Bitcoin Investment Theses (Part 2)

Bitcoin Investment Theses (Part 2)

By Pierre Rochard

Posted June 24, 2018

- Bitcoin Investment Theses Part 1

- Bitcoin Investment Theses Part 2

- Bitcoin Investment Theses Part 3 NOT YET PUBLISHED

These descriptions of the numerous Bitcoin investment theses are all open source on GitHub. Feel free to open an issue here if you have an investment thesis you’d like to see listed but are unfamiliar with how to use git.

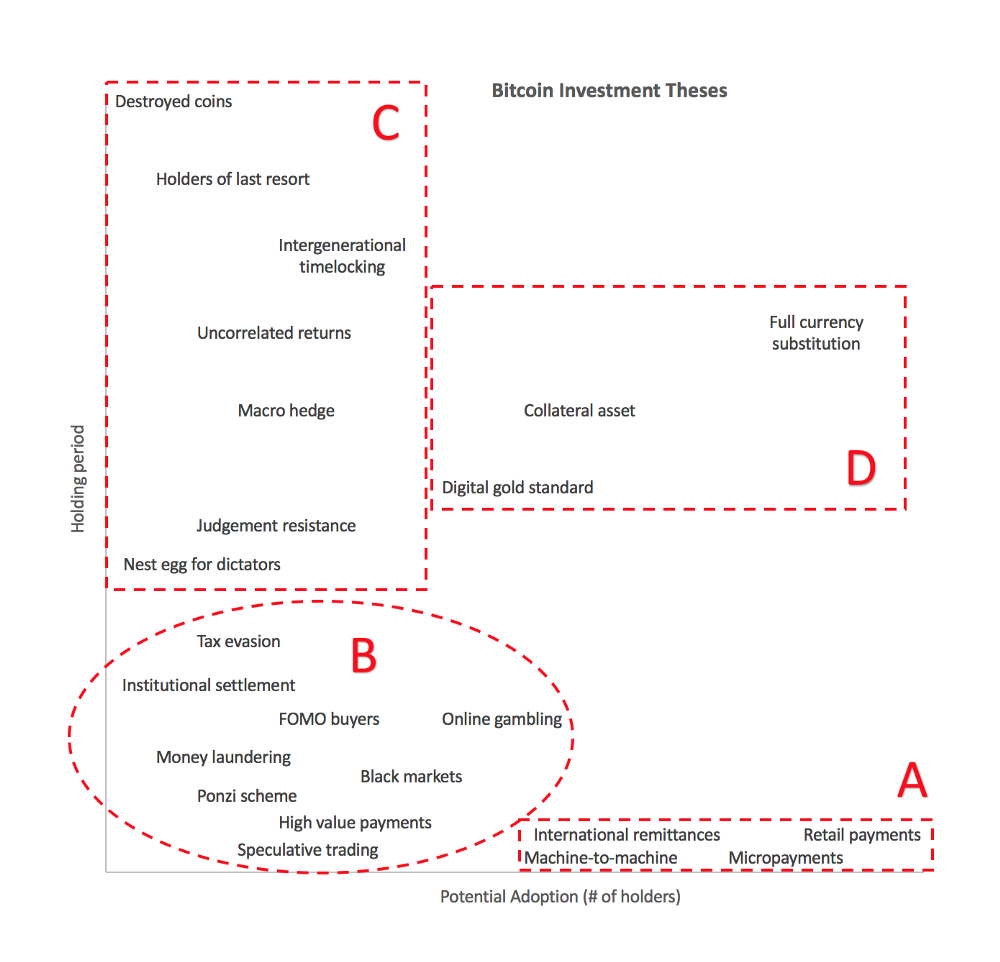

C. Long holding period, low adoption

1. Nest egg for dictators

“Normally when you have a parabolic curve, eventually it has a very sharp break,” Soros said Thursday. “But in this case, as long as you have dictatorships on the rise you will have a different ending, because the rulers in those countries will turn to Bitcoin to build a nest egg abroad.” George Soros, January 25, 2018

Thesis: While we don’t have any evidence that dictators are currently holding bitcoins abroad, George Soros suggests that they will in the future. Dictators amass fortunes by seizing private businesses, demanding bribes from resource producers, and exploiting government monopolies. For example, the dictator of Equatorial Guinea has a net worth of $600 million. This is small compared to the $95 billion belonging to the Supreme Leader of Iran. Dictators could include bitcoins in their asset allocation so that they have an unseizable slush fund in case they get ousted and exiled.

Anti-thesis: The wealth of dictators is often just the wealth of their government and is already invested in productive assets or used to stay in power by buying supporters. Even if dictators are holding cash abroad, they will continue to be more comfortable with the stability of gold and the U.S. dollar. Unless they have been specifically targeted by financial sanctions, dictators have an easy time holding cash in the international financial system with shell companies.

2. Seizure Resistant

Thesis: Bitcoin allows civilians to more easily withhold wealth from rapacious governments. Fleeing a totalitarian regime with your family’s wealth used to mean concealing gold or diamonds, and praying that a greedy border guard didn’t find your stash. With bitcoin, you could memorize 24 words that store an arbitrary amount of value. Abusive seizures of wealth are not limited to totalitarian regimes, the United States government takes $5 billion per year with a process called civil asset forfeiture that assumes “guilty until proven innocent”. Additionally, a United States federal district court judge can freeze supposedly tainted assets before a criminal trial happens, which could prevent you from hiring the lawyer you want. Having a secret stash of bitcoins could secure criminal defendants’ due process rights.

Anti-thesis: Governments will still be able to identify who owns bitcoins due to the public blockchain and seizing records from exchanges and brokerages. This would allow them to imprison and torture bitcoiners until they divulge their private key. While it is not criminal for an attorney to accept a tainted asset as payment, they may still refuse to do so to avoid the risk of themselves being subject to civil asset forfeiture.

3. Judgement Resistant

Thesis: The successful party in civil litigation can have a right to recover money or property from the unsuccessful party, in which case the successful party is a judgement creditor. Judgement creditors can freeze a bank account with a court order, called a garnishment or attachment. Bitcoin can be used to illegally hide value from judgement creditors. More interestingly, holding bitcoins with multi-signature technology in one or more foreign jurisdictions can be part of a legal strategy to frustrate or prevent the recognition and enforcement of a just or unjust judgement. Even before a party succeeds and obtains a judgement, they could freeze an individual or business bank account with a pre-judgement attachment. This can be an economic hardship, regardless of whether the trial lasts weeks, months, or years. This is especially problematic for large multinationals which operate in jurisdictions with dysfunctional or abusive judiciary systems. International banks currently provide a similar service with judgement resistant trusts, but these are expensive and cumbersome compared to a Bitcoin solution. This thesis was formulated by Ari Paul.

Anti-thesis: We don’t have any examples of Bitcoin’s judgement resistance being tested. We don’t know how judges will respond to the complexity of an asset being in multiple foreign jurisdictions simultaneously. Judgement-resistant does not mean judgement-proof, it may just take longer and be more expensive but lawyers will get to the bitcoins eventually. We may see treaties or case law emerge to prevent bitcoin multi-sig jurisdictional “abuse”.

3. Banking crisis hedge

Thesis: In 2008, WaMu experienced two bank runs. Even with FDIC insurance, if this were to happen to several major international banks simultaneously it would be disruptive enough to freeze the banking services of many businesses and individuals. Bitcoin’s layer 1 and layer 2 payments systems are decentralized and 100% reserve, thus immune to bank runs, they would continue to process payments seamlessly in a crisis. Bitcoin has no bank holidays. For this payments system hedge to work, the hedger has to be holding bitcoins ahead of the crisis, otherwise fiat payments to exchanges and OTC brokers would get caught up in the fiat freeze. Worse than a temporary payments freeze would be a bank bail-in, for example in 2013 Cypriot banks’ depositors were subjected a one-off 9.9% levy for any deposits above €100,000. Bitcoin is an insurance policy for both individuals and corporate treasuries and should be a part of business continuity planning.

Anti-thesis: Governments would just bail out “too big to fail” financial institutions to keep fiat payment systems from freezing up. The hedge does not work if retail stores, vendors, suppliers, employees, business owners, etcetera are unable or unwilling to accept bitcoins as payment even in a crisis.

4. Inflation hedge

Thesis: Central banks are engaging in unorthodox monetary experiments to stabilize financial systems and economies after the 2008 crisis. These experiments will eventually result in uncontrolled inflation. Countries with failing governmental institutions, like Venezuela, are currently suffering from hyperinflation. Bitcoin’s ultra-orthodox monetary policy of targeting a fixed money supply, with 80% of the total 21 million bitcoins already in circulation, is the ideal hedge for fiat money printing.

Anti-thesis: People have been predicting fiat hyperinflation since quantitative easing started a decade ago, and yet inflation is still very low in developed countries. Owning stocks, real estate, commodities, or precious metals is a better long-term inflation hedge than Bitcoin, which has a very short track-record. Bitcoin’s track-record indicates that its value is not tied to expected inflation.

5. Uncorrelated returns

Thesis: Bitcoin’s returns are uncorrelated or weakly correlated with other asset classes. This makes it ideal for diversifying a portfolio. The optimal allocation to Bitcoin has been estimated to be 1.3%.

Anti-thesis: Bitcoin is increasingly correlated with the stock market. It is widely viewed as a “risk-on” asset that is being inflated by easy money going into the broader tech ecosystem. Past lack of correlation was just due to how small bitcoin was relative to other asset classes.

6. Intergenerational timelocking

Thesis: OP_CHECKLOCKTIMEVERIFY could be used to lock up bitcoins for several centuries. This could help overcome what’s called the rule against perpetuities which prevents the deceased from affecting the ownership of property long after they have died.

Anti-thesis: Time-locked bitcoins will end up trading in a secondary market at a discount.

7. Holders of last resort

Thesis: Fractional-reserve monetary systems require lenders of last resort to stop debt-deflation from causing the economy to collapse. An emerging 100% reserve monetary system like Bitcoin requires holders, and buyers, of last resort to stop a crisis of confidence from causing the value of bitcoins to collapse. This is functionally similar to a central bank using its reserves to buy the domestic currency, fighting off speculators who are betting on devaluation. Holders of last resort are intransigent advocates for Bitcoin’s economics and technology.

Anti-thesis: Not enough people are interested in Bitcoin maximalism’s ideology to form a set of holders of last resort with enough capital to defend bitcoin from a catastrophic and final loss of value. Holders of last resort are delusional and will end up just holding a worthless bag of buttcoins.

8. Destroyed coins

Thesis: Many bitcoins have been destroyed, accidentally or deliberately. This permanently removes them from the market. When a bitcoin is destroyed this makes all other bitcoins proportionately scarcer, and thus presumably more valuable.

Part 3 coming soon!

If you have any ideas for investment theses, feel free to reach out! I’m on Twitter @pierre_rochard, DMs are open.

Did you disagree or agree with any of the above? Leave a comment below!