Bitcoin and the Tyranny of Time Scarcity

| If you find WORDS helpful, Bitcoin donations are unnecessary but appreciated. Our goal is to spread and preserve Bitcoin writings for future generations. Read more. | Make a Donation |

Bitcoin and the Tyranny of Time Scarcity

By Robert Breedlove

Posted December 19, 2019

The tyranny of time scarcity is ubiquitous in life; here we will explore how mankind cooperates to resist this immortal tyrant using one of our most ancient social technologies, money, and why Bitcoin is bound to achieve global monetary dominance.

A Tyrant of Time Immemorial

All human action inescapably occurs within the bounds of time. As the universally shared element of experience, time is the grand paradox of nature; it heals all wounds, yet ultimately ravages all things. Each of us feels a current of time that is totally impersonal; in a ruthlessly egalitarian manner, time flows equally for rich and poor, sick and healthy, young and old alike. The temporal flows we experience cannot be reproduced, reversed, or stopped. At an intrapersonal level, our allotment of time is as scarce as our lifespan is limited. Interpersonally, time scarcity manifests as the total time we can collectively allocate towards serving one another; whether we are making goods, providing services, or gaining knowledge — we have but a finite quantity of hours to commit towards our efforts. In this sense, time scarcity is the immortal tyrant subjugating all of us mortals. Only through cooperative action can we break free of the restraints time scarcity clasps upon us.

Society is the sum total of cooperative actions taken, a social order that is, paradoxically, shaped by competition among its constituents — free people. Actions intent on improving our relationship with nature, which enhance our quality of life by saving us time, necessarily involve the use of natural resources. If one seeks to dig ditches faster, he will first need to construct a shovel — a tool that requires wood from a felled tree, refined metal ore, and expertly shaped screws to hold the (earth-shattering) device together. Since the Earth we share is physically finite its natural resources are inherently scarce, and we must each compete to earn our own fair share. In a world that is as physically abundant as our ingenuity will allow, it is ultimately only our finite time that constrains us from producing more of anything we want.

Existing under the ubiquitous tyranny of time scarcity, it’s natural for animals to adopt more energy efficient means of satisfying their wants. The “Law of Conservation of Energy-Mass” is the 1st Law of Thermodynamics; an inviolable principle of the universe that organisms (lazily and cleverly) follow to the letter. Predators in the wild frequently make expected-value calculations when deciding whether or not the anticipated energy expenditure in pursuit of a particular prey is worth the caloric value of the meal, should the hunt be successful (most hunts have low chances of success). Even herbivores like koala bears economize their physical movements to maximize their consumption of eucalyptus leaves per exertion. Of course, these decisions are not (likely) based on any mathematical knowledge, but rather on instinct.

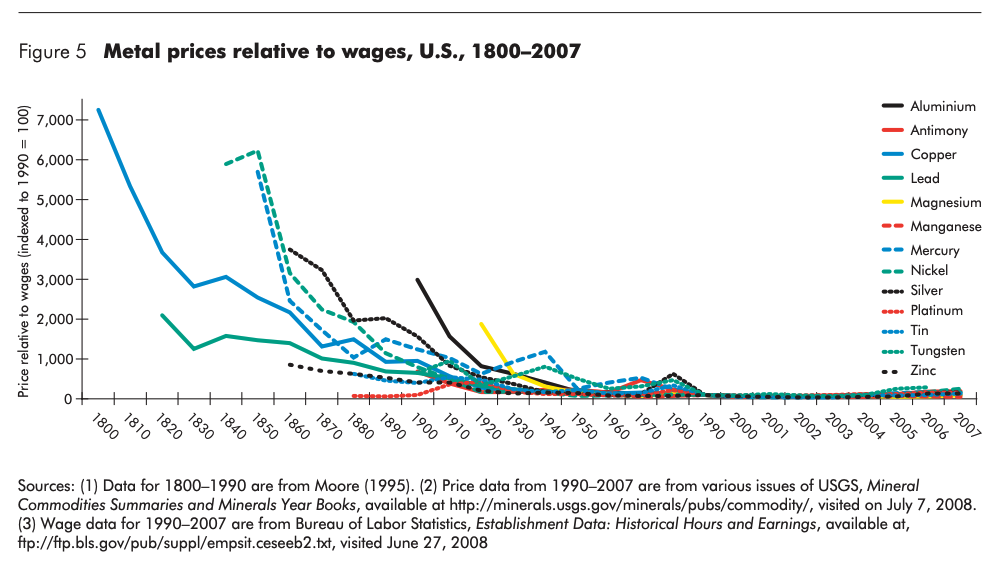

Similarly, driven by an instinct to overcome the oppression of time scarcity, us humans have always found ways to uncover and extract ever-more natural resources as we “hunt” for satisfactions to our wants. We have literally “just scratched the surface,” as our efforts haven’t even taken us halfway into the Earth’s crust, its thinnest and outermost layer. Through generations of trial and error, with our collective learnings accumulated in heuristics, written knowledge, and methodologies, mankind has steadily economized his productive efforts, gradually making more and more use of his time. The fruits of our labor are evident: the price of all natural resources, in terms of time necessary to produce them, has steadily decreased over the long-run as technological advancements continually increase our productivity — our capacity to produce the greatest results with the least effort. Metal prices over the past two centuries are a testament to this:

Evincing the simple truth of mankind’s ever-rising productivity is gold: as the annual new supply flow of this extremely rare metal remains steady, it makes no sense to consider other natural resources (which are less rare than gold) as scarce in any practical sense[1] . Indeed, only time scarcity truly constrains our creative output. In this sense, time — both individually and collectively — is our most precious and scarce resource. Each of us seek to extend and savor our time on Earth. As a population, we strive to economize our actions and increase our productivity to attain the greatest results possible with minimal use of time and effort. Indeed, the purpose of the world economy is to accelerate our collective productivity gains through innovation and trade; in a term, to gain energy efficiency — our sole emancipator from the hardships imposed by time scarcity.

Trade Interconnects Us

Acts of trade (or interpersonal exchange) interconnect us into economic networks which increase our productivity by virtue of our inherent comparative advantages: a diversity of skills, experience, and know-how that arises naturally among us. Trade allows us to focus on our comparative advantages and become ever-more specialized in our skills over time. This positive-sum game undergirds all economic activity; by working as a cooperative ensemble we become more productive than we would be working as isolated individuals. Our economic interdependence makes us collectively more productive and prosperous. This cooperative dynamic is commonly called the “division of labor” and the general purpose of society is to foster an environment which favors its proliferation.

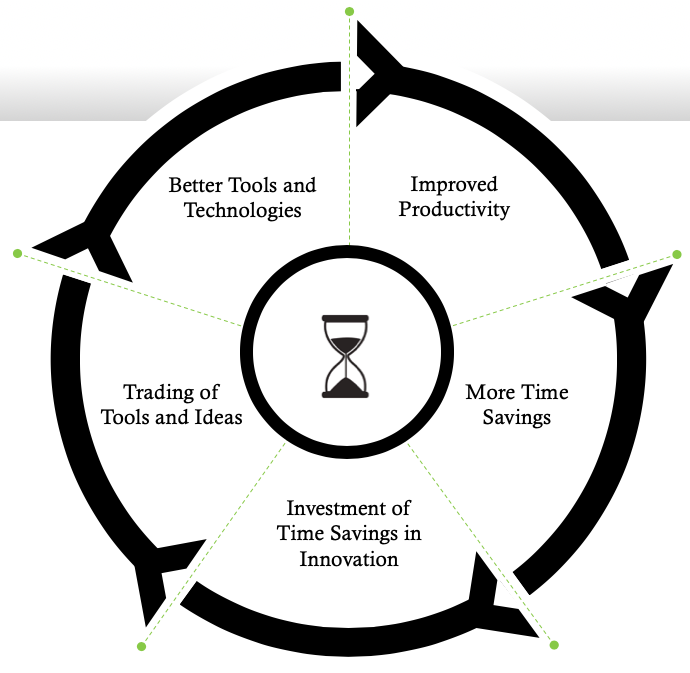

The division of labor enables each of us to concentrate on what we do best and increases our collective productivity: meaning it lets us produce the same amount in less time or a greater amount in the same time. Alternatively, we can choose to use these newfound time savings to innovate. Innovation involves the creation of tools and technologies to help us do even more in less time (i.e. digging with a shovel instead of by hand). As innovative new tools and ideas become diffused into society through trade, more time savings are generated, and this process becomes recursive into a self-reinforcing, virtuous cycle with no known natural limit:

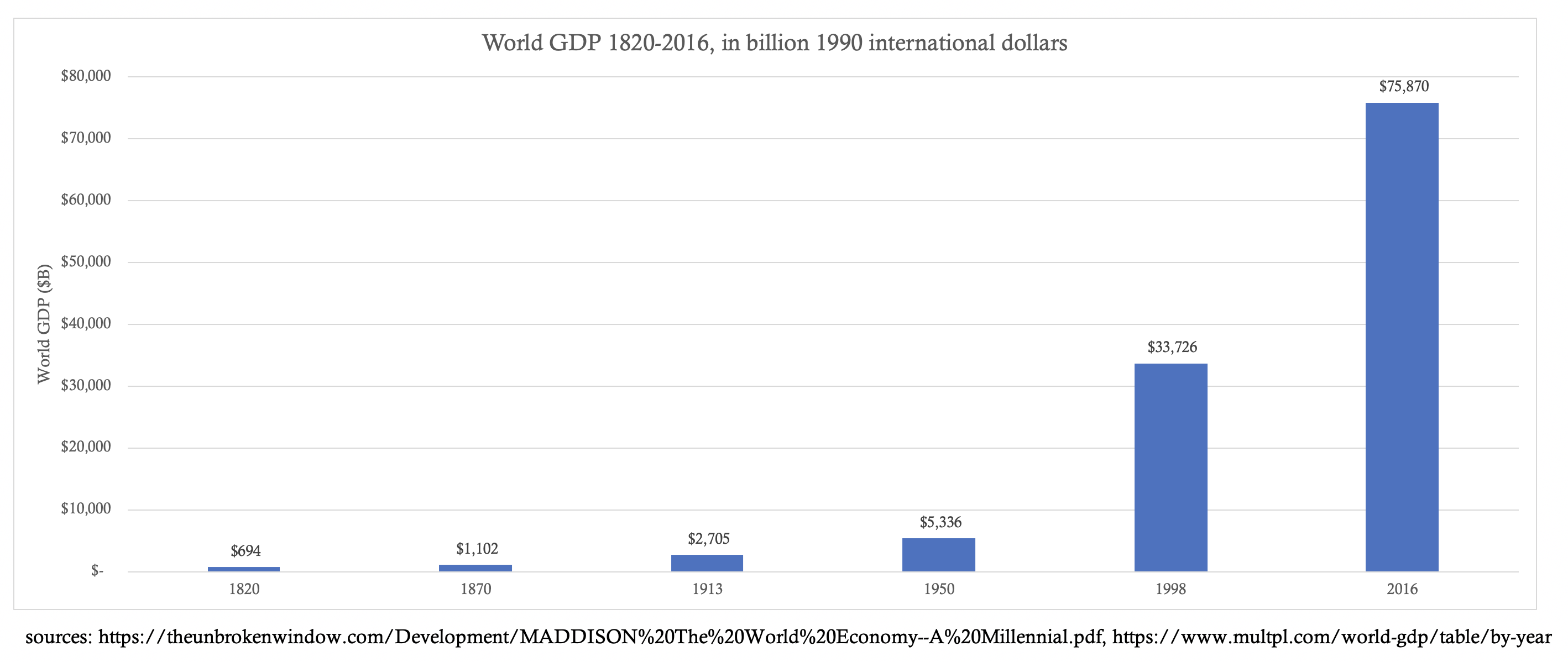

By specializing, trading, and innovating societies create a (literal) wealth of time savings that can be spent productively or leisurely. By spending time savings productively, societies create wealth — the accumulation of time saved in the form of capital. Anything that economizes human action — tools, knowledge, or even relationships — is considered capital, as it provides a way for us to more quickly satisfy our wants. Said simply, as we become more productive, we accumulate more capital — a form of frozen time savings. In this respect, we have come a long way over the past two centuries:

Money: Mankind’s Masterwork

Money is the most marketable (or readily exchangeable) capital in an economy; it is the most liquid measure of time savings — a social chronometer of sorts. Money is the technology we use to measure and move the value of our time savings across time and space. The primary function of money is to store value, meaning that it must (at a minimum) retain its own exchange value across time. Naturally, as our collective productivity increases, the value of money rises in tandem, and prices expressed in it decline. The secondary function of money is to mediate exchange, meaning that it can be exchanged for anything in the marketplace — goods, services, or knowledge. Money is sought by all seeking to trade their way into satisfying personal wants[3] (this includes everyone that isn’t entirely self-sufficient). The tertiary function of money is to quantify exchange ratios, meaning it is used to denominate prices across the minds of market participants. Consider how we think in dollars, or in our local currency, when deciding whether and how much to buy or sell of anything in the marketplace. Interestingly, this “unit of account” function of money is so deeply etched into our mental machinery that it actually changes how we think and perceive the world.

Besides these three functions, monetary technologies generally exhibit the following traits:

- Scarcity: resistance to money supply manipulations and, thus, dilutions to its monetary unit value (difficult to produce)

- Divisibility: ease of accounting and transacting at various scales (separable and combinable units)

- Portability: ease of moving value across space (high value to weight ratio)

- Durability: ease of moving value across time (resilient to deterioration)

- Recognizability: ease of identifying and verifying the monetary value by other parties in a transaction (universally identifiable and verifiable)

Whatever good is most impervious to the depredations of time, transference, and greed is naturally selected as “money”. The monetary technology selected freely in a marketplace is referred to as “hard money”; a haven for liquid value (exchangeable time savings) that resists the ravages of time, damages related to transference across space, and intentional misappropriations by those vicious two-legged apes (people). In these respects, monetary metals have been historically superior due to their durability and portability, making them ideal for storing value across time and space, respectively. With the advent of coinage, which standardized each monetary unit, the divisibility and recognizability traits of these metals were greatly enhanced. Critically, the scarcity of monetary metals is governed by natural laws that are beyond the control of man, making their supplies (mostly) resistant to greedy manipulations. Gold became, and remains, the prime monetary metal of the world precisely because of its superior relative scarcity — historically, it has been the best reflector of absolutely scarce time.

Gold is the hardest monetary metal to produce and nearly every ounce ever mined remains part of its extant supply today, as it is chemically an ultra-stable element. Taken in combination, these properties made gold the best medium for storing value across time, as its supply is the most resistant to change, and therefore the most inflation-resistant. By providing sufficient monetary characteristics (divisibility, portability, durability, recognizability) coupled with superior physical scarcity, gold was naturally selected as money on the free market (hard money). With a (low) reproducibility and physical scarcity most closely aligned with the absolute irreproducibility and scarcity of time, gold has been the most credible store of value historically — which explains why freely acting individuals have hoarded it for centuries. More technically, gold’s superior stock-to-flow ratio makes it more resistant to supply inflation (and, its corollary, monetary value dilution) than all other monetary technologies (prior to the invention of Bitcoin).

Game Time

To understand gold’s ascent, we must realize the actions of people in free markets are driven by game theory. In game-theoretic terms, a “game” is any situation in which people can win or lose — as is the case in markets. A “strategy” is just process for making decisions. Game theory is applicable in any domain where people must decide whether to cooperate or compete. For instance, if you and I are being chased by a bear, my decision to run or fight is not based on how fast I am, but rather how fast I think you are. Game-theoretically, I only need to be faster than you, not the bear, to ensure my survival. Such assessments of interpersonal dynamics are also closely related to economics and monetary evolution.

In the context of monetary evolution’s relationship with time: free market participants choose hard money over all other monetary technologies because its resistance to supply increases most closely reflects the immutable flow of time. No matter how much time was allocated to gold production, its supply resisted inflation more than any other monetary metal, causing people to coalesce around its use as a superiorly sound store of value. In game theory terms, gold production became the “Nash Equilibrium”, a game state in which everyone follows the same strategy because there is no advantage to be gained by switching to any other strategy. So long as people sought to maximize their freedom from time scarcity by accumulating capital, collectively produced more than they consumed, and accomplished these goals through trade, gold remained the best proxy for the scarcest economic resource — time.

Unicity of Time and Money

Time is the only irreversible element in existence. Its directionality is imparted by the ever-growing entropy of the universe — as defined by the 2nd Law of Thermodynamics. This “Thermodynamic Arrow of Time” which points us into an increasingly chaotic universe is, in fact, the only irreversible aspect of reality; every other natural process is symmetrical, making it impossible to discern whether an event is unfolding forward or backward in time. As such, this universally objective and unidirectional flow of time provides our purest reference point for all values (of the seven key metrics maintained by the Systeme Internationale of Units and Measures, six are rooted in the time it takes light to move through a vacuum). Gold, then, as the most difficult commodity to produce no matter how much time was allocated towards its extraction, served as the best market proxy for the objective purity of ever-flowing time. It is commonly said that time is money, but few realize that the reciprocal is also true — money is time.

Beyond relative irreproducibility, hard money exhibits other properties akin to the natural flow of time. Markets naturally optimize for a hard money that is as impersonal, irreversible, and unstoppable as the flow of time to which it is anchored, and which it is intended to epitomize in the marketplace. As hard money arises naturally as the result of countless market interactions in which individuals seek to trade their goods for steadily more exchangeable goods, it is inherently beyond the control of any single individual, nation, or central bank. This makes hard money apolitical and impersonal; it cannot be used to benefit any one group over another. In other words, hard money tends to be politically neutral, like time.

Hard money is also equity-based, meaning that physically possessing gold as an asset, for instance, is 100% equity and 0% debt (a bearer asset). This makes payments in gold immune to reversal, unlike those made with monopolistically imposed debt-based monies, called fiat currencies, which are liable to the whims of bureaucrats, who can choose to confiscate, censor, or deauthorize fiat currencies at any time, for any reason. Finally, hard money is unstoppable, in the sense that if I flip you a gold coin, there is no single authority on Earth that can block or devalue that transaction. Hard money, like gold, derives its value from freely acting individuals choosing the best monetary technology available to them.

Sacred Sovereignty

Bearer assets, like gold, offer another significant advantage — each individual unit is self-sovereign. Sovereignty refers to the freedom to take action as one sees fit. As Rosseau said: “Man is born free and everywhere he is in chains.” The struggle of history has been the need for flexible coordination of human action on a large scale against the usurpation of individual sovereignty that the institutions built for this purpose typically impose. Paradoxically, as mankind pursued large scale mobilization of his efforts to overcome the natural tyranny of time scarcity, he gave birth to an artificial tyrant that engorges itself by consuming our individual sovereignty — the government and, its apparatus of thievery, central banking. True sovereignty originates at the individual level; it naturally reigns when our individual expressions, whether verbal or financial, are unmanipulable by others. When a government censors your speech or a central bank devalues your dollar, it is a violation of your individual sovereignty. Let no one prevent you from speaking your mind or spending your time and money as you see fit. We are each our own supreme ruler:

Gold is a self-sovereign bearer asset whose credibility and value as money is derived from the combined sovereignty of countless self-interested individuals exercising free choice in the marketplace. When a good gains value on the free market, it is a result of market participants finding it useful, making sacrifices for it, and, thereby, imbuing it with part of their individual sovereignty. Since gold achieved dominance on the free market as a result of countless “votes” in the form of self-interested trade decisions by a faceless multitude across history, it can be considered the monetary materialization of popular sovereignty — the founding principle of Western Civilization:

Although it’s an ancient monetary technology, gold still forms the prime monetary sovereignty layer of Earth, as it underpins all governmental sovereignty. In turn, governments use this power to monopolize the market for money (via their central bank henchmen) and insulate fiat currencies from direct monetary competition. Such insulation is the only way debt-based monies can survive alongside hard money. Gold and other bearer assets are final extinguishers of debt, as payments in them carry no associated liability. Modern central banks still perform final settlement exclusively in gold and actively engage in market machinations to suppress its price (see Gata.org); a testament to the primacy of this ancient monetary metal.

Den of Thieves

Despite this misappropriation of gold’s sovereignty by government for its own self-seeking purposes, fiat currency is no longer anchored to gold, making it highly reproducible at near-zero cost. Indeed, fiat currency is the softest form of money in history; it can (and in virtually all cases does) suffer from counterparty risks such as censorship, deauthorization, or hyperinflation. Hard money is anchored in the reality of time to secure the time savings of its holders; fiat currency is a political tool that facilitates the institutionalized system of time-theft known as “expansionary monetary policy” perpetrated by central banks globally.

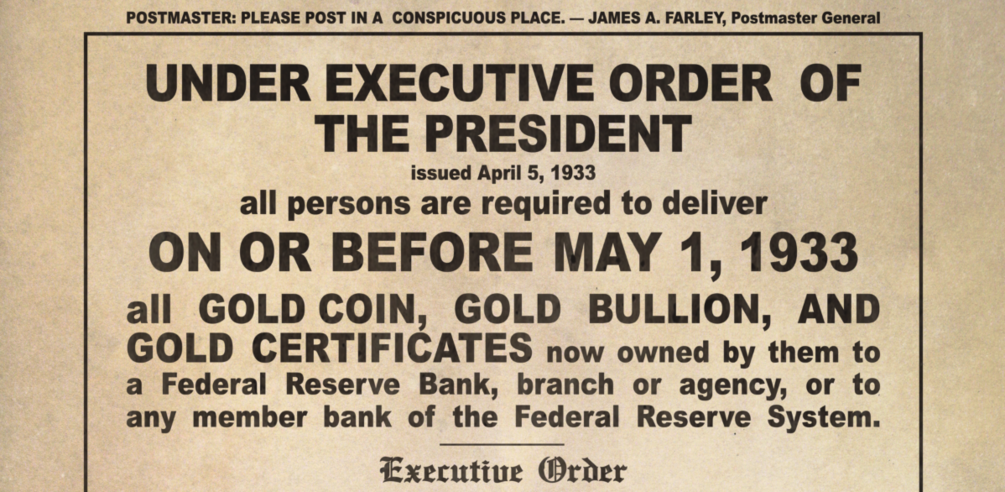

Although governments legally compel us to use fiat currencies today, these rules are only enforceable due to their vampirism — the sucking of sovereignty out of gold holdings. Ironically, this stolen power is used to monopolize violence and silence dissent. Government sovereignty, then, is derived from the agglomerated self-sovereignty of its gold hoards; which, in combination with the anticompetitive artifices it erects (legal tender laws, capital controls, capital gains taxes, etc.) in the sphere of money, explains why gold has been confiscated and its private ownership outlawed repeatedly throughout history:

There is only one reason for such confiscatory acts: governments grasping for more power; a means to usurp gold’s self-sovereignty, an embezzlement of power which itself originates in the actions of free people selecting a monetary technology in the marketplace; a tragedy at the heart of all modern economies. As the axiom says: “Whoever has the gold, makes the rules.”:

Prime Money

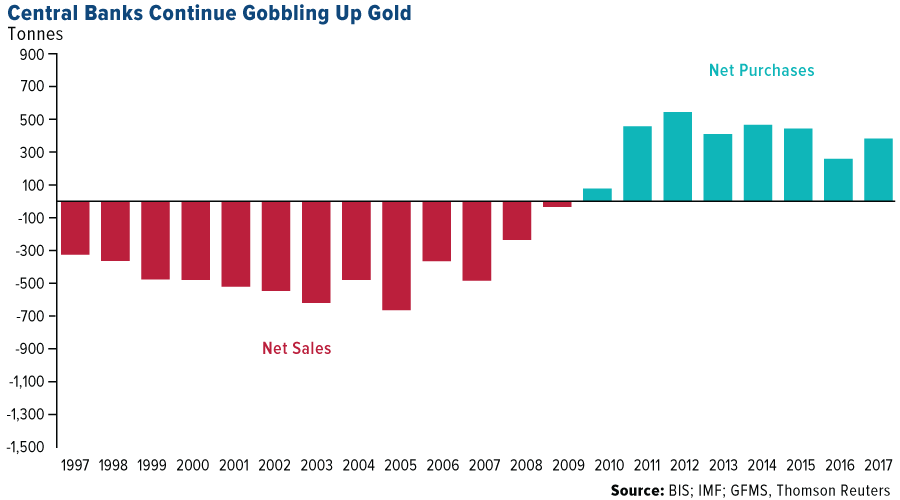

In this sense, gold is prime money: as its physical possession underpins the sovereignty of governments, which misappropriate it to enforce central bank money production monopolies on free people. Paradoxically, it was the actions of free people that generated the sovereignty that is now wielded against them by governments and central banks. This “duopoly of monopolists” has proclaimed time and time again that gold is irrelevant, a mere monetary artifact, and that they alone will lead the world economy to a brighter future. Ignore anti-gold propaganda; just watch their actions:

Although gold resisted supply manipulation in many ways, it is far from perfect. Through the London Gold Pool and other machinations (seriously, see Gata.org) central banks cornered the market on gold, enabling them to surreptitiously suppress its price and better insulate fiat currency (soft money) from direct competition with gold (hard money). Market manipulation like this is only possible because of our passivity. In surrendering our sovereignty to unaccountable institutions like central banks, we cede conscious control over most aspects of our lives. Remember: central banks engaged in “expansionary monetary policy” are actively stealing time from free people; as they increase money supplies, they reallocate claims on productive capital from the majority to a politically favored few. This parasitism on the savings of society extends the working lives for most of the citizenry. In this way, monetary inflation is a direct violation of private property rights and individual sovereignty. It is worth repeating: human action is the essence of sovereignty; it is our actions that instill institutions with this divine quality intrinsic to free people. Let us all exercise the utmost vigilance in deciding which institutions to empower with our sacred sovereign energies:

Hard Money Renaissance

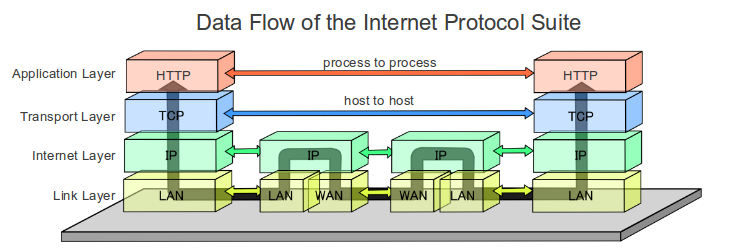

Against this usurpation of our individual sovereignty by government, we find hope in the emergence of a modern innovation called the internet — the universal exchange engine for knowledge. The internet has already democratized and disintermediated many aspects of our lives — from lodging and transportation, to media distribution and commerce. Compositionally, the internet is a set of open-source protocols (known as the internet protocol suite) for permissionlessly moving information worldwide in an instant. Constructed in a free market manner, through years of cooperation and standardization efforts, the internet is the greatest knowledge network in history. Today, we all benefit from this readily-accessible library of human knowledge:

As Milton Friedman so aptly pointed out in 1999, about ten years before the invention of Bitcoin, the one thing the internet lacked was a secure, private “e-cash”:

“The one thing that’s missing, but that will soon be developed, is a reliable e-cash, a method whereby on the Internet you can transfer funds from A to B, without A knowing B or B knowing A.”

Friedman’s prescience proved astonishingly accurate. Coming into the 21st century, we had two key inceptors for digital hard money: gold, the ancient and prevailing monetary sovereignty layer (representing an unmanipulable money supply), and the internet, the ultimate engine of exchange (representing global interconnectivity or liquidity). By combining and building upon the economic properties of both, Bitcoin is a momentous monetary innovation that has achieved the divisibility, portability, durability, and recognizability of pure information infused with the absolute scarcity of time. As the internet gives us freedom to express and absorb ideas without obstruction, Bitcoin gives us the freedom to express and receive value in a hard money that cannot be stopped. In this sense, Bitcoin is the latest evolutionary layer of the internet protocol suite; a quantum leap over the monetary “Nash Equilibrium” gold represented.

Historically, gold has become more difficult to extract with the passage of time due to chemistry, physical rarity, and game theory. Gold is the ancient anchor to the prime economic reality of time scarcity, precisely why it remains the prime money of modernity. Time is the most objective measure for our intersubjective (opinion-based) valuations, as it is the one unarguable aspect of existence. In a society run on hard money, price levels naturally decline over time as our productivity grows in tandem with the division of labor. Put another way, hard money tends to appreciate over time as human knowledge becomes more specialized. In this way, increases in the value of hard money reflect how far humanity has liberated itself from time scarcity.

Liquidity of Time and Information

Conceptually then, money is both frozen time (as a means of storing time savings) and liquid time (as a means of exchanging time savings). We earn money by sacrificing our intrapersonal time and can trade it for commensurate sacrifices from others. As such, anyone that gains control over a money supply, and can manipulate it at will, can steal time savings directly from the users of its money via the shadow tax of inflation. To shed light on the true nature of fiat currency in one line, let’s call it like it is: a pyramid scheme built atop gold that is subject to unlimited supply inflation. Since it bears repeating: inflation is intrapersonal time theft — a legally enforced injustice.

Manipulation of money supplies has other consequences. Money is an economy’s main informational utility; a touchstone to measure the value of the time savings (or spending) expected to be made possible by an economic good in the future. When a money supply is manipulated, the objectivity of its measurement ability is compromised. This breakdown of money’s informational utility is called price signal distortion. Such manipulation makes economic calculation less reliable and causes entrepreneurs to overborrow, misallocate capital, and, ultimately, degenerates time savings as capital is consumed instead of being compounded through reinvestment. Price signals provide a system for “market participant telecommunications” and can be explained as follows:

Price signals are the navigational instruments for entrepreneurs sailing the tempestuous seas of markets, and money is the medium through which these signals propagate. Said another way: money is a measurement system for value (a temporal quality) in the same way a ruler is for length (a spatial quality). The less elastic the supply of money is, the better it fulfills this mensural purpose. If you are measuring a table with a ruler that you cannot trust, then you can’t be sure whether you’re measuring the table or the ruler; you cannot distinguish the signal (the actual length) from the noise (changes in unit of measurement). [4] Gold outcompeted historically because of its relative supply inelasticity, which made it both the best store of value and conveyor of price signals. Uniquely, Bitcoin is a money with perfect supply inelasticity; it is the most uncompromising measurement system for value the world has ever known. In this sense, Bitcoin is like an inviolable ruler: a perfectly objective unit of measurement for the endless variations of market values.

Therefore, the more closely a money supply is credibly congruent with the absolutely scarcity of time, the better it communicates the time savings generated by our collective productivity gains. In this way, both gold and Bitcoin share the same principal attractiveness: they are more closely reflective of the impersonal, irreproducible, irreversible, unstoppable, and absolutely scarce nature of the experiential element money is intended to symbolize in the marketplace — time.

Temporal Anchorage

When money is disconnected from time scarcity (as fiat currency is), its “skin in the game” is compromised and the economies it facilitates start suffering from distorted price signals, malinvestments, recessions, and an exacerbated boom-and-bust business cycle. As with most systems, money requires skin in the game to function properly — meaning that money must be costly to produce,[5] otherwise those who can produce it cheaply will do so to steal the value of time savings stored therein (as central banks do).

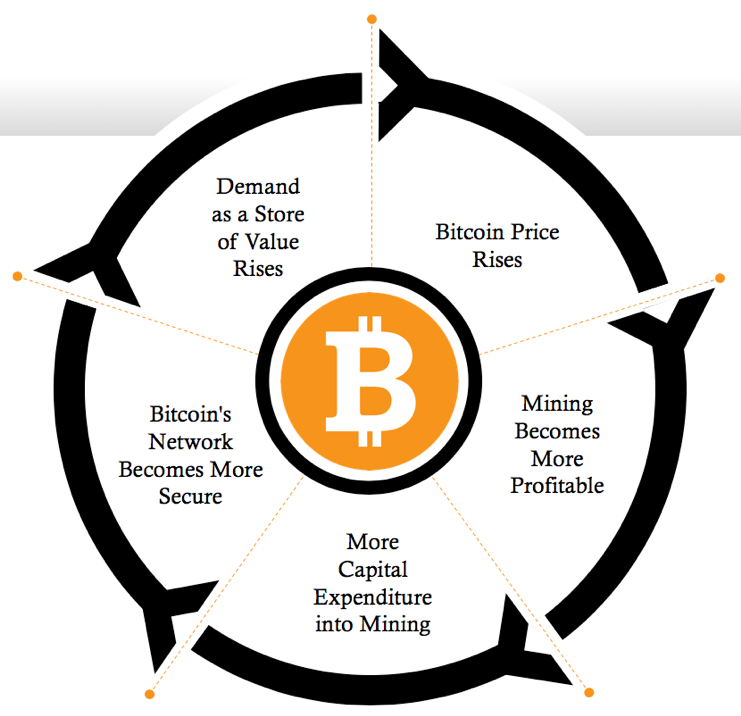

For gold, the costs associated with mining provide this critical skin in the game characteristic. For Bitcoin, an ingenious composite of proof-of-work energy expenditure (skin in the game) and economic incentives (game theory) enabled it to digitize scarcity. In this sense, Bitcoin’s blockchain is like a bridge between physical and digital reality — the first incarnation of a digital asset with provable scarcity. An innovative amalgamation of open-source software and behavioral economics, Bitcoin was designed to be a monetary network that reproduces itself relentlessly:

From this perspective, the value of mining both gold and Bitcoin is the “unforgeable costliness” that each represents — a measure of the time sacrificed in production, which is redeemable for the time of others. Imbued with digital scarcity, Bitcoin preserves the advantages offered by gold’s physicality (self-sovereignty, irreversible transactions, final settlement) while eliminating its disadvantages (ease of confiscation, expensive safeguarding, high settlement costs). Digitization also makes Bitcoin a weightless, intangible, and (potentially) everlasting monetary technology. As a totally impersonal and self-sovereign monetary network capable of adopting market-proven features from competitors over time, while simultaneously resisting changes that negatively impact its users, Bitcoin may be the last evolution we ever see in global prime money. Gold is the “pristine collateral” which underpins the entirety of the highly-levered fiat currency financial complex; Bitcoin is poised to become the foundation for an entirely new economic order.

Monetary Horizons

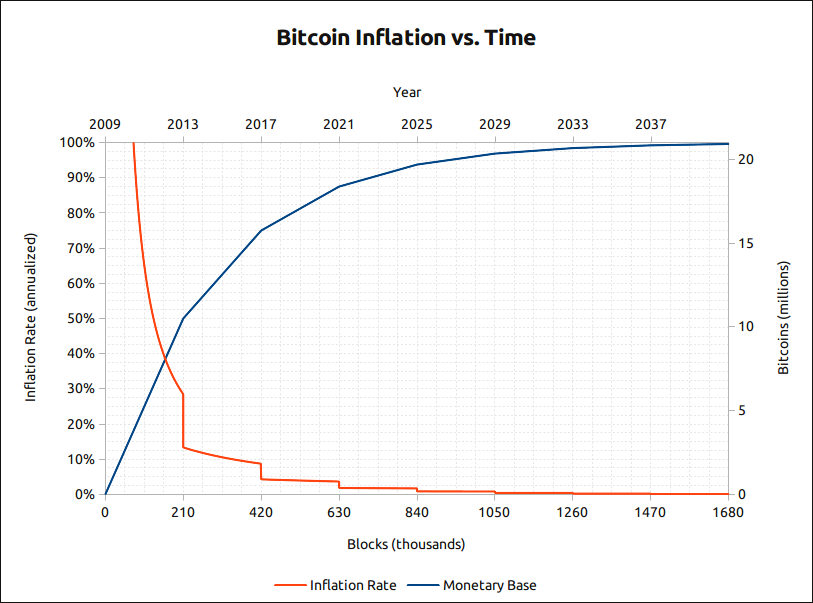

In the near future and for the first time in history, the world will have a money that is harder to produce than gold. A fixed supply of 21 million units makes Bitcoin absolutely scarce — a property never before achieved by anything other than time itself. In the same way that Galelio’s invention of the telescope led to discoveries that reoriented our relationship with space, so too has the invention of Bitcoin led to the discovery of absolute scarcity; a bewildering breakthrough that perfectly parallels and will forever change mankind’s relationship with time. Soon, in accordance with its perfectly predictable issuance schedule, Bitcoin will become the scarcest liquid asset in human history. At this point, Bitcoin will become the monetary technology most closely aligned with the absolutely scarce nature of time. From there, every block produced will (asymptotically) further perfect this alignment until the last Bitcoin in mined in the mid-22nd century:

The supreme divisibility, portability, durability, recognizability, and scarcity characteristics of Bitcoin constantly increase the likelihood (via the Lindy Effect) that it will continue to outcompete gold and fiat currencies in its long climb toward becoming global prime money. Bitcoin, with a supply more closely aligned with the prime economic reality of time scarcity, is slowly but surely *undermining* gold’s role as prime money. The word *undermine* literally means “to dig under fortifications to collapse them”. In this sense, Satoshi designed Bitcoin to “dig deeper” into reality than gold and, in doing so, undermine its role as prime money by more closely mirroring the fundamental nature of time. As a result, the value of fiat currencies will also diminish as gold slips from its position of primacy.

Temporal Metaphor

Time is the ultimate experiential element we all share. It is ruthlessly egalitarian, flowing equally for all alike. Time is our objective anchor in a world of ceaselessly shifting intersubjective valuations. Abstractly, money is our metaphor for time. As a tool, it best serves mankind when its supply is as inelastic as the absolute scarcity of time. Here, gold does well; yet Bitcoin, the first money with a supply that is absolutely scarce, reflects time perfectly.

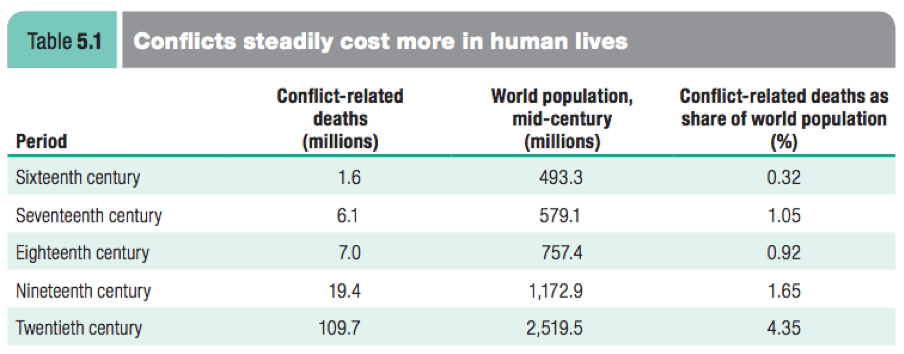

Money is the medium through which many minds become one; it is the coordinating mechanism of human action. Money matters because only through cooperation and innovation do we mortals gain ground in our struggle against the immortal tyrant of time scarcity. Perhaps one day to be regarded as the most impactful technology ever invented, Bitcoin is simply a tool for saving time; it stores the value created from our time spent serving one another, reduces the time needed to establish trustful coordination, and it protects our mutually generated time savings from confiscation. Furthermore, Bitcoin promises to reduce the money, capital, and life wasted in warfare. Bitcoin accomplishes this by transcending laws and outcompeting money production monopolies, which use taxation via inflation to stealthily fund perpetual warfare. As Ron Paul said: “It is no coincidence that the century of total war coincided with the century of central banking.”:

Bitcoin also promises to help generate even more time savings by deepening the division of labor, a direct result of financial disintermediation, the benefits of which flow to everyone. Finally, Bitcoin encourages us to adopt lower time preferences and think long-term. Hard money incentivizes us to save and invest, and disincentivizes excessive debt and spending, since it naturally appreciates over time as our collective productivity grows. Fiat currency is the reverse: it pushes up our time preferences and disintegrates societies. As the repeated fall of ancient civilizations shows, monetary integrity and social cohesion are inexorably linked.

Breaking the Chains

Bitcoin belongs in a certain class of momentous innovations — like antiseptics, electricity, or the internet — that either extend our lifespans individually or enhance our productivity and, therefore, our time savings collectively. These innovations expand our relationship with time in one or more ways: extending life expectancies, lowering time preferences, or enhancing productivity. Bitcoin promises to contribute to all three by being the best self-sovereign savings technology in history: reducing death tolls and capital destruction from warfare by financially starving governments, incentivizing savings and investment in innovation, and accelerating our productivity gains by reducing artificial and arbitrary trade frictions.

Bitcoin has the potential to bend the grand arc of human history back towards a free market paradigm. Bitcoin is doing this in the market for money, and its underlying technology may one day be applied to other markets like equities, bonds, and real estate. Going forward, Bitcoin promises to further liberate us from the clutches of time scarcity, eliminate time theft via inflation, reinvigorate individual sovereignty, and, as a cumulative result, radically increase social scalability worldwide. As Alfred North Whitehead said:

“It is a profoundly erroneous truism repeated by all copy-books and by eminent people when they’re making speeches, that we should cultivate the habit of thinking about what we’re doing. The precise opposite is the case. Civilization advances by extending the number of important operations which we can perform without thinking about them.”

As we continue our endless contentions with time scarcity, government-authorized money monopolies remain a scourge on our humanity. Central banking, an institution of monetary socialism and systemized time theft, has repeatedly wounded our individual sovereignty, time preferences, and freedoms throughout history. We mortals must break the shackles of this oppressive institution and focus our energies on innovating against time scarcity — the immortal tyrant. In doing so, we will create a world in which our children, their children, and all future generations are born able to live totally self-sovereign lives — forever free from the chains of governmental tyranny.

By Robert Breedlove Oct, 2019

Thank you for reading “Bitcoin and the Tyranny of Time Scarcity” My sincerest gratitude to these amazing minds:

@real_vijay, Saifedean Ammous, Brandon Quittem, Dan Held, Naval Ravikant, @NickSzabo4, Nic Carter, @MartyBent, Pierre Rochard, Anthony Pompliano, Chris Burniske, @MarkYusko, @CaitlinLong_, Nik Bhatia, Nassim Nicholas Taleb, Stephan Livera, Peter McCormack, Gigi, Hasu, @MustStopMurad, Misir Mahmudov, Mises Institute, John Vallis, @FriarHass, Conner Brown, Ben Prentice, Aleksandar Svetski, Cryptoconomy, Citizen Bitcoin, Keyvan Davani, @RaoulGMI, @DTAPCAP, Parker Lewis, @Rhythmtrader, Russell Okung, @sthenc, Nathaniel Whittemore, @ck_SNARKs, Trevor Noren, Cory Klippsten, Knut Svanholm

And anyone else I forgot :)

The Bitcoin Times Ed 2 is the collaborative work of 8 writers & 1 designer with the intent to educate, inspire and spread ideas on bitcoin.

Each section will be released on Medium as a free long form article, and the full, compiled version of the Bitcoin Times will be available for free at the link below. In 2020, we’ll release a limited edition hard cover collectible, for purchase, which you’ll be notified of by email if you download the free pdf.

If you found value in this or any of the other essays and articles, please support each of the contributors by sharing it out & following their work.

ownload the full guide at:

(Soon to be updated to: https://bitcointimes.news)