Bitcoin As a Startup

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Bitcoin As a Startup

By Hass McCook

Posted December 29, 2019

Original Presentation of Framework from November 2019

People hate Bitcoin analogies. But Bitcoin is so hard to understand for so many, concessions need to be made.

VCs are a group of people demonized in the Bitcoin industry for not understanding Bitcoin’s value proposition. Well, how do you expect a VC to value Bitcoin if they’re only used to valuing startups?

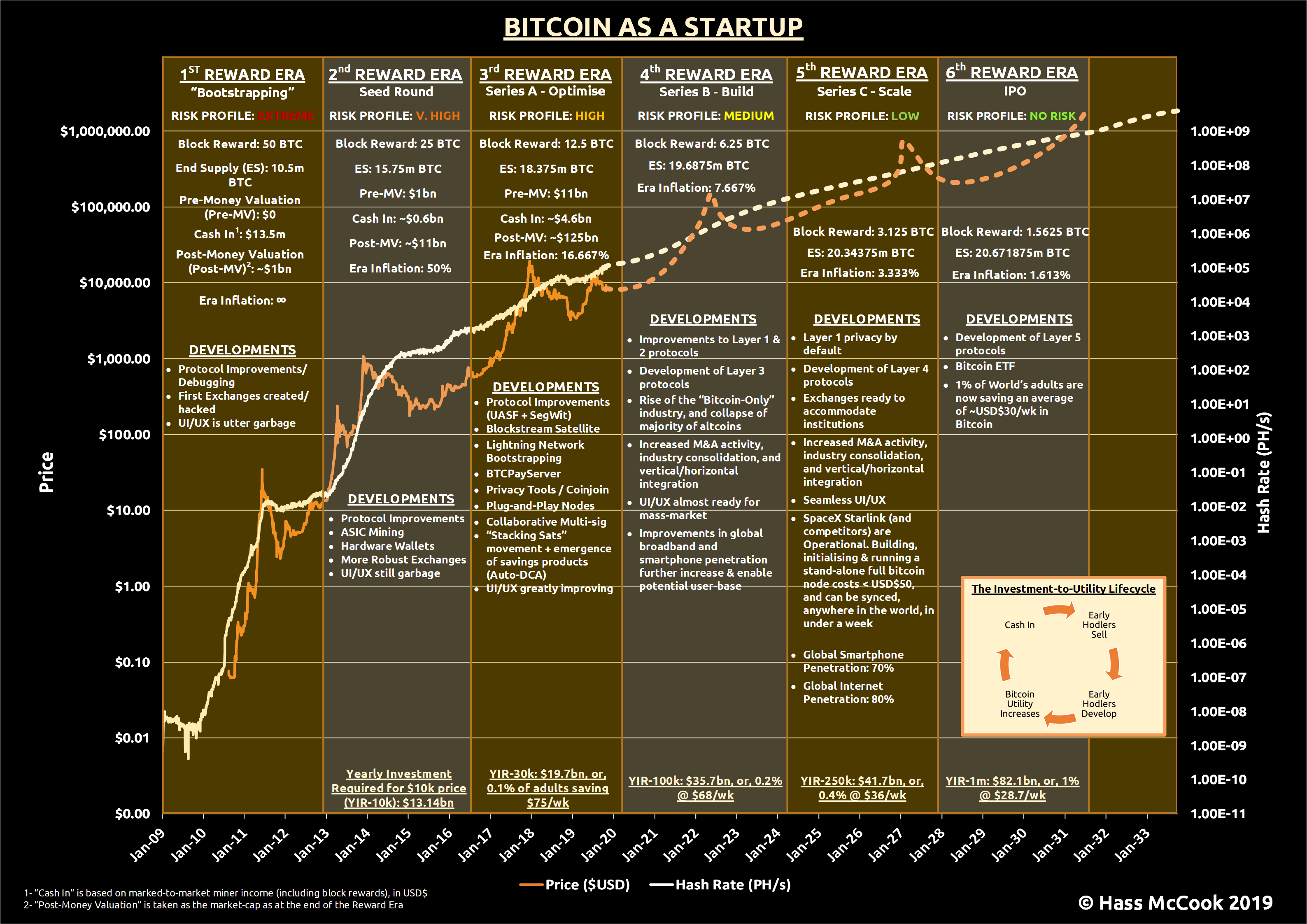

Here is a framework that will hopefully help. It tracks the development and evolution of the Bitcoin ecosystem in discreet “fundraising rounds”, which coincide with Bitcoin’s Reward Eras. An organization is defined as “an organized group of people with a particular purpose”. If that’s the case, then Bitcoin is a well-oiled “un-organisation” with founders but no CEOs, many volunteers but no employees, and provably non-diluting equity, available to anyone who is willing to trade their energy for it.

Bitcoin As A Startup

Bitcoin As A Startup

I will be borrowing heavily from Nathan Reiff’s piece “Series A, B, C Funding: How It Works”

Pre-seed Round (1st Reward Era, 3/1/2009–28/11/2012)

The earliest stage of funding a new company comes so early in the process that it is not generally included among rounds of funding at all. Known as “pre-seed” funding, this stage typically refers to the period in which a company’s founders are first getting their operations off the ground. The most common “pre-seed” funders are the founders themselves, as well as close friends, supporters, and family (Reiff, 2019)

The “Bitcoin Company” was founded by Satoshi Nakamoto, with its single product offering being an open-source monetary system project, known as Bitcoin. 2,100,000,000,000,000 shares were to be issued on a predetermined schedule, and anyone was free to buy or sell these shares. The founders initially held no initial equity, but equity was easy to build in those days, and rightly so. Just like any startup, it is the founding team and initial bootstrappers who should get the biggest rewards down the line for putting the most skin in the game.

Due to the nature of Bitcoin’s incentive mechanisms, many early “equity holders” were encouraged to use their time, skills and money to evangelise or develop the product, and hence increase the value of their equity. The company manages itself, in a zero-overhead environment.

During the first stage of “the company’s” life, traditionally the “the first bugs appeared and were ironed out, and this was an iterative process for many months. After proving to be robust and reliable, a market developed, and the first exchanges started to emerge. User experience, both from a software point of view, and a financial point of view, were a disaster. Bitcoin was virtually unusable without a PhD in Computer Science, and when you could use it, you’d be robbed by an exchange that had been “hacked”. Volatility was extreme, and the risk was unpalatable for the majority of onlookers. Whether or not “The Bitcoin Company” would remain “in business” was still a very dubious proposition.

This Era, the early equity holders were blessed with a parabolic bubble, and many divested some equity to give themselves runway to work on Bitcoin full time. It’s just like a fund-raise: get a big cash injection, and then burn it relentlessly until the next funding round. Coincidently, each round has exhibited at least one of these massive injections and equally massive drawn-out draw-downs.

During this Era, miners were rewarded with USD$13.5m in total block rewards and transaction fees. Assuming that, on average, cost to mine a bitcoin is equal to the market price, we can consider the mining reward to be miners buying bitcoin at-spot. Therefore, we can take the “money-in” for the round to be the cumulative miner’s revenue. Money-in is never consistent, and even a small injection is enough to make the price fly and form a bubble.

With all the above said, fortune favours the bold, and Bitcoin entered its seed round at a $1bn pre-money valuation (i.e. Bitcoin’s Market Cap was $1bn at the end of the first reward era).

Seed Round (2nd Reward Era, 28/11/2012–9/7/2016)

You can think of the “seed” funding as part of an analogy for planting a tree. This early financial support is ideally the “seed” which will help to grow the business. Given enough revenue and a successful business strategy, as well as the perseverance and dedication of investors, the company will hopefully eventually grow into a “tree.” (Reiff, 2019)

Risk of short-term ecosystem death did not substantially decrease until the end of the Secord Reward Era. You could say that the risk profile dropped from “Extreme” to “Very High”. In terms of PR/Optics, this was arguably the worst and most dubious “round” of Bitcoin’s existence. In the face of these FUD-inspiring superficial problems, Bitcoin did what it does best — got on with it.

This era saw the first Bitcoin bubble to be featured in Mainstream Media in some way shape or form. Going from catastrophe to catastrophe; from the numerous exchange hacks, scams, asset seizures, 51% attacks (GHash.io) and China bans, those who invested in the mania of 2013 would not break even until the Third Reward Era. Inflation made things worse, with the market having to absorb the 5.25 million Bitcoin producing during the Era. However, those who divested during the mania provided themselves with many years of runway to give back to Bitcoin and make their equity more valuable.

In this Era, we started to see the emergence of user-friendly plug-and-play hardware wallets; the age of ASIC mining was in full swing, with miner fabrication done at a huge scale. The gamblers had a field day — with the majority of “fiat-onramps” providing toys for the traders, but not for the savers. For better or worse though, this added much needed liquidity and means for price-discovery. That said, liquidity was quite low, and for the first half of the era when the exchanges were just so sketchy, you couldn’t even really trust what the advertised market price was.

The first VCs entered the game; some investing in Bitcoin companies, and others, like Tim Draper, investing directly in the underlying.

Miners were not put off by the prolonged bear market, with the network hashrate growing by orders of magnitude mostly due to competition-driven innovation among ASIC fabricators. In the Second Reward Era, miners earned a total of USD$600m for their efforts. This USD$600m “investment” resulted in an $11bn post-money valuation at the end of the Round.

Despite failing to reclaim the heights of 2013, Bitcoin closed this round on the upswing — one that wouldn’t end for another year and a half.

Series A — Optimise (3rd (and Current) Reward Era, 9/7/2016 — May 2020)

Once a business has developed a track record (an established user base, consistent revenue figures, or some other key performance indicator), that company may opt for Series A funding in order to further optimize its user base and product offerings. (Reiff, 2019)

With “traditional” startups, their Series A round is used to fund the optimization of the offering, and to lay a solid platform to build further during the next round. Several experts and industry stakeholders were split on how to best optimize Bitcoin to increase transaction throughput. The Establishment took the view that achieving this through an increase in block size was the answer, The People took the view that this was a slippery slope, and that scaling be achieved with protocol optimisations, i.e., Segregated Witness (SegWit). The People were victorious, which was a huge positive indicator that centralizing Bitcoin would be a Sisyphean task. As a result, and in combination with a supply halving, the money flowed in, and Bitcoin achieved a valuation in the hundreds of billions at its all-time-high.

The Third Era also featured “The Scambrian Explosion”, with thousands of cryptocurrencies being spawned, sending Bitcoin’s dominance of the cryptocurrency to a paltry 35% at one point in time. While most of these altcoins now having lost over 95% of their value (hundreds have lost >99% of their value), the only result was the wasting of hundreds of thousands of hours of development time and hundreds of millions of dollars which should have been directed at Bitcoin. The fact that Bitcoin now accounts for 75% of the cryptocurrency market (and rising) is a testament to why people should have just stuck to Bitcoin.

The huge influx of money in this Era allowed early equity holders to further divest to focus on development — and my oh my, was there a lot of development. In terms of scalability, The Lightning Network successfully came out of beta and is being extensively used. Privacy and coin-joining solutions emerged and became easier to use. There are literal satellites in space broadcasting the network. The rise of the “run your own node” movement gathered serious momentum and was bolstered by a host of companies offering “plug-and-play” nodes. With your own node, you can also be your own payments provider through BTCPayServer. Multi-signature security has never been easier. This paragraph could go on for pages — so if you want a full technical recap of just 2019, the Bitcoin Optech Newsletter will give you everything you need to know.

At time of writing, Era miner revenue is USD$4.6bn, and the valuation has risen from $11bn to over $125bn.

Despite all the progress made, Bitcoin is still a high-to-very-high risk investment at this stage, as the market price can still move in excess of 30%, in either direction, in one week, regularly. This will ultimately remain the case until both the liquidity pool grows, and the mining reward (inflation) shrinks.

Series B — Build (4th Reward Era, May 2020 — Apr 2024)

Series B rounds are all about taking businesses to the next level, past the development stage. Investors help startups get there by expanding market reach. Companies that have gone through seed and Series A funding rounds have already developed substantial user bases and have proven to investors that they are prepared for success on a larger scale. Series B funding is used to grow the company so that it can meet these levels of demand

With the necessary protocol upgrades happening during Series A and early in Series B, the focus will shift to the building of products and services on top of the slowly ossifying Bitcoin base layer. This Era will see the replacement of the “Old Guard” by a newer generation of more business-savvy Bitcoin entrepreneurs and through merger and acquisition activity.

There will also be a lot of vertical and horizontal integration, as companies aim to achieve a “full-stack”. One example of all this is Layer1 mining, in what is effectively an electricity utility that also mines, and designs and fabricates ASIC miners.

It is impossible to predict what’s specifically going to happen during this 4 year era, let alone in the first year of it, but if the past 18 months are anything to go by, security, privacy, and most importantly going forward, UI/UX, will improve dramatically. I’d expect that running a full-sovereignty stack (your own VPN, node, electrum & BTCPay servers, multi-sig setup, etc.) will be easy enough for almost anyone to do at the end of The Era. Effectively, Bitcoin’s infrastructure will be developed enough to handle some proper scale.

What will be most interesting thing to see will be the technological, economic and political developments during this Era. In this regard, everything is “Good for Bitcoin”. Internet access, computers and smartphones become cheaper and more accessible? This is good for Bitcoin. Never ending quantitative easing and negative interest rates? This is good for Bitcoin. Increased political turmoil, censorship, or surveillance? This is good for Bitcoin.

Should Bitcoin “stay in business”, risk level at this point would be medium-to-high, and you could expect to be exposed to weekly swings of +/-15%, but maybe not as regularly as in Series A.

When looked at in conjunction with some economic models like the Stock-to-Flow model, there is little reason to think a 10x growth in market cap will not be seen in this series, as per the 3 series preceding it. This would mean a series-end market cap of about USD$1 trillion, or, around USD$50k per bitcoin. Chances are that the All-time-high price achieved during this series will be dramatically higher than the end price, as this is the main driver of the “investment-to-utility” loop.

Series C — Scale (5th Reward Era, Apr 2024 — Mar 2028)

Businesses that make it to Series C funding sessions are already quite successful. Series C funding is focused on scaling the company, growing as quickly and as successfully as possible. (Reiff, 2019)

Inflation is finally starting to drop, with only ~650,000 BTC needing to be absorbed by the market over the 4-year period — the inflation rate is now lower than that of Gold. Scarcity is becoming a more dominant element of Bitcoin’s value proposition.

With basically all the infrastructure largely built, and UI/UX continuing to improve, this Era is “The Era of The Evangelist”. Bitcoin is ready for prime time; somebody just has to go out and tell everybody. This Series’ fund raising round made all the right people very wealthy (if they weren’t already wealthy from the Series B raise), and these people will begin to use their influence (i.e. money) to promote Bitcoin, and increase the “saver-base”, i.e., the number of people who buy bitcoin on a weekly basis, or, earn their living in Bitcoin.

At this stage, to maintain a USD$500k price, about 10 million people are each saving USD$150/wk in Bitcoin. This represents 0.2% of the world’s adult population. Considering the level of utility and the seamlessness of the UI/UX in the late stages of this series, only 10 million active savers may even feel like a failure of sorts! From here, it is simply an exercise of marketing.

Discussion of The Framework on The Total Connector Podcast with Keyvan Davani

IPO (6th Reward Era, Mar 2028 — Feb 2032), and beyond…

At this point, if Bitcoin is still alive, it is effectively unkillable. Major banks have now made big acquisitions, and are offering bitcoin services to their customers. Most power utilities have skin in the Bitcoin game. People won’t know that they’re using Bitcoin — and we’ll probably have 4 (or even 5) layers on top of Bitcoin now. On-chain base-layer transactions are reserved for high value transactions, all people adopting Bitcoin going forward won’t be onboarded via the base layer. The Bitcoin ETF has FINALLY been approved after an 18 year effort. Price per coin is in the millions, and fairly stable (to the downside, at least). Number still go up — just as designed.

It’s improper to say that it is “zero risk” in 2032, but the risk is extremely low. That said, if it gets to a 7th Era, I’d be comfortable enough to say that Bitcoin may become the first ever truly risk-free asset, with inflation rapidly approaching zero. I’ll be 50 years old by the end of Era 7, so I’m literally betting my career that this will be the case. Talk about skin in the game!