WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

WORDS is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the June 2018 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

Bitcoin Miners Beware: Invalid Blocks Need Not Apply

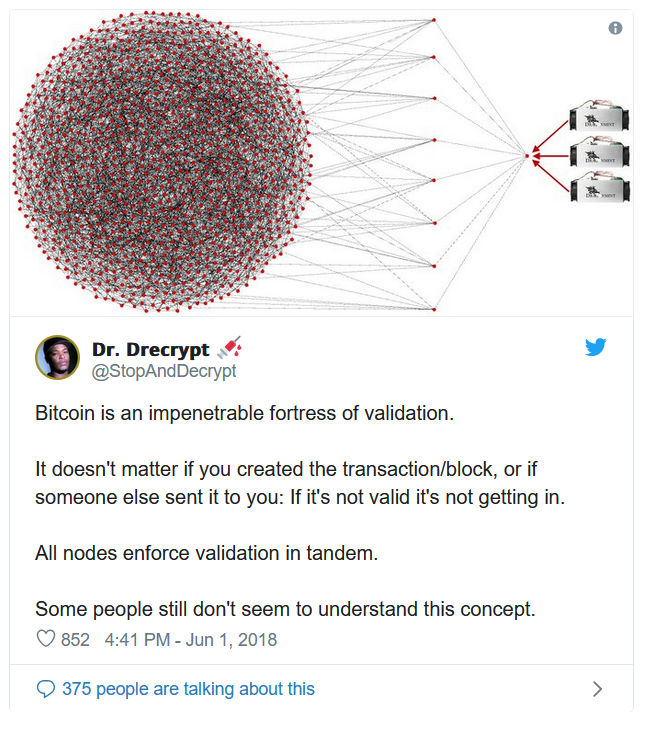

Bitcoin is an impenetrable fortress of validation.

StopAndDecrypt

Posted June 1, 2018

Like my Moore’s Law article , this is an excerpt from a much larger article . It’s good enough to serve as a standalone piece because the misconception this aims to put to rest is a commonly raised one that becomes annoyingly repetitive.

Understanding the Bitcoin network without math.

Bitcoin is more than just a chain of blocks. I want to help you understand how Bitcoin’s blockchain network is designed because it’ll help you fill in some gaps as you begin to acquire more knowledge in this field. I say blockchain network because Bitcoin also has a payment channel network (lightning) layered on top of it that doesn’t effect the structure of the blockchain network. I won’t be discussing Bitcoin’s lightning network in this article though, as it’s not that relevant to the points I’ll make.

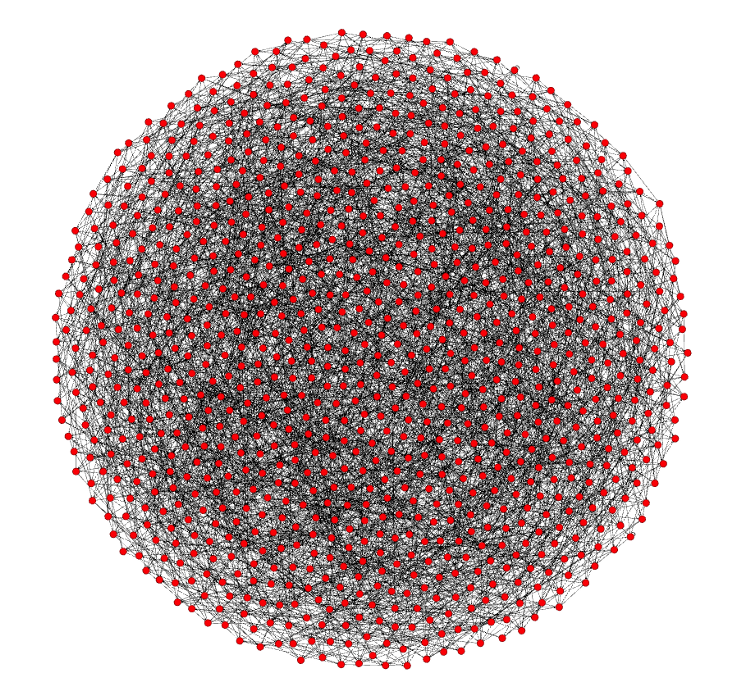

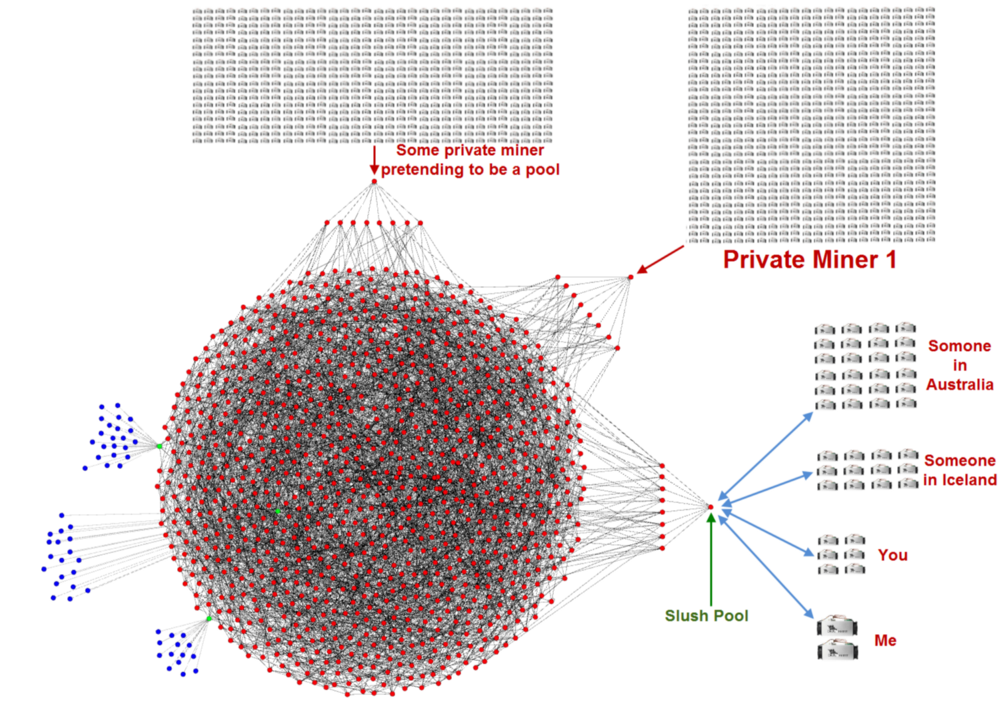

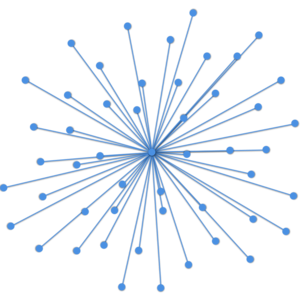

Below is a rough example of the Bitcoin network scaled down to 1000 fully validating nodes (there’s really 115,000 currently). Each node here has 8 connections to other nodes, because this is the default amount of connections the client makes without any changes made to it. My node is in here somewhere, and if you’re running one, it’s in there too. Coinbase’s nodes are in there, Bitmain’s nodes are in there, and if Satoshi is still around, Satoshi’s node is in there too.

Please note that this is just a diagram, and that the real network topology can (and probably does) vary from this. Some nodes have more than the default amount of connections while others may opt to connect to a limited number or stay behind just one other node. There’s no way to know what it actually looks like because it’s designed with privacy in mind (although some monitoring companies certainly try to get very close approximations) and nodes can routinely changed who their peers are.

I started with that diagram because I want you to understand that there are no differences in these nodes because they all fully validate. This means they all check the entire chain to make sure each and every transaction and block follow the rules. This will prove to be important as I explain further.

The ones on the inside are no different than the ones on the outside, they all have the same amount of connections. When you start up a brand new node, it finds peers and becomes one of the hive. The longest distance in this graph from any of these nodes to another is 6. In real life there are some deviations to this distance because finding new peers isn’t a perfectly automated process that distributes everyone evenly, but generally, adding more nodes to the network doesn’t change this. There are 6 degrees of Kevin Bacon, and in 6 hops my transaction is in the hands of (almost) every node, if it’s valid.

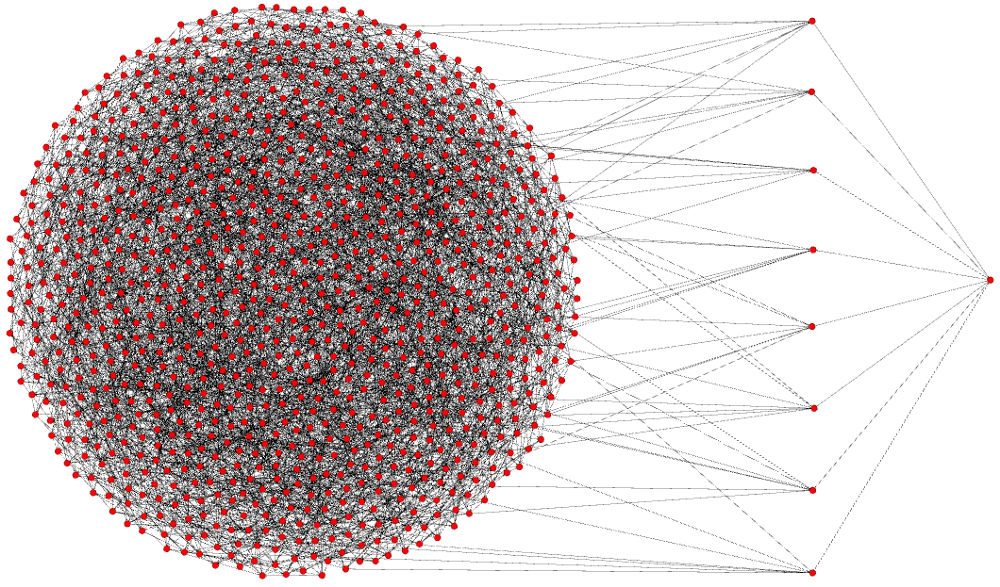

I’m going to select “my” node from this group and drag it out, so I can demonstrate what happens when I create a transaction and announce it to the network. Below you’ll see my node all the way to the right, and then you’ll see the 8 other nodes (peers) that mine is connected to.

When I create a transaction and “send it out to the world”, it’s actually only going to these 8 peers. Since Bitcoin is designed from the ground up to make every node a fully validating node, when these 8 nodes receive my transaction they check to see if it’s valid before sending it out to their 8 peers. If my transaction is invalid it will never break the “surface” of the network. My peers will never send that bad transactions to their peers. They actually don’t even know that I created that transaction. There’s no way for them to tell, and they treat all data as equal, but if I were to keep sending invalid transaction to any of my 8 peers, they would all eventually block me. This is done by them automatically to prevent me from spamming my connection to them. No matter who you are, or how big your company is, your transaction won’t propagate if it’s invalid.

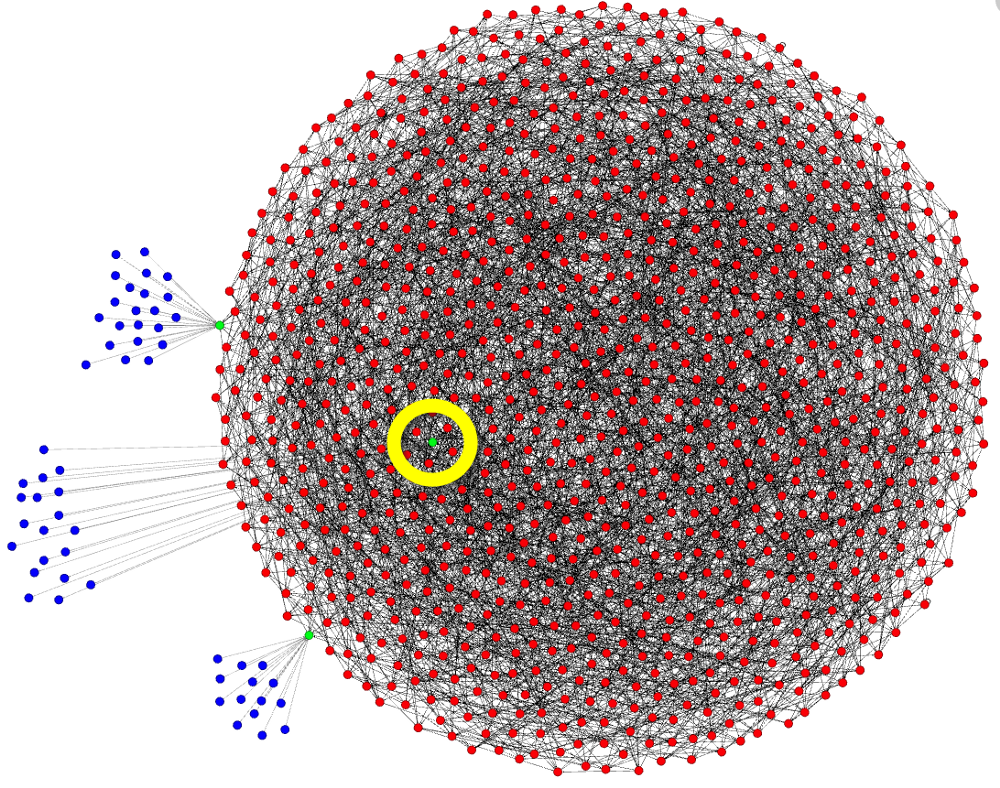

Now let’s say you’re not running a full-node, but you’re using a light-client instead. Various light-clients exist for the desktop, and for your mobile phone. Some of them are Electrum, Armory, Bread, and Samourai Wallet. Light-clients tether to a specific node. Some can be set up to change the one they connect to over time, but they are still ultimately tethered. This is what tethering looks like:

I want you to note that this is just a diagram, and it’s easy to demonstrate tethering using a node that happens to be on the rim, but there is no real rim, and tethering is tethering wherever that node happens to be within this diagram. I’ve highlighted this in yellow. The nodes being tethered to are green, and the blue dots are light-clients. All information going to or coming from the light-client goes through the node they’re tethered to. They depend on that node. They are not part of the network. They’re not nodes.

Here’s where it gets fun, and where other people try to misrepresent how the network actually works: What if I wanted to start mining?

Mining a block is the act of creating a block. Much like a transaction you want to send, you must create the block and announce it to the network. Any node can announce a new block, there’s nothing special about that process, you just need a new block. Mining has gotten increasingly difficult, but if you want you can purchase specialized hardware and connect it to your personal node.

Remember that bit about invalid transactions? Same goes for blocks, but you need to understand something very specific about how blocks are created.

First watch this video. I skipped to the important part about hashing, using nonces (random value) and appending the chain with that new block header:

Please watch the entire thing if you have time. It’s personally my favorite video explaining how mining works.

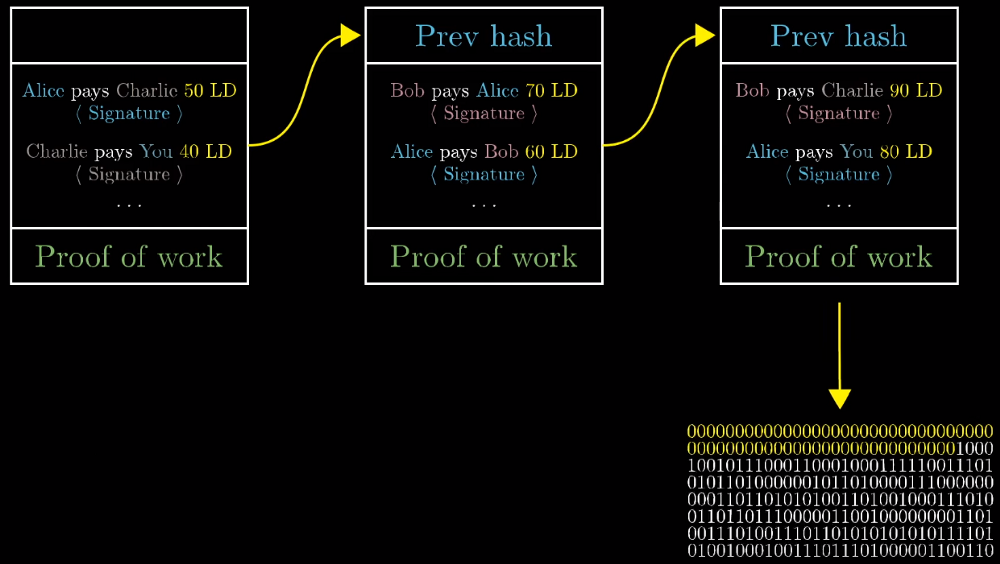

When you get to the following part in the video where the labels “Prev hash” are applied, those are the block headers:

What’s not mentioned in this video is you can create valid blocks headers even if all the transactions inside the block are invalid. It still requires the same amount of time to mine blocks with invalid transactions as it does to mine a block with valid transactions. T he incentive to spend all that time and energy creating such a block would be to push through a transaction that rewards you with Bitcoin that aren’t yours. This is why it’s important that all nodes check not just the block headers, but the transactions as well. This is what stops miners from spending that time. Because all nodes check, no miners can cheat the system. If all nodes didn’t check you’d have to rely on the ones that do check. This would separate nodes into “types”, and the only type that would matter would be the ones that check.

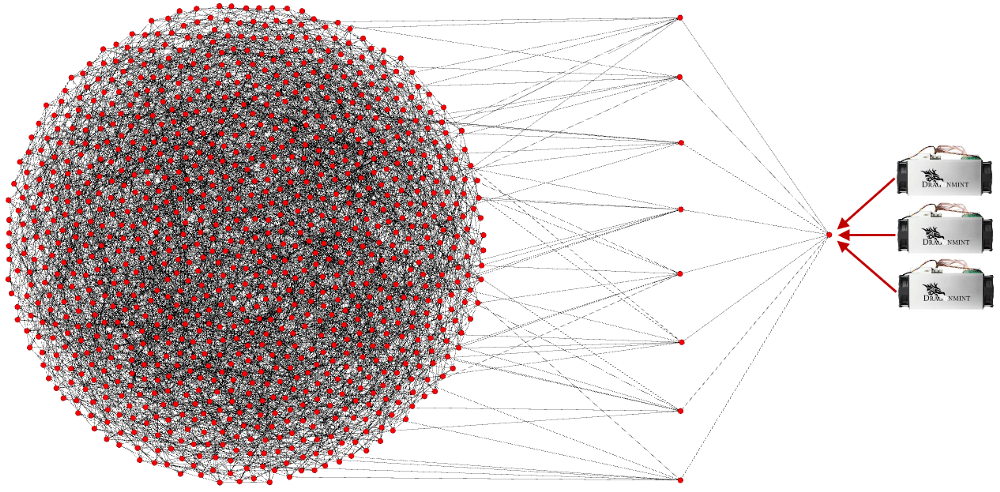

So what if you join a mining pool? You might do this because mining is too difficult for you to do alone, or if you’re a slightly larger entity you might prefer a steady income as opposed to a sporadic one. Many miners do this, and they connected their specialized hardware directly to a mining pool using an entirely different protocol call the Stratum mining protocol. Just like creating a transaction with your non-node cellphone, you don’t have to run a node to connect your hardware to a mining pool.You can mine without running a node, and many miners do exactly that. Here’s what that looks like below in blue. I’ve used Slush Pool for this example:

Remember, I dragged these pool-run nodes out of the diagram for demonstration purposes. Just like any other node, these pool-run nodes need peers. They need peers to receive transactions & blocks, and they need peers to announce blocks they create. Allow me to reiterate again: All nodes validate all blocks and all transactions.

If any of these pools announce an invalid block, their peers will know because they fully-validate, and they won’t send it out to other nodes. Just like transactions, invalid blocks do not enter the network.

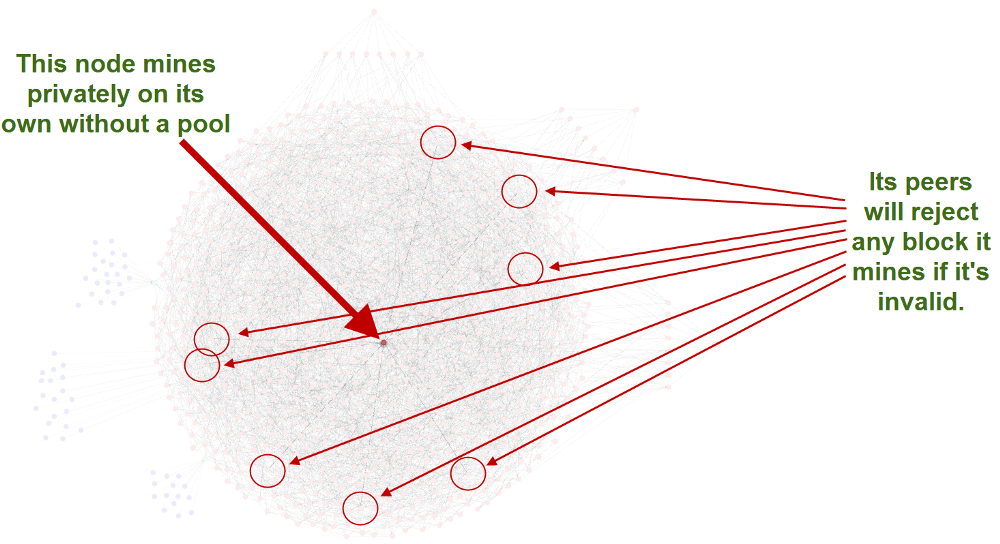

Here’s another way to look at this without pulling these nodes out from the diagram. Below is a private miner who doesn’t want to be known, it has 8 random peers, and none of those peers knows that it’s a miner. Again, this is intensionally designed this way for privacy reasons. There’s no way for any node in the network to know that the block they received was created by their peer, or relayed by their peer. All they know is if it’s valid or not, and if it is they send it along, if it’s not, they don’t.

Hopefully you’re getting the picture, and I don’t believe I used any fancy math or equations to get here. I’d like to move on because I feel like this is complete coverage, but there is one final thing I’d like to address because it’s this final aspect that is used to confuse others who don’t fully understand everything I just explained. It’s so rampantly used that I need to address it.

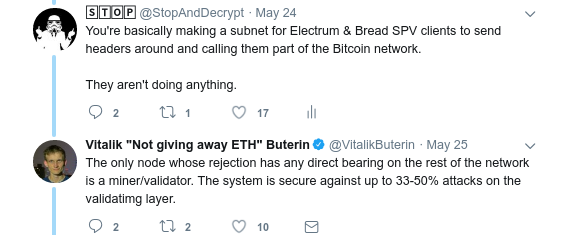

https://twitter.com/VitalikButerin/status/1000232465540136960

https://twitter.com/VitalikButerin/status/1000232465540136960

My original comment was talking about light-clients, also called SPV clients, and how they aren’t part of the network. I demonstrated this above with the blue tethered dots. His follow-up comment tries to imply that nodes that mine are the only nodes who’s rejection matters. Remember: nodes have no way of knowing which other nodes mined a block versus who relayed a block, this was designed intentionally.

Now for a final diagram so I can try and explain the logic that’s used when people say “only mining nodes matter”. Some miners connect directly to other miners so that out of their peer list with the network, some of them are also other miners. Not all miners do this. Some of these miners that connect directly also use optional relay networks like the FIBRE network being designed by Bitcoin Core developer Matt Corallo, but even this side-network isn’t exclusive to miners, anyone can join including you or me and it’s just there to help block relay across the network. E ither way, people try to argue that this interconnectivity of “nodes that mine” (whether using something like FIBRE or not) implies they’re the only ones that matter, and it’s absurd:

In this example I left the node’s peers inside the diagram. You should get the point by now. They reject invalid blocks. That group of nodes inside the green circles are most definitely not the only set of nodes that matter in this network.

The Time Value of Bitcoin

By Nik Bhatia

Posted June 8, 2018

- 1/4 The Bitcoin Second Layer

- 2/4 The Time Value of Bitcoin

- 3/4 The Bitcoin Risk Spectrum

- 4/4 The Lightning Network Reference Rate

tl;dr

The HTLCs in Lightning Network give bitcoin a path to become a global reserve currency.

Abstract

Lightning Network provides a framework to measure the time-value of bitcoin, a precursor for a capital market and reserve currency status. Observable variables in Hashed Time Locked Contracts can be used to calculate the interest rate received on bitcoin held in payment channels, allowing investors to measure their opportunity cost of capital. Lightning Network wallet software should include ways to calculate interest and prove the rate received in a trust-minimized way. A reference rate should be developed akin to US Dollar LIBOR, using consensus to dictate how the rate is calculated. This reference rate can anchor off-chain bitcoin lending into the global economy, leading to bitcoin-denominated banks, credit ratings, debt capital markets, and eventually an entire financial system: a path toward status as a global reserve currency.

Calculation Method

Three observable variables are needed to calculate an interest rate: principal, cash flows, and time. In Lightning Network, the principal is the amount of bitcoin in a payment channel; cash flows are routing fees; time is the block-time in which the fee collection is measured. Wallet implementations should experiment with different interest rate calculation methods with the eventual goal of a consensus method. The US Dollar has Treasuries, Fed Funds, LIBOR, OIS, and SOFR all acting as reference rates within the capital market for lending, borrowing, and swapping cash flows. Bitcoin needs to establish a reference rate of its own, referred to in this writing as LNRR (Lightning Network Reference Rate).

There are many possible ways to calculate LNRR. Principal may be measured once per block or using an average over time. Fees may be measured for individual HTLCs, individual payment channels, or Lightning Network nodes with multiple channels. Block-time may be measured by the locktime of HLTCs or measured one block at a time. Compounding conventions may be discrete or continuous. On-chain fees paid to open and close channels may be included or excluded in the calculation. We need to experiment with calculation methods because bitcoin is an entirely new asset class and shouldn’t adhere to financial conventions of the past, even though traditional fixed income markets set the bar extremely high for financial sophistication.

Time-value of bitcoin

Fees, time-value, and security risk premiums are discussed in the The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments by Joseph Poon and Thaddeus Dryja:

The time-value of fees pays for consuming time (e.g. 3 days) and is conceptually equivalent to a gold lease rate without custodial risk; it is the time-value for using up the access to money for a very short duration.

Historically, one of the largest component of fees and interest in the financial system are from various forms of counterparty risk — in Bitcoin it is possible that the largest component in fees will be derived from security risk premiums .

Fees in Lightning Network can be attributed to two components, time-value and security risk premium. Fees compensate the leasing of bitcoin which translates into time-value. Positive interest rates should attract capital and competition. But Lightning Network node operators investing capital are not doing so purely risk-free. They are taking on a variety of risks, most notably the risk of using hot wallets to stake liquidity to the network. Therefore, interest rates will vary between nodes due to different security practices, captured here by the catch-all variable security risk premium.

r = time-value + security risk premium

Lightning Banks

Lightning Network will birth Lightning banks. Their first function will be to provide liquidity to Lightning Network by funding payment channels. They will try to position themselves as central routing hubs, capturing as many fees as possible. Competition will be open and fierce. Those with the greatest ability to efficiently manage payment channels and actively optimize routing positioning will profit.

Reference Rate

LIBOR was originally intended as an inter-dealer interest rate, however market conditions and manipulation scandals have significantly changed its role. Despite its evolution, LIBOR’s model could serve as an example for LNRR to follow. The calculation method for LIBOR is essentially a panel: banks are asked to submit rates and these rates are aggregated to form a reference rate published once a day. Lightning banks can publish their interest rates to each other in order to foster a dealer community similar to the LIBOR panel banks. Any node that can publish an interest rate can potentially contribute to LNRR, and ideally all interest rates that are published would be cryptographically provable by all participants to assure complete transparency.

Once Lightning banks establish LNRR, they can reference this rate and charge a spread for loans that are not secured by the Bitcoin blockchain. They can use the reference rate to attract deposits which would also not be secured by the blockchain. While off-chain, trusted, bitcoin denominated capital market activity does not benefit from Bitcoin’s immutability, it is essential for the establishment of bitcoin as a currency capable of global economic activity. Economic activity requires a tradeoff between time preferences which can only be achieved when savers are allowed to lend capital.

Conclusion

LNRR is not some magic solution. This paper is a suggestion to the Lightning developer community to start experimenting with the translation of HTLCs to a financial framework. We cannot go from Trace Mayer’s sixth network effect of financialization to the seventh network effect of reserve currency status without the correct financial tools. Bitcoin has already emerged as a new asset class and is now acting as a reserve asset for millions around the world. Transitioning from reserve asset to reserve currency will present a challenging path. Ideas like LNRR should be discussed and explored so that we can continue to push bitcoin forward as the world’s best abstraction of money.

Follow me at https://twitter.com/timevalueofbtc

Sources

Bitcoin: A Peer-to-Peer Electronic Cash System by Satoshi Nakamoto

https://bitcoin.org/bitcoin.pdf

The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments by Joseph Poon and Thaddeus Dryja

https://lightning.network/lightning-network-paper.pdf

Mastering Bitcoin 2nd Edition — Programming the Open Blockchain by Andreas M. Antonopoulos

https://github.com/bitcoinbook/bitcoinbook

CRYPSA event with Trace Mayer

http://www.bitcoin.kn/2015/06/crypsa-event-with-trace-mayer/

Bitcoin Investment Theses (Part 1)

By Pierre Rochard

Posted June 9, 2018

- Bitcoin Investment Theses Part 1

- Bitcoin Investment Theses Part 2

- Bitcoin Investment Theses Part 3 NOT YET PUBLISHED

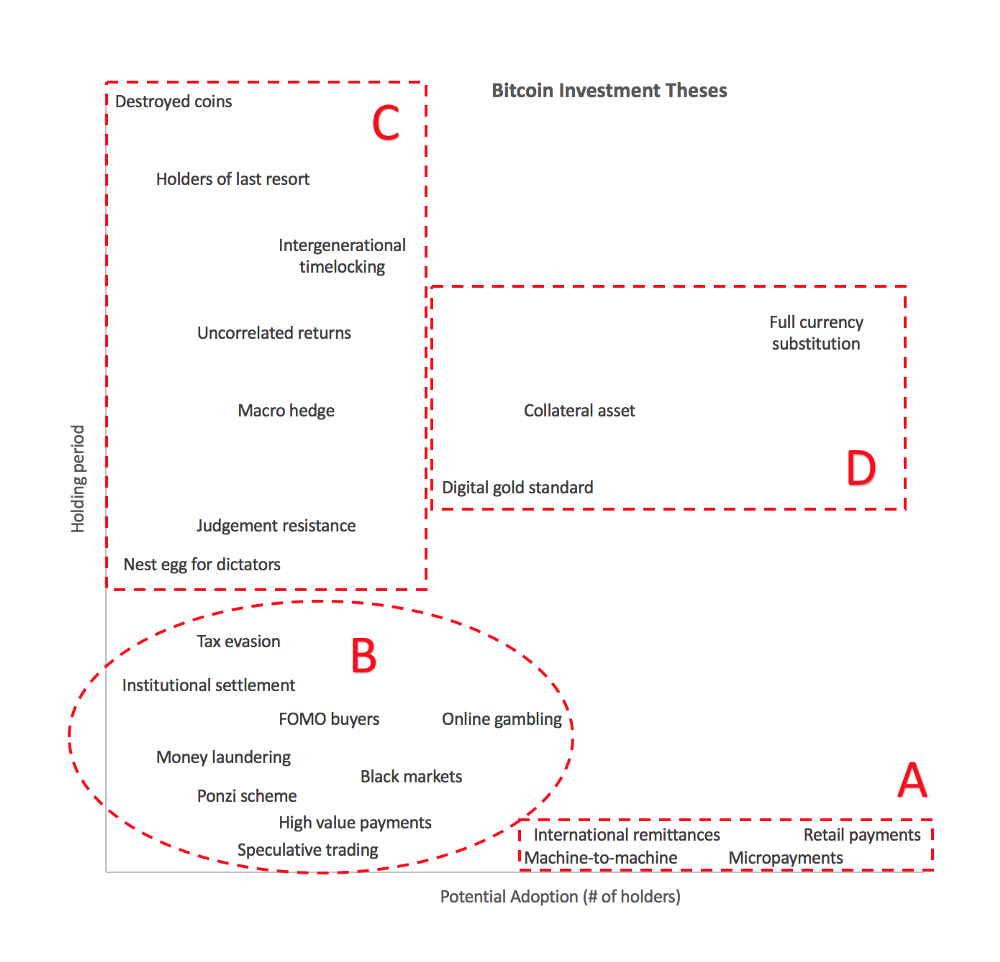

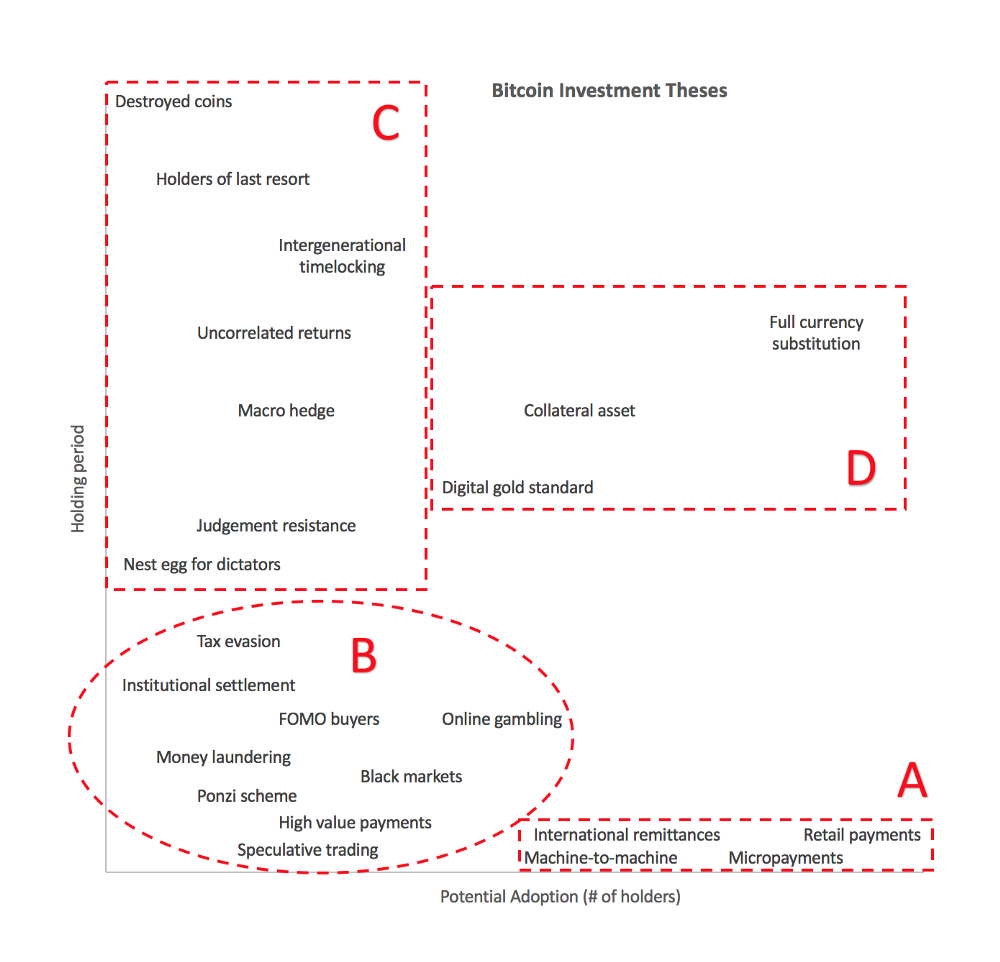

We can classify the investment theses for (and against) investing in Bitcoin into categories. This helps clarify how much of an impact a given narrative could have to Bitcoin’s valuation. Investment theses that have a short holding period are less meaningful for investors than ones with a long holding period. Likewise, theses with a large number of potential adopters are more meaningful for investors than ones with a small number of potential adopters. This is an imperfect heuristic that should be debated and refined.

Investment theses with a short holding period are focused on using bitcoins as a method of payment. Some of these theses would find ubiquitous usage while others are niche verticals. If you disagree with anything written here, feel free to contact me on Twitter or on GitHub.

A. Short holding period, wide adoption

1. Retail payments

Thesis: Bitcoin, whether it’s on-chain, off-chain, or Lightning, will supplant current retail payment methods including cash, checks, and credit cards. Bitcoin’s advantage over cash and checks is that it is digital, the consumer only needs a smartphone and the retailer does not have to worry about handling cash or depositing checks. Bitcoin’s advantage over credit cards is lower transaction fees, irreversibility which protects the merchant, and a “push” system with no credit card numbers — which protects the consumer. Fast settlement means that merchants require less in working capital.

Anti-thesis: Reversibility increases consumer confidence. A “pull” system enables subscriptions which are an important business model. On-chain transactions can not scale without centralizing the Bitcoin network. Off-chain and layer 2 transactions have an up-hill battle against entrenched debit and credit card payment systems. Credit cards give consumers flexibility in financing their purchases. Many countries have already deployed payment systems that are instant with low to zero fees. Consumers who acquire bitcoins with the intent of making retail payments end up just holding the bitcoins for price appreciation instead.

2. Micropayments

Thesis: Bitcoin’s Lightning network enables instant, high-volume micropayments. Micropayments will be leveraged by online games, content publishers, and social media tipping services to monetize interactions and consumption.

Anti-thesis: Subscriptions provide a better revenue model for content publishers and social media tipping ignores why people actually engage with each other. Game creators and players currently have no serious issues with in-game purchases. If there are any complaints, it’s from players who feel nickel-and-dimed, which would only be worse with micropayments.

3. Machine-to-machine payments

Thesis: The Internet of Things (IoT) means your refrigerator could communicate with several grocery business APIs to negotiate for the best value replenishment. Soon the grocery business itself will automatically be negotiating with self-driving cars providing delivery services. This network of machine-to-machine payments will all be with Bitcoin’s Lightning Network.

Anti-thesis: It’s unclear why the businesses, which own the machines, would not invoice each other on a monthly basis, instead of continuously streaming payments. Companies will continue to keep track of their payables and receivables, and netting them out for payment, in which case Bitcoin is not a necessity. Today Amazon Web Services charges by the second and can be controlled by an API, but payments are made monthly with fiat-denominated credit cards, wire transfers, or ACH.

4. International remittances

Thesis: Money transfers between countries are expensive and slow; Bitcoin can make them fast and cheap. Anyone, anywhere in the world who has an internet connection can receive bitcoins.

Anti-thesis: Senders want to send their local fiat currency and recipients want to receive their local fiat currency. Neither side has bitcoins. Using Bitcoin means adding an FX conversion on the sender’s side and on the recipient’s side. This inherently increases cost. The cost of sending $200 anywhere in the world has declined from 10% in 2008 to 7% in 2017. Money transfers are expensive due to physical locations, marketing, licensing, and compliance. Bitcoin on its own does not solve any of those issues. The slow fiat payment rails are being improved by fintech startups using fiat banks and SQL databases.

B. Short holding period, narrow adoption

1. Tax evasion

Thesis: Just as restaurant waiters can under-report their cash tips, a person or business receiving bitcoin revenues could under-report them. There is no financial institution which the IRS can subpoena for records. If the tax evader is careful about how they use Bitcoin’s public blockchain ledger then they can also avoid being caught with data analysis.

Anti-thesis: Tax auditors have experts in computer forensics and there’s always a paper trail for the creation and sale of a good or service. It would be risky and time consuming to convert the proceeds into fiat. Tax evasion does not scale due to whistle-blowers, reporting by third parties (1099’s in the US), and the lifestyle/income mismatch.

2. Black markets

Thesis: Before it was shutdown in 2013, the Silk Road was a marketplace for illegal drugs. It had tens of thousands of users and $22 million in annual sales. In 2017, a successor of the Silk Road called AlphaBay was also shut down. It was ten times the size of the Silk Road with hundreds of thousands of users. Bitcoin enables the sales of illegal goods and services because it is a permissionless, censorship-resistant payments network.

Anti-thesis: Ultimately most goods and services have to be delivered in the real world, so even if the payment is pseudonymous the delivery can reveal the identities of buyers and sellers. Additionally, even if the bitcoins are bought and sold in person for fiat cash, there is a risk that the bitcoin broker is an informant or government agent. Buying and selling bitcoins on an online exchange with KYC/AML is even riskier. This problem is compounded by the visibility of on-chain Bitcoin transactions.

3. Ransomware

Thesis: Ransomware is when malicious software encrypts a user’s data, locking them out of personal or business information. The virus demands payment in bitcoins to decrypt the data.

Anti-thesis: Increasing awareness of the problem is leading to effective mitigation strategies, whether with anti-virus software or offline data backups.

4. Online gambling

Thesis: While online poker is legal in the United States, in practice the Unlawful Internet Gambling Enforcement Act of 2006 made it illegal for financial institutions to service online poker platforms and players. This eventually led to the wide usage of Bitcoin for funding online poker games. The phenomenon has expanded beyond poker. There are Bitcoin-funded sites for sports betting, blackjack, dice, and slots.

Anti-thesis: If US legislation changes to be more favorable towards online gambling then this niche for Bitcoin could disappear.

5. Unbanked businesses

Thesis: Payment processors and banks are facing pressure to not service businesses for political reasons. These businesses include gun stores, marijuana dispensaries, and sex workers. Other businesses and individuals do not have access to banking services due to redlining or credit history. A Bitcoin wallet enables these demographics to “be their own bank” with a checking account and the ability to send and receive payments.

Anti-thesis: As long as the rest of the economy is using fiat currencies, the unbanked still need a way to exchange their bitcoins for fiat. They can use in-person cash exchange services, though there are cases of people being robbed and it is not a scalable solution for anything but the smallest business.

6. Speculative trading

Thesis: Bitcoin exchanges are open for trading 24/7. On top of Bitcoin’s volatility, they also offer up to 100x leverage. Tech-savvy traders are building bots that use the exchanges’ public APIs to execute their strategies. The matching engines of exchanges are moving from AWS to dedicated hosting, in the same facilities where US equities trade. Exchanges are the most profitable businesses in the Bitcoin ecosystem, offering both spot and futures products. Speculators can now profit by going long or going short. The limited supply of bitcoins has led to repeated speculative frenzies, where fortunes have been made and lost.

Anti-thesis: Speculation is zero-sum, eventually bad traders will run out of capital and good traders will see diminishing profits and move to greener pastures. Bitcoin’s volatility has been decreasing as its liquidity increases. The markets are manipulated to favor whales and they will be shutdown or become boring when government regulators intervene to stop manipulation. The speculative frenzies are faked by wash-trading volume and fractional reserve exchanges.

7. Ponzi scheme

Thesis: While Bitcoin may not fit the definition of an actual Ponzi scheme, it has a lot of similarities. Preston Byrne popularized the concept of a Nakamoto Scheme. Early buyers of bitcoins recruit and sell to later buyers, at ever higher prices. The cries to “HODL” are there to prop up the price and keep the scheme from falling apart. “Tulips” and “greater fool theory” are used as shorthand for this thesis. Once the number of gullible buyers runs out, the price will crash as everyone tries to get out at the same time, much like a bank run.

Anti-thesis: Every money has no intrinsic value. They are bubbles, shared illusions, inter-subjective Schelling points. A money is an unproductive asset which is best suited to be society’s medium of exchange, store of value, and unit of account. Bitcoin is bootstrapping to potentially fill that role from a value of zero. This has led to an astounding run-up in its fiat price. What goes unexplained in the Ponzi scheme thesis is why severe drawdowns (most recently a 91% peak to trough drawdown in 2014) are not a deathblow. So far, the value of Bitcoin has recovered and ultimately has increased beyond the previous all time high.

8. Money laundering

Thesis: Corrupt politicians who were bribed with bitcoins want to convert them into legitimate assets without raising suspicions. The money launderer can take advantage of Bitcoin’s fragmented market by sending small amounts to many different exchanges to sell for fiat, a form of structuring. A money launderer can also mix the illegal Bitcoin revenues with legal Bitcoin revenues, for example from an online poker business they control or partner with. A growing strategy is purchasing property with bitcoins, and then selling the property for fiat.

Anti-thesis: Any involvement of Bitcoin raises suspicion, so laundering bitcoins is ultimately harder than laundering fiat. Data indicates that Bitcoin money laundering has been an increasingly marginal activity. Bitcoin faces stiff competition from large international banks, which continue to be the go-to providers of money laundering services.

9. Routing around capital controls

Thesis: Countries which have a currency peg, like China, have to rely on capital controls to prevent their currency’s exchange rate from appreciating or depreciating in an unexpected manner. For example, Chinese citizens can only purchase up to $50,000 of foreign currency per year. Chinese regulators have also recently prevented offshore investments into U.S. real estate. Bitcoin allows people to route around capital controls, by buying bitcoins locally, sending them to an exchange abroad, and selling them for the foreign currency.

Anti-thesis: While Bitcoin can help small-scale evasion of capital controls, it is not liquid enough to capture market share from other forms of evasion. Governments have and will crackdown on their local Bitcoin exchanges to further reduce liquidity.

10. FOMO buyers

Thesis: Retail investors see the price going up and experience a “fear of missing out” on further price gains and the social phenomenon. Individuals want to be able to relate to each other, i.e. if your friends are talking about investing in Bitcoin then you feel a need to do so yourself. When the price stops going up parabolically the social fad quickly passes. Conversation turns to embarrassing losses and moves on to the next trendy investment.

Anti-thesis: The FOMO buyers become FOCO (fear of cashing out) holders. They sit on the bitcoins they impulsively bought, waiting for the next bubble. A small percentage start to research what Bitcoin is and continue accumulating during the bear market.

11. Vehicle Currency

Thesis: In 1979 Paul Krugman published a paper titled “Vehicle Currencies and the Structure of International Exchange”. In this paper he explained that “People who want to exchange one currency for another will not necessarily make the exchange directly. They may make the exchange by way of some third currency, which becomes a “vehicle” for the transaction. Historically, certain currencies — the pound sterling before 1914, the U.S. dollar in recent years — have come to be widely used as vehicle currencies.” Bitcoin has the potential to become the vehicle currency of international trade.

Anti-thesis: Bitcoin is not nearly liquid enough to be a vehicle currency. Competing with the U.S. dollar for this is extremely difficult, the most likely candidate has been the euro and it has made little progress.

12. Electricity monetization

Thesis: Governments and individuals that are struggling to get hard currency can use cheap local electricity to mine for bitcoins. The Venezuelan government has been seizing imported Bitcoin mining equipment so that they can use it themselves. The North Korean government acquired 11,000 bitcoins through a combination of mining and hacking.

Anti-thesis: As Bitcoin mining finds increasingly inexpensive sources of electricity, it will become less and less profitable for governments to mine even if they have favorable access to fossil fuels.

Bitcoin Investment Theses (Part 2)

By Pierre Rochard

Posted June 24, 2018

- Bitcoin Investment Theses Part 1

- Bitcoin Investment Theses Part 2

- Bitcoin Investment Theses Part 3 NOT YET PUBLISHED

These descriptions of the numerous Bitcoin investment theses are all open source on GitHub. Feel free to open an issue here if you have an investment thesis you’d like to see listed but are unfamiliar with how to use git.

C. Long holding period, low adoption

1. Nest egg for dictators

“Normally when you have a parabolic curve, eventually it has a very sharp break,” Soros said Thursday. “But in this case, as long as you have dictatorships on the rise you will have a different ending, because the rulers in those countries will turn to Bitcoin to build a nest egg abroad.” George Soros, January 25, 2018

Thesis: While we don’t have any evidence that dictators are currently holding bitcoins abroad, George Soros suggests that they will in the future. Dictators amass fortunes by seizing private businesses, demanding bribes from resource producers, and exploiting government monopolies. For example, the dictator of Equatorial Guinea has a net worth of $600 million. This is small compared to the $95 billion belonging to the Supreme Leader of Iran. Dictators could include bitcoins in their asset allocation so that they have an unseizable slush fund in case they get ousted and exiled.

Anti-thesis: The wealth of dictators is often just the wealth of their government and is already invested in productive assets or used to stay in power by buying supporters. Even if dictators are holding cash abroad, they will continue to be more comfortable with the stability of gold and the U.S. dollar. Unless they have been specifically targeted by financial sanctions, dictators have an easy time holding cash in the international financial system with shell companies.

2. Seizure Resistant

Thesis: Bitcoin allows civilians to more easily withhold wealth from rapacious governments. Fleeing a totalitarian regime with your family’s wealth used to mean concealing gold or diamonds, and praying that a greedy border guard didn’t find your stash. With bitcoin, you could memorize 24 words that store an arbitrary amount of value. Abusive seizures of wealth are not limited to totalitarian regimes, the United States government takes $5 billion per year with a process called civil asset forfeiture that assumes “guilty until proven innocent”. Additionally, a United States federal district court judge can freeze supposedly tainted assets before a criminal trial happens, which could prevent you from hiring the lawyer you want. Having a secret stash of bitcoins could secure criminal defendants’ due process rights.

Anti-thesis: Governments will still be able to identify who owns bitcoins due to the public blockchain and seizing records from exchanges and brokerages. This would allow them to imprison and torture bitcoiners until they divulge their private key. While it is not criminal for an attorney to accept a tainted asset as payment, they may still refuse to do so to avoid the risk of themselves being subject to civil asset forfeiture.

3. Judgement Resistant

Thesis: The successful party in civil litigation can have a right to recover money or property from the unsuccessful party, in which case the successful party is a judgement creditor. Judgement creditors can freeze a bank account with a court order, called a garnishment or attachment. Bitcoin can be used to illegally hide value from judgement creditors. More interestingly, holding bitcoins with multi-signature technology in one or more foreign jurisdictions can be part of a legal strategy to frustrate or prevent the recognition and enforcement of a just or unjust judgement. Even before a party succeeds and obtains a judgement, they could freeze an individual or business bank account with a pre-judgement attachment. This can be an economic hardship, regardless of whether the trial lasts weeks, months, or years. This is especially problematic for large multinationals which operate in jurisdictions with dysfunctional or abusive judiciary systems. International banks currently provide a similar service with judgement resistant trusts, but these are expensive and cumbersome compared to a Bitcoin solution. This thesis was formulated by Ari Paul.

Anti-thesis: We don’t have any examples of Bitcoin’s judgement resistance being tested. We don’t know how judges will respond to the complexity of an asset being in multiple foreign jurisdictions simultaneously. Judgement-resistant does not mean judgement-proof, it may just take longer and be more expensive but lawyers will get to the bitcoins eventually. We may see treaties or case law emerge to prevent bitcoin multi-sig jurisdictional “abuse”.

3. Banking crisis hedge

Thesis: In 2008, WaMu experienced two bank runs. Even with FDIC insurance, if this were to happen to several major international banks simultaneously it would be disruptive enough to freeze the banking services of many businesses and individuals. Bitcoin’s layer 1 and layer 2 payments systems are decentralized and 100% reserve, thus immune to bank runs, they would continue to process payments seamlessly in a crisis. Bitcoin has no bank holidays. For this payments system hedge to work, the hedger has to be holding bitcoins ahead of the crisis, otherwise fiat payments to exchanges and OTC brokers would get caught up in the fiat freeze. Worse than a temporary payments freeze would be a bank bail-in, for example in 2013 Cypriot banks’ depositors were subjected a one-off 9.9% levy for any deposits above €100,000. Bitcoin is an insurance policy for both individuals and corporate treasuries and should be a part of business continuity planning.

Anti-thesis: Governments would just bail out “too big to fail” financial institutions to keep fiat payment systems from freezing up. The hedge does not work if retail stores, vendors, suppliers, employees, business owners, etcetera are unable or unwilling to accept bitcoins as payment even in a crisis.

4. Inflation hedge

Thesis: Central banks are engaging in unorthodox monetary experiments to stabilize financial systems and economies after the 2008 crisis. These experiments will eventually result in uncontrolled inflation. Countries with failing governmental institutions, like Venezuela, are currently suffering from hyperinflation. Bitcoin’s ultra-orthodox monetary policy of targeting a fixed money supply, with 80% of the total 21 million bitcoins already in circulation, is the ideal hedge for fiat money printing.

Anti-thesis: People have been predicting fiat hyperinflation since quantitative easing started a decade ago, and yet inflation is still very low in developed countries. Owning stocks, real estate, commodities, or precious metals is a better long-term inflation hedge than Bitcoin, which has a very short track-record. Bitcoin’s track-record indicates that its value is not tied to expected inflation.

5. Uncorrelated returns

Thesis: Bitcoin’s returns are uncorrelated or weakly correlated with other asset classes. This makes it ideal for diversifying a portfolio. The optimal allocation to Bitcoin has been estimated to be 1.3%.

Anti-thesis: Bitcoin is increasingly correlated with the stock market. It is widely viewed as a “risk-on” asset that is being inflated by easy money going into the broader tech ecosystem. Past lack of correlation was just due to how small bitcoin was relative to other asset classes.

6. Intergenerational timelocking

Thesis: OP_CHECKLOCKTIMEVERIFY could be used to lock up bitcoins for several centuries. This could help overcome what’s called the rule against perpetuities which prevents the deceased from affecting the ownership of property long after they have died.

Anti-thesis: Time-locked bitcoins will end up trading in a secondary market at a discount.

7. Holders of last resort

Thesis: Fractional-reserve monetary systems require lenders of last resort to stop debt-deflation from causing the economy to collapse. An emerging 100% reserve monetary system like Bitcoin requires holders, and buyers, of last resort to stop a crisis of confidence from causing the value of bitcoins to collapse. This is functionally similar to a central bank using its reserves to buy the domestic currency, fighting off speculators who are betting on devaluation. Holders of last resort are intransigent advocates for Bitcoin’s economics and technology.

Anti-thesis: Not enough people are interested in Bitcoin maximalism’s ideology to form a set of holders of last resort with enough capital to defend bitcoin from a catastrophic and final loss of value. Holders of last resort are delusional and will end up just holding a worthless bag of buttcoins.

8. Destroyed coins

Thesis: Many bitcoins have been destroyed, accidentally or deliberately. This permanently removes them from the market. When a bitcoin is destroyed this makes all other bitcoins proportionately scarcer, and thus presumably more valuable.

Part 3 coming soon!

If you have any ideas for investment theses, feel free to reach out! I’m on Twitter @pierre_rochard, DMs are open.

Did you disagree or agree with any of the above? Leave a comment below!

Bitcoin’s Energy Consumption

A shift in perspective

By Gigi

June 10, 2018

You might have heard that Bitcoin wastes a tremendous amount of energy. You might also have heard that Bitcoin will use half a percent of the world’s electric energy by the end of the year, the computations used for mining don’t do anything useful, and if the current rate of growth continues it will suck up all the energy and we are all going to die.

You might have heard that Bitcoin wastes a tremendous amount of energy. You might also have heard that Bitcoin will use half a percent of the world’s electric energy by the end of the year, the computations used for mining don’t do anything useful, and if the current rate of growth continues it will suck up all the energy and we are all going to die.

I don’t want to dispute the numbers or compare Bitcoin’s energy usage to the current banking system. I simply want to offer a shift in perspective.

Bitcoin is Offensive

Bitcoin is a global, permission-less, censorship-resistant network. Its nature is inherently offensive. It offends governments, bankers, and central authorities alike. Hell, offending banks was the whole point of this experiment in the first place.

At first glance, Bitcoin is the worst database ever devised by mankind. In addition to being seemingly inefficient and slow, it is eating up computational resources at a mad pace and consumes as much energy as a small country.

“In comparison to modern distributed databases, blockchains are slow, ponderous, unnecessarily redundant and overly paranoid.”Dhruv Bansal

As Nick Szabo so succinctly put it: “Bitcoin offends the sensibilities of resource-conscious and performance-measure-maximizing engineers and businessmen alike.” It also offends our globally shared understanding that wasting energy is bad, and energy-efficiency is always good.

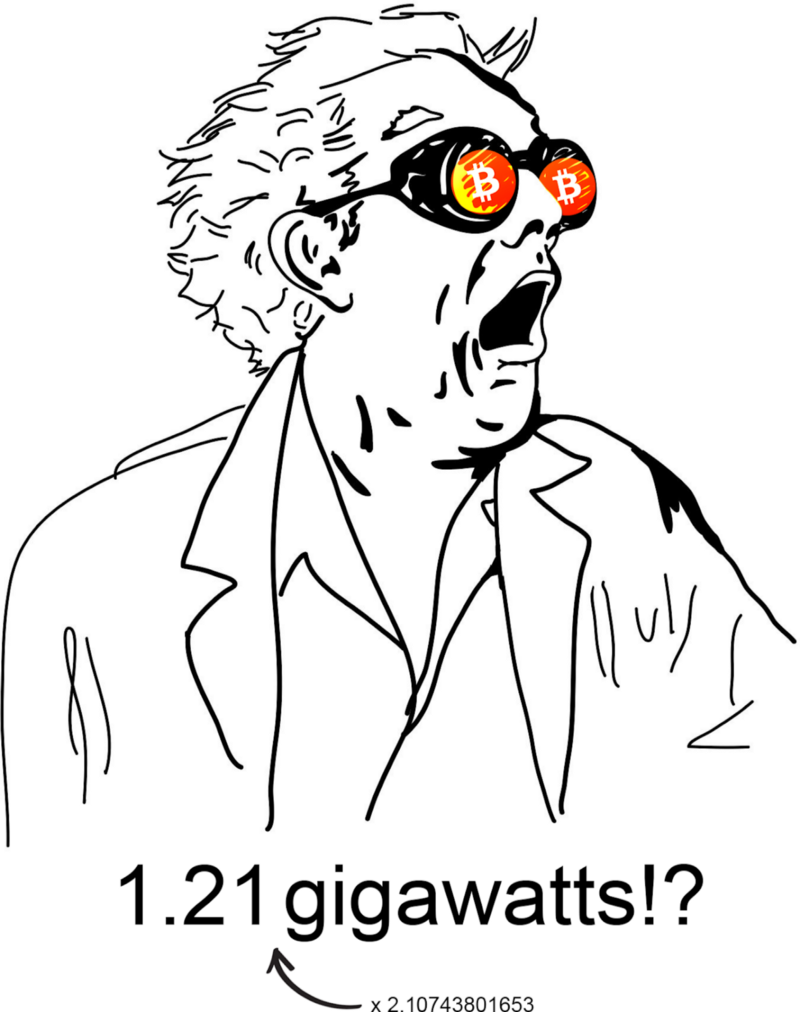

According to a recent paper “the Bitcoin network can be estimated to consume at least 2.55 gigawatts of electricity currently, and potentially 7.67 gigawatts in the future, making it comparable with countries such as Ireland (3.1 gigawatts) and Austria (8.2 gigawatts).”

It’s easy to be concerned, outraged or offended. “Did you know Bitcoin uses as much energy as Austria? Baby cows are dying because of Bitcoin!”

What-what the hell is a gigawatt?

What-what the hell is a gigawatt?

To understand why all these gigawatts are necessary for the Bitcoin network to function properly and securely, we will have to take a closer look at the nuances of mining.

Mining Blocks and Coins

The name “mining” stems from the proposition that bitcoin has more in common with gold and other precious metals than paper money. Satoshi made this clear in one of his posts.

“In this sense, it’s more typical of a precious metal. Instead of the supply changing to keep the value the same, the supply is predetermined and the value changes.”Satoshi Nakamoto

Hence bitcoins are not printed, they are mined. Even though we talk about “mining bitcoins” all the time, keep in mind that it isn’t bitcoins which are mined. Blocks are mined, and miners are currently rewarded with new bitcoins if they find a valid block. Miners are rewarded because finding new blocks is inherently difficult. The system is set up in a way that the difficulty of finding a new block is adjusted automatically so that a new block is found every 10 minutes on average. Differentiating between “mining bitcoins” and “mining blocks” helps to point out a couple of things:

First, that the rate at which bitcoins are mined is decoupled from Bitcoin’s energy use. If everyone would decide to double the energy spent on mining, the number of bitcoins mined would not double as a consequence. The rate of supply is fixed, no matter how much energy you choose to expend for mining.

Second, that miners do a lot more than bringing new bitcoins into existence: maintaining the security and continuity of the network, confirming transactions, and signaling their support or rejection of network changes, to name a few. Not all of these require an excessive amount of energy, which is one of the reasons why running a full node is important.

Third, that mining is not a fixed process. Both the mining reward and the mining difficulty are dynamic and thus will necessarily change over time.

Fourth, that mining is supposed to cost a lot of energy. It is computationally expensive by design, which is why Satoshi chose to reward people extra for expending this energy. It is the main ingredient of the Nakamoto Consensus. It is the work in proof-of-work. It is absolutely essential.

Without a closer look at the mining process, it is easy to confuse the energy-intensive process of finding valid blocks with “finding new bitcoins”. From this perspective, it seems like all this electrical energy is transmuted into new bitcoins.

This is wrong.

The energy expended acts as a barrier which protects the public ledger. The creation of new bitcoins is just a side-effect.

Cryptographic Walls

Until very recently, securing something meant building a thick wall around whatever is deemed valuable. We all know how to do this, and we all agree that this is a sensible thing to do.

The new world of cryptocurrencies is unintuitive and weird. There are no physical walls to protect our money, no doors to access our vaults. Bitcoin’s public ledger is secured by its collective hashing power: the sum of all energy expended to do the work in its proof-of-work chain.

Thus, we can think of Bitcoin’s energy usage like a giant wall — a sort of electrical force-field — which secures all bitcoin balances of all users, now, and in the future.

It is hard to say how much energy has to be expended building these cryptographic walls. Financial systems are critical infrastructure, which is why most engineers in this space rightfully argue that security and stability are paramount. If Bitcoin will be the money of the future, it better be prepared to withstand high-impact, low-probability events.

How thick will these cryptographic walls need to be? Only time will tell. If Bitcoin is able to survive coordinated attacks by multiple state-level attackers, the walls were thick enough.

The End of Mining New Bitcoins

Bootstrapping a new network is difficult. It’s like trying to convince everyone to buy a fax machine if you are the only guy in the world with a fax machine. It’s really, really hard. As outlined above, Satoshi solved this problem by adding a block reward mechanism, which acts as (a) the controlled currency supply of Bitcoin and (b) an incentive for people to participate in the network to expand and secure the public ledger.

Expending energy is essential to provide security for this new financial network.

The current phase of “mining bitcoins”, where miners are incentivized with a high reward, is a clever way to get the network started. In other words: everyone who is greedily mining bitcoins today is helping to bootstrap this new financial system, whether they realize it or not.

John Nash commenting on the game theoretical aspect of Satoshi’s invention.

John Nash commenting on the game theoretical aspect of Satoshi’s invention.

As mentioned above, Bitcoin’s mining difficulty adjusts automatically, leading to a dynamic, self-correcting system. If mining — for whatever reason — gets more expensive, fewer people will mine at a profit, resulting in fewer people mining, lowering the mining difficulty. This, in turn, will make mining easier again and thus cheaper, which will incentivize more people to mine.

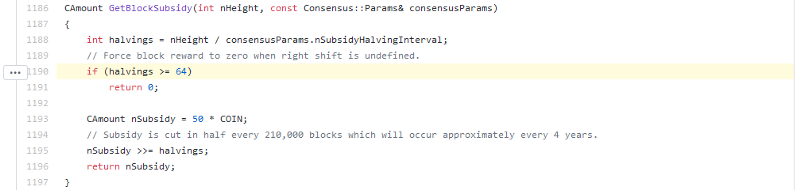

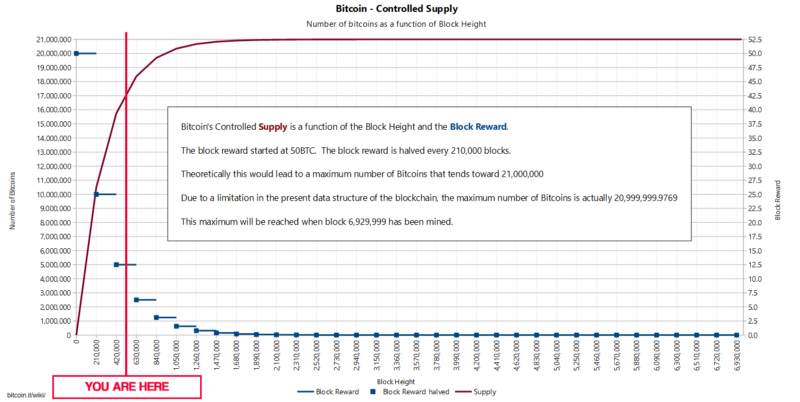

Over time, the financial incentive of running a mining operation will change. It follows that Bitcoin’s energy consumption will change as well. The reason why change is inevitable is Bitcoin’s block reward function which ensures a controlled, limited supply.

The block reward is halving every 210.000 blocks and will eventually reach zero, after 64 halvings. After the last of these halvings, miners will be left with transaction fees as the only financial reward for mining a new block.

In other words: The “mining of new bitcoins” will eventually stop. The mining of valid blocks will continue after that.

In Bitcoin, code truly is law.

In Bitcoin, code truly is law.

One could argue that we are currently in the bitcoin equivalent of the Gold Rush, where the reward for mining as well as the future projected reward far outstrips the investment and energy costs. While it is hard to estimate how much security is enough security, a case could be made that the Bitcoin network is currently “hypersecured” as a side-effect of this Gold Rush.

Bitcoin’s controlled supply and block reward over time.

Bitcoin’s controlled supply and block reward over time.

We are still in the early phases of Bitcoin’s block reward phase, as the above graph shows.

Whether the adaption of bitcoin as a currency will be slow and steady, or exponential and parabolic, a continued exponential growth of energy consumption is very questionable. I would argue that excessive growth will give way to a somewhat sensible balance between security and energy consumption as the block reward approaches zero. Depending on the future value of bitcoin and the willingness of people to pay transaction fees, this balance might be leaning more towards security or more towards conservative use of energy.

Modern Blocks of Marble

Once you wrap your head around proof-of-work, it becomes more and more clear that the energy consumption of the Bitcoin network is not a bug, it’s a feature. As far as we know, you can’t cheat the laws of thermodynamics. Given that we don’t have any world-shattering breakthroughs in physics, mathematics and/or quantum computing, expending energy is the only way to flip bits, and flipping bits is the only way to mine new blocks.

Unfortunately, we don’t have an intuitive understanding of this new cryptographic world (yet). Fully grasping the importance of proof-of-work requires a deep-dive into a multitude of topics. We lack concise, easy, elegant explanations and metaphors. Hugo Nguyen did a great job explaining how proof-of-work links the abstract, digital world of bitcoin to our physical world:

“By attaching energy to a block, we give it “form”, allowing it to have real weight & consequences in the physical world.”Hugo Nguyen

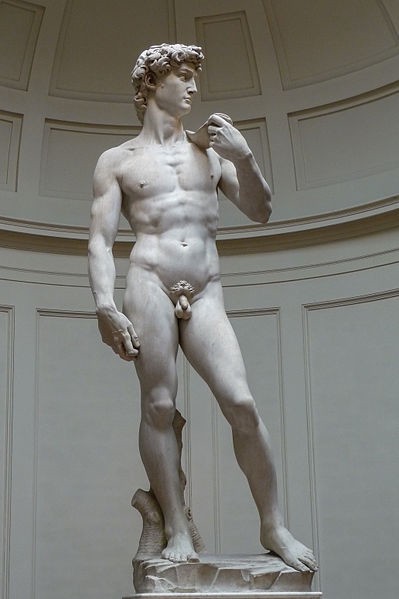

Proof-of-work is essentially a mechanism to easily check the truthfulness of the statement “I worked really hard to create this thing”. From that perspective, our new and fancy computational blocks are a bit like blocks of marble, and proof-of-work is a bit like looking at a beautiful marble statue. It is immediately obvious that a lot of work went into creating the statue. Cheating is extremely hard, because creating such a glorious statue without actually doing the work is pretty much impossible. You can’t throw a block of marble against a wall and everything which is not David will fall off. It’s not impossible, but it is very, very, very unlikely. Instead, you have to chisel away at the marble, and you have to do it properly and with care. One might argue that this is one of the reasons why great artworks are so valuable: a lot of thought, care and work was expended to create them.

Oldschool proof-of-work by Michelangelo. Photo by Jörg Bittner Unna

Oldschool proof-of-work by Michelangelo. Photo by Jörg Bittner Unna

It is similarly unlikely to find valid blocks without actually doing the work. Like an ugly half-haphazardly chiseled statue, an invalid block can be simply thrown away. When you see a valid block, however, you immediately know a lot of work went into it.

In both cases, the artifacts themselves, the statue and the valid block, are in itself the proof of work.

My point is that understanding the nature of proof-of-work and the incentives of mining valid blocks, as well as the security properties and thus the value of proof-of-work, might help to shift the perspective from “energy wasted” to “energy used for creating something valuable”. Most people value beautiful marble statues. A rising number of people value a chain of valid blocks.

Security Through Purity

Another feature disguised as a bug is the randomness of bitcoin’s proof-of-work. A common suggestion for improvement is that we could use all this electricity to do something else, something truly useful, like finding prime numbers or compute protein foldings, in addition to securing the network.

Again, this objection to Bitcoin’s proof-of-work algorithm is rooted in the assumption that finding valid blocks is inherently useless. It is not.

While introducing a secondary reward for doing the work might seem like a good idea, it actually introduces a security risk.

The problem with doing something else — something that other people might consider useful — is that that splits the reward. It means that miners have two reasons for which they are mining.Andreas M. Antonopoulos

Splitting the reward can lead to a situation where “it’s more worthwhile to do the secondary function that it is to do the primary function”. Bitcoin will never have this problem. Bitcoin guarantees its security by the purity of its proof-of-work algorithm.

If someone figures out a more energy-efficient way to secure an open, decentralized, censorship-resistant, permission- and trustless network for value exchange — without compromising one of these qualities — this hypothetical future network will eventually dethrone Bitcoin, solving this supposed energy problem. And no, proof-of-stake is probably not the answer.

In the future, we might find something which is even more suited to be an anchor for truth than energy. Until we do, we should stick to something we are extremely confident in: the laws of thermodynamics; the energy required to do the work in proof-of-work.

Conclusion

I hope to have planted the seed for a shift in perspective: that spending energy on proof-of-work is not a waste, but a worthwhile endeavor.

Understanding mining and proof-of-work in more detail might help to convince some of Bitcoin’s critics and shift the perspective from “inefficient and wasteful” to “secure and censorship-resistant”. Pointing out these nuances might also be helpful to understand that Bitcoin’s energy consumption most strongly correlates with the network’s security, and not with the adoption, usage, or utility of bitcoin. Even if the utility of the network and the price of bitcoin continues to increase exponentially, the energy consumption does not necessarily need to follow the same exponential trend. Gaining a better understanding of the Bitcoin network might also help to understand where other solutions fall short.

Satoshi’s genius was to combine a bunch of clever tricks into a new economic game which creates a digital, scarce artifact, without central issuance. This artifact is backed by computation, and computation requires energy.

The current economic game is a game of walls and vaults, closed systems and centralized power. The new economic game is a game of hashes and blocks, public keys and private keys, based on mathematical proofs and physical reality. A game without gatekeepers, without central authorities, without censorship or discrimination.

The old rules have led to a system where money is valuable “because I say so”, leading to magic tricks like fractional reserve banking, inflation to stimulate excessive consumption, and even hyperinflation because the temptation to print ever more money is simply irresistible.

The new rules might not be easy to understand. They might, however, lead to a new financial reality: a new economy based on sound money. We will all have to adapt to these rules and become familiar with the nuances of this new game. And we will have to come to terms with the fact that a finite resource has to be used to secure this new, decentralized economy. In the case of Bitcoin, this resource is energy.

The Bitcoin Lightning Network: A Technical Primer

By Joe Kendzicky

Posted June 5, 2018

TL;DR:

The Lightning Network is a protocol layer that seeks to provide instantaneous, trustless Bitcoin payments. In this article, I walk through the construction process for Lightning Channels and illustrate how multi-hop transfers are initiated. This article is the third piece in a multi-part series where I attempt to deep dive into notable cryptoasset projects.

Background

The Lightning Network is Layer 2 infrastructure built on top of the Bitcoin protocol, and hopes to increase transactional throughput. Bitcoin has a hardcoded upper bound limit on the number of transactions it can process. In traditional payment rails, ledgers are updated every few seconds and can achieve high degrees of scalability. These systems reach finality quickly and efficiently due to their centralized structure: clients_communicate directly with the _master server, who make ledger alterations in real time as notice is provided.

Image Source

Image Source

Bitcoin faces inherent challenges since the system utilizes distributed architecture. When new information needs to be appended to the ledger, that information must be redundantly pushed across every participating server inside the network. These servers must parse through the data and reach consensual agreement on which transactions they intend to accept and write to database, and which to reject. The difficulty in this scenario arises when multiple servers have conflicting views on transactional sequencing. Each node in the ecosystem maintains equivalent weight, so without top-down authority to establish a canonical vision, the system would eventually stall out if participating validators are unable to reach consensus.

Image Source

Image Source

Bitcoin introduces the concept of mining to guarantee network progression and prevent ledger fragmentation. Miners contribute computational power from specialized hardware to earn the right to propose ledger alterations during iteration rounds which occur roughly every 10 minutes. A mathematical challenge is included in each round. If a miner is able to find a solution, they earn the right to establish canonical vision of the ledger, which the rest of the network accepts based off protocol rules. When a claimant proposes a solution, other nodes can verify integrity of the solution. Peers will only recognize the claimant’s ledger version if the solution is valid.

When we talk about “vision” of the ledger, we are referring to the construction of blocks. Blocks are aggregations of transactions compressed into a singular file unit. When a miner “solves” a block, they earn the right to inscribe their view of the ledger to the blockchain, an immutable database containing an archive of previous network transactions. Transactions are simply lines of code, so they have deterministic size. With the blocks having an upper bound limit at 1MB, the system can process ~7 transactions per second (tps). In contrast, networks like VISA can support ~50,000 tps.

Overview

The Lightning Network utilizes the concept of payment channels to provide bi-directional monetary transfers, and envisions a network with near-instantaneous speed, zero counterparty risk, and low fees. In doing so, the Lightning Network aims to alleviate scalability concerns surrounding the Bitcoin protocol. The system routes around the bottlenecks of universal consensus by settling transactions off chain, avoiding latency and computational redundancies that plague blockchains. Lightning claims transactional processing capabilities in the millions of tps.

Funding Payment Channel

The first step involves an initial funding transaction where each party deposits BTC into a 2-of-2 multisignature address. Once deposited, each participant has full guarantee of security, since any forward movement of funds will require signature authentication from both parties. But what if the channel is unable to progress forward after the funding transaction? If the opposing party becomes unresponsive or loses their private key, any balance locked up in that channel is permanently lost. Thus, both sides of the agreement need insurance against counterparty risk that may ensue.

To solve this dilemma, users draft refund transactions and have their counterparty sign. These transactions are constructed before either individual deposit to the multisignature address, and allows for revocation of the original funds back to channel depositors. Bob asks Alice to draft a settlement transaction that refunds his deposit back to himself. Alice complies with the request, drafts the message, and signs it with her key. She then returns it to Bob. In the process, she also includes a similar refund script for her bitcoins. Bob reviews the transaction, and if the outputs align with his specifications, attaches his signature to the message, relaying it back to Alice. Both members now possess a symmetric transaction which they tuck away as leverage for a future mishap. In the event either party becomes unresponsive, the counterparty can simply broadcast the transaction to the network, creating an escape route to withdrawal their balance from the multisig. Both individuals are now protected and can deposit to the channel with full reassurance.

Commitment Advances

With funds locked up in the multisig account, a “channel” is now created. Participants can issue fully valid transaction scripts to one another via private medium, and both parties can accept these instruments of payment as valid without having to broadcast the payment on-chain. In doing so, these commitments act as a form of promissory note with enforceable guarantees backed by the Bitcoin blockchain, all while avoiding the bottlenecks and costs of universal consensus. If circumstance requires, either party can push the latest commitment version to the blockchain and close out the channel without requiring approval from their counterparty.

Problems arise when it becomes economically advantageous for a participant to push a previous commitment to the blockchain. Returning to our example, after both depositing a 1 BTC balance, Bob sends 0.5 BTC to Alice inside the channel. His balance will now show 0.5 BTC, and Alice’s will read 1.5 BTC. But remember, Bob has his initial refund TX, signed by Alice, that allocates 1 BTC back to himself. Bob is now incentivized to push this outdated transaction to the network and make off with Alice’s money. Thus, we need some method to invalidate previous commitments.

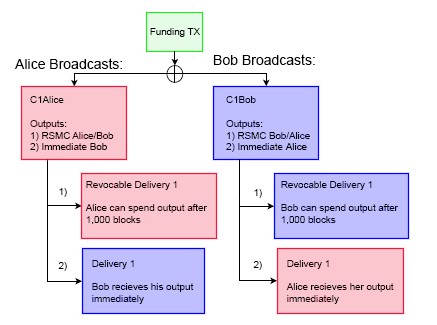

Commitment Transactions

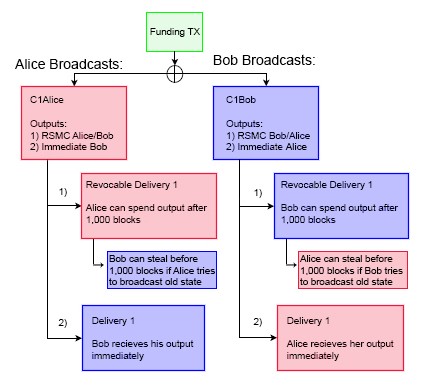

When Bob and Alice want to advance the state of the channel, they need a way to autonomously enforce their contracts. This is done through commitment transactions. Suppose Bob wishes to send Alice 0.5 BTC. Each party creates two near-identical transactions spending the same input values. These transactions operate similar to a RBF or a Doublespend- if both transactions are pushed to the blockchain, only one of them will ultimately confirm and be appended to the ledger since they reference the same input values. Bob and Alice carefully construct these transactions in a manner that makes it deterministically provable which will be included into a block first.

Bob creates a transaction by referencing a set of outputs, and signs with his key. We call this transaction C1Bob (Commitment1Bob), which he forwards to Alice. Alice mirrors this action, creating C1Alice and forwards to Bob. Because these transactions are originating from the 2-of-2 multisig, neither party’s script is valid until both signatures are transcribed. Once Bob and Alice put their stamp of approval on each other’s commitments, they are voluntarily accepting the potential of their counterparty broadcast the transaction at any point in the future (thereby closing the channel). Bob cannot push the transaction he constructed to the network, since he doesn’t possess Alice’s private key. Bob can only broadcast Alice’s version, and Alice can only broadcast Bob’s.

The above illustration describes the redemption paths if a commitment were broadcast on-chain. If Alice were to push her transaction to the network, she would initiate two events. The first would immediately unlock Bob’s balance, allowing him to transfer his funds. The second would trigger a countdown on her funds. Alice will have to wait 1,000 blocks in order for her outputs to unlock. Once this timespan has elapsed, her funds will become available for redemption. This process is mirrored on Bob’s commitment. If he pushes his version to the network, Alice’s funds are immediately unlocked, while he has to wait 1,000 blocks. These lockup intervals are set to mitigate counterparty risk.

We introduce the concept of Revocable Sequence Maturity Contracts (RSMC) as a means to invalidate previous commitments. This occurs via the scripting flag CHECKSEQUENCEVERIFY (CSV). CSV’s are a way to dynamically lock up bitcoins over a predefined time interval, and is enforced by the Bitcoin blockchain rather than users themselves. CSV checks for the current block height (aka the sequence) from the moment the transaction is included in a block, and verifies_that the encumbrance scripts are met. In the example above, it is the CSV encumbrance in the transaction that forces Alice/Bob to wait 1,000 blocks for their funds to become redeemable. This creates a _bonded deposit window where a plaintiff can present a breached remedy tool in the event the counterparty tries to broadcast an outdated commitment.

Creating Breached Remedy Commitments

When Bob and Alice want to advance the state of the channel, they need a way to invalidate previous commitments. Bob and Alice repeat the commitment process by constructing a new 2-of-2 multisig account (aka C2Bob, C2Alice) with a fresh set of keys. They reference their outputs, enact similar 1,000 block CSV scripts, sign the transaction with their own keys and pass along to their counterparty. Their counterparty tucks this transaction away. However, before finalizing the new C2Bob/C2Alice commitment schemes, both parties disclose their private keys used in C1Bob/C1Alice. Once this occurs, each party is protected from publication of outdated commitments.

As mentioned earlier, if Bob closes out the channel, Alice’s funds are immediately spendable. Bob’s money on the other hand is locked up for 1,000 blocks by the CSV encumbrance. If Bob tries to cheat the system by broadcasting an outdated commitment whenever financially incentivizing to do so, those funds are not immediately accessible. Alice will see that Bob is trying to cheat her, and use her breach remedy “tool”. This tool allows Alice to spend the 1,000 block encumbered funds immediately if she can provide Bob’s private key. Alice is capable of fulfilling this obligation now that the channel state has advanced, because Bob has voluntarily relinquished the key to her in the last round. Thus, Alice can not only ensure that she won’t be cheated out of the BTC she is owed, but will be able to walk away with the entirety of Bob’s balance, making additional money. Thus, Bob is highly incentivized not to try and cheat the system by publishing outdated commitments, since Alice will be able to walk with his entire deposit. Conversely, if Alice tries to pull a similar trick on Bob, he can walk with the entirety of her deposit. This creates incentive models where both parties are highly incentivized to act altruistically.

Cooperative Channel Closeout

When either party wants to close out the channel, they can do so cooperatively by disregarding all outstanding promissory notes and constructing a normal transaction from the original 2-of-2 escrow. This transaction would pay out the respective balance to each member, based off the most recent commitments. Because the outstanding promissory notes are backed with full guarantee by the blockchain, both parties have an incentive to collaborate. Neither individual has to go through the frictionary process of paying additional on-chain fees, nor lose out on opportunity costs of time having their BTC locked up by the CSV encumbrances for 1,000 blocks.

Hashed Timelock Contracts (HTLC’s) and Multi-hop Transfers

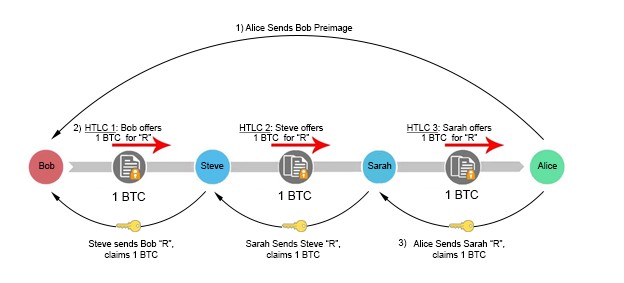

HTLC’s are forms of transactional encumbrances which use hashlocks (locking scripts that ensure certain data is known) and timelocks (restricts future spending of outputs until a predetermined date) as a way to enforce provisions on a transaction. Both types of encumbrances are enforced by the blockchain rather than channel counterparties. The concept is fairly simple, and serves as a way to extend payment channels beyond a bi-directional state. Lightning Network will have the ability to route channels deterministically through multiple parties through a process called multi-hop transfers. At first, Lightning might not be very appealing unless two participants plan to remunerate very frequently, since opening a new channel requires locking up assets via an on-chain broadcasted transaction. Bob having unique channels with many participants means less money in his wallet for discretionary spending, significantly reducing the versatility of his funds. Lightning alleviates these concerns by introducing an effective path finding algorithm between network participants, and linking their channels together via HTLC’s. Bob and Alice are two individuals who want to transact, but don’t have an existing channel open. If both parties have a mutual channel connection with Steve, they can still route the transaction with full guarantee of atomic settlement. This works by Bob paying Steve, who in turn pays Alice. Bob has now trustlessly paid Alice without needing to open a channel with her. If the relationships between participants are extremely isolated, we can keep introducing more intermediaries to form a lineage robust enough to facilitate payments.

Bob(the sender) initiates the multi-hop process by communicating directly with Alice(the beneficiary). Bobs asks Alice to create a randomly generated secret R, which remains private to Alice. Bob asks Alice for a hash of R, called the preimage, but not the plaintext version of R itself. Bob subsequently specifies only to disclose R to an intermediary party, Steve, in exchange for 1 BTC.

So, Alice hashes R, and sends a copy of the preimage to Bob. Bob takes this preimage to Steve, and offers a 1 BTC bounty if he can produce the hash’s plaintext version, R. Steve accepts the offer, and goes to Alice with an offering of 1 BTC in exchange for the secret value. Note that in this situation, Steve front runs his own capital to make this exchange with Alice. Alice, seeing this offer of 1 BTC in exchange for an arbitrary secret R, accepts the proposition and gives the value of R to Steve, just as she was instructed earlier by Bob. Steve then hands R to Bob in order to claim his bounty. In this example, Bob has found a trustless way to pay Alice, without having to go through the burden of opening a channel with her. If Bob and Alice lack a mutual contact to route the channel through, we can keep introducing more intermediary liquidity providers until a connection is made. For example, if Bob has an open channel with Steve, and Alice has an open channel with Sarah, and Sarah and Steve have a channel together, a payment can be initiated.

CHECKLOCKTIMEVERIFY (CLTV) vs. CHECKSEQUENCEVERIFY (CSV)

What is the difference between a CLTV and a CSV? Both are examples of timelock encumbrances, and are used to accomplish similar goals.

Suppose a CLTV encumbrance is placed on an output for 10 blocks. The current BTC block height is b=500,000. Once the blockchain hits b=500,010 the outputs unlock and become spendable. The time at which the original transaction gets a confirmation is irrelevant to the spender.

In contrast, a CSV script is based entirely on the time the original transaction is included into a block. Suppose a CSV script is placed on an output for 10 blocks. The current BTC block is b= 500,000. Once this transaction is broadcast, it sits unconfirmed for 5 blocks. After 5 blocks ensue, it finally gets picked up and included at b=500,005. In this scenario, the timer begins once that transaction gets its first confirmation. The CSV encumbered output doesn’t become spendable until 10 subsequent blocks at b=500,015. Conversely, if the original transaction receives its first confirmation at b=500,003 then the outputs becomes spendable at b=500,013.

In summary, a CSV sets a dynamic encumbrance that makes an output spendable after a specified number of confirmations once the original transaction is included in a block. In contrast, with CLTV you are specifying when the output will become spendable based off block height. This means that the output’s encumbrance status is completely independent of the mining process.

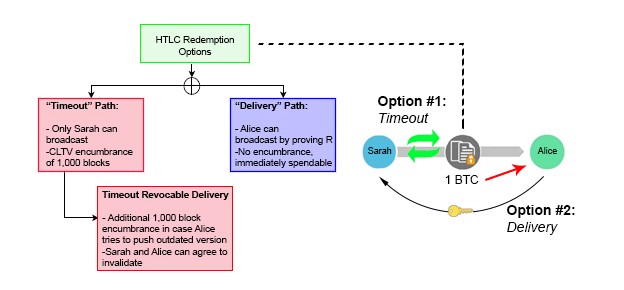

Constructing Hashed Timelock Contracts

In our previous example, we presented a basic overview of how a multihop transfer can occur, but failed to articulate how to create an enforceable contract on the blockchain to facilitate those functions. For example, what if Alice fails to produce the secret value after Bob transfers her the bitcoin? Or what if Bob revokes his bounty commitment to Steve after acquiring the secret from Alice? In both scenarios, Steve has lost money.

In order to create a trustless layer of commitments, we build off similar RSMC properties outlined in earlier sections, but add a few twists. After Bob communicates directly with Alice and receives a copy of her preimage, he constructs a hashed-timelock contract (HTLC) transaction with Steve. This contract has two paths for output redemption. The first is a “delivery” path which sends Steve 1 BTC immediately if he can produce the secret R. The second is a “timeout” path which allows Bob to refund himself in the event Steve cannot produce the secret. This is accomplished using a CLTV flag instead of the CSV as in previous examples.

In the transactional script, Bob sets the timeout length of the CTLV to 1,000 blocks. This means Steve essentially has 1,000 blocks to obtain R from Alice and claim the 1 BTC bounty via the “delivery” path. If he waits longer than this time, he loses guaranteed insurance that he can claim the bounty safely. Steve mirrors this same transactional script with Alice, front running his own personal capital in the process. If Alice wants to claim the 1 BTC sitting in escrow, all she needs to do is reveal the secret R. Once Steve has R, he can turn around and use it to pull the 1 BTC out of escrow sitting between him and Bob. Everyone gets paid.

Importantly though, these “timeout” intervals must decrease in length as the chain progresses right to left. The timeout between Alice and Steve must expire earlier than the timeout between Steve and Bob. If they expire simultaneously, Bob runs the risk of transferring his funds to Alice near the end of expiration, and then having Bob’s “timeout” unlocking before he has time to grab his funds out of escrow. In this scenario, Steve would be left doing the bagholding, since he front ran capital to Alice but was not able to collect from Bob. To make matters even more challenging, blocks are solved in random 10-minute intervals. There is no inherent guarantee that a subsequent block will be solved 10 minutes after a previous. It could happen 1 second afterward. This is why CLTVs are used instead of CSVs. Thus, it is imperative that participants provide ample blocks between channel “timeouts” to prevent loss of funds.

If Steve cannot obtain R from Alice (she is a fraudulent actor, becomes unresponsive etc.), nothing is hurt. He simply lets the channel expire and revokes his money out of the escrow by using the “timeout” path. This will set off a chain reaction, where Bob will revoke his funds out of escrow once they timeout. Though the parties may experience opportunity costs of locked-up capital, they have full reassurance that they can ultimately reclaim those escrowed funds.

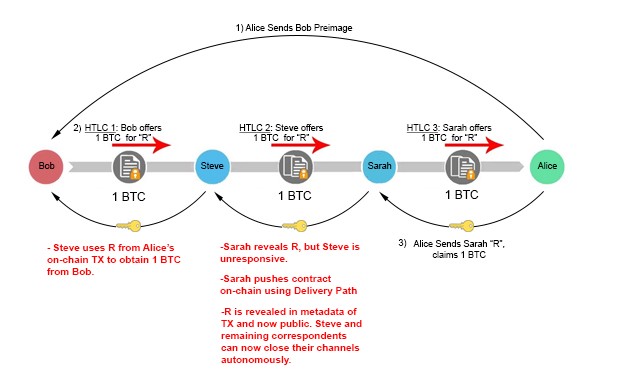

Interestingly, disruption of the channel somewhere along the line does not destroy payment guarantee, but actually strengthens it. Suppose Sarah fulfills her end of the obligation and provides Steve with R, but Steve remains unresponsive and does not update their channel balance. In such a situation, Sarah is still capable of obtaining the 1 BTC she is owed through the HTLC contract. If Sarah uses the “Delivery” Path, R becomes publicly available on the blockchain; she has to disclose it in the metadata of the transaction to unlock the encumbrance and receive her BTC. Intermediary liquidity providers can extract this information off the blockchain and use it to unlock their escrow channels immediately, without ever having to wait for their correspondent to reveal R to them. This structure provides cryptographic certainty that each claimant will be able to receive their capital, so long as they push the TX before the CLTV encumbrance expires.

Recap

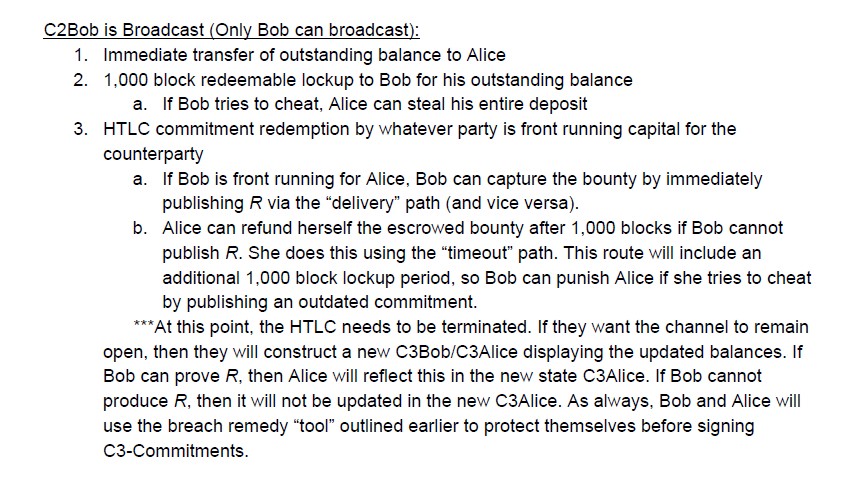

Sequence of events for a C2Bob broadcast

Sequence of events for a C2Bob broadcast