. It is not a secret that money talks even when the world is in dire straits.

Escape Plan

In the unlikely situation where the only way to survive is to leave the infected behind, as devastating as it may be, the citadel may enact its emergency evacuation plan. In Asteria’s case, the plan involves a fully equipped and stocked-up ark, that can sail the open sea for a few months and even submerge for extended periods.

The longest submerged and unsupported patrol made public is 111 days (57,085 km 30,804 nautical miles) by HM Submarine Warspite (Cdr J. G. F. Cooke RN) in the South Atlantic from 25 November 1982 to 15 March 1983.—Guinness World Records

Inland citadels may devise other ways of escape, such as by road, tunnels or aircraft.

Bunker

If neither staying in the city or escaping is possible, a bunker space may be the most appropriate option for self-isolation. It may be located underground or built as an artificial structure adjacent to the island.

Nature Does Not Wait

I have written all of this to show that a citadel, being an alternative way of structuring the way we live together, may be a lot more efficient when it comes to scenarios in which fast decision-making is of extreme importance. Just like slow, overly bureaucratic national companies of today have no chance competing with private-enterprise alternatives, nation-states will be at a disadvantage compared to citadels when it comes to acts of God. Nature does not wait for committees with their rubber stamps. When things get serious rapidly, decision-making and action must be swift. An efficiently managed citadel, therefore, would be a better place to be in considering the alternatives.

Cryptocurrencies as Cyberstatism

By Frank Braun

Posted January 6, 2020

2020-01-06 [read as txt or PDF]

Prelude

(Note: Most of this prelude has been put on Twitter before, the impatient reader might want to skip to section Cyberstatism) I have been wondering for a long time why cryptocurrencies in general and Bitcoin especially became so, for lack of a better word, toxic. Maybe it’s just my personal experience and that experience is totally subjective, but to me it seems that the level of hostility experienced (mostly) online in Bitcoin is way stronger than:

- It was in the beginning. I have been “around” Bitcoin since the very early days and I didn’t experience it like that at all during that time. It seemed to be more of a collaborative effort driven by the excitement of building something new and potentially revolutionary.

- The level of hostility which can be witnessed in other tech oriented online communities. Nerds are kind of famous for strongly voiced opinions, especially regarding their favorite tech, may it be an editor, operating system, or programming language.

However, the toxicity level in cryptocurrencies in general and Bitcoin especially seems to be off the charts compared to other tech projects. It seems to be have become almost impossible to have rational discussions about technical details that do not devolve into flame wars.

My first hypothesis for why that is the case was:

Toxicity is the consensus mechanism in Bitcoin.

The reasoning being that while proof-of-work is a great mechanism to reach consensus in the distributed ledger for already agreed upon rules, it is terrible to reach consensus for rule changes.

If not most of all miners and users agree on a rule change it will lead to a fork.

Forks lead to a fracturing of the user base without solving future conflicts. The BTC/BCH fork was such a case. The BCH/BSV gives empirical evidence that a fork doesn’t solve that problem permanently.

Forks are economically bad, because they lead to a fracturing of the user base and developers, bring uncertainty for new and existing users, etc.

So basically the only good rule change mechanism Bitcoin has is to reach nearly 100% consensus between miners and users upfront, which makes it extremely hard to make even very desirable upgrades.

This solidifies the Bitcoin protocol and makes it attackable by altcoins (in terms of additional features).

It has been argued that a solidification of the Bitcoin protocol is not necessarily a bad thing, especially given the “digital gold” and Bitcoin as a store-of-value narrative.

So an economically sound consensus mechanism (for rule upgrades / governance) seems to be toxicity.

Toxicity keeps the community together and bashes all outsiders (for example, this leads to terms like “Bcash” and “shitcoins”).

However, toxicity alienates outsiders and prevents upgrades, making Bitcoin effectively the orthodoxy of cryptocurrencies.

So either the Bitcoin protocol is good enough as it is to build innovation on top of it (there will likely not be any major changes to the protocol) or it will be out-competed in terms of features.

Granted, given Bitcoin’s first mover advantage, brand recognition, and its position as the major cryptocurrency and default trading pair on most exchanges might give Bitcoin a position which is uncatchable far into the future.

Newer cryptocurrencies like Decred put a consensus mechanism in place which is extremely fork resistant (see Detailed analysis of Decred fork resistance), which might be the reason why the discussions over there seem to be much more civil, they actually can resolve disagreements without a fork.

But it might also be that it’s just because their community and position in the market is much smaller.

Cyberstatism

The argument above might explain parts of the picture, but further discussing and thinking about the problem let me come to the following, for a libertarian rather uncomfortable, conclusion: Cryptocurrencies are a form of Cyberstatism.

Let me try to explain what I mean by that phrase.

Cryptocurrencies like Bitcoin are a form of Fiat money in the sense that they create money “out of thin air” which doesn’t have intrinsic value to begin with. Granted, most cryptocurrencies do not suffer from the inflation problem of government fiat money (cryptocurrencies usually have a fixed monetary supply) and energy has to be expended in order to “print” them (through mining).

However, cryptocurrencies like Bitcoin lack intrinsic value when they are started. The famous Bitcoin pizza purchase is often viewed as the point in time where Bitcoin switched from being a curiosity to becoming useful and valuable as a medium of exchange.

If you look at cryptocurrencies from the lens of fiat money, different cryptocurrencies competing with each other could be viewed as a zero-sum game. They are all competing to become “cybermoney” (a term from The Sovereign Individual), just like states compete over a fixed amount of available territory.

If the market for cybermoney is fixed, this is a zero-sum game and competing cryptocurrencies indeed show signs of competing states.

Politics becomes the main mechanism of resolving conflicts, not competition of different products on a free market.

Coins forking off become secession movements and are fought strongly as such (e.g., BTC/BCH and BCH/BSV).

People heavily invested into certain coins (emotionally and/or financially) start to behave like nationalists, fighting for their coin and against the other coins. Financial investment only makes that a stronger force, because it makes economic sense (if the coins “captures” more territory the value of the investment will go up).

Like with states, the biggest player often becomes the biggest bully…

Conclusion

This is just a theory and I’m sure I will get my fair share of hate for it. If, however, there is some truth to the argument I’m wondering what the conclusion is, given that I find it rather worrisome from a libertarian perspective.

First of all, the competition to become “cybermoney” is not a zero-sum game. The real competitor is government-issued fiat money and upcoming state- and corporate-issued cryptocurrencies like Facebook’s Libra. That’s where the actual war is fought and where it is determined if the world will see an alternative to fiat and these centrally controlled coins. Since there is a “war on cash” going on, there seems to be a limited amount of time left to establish one or more decentralized cryptocurrencies as a valid alternative for payments.

Furthermore, exchangeability between different cryptocurrencies independent from centralized exchanges is of paramount importance. The Decred DEX and Bisq are very important steps in that direction. What is also needed is a wider availability of over-the-counter exchanges that allow to trade cash for crypto in person.

If all cryptocurrencies can be easily exchanged for one another in a decentralized fashion, they can compete with each other more like different products on a free market and form a “cyberbloc” against the real enemy. There is no need to look at the competition between different cryptocurrencies as a zero-sum game.

Given the two, focus on the real competition and better exchangeability between different cryptocurrencies, it might be possible to make a real dent into the system of government issued fiat money.

Do you like my work and want to give back?

Donate bitcoin: 3FguRzVXe24cicayb2tmVnHVu4Sp1rULNC

Few Words on Decentralization and Anonymous Payments

By nopara

Posted May 6, 2020

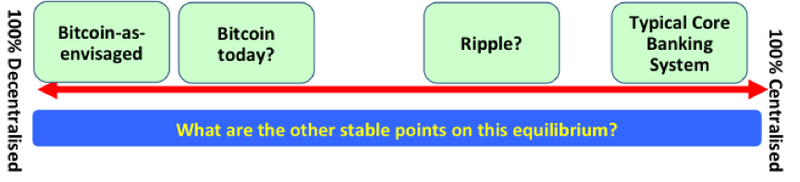

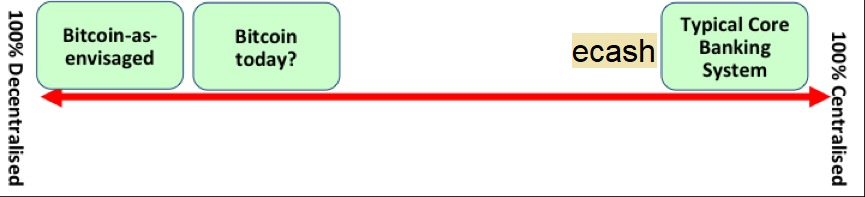

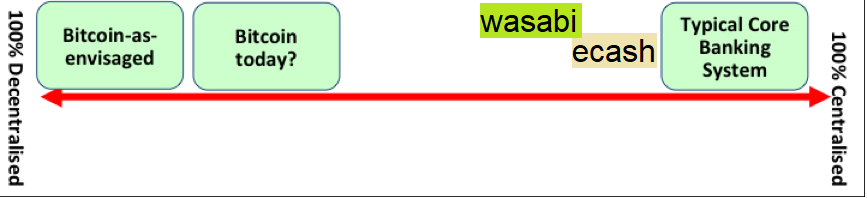

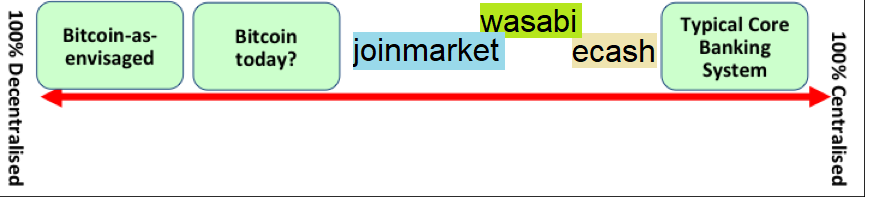

Something is centralized and something else is decentralized. Such binary thinking is prevalent in the Bitcoin community. Here I’d like to present a scale that describes reality in a better way. Our contenders are: Legacy Banking System, Chaumian E-Cash, Wasabi Wallet, JoinMarket, Bitcoin, and Bitcoin-as-envisaged.

I recall an article that brainstormed on a decentralization scale in the context of payment systems. I am intending to do the same in the context of anonymous payment systems. The article can be summarized with the following depiction:

Chaumian E-Cash

Chaumian E-Cash (shall I say as-envisaged?) is a centralized anonymous payment system. I argue calling it centralized does it a disservice, because it is more decentralized than our legacy banking system. While in the legacy banking system the information of who pays who is centralized, too, in ecash it is not the case. Only the receiver and the sender of the payment knows who pays who. While the data is (not always), the information isn’t stored in a central location, like in the traditional banking system. This is important, because an ecash bank cannot pinpoint a specific user to steal its money, which increases its censorship resistance. There just isn’t as many things to censor.

Wasabi Wallet

Wasabi Wallet is a Bitcoin wallet that uses Chaumian CoinJoin to bring privacy for its users. The main difference between ecash and Wasabi is that the latter cannot steal funds of its users. The users have complete control over their money, thus it decentralizes security. Thus it’s more decentralized than an ecash bank.

JoinMarket

JoinMarket just like Wasabi also utilizes a CoinJoin protocol. However Wasabi uses a server, called the Coordinator, which has more responsibilities than JoinMarket’s server, which simply acts as a bulletin board. For example Wasabi coordinator could potentially blacklist UTXOs from participating in the mix. In fact this is by design, it’s doing it all the time as this is how Denial of Service protection filters out the malicious actors. Thus the argument is made the JoinMarket is more decentralized than Wasabi Wallet.

Bitcoin vs Bitcoin-as-envisaged

While compared to JoinMarket Bitcoin does not require a bulletin board to work, it isn’t as decentralized as we would like it to be, since the dream decentralization of Bitcoin would be if every single Bitcoin user would be also a Bitcoin miner. But even that’s not ultimate decentralization. The ultimate decentralization would be if every single person on this planet would have equal chance of mining the next block in the Blockchain and no one would ever learn payment information unless they were authorized to do so by the transacting parties. But even if we’d reach this novel goal, we’d surely encounter terrific scaling issues after space colonization.

Nuances

I’m going to destroy everything I built up so far.

In this article I showed you why calling things centralized and decentralized is more often a rhetoric rather than an argument and presented you a more accurate model: a scale of decentralization. In this section I’m going to hopefully convince you that even this scale of decentralization is a wrong model that suffers from a number of nuances that I conveniently skipped through.

- Could one make a case that data mining payment information from the Bitcoin blockchain is easier than figuring out anything about Chaumian e-cash payments, thus the latter has a more decentralized way of handling payment information? “Chaumian E-Cash Analysis Companies” will never emerge, but “Blockchain Analysis Companies” do have a role to play.

- The peer discovery of Bitcoin is another rabbit hole I didn’t want to go into.

- Where would you put on the scale, services like Blockchain.info’s SharedCoin and Samourai Wallet where a central entity learns everything? The payment information is centralized there, so they would have a place behind Wasabi, however in ecash the payment information isn’t centralized, so would you put them behind ecash, too? Or you’d prefer the security aspect of centralization, as in these schemes the security is decentralized compared to ecash.

- Where would you put Traditional Bitcoin Mixers? They’d obviously be between ecash and legacy banking, because not only the payment information is centralized, but also the security aspect. But do they win the decentralization game against traditional banks?

- How about Bitcoin exchanges or Bitcoin casinos? Is there any difference between them and Traditional Bitcoin Mixers? Is the fact that the latter does not intend to store bitcoins only tunnel them through their system makes it more decentralized?

- There’s also a rabbit hole on the information asymmetry of JoinMarket. There the taker of the CoinJoin learns the mapping so in this regard is it less decentralized than Wasabi and ecash? Oh, wait this gets more complex, the takers of JoinMarket are decentralized in the first place, so does learning the mapping even matter?

Conclusion

Decentralization a meme. In practice it’s a nuanced topic and not at all a zero sum game.

Tweetstorm: The 4th Bitcoin Epoch

By John Vallis

Posted May 7, 2020

The 4th Bitcoin epoch, and you. A thread. 1/23

1/ Pumped for the halving? I sure as shit am. It’s an important occasion, marking the next step in bitcoin’s inevitable march to becoming not only the hardest money ever, but the first instantiation of objectively verifiable absolute scarcity that humanity has ever engaged with.

2/ As such, each step in this process, and in particular the early ones, are a big deal. If demand remains constant, and supply is cut, there should be upwards pressure on price. Happy days! But this is not the only story here.

3/ As many who have engaged with bitcoin have noticed, bitcoin changes you. Of course, as everyone comes at bitcoin from a different perspective, the changes experienced are not uniform, but there are many similarities.

4/ What are these changes? Some include improving ones health/fitness, being more productive, reducing waste or excess, studying/learning more, dropping negative relationships, starting a family, saving more, thinking longer-term, challenging assumptions, gaining confidence..

5/ ..accessing greater energy and enthusiasm, being more hopeful for the future, connecting with more like-minded individuals, taking more personal responsibility, just to name a few.

6/ These are significant lifestyle changes, not to be dismissed casually. From an evolutionary perspective, these changes could very well be making those who adopt them more ‘fit’. Put another way, bitcoin may indeed be accelerating human evolution.

7/ Wow. But what is it about interacting with bitcoin that inspires such changes? Tough question. But it seems that as we engage with it, and the more we understand it, the more we begin to realize what it represents.

8/ That is to say, recognizing the implications of its inherent properties, we begin to change how we see the world, and thus how we see ourselves in reference to it. This is powerful, as how we see ourselves contributes greatly to who we become.

9/ It’s hard to say why bitcoin’s properties inspire the particular changes they do. Is it just because we are interacting with the concepts of scarcity, trust, immutability, freedom, security etc. in a way we never have before? Perhaps.

10/ But this is the halving after all, so let’s focus on scarcity. What kind of affect should we expect from encountering absolute scarcity for the first time?

11/ This is such a dramatically new concept for our consciousness to contend with, that it’s hard to imagine it wouldn’t fundamentally shift our perspective in some (or several) ways.

12/ So if bitcoin’s properties are changing us, despite not knowing exactly why or how, what then should we expect when bitcoin becomes more scarce? The obvious answer, is that we should expect to see a commensurate change in ourselves too.

13/ Though this process is far from fully understood, I’m going to speculate that as bitcoin ‘hardens’, so too shall bitcoiners.

14/ Our conviction, determination, focus, energy, passion, enthusiasm, purpose, and desire to understand and engage this thing will all ‘harden’, and the behavior changes that have been inspired by bitcoin already will continue to compound.

15/ What’s my point with all of this? I guess it’s to say that the missing half of the ‘halving story’, is us!

16/ What if the halving is not just an inflection point for bitcoin’s price, but also for the process of our becoming? A point that represents a very specific shift from the person you were in the last four years, to the one you will become over the next four?

17/ For hardcore bitcoiners, this change will likely happen regardless of whether we decide to recognize it or not, as bitcoin will continue to assert it’s nature through us. Hwvr, as is often true, I think there is even more to be gained by consciously engaging in this process.

18/ Bitcoiners represent the tip of the spear in what is ultimately a revolution in human action, guided by those behaviors which bitcoin either permits or prohibits.

19/ Whether we like it or not, we are living proof of the merits of this protocol for improving the lives of individuals everywhere.

20/ I’m not here to tell you how to act, that’s entirely up to you. I guess I’m just asking, if this revolution isn’t about changing how we can and desire to act and interact, then what is it about?

21/ And if we believe it is about that, then those occasions (halvings) which represent a step change in how we are influenced by this protocol, are probably significant events for each of us.

22/ It’s a coming of age of sorts. The 3rd epoch was fun, but nothing compared to what the 4th epoch will be, and who we will necessarily become to meet the challenges and opportunities which it represents. Strap in Bitcoiners, and Happy Halving! LET’S GOOOOOOOO!

Where are the coins?

By Fabian Jahr

Posted May 8, 2020

EDIT: An earlier version of this post linked to a BitcoinTalk post that speculated on the cause of BIP30 being the introduction of LevelDB. Pieter Wuille kindly informed me that LevelDB was introduced after BIP30 occured , which means that post was definitely false.

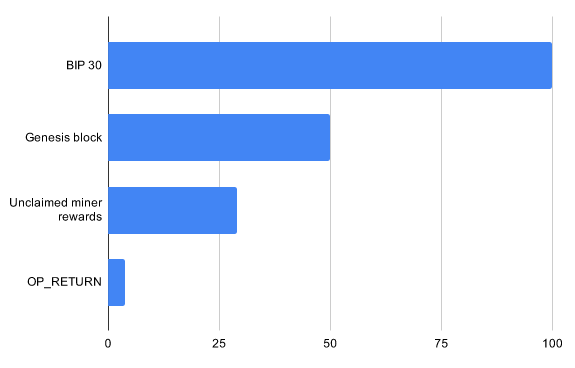

The third Bitcoin halving is coming up quickly as I write this. I thought this would be a great time to write down what I learned about the amount of BTC in the UTXO set. Everyone is talking about coin supply at the moment but detailed, granular information on this topic seemed to be hard to find. Strangely, I only found this excellent StackExchange answer by Pieter Wuille very late into writing this article and there is a lot of overlap. If you like this post I recommend you read Pieter’s as well since it basically approaches the same question from the angle of future total coin supply and it’s a quick read.

My insights on the current coin supply and the UTXO set mostly stem from my work on #18000. There I am working on an index for coin statistics with the main goal to make the RPC command gettxoutsetinfo faster. Even much earlier before starting the work on #18000, I remember being thrown off by gettxoutsetinfo because of the total_amount. To my surprise, it was a very crocket number and that has not changed. At the time of this analysis, the blockheight is 629038 and the total_amount reported is 18362804.82079165.

This is weird because one of the first things most people learn about Bitcoin is that supply is pre-determined through the inflation schedule. It prescribes that the block rewards were 50 BTC initially, then 25 BTC, currently still 12.5 BTC. So the number should be evenly divisible by 12.5 theoretically but it is clearly not. In short, the reason for that discrepancy is that gettxoutsetinfo does not report the theoretical number of the inflation schedule but the actual number of unspent coins that the node knows about. Among others, the most intuitive reason for this is to save disc space. If these unspendable outputs would not be removed they could bloat the UTXO set and take up disc space on every full node, forever.

The UTXO set

I want to briefly recap what the UTXO set (unspent transaction output set) is and why it exists to make a bit more sense of what is coming next. You probably know that Bitcoin has a blockchain and that every (fully-validating) node in the network is validating the whole blockchain. Simply put, the UTXO set is both the product of that validation process and helps speed it up as well. Each Bitcoin transaction has outputs and all non-coinbase transactions consume previous outputs as inputs. Outputs can only be spent once and need to be spent in full. If that is not the case a transaction, and a block that contains such a transaction, is invalid. For every valid block in the chain, all the unspent outputs created in a block are written into a database, the UTXO set. At the same time, every output that gets consumed by a transaction in a block as an input is considered spent and gets removed from the UTXO set. The UTXO set helps to speed up the transaction validation processes considerably since it gives a very quick overview of all the outputs that are valid and can be spent.

Now, the RPC gettxoutsetinfo iterates over all these unspent outputs in the database and aggregates the total amount. One might say, getutxosetinfo would have been the better name to match today’s widely used terminology. But as we already established earlier, there seems to be some kind of a ‘leak’ since it reflects fewer bitcoins than expected.

So how many coins are lost exactly and where are they? During my initial search for the answer, I only found some high-level ideas but not a detailed analysis of this. That’s what I am trying to provide here.

The amount of missing coins

The Bitcoin supply schedule started with 50 BTC for every new block, with the reward halving every 210,000 blocks. That means we should currently have:

210000 * 50 + 210000 * 25 + ((629038 + 1) - 420000) * 12.5

= 10500000 + 5250000 + 2612987.5

= 18362987.5 BTC

Where does the +1 come from? It’s the Genesis block which is special because it is hardcoded into the codebase and located at index 0 of the blockchain. It also has a coinbase reward. So we are missing exactly:

18362987.5 - 18362804.82079165 = 182.67920835 BTC

Finally, where did these coins go?

Genesis Block

We just added it in with the +1 in the last paragraph and now we are taking it out again. Well, this post is about going into the details so it would be wrong to ignore this. The Genesis block has a coinbase reward but it is not spendable, and that’s why it also not part of the UTXO set. It is not spendable because Satoshi’s implementation is skipping the Genesis block in validation, meaning it is also not adding the coinbase output to the UTXO set. They probably did this because block validation generally includes checking that the block has a valid ancestor, the previous block in the chain, as well. And if they had not skipped validation altogether they would have needed to code a special exception there which would have been more difficult. But that is speculation.

182.67920835 - 50 = 132.67920835 BTC

Status: 132.67920835 BTC still missing!

BIP 30

BIP 30 describes a bug from the early days of Bitcoin. It turned out that there was no measure against duplicate transaction ids (TXIDs) in the earlier versions of Bitcoin. This was probably overlooked because a normal user can not simply create a transaction with a specific TXID. Each transaction depends, among other things, on the TXIDs of the outputs it spends. Since the TXID is a SHA256 hash and the previous TXIDs make it’s content unique, achieving a duplicate id would require the user to find a hash collision in SHA256, breaking one of the main security assumptions in Bitcoin itself.

But there is an exception to that. Coinbase transactions don’t have parent tx’s, so their input is all zeros, which means the content of the SHA256 hash is not necessarily unique. So, unfortunately, a duplicate coinbase transaction id used to be both possible and valid and it happened twice in bitcoins history before it could be fixed:

- Block 91722 coinbase TXID is repeated in Block 91880

- Block 91812 coinbase TXID is repeated in Block 91842

The implementation of BIP 30 in the Bitcoin Core code base still has the overriding blocks hardcoded into the codebase.

The reason why this is a problem may not be completely obvious but the term ‘transaction ID’ gives a hint. TXIDs also serve as the identifier for coins that are stored in the UTXO set. In this case, an existing output of the last coinbase got overridden by the next tx with the same TXID.

As a fix, transactions with TXIDs that are already present in the UTXO set, i.e. that have existed before and still have unspent outputs, are declared invalid. TXIDs can reappear but only after all outputs have been spent. But the rewards of the two overridden coinbase transactions mentioned above were lost forever. Since the block subsidy was 50 BTC at the time, that’s 100 BTC lost.

132.67920835 - 100 = 32.67920835 BTC

Status: 32.67920835 BTC still missing! By the way, the more long term fix for this issue was implemented with BIP34. It prescribed the introduction of a new block version (v2) which required coinbase transactions to start with the height of the current block. Since this part made coinbase transactions unique it is now virtually impossible to introduce a duplicate coinbase transaction by accident.

OP_RETURN

For somewhat more experienced bitcoin users this opcode might come to mind first when they think of unspendable or ‘burned’ outputs. Producing those is the whole purpose of OP_RETURN. Yes, the use of OP_RETURN means that the output is automatically marked invalid and cannot be spent anymore. Because of that, these outputs are also not included in the UTXO set.

Looking at the blockchain I found 3.72417931 BTC have been “burned” with the use of OP_RETURN. That number still expands steadily, by the way, so the OP_RETURN opcode is still frequently used. I imagine services like OpenTimestamps are responsible for most of it today.

32.67920835 - 3.72417931 = 28.955029039 BTC

Status: 28.95502904 BTC still missing!

Script too large

Another reason for an output to be marked as not spendable in the future is a script size that is too large. The threshold is defined in MAX_SCRIPT_SIZE and set to 10000 bytes.

I did not find evidence of any specific cases of this, but since the rule was explicit in the code, I figured I should look into it. But it appears there were no coins that were excluded from the UTXO set specifically for this reason.

Status: 28.95502904 BTC still missing!

Unclaimed Miner Rewards

This may sound weird at first, but there is a possibility that miners don’t claim their full block reward in a block they mined. The mining reward in the coinbase transaction is not checked against a specific value but rather to not exceed the valid block reward. So a block with a reward smaller than the sum of the current block subsidy and the total fees would still be valid. But for a miner who has mined a block with a smaller reward, there is also no way to claim these funds later. After the block is included in the blockchain these coins are also lost forever and will never appear in the UTXO set.

Why would a miner do this? I can not think of any good reason, it seems much more likely that this is always the result of a bug.

Thankfully Pieter Wuille lists some known incidents in his StackExchange answer saving me from writing more custom code and hours of research:

- Block 124724 tried to intentionally claim 0.00000001 BTC less than allowed, but accidentally also failed to claim the fees, losing 0.01000001 BTC.

- Between block 162705 and block 169899, 193 blocks claimed less than allowed due to a bug, resulting in a total loss of 9.66184623 BTC.

- Between block 180324 and block 249185, another 836 blocks claimed less than allowed, resulting in a total loss of 0.52584193 BTC.

- Block 501726 had no transaction outputs (except a 0-value commitment), losing the entire 12.5 BTC subsidy.

- Block 526591 didn’t claim half of the block reward, losing 6.25 BTC.

Pieter describes a loss of 28.94768817 BTC in his answer. I found a few more satoshis that miners lost, most likely by miscalculating the total fee. My analysis showed 28.95502904 BTC went missing this way, which is 734087 sats more than Pieter accounted for.

28.95502904 - 28.95502904 = 0 BTC

Status: 0 BTC still missing!

Other unspendable outputs

These are not all the outputs that are known to be unspendable. There are several more types of outputs that are impossible to spend (see the list in this BitcoinTalk post by user DeathAndTax for example). However, these are still included in the UTXO set. An update on the numbers of these other unspendable outputs would certainly be interesting as well.

Final thoughts

Pfew, I am really happy that worked out evenly at the end ;) So now you know why the total_amount is not the number you probably expected at first. I found it very satisfying to explore these internals of Bitcoin Core, especially because it had been an open question for me from the very first time I spun up a node. I hope you enjoyed reading this post as much as I enjoyed figuring these things out and writing them down.

Special thanks to James, Max, Freerk, Felix and Elaine for reading and providing feedback on an earlier version of this post.

You can find the custom code I used to collect these numbers here.

How Does Quantitative Easing (QE) Affect the Price of Bitcoin?

By Pedro Febrero on Quantum Economics

Posted May 11, 2020

With QE on the rise, is Bitcoin poised to fill the gap?

Since the 2008 financial crisis, expansive monetary policies have barely kept the struggling economy alive. With infinite QE on the rise, the only solution in sight seems to be a return to a hard money standard. Will Bitcoin fill in the gap?

In this article, we aim to explore the impact that quantitative easing (QE) has on the price of Bitcoin. To achieve that goal, we will first look into the effects of massive currency creation, how QE works and why it’s so dangerous in the long-term.

Finally, we’ll connect the dots by showing how QE and other expansive monetary measures have influenced the price of traditional assets and commodities, including bitcoin. We’ll conclude the piece by sharing our thoughts on why the return to a hard-money asset is the long-term solution to this particular economic crisis.

How money differs from currency

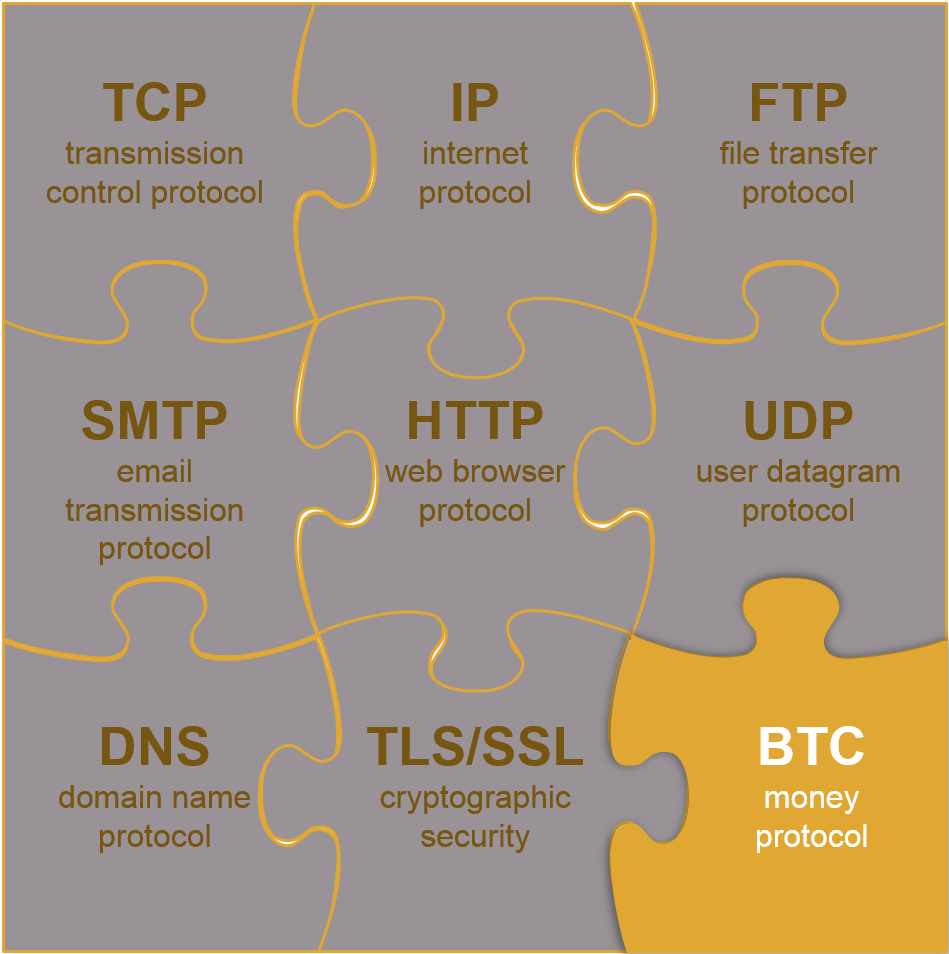

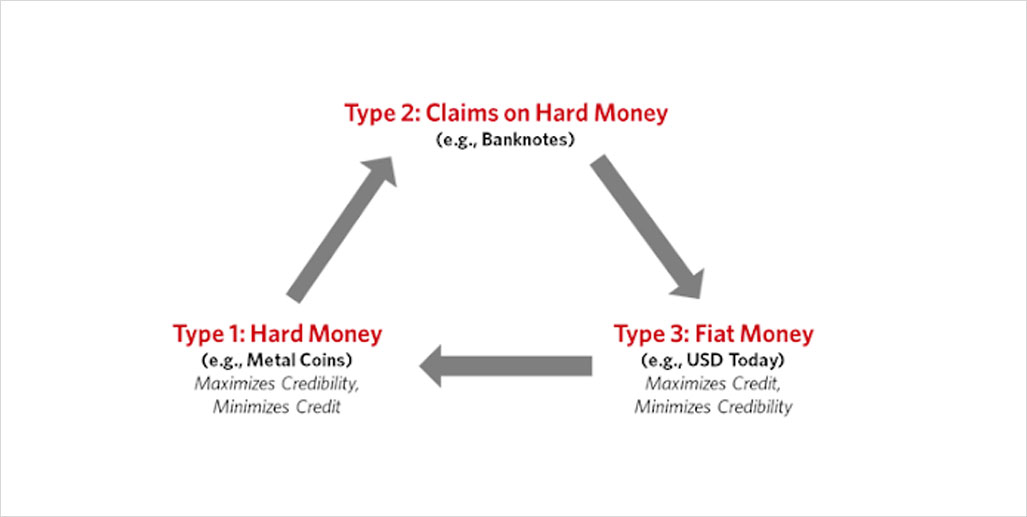

Image: Author

Image: Author

A great starting point for our analysis is to discuss the key differences between money and currency. Since we’ll be looking into topics such as hard money and QE, we should, beforehand, briefly explain what makes money different from currency.

Let’s begin by defining what hard money is. Investopedia defines hard money as _“a physical currency, such as coins made out of precious metals including gold, silver or platinum.” _A better definition could perhaps be a form of money that requires a significant amount of energy to produce.

To make the topic more understandable, we’ve developed the picture above. It visualizes what money is (or should be): an asset or commodity, like gold and Bitcoin, that grants its holders the power to store value, exchange value and measure value. Unlike currency, which is great to exchange and measure value, one of money’s most important traits is its ability to store value across long periods of time.

A very good example follows. In ancient Rome, an average centurion soldier would get paid just over 1,077g of gold per year (in sestertii equivalency), which in today’s terms means close to $61,000. In terms of purchasing power, two months’ salary was enough money for a centurion to acquire one year’s worth of bread, much like today, according to some researchers.

Hence, we can conclude that gold has maintained purchasing power since the ancient Roman times.

If we wonder what characteristics allow money to store value during very long periods of time, we come to the conclusion it’s mainly due to skin in the game and proof-of-work. In other words, any commodity that desires to be treated as money should be quite hard to acquire (skin in the game) and should have a limited supply, granted lots of energy is required to mint a new unit (proof-of-work). That’s why gold coins and units of bitcoin are treated as hard money, since they are kinds of currency that are rare and difficult to produce.

Unfortunately, since 1973, the equivalence or standard between currency and money has deteriorated. With the introduction of a global fiat standard, the relationship between the U.S. dollar and gold was relinquished. Effectively, all fiat currencies use the greenback as reserve money, even though those same dollars could be printed at any time by a central bank.

The problem is when economies mix the concept of money and currency. As it is discussed in money theory, base currency should only inflate as much as the real economy requires, and credit money should expand based on hard money reserves. However, since the world’s reserve currency is the U.S. dollar, not gold, central banks could incur a massive expansion of credit through low reserve requirements, simply because paper, or digital numbers on a ledger, aren’t that hard to produce.

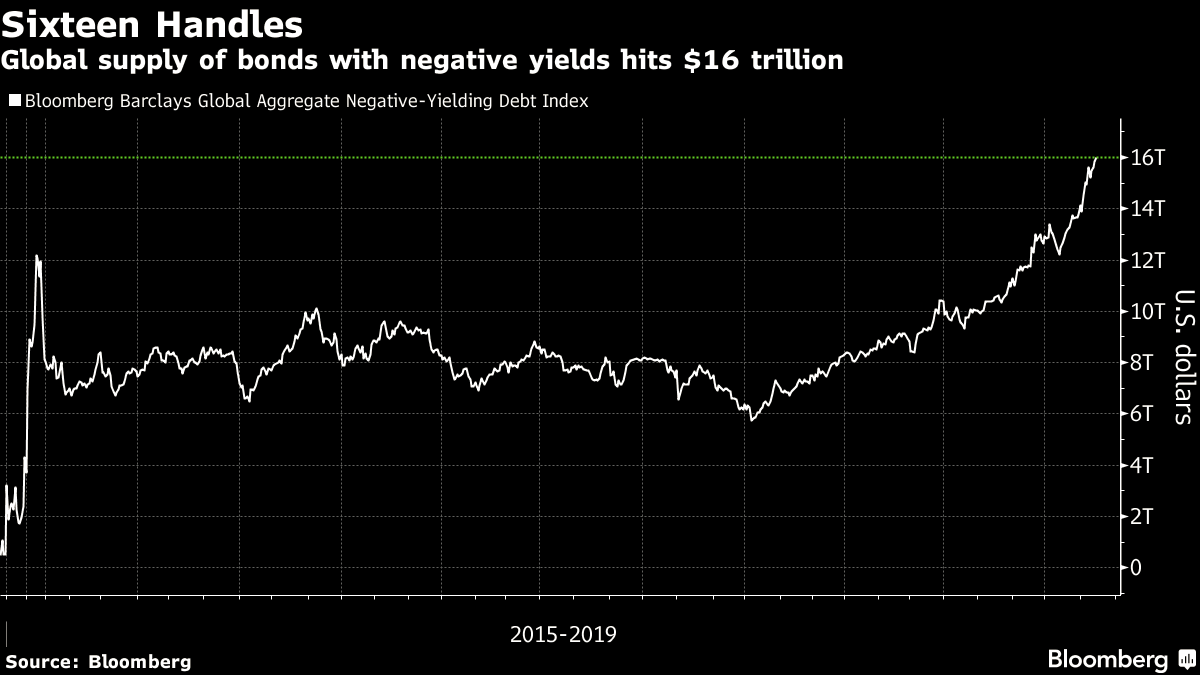

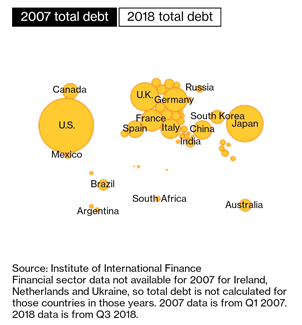

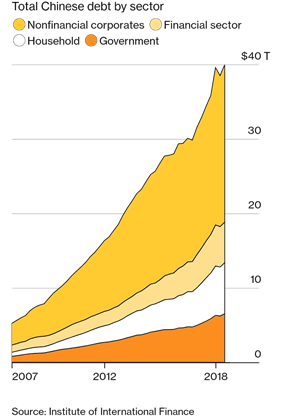

Hence, the world entered a downward spiral of nontraditional monetary policies, including quantitative easing, zero interest rates and negative interest rates. The allocation of capital was displaced from the real productive economy into the financial economy, making waves for a period of highly leveraged stock markets.

What is the relation between fiat currency, QE and financial markets?

This chart shows the S&P 500 and the Dow Jones Industrial Average, 2008–2020 (Source: https://www.tradingview.com/x/O5sPX7vu/)

This chart shows the S&P 500 and the Dow Jones Industrial Average, 2008–2020 (Source: https://www.tradingview.com/x/O5sPX7vu/)

QE is a brand new monetary policy introduced by central banks worldwide in response to the 2008 financial crisis.

Investopedia describes QE as the following:

“Quantitative easing (QE) is a form of unconventional monetary policy in which a central bank purchases longer-term securities from the open market in order to increase the money supply and encourage lending and investment. Buying these securities adds new money to the economy, and also serves to lower interest rates by bidding up fixed-income securities. It also greatly expands the central bank’s balance sheet”

To give another perspective, we see QE as the tool that allows central banks to purchase assets for free in order to indirectly sponsor corporations into spending. QT, on the other hand, translates to quantitative tightening. This is the exact opposite process, where central banks aim to decrease the assets held, which normally places downward pressure on asset prices.

Without the possibility of creating infinite currency and artificially suppressing interest rates, it would be impossible for central banks to finance their own economies directly. That means government spending would be considerably more restricted to actual money reserves and economic growth, and malinvestment would be costly, since there would be no direct way to bail out failing corporations.

In sum, if governments can’t debase a currency, they can’t print infinite currency, meaning bailouts can only happen through costly debt or increased taxes on income, products or companies. Therefore, had QE not been invented, companies would likely be more careful and would be less likely to misallocate their capital.

Since QE has begun, the global asset markets have skyrocketed in price. The above chart shows precisely what we mean. Did you notice how after each QE round (pink columns), the markets tend to appreciate in value?

From November 2008 to November 2010, between QE 1 and QE 2, both the SPX and the DJI increased, on average, close to 60%. Additionally, from QE 2 to QE 3, which started in September 2012, both markets rose more than 20%.

However, the biggest appreciation took place between September 2012 and 18th February 2020. Both indices increased over 130%, an astonishing accomplishment according to price history. Not surprisingly, during the period of QT, from 2018 until early 2019, both the SPX and DJI had the exact opposite behaviour. Both indexes dropped substantially, between 16% to 20% respectively.

Bitcoin was born amidst the financial crisis, in January 2009, and has gained substantial value since its inception. Undoubtedly, the easing of cash to purchase financial assets may have played a significant role in the optimism surrounding BTC, as we’ll discuss near the end.

Nevertheless, before we dive into Bitcoin, we shall look into how QE influenced the markets in Europe and the United States. Only after we evaluate the impact of QE on asset prices and how it relates to each jurisdiction’s Gross Domestic Product (GDP), we may begin to unravel the answer we seek.

Additionally, in order to make our analysis easy to understand, we’ll look into the effects of the Fed’s and the ECB’s money printing on consumer behaviour by comparing the velocity of money to its total supply.

Hopefully, by the end, we’ll be able to extrapolate the short-term and long-term effects of QE and other expansive monetary policies on the price of Bitcoin.

Now, we’ll start by looking into the ECB’s QE programme, immediately followed by the Fed’s.

Let’s have some fun, shall we?

European Central Bank QE

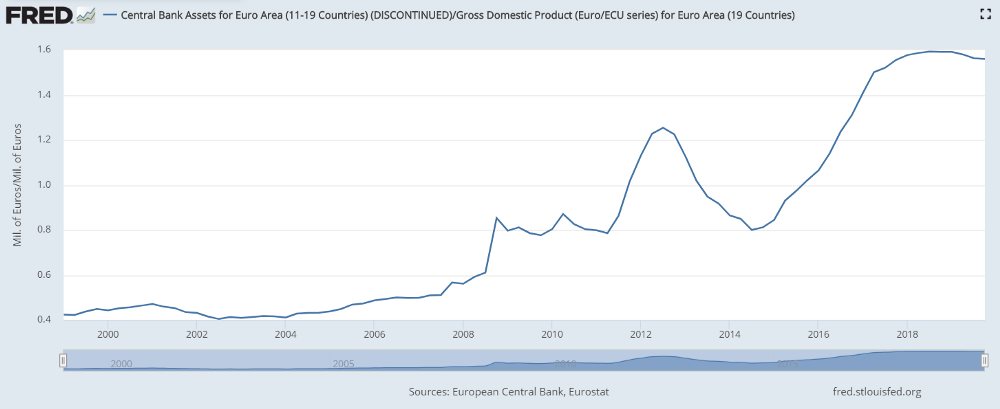

This chart shows the total assets held by the ECB. (Source: https://fred.stlouisfed.org/series/ECBASSETS#0)

This chart shows the total assets held by the ECB. (Source: https://fred.stlouisfed.org/series/ECBASSETS#0)

First, let us dive deep into QE, by looking at the European Central Bank’s (ECB’s) QE program.

Much like in the United States, its QE measures started amidst the 2008 Financial Crisis. The ECB’s first round of purchases took place in Q2 2008, and the institution acquired assets worth more than 20% of the European Union’s total GDP.

A few years later, in late 2011, there was a second round of massive purchases. Essentially, from Q2 2011 until Q2 2012, the ECB bought assets worth 50% of the EU’s total GDP.

By the beginning of 2013, the assets accumulated by the ECB were worth more than 120% of the entire eurozone GDP.

But wait, there’s more.

Soon afterwards, the ECB reduced its balance sheet significantly, reaching the same levels it had in Q2 2011 by mid-2014, at around 80% of total eurozone GDP.

However, the most aggressive buying of assets started soon after. If not, how could they expedite the massive financing of private corporations? Through large scale purchases, the ECB took the total value of the assets it owned from roughly 80% of total eurozone GDP in mid-2014 to around 134% in early 2019.

In other words, while the eurozone GDP was close to €3.5 trillion, assets held by the ECB were valued at €4.7 trillion.

In total, the ECB doubled the value of assets it held in the span of five years.

U.S. Federal Reserve QE

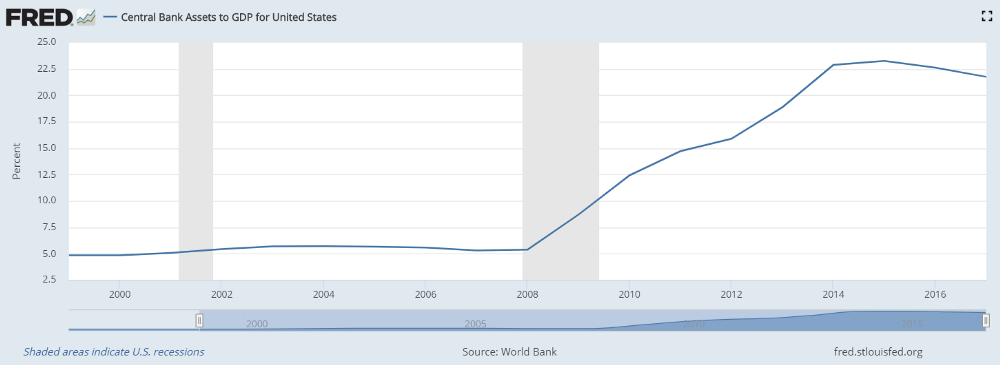

This chart shows the total assets held by the Fed. (Source: https://fred.stlouisfed.org/series/DDDI06USA156NWDB)

This chart shows the total assets held by the Fed. (Source: https://fred.stlouisfed.org/series/DDDI06USA156NWDB)

In the introduction, we already discussed the effects QE has on major stock indices, namely he S&P 500 and the Dow Jones Industrial Average. To complement the initial discussion, we’ll measure the impact the Fed’s QE has on total U.S. GDP, much as we did in the previous section with the ECB.

When QE started in late 2008, assets held by the Fed went from roughly 5% of total U.S. GDP to about 12.5% in early 2010. Soon after, the Fed slowed its pace and only increased its balance sheet by approximately 5% between 2010 and early 2012.

However, things were not looking great for the financial markets and the economy in general. Hence, from 2012 until early 2014, the Fed acquired assets worth more than 7.5% of U.S. GDP.

At its peak, the Fed held assets worth close to 25% of U.S. GDP.

Essentially, the only way markets around the world could appreciate, especially in Europe, the US and Japan — where the BoJ currently holds assets worth over 100% of the total of GDP — was through currency manipulation.

In fact, without the massive repurchasing of global assets, many companies would not be able to survive, for example Boeing, American Airlines or even Hilton. Over a period of two years, Boeing spent $11.7 billion on share repurchases, according to CNN. In addition, American Airlines Group devoted $1.1 billion to such transactions and Hilton announced $2 billion worth of buybacks.

The issue is the fact most of that cash seems to have come directly from the Fed. Curiously, Boeing is now requesting $60 billion in federal assistance, the rest of the airline industry another $50 billion and, finally, the hotel industry is asking for around $150 billion in federal assistance as well.

What this translates into is corporations using near-free cash to provide benefits to shareholders, instead of reinvesting that capital into their business.

Next, we’ll analyse the relationship between the money supply and the velocity of money. Our goal is to predict the current and future behaviour of consumers — if they are either hoarding or spending U.S. dollars — and how that may affect short-term and long-term asset and consumer prices.

The relationship between velocity and supply

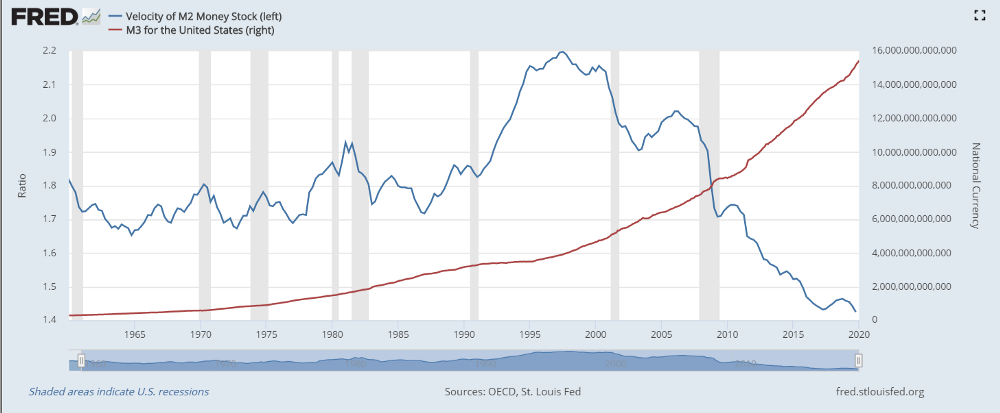

This chart shows the velocity of money (left, blue) and the total money supply M3 (right, red). (Source: https://fred.stlouisfed.org/series/MABMM301USM189S#0)

This chart shows the velocity of money (left, blue) and the total money supply M3 (right, red). (Source: https://fred.stlouisfed.org/series/MABMM301USM189S#0)

Proponents of Modern Monetary Theory (MMT) and followers of the Keynesian and Chicago schools of economics, like the Bitcoin critic and Nobel Prize winner, Nouriel Roubini, firmly believe it’s possible to print our way out of a financial crisis. However, historical data tells a rather different tale.

Before discussing the chart above, let us summarize our findings so far.

In the previous three sections, we concluded that:

- Europe (ECB) is printing large quantities of currency. At the time of writing, it has confirmed additional QE measures, without an end in sight.

- In 2019, the assets held by the ECB were worth 130% of the total eurozone GDP.

- The United States (Fed) is printing large quantities of currency as well. Much like in Europe, it’s currently breaking all-time highs in terms of available supply. Infinite QE measures have been guaranteed in response to the recent COVID-19 crisis.

- In 2019, the FED held assets totaling 25% of the country’s GDP.

- Since QE 1 started in late 2008, both the SPX and DJI have climbed more than 300%.

Let’s get back to the pretty picture.

The chart above shows the velocity of money compared to the total supply of currency.

The velocity of money (VoM) is measured by looking at how often each unit of currency exchanges hands during a quarter. To calculate the VoM, we simply divide GDP by the money supply. We can see three distinct phases in the chart.

- Between 1950 and 1990, the VoM ratio drifted between 1.7 and 1.9, meaning between 170% to 190% of the entire money supply’s value was being exchanged every quarter.

- In the 1990s, the VoM ratio started rose above 2.0, which means that more than 200% of the entire money supply’s worth was being exchanged on a quarterly basis. The figure stayed above 2.0 for much of the 2000s.

- Finally, starting in the late 2000s, the VoM ratio dropped significantly, falling over 35%. It went from a high of 2.2 to a current low of about 1.44, meaning only around 144% of the entire money supply’s worth is currently being exchanged per quarter.

Hence, we can safely say a smaller percentage of monetary units are being exchanged today than in 1950, which means that either corporations (or people) are hoarding cash because they’re scared, or the number of monetary units has flooded the economy.

Could it be both?

The long-term impact of QE on consumer prices

We concluded in the previous section that less of the money supply is being spent. The downturn started at the eve of the “internet bubble,” in the late 1990s, and VoM continued to fall further until today. There have been a few attempts to recover consumers’ and corporations’ confidence in the economy, but none have succeeded. The problem will only get worse. What do you think will happen when the economy picks up and the saved-up money reenters consumer markets?

To answer that question, we need to take another look at the chart. But now, let’s analyse the increase in money supply (red).

Over the course of almost 50 years, from 1950 until 1998, the money supply increased 13x, from $300 billion to nearly $4 trillion (red line on the chart above). Still, what happened next is astonishing. From 2000 until 2020, the money supply quadrupled. It went from around $4 trillion to over $16 trillion, where it awaits the next pump. We can conclude that since 1950, money supply has grown around 285% every decade.

If the trend continues over the next 10 years, there should be at least $32 trillion in circulation. In 20 years, we’re talking about $64 trillion. Does it mean the United States will produce $64 trillion in goods and services?

The only safeguard against massive inflation in the short-term is that newly minted currency most likely won’t be going directly to the people.

As we discussed in sections one and two, money is going to the acquisition of assets (stock, corporate bonds, etc). Therefore, a great number of dollars are not going directly into the economy. Rather, those dollars are flowing into companies’ balance sheets.

In response to the coronavirus, most governments are discussing the possibility of handing out some sort of Universal Basic Income (UBI) scheme. The logic is simple: every citizen will be given a monthly recurring payment (most likely in a digital form), during a fixed period of time.